|

|

|

|

|

Previous: PUBLIC SERVICE CO OF NEW MEXICO, 8-K, 2000-09-21 |

Next: FORTIS SECURITIES INC, N-30D, 2000-09-21 |

Fidelity®

Fund

Annual Report

July 31, 2000

(2_fidelity_logos) (Registered_Trademark)

|

President's Message |

3 |

Ned Johnson on investing strategies. |

|

Performance |

4 |

How the fund has done over time. |

|

Fund Talk |

6 |

The managers' review of fund performance, strategy and outlook. |

|

Investment Changes |

10 |

A summary of major shifts in the fund's investments over the past six months. |

|

Investments |

11 |

A complete list of the fund's investments with their market values. |

|

Financial Statements |

31 |

Statements of assets and liabilities,

operations, and changes in net assets, |

|

Notes |

35 |

Notes to the financial statements. |

|

Report of Independent Accountants |

40 |

The auditors' opinion. |

|

Distributions |

41 |

|

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks. This report and the financial statements contained herein are submitted for the

general information

of the shareholders of the fund. This report is not authorized for distribution to prospective investors

in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Annual Report

(Photograph of Edward C. Johnson 3d.)

Dear Shareholder:

The Federal Reserve Board's effort to keep inflation in check without over-cooling the U.S. economy has taken a toll on the stock market. Through July 2000, bellwether equity indexes such as the Dow Jones Industrial Average, NASDAQ and S&P 500® have negative returns for the year. On the other hand, fixed-income markets are enjoying strong performance. Except for high-yield, most bond sectors - corporates, mortgages, Treasuries and agencies - have returned 4%-6% year to date.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

First, investors are encouraged to take a long-term view of their portfolios. If you can afford to leave your money invested through the inevitable up and down cycles of the financial markets, you will greatly reduce your vulnerability to any single decline. We know from experience, for example, that stock prices have gone up over longer periods of time, have significantly outperformed other types of investments and have stayed ahead of inflation.

Second, you can further manage your investing risk through diversification. A stock mutual fund, for instance, is already diversified, because it invests in many different companies. You can increase your diversification further by investing in a number of different stock funds, or in such other investment categories as bonds. If you have a short investment time horizon, you might want to consider moving some of your investment into a money market fund, which seeks income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value).

Cumulative Total Returns

|

Periods ended July 31, 2000 |

|

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Balanced |

|

1.82% |

87.47% |

215.17% |

|

Fidelity Balanced Income Composite |

|

-0.04% |

82.70% |

222.99% |

|

LB Aggregate Bond |

|

5.97% |

36.94% |

111.27% |

|

S&P 500 ® |

|

8.98% |

177.11% |

408.31% |

|

Balanced Funds Average |

|

6.04% |

84.11% |

207.07% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, one year, five years or 10 years. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's returns to the performance of the Fidelity Balanced Income Composite Index - a hypothetical combination of unmanaged indices combining the total returns of the Russell 3000® Value Index and the Lehman Brothers Aggregate Bond Index using a weighting of 60% and 40%, respectively. To measure how the fund's performance stacked up against its peers, you can compare it to the balanced funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past one year average represents a peer group of 461 mutual funds. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended July 31, 2000 |

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Balanced |

1.82% |

13.39% |

12.16% |

|

Fidelity Balanced Income Composite |

-0.04% |

12.81% |

12.44% |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year.

Annual Report

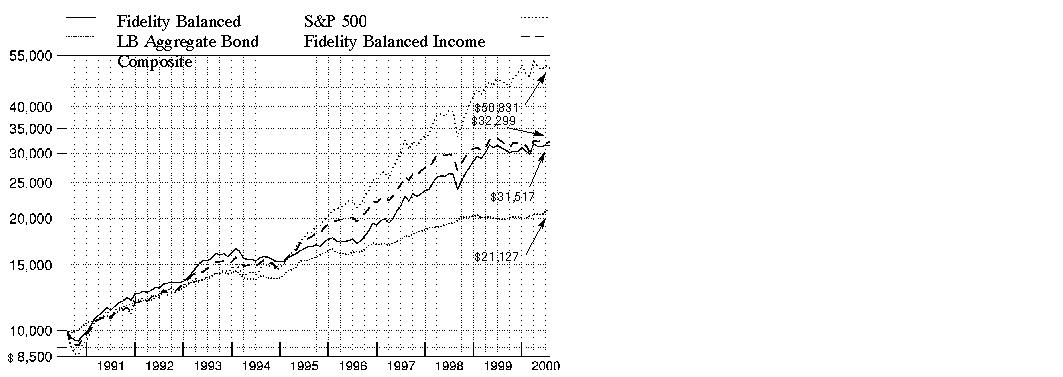

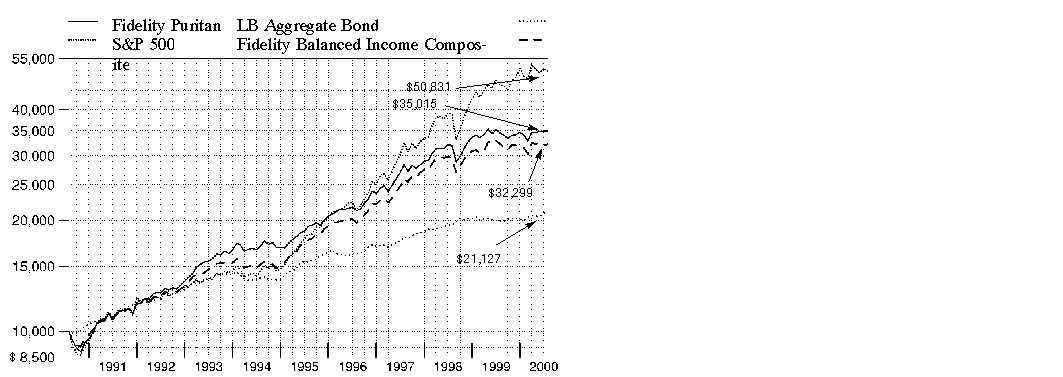

$10,000 Over 10 Years

$10,000 Over 10 Years: Let's say hypothetically that $10,000 was invested in Fidelity Balanced Fund on July 31, 1990. As the chart shows, by July 31, 2000, the value of the investment would have grown to $31,517 - a 215.17% increase on the initial investment. For comparison, look at how both the Standard & Poor's 500 SM Index, a market capitalization-weighted index of common stocks, and the Lehman Brothers Aggregate Bond Index, a market value-weighted index of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of one year or more, did over the same period. With dividends and capital gains, if any, reinvested, the Standard & Poor's 500 Index would have grown to $50,831 - a 408.31% increase. If $10,000 was invested in the Lehman Brothers Aggregate Bond Index, it would have grown to $21,127 - a 111.27% increase. You can also look at how the Fidelity Balanced Income Composite Index did over the same period. The composite index combines the total returns of the Russell 3000 Value Index and the Lehman Brothers Aggregate Bond Index, and assumes monthly rebalancing of the mix. With dividends and interest, if any, reinvested, the same $10,000 would have grown to $32,299 - a 222.99% increase.

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. The stock market, for example, has a history of long-term growth and short-term volatility. In turn, the share price and return of a fund that invests in stocks will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

3Annual Report

Market Recap

During the 12-month period that ended July 31, 2000, the U.S. securities markets struggled to break free from the grip of the Federal Reserve Board, whose effort to cool the overheated economy was delivered via a series of five interest-rate hikes. With every clench of its fist, the Fed's effort - which raised the federal funds rate by a combined total of 1.50% - gradually tempered the optimism toward stocks as the period progressed. Most of the effect of the Fed's tightening, coupled with the market's concerns about corporate earnings, took its toll on stocks starting in the second quarter of 2000. The Standard & Poor's 500 Index, an index of 500 larger companies, returned 8.98% for the past year, but feeling the impact of the Fed's action, has lost 1.98% year to date. Even the seemingly invincible NASDAQ Composite Index, which finished the period with a 43.08% gain, has given back 7.65% so far this year. Despite higher rates that put pressure on bonds earlier in the period, fixed-income markets posted solid returns relative to equities in 2000 as investors fled technology stocks in favor of less-volatile areas. The Lehman Brothers Aggregate Bond Index - a broad measure of the U.S. taxable investment-grade bond market - returned 5.97% for the 12-month period.

SM(Portfolio Manager photograph)

An interview with Robert Ewing (right), Lead Portfolio Manager of Fidelity Balanced Fund, and Kevin Grant (left), manager for fixed-income

investments

Q. How did the fund perform, Bob?

R.E. For the 12 months that ended July 31, 2000, the fund delivered a total return of 1.82%. That topped the Fidelity Balanced Income Composite Index, which returned -0.04%. The balanced funds average tracked by Lipper Inc. returned 6.04% during the same period.

Q. Why did the fund outperform its index, yet fall short of its peers?

R.E. Solid stock selection on the equity front, teamed with strong performance from the fund's bond subportfolio, helped us maintain an edge over the index. It was a difficult period overall for value stocks - which this fund favors - as growth dominated the investment landscape for most of the period, with technology stocks largely responsible for fueling the performance disparity in the marketplace. The major indexes highlighted this dichotomy, with the tech-laden NASDAQ Composite Index trouncing the Russell 3000 Value Index by a count of 43.08% to -4.39% during the past year. Not surprisingly, given the fund's emphasis on value, we struggled to keep pace with our competitors, which tended to own more growth-oriented tech names than we did, on average. In terms of absolute performance, our biggest wins came by way of the health, finance, energy and consumer nondurables sectors. Unfortunately, our modest exposure to technology stocks failed to pay dividends, as investors swarmed around market leaders, leaving many of the value tech names we owned by the wayside.

Annual Report

Fund Talk: The Managers' Overview - continued

Q. What changes did you make since taking over the fund in February?

R.E. The few changes I made were in preparation for an economic slowdown. My feeling was that the rate of economic growth was likely unsustainable, especially in light of markedly higher interest rates. So, I chose to adopt a more defensive posture, positioning the fund to take advantage of a deceleration in the economy. In addition to bringing down the overall price-to-earnings ratio, or P/E, of the fund, I began to focus even more intently on value characteristics. In every industry, I consciously decided to own the cheaper of two comparable situations. As the period progressed, I began to tilt the fund toward those sectors that tend to perform well in a slowdown, namely drug stocks and consumer nondurables. I also raised the fund's energy weighting early on to gain exposure to a favorable global supply/demand picture. My focus here was on individual energy services stocks, which benefited from a higher pricing environment, as energy

companies started to do more drilling and exploratory work for oil and gas. I did take profits late in the period, however, as many of these names reached all-time highs. In addition, effective September 28, 2000 - after the end of the period covered by this report - the fund's trustees approved allowing the fund to invest in high-yield securities. This investment alternative is available, and I plan to use it if I feel high-yield securities present attractive investment opportunities.

Q. What was your asset allocation strategy during the period?

R.E. Since this is a balanced fund, I try not to make big asset allocation calls outside of the 60%/40% stocks/bonds boundary. I was a little underweighted in equities overall, averaging around 56% during the period, which was consistent with my defensive posture.

Q. What stocks performed well for the fund?

R.E. Eli Lilly was rewarded for having one of the best drug pipelines in the business, including a possible blockbuster in Zovant, the first of its kind in the treatment of an often-fatal blood disease called sepsis. Weatherford is an energy services name that responded nicely to rising oil prices and improvements in the international marketplace. Timely trading allowed us to take profits in Chase Manhattan, which peaked in the spring. Computer chipmaker Micron Technology was one of the only cheap tech stocks that worked for the fund, nearly tripling in price during the period. Nabisco also was a key contributor.

Annual Report

Fund Talk: The Managers' Overview - continued

Q. Which stocks hurt performance during the period?

R.E. Unisys was a big disappointment. Shares of the computer services supplier shed over 75% of its market value during the period. The firm missed the mark on

earnings due to weakness in its government and financial services business, along with the deferral of several large technology contracts. The stock looked to provide

good value, yet company fundamentals continued to deteriorate.

Lucent was punished for missing a key product cycle in the fiber-optic space and giving up additional market share to key rival Nortel. AT&T continued to struggle in

the face of increased competition, which sparked a deterioration in its core consumer and business long-distance segments.

Q. Turning to you, Kevin, how did the fund's bond subportfolio fare?

K.G. It performed well during the past 12 months, benefiting from its ample exposure to a strong rally in the government market. An announcement by the U.S. Treasury in January of its intent to use government surplus proceeds to buy back long-term debt, as well as reduce future issuance, sent the price of the long bond higher and its yield lower. This move, coupled with rising short-term interest rates, induced an inverted yield curve, which occurs when short-term issues provide higher yields than their longer-term counterparts. This inversion forced the spread sectors - most notably corporate bonds and agency securities - to give up the returns they had accumulated during the first half of the period as yield spreads widened out significantly relative to comparable duration Treasuries. The fund was well-positioned for these changes, and we responded early to the buybacks by reducing our exposure to long-term corporates in exchange for more Treasuries, which worked out well. This strategy, along with strong security selection, helped the fund's bond subportfolio outperform the Lehman Brothers Aggregate Bond Index during the period. So, despite the Federal Reserve Board's efforts to raise rates during the period, the supply/demand imbalance spurred by the Treasury buybacks helped ensure our success.

Q. Bob, what's your outlook for the fund over the next several months?

R.E. Cautious, yet optimistic. If growth can slow sufficiently to convince the Fed to cease further tightening, industries that have been under pressure from rising rates could stage a comeback. If so, the fund should benefit given its significant exposure to these areas of the market. A slowing economy could make for a bumpy ride in the equity markets, which will place even more emphasis on security selection. I'm comfortable with the fund's conservative positioning heading into this period of uncertainty.

The views expressed in this report reflect those of the portfolio managers only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Fund Talk: The Managers' Overview - continued

Fund Facts

Goal: income and capital growth consistent with reasonable risk

Fund number: 304

Trading symbol: FBALX

Start date: November 6, 1986

Size: as of July 31, 2000, more than $5.8 billion

Manager: Robert Ewing, since February 2000; manager, Fidelity Advisor Financial Services Fund, 1998-2000; several Fidelity Select Portfolios, 1996-2000; joined Fidelity in 1990; Kevin Grant, since 1997; manager, several Fidelity investment-grade taxable bond funds; joined Fidelity in 1993

3Bob Ewing on finding value in today's marketplace:

"For a market that's incredibly expensive, there's a lot of value out there, which makes me feel pretty good about running a value-oriented fund under these conditions. Since history has a tendency of repeating itself, I'm fairly confident that there again will be a time when value outperforms growth. And when it does, the fund will be poised to benefit. The truth of the matter is, value hasn't mattered for some time now, with investors off chasing high-growth companies involved in the technological revolution.

"Leaders in the growth space continue to trade at unprecedented valuations, but that doesn't concern me much since I don't tend to traffic in this area to begin with. Those areas of the market I do frequent are currently ripe with bargain-basement specials. Traditional value names are trading at all-time lows in many cases, especially those sensitive to the economy's ebbs and flows. At some point, however, these stocks will get cheap enough that they'll be ready to go up again even if the economy is slowing. I'm starting to find more and more value by watching out for these cues."

Annual Report

|

Top Five Stocks as of July 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

Exxon Mobil Corp. |

2.3 |

3.1 |

|

Eli Lilly & Co. |

1.4 |

1.4 |

|

Citigroup, Inc. |

1.4 |

1.2 |

|

Bristol-Myers Squibb Co. |

1.1 |

0.2 |

|

Associates First Capital Corp. Class A |

1.1 |

0.4 |

|

|

7.3 |

6.3 |

|

Top Five Bond Issuers as of July 31, 2000 |

||

|

(with maturities greater than one year) |

% of fund's |

% of fund's net assets |

|

Fannie Mae |

14.3 |

10.1 |

|

U.S. Treasury Obligations |

8.3 |

8.4 |

|

Government National Mortgage Association |

2.8 |

2.9 |

|

Freddie Mac |

0.9 |

0.3 |

|

Nomura Asset Securities Corp. |

0.4 |

0.3 |

|

|

26.7 |

22.0 |

|

Top Five Market Sectors as of July 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

Finance |

16.0 |

17.2 |

|

Technology |

9.8 |

7.6 |

|

Utilities |

9.2 |

10.6 |

|

Health |

5.7 |

3.1 |

|

Media & Leisure |

5.0 |

6.9 |

|

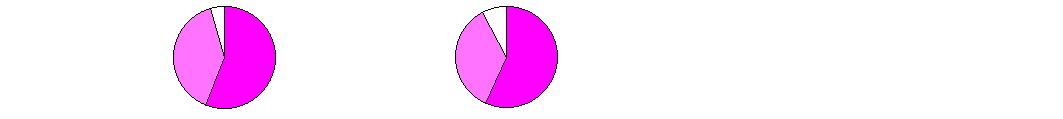

Asset Allocation (% of fund's net assets) |

|||||||

|

As of July 31, 2000 * |

As of January 31, 2000 ** |

||||||

|

Stocks 56.0% |

|

|

Stocks 56.6% |

|

||

|

Bonds 39.6% |

|

|

Bonds 35.5% |

|

||

|

Short-Term |

|

|

Short-Term |

|

||

|

* Foreign investments |

3.9% |

|

** Foreign investments |

2.6% |

|

||

Annual Report

Showing Percentage of Net Assets

|

Common Stocks - 56.0% |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

AEROSPACE & DEFENSE - 1.1% |

|||

|

Boeing Co. |

543,200 |

$ 26,617 |

|

|

Northrop Grumman Corp. |

270,000 |

19,187 |

|

|

Textron, Inc. |

275,000 |

15,692 |

|

|

TOTAL AEROSPACE & DEFENSE |

61,496 |

||

|

BASIC INDUSTRIES - 1.8% |

|||

|

Chemicals & Plastics - 1.0% |

|||

|

E.I. du Pont de Nemours and Co. |

455,703 |

20,649 |

|

|

Praxair, Inc. |

475,000 |

18,792 |

|

|

Union Carbide Corp. |

400,000 |

17,925 |

|

|

|

57,366 |

||

|

Metals & Mining - 0.3% |

|||

|

Alcoa, Inc. |

331,600 |

10,031 |

|

|

Phelps Dodge Corp. |

157,400 |

6,404 |

|

|

|

16,435 |

||

|

Paper & Forest Products - 0.5% |

|||

|

Kimberly-Clark Corp. |

515,000 |

29,580 |

|

|

Pentair, Inc. |

100,000 |

3,063 |

|

|

|

32,643 |

||

|

TOTAL BASIC INDUSTRIES |

106,444 |

||

|

CONSTRUCTION & REAL ESTATE - 0.8% |

|||

|

Building Materials - 0.0% |

|||

|

Lafarge Corp. |

150,933 |

3,396 |

|

|

Construction - 0.3% |

|||

|

Centex Corp. |

332,000 |

7,947 |

|

|

Pulte Corp. |

325,000 |

7,455 |

|

|

|

15,402 |

||

|

Real Estate Investment Trusts - 0.5% |

|||

|

Equity Office Properties Trust |

772,400 |

23,558 |

|

|

ProLogis Trust |

150,000 |

3,497 |

|

|

|

27,055 |

||

|

TOTAL CONSTRUCTION & REAL ESTATE |

45,853 |

||

|

DURABLES - 1.9% |

|||

|

Autos, Tires, & Accessories - 1.2% |

|||

|

AutoNation, Inc. |

1,650,000 |

11,447 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

DURABLES - continued |

|||

|

Autos, Tires, & Accessories - continued |

|||

|

Danaher Corp. |

73,400 |

$ 3,739 |

|

|

General Motors Corp. |

56,407 |

3,212 |

|

|

Navistar International Corp. (a) |

1,480,000 |

52,818 |

|

|

|

71,216 |

||

|

Consumer Durables - 0.5% |

|||

|

Minnesota Mining & Manufacturing Co. |

282,300 |

25,425 |

|

|

Consumer Electronics - 0.2% |

|||

|

General Motors Corp. Class H (a) |

429,403 |

11,111 |

|

|

TOTAL DURABLES |

107,752 |

||

|

ENERGY - 4.7% |

|||

|

Energy Services - 1.1% |

|||

|

Diamond Offshore Drilling, Inc. |

150,000 |

5,634 |

|

|

Halliburton Co. |

100,000 |

4,613 |

|

|

Varco International, Inc. (a) |

505,850 |

8,726 |

|

|

Weatherford International, Inc. |

1,163,400 |

46,609 |

|

|

|

65,582 |

||

|

Oil & Gas - 3.6% |

|||

|

Burlington Resources, Inc. |

325,000 |

10,603 |

|

|

Chevron Corp. |

190,400 |

15,042 |

|

|

Conoco, Inc. Class B |

625,000 |

14,414 |

|

|

Exxon Mobil Corp. |

1,662,200 |

132,976 |

|

|

Grant Prideco, Inc. (a) |

1,438,400 |

28,948 |

|

|

Sunoco, Inc. |

150,000 |

3,656 |

|

|

|

205,639 |

||

|

TOTAL ENERGY |

271,221 |

||

|

FINANCE - 12.5% |

|||

|

Banks - 3.0% |

|||

|

Bank of America Corp. |

572,300 |

27,113 |

|

|

Bank of New York Co., Inc. |

200,000 |

9,363 |

|

|

Bank One Corp. |

600,000 |

19,088 |

|

|

Chase Manhattan Corp. |

619,950 |

30,804 |

|

|

First Union Corp. |

325,000 |

8,389 |

|

|

Firstar Corp. |

600,000 |

11,850 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

FINANCE - continued |

|||

|

Banks - continued |

|||

|

Mellon Financial Corp. |

1,304,000 |

$ 49,145 |

|

|

PNC Financial Services Group, Inc. |

327,500 |

16,662 |

|

|

|

172,414 |

||

|

Credit & Other Finance - 3.3% |

|||

|

American Express Co. |

595,000 |

33,729 |

|

|

Associates First Capital Corp. Class A |

2,400,000 |

62,850 |

|

|

Citigroup, Inc. |

1,178,950 |

83,190 |

|

|

Household International, Inc. |

350,000 |

15,597 |

|

|

|

195,366 |

||

|

Federal Sponsored Credit - 1.5% |

|||

|

Fannie Mae |

558,000 |

27,830 |

|

|

Freddie Mac |

1,527,500 |

60,241 |

|

|

|

88,071 |

||

|

Insurance - 3.0% |

|||

|

AFLAC, Inc. |

200,000 |

10,388 |

|

|

AMBAC Financial Group, Inc. |

268,600 |

17,308 |

|

|

American International Group, Inc. |

671,531 |

58,885 |

|

|

CIGNA Corp. |

109,800 |

10,966 |

|

|

Marsh & McLennan Companies, Inc. |

72,400 |

8,833 |

|

|

MetLife, Inc. |

1,450,000 |

30,450 |

|

|

Protective Life Corp. |

95,500 |

2,590 |

|

|

The Chubb Corp. |

183,300 |

13,564 |

|

|

UnumProvident Corp. |

600,000 |

13,800 |

|

|

XL Capital Ltd. Class A |

85,000 |

5,610 |

|

|

|

172,394 |

||

|

Securities Industry - 1.7% |

|||

|

Charles Schwab Corp. |

658,850 |

23,801 |

|

|

Lehman Brothers Holdings, Inc. |

236,300 |

26,554 |

|

|

Merrill Lynch & Co., Inc. |

145,000 |

18,741 |

|

|

Morgan Stanley Dean Witter & Co. |

332,600 |

30,350 |

|

|

|

99,446 |

||

|

TOTAL FINANCE |

727,691 |

||

|

HEALTH - 5.7% |

|||

|

Drugs & Pharmaceuticals - 4.1% |

|||

|

American Home Products Corp. |

168,500 |

8,941 |

|

|

Bristol-Myers Squibb Co. |

1,349,700 |

66,979 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

HEALTH - continued |

|||

|

Drugs & Pharmaceuticals - continued |

|||

|

Elan Corp. PLC sponsored ADR (a) |

150,000 |

$ 8,016 |

|

|

Eli Lilly & Co. |

802,300 |

83,339 |

|

|

Exelixis, Inc. |

165,500 |

6,444 |

|

|

Pfizer, Inc. |

898,700 |

38,756 |

|

|

Schering-Plough Corp. |

641,000 |

27,683 |

|

|

|

240,158 |

||

|

Medical Equipment & Supplies - 1.4% |

|||

|

Abbott Laboratories |

1,055,700 |

43,944 |

|

|

Baxter International, Inc. |

292,900 |

22,773 |

|

|

Cardinal Health, Inc. |

125,000 |

9,188 |

|

|

Johnson & Johnson |

50,000 |

4,653 |

|

|

|

80,558 |

||

|

Medical Facilities Management - 0.2% |

|||

|

HCA - The Healthcare Co. |

400,000 |

13,600 |

|

|

TOTAL HEALTH |

334,316 |

||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 2.2% |

|||

|

Electrical Equipment - 1.7% |

|||

|

Alcatel SA sponsored ADR |

225,000 |

16,453 |

|

|

Emerson Electric Co. |

417,400 |

25,487 |

|

|

General Electric Co. |

1,158,200 |

59,575 |

|

|

|

101,515 |

||

|

Industrial Machinery & Equipment - 0.5% |

|||

|

Caterpillar, Inc. |

342,700 |

11,673 |

|

|

Ingersoll-Rand Co. |

410,000 |

16,093 |

|

|

|

27,766 |

||

|

TOTAL INDUSTRIAL MACHINERY & EQUIPMENT |

129,281 |

||

|

MEDIA & LEISURE - 3.6% |

|||

|

Broadcasting - 1.2% |

|||

|

American Tower Corp. Class A (a) |

200,000 |

8,575 |

|

|

AMFM, Inc. (a) |

75,000 |

5,358 |

|

|

AT&T Corp. - Liberty Media Group Class A (a) |

1,163,600 |

25,890 |

|

|

Clear Channel Communications, Inc. (a) |

91,500 |

6,971 |

|

|

Infinity Broadcasting Corp. Class A (a) |

250,000 |

8,813 |

|

|

Time Warner, Inc. |

182,828 |

14,021 |

|

|

|

69,628 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

MEDIA & LEISURE - continued |

|||

|

Entertainment - 1.6% |

|||

|

Fox Entertainment Group, Inc. Class A (a) |

588,000 |

$ 18,008 |

|

|

News Corp. Ltd. sponsored ADR |

223,200 |

10,993 |

|

|

Viacom, Inc. Class B (non-vtg.) (a) |

450,000 |

29,841 |

|

|

Walt Disney Co. |

821,400 |

31,778 |

|

|

|

90,620 |

||

|

Lodging & Gaming - 0.1% |

|||

|

Starwood Hotels & Resorts Worldwide, Inc. unit |

200,000 |

6,825 |

|

|

Publishing - 0.4% |

|||

|

McGraw-Hill Companies, Inc. |

223,300 |

13,272 |

|

|

The New York Times Co. Class A |

289,500 |

11,924 |

|

|

|

25,196 |

||

|

Restaurants - 0.3% |

|||

|

McDonald's Corp. |

485,200 |

15,284 |

|

|

TOTAL MEDIA & LEISURE |

207,553 |

||

|

NONDURABLES - 2.8% |

|||

|

Beverages - 0.6% |

|||

|

Anheuser-Busch Companies, Inc. |

355,400 |

28,610 |

|

|

Seagram Co. Ltd. |

100,000 |

5,606 |

|

|

|

34,216 |

||

|

Foods - 1.2% |

|||

|

Keebler Foods Co. |

575,000 |

25,372 |

|

|

Nabisco Group Holdings Corp. |

575,000 |

15,238 |

|

|

PepsiCo, Inc. |

125,000 |

5,727 |

|

|

Quaker Oats Co. |

361,900 |

24,338 |

|

|

|

70,675 |

||

|

Household Products - 0.5% |

|||

|

Avon Products, Inc. |

164,100 |

6,513 |

|

|

Procter & Gamble Co. |

395,000 |

22,466 |

|

|

|

28,979 |

||

|

Tobacco - 0.5% |

|||

|

Philip Morris Companies, Inc. |

1,100,000 |

27,775 |

|

|

TOTAL NONDURABLES |

161,645 |

||

|

PRECIOUS METALS - 0.1% |

|||

|

Newmont Mining Corp. |

500,300 |

8,880 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

RETAIL & WHOLESALE - 1.5% |

|||

|

Apparel Stores - 0.6% |

|||

|

AnnTaylor Stores Corp. (a) |

425,000 |

$ 12,006 |

|

|

Gap, Inc. |

164,600 |

5,895 |

|

|

The Limited, Inc. |

745,000 |

15,226 |

|

|

|

33,127 |

||

|

General Merchandise Stores - 0.7% |

|||

|

BJ's Wholesale Club, Inc. (a) |

425,000 |

12,723 |

|

|

Costco Wholesale Corp. (a) |

150,000 |

4,884 |

|

|

Target Corp. |

720,000 |

20,880 |

|

|

|

38,487 |

||

|

Grocery Stores - 0.1% |

|||

|

Safeway, Inc. (a) |

205,400 |

9,256 |

|

|

Retail & Wholesale, Miscellaneous - 0.1% |

|||

|

Best Buy Co., Inc. (a) |

100,000 |

7,275 |

|

|

TOTAL RETAIL & WHOLESALE |

88,145 |

||

|

SERVICES - 0.7% |

|||

|

Printing - 0.1% |

|||

|

Reynolds & Reynolds Co. Class A |

475,000 |

7,927 |

|

|

Services - 0.6% |

|||

|

H&R Block, Inc. |

568,500 |

18,192 |

|

|

True North Communications |

299,800 |

14,634 |

|

|

|

32,826 |

||

|

TOTAL SERVICES |

40,753 |

||

|

TECHNOLOGY - 9.4% |

|||

|

Communications Equipment - 1.2% |

|||

|

ADC Telecommunications, Inc. (a) |

280,000 |

11,743 |

|

|

Cisco Systems, Inc. (a) |

530,000 |

34,682 |

|

|

Lucent Technologies, Inc. |

265,000 |

11,594 |

|

|

Nokia AB sponsored ADR |

310,000 |

13,737 |

|

|

|

71,756 |

||

|

Computer Services & Software - 2.3% |

|||

|

Adobe Systems, Inc. |

67,700 |

7,752 |

|

|

Cadence Design Systems, Inc. (a) |

487,100 |

10,168 |

|

|

Computer Associates International, Inc. |

1,001,200 |

24,842 |

|

|

Computer Sciences Corp. (a) |

242,300 |

15,144 |

|

|

Covad Communications Group, Inc. (a) |

351,750 |

5,804 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

TECHNOLOGY - continued |

|||

|

Computer Services & Software - continued |

|||

|

Electronic Data Systems Corp. |

300,000 |

$ 12,900 |

|

|

Microsoft Corp. (a) |

490,400 |

34,236 |

|

|

Sabre Holdings Corp. Class A |

252,928 |

6,181 |

|

|

Unisys Corp. (a) |

1,859,500 |

18,246 |

|

|

|

135,273 |

||

|

Computers & Office Equipment - 3.1% |

|||

|

Adaptec, Inc. (a) |

225,000 |

5,569 |

|

|

Apple Computer, Inc. (a) |

556,200 |

28,262 |

|

|

Comdisco, Inc. |

330,000 |

8,539 |

|

|

Compaq Computer Corp. |

1,100,000 |

30,869 |

|

|

Dell Computer Corp. (a) |

500,100 |

21,973 |

|

|

Diebold, Inc. |

450,000 |

12,741 |

|

|

EMC Corp. (a) |

280,000 |

23,835 |

|

|

Hewlett-Packard Co. |

119,300 |

13,026 |

|

|

International Business Machines Corp. |

207,100 |

23,286 |

|

|

Lexmark International Group, Inc. Class A (a) |

200,000 |

9,013 |

|

|

|

177,113 |

||

|

Electronic Instruments - 0.5% |

|||

|

Agilent Technologies, Inc. |

418,148 |

17,040 |

|

|

Thermo Electron Corp. (a) |

400,000 |

8,300 |

|

|

|

25,340 |

||

|

Electronics - 2.3% |

|||

|

Advanced Micro Devices, Inc. (a) |

127,700 |

9,186 |

|

|

Analog Devices, Inc. (a) |

87,400 |

5,845 |

|

|

Intel Corp. |

160,000 |

10,680 |

|

|

Micron Technology, Inc. (a) |

458,000 |

37,327 |

|

|

Motorola, Inc. |

1,244,400 |

41,143 |

|

|

Texas Instruments, Inc. |

531,600 |

31,198 |

|

|

|

135,379 |

||

|

TOTAL TECHNOLOGY |

544,861 |

||

|

TRANSPORTATION - 0.5% |

|||

|

Air Transportation - 0.3% |

|||

|

AMR Corp. |

100,000 |

3,306 |

|

|

Continental Airlines, Inc. Class B (a) |

50,000 |

2,613 |

|

|

Southwest Airlines Co. |

426,900 |

10,086 |

|

|

|

16,005 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) (000s) |

||

|

TRANSPORTATION - continued |

|||

|

Railroads - 0.2% |

|||

|

Burlington Northern Santa Fe Corp. |

400,000 |

$ 9,775 |

|

|

Union Pacific Corp. |

124,900 |

5,394 |

|

|

|

15,169 |

||

|

TOTAL TRANSPORTATION |

31,174 |

||

|

UTILITIES - 6.7% |

|||

|

Cellular - 1.2% |

|||

|

Nextel Communications, Inc. Class A (a) |

200,000 |

11,188 |

|

|

Sprint Corp. - PCS Group Series 1 (a) |

540,000 |

29,835 |

|

|

Vodafone Group PLC sponsored ADR |

273,400 |

11,790 |

|

|

VoiceStream Wireless Corp. (a) |

135,000 |

17,314 |

|

|

|

70,127 |

||

|

Electric Utility - 1.4% |

|||

|

AES Corp. (a) |

600,000 |

32,063 |

|

|

Calpine Corp. (a) |

300,000 |

21,375 |

|

|

IPALCO Enterprises, Inc. |

717,100 |

16,224 |

|

|

Montana Power Co. |

250,000 |

7,234 |

|

|

NRG Energy, Inc. |

149,000 |

3,492 |

|

|

|

80,388 |

||

|

Gas - 0.9% |

|||

|

Dynegy, Inc. Class A |

563,117 |

39,629 |

|

|

Enron Corp. |

188,500 |

13,878 |

|

|

|

53,507 |

||

|

Telephone Services - 3.2% |

|||

|

AT&T Corp. |

1,212,850 |

37,523 |

|

|

BellSouth Corp. |

785,500 |

31,273 |

|

|

Qwest Communications International, Inc. (a) |

719,300 |

33,762 |

|

|

SBC Communications, Inc. |

1,314,000 |

55,927 |

|

|

Time Warner Telecom, Inc. Class A (a) |

249,900 |

15,478 |

|

|

WorldCom, Inc. (a) |

276,771 |

10,811 |

|

|

|

184,774 |

||

|

TOTAL UTILITIES |

388,796 |

||

|

TOTAL COMMON STOCKS (Cost $2,834,796) |

3,255,861 |

||

|

Nonconvertible Bonds - 10.5% |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

AEROSPACE & DEFENSE - 0.2% |

|||||

|

Defense Electronics - 0.2% |

|||||

|

Raytheon Co. 7.9% 3/1/03 (e) |

Baa2 |

|

$ 8,780 |

$ 8,830 |

|

|

BASIC INDUSTRIES - 0.0% |

|||||

|

Paper & Forest Products - 0.0% |

|||||

|

Abitibi-Consolidated, Inc. 8.85% 8/1/30 |

Baa3 |

|

2,130 |

2,128 |

|

|

Fort James Corp. 6.625% 9/15/04 |

Baa2 |

|

910 |

863 |

|

|

|

2,991 |

||||

|

CONSTRUCTION & REAL ESTATE - 0.7% |

|||||

|

Real Estate - 0.1% |

|||||

|

Duke Realty LP 7.3% 6/30/03 |

Baa1 |

|

5,000 |

4,936 |

|

|

Real Estate Investment Trusts - 0.6% |

|||||

|

CenterPoint Properties Trust 6.75% 4/1/05 |

Baa2 |

|

2,600 |

2,428 |

|

|

Equity Office Properties Trust: |

|

|

|

|

|

|

6.5% 1/15/04 |

Baa1 |

|

6,000 |

5,762 |

|

|

6.625% 2/15/05 |

Baa1 |

|

2,500 |

2,371 |

|

|

7.25% 2/15/18 |

Baa1 |

|

15,000 |

13,097 |

|

|

ProLogis Trust 6.7% 4/15/04 |

Baa1 |

|

1,550 |

1,484 |

|

|

Spieker Properties LP 6.8% 5/1/04 |

Baa2 |

|

2,050 |

1,972 |

|

|

Spieker Properties, Inc. 7.125% 7/1/09 |

Baa2 |

|

9,700 |

8,996 |

|

|

|

36,110 |

||||

|

TOTAL CONSTRUCTION & REAL ESTATE |

41,046 |

||||

|

ENERGY - 0.3% |

|||||

|

Oil & Gas - 0.3% |

|||||

|

Anadarko Petroleum Corp. 7.2% 3/15/29 |

Baa1 |

|

6,970 |

6,508 |

|

|

Apache Corp.: |

|

|

|

|

|

|

7.625% 7/1/19 |

Baa1 |

|

1,535 |

1,504 |

|

|

7.7% 3/15/26 |

Baa1 |

|

1,500 |

1,476 |

|

|

Apache Finance Property Ltd. 6.5% 12/15/07 |

Baa1 |

|

2,600 |

2,414 |

|

|

Conoco, Inc. 5.9% 4/15/04 |

A3 |

|

2,300 |

2,204 |

|

|

YPF Sociedad Anonima: |

|

|

|

|

|

|

7.75% 8/27/07 |

B1 |

|

175 |

166 |

|

|

8% 2/15/04 |

B1 |

|

1,190 |

1,170 |

|

|

|

15,442 |

||||

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

FINANCE - 3.5% |

|||||

|

Banks - 1.5% |

|||||

|

ABN-Amro Bank NV, Chicago 6.625% 10/31/01 |

A1 |

|

$ 6,750 |

$ 6,678 |

|

|

Bank of Tokyo-Mitsubishi Ltd. 8.4% 4/15/10 |

A3 |

|

3,300 |

3,322 |

|

|

Bank One Corp. 7.875% 8/1/10 |

A1 |

|

12,500 |

12,453 |

|

|

BanPonce Financial Corp. 6.75% 8/9/01 |

A3 |

|

770 |

765 |

|

|

Barclays Bank PLC yankee 5.95% 7/15/01 |

A1 |

|

10,200 |

10,140 |

|

|

Capital One Bank 6.375% 2/15/03 |

Baa2 |

|

5,300 |

5,096 |

|

|

Commonwealth Bank of Australia 8.5% 6/1/10 |

Aa3 |

|

2,000 |

2,072 |

|

|

HSBC Finance Nederland BV 7.4% 4/15/03 (e) |

A1 |

|

750 |

748 |

|

|

Korea Development Bank: |

|

|

|

|

|

|

6.625% 11/21/03 |

Baa2 |

|

4,045 |

3,896 |

|

|

7.125% 4/22/04 |

Baa2 |

|

600 |

574 |

|

|

7.375% 9/17/04 |

Baa2 |

|

1,295 |

1,257 |

|

|

MBNA Corp.: |

|

|

|

|

|

|

6.34% 6/2/03 |

Baa2 |

|

1,800 |

1,718 |

|

|

6.875% 11/15/02 |

Baa2 |

|

8,350 |

8,249 |

|

|

Providian National Bank: |

|

|

|

|

|

|

6.25% 5/7/01 |

Baa3 |

|

2,345 |

2,313 |

|

|

6.75% 3/15/02 |

Baa3 |

|

905 |

886 |

|

|

Sanwa Finance Aruba AEC 8.35% 7/15/09 |

Baa1 |

|

14,100 |

14,020 |

|

|

Sumitomo Bank International Finance NV 8.5% 6/15/09 |

Baa1 |

|

1,500 |

1,528 |

|

|

Union Planters National Bank 6.81% 8/20/01 |

A3 |

|

4,000 |

3,982 |

|

|

Zions Bancorp 8.625% 10/15/02 |

A3 |

|

6,000 |

6,118 |

|

|

|

85,815 |

||||

|

Credit & Other Finance - 1.8% |

|||||

|

Associates Corp. of North America: |

|

|

|

|

|

|

6% 4/15/03 |

Aa3 |

|

5,550 |

5,358 |

|

|

6% 7/15/05 |

Aa3 |

|

10,000 |

9,347 |

|

|

Bellsouth Capital Funding Corp. 7.75% 2/15/10 |

Aa3 |

|

2,800 |

2,808 |

|

|

CIT Group, Inc. 5.5% 2/15/04 |

A1 |

|

2,000 |

1,859 |

|

|

Daimler-Chrysler NA Holding Corp. 6.59% 6/18/02 |

A1 |

|

1,250 |

1,237 |

|

|

ERP Operating LP: |

|

|

|

|

|

|

6.55% 11/15/01 |

A3 |

|

2,000 |

1,974 |

|

|

7.1% 6/23/04 |

A3 |

|

4,000 |

3,886 |

|

|

Finova Capital Corp.: |

|

|

|

|

|

|

6.12% 5/28/02 |

Baa2 |

|

5,000 |

4,500 |

|

|

7.25% 11/8/04 |

Baa2 |

|

2,200 |

1,881 |

|

|

First Security Capital I 8.41% 12/15/26 |

A3 |

|

3,490 |

3,276 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

FINANCE - continued |

|||||

|

Credit & Other Finance - continued |

|||||

|

Ford Motor Credit Co. 7.875% 6/15/10 |

A2 |

|

$ 5,490 |

$ 5,490 |

|

|

General Motors Acceptance Corp. 7.5% 7/15/05 |

A2 |

|

5,000 |

4,975 |

|

|

Household Finance Corp. 8% 5/9/05 |

A2 |

|

6,900 |

6,983 |

|

|

HSBC Capital Funding LP 10.176% 12/31/49 (d)(e) |

A1 |

|

2,825 |

3,063 |

|

|

Newcourt Credit Group, Inc. 6.875% 2/16/05 |

A1 |

|

8,265 |

7,882 |

|

|

Popular North America, Inc. 7.375% 9/15/01 |

A3 |

|

3,000 |

2,990 |

|

|

Sprint Capital Corp.: |

|

|

|

|

|

|

5.875% 5/1/04 |

Baa1 |

|

8,670 |

8,212 |

|

|

6.875% 11/15/28 |

Baa1 |

|

16,065 |

13,891 |

|

|

The Money Store, Inc. 7.3% 12/1/02 |

A2 |

|

3,850 |

3,823 |

|

|

Trizec Finance Ltd. yankee 10.875% 10/15/05 |

Baa3 |

|

2,270 |

2,281 |

|

|

TXU Eastern Funding 6.75% 5/15/09 |

Baa1 |

|

3,920 |

3,505 |

|

|

U.S. West Capital Funding, Inc. 6.875% 7/15/28 |

Baa1 |

|

4,835 |

4,195 |

|

|

|

103,416 |

||||

|

Insurance - 0.2% |

|||||

|

Executive Risk Capital Trust 8.675% 2/1/27 |

Baa3 |

|

10,000 |

9,756 |

|

|

Savings & Loans - 0.0% |

|||||

|

Long Island Savings Bank FSB 6.2% 4/2/01 |

Baa3 |

|

3,750 |

3,708 |

|

|

Securities Industry - 0.0% |

|||||

|

Amvescap PLC yankee 6.375% 5/15/03 |

A3 |

|

3,600 |

3,443 |

|

|

TOTAL FINANCE |

206,138 |

||||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 0.4% |

|||||

|

Tyco International Group SA: |

|

|

|

|

|

|

yankee 6.875% 1/15/29 |

Baa1 |

|

8,000 |

6,995 |

|

|

6.875% 9/5/02 |

Baa1 |

|

15,000 |

14,947 |

|

|

|

21,942 |

||||

|

MEDIA & LEISURE - 1.4% |

|||||

|

Broadcasting - 1.0% |

|||||

|

British Sky Broadcasting Group PLC 8.2% 7/15/09 |

Baa3 |

|

7,750 |

7,134 |

|

|

Clear Channel Communications, Inc.: |

|

|

|

|

|

|

6.875% 6/15/18 |

Baa3 |

|

10,000 |

8,835 |

|

|

7.25% 10/15/27 |

Baa3 |

|

2,000 |

1,800 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

MEDIA & LEISURE - continued |

|||||

|

Broadcasting - continued |

|||||

|

Continental Cablevision, Inc. 8.3% 5/15/06 |

A2 |

|

$ 2,485 |

$ 2,553 |

|

|

Nielsen Media Research, Inc. 7.6% 6/15/09 |

A3 |

|

3,495 |

3,335 |

|

|

Shaw Communications, Inc. 8.25% 4/11/10 |

Baa2 |

|

3,120 |

3,152 |

|

|

TCI Communications, Inc.: |

|

|

|

|

|

|

8.75% 8/1/15 |

A2 |

|

4,120 |

4,380 |

|

|

9.8% 2/1/12 |

A2 |

|

6,290 |

7,109 |

|

|

TCI Communications Financing III 9.65% 3/31/27 |

A3 |

|

4,100 |

4,583 |

|

|

Time Warner, Inc. 6.85% 1/15/26 |

Baa3 |

|

10,000 |

9,731 |

|

|

USA Networks, Inc./USANi LLC 6.75% 11/15/05 |

Baa3 |

|

3,760 |

3,615 |

|

|

|

56,227 |

||||

|

Entertainment - 0.1% |

|||||

|

Viacom, Inc. 7.75% 6/1/05 |

Baa1 |

|

5,300 |

5,338 |

|

|

Publishing - 0.3% |

|||||

|

News America Holdings, Inc. 8% 10/17/16 |

Baa3 |

|

13,000 |

12,631 |

|

|

News America, Inc. 7.125% 4/8/28 |

Baa3 |

|

1,800 |

1,551 |

|

|

Time Warner Entertainment Co. LP 8.375% 7/15/33 |

Baa2 |

|

6,500 |

6,689 |

|

|

|

20,871 |

||||

|

TOTAL MEDIA & LEISURE |

82,436 |

||||

|

NONDURABLES - 0.3% |

|||||

|

Beverages - 0.1% |

|||||

|

Seagram JE & Sons, Inc.: |

|

|

|

|

|

|

6.625% 12/15/05 |

Baa3 |

|

1,555 |

1,492 |

|

|

6.8% 12/15/08 |

Baa3 |

|

4,590 |

4,321 |

|

|

|

5,813 |

||||

|

Foods - 0.1% |

|||||

|

ConAgra, Inc. 7.125% 10/1/26 |

Baa1 |

|

5,000 |

4,741 |

|

|

Tobacco - 0.1% |

|||||

|

RJ Reynolds Tobacco Holdings, Inc. 7.375% 5/15/03 |

Baa2 |

|

5,100 |

4,774 |

|

|

TOTAL NONDURABLES |

15,328 |

||||

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

RETAIL & WHOLESALE - 0.2% |

|||||

|

Drug Stores - 0.1% |

|||||

|

Rite Aid Corp.: |

|

|

|

|

|

|

6.5% 12/15/05 (e) |

Caa1 |

|

$ 6,910 |

$ 2,971 |

|

|

7.125% 1/15/07 |

Caa1 |

|

2,465 |

1,035 |

|

|

|

4,006 |

||||

|

General Merchandise Stores - 0.1% |

|||||

|

Federated Department Stores, Inc.: |

|

|

|

|

|

|

6.79% 7/15/27 |

Baa1 |

|

6,000 |

5,716 |

|

|

8.5% 6/15/03 |

Baa1 |

|

2,275 |

2,276 |

|

|

|

7,992 |

||||

|

TOTAL RETAIL & WHOLESALE |

11,998 |

||||

|

TECHNOLOGY - 0.4% |

|||||

|

Computers & Office Equipment - 0.4% |

|||||

|

Comdisco, Inc.: |

|

|

|

|

|

|

5.95% 4/30/02 |

Baa1 |

|

6,000 |

5,703 |

|

|

6.375% 11/30/01 |

Baa1 |

|

12,000 |

11,624 |

|

|

7.25% 9/1/02 |

Baa1 |

|

6,360 |

6,159 |

|

|

|

23,486 |

||||

|

TRANSPORTATION - 0.6% |

|||||

|

Air Transportation - 0.1% |

|||||

|

Continental Airlines, Inc. pass thru trust certificates: |

|

|

|

|

|

|

7.434% 3/15/06 |

Baa1 |

|

1,615 |

1,570 |

|

|

7.73% 9/15/12 |

Baa1 |

|

659 |

633 |

|

|

Delta Air Lines, Inc.: |

|

|

|

|

|

|

equipment trust certificate 8.54% 1/2/07 |

Baa1 |

|

734 |

702 |

|

|

9.875% 4/30/08 |

Baa1 |

|

4,265 |

4,260 |

|

|

|

7,165 |

||||

|

Railroads - 0.5% |

|||||

|

Burlington Northern Santa Fe Corp.: |

|

|

|

|

|

|

6.53% 7/15/37 |

Baa2 |

|

12,000 |

11,650 |

|

|

6.875% 12/1/27 |

Baa2 |

|

5,000 |

4,369 |

|

|

Norfolk Southern Corp. 7.05% 5/1/37 |

Baa1 |

|

8,820 |

8,640 |

|

|

Union Pacific Corp. 7.125% 2/1/28 |

Baa3 |

|

4,000 |

3,605 |

|

|

|

28,264 |

||||

|

TOTAL TRANSPORTATION |

35,429 |

||||

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

UTILITIES - 2.5% |

|||||

|

Electric Utility - 1.0% |

|||||

|

Avon Energy Partners Holdings: |

|

|

|

|

|

|

6.46% 3/4/08 (e) |

Baa2 |

|

$ 6,800 |

$ 6,057 |

|

|

7.05% 12/11/07 (e) |

Baa2 |

|

20,000 |

18,499 |

|

|

Dominion Resources, Inc.: |

|

|

|

|

|

|

7.6% 7/15/03 |

Baa1 |

|

3,450 |

3,456 |

|

|

8.125% 6/15/10 |

Baa1 |

|

3,680 |

3,750 |

|

|

DR Investments UK PLC yankee 7.1% 5/15/02 (e) |

A2 |

|

7,500 |

7,436 |

|

|

Illinois Power Co. 7.5% 6/15/09 |

Baa1 |

|

3,330 |

3,217 |

|

|

Israel Electric Corp. Ltd.: |

|

|

|

|

|

|

7.75% 12/15/27 (e) |

A3 |

|

10,795 |

9,566 |

|

|

yankee 7.25% 12/15/06 (e) |

A3 |

|

3,000 |

2,905 |

|

|

Niagara Mohawk Power Corp. 8.875% 5/15/07 |

Baa3 |

|

1,660 |

1,722 |

|

|

Texas Utilities Co. 6.375% 1/1/08 |

Baa3 |

|

4,135 |

3,724 |

|

|

|

60,332 |

||||

|

Gas - 0.3% |

|||||

|

CMS Panhandle Holding Co.: |

|

|

|

|

|

|

6.125% 3/15/04 |

Baa3 |

|

3,500 |

3,318 |

|

|

7% 7/15/29 |

Baa3 |

|

2,650 |

2,259 |

|

|

Reliant Energy Resources Corp. 8.125% 7/15/05 (e) |

Baa1 |

|

4,000 |

4,008 |

|

|

Southwest Gas Corp. 9.75% 6/15/02 |

Baa2 |

|

8,700 |

8,972 |

|

|

|

18,557 |

||||

|

Telephone Services - 1.2% |

|||||

|

Cable & Wireless Optus Ltd.: |

|

|

|

|

|

|

8% 6/22/10 (e) |

Baa1 |

|

6,500 |

6,527 |

|

|

8.125% 6/15/09 (e) |

Baa1 |

|

5,000 |

5,042 |

|

|

Deutsche Telekom International Finance BV: |

|

|

|

|

|

|

8% 6/15/10 |

Aa2 |

|

7,800 |

7,841 |

|

|

8.25% 6/15/30 |

Aa2 |

|

13,130 |

13,320 |

|

|

Telecomunicaciones de Puerto Rico, Inc. 6.65% 5/15/06 |

Baa2 |

|

5,020 |

4,699 |

|

|

Teleglobe Canada, Inc.: |

|

|

|

|

|

|

7.2% 7/20/09 |

Baa1 |

|

10,070 |

9,620 |

|

|

7.7% 7/20/29 |

Baa1 |

|

11,392 |

10,756 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

UTILITIES - continued |

|||||

|

Telephone Services - continued |

|||||

|

WorldCom, Inc.: |

|

|

|

|

|

|

7.75% 4/1/07 |

A3 |

|

$ 1,350 |

$ 1,359 |

|

|

8.875% 1/15/06 |

A3 |

|

9,592 |

9,894 |

|

|

|

69,058 |

||||

|

TOTAL UTILITIES |

147,947 |

||||

|

TOTAL NONCONVERTIBLE BONDS (Cost $641,147) |

613,013 |

||||

|

U.S. Government and Government Agency Obligations - 11.4% |

|||||

|

|

|||||

|

U.S. Government Agency Obligations - 3.0% |

|||||

|

Fannie Mae: |

|

|

|

|

|

|

5.25% 1/15/09 |

Aaa |

|

9,850 |

8,674 |

|

|

6.5% 4/29/09 |

Aaa |

|

86,000 |

80,370 |

|

|

7% 7/15/05 |

Aaa |

|

15,320 |

15,332 |

|

|

7.25% 5/15/30 |

Aaa |

|

9,735 |

9,998 |

|

|

Federal Agricultural Mortgage Corp.: |

|

|

|

|

|

|

7.01% 2/10/05 |

Aaa |

|

1,530 |

1,529 |

|

|

7.04% 8/10/05 |

Aaa |

|

2,400 |

2,398 |

|

|

Financing Corp. - coupon STRIPS 0% 3/26/04 |

Aaa |

|

4,574 |

3,511 |

|

|

Freddie Mac: |

|

|

|

|

|

|

5.75% 3/15/09 |

Aaa |

|

12,000 |

10,920 |

|

|

6.25% 7/15/04 |

Aaa |

|

10,930 |

10,650 |

|

|

6.45% 4/29/09 |

Aaa |

|

12,000 |

11,188 |

|

|

6.875% 1/15/05 |

Aaa |

|

4,880 |

4,856 |

|

|

7% 7/15/05 |

Aaa |

|

6,800 |

6,802 |

|

|

Government Trust Certificates (assets of Trust guaranteed by U.S. Government through Defense Security Assistance Agency): |

|

|

|

|

|

|

Class 1-C, 9.25% 11/15/01 |

Aaa |

|

2,918 |

2,970 |

|

|

Class 3-T, 9.625% 5/15/02 |

Aaa |

|

555 |

564 |

|

|

Private Export Funding Corp. secured 6.86% 4/30/04 |

Aaa |

|

964 |

958 |

|

|

Tennessee Valley Authority 7.125% 5/1/30 |

Aaa |

|

2,065 |

2,074 |

|

|

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS |

172,794 |

||||

|

U.S. Government and Government Agency Obligations - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

U.S. Treasury Obligations - 8.4% |

|||||

|

U.S. Treasury Bonds: |

|

|

|

|

|

|

6.125% 8/15/29 |

Aaa |

|

$ 37,370 |

$ 38,462 |

|

|

8.75% 5/15/17 |

Aaa |

|

7,665 |

9,738 |

|

|

8.875% 8/15/17 |

Aaa |

|

83,420 |

107,260 |

|

|

9.875% 11/15/15 |

Aaa |

|

9,860 |

13,464 |

|

|

14% 11/15/11 |

Aaa |

|

30,720 |

42,619 |

|

|

U.S. Treasury Notes: |

|

|

|

|

|

|

5.5% 2/15/08 |

Aaa |

|

23,610 |

22,677 |

|

|

5.625% 9/30/01 |

Aaa |

|

2,340 |

2,318 |

|

|

5.875% 10/31/01 |

Aaa |

|

68,800 |

68,327 |

|

|

6.5% 5/31/02 |

Aaa |

|

108,910 |

109,149 |

|

|

6.625% 6/30/01 |

Aaa |

|

5,000 |

5,008 |

|

|

7% 7/15/06 |

Aaa |

|

36,000 |

37,395 |

|

|

7.5% 11/15/01 |

Aaa |

|

8,510 |

8,618 |

|

|

U.S. Treasury Notes - coupon STRIPS 0% 11/15/11 |

Aaa |

|

54,800 |

27,477 |

|

|

TOTAL U.S. TREASURY OBLIGATIONS |

492,512 |

||||

|

TOTAL U.S. GOVERNMENT AND GOVERNMENT (Cost $663,230) |

665,306 |

||||

|

U.S. Government Agency - Mortgage Securities - 15.1% |

|||||

|

|

|||||

|

Fannie Mae - 12.3% |

|||||

|

5.5% 11/1/08 to 3/1/14 |

Aaa |

|

13,051 |

12,258 |

|

|

6% 1/1/12 to 1/1/29 |

Aaa |

|

53,329 |

49,071 |

|

|

6.5% 7/1/08 to 8/1/30 |

Aaa |

|

244,324 |

231,163 |

|

|

6.5% 8/1/30 (h) |

Aaa |

|

65,000 |

61,384 |

|

|

7% 12/1/08 to 4/1/30 |

Aaa |

|

88,458 |

85,683 |

|

|

7.5% 6/1/07 to 7/1/30 |

Aaa |

|

179,765 |

177,289 |

|

|

8% 9/1/17 to 8/1/30 |

Aaa |

|

95,844 |

96,138 |

|

|

TOTAL FANNIE MAE |

712,986 |

||||

|

Government National Mortgage Association - 2.8% |

|||||

|

6.5% 3/15/26 to 4/15/29 (i) |

Aaa |

|

66,043 |

62,627 |

|

|

7% 8/15/25 to 12/15/28 |

Aaa |

|

78,005 |

75,823 |

|

|

7.5% 1/15/26 to 9/15/28 |

Aaa |

|

23,366 |

23,165 |

|

|

8% 1/15/17 to 8/15/25 |

Aaa |

|

824 |

832 |

|

|

U.S. Government Agency - Mortgage Securities - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

Government National Mortgage Association - continued |

|||||

|

9% 11/15/14 to 1/15/23 |

Aaa |

|

$ 358 |

$ 371 |

|

|

9.5% 11/15/20 to 3/15/23 |

Aaa |

|

209 |

219 |

|

|

TOTAL GOVERNMENT NATIONAL MORTGAGE ASSOCIATION |

163,037 |

||||

|

TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $899,407) |

876,023 |

||||

|

Asset-Backed Securities - 0.7% |

|||||

|

|

|||||

|

American Express Credit Account Master Trust 6.1% 12/15/06 |

A1 |

|

4,200 |

4,021 |

|

|

Capita Equipment Receivables Trust 6.48% 10/15/06 |

Baa2 |

|

4,680 |

4,537 |

|

|

Discover Card Master Trust I 5.85% 11/16/04 |

A2 |

|

5,000 |

4,859 |

|

|

Ford Credit Auto Owner Trust: |

|

|

|

|

|

|

6.2% 12/15/02 |

Aa2 |

|

3,850 |

3,803 |

|

|

6.4% 12/15/02 |

Aa2 |

|

2,360 |

2,329 |

|

|

7.03% 11/15/03 |

Aaa |

|

1,119 |

1,119 |

|

|

Key Auto Finance Trust: |

|

|

|

|

|

|

6.3% 10/15/03 |

A2 |

|

1,405 |

1,395 |

|

|

6.65% 10/15/03 |

Baa3 |

|

412 |

411 |

|

|

Premier Auto Trust 5.59% 2/9/04 |

Aaa |

|

15,000 |

14,578 |

|

|

Sears Credit Account Master Trust II 7.5% 11/15/07 |

A2 |

|

6,100 |

6,096 |

|

|

TOTAL ASSET-BACKED SECURITIES (Cost $44,046) |

43,148 |

||||

|

Collateralized Mortgage Obligations - 0.1% |

|||||

|

|

|||||

|

U.S. Government Agency - 0.1% |

|||||

|

Freddie Mac planned amortization class |

Aaa |

|

4,100 |

3,825 |

|

|

Commercial Mortgage Securities - 1.3% |

|||||

|

|

|||||

|

CS First Boston Mortgage Securities Corp.: |

|

|

|

|

|

|

Series 1997-C2 Class D, 7.27% 1/17/35 |

Baa2 |

|

5,790 |

5,354 |

|

|

Series 1998-FL1: |

|

|

|

|

|

|

Class D, 7.145% 12/10/00 (e)(f) |

A2 |

|

6,100 |

6,103 |

|

|

Commercial Mortgage Securities - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount (000s) |

Value (Note 1) (000s) |

|||

|

CS First Boston Mortgage Securities Corp.: - continued |

|

|

|

|

|

|

Class E, 7.495% 1/10/13 (e)(f) |

Baa2 |

|

$ 12,180 |

$ 12,158 |

|

|

Series 2000-C1 Class A2, 7.545% 4/15/62 |

AAA |

|

5,000 |

5,020 |

|

|

Equitable Life Assurance Society of the |

|

|

|

|

|

|

Class B1, 7.33% 5/15/06 (e) |

Aa2 |

|

4,000 |

3,938 |

|

|

Class C1, 7.52% 5/15/06 (e) |

A2 |

|

4,000 |

3,938 |

|

|

GS Mortgage Securities Corp. II Series 1998-GLII Class E, 6.9698% 4/13/31 (e)(f) |

Baa3 |

|

5,000 |

4,447 |

|

|

Nomura Asset Securities Corp. Series 1998-D6: |

|

|

|

|

|

|

Class A1C, 6.69% 3/17/28 |

Aaa |

|

10,000 |

9,314 |

|

|

Class A4, 7.3615% 3/17/28 (f) |

Baa2 |

|

20,000 |

18,291 |

|

|

Thirteen Affiliates of General Growth Properties, Inc. sequential pay Series 1 Class A2, 6.602% 12/15/10 (e) |

Aaa |

|

8,000 |

7,560 |

|

|

TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $79,070) |

76,123 |

||||

|

Foreign Government and Government Agency Obligations (g) - 0.4% |

|||||

|

|

|||||

|

Korean Republic yankee: |

|

|

|

|

|

|

8.75% 4/15/03 |

Baa2 |

|

1,900 |

1,936 |

|

|

8.875% 4/15/08 |

Baa2 |

|

2,946 |

3,035 |

|

|

Quebec Province yankee: |

|

|

|

|

|

|

7.125% 2/9/24 |

A2 |

|

680 |

649 |

|

|

7.5% 7/15/23 |

A2 |

|

2,880 |

2,870 |

|

|

United Mexican States: |

|

|

|

|

|

|

global 8.5% 2/1/06 |

Baa3 |

|

8,600 |

8,572 |

|

|

9.875% 2/1/10 |

Baa3 |

|

5,000 |

5,260 |

|

|

TOTAL FOREIGN GOVERNMENT AND (Cost $22,969) |

22,322 |

||||

|

Supranational Obligations - 0.1% |

|||||

|

|

|||||

|

Inter-American Development Bank yankee 6.29%

7/16/27 |

Aaa |

|

3,000 |

2,872 |

|

|

Cash Equivalents - 5.4% |

|||

|

Shares |

Value (Note 1) |

||

|

Fidelity Cash Central Fund, 6.57% (c) |

305,453,245 |

$ 305,453 |

|

|

Fidelity Securities Lending Cash Central Fund, 6.65% (c) |

6,489,200 |

6,489 |

|

|

TOTAL CASH EQUIVALENTS (Cost $311,942) |

311,942 |

||

|

TOTAL INVESTMENT PORTFOLIO - 101.0% (Cost $5,503,376) |

5,870,435 |

||

|

NET OTHER ASSETS - (1.0)% |

(56,346) |

||

|

NET ASSETS - 100% |

$ 5,814,089 |

||

|

Legend |

|

(a) Non-income producing |

|

(b) S&P ® credit ratings are used in the absence of a rating by Moody's Investors Service, Inc. |

|

(c) The rate quoted is the annualized seven-day yield of the fund at |

|

(d) Debt obligation initially issued at one coupon which converts to a higher coupon at a specified date. The rate shown is the rate at period end. |

|

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the period end, the value of these securities amounted to $113,796,000 or 2.0% of net assets. |

|

(f) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

|

(g) For foreign government obligations not individually rated by S&P or Moody's, the ratings listed have been assigned |

|

(h) Security purchased on a delayed delivery or when-issued basis. |

|

(i) Security is subject to a forward commitment to sell. |

|

Other Information |

|

The composition of long-term debt holdings as a percentage of total value of investments in securities, is as follows (ratings are unaudited): |

|

Moody's Ratings |

S&P Ratings |

|||

|

Aaa, Aa, A |

30.9% |

|

AAA, AA, A |

28.0% |

|

Baa |

8.2% |

|

BBB |

7.3% |

|

Ba |

0.0% |

|

BB |

0.4% |

|

B |

0.0% |

|

B |

0.1% |

|

Caa |

0.1% |

|

CCC |

0.0% |

|

Ca, C |

0.0% |

|

CC, C |

0.0% |

|

|

|

|

D |

0.0% |

|

Income Tax Information |

|

At July 31, 2000, the aggregate cost of investment securities for income tax purposes was $5,515,877,000. Net unrealized appreciation aggregated $354,558,000, of which $623,135,000 related to appreciated investment securities and $268,577,000 related to depreciated investment securities. |

|

The fund hereby designates approximately $351,419,000 as a capital gain dividend for the purpose of the dividend paid deduction. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

|

Amounts in thousands (except per-share amount) |

July 31, 2000 |

|

|

Assets |

|

|

|

Investment in securities, at value (cost $5,503,376) - |

|

$ 5,870,435 |

|

Commitment to sell securities on a delayed delivery basis |

$ (61,628) |

|

|

Receivable for securities sold on a delayed delivery basis |

61,851 |

223 |

|

Receivable for investments sold, regular delivery |

|

66,113 |

|

Cash |

|

36 |

|

Receivable for fund shares sold |

|

3,583 |

|

Dividends receivable |

|

2,604 |

|

Interest receivable |

|

27,915 |

|

Other receivables |

|

90 |

|

Total assets |

|

5,970,999 |

|

Liabilities |

|

|

|

Payable for investments purchased |

77,626 |

|

|

Delayed delivery |

61,682 |

|

|

Payable for fund shares redeemed |

7,962 |

|

|

Accrued management fee |

2,088 |

|

|

Other payables and accrued expenses |

1,063 |

|

|

Collateral on securities loaned, at value |

6,489 |

|

|

Total liabilities |

|

156,910 |

|

Net Assets |

|

$ 5,814,089 |

|