|

|

|

|

|

Previous: NATIONAL MANUFACTURING TECHNOLOGIES, DEF 14A, 2000-11-21 |

Next: TUTOGEN MEDICAL INC, SC 13D/A, 2000-11-21 |

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

| Check the appropriate box: |

||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-12 |

|

| ANGEION CORPORATION |

||||

(Name of Registrant as Specified In Its Charter) |

||||

| N/A |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

|

ANGEION CORPORATION

350 Oak Grove Parkway

Saint Paul, Minnesota 55127-8599

(651) 484-4874

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Wednesday, December 13, 2000

Notice is hereby given that the Annual Meeting of Shareholders of Angeion Corporation (the "Company") will be held at Angeion's offices at 350 Oak Grove Parkway, Saint Paul, Minnesota 55127-8599, on Wednesday, December 13, 2000 at 3:30 p.m. local time, for the following purposes:

Shareholders of record at the close of business on November 10, 2000 will be entitled to notice of and to vote at the Annual Meeting. Accompanying this Notice is a Proxy Statement, Form of Proxy and the Company's Annual Report to Shareholders for the year ended December 31, 1999.

Since a majority of the outstanding shares of the Company's Common Stock must be represented either in person or by proxy to constitute a quorum for the conduct of business, please sign, date and return the enclosed proxy card promptly.

By

Order of the Board of Directors,

Richard

E. Jahnke

Director, President and Chief Executive Officer

Saint

Paul, Minnesota

November 17, 2000

PLEASE REMEMBER TO SIGN AND RETURN YOUR PROXY.

ANGEION CORPORATION

350 Oak Grove Parkway

St. Paul, Minnesota 55127-8599

PROXY STATEMENT

The Board of Directors of Angeion Corporation (the "Company") is soliciting your proxy for use at the 2000 Annual Meeting of Shareholders to be held on Wednesday, December 13, 2000, or any adjournment(s). This Proxy Statement and the enclosed form of proxy will be mailed to shareholders commencing on or about November 21, 2000.

Voting

Each share of the Company's Common Stock is entitled to one vote. You may vote your shares in person by attending the Annual Meeting or you may vote by proxy. If you vote by proxy, you must sign, date and return the enclosed proxy card in the envelope provided, or follow the instructions on the proxy card to vote by telephone or the Internet.

If you sign and return the proxy card on time, the individuals named on the proxy card will vote your shares as you have directed. If you do not specify on your proxy card how you want your shares voted, the individuals named on the enclosed proxy card will vote your shares:

Quorum and Vote Requirements

The total number of shares outstanding as of November 10, 2000 and entitled to vote at the meeting consisted of 3,465,725 shares of Common Stock, $.01 par value. Each share of Common Stock is entitled to one vote. Only shareholders of record at the close of business on November 10, 2000 will be entitled to vote at the Annual Meeting. A quorum, consisting of a majority of the shares of Common Stock entitled to vote at the Annual Meeting, must be present in person or by proxy before action may be taken at the Annual Meeting. If an executed proxy is returned and the shareholder has abstained from voting on any matter, the shares represented by such proxy will be considered present at the meeting for purposes of determining a quorum and for purposes of calculating the vote, but will not be considered to have been voted in favor of such matter. If an executed proxy is returned by a broker holding shares in "street name" indicating that the broker does not have discretionary authority as to certain shares to vote on one or more matters, such shares will be considered present at the meeting for purposes of determining a quorum, but will not be considered to be represented at the meeting for purposes of calculating the vote with respect to such matters.

Each of the proposals presented at the Annual Meeting will be approved if a majority of the shares of Common Stock present in person or represented by proxy vote for the proposal. Broker nonvotes are not counted as votes for or against a proposal.

1

Revoking A Proxy

If you give a proxy and later wish to revoke it before it is voted, you may do so by (1) sending a written notice to that effect to the Secretary of the Company at the address indicated in this Proxy Statement, (2) submitting a properly signed proxy with a later date, or (3) voting in person at the Annual Meeting. Otherwise, your shares will be voted as indicated on your proxy.

STOCK OWNERSHIP OF PRINCIPAL

SHAREHOLDERS AND MANAGEMENT

The following table shows the amount of Common Stock beneficially owned, as of November 10, 2000, by (1) shareholders known by the Company to hold more than 5% of the Common Stock of the Company, (2) each director and executive officer of the Company, and (3) all current directors and executive officers of the Company as a group. Unless otherwise indicated, the persons listed below have sole voting and investment power with respect to the shares and may be reached at the Company's address.

| Name and Address of Beneficial Owner |

Shares of Common Stock(1) |

Shares Acquirable Within 60 days |

Total |

Percentage |

|||||

|---|---|---|---|---|---|---|---|---|---|

| Arnold A. Angeloni | 28,788 | 8,300 | 37,088 | 1.1 | % | ||||

| Dennis E. Evans(2) | 30,895 | 8,300 | 39,195 | 1.1 | % | ||||

| James B. Hickey, Jr. | 16,538 | 3,000 | 19,538 | * | |||||

| Richard E. Jahnke | 20,200 | 50,000 | 70,200 | 2.0 | % | ||||

| Dale H. Johnson | 0 | 3,000 | 3,000 | * | |||||

| John C. Penn | 11,538 | 3,000 | 14,538 | * | |||||

| Mark W. Sheffert | 11,538 | 3,000 | 14,538 | * | |||||

| Glen Taylor | 64,207 | 8,300 | 72,507 | 2.1 | % | ||||

| All executive officers and directors as a group (8 persons) | 183,704 | 86,900 | 270,604 | 7.6 | % |

2

PROPOSAL 1: ELECTION OF DIRECTORS

The Company's Bylaws, as amended, provide that the Board of Directors shall consist of the number of members last elected by a majority vote of the Shareholders or by the Board of Directors, which number shall be not less than two nor more than nine. There are currently seven Directors and the Board of Directors has determined that there will be seven directors elected at the Annual Meeting. Directors elected at the Annual Meeting will hold office until the next regular meeting of Shareholders or until their successors are duly elected and qualified. Vacancies on the Board of Directors and newly created directorships can be filled by vote of a majority of the directors then in office.

It is intended that proxies will be voted for the named nominees. Unless otherwise indicated, each nominee has been engaged in his present occupation as set forth below, or has been an officer with the organization indicated, for more than five years. The names and biographical information concerning the nominees are set forth below, based upon information furnished to the Company by the nominees. The nominees listed below have consented to serve if elected. If the nominee is unable to serve for any reason, the persons named on the enclosed proxy card may vote for a substitute nominee proposed by the Board, or the Board may reduce the number of directors to be elected.

Nominees for Election to the Board of Directors

Arnold A. Angeloni, 57, has been President of Gateway Alliance LLC, a consulting firm for start-up ventures and business consolidations, since January 1996. From 1961 to 1995, Mr. Angeloni was employed by Deluxe Corporation, a provider of check products and services to the financial payments industry, in various administrative, marketing, and operations positions, most recently as Senior Vice President and President of the Business Systems Division.

Dennis E. Evans, 61, has been President and Chief Executive Officer of Hanrow Financial Group Ltd., a merchant banking partnership, since February 1989. Mr. Evans also serves on the board of directors of Minnesota Power & Light Co.

James B. Hickey, Jr., 46, was President and Chief Executive Officer of the Company from July 1998 to December 1999. From 1993 to 1997, Mr. Hickey was President and Chief Executive Officer of Aequitron Medical, Inc., a publicly-traded medical device company, whose principle products were portable ventilators, infant apnea monitors and sleep diagnostic equipment. He also serves on the board of directors of Allied Healthcare, Inc., Pulmonetics Systems, Inc. and Vital Images, Inc.

Richard E. Jahnke, 51, has served as the Company's President and Chief Executive Officer since January 2000. Since August 1998, Mr. Jahnke has also served as the President and Chief Executive Officer of Medical Graphics. From 1993 to March 1998, Mr. Jahnke served as President and Chief Operating Officer of CNS, Inc., a consumer health care products company. From 1991 to 1993, he was Executive Vice President and Chief Operating Officer of Lemna Corporation, which manufacturers and sells waste water treatment systems. From 1986 to 1991, Mr. Jahnke was general manager of the government operations division of ADC Telecommunications, an electronic communications systems manufacturer. From 1982 to 1986, he was Director of Marketing and Business and Technical Development at BMC Industries, Inc. From 1972 to 1982, he held various positions of increasing responsibility in engineering, sales and marketing management at 3M Company. Mr. Jahnke is also a director of Rehabilicare, Inc.

John C. Penn, 59, has served as Vice Chairman and Chief Operating Officer of Satellite Industries, Inc., a manufacturer of portable restroom facilities and also of Satellite Shelters, Inc., a distributor of relocatable buildings, since March 1998. From 1990 to March 1998, Mr. Penn served as President and Chief Executive Officer of CDI Management Corp. From 1988 to 1990, he served as President and Chief Executive Officer of Benson Optical Company. During the previous 26 years, he

3

served in various senior operations capacities for various companies. Mr. Penn serves and has served on the Board of Directors of several privately held corporations. He also served as a director of Medical Graphics from December 1996 to December 1999.

Mark W. Sheffert, 51, has over 25 years of financial and financial services experience. He is the founder of Manchester Companies, Inc. ("MCI") whose business is investment banking, management consulting, corporate renewal and commercial finance. Before founding MCI in December 1994, Mr. Sheffert was a senior executive with First Bank System (now US Bancorp) for over eight years where he served in various high-level management capacities and was eventually named one of two Presidents of First Bank System. Before joining First Bank System, Mr. Sheffert was Chief Operating Officer and Director of North Central Life Insurance Company. Mr. Sheffert serves on the Board of Directors of LifeRate Systems, Inc. and Fourth Shift, Inc. Mr. Sheffert also served as a director of Medical Graphics from 1997 to December 1999.

Glen Taylor, 58, is Chairman of the Board and Chief Executive Officer of Taylor Corporation, which he founded in 1975. Taylor Corporation's businesses include printing, direct mail marketing and electrical manufacturing. Mr. Taylor is also the owner of the Minnesota Timberwolves, a National Basketball Association franchise.

Vote Required

The election of the nominees requires the affirmative vote of the holders of a majority of the shares of Common Stock present and voting on this matter.

OTHER INFORMATION REGARDING THE BOARD OF DIRECTORS

Director Compensation

Directors of the Company receive no cash compensation (except as discussed below) for their services as members of the Board of Directors, although their out-of-pocket expenses incurred on behalf of the Company are reimbursed.

Pursuant to the Company's 1994 Non-Employee Director Plan ("1994 Director Plan"), non-employee directors of the Company automatically receive an annual grant of shares of Common Stock equal to $24,000, as determined by the fair market value of one share of Common Stock on the date of grant (a "Director Stock Award"), and an annual grant of an option to purchase 3,000 shares of Common Stock (a "Director Option") on the date of each Annual Meeting of Shareholders upon their election or re-election, as the case may be, as a non-employee director of the Company. Under the 1994 Director Plan, if no Annual Meeting has been scheduled by May 31 of any year, then a Director Stock Award and Director Option shall be granted to the Directors as of May 31 of such year. Pursuant to this provision, each of the Company's six non-employee directors was issued 11,538 shares of Common Stock on May 31, 2000 and an option to purchase 3,000 shares of Common Stock at an exercise price of $2.08 per share. On November 8, 2000 the Board of Directors amended the 1994 Director Plan to increase the maximum number of shares to Common Stock available for issuance under the 1994 Director Plan from 250,000 shares to 350,000 shares.

Meetings and Committees of the Board of Directors

The business and affairs of the Company are managed by the Board of Directors, which met 18 times and took written action in lieu of meetings 2 times during 1999. The Board currently has an Audit Committee and a Compensation Committee. The Audit Committee and the Compensation Committee did not meet during 1999, but conducted business during the 18 meetings of the Board. Other than Mr. Taylor, who attended eleven meetings, each incumbent director attended at least 75%

4

of the total number of Board meetings and all of the committee meetings on which he served during 1999.

The function of the Audit Committee is to review the Company's financial statements, oversee the financial reporting and disclosures prepared by management, make recommendations regarding the Company's financial controls, and confer with the Company's outside auditors. Messrs. Evans (chair), Angeloni and Penn currently serve as members of the Audit Committee.

The responsibilities of the Compensation Committee include setting the compensation for those officers who are also directors of the Company and setting the terms of and grants of awards under the Company's 1993 Stock Incentive Plan (the "1993 Plan"). Messrs. Hickey (chair), Sheffert and Angeloni currently serve as members of the Compensation Committee.

MANAGEMENT RECOMMENDS A VOTE "FOR"

THE ELECTION OF THE NOMINEES

5

Summary Compensation Table

The following table sets forth the cash and non-cash compensation for the years ended December 31, 1999, December 31, 1998 and for the five month transition period ended December 31, 1997 earned by, or awarded to, James B. Hickey, Jr. who served as the Chief Executive Officer of the Company in the year ended December 31, 1999 and by the only other executive officers of the Company that received aggregate cash compensation of $100,000 or more with respect to 1999 (the "Named Executive Officers").

| |

|

|

|

Long Term Compensation |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Annual Compensation |

|

|||||||||||||

| |

Restricted Stock Award |

Securities Underlying Options |

All Other Compensation(1) |

||||||||||||

| Name and Principal Position |

Year |

Salary |

Bonus |

||||||||||||

| James B. Hickey, Jr.(2) President and Chief Executive Officer |

1999 1998 1997 |

$ |

260,000 105,000 — |

— — — |

— — — |

100,000 — |

$ |

9,000 3,750 — |

|||||||

| William J. Rissmann(3) Vice President of Product Development |

|

1999 1998 TP97 1997 |

|

|

70,807 137,052 46,162 107,056 |

|

37,750 8,750 — — |

|

— — — — |

|

— — — — |

|

|

74,000 6,000 2,500 — |

(4) |

| Terrence W. Bunge(5) Vice President of Interventional Technology |

|

1999 1998 TP97 1997 |

|

|

82,642 113,327 —(6) —(6) |

|

75,250 66,013 — — |

|

— — 3,333 |

|

— — — |

|

|

78,000 6,000 2,500 — |

(7) |

Option Grants In Fiscal Year 1999

There were no options granted by the Company to the Named Executive Officers in fiscal 1999.

6

Aggregated Option Exercises in Last Year and Year-End Option Values

The following table summarizes stock option exercises during the fiscal year ended December 31, 1999 and the total number of options held at the end of 1999 by the Named Executive Officers.

| |

Number of Securities Underlying Unexercised Options at December 31, 1999 |

Value of Unexercised In-the-Money Options at December 31, 1999(1) |

||||||

|---|---|---|---|---|---|---|---|---|

| |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

||||

| James B. Hickey, Jr. | 25,000 | 75,000 | — | — | ||||

| William J. Rissmann | 0 | 0 | — | — | ||||

| Terrence W. Bunge | 0 | 0 | — | — | ||||

Employment Agreements

In December 1999 the Company entered into a written employment agreement with Mr. Richard E. Jahnke under which Mr. Jahnke agreed to serve as President and Chief Executive Officer of the Company. In exchange for his service, Mr. Jahnke will receive a salary of $265,000, a cash bonus of up to 35% of his annual salary based upon a bonus plan established by the Board of Directors, as well as an automobile reimbursement of up to $600 per month. Mr. Jahnke was also elected as a member of the Board of Directors in January 2000 and receives no additional compensation for this service. The agreement will terminate upon 30 days written notice by either party, upon notice by the Company of termination "for cause" or upon the event of Mr. Jahnke's death or disability. The agreement also contains a non-compete provision for one year after the termination of Mr. Jahnke's employment.

As an inducement to enter into the employment agreement, Mr. Jahnke received a restricted stock grant for 20,000 shares of the Company's Common Stock under the Company's 1993 Stock Incentive Plan. Mr. Jahnke also received a grant of options to purchase the Company's Common Stock in a total amount of 180,000 shares. These options expire 10 years from the date of issuance and vesting is accelerated upon a "change in control" as defined in the Company's stock option agreements. Options to purchase 50,000 shares vested on December 21, 1999. Options to purchase 25,000 will vest on each of the first and second anniversary dates of Mr. Jahnke's employment. Options to purchase the remaining 80,000 shares will vest according to a performance schedule established by the Company's Board of Directors.

Certain Relationships and Related Transactions

In January 1999, the Company entered into financing agreements with Norwest Business Credit, Inc. (the "Bank") in which the Bank made two term loans to the Company in the amount of $4,000,000 and $2,000,000. The loan in the amount of $4,000,000 was guaranteed by Glen Taylor, a director of the Company, and the $2,000,000 loan was guaranteed by a private investor not affiliated with the Company. These term loans were repaid by the Company in May 1999. As a condition to receiving the loans, Mr. Taylor and the private investor were required to deposit $4,000,000 and $2,000,000, respectively, into accounts under the Bank's control earning interest at approximately 4.95% per annum. Upon deposit, the individuals guaranteeing these loans received a one-time commitment fee equal to 2% of the respective loan amount and a guarantee fee equal to an annualized rate of 5.05%. These transactions resulted in total annualized rates of return to Mr. Taylor and the private investor of approximately 12%. Mr. Taylor received fees totaling $148,000 from the Company for his agreement to guarantee the $4,000,000 loan.

7

On March 12, 1999, the Company received an equity investment of $10,000,000 from the Company's strategic partner, Sanofi-Synthélabo, as a result of the Company receiving premarket approval ("PMA") for its 2020 ICD and lead systems. This payment was made in accordance with and pursuant to the Investment Agreement. As a result of the equity investment, Sanofi-Synthélabo received warrants to purchase 909,017 and 540,541 shares of the Company's Common Stock at exercise prices of $0.10 and $11.10 per share, respectively. On March 24, 2000, Sanofi-Synthélabo surrendered 745,994 shares of the Company's Common Stock and the aforementioned warrants to purchase an additional 1,897,186 shares as part of an Asset Purchase Agreement between the Company and ELA Medical and Sanofi-Synthélabo.

On March 26, 1999 Manchester Companies, Inc., of which Mark Sheffert, a director of the Company, is the sole shareholder, entered into a 12-month agreement with the Company pursuant to which Manchester agreed to provide certain services to Angeion relative to Angeion's financing and capitalization, management of expenses, restructuring of obligations, financial and account support and Nasdaq listing. Manchester was paid $239,175 for these services in fiscal 1999. Mr. Sheffert was not a director of Angeion at the time the transaction was entered into and did not become a director until January 2000.

Compensation Committee Report on Executive Compensation

The Compensation Committee of the Board of Directors establishes the compensation for executive officers who are also directors of the Company and acts on such other matters relating to their compensation as it deems appropriate. The Compensation Committee consists of three non-employee directors and meets one to four times per year. The current members of the Compensation Committee are Messrs. Hickey, Sheffert and Angeloni. The Company's President and Chief Executive Officer, in turn, establishes the compensation of all executive officers who are not also directors of the Company. The Compensation Committee also administers, with respect to all eligible recipients, the Company's stock option plans and determines the participants in such plans and the amount, timing and other terms and conditions of awards under such plans.

Compensation Philosophy and Objectives. The Compensation Committee is committed to the general principle that overall executive compensation should be commensurate with performance by the Company and the individual executive officers, and the attainment of predetermined individual and corporate goals. The primary objectives of the Company's executive compensation program are to:

The Company's executive compensation program provides a level of compensation opportunity that is competitive for companies in comparable industries and of comparable development, complexity and size. In determining compensation levels, the Compensation Committee considers a number of factors, including Company performance, both separately and in relation to other companies competing in the Company's markets; the individual performance of each executive officer; comparative compensation surveys concerning compensation levels and stock grants at other companies; historical compensation levels and stock awards at the Company; and the overall competitive environment for executives and the level of compensation necessary to attract and retain key executives. Compensation levels may be greater or less than competitive levels in comparable companies based upon factors such as annual and long-term Company performance and individual performance.

8

Executive Compensation Program Components. The Company's executive compensation program consists of base salary, bonuses and long-term incentive compensation in the form of stock options. The particular elements of the compensation program are discussed more fully below.

Base Salary. Base pay levels of executives are determined by the potential impact of the individual on the Company and its performance, the skills and experience required by the position, the individual performance and potential of the executive, and the Company's overall performance. Other than with respect to Mr. Jahnke, the President and Chief Executive Officer of the Company, whose base salary was determined pursuant to an employment agreement with the Company, base salaries for executives are evaluated and adjusted on the employee's annual review date. Base salaries for 1999 increased modestly from 1998 levels due to the Company's focus on development activities requiring the conservation of cash. In connection with the Compensation Committee's annual evaluations of participants in its executive compensation program, the Company generally limited base salary increases to relatively small inflationary adjustments, unless larger increases were merited by performance or to keep compensation commensurate with other companies.

Bonuses. The Company also may pay bonuses to executive officers as part of its executive compensation program. Historically, bonuses paid by the Company have been minimal, based in part on the Company's focus on development activities requiring the conservation of cash. By the terms of his employment agreement, Mr. Jahnke is eligible for a cash bonus of up to 35% of his base salary. Mr. Jahnke was not an employee of the Company during 1999 and therefore, did not receive a bonus during that year. The Compensation Committee will determine the amount of Mr. Jahnke's bonus, if any, after the end of year 2000. Bonuses aggregating $303,000 were paid to executive officers during 1999 for achieving certain performance objectives.

Long-term Incentive Compensation. Stock options are used to enable key executives to participate in a meaningful way in the success of the Company and to link their interests directly with those of the Shareholders. The number of stock options granted to executives is based upon a number of factors, including base salary level and how such base salary level relates to those of other companies in the Company's industry, the number of options previously granted and individual and Company performance during the year.

Section 162(m). The Omnibus Reconciliation Act of 1993 added Section 162(m) to the Internal Revenue Code of 1986, as amended (the "Code"), limiting corporate deductions to $1,000,000 for certain compensation paid to the chief executive officer and each of the four other most highly compensated executives of publicly held companies. The Company does not believe it will pay "compensation" within the meaning of Section 162(m) to such executive officers in excess of $1,000,000 in the foreseeable future. Therefore, the Company does not have a policy at this time regarding qualifying compensation paid to its executive officers for deductibility under Section 162(m), but will formulate a policy if compensation levels ever approach $1,000,000.

JAMES B. HICKEY ARNOLD A. ANGELONI MARK W. SHEFFERT

BY THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

Compliance with Section 16(a) of the Securities Exchange Act of 1934

To the Company's knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the year ended December 31, 1999, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with, except that each of Messrs. Angeloni, Evans, Hickey and Taylor, as well as five former directors of the Company, Messrs. Joyce, Kiser, McFarlin, Maurer and Wilson, were late in reporting options granted in December, 1999.

9

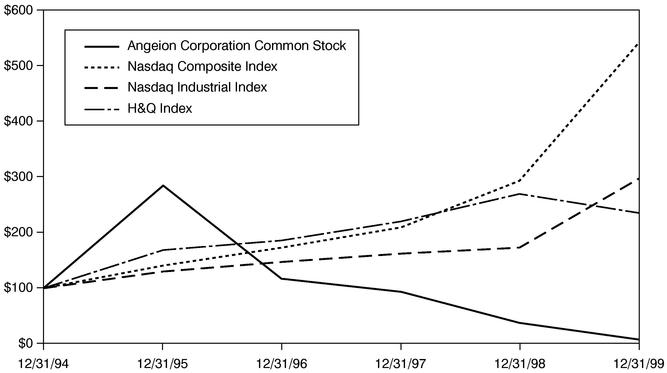

Performance Graph

The Securities and Exchange Commission requires that the Company include in this Proxy Statement a line graph presenting comparing cumulative, five-year stockholder returns on an indexed basis with a broad market index and either a nationally-recognized industry standard or an index of peer companies selected by the Company. The Company has chosen the use of the Nasdaq Composite Index as its broad market index, the Nasdaq Industrial Index and the Hambrecht & Quist Health Care (without Biotechnology) Subsector Index ("H & Q Index") because the H & Q Index was used by the Company in last year's proxy statement. The table below compares the cumulative total return as of the end of each of the Company's last five years on $100 invested as of December 31, 1994, with the Nasdaq Composite Index, the Nasdaq Industrial Index and the H & Q Index assuming the reinvestment of all dividends.

| |

12/31/94 |

12/31/95 |

12/31/96 |

12/31/97 |

12/31/98 |

12/31/99 |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Nasdaq Composite Index | $ | 100 | $ | 140 | $ | 172 | $ | 209 | $ | 292 | $ | 541 | ||||||

| Nasdaq Industrial Index | $ | 100 | $ | 128 | $ | 147 | $ | 162 | $ | 173 | $ | 297 | ||||||

| H & Q Index | $ | 100 | $ | 167 | $ | 185 | $ | 220 | $ | 268 | $ | 235 | ||||||

| Angeion Corporation Common Stock | $ | 100 | $ | 283 | $ | 117 | $ | 92 | $ | 36 | $ | 6 | ||||||

10

PROPOSAL 2: AMENDMENT TO THE 1994 NON-EMPLOYEE DIRECTOR PLAN

Introduction

The 1994 Director Plan provides for: (i) an annual grant of shares of Common Stock equal to $24,000, as determined by the fair market value of one share of Common Stock on the date of grant, and (ii) an automatic annual grant of an option to purchase 3,000 shares of Common Stock to members of the Board of Directors who are not also employees of the Company, upon the election or re-election to the Board of Directors, as the case may be, of each non-employee director of the Company. If no Annual Meeting has been scheduled by May 31 of any year, then the Director Stock Awards and Director Options shall be granted to the Directors as of May 31 of such year.

The 1994 Director Plan, as currently in effect, allows for the issuance of a maximum of 250,000 shares of Common Stock. The Board of Directors believes that the 1994 Director Plan advances the interests of the Company and its Shareholders by (i) increasing the proprietary interests of non-employee directors in the Company's long-term success and more closely aligning the interests of such directors with the interests of the Shareholders, and (ii) providing an additional means by which the Company can attract and retain experienced and knowledgeable people to serve as directors.

Amendments

The Board of Directors amended the 1994 Director Plan on November 7, 2000 to increase the number of shares of Common Stock issuable under the 1994 Director Plan from 250,000 shares to 350,000 shares. The amendments to the 1994 Director Plan are subject to approval by the Shareholders at the Annual Meeting.

Reason For The Amendments.

Of the maximum number of 250,000 shares of Common Stock that were available for issuance under the 1994 Director Plan prior to its amendments, approximately 215,000 shares have been issued as Director Stock Awards or reserved for issuance upon the exercise of Director Options. The increase in the number of shares issuable under the 1994 Director Plan, as provided by the amendments, is required to provide shares for the full issuance of the Director Stock Awards and Director Option grants to be made as of the date of future Annual Meetings.

Summary of the 1994 Director Plan

The following summary of the principal features of the 1994 Director Plan, as amended, describes the purpose and effect of material terms contained in the 1994 Director Plan, a copy of which may be obtained from the Company.

Shares Available under the 1994 Director Plan. The shares of Common Stock issuable under the 1994 Director Plan will be authorized but unissued shares. If there is any change in the corporate structure or shares of the Common Stock of the Company such as in connection with a merger, recapitalization, stock split, stock dividend, or other extraordinary dividend (including a spin-off), the aggregate number and kind of securities subject to Director Options under the 1994 Director Plan, the number of shares issuable upon the exercise of Director Options and the exercise price of Director Options will be appropriately adjusted to prevent dilution or enlargement of rights of participants. If any Director Option terminates, expires or is canceled without having been exercised in full, then such unexercised shares subject to the Director Option will automatically again become available for issuance under the 1994 Director Plan.

Eligibility. All directors of the Company who are not employees of the Company or its subsidiaries are eligible to participate in the 1994 Director Plan.

11

Director Option Grants. Annual grants of Director Options to purchase 3,000 shares of Common Stock are made automatically to each non-employee director on the date the director is elected or re-elected to the Board of Directors by the Shareholders. Non-employee directors who are elected or appointed to fill vacancies or newly created directorships following the date of an annual meeting but prior to the beginning of the next fiscal year receive pro-rata grants of Director Options for their services between the date of their election or appointment and the date of the next annual meeting. The exercise price per share of each Director Option granted under the 1994 Director Plan is 100% of the fair market value of the underlying Common Stock on the date the Director Option is granted based upon the closing price of the Common Stock for the twenty previous trading days. Payment for stock purchased upon the exercise of a Director Option must be made in full in cash at the time of exercise. A Director Option granted under the 1994 Director Plan becomes exercisable in full six months after its date of grant, and expires 10 years from its date of grant. If an eligible director's service as a director is terminated due to death or disability, all outstanding Director Options then held by the director become exercisable in full and remain exercisable for a period of one year after such death or disability (but in no event after the expiration date of the Director Option). If a director's service is terminated for any other reason, all outstanding Director Options then held by the director remain exercisable for a period of three months after termination of service as a director to the extent such Director Options were exercisable as of such termination.

Director Stock Awards. Annual grants of such number of shares of Common Stock equal to $24,000, as determined by the fair market value of one share of Common Stock on the date of grant, are made automatically to each non-employee director on the date the director is elected or re-elected to the Board of Directors by Shareholders. Non-employee directors who are elected or appointed to fill vacancies, or newly created directorships following the date of an annual meeting but prior to the beginning of the next year receive pro-rata grants of Director Stock Awards for their services between the date of their election or appointment and the date of the next annual meeting.

Administration of the 1994 Director Plan. The 1994 Director Plan is administered by the Compensation Committee. The Compensation Committee, however, has no authority or discretion to determine eligibility for participation in the 1994 Director Plan, the number of shares of Common Stock to be subject to Director Options or Director Stock Awards granted under the 1994 Director Plan, or the timing, pricing or other terms and conditions of such Director Options or Director Stock Awards.

Amendment and Termination of the 1994 Director Plan. The Board of Directors may amend the 1994 Director Plan in any respect it deems advisable. No such amendment, however, will be effective without the approval of the Shareholders, if required by federal securities laws or the rules of the Nasdaq National Market System. The 1994 Director Plan will terminate on October 7, 2004, but may be terminated prior to such date by action of the Board of Directors.

Non-transferability of Director Options. No Director Option granted under the 1994 Director Plan may be transferred by a participant for any reason or by any means, except by will or by the laws of descent and distribution.

Federal Income Tax Consequences. The following description of federal income tax consequences is based on current statutes, regulations and interpretations. The description does not include state or local income tax consequences. In addition, the description is not intended to address specific tax consequences applicable to an individual participant who receives a Director Option or Director Stock Award.

Director Options granted under the 1994 Director Plan do not qualify as incentive stock options within the meaning of Section 422 of the Code. Generally, neither the non-employee director nor the Company incurs any federal income tax consequences as a result of the grant of a Director Option.

12

Upon exercise of a Director Option, the non-employee director will recognize ordinary compensation income in an amount equal to the difference between (i) the fair market value of the shares purchased, determined on the day of exercise, and (ii) the consideration paid for the shares. At the time of a subsequent sale or disposition of any shares of Common Stock obtained upon exercise of a Director Option, any gain or loss will be a capital gain or loss. Whether the gain (or loss) constitutes long-term or short-term capital gain (or loss) will depend upon the length of time the non-employee director held the stock prior to its disposition. Non-employee directors should consult their tax advisors to determine whether any specific gain (or loss) constitutes long-term or short-term capital gain (or loss).

In general, the Company will be entitled to a compensation expense deduction in connection with the exercise of a Director Option for any amounts includable in the taxable income of a non-employee director as ordinary compensation income, provided the Company complies with any applicable withholding requirements. The Company will be entitled to a deduction in the Company's tax year in which the non-employee director is taxed.

A non-employee director will recognize as ordinary income in the year of grant of a Director Stock Award an amount equal to the fair market value of a Director Stock Award on the date of grant ($24,000). In such circumstances, the Company will receive a corresponding tax deduction for any amounts includable in the taxable income of a non-employee director as ordinary income.

Awards under the 1994 Director Plan. As noted above, because the 2000 Annual Meeting of Shareholders was scheduled after May 31, 2000, each of the six non-employee directors received a Director Option and Director Stock Award on May 31, 2000.

Registration with the SEC. The Company will file a Registration Statement covering the 1994 Director Plan with the Securities and Exchange Commission pursuant to the Securities Act of 1933, after Shareholder approval.

Vote Required

Shareholder approval of the amendment to the 1994 Director Plan requires the affirmative vote of the holders of a majority of the shares of Common Stock present and voting at the meeting.

THE BOARD OF DIRECTORS RECOMMENDS THAT

SHAREHOLDERS VOTE "FOR" APPROVAL OF THIS PROPOSAL.

13

PROPOSAL 3: AMENDMENT TO THE 1997 EMPLOYEE STOCK PURCHASE PLAN

Introduction

On November 7, 2000, the Company's Board of Directors adopted an amendment to increase the number of shares available under the Angeion Corporation 1997 Employee Stock Purchase Plan (the "1997 Employee Plan") from 50,000 to 150,000, subject to approval by the Company's shareholders. The purpose of the 1997 Employee Plans to provide eligible employees of the Company and its Participating Subsidiaries with an opportunity to acquire an ownership interest in the Company through the purchase of Common Stock of the Company on favorable terms through payroll deductions.

Amendments

The Board of Directors amended the 1997 Employee Plan November 7, 2000 to increase the number of shares of Common Stock issuable under the 1997 Employee Plan 50,000 shares to 150,000 shares. The amendments to the 1997 Employee Plan subject to approval by the Shareholders at the Annual Meeting.

Reason For The Amendments.

Of the maximum number of 50,000 shares of Common Stock that were available for issuance under the 1997 Employee Plan prior to its amendment, approximately 49,000 shares have been issued upon the exercise of employee Options or reserved for issuance upon the exercise of Options. The increase in the number of shares issuable under the 1997 Employee Plan, as provided by the amendments, is required to provide shares for future grants to employees of the Company.

Summary of the Plan

Number of Shares. The maximum number of shares of Common Stock currently reserved and available under the 1997 Employee Plan for awards is 50,000 shares (subject to adjustment in the event of possible future stock splits or similar changes in the Common Stock). Shares of Common Stock covered by terminated stock options may be used for subsequent awards under the 1997 Employee Plan. The proposed amendment would increase the number of shares reserved and available under the plan from 50,000 to 150,000.

Eligibility and Administration. Any employee of the Company who has completed at least one month two weeks of service prior to the Offering Commencement Date of a Offering Period of the 1997 Employee Plan and who does not own five percent (5%) or more of the Company's stock is eligible to participate. As of November 1, 2000, approximately 123 employees of the Company were eligible to participate.

Conditions of Purchase. Eligible employees elect to participate in the 1997 Employee Plan through payroll deductions limited to 10% of a participant's base pay for the term of the Offering Period. As of the Offering Commencement Date of each Offering Period of the 1997 Employee Plan, an employee is granted an option for as many full shares as he or she will be able to purchase through the payroll deduction procedure. The option rate for employees who participate shall be the lower of (i) 85% of the fair market value of the shares on the Offering Commencement Date or (ii) 85% of the fair market value of the shares on the Offering Termination Date.

Federal Income Tax Consequences. The following description of federal income tax consequences is based on current statutes, regulations and interpretations. The description does not include state or local income tax consequences. In addition, the description is not intended to address specific tax consequences applicable to an individual participant who receives an award.

14

The 1997 Employee Plan intended to qualify as an "Employee Stock Purchase Plan" within the meaning of Section 423 of the Internal Revenue Code of 1954. In order for the employee participants to have such qualified tax treatment, this amendment to increase the share issuable under the 1997 Purchase Plan must be approved by the Company's shareholders. If the 1997 Employee Plans qualifies, no income will result to a grantee of an option upon the granting or exercise of an option, and no deduction will be allowed to the Company. The gain, if any, resulting from a disposition of the shares received by a Participant will be reported according to the provisions of Section 423 of the Internal Revenue Code and will be taxed in part as ordinary income and in part as capital gain.

Registration with the SEC. The Company will file a Registration Statement covering the 1997 Employee Plan with the Securities and Exchange Commission pursuant to the Securities Act of 1933, after Shareholder approval.

Vote Required

Shareholder approval of the amendment to the 1997 Employee Plan requires the affirmative vote of the holders of a majority of the shares of Common Stock present and voting on this matter.

THE BOARD OF DIRECTORS RECOMMENDS THAT

SHAREHOLDERS VOTE "FOR" APPROVAL OF THIS PROPOSAL.

15

Shareholder Proposals For 2001 Annual Meeting

The Company anticipates holding its 2001 Annual Meeting on or about June 30, 2001 and anticipates mailing its materials on or about June 1, 2001. Any shareholder proposal intended for inclusion in the Company's proxy material for the 2001 Annual Meeting of Shareholders must be received by the Secretary of the Company no later than the close of business on February 1, 2001.

A shareholder who wishes to make a proposal for consideration at the 2001 Annual Meeting, but does not seek to include the proposal in the Company's proxy material, must notify the Secretary of the Company. The notice must be received no later than May 2, 2001. If the notice is not timely, then the persons named on the Company's proxy card for the 2001 Annual Meeting may use their discretionary voting authority when the proposal is raised at the meeting.

Annual Report

The Annual Report of the Company for the fiscal year ended December 31, 1999, which includes the Company's Annual Report on Form 10-K, incorporating all amendments thereto, as filed with the Securities and Exchange Commission, accompanies this Notice of Annual Meeting and proxy solicitation material. A copy of the Company's exhibits to the Form 10-K Annual Report may be obtained by shareholders without charge from the Securities and Exchange Commission at www.sec.gov or for a nominal fee upon written request to the Chief Financial Officer of the Company at the address indicated on this Proxy Statement.

Independent Certified Public Accountants

KPMG LLP, independent certified public accountants, served as independent accountants of the Company for a number of years including the fiscal year ended December 31, 1999. The Company has not yet made a formal decision with respect to its auditors for the year ended December 31, 2000.

Representatives of KPMG LLP will be in attendance at the Annual Meeting of Shareholders and will have the opportunity to make a statement if they desire to do so. In addition, representatives will be available to respond to appropriate questions.

Cost and Method of Solicitation

The Company will pay the cost of soliciting proxies and may make arrangements with brokerage firms, custodians, nominees and other fiduciaries to send proxy materials to beneficial owners of Common Stock. The Company will reimburse them for reasonable out-of-pocket expenses. In addition to solicitation by mail, proxies may be solicited by telephone, electronic transmission or in person by directors, officers and employees of the Company.

Other Matters

As of the date of this Proxy Statement, management knows of no other matters that may come before the 2000 Annual Meeting. However, if matters other than those referred to above should properly come before the 2000 Annual Meeting, the individuals named on the enclosed proxy card intend to vote such proxy in accordance with their best judgment.

By Order of the Board of Directors,

Richard

E. Jahnke

Director, President and Chief Executive Officer

16

| ANGEION CORPORATION 350 Oak Grove Parkway St. Paul, Minnesota 55127-8599 |

| PROXY SOLICITED BY THE BOARD OF DIRECTORS For Annual Meeting of Shareholders December 13, 2000 |

| Angeion Corporation 350 Oak Grove Parkway, St. Paul, Minnesota 55127-8599 |

proxy | |

The undersigned, having duly received the Notice of Annual Meeting and Proxy Statement dated November 21, 2000, hereby appoints Richard E. Jahnke and Dennis E. Evans, or either of them, proxies (each with full power to act alone and with the power of substitution and revocation), to represent the undersigned and to vote in their discretion, all shares of Common Stock of Angeion Corporation held of record in the name of the undersigned at the close of business on November 10, 2000, at the Annual Meeting of Shareholders to be held on December 13, 2000, or at any adjournment or adjournments, hereby revoking all former proxies.

(Continued, and to be completed and signed, on the reverse side)

| COMPANY # CONTROL # |

||

There are three ways to vote your Proxy

Your telephone or Internet vote authorizes the Named Proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

VOTE BY PHONE — TOLL FREE — 1-800-240-6326 — QUICK *** EASY *** IMMEDIATE

VOTE BY INTERNET — http://www.eproxy.com/angn/ — QUICK *** EASY *** IMMEDIATE

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we've provided or return it to Angeion Corporation,

c/o Shareowner ServicesSM, P.O. Box 64873, St. Paul, MN 55164-0873.

If you vote by Phone or Internet, please do not mail your Proxy Card.

Please Return Promptly in the Enclosed Envelope

Which Requires No Postage If Mailed Within the United States

Please detach here

The Board of Directors Recommends a Vote For "All" of the Following Proposals:

| 1. | ELECTION OF DIRECTORS: | / / | FOR the nominees listed below (except as indicated to the contrary) |

/ / | WITHHOLD AUTHORITY to vote for the nominees listed below |

(INSTRUCTION: To withhold authority to vote for an individual nominee, write the number of the nominee's in the box): / /

| 01 - ARNOLD A. ANGELONI | 02 - DENNIS E. EVANS | 03 - JAMES B. HICKEY | 04 - RICHARD E. JAHNKE | |

| 05 - JOHN C. PENN | 06 - MARK W. SHEFFERT | 07 - GLEN TAYLOR |

| 2. |

|

PROPOSAL TO APPROVE AMENDMENT TO THE ANGEION CORPORATION 1994 NON-EMPLOYEE DIRECTOR PLAN. |

|

/ / |

|

FOR |

|

/ / |

|

AGAINST |

|

/ / |

|

ABSTAIN |

| 3. |

|

PROPOSAL TO APPROVE AMENDMENT TO THE ANGEION CORPORATION 1997 EMPLOYEE STOCK PURCHASE PLAN. |

|

/ / |

|

FOR |

|

/ / |

|

AGAINST |

|

/ / |

|

ABSTAIN |

This Proxy When Properly Executed Will Be Voted in The Manner Directed Herein by The Undersigned Shareholder. If No Direction Is Made, The Shares Represented by This Proxy Will Be Voted "For" The Election of All Nominees For Director Listed on The Reverse Side, And "For" Proposal Numbers 2 and 3 And, in the Discretion of the Proxies, on Any Other Matters That May Properly Come Before the Meeting.

| I plan to attend the meeting. / / | Dated: | , 2000 | ||

| Address Change? Mark Box / / Indicate changes below: | ||||

| |

|

|||

| |

|

|||

| Signature if held jointly | ||||

| |

PLEASE SIGN exactly as name appears on this card. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by president or other authorized officer. If a partnership, please sign in partnership name by an authorized person. |

|||

|

|