|

|

|

|

|

Previous: HARTFORD LIFE INS CO PUTNAM CAPITAL MGR TR SEPARATE ACCT TWO, 497, 2000-09-19 |

Next: CHASE FUNDING INC, 8-K, 2000-09-19 |

Fidelity®

Funds - 2001, 2003

Annual Report

July 31, 2000

(2_fidelity_logos)(Registered_Trademark)

|

President's Message |

3 |

Ned Johnson on investing strategies. |

|

Performance |

4 |

How the funds have done over time. |

|

Fund Talk |

11 |

The manager's review of the funds' performance, strategy and outlook. |

|

Target Timeline 2001 |

14 |

Investment Changes |

|

|

15 |

Investments |

|

|

22 |

Financial Statements |

|

Target Timeline 2003 |

26 |

Investment Changes |

|

|

27 |

Investments |

|

|

33 |

Financial Statements |

|

Notes |

37 |

Notes to the financial statements. |

|

Report of Independent Accountants |

41 |

The auditors' opinion. |

|

Distributions |

42 |

|

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the funds nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Annual Report

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

The Federal Reserve Board's effort to keep inflation in check without over-cooling the U.S. economy has taken a toll on the stock market. Through July 2000, bellwether equity indexes such as the Dow Jones Industrial Average, NASDAQ and S&P 500® have negative returns for the year. On the other hand, fixed-income markets are enjoying strong performance. Except for high-yield, most bond sectors - corporates, mortgages, Treasuries and agencies - have returned 4%-6% year to date.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

The longer your investment time frame, the less likely it is that you will be affected by short-term market volatility. A 10-year investment horizon appropriate for saving for a college education, for example, enables you to weather market cycles in a long-term fund, which may have a higher risk potential, but also has a higher potential rate of return.

An intermediate-length fund could make sense if your investment horizon is two to four years, while a short-term bond fund could be the right choice if you need your money in one or two years.

If your time horizon is less than a year, you might want to consider moving some of your bond investment into a money market fund. These funds seek income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

Fidelity Target Timeline 2001

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at a fund's income, as reflected in its yield, to measure performance. If Fidelity had not reimbursed certain fund expenses, the total returns and dividends would have been lower.

Cumulative Total Returns

|

Periods ended July 31, 2000 |

|

Past 1 |

Life of |

|

Target Timeline 2001 |

|

4.96% |

25.74% |

|

LB Aggregate Bond |

|

5.97% |

27.86% |

|

U.S. Treasury Strips (8/15/01 and 11/15/01) |

|

5.24% |

25.63% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, one year or since the fund started on February 8, 1996. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's return to the Lehman Brothers Aggregate Bond Index - a market value-weighted index of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of one year or more. You can also compare the fund to the average of the total returns of U.S. Treasury Strips maturing on 8/15/01 and 11/15/01, which reflects the performance of zero-coupon bonds with maturities similar to the fund's. These benchmarks reflect reinvestment of dividends and capital gains, if any.

Average Annual Total Returns

|

Periods ended July 31, 2000 |

|

Past 1 |

Life of |

|

Target Timeline 2001 |

|

4.96% |

5.25% |

|

LB Aggregate Bond |

|

5.97% |

5.64% |

|

U.S. Treasury Strips (8/15/01 and 11/15/01) |

|

5.24% |

5.23% |

Average annual total returns take the fund's cumulative return and show what would have happened if the fund performed at a constant rate each year.

Annual Report

Fidelity Target Timeline 2001

Performance - continued

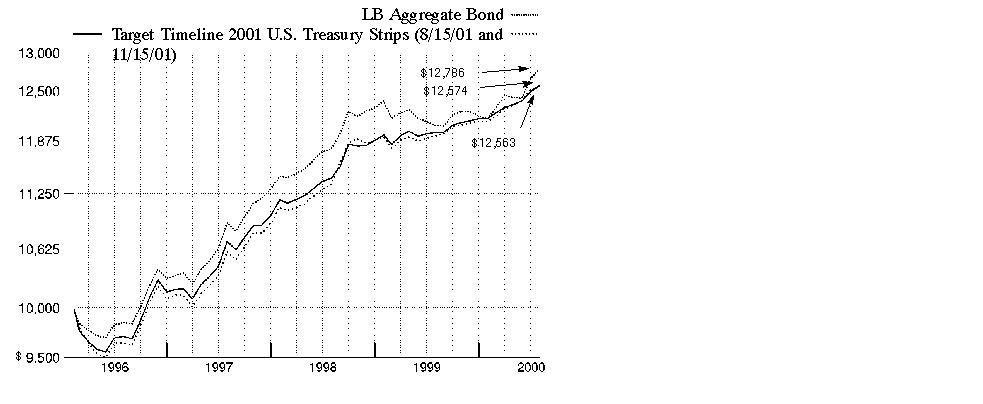

$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity Target Timeline 2001 on February 8, 1996, when the fund started. As the chart shows, by July 31, 2000, the value of the investment would be $12,574 - a 25.74% increase on the initial investment. For comparison, look at how the Lehman Brothers Aggregate Bond Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment would be $12,786 - a 27.86% increase. If $10,000 was put in U.S. Treasury Strips (8/15/01 and 11/15/01), it would be valued at $12,563 - a 25.63% increase.

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. Bond prices, for example, generally move in the opposite direction of interest rates. In turn, the share price, return and yield of a fund that invests in bonds will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

3Annual Report

Fidelity Target Timeline 2001

Performance - continued

Total Return Components

|

|

Years ended July 31, |

February 8, 1996 |

|||

|

|

2000 |

1999 |

1998 |

1997 |

1996 |

|

Dividend returns |

6.34% |

6.68% |

6.95% |

7.71% |

3.12% |

|

Capital returns |

-1.38% |

-1.87% |

-0.21% |

2.55% |

-6.00% |

|

Total returns |

4.96% |

4.81% |

6.74% |

10.26% |

-2.88% |

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the fund. A capital return reflects both the amount paid by the fund to shareholders as capital gain distributions and changes in the fund's share price. Both returns assume the dividends or capital gains, if any, paid by the fund are reinvested.

Dividends and Yield

|

Periods ended July 31, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

4.79 ¢ |

28.75 ¢ |

58.23 ¢ |

|

Annualized dividend rate |

6.06% |

6.21% |

6.24% |

|

30-day annualized yield |

6.69% |

- |

- |

Dividends per share show the income paid by the fund for a set period. If you annualize this number, based on an average share price of $9.30 over the past one month, $9.29 over the past six months and $9.33 over the past one year, you can compare the fund's income over these three periods. The 30-day annualized yield is a standard formula for all bond funds based on the yields of the bonds in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you compare funds from different companies on an equal basis. If Fidelity had not reimbursed certain expenses, the yield would have been 6.46%.

Annual Report

Fidelity Target Timeline 2003

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). You can also look at a fund's income, as reflected in its yield, to measure performance. If Fidelity had not reimbursed certain fund expenses, the total returns and dividends would have been lower.

Annual Report

Fidelity Target Timeline 2003

Performance - continued

Cumulative Total Returns

|

Periods ended July 31, 2000 |

|

Past 1 |

Life of |

|

Target Timeline 2003 |

|

4.70% |

24.18% |

|

LB Aggregate Bond |

|

5.97% |

27.86% |

|

U.S. Treasury Strips (8/15/03 and 11/15/03) |

|

5.51% |

26.27% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, one year or since the fund started on February 8, 1996. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's return to the Lehman Brothers Aggregate Bond Index - a market value-weighted index of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of one year or more. You can also compare the fund to the average of the total returns of U.S. Treasury Strips maturing on 8/15/03 and 11/15/03, which reflects the performance of zero-coupon bonds with maturities similar to the fund's. These benchmarks reflect reinvestment of dividends and capital gains, if any.

Average Annual Total Returns

|

Periods ended July 31, 2000 |

|

Past 1 |

Life of |

|

Target Timeline 2003 |

|

4.70% |

4.95% |

|

LB Aggregate Bond |

|

5.97% |

5.64% |

|

U.S. Treasury Strips (8/15/03 and 11/15/03) |

|

5.51% |

5.34% |

Average annual total returns take the fund's cumulative return and show what would have happened if the fund performed at a constant rate each year.

Annual Report

Fidelity Target Timeline 2003

Performance - continued

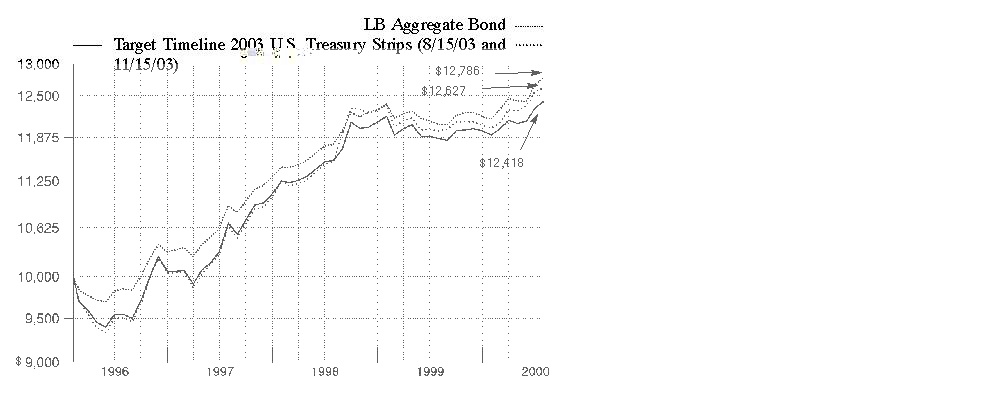

$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity Target Timeline 2003 on February 8, 1996, when the fund started. As the chart shows, by July 31, 2000, the value of the investment would be $12,418 - a 24.18% increase on the initial investment. For comparison, look at how the Lehman Brothers Aggregate Bond Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment would be $12,786 - a 27.86% increase. If $10,000 was put in U.S. Treasury Strips (8/15/03 and 11/15/03), it would be valued at $12,627 - a 26.27% increase.

Understanding

Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. Bond prices, for example, generally move in the opposite direction of interest rates. In turn, the share price, return and yield of a fund that invests in bonds will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

3Annual Report

Fidelity Target Timeline 2003

Performance - continued

Total Return Components

|

|

Years ended July 31, |

February 8, 1996 |

|||

|

|

2000 |

1999 |

1998 |

1997 |

1996 |

|

Dividend returns |

7.18% |

6.99% |

7.17% |

7.29% |

3.07% |

|

Capital returns |

-2.48% |

-4.23% |

0.83% |

4.65% |

-7.60% |

|

Total returns |

4.70% |

2.76% |

8.00% |

11.94% |

-4.53% |

Total return components include both dividend returns and capital returns. A dividend return reflects the actual dividends paid by the fund. A capital return reflects both the amount paid by the fund to shareholders as capital gain distributions and changes in the fund's share price. Both returns assume the dividends or capital gains, if any, paid by the fund are reinvested.

Dividends and Yield

|

Periods ended July 31, 2000 |

Past 1 |

Past 6 |

Past 1 |

|

Dividends per share |

5.62 ¢ |

32.85 ¢ |

64.77 ¢ |

|

Annualized dividend rate |

7.31% |

7.30% |

7.12% |

|

30-day annualized yield |

6.95% |

- |

- |

Dividends per share show the income paid by the fund for a set period. If you annualize this number, based on an average share price of $9.05 over the past one month, $9.02 over the past six months and $9.10 over the past one year, you can compare the fund's income over these three periods. The 30-day annualized yield is a standard formula for all bond funds based on the yields of the bonds in the fund, averaged over the past 30 days. This figure shows you the yield characteristics of the fund's investments at the end of the period. It also helps you compare funds from different companies on an equal basis. If Fidelity had not reimbursed certain expenses, the yield would have been 6.52%.

Annual Report

Market Recap

Despite facing the challenge of five interest-rate increases during the 12-month period that ended July 31, 2000, the taxable bond market - as measured by the Lehman Brothers Aggregate Bond Index - returned 5.97%. The Federal Reserve Board's tightening policy, adopted to help slow down an overheated U.S. economy and ward off inflation, made for a sometimes difficult investing environment for bonds. During the first half of the period, the brunt of the Fed's action was felt by Treasuries, as they underperformed higher-yielding investment-grade spread sectors, such as corporate bonds and mortgage and government agency securities. In January, however, the momentum turned after the Treasury announced a plan to repurchase long-term debt and curtail future issuance. Treasury prices soared in response, sending their yields lower. This shift helped the Lehman Brothers Treasury Index return 6.48% during the period. At the same time, the Lehman Brothers Credit Bond Index - a measure of corporate bond performance - and the Lehman Brothers Mortgage-Backed Securities and U.S. Agency indexes returned 4.83%, 6.43% and 5.19%, respectively. Mortgage-backed securities rallied in the spring as a result of reduced supply, slower origination and a favorable prepayment environment. Elsewhere, rising default rates caused high-yield bonds to suffer more than most bonds, as the Merrill Lynch High Yield Master II Index returned -0.57% for the 12-month period.

(Portfolio Manager photograph)

An interview with Ford O'Neil, Portfolio Manager of Fidelity Target Timeline Funds 2001 and 2003

Q. How did the funds perform, Ford?

A. For the 12 months that ended July 31, 2000, Target Timeline 2001 and 2003 returned 4.96% and 4.70%, respectively. In comparison, U.S. Treasury Strips maturing at approximately the same times as the funds (August and November 2001 and 2003) averaged 5.24% and 5.51%, respectively. The Lehman Brothers Aggregate Bond Index had a 12-month return of 5.97%. The important thing to keep in mind is that it's difficult to measure these funds on a six- or 12-month time horizon; instead, they should be measured at maturity.

Q. What factors had the most influence on performance during the past 12 months?

A. The funds faced a stiff headwind of rising interest rates throughout the period, which constrained returns. Repeated efforts by the Federal Reserve Board to tighten monetary policy, coupled with the U.S. Treasury's decision in January to use government surplus proceeds to buy back long-term debt, spawned an inverted yield curve - which results when short-term bonds offer higher yields than longer-dated issues. Long-term Treasuries soared in response, inducing wider spreads and erasing the yield advantage enjoyed by the spread sectors - namely corporate bonds and government agencies - earlier in the period. Matters only got worse for some corporates, which suffered from declining credit quality related to the increased prevalence of share buybacks and recapitalizations in old economy companies. Short-term corporates slightly lagged comparable duration Treasuries, while intermediate issues underperformed their government counterparts. The story wasn't any brighter for agency securities, which underperformed across the curve thanks to growing uncertainty surrounding the credit quality of dominant issuers Fannie Mae and Freddie Mac. The 2003 fund paid the price for holding longer-duration corporates and agencies relative to an all-Treasury index. On the other hand, the 2001 fund didn't suffer as much because the yield advantage from owning corporates and agencies - in most cases - more than offset the price declines associated with the spread widening.

Annual Report

Fund Talk: The Manager's Overview - continued

Q. What were the challenges of meeting the funds' investment objective in this environment?

A. Our goal is to generate a predictable return, slightly greater than the index net of fees, over each fund's lifetime. We typically are successful at this task when spreads are either unchanged or tightening. However, when spreads are moving in the opposite direction, we hope that our yield advantage is greater than the losses incurred by the widening. In an environment such as the past 12 months, where spreads of some of the securities we owned doubled over a very short period of time, it was difficult to keep pace with an index consisting only of Treasuries.

Q. What were some of your key strategies, and how did they play out for the funds?

A. Given the "negative event risk" that threatened the credit quality of many corporate bonds during the period, I felt the best strategy to limit the funds' downside potential was to diversify and transform many of their bigger plays into several smaller positions, while simultaneously looking to improve the overall credit quality of the portfolios. I did so within the maturity constraints of the funds. Tactical allocations into different subsectors, teamed with strong security selection, helped mitigate the effects of our overweighting in corporates relative to the index. The funds' investments in Yankee bonds - or dollar-denominated foreign government and corporate debt - helped the most, benefiting in large part from our exposure to recovering Asian economies, particularly South Korea. Having good exposure to energy and the rebound in oil prices also helped, as did many of our bank and brokerage holdings. On the flip side, tobacco and select industrial issues trended lower, detracting from fund returns.

Q. What's your outlook?

A. It remains positive. We're beginning to see signs that the economy is downshifting, which could mean that we're close to the end of the Fed's yearlong tightening cycle. If so, corporate spreads could narrow - barring any major credit problems - from their most attractive levels in over a decade. I plan to maintain the funds' emphasis on higher-quality, defensive corporates, as well as short-duration agencies, for the yield advantage they offer relative to Treasuries and their potential for capital appreciation.

Annual Report

Fund Talk: The Manager's Overview - continued

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fund Facts

Goal: definable returns over the life of the funds by investing mainly in investment-grade quality debt securities whose average duration is approximately equal to each fund's maturity

Fund numbers: 381 (2001), 383 (2003)

Trading symbols: FTTBX (2001), FTARX (2003)

Start date: February 8, 1996

Size: as of July 31, 2000, more than $202 million, 2001 fund; more than $37 million, 2003 fund

Manager: Ford O'Neil, since 1998; manager, various Fidelity bond funds; joined Fidelity in 1990

3Ford O'Neil reflects on the inverted Treasury yield curve:

"Historically, inversions often have been the precursor to recession, getting their spark from aggressive Fed tightening at the short end of the curve. Recently, however, we've had more of a gradual approach to tightening, but nowhere near the magnitude of what we experienced in the 1970s, 80s and early 90s - the last three times we had an inverted yield curve. I believe the environment today is starkly different. Fundamentally, economic indicators are pointing more toward a slowdown - albeit from a torrid pace - than a recession.

"So, what's really behind the inversion? The answer lies in the technicals of the market. Influenced by a growing federal budget surplus, the U.S. Treasury announced midway through the period its intent to buy back higher-yielding long-term debt and reduce future bond issuance. This action, coupled with the government's desire to reduce the average maturity of its issues, induced a strong rally at the long end of the curve. Rising short-term rates - responding to an aggressive Fed, partially influenced by a booming domestic economy - ensured the curve's inversion. As long Treasury yields have fallen, comparable corporate spreads have widened, leaving their yields relatively unchanged. This all makes for a rather unfavorable risk/reward scenario for investors such as myself who demand more yield for the extra risk associated with longer-duration securities."

Annual Report

Fidelity Target Timeline 2001

|

Quality Diversification as of July 31, 2000 |

||

|

(Moody's Ratings) |

% of fund's investments |

% of fund's investments |

|

Aaa |

60.3 |

42.1 |

|

Aa |

7.7 |

10.1 |

|

A |

15.0 |

19.3 |

|

Baa |

14.7 |

20.9 |

|

Table excludes short-term investments. Where Moody's ratings are not available, we have used |

|

Average Years to Maturity as of July 31, 2000 |

||

|

|

|

6 months ago |

|

Years |

1.2 |

1.7 |

|

Average years to maturity is based on the average time remaining until principal payments are expected from each of the fund's bonds, weighted by dollar amount. |

|

Duration as of July 31, 2000 |

||

|

|

|

6 months ago |

|

Years |

1.1 |

1.5 |

|

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. |

|

Asset Allocation (% of fund's net assets) |

|||||||

|

As of July 31, 2000 * |

As of January 31, 2000 ** |

||||||

|

Corporate Bonds 33.9% |

|

|

Corporate Bonds 45.5% |

|

||

|

U.S. Government |

|

|

U.S. Government |

|

||

|

Other Investments 3.9% |

|

|

Other Investments 5.3% |

|

||

|

Short-Term |

|

|

Short-Term |

|

||

|

* Foreign |

6.3% |

|

** Foreign |

8.5% |

|

||

Annual Report

Fidelity Target Timeline 2001

Showing Percentage of Net Assets

|

Nonconvertible Bonds - 33.9% |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

AEROSPACE & DEFENSE - 0.4% |

|||||

|

Lockheed Martin Corp. 6.85% 5/15/01 |

Baa3 |

|

$ 700,000 |

$ 697,060 |

|

|

BASIC INDUSTRIES - 0.7% |

|||||

|

Chemicals & Plastics - 0.6% |

|||||

|

Monsanto Co. 5.375% 12/1/01 |

A2 |

|

1,275,000 |

1,253,185 |

|

|

Paper & Forest Products - 0.1% |

|||||

|

Fort James Corp. 6.5% 9/15/02 |

Baa2 |

|

250,000 |

244,698 |

|

|

TOTAL BASIC INDUSTRIES |

1,497,883 |

||||

|

CONSTRUCTION & REAL ESTATE - 0.5% |

|||||

|

Real Estate Investment Trusts - 0.5% |

|||||

|

Avalon Properties, Inc. 7.375% 9/15/02 |

Baa1 |

|

900,000 |

889,956 |

|

|

Equity Office Properties Trust 6.375% 1/15/02 |

Baa1 |

|

150,000 |

146,927 |

|

|

|

1,036,883 |

||||

|

DURABLES - 1.2% |

|||||

|

Autos, Tires, & Accessories - 1.2% |

|||||

|

TRW, Inc.: |

|

|

|

|

|

|

6.45% 6/15/01 |

Baa1 |

|

1,500,000 |

1,485,330 |

|

|

6.5% 6/1/02 |

Baa1 |

|

950,000 |

927,257 |

|

|

|

2,412,587 |

||||

|

ENERGY - 1.4% |

|||||

|

Oil & Gas - 1.4% |

|||||

|

Oryx Energy Co. 10% 4/1/01 |

Baa1 |

|

1,500,000 |

1,522,200 |

|

|

Petro-Canada yankee 8.6% 10/15/01 |

A3 |

|

190,000 |

192,022 |

|

|

The Coastal Corp. 8.125% 9/15/02 |

Baa2 |

|

1,110,000 |

1,124,685 |

|

|

|

2,838,907 |

||||

|

FINANCE - 19.8% |

|||||

|

Banks - 7.8% |

|||||

|

Banc One Corp. 7.25% 8/1/02 |

A1 |

|

500,000 |

499,115 |

|

|

Bank of New York Co., Inc.: |

|

|

|

|

|

|

7.625% 7/15/02 |

A1 |

|

500,000 |

504,250 |

|

|

7.875% 11/15/02 |

A1 |

|

136,000 |

137,866 |

|

|

Bank One Corp. 6.4% 8/1/02 |

Aa3 |

|

300,000 |

294,582 |

|

|

BankAmerica Corp. 7.5% 10/15/02 |

Aa3 |

|

25,000 |

25,100 |

|

|

BanPonce Financial Corp. 7.3% 6/5/02 |

A3 |

|

400,000 |

399,132 |

|

|

Barclays Bank PLC yankee 5.95% 7/15/01 |

A1 |

|

1,000,000 |

994,150 |

|

|

Boatmens Bancshares, Inc. 9.25% 11/1/01 |

Aa3 |

|

1,000,000 |

1,023,730 |

|

|

Capital One Bank 6.76% 7/23/02 |

Baa2 |

|

500,000 |

489,035 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

FINANCE - continued |

|||||

|

Banks - continued |

|||||

|

Central Fidelity Banks, Inc. 8.15% 11/15/02 |

A1 |

|

$ 1,200,000 |

$ 1,220,136 |

|

|

Citicorp 5.625% 2/15/01 |

Aa3 |

|

300,000 |

297,564 |

|

|

Firstar Corp. 6.35% 7/13/01 |

A1 |

|

1,200,000 |

1,191,240 |

|

|

Huntington Bancshares, Inc. 7.875% 11/15/02 |

A3 |

|

100,000 |

100,487 |

|

|

Integra Financial Corp. 8.5% 5/15/02 |

A2 |

|

350,000 |

355,957 |

|

|

Kansallis-Osake-Pankki (NY Branch) yankee |

A1 |

|

705,000 |

733,574 |

|

|

Korea Development Bank: |

|

|

|

|

|

|

6.625% 11/21/03 |

Baa2 |

|

70,000 |

67,423 |

|

|

7.125% 9/17/01 |

Baa2 |

|

1,090,000 |

1,081,912 |

|

|

MBNA Corp. 6.963% 9/12/02 |

Baa2 |

|

600,000 |

594,396 |

|

|

Mellon Financial Co. 9.25% 8/15/01 |

A2 |

|

557,000 |

567,672 |

|

|

National Westminster Bank PLC 9.45% 5/1/01 |

Aa3 |

|

1,250,000 |

1,270,875 |

|

|

NCNB Corp. 9.125% 10/15/01 |

Aa3 |

|

500,000 |

510,735 |

|

|

Providian National Bank 6.25% 5/7/01 |

Baa3 |

|

1,500,000 |

1,479,375 |

|

|

Summit Bancorp 8.625% 12/10/02 |

A3 |

|

250,000 |

254,420 |

|

|

US Bank NA, Minnesota: |

|

|

|

|

|

|

5.25% 6/4/03 |

Aa3 |

|

250,000 |

236,105 |

|

|

6.35% 9/28/01 |

Aa3 |

|

1,000,000 |

990,600 |

|

|

Wells Fargo & Co. 6.875% 4/15/03 |

Aa3 |

|

160,000 |

158,619 |

|

|

Westpac Banking Corp. 7.875% 10/15/02 |

A1 |

|

200,000 |

201,894 |

|

|

|

15,679,944 |

||||

|

Credit & Other Finance - 8.2% |

|||||

|

Aristar, Inc. 7.75% 6/15/01 |

A3 |

|

800,000 |

801,216 |

|

|

Associates Corp. of North America: |

|

|

|

|

|

|

5.875% 7/15/02 |

Aa3 |

|

250,000 |

243,380 |

|

|

6.45% 10/15/01 |

Aa3 |

|

725,000 |

717,018 |

|

|

AT&T Capital Corp. 6.25% 5/15/01 |

A1 |

|

1,200,000 |

1,188,636 |

|

|

Chrysler Financial Corp.: |

|

|

|

|

|

|

5.25% 10/22/01 |

A1 |

|

450,000 |

438,759 |

|

|

5.69% 11/15/01 |

A1 |

|

1,000,000 |

979,140 |

|

|

6.02% 4/9/01 |

A1 |

|

520,000 |

516,152 |

|

|

Countrywide Funding Corp. 8.25% 7/15/02 |

Baa1 |

|

1,250,000 |

1,267,850 |

|

|

Finova Capital Corp. 7.125% 5/1/02 |

Baa2 |

|

174,000 |

157,470 |

|

|

Ford Capital BV yankee 9.5% 7/1/01 |

A2 |

|

1,500,000 |

1,524,570 |

|

|

Ford Motor Credit Co. 5.125% 10/15/01 |

A2 |

|

200,000 |

195,380 |

|

|

General Electric Capital Corp. 6.33% 9/17/01 |

Aaa |

|

2,000,000 |

1,983,000 |

|

|

General Motors Acceptance Corp. 5.95% 4/20/01 |

A2 |

|

1,000,000 |

989,810 |

|

|

Greyhound Financial Corp. 7.82% 1/27/03 |

Baa1 |

|

100,000 |

90,631 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

FINANCE - continued |

|||||

|

Credit & Other Finance - continued |

|||||

|

Household Finance Corp. 6.93% 4/11/01 |

A2 |

|

$ 1,500,000 |

$ 1,498,230 |

|

|

PNC Funding Corp. 6.95% 9/1/02 |

A2 |

|

2,000,000 |

1,982,920 |

|

|

Sanwa Business Credit Card, Inc. 7.25% 9/15/01 (b) |

A1 |

|

1,000,000 |

1,001,620 |

|

|

Southwestern Bell Capital Corp. 7.36% 5/1/02 |

Aa3 |

|

100,000 |

100,528 |

|

|

TXU Eastern Funding 6.15% 5/15/02 |

Baa1 |

|

200,000 |

195,994 |

|

|

U.S. West Capital Funding, Inc. 6.875% 8/15/01 |

Baa1 |

|

750,000 |

746,100 |

|

|

|

16,618,404 |

||||

|

Insurance - 0.6% |

|||||

|

Sun America, Inc. 6.58% 1/15/02 |

Baa1 |

|

200,000 |

198,944 |

|

|

Travelers Property Casualty Corp. 6.75% 4/15/01 |

A1 |

|

1,000,000 |

997,650 |

|

|

|

1,196,594 |

||||

|

Savings & Loans - 0.3% |

|||||

|

Great Western Financial Corp. 8.6% 2/1/02 |

A3 |

|

100,000 |

101,132 |

|

|

Household Bank FSB 6.87% 5/15/01 |

A2 |

|

250,000 |

248,438 |

|

|

Long Island Savings Bank FSB 7% 6/13/02 |

Baa3 |

|

250,000 |

245,728 |

|

|

|

595,298 |

||||

|

Securities Industry - 2.9% |

|||||

|

DLJ, Inc. 6% 12/1/01 |

A3 |

|

1,000,000 |

980,940 |

|

|

Goldman Sachs Group LP 6.2% 2/15/01 |

A1 |

|

1,000,000 |

993,720 |

|

|

Merrill Lynch & Co., Inc. 5.71% 1/15/02 |

Aa3 |

|

1,000,000 |

973,610 |

|

|

Morgan Stanley Dean Witter & Co. 7.125% 1/15/03 |

Aa3 |

|

1,000,000 |

996,740 |

|

|

Morgan Stanley Dean Witter Discover & Co. 6.5% 3/30/01 |

Aa3 |

|

1,000,000 |

995,620 |

|

|

Salomon Smith Barney Holdings, Inc. 6.65% 7/15/01 |

Aa3 |

|

1,000,000 |

996,510 |

|

|

|

5,937,140 |

||||

|

TOTAL FINANCE |

40,027,380 |

||||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 0.7% |

|||||

|

Tyco International Group SA yankee 6.125% 6/15/01 |

Baa1 |

|

1,500,000 |

1,482,045 |

|

|

MEDIA & LEISURE - 0.1% |

|||||

|

Broadcasting - 0.1% |

|||||

|

Continental Cablevision, Inc. 8.5% 9/15/01 |

A2 |

|

250,000 |

252,845 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

NONDURABLES - 1.3% |

|||||

|

Beverages - 0.8% |

|||||

|

Seagram JE & Sons, Inc.: |

|

|

|

|

|

|

5.79% 4/15/01 |

Baa3 |

|

$ 1,050,000 |

$ 1,036,644 |

|

|

6.25% 12/15/01 |

Baa3 |

|

650,000 |

638,801 |

|

|

|

1,675,445 |

||||

|

Tobacco - 0.5% |

|||||

|

Philip Morris Companies, Inc. 7.5% 1/15/02 |

A2 |

|

1,000,000 |

987,360 |

|

|

TOTAL NONDURABLES |

2,662,805 |

||||

|

RETAIL & WHOLESALE - 1.7% |

|||||

|

General Merchandise Stores - 1.0% |

|||||

|

Dayton Hudson Corp. 9.75% 7/1/02 |

A2 |

|

390,000 |

408,182 |

|

|

Federated Department Stores, Inc. 8.125% 10/15/02 |

Baa1 |

|

1,600,000 |

1,612,672 |

|

|

|

2,020,854 |

||||

|

Grocery Stores - 0.7% |

|||||

|

Safeway, Inc. 7% 9/15/02 |

Baa2 |

|

1,500,000 |

1,486,875 |

|

|

TOTAL RETAIL & WHOLESALE |

3,507,729 |

||||

|

TECHNOLOGY - 0.1% |

|||||

|

Computers & Office Equipment - 0.1% |

|||||

|

Comdisco, Inc. 5.95% 4/30/02 |

Baa1 |

|

250,000 |

237,618 |

|

|

TRANSPORTATION - 0.7% |

|||||

|

Air Transportation - 0.2% |

|||||

|

Delta Air Lines, Inc. 8.5% 3/15/02 |

Baa3 |

|

311,000 |

312,922 |

|

|

Railroads - 0.5% |

|||||

|

Norfolk Southern Corp. 6.875% 5/1/01 |

Baa1 |

|

1,000,000 |

994,420 |

|

|

TOTAL TRANSPORTATION |

1,307,342 |

||||

|

UTILITIES - 5.3% |

|||||

|

Electric Utility - 2.0% |

|||||

|

Commonwealth Edison Co. 7.375% 9/15/02 |

Baa1 |

|

1,500,000 |

1,495,485 |

|

|

Houston Industries, Inc. 9.375% 6/1/01 |

Baa1 |

|

1,067,000 |

1,078,492 |

|

|

Niagara Mohawk Power Corp. 9.25% 10/1/01 |

Baa2 |

|

500,000 |

507,605 |

|

|

Philadelphia Electric Co. 5.625% 11/1/01 |

Baa1 |

|

250,000 |

244,160 |

|

|

Texas Utilities Electric Co. 8.125% 2/1/02 |

A3 |

|

850,000 |

860,056 |

|

|

|

4,185,798 |

||||

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

UTILITIES - continued |

|||||

|

Gas - 1.9% |

|||||

|

El Paso Energy Corp. 6.625% 7/15/01 |

Baa2 |

|

$ 1,200,000 |

$ 1,191,480 |

|

|

Enron Corp. 6.45% 11/15/01 |

Baa1 |

|

1,325,000 |

1,309,630 |

|

|

Southwest Gas Corp. 9.75% 6/15/02 |

Baa2 |

|

1,000,000 |

1,031,320 |

|

|

TransCanada Pipelines Ltd. 6.77% 4/30/01 |

A2 |

|

250,000 |

248,428 |

|

|

|

3,780,858 |

||||

|

Telephone Services - 1.4% |

|||||

|

GTE Corp. 9.1% 6/1/03 |

A2 |

|

95,000 |

99,277 |

|

|

Pacific Bell 8.7% 6/15/01 |

Aa3 |

|

250,000 |

253,195 |

|

|

Telecomunicaciones de Puerto Rico, Inc. 6.15% 5/15/02 |

Baa2 |

|

885,000 |

863,300 |

|

|

WorldCom, Inc. 6.125% 8/15/01 |

A3 |

|

1,600,000 |

1,581,072 |

|

|

|

2,796,844 |

||||

|

TOTAL UTILITIES |

10,763,500 |

||||

|

TOTAL NONCONVERTIBLE BONDS (Cost $69,642,019) |

68,724,584 |

||||

|

U.S. Government and Government Agency Obligations - 58.0% |

|||||

|

|

|||||

|

U.S. Government Agency Obligations - 20.4% |

|||||

|

Federal Home Loan Bank: |

|

|

|

|

|

|

5.875% 8/15/01 |

Aaa |

|

1,500,000 |

1,485,465 |

|

|

5.875% 9/17/01 |

Aaa |

|

40,000,000 |

39,581,200 |

|

|

Financing Corp. - coupon STRIPS 0% 5/2/01 |

Aaa |

|

300,000 |

284,619 |

|

|

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS |

41,351,284 |

||||

|

U.S. Treasury Obligations - 37.6% |

|||||

|

U.S. Treasury Bonds 11.625% 11/15/02 |

Aaa |

|

5,000,000 |

5,542,200 |

|

|

U.S. Treasury Notes: |

|

|

|

|

|

|

5.5% 8/31/01 |

Aaa |

|

65,550,000 |

64,894,493 |

|

|

7.875% 8/15/01 |

Aaa |

|

5,630,000 |

5,709,158 |

|

|

TOTAL U.S. TREASURY OBLIGATIONS |

76,145,851 |

||||

|

TOTAL U.S. GOVERNMENT AND (Cost $118,066,844) |

117,497,135 |

||||

|

Foreign Government and Government Agency Obligations (c) - 3.4% |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

British Columbia Province 5.5%, 10/30/00 |

Aa2 |

|

$ 1,000,000 |

$ 997,000 |

|

|

Canadian Government 6.125% 7/15/02 |

Aa1 |

|

400,000 |

394,400 |

|

|

Irish Republic: |

|

|

|

|

|

|

7.64% 1/2/02 |

Aaa |

|

210,000 |

212,314 |

|

|

yankee 8.625% 4/15/01 |

Aaa |

|

85,000 |

85,925 |

|

|

Manitoba Province yankee 8% 4/15/02 |

Aa3 |

|

400,000 |

407,240 |

|

|

Nova Scotia Province yankee 9.375% 7/15/02 |

A3 |

|

1,275,000 |

1,326,383 |

|

|

Ontario Province yankee: |

|

|

|

|

|

|

7.375% 1/27/03 |

Aa3 |

|

150,000 |

151,164 |

|

|

7.75% 6/4/02 |

Aa3 |

|

2,150,000 |

2,177,585 |

|

|

Quebec Province 8.69% 2/22/01 |

A2 |

|

1,000,000 |

1,007,820 |

|

|

Swedish Kingdom yankee 0%, 4/1/01 |

Aa1 |

|

174,000 |

166,193 |

|

|

TOTAL FOREIGN GOVERNMENT AND (Cost $7,072,010) |

6,926,024 |

||||

|

Supranational Obligations - 0.5% |

|||||

|

|

|||||

|

African Development Bank yankee 7.7%

7/15/02 |

Aa1 |

|

875,000 |

884,406 |

|

|

Cash Equivalents - 2.3% |

|||

|

Maturity Amount |

|

||

|

Investments in repurchase agreements (U.S. Government Obligations), in a joint trading account at 6.65%, dated 7/31/00 due

8/1/00 |

$ 4,642,857 |

4,642,000 |

|

|

TOTAL INVESTMENT PORTFOLIO - 98.1% (Cost $200,325,350) |

198,674,149 |

|

|

NET OTHER ASSETS - 1.9% |

3,943,300 |

||

|

NET ASSETS - 100% |

$ 202,617,449 |

||

|

Legend |

|

(a) S&P credit ratings are used in the absence of a rating by Moody's Investors Service, Inc. |

|

(b) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally

to qualified institutional buyers. At the period end, the value of these securities amounted to $1,001,620 |

|

(c) For foreign government obligations not individually rated by S&P or Moody's, the ratings listed have been assigned |

|

Other Information |

|

The composition of long-term debt holdings as a percentage of total value of investments in securities, is as follows (ratings are unaudited): |

|

Moody's Ratings |

S&P Ratings |

|||

|

Aaa, Aa, A |

83.0% |

|

AAA, AA, A |

62.7% |

|

Baa |

14.7% |

|

BBB |

14.3% |

|

Ba |

0.0% |

|

BB |

0.0% |

|

B |

0.0% |

|

B |

0.0% |

|

Caa |

0.0% |

|

CCC |

0.0% |

|

Ca, C |

0.0% |

|

CC, C |

0.0% |

|

|

|

|

D |

0.0% |

|

|

|

Purchases and sales of securities, other |

|

Income Tax Information |

|

At July 31, 2000, the aggregate cost of investment securities for income tax purposes was $200,373,953. Net unrealized depreciation aggregated $1,699,804, of

which $229,190 related |

|

At July 31, 2000, the fund had a capital loss carryforward of approximately $63,000 of which $26,000 and $37,000 will expire on July 31, 2005 and 2008, respectively. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Target Timeline 2001

Statement of Assets and Liabilities

|

|

July 31, 2000 |

|

|

Assets |

|

|

|

Investment in securities, at value (including repurchase agreements of $4,642,000) (cost $200,325,350) - |

|

$ 198,674,149 |

|

Cash |

|

438 |

|

Receivable for fund shares sold |

|

265,150 |

|

Interest receivable |

|

4,049,692 |

|

Total assets |

|

202,989,429 |

|

Liabilities |

|

|

|

Payable for fund shares redeemed |

$ 170,276 |

|

|

Distributions payable |

81,138 |

|

|

Accrued management fee |

26,563 |

|

|

Other payables and accrued expenses |

94,003 |

|

|

Total liabilities |

|

371,980 |

|

Net Assets |

|

$ 202,617,449 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 204,554,819 |

|

Undistributed net investment income |

|

5,655 |

|

Accumulated undistributed net realized gain (loss) |

|

(291,824) |

|

Net unrealized appreciation (depreciation) on investments |

|

(1,651,201) |

|

Net Assets, for 21,774,591 shares outstanding |

|

$ 202,617,449 |

|

Net Asset Value, offering price and redemption price |

|

$9.31 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Target Timeline 2001

Financial Statements - continued

Statement of Operations

|

|

Year ended July 31, 2000 |

|

|

Investment Income Interest |

|

$ 9,551,593 |

|

Security lending |

|

7,813 |

|

Total Income |

|

9,559,406 |

|

Expenses |

|

|

|

Management fee |

$ 624,417 |

|

|

Transfer agent fees |

181,600 |

|

|

Accounting and security lending fees |

62,458 |

|

|

Non-interested trustees' compensation |

404 |

|

|

Custodian fees and expenses |

5,263 |

|

|

Registration fees |

93,284 |

|

|

Audit |

26,514 |

|

|

Legal |

3,526 |

|

|

Miscellaneous |

62 |

|

|

Total expenses before reductions |

997,528 |

|

|

Expense reductions |

(491,464) |

506,064 |

|

Net investment income |

|

9,053,342 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on investment securities |

|

(243,492) |

|

Change in net unrealized appreciation (depreciation) on investment securities |

|

(1,299,131) |

|

Net gain (loss) |

|

(1,542,623) |

|

Net increase (decrease) in net assets resulting |

|

$ 7,510,719 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Target Timeline 2001

Financial Statements - continued

Statement of Changes in Net Assets

|

|

Year ended |

Year ended |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

$ 9,053,342 |

$ 1,037,235 |

|

Net realized gain (loss) |

(243,492) |

(19,781) |

|

Change in net unrealized appreciation (depreciation) |

(1,299,131) |

(356,371) |

|

Net increase (decrease) in net assets resulting |

7,510,719 |

661,083 |

|

Distributions to shareholders from net investment income |

(9,053,569) |

(1,038,591) |

|

Share transactions |

214,594,635 |

7,318,267 |

|

Reinvestment of distributions |

8,334,490 |

983,793 |

|

Cost of shares redeemed |

(36,232,949) |

(3,604,403) |

|

Net increase (decrease) in net assets resulting |

186,696,176 |

4,697,657 |

|

Redemption fees |

29,603 |

1,961 |

|

Total increase (decrease) in net assets |

185,182,929 |

4,322,110 |

|

Net Assets |

|

|

|

Beginning of period |

17,434,520 |

13,112,410 |

|

End of period (including undistributed net investment income of $5,655 and $3,455, respectively) |

$ 202,617,449 |

$ 17,434,520 |

|

Other Information Shares |

|

|

|

Sold |

22,922,349 |

757,745 |

|

Issued in reinvestment of distributions |

895,204 |

102,111 |

|

Redeemed |

(3,890,719) |

(374,885) |

|

Net increase (decrease) |

19,926,834 |

484,971 |

Annual Report

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

|

Years ended July 31, |

2000 |

1999 |

1998 |

1997 |

1996 G |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, |

$ 9.440 |

$ 9.620 |

$ 9.640 |

$ 9.400 |

$ 10.000 |

|

Income from Investment Operations |

.574 D |

.634 D |

.648 D |

.690 D |

.310 |

|

Net realized and unrealized gain (loss) |

(.124) |

(.178) |

(.019) |

.240 |

(.600) |

|

Total from investment operations |

.450 |

.456 |

.629 |

.930 |

(.290) |

|

Less Distributions |

|

|

|

|

|

|

From net investment income |

(.582) |

(.637) |

(.649) |

(.690) |

(.310) |

|

Redemption fees added to paid |

.002 |

.001 |

.000 |

.000 |

.000 |

|

Net asset value, end of period |

$ 9.310 |

$ 9.440 |

$ 9.620 |

$ 9.640 |

$ 9.400 |

|

Total Return B, C |

4.96% |

4.81% |

6.74% |

10.26% |

(2.88)% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

Net assets, end of period |

$ 202,617 |

$ 17,435 |

$ 13,112 |

$ 10,378 |

$ 6,180 |

|

Ratio of expenses to average |

.35% E |

.35% E |

.35% E |

.35% E |

.35% A, E |

|

Ratio of expenses to average net assets after expense reductions |

.35% |

.35% |

.35% |

.34% F |

.34% A, F |

|

Ratio of net investment income |

6.23% |

6.60% |

6.75% |

7.31% |

6.93% A |

|

Portfolio turnover rate |

24% |

16% |

47% |

97% |

93% A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C The total returns would have been lower had certain expenses not been reduced during the periods shown.

D Net investment income per share has been calculated based on average shares outstanding during the period.

E FMR agreed to reimburse a portion of the fund's expenses during the period. Without this reimbursement, the fund's expense ratio would have been higher.

F FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses.

G For the period February 8, 1996 (commencement of operations) to July 31, 1996.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Target Timeline 2003

|

Quality Diversification as of July 31, 2000 |

||

|

(Moody's Ratings) |

% of fund's investments |

% of fund's investments |

|

Aaa |

53.8 |

40.1 |

|

Aa |

5.6 |

7.8 |

|

A |

16.2 |

19.8 |

|

Baa |

20.8 |

28.4 |

|

Table excludes short-term investments. Where Moody's ratings are not available, we have used |

|

Average Years to Maturity as of July 31, 2000 |

||

|

|

|

6 months ago |

|

Years |

3.7 |

4.7 |

|

Average years to maturity is based on the average time remaining until principal payments are expected from each of the fund's bonds, weighted by dollar amount. |

|

Duration as of July 31, 2000 |

||

|

|

|

6 months ago |

|

Years |

3.0 |

3.6 |

|

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. |

|

Asset Allocation (% of fund's net assets) |

|||||||

|

As of July 31, 2000 * |

As of January 31, 2000 ** |

||||||

|

Corporate Bonds 39.3% |

|

|

Corporate Bonds 50.9% |

|

||

|

U.S. Government |

|

|

U.S. Government |

|

||

|

Other Investments 2.7% |

|

|

Other Investments 3.8% |

|

||

|

Short-Term |

|

|

Short-Term |

|

||

|

* Foreign |

8.6% |

|

** Foreign |

11.8% |

|

||

Annual Report

Fidelity Target Timeline 2003

Showing Percentage of Net Assets

|

Nonconvertible Bonds - 39.3% |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

AEROSPACE & DEFENSE - 1.3% |

|||||

|

Defense Electronics - 1.3% |

|||||

|

Raytheon Co. 6.5% 7/15/05 |

Baa2 |

|

$ 500,000 |

$ 474,560 |

|

|

BASIC INDUSTRIES - 0.4% |

|||||

|

Paper & Forest Products - 0.4% |

|||||

|

Fort James Corp. 6.625% 9/15/04 |

Baa2 |

|

150,000 |

142,217 |

|

|

CONSTRUCTION & REAL ESTATE - 1.6% |

|||||

|

Real Estate - 0.7% |

|||||

|

Cabot Industrial Property LP 7.125% 5/1/04 |

Baa2 |

|

290,000 |

277,298 |

|

|

Real Estate Investment Trusts - 0.9% |

|||||

|

Equity Office Properties Trust 6.5% 1/15/04 |

Baa1 |

|

200,000 |

192,080 |

|

|

Spieker Properties LP 6.8% 5/1/04 |

Baa2 |

|

150,000 |

144,267 |

|

|

|

336,347 |

||||

|

TOTAL CONSTRUCTION & REAL ESTATE |

613,645 |

||||

|

DURABLES - 0.6% |

|||||

|

Autos, Tires, & Accessories - 0.6% |

|||||

|

Enron Corp. Series A, 8.375% 5/23/05 |

Baa1 |

|

230,000 |

238,328 |

|

|

ENERGY - 0.7% |

|||||

|

Energy Services - 0.5% |

|||||

|

Baker Hughes, Inc. 5.8% 2/15/03 |

A2 |

|

200,000 |

191,800 |

|

|

Oil & Gas - 0.2% |

|||||

|

Conoco, Inc. 5.9% 4/15/04 |

A3 |

|

75,000 |

71,865 |

|

|

TOTAL ENERGY |

263,665 |

||||

|

FINANCE - 21.5% |

|||||

|

Banks - 12.1% |

|||||

|

Bank of Montreal 6.1% 9/15/05 |

A1 |

|

125,000 |

116,584 |

|

|

Bank One Corp. 7.25% 8/15/04 |

A1 |

|

395,000 |

389,359 |

|

|

Bayerische Landesbank Gironzentrale yankee 6.375% 10/15/05 |

Aaa |

|

200,000 |

192,648 |

|

|

Capital One Bank 6.375% 2/15/03 |

Baa2 |

|

250,000 |

240,363 |

|

|

First National Boston Corp. 8% 9/15/04 |

A2 |

|

325,000 |

328,715 |

|

|

First Security Corp. 7% 7/15/05 |

A3 |

|

375,000 |

364,264 |

|

|

First Tennessee National Corp. 6.75% 11/15/05 |

A3 |

|

200,000 |

191,804 |

|

|

Korea Development Bank: |

|

|

|

|

|

|

6.625% 11/21/03 |

Baa2 |

|

10,000 |

9,632 |

|

|

7.375% 9/17/04 |

Baa2 |

|

225,000 |

218,403 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

FINANCE - continued |

|||||

|

Banks - continued |

|||||

|

Korea Development Bank: - continued |

|

|

|

|

|

|

yankee 6.5% 11/15/02 |

Baa2 |

|

$ 100,000 |

$ 97,052 |

|

|

Meridian Bank Pennsylvania 6.625% 3/15/03 |

A1 |

|

250,000 |

244,300 |

|

|

Merita Bank Ltd. yankee 6.5% 1/15/06 |

A1 |

|

150,000 |

142,727 |

|

|

Signet Bank 7.8% 9/15/06 |

A1 |

|

250,000 |

249,190 |

|

|

Society National Bank 7.25% 6/1/05 |

A1 |

|

500,000 |

493,650 |

|

|

Sovran Financial Corp. 9.25% 6/15/06 |

Aa2 |

|

125,000 |

136,289 |

|

|

St. George Bank Ltd. yankee 7.15% 10/15/05 (b) |

Baa1 |

|

500,000 |

487,170 |

|

|

Swiss Bank Corp. 6.75% 7/15/05 |

Aa2 |

|

500,000 |

484,400 |

|

|

Union Planters Corp. 6.75% 11/1/05 |

Baa2 |

|

150,000 |

143,579 |

|

|

|

4,530,129 |

||||

|

Credit & Other Finance - 5.8% |

|||||

|

Abbey National PLC 6.69% 10/17/05 |

Aa3 |

|

300,000 |

290,076 |

|

|

Associates Corp. of North America 5.75% 11/1/03 |

Aa3 |

|

400,000 |

380,324 |

|

|

Finova Capital Corp. 6.12% 5/28/02 |

Baa2 |

|

300,000 |

270,000 |

|

|

Fleet Financial Group, Inc. 7.125% 4/15/06 |

A3 |

|

375,000 |

364,890 |

|

|

Ford Motor Credit Co. 7.5% 6/15/03 |

A2 |

|

250,000 |

249,870 |

|

|

PNC Funding Corp. 7.75% 6/1/04 |

A3 |

|

220,000 |

219,749 |

|

|

Sears Roebuck Acceptance Corp. 6% 3/20/03 |

A3 |

|

70,000 |

67,330 |

|

|

Southwestern Bell Capital Corp. 7.13% 6/1/05 |

A2 |

|

100,000 |

98,569 |

|

|

Sprint Capital Corp. 5.7% 11/15/03 |

Baa1 |

|

250,000 |

236,535 |

|

|

|

2,177,343 |

||||

|

Insurance - 0.9% |

|||||

|

Western National Corp. 7.125% 2/15/04 |

A2 |

|

351,000 |

344,528 |

|

|

Savings & Loans - 1.9% |

|||||

|

H.F. Ahmanson & Co. 7.875% 9/1/04 |

Baa1 |

|

700,000 |

701,792 |

|

|

Securities Industry - 0.8% |

|||||

|

Amvescap PLC yankee 6.6% 5/15/05 |

A3 |

|

50,000 |

46,679 |

|

|

Morgan Stanley Dean Witter & Co. 7.125% 1/15/03 |

Aa3 |

|

250,000 |

249,185 |

|

|

|

295,864 |

||||

|

TOTAL FINANCE |

8,049,656 |

||||

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

MEDIA & LEISURE - 3.3% |

|||||

|

Broadcasting - 0.8% |

|||||

|

Cox Communications, Inc. 6.5% 11/15/02 |

Baa2 |

|

$ 200,000 |

$ 195,982 |

|

|

Time Warner, Inc. 7.75% 6/15/05 |

Baa3 |

|

111,000 |

111,935 |

|

|

|

307,917 |

||||

|

Entertainment - 0.5% |

|||||

|

Viacom, Inc. 6.75% 1/15/03 |

Baa1 |

|

200,000 |

196,780 |

|

|

Publishing - 2.0% |

|||||

|

News America Holdings, Inc. 8.5% 2/15/05 |

Baa3 |

|

710,000 |

731,662 |

|

|

TOTAL MEDIA & LEISURE |

1,236,359 |

||||

|

NONDURABLES - 1.5% |

|||||

|

Beverages - 0.6% |

|||||

|

Seagram JE & Sons, Inc. 6.4% 12/15/03 |

Baa3 |

|

250,000 |

241,390 |

|

|

Tobacco - 0.9% |

|||||

|

Philip Morris Companies, Inc. 7% 7/15/05 |

A2 |

|

255,000 |

240,717 |

|

|

RJ Reynolds Tobacco Holdings, Inc. 7.375% 5/15/03 |

Baa2 |

|

100,000 |

93,617 |

|

|

|

334,334 |

||||

|

TOTAL NONDURABLES |

575,724 |

||||

|

RETAIL & WHOLESALE - 1.0% |

|||||

|

General Merchandise Stores - 1.0% |

|||||

|

Dayton Hudson Corp. 7.5% 7/15/06 |

A2 |

|

375,000 |

375,600 |

|

|

TRANSPORTATION - 2.8% |

|||||

|

Air Transportation - 0.4% |

|||||

|

Delta Air Lines, Inc. 8.5% 3/15/02 |

Baa3 |

|

174,000 |

175,075 |

|

|

Railroads - 2.4% |

|||||

|

Canadian National Railway Co. 7% 3/15/04 |

Baa2 |

|

300,000 |

292,506 |

|

|

Norfolk Southern Corp. 7.875% 2/15/04 |

Baa1 |

|

400,000 |

402,248 |

|

|

Union Pacific 6.34% 11/25/03 |

Baa3 |

|

200,000 |

192,940 |

|

|

|

887,694 |

||||

|

TOTAL TRANSPORTATION |

1,062,769 |

||||

|

UTILITIES - 4.6% |

|||||

|

Electric Utility - 2.6% |

|||||

|

Commonwealth Edison Co. 6.625% 7/15/03 |

Baa1 |

|

250,000 |

242,648 |

|

|

Niagara Mohawk Power Corp. 7.375% 8/1/03 |

Baa2 |

|

200,000 |

199,592 |

|

|

Nonconvertible Bonds - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

UTILITIES - continued |

|||||

|

Electric Utility - continued |

|||||

|

Philadelphia Electric Co.: |

|

|

|

|

|

|

6.5% 5/1/03 |

Baa1 |

|

$ 105,000 |

$ 101,989 |

|

|

6.625% 3/1/03 |

Baa1 |

|

270,000 |

263,650 |

|

|

Public Service Electric & Gas Co. 6.125% 8/1/02 |

A3 |

|

143,000 |

139,801 |

|

|

|

947,680 |

||||

|

Gas - 2.0% |

|||||

|

CMS Panhandle Holding Co. 6.125% 3/15/04 |

Baa3 |

|

100,000 |

94,800 |

|

|

Consolidated Natural Gas Co. 5.75% 8/1/03 |

A2 |

|

500,000 |

477,340 |

|

|

Enserch Corp. 6.25% 1/1/03 |

Baa2 |

|

190,000 |

184,251 |

|

|

|

756,391 |

||||

|

TOTAL UTILITIES |

1,704,071 |

||||

|

TOTAL NONCONVERTIBLE BONDS (Cost $15,290,426) |

14,736,594 |

||||

|

U.S. Government and Government Agency Obligations - 51.9% |

|||||

|

|

|||||

|

U.S. Government Agency Obligations - 25.0% |

|||||

|

Fannie Mae: |

|

|

|

|

|

|

5.125% 2/13/04 |

Aaa |

|

140,000 |

131,907 |

|

|

7% 7/15/05 |

Aaa |

|

1,060,000 |

1,060,827 |

|

|

Federal Home Loan Bank: |

|

|

|

|

|

|

6.25% 8/13/04 |

Aaa |

|

4,500,000 |

4,383,990 |

|

|

6.75% 5/1/02 |

Aaa |

|

2,000,000 |

1,994,680 |

|

|

9.5% 2/25/04 |

Aaa |

|

150,000 |

161,462 |

|

|

Freddie Mac: |

|

|

|

|

|

|

6.875% 1/15/05 |

Aaa |

|

45,000 |

44,782 |

|

|

7% 7/15/05 |

Aaa |

|

65,000 |

65,020 |

|

|

7.375% 5/15/03 |

Aaa |

|

1,500,000 |

1,515,705 |

|

|

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS |

9,358,373 |

||||

|

U.S. Treasury Obligations - 26.9% |

|||||

|

U.S. Treasury Bonds: |

|

|

|

|

|

|

10.75% 5/15/03 |

Aaa |

|

6,700,000 |

7,430,697 |

|

|

U.S. Government and Government Agency Obligations - continued |

|||||

|

Moody's Ratings |

Principal Amount |

Value |

|||

|

U.S. Treasury Obligations - continued |

|||||

|

U.S. Treasury Bonds: - continued |

|

|

|

|

|

|

10.75% 8/15/05 |

Aaa |

|

$ 1,000,000 |

$ 1,191,090 |

|

|

11.75% 2/15/10 (callable) |

Aaa |

|

1,225,000 |

1,475,549 |

|

|

TOTAL U.S. TREASURY OBLIGATIONS |

10,097,336 |

||||

|

TOTAL U.S. GOVERNMENT AND (Cost $19,805,495) |

19,455,709 |

||||

|

Foreign Government and Government Agency Obligations (c) - 2.7% |

|||||

|

|

|||||

|

Manitoba Province yankee 6.125% 1/19/04 |

Aa3 |

|

250,000 |

243,475 |

|

|

Ontario Province 7%, 8/4/05 |

Aa3 |

|

275,000 |

272,902 |

|

|

Saskatchewan Province yankee 8% 7/15/04 |

A2 |

|

500,000 |

514,700 |

|

|

TOTAL FOREIGN GOVERNMENT AND (Cost $1,073,601) |

1,031,077 |

||||

|

Cash Equivalents - 3.5% |

|||

|

Maturity Amount |

|

||

|

Investments in repurchase agreements (U.S. Government Obligations), in a joint trading account at 6.65%, dated 7/31/00 due

8/1/00 |

$ 1,316,243 |

1,316,000 |

|

|

TOTAL INVESTMENT PORTFOLIO - 97.4% (Cost $37,485,522) |

36,539,380 |

||

|

NET OTHER ASSETS - 2.6% |

962,338 |

||

|

NET ASSETS - 100% |

$ 37,501,718 |

||

|

Legend |

|

(a) S&P credit ratings are used in the absence of a rating by Moody's Investors Service, Inc. |

|

(b) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the period end, the value of these securities amounted to $487,170 or 1.3% of net assets. |

|

(c) For foreign government obligations not individually rated by S&P or Moody's, the ratings listed have been assigned |

|

Other Information |

|

The composition of long-term debt holdings as a percentage of total value of investments in securities, is as follows (ratings are unaudited): |

|

Moody's Ratings |

S&P Ratings |

|||

|

Aaa, Aa, A |

75.6% |

|

AAA, AA, A |

47.6% |

|

Baa |

20.8% |

|

BBB |

23.6% |

|

Ba |

0.0% |

|

BB |

0.0% |

|

B |

0.0% |

|

B |

0.0% |

|

Caa |

0.0% |

|

CCC |

0.0% |

|

Ca, C |

0.0% |

|

CC, C |

0.0% |

|

|

|

|

D |

0.0% |

|

Purchases and sales of securities, other |

|

Income Tax Information |

|

At July 31, 2000, the aggregate cost |

|

At July 31, 2000, the fund had a capital loss carryforward of approximately $333,000 all of which will expire on July 31, 2008. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Target Timeline 2003

Statement of Assets and Liabilities

|

|

July 31, 2000 |

|

|

Assets |

|

|

|

Investment in securities, at value (including repurchase agreements of $1,316,000) (cost $37,485,522) - |

|

$ 36,539,380 |

|

Receivable for fund shares sold |

|

261,357 |

|

Interest receivable |

|

765,052 |

|

Receivable from investment adviser for expense reductions |

|

1,371 |

|

Total assets |

|

37,567,160 |

|

Liabilities |

|

|

|

Payable for fund shares redeemed |

$ 10,660 |

|

|

Distributions payable |

19,232 |

|

|

Other payables and accrued expenses |

35,550 |

|

|

Total liabilities |

|

65,442 |

|

Net Assets |

|

$ 37,501,718 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 39,052,930 |

|

Undistributed net investment income |

|

5,416 |

|

Accumulated undistributed net realized gain (loss) |

|

(610,486) |

|

Net unrealized appreciation (depreciation) on investments |

|

(946,142) |

|

Net Assets, for 4,141,274 shares outstanding |

|

$ 37,501,718 |

|

Net Asset Value, offering price and redemption price |

|

$9.06 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Target Timeline 2003

Financial Statements - continued

Statement of Operations

|

|

Year ended July 31, 2000 |

|

|

Investment Income Interest |

|

$ 2,110,401 |

|

Expenses |

|

|

|

Management fee |

$ 121,834 |

|

|

Transfer agent fees |

43,022 |

|

|

Accounting fees and expenses |

61,519 |

|

|

Non-interested trustees' compensation |

82 |

|

|

Custodian fees and expenses |

1,709 |

|

|

Registration fees |

27,215 |

|

|

Audit |

28,136 |

|

|

Legal |

1,835 |

|

|

Miscellaneous |

79 |

|

|

Total expenses before reductions |

285,431 |

|

|

Expense reductions |

(186,299) |

99,132 |

|

Net investment income |

|

2,011,269 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on investment securities |

|

(560,622) |

|

Change in net unrealized appreciation (depreciation) on investment securities |

|

(33,451) |

|

Net gain (loss) |

|

(594,073) |

|

Net increase (decrease) in net assets resulting |

|

$ 1,417,196 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Target Timeline 2003

Financial Statements - continued

Statement of Changes in Net Assets

|

|

Year ended |

Year ended |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

$ 2,011,269 |

$ 1,624,346 |

|

Net realized gain (loss) |

(560,622) |

(14,251) |

|

Change in net unrealized appreciation (depreciation) |

(33,451) |

(1,113,533) |

|

Net increase (decrease) in net assets resulting |

1,417,196 |

496,562 |

|

Distributions to shareholders |

(2,026,046) |

(1,639,211) |

|

From net realized gain |

- |

(90,269) |

|

In excess of net realized gain |

- |

(15,284) |

|

Total distributions |

(2,026,046) |

(1,744,764) |

|

Share transactions |

22,888,769 |

12,280,874 |

|

Reinvestment of distributions |

1,884,618 |

1,671,487 |

|

Cost of shares redeemed |

(10,387,122) |

(8,768,624) |

|

Net increase (decrease) in net assets resulting |

14,386,265 |

5,183,737 |

|

Redemption fees |

7,538 |

4,022 |

|

Total increase (decrease) in net assets |

13,784,953 |

3,939,557 |

|

Net Assets |

|

|

|

Beginning of period |

23,716,765 |

19,777,208 |

|

End of period (including undistributed net investment income of $5,416 and $13,804, respectively) |

$ 37,501,718 |

$ 23,716,765 |

|

Other Information Shares |

|

|

|

Sold |

2,520,940 |

1,260,185 |

|

Issued in reinvestment of distributions |

207,449 |

172,491 |

|

Redeemed |

(1,141,001) |

(907,278) |

|

Net increase (decrease) |

1,587,388 |

525,398 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

|

Years ended July 31, |

2000 |

1999 |

1998 |

1997 |

1996 G |

|

Selected Per-Share Data |

|

|