|

|

|

|

|

Previous: MICROAGE INC /DE/, 10-Q, EX-27, 2000-09-21 |

Next: FIDELITY BOSTON STREET TRUST, 485BPOS, EX-99.DADVSRCONTR, 2000-09-21 |

|

SECURITIES AND EXCHANGE COMMISSION |

||||

|

Washington, D.C. 20549 |

||||

|

FORM N-1A |

||||

|

|

||||

|

REGISTRATION STATEMENT (No. 33-17704) |

||||

|

|

UNDER THE SECURITIES ACT OF 1933 |

[X] |

||

|

|

Pre-Effective Amendment No. |

[ ] |

||

|

|

Post-Effective Amendment No. 25 |

[X] |

||

|

and |

||||

|

REGISTRATION STATEMENT (No. 811-5361) |

||||

|

|

UNDER THE INVESTMENT COMPANY ACT OF 1940 |

[X] |

||

|

|

Amendment No. 25 |

[X] |

||

|

|

||||

|

Fidelity Boston Street Trust |

||||

|

(Exact Name of Registrant as Specified in Charter) |

||||

|

|

||||

|

82 Devonshire St., Boston, Massachusetts 02109 |

||||

|

(Address Of Principal Executive Offices) (Zip Code) |

||||

|

|

||||

|

Registrant's Telephone Number: 617-563-7000 |

||||

|

|

||||

|

Eric D. Roiter, Secretary |

||||

|

82 Devonshire Street |

||||

|

Boston, Massachusetts 02109 |

||||

|

(Name and Address of Agent for Service) |

||||

|

|

||||

|

It is proposed that this filing will become effective |

||||

|

|

( ) |

immediately upon filing pursuant to paragraph (b). |

||

|

|

(X) |

on (September 25, 2000) pursuant to paragraph (b). |

||

|

|

( ) |

60 days after filing pursuant to paragraph (a)(1). |

||

|

|

( ) |

on ( ) pursuant to paragraph (a)(1) of Rule 485. |

||

|

|

( ) |

75 days after filing pursuant to paragraph (a)(2). |

||

|

|

( ) |

on ( ) pursuant to paragraph (a)(2) of Rule 485. |

||

|

|

||||

|

If appropriate, check the following box: |

||||

|

|

( ) |

this post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

||

Like securities of all mutual funds, these securities have not been approved or disapproved by the Securities and Exchange Commission, and the Securities and Exchange Commission has not determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Fidelity®

Funds

Fidelity

Target Timeline 2001

(fund number 381, trading symbol FTTBX)

Fidelity

Target Timeline 2003

(fund number 383, trading symbol FTARX)

Prospectus

September 25, 2000

(fidelity_logo_graphic) 82 Devonshire Street, Boston, MA 02109

|

Fund Summary |

Investment Summary |

|

|

|

Performance |

|

|

|

Fee Table |

|

|

Fund Basics |

Investment Details |

|

|

|

Valuing Shares |

|

|

Shareholder Information |

Buying and Selling Shares |

|

|

|

Exchanging Shares |

|

|

|

Account Features and Policies |

|

|

|

Dividends and Capital Gain Distributions |

|

|

|

Tax Consequences |

|

|

Fund Services |

Fund Management |

|

|

|

Fund Distribution |

|

|

Appendix |

Financial Highlights |

Prospectus

Investment Objective

Target Timeline® 2001 seeks a definable return over its lifetime.

Principal Investment Strategies

Fidelity Management & Research Company (FMR)'s principal investment strategies include:

Principal Investment Risks

The fund is subject to the following principal investment risks:

In addition, the fund is considered non-diversified and can invest a greater portion of assets in securities of individual issuers than a diversified fund. As a result, changes in the market value of a single issuer could cause greater fluctuations in share price than would occur in a more diversified fund.

An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

When you sell your shares of the fund, they could be worth more or less than what you paid for them.

Investment Objective

Target Timeline 2003 seeks a definable return over its lifetime.

Prospectus

Fund Summary - continued

Principal Investment Strategies

FMR's principal investment strategies include:

Principal Investment Risks

The fund is subject to the following principal investment risks:

Issuer-Specific Changes. The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently <R>from</R> the value of the market as a whole.

Interest Rate Sensitivity Management. FMR's interest rate sensitivity management strategy may not be effective in all market or economic conditions.

In addition, the fund is considered non-diversified and can invest a greater portion of assets in securities of individual issuers than a diversified fund. As a result, changes in the market value of a single issuer could cause greater fluctuations in share price than would occur in a more diversified fund.

An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

When you sell your shares of the fund, they could be worth more or less than what you paid for them.

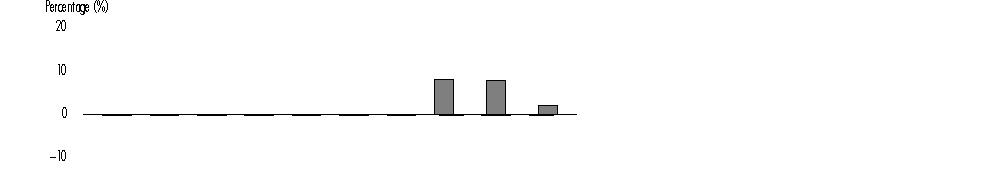

The following information illustrates the changes in each fund's performance from year to year and compares each fund's performance to the performance of a market index and an average of the performance of similar funds over various periods of time. Each fund also compares its performance to the performance of an additional index over various periods of time. Returns are based on past results and are not an indication of future performance.

Prospectus

Fund Summary - continued

|

Target Timeline 2001 |

|

<R>Calendar Years |

|

|

|

|

|

|

|

1997 |

1998 |

1999</R> |

|

<R> |

|

|

|

|

|

|

|

8.23% |

8.04% |

2.27%</R> |

<R>

</R>

During the periods shown in the chart for Target Timeline 2001, the highest return<R> for a quarter was 3.91% (quarter ended September 30, 1998) and the lowest return for a quarter was -0.69% (quarter ended March 31, 1997)</R>.

<R>The year-to-date return as of June 30, 2000 for Target Timeline 2001 was 2.83%.</R>

|

Target Timeline 2003 |

|

<R>Calendar Years |

|

|

|

|

|

|

|

1997 |

1998 |

1999</R> |

|

<R> |

|

|

|

|

|

|

|

10.14% |

9.22% |

-1.12%</R> |

<R>

</R>

<R>During the periods shown in the chart for Target Timeline 2003, the highest return for a quarter was </R>5.00%<R> (quarter ended </R>September 30, 1998<R>) and the lowest return for a quarter was </R>-1.54%<R> (quarter ended </R>March 31, 1997).

<R>The year-to-date return as of June 30, 2000 for Target Timeline 2003 was 2.88%.</R>

Prospectus

Fund Summary - continued

|

<R>For the periods ended |

Past 1 |

Life of |

|

<R>Target Timeline 2001 |

2.27% |

5.13%</R> |

|

<R>Lehman Brothers Aggregate Bond Index |

-0.82% |

5.20%</R> |

|

<R>U.S. Treasury STRIPS (8/15/01 and 11/15/01) |

1.97% |

5.05%</R> |

|

<R>Target Timeline 2003 |

-1.12% |

4.72%</R> |

|

<R>Lehman Brothers Aggregate Bond Index |

-0.82% |

5.20%</R> |

|

<R>U.S. Treasury STRIPS (8/15/03 and 11/15/03) |

-1.78% |

4.92%</R> |

A From February 8, 1996.

<R>If F</R>MR had not reimbursed certain fund expenses during these periods, each fund's returns would have been lower.

The Lehman Brothers Aggregate Bond Index is a market value-weighted index of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of one year or more.

U.S. Treasury STRIPS are zero-coupon bonds which pay principal and interest on maturity. Each fund compares its performance to the average of the total returns of two U.S. Treasury STRIPS (evenly weighted by par amount) that mature close to the fund's target maturity date (August 15 and November 15 of the appropriate year).

The following table describes the fees and expenses that are incurred when you buy, hold, or sell shares of a fund. <R>The annual fund operating expenses provided below for each fund</R> do not reflect the effect of any expense reimbursements during the period.

Shareholder fees (paid by the investor directly)

|

Sales charge (load) on purchases and reinvested distributions |

None |

|

Deferred sales charge (load) on redemptions |

None |

|

Redemption fee on shares held less than 90 days (as a % of amount redeemed) |

0.50% |

|

Annual account maintenance fee (for accounts under $2,500) |

$12.00 |

Prospectus

Fund Summary - continued

Annual fund operating expenses (paid from fund assets)

|

<R>Target Timeline 2001 |

Management fee |

0.43%</R> |

|

|

Distribution and Service (12b-1) fee |

None |

|

<R> |

Other expenses |

0.26%</R> |

|

<R> |

Total annual fund operating expensesA |

0.69%</R> |

|

<R>Target Timeline 2003 |

Management fee |

0.43%</R> |

|

|

Distribution and Service (12b-1) fee |

None |

|

<R> |

Other expenses |

0.58%</R> |

|

<R> |

Total annual fund operating expensesA |

1.01%</R> |

A Effective February 8, 1996, FMR has voluntarily agreed to reimburse each fund to the extent that <R>total operating expenses (excluding interest, taxes, certain securities lending costs, brokerage commissions, and extraordinary expenses), as</R> a percentage of their respective average net assets, exceed 0.35%. These arrangements can be discontinued by FMR at any time.

This example helps you compare the cost of investing in the funds with the cost of investing in other mutual funds.

<R>Let's say, hypothetically, that each fund's annual return is 5% and that your shareholder fees and each fund's annual operating expenses are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you close your account at the end of each time period indicated:</R>

|

<R>Target Timeline 2001 |

1 year |

$ 70</R> |

|

<R> |

3 years |

$ 221</R> |

|

<R> |

5 years |

$ 384</R> |

|

<R> |

10 years |

$ 859</R> |

|

<R>Target Timeline 2003 |

1 year |

$ 103</R> |

|

<R> |

3 years |

$ 322</R> |

|

<R> |

5 years |

$ 558</R> |

|

<R> |

10 years |

$ 1,236</R> |

Prospectus

Investment Objective

Each of Target Timeline 2001 and Target Timeline 2003 seeks a definable return over its lifetime.

Principal Investment Strategies

FMR normally invests each fund's assets in U.S. dollar-denominated investment-grade bonds (those of medium and high quality).

Each fund has a target date for maturity of September 30 of the year in its name. Each fund will be liquidated shortly after its target date.

FMR manages each fund to provide shareholders with a total return that approximates the fund's quoted yield (within ±0.50% annually) as of the date of purchase if shareholders hold their investment to the fund's target date and reinvest all distributions. The yield quoted by a fund represents the average yield to maturity of the fund's investments according to the Securities and Exchange Commission (SEC) standards. Yield to maturity approximates the annualized expected return of a bond over its lifetime, assuming the interest payments are reinvested at the same rate. FMR will seek to generate this return on average over each fund's lifetime, not on a year-by-year basis. The funds do not seek to provide stability of principal, to give shareholders their principal back at maturity, or to achieve any target share price.

FMR seeks to achieve a definable return by managing each fund's sensitivity to changing interest rates. In addition to affecting the value of the funds' bonds, changes in interest rates affect the amount the funds earn from reinvesting the income from the bonds. Falling interest rates, for example, will increase the value of the funds' bonds but decrease earnings from reinvestment, while rising interest rates will increase earnings from reinvestment but decrease the value of the funds' bonds. In seeking a definable return, FMR structures each fund's portfolio so that these interest rate effects generally offset each other over the fund's lifetime. This strategy involves selecting securities whose average duration is approximately equal to the amount of time remaining to a fund's target date.

The duration of a security measures the weighted average time until the interest and principal from a security are received. For a typical bond, duration is shorter than maturity because much of the bond's return consists of interest paid prior to the maturity date. In matching a fund's duration to the time remaining to its target date, the fund is likely to hold individual securities with longer maturities than the time remaining before its target date. As the target date approaches, a fund will generally sell securities with longer maturities and purchase securities that mature closer to the target date.

Because each fund is considered non-diversified, FMR may invest a significant percentage of the fund's assets in a single issuer.

In buying and selling securities for each fund, FMR analyzes a security's structural feature<R>s and c</R>urrent price compared to its estimated long-term value, any short-term trading opportunities resulting from market inefficiencies, and the credit quality of its issuer.

Prospectus

Fund Basics - continued

FMR may use various techniques, such as buying and selling futures contracts, to increase or decrease a fund's exposure to changing security prices, interest rates<R>, </R>or other factors that affect security values. If FMR's strategies do not work as intended, a fund may not achieve its objective.

Description of Principal Security Types

Debt securities are used by issuers to borrow money. The issuer usually pays a fixed, variable<R>,</R> or floating rate of interest, and must repay the amount borrowed at the maturity of the security. Some debt securities, such as zero coupon bonds, do not pay current interest but are sold at a discount from their face values. Debt securities include corporate bonds, government securities, and mortgage and other asset-backed securities.

Principal Investment Risks

Many factors affect each fund's performance. A fund's yield and share price change daily based on changes in interest rates and market conditions and in response to other economic, politica<R>l,</R> or financial developments. A fund's reaction to these developments will be affected by the types and maturities of securities in which the fund invests, the financial condition, industry and economic sector, and geographic location of an issuer, and the fund's level of investment in the securities of that issuer. Because FMR may invest a significant percentage of each fund's assets in a single issuer, the fund's performance could be closely tied to the market value of that one issuer and could be more volatile than the performance of more diversified funds. The funds' quoted yields are not guaranteed and there is no assurance that they will be achieved. If you sell your shares before a fund's target date, you could earn more or less than your original yield, and could have an overall loss on your investment. Upon liquidation of a fund, your shares could be worth more or less than what you paid for them.

The following factors can significantly affect a fund's performance:

Interest Rate Changes. Debt securities have varying levels of sensitivity to changes in interest rates. In general, the price of a debt security can fall when interest rates rise and can rise when interest rates fall. Securities with longer maturities and mortgage securities can be more sensitive to interest rate changes. In other words, the longer the maturity of a security, the greater the impact a change in interest rates could have on the security's price. In addition, short-term and long-term interest rates do not necessarily move in the same amount or the same direction. Short-term securities tend to react to changes in short-term interest rates, and long-term securities tend to react to changes in long-term interest rates.

Foreign Exposure. Foreign securities and securities issued by U.S. entities with substantial foreign operations can involve additional risks relating to political, economic<R>,</R> or regulatory conditions in foreign countries. All of these factors can make foreign investments more volatile than U.S. investments.

Prospectus

Fund Basics - continued

Prepayment. Many types of debt securities, including mortgage securities, are subject to prepayment risk. Prepayment occurs when the issuer of a security can repay principal prior to the security's maturity. Securities subject to prepayment can offer less potential for gains during a declining interest rate environment and similar or greater potential for loss in a rising interest rate environment. In addition, the potential impact of prepayment features on the price of a debt security can be difficult to predict and result in greater volatility.

Issuer-Specific Changes. Changes in the financial condition of an issuer, changes in specific economic or political conditions that affect a particular type of security or issuer, and changes in general economic or political conditions can affect the value of an issuer's securities. Lower-quality debt securities (those of less than investment-grade quality) tend to be more sensitive to these changes than higher-quality debt securities.

Interest Rate Sensitivity Management. FMR's interest rate sensitivity management strategy may not be effective in all market and economic conditions. For example, if interest rates change significantly, if interest rates for securities with different maturities do not move in the same direction, or if a security pays in a different manner than FMR expects, changes in the value of a fund's investments may not equal changes in the fund's income from reinvestment. In addition, if the issuer of a security defaults or the credit quality of a security declines and the security is sold before maturity, a fund's return will be reduced.

In response to market, economic, political<R>,</R> or other conditions, FMR may temporarily use a different investment strategy for defensive purposes. If FMR does so, different factors could affect a fund's performance and the fund may not achieve its investment objective.

Fundamental Investment Policies

The policies discussed below are fundamental, that is, subject to change only by shareholder approval.

Target Timeline 2001 seeks a definable return over its lifetime.

Target Timeline 2003 seeks a definable return over its lifetime.

Each fund is open for business each day the New York Stock Exchange (NYSE) is open.

Each fund's net asset value per share (NAV) is the value of a single share. Fidelity normally calculates each fund's NAV as of the close of business of the NYSE, normally 4:00 p.m. Eastern time. However, NAV may be calculated earlier if trading on the NYSE is restricted or as permitted by the SEC. Each fund's assets are valued as of this time for the purpose of computing the fund's NAV.

To the extent that each fund's assets are traded in other markets on days when the NYSE is closed, the value of the fund's assets may be affected on days when the fund is not open for business. In addition, trading in some of a fund's assets may not occur on days when the fund is open for business.

Prospectus

Fund Basics - continued

Each fund's assets are valued primarily on the basis of information furnished by a pricing service or market quotations. Certain short-term securities are valued on the basis of amortized cost. If market quotations or information furnished by a pricing service is not readily available <R>or does not accurately reflect fair value fo</R>r a security or if a security's value has been materially affected by events occurring after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), that security may be valued by another method that the Board of Trustees believes accurately reflects fair value. A security's valuation may differ depending on the method used for determining value.

Prospectus

Fidelity Investments was established in 1946 to manage one of America's first mutual funds. Today, Fidelity is the largest mutual fund company in the country, and is known as an innovative provider of high-quality financial services to individuals and institutions.

In addition to its mutual fund business, the company operates one of America's leading discount brokerage firms, <R>Fidelity Brokerage Services LLC (FBS LLC).</R> Fidelity is also a leader in providing tax-advantaged retirement plans for individuals investing on their own or through their employer.

For account, produc<R>t, </R>and service information, please use the following web site and phone numbers:

Please use the following addresses:

Buying Shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0002

Overnight Express

Fidelity Investments

2300 Litton Lane - KH1A

Hebron, KY 41048

Selling Shares

Fidelity Investments

P.O. Box 660602

Dallas, TX 75266-0602

Overnight Express

Fidelity Investments

Attn: Redemptions - CP6I

400 East Las Colinas Blvd.

Irving, TX 75039-5587

You may buy or sell shares of the funds through a retirement account or an investment professional. If you invest through a retirement account or an investment professional, the procedures for buying, selling, and exchanging shares of a fund and the account features and policies may differ. Additional fees may also apply to your investment in a fund, including a transaction fee if you buy or sell shares of the fund through a broker or other investment professional.

Certain methods of contacting Fidelity, such as by telephone or electronically, may be unavailable or delayed (for example, during periods of unusual market activity). In addition, the level and type of service available may be restricted based on criteria established by Fidelity.

Prospectus

Shareholder Information - continued

The different ways to set up (register) your account with Fidelity are listed in the following table.

|

Ways to Set Up Your Account |

|

Individual or Joint Tenant For your general investment needs |

|

Retirement For tax-advantaged retirement savings |

|

|

|

|

|

|

|

|

|

|

|

Gifts or Transfers to a Minor (UGMA, UTMA) To invest for a child's education or other future needs |

|

Trust For money being invested by a trust |

|

Business or Organization For investment needs of corporations, associations, partnerships, or other groups |

<R>Target Timeline 2003's Board of Trustees anticipates closing the fund to new accounts approximately one year prior to the target date of the fund. Shareholders of the fund on the date the fund is closed will be able to continue to buy fund shares in accounts existing on that date.</R>

<R>Effective the close of business on September 25, 2000, Target Timeline 2001's shares are no longer available to new accounts. Shareholders of the fund on that date may continue to buy shares in accounts existing on that date. Investors who did not own shares of the fund on September 25, 2000, generally will not be allowed to buy shares of the fund except that new accounts may be established: 1) by participants in most group employer retirement plans (and their successor plans) if the fund had been established as an investment option under the plans (or under another plan sponsored by the same employer) by September 25, 2000, and 2) for accounts managed on a discretionary basis by certain registered investment advisers that have discretionary assets of at least $500 million invested in mutual funds and have included the fund in their discretionary account program since September 25, 2000. These restrictions generally will apply to investments made directly with Fidelity and investments made through intermediaries. Investors may be required to demonstrate eligibility to buy shares of the fund before an investment is accepted. </R>

The price to buy one share of each fund is the fund's NAV. Each fund's shares are sold without a sales charge.

Your shares will be bought at the next NAV calculated after your investment is received in proper form.

Prospectus

Shareholder Information - continued

Short-term or excessive trading into and out of a fund may harm performance by disrupting portfolio management strategies and by increasing expenses. Accordingly, a fund may reject any purchase orders, including exchanges, particularly from market timers or investors who, in FMR's opinion, have a pattern of short-term or excessive trading or whose trading has been or may be disruptive to that fund. For these purposes, FMR may consider an investor's trading history in that fund or other Fidelity funds, and accounts under common ownership or control.

Each fund may stop offering shares completely or may offer shares only on a limited basis, for a period of time or permanently.

When you place an order to buy shares, note the following:

Certain financial institutions that have entered into sales agreements with Fidelity Distributors Corporation (FDC) may enter confirmed purchase orders on behalf of customers by phone, with payment to follow no later than the time when a fund is priced on the following business day. If payment is not received by that time, the order will be canceled and the financial institution could be held liable for resulting fees or losses.

Minimums

|

To Open an Account |

$2,500 |

|

For certain Fidelity retirement accountsA |

$500 |

|

To Add to an Account |

$250 |

|

Through regular investment plans |

$100 |

|

Minimum Balance |

$2,000 |

|

For certain Fidelity retirement accountsA |

$500 |

A Fidelity Traditional IRA, Roth IRA, Rollover IRA, SEP-IRA, and Keogh accounts.

There is no minimum account balance or initial or subsequent purchase minimum for investments through Fidelity Portfolio Advisory ServicesSM , a qualified state tuition program, certain Fidelity retirement accounts funded through salary deduction, or accounts opened with the proceeds of distributions from such retirement accounts. In addition, each fund may waive or lower purchase minimums in other circumstances.

Prospectus

Shareholder Information - continued

|

Key Information |

|

|

<R>Phone |

To Open an Account</R>

To Add to an Account

|

|

Internet |

To Open an Account

To Add to an Account

|

|

Mail |

To Open an Account

To Add to an Account

|

|

In Person |

To Open an Account

To Add to an Account

|

|

<R>Wire |

To Open an Account</R>

To Add to an Account

|

|

Automatically |

To Open an Account

To Add to an Account

|

The price to sell one share of each fund is the fund's NAV, minus the redemption fee (short-term trading fee), if applicable.

Each fund will deduct a short-term trading fee of 0.50% from the redemption amount if you sell your shares after holding them less than 90 days. <R>Trading fees are</R> paid to the fund<R>s</R> rather than Fidelity, and <R>are</R> designed to offset the brokerage commissions, market impact, and other costs associated with fluctuations in fund asset levels and cash flow caused by short-term shareholder trading.

Prospectus

Shareholder Information - continued

If you bought shares on different days, the shares you held longest will be redeemed first for purposes of determining whether the short-term trading fee applies. The short-term trading fee does not apply to shares that were acquired through reinvestment of distributions.

Your shares will be sold at the next NAV calculated after your order is received in proper form, minus the short-term trading fee, if applicable.

Certain requests must include a signature guarantee. It is designed to protect you and Fidelity from fraud. Your request must be made in writing and include a signature guarantee if any of the following situations apply:

You should be able to obtain a signature guarantee from a bank, broker (including Fidelity Investor Centers), dealer, credit union (if authorized under state law), securities exchange or association, clearing agency, or savings association. A notary public cannot provide a signature guarantee.

When you place an order to sell shares, note the following:

Prospectus

Shareholder Information - continued

|

Key Information |

|

|

<R>Phone |

|

|

Internet |

|

|

Mail |

Individual, Joint Tenant, Sole Proprietorship, UGMA, UTMA

Retirement Account

Trust

Business or Organization

Executor, Administrator, Conservator, Guardian

|

|

In Person |

Individual, Joint Tenant, Sole Proprietorship, UGMA, UTMA

Retirement Account

Trust

Business or Organization

Executor, Administrator, Conservator, Guardian

|

|

Automatically |

|

An exchange involves the redemption of all or a portion of the shares of one fund and the purchase of shares of another fund.

As a shareholder, you have the privilege of exchanging shares of a fund for shares of other Fidelity funds.

However, you should note the following policies and restrictions governing exchanges:

Prospectus

Shareholder Information - continued

The funds may terminate or modify the exchange privilege in the future.

Other funds may have different exchange restrictions, and may impose trading fees of up to <R>2.00% o</R>f the amount exchanged. Check each fund's prospectus for details.

The following features are available to buy and sell shares of the funds.

Automatic Investment and Withdrawal Programs. Fidelity offers convenient services that let you automatically transfer money into your account, between accounts, or out of your account. While automatic investment programs do not guarantee a profit and will not protect you against loss in a declining market, they can be an excellent way to invest for retirement, a home, educational expenses, and other long-term financial goals. Automatic withdrawal or exchange programs can be a convenient way to provide a consistent income flow or to move money between your investments.

Prospectus

Shareholder Information - continued

|

Fidelity Automatic Account Builder |

||

|

Minimum $100 |

Frequency Monthly or quarterly |

Procedures

|

|

Direct Deposit |

||

|

Minimum $100 |

Frequency Every pay period |

Procedures

|

|

A Because their share prices fluctuate, these funds may not be appropriate choices for direct deposit of your entire check. |

||

|

Fidelity Automatic Exchange Service |

||

|

Minimum $100 |

Frequency Monthly, bimonthly, quarterly, or annually |

Procedures

|

|

Personal Withdrawal Service |

||

|

Frequency Monthly |

Procedures

|

|

Prospectus

Shareholder Information - continued

Other Features. The following other features are also available to buy and sell shares of the funds.

|

Wire |

|

|

Fidelity Money Line |

|

|

Fidelity On-Line Xpress+® |

|

Call 1-800-544-0240 or visit Fidelity's web site for more information.

|

|

Fidelity Online Trading |

|

|

FAST |

|

Call 1-800-544-5555.

|

The following policies apply to you as a shareholder.

Maturity and Liquidation of the Funds. The target date for Target Timeline 2001 and Target Timeline 2003 is September 30, 2001 and 2003, respectively. On those dates, the respective funds will mature. The funds' Board of Trustees expects to liquidate each fund within one month after the fund's target date.<R> In anticipation of the liquidation of Target Timeline 2001, effective the close of business on September 25, 2000, shares of Target Timeline 2001 will no longer be available to new accounts.</R> Prior to the target date, Fidelity will notify shareholders of each fund of the liquidation, and shareholders may elect to receive payment for the value of their shares or exchange their shares for shares of another Fidelity fund. If Fidelity does not receive instructions in proper form prior to the liquidation, shares will be exchanged for shares of Fidelity Cash Reserves, or if Fidelity Cash Reserves shares are not available, shares of another money market fund advised by FMR or an affiliate, or in the case of employee benefit plans, the cash option specified by the plan.

Statements and reports that Fidelity sends to you include the following:

To reduce expenses, only one copy of most financial reports and prospectuses may be mailed to households, even if more than one person in the household holds shares of a fund. Call Fidelity at 1-800-544-8544 if you need additional copies of financial reports or prospectuses. If you do not want the mailing of these documents to be combined with those for other members of your household, contact Fidelity in writing at P.O. Box 5000, Cincinnati, Ohio 45273-8692.

Prospectus

Shareholder Information - continued

Electronic copies of most financial reports and prospectuses are available at Fidelity's web site. To participate in Fidelity's electronic delivery program, call Fidelity or visit Fidelity's web site for more information.

You may initiate many transactions by telephone or electronically. Fidelity will not be responsible for any losses resulting from unauthorized transactions if it follows reasonable security procedures designed to verify the identity of the investor. Fidelity will request personalized security codes or other information, and may also record calls. For transactions conducted through the Internet, Fidelity recommends the use of an Internet browser with 128-bit encryption. You should verify the accuracy of your confirmation statements immediately after you receive them. If you do not want the ability to sell and exchange by telephone, call Fidelity for instructions.

When you sign your account application, you will be asked to certify that your social security or taxpayer identification number is correct and that you are not subject to 31% backup withholding for failing to report income to the IRS. If you violate IRS regulations, the IRS can require a fund to withhold 31% of your taxable distributions and redemptions.

Fidelity may deduct an annual maintenance fee of $12.00 from accounts with a value of less than $2,500, subject to an annual maximum charge of $24.00 per shareholder. It is expected that accounts will be valued on the second Friday in November of each year. Accounts opened after September 30 will not be subject to the fee for that year. The fee, which is payable to Fidelity, is designed to offset in part the relatively higher costs of servicing smaller accounts. This fee will not be deducted from Fidelity brokerage accounts, retirement accounts (except non-prototype retirement accounts), accounts using regular investment plans, or if total assets with Fidelity exceed $30,000. Eligibility for the $30,000 waiver is determined by aggregating accounts with Fidelity maintained by Fidelity Service Company, Inc. or <R>FBS LLC</R> which are registered under the same social security number or which list the same social security number for the custodian of a Uniform Gifts/Transfers to Minors Act account.

If your account balance falls below $2,000 (except accounts not subject to account minimums), you will be given 30 days' notice to reestablish the minimum balance. If you do not increase your balance, Fidelity may close your account and send the proceeds to you. Your shares will be sold at the NAV, minus the short-term trading fee, if applicable, on the day your account is closed.

Fidelity may charge a fee for certain services, such as providing historical account documents.

Dividends and Capital Gain Distributions

Each fund earns interest, dividends, and other income from its investments, and distributes this income (less expenses) to shareholders as dividends. Each fund also realizes capital gains from its investments, and distributes these gains (less any losses) to shareholders as capital gain distributions.

Prospectus

Shareholder Information - continued

Each fund normally declares dividends daily and pays them monthly. Each fund normally pays capital gain distributions in September and December.

Earning Dividends

Shares begin to earn dividends on the first business day following the day of purchase.

Shares earn dividends until, but not including, the next business day following the day of redemption.

When you open an account, specify on your application how you want to receive your distributions. The following options may be available for each fund's distributions:

1. Reinvestment Option. Your dividends and capital gain distributions will be automatically reinvested in additional shares of the fund. If you do not indicate a choice on your application, you will be assigned this option.

2. Income-Earned Option. Your capital gain distributions will be automatically reinvested in additional shares of the fund. Your dividends will be paid in cash.

3. Cash Option. Your dividends and capital gain distributions will be paid in cash.

4. Directed Dividends® Option. Your dividends will be automatically invested in shares of another identically registered Fidelity fund. Your capital gain distributions will be automatically invested in shares of another identically registered Fidelity fund, automatically reinvested in additional shares of the fund, or paid in cash.

Not all distribution options are available for every account. If the option you prefer is not listed on your account application, or if you want to change your current option, call Fidelity.

If you elect to receive distributions paid in cash by check and the U.S. Postal Service does not deliver your checks, your distribution option may be converted to the Reinvestment Option. You will not receive interest on amounts represented by uncashed distribution checks.

As with any investment, your investment in a fund could have tax consequences for you. If you are not investing through a tax-advantaged retirement account, you should consider these tax consequences.

Taxes on distributions. Distributions you receive from each fund are subject to federal income tax, and may also be subject to state or local taxes.

For federal tax purposes, each fund's dividends and distributions of short-term capital gains are taxable to you as ordinary <R>income, while each fund</R>'s distributions of long-term capital gains are taxable to you generally as capital gains.

If a fund's distributions exceed its income and capital gains realized in any year, all or a portion of those distributions may be treated as a return of capital to shareholders for tax purposes. A return of capital <R>generally</R> will not be taxable to you but will reduce the cost basis of your shares and result in a higher reported capital gain or a lower reported capital loss when you sell your shares.

Prospectus

Shareholder Information - continued

If you buy shares when a fund has realized but not yet distributed income or capital gains, you will be "buying a dividend" by paying the full price for the shares and then receiving a portion of the price back in the form of a taxable distribution.

Any taxable distributions you receive from a fund will normally be taxable to you when you receive them, regardless of your distribution option. If you elect to receive distributions in cash or to invest distributions automatically in shares of another Fidelity fund, you will receive certain December distributions in January, but those distributions will be taxable as if you received them on December 31.

Taxes on transactions. Your redemptions, including exchanges, as well as payments resulting from liquidation of <R>a fund after its respective target date,</R> may result in a capital gain or loss for federal tax purposes. A capital gain or loss on your investment in a fund <R>generally is the difference between the </R>cost of your shares and the price you receive when you sell them.

Prospectus

Each fund is a mutual fund, an investment that pools shareholders' money and invests it toward a specified goal.

FMR is each fund's manager.

As of<R> March 31, 2000, FMR had approximately $639.1 bi</R>llion in discretionary assets under management.

As the manager, FMR is responsible for choosing each fund's investments and handling its business affairs.

Affiliates assist FMR with foreign investments:

Fidelity Investments Money Management, Inc. (FIMM), in Merrimack, New Hampshire, serves as <R>a </R>sub-adviser for each fund. FIMM is primarily responsible for choosing investments for each fund.

FIMM is an affiliate of FMR. As of <R>March 31, 2000, FIMM had approximately $206.8 billion in di</R>scretionary assets under management.

Ford O'Neil is vice president and manager of the <R>Fidelity </R>Target Timeline funds, which he had managed since July 1998. He also manages other Fidelity funds. Since joining Fidelity in 1990, Mr. O'Neil has worked as a research analyst and manager.

From time to time a manager, analyst, or other Fidelity employee may express views regarding a particular company, security, industr<R>y, o</R>r market sector. The views expressed by any such person are the views of only that individual as of the time expressed and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Each fund pays a management fee to FMR. The management fee is calculated and paid to FMR every month. The fee is calculated by adding a group fee rate to an individual fund fee rate, dividing by twelve, and multiplying the result by the fund's average net assets throughout the month.

Prospectus

Fund Services - continued

The group fee rate is based on the average net assets of all the mutual funds advised by FMR. This rate cannot rise above 0.37%, and it drops as total assets under management increase.

For Jul<R>y 2000, the group fee rate was 0.1250% for Target Timeline 2001 and Target Timeline 2003. The individual fund fee rate is 0.30% for Target Timeline 2001 and 0.30% for Target Timeline</R> 2003.

The total management fee for the fiscal year ended Jul<R>y 31, 2000, was 0.09%, after reimbursement, of the fund's average net assets for Target Timeline 2001 and 0.00%, after reimbu</R>rsement, of the fund's average net assets for Target Timeline 2003.

FMR pays FIMM, FMR U.K.<R>,</R> and FMR Far East for providing sub-advisory services. FMR Far East in turn pays FIJ for providing sub-advisory services.

FMR may, from time to time, agree to reimburse the funds for management fees and other expenses above a specified limit. FMR retains the ability to be repaid by a fund if expenses fall below the specified limit prior to the end of the fiscal year. Reimbursement arrangements, which may be discontinued by FMR at any time, can decrease a fund's expenses and boost its performance.

FDC distributes each fund's shares.

Each fund has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the Investment Company Act of 1940 that recognizes that FMR may use its management fee revenues, as well as its past profits or its resources from any other source, to pay FDC for expenses incurred in connection with providing services intended to result in the sale of fund shares and/or shareholder support services. FMR, directly or through FDC, may pay<R> significant amounts to i</R>ntermediaries, such as banks, broker-dealers<R>,</R> and other service-providers, that provide those services. Currently, the Board of Trustees of each fund has authorized such payments.

<R>If payments made by FMR to FDC or to intermediaries under a Distribution and Service Plan were considered to be paid out of a fund's assets on an ongoing basis, they might increase the cost of your investment and might cost you more than paying other types of sales charges.</R>

To receive payments made pursuant to a Distribution and Service Plan, intermediaries must sign the appropriate agreement with FDC in advance.

FMR may allocate brokerage transactions in a manner that takes into account the sale of shares of a fund, provided that the fund receives brokerage services and commission rates comparable to those of other broker-dealers.

No dealer, sales representative, or any other person has been authorized to give any information or to make any representations, other than those contained in this prospectus and in the related statement of additional information (SAI), in connection with the offer contained in this prospectus. If given or made, such other information or representations must not be relied upon as having been authorized by the funds or FDC. This prospectus and the related SAI do not constitute an offer by the funds or by FDC to sell shares of the funds to or to buy shares of the funds from any person to whom it is unlawful to make such offer.

Prospectus

The financial highlights tables are intended to help you understand each fund's financial history for the period of the fund's operations. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund (assuming reinvestment of all dividends and distributions). This information has b<R>een audited by Deloitte & Touche LLP, independent accountants, whose report, along with each fund's financial highlights and financial statements, are included in each fund's annual</R> report. A free copy of each annual report is available upon request.

<R>Target Timeline 2001</R>

|

<R>Years ended July 31, |

2000 |

1999 |

1998 |

1997 |

1996 G</R> |

|

<R>Selected Per-Share Data |

|

|

|

|

</R> |

|

<R>Net asset value, beginning of period |

$ 9.440 |

$ 9.620 |

$ 9.640 |

$ 9.400 |

$ 10.000</R> |

|

<R>Income from Investment Operations |

|

|

|

|

</R> |

|

<R> Net investment income |

.574 D |

.634 D |

.648 D |

.690 D |

.310</R> |

|

<R> Net realized and unrealized gain (loss) |

(.124) |

(.178) |

(.019) |

.240 |

(.600)</R> |

|

<R> Total from investment operations |

.450 |

.456 |

.629 |

.930 |

(.290)</R> |

|

<R>Less Distributions |

|

|

|

|

</R> |

|

<R> From net investment income |

(.582) |

(.637) |

(.649) |

(.690) |

(.310)</R> |

|

<R>Redemption fees added to paid in capital |

.002 |

.001 |

.000 |

.000 |

.000</R> |

|

<R>Net asset value, end of period |

$ 9.310 |

$ 9.440 |

$ 9.620 |

$ 9.640 |

$ 9.400</R> |

|

<R>Total Return B, C |

4.96% |

4.81% |

6.74% |

10.26% |

(2.88)%</R> |

|

<R>Ratios and Supplemental Data |

|

|

|

|

</R> |

|

<R>Net assets, end of period (000 omitted) |

$ 202,617 |

$ 17,435 |

$ 13,112 |

$ 10,378 |

$ 6,180</R> |

|

<R>Ratio of expenses to average net assets |

.35% E |

.35% E |

.35% E |

.35% E |

.35% A, E</R> |

|

<R>Ratio of expenses to average net assets after expense reductions |

.35% |

.35% |

.35% |

.34% F |

.34% A, F</R> |

|

<R>Ratio of net investment income |

6.23% |

6.60% |

6.75% |

7.31% |

6.93% A</R> |

|

<R>Portfolio turnover rate |

24% |

16% |

47% |

97% |

93% A</R> |

<R>A Annualized</R>

<R>B Total returns for periods of less than one year are not annualized.</R>

<R>C The total returns would have been lower had certain expenses not been reduced during the periods shown.</R>

<R>D Net investment income per share has been calculated based on average shares outstanding during the period.</R>

<R>E FMR agreed to reimburse a portion of the fund's expenses during the period. Without this reimbursement, the fund's expense ratio would have been higher.</R>

<R>F FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses.</R>

<R>G For the period February 8, 1996 (commencement of operations) to July 31, 1996.</R>

Prospectus

Appendix - continued

<R>Target Timeline 2003</R>

|

<R>Years ended July 31, |

2000 |

1999 |

1998 |

1997 |

1996 G</R> |

|

<R>Selected Per-Share Data |

|

|

|

|

</R> |

|

<R>Net asset value, beginning of period |

$ 9.290 |

$ 9.750 |

$ 9.670 |

$ 9.240 |

$ 10.000</R> |

|

<R>Income from Investment Operations |

|

|

|

|

</R> |

|

<R> Net investment income |

.645 D |

.677 D |

.670 D |

.634 D |

.307</R> |

|

<R> Net realized and unrealized gain (loss) |

(.229) |

(.404) |

.078 |

.428 |

(.762)</R> |

|

<R> Total from investment operations |

.416 |

.273 |

.748 |

1.062 |

(.455)</R> |

|

<R>Less Distributions |

|

|

|

|

</R> |

|

<R> From net investment income |

(.648) |

(.685) |

(.670) |

(.634) |

(.306)</R> |

|

<R> From net realized gain |

- |

(.043) |

- |

- |

-</R> |

|

<R> In excess of net realized gain |

- |

(.007) |

- |

- |

-</R> |

|

<R> Total distributions |

(.648) |

(.735) |

(.670) |

(.634) |

(.306)</R> |

|

<R>Redemption fees added to paid in capital |

.002 |

.002 |

.002 |

.002 |

.001</R> |

|

<R>Net asset value, end of period |

$ 9.060 |

$ 9.290 |

$ 9.750 |

$ 9.670 |

$ 9.240</R> |

|

<R>Total Return B, C |

4.70% |

2.76% |

8.00% |

11.94% |

(4.53)%</R> |

|

<R>Ratios and Supplemental Data |

|

|

|

|

</R> |

|

<R>Net assets, end of period (000 omitted) |

$ 37,502 |

$ 23,717 |

$ 19,777 |

$ 13,211 |

$ 6,977</R> |

|

<R>Ratio of expenses to average net assets |

.35% E |

.35% E |

.35% E |

.35% E |

.35% A, E</R> |

|

<R>Ratio of expenses to average net assets after expense reductions |

.35% |

.35% |

.35% |

.34% F |

.34% A, F</R> |

|

<R>Ratio of net investment income to |

7.10% |

7.00% |

6.92% |

6.76% |

6.93% A</R> |

|

<R>Portfolio turnover rate |

31% |

18% |

67% |

83% |

180% A</R> |

<R>A Annualized</R>

<R>B Total returns for periods of less than one year are not annualized.</R>

<R>C The total returns would have been lower had certain expenses not been reduced during the periods shown.</R>

<R>D Net investment income per share has been calculated based on average shares outstanding during the period.</R>

<R>E FMR agreed to reimburse a portion of the fund's expenses during the period. Without this reimbursement, the fund's expense ratio would have been higher.</R>

<R>F FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses.</R>

<R>G For the period February 8, 1996 (commencement of operations) to July 31, 1996.</R>

Prospectus

Notes

Notes

You can obtain additional information about the funds. The funds' SAI includes more detailed information about each fund and its investments. The SAI is incorporated herein by reference (legally forms a part of the prospectus). Each fund's annual and semi-annual reports include a discussion of the fund's holdings and recent market conditions and the fund's investment strategies that affected performance.

For a free copy of any of these documents or to request other information or ask questions about a fund, call Fidelity at 1-800-544-8544. In addition, you may visit Fidelity's web site at www.fidelity.com for a free copy of a prospectus or an annual or semi-annual report or to request other information.

|

<R>The SAI, the funds' annual and semi-annual reports and other related materials are available from the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) Database on the SEC's web site (http://www.sec.gov). You can obtain copies of this information, after paying a duplicating fee, by sending a request by e-mail to [email protected] or by writing the Public Reference Section of the SEC, Washington, D.C. 20549-0102. You can also review and copy information about the funds, including the funds' SAI, at the SEC's Public Reference Room in Washington, D.C. Call 1-202-942-8090 for information on the operation of the SEC's Public Reference Room.</R> Investment Company Act of 1940, File Number, 811-5361 |

<R>Fidelity, Target Time</R>line, Fidelity Investments & (Pyramid) Design, FAST, Fidelity Money Line, Fidelity Automatic Account Builder, Fidelity On-Line Xpress+, and Directed Dividends are registered trademarks of FMR Corp.

Portfolio Ad<R>visory Services is a service mar</R>k of FMR Corp.

1.5<R>36266.</R>103 TTI-pro-0900

FIDELITY® TARGET TIMELINE® 2001 AND FIDELITY TARGET TIMELINE 2003

Funds of Fidelity Boston Street Trust

STATEMENT OF ADDITIONAL INFORMATION

<R>September 25, 2000</R>

This statement of additional information (SAI) is not a prospectus. Portions of each fund's annual report are incorporated herein. The annual reports <R>are</R> supplied with this SAI.

To obtain a free additional copy of the prospectus, dated <R>September 25, 2000</R>, or an annual report, please call Fidelity at 1-800-544-8544 or visit Fidelity's web site at www.fidelity.com.

|

TABLE OF CONTENTS |

PAGE |

|

Investment Policies and Limitations |

|

|

Portfolio Transactions |

|

|

Valuation |

|

|

Performance |

|

|

Additional Purchase, Exchange and Redemption Information |

|

|

Distributions and Taxes |

|

|

Trustees and Officers |

|

|

Control of Investment Advisers |

|

|

Management Contracts |

|

|

Distribution Services |

|

|

Transfer and Service Agent Agreements |

|

|

Description of the Trust |

|

|

Financial Statements |

|

|

Appendix |

TTI-ptb-0900

1.460074.103

(fidelity_logo_graphic)

82 Devonshire Street, Boston, MA 02109

INVESTMENT POLICIES AND LIMITATIONS

The following policies and limitations supplement those set forth in the prospectus. Unless otherwise noted, whenever an investment policy or limitation states a maximum percentage of a fund's assets that may be invested in any security or other asset, or sets forth a policy regarding quality standards, such standard or percentage limitation will be determined immediately after and as a result of the fund's acquisition of such security or other asset. Accordingly, any subsequent change in values, net assets, or other circumstances will not be considered when determining whether the investment complies with the fund's investment policies and limitations.

A fund's fundamental investment policies and limitations cannot be changed without approval by a "majority of the outstanding voting securities" (as defined in the Investment Company Act of 1940 (the 1940 Act)) of the fund. However, except for the fundamental investment limitations listed below, the investment policies and limitations described in this SAI are not fundamental and may be changed without shareholder approval.

Investment Limitations of Target Timeline<R>®</R> 2001

The following are the fund's fundamental investment limitations set forth in their entirety. The fund may not:

(1) issue senior securities, except in connection with the insurance program established by the fund pursuant to an exemptive order issued by the Securities and Exchange Commission or as otherwise permitted under the Investment Company Act of 1940;

(2) borrow money, except that the fund may borrow money for temporary or emergency purposes (not for leveraging or investment) in an amount not exceeding 33 1/3% of its total assets (including the amount borrowed) less liabilities (other than borrowings). Any borrowings that come to exceed this amount will be reduced within three days (not including Sundays and holidays) to the extent necessary to comply with the 33 1/3% limitation;

(3) underwrite securities issued by others, except to the extent that the fund may be considered an underwriter within the meaning of the Securities Act of 1933 in the disposition of restricted securities;

(4) purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. government or any of its agencies or instrumentalities) if, as a result, more than 25% of the fund's total assets would be invested in the securities of companies whose principal business activities are in the same industry;

(5) purchase or sell real estate unless acquired as a result of ownership of securities or other instruments (but this shall not prevent the fund from investing in securities or other instruments backed by real estate or securities of companies engaged in the real estate business);

(6) purchase or sell physical commodities unless acquired as a result of ownership of securities or other instruments (but this shall not prevent the fund from purchasing or selling options and futures contracts or from investing in securities or other instruments backed by physical commodities); or

(7) lend any security or make any other loan if, as a result, more than 33 1/3% of its total assets would be lent to other parties, but this limitation does not apply to purchases of debt securities or to repurchase agreements.

(8) The fund may, notwithstanding any other fundamental investment policy or limitation, invest all of its assets in the securities of a single open-end management investment company managed by Fidelity Management & Research Company or an affiliate or successor with substantially the same fundamental investment objective, policies, and limitations as the fund.

The following investment limitations are not fundamental and may be changed without shareholder approval.

(i) In order to qualify as a "regulated investment company" under Subchapter M of the Internal Revenue Code of 1986, as amended, the fund currently intends to comply with certain diversification limits imposed by Subchapter M.

(ii) The fund does not currently intend to sell securities short, unless it owns or has the right to obtain securities equivalent in kind and amount to the securities sold short, and provided that transactions in futures contracts and options are not deemed to constitute selling securities short.

(iii) The fund does not currently intend to purchase securities on margin, except that the fund may obtain such short-term credits as are necessary for the clearance of transactions, and provided that margin payments in connection with futures contracts and options on futures contracts shall not constitute purchasing securities on margin.

(iv) The fund may borrow money only (a) from a bank or from a registered investment company or portfolio for which FMR or an affiliate serves as investment adviser or (b) by engaging in reverse repurchase agreements with any party (reverse repurchase agreements are treated as borrowings for purposes of fundamental investment limitation (2)).

(v) The fund does not currently intend to purchase any security if, as a result, more than 10% of its net assets would be invested in securities that are deemed to be illiquid because they are subject to legal or contractual restrictions on resale or because they cannot be sold or disposed of in the ordinary course of business at approximately the prices at which they are valued.

(vi) The fund does not currently intend to lend assets other than securities to other parties, except by (a) lending money (up to 15% of the fund's net assets) to a registered investment company or portfolio for which FMR or an affiliate serves as investment adviser or (b) acquiring loans, loan participations, or other forms of direct debt instruments and, in connection therewith, assuming any associated unfunded commitments of the sellers. (This limitation does not apply to purchases of debt securities or to repurchase agreements.)

(vii) The fund does not currently intend to invest all of its assets in the securities of a single open-end management investment company managed by Fidelity Management & Research Company or an affiliate or successor with substantially the same fundamental investment objective, policies, and limitations as the fund.

For purposes of limitation (i), Subchapter M generally requires the fund to invest no more than 25% of its total assets in securities of any one issuer and to invest at least 50% of its total assets so that no more than 5% of the fund's total assets are invested in securities of any one issuer. However, Subchapter M allows unlimited investments in cash, cash items, government securities (as defined in Subchapter M) and securities of other investment companies. These tax requirements are generally applied at the end of each quarter of the fund's taxable year.

With respect to limitation (v), if through a change in values, net assets, or other circumstances, the fund were in a position where more than 10% of its net assets were invested in illiquid securities, it would consider appropriate steps to protect liquidity.

For the fund's limitations on futures and options transactions, see the section entitled "Limitations on Futures and Options Transactions" on page <R><Click Here></R>.

Investment Limitations of Target Timeline 2003

The following are the fund's fundamental investment limitations set forth in their entirety. The fund may not:

(1) issue senior securities, except in connection with the insurance program established by the fund pursuant to an exemptive order issued by the Securities and Exchange Commission or as otherwise permitted under the Investment Company Act of 1940;

(2) borrow money, except that the fund may borrow money for temporary or emergency purposes (not for leveraging or investment) in an amount not exceeding 33 1/3% of its total assets (including the amount borrowed) less liabilities (other than borrowings). Any borrowings that come to exceed this amount will be reduced within three days (not including Sundays and holidays) to the extent necessary to comply with the 33 1/3% limitation;

(3) underwrite securities issued by others, except to the extent that the fund may be considered an underwriter within the meaning of the Securities Act of 1933 in the disposition of restricted securities;

(4) purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. government or any of its agencies or instrumentalities) if, as a result, more than 25% of the fund's total assets would be invested in the securities of companies whose principal business activities are in the same industry;

(5) purchase or sell real estate unless acquired as a result of ownership of securities or other instruments (but this shall not prevent the fund from investing in securities or other instruments backed by real estate or securities of companies engaged in the real estate business);

(6) purchase or sell physical commodities unless acquired as a result of ownership of securities or other instruments (but this shall not prevent the fund from purchasing or selling options and futures contracts or from investing in securities or other instruments backed by physical commodities); or

(7) lend any security or make any other loan if, as a result, more than 33 1/3% of its total assets would be lent to other parties, but this limitation does not apply to purchases of debt securities or to repurchase agreements.

(8) The fund may, notwithstanding any other fundamental investment policy or limitation, invest all of its assets in the securities of a single open-end management investment company managed by Fidelity Management & Research Company or an affiliate or successor with substantially the same fundamental investment objective, policies, and limitations as the fund.

The following investment limitations are not fundamental and may be changed without shareholder approval.

(i) In order to qualify as a "regulated investment company" under Subchapter M of the Internal Revenue Code of 1986, as amended, the fund currently intends to comply with certain diversification limits imposed by Subchapter M.

(ii) The fund does not currently intend to sell securities short, unless it owns or has the right to obtain securities equivalent in kind and amount to the securities sold short, and provided that transactions in futures contracts and options are not deemed to constitute selling securities short.

(iii) The fund does not currently intend to purchase securities on margin, except that the fund may obtain such short-term credits as are necessary for the clearance of transactions, and provided that margin payments in connection with futures contracts and options on futures contracts shall not constitute purchasing securities on margin.

(iv) The fund may borrow money only (a) from a bank or from a registered investment company or portfolio for which FMR or an affiliate serves as investment adviser or (b) by engaging in reverse repurchase agreements with any party (reverse repurchase agreements are treated as borrowings for purposes of fundamental investment limitation (2)).

(v) The fund does not currently intend to purchase any security if, as a result, more than 10% of its net assets would be invested in securities that are deemed to be illiquid because they are subject to legal or contractual restrictions on resale or because they cannot be sold or disposed of in the ordinary course of business at approximately the prices at which they are valued.

(vi) The fund does not currently intend to lend assets other than securities to other parties, except by (a) lending money (up to 15% of the fund's net assets) to a registered investment company or portfolio for which FMR or an affiliate serves as investment adviser or (b) acquiring loans, loan participations, or other forms of direct debt instruments and, in connection therewith, assuming any associated unfunded commitments of the sellers. (This limitation does not apply to purchases of debt securities or to repurchase agreements.)

(vii) The fund does not currently intend to invest all of its assets in the securities of a single open-end management investment company managed by Fidelity Management & Research Company or an affiliate or successor with substantially the same fundamental investment objective, policies, and limitations as the fund.

For purposes of limitation (i), Subchapter M generally requires the fund to invest no more than 25% of its total assets in securities of any one issuer and to invest at least 50% of its total assets so that no more than 5% of the fund's total assets are invested in securities of any one issuer. However, Subchapter M allows unlimited investments in cash, cash items, government securities (as defined in Subchapter M) and securities of other investment companies. These tax requirements are generally applied at the end of each quarter of the fund's taxable year.

With respect to limitation (v), if through a change in values, net assets, or other circumstances, the fund were in a position where more than 10% of its net assets were invested in illiquid securities, it would consider appropriate steps to protect liquidity.

For the fund's limitations on futures and options transactions, see the section entitled "Limitations on Futures and Options Transactions" on page <R><Click Here></R>.

The following pages contain more detailed information about types of instruments in which a fund may invest, strategies <R>Fidelity Management & Research Company (FMR)</R> may employ in pursuit of <R>a</R> fund's investment objective, and a summary of related risks. FMR may not buy all of these instruments or use all of these techniques unless it believes that doing so will help a fund achieve its goal.

Affiliated Bank Transactions. A fund may engage in transactions with financial institutions that are, or may be considered to be, "affiliated persons" of the fund under the 1940 Act. These transactions may involve repurchase agreements with custodian banks; short-term obligations of, and repurchase agreements with, the 50 largest U.S. banks (measured by deposits); municipal securities; U.S. Government securities with affiliated financial institutions that are primary dealers in these securities; short-term currency transactions; and short-term borrowings. In accordance with exemptive orders issued by the Securities and Exchange Commission (SEC), the Board of Trustees has established and periodically reviews procedures applicable to transactions involving affiliated financial institutions.

Asset-Backed Securities represent interests in pools of mortgages, loans, receivables or other assets. Payment of interest and repayment of principal may be largely dependent upon the cash flows generated by the assets backing the securities and, in certain cases, supported by letters of credit, surety bonds, or other credit enhancements. Asset-backed security values may also be affected by other factors including changes in interest rates, the availability of information concerning the pool and its structure, the creditworthiness of the servicing agent for the pool, the originator of the loans or receivables, or the entities providing the credit enhancement. In addition, these securities may be subject to prepayment risk.

Borrowing. Each fund may borrow from banks or from other funds advised by FMR or its affiliates, or through reverse repurchase agreements. If a fund borrows money, its share price may be subject to greater fluctuation until the borrowing is paid off. If a fund makes additional investments while borrowings are outstanding, this may be considered a form of leverage.

Cash Management. A fund can hold uninvested cash or can invest it in cash equivalents such as money market securities, repurchase agreements or shares of money market funds. Generally, these securities offer less potential for gains than other types of securities.

Central Cash Funds are money market funds managed by FMR or its affiliates that seek to earn a high level of current income (free from federal income tax in the case of a municipal money market fund) while maintaining a stable $1.00 share price. The funds comply with industry-standard requirements for money market funds regarding the quality, maturity, and diversification of their investments.

Dollar-Weighted Average Maturity is derived by multiplying the value of each investment by the time remaining to its maturity, adding these calculations, and then dividing the total by the value of the fund's portfolio. An obligation's maturity is typically determined on a stated final maturity basis, although there are some exceptions to this rule.

For example, if it is probable that the issuer of an instrument will take advantage of a maturity-shortening device, such as a call, refunding, or redemption provision, the date on which the instrument will probably be called, refunded, or redeemed may be considered to be its maturity date. Also, the maturities of mortgage securities, including collateralized mortgage obligations, and some asset-backed securities are determined on a weighted average life basis, which is the average time for principal to be repaid. For a mortgage security, this average time is calculated by estimating the timing of principal payments, including unscheduled prepayments, during the life of the mortgage. The weighted average life of these securities is likely to be substantially shorter than their stated final maturity.

Exposure to Foreign Markets. Foreign securities, foreign currencies, and securities issued by U.S. entities with substantial foreign operations may involve significant risks in addition to the risks inherent in U.S. investments.

Foreign investments involve risks relating to local political, economic, regulatory, or social instability, military action or unrest, or adverse diplomatic developments, and may be affected by actions of foreign governments adverse to the interests of U.S. investors. Such actions may include expropriation or nationalization of assets, confiscatory taxation, restrictions on U.S. investment or on the ability to repatriate assets or convert currency into U.S. dollars, or other government intervention. Additionally, governmental issuers of foreign debt securities may be unwilling to pay interest and repay principal when due and may require that the conditions for payment be renegotiated. There is no assurance that FMR will be able to anticipate these potential events or counter their effects. In addition, the value of securities denominated in foreign currencies and of dividends and interest paid with respect to such securities will fluctuate based on the relative strength of the U.S. dollar.

The risks of foreign investing may be magnified for investments in emerging markets, which may have relatively unstable governments, economies based on only a few industries, and securities markets that trade a small number of securities.

Foreign Currency Transactions. A fund may conduct foreign currency transactions on a spot (i.e., cash) or forward basis (i.e., by entering into forward contracts to purchase or sell foreign currencies). Although foreign exchange dealers generally do not charge a fee for such conversions, they do realize a profit based on the difference between the prices at which they are buying and selling various currencies. Thus, a dealer may offer to sell a foreign currency at one rate, while offering a lesser rate of exchange should the counterparty desire to resell that currency to the dealer. Forward contracts are customized transactions that require a specific amount of a currency to be delivered at a specific exchange rate on a specific date or range of dates in the future. Forward contracts are generally traded in an interbank market directly between currency traders (usually large commercial banks) and their customers. The parties to a forward contract may agree to offset or terminate the contract before its maturity, or may hold the contract to maturity and complete the contemplated currency exchange.