|

|

|

|

|

Previous: SCOTTS COMPANY, DEF 14A, 2000-12-15 |

Next: TRUST FOR CREDIT UNIONS, 485BPOS, EX-99.JOTHEROPININ, 2000-12-15 |

As filed with the Securities and Exchange Commission on

December 15, 2000.

1933 Act Registration No. 33-18781

1940 Act Registration No. 811-5407

________________________________________________________________________________

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

____________

Form N-1A

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933 ( X )

Post-Effective Amendment No. 23 ( X )

and/or

REGISTRATION STATEMENT UNDER THE

INVESTMENT COMPANY ACT OF 1940 ( X )

Amendment No. 25 ( X )

(Check appropriate box or boxes)

____________

Trust for Credit Unions

(Exact name of registrant as specified in charter)

4900 Sears Tower

Chicago, Illinois 60606-6303

(Address of principal executive offices)

Registrant's Telephone Number,

including Area Code 800-621-2550

____________

Howard B. Surloff

Goldman, Sachs & Co.

32 Old Slip - 19th Floor

New York, New York 10005

212-902-3309

(Name and address of agent for service)

____________

It is proposed that this filing will become effective (check appropriate box):

( ) Immediately upon filing pursuant to paragraph (b)

( X ) On December 29, 2000 pursuant to paragraph (b)

( ) 60 days after filing pursuant to paragraph (a)(1)

( ) On (date) pursuant to paragraph (a)(1)

( ) 75 days after filing pursuant to paragraph (a)(2)

( ) On (date) pursuant to paragraph (a)(2) of Rule 485.

If appropriate, check the following box:

( ) This Post-Effective Amendment designates a new effective date for a

previously filed Post-Effective Amendment.

| Prospectus

|

n

|

Money Market

Portfolio

|

n

|

Government

Securities Portfolio

|

n

|

Mortgage

Securities Portfolio

|

|

| TRUST FOR CREDIT UNIONS

|

| THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS PROSPECTUS.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

|

| AN INVESTMENT IN A PORTFOLIO IS NOT A CREDIT UNION DEPOSIT AND IS NOT INSURED BY THE NATIONAL CREDIT UNION SHARE INSURANCE FUND, THE

NATIONAL CREDIT UNION ADMINISTRATION OR ANY OTHER GOVERNMENT AGENCY. AN INVESTMENT IN A PORTFOLIO INVOLVES INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF PRINCIPAL. ALTHOUGH THE MONEY MARKET PORTFOLIO SEEKS TO PRESERVE THE VALUE OF YOUR INVESTMENT AT $1.00

PER UNIT, IT IS POSSIBLE TO LOSE MONEY BY INVESTING IN THE PORTFOLIO.

|

| NOT FDIC-INSURED

|

May Lose Value

|

No Bank Guarantee

|

n

|

The Fund is offered solely to state and federally chartered credit unions. Units of each of the Fund’s Portfolios are

designed to qualify as eligible investments for federally chartered credit unions pursuant to Sections 107(7), 107(8) and 107(15) of the Federal Credit Union Act, Part 703 of the National Credit Union Administration (“NCUA”) Rules and

Regulations and NCUA Letter Number 155. Units of the Fund, however, may or may not qualify as eligible investments for particular state chartered credit unions. The Fund encourages each state chartered credit union to consult qualified legal counsel

concerning whether the Portfolios are permissible investments under the laws applicable to it.

|

n

|

The Fund intends to review changes in the applicable laws, rules and regulations governing eligible investments for federally

chartered credit unions, and to take such action as may be necessary so that the investments of the Fund qualify as eligible investments under the Federal Credit Union Act and the regulations thereunder.

|

n

|

Manage credit risk

|

n

|

Manage interest rate risk

|

n

|

Manage liquidity

|

| Since 1988, the Investment Adviser has actively managed the Money Market Portfolio to provide credit union investors with the

greatest possible preservation of principal and income potential.

|

| Investment Process

|

| 1. Managing Credit Risk

|

| The Investment Adviser’s process for managing risk emphasizes:

|

n

|

Intensive research—The Credit Department,

a separate operating entity of Goldman Sachs, approves all money market fund eligible securities for the Money Market Portfolio. Sources for the Credit Department’s analysis include third-party inputs, such as financial statements and media sources,

ratings releases and company meetings, as well as the Investment Research, Legal and Compliance Departments of Goldman Sachs.

|

n

|

Timely updates—A Credit Department-approved list of securities is continuously communicated on a

“real-time” basis to the portfolio management team via computer link.

|

| The Result: An “approved” list of high-quality credits—The Investment Adviser’s portfolio

management team uses this approved list to construct portfolios which offer the best available risk-return tradeoff within the “approved” credit universe.

|

| 2. Managing Interest Rate Risk

|

| Three main steps are followed in seeking to manage interest rate risk:

|

n

|

Establish dollar-weighted average maturity (WAM) target—WAM (the weighted average time until the

yield of a portfolio reflects any changes in the current interest rate environment) is constantly revisited and adjusted as market conditions change. An overall strategy is developed by the portfolio management team based on insights gained from weekly

meetings with both Goldman Sachs economists and economists from outside the firm.

|

n

|

Implement optimum portfolio structure—

Proprietary models that seek the optimum balance of risk and return, in conjunction with the Investment Adviser’s analysis of factors such as market events, short-term interest rates and the Money Market Portfolio’s asset volatility, are used to

identify the most effective portfolio structure.

|

n

|

Conduct rigorous analysis of new securities—The Investment Adviser’s five-step process

includes legal, credit, historical index and liquidity analysis, as well as price stress testing to determine suitability for money market mutual funds.

|

3.

|

Managing Liquidity

|

| Factors that the Investment Adviser’s portfolio managers continuously monitor and that affect the liquidity of the Money

Market Portfolio include:

|

n

|

The Money Market Portfolio’s clients and factors that influence their asset volatility;

|

n

|

Technical events that influence the trading range of federal funds and other short-term fixed-income markets; and

|

n

|

Bid-ask spreads associated with securities in the Portfolio.

|

| The Fund’s Fixed Income Investment Philosophy:

|

| Active Management Within a Risk-Managed Framework

|

| The Government Securities Portfolio and the Mortgage Securities Portfolio (the “Bond Portfolios”) are managed to seek a

high level of current income, consistent with low volatility of principal. The Investment Adviser follows a disciplined, multi-step process to evaluate potential mortgage-related investments by assessing:

|

n

|

Sector Allocation

|

n

|

Security Selection

|

n

|

Yield Curve Strategies

|

| Investment Process

|

| 1. Sector Allocation—The Investment Adviser assesses the relative value of different mortgage-related

securities to create investment strategies that meet each Bond Portfolio’s objectives.

|

| 2. Security Selection—In selecting securities for each Bond Portfolio, the Investment Adviser draws on the

extensive resources of Goldman Sachs, including fixed-income research professionals.

|

| 3. Yield Curve Strategies—The Investment Adviser adjusts the term structure of the Bond Portfolios based on its

expectations of changes in the shape of the yield curve while closely controlling the overall duration of the Bond Portfolios.

|

| Among the quantitative techniques used in the Bond Portfolios’ investment process are:

|

n

|

Option-adjusted analytics to make initial strategic asset allocations within the mortgage markets and to reevaluate investments as

market conditions change; and

|

n

|

Analytics to estimate mortgage prepayments and cash flows under different interest rate scenarios and to maintain an optimal

portfolio structure.

|

| The Investment Adviser de-emphasizes interest rate predictions as a means of generating incremental return. Instead, the

Investment Adviser seeks to add value through the selection of particular securities and investment sector allocation as described above.

|

| With the Bond Portfolios, the Investment Adviser applies a team approach that emphasizes risk management and capitalizes on

Goldman Sachs’ extensive research capabilities.

|

| Each of the Bond Portfolios described in this Prospectus has a target duration. A Bond Portfolio’s duration approximates its

price sensitivity to changes in interest rates including expected cash flow and mortgage prepayments. Maturity measures the time until final payment is due; it takes no account of the pattern of a security’s cash flows over time. In computing

portfolio duration, a Bond Portfolio will estimate the duration of obligations that are subject to prepayment or redemption by the issuer, taking into account the influence of interest rates on prepayments and coupon flows. This method of computing

duration is known as “option-adjusted” duration. The Bond Portfolios have no restrictions as to the minimum or maximum maturity of any particular security held by them but intend to maintain the maximum durations noted under “Portfolio

Investment Objectives and Strategies.” There can be no assurance that the Investment Adviser’s estimation of duration will be accurate or that the duration of a Portfolio will always remain within the Portfolio’s maximum target duration.

|

| INVESTMENT OBJECTIVE

|

| The Money Market Portfolio seeks to maximize current income to the extent consistent with the preservation of capital and the

maintenance of liquidity by investing in high quality money market instruments authorized under the Federal Credit Union Act.

|

| PRINCIPAL INVESTMENT STRATEGIES

|

| The Money Market Portfolio invests exclusively in:

|

n

|

Securities issued or guaranteed as to principal and interest by the U.S. government or by its agencies, instrumentalities or

sponsored enterprises (“U.S. Government Securities”) and related custodial receipts

|

n

|

U.S. dollar-denominated obligations issued or guaranteed by U.S. banks with total assets exceeding $1 billion (including

obligations issued by foreign branches of such banks), but only to the extent permitted under the Federal Credit Union Act and the rules and regulations thereunder

|

n

|

Repurchase agreements pertaining thereto

|

n

|

Federal funds

|

| Pursuant to an order of the Securities and Exchange Commission (“SEC”), the Money Market Portfolio may enter into

principal transactions in certain taxable money market instruments, including repurchase agreements, with Goldman Sachs.

|

| GENERAL INVESTMENT POLICIES

|

| The Portfolio: The Money Market Portfolio’s securities are valued by the amortized cost method as permitted by

Rule 2a-7 under the Investment Company Act of 1940, as amended (the “Act”). Under Rule 2a-7, the Portfolio may invest only in U.S. dollar-denominated securities that are determined to present minimal credit risk and meet certain other criteria,

including conditions relating to maturity, diversification and credit quality. These operating policies may be more restrictive than the fundamental policies set forth in the Statement of Additional Information (the “Additional Statement”).

|

| Net Asset Value (“NAV”): The Portfolio seeks to maintain a stable NAV of $1.00 per unit.

|

| Maximum Remaining Maturity of Portfolio Investments: 13 months (as determined pursuant to Rule 2a-7) at the time of

purchase.

|

| Dollar-Weighted Average Portfolio Maturity (“WAM”): Not more than 90 days (as required by Rule 2a-7).

|

| Diversification: Diversification can help the Portfolio reduce the risks of investing. In accordance with current

regulations of the SEC, the Portfolio may not invest more than 5% of the value of its total assets at the time of purchase in the securities of any single issuer. However, the Portfolio may invest up to 25% of the value of its total assets in the

securities of a single issuer for up to three business days. These limitations do not apply to cash, certain repurchase agreements or U.S. Government Securities. In addition, securities subject to certain unconditional guarantees are subject to different

diversification requirements as described in the Additional Statement.

|

| Credit Quality: Investments by the Money Market Portfolio must present minimal credit risk and be “First Tier

Securities.” First Tier Securities are securities that are rated in the highest short-term ratings category by at least two Nationally Recognized Statistical Rating Organizations (“NRSROs”), or if only one NRSRO has assigned a rating, by

that NRSRO; or have been issued or guaranteed by, or otherwise allow the Portfolio under certain conditions to demand payment from, an entity with such ratings. U.S. Government Securities are considered First Tier Securities. Securities without short-term

ratings may be purchased only if they are deemed by the Investment Adviser to be of comparable quality to First Tier Securities. NRSROs include Standard & Poor’s Ratings Group, Moody’s Investors Service, Inc. and Fitch, Inc. For a

description of each NRSRO’s rating categories, see the Additional Statement.

|

| INVESTMENT OBJECTIVE

|

| The Government Securities Portfolio seeks to achieve a high level of current income, consistent with low volatility of principal,

by investing in obligations authorized under the Federal Credit Union Act.

|

| PRINCIPAL INVESTMENT STRATEGIES

|

| The Government Securities Portfolio invests exclusively in:

|

n

|

U.S. Government Securities and related custodial receipts

|

n

|

Repurchase agreements pertaining thereto

|

n

|

Short-term obligations that are permitted investments for

the Money Market Portfolio

|

| Under normal market and interest rate conditions, at least 65% of the total assets of the Government Securities Portfolio will

consist of adjustable rate mortgage-related securities issued or guaranteed by the U.S. government, its agencies, instrumentalities or sponsored enterprises. While there will be fluctuations in the NAV of the Government Securities Portfolio, the Portfolio

is expected to have less interest rate risk and asset value fluctuation than funds investing primarily in longer-term mortgage-backed securities paying a fixed rate of interest.

|

| Duration (under normal interest rate conditions):

|

| Target = No shorter than a Six-Month U.S. Treasury Security; no longer than a One-Year U.S. Treasury Security

|

| Maximum = Two-Year U.S. Treasury Security

|

| Expected Approximate Interest Rate Sensitivity: Nine-Month Treasury Bill

|

| Credit Quality: U.S. Government Securities

|

| Benchmark: An equally weighted blend of the Six-Month and One-Year U.S. Treasury Security as reported by Merrill Lynch

|

| INVESTMENT OBJECTIVE

|

| The Mortgage Securities Portfolio seeks to achieve a high level of current income, consistent with relatively low volatility of

principal, by investing in obligations authorized under the Federal Credit Union Act.

|

| PRINCIPAL INVESTMENT STRATEGIES

|

| Under normal circumstances, the Mortgage Securities Portfolio will invest primarily (and at least 65% of its total assets) in

privately-issued mortgage-related securities rated, at the time of purchase, in one of the two highest rating categories by an NRSRO and in mortgage-related securities issued or guaranteed by the U.S. government, its agencies, instrumentalities or

sponsored enterprises. These securities will include both adjustable rate and fixed rate mortgage pass-through securities, collateralized mortgage obligations and other multiclass mortgage-related securities, as well as other securities that are

collateralized by or represent direct or indirect interests in mortgage-related securities or mortgage loans.

|

| The Mortgage Securities Portfolio may also invest in:

|

n

|

Other U.S. Government Securities and related custodial receipts

|

n

|

Repurchase agreements pertaining thereto

|

n

|

Short-term obligations that are permitted investments for the Money Market Portfolio

|

| The Mortgage Securities Portfolio will attempt, through the purchase of securities with short or negative durations, to limit the

effect of interest rate fluctuations on the Portfolio’s NAV.

|

| Duration (under normal interest rate conditions):

|

| Target = Two-Year U.S. Treasury Security

|

| Maximum = Three-Year U.S. Treasury Security

|

| Expected Approximate Interest Rate Sensitivity: Two-Year U.S. Treasury note

|

| Credit Quality: Privately issued mortgage securities rated AAA or Aaa or AA or Aa by a NRSRO at the time of purchase;

U.S. Government Securities

|

| Benchmark: The Two-Year U.S. Treasury Security as reported by Merrill Lynch

|

Ÿ

|

No specific percentage limitation on usage;

limited only by the objectives and strategies of the Portfolio |

| Money

Market Portfolio |

Government

Securities Portfolio |

Mortgage

Securities Portfolio |

|||||||

|---|---|---|---|---|---|---|---|---|---|

| Investment Practices | |||||||||

| Investment Company Securities | — | — | Ÿ | 1 | |||||

| Mortgage Dollar Rolls | — | Ÿ | Ÿ | ||||||

| Repurchase Agreements | Ÿ | Ÿ | Ÿ | ||||||

| Securities Lending | — | Ÿ | 2 | Ÿ | 2 | ||||

| When-Issued Securities and Forward Commitments | Ÿ | Ÿ | Ÿ | ||||||

| Investment Securities | |||||||||

| Bank Obligations 3 | Ÿ | Ÿ | Ÿ | ||||||

| Custodial Receipts | Ÿ | Ÿ | Ÿ | ||||||

| U.S. Government Securities | Ÿ | Ÿ | Ÿ | ||||||

| Inverse Floating Rate Securities 4 | — | Ÿ | Ÿ | ||||||

| Federal Funds 5 | Ÿ | Ÿ | Ÿ | ||||||

| Mortgage-Related Securities | |||||||||

| Adjustable Rate Mortgage Loans | — | Ÿ | Ÿ | ||||||

| Fixed Rate Mortgage Loans | — | Ÿ | Ÿ | ||||||

| Collateralized Mortgage Obligations | — | Ÿ | Ÿ | ||||||

| Government Mortgage-Related Securities | Ÿ | Ÿ | Ÿ | ||||||

| Multiple Class Mortgage-Related Securities | — | Ÿ | Ÿ | ||||||

| Privately Issued Mortgage Pass-Through Securities | — | — | Ÿ | ||||||

1

|

The Mortgage Securities Portfolio may invest up to 10% of its total assets in the securities of other investment companies

.

|

2

|

With respect to no more than 5% of net assets.

|

3

|

The Portfolios may invest in U.S. dollar-denominated obligations issued or guaranteed by U.S. banks with total assets

exceeding $1 billion (including obligations issued by foreign branches of such banks) only to the extent permitted under the Federal Credit Union Act and the rules and regulations thereunder.

|

4

|

To the extent permitted by NCUA Rules and Regulations.

|

5

|

The Portfolios may make unsecured loans of federal funds to U.S. banks with total assets exceeding $1 billion (including

obligations issued by foreign branches of such banks) to the extent permitted by the Federal Credit Union Act and the rules and regulations thereunder.

|

| Money

Market Portfolio |

Government

Securities Portfolio |

Mortgage

Securities Portfolio |

|||||

|---|---|---|---|---|---|---|---|

| Stable NAV | Ÿ | N/A | N/A | ||||

| Interest Rate | Ÿ | Ÿ | Ÿ | ||||

| Credit/Default | Ÿ | Ÿ | Ÿ | ||||

| Call | Ÿ | Ÿ | Ÿ | ||||

| Extension | Ÿ | Ÿ | Ÿ | ||||

| Derivatives | N/A | Ÿ | Ÿ | ||||

| U.S. Government Securities | Ÿ | Ÿ | Ÿ | ||||

| Market | Ÿ | Ÿ | Ÿ | ||||

| Management | Ÿ | Ÿ | Ÿ | ||||

| Liquidity | Ÿ | Ÿ | Ÿ | ||||

| Other | Ÿ | Ÿ | Ÿ | ||||

n

|

Stable NAV Risk—The risk that the Money Market Portfolio will not be able to maintain a NAV per

unit of $1.00 at all times. The Bond Portfolios are not exposed to this risk as they do not maintain a stable NAV; rather, the value of their units fluctuates.

|

n

|

Interest Rate Risk—The risk that during periods of rising interest rates, a Portfolio’s

yield (and the market value of its fixed-income securities) will tend to be lower than prevailing market rates; in periods of falling interest rates, a Portfolio’s yield will tend to be higher.

|

n

|

Credit/Default Risk—The risk that an issuer or guarantor of a security, or a bank (or a foreign

branch of a U.S. bank) or other financial institution that has entered into a repurchase agreement, may default on its payment obligations.

|

n

|

Call Risk—The risk that an issuer will exercise its right to pay principal on an obligation held

by a Portfolio (such as a mortgage-backed security) earlier than expected. This may happen when there is a decline in interest rates. Under these circumstances, a Portfolio may be unable to recoup all of its initial investment and will also suffer from

having to reinvest in lower yielding securities.

|

n

|

Extension Risk—The risk that an issuer will exercise its right to pay principal on an obligation

held by a Portfolio (such as a mortgage-backed security) later than expected. This may happen when there is a rise in interest rates. Under these circumstances, the value of the obligation will decrease, and a Portfolio will also suffer from the inability

to invest in higher yielding securities.

|

n

|

Derivatives Risk—The risk that loss may result from a Portfolio’s investments in mortgage

derivatives, forward commitments, mortgage dollar rolls and other derivative instruments. These instruments may be leveraged so that small changes may produce disproportionate losses to a Portfolio.

|

n

|

U.S. Government Securities Risk—The risk that the U.S. government will not provide financial

support to U.S. government agencies, instrumentalities or sponsored enterprises if it is not obligated to do so by law.

|

n

|

Market Risk—The risk that the value of the securities in which a Portfolio invests may go up or

down in response to the prospects of individual companies and/or general economic conditions. Price changes may be temporary or last for extended periods.

|

n

|

Management Risk—The risk that a strategy used by the Investment Adviser may fail to produce the

intended results.

|

n

|

Liquidity Risk—The risk that a Portfolio will not be able to pay redemption proceeds within the

time period stated in this Prospectus, because of unusual market conditions, an unusually high volume of redemption requests, or other reasons.

|

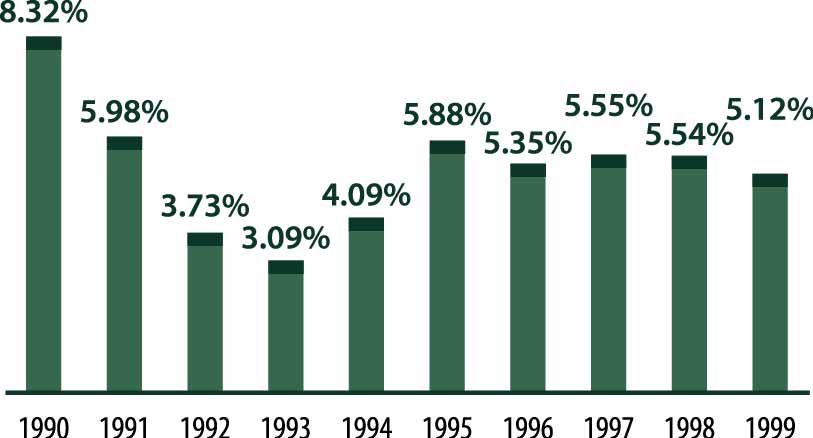

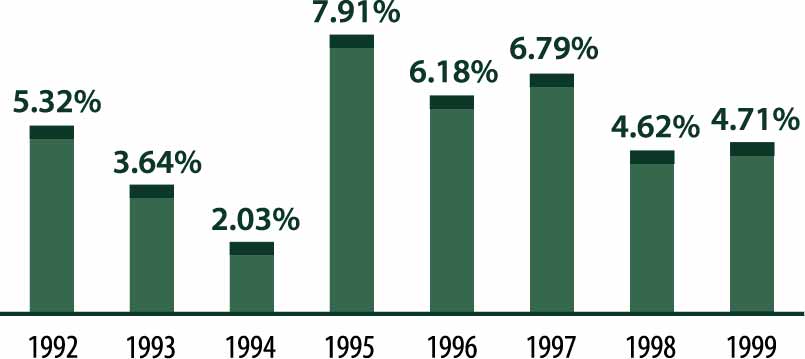

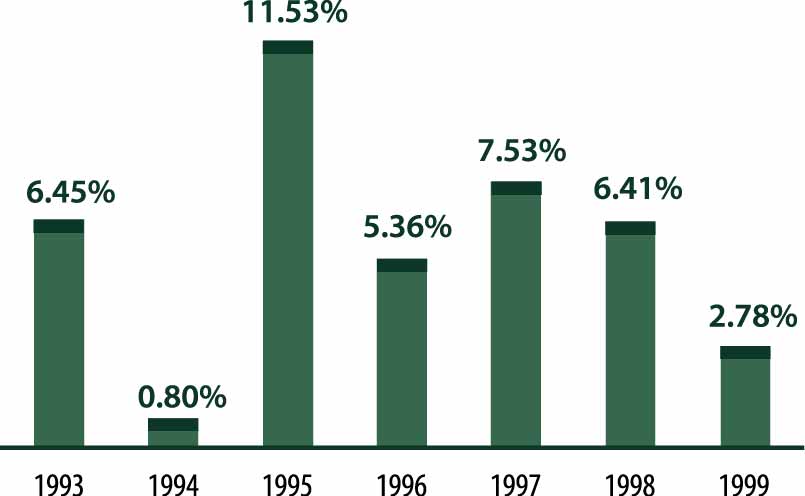

| HOW THE PORTFOLIOS HAVE PERFORMED

|

| The bar chart and table below provide an indication of the risks of investing in a Portfolio by showing: (a) changes in the

performance of a Portfolio from year to year; and (b) the average annual returns of the Portfolios and how the returns of the Bond Portfolios compare to those of broad-based securities market indices. The bar chart and table assume reinvestment of

dividends and distributions. A Portfolio’s past performance is not necessarily an indication of how the Portfolio will perform in the future. Performance reflects expense limitations in effect. If expense limitations were not in place, a

Portfolio’s performance would have been reduced.

|

| You may obtain the Money Market Portfolio’s current yield by calling 1-800-342-5828 or 1-800-237-5678.

|

| TOTAL RETURN

|

| The total return for the 9-month period ended September 30, 2000 was 4.68%.

Best Quarter

Q2 ’90

2.05%

Worst Quarter

Q2 ’93

0.75%

|

|

| AVERAGE ANNUAL TOTAL RETURN

|

| For the period ended December 31, 1999 | 1 Year | 5 Years | 10 Years | Since

Inception |

|||||

|---|---|---|---|---|---|---|---|---|---|

| Money Market Portfolio (Inception 5/17/88) | 5.12% | 5.49% | 5.26% | 5.76% | |||||

| TOTAL RETURN

|

| The total return for the 9-month period ended September 30, 2000 was 4.76%.

Best Quarter

Q1 ’95

2.44%

Worst Quarter

Q2 ’94

0.23%

|

|

| AVERAGE ANNUAL TOTAL RETURN

|

| For the period ended December 31, 1999 | 1 Year | 5 Years | Since

Inception |

||||

|---|---|---|---|---|---|---|---|

| Government Securities Portfolio (Inception 7/10/91) | 4.71% | 6.03% | 5.28% | ||||

| Six-Month U.S. Treasury Security* | 4.64% | 5.52% | 5.01% | ||||

| One-Year U.S. Treasury Security* | 4.03% | 5.85% | 5.28% | ||||

| Lehman Brothers Mutual Fund Adjustable Rate Mortgage

(“ARM”) Index** |

4.82% | 7.11% | 5.88% | ||||

| Lehman Brothers Mutual Fund Short (1-2) Government Index*** | 3.42% | 6.27% | 5.83% | ||||

| * The Six-Month and One-Year U.S. Treasury Securities, as reported by Merrill Lynch,

do not reflect any fees or expenses.

|

| ** The Lehman Brothers Mutual Fund Adjustable Rate Mortgage Index is unmanaged and

the Index figures do not reflect any fees or expenses.

|

***

|

The Lehman Brothers Mutual Fund Short (1-2) Government Index is unmanaged and the Index figures do not reflect any fees

or expenses.

|

| TOTAL RETURN

|

| The total return for the 9-month period ended September 30, 2000 was 5.60%.

Best Quarter

Q1 ’95

3.47%

Worst Quarter

Q1 ’94

-0.46%

|

|

| AVERAGE ANNUAL TOTAL RETURN

|

| For the period ended December 31, 1999 | 1 Year | 5 Years | Since

Inception |

||||

|---|---|---|---|---|---|---|---|

| Mortgage Securities Portfolio (Inception 10/9/92) | 2.78% | 6.68% | 5.65% | ||||

| Two-Year U.S. Treasury Security* | 1.89% | 6.10% | 4.99% | ||||

| Lehman Brothers ARM Index** | 4.82% | 7.11% | 5.92% | ||||

| Lehman Brothers Mutual Fund Short (1-3) Government Index*** | 2.97% | 6.47% | 5.43% | ||||

| * The Two-Year U.S. Treasury Security, as reported by Merrill Lynch, does not

reflect any fees or expenses.

|

| ** The Lehman Brothers ARM Index is unmanaged and the Index figures do not reflect

any fees or expenses.

|

***

|

The Lehman Brothers Mutual Fund Short (1-3) Government Index is unmanaged and the Index figures do not reflect any fees

or expenses.

|

| Money

Market Portfolio |

Government

Securities Portfolio |

Mortgage

Securities Portfolio |

|||||||

|---|---|---|---|---|---|---|---|---|---|

| Unitholder Fees | |||||||||

| (fees paid directly from your investment): | |||||||||

| Maximum Sales Charge (Load) Imposed on

Purchases |

None | None | None | ||||||

| Maximum Deferred Sales Charge (Load) | None | None | None | ||||||

| Maximum Sales Charge (Load) Imposed on

Reinvested Dividends |

None | None | None | ||||||

| Redemption Fees | None | None | None | ||||||

| Exchange Fees | None | None | None | ||||||

| Annual Portfolio Operating Expenses* | |||||||||

| (expenses that are deducted from Portfolio assets): 1 | |||||||||

| Management Fees | 0.17% | 2 | 0.20% | 0.20% | |||||

| Administration Fees | 0.10% | 3 | 0.10% | 0.05% | |||||

| Other Expenses | 0.03% | 0.04% | 5 | 0.05% | |||||

| Total Portfolio Operating Expenses* | 0.30% | 4 | 0.34% | 0.30% | |||||

*

|

As a result of the current fee waivers and expense limitations, “Other Expenses” and “Total Portfolio Operating

Expenses” of the Portfolios which are actually incurred as of the date of this Prospectus are as set forth below. The expense limitations may be terminated at any time at the option of the Investment Adviser and Administrator. If this occurs, a

Portfolio’s operating expenses may increase without unitholder approval.

|

| Money

Market Portfolio |

Government

Securities Portfolio |

Mortgage

Securities Portfolio |

|||||||

|---|---|---|---|---|---|---|---|---|---|

| Annual Portfolio Operating Expenses | |||||||||

| (expenses that are deducted from Portfolio assets): 1 | |||||||||

| Management Fees | 0.07% 2 | 0.20% | 0.20% | ||||||

| Administration Fees | 0.02% | 3 | 0.10% | 0.05% | |||||

| Other Expenses | 0.03% | 0.04% | 5 | 0.05% | |||||

| Total Portfolio Operating Expenses (after current

waivers and expense limitations) |

0.12% 4 | 0.34% | 0.30% | ||||||

|

1

The Portfolios’ annual operating expenses are based on actual expenses.

|

|

2

The management fee for the Money Market Portfolio is payable monthly at annual rates equal to 0.20%

of the first $300 million and 0.15% over $300 million of the average daily net assets of the Portfolio. The Investment Adviser has voluntarily agreed to limit its advisory fee to 0.07% of the Portfolio’s average daily net assets. The limitation may

be terminated at any time at the option of the Investment Adviser.

|

|

3

The Administrator has voluntarily agreed to limit its administration fee on the Money Market

Portfolio to 0.02% of the Portfolio’s average daily net assets. The limitation may be terminated at any time at the option of the Administrator.

|

|

4

The Administrator has voluntarily agreed to reduce or limit “Total Portfolio Operating

Expenses” of the Money Market Portfolio (excluding interest, taxes, brokerage and extraordinary expenses) to 0.20% of the Portfolio’s average daily net assets.

|

|

5

The Administrator and the Investment Adviser have voluntarily agreed to reduce or limit “Other

Expenses” (excluding advisory fees, administration fees, interest, taxes, brokerage and extraordinary expenses) of the Government Securities Portfolio such that the Administrator will reimburse expenses that exceed 0.05% up to 0.10% of the

Portfolio’s average daily net assets and the Investment Adviser will reimburse expenses that exceed 0.10% up to 0.15% of the Portfolio’s average daily net assets.

|

| Portfolio | 1 Year | 3 Years | 5 Years | 10 Years | |||||

|---|---|---|---|---|---|---|---|---|---|

| Money Market | $31 | $ 97 | $169 | $381 | |||||

| Government Securities | $35 | $109 | $191 | $431 | |||||

| Mortgage Securities | $31 | $ 97 | $169 | $381 | |||||

| INVESTMENT ADVISER

|

| Goldman Sachs Asset Management (“GSAM”) is a separate business unit of the Investment Management Division (“

IMD”) of Goldman Sachs. Goldman Sachs registered as an investment adviser in 1981. As of September 30, 2000, GSAM, along with other units of IMD, had assets under management of $281.3 billion.

|

| The Investment Adviser provides day-to-day advice regarding the Portfolios’ transactions. The Investment Adviser also

performs the following services for the Portfolios:

|

n

|

Continually manages each Portfolio, including the purchase, retention and disposition of securities and other assets

|

n

|

Performs various administrative and recordholder servicing functions (to the extent not provided by CUFSLP, as Administrator)

|

| MANAGEMENT FEES

|

| As compensation for its services and its assumption of certain expenses, the Investment Adviser is entitled to the following fees,

computed daily and payable monthly, at the annual rates listed below (as a percentage of each Portfolio’s average daily net assets):

|

| Portfolio | Contractual Rate | Actual Rate For the

Fiscal Year Ended August 31, 2000 |

|||

|---|---|---|---|---|---|

| Money Market | 0.20% on first

$300 million, 0.15% on remainder |

0.07% | |||

| Government Securities | 0.20% | 0.20% | |||

| Mortgage Securities | 0.20% | 0.20% | |||

| The difference, if any, between the stated fees and the actual fees paid by the Portfolios reflects that the Investment Adviser

did not charge the full amount of the fees to which it would have been entitled. The Investment Adviser may discontinue or modify any such voluntary limitations in the future at its discretion.

|

| ADMINISTRATOR

|

| Callahan Credit Union Financial Services Limited Partnership (“CUFSLP”), a Delaware limited partnership in which 40

major credit unions are limited partners, acts as the Administrator of the Fund. In this capacity, CUFSLP periodically reviews the performance of the Investment Adviser, the Transfer Agent, the Distributors and the custodian of the Fund; provides

facilities, equipment and personnel to serve the needs of investors; develops and monitors investor programs for credit unions; provides assistance in connection with the processing of unit purchase and redemption orders as reasonably requested by the

Transfer Agent or the Fund; handles unitholder problems and calls relating to administrative matters; provides advice and assistance concerning the regulatory requirements applicable to credit unions that invest in the Fund; and provides other

administrative services to the Fund. The administration fee payable to CUFSLP is described under “Portfolio Fees and Expenses.”

|

| DISTRIBUTORS AND TRANSFER AGENT

|

| Callahan Financial Services, Inc. (“CFS”), 1001 Connecticut Avenue, N.W., Suite 1001, Washington, D.C. 20036-5504, a

Delaware corporation, and Goldman Sachs, 85 Broad Street, New York, New York 10004, serve as the distributors (the “Distributors”) of units of the Fund. CFS, a registered broker-dealer under the Securities Exchange Act of 1934, is an affiliate

of Callahan & Associates, Inc., a corporation organized under the laws of the District of Columbia, founded in 1985. Goldman Sachs, 4900 Sears Tower, Chicago, Illinois 60606-6372, also serves as the Fund’s transfer agent (the “Transfer

Agent”) and, as such, performs various unitholder servicing functions.

|

| PORTFOLIO MANAGERS

|

| The portfolio managers for the Bond Portfolios are:

|

| Name and Title | Years Primarily

Responsible |

Five Year Employment History | |||

|---|---|---|---|---|---|

| Jonathan A. Beinner

Managing Director and Co-Head U.S. Fixed Income |

Since 1991 | Mr. Beinner joined the Investment Adviser in 1990. | |||

| James B. Clark

Vice President |

Since 1994 | Mr. Clark joined the Investment Adviser in 1994 after

working as an investment manager in the mortgage- backed securities group at Travelers Insurance Company. |

|||

| Peter A. Dion

Vice President |

Since 1995 | Mr. Dion joined the Investment Adviser in 1992. From

1994 to 1995, he was an associate portfolio manager. |

|||

| James P. McCarthy

Vice President |

Since 1995 | Mr. McCarthy joined the Investment Adviser in 1995 after

working four years at Nomura Securities, where he was an assistant vice president and an adjustable rate mortgage trader. |

|||

| ACTIVITIES OF GOLDMAN SACHS AND ITS AFFILIATES AND OTHER ACCOUNTS MANAGED BY GOLDMAN SACHS

|

| The involvement of the Investment Adviser, Goldman Sachs and their affiliates in the management of, or their interest in, other

accounts and other activities of Goldman Sachs may present conflicts of interest with respect to the Portfolios or limit their investment activities. Goldman Sachs and its affiliates engage in proprietary trading and advise accounts and funds which have

investment objectives similar to those of the Portfolios and/or which engage in and compete for transactions in the same types of securities and instruments as the Portfolios. Goldman Sachs and its affiliates will not have any obligation to make available

any information regarding their proprietary activities or strategies, or the activities or strategies used for other accounts managed by them, for the benefit of the management of the Portfolios. The results of the Portfolios’ investment activities,

therefore, may differ from those of Goldman Sachs and its affiliates, and it is possible that the Portfolios could sustain losses during periods in which Goldman Sachs and its affiliates and other accounts achieve significant profits on their trading for

proprietary or other accounts. In addition, the Portfolios may, from time to time, enter into transactions in which other clients of Goldman Sachs have an adverse interest. The Portfolios’ activities may be limited because of regulatory restrictions

applicable to Goldman Sachs and its affiliates, and/or their internal policies designed to comply with such restrictions.

|

n

|

Cash

|

n

|

Additional units of the same Portfolio

|

n

|

Units of the Money Market Portfolio (for reinvesting dividends accrued and paid with respect to the Bond Portfolios)

|

| Investment Income

Dividends |

Capital Gains

Distributions |

||||||

|---|---|---|---|---|---|---|---|

| Portfolio | Declared | Paid | Declared and Paid | ||||

| Money Market | Daily | Monthly | Annually | ||||

| Government Securities | Daily | Monthly | Annually | ||||

| Mortgage Securities | Daily | Monthly | Annually | ||||

| The following section will provide you with answers to some of the most often asked questions regarding buying and selling units

of the Portfolios. A unitholder may also utilize the SMARTPlus personal computer software system to buy and sell units and also obtain Portfolio and account information. For more information about such on-line purchasing options, please call Goldman Sachs

at 1-800-621-2553.

|

| Purchases of units of the Portfolios may be made only by Federal Reserve wire. There is no minimum for initial or subsequent

investments nor are minimum balances required.

|

| Money Market Portfolio

|

| You may purchase units of the Money Market Portfolio on any business day at their NAV next determined after receipt of an order by

wiring federal funds to The Northern Trust Company (“Northern”), as subcustodian for State Street Bank and Trust Company (“State Street”). You may place a purchase order in writing or by telephone.

|

| |

| By Writing: | Goldman Sachs Funds | ||

| Trust for Credit Unions | |||

| 4900 Sears Tower | |||

| Chicago, IL 60606-6372 | |||

| By Telephone: | 1-800-342-5828 | ||

| (8:00 a.m. to 4:30 p.m. New York time) | |||

| Units of the Money Market Portfolio are deemed to have been purchased when an order becomes effective and are entitled to

dividends on units purchased as follows:

|

| If an effective order is received: | Dividends begin: | ||

|---|---|---|---|

| n By 3:00 p.m. New York time | Same business day | ||

| n After 3:00 p.m. New York time | Next business day | ||

| Federal Reserve wires should be sent as early as possible, but must be received before the end of the business day, for a purchase

order to be effective.

|

| Government Securities Portfolio and Mortgage Securities Portfolio

|

| You may purchase units of each of the Bond Portfolios on any business day at their NAV next determined after receipt of an order

by wiring federal funds to Northern. You may place a purchase order in writing or by telephone.

|

| |

| By Writing: | Goldman Sachs Funds | ||

| Trust for Credit Unions | |||

| 4900 Sears Tower | |||

| Chicago, IL 60606-6372 | |||

| By Telephone: | 1-800-342-5828 | ||

| (8:00 a.m. to 4:30 p.m. New York time) | |||

| Dividends will begin to accrue as follows:

|

n

|

If a purchase order is received by Goldman Sachs by 4:00 p.m. New York time on a business day, units will be issued and dividends

will begin to accrue on the purchased units on the next business day, provided that Northern receives the federal funds in respect to such order by such next business day.

|

n

|

If a purchase order is received by Goldman Sachs after 4:00 p.m. New York time, units will be issued and dividends will begin to

accrue on the purchased units on the second business day thereafter, provided that Northern receives the federal funds with respect to such order by such second business day.

|

| What Else Should I Know About Unit Purchases?

|

| The following generally applies to purchases of units:

|

n

|

If payment in federal funds is not received within the

periods stated above, your purchase order will be cancelled, and you will be responsible for any loss resulting to the Fund.

|

n

|

For your initial purchase of units of the Portfolios, you should promptly complete an Account Information Form, and mail it to

Goldman Sachs Funds, Trust for Credit Unions, 4900 Sears Tower, Chicago, Illinois 60606-6372 or Callahan Financial Services, Inc., 1001 Connecticut Avenue, N.W., Suite 1001, Washington, D.C. 20036. You may not redeem units prior to receipt of such Account

Information Form.

|

n

|

Goldman Sachs and/or CFS may from time to time, at their own expense, provide compensation to certain dealers whose customers

purchase significant amounts of units of the Fund. The amount of such compensation may be made on a one-time and/or periodic basis and, in the case of Goldman Sachs, may be up to 20% of the annual fees that are earned by Goldman Sachs as Investment

Adviser to the Fund (after adjustments) and are attributable to units held by such customers. Such compensation does not represent an additional expense to the Fund or its unitholders, since it will be paid from the assets of Goldman Sachs, its affiliates

or CFS.

|

| The Fund and its Distributors reserve the right to:

|

n

|

Reject or restrict any purchase or exchange orders by a particular purchaser (or group of related purchasers).

|

| How Are Units Priced?

|

| The price you pay or receive when you buy, sell or exchange units of the Fund is determined by a Portfolio’s NAV. The Fund

calculates NAV as follows:

|

| (Value of Assets of the Portfolio)

|

| NAV =

|

– (Liabilities of the Portfolio)

|

| |

||

| Number of Outstanding Units of the Portfolio

|

||

| Money Market Portfolio

|

n

|

The NAV of the Money Market Portfolio is calculated by State Street as of the close of regular trading on the New York Stock

Exchange (normally 4:00 p.m. New York time) on each business day. Units will be priced on any day the New York Stock Exchange is open, except for days on which Chicago, Boston or New York banks are closed for local holidays.

|

n

|

To help the Portfolio maintain its $1.00 constant unit price, portfolio securities are valued at amortized cost in accordance with

SEC regulations. Amortized cost will normally approximate market value. There can be no assurance that the Portfolio will be able at all times to maintain a NAV of $1.00 per unit.

|

| Government Securities Portfolio and Mortgage Securities Portfolio

|

| The investments of the Bond Portfolios are valued based on market quotations, which may be furnished by a pricing service or

provided by securities dealers. If accurate quotations are not readily available, the fair value of the Bond Portfolios’ investments may be determined based on yield equivalents, a pricing matrix or other sources, under valuation procedures

established by the Trustees. Debt obligations with a remaining maturity of 60 days or less are valued at amortized cost.

|

n

|

NAV per unit is calculated by State Street on each business day as of the close of regular trading on the New York Stock Exchange

(normally 4:00 p.m. New York time). This occurs after the determination, if any, of the income to be declared as a dividend. Units will not be priced on any day the New York Stock Exchange is closed.

|

n

|

When you buy units, you pay the NAV next calculated after the Bond Portfolios receive your order in proper form.

|

n

|

When you sell units, you receive the NAV next calculated after the Bond Portfolios receive your order in proper form.

|

n

|

NAV per unit will fluctuate as the values of portfolio securities change in response to changing market rates of interest,

principal prepayments, yield spreads and other factors.

|

| General Valuation Policies

|

n

|

On any business day when the Bond Market Association (“BMA”) recommends that the securities markets close early, each

Portfolio reserves the right to close at or prior to the BMA recommended closing time. If a Portfolio does so, it will cease granting same business day credit for purchase and redemption orders received after the Portfolios’ closing time and credit

will be given to the next business day.

|

n

|

Each Portfolio reserves the right to advance the time by which purchase and redemption orders must be received for same business

day credit as otherwise permitted by the SEC.

|

| Note: The time at which transactions and units are priced and the time by which orders must be received may be changed in

case of an emergency or if regular trading on the New York Stock Exchange is stopped at a time other than 4:00 p.m. New York time.

|

| How Can I Sell Units Of The Fund?

|

| You may arrange to take money out of your account by selling (redeeming) some or all of your units. The Fund will redeem your

units without charge upon request on any business day at their NAV next determined after receipt of such request in proper form. Redemptions may be requested in writing or by telephone.

|

| Instructions For Redemptions: | |||||

|---|---|---|---|---|---|

| By Writing: | n Write a letter of instruction that includes: | ||||

| n Your name(s) and signature(s) | |||||

| n Your account number | |||||

| n The Portfolio name | |||||

| n

The dollar amount or number of units you

want to sell |

|||||

| n How and where to send the proceeds | |||||

| n

Mail the request to:

Goldman Sachs Funds Trust for Credit Unions 4900 Sears Tower Chicago, IL 60606-6372 |

|||||

| By Telephone: | If you have elected the telephone redemption and

exchange privileges on your Account Information Form: |

||||

| n

1-800-342-5828

(8:00 a.m. to 4:30 p.m. New York time) |

|||||

| What Do I Need To Know About Telephone Redemption Requests?

|

| The Fund, the Distributors, the Administrator, the Investment Adviser and the Transfer Agent will not be liable for any loss you

may incur in the event that the Fund accepts unauthorized telephone redemption requests that the Fund reasonably believes to be genuine. In an effort to prevent unauthorized or fraudulent redemption and exchange requests by telephone, Goldman Sachs and

State Street each employ reasonable procedures specified by the Fund to confirm that such instructions are genuine. If reasonable procedures are not employed, the Fund may be liable for any loss due to unauthorized or fraudulent transactions. The

following general policies are currently in effect:

|

n

|

All telephone requests are recorded.

|

n

|

Proceeds of telephone redemptions will be wired directly to the credit union, central credit union, or other depository account

designated on the Account Information Form unless you provide written instructions signed by an authorized person designated on the Account Information Form indicating another credit union, or other depository accounts.

|

n

|

The telephone redemption option may be modified or terminated at any time.

|

| Note: It may be difficult to make telephone redemptions in times of drastic economic or market conditions.

|

| How Are Redemption Proceeds Paid?

|

| You may arrange for your redemption proceeds to be wired as federal funds to the credit union, central credit union or other

depository institution designated on your Account Information Form.

|

| Money Market Portfolio

|

| If a redemption request is received by Goldman Sachs before 3:00 p.m. New York time, the units to be redeemed do not earn income

on the day the request is received, but proceeds are ordinarily wired on the same day. If such request is received by Goldman Sachs after such time and prior to 4:00 p.m., New York time, the units to be redeemed earn income on the day the request is

received, and proceeds are ordinarily wired on the morning of the following business day.

|

| Government Securities Portfolio and Mortgage Securities Portfolio

|

| If a redemption request is received by Goldman Sachs by 4:00 p.m. New York time, the proceeds are ordinarily wired on the next

business day. Units to be redeemed earn income with respect to the day the request is received. Also, units redeemed on a day immediately preceding a weekend or holiday continue to earn income until the next business day.

|

| What Else Do I Need To Know About Redemptions?

|

n

|

If its authorized signature is guaranteed by a credit union, commercial bank, trust company, member firm of a national securities

exchange or other eligible guarantor institution, a unitholder may change the designated credit union, central credit union or other depository account at any time upon written notice to Goldman Sachs. Additional documentation regarding any such change or

regarding a redemption by any means, may be required when deemed appropriate by Goldman Sachs and the request for such redemption will not be considered to have been received in proper form until such additional documentation has been received.

|

n

|

Once wire instructions have been given to Northern, neither the Fund nor Goldman Sachs assumes responsibility for the performance

of Northern or of any intermediaries in the transfer process. If a problem with such performance arises, you should deal directly with Northern or such intermediaries.

|

n

|

The right of a unitholder to redeem units and the date of payment by the Fund may be suspended for more than seven days for any

period during which the New York Stock Exchange is closed, or trading on the Exchange is restricted as determined by the SEC; or during any emergency, as determined by the SEC; or for such other period as the SEC may by order permit for the protection of

unitholders of the Fund.

|

n

|

Units are redeemable at the option of the Fund if the Trustees determine in their sole discretion that failure to so redeem may

have materially adverse consequences to the unitholders of the Portfolio.

|

| Can My Dividends And Distributions From A Bond Portfolio Be Reinvested In The Money Market Portfolio?

|

| You may elect to reinvest dividends and capital gain distributions paid by the Bond Portfolios in units of the same Bond Portfolio

or in units of the Money Market Portfolio.

|

n

|

Units will be purchased at NAV.

|

n

|

Cross-reinvestment of dividends will be made to an identically registered account unless you provide written instructions signed

by an authorized person designated on the Account Information Form indicating an account registered in a different name or with a different address or taxpayer identification number.

|

| Can I Exchange My Investment From One Portfolio To Another?

|

| You may exchange units of each Portfolio at NAV for units of any other Portfolio of the Fund. The exchange privilege may be

materially modified or withdrawn at any time upon 60 days’ written notice to you.

|

| Instructions For Exchanging Shares: | |||||

|---|---|---|---|---|---|

| By Writing: | n Write a letter of instruction that includes: | ||||

| n Your name(s) and signature(s) | |||||

| n Your account number | |||||

| n The Portfolio name | |||||

| n

The dollar amount or number of units to be

exchanged |

|||||

| n

Mail the request to:

Goldman Sachs Funds Trust for Credit Unions 4900 Sears Tower Chicago, IL 60606-6372 |

|||||

| By Telephone: | If you have elected the telephone redemption and

exchange privileges on your Account Information Form: |

||||

| n

1-800-342-5828

(8:00 a.m. to 4:30 p.m. New York time) |

|||||

| You should keep in mind the following factors when making or considering an exchange:

|

n

|

You should read the Prospectus before making an exchange.

|

n

|

Exchanges are available only in states where exchanges may be legally made.

|

n

|

It may be difficult to make telephone exchanges in times of drastic economic or market conditions.

|

n

|

Goldman Sachs may use reasonable procedures described under “What Do I Need To Know About Telephone Redemption Requests?”

in an effort to prevent unauthorized or fraudulent telephone exchange requests.

|

n

|

Telephone exchanges normally will be made only to an identically registered account.

|

n

|

The Fund reserves the right to reject any exchange request.

|

| What Types Of Reports Will I Be Sent Regarding Investments In The Portfolios?

|

| You will receive an annual report containing audited financial statements and a semi-annual report. All unitholders will be

provided with an individual monthly statement for each Portfolio showing each transaction for the reported month. Unitholders of the Bond Portfolios will also be provided with a printed confirmation for each transaction in their accounts. A year-to-date

statement for your account will be provided upon request made to Goldman Sachs.

|

| TAXATION OF UNITHOLDERS

|

| If state and federally chartered credit unions meet all requirements of Section 501(c)(14)(A) of the Code, and all rules and

regulations thereunder, they will be exempt from federal income taxation on any income, dividends or capital gains realized as the result of purchasing, holding, exchanging or redeeming units of the Fund.

|

| FEDERAL TAXATION OF THE FUND

|

| The Fund intends that each of its Portfolios will qualify for the special tax treatment afforded regulated investment companies

under Subchapter M of the Code. Each Portfolio of the Fund is treated as a separate corporation for federal tax purposes and generally must comply with the qualification and other requirements applicable to regulated investment companies, without regard

to the Fund’s other Portfolios. If a Portfolio otherwise complies with such provisions, then in any taxable year for which it distributes at least 90% of its investment company taxable income determined for federal income tax purposes (before any

deduction for dividends paid), the Portfolio will be relieved of federal income tax on the amounts distributed. The Fund intends to distribute to its unitholders substantially all of each Portfolio’s net investment company taxable income and net

capital gain.

|

| The Code will impose a 4% excise tax if a Portfolio fails to meet certain requirements with respect to distributions of net

ordinary income and capital gain net income. It is not anticipated that this provision will have any material impact on the Portfolios or their unitholders.

|

| If for any taxable year a Portfolio does not qualify as a regulated investment company, all of its taxable income will be taxed to

such Portfolio at the appropriate corporate rate without any reduction for distributions made to unitholders.

|

| The foregoing discussion of tax consequences is based on federal tax laws and regulations in effect on the date of this

Prospectus, which are subject to change by legislative or administrative action. You should also consult your own tax adviser for information regarding all tax consequences applicable to your investments in the Portfolios.

|

| A. General Portfolio Risks

|

| Risks of Fixed Income Securities. The Portfolios will be subject to the risks associated with fixed-income

securities. These risks include interest rate risk, credit risk and call/extension risk. In general, interest rate risk involves the risk that when interest rates decline, the market value of fixed-income securities tends to increase (although many

mortgage-related securities will have less potential than other debt securities for capital appreciation during periods of declining rates). Conversely, when interest rates increase, the market value of fixed-income securities tends to decline. Credit

risk involves the risk that the issuer could default on its obligations, and a Portfolio will not recover its investment. Call risk and extension risk are normally present in adjustable rate mortgage loans (“ARMs”) and mortgage-backed

securities. For example, homeowners have the option to prepay their mortgages. Therefore, the duration of a security backed by home mortgages can either shorten (call risk) or lengthen (extension risk). In general, if interest rates on new mortgage loans

fall sufficiently below the interest rates on existing outstanding mortgage loans, the rate of prepayment would be expected to increase. Conversely, if mortgage loan interest rates rise above the interest rates on existing outstanding mortgage loans, the

rate of prepayment would be expected to decrease. In either case, a change in the prepayment rate can result in losses to investors.

|

| Risks of Derivative Investments. Derivative mortgage-related securities are particularly exposed to call and

extension risks. Small changes in mortgage prepayments can significantly impact the cash flow and the market value of these securities. In general, the risk of faster than anticipated prepayments adversely affects super floaters and premium priced

mortgage-related securities. The risk of slower than anticipated prepayments generally adversely affects floating-rate securities subject to interest rate caps, support tranches and discount priced mortgage-related securities. In addition, particular

derivative securities may be leveraged such that their exposure (i.e., price sensitivity) to interest rate and/or prepayment risk is magnified.

|

| Some floating-rate derivative debt securities can present more complex types of derivative and interest rate risks. For example,

range floaters are subject to the risk that the coupon will be reduced below market rates if a designated interest rate floats outside of a specified interest rate band or collar. Dual index or yield

curve floaters are subject to lower prices in the event of an unfavorable change in the spread between two designated interest rates.

|

| Risks of Illiquid Securities. The Bond Portfolios may invest up to 15% of their net assets and the Money Market

Portfolio may invest up to 10% of its net assets in illiquid securities, which cannot be disposed of in seven days in the ordinary course of business at fair value. Illiquid securities include:

|

n

|

Securities that are not readily marketable

|

n

|

Repurchase agreements, federal funds loans and fixed time deposits with a notice or demand period of more than seven days

|

n

|

Loan participations of foreign governments or their agencies that are guaranteed as to principal and interest by the U.S.

government or its agencies, instrumentalities or sponsored enterprises where a substantial secondary market is absent

|

n

|

Certain restricted securities, unless it is determined, based upon a review of the trading markets for a specific restricted

security, that such restricted security is liquid because it is so-called “4(2) commercial paper” or is otherwise eligible for resale pursuant to Rule 144A under the Securities Act of 1933 (“144A Securities”) and, therefore, is liquid

|

| Investing in restricted securities may decrease a Portfolio’s liquidity to the extent that qualified institutional buyers

become for a time uninterested in purchasing these restricted securities. The purchase price and subsequent valuation of restricted and illiquid securities normally reflect a discount, which may be significant, from the market price of comparable

securities for which a liquid market exists.

|

| Portfolio Turnover Rate. The Investment Adviser will not consider the portfolio turnover rate a limiting factor in

making investment decisions for a Portfolio. A high rate of portfolio turnover (100% or more) involves correspondingly greater expenses which must be borne by a Portfolio and its unitholders. The portfolio turnover rate is calculated by dividing the

lesser of the dollar amount of sales or purchases of portfolio securities by the average monthly value of a Portfolio’s portfolio securities, excluding securities having a maturity at the date of purchase of one year or less. See “Financial

Highlights” in Appendix B for a statement of the historical portfolio turnover rates of the Government Securities Portfolio and the Mortgage Securities Portfolio.

|

| Investment Criteria. If, after purchase by a Portfolio, an investment ceases to meet the investment criteria stated

in this Prospectus, the Investment Adviser will consider whether the Portfolio should continue to hold the investment. Investments purchased prior to January 1, 1998 will be governed by the NCUA Rules and Regulations in effect when purchased, and the

Portfolios may continue to hold such investments after that date subject to compliance with the NCUA Rules and Regulations.

|

| B. Portfolio Securities and Techniques

|

| This section provides further information on certain types of securities and investment techniques that may be used by the

Portfolios, including their associated risks. Additional information is provided in the Additional Statement, which is available upon request. Among other things, the Additional Statement describes certain fundamental investment restrictions that cannot

be changed without unitholder approval. You should note, however, that all policies not specifically designated as fundamental are non-fundamental and may be changed without unitholder approval.

|

| U.S. Government Securities. U.S. Government Securities include U.S. Treasury obligations and obligations issued or

guaranteed by U.S. government agencies, instrumentalities or sponsored enterprises. U.S. Government Securities may be supported by (a) the full faith and credit of the U.S. Treasury (such as the Government National Mortgage Association (“Ginnie

Mae”)); (b) the right of the issuer to borrow from the U.S. Treasury (such as securities of the Student Loan Marketing Association); (c) the discretionary authority of the U.S. government to purchase certain obligations of the issuer (such as the

Federal National Mortgage Association (“Fannie Mae”) and Federal Home Loan Mortgage Corporation (“Freddie Mac”)); or (d) only the credit of the issuer. U.S. Treasury obligations include, among other things, the separately traded

principal and interest components of securities guaranteed or issued by the U.S. Treasury that components are traded independently under the Separate Trading of Registered Interest and Principal of Securities program (“STRIPS”).

|

| U.S. Government Securities are deemed to include (a) securities for which the payment of principal and interest is backed by an

irrevocable letter of credit issued by the U.S. government, its agencies, instrumentalities or sponsored enterprises; and (b) participations in loans made to foreign governments or their agencies that are so guaranteed as to principal and interest.

Certain of these participations may be regarded as illiquid. U.S. Government Securities also include zero coupon bonds.

|

| U.S. Government Securities have historically involved little risk of loss of principal if held to maturity. However, no assurance

can be given that the U.S. govern-ment will provide financial support to U.S. government agencies, authorities, instrumentalities or sponsored enterprises if it is not obligated to do so by law.

|

| Custodial Receipts. Interests in U.S. Government Securities may be purchased in the form of custodial receipts that

evidence ownership of future interest payments, principal payments or both on certain notes or bonds issued or guaranteed as to principal and interest by the U.S. government, its agencies, instrumentalities or

authorities. For certain securities law purposes, custodial receipts are not considered obligations of the U.S. government.

|

| Mortgage-Related Securities. Mortgage-related securities represent direct or indirect participations in, or are

collateralized by and payable from, mortgage loans secured by real property. Mortgage-related securities can be backed by either fixed rate mortgage loans or adjustable rate mortgage loans, and may be issued by either a governmental or non-governmental

entity. The Mortgage Securities Portfolio may invest in privately-issued mortgage pass-through securities that are rated high quality and represent interests in pools of mortgage loans that are issued by trusts formed by originators of and institutional

investors in mortgage loans (or represent interests in custodial arrangements administered by such institutions). These originators and institutions include commercial banks, savings and loans associations, credit unions, savings banks, mortgage bankers,

insurance companies, investment banks or special purpose subsidiaries of the foregoing. The pools underlying privately-issued mortgage pass-through securities consist of mortgage loans secured by mortgages or deeds of trust creating a first lien on

residential, residential multi-family and mixed residential/commercial properties. (In conformance with the NCUA Rules and Regulations, the Mortgage Securities Portfolio will not invest in commercial mortgage-related securities.)

|

| Privately-issued mortgage pass-through securities generally offer a higher yield than similar securities issued by a government

entity because of the absence of any direct or indirect government or agency payment guarantees. However, timely payment of interest and principal on mortgage loans in these pools may be supported by various forms of insurance or guarantees, including

individual loan, pool and hazard insurance, subordination and letters of credit. The insurance and guarantees are issued by government entities, private insurers, banks and mortgage poolers. Mortgage-related securities without insurance or guarantees may

also be purchased by the Mortgage Securities Portfolio if they have the required rating from an NRSRO. Although the market for such securities is becoming increasingly liquid, some mortgage-related securities issued by private organizations may not be

readily marketable.

|

| Mortgage-related securities may include multiple class securities, including collateralized mortgage obligations (“CMOs”

) and Real Estate Mortgage Investment Conduit (“REMIC”) pass-through or participation certificates. A REMIC is a CMO that qualifies for special tax treatment under the Code and invests in certain mortgages principally secured by interests in

real property and other permitted investments. CMOs provide an investor with a specified interest in the cash flow from a pool of underlying mortgages or of other mortgage-related securities. CMOs are issued in multiple classes, each with a specified

fixed or floating inter

est rate and a final scheduled distribution date. The relative payment rights of the various CMO classes may be structured in many ways. In many cases, payments of principal are applied to the CMO classes in the order of their respective stated

maturities, so that no principal payments will be made on a CMO class until all other classes having an earlier stated maturity date are paid in full. Sometimes, however, CMO classes are “parallel pay,” i.e., payments of principal are made to two or more classes concurrently. In some cases, CMOs may have the characteristics of a stripped mortgage-backed security whose prices can be highly volatile. CMOs may exhibit more or less price volatility

and interest rate risk than other types of mortgage-related obligations, and under certain interest rate and payment scenarios, a Portfolio may fail to recoup fully its investment in certain of these securities regardless of their credit quality.

|

| To the extent a Portfolio concentrates its investments in pools of mortgage-related securities sponsored by the same sponsor or

serviced by the same servicer, it may be subject to additional risks. Servicers of mortgage-related pools collect payments on the underlying mortgage assets for pass-through to the pool on a periodic basis. Upon insolvency of the servicer, the pool may be

at risk with respect to collections received by the servicer but not yet delivered to the pool.

|

| Inverse Floating Rate Securities. The Bond Portfolios may, to the extent permitted by the NCUA, invest in leveraged

inverse floating rate debt securities (“inverse floaters”). The interest rate on inverse floaters resets in the opposite direction from the market rate of interest to which the inverse floater is indexed. An inverse floater may be considered to

be leveraged to the extent that its interest rate varies by a magnitude that exceeds the magnitude of the change in the index rate of interest. The higher the degree of leverage of an inverse floater, the greater the volatility of its market value.

|

| Zero Coupon Bonds. Each Portfolio will only purchase zero coupon bonds which are U.S. Government Securities and do

not have maturity dates of more than ten years from settlement. Zero coupon bonds are issued at a discount from their face value because interest payments are typically postponed until maturity. The market prices of these securities generally are more

volatile than the market prices of interest-bearing securities and are likely to respond to a greater degree to changes in interest rates than interest-bearing securities having similar maturities and credit quality.

|

| Mortgage Dollar Rolls. The Bond Portfolios may enter into mortgage dollar rolls. A mortgage dollar roll involves the

sale by a Portfolio of securities for delivery in the current month. The Portfolio simultaneously contracts with the same counterparty to repurchase substantially similar (same type, coupon and maturity) but not identical securities on a specified future

date. During the roll period, the

Portfolio loses the right to receive principal and interest paid on the securities sold. However, the Portfolio benefits to the extent of any difference between (a) the price received for the securities sold and (b) the lower forward price for the future

purchase and/or fee income plus the interest earned on the cash proceeds of the securities sold. Unless the benefits of a mortgage dollar roll exceed the income, capital appreciation and gain or loss due to mortgage prepayments that would have been

realized on the securities sold as part of the roll, the use of this technique will diminish the Portfolio’s performance.

|

| Successful use of mortgage dollar rolls depends upon the Investment Adviser’s ability to predict correctly interest rates and

mortgage prepayments. If the Investment Adviser is incorrect in its prediction, a Portfolio may experience a loss. For financial reporting and tax purposes, the Portfolios treat mortgage dollar rolls as two separate transactions: one involving the

purchase of a security and a separate transaction involving a sale. The Portfolios do not currently intend to enter into mortgage dollar rolls that are accounted for as a financing and do not treat them as borrowings.

|

| When-Issued Securities and Forward Commitments. The Portfolios may purchase or sell portfolio securities in

when-issued or delayed delivery transactions provided settlement is regular-way. (Regular-way settlement means delivery of a security from a seller to a buyer within the time frame that the securities industry has established for that type of security.)

In these transactions, instruments are bought or sold with payment and delivery taking place in the future in order to secure what is considered to be an advantageous yield or price.

|

| The purchase of securities on a when-issued or forward commitment basis involves a risk of loss if the value of the security to be

purchased declines before the settlement date. Conversely, the sale of securities on a forward commitment basis involves the risk that the value of the securities sold may increase before the settlement date. Although the Portfolios will generally

purchase securities on a when-issued or forward commitment basis with the intention of acquiring the securities, a Portfolio may dispose of when-issued securities or forward commitments prior to settlement if the Investment Adviser deems it appropriate.

|

| Lending of Portfolio Securities. The Bond Portfolios may seek to increase their income by lending portfolio

securities to institutions, such as banks and broker-dealers. The borrowers are required to secure their loans continuously with cash, cash equivalents or U.S. Government Securities in an amount at least equal to the market value of the securities loaned.

Cash collateral may be invested in cash equivalents. To the extent that cash collateral is invested in other investment securities, such collateral will be subject to market depreciation or appreciation and a Portfolio will be responsible for any loss

that might result from its investment of

the borrowers’ collateral. Any investments purchased with the cash (as well as other cash received in connection with the loan) must be permissible for federally chartered credit unions and must mature no later than the maturity of the transaction.

If the Investment Adviser determines to make securities loans, the value of the securities loaned may not exceed 5% of the value of the net assets of a Bond Portfolio (including the loan collateral). A Bond Portfolio may experience delay in the recovery

of its securities if the institution with which it has engaged in a portfolio loan transaction breaches its agreement with the Bond Portfolio.

|

| Repurchase Agreements. Each Portfolio may enter into repurchase agreements with dealers in U.S. Government

Securities and member banks of the Federal Reserve System. Repurchase agreements involve the purchase of securities subject to the seller’s agreement to repurchase them at a mutually agreed upon date and price.

|

| If the other party or “seller” defaults, a Portfolio might suffer a loss to the extent that the proceeds from the sale

of the underlying securities and other collateral held by the Portfolio are less than the repurchase price and the Portfolio’s cost associated with delay and enforcement of the repurchase agreement. In addition, in the event of bankruptcy of the

seller, a Portfolio could suffer additional losses if a court determines that the Portfolio’s interest in the collateral is not enforceable.

|

| In evaluating whether to enter into a repurchase agreement, the Investment Adviser will carefully consider the creditworthiness of