|

|

|

|

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant [X] | ||||

| Filed by a Party other than the Registrant [ ] | ||||

| Check the appropriate box: | ||||

| [ ] Preliminary Proxy Statement | [ ] | Confidential, for Use of the | ||

| Commission Only (as permitted | ||||

| by Rule 14a-6(e)(2)) | ||||

| [X] Definitive Proxy Statement | ||||

| [ ] Definitive Additional Materials | ||||

| [ ] Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

MEDICIS PHARMACEUTICAL CORPORATION

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11.

(1) Title of each class of securities to which transaction applies:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

Dear Fellow Shareholder:

You are cordially invited to attend the 2000 Annual Meeting of Shareholders of Medicis Pharmaceutical Corporation. The meeting will be held at The Phoenician, 6000 East Camelback Road, Scottsdale, Arizona, on Wednesday, November 8, 2000. The meeting will begin at 9:30 a.m. local time. Our board of directors called this meeting for the following purposes:

| 1. To elect two directors for a term of three years; |

| 2. To ratify the appointment of Ernst & Young LLP as independent

auditors for our fiscal year ending June 30, 2001; and |

| 3. To transact such other business as may properly come before

the meeting and any adjournments. We are currently unaware of any additional business to be presented at the meeting. |

You must own shares at the close of business on September 27, 2000 to vote at the meeting.

In order that your shares may be represented at the meeting in case you are not personally present, please complete, sign and date the enclosed proxy/voting card and return it as soon as possible in the enclosed addressed envelope. If you attend the meeting, you may vote your shares in person even if you have signed and returned the proxy card.

| Sincerely, | ||

| /s/ Mark A. Prygocki | ||

|

Mark A. Prygocki, Sr. Chief Financial Officer, Treasurer and Corporate Secretary |

||

| September 29, 2000 Scottsdale, Arizona |

ANNUAL MEETING OF SHAREHOLDERS

November 8, 2000

The annual meeting of shareholders of Medicis Pharmaceutical Corporation will be held on Wednesday, November 8, 2000, at 9:30 a.m. local time, at The Phoenician, 6000 East Camelback Road, Scottsdale, Arizona. This proxy statement and the accompanying form of proxy is being mailed beginning October 6, 2000 in connection with the solicitation of proxies by the board of directors for use at the annual meeting.

Medicis will bear the cost of soliciting the proxies, including the charges and expenses of brokerage firms and others that forward the proxy material to beneficial owners of our stock. Proxies may be solicited by mail, telephone, e-mail or personal communications.

The close of business on September 27, 2000, has been fixed as the “record date” for the annual meeting. If you were a shareholder at that time, you are entitled to notice and may vote at the meeting. On the record date, we had 30,005,370 shares of Class A common stock and 422,962 shares of Class B common stock outstanding. Each share of Class A common stock is entitled to one vote on each matter of business considered at the meeting. Each share of Class B common stock outstanding on the record date is entitled to ten votes on each matter of business considered at the meeting. A majority of the voting power of the outstanding capital stock entitled to vote at the meeting shall constitute a quorum. If you want to vote in person at the annual meeting, and you hold your Medicis stock through a securities broker (that is, in street name), you must obtain a proxy from your broker and bring that proxy to the meeting.

Unless you tell us on your proxy card to vote differently, we will vote “FOR”

| (i) the director nominees named in this proxy statement; and |

| (ii) the appointment of Ernst & Young LLP as auditors. |

You may revoke your proxy by sending in a new proxy card with a later date or by sending written notice of revocation to our secretary at the address in the paragraph below. If you attend the meeting, you may revoke in writing previously submitted proxies and vote in person.

Our headquarter offices are located at 8125 North Hayden Road, Scottsdale, Arizona 85258-2463.

1

TABLE OF CONTENTS

| Page | |||||

| PROPOSAL 1: ELECTION OF DIRECTORS | 3 | ||||

| DIRECTORS, DIRECTOR NOMINEES AND EXECUTIVE OFFICERS | 3 | ||||

| Committees and Meetings | 5 | ||||

| Director Compensation | 6 | ||||

| PROPOSAL 2: RATIFICATION OF APPOINTMENT OF AUDITORS | 6 | ||||

| EXECUTIVE COMPENSATION | 7 | ||||

| Summary Compensation Table | 7 | ||||

| STOCK OPTIONS | 7 | ||||

| Options Granted in the Last Fiscal Year | 7 | ||||

| Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values | 8 | ||||

| STOCK OPTION AND COMPENSATION COMMITTEE REPORT | 9 | ||||

| Stock Price Performance | 10 | ||||

| Section 16(a) Beneficial Ownership Reporting Compliance | 11 | ||||

| PRINCIPAL SHAREHOLDERS AND SHAREHOLDINGS OF MANAGEMENT | 12 | ||||

| EXECUTIVE EMPLOYMENT AGREEMENTS AND OTHER RELATIONSHIPS | 13 | ||||

| Executive Retention Plan | 13 | ||||

| Compensation Committee Interlocks and Insider Participation | 13 | ||||

| Employment Agreement | 14 | ||||

| OTHER MATTERS | 15 | ||||

| Shareholder Proposals | 15 | ||||

| Voting Rights and Revocability of Proxies | 15 | ||||

| Annual Report | 15 | ||||

| Other Matters | 16 | ||||

2

PROPOSAL 1: ELECTION OF DIRECTORS

At the meeting, two directors will be elected to serve a three-year term, which is scheduled to expire at the close of our annual meeting in 2003. The shares represented by the enclosed proxy will be voted to elect as a director the nominees named below, unless a vote is withheld for an individual nominee. If a nominee cannot or will not serve as a director (which events are not anticipated), the shares represented by the enclosed proxy may be voted for another person as determined by the holder of the proxies.

Board Structure

Our board of directors has seven members. The directors are divided into three classes. At each annual meeting, the term of one class expires. Directors in each class serve three years.

Board Nominees

The board of directors has nominated Arthur G. Altschul, Jr. and Philip S. Schein, M.D. for re-election as directors. Each director nominee would serve a three-year term expiring at our 2003 meeting. Mr. Altschul and Dr. Schein are currently directors of Medicis. Biographical information on Mr. Altschul and Dr. Schein is furnished below under “Directors, Director Nominees and Executive Officers.”

Vote Required

The two nominees receiving the highest number of votes cast at the meeting will be elected to serve for a term of three years, or until their successors are duly elected and qualified.

Board Recommendation

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE

DIRECTOR NOMINEES SPECIFIED IN PROPOSAL 1.

DIRECTORS, DIRECTOR NOMINEES AND EXECUTIVE OFFICERS

The following biographical information is furnished with regard to the directors, the nominees for election as a director at the meeting and the executive officers.

| Director | Term | |||||||||||||

| Name | Age | Position | Since | Expires | ||||||||||

| Jonah Shacknai(1) | 43 | Chairman and Chief Executive Officer | 1988 | 2001 | ||||||||||

| Mark A. Prygocki, Sr. | 34 | Chief Financial Officer, Treasurer and Corporate Secretary | N/A | N/A | ||||||||||

| Arthur G. Altschul, Jr.(2) | 36 | Director and Director Nominee | 1992 | 2000 | ||||||||||

| Spencer Davidson(3) | 58 | Director | 1999 | 2002 | ||||||||||

| Peter S. Knight, Esq.(3) | 49 | Director | 1997 | 2002 | ||||||||||

| Michael A. Pietrangelo(1)(3) | 58 | Director | 1990 | 2001 | ||||||||||

| Philip S. Schein, M.D.(2) | 61 | Director and Director Nominee | 1990 | 2000 | ||||||||||

| Lottie H. Shackelford(2) | 59 | Director | 1993 | 2001 | ||||||||||

| (1) | Member of the Executive Committee | |

| (2) | Member of the Audit Committee | |

| (3) | Member of the Stock Option and Compensation Committee |

3

Jonah Shacknai is a founder of our company and has served as our Chairman and Chief Executive Officer since July 1988. From 1977 until late 1982, Mr. Shacknai served as chief aide to the House of Representatives’ committee with responsibility for health policy, and in other senior legislative positions. During his service with the House of Representatives, Mr. Shacknai drafted significant legislation affecting health care, environmental protection, science policy, and consumer protection. He was also a member of the Commission on the Federal Drug Approval Process, and the National Council on Drugs. From 1982 to 1988, as senior partner in the law firm of Royer, Shacknai, and Mehle, Mr. Shacknai represented over 30 multinational pharmaceutical and medical device concerns, as well as four major industry trade associations. Mr. Shacknai also served in an executive position with Key Pharmaceuticals, Inc., prior to its acquisition by Schering-Plough Corporation. Mr. Shacknai was recently selected to serve on the Listed Company Advisory Committee to the New York Stock Exchange (LCAC). The LCAC was created in 1976 by the NYSE board to address issues that are of critical importance to the Exchange and the corporate community. In January 2000, Mr. Shacknai was selected as an Entrepreneurial Fellow at the Karl Eller Center of the University of Arizona. Mr. Shacknai is a director of Delta Society, a public service organization promoting animal-human bonds, and the Whispering Hope Ranch, a foundation that fosters animal-assisted therapy for special needs children and adults. He is also a director of the Southwest Autism Research Center and a member of the Board of Trustees of the National Public Radio Foundation. In 1997, he received the Arizona Entrepreneur of the Year award, and was one of three national finalists for that award. Mr. Shacknai has served as a member of the National Arthritis and Musculoskeletal and Skin Diseases Advisory Council of the National Institutes of Health, and currently serves on the U.S.-Israel Science and Technology Commission, both of which are federal cabinet-appointed positions. Mr. Shacknai obtained a B.S. degree from Colgate University and a J.D. from Georgetown University Law Center.

Mark A. Prygocki, Sr. has served as our Chief Financial Officer, Treasurer and Corporate Secretary since May 1995, and served as our Controller from October 1992 until May 1995. From July 1990 through October 1992, Mr. Prygocki was employed by Salomon Smith Barney, Inc., an investment banking firm, as an accountant in the Regulatory Reporting Division.

Arthur G. Altschul, Jr. has been a director since December 1992. He has worked in investment banking, venture capital and as a member of senior management of a publicly traded healthcare concern. Mr. Altschul is a founder and Managing Partner of Diaz & Altschul Group, LLC, a merchant banking organization which, through its subsidiaries, provides investment banking and investment advisory services. Between 1985 and 1991, Mr. Altschul worked in the Equity and Fixed-Income Trading Departments at Goldman, Sachs & Co., was a founding limited partner of The Maximus Fund, LP, and worked in the Equity Research Department at Morgan Stanley & Company. From 1992 to 1996, Mr. Altschul worked at SUGEN, Inc., most recently as Senior Director of Corporate Affairs. SUGEN, Inc. is a NASDAQ-traded biopharmaceutical company focused on cancer research and drug development. Mr. Altschul serves on the Board of Directors of General American Investors, Inc., a NYSE-traded closed-end investment company; Delta Opportunity Fund, Ltd., an offshore investment fund which invests primarily in private placements of publicly traded technology companies; Microbes Inc.; NY Council for Humanities; and Prototek II, Inc. Mr. Altschul holds a B.S. from Columbia University in Computer Science.

Spencer Davidson has been a director since January 1999. Mr. Davidson serves as President and Chief Executive Officer of General American Investors Company, Inc., a closed-end investment company listed on the New York Stock Exchange (NYSE:GAM). His background also includes a distinguished career on Wall Street with positions held at Brown Brothers Harriman; Beck, Mack & Oliver as General Partner; and Odyssey Partners, where he served as Fund Manager. Additionally, Mr. Davidson acts as the General Partner of The Hudson Partnership, a private investment partnership, and serves as Trustee for both the Innisfree Foundation, Inc. of Millbrook, New York, and the Neurosciences Research Foundation, Inc. of San Diego, California. A graduate of City College and Columbia University, Mr. Davidson holds a M.B.A., a C.F.A. and a C.I.C.

Peter S. Knight, Esq. has been a director of the Company since June 1997. Mr. Knight is a principal with Sage Venture Partners. From 1991 through 1999, he was a partner at the law firm of Wunder, Knight, Forscey & DeVierno, where he specialized in pharmaceutical, environmental and communication matters. In 1996, at the request of President Clinton, Mr. Knight served as the National Campaign Manager for Clinton/Gore ‘96. Mr. Knight served as the General Counsel and Secretary of the Company from 1989 to 1991. Mr. Knight currently serves on the Boards of Whitman Education Group, GHBM and the Schroder Series Trust. He also serves on the Board of the Center for National Policy and the Vice President’s Residence Foundation.

4

Michael A. Pietrangelo has been a director since October 1990. Admitted to the bar in New York, Tennessee and the District of Columbia, he was an attorney with the Federal Trade Commission and later for Pfizer, Inc., from 1967 to 1972. Joining Schering-Plough Corporation in Memphis, Tennessee in 1972, Mr. Pietrangelo served in legal capacities first, as Legal Director and then as Associate General Counsel. During that time he was also appointed Visiting Professor of Law by the University of Tennessee and University of Mississippi Schools of Pharmacy. In 1980, Mr. Pietrangelo left corporate law and focused on consumer products management, serving in a variety of executive positions at Schering-Plough Corporation prior to being named President of the Personal Care Products Group in 1985. In 1989, he was asked to join Western Publishing Group as President and Chief Operating Officer. From 1990 to 1994, Mr. Pietrangelo was the President and Chief Executive Officer of CLEO, Inc., a Memphis-based subsidiary of Gibson Greetings, Inc., a manufacturer of specialized paper products. In 1994, he accepted a position as President of Johnson Products Company, a subsidiary of IVAX Corporation. He served in that capacity until February 1998, when he returned to the practice of law with Pietrangelo Cook PLC, based in Memphis, Tennessee.

Philip S. Schein, M.D. has been a director since October 1990. Dr. Schein was the Chairman and Chief Executive Officer of U.S. Bioscience, Inc., a publicly held pharmaceutical company involved in the development and marketing of chemotherapeutic agents, from 1987 to 1998. His prior appointments included Scientific Director of the Vincent T. Lombardi Cancer Research Center at Georgetown University, Vice President for Worldwide Clinical Research and Development, SmithKline and French Labs. He has served as President of the American Society of Clinical Oncology and has chaired the Food and Drug Administration Oncology Drugs Advisory Committee. Dr. Schein presently serves as President (U.S.A.) of the International Network for Cancer Treatment and Research and as President of The Schein Group.

Lottie H. Shackelford has been a director since July 1993. Ms. Shackelford has been Executive Vice President of Global USA, Inc., a government relations firm, since April 1994, and has been Vice Chair of the Democratic National Committee since February 1989. Ms. Shackelford was Executive Vice President of U.S. Strategies, Inc., a government relations firm, from April 1993 to April 1994. She was also Co-Director of Intergovernmental Affairs for the Clinton/Gore presidential transition team between November 1992 and March 1993, Deputy Campaign Manager of Clinton for President from February 1992 to November 1992, and Executive Director, Arkansas Regional Minority Purchasing Council, from February 1982 to January 1992. In addition, Ms. Shackelford has served in various local government positions, including Mayor of Little Rock, Arkansas. She also is a director of Philander Smith College, the Chapman Funds in Baltimore, Maryland, and the Overseas Private Investment Corporation.

Committees and Meetings

The board of directors has a Stock Option and Compensation Committee, an Audit Committee and an Executive Committee.

The Stock Option and Compensation Committee administers our stock option plans and oversees the compensation of our officers. Messrs. Michael A. Pietrangelo, Peter S. Knight and Spencer Davidson were the members of the Stock Option and Compensation Committee in fiscal 2000. The Stock Option and Compensation Committee met once in fiscal 2000.

The Audit Committee reviews financial reporting, policies, procedures and internal controls of Medicis, recommends appointment of outside auditors and reviews related party transactions. Ms. Lottie Shackelford, Mr. Arthur G. Altschul, Jr. and Dr. Philip S. Schein were the members of the Audit Committee in fiscal 2000. The Audit Committee met three times in fiscal 2000.

The Executive Committee exercises the rights, powers and authority of the board of directors between board meetings. Messrs. Jonah Shacknai and Michael A. Pietrangelo were the members of the Executive Committee. The Executive Committee met three times in fiscal 2000.

Medicis does not have a Nominating Committee; the entire board of directors considers nominations to serve as a member of the board.

5

The board of directors held four meetings in fiscal 2000. Each director attended at least 71% of the combined total of (i) all board meetings and (ii) all meetings of committees of the board of which the director was a member.

Director Compensation

Outside directors are paid $1,000 plus reasonable expenses for each board and committee meeting attended, excluding telephonic meetings. They also receive an automatic annual stock option grant of 10,000 shares of Class A common stock. The options are granted at the fair market value of Class A common stock on the last business day of September and are exercisable on the one-year anniversary of the date of the grant. Each option has a term of ten years.

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF AUDITORS

The board of directors has reappointed Ernst & Young LLP, independent auditors, to audit the accounts of Medicis and its subsidiaries for the fiscal year ending June 30, 2001. We have been advised by Ernst & Young LLP that no member of that firm, to the best of its knowledge and belief, has any direct or any material indirect financial interest in Medicis or its subsidiaries, nor during the past three fiscal years has any member of the firm had any connection with Medicis or its subsidiaries in the capacity of promoter, underwriter, voting trustee, director, officer or employee. A representative of Ernst & Young LLP is expected to be present at the meeting, will have an opportunity to make a statement should he or she desire to do so and is expected to be available to respond to appropriate questions.

Vote Required

The proposal to ratify the appointment of Ernst & Young LLP as our independent auditors, requires an affirmative vote of a majority of the voting power of the capital stock present at the meeting in person or represented by proxy. Notwithstanding ratification of the appointment of Ernst & Young LLP as our auditors for the fiscal year ending June 30, 2001, the board of directors may select other auditors for such year without any vote of the shareholders. If the shareholders do not ratify the appointment, the matter of the appointment of independent auditors will be considered by the board of directors.

Board Recommendation

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL 2 TO RATIFY THE

APPOINTMENT OF ERNST & YOUNG LLP AS AUDITORS.

6

Executive Compensation

This table shows the annual compensation and long-term compensation awards for each of the three most recent fiscal years for Medicis’ chief executive officer and the one other executive officer whose salary and bonus exceeded $100,000 during the fiscal year ended June 30, 2000.

SUMMARY COMPENSATION TABLE

| Long-Term Compensation Awards | ||||||||||||||||||||

| Annual Compensation | ||||||||||||||||||||

| Other Annual | Number of LTIP | |||||||||||||||||||

| Name and Position | Year | Salary ($) | Bonus ($) | Compensation ($) | Options | |||||||||||||||

| Jonah Shacknai | 2000 | 600,000 | 440,000 | — | 200,000 | |||||||||||||||

| Chairman of the Board and | 1999 | 525,000 | 400,000 | — | 150,000 | |||||||||||||||

| Chief Executive Officer | 1998 | 437,000 | 400,000 | — | 150,000 | |||||||||||||||

| Mark A. Prygocki, Sr. | ||||||||||||||||||||

| Chief Financial Officer, | 2000 | 240,000 | 240,000 | — | 60,000 | |||||||||||||||

| Treasurer and Corporate | 1999 | 185,000 | 200,000 | — | 52,501 | |||||||||||||||

| Secretary | 1998 | 150,000 | 150,000 | — | 45,000 | |||||||||||||||

Medicis has no defined benefit or defined contribution retirement plans other than the Medicis Pharmaceutical Corporation 401(k) Employee Savings Plan established under Section 401(k) of the Internal Revenue Code of 1986, as amended. Contributions to the 401(k) plan are voluntary and all employees are eligible to participate. The 401(k) plan permits Medicis to match certain employee contributions, but we have not made any matching contributions.

Stock Options

Medicis’ stock option plans provide for the grant of stock options to key employees and key consultants. Options may be either incentive stock options or non-qualified stock options. The plans are administered by the Stock Option and Compensation Committee appointed by the board of directors. This table sets forth certain information for our last fiscal year with respect to options to purchase shares of Class A common stock granted to Medicis’ chief executive officer and our other named executive officer pursuant to stock option plans.

OPTIONS GRANTED IN THE LAST FISCAL YEAR

| Percentage of | ||||||||||||||||||||||||||||

| Total Options | Exercise | Potential Realized Value at Assumed | ||||||||||||||||||||||||||

| Granted to | or Base | Annual Rates of Stock Price | ||||||||||||||||||||||||||

| Number of Options | Employees in | Price | Expiration | Appreciation | ||||||||||||||||||||||||

| Name | Granted (1) | Fiscal Year | ($/sh) | Date | for Option Term (2) | |||||||||||||||||||||||

| 0% ($) | 5% ($) | 10% ($) | ||||||||||||||||||||||||||

| Jonah Shacknai | 200,000 | 11.0 | % | $ | 22.00 | 7/29/09 | — | 2,768,000 | 7,012,000 | |||||||||||||||||||

| Mark A. Prygocki, Sr. | 60,000 | 3.3 | % | $ | 22.00 | 7/29/09 | — | 830,400 | 2,103,600 | |||||||||||||||||||

| (1) | Of Mr. Shacknai’s options noted above, 66,666 vested on July 29, 2000; 66,667 vest on July 29, 2001; and 66,667 vest on July 29, 2002. Of Mr. Prygocki’s options noted above, 12,000 vested on July 29, 2000; 12,000 vest on July 29, 2001; 12,000 vest on July 29, 2002; 12,000 vest on July 29, 2003; and 12,000 vest on July 29, 2004. | |

| (2) | The potential realizable value portion of the table illustrates amounts that might be realized upon exercise of the options immediately prior to the expiration of their term, assuming the specified compounded annual rates of stock price |

7

| appreciation over the scheduled life of the options. This table does not take into account provisions of certain options providing for termination of the option following termination of employment, nontransferability or vesting schedules. The dollar amounts under these columns are the result of calculations at the 5% and 10% rates set by the Securities and Exchange Commission and are not intended to forecast possible future appreciation, if any, of our stock price. The column indicating 0% appreciation is included to reflect the fact that a zero percent gain in stock price appreciation from the market price of the Class A common stock on the date of grant will result in zero dollars for the optionee. No gain to the optionees is possible without an increase in stock price, which will benefit all shareholders commensurately. Dollar amounts shown are not discounted to present value. |

During the last fiscal year, 192 employees and six non-employee directors were granted options to purchase an aggregate of 1,903,250 shares of common stock under Medicis’ stock option plans.

This table shows all stock options exercised by the named executives during the fiscal year ended June 30, 2000, and the number and value of options they held at fiscal year end.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

| Value of Unexercised | ||||||||||||||||||||||||

| Number of Unexercised | In-the-Money Options | |||||||||||||||||||||||

| Number of Shares | Options at Fiscal Year End | at Fiscal Year End ($)(1) | ||||||||||||||||||||||

| Acquired on | Value | |||||||||||||||||||||||

| Name | Exercise | Realized ($) | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||||||||

| Jonah Shacknai | 293,439 | 10,431,470 | 276,993 | 397,250 | 10,753,109 | 13,846,553 | ||||||||||||||||||

| Mark A. Prygocki, Sr. | 2,895 | 61,981 | 38,384 | 145,636 | 1,331,255 | 5,032,736 | ||||||||||||||||||

| (1) | Value of unexercised in-the-money options is calculated based on the market value of the underlying shares, minus the exercise price and assumes the sale of all the underlying shares on June 30, 2000, at a price of $57.00, which was the closing price of the Class A common stock on the New York Stock Exchange on that date. |

8

STOCK OPTION AND COMPENSATION COMMITTEE REPORT

The Stock Option and Compensation Committee is responsible for the oversight of the compensation of our officers and administration of our stock option plans. Our executive officers’ compensation is composed of salary, stock options and, in some cases, cash bonuses. Jonah Shacknai, our chairman and chief executive officer, recommends the annual salary and any cash bonus for each executive officer other than himself. Currently, we have only one other executive officer, Mr. Prygocki, our chief financial officer, treasurer and corporate secretary. In the case of an increase in salary or bonus to an executive officer, Mr. Shacknai makes a recommendation to this committee to approve the increase. Mr. Shacknai and the committee apply the largely subjective and non-quantitative criteria discussed below in evaluating compensation and have not assigned any particular numerical weight to these factors. The salary of an executive officer is determined by the significance of the position to our company, individual experience, talents and expertise, tenure with our company, cumulative contribution to our company’s success, individual performance as it relates to effort and achievement of progress toward particular objectives for the executive officer and to Medicis’ immediate and long-term goals, and information gathered informally as to comparable companies in the same industry as the Company. Due to Medicis’ phase of growth and development, in addition to its goal of increasing profitability, other elements of performance that are used in structuring executive compensation levels are increases in revenues, new product introductions, progress in research, raising new capital if necessary, strategic alliances, customer service values, cost-effective operation and the personal commitment to Medicis’ ideals and mission. This committee believes the compensation of our executive officers is generally in the middle section of the range of compensation data obtained when we informally gathered data as to comparable companies. However, this belief should be considered in light of the facts that (i) the data gathered were not gathered with a statistically reliable methodology, and (ii) the elements of compensation of such comparable companies are not necessarily directly comparable to those of our company. Although we do not have a formal bonus plan for executive officers, from time to time we award cash bonuses to certain executive officers after fiscal year end. The amount awarded to a particular executive officer is based upon Medicis’ overall performance as described above, individual performance, the particular executive officer’s base salary level, and overall equity and fairness.

We grant stock options to our executive officers to link the interests and risks of our executive officers with those of our shareholders. The executive officers granted options receive value as the price of our stock increases. We generally grant stock options to the executive officers after the close of the fiscal year. We base our decisions on Medicis’ performance and the individual’s performance as discussed above, base salary and bonus levels, the amount of prior option grants, length of service, and overall equity and fairness.

For fiscal 2000, Jonah Shacknai, chairman of the board and chief executive officer, received an annual salary of $600,000, was paid a bonus of $440,000, and was granted options to purchase 200,000 shares of Class A common stock in fiscal 2000 (at an exercise price of $22.00 per share, which was the fair market value of Medicis shares on the date the options were granted). We made these decisions based upon a subjective analysis of his contributions to Medicis’ improved performance in the most recent fiscal year, and the above noted criteria. The committee did not assign any particular numerical weight to any of these matters.

| September 29, 2000 | Stock Option and Compensation Committee | |

|

Michael A. Pietrangelo, Chairman Peter S. Knight, Esq. Spencer Davidson |

9

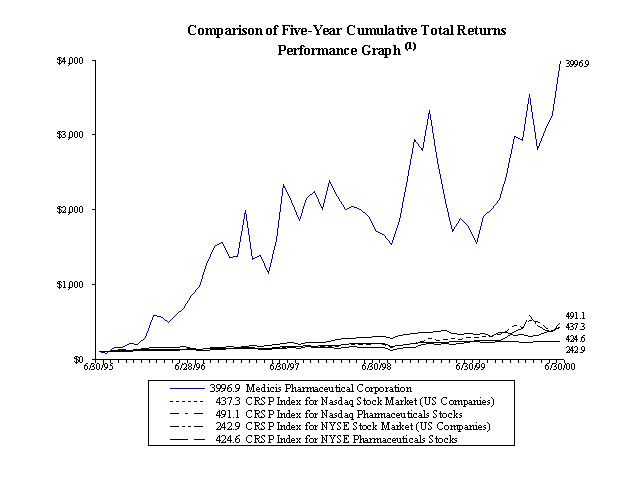

Stock Price Performance

This graph shows a comparison of the cumulative total shareholder return for Medicis, the Nasdaq Stock Market (U.S. Companies) Total Return Index and the Nasdaq Pharmaceutical Stocks Total Return Index for the period commencing June 30, 1995 through June 30, 2000. Medicis began trading on the New York Stock Exchange on September 24, 1998, under the ticker symbol MRX. Due to the move to the New York Stock Exchange, we provide a comparison of the NYSE (U.S. Companies) Total Return Index and the NYSE Pharmaceutical Stocks Total Return Index for the period commencing June 30, 1995 through June 30, 2000. Before the move to the New York Stock Exchange, our common stock traded on the Nasdaq National Market. The Nasdaq Stock Market Total Return Index comprises all domestic common shares traded on the Nasdaq National Market System and the Nasdaq Small-Cap MarketSM. The Nasdaq Pharmaceutical Stocks Index represents all companies, including biotechnology companies, trading on Nasdaq classified under the Standard Industrial Classification Code for pharmaceuticals. The NYSE Total Return Index comprises all domestic common shares traded on the NYSE. The NYSE Pharmaceutical Stocks Total Return Index represents all companies classified under the Standard Industrial Classification Code for pharmaceuticals.

| (1) | The lines represent monthly index levels derived from compounded daily returns that include all dividends. The indexes are reweighted daily, using the market capitalization on the previous trading day. If the end of the monthly interval, based upon the fiscal year end, is not a trading day, the preceding trading day is used. The index level for all series was set to 100.0 on June 30, 1995. |

10

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than 10% of a registered class of our securities, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities of our company. These reports are also filed with the New York Stock Exchange. A copy of each report is furnished to Medicis.

SEC rules require Medicis to identify anyone who filed a required report late during the most recent fiscal year. Based solely on a review of reports furnished to Medicis and written representations that no other reports were required, we believe that during the year ended June 30, 2000, all Section 16(a) filing requirements were met except that Mr. Shacknai sold shares during December 1999 and filed the report in August 2000.

11

PRINCIPAL SHAREHOLDERS AND SHAREHOLDINGS OF MANAGEMENT

This table shows ownership of Medicis stock on September 20, 2000 by (i) each person known to Medicis to own beneficially five percent (5%) or more of Medicis’ capital stock, (ii) each director and executive officer, and (iii) all directors and executive officers as a group:

| Shares Beneficially Owned | ||||||||||||||||

| Class A | Class B | Percentage of | Percentage of | |||||||||||||

| Common | Common | Outstanding | Voting | |||||||||||||

| Name(1) | Stock | Stock | Capital Stock | Power | ||||||||||||

| Jonah Shacknai(2) | 469,766 | 379,016 | 2.79 | % | 12.45 | % | ||||||||||

| Mark A. Prygocki, Sr. | 17,664 | — | * | * | ||||||||||||

| Arthur G. Altschul, Jr.(3) | 15,000 | — | * | * | ||||||||||||

| Spencer Davidson(4) | 20,063 | — | * | * | ||||||||||||

| Peter S. Knight, Esq.(5) | 29,030 | — | * | * | ||||||||||||

| Michael A. Pietrangelo(6) | 75,152 | — | * | * | ||||||||||||

| Philip S. Schein, M.D.(7) | 35,732 | — | * | * | ||||||||||||

| Lottie H. Shackelford(8) | 47,011 | — | * | * | ||||||||||||

| All executive officers and directors as a group (8 persons)(9) | 709,418 | 379,016 | 3.56 | % | 13.09 | % | ||||||||||

| Putnam Investments, Inc. | 2,214,567 | — | 7.38 | % | 6.55 | % | ||||||||||

| One Post Office Square Boston, MA 02109(10) | ||||||||||||||||

| Capital Research and Management Company | 2,784,000 | — | 9.28 | % | 8.24 | % | ||||||||||

| 333 South Hope Street Los Angeles, CA 90071(11) | ||||||||||||||||

| AMVESCAP PLC | 1,962,000 | — | 6.54 | % | 5.80 | % | ||||||||||

| 1315 Peachtree Street, N.E | ||||||||||||||||

| Suite 250 | ||||||||||||||||

| Atlanta, GA 30309(12) | ||||||||||||||||

| * | Less than 1%. | |

| (1) | The address of each beneficial owner is c/o Medicis Pharmaceutical Corporation, 8125 North Hayden Road, Scottsdale, Arizona 85258-2463, unless otherwise indicated. | |

| (2) | Includes 411,166 shares of Class A common stock subject to options granted pursuant to stock option plans which were exercisable as of September 20, 2000, or which become exercisable within 60 days thereafter (November 18, 2000). | |

| (3) | Includes 15,000 shares of Class A common stock subject to options granted pursuant to stock option plans which were exercisable as of September 20, 2000, or which become exercisable within 60 days thereafter (November 18, 2000). | |

| (4) | Includes 20,063 shares of Class A common stock subject to options granted pursuant to stock option plans which were exercisable as of September 20, 2000, or which become exercisable within 60 days thereafter (November 18, 2000). | |

| (5) | Includes 25,125 shares of Class A common stock subject to options granted pursuant to stock option plans which were exercisable as of September 20, 2000, or which become exercisable within 60 days thereafter (November 18, 2000). | |

| (6) | Includes 47,784 shares of Class A common stock subject to options granted pursuant to stock option plans which were exercisable as of September 20, 2000, or which become exercisable within 60 days thereafter (November 18, 2000). | |

| (7) | Includes 35,732 shares of Class A common stock subject to options granted pursuant to stock option plans which were exercisable as of September 20, 2000, or which become exercisable within 60 days thereafter (November 18, 2000). |

12

| (8) | Includes an aggregate of 44,170 shares of Class A common stock subject to options granted pursuant to stock option plans which were exercisable as of September 20, 2000, or which become exercisable within 60 days thereafter (November 18, 2000). | |

| (9) | Includes an aggregate of 709,418 shares of Class A common stock subject to options granted pursuant to stock option plans which were exercisable as of September 20, 2000, or which become exercisable within 60 days thereafter (November 18, 2000), held by eight executive officers and directors. | |

| (10) | In a filing on Schedule 13G, dated February 7, 2000, Putnam Investments, Inc. reported shared dispositive power with respect to 2,214,567 shares of common stock and shared voting power to 148,679 shares of common stock. Putnam Investment Management, Inc. reported shared dispositive power of 1,958,920 shares of common stock. The Putnam Advisory Company, Inc. reported shared dispositive power of 255,647 shares of common stock and shared voting power of 148,679 shares of common stock. Marsh & McLennan Companies, Inc., Putnam Investment’s parent holding company, reported no shared dispositive power and no shared voting power. The foregoing information is based solely on a review of the referenced Schedule 13G. | |

| (11) | In a filing on Schedule 13G, dated February 10, 2000, Capital Research & Management Company reported sole dispositive power of 2,784,000 shares of common stock. Capital Research & Management Company is an investment adviser registered under Section 203 of the Investment Advisers Act of 1940. The foregoing information is based solely on a review of the referenced Schedule 13G. | |

| (12) | In a filing on Schedule 13G, dated February 3, 2000, AMVESCAP PLC reported shared dispositive power of 1,962,600 shares of common stock and shared voting power of 1,962,600 shares of common stock. AVZ, Inc., AIM Management Group, Inc., and AMVESCAP Group Services, Inc., all of which are subsidiaries of AMVESCAP PLC, reported shared dispositive power of 1,962,600 shares of common stock and 1,962,600 shares of shared voting power. Also included in the 13G were INVESCO, Inc., INVESCO North American Holdings, Inc., INVESCO Capital Management, Inc., INVESCO Funds Group, Inc., INVESCO Management and Research, Inc., INVESCO Realty Advisors, Inc. and INVESCO (NY) Asset Management, Inc., all of which reported shared dispositive power of 1,962,600 shares of common stock and shared voting power of 1,962,600 of common stock. The foregoing information is based solely on a review of the referenced Schedule 13G. |

EXECUTIVE EMPLOYMENT AGREEMENTS AND OTHER RELATIONSHIPS

Executive Retention Plan

On March 2, 1999, the board of directors authorized and adopted the Medicis Pharmaceutical Corporation Executive Retention Plan, effective on April 1, 1999. The purpose of the retention plan is to facilitate the exercise of best judgment and improve the recruitment and retention of key employees by Medicis. Pursuant to the retention plan, Mr. Prygocki and certain other key employees will receive a “Benefit Allowance” upon an “Involuntary Termination” other than for “Good Cause” in connection with a “Change in Control,” as each term is defined in the retention plan. Upon a Change in Control, persons who report directly to the chief executive officer and such others as may be designated by the chief executive officer receive a Benefit Allowance of two times salary and bonus, and insurance and retirement benefit payments for two years, and certain other key employees designated by the chief executive officer receive a Benefit Allowance of one times salary and bonus, and insurance and retirement benefit payments for one year.

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended June 30, 2000, the compensation committee of the board of directors consisted of Michael A. Pietrangelo, Peter S. Knight and Spencer Davidson, all of whom are non-employee directors. No member of the compensation committee has a relationship that would constitute an interlocking relationship with executive officers or directors of another entity.

13

Employment Agreement

In July 1996, Medicis entered into an employment agreement with Mr. Shacknai, effective July 1, 1996, to continue to serve as chairman and chief executive officer. The agreement expires on June 30, 2001, and automatically renews for successive periods of five years, unless either party gives timely notice of an intention not to renew. Mr. Shacknai also may terminate the employment agreement prior to the end of the term. Under the agreement, Mr. Shacknai agreed that, during his employment, and for a period of one year following termination for reasons other than a change in ownership or control of Medicis, he will not engage in, consult with or be employed by any Competing Business (as defined in the employment agreement). The agreement contains customary non-solicitation provisions and provides for the transfer to Medicis of any intellectual property relating to its business.

Under the agreement, Mr. Shacknai receives an annual base salary of $400,000, effective July 1996, plus certain benefits and an annual grant of options to purchase shares of common stock representing a minimum specified percentage of the fully diluted capitalization of Medicis. He is also eligible for annual cash bonuses and increases in his base compensation.

The agreement provides that, if Mr. Shacknai’s employment is terminated as a result of a change in control, Medicis will pay him a lump sum amount equal to four times the sum of (i) his base salary at the highest rate in effect during the preceding 12 months and (ii) the average annual bonus, if any, paid during the preceding three years. If Mr. Shacknai’s employment is terminated without cause or by his Resignation for Good Reason (as defined in the agreement), Medicis will pay him a lump sum equal to the sum of (i) the amount he would have collected in salary for the unexpired term of the agreement, were he paid at the highest salary rate in effect for the 12 months preceding his termination, and (ii) his average annual bonus for the preceding three years multiplied by the number of years remaining in the agreement. In no event, however, will Mr. Shacknai’s severance payment for termination without cause be less than twice the sum of (i) his highest effective salary and (ii) the average annual bonus for the preceding three years, plus 1/24 of such lump sum for each full year of Mr. Shacknai’s service with Medicis. If Mr. Shacknai’s employment is terminated by his death, the agreement provides that Medicis will continue to pay his salary, at the then-current rate, to his estate for 12 months. If Mr. Shacknai is terminated pursuant to his Disability (as defined in the agreement), Medicis will pay him 100% of his base salary for 12 months, and 50% of that base salary for the remainder of the term of the agreement, but in no event for less than an additional 12 months of his base salary. Finally, the agreement provides that, if it is not renewed by Medicis for at least three years after its initial expiration, Medicis must pay Mr. Shacknai a lump sum equal to twice the sum of (i) his annual base salary at the highest rate in effect during his last 12 months of employment and (ii) the annual average of bonus payments made to him over the preceding three years, plus 1/24 of such lump sum for each full year of Mr. Shacknai’s service with Medicis.

Upon the termination of Mr. Shacknai’s employment, all options previously granted to him will automatically vest and will remain exercisable for their full term. After termination, Mr. Shacknai will also receive the employee benefits he was eligible to participate in for four years, unless the agreement is not renewed, in which event he will receive those benefits for two years. Under certain circumstances, the agreement may require Medicis to make payments that would constitute excess parachute payments under the Internal Revenue Code of 1986, as amended. If Medicis makes excess parachute payments to Mr. Shacknai, those payments would not be deductible by Medicis for tax purposes, and Mr. Shacknai would be required to pay an excise tax.

| Medicis currently has no employment agreements with other employees. |

14

OTHER MATTERS

Shareholder Proposals

Any shareholder proposal that is intended to be presented at the 2001 annual meeting and included in Medicis’ proxy statement relating to that meeting, must be received at our principal offices no later than June 8, 2001.

In order for a shareholder to bring other business before our shareholders meeting, timely notice must be received by us at our principal offices between the dates of June 25, 2001 and July 25, 2001. This notice must include a description of the proposed business, the reasons for this proposed business, and other specified matters. These requirements are separate from and in addition to the requirements a shareholder must meet to have a proposal included in our proxy statement. The time limit also applies in determining whether notice is timely for purposes of rules adopted by the Securities and Exchange Commission relating to the exercise of discretionary voting authority.

The address of our principal offices is 8125 North Hayden Road, Scottsdale, Arizona 85258-2463.

Voting Rights and Revocability of Proxies

A majority of the outstanding shares of capital stock on the record date will constitute a quorum for the annual meeting. Shares may be represented at the meeting in person or by proxy.

Votes will be tabulated by the inspector of election appointed for the meeting. The inspector of election will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Under Medicis’ bylaws and Delaware law: (1) shares represented by proxies that reflect abstentions or “broker non-votes” will be counted as shares that are present for purposes of determining the presence of a quorum; (2) there is no cumulative voting, and the two director nominees receiving the highest number of votes are elected and, accordingly, abstentions, broker non-votes and withholding of authority to vote will not affect the election of directors; (3) proxies that reflect abstentions as to a particular proposal will be treated as voted for purposes of determining the approval of that proposal and will have the same effect as a vote against that proposal; and (4) proxies that reflect broker non-votes will be treated as unvoted and will not be counted for or against a proposal.

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. A proxy may be revoked by sending to the Corporate Secretary, at 8125 North Hayden Road, Scottsdale, Arizona 85258-2463, a written notice of revocation or a duly executed proxy bearing a later date, or a proxy may be revoked by attending the annual meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

Annual Report

Medicis’ annual report for fiscal 2000 is being mailed to shareholders together with this proxy statement.

15

Other Matters

The board of directors does not know of any other matters that are to be presented for action at the annual meeting. If any other matters come before the meeting, the persons named in the enclosed proxy will have the discretionary authority to vote all proxies received with regard to those matters in accordance with their best judgment.

| MEDICIS PHARMACEUTICAL CORPORATION | ||

| /s/ Mark A. Prygocki | ||

|

Mark A. Prygocki, Sr. Chief Financial Officer, Treasurer and Corporate Secretary |

||

| September 29, 2000 |

SHAREHOLDERS ARE URGED TO DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT IN

THE ENCLOSED ENVELOPE.

16

PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

FOR 2000 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 8, 2000

The undersigned hereby constitutes and appoints Jonah Shacknai and Mark A. Prygocki Sr., and each of them, proxies and attorneys-in-fact, with full power to each of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the 2000 Annual Meeting of Shareholders of MEDICIS PHARMACEUTICAL CORPORATION (“Medicis”), to be held on November 8, 2000 and at any adjournment or postponement thereof. This proxy, when properly executed and returned in a timely manner, will be voted at this annual meeting and any adjournment or postponement thereof in the manner described herein. If no contrary indication is made, the proxy will be voted FOR Proposal 1, the election of the director nominees named herein, and FOR Proposal 2, ratification of appointment of auditors, and as to all other matters which may come before the meeting in accordance with the judgment of the persons named as proxies herein.

PLEASE MARK, SIGN, DATE AND MAIL THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

(Continued, and to be signed and dated, on reverse side.)

The undersigned hereby directs this proxy to be voted as follows:

PLEASE MARK YOUR VOTES IN THE FOLLOWING MANNER, USING DARK INK ONLY: [X]

| FOR ALL NOMINEES | WITHHOLD | ||||||||||||||||

| (except as marked to | ALL | ||||||||||||||||

| the contrary below) | NOMINEES | ||||||||||||||||

| Proposal 1: Election of Directors. | [ ] | [ ] | |||||||||||||||

| Nominees: Arthur G. Altschul, Jr.; | |||||||||||||||||

| Philip S. Schein, M.D. | |||||||||||||||||

| FOR, except vote withheld from the

following nominee(s): _________________________________________ |

|||||||||||||||||

| _________________________________________ | |||||||||||||||||

| FOR | AGAINST | ABSTAIN | |||||||||||||||||||||||

| Proposal 2: to ratify the appointment of Ernst & Young LLP as independent auditors | [ ] | [ ] | [ ] | ||||||||||||||||||||||

| At the proxies’ discretion on any other matters which may properly come before the meeting or any adjournment or postponement thereof. | |||||||||||||||||||||||||

Dated: ___________________, 2000.

Signature(s):____________________________________________

This proxy should be dated, signed by the shareholder(s) exactly as his or her name appears herein, and returned promptly in the enclosed envelope. Persons signing in a fiduciary capacity should so indicate, if shares are held by joint tenants or as community property, both shareholders should sign.

|

|