|

|

|

|

Filer: The AES Corporation

Pursuant to Rule 425 under the Securities Act of 1933

Commission File No. 001-12291

Subject Company: Gener S.A.

Commission File No: 001-13210

These materials contain forward-looking statements concerning the financial

condition, results of operations and business of AES following the consummation

of its proposed acquisition of Gener and the anticipated financial and other

benefits of such proposed acquisition. In some cases, you can identify forward

looking statements by the words "will", "believes", "plans", "would", or similar

expressions. These forward looking statements are not guarantees of future

performances and are subject to risks and uncertainties and other important

factors, including those that could cause actual results to differ materially

from expectations based on forward looking statements made in this press release

or elsewhere. For a description of certain of these risks please refer to AES's

and Gener's filings with the SEC.

* * * * *

These materials are for informational purposes only. It is not an offer to buy

or a solicitation of an offer to sell any shares of AES common stock. The

solicitation of offers to buy Gener common stock will only be made pursuant to a

prospectus and related materials that AES expects to send to Gener shareholders.

These securities may not be sold, nor may offers to buy be effected prior to the

time the registration statement becomes effective. This communication shall not

constitute an offer to sell or the solicitation of an offer to buy, nor shall

there be any sale of these securities in any state in which such offer,

solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such state.

* * * * *

AES intends to file a Tender Offer Statement and an Exchange Offer Registration

Statement with the Securities and Exchange Commission as soon as practicable. We

urge investors and security holders of Gener to read carefully the U.S. exchange

offer regarding the proposed transaction when it becomes available because it

will contain important information about the transaction. Investors and security

holders may obtain a free copy of the U.S. exchange offer when it is available

and other documents filed by AES and Gener with the Securities and Exchange

Commission at the Securities and Exchange Commission's Web site at www.sec.gov.

The U.S. exchange offer and these other documents may also be obtained for free

from D.F. King & Co., Inc., the Information Agent, by calling 1-800-755-3105.

* * * * *

For more general information visit our web site at www.aesc.com or contact

investor relations at [email protected]. The list aes-pr-announce is an

automated mailing list and can be found on the investing page of our web site.

Those who subscribe to this list will receive updates when AES issues a press

release.

* * * * *

This document is being filed pursuant to Rule 425 under the Securities Act of

1933.

2

Tender Offer

for Gener Shares

November 2000

Introduction

2

AES is the leading global power company

4

AES’s presence in Latin America

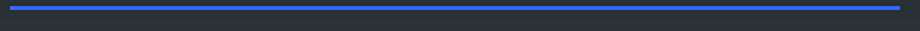

Consistent and strong financial performance

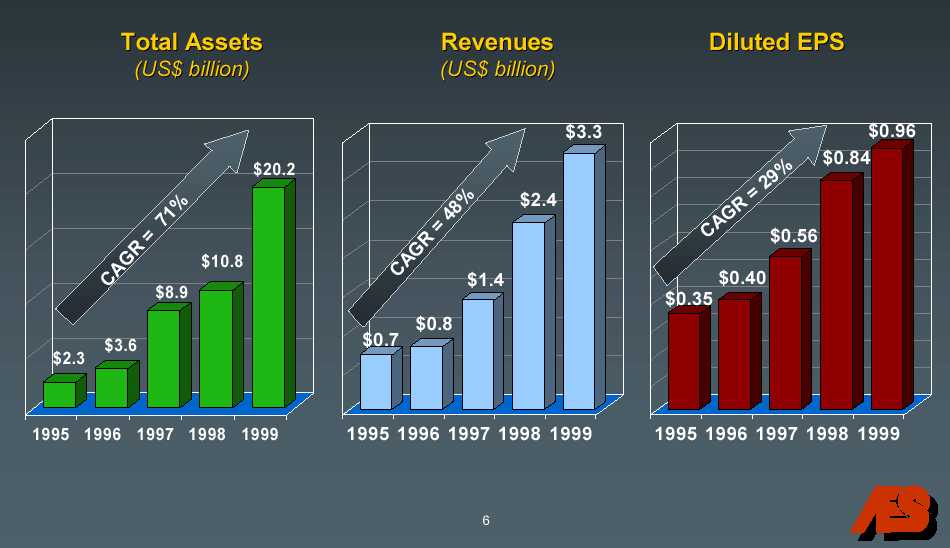

AES stock performance

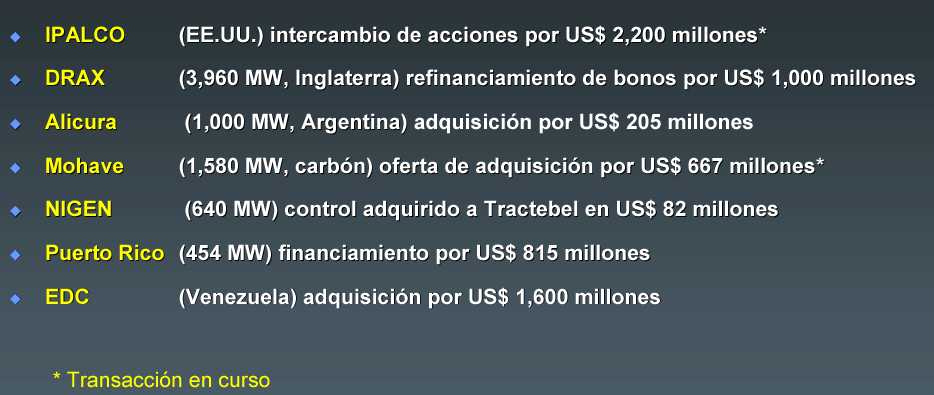

AES is experienced in closing transactions for benefit of shareholders

* Denotes pending transaction

8

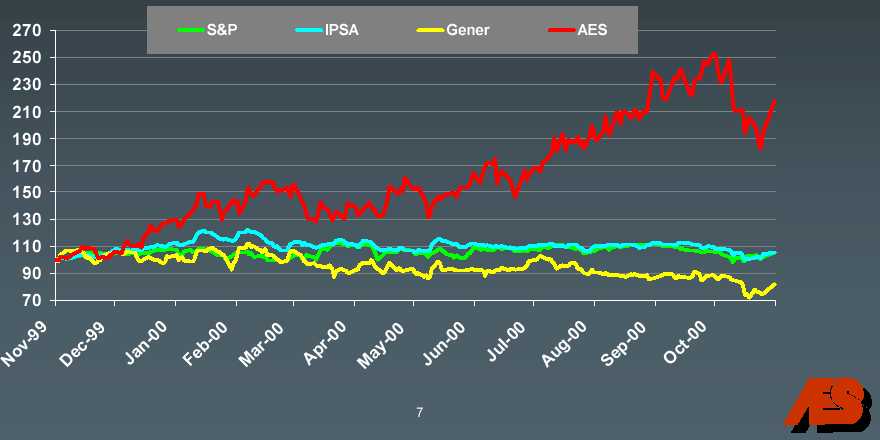

Summary of offers’ terms

10

Chilean offer

11

US offer

12

All shareholders must vote

13

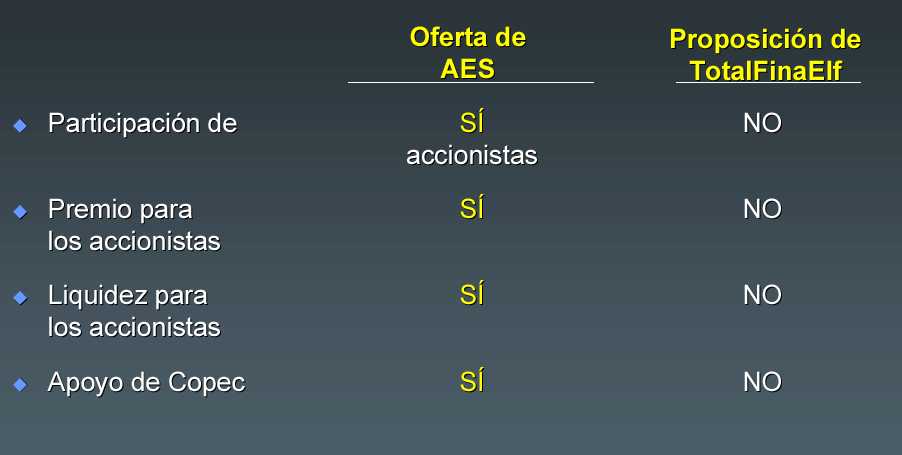

Offer by AES vs. proposal by TotalFinaElf

14

Bid vs. historic Gener price

Offer price represents a 40% premium over the last 10-day closing price average before announcement

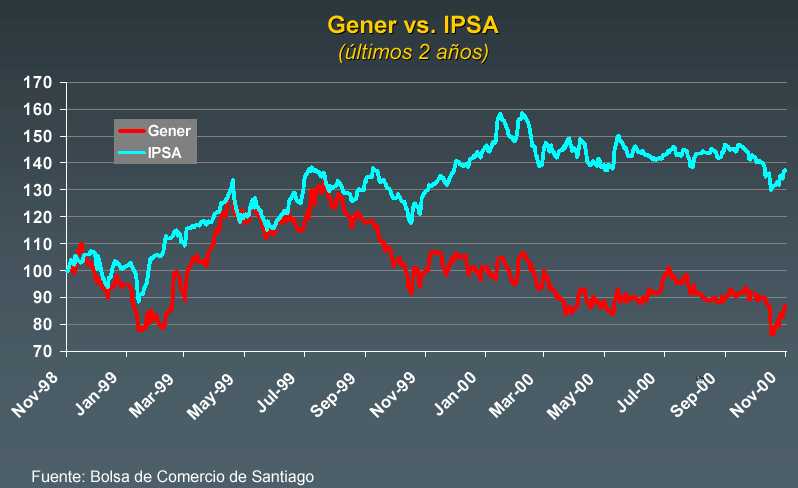

Gener price evolution

Flow to Gener shareholders

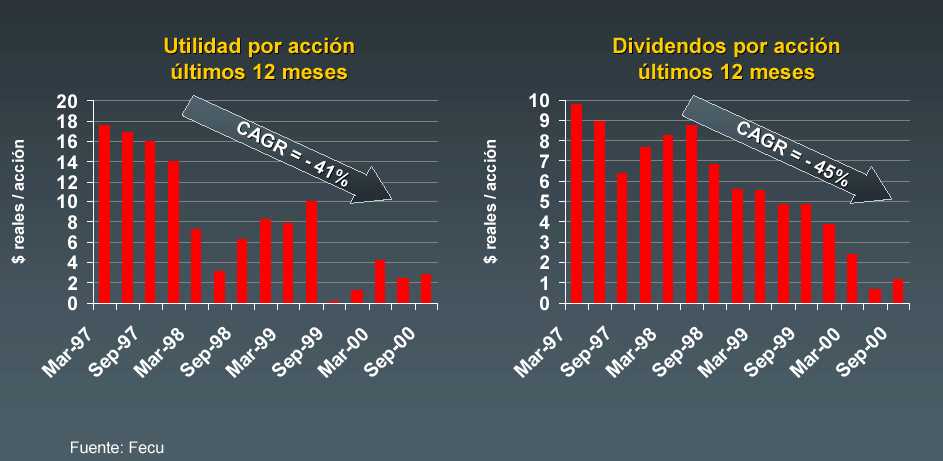

Financial performance of Gener

Gener has not performed well over the last few years and thus has not created sufficient shareholder value

Analysts’ recommendations

| Analyst | Date | Recommendation |

| SSB | Oct 2000 | Underperform |

| DB | Sep 2000 | Market perform |

| DLJ | Aug 2000 | Market perform |

| FIT | Aug 2000 | Sell |

| BSCH | May 2000 | Underperform |

| WDR | Jan 2000 | Sell |

| Larraín Vial | Jan 2000 | Underperform |

Source: Analysts’ reports

19

Conclusion

21

Tender Offer

for Gener Shares

November 2000

Oferta de Adquisición de Acciones de Gener

Noviembre de 2000

1. Introducción

2. The AES Corporation

3. Oferta de Adquisición de Acciones

4. Conclusión

Introducción

2

1. Introducción

2. The AES Corporation

3. Oferta de Adquisición de Acciones

4. Conclusión

AES es una empresa líder de energía global en el mundo

- 17 millones de clientes de distribución en el mundo

- 137 plantas generadoras con más de 49.000 MW de capacidad

- Operaciones en 28 países de Latinoamérica, EE.UU., Europa y Asia

- 56.000 personas en el mundo

- Capitalización Bursátil: US$28.000 millones

4

AES en Latinoamérica

Desempeño financiero exitoso y consistente

Desempeño de la acción de AES

7

Experiencia en ejecutar transacciones beneficiosas para los accionistas

8

1. Introducción

2. The AES Corporation

3. Oferta de Adquisición de Acciones

4. Conclusión

Términos generales de las ofertas

| Oferta | Chile | EE.UU. |

| Tipo | en efectivo | canje de acciones |

| Acciones (MM) | hasta 3,466.6 | todos los ADSs |

| % del mercado | 75% | Todos |

| Precio | US$ 0,235294118 / acción | US$ 16/ ADS |

| Monto | US$ 816 MM | US$ 237 MM |

| Agente Comprador | Deutsche Securities C. de B. | DB Alex Brown |

10

Oferta en Chile

- ofertas de venta por al menos la mayoria de las acciones de Gener

- modificacion de los estatutos para eliminar el limite de propiedad de 20%

- rechazo de la proposicion de TotalFinaElf en la junta del 28 de noviembre

- obtencion de financiamiento suficiente para pagar la adquisicion de las acciones en la oferta en Chile

- Venta a traves de un Remate a efectuarse en la Bolsa de Comercio de Santiago

11

Oferta en EE.UU.

12

Todos los accionistas deben votar

13

Oferta de AES vs. proposición de TotalFinaElf

14

Oferta vs. precio histórico de Gener

El precio de la oferta representa un 40% de premio respecto del precio de cierre promedio de los 10 dias bursatiles previos al anuncio

15

Evolución de precio de Gener

El IPSA ha rentado más que Gener en los últimos 2 años

16

Flujo para el accionista de Gener

17

Desempeño financiero de Gener

Gener no ha tenido un buen desempeno en los ultimos anos, y en consecuencia no ha creado suficiente valor para sus accionistas

18

Recomendaciones de analistas

| Recomendacion | Fecha | Analista |

|---|---|---|

| SSB | Oct 2000 | Underperform |

| DB | Sep 2000 | Market Perform |

| DLJ | Ago 2000 | Market Perform |

| FIT | Ago 2000 | Sell |

| BSCH | May 2000 | Underperform |

| WDR | Ene 2000 | Sell |

| Larrain Vial | Ene 2000 | Underperform |

Fuente: reportes de analistas

19

1. Introducción

2. The AES Corporation

3. Oferta de Adquisición de Acciones

4. Conclusión

Conclusión

21

Oferta de Adquisición

de Acciones de Gener

Noviembre de 2000

|

|