|

|

|

|

Filer: The AES Corporation

Pursuant to Rule 425 under the Securities Act of 1933

Commission File No. 001-12291

Subject Company: Gener S.A.

Commission File No: 001-13210

These materials contain forward-looking statements concerning the financial condition, results of operations and business of AES following the consummation of its proposed acquisition of Gener and the anticipated financial and other benefits of such proposed acquisition. In some cases, you can identify forward looking statements by the words "will", "believes", "plans", "would", or similar expressions. These forward looking statements are not guarantees of future performances and are subject to risks and uncertainties and other important factors, including those that could cause actual results to differ materially from expectations based on forward looking statements made in this press release or elsewhere. For a description of certain of these risks please refer to AES's and Gener's filings with the SEC.

* * * * *

These materials are for informational purposes only. It is not an offer to buy or a solicitation of an offer to sell any shares of AES common stock. The solicitation of offers to buy Gener common stock will only be made pursuant to a prospectus and related materials that AES has sent to Gener shareholders. These securities may not be sold, nor may offers to buy be effected prior to the time the registration statement becomes effective. This communication shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

* * * * *

AES has filed a Tender Offer Statement and an Exchange Offer Registration Statement with the Securities and Exchange Commission. We urge investors and security holders of Gener to read carefully the U.S. exchange offer regarding the proposed transaction because it contains important information about the transaction. Investors and security holders may obtain a free copy of the U.S. exchange offer and other documents filed by AES and Gener with the Securities and Exchange Commission at the Securities and Exchange Commission's Web site at www.sec.gov. The U.S.

exchange offer and these other documents may also be obtained for free from D.F. King & Co., Inc., the Information Agent, by calling 1-800-755-3105.

* * * * *

For more general information visit our web site at www.aesc.com or contact investor relations at [email protected]. The list aes-pr-announce is an automated mailing list and can be found on the investing page of our web site. Those who subscribe to this list will receive updates when AES issues a press release.

* * * * *

This document is being filed pursuant to Rule 425 under the Securities Act of 1933.

The Global Power Company

December 1, 2000

Dear Gener ADS Holder:

On November 3, 2000, The AES Corporation announced its offer to exchange all Gener S.A. ADSs for AES common stock valued at US $16.00 per ADS.

To help you better understand the offer, AES invites you to participate in a special conference call on Thursday, December 7, 2000, at 11:00 a.m. New York City time. The format will consist of approximately 15 minutes of comments from AES management and a question and answer session where you will be able to ask AES management any questions you may have about the offer.

If you wish to participate in the call, U.S.-based ADS holders can dial toll-free to 888-273-9890 shortly before 11:00 a.m. on December 7. The international access/caller-paid dial in number is 612-332-0932. Please ask the operator for the ‘‘AES Corporation’’ conference call. Note that there are a limited number of spaces available on this call, and that it is open to Gener ADS holders by invitation only. We will not be discussing any material that has not already been made public prior to the commencement of the call.

We have enclosed a copy of a short presentation outlining AES and our offer for the Gener S.A. ADSs for your information ahead of the conference call. We look forward to speaking with new ADS holders, as well as continuing our dialogue with those holders we have already spoken to, on December 7.

THE AES CORPORATION

Tender Offer for Gener ADSs

December 2000

Table of Contents

1. Introduction

2. Tender Offer

3. The AES Corporation

4. Conclusion

1

1. Introduction

2. Tender Offer

3. The AES Corporation

4. Conclusion

Introduction

3

1. Introduction

2. Tender Offer

3. The AES Corporation

4. Conclusion

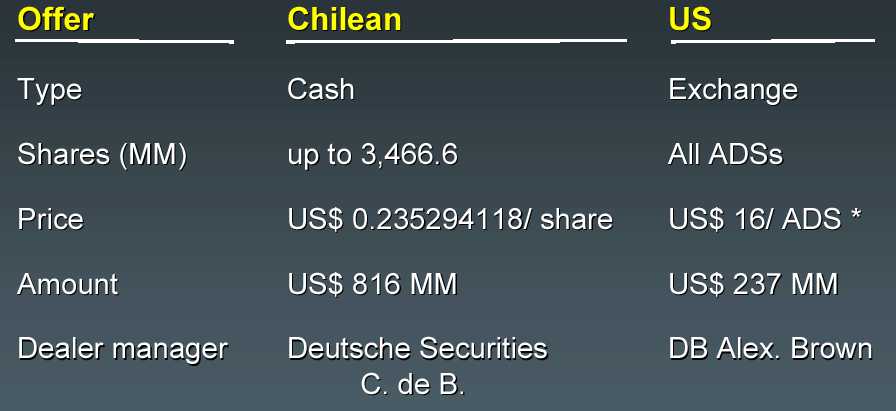

Summary of offers’ terms

(*) Each ADS represents 68 Gener common shares

5

Offer for Gener ordinary shares (Chile)

6

Offer for Gener ADSs (U.S.)

7

AES’s agreement with TotalFinaElf

8

The Bylaw amendment vote

9

Record date for the Bylaw amendment vote

10

After the Bylaw amendment vote

11

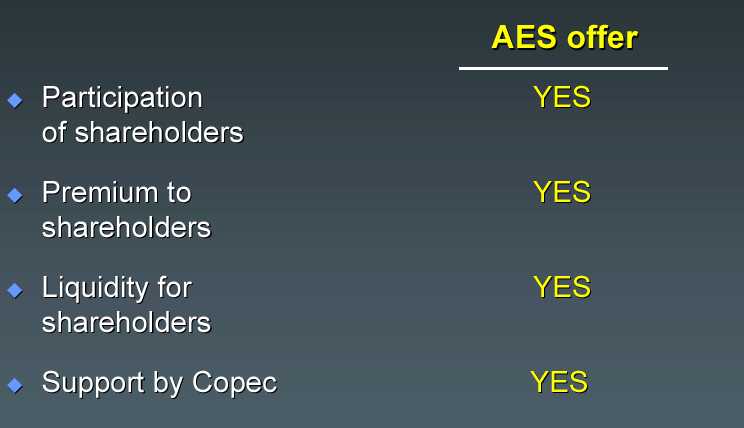

Summary of the AES offer’s benefits

12

AES bid vs. historic Gener price

AES’s tender offer price represents a nearly 40% premium over the last 10-day closing price average before announcement

Source: Santiago Stock Exchange

(*) Based on November 3rd, 2000 Observed Dollar exchange rate of Ch$ 571.8/ US$

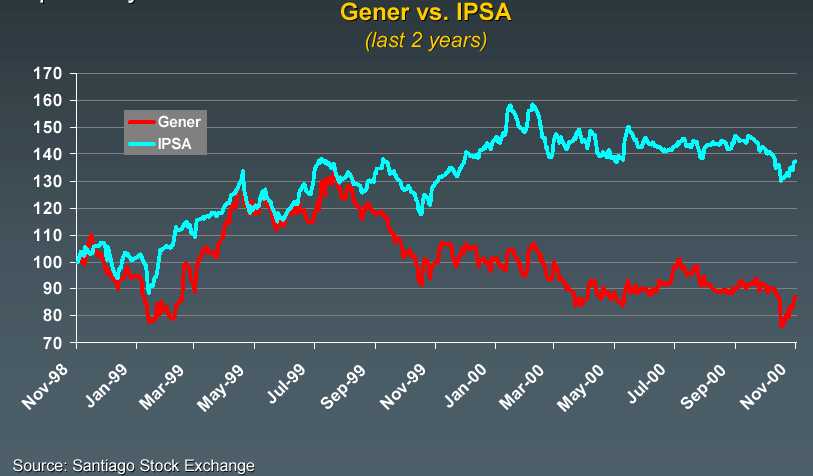

Gener price evolution

The Chilean IPSA index has outperformed Gener over the past 2 years

14

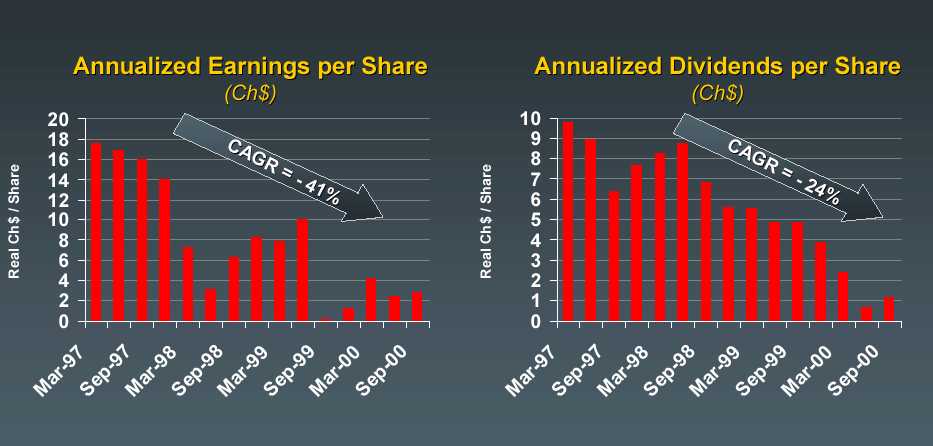

Flow to Gener shareholders

Source: FECU

15

Financial performance of Gener

Gener’s financial performance has deteriorated over the past few years and has not created significant shareholder value

(*) EBITDA = Operating income + Depreciation + Amortization

Source: FECU

16

1. Introduction

2. Tender Offer

3. The AES Corporation

4. Conclusion

AES is the leading global power company

18

AES’s presence in Latin America

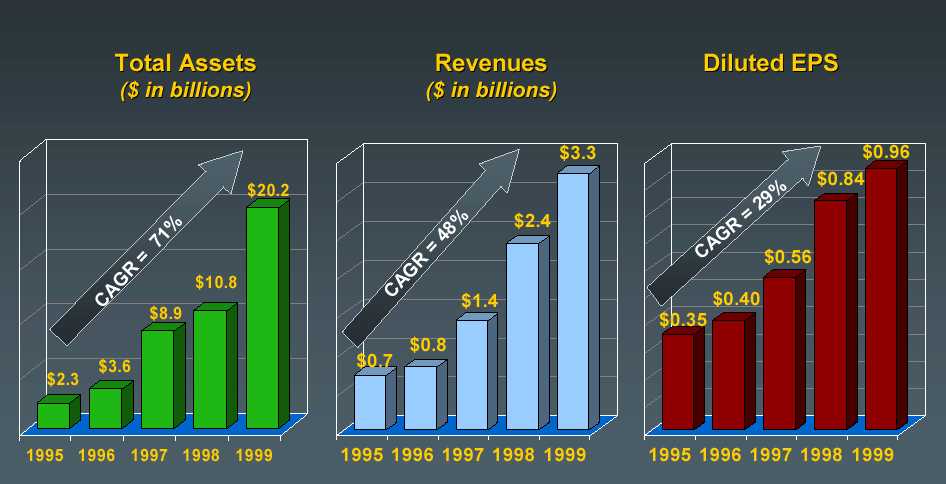

Consistent and strong financial performance

20

AES stock performance

21

AES is experienced in closing transactions for shareholders’ benefit

| (U.S. utility) US$ 2,200 MM stock for stock transaction * |

|

(3,960 MW UK power station) US$ 1,000 MM bond refinancing |

|

(1,000 MW Argentine hydro) US$ 205 MM purchase |

|

Bid to acquire 1,580 MW coal-fired plant for US$ 667 MM * |

|

(640 MW) acquired control from Tractebel for US$ 82 MM |

|

(454 MW) completed US$ 815 MM financing |

|

(Venezuelan utility) US$ 1,600 MM purchase |

(*) Denotes pending transaction

22

Analysts’ comments

Andre Meade (Commerzbank), 11/03/00

Chris Ellinghaus (Salomon Smith Barney), 9/20/00

Robert Chewning (Morgan Stanley Dean Witter), 9/13/00

23

Press quotes

Utility Business, April 2000

The Yankee Group, April 2000

Global Energy Business, February 2000

24

1. Introduction

2. Tender Offer

3. The AES Corporation

4. Conclusion

Conclusion

26

Tender Offer

for Gener ADSs

December 2000

|

|