|

|

|

|

|

Previous: AMERICAN MUNICIPAL TERM TRUST INC II, SC 13D/A, 2001-01-08 |

Next: RIGHT START INC /CA, SC 13D/A, 2001-01-08 |

Income Advantage

Introduction

This prospectus describes a single premium variable income annuity contract (the "Contract") offered by Empire Fidelity Investments Life Insurance Company ("EFILI," "we," or "us"), the insurance company that is part of the group of financial service companies known as Fidelity Investments.

There are two types of Contracts. You may purchase:

(1) a "Non-qualified Contract" with money from any source; and

(2) a "Qualified Contract" that is an Individual Retirement Annuity with contributions rolled-over from tax-qualified plans such as 403(b) plans, 401(k) plans, or IRAs.

The Contract provides you (the "Annuitant") with the opportunity to receive annuity income for life at regular intervals (the "Annuity Income Dates"). You choose the first Annuity Income Date, which may be up to one year from the day we issue the Contract (the "Contract Date"), and whether you want the Annuity Income Dates to be monthly, quarterly, semi-annual, or annual. Annuity income can be for your lifetime, or for your lifetime and the lifetime of a second person you name (the "Joint Annuitant").

You may choose a guaranteed minimum number of years of annuity income. Or, if you have a Qualified Contract, you may choose a Contract which permits you to withdraw part or all of the Withdrawal Value of your Contract. Withdrawals are only available for allocations to variable annuity income. Withdrawals may result in a reduction or elimination of future annuity income. A Contract with a Withdrawal Option will provide slightly less annuity income than an otherwise identical Contract that does not permit withdrawals.

You purchase a Contract with a single payment (the "Purchase Payment"). You may not make additional purchase payments. The minimum Purchase Payment for a Contract is generally $25,000.

For a Non-qualified Contract, the portion of annuity income that is considered a return of the Purchase Payment will generally be non-taxable, and the portion of annuity income that is considered a distribution of earnings will generally be taxable. For Qualified Contracts the entire amount of annuity income each year will generally be taxable. For a more detailed discussion of the tax treatment of annuity income, see Tax Considerations on page 32.

Investment Options

You allocate your Purchase Payment between fixed and variable annuity income. You may choose all fixed annuity income, all variable annuity income, or a combination of the two.

If you allocate all or a portion to variable annuity income, you may choose one or more of twenty-eight available Subaccounts of the Empire Fidelity Investments Variable Annuity Account A (the "Variable Account"). Amounts allocated to the Subaccounts will result in annuity income that varies in amount according to the investment results of the Subaccounts. The variable Subaccounts invest in the mutual fund portfolios ("Portfolios") of Variable Insurance Products Fund, Variable Insurance Products Fund II, and Variable Insurance Products Fund III (the "Fidelity Funds"). Fidelity Management & Research Company ("FMR") manages the Fidelity Funds.

The variable Subaccounts also invest in mutual fund portfolios managed by Morgan Stanley Asset Management ("Morgan Stanley"), Pilgrim Baxter & Associates, Ltd. or Pilgrim Baxter Value Investors, Inc. ("PBHG"), Strong Capital Management, Inc. ("Strong") and Credit Suisse Asset Management, LLC for the Warburg Pincus Trust Portfolios ("Warburg Pincus") ("Other Funds").

All mutual fund portfolios available in this prospectus are collectively known as the "Funds." We may add additional Subaccounts and portfolios in the future.

Legal Information

This prospectus provides information that you should know before purchasing a Contract. We have filed additional information about the Contract and the Variable Account with the U.S. Securities and Exchange Commission in a Statement of Additional Information dated April 30, 2000. The Statement of Additional Information is incorporated by reference in this prospectus and is available without charge by calling EFILI at 1-800-544-2442 or by accessing the SEC Internet website at (http://www.sec.gov). The table of contents of the Statement of Additional Information appears on page 44.

EFIA

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Please read this prospectus and keep it for future reference. It is not valid unless accompanied by either the current prospectus for the Money Market Investment Option or the prospectuses for all the investment options available in the Contract.

The Contract is not available in all states. This prospectus does not constitute an offering in any jurisdiction in which such offering may not be lawfully made. No person is authorized to make any representations in connection with this offering other than those contained in this prospectus.

FOR FURTHER INFORMATION CALL EMPIRE FIDELITY INVESTMENTS LIFE

Nationally 1-800-544-2442

<R>Date: April 30, 2000 as revised on January 8, 2001</R>

EFIA

Prospectus Contents

|

|

|

|

Glossary |

|

|

Summary of the Contract |

|

|

Facts About EFILI, the Variable Account and the Funds |

|

|

EFILI |

|

|

The Variable Account |

|

|

The Funds |

|

|

Facts About the Contract |

|

|

Purchase of a Contract |

|

|

Free Look Privilege |

|

|

Investment Allocation of Your Purchase Payment |

|

|

Trading Among Variable Subaccounts |

|

|

Charges |

|

|

Annuity Income Dates |

|

|

Signature Guarantee |

|

|

Death Benefit |

|

|

Fixed, Variable or Combination Annuity Income |

|

|

Benchmark Rate of Return |

|

|

Types of Annuity Income Options |

|

|

Guarantee Period |

|

|

Withdrawal Provisions |

|

|

Reports |

|

|

More About the Contract |

|

|

Tax Considerations |

|

|

Other Contract Provisions |

|

|

Selling the Contracts |

|

|

Postponement of Benefits |

|

|

More About the Variable Account and the Funds |

|

|

Changes in Investment Options |

|

|

Total Return for a Subaccount |

|

|

Voting Rights |

|

|

Resolving Material Conflicts |

|

|

Performance |

|

|

Litigation |

|

|

Appendix - Illustrations of Values |

|

|

Table of Contents of the Statement of Additional Information |

EFIA

Glossary

Annuitant - You are the Annuitant. You receive lifetime income. For Qualified Contracts all annuity income must be received only by you during your lifetime. Either you or the Joint Annuitant generally must be no older than 85 years of age on the Contract Date. You must also be an Owner.

Annuity Income Dates - The dates we determine the amount of annuity income. If the New York Stock Exchange is closed on an Annuity Income Date, we will determine the amount of annuity income on the next day it is open. You choose whether you want Annuity Income Dates to be monthly, quarterly, semi-annual or annual.

Annuity Income Unit - A unit of measure used to calculate the amount of variable annuity income.

Benchmark Rate of Return - The return that is assumed in the calculation of each amount of variable annuity income. The Benchmark Rate of Return applies only to the variable income portion of the Contract and the following description assumes you make no withdrawals.

The estimated first annuity income amount is calculated assuming that the Investment Options will earn the Benchmark Rate of Return you choose. If the annualized Total Return (performance after all expenses) of the Investment Options you choose matches the benchmark, annuity income will stay constant. If the Total Return exceeds the benchmark, annuity income will increase. If the Total Return falls below the benchmark, annuity income will decrease.

If you choose a higher benchmark, annuity income will start at a higher amount but you will need better investment performance in order to keep annuity income from declining.

You will be able to choose a Benchmark Rate of Return of 3.5% or 5.0%. We may make other rates available, as permitted by state law.

Beneficiary(ies) - The person(s) who may receive certain benefits under this Contract when there is no longer a living Annuitant or Joint Annuitant.

Code - The Internal Revenue Code of 1986, as amended.

Contract - A Contract designed to provide you and the Joint Annuitant (if any) with annuity income for your life (or lives) beginning with the first Annuity Income Date.

Contract Date - The date your Contract becomes effective. This will be stated in your Contract.

Funds - Variable Insurance Products Fund, Variable Insurance Products Fund II, Variable Insurance Products Fund III and Other Funds available in the Contract.

Guarantee Period - The minimum period of time that income is guaranteed to you or your heirs. If the Annuitant(s) die prior to the end of the Guarantee Period, your beneficiary will continue to receive income for the remainder of the Guarantee Period (or can choose a commuted value as a lump sum benefit). Guarantee Periods available range from 5 - 45 years.

Investment Options - The Subaccounts.

IRA - Refers generally to both an Individual Retirement Account and an Individual Retirement Annuity as defined in Sections 408(a) and (b), respectively, of the Code. When it is used to refer to a Qualified Contract, it means a Contract that qualifies as an Individual Retirement Annuity as defined in Section 408(b) of the Code.

Joint Annuitant - The Joint Annuitant (if any), receives lifetime annuity income. However, for Qualified Contracts all annuity income must be received only by the Annuitant during the Annuitant's lifetime. Either the Annuitant or the Joint Annuitant generally must be no older than 85 years of age on the Contract Date. For Non-qualified Contracts the Joint Annuitant may, but need not be, an Owner. For Qualified Contracts the Joint Annuitant may not be an Owner.

Net Investment Factor - An index used to measure the investment performance of an Investment Option from one Valuation Period to the next. The Net Investment Factor can be greater or less than one. The Net Investment Factor for each Investment Option for a Valuation Period is determined by adding (a) and (b), subtracting (c) and then dividing the result by (a) where: (a) is the value of the assets at the end of the preceding Valuation Period; (b) is the investment income and capital gains, realized or unrealized, credited during the current Valuation Period; and (c) is the sum of: (1) the capital losses, realized or unrealized, charged during the current Valuation Period plus any amount charged or set aside for taxes during the current Valuation Period; PLUS (2) the deduction from the Investment Option during the current Valuation Period representing the daily charge equivalent to an effective annual rate of not more than 1%.

EFIA

Non-qualified Contract - A Contract other than a Qualified Contract. This type of Contract may be purchased with money from any source.

Owner(s) - The person(s) who have certain rights under the Contract. You (the Annuitant) must be an Owner. If there is a Joint Annuitant, he or she may also be an Owner (except for a Qualified Contract, where only one Owner is permitted). The Joint Annuitant is never required to be an Owner. Only you and the Joint Annuitant (if any), may ever be Owners.

Portfolio - An investment portfolio of a Fund.

Qualified Contract - A Contract that qualifies as an Individual Retirement Annuity under Section 408(b) of the Code.

Subaccount - A division of the Variable Account, the assets of which are invested in the shares of the corresponding portfolio of the Funds available in the Contract.

Total Return - Used to measure the investment performance of an Investment Option, after all expenses.

Trading among Variable Subaccounts - Transfers of amounts among the investment options.

Valuation Period - The period of time from the time Annuity Income Unit values are calculated to the next time such values are calculated. These calculations are made as of the close of business (normally 4:00 p.m. Eastern Time) each day the New York Stock Exchange is open for trading.

Variable Account - Empire Fidelity Investments Variable Annuity Account A.

Withdrawal (Liquidity) Period - Period of time you can take money out of your annuity. The initial Withdrawal Period will be equal to the life expectancy of the Annuitant(s). The life expectancy is in whole numbers and is determined by IRS guidelines. If no withdrawals are made from your annuity, the Withdrawal Period will operate as a Guarantee Period. The length of the Withdrawal Period may shorten if a withdrawal is made five or more years after your first income annuity date. Withdrawals are only available for allocations to variable annuity income.

Withdrawal Value - The total amount you can take out of your annuity during the Withdrawal Period is known as your Withdrawal Value. The Withdrawal Value is only available for allocations to variable annuity income.

You - The Annuitant. The Annuitant is always an Owner.

EFIA

THIS PAGE INTENTIONALLY LEFT BLANK

EFIA

Purpose

This variable annuity provides periodic annuity income for your life, or for your life and the life of a Joint Annuitant unless you choose to surrender the Contract, if allowed. You may select from a number of annuity income options. You may also choose a guaranteed minimum number of years of annuity income or, if you have a Qualified Contract, you may choose a Withdrawal option. See Types of Annuity Income Options on page <Click Here> and Annuity Income Including Withdrawal Options on page <Click Here>. You may choose annuity income that is entirely fixed, entirely variable, or a combination of fixed and variable. See Fixed, Variable or Combination Annuity Income on page <Click Here>.

Annuity Income

We guarantee to provide annuity income for each Annuity Income Date for your lifetime and for the lifetime of the Joint Annuitant, if any (unless you choose to surrender the Contract, if allowed). We guarantee the amount of fixed annuity income on each Annuity Income Date, but we do not guarantee the amount of any variable annuity income. Neither do we guarantee any minimum number of Annuity Income Dates, unless you choose an option that provides for such a guarantee.

Under the Contract, we will distribute lifetime annuity income to you, or to you and the Joint Annuitant. The federal income tax laws have a special requirement for Qualified that have a Joint Annuitant. For these Contracts, during your lifetime annuity income can be payable only to you.

You are an Owner of the Contract. The Joint Annuitant will also be an Owner if so named on the application, except that for Qualified Contracts and you must be the only Owner.

Purchase of Contract

You purchase the Contract with a single Purchase Payment. The minimum Purchase Payment is generally $25,000. EFILI reserves the right to reject Purchase Payments in excess of limits it establishes from time to time.

There are two types of Contracts. You may purchase a Non-qualified Contract with money from any source. In addition, you may purchase a Qualified Contract that is an Individual Retirement Annuity with contributions rolled-over from tax-qualified plans such as 403(b) plans, 401(k) plans, or IRAs.

Investment Options

You allocate your Purchase Payment between variable and fixed annuity income on your application. This allocation may not be changed. The amount of variable annuity income will fluctuate from one Annuity Income Date to the next according to the investment results of the Investment Options you select.

There are currently twenty-eight variable Subaccounts available as Investment Options.

Free Look Period

The portion of your Purchase Payment allocated to variable annuity income will be placed in the Money Market Investment Option during the Money Market Period, and you may currently reallocate among the variable Investment Options at any time after the end of the Money Market Period.

EFIA

You may return the Contract for a refund during the free look period. See Free Look Privilege on page <Click Here>. ONCE THE FREE LOOK PERIOD EXPIRES, YOU CANNOT RETURN THE CONTRACT FOR A REFUND. If neither you nor the Joint Annuitant survives to the first Annuity Income Date, the Contract will be canceled and we will make a refund equal to your Purchase Payment to your Beneficiary or Beneficiaries. See Death Benefit on page <Click Here>.

Important

We intend this summary to provide only an overview of the more significant aspects of the Contract. You will find more detailed information in the rest of this prospectus and in the Contract. The Contract constitutes the entire agreement between you and EFILI and should be retained.

FEE TABLE

This information may assist you in understanding the various costs and expenses that a Contract Owner will bear directly or indirectly. It reflects expenses of the Variable Account as well as the Portfolios. The tables below do not reflect any deductions for taxes. Any applicable premium taxes are deducted from a Contract on the Contract Date. See Charges on page <Click Here> for additional information.

CONTRACT EXPENSES

NONE

|

SEPARATE ACCOUNT ANNUAL EXPENSES (as a percentage of Portfolio average net assets) |

|

|

Mortality and Expense Risk Charge |

0.75% |

|

Account Fees and Expenses: |

|

|

Administrative Charge |

0.25% |

|

Total Separate Account Annual Expenses |

1.00% |

EFIA

PORTFOLIO ANNUAL EXPENSES

(as a percentage of Portfolio average net assets)

|

|

Management Fees |

Other Expenses |

Total Annual Expenses (after reimbursement) |

|

FidelityA |

|

|

|

|

Asset Manager |

0.53% |

0.09% |

0.62% |

|

Money Market |

0.18% |

0.09% |

0.27% |

|

Investment Grade Bond |

0.43% |

0.11% |

0.54% |

|

High Income |

0.58% |

0.11% |

0.69% |

|

Equity-Income |

0.48% |

0.08% |

0.56% |

|

Index 500 |

0.24% |

0.04% |

0.28%B |

|

Growth |

0.58% |

0.07% |

0.65% |

|

Overseas |

0.73% |

0.14% |

0.87% |

|

Asset Manager: Growth |

0.58% |

0.12% |

0.70% |

|

Contrafund |

0.58% |

0.07% |

0.65% |

|

Growth Opportunities |

0.58% |

0.10% |

0.68% |

|

Balanced |

0.43% |

0.12% |

0.55% |

|

Growth & Income |

0.48% |

0.11% |

0.59% |

|

Mid Cap |

0.57% |

0.40% |

0.97% |

|

Morgan Stanley Asset Management |

|

|

|

|

Emerging Markets Debt |

0.45% |

0.98% |

1.43%C |

|

Emerging Markets Equity |

0.42% |

1.37% |

1.79%C |

|

Global Equity |

0.47% |

0.68% |

1.15%C |

|

International Magnum |

0.29% |

0.87% |

1.16%C |

|

PBHG |

|

|

|

|

Select 20 |

0.85% |

0.20% |

1.05%D |

|

Growth II |

0.85% |

0.35% |

1.20%D |

|

Select Value* |

0.65% |

0.30% |

0.95%D |

|

Small Cap Value |

0.91% |

0.29% |

1.20%D |

|

Technology & Communications |

0.85% |

0.24% |

1.09%D |

|

Strong |

|

|

|

|

Mid Cap Growth Fund II |

1.00% |

0.15% |

1.15%E |

|

Opportunity Fund II |

1.00% |

0.14% |

1.14%E |

|

Warburg Pincus |

|

|

|

|

International Equity |

1.00% |

0.32% |

1.32%F |

|

Global Post-Venture Capital** |

1.07% |

0.33% |

1.40%F |

|

Small Company Growth |

0.90% |

0.24% |

1.14%F |

* Previously called Large Cap Value.

** Previously called Post-Venture Capital.

A A portion of the brokerage commissions that certain Fidelity Funds pay was used to reduce Fund expenses. In addition, certain Fidelity Funds, or FMR on behalf of certain funds, have entered into arrangements with their custodian whereby credits realized as a result of uninvested cash balances were used to reduce a portion of Fund expenses. Without these reductions, the total operating expenses presented in the table would have been 0.57% for Equity-Income Portfolio, 0.66% for Growth Portfolio, 0.91% for Overseas Portfolio, 0.63% for Asset Manager Portfolio, 0.67% for Contrafund Portfolio, 0.70% for Asset Manager: Growth Portfolio, 0.68% for Growth Opportunities Portfolio, 0.55% for Balanced Portfolio, 0.59% for Growth and Income Portfolio, and 3.34% for Mid Cap Portfolio.

B FMR agreed to reimburse a portion of Index 500 Portfolio's expenses during the period. Without this reimbursement, the Fund's management fee, other expenses, and total expenses would have been 0.24%, 0.10% and 0.34%, respectively.

EFIA

C Morgan Stanley Asset Management, with respect to the Portfolios, has voluntarily agreed to waive receipt of its management fees and agreed to reimburse certain expenses of the Portfolio. Morgan Stanley Asset Management may terminate this voluntary waiver and reimbursement at any time at its sole discretion. Without waivers and reimbursements, "Management Fees," "Other Expenses" and "Total Annual Expenses," respectively, would be as follows: Emerging Markets Debt Portfolio (0.80%, 0.98%, 1.78%); Emerging Markets Equity Portfolio (1.25%, 1.37%, 2.62%); Global Equity Portfolio (0.80%, 0.68%, 1.48%); International Magnum Portfolio (0.80%, 0.87%, 1.67%).

D Pilgrim Baxter & Associates, Ltd. (the "Adviser") has voluntarily agreed to waive or limit its Advisory Fees or assume Other Expenses in an amount that operates to limit Total Operating Expenses of the Portfolios to not more than 1.20% of the average daily net assets of the Growth II, Small Cap Value, Technology & Communications and Select 20 Portfolios and to not more than 1.00% of the average daily net assets of the Select Value Portfolio, through December 31, 1999. Total Operating Expenses include, but are not limited to, expenses such as investment advisory fees, transfer agent fees and legal fees. Such waivers of Advisory fees and possible assumptions of Other Expenses by the Adviser is subject to a possible reimbursement by the Portfolios in future years if such reimbursement can be achieved within foregoing annual expense limits. Such fee waiver/expense reimbursement arrangements may be modified or terminated at any time after December 31, 1999. Absent such fee waivers/expense reimbursements the Advisory Fees and estimated Total Operating Expenses for the Small Cap Value Portfolio would be 1.00% and 1.29%.

E Strong Capital Management, Inc., the investment Adviser, has voluntarily agreed to cap the Fund's total operating expenses at 1.20%. The Adviser has no current intention to, but may in the future, discontinue or modify any waiver of fees or absorption of expenses at its discretion with appropriate notification to its shareholders. Management Fees, Other Expenses, and Total Annual Expenses for Opportunity II and Mid Cap Growth Fund II are calculated on an annualized basis from the beginning of the fiscal year through the current quarter end. The advisor for Mid Cap Growth Fund II is absorbing expenses of 0.02%. Without these absorptions the expense ratio would have been 1.17%.

F Management Fees, Other Expenses and Total Annual Expenses for the International Equity, Global Post-Venture Capital and Small Company Growth Portfolios are based on actual expenses for the fiscal year ended December 31, 1999, net any fee waivers or expense reimbursements. Without such waivers or reimbursements, Management Fees would have equaled 1.00%, 1.25% and 0.90%; Other Expenses would have equalled 0.32%, 0.33% and 0.24%; and Total Annual Expenses would have equalled 1.32%, 1.58% and 1.14% for the International Equity, Global Post-Venture Capital, and Small Company Growth Portfolios, respectively. Fee waivers and expense reimbursements or credits may be discontinued at any time.

Facts about EFILI, the Variable Account and the Funds

EMPIRE FIDELITY INVESTMENTS LIFE

Empire Fidelity Investments Life is a stock life insurance company organized under the laws of the State of New York on May 1, 1991. EFILI is part of Fidelity Investments, a group of companies that provides a variety of financial services and products. EFILI is a wholly-owned subsidiary of Fidelity Investments Life Insurance Company. Fidelity Investments Life Insurance Company is a wholly-owned subsidiary of FMR Corp., the parent company of the Fidelity companies. Edward C. Johnson 3d, the Johnson family members, and various key employees of FMR Corp. own the voting common stock of FMR Corp. EFILI's financial statements appear in the Statement of Additional Information. Our principal executive offices are located at 200 Liberty Street, One World Financial Center, New York, New York 10281.

Empire Fidelity Investments Variable Annuity Account A was established as a separate investment account on July 15, 1991. It supports the Contracts and other forms of variable annuity contracts, and may be used for other purposes permitted by law.

The Variable Account is registered with the Securities and Exchange Commission ("SEC") as a unit investment trust under the Investment Company Act of 1940 ("1940 Act"). Financial statements for the Variable Account are in the Statement of Additional Information.

We own the assets in the Variable Account. The assets of the Variable Account are kept separate from our general account assets and from any other separate accounts we may have, as required by law. The assets of the Variable Account may not be charged with liabilities from any other business we conduct. All income, gains and losses concerning assets allocated to the Variable Account are credited to or charged against the Variable Account without regard to other income, gains or losses of EFILI. Assets are maintained in the Variable Account at least equal to the reserves and other liabilities of the Variable Account. If the assets exceed the required reserves and other liabilities, we may transfer the excess to its general account. EFILI is obligated to provide all benefits under the Contracts.

There are currently twenty-nine Subaccounts in the Variable Account. One of these Subaccounts, Strong Discovery Fund II Portfolio, is no longer available as an investment option in the Contract and no money may be allocated to this Subaccount. On or about May 26, 2000, any assets remaining in Strong Discovery Fund II Portfolio will be exchanged to VIP III Mid Cap Portfolio. Five Subaccounts invest exclusively in shares of a specific portfolio of Fidelity Variable Insurance Products Fund. Five Subaccounts invest exclusively in shares of a specific portfolio of Fidelity Variable Insurance Products Fund II. Four Subaccounts invest exclusively in shares of a specific portfolio of Fidelity Variable Insurance Products Fund III. The other 14 available investment options are offered by four different mutual fund investment advisers.

EFIA

Fidelity:

The Fidelity Funds are Variable Insurance Products Fund, Variable Insurance Products Fund II, and Variable Insurance Products Fund III. Each Fund is an open-end, diversified management investment company organized by FMR and is the type of investment company commonly known as a series mutual fund.

The investment objectives of the Portfolios of Variable Insurance Products Fund, Variable Insurance Products Fund II, and Variable Insurance Products Fund III are described below. There is of course no assurance that any Portfolio will meet its investment objective.

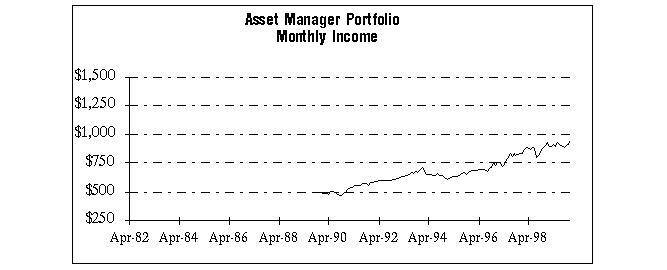

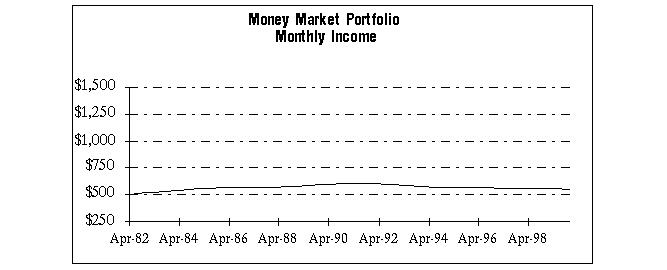

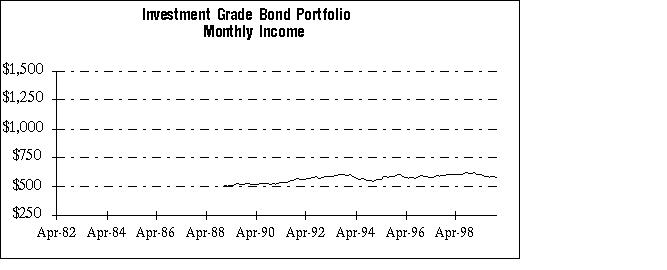

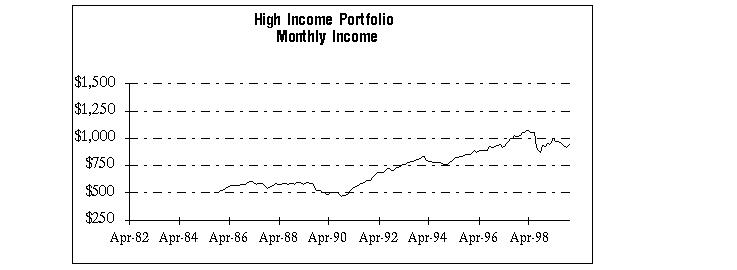

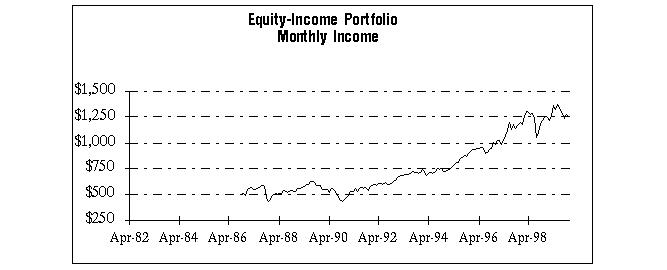

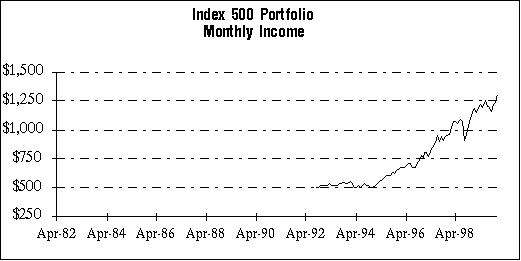

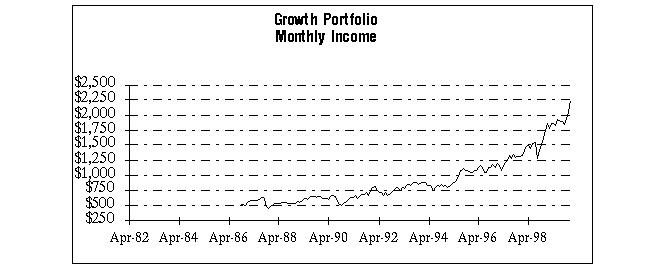

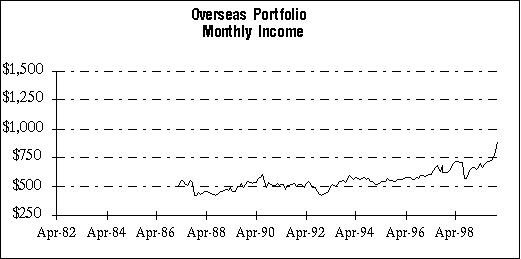

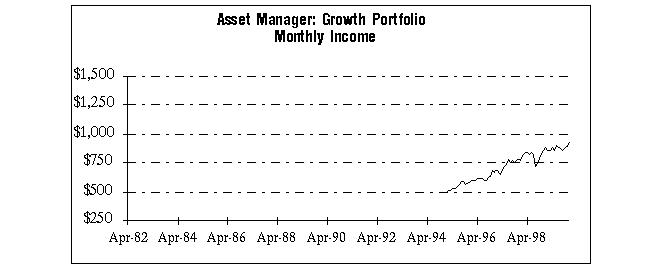

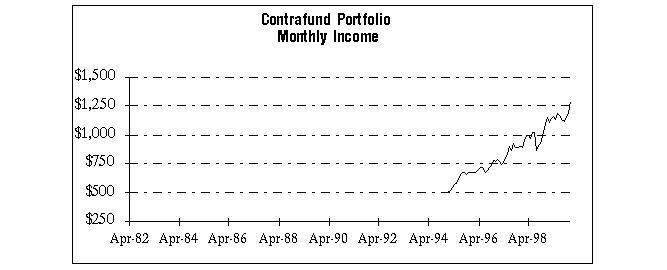

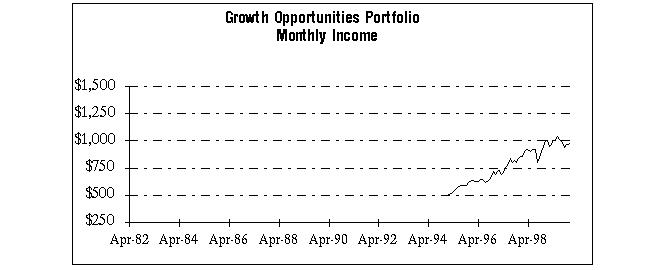

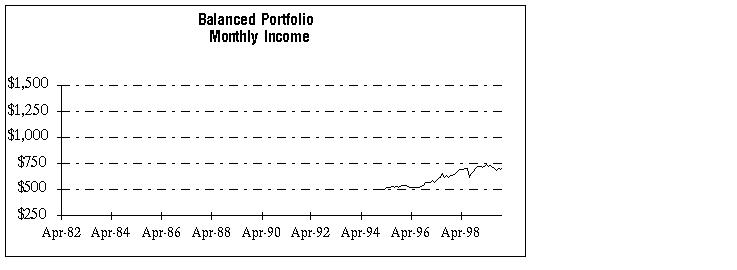

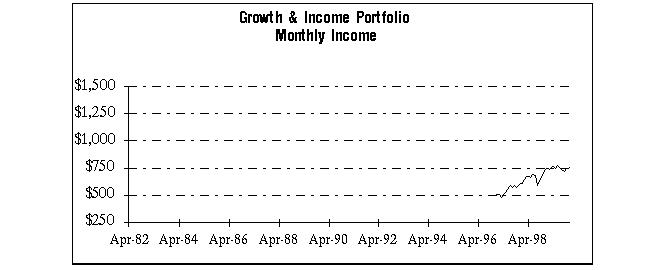

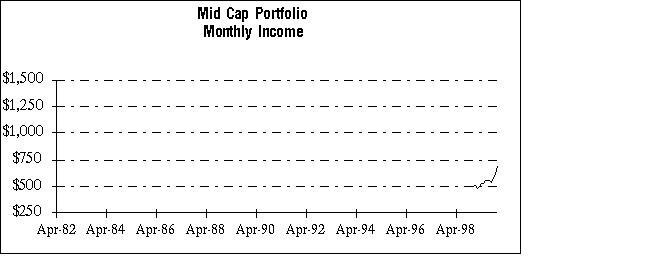

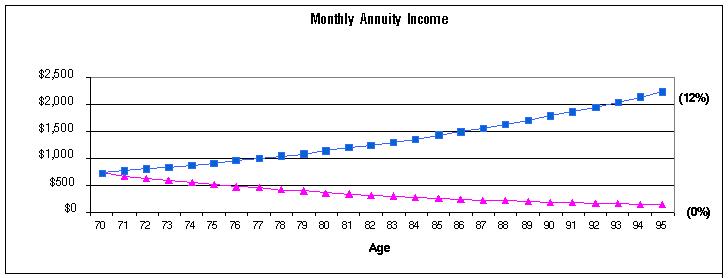

Following the description of each Portfolio is a graph showing how your annuity income can fluctuate based on past investment performance through December 31, 1999. Each graph shows the effect that the Portfolio's investment performance would have had if a Contract with a Benchmark Rate of Return of 5.0%, providing an initial monthly annuity income of $500, was purchased on the date the Portfolio commenced operations.

Annuity income increases for a given month if the annualized Total of Return for that month is higher than the Benchmark Rate of Return, and decreases for a given month if the annualized Total of Return is lower than the Benchmark Rate of Return. The Purchase Payment necessary for an initial monthly annuity income of $500 will vary depending on the age and sex of the Annuitant (and Joint Annuitant, if any), the annuity income option, and the first Annuity Income Date. Suppose a 65 year old male who lives in a state that does not charge a premium tax wishes to purchase $500 of initial monthly variable annuity income beginning on the Contract Date. If there is no Joint Annuitant and no guarantee period and he chooses a 5% Benchmark Rate of Return, the Purchase Payment needed would be $74,520. If the purchaser were female, the Purchase Payment necessary would be $83,417. This is because females have a longer life expectancy than males.

All the graphs take into account all charges under the Contract and the actual expenses of the Portfolios.

The graphs for the Other Funds are not available.

Asset Manager Portfolio of Variable Insurance Products Fund II seeks high total return with reduced risk over the long term by allocating its assets among stocks, bonds, and short-term instruments.

Principal Investment Strategies:

Investor Profile. The fund may be appropriate for investors who want to diversify among stocks, bonds, short-term instruments and other types of securities. The fund's assets may also be invested in other instruments that do not fall within these classes.

The graph below is based on a 5% Benchmark Rate of Return and initial monthly annuity income of $500.

EFIA

Money Market Portfolio of Variable Insurance Products Fund seeks as high a level of current income as is consistent with the preservation of capital and liquidity.

Principal Investment Strategies:

Investor Profile. The fund may be appropriate for investors who would like to earn income at current money market rates while preserving the value of their investment. An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the fund.

The graph below is based on a 5% Benchmark Rate of Return and initial monthly annuity income of $500.

EFIA

Investment Grade Bond Portfolio of Variable Insurance Products Fund II seeks as high a level of current income as is consistent with the preservation of capital.

Principal Investment Strategies:

Investor Profile. The fund may be appropriate for investors who want the potential for high current income from a portfolio of investment-grade debt securities. The fund's level of risk and potential reward depend on the quality and maturity of its investments, and has overall interest rate risk similar to the index.

The graph below is based on a 5% Benchmark Rate of Return and initial monthly annuity income of $500.

EFIA

High Income Portfolio of Variable Insurance Products Fund seeks a high level of current income. Growth of capital may also be considered.

Principal Investment Strategies:

Investor Profile. The fund is for long-term, aggressive investors who understand the potential risks and rewards of investing in lower-quality debt, including defaulted securities. Investors must be willing to accept the fund's greater price movements and credit risks.

The graph below is based on a 5% Benchmark Rate of Return and initial monthly annuity income of $500.

EFIA

Equity-Income Portfolio of Variable Insurance Products Fund seeks reasonable income. The fund will consider the potential for capital appreciation. The fund seeks a yield for its shareholders that exceeds the yield on the securities comprising the S&P 500.

Principal Investment Strategies:

Investor Profile. The fund may be appropriate for investors who are willing to ride out stock market fluctuations in pursuit of potentially above-average long-term returns. The fund is designed for those who want some income from equity and bond securities, but also want to be invested in the stock market for its long-term growth potential.

The graph below is based on a 5% Benchmark Rate of Return and initial monthly annuity income of $500.

EFIA

Index 500 Portfolio of Variable Insurance Products Fund II seeks investment results that correspond to the total return (i.e., the combination of capital changes and income) of common stocks publicly traded in the United States, as represented by the S&P 500, while keeping transaction costs and other expenses low.

Principal Investment Strategies. Bankers Trust Company's ("BT," a New York banking corporation serving as sub-adviser and custodian for VIP II Index 500) principal investment strategies include:

Investor Profile. The fund may be appropriate for investors who are willing to ride out stock market fluctuations in pursuit of potentially above-average long-term returns in relation to the S&P 500.

The graph below is based on a 5% Benchmark Rate of Return and initial annuity income of $500.

EFIA

Growth Portfolio of Variable Insurance Products Fund seeks to achieve capital appreciation.

Principal Investment Strategies:

Investor Profile. The fund may be appropriate for investors who are willing to ride out stock market fluctuations in pursuit of potentially above-average long-term returns. The fund is designed for those who want to pursue growth potential, and who understand that this strategy often leads to more volatile investments than the market as a whole. The fund invests for growth and does not pursue an income strategy.

The graph below is based on a 5% Benchmark Rate of Return and initial monthly annuity income of $500.

EFIA

Overseas Portfolio of Variable Insurance Products Fund seeks long-term growth of capital.

Principal Investment Strategies:

Investor Profile and Risk:

The graph below is based on a 5% Benchmark Rate of Return and initial monthly annuity income of $500.

EFIA

Asset Manager: Growth Portfolio of Variable Insurance Products Fund II seeks to maximize total return over the long term by allocating its assets among stocks, bonds, short-term instruments, and other investments.

Principal Investment Strategies:

Investor Profile. The fund may be appropriate for investors who want to diversify among domestic and foreign stocks, bonds, short-term instruments and other types of securities. The fund, while spreading its assets among all three asset classes, uses a more aggressive approach by focusing on stocks for a higher potential return. The value of each fund's investments and the income they generate will vary.

The graph below is based on a 5% Benchmark Rate of Return and initial monthly annuity income of $500.

EFIA

Contrafund Portfolio of Variable Insurance Products Fund II seeks long-term capital appreciation.

Principal Investment Strategies:

Investor Profile. The fund may be appropriate for investors who are willing to ride out stock market fluctuations in pursuit of potentially above-average long-term returns.

The graph below is based on a 5% Benchmark Rate of Return and initial monthly annuity income of $500.

EFIA

Growth Opportunities Portfolio of Variable Insurance Products Fund III seeks to provide capital growth.

Principal Investment Strategies:

Investor Profile. The fund may be appropriate for investors seeking growth of capital. The investment philosophy is not constrained by any particular investment style. The fund's assets may be invested in securities of foreign issuers in addition to securities of domestic issuers.

The graph below is based on a 5% Benchmark Rate of Return and initial monthly annuity income of $500.

EFIA

Balanced Portfolio of Variable Insurance Products Fund III seeks both income and growth of capital.

Principal Investment Strategies:

Investor Profile. The fund may be appropriate for investors who seek a balance between stocks and bonds. The fund may invest its assets in securities of foreign issuers in addition to domestic issuers.

The graph below is based on a 5% Benchmark Rate of Return and initial monthly annuity income of $500.

EFIA

Growth & Income Portfolio of Variable Insurance Products Fund III seeks high total return through a combination of current income and capital appreciation.

Principal Investment Strategies:

Investor Profile. The fund may be appropriate for investors who are willing to ride out stock market fluctuations in pursuit of potentially high long-term returns. The fund is designed for those who seek a combination of growth and income from equity and some bond investments.

The graph below is based on a 5% Benchmark Rate of Return and initial monthly annuity income rate of $500.

EFIA

Mid Cap Portfolio of Variable Insurance Products Fund III seeks long-term growth of capital.

Principal Investment Strategies:

Investor Profile. The fund may be appropriate for investors seeking long-term growth of capital through equity securities, including growth or value stocks, or a combination of both.

The graph below is based on a 5% Benchmark Rate of Return and initial monthly income of $500.

Morgan Stanley Asset Management

Emerging Markets Debt Portfolio

Objective and Strategy

EFIA

Emerging Markets Equity Portfolio

Objective and Strategy

Global Equity Portfolio

Objective and Strategy

International Magnum Portfolio

Objective and Strategy

EFIA

PBHG

Select 20 Portfolio

Objective and Strategy

Growth II Portfolio

Objective and Strategy

Select Value Portfolio (previously called Large Cap Value Portfolio)

Objective and Strategy

Small Cap Value Portfolio

Objective and Strategy

Technology & Communications Portfolio

Objective and Strategy

EFIA

Strong

Mid Cap Growth Fund II

Objective and Strategy

Opportunity Fund II

Objective and Strategy

EFIA

Warburg Pincus

International Equity Portfolio

Objective and Strategy

Risk. In addition to risks associated with equity securities, international investment entails special risk considerations including currency fluctuations, lower liquidity, economic instability, political uncertainty, and differences in accounting methods.

Global Post-Venture Capital Portfolio (previously called Post-Venture Capital Portfolio)

Objective and Strategy

EFIA

Risk. The main risks associated with the portfolio include risks associated with equity securities, particularly small, start-up and special-situation companies. In addition to risks associated with equity securities, international investment entails special risk considerations including currency fluctuations, lower liquidity, economic instability, political uncertainty, and differences in accounting methods. The Portfolio employs aggressive strategies and may not be appropriate for all investors.

Small Company Growth Portfolio

Objective and Strategy

Risk. The Portfolio's main risks are the risks associated with equity securities, particularly small, start-up, and special-situation companies. The Portfolio may be subject to volatility resulting from its non-diversified status.

Funds' Availability to Separate Accounts

Shares of the Funds may also be sold to a variable life separate account of Fidelity Investments Life and to variable annuity and variable life separate accounts of other insurance companies. For a discussion of the possible consequences associated with having the Funds available to such other separate accounts, see Resolving Material Conflicts on page <Click Here>.

The Investment Advisers

Fidelity

The investment adviser for the Fidelity Funds is Fidelity Management & Research Company, a registered adviser under the Investment Advisers Act of 1940. Fidelity Management & Research Company (FMR) is the original Fidelity company and was founded in 1946. It provides a number of mutual funds and other clients with investment research and portfolio management services. It maintains a large staff of experienced investment personnel and a full complement of related support facilities. As of February 29, 2000, FMR managed over $829 billion in assets. The portfolios of the Fidelity Funds, as part of their operating expenses, pay an investment management fee to FMR. These fees are part of the Funds' expenses. See the prospectuses for the Funds for discussions of the Funds' expenses. Fidelity Investments Money Management, Inc., a subsidiary of FMR, chooses certain investments for some of the Fidelity Funds. Beginning January 1, 2001, FMR Co., Inc., a subsidiary of FMR, will also choose certain investments for the Fidelity Funds. Foreign affiliates of FMR may help choose investments for some of the Funds. BT is a wholly-owned subsidiary of Bankers Trust Corporation (formerly Bankers Trust New York Corporation). BT currently serves as sub-adviser and custodian for the Index 500 Portfolio.

Morgan Stanley Asset Management

On December 1, 1998, Morgan Stanley Asset Management Inc. changed its name to Morgan Stanley Dean Witter Investment Management Inc. but continues to do business in certain instances using the name Morgan Stanley Asset Management. The investment Adviser for The Universal Institutional Funds, Inc. is Morgan Stanley Asset Management, which is a wholly-owned subsidiary of Morgan Stanley Dean Witter & Co., which is a preeminent global financial services firm that maintains leading market positions in each of its three primary businesses - securities, asset management and credit services. Morgan Stanley Asset Management, a registered investment Adviser under the Investment Advisers Act of 1940, as amended, serves as investment Adviser to numerous open-end and closed-end investment companies as well as, to employee benefit plans, endowment funds, foundations and other institutional investors. Morgan Stanley Asset Management's principal business office is located at 1221 Avenue of the Americas, New York, New York 10020.

EFIA

PBHG

The investment Adviser for the PBHG Insurance Series Fund, Inc. is Pilgrim Baxter & Associates, Ltd. ("Pilgrim Baxter"), a professional investment management firm and registered investment Adviser that, along with its predecessors, has been in business since 1982. The controlling shareholder of Pilgrim Baxter is United Asset Management Corporation ("UAM"), a New York stock exchange listed holding company principally engaged through affiliated firms, in providing institutional investments management services and acquiring institutional investment management firms. UAM's headquarters are located at One International Place, Boston, Massachusetts 02110. The principal business address of the Adviser is 825 Duportail Road, Wayne, Pennsylvania 19087. Pilgrim Baxter Value Investors, Inc., the Sub-Adviser, is a wholly owned subsidiary of Pilgrim Baxter and is a registered investment Adviser that was formed in 1940. As with the Adviser, the controlling shareholder of the Sub-Adviser is UAM. The principal business address of the Sub-Adviser is 825 Duportail Road, Wayne, Pennsylvania 19087.

Strong

The investment Adviser for the Strong Funds is Strong Capital Management, Inc. The Adviser began conducting business in 1974. Since then, its principal business has been providing continuous investment supervision for individuals and institutional accounts, such as pension funds and profit-sharing plans, as well as mutual funds, several of which are funding vehicles for variable insurance products. The Adviser's principal mailing address is P.O. Box 2936, Milwaukee, Wisconsin 53201. Mr. Richard S. Strong, the Chairman of the Board of the Fund, is the controlling shareholder of the Adviser.

Warburg Pincus

The investment Adviser for the Warburg Pincus Trust is Credit Suisse Asset Management, LLC. Credit Suisse Asset Management, LLC is a member of Credit Suisse Asset Management, the institutional asset management and mutual fund arm of Credit Suisse Group, one of the world's leading banks. Credit Suisse Asset Management companies manage approximately $72 billion in the U.S. and $203 billion globally.

Important

You will find more complete information about the Funds, including the risks associated with each portfolio, in their respective prospectuses. You should read them in conjunction with this prospectus.

We offer the Contracts only in states in which we have obtained approval. Two types of Contracts are available. You may purchase: (1) a Non-qualified Contract using money from any source; and (2) a Qualified Contract with money rolled over from a qualified retirement plan, such as a 401(k) plan, 403(b) plan or IRA.

When we receive your properly completed application, we apply your payment to the purchase of a Contract within two valuation periods after receipt at the Annuity Service Center. We will consider your application properly completed as soon as:

EFIA

(1) you have provided all the information requested on the application form, including your choice of annuity income option;

(2) we have received adequate proof of your date of birth (and the date of birth of the Joint Annuitant, if any); and

(3) we receive the entire amount of your Purchase Payment.

The date we credit the payment and issue your Contract is called the Contract Date. If your application is incomplete, we will request the information necessary to complete the application. If you do not furnish the information within five business days of the time we receive your application, we will return your payment unless we obtain your specific permission to keep it until you complete the application.

You may return a Contract for a refund within 30 calendar days after you receive it (the "free look period"). If you choose to cancel the Contract, return it to the Annuity Service Center with a written request within the free look period.

For most Contracts, we assume that you receive your Contract five days after the Contract Date. For Contracts with large Purchase Payments, we may use the actual date you receive the Contract.

If you return a Contract more than ten days after you receive it, we will promptly refund your Purchase Payment adjusted for investment performance. If you return a Contract during the first ten calendar days after you receive it, we will promptly refund the greater of (1) your Purchase Payment in full, neither crediting your Contract for earnings nor charging it with any administrative expenses, and (2) your Purchase Payment plus the investment performance of the Money Market Investment Option.

We will also make an adjustment for the amount of any annuity income we paid before we received the Contract. If your free look period ends on a non-business day, the next business day will be used. ONCE THE FREE LOOK PERIOD EXPIRES, YOU CANNOT RETURN THE CONTRACT FOR A REFUND.

INVESTMENT ALLOCATION OF YOUR PURCHASE PAYMENT

The portion of your Purchase Payment you allocate to the Subaccounts will be invested in the Money Market Investment Option for the Money Market Period. At the end of the Valuation Period in which the Money Market Period ends any amount then in the Money Market Investment Option (the "Free Look Units") will be exchanged for Annuity Income Units in the percentages you have chosen. You allocate percentages that are whole numbers, not fractions. Immediately following the reallocations, the total dollar value of the Annuity Income Units will be the same as the Free Look Units that were exchanged.

At least 10% of the variable portion of your Purchase Payment must be allocated to each Investment Option you select. If your instructions are incomplete (e.g. unclear or percentages do not equal 100%), your payments will be allocated to the VIP Money Market Portfolio until we receive your complete instructions. In these cases, we will not be responsible for the results of unit value changes or lost market opportunity.

TRADING AMONG VARIABLE SUBACCOUNTS

You may currently exchange amounts among Subaccounts as often as you wish without charge. However, excessive exchange activity can disrupt Portfolio management strategy and increase Portfolio expenses, which are borne by everyone participating in the Portfolio regardless of their exchange activity. Therefore, EFILI reserves the right to limit the number of exchanges permitted, but not to fewer than <R>twelve </R>per calendar year.

You tell us the percentage you want for your new allocation in each Subaccount. Your allocation percentages must be in whole numbers, not fractions. You may change the allocations among the Subaccounts by writing or telephoning the Annuity Service Center or on our Internet website.

EFILI reserves the right to change telephone or Internet exchange provisions, or to eliminate them, and to limit or reject any telephone or Internet exchange at any time. You may make up to a combined total of eighteen telephone/Internet exchanges per calendar year. All exchanges made on the same day count as one exchange. After this total is reached, you will only be permitted to complete exchanges in writing. Multiple exchanges among the Subaccounts in a single trading day count as one exchange. We will not accept exchange requests via fax or electronic mail.

We will not be responsible for any losses resulting from unauthorized telephone or Internet exchanges if we follow reasonable procedures designed to verify the identity of the caller or Internet user. We may record calls. You should verify the accuracy of your confirmation statements immediately after you receive them and notify the Annuity Service Center promptly of any discrepancies as we will not be responsible for resulting losses due to unit value changes after 10 calendar days from the mailing of the report.

EFIA

In some cases, we may sell Contracts to individuals who independently utilize the services of a firm or individual engaged in market timing. Generally, market timing services obtain authorization from Contract Owner(s) to make exchanges among the Subaccounts on the basis of perceived market trends. Because the large exchange of assets associated with market timing services may disrupt the management of the portfolios of the Funds, such transactions may become a detriment to Contract Owners not utilizing the market timing service.

The right to exchange Contract values among Subaccounts may be subject to modification if such rights are executed by a market timing firm or similar third party authorized to initiate exchange transactions on behalf of a Contract Owner(s). In modifying such rights, we may, among other things, decline to accept (1) the exchange instructions of any agent acting under a power of attorney on behalf of more than one Contract Owner, or (2) the exchange instructions of individual Contract Owners who have executed pre-authorized exchange forms which are submitted by market timing firms or other third parties on behalf of more than one Contract Owner at the same time. We will impose such restrictions only if we believe that doing so will prevent harm to other Contract Owners.

When you exchange among the Variable Subaccounts, we will redeem shares of the appropriate Portfolios at their prices as of the end of the current Valuation Period. Generally, any Subaccount you exchange to is credited at the same time.

However, we may wait to credit the amount to a new Subaccount until an Investment Option you exchange from becomes liquid. This will happen only if (1) the Subaccount you exchange to invests in a Portfolio that accrues dividends on a daily basis and requires Federal funds before accepting a purchase order, and (2) the Subaccount you exchange from is investing in an equity Portfolio in an illiquid position due to substantial redemptions or exchanges that require it to sell Portfolio securities in order to make funds available.

The Subaccount you exchange from will be liquid when it receives proceeds from sales of Portfolio securities, the purchase of new Contracts, or otherwise. During any period that we wait to credit a Subaccount for this reason, the amount you exchange will be uninvested. After seven days the exchange will be made even if the Investment Option you exchange from is not liquid.

The amount of the allocation in each Subaccount will change with its investment performance. You should periodically review the allocations in light of market conditions and financial objectives.

The following are all the charges we make under the Contract.

1. Premium Taxes. Some states charge a "premium tax" based on the amount of your Purchase Payment. State premium taxes range from 0% to 3.5%. In addition, some counties, cities or towns may charge additional premium taxes. If you reside in a place where premium taxes apply, any amount needed to provide for the applicable premium taxes is deducted from your Purchase Payment. We will allocate the remainder of your Purchase Payment to the Investment Options and/or apply it to the purchase of fixed annuity income.

2. Administrative Charges. Administrative charges compensate us for the expenses incurred in administering the Contracts. These expenses include the cost of issuing the Contract, making electronic funds transfers to your bank account or issuing checks, maintaining necessary systems and records, and providing reports. These expenses are covered by a daily administrative charge.

Each day, a deduction is made from the assets of the Investment Options at an effective annual rate of 0.25%. We guarantee this charge will never increase. This charge does not affect the amount of fixed annuity income.

3. Mortality and Expense Risk Charge. We deduct a daily asset charge for our assumption of mortality and expense risks. Each day we deduct an amount from the assets of each Investment Option at an effective annual rate of 0.75%.

The mortality risk is our obligation to provide annuity income for your life (and the life of the Joint Annuitant, if any) no matter how long that might be. The expense risk is our obligation to cover the cost of issuing and administering the Contracts, no matter how large that cost may be. EFILI will realize a gain from the charge for these risks to the extent that it is not needed to provide for benefits and expenses under the Contracts. This charge does not affect the amount of fixed annuity income.

EFIA

4. Expenses of the Funds. The Funds are charged management fees and incur operating expenses. The effect of these fees and expenses is reflected in the performance of the Investment Options. See the prospectuses for the Funds for a description of the Funds' fees and expenses.

5. Other Taxes. EFILI reserves the right to charge for certain taxes (other than premium taxes) that it may have to fund. Currently, no such charges are being made. See EFILI's Tax Status on page <Click Here>.

We calculate the amount of your annuity income on each Annuity Income Date. You select the first Annuity Income Date when you purchase the Contract. The first Annuity Income Date may be either the first or the fifteenth day of a month. All subsequent Annuity Income Dates will be on the same day of the month as the first Annuity Income Date. The first Annuity Income Date may be up to one year after the Contract Date. The first Annuity Income Date generally may not be earlier than 30 days after the Contract Date.

On the application, you choose the frequency of annuity income. You can choose monthly, quarterly, semi-annual, or annual annuity income.

If an Annuity Income Date falls on a day that is not the last day of a Valuation Period, the amount of annuity income will be determined based on the value of your selected Investment Options at the close of the Valuation Period. Annuity income will generally be sent at the end of the Valuation Period immediately following the day on which the amount is determined.

A signature guarantee is designed to protect you and Empire Fidelity Investments Life from fraud. Free look or disbursement requests, must include a signature guarantee if any of the following situations apply.

1. The requested amount is more than $100,000.

2. In any circumstances where we deem it necessary for your protection.

You should be able to obtain a signature guarantee from a bank, broker dealer (including Fidelity Investor Centers), credit union (if authorized under state law), securities exchange or association, clearing agency, or savings association. A notary public cannot provide a signature guarantee.

If no Annuitant or Joint Annuitant is alive on the first Annuity Income Date, the Contract will be canceled and we will make a refund equal to your Purchase Payment to your Beneficiary or Beneficiaries.

If your Contract is a joint and survivor annuity and either you or the Joint Annuitant die before the first Annuity Income Date we will adjust the annuity income so that it equals what would have been paid under a single life annuity issued to the survivor. This will usually result in greater annuity income.

FIXED, VARIABLE OR COMBINATION ANNUITY INCOME

At the time of purchase, you allocate your Purchase Payment between fixed and variable annuity income. You may choose all fixed annuity income, all variable annuity income, or a combination of the two.

If you choose all variable annuity income, all of your annuity income will vary according to the investment experience of the Investment Options. Variable annuity income may decrease upon the death of the Annuitant or Joint Annuitant, as described for Options 3 and 4 under Types of Annuity Income Options on page <Click Here>.

Any portion of your Purchase Payment allocated to variable annuity income will initially purchase Free Look Units. EFILI will determine the number of Free Look Units based upon (a) your age and sex (and the age and sex of the Joint Annuitant, if any); (b) the type of annuity income option you choose; (c) the frequency of Annuity Income Dates you choose; (d) the first Annuity Income Date you choose; (e) the Benchmark Rate of Return you choose; and (f) the value of the Free Look Units on the Contract Date. The value of the Free Look Units reflects the investment performance of the Money Market Investment Option.

EFIA

On the date the Money Market Period ends, EFILI will exchange Free Look Units for Annuity Income Units in the Investment Options you select. The total dollar value of the Annuity Income Units will be the same as the Free Look Units that were exchanged. The number of Annuity Income Units allocated to each Investment Option under a single life Contract will not change unless you reallocate among the Investment Options. If you choose a joint life Contract and benefits are reduced due to your death or the death of the Joint Annuitant, the number of Annuity Units will be reduced at that time.

EFILI calculates the amount of your variable annuity income based on the number of Annuity Income Units credited to each Investment Option. At the close of business on each Annuity Income Date (or on the next Valuation Date if the Annuity Income Date falls on a non-business day), the number of Annuity Income Units is multiplied by the value of the Annuity Income Units for each Investment Option. The amount of variable annuity income on the Annuity Income Date will be the sum of annuity income amounts for each Investment Option.

When you purchase a Contract, we calculate an estimated first annuity income amount, assuming that the Investment Options will earn the Benchmark Rate of Return you choose. If the annualized Total Return of the Investment Options is greater than the Benchmark Rate of Return between the Contract Date and the first Annuity Income Date, assuming you do not make any withdrawals, the first annuity income amount will be higher than the estimate. If it is less, the first annuity income amount will be lower than the estimate.

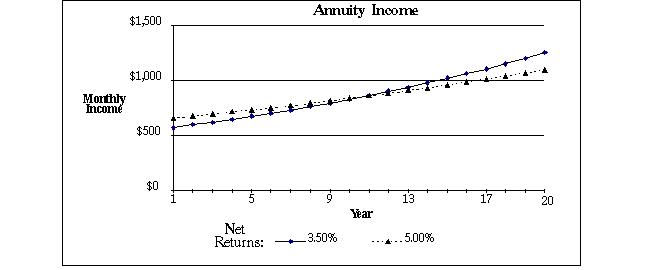

Assuming you do not make any withdrawals, income will increase from one Annuity Income Date to the next if the annualized Total Return during that time is greater than the Benchmark Rate of Return you choose, and will decrease if the annualized Total Return is less than the Benchmark Rate of Return. Choosing a 5.0% Benchmark Rate of Return instead of a 3.5% Benchmark Rate of Return will result in a higher initial amount of income, but income will increase more slowly during periods of good investment performance and decrease more rapidly during periods of poor investment performance.

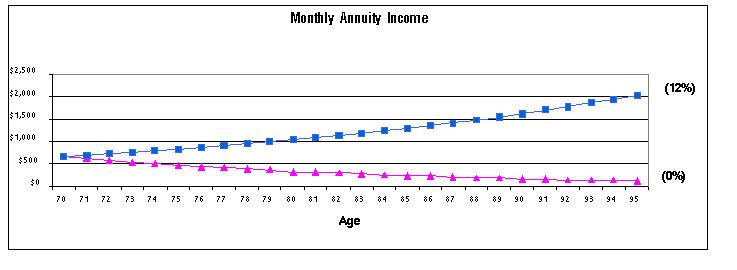

The following graph illustrates the effect that your choice of a Benchmark Rate of Return would have on your annuity income for a hypothetical Contract. The graph assumes the following: (a) a Purchase Payment of $100,000; (b) annuity income is entirely variable; (c) the Contract is a single life Contract providing annuity income for ten years or the rest of your life, whichever is longer; (d) you are a 65 year old male; and (e) the selected Portfolios earn a constant 10% gross investment return before fees and expenses (equal to a 7.90% annualized Total Return after fees and expenses). Monthly income amounts are shown for two Benchmark Rates of Return: 3.5% and 5.0% annually. Notice that with the lower Benchmark Rate of Return your monthly income starts at a lower level but increases more rapidly. With the higher Benchmark Rate of Return monthly income starts at a higher level but increases less rapidly.

EFIA

TYPES OF ANNUITY INCOME OPTIONS

At the time of purchase, you have a choice among a number of annuity income options. You also choose whether you want a minimum guaranteed number of years of annuity income. For any income option, you may choose to receive annuity income monthly, quarterly, semi-annually, or annually. Once you make these choices, they cannot be changed. The options EFILI currently offers are described below. Other annuity income options may be made available. The Federal income tax laws may limit your annuity income options where the Contract is used as a Qualified Contract.

1. Single Life Annuity. We will provide annuity income for your entire life, no matter how long that may be. Annuity income stops when you are no longer living. It is possible that your total annuity income under this option will be less than your Purchase Payment. It is even possible that you might receive annuity income only once under this option. This would happen if you were to die before the second Annuity Income Date. Because of this risk, this option offers you the highest level of annuity income. The Contract, like many annuities, pools the mortality experience of all Annuitants and Joint Annuitants. In effect, Annuitants and Joint Annuitants who live longer are subsidized by those who do not.

2. Joint and Survivor Annuity With Full Annuity Income to the Survivor. Under this option, we will provide annuity income jointly to you and the Joint Annuitant while you are both living, except that for a Qualified Contract during your lifetime we provide the income only to you. After the death of either of you, we will continue to provide the full amount of annuity income to the survivor. Annuity income stops when both you and the Joint Annuitant are no longer living. As in the case of the single life annuity described above, there is the risk that you may receive annuity income only once.

3. Joint and Survivor Annuity With Reduced Annuity Income to the Survivor. This option is like Option 2 above, except that annuity income is higher while both you and the Joint Annuitant are living, and lower when only one of you is still living. You indicate on your application whether annuity income to the survivor is reduced to two-thirds, or one-half, of the amount that it would have been were you both still alive.

4. Joint and Survivor Annuity With Full Annuity Income to the Annuitant if the Joint Annuitant Dies, But Reduced Annuity Income to the Joint Annuitant if the Annuitant Dies. This option is like Option 3 above, but annuity income is not reduced upon the death of the Joint Annuitant if the Joint Annuitant is the first to die. In case you are the first to die, you indicate on your application whether annuity income to the Joint Annuitant is reduced to two-thirds, or one-half, of the amount that it would have been were you both still alive. While you and the Joint Annuitant are both still alive, this option provides greater annuity income than Option 2 but not as much annuity income as Option 3.

For Options 2, 3, and 4, if either you or the Joint Annuitant die before the first Annuity Income Date, we will adjust the annuity income so that it equals what would have been paid under a single life annuity issued to the survivor. This will generally result in greater annuity income.

ANNUITY INCOME INCLUDING WITHDRAWAL OPTIONS

If you have a Qualified Contract, you may elect the following options only if a portion or all of your purchase payment is allocated to the variable account. Withdrawals are not available for any allocations to fixed income. The Withdrawal option feature may not be available in your state.

Single Life Annuity with Withdrawal Option. We will provide annuity income, beginning with the first Annuity Income Date, for as long as you live unless you surrender your Contract. If you die on or after the first Annuity Income Date and before the end of the Withdrawal Period, we will provide any remaining annuity income to the beneficiary(ies) according to the terms of the Contract.

Joint and Survivor with Full Annuity Income to the Survivor with Withdrawal Option. Assuming you do not surrender your Contract or make withdrawals, we will provide full annuity income, beginning with the first Annuity Income Date, while either you or the Joint Annuitant is still living.

If either you or the Joint Annuitant dies before the first Annuity Income Date, we will adjust the annuity income so that it equals what would have been paid under a single life annuity with a Withdrawal option. If the person who dies (you or the Joint Annuitant) is an Owner and the survivor is not the deceased Owner's spouse, we will adjust the Withdrawal Period, as required by law, so that it is not longer than the life expectancy of the survivor. This may result in a shorter Withdrawal Period and a higher amount of annuity income. For any allocations to fixed income, similar adjustments will be made to the Guarantee Period, if any.

If you and the Joint Annuitant both die on or after the first Annuity Income Date and before the end of the Withdrawal Period, we will provide any remaining annuity income or Withdrawal Value to the Beneficiary(ies) according to the terms of the Contract.

On your application, you may choose a guaranteed number of years of annuity income beginning with the first Annuity Income Date. You may choose a number of years from five (5) to forty-five (45). You may choose a Guarantee Period for annuity income options 1 through 4. If you choose an income option with a Withdrawal Option, you cannot also choose a guarantee period. If neither you nor the Joint Annuitant lives to the end of the guarantee period, any remaining annuity income will go to your Beneficiary or Beneficiaries. For Options 3 and 4 above, if you and the Joint Annuitant die at the same time, the annuity income due to any Beneficiary will be the same as if you died before the Joint Annuitant. If you choose to have a guarantee period, the amount of annuity income on each Annuity Income Date will be lower than if you had not chosen the guarantee.

EFIA

If (a) you choose Option 2, 3 or 4 with a guarantee period, (b) an Owner dies before the first Annuity Income Date, and (c) the survivor (whether it is you or the Joint Annuitant) is not the deceased Owner's spouse, we will adjust the guarantee period, as required by the federal income tax laws, so that it is not longer than the life expectancy of the survivor. This may result in a shorter guarantee period and a generally higher amount of annuity income.

Any lump sum attributable to the fixed annuity portion of a Contract will generally be the present value of the annuity income for the remaining guaranteed Annuity Income Dates, discounted at a rate equal to the rate used to determine annuity income payments.

Any lump sum attributable to the variable annuity income portion of a Contract will generally be the present value of the annuity income for the remaining guaranteed Annuity Income Dates, based on interest compounded annually at the Benchmark Rate of Return that EFILI used in determining the annuity income on the first Annuity Income Date.

If EFILI believes that the first annuity income amount due to any Beneficiary will be less than $50, EFILI may instead provide a lump sum for the value of all remaining annuity income. The amount of the lump sum will be determined on the same basis as described above for other lump sums.

If you have purchased a Qualified Contract with a withdrawal option, you can withdraw amounts from the variable portion of your Contract by writing to our Annuity Service Center. See How to Make Withdrawals below.

You can not purchase a Qualified Contract with a withdrawal option if your Contract provides only fixed annuity income. Also, you can not elect a withdrawal option if you purchase a Non-qualified Contract.

The amount you can withdraw will depend on when you make the withdrawal, how much of your Purchase Payment you allocated to variable annuity income and the investment experience of your Contract. See Withdrawal Value below.

The length of time you can make withdrawals is called the Withdrawal Period or Liquidity Period. See Withdrawal (Liquidity) Period below.

Certain withdrawals will have the effect of ending your Contract, i.e. you will receive no more annuity income. Other withdrawals may shorten the Withdrawal Period. All withdrawals will reduce the amount of variable annuity income. See Effect of Withdrawals below.

All requests for withdrawals must be in writing to our Annuity Service Center. You may request to withdraw all of the Withdrawal Value (full withdrawal) or a portion of the Withdrawal Value (partial withdrawal). You may not make more than two partial withdrawals each calendar year. Any partial withdrawal must be for at least $500. You may not make any partial withdrawal that would reduce your variable annuity income below $1,200 per year at the time of the withdrawal.

The Withdrawal Value changes each Valuation Period. What follows is an overview of how we determine the Withdrawal Value for each Valuation Period. For a complete description of how the Withdrawal Value is calculated, see Withdrawal Value in the Statement of Additional Information.

EFIA

The Withdrawal Value for a Valuation Period is the sum of two amounts, which we call Part A and Part B. On the day we issue your contract, the total of Part A and Part B equals your Purchase Payment less any federal, state or local taxes we deducted from your Purchase Payment. The amount you can withdraw from your Contract decreases over time, eventually becoming zero.

Part A is based on the portion of your Purchase Payment that provides variable annuity income during the Withdrawal Period. Part B is based on the portion of your Purchase Payment that provides variable annuity income after the Withdrawal Period.

Part A changes (up or down) each Valuation Period based on the investment experience of your Contract. Also, each withdrawal and each annuity income payment reduces the value of Part A. Part A becomes zero at the end of the Withdrawal Period and remains zero thereafter.

Part B also changes (up or down) each Valuation Period based on the investment experience of your Contract. Withdrawals (but not annuity income payments) also reduce the value of Part B. Beginning one year after your first Annuity Income Date, Part B reflects a percentage which declines each day. The percentage declines at a rate of 25% per year, so five years after your first Annuity Income Date Part B becomes zero and remains zero thereafter.

The reductions in the values of Part A and Part B resulting from a withdrawal are in proportion to their values just before the withdrawal.

Withdrawal (Liquidity) Period

When you purchase your Contract we set the Withdrawal Period to be equal to the life expectancy of the Annuitant or Annuitants. Life expectancy is determined in accordance with requirements published by the Internal Revenue Service. It is always expressed in whole numbers.

If no withdrawals are made from your Contract, then you or your beneficiaries will receive variable annuity income for the entire length of the Withdrawal Period. In this respect the Withdrawal Period works like a Guarantee Period, i.e. variable annuity income would be guaranteed to last for (1) the life or lives of the Annuitant(s) or (2) the Withdrawal Period, whichever is longer. However, if you make withdrawals, the Withdrawal Period may shorten or disappear, as described below.

If all the Annuitants die before the end of the Withdrawal Period, each Beneficiary may choose (a) to continue receiving annuity income on each remaining Annuity Income Date, or (b) to receive a lump sum instead. The Beneficiary must notify us within 60 days of the date we receive notice of the relevant death to elect a lump sum. Otherwise, the Beneficiary will receive annuity income for the remaining Annuity Income Dates in the Withdrawal Period.

Comparing Withdrawal Period to Guarantee Period

You may compare a Contract with a Withdrawal Period to one that provides a Guarantee Period.

Under a Contract with a Withdrawal Period, variable annuity income is guaranteed to last for (1) the life or lives of the Annuitant(s) or (2) the Withdrawal Period, whichever is longer.

Under a Contract with a Guarantee Period, all annuity income (fixed and variable) is guaranteed to last for (1) the life or lives of the Annuitant(s) or (2) the Guarantee Period, whichever is longer.

Under a Contract with a Withdrawal Period, a withdrawal may cause the Withdrawal Period to shorten or disappear.

Under a Contract with a Guarantee Period, withdrawals are not possible, and the date on which the Guarantee Period will end will not change after the Contract is issued.

Withdrawals made within five years of the first annuity income date will have different consequences from withdrawals made after the first five years. Full withdrawals will have different consequences from partial withdrawals.

YOU SHOULD THINK MORE CAREFULLY ABOUT MAKING A WITHDRAWAL THE CLOSER YOU ARE TO THE FIFTH ANNIVERSARY OF YOUR FIRST ANNUITY INCOME DATE. IN MANY CIRCUMSTANCES YOU WILL BE BETTER OFF WAITING UNTIL AFTER THAT DATE TO MAKE A WITHDRAWAL. For example, if you buy a Contract that provides only variable income, withdrawals made after the end of the fifth year of annuity income would reduce your annuity income but would not cause your annuity income to end. In the same Contract, making a full withdrawal before the end of the fifth year would result in the loss of all future annuity income and your Contract would end. See the descriptions below to understand how withdrawals made during your first five years of annuity income may have different effects from withdrawals made later.

EFIA

If all of your Purchase Payment is allocated to variable annuity income and you withdraw all of the Withdrawal Value on or before the fifth anniversary of your Contract's first Annuity Income Date, your Contract will end and you will not receive any more annuity income.

If your Purchase Payment is allocated part to variable annuity income and part to fixed annuity income, and you withdraw all of the Withdrawal Value on or before the fifth anniversary of your Contract's first Annuity Income Date, you will not receive any more variable annuity income. Fixed annuity income will continue in accordance with the income option you selected.

If you withdraw part of the Withdrawal Value on or before the fifth anniversary of your Contract's first Annuity Income Date, then the amount withdrawn will be subtracted from the Withdrawal Value and all remaining variable annuity income will be reduced, in the same ratio that the amount withdrawn bears to the Withdrawal Value. A partial withdrawal during the first five years will have no impact on the length of the remainder of the Withdrawal Period.

If all of your Purchase Payment is allocated to variable annuity income and you withdraw all of the Withdrawal Value after the fifth anniversary of your Contract's first Annuity Income Date, you will no longer have a Withdrawal Value, the Withdrawal Period will end, and all remaining variable annuity income will be reduced.

If you withdraw part of the Withdrawal Value after the fifth anniversary of your Contract's first Annuity Income Date, the amount withdrawn will be subtracted from the Withdrawal Value, all remaining variable annuity income will be reduced, and the Withdrawal Period will be reduced.