|

|

|

|

|

Previous: SCI CAPITAL MANAGEMENT INC, 13F-HR, 2000-10-17 |

Next: STRUCTURED ASSET MORTGAGE INVESTMENTS INC, 8-K, 2000-10-17 |

Fidelity ®

Daily Income

Trust

Annual Report

August 31, 2000

(Fidelity Investment logo)(registered trademark)

Contents

|

President's Message |

Ned Johnson on investing strategies. |

|

|

Performance |

How the fund has done over time. |

|

|

Fund Talk |

The manager's review of fund performance, strategy and outlook. |

|

|

Investment Changes |

A summary of major shifts in the fund's investments over the past six months and one year. |

|

|

Investments |

A complete list of the fund's investments. |

|

|

Financial Statements |

Statements of assets and liabilities,

operations, and changes in net assets, |

|

|

Notes |

Notes to the financial statements. |

|

|

Report of Independent Accountants |

The auditors' opinion. |

|

|

|

|

|

Third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general

information of the shareholders of the fund. This report is not authorized for distribution to

prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed

by, any depository institution. Shares are not insured by the FDIC,

the Federal Reserve Board, or any other agency, and are subject to

investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Annual Report

(photo_of_Edward_C_Johnson_3d)

(Photograph of Edward C. Johnson 3d.)

Dear Shareholder:

A slowing U.S. economy triggered an equity market rally during the later stages of summer, boosting most major stock indexes back into positive territory for calendar year 2000. One notable exception, however, was the Dow Jones Industrial Average, which posted a negative return during that timeframe. Fixed-income markets - particularly Treasuries - continued their yearlong trend of strong performance, as nearly every bond sector outperformed the stock market on a year-to-date basis.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

First, investors are encouraged to take a long-term view of their portfolios. If you can afford to leave your money invested through the inevitable up and down cycles of the financial markets, you will greatly reduce your vulnerability to any single decline. We know from experience, for example, that stock prices have gone up over longer periods of time, have significantly outperformed other types of investments and have stayed ahead of inflation.

Second, you can further manage your investing risk through diversification. A stock mutual fund, for instance, is already diversified, because it invests in many different companies. You can increase your diversification further by investing in a number of different stock funds, or in such other investment categories as bonds. You should also keep money you'll need in the near future in a more stable investment.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

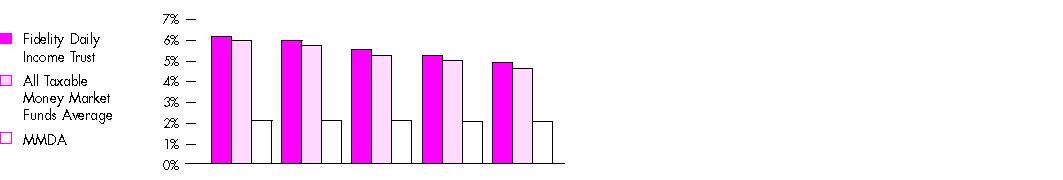

To evaluate a money market fund's historical performance, you can look at either total return or yield. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income. Yield measures the income paid by a fund. Since a money market fund tries to maintain a $1 share price, yield is an important measure of performance.

Cumulative Total Returns

|

Periods ended August 31, 2000 |

|

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Daily Income Trust |

|

5.76% |

29.26% |

60.95% |

|

All Taxable Money Market Funds Average |

|

5.49% |

28.18% |

58.58% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, one year, five years or 10 years. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. To measure how the fund's performance stacked up against its peers, you can compare it to the all taxable money market funds average, which reflects the performance of taxable money market funds with similar objectives tracked by iMoneyNet, Inc. The past one year average represents a peer group of 974 money market funds.

Average Annual Total Returns

|

Periods ended August 31, 2000 |

|

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Daily Income Trust |

|

5.76% |

5.27% |

4.87% |

|

All Taxable Money Market Funds Average |

|

5.49% |

5.08% |

4.71% |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year.

Annual Report

Performance - continued

Yields

|

|

8/29/00 |

5/30/00 |

2/29/00 |

11/30/99 |

8/31/99 |

|

|

|||||

|

|

6.20% |

6.01% |

5.56% |

5.29% |

4.95% |

|

|

|||||

|

All Taxable Money |

6.00% |

5.76% |

5.27% |

5.03% |

4.64% |

|

|

|||||

|

|

8/30/00 |

5/31/00 |

3/1/00 |

12/1/99 |

9/1/99 |

|

|

|||||

|

|

2.12% |

2.10% |

2.09% |

2.07% |

2.06% |

|

|

|||||

Yield refers to the income paid by the fund over a given period. Yields for money market funds are usually for seven-day periods, expressed as annual percentage rates. A yield that assumes income earned is reinvested or compounded is called an effective yield. The table above shows the fund's current seven-day yield at quarterly intervals over the past year. You can compare these yields to the all taxable money market funds average and the bank money market deposit account (MMDA) average. Figures for the all taxable money market funds average are from iMoneyNet, Inc. The MMDA average is supplied by BANK RATE MONITOR.(TM)

A money market fund's total returns and yields will vary, and reflect past results rather than predict future performance.

Comparing

Performance

There are some important differences between a bank money market deposit account (MMDA) and a money market fund. First, the U.S. government neither insures nor guarantees a money market fund. In fact, there is no assurance that a money market fund will maintain a $1 share price. Second, a money market fund returns to its shareholders income earned by the fund's investments after expenses. This is in contrast to banks, which set their MMDA rates periodically based on current interest rates, competitors' rates, and internal criteria.

3

Annual Report

Fund Talk: The Manager's Overview

(Portfolio Manager photograph)

An interview with Robert Duby, Portfolio Manager of Fidelity Daily Income Trust

Q. Bob, what was the investment environment like during the 12 months that ended August 31, 2000?

A. The U.S. economy posted very strong performance, as unemployment reached its lowest rate in 30 years and real GDP - gross domestic product adjusted for inflation - enjoyed robust gains. This growth was fueled by high levels of personal consumption and business investment. Commodity prices rose due to improving global economic conditions and strong demand on the domestic front. This development led to the expectation among market participants that the Federal Reserve Board would hike short-term interest rates in order to slow growth and head off inflation. Because of increasing energy prices we did see consumer and producer prices rise during the period, despite significant improvements in productivity.

Q. What was the Fed's reaction to these developments?

A. It implemented a program of interest-rate hikes, because of strong real GDP growth and concerns about the impact of wage pressures within firm labor markets. Starting in June 1999, the Fed raised the rate banks charge each other for overnight loans - known as the fed funds target rate - six times altogether. Four of these rate hikes occurred during the one-year period that ended August 31, 2000. Three of them - in November 1999, February 2000 and March 2000 - came in increments of 0.25 percentage points. The last, in May 2000, was an increase of 0.50 percentage points, the first increase of such magnitude in more than five years. The Fed chose to strike at growth more forcefully at that time because of continued solid GDP growth, an increase in the core rate of inflation, a decline in the unemployment rate and a larger-than-expected increase in average hourly earnings. Since May, however, continued emerging evidence of an economic slowdown has prompted the Fed to keep key short-term interest rates unchanged.

Q. What was your strategy as all of this unfolded?

A. My strategy shifted periodically during the 12 months, as I sought to capitalize on Fed rate hikes while maintaining adequate portfolio liquidity to accommodate cash outflows. I lengthened the fund's average maturity early in the period through purchases of securities with maturities of six months or longer. These longer-term securities offered attractive risk/reward tradeoffs. But expectations for further Fed rate hikes pervaded the market in the fourth quarter of 1999 as 2000 approached. Accordingly, I positioned the fund defensively by shortening its average maturity. Through the rest of the period, I shortened the fund's average maturity at times when the market priced in overly optimistic expectations for changes in Fed monetary policy. Conversely, I lengthened the fund's average maturity when the market priced in overly aggressive expectations of Fed rate hikes.

Annual Report

Fund Talk: The Manager's Overview - continued

Q. How did the fund perform?

A. The fund's seven-day yield on August 31, 2000, was 6.21%, compared to 4.95% 12 months ago. For the 12 months that ended August 31, 2000, the fund had a total return of 5.76%, compared to 5.49% for the all taxable money market funds average, according to iMoneyNet, Inc.

Q. What is your outlook?

A. Economic data continue to suggest that the Fed's monetary policy has begun to soften economic activity. Slower retail and home sales demonstrate that the Fed rate hikes appear to have tempered consumer spending. In turn, manufacturing activity has declined, coming off of record levels. It's still unclear as to whether the economy is taking a breather or if the Fed has successfully implemented a "soft landing" - slowing economic growth enough to keep inflation at bay, but not so much as to plunge the economy into a recession. Money market prices currently reflect that the Fed has finished its rate-hike program. In any event, it appears the Fed will remain on hold until after the November elections, unless there is some dramatic pick-up in inflation.

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fund Facts

Goal: to provide current

income while maintaining

a stable $1 share price by

investing in high-quality,

short-term money market

securities

Fund number: 031

Trading symbol: FDTXX

Start date: May 31, 1974

Size: as of August 31, 2000,

more than $3.0 billion

Manager: Robert Duby, since

1998; manager, several

taxable money market funds;

joined Fidelity in 1982

Annual Report

Investment Changes

Maturity Diversification

Days

% of fund's

investments % of fund's

investments

2/29/00

% of fund's

investments

8/31/99

0 - 30

64.0

55.4

58.7

31 - 90

28.8

30.1

19.1

91 - 180

3.2

14.0

16.6

181 - 397

4.0

0.5

5.6

Weighted Average Maturity

8/31/00

2/29/00

8/31/99

Fidelity Daily Income Trust

42 Days

46 Days

56 Days

All Taxable Money Market 51 Days

49 Days

56 Days

Asset Allocation (% of fund's net assets)

As of August 31, 2000

As of February 29, 2000

Commercial Paper 61.2%

Commercial Paper 58.3%

Bank CDs, BAs,

Bank CDs, BAs,

Government

Government

Other Investments

Other Investments

Annual Report

Investments August 31, 2000

Showing Percentage of Net Assets

Certificates of Deposit - 10.9%

Due Date

Annualized Yield at

Time of Purchase

Principal Amount

(000s)

Value (Note 1)

(000s)

Domestic Certificates Of Deposit - 10.9%

American Express Centurion Bank

9/11/00

6.53%

$ 25,000

$ 25,000

9/28/00

6.54

25,000

25,000

Chase Manhattan Bank USA NA

9/5/00

6.70

25,000

25,000

Citibank NA, New York

11/3/00

6.78

48,000

48,000

11/15/00

7.02

35,000

35,000

First Tennessee Bank NA, Memphis

9/25/00

6.53

65,000

65,000

First Union National Bank, North Carolina

4/30/01

7.00

45,000

45,000

5/15/01

7.35

50,000

50,000

U.S. Bank NA, Minnesota

9/1/00

6.72 (b)

10,000

10,000

TOTAL CERTIFICATES OF DEPOSIT

328,000

Commercial Paper - 61.2%

Asset Securitization Coop. Corp.

9/25/00

6.56 (b)

25,000

24,999

AT&T Corp.

9/5/00

6.56

20,000

19,986

9/19/00

6.65 (b)

15,000

15,000

Bank of America Corp.

9/11/00

6.30

25,000

24,958

Centric Capital Corp.

9/11/00

6.72

20,000

19,963

CIESCO LP

11/8/00

6.57

50,000

49,388

Citibank Credit Card Master Trust I (Dakota Certificate Program)

9/13/00

6.55

55,445

55,325

11/9/00

6.64

15,000

14,812

ConAgra, Inc.

9/15/00

6.69

5,000

4,987

9/25/00

6.73

19,000

18,915

Conoco, Inc.

9/29/00

6.69

25,000

24,871

Commercial Paper - continued

Due Date

Annualized Yield at

Time of Purchase

Principal Amount

(000s)

Value (Note 1)

(000s)

Corporate Receivables Corp.

9/20/00

6.56%

$ 10,000

$ 9,966

10/2/00

6.58

20,000

19,888

10/13/00

6.57

15,000

14,886

10/25/00

6.58

35,000

34,659

11/16/00

6.60

20,000

19,726

CXC, Inc.

9/25/00

6.56

15,000

14,935

11/8/00

6.62

10,000

9,877

11/21/00

6.61

50,000

49,269

Delaware Funding Corp.

9/11/00

6.57

10,000

9,982

9/13/00

6.58

20,452

20,408

9/25/00

6.54

26,215

26,101

10/24/00

6.58

35,000

34,665

11/22/00

6.61

25,587

25,208

Dominion Resources, Inc.

9/12/00

6.73

5,000

4,990

9/21/00

6.75

25,000

24,907

Edison Asset Securitization LLC

9/25/00

6.55

100,000

99,567

10/10/00

6.60

9,815

9,746

10/27/00

6.58

25,000

24,747

Enterprise Funding Corp.

10/26/00

6.58

15,850

15,693

Falcon Asset Securitization Corp.

9/19/00

6.54

26,295

26,209

9/20/00

6.55

87,525

87,224

9/26/00

6.56

25,449

25,334

GE Capital International Funding, Inc.

9/13/00

6.34

50,000

49,898

General Electric Capital Corp.

9/5/00

6.54

47,500

47,466

9/5/00

6.77

50,000

49,963

General Electric Capital Services, Inc.

11/6/00

6.59

45,000

44,465

11/20/00

7.00

25,000

24,625

11/21/00

7.00

25,000

24,620

2/7/01

6.72

30,000

29,136

General Motors Acceptance Corp.

9/21/00

6.53

50,000

49,820

9/25/00

6.53

25,000

24,892

Commercial Paper - continued

Due Date

Annualized Yield at

Time of Purchase

Principal Amount

(000s)

Value (Note 1)

(000s)

Household Finance Corp.

9/12/00

6.55%

$ 25,000

$ 24,950

Kitty Hawk Funding Corp.

9/20/00

6.40

10,000

9,967

9/20/00

6.41

5,882

5,863

10/12/00

6.59

20,238

20,088

Lehman Brothers Holdings, Inc.

9/11/00

6.72 (b)

18,000

18,000

9/20/00

6.72 (b)

4,000

4,000

Marsh USA, Inc.

9/19/00

6.50

30,000

29,906

National Rural Utility Coop. Finance Corp.

9/13/00

6.30

25,000

24,949

New Center Asset Trust

9/21/00

6.55

20,000

19,928

Park Avenue Receivables Corp.

9/15/00

6.55

34,692

34,604

Phillips Petroleum Co.

9/29/00

6.75

15,000

14,922

Preferred Receivables Funding Corp.

9/15/00

6.58

30,000

29,924

9/25/00

6.54

45,414

45,217

10/23/00

6.58

17,135

16,974

11/15/00

6.64

11,400

11,245

Salomon Smith Barney Holdings, Inc.

10/12/00

6.59

10,000

9,926

Southern Co.

9/26/00

6.61

5,000

4,977

Three Rivers Funding Corp.

9/5/00

6.57

20,230

20,215

Triple-A One Funding Corp.

9/12/00

6.54

25,000

24,950

9/20/00

6.55

100,000

99,654

Variable Funding Capital Corp.

9/21/00

6.75

25,000

24,908

11/22/00

6.62

30,000

29,555

Ventures Business Trust

9/6/00

6.56

25,000

24,977

9/25/00

6.55

40,000

39,826

Commercial Paper - continued

Due Date

Annualized Yield at

Time of Purchase

Principal Amount

(000s)

Value (Note 1)

(000s)

WorldCom, Inc.

9/5/00

6.69%

$ 10,000

$ 9,993

9/15/00

6.68

15,000

14,961

TOTAL COMMERCIAL PAPER

1,840,555

Bank Notes - 11.8%

American Express Centurion Bank

9/1/00

6.68 (b)

25,000

25,000

9/23/00

6.59 (b)

40,000

40,000

Bank of America NA

11/2/00

6.63

35,000

35,000

2/20/01

6.72

50,000

50,000

5/4/01

7.20

25,000

25,000

Bank One NA

10/16/00

6.75

25,000

25,000

Bank One NA, Chicago

10/23/00

6.70 (b)

15,000

14,998

First Union National Bank, North Carolina

10/4/00

6.86 (b)

25,000

25,000

Lasalle Bank NA

9/11/00

6.70

25,000

25,000

10/16/00

6.56

40,000

40,000

11/20/00

7.01

50,000

50,000

TOTAL BANK NOTES

354,998

Master Notes - 1.5%

Goldman Sachs Group, Inc.

10/19/00

6.65 (c)

25,000

25,000

J.P. Morgan Securities, Inc.

9/7/00

6.61 (b)

20,000

20,000

TOTAL MASTER NOTES

45,000

Medium-Term Notes - 3.2%

Due Date

Annualized Yield at

Time of Purchase

Principal Amount

(000s)

Value (Note 1)

(000s)

Centex Home Mortgage LLC

9/20/00

6.76% (a)(b)

$ 15,000

$ 15,000

CIT Group, Inc.

9/1/00

6.61 (b)

15,000

14,993

General Motors Acceptance Corp.

9/28/00

6.56 (b)

15,000

14,996

General Motors Acceptance Corp. Mortgage Credit

9/1/00

6.69

25,000

25,000

Merrill Lynch & Co., Inc.

9/5/00

6.59 (b)

25,000

24,999

TOTAL MEDIUM-TERM NOTES

94,988

Short-Term Notes - 5.3%

GE Life & Annuity Assurance Co.

9/1/00

6.72 (b)(c)

25,000

25,000

Monumental Life Insurance Co.

9/1/00

6.76 (b)(c)

14,000

14,000

11/1/00

6.91 (b)(c)

15,000

15,000

New York Life Insurance Co.

10/1/00

6.90 (b)(c)

7,000

7,000

12/1/00

6.81 (b)(c)

16,000

16,000

Pacific Life Insurance Co.

9/8/00

6.89 (b)(c)

10,000

10,000

Strategic Money Market Trust Series 1999 A6,

9/13/00

6.78 (a)(b)

26,000

26,000

Strategic Money Market Trust Series 2000 B,

9/13/00

6.81 (a)(b)

10,000

10,000

Travelers Insurance Co.

10/2/00

6.88 (b)(c)

35,000

35,000

TOTAL SHORT-TERM NOTES

158,000

Repurchase Agreements - 5.2%

Maturity

Amount (000s)

Value (Note 1)

(000s)

In a joint trading account (U.S. Government Obligations) dated 8/31/00 due 9/1/00 At 6.67%

$ 603

$ 603

With:

Morgan Stanley & Co. At 6.75%, dated 8/31/00 due 9/1/00 (Commercial Paper Obligations) (principal amount $45,253,000) 0%, 9/13/00 -

11/22/00

44,008

44,000

Salomon Smith Barney At 6.76%, dated 8/31/00 due 9/1/00 (Commercial Paper Obligations) (principal amount $116,105,000) 0% - 6.74%,

9/18/00 - 11/29/00

113,021

113,000

TOTAL REPURCHASE AGREEMENTS

157,603

TOTAL INVESTMENT PORTFOLIO - 99.1%

2,979,144

NET OTHER ASSETS - 0.9%

27,265

NET ASSETS - 100%

$ 3,006,409

Total Cost for Income Tax Purposes $ 2,979,144

Legend

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified

institutional buyers. At the period end, the value of these securities amounted to $51,000,000 or 1.7% of net assets.

(b) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. The due dates on these types of securities reflects the next interest rate reset date

or, when applicable, the final maturity date.

(c) Restricted securities - Investment in securities not registered under the Securities Act of 1933.

Additional information on each holding is as follows:

Security

Acquisition Date

Cost GE Life & Annuity Assurance Co. 6.72%, 9/1/00

4/8/00

$ 25,000

Goldman Sachs Group, Inc. 6.65%, 10/19/00

8/16/00

$ 25,000

Monumental Life Insurance Co.: 6.76%, 9/1/00

7/31/98 - 9/17/98

$ 14,000

6.91%, 11/1/00

2/1/00

$ 15,000

New York Life Insurance Co.: 6.81%, 12/1/00

8/28/00

$ 16,000

6.90%, 10/1/00

12/20/99

$ 7,000

Pacific Life Insurance Co. 6.89%, 9/8/00

8/31/99

$ 10,000

Travelers 3/30/00

$ 35,000

Income Tax Information

At August 31, 2000, the fund had a capital loss carryforward of approximately $1,128,000 of which $336,000, $536,000, $19,000, $99,000, $109,000, $15,000 and $14,000

will expire on August 31, 2001, 2002, 2003, 2004, 2006, 2007 and 2008, respectively.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

Amounts in thousands (except per share amount)

August 31, 2000

Assets

Investment in securities, at value (including repurchase agreements of $157,603) -

$ 2,979,144

Receivable for fund shares sold

55,940

Interest receivable

10,231

Other receivables

3

Prepaid expenses

37

Total assets

3,045,355

Liabilities

Payable to custodian bank

$ 12

Payable for fund shares redeemed

37,122

Distributions payable

495

Accrued management fee

920

Other payables and accrued expenses

397

Total liabilities

38,946

Net Assets

$ 3,006,409

Net Assets consist of:

Paid in capital

$ 3,007,537

Accumulated net realized gain (loss) on investments

(1,128)

Net Assets, for 3,006,910 shares outstanding

$ 3,006,409

Net Asset Value, offering price and redemption price

$1.00

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

Amounts in thousands

Year ended August 31, 2000

Interest Income

$ 178,243

Expenses

Management fee

$ 9,952

Transfer agent fees

3,808

Accounting fees and expenses

261

Non-interested trustees' compensation

11

Custodian fees and expenses

50

Registration fees

239

Audit

33

Legal

13

Miscellaneous

117

Total expenses before reductions

14,484

Expense reductions

(65)

14,419

Net interest income

163,824

Net Realized Gain (Loss) on Investments

7

Net increase in net assets resulting from operations

$ 163,831

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Changes in Net Assets

Amounts in thousands

Year ended Year ended Increase (Decrease) in Net Assets

Operations $ 163,824

$ 129,487

Net realized gain (loss)

7

(25)

Net increase (decrease) in net assets resulting 163,831

129,462

Distributions to shareholders from net interest income

(163,824)

(129,487)

Share transactions at net asset value of $1.00 per share 15,456,165

12,419,943

Reinvestment of distributions from net interest income

159,219

126,012

Cost of shares redeemed

(15,367,304)

(12,412,784)

Net increase (decrease) in net assets and shares resulting from share transactions

248,080

133,171

Total increase (decrease) in net assets

248,087

133,146

Net Assets

Beginning of period

2,758,322

2,625,176

End of period

$ 3,006,409

$ 2,758,322

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

Years ended August 31,

2000

1999

1998

1997

1996

Selected Per-Share Data

Net asset value, $ 1.000

$ 1.000

$ 1.000

$ 1.000

$ 1.000

Income from Investment Operations .056

.047

.052

.051

.051

Less Distributions

From net interest income

(.056)

(.047)

(.052)

(.051)

(.051)

Net asset value, end of period

$ 1.000

$ 1.000

$ 1.000

$ 1.000

$ 1.000

Total Return A

5.76%

4.84%

5.31%

5.18%

5.25%

Ratios and Supplemental Data

Net assets, end of period $ 3,006

$ 2,758

$ 2,625

$ 2,425

$ 2,317

Ratio of expenses to average .50%

.48%

.50%

.50%

.50%

Ratio of expenses to average net assets after expense reductions

.50%

.48%

.50%

.49% B

.50%

Ratio of net interest income to average net assets

5.62%

4.74%

5.19%

5.07%

5.11%

A The total returns would have been lower had certain expenses not been reduced during the periods shown.

B FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements For the period ended August 31, 2000

1. Significant Accounting Policies.

Fidelity Daily Income Trust (the fund) is a fund of Fidelity Union Street Trust II (the trust) and is authorized to issue an unlimited number of shares. The trust is

registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware

business trust. The financial statements have been prepared in conformity with generally accepted accounting principles which require management to make certain

estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. As permitted under Rule 2a-7 of the 1940 Act, and certain conditions therein, securities are valued initially at cost and thereafter assume a

constant amortization to maturity of any discount or premium.

Income Taxes. As a qualified regulated investment company under Subchapter M of the Internal Revenue Code, the fund is not subject to income taxes to the extent

that it distributes substantially all of its taxable income for its fiscal year. The schedule of investments includes information regarding income taxes under the caption

"Income Tax Information."

Interest Income. Interest income, which includes amortization of premium and accretion of discount, is accrued as earned.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among the funds in the trust.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan) non-interested Trustees must defer receipt of a portion of, and may elect to

defer receipt of an additional portion of, their annual compensation. Deferred amounts are treated as though equivalent dollar amounts had been invested in shares of

the fund or are invested in a cross-section of other Fidelity money market funds. Deferred amounts remain in the fund until distributed in accordance with the Plan.

Distributions to Shareholders. Dividends are declared daily and paid monthly from net interest income.

Security Transactions. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost.

2. Operating Policies.

Joint Trading Account. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission (the SEC), the fund, along with other affiliated entities

of Fidelity Management & Research Company (FMR), may transfer uninvested cash balances into one or more joint trading accounts. These balances are invested in one

or more repurchase agreements for U.S. Treasury or Federal Agency obligations.

Repurchase Agreements. The underlying U.S. Treasury, Federal Agency, or other obligations found to be satisfactory

Annual Report

Notes to Financial Statements - continued

2. Operating Policies - Repurchase Agreements - continued

by FMR are transferred to an account of the fund, or to the Joint Trading Account, at a custodian bank. The securities are marked-to-market daily and maintained at a

value at least equal to the principal amount of the repurchase agreement (including accrued interest). FMR, the fund's investment adviser, is responsible for

determining that the value of the underlying securities remains in accordance with the market value requirements stated above.

Interfund Lending Program. Pursuant to an Exemptive Order issued by the SEC, the fund, along with other registered investment companies having management

contracts with FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the fund to borrow from, or lend

money to, other participating funds.

When-Issued Securities. The fund may purchase or sell securities on a when-issued basis. Payment and delivery may take place after the customary settlement

period for that security. The price of the underlying securities is fixed at the time the transaction is negotiated. The fund may receive compensation for interest forgone

in the purchase of a when-issued security. With respect to purchase commitments, the fund identifies securities as segregated in its records with a value at least equal

to the amount of the commitment. Losses may arise due to changes in the value of the underlying securities, if the counterparty does not perform under the contract, or

if the issuer does not issue the securities due to political, economic, or other factors.

Restricted Securities. The fund is permitted to invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be

resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations

and expense, and prompt sale at an acceptable price may be difficult. At the end of the period, restricted securities (excluding 144A issues) amounted to $147,000,000 or

4.9% of net assets.

3. Fees and Other Transactions with Affiliates.

Management Fee. As the fund's investment adviser, FMR receives a monthly fee computed daily and paid monthly, based on the fund's average net assets and gross

income earned each month. The portion of the fee based on average net assets is graduated ranging from an annual rate of .10% of average net assets up to $2 billion

to an annual rate of .05% of average net assets in excess of $6 billion. The portion of the fee based on gross income is equal to 4% of the gross income earned by the

fund each month (exclusive of gains realized from the sales of investments) provided the amount of such fee, at a minimum, amounts to an annual rate of .20% and,

at a maximum, does not exceed an annual rate of .40% of the fund's average

Annual Report

Notes to Financial Statements - continued

3. Fees and Other Transactions with Affiliates - continued

Management Fee - continued

net assets. For the period, the total management fee was equivalent to an annual rate of .34%. The gross income-based portion of this fee was equal to $7,131,000, or

an annual rate of .24% of the fund's average net assets.

Sub-Adviser Fee. As the fund's investment sub-adviser, Fidelity Investments Money Management, Inc. (FIMM), a wholly owned subsidiary of FMR, receives a fee

from FMR of 50% of the management fee payable to FMR. The fee is paid prior to any voluntary expense reimbursements which may be in effect.

Transfer Agent Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, is the fund's transfer, dividend disbursing and shareholder servicing agent. FSC

receives account fees and asset-based fees that vary according to account size and type of account. FSC pays for typesetting, printing and mailing of all shareholder

reports, except proxy statements. For the period, the transfer agent fees were equivalent to an annual rate of .13% of average net assets.

Accounting Fees. FSC maintains the fund's accounting records. The fee is based on the level of average net assets for the month plus out-of-pocket expenses.

Money Market Insurance. Pursuant to an Exemptive Order issued by the SEC, the fund, along with other money market funds advised by FMR or its affiliates, has

entered into insurance agreements with FIDFUNDS Mutual Limited (FIDFUNDS), an affiliated mutual insurance company. FIDFUNDS provides limited coverage for

certain loss events including issuer default as to payment of principal or interest and bankruptcy or insolvency of a credit enhancement provider. The insurance does

not cover losses resulting from changes in interest rates, ratings downgrades or other market conditions. The fund may be subject to a special assessment of up to

approximately 2.5 times the fund's annual gross premium if covered losses exceed certain levels. During the period, the fund paid premiums of $111,000 for the calendar

year 2000 to FIDFUNDS, which are being amortized over one year.

4. Interfund Lending Program.

The fund participated in the interfund lending program as a lender. The average daily loan balance during the period for which the loans were outstanding amounted to

$7,945,000. The weighted average interest rate was 5.92%. Interest earned from the interfund lending program amounted to $3,000 and is included in interest income

on the Statement of Operations. At period end there were no interfund loans outstanding.

5. Expense Reductions.

Through an arrangement with the fund's transfer agent, credits realized as a result of uninvested cash balances were used to reduce a portion of the fund's expenses.

During the period, the fund's transfer agent fees were reduced by $65,000 under this arrangement.

Annual Report

Report of Independent Accountants

To the Trustees of Fidelity Union Street Trust II and the Shareholders of Fidelity Daily Income Trust:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes

in net assets and the financial highlights present fairly, in all material respects, the financial position of Fidelity Daily Income Trust (a fund of Fidelity Union Street

Trust II) at August 31, 2000, and the results of its operations, the changes in its net assets and the financial highlights for the periods indicated, in conformity with

accounting principles generally accepted in the United States. These financial statements and financial highlights (hereafter referred to as "financial statements")

are the responsibility of the Fidelity Daily Income Trust's management; our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits of these financial statements in accordance with auditing standards generally accepted in the United States which require that we plan and

perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test

basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by

management, and evaluating the overall financial statement presentation. We believe that our audits, which included

confirmation of securities at August 31, 2000 by correspondence with the custodian and brokers, provide a reasonable basis for the opinion expressed above.

/s/PricewaterhouseCoopers LLP Boston, Massachusetts Annual Report

Investment Adviser

Fidelity Management & Research Sub-Adviser

Fidelity Investments Officers

Edward C. Johnson 3d, President

Robert C. Pozen, Senior Vice President

Dwight D. Churchill, Vice President

Boyce I. Greer, Vice President

Robert K. Duby, Vice President

Eric D. Roiter, Secretary

Robert A. Dwight, Treasurer

Maria F. Dwyer, Deputy Treasurer

Stanley N. Griffith, Assistant John H. Costello, Assistant Treasurer

Thomas J. Simpson, Assistant Treasurer

Board of Trustees

Ralph F. Cox *

8/31/00

Funds Average*

TDs, and Notes 32.7%

TDs, and Notes 30.6%

Securities 0.0%

Securities 10.4%

and Net Other

Assets 6.1%

and Net Other

Assets 0.7%

(000's)

Insurance Co. 6.88%, 10/2/00

See accompanying schedule

per share ($3,006,409 ÷ 3,006,910 shares)

August 31,

2000

August 31,

1999

Net interest income

from operations

Proceeds from sales of shares

beginning of period

Net interest income

(in millions)

net assets

continued

PricewaterhouseCoopers LLP

October 6, 2000

Company

Boston, MA

Money Management, Inc.

Vice President

Phyllis Burke Davis *

Robert M. Gates *

Edward C. Johnson 3d

Donald J. Kirk *

Ned C. Lautenbach *

Peter S. Lynch

Marvin L. Mann *

William O. McCoy *

Gerald C. McDonough *

Robert C. Pozen

Thomas R. Williams *

Advisory Board

J. Michael Cook

Abigail P. Johnson

Marie L. Knowles

* Independent trustees

General Distributor

Fidelity Distributors Corporation

Boston, MA

Transfer and Shareholder

Servicing Agent

Fidelity Service Company, Inc.

Boston, MA

Custodian

Bank of New York

New York, NY

Fidelity's Taxable

Money Market Funds

Fidelity Cash Reserves

Fidelity Daily Income Trust

Fidelity U.S. Government Reserves

Spartan® Money Market Fund

Spartan U.S. Government

Money Market Fund

Spartan U.S. Treasury

Money Market Fund

The Fidelity Telephone Connection

Mutual Fund 24-Hour Service

Exchanges/Redemptions

and Account Assistance 1-800-544-6666

Product Information 1-800-544-6666

Retirement Accounts 1-800-544-4774 (8 a.m. - 9 p.m.)

TDD Service 1-800-544-0118

for the deaf and hearing impaired

(9 a.m. - 9 p.m. Eastern time)

Fidelity Automated Service

Telephone (FAST®) (automated graphic) 1-800-544-5555

(automated graphic) Automated line for quickest service

FDI-ANN-1000 113108

1.536737.103

(Fidelity Investment logo)(registered trademark)

Corporate Headquarters

82 Devonshire St., Boston, MA 02109

www.fidelity.com

Fidelity®

Municipal Money Market

Fund

Annual Report

August 31, 2000

(Fidelity Investment logo)(registered trademark)

Contents

|

President's Message |

Ned Johnson on investing strategies. |

|

|

Performance |

How the fund has done over time. |

|

|

Fund Talk |

The manager's review of fund performance, strategy and outlook. |

|

|

Investment Changes |

A summary of major shifts in the fund's

investments over the past six months |

|

|

Investments |

A complete list of the fund's investments. |

|

|

Financial Statements |

Statements of assets and liabilities,

operations, and changes in net assets, |

|

|

Notes |

Notes to the financial statements. |

|

|

Report of Independent Accountants |

The auditors' opinion. |

|

|

Distributions |

|

Third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, the Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Annual Report

(photo_of_Edward_C_Johnson_3d)

(Photograph of Edward C. Johnson 3d.)

Dear Shareholder:

A slowing U.S. economy triggered an equity market rally during the later stages of summer, boosting most major stock indexes back into positive territory for calendar year 2000. One notable exception, however, was the Dow Jones Industrial Average, which posted a negative return during that timeframe. Fixed-income markets - particularly Treasuries - continued their yearlong trend of strong performance, as nearly every bond sector outperformed the stock market on a year-to-date basis.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

First, investors are encouraged to take a long-term view of their portfolios. If you can afford to leave your money invested through the inevitable up and down cycles of the financial markets, you will greatly reduce your vulnerability to any single decline. We know from experience, for example, that stock prices have gone up over longer periods of time, have significantly outperformed other types of investments and have stayed ahead of inflation.

Second, you can further manage your investing risk through diversification. A stock mutual fund, for instance, is already diversified, because it invests in many different companies. You can increase your diversification further by investing in a number of different stock funds, or in such other investment categories as bonds. You should also keep money you'll need in the near future in a more stable investment.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

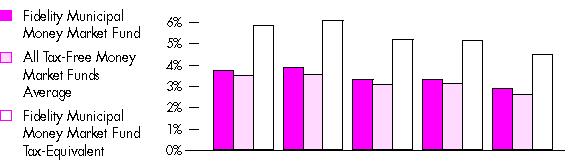

To evaluate a money market fund's historical performance, you can look at either total return or yield. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income. Yield measures the income paid by a fund. Since a money market fund tries to maintain a $1 share price, yield is an important measure of performance.

Cumulative Total Returns

|

Periods ended August 31, 2000 |

|

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Municipal Money Market |

|

3.55% |

17.17% |

37.44% |

|

All Tax-Free Money Market |

|

3.29% |

16.21% |

34.80% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, one year, five years or 10 years. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. To measure how the fund's performance stacked up against its peers, you can compare it to the all tax-free money market funds average, which reflects the performance of municipal money market funds with similar objectives tracked by iMoneyNet, Inc. The past one year average represents a peer group of 461 money market funds.

Average Annual Total Returns

|

Periods ended August 31, 2000 |

|

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Municipal Money Market |

|

3.55% |

3.22% |

3.23% |

|

All Tax-Free Money Market |

|

3.29% |

3.05% |

3.03% |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year.

Annual Report

Performance - continued

Yields

|

|

8/28/00 |

5/29/00 |

2/28/00 |

11/29/99 |

8/30/99 |

|

Fidelity Municipal Money Market Fund |

3.81% |

3.95% |

3.37% |

3.34% |

2.90% |

|

All Tax-Free Money Market Funds Average |

3.56% |

3.60% |

3.12% |

3.16% |

2.66% |

|

Fidelity Municipal Money Market Fund Tax-Equivalent |

5.95% |

6.17% |

5.27% |

5.22% |

4.53% |

Yield refers to the income paid by the fund over a given period. Yields for money market funds

are usually for seven-day periods, expressed as annual percentage rates. A

yield that assumes income earned is reinvested or compounded is called an effective yield. The table above shows the

fund's current seven-day yield at quarterly intervals over

the past year. You can compare these yields to the all tax-free money market funds average as tracked by iMoneyNet, Inc. Or you can look at the fund's tax-equivalent

yield, which assumes you're in the 36% federal tax bracket. A portion of the fund's income may be subject to the alternative federal minimum tax. Comparing Yields on tax-free investments

are usually lower than yields on

taxable investments. However,

a straight comparison between

the two may be misleading

because it ignores the way

taxes reduce taxable returns.

Tax-equivalent yield - the yield

you'd have to earn on a similar

taxable investment to match the

tax-free yield - makes the

comparison more meaningful.

Keep in mind that the U.S.

government neither insures nor

guarantees a money market

fund. In fact, there is no

assurance that a money fund

will maintain a $1 share price.

Performance

A money market fund's total returns and yields will vary, and reflect past results rather than predict future performance.

Annual Report

Fund Talk: The Manager's Overview

(Portfolio Manager photograph)

An interview with Diane McLaughlin, Portfolio Manager of Fidelity Municipal Money Market Fund

Q. What was the investment environment like during the 12 months that ended August 31, 2000, Diane?

A. Throughout the period, the U.S. economy demonstrated considerable strength. Real GDP - gross domestic product adjusted for inflation - grew at an annual rate of 6.9% in the fourth quarter of 1999, its largest gain in three years. In 2000, real GDP grew at an annual rate of 4.8% in the first quarter and 5.6% in the second quarter. The American consumer, buoyed with confidence, helped support economic growth through healthy spending. Business investment provided yet another stimulus to economic growth. The healthy economy led to a decline in unemployment, which fell to 3.9% in April, its lowest level in 30 years.

Q. How did the Federal Reserve Board react to the state of the U.S. economy?

A. Against this backdrop, the Federal Reserve Board felt the need to restrain growth and head off any inflationary pressures that might be building. To do so, the Fed implemented a series of six hikes in the rate banks charge each other for overnight loans - the fed funds target rate - starting in June 1999. Four of those rate increases occurred during the period covered by this report. Three of them - in November 1999, February 2000 and March 2000 - came in increments of 0.25 percentage points each. The last, in May 2000 - a hike of 0.50 percentage points - came on the heels of an unexpectedly sharp increase in the employment cost index, a broad measure of the costs incurred by businesses for wages and benefits. During the last three months of the period, however, the Fed chose to leave rates unchanged. While some indications of price inflation surfaced, most price gains were offset by improvements in productivity. More importantly, later in the period there were signs that economic growth was slowing to a more sustainable rate.

Q. What was your strategy with the fund?

A. For most of the period, I kept the fund's average maturity shorter than that of its peers. The combination of low supply and strong demand caused yields on longer-term one-year notes to fall to unattractive levels. Supply was low because, with the strong economy, municipalities had less of a need to come to market to raise funds. On the other hand, demand for one-year, fixed-rate notes remained strong as the municipal money market was flooded with assets. We found few opportunities to buy one-year notes that incorporated enough yield to compensate the fund for the anticipated rise in rates. At times, rates on short-term variable-rate demand notes (VRDNs) - whose yields are reset every seven days - spiked up. One such period was the turn into the year 2000, when very soft demand caused short-term money market securities to offer yields that were, in some cases, higher than those offered by taxable alternatives. Another opportunity arose in April, when money market managers sold VRDNs to meet redemptions as shareholders withdrew funds to pay taxes. Yields on VRDNs rose, with some again offering yields as high as those provided by taxable money market securities. These were opportunities for the fund to add VRDNs and, because of its overweighting in VRDNs at those times, the fund was positioned to take advantage of the increases in yield.

Annual Report

Fund Talk: The Manager's Overview - continued

Q. How did the fund perform?

A. The fund's seven-day yield on August 31, 2000, was 3.82%, compared to 2.90% 12 months ago. The latest yield was the equivalent of a 5.97% taxable yield for investors in the 36% federal tax bracket. Through August 31, 2000, the fund's 12-month total return was 3.55%, compared to 3.29% for the all tax-free money market funds average, according to iMoneyNet, Inc.

Q. What is your outlook?

A. Recent economic data indicate that the economy is slowing. In addition, sharp increases in oil prices and the steady decline in the value of the euro - which has made U.S. imports in Europe more expensive - may help slow U.S. economic growth. Although the Fed indicated at its last meeting its continued bias toward raising rates, the market at this point sees very little chance the Fed will do so. In fact, recent market sentiment has reflected a higher chance of a Fed rate cut in the near future. Looking at the fund, I'll continue to take advantage of opportunities arising from supply/demand imbalances.

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fund Facts

Goal: tax-free income with share-price stability by investing in high-quality, short-term municipal securities

Fund number: 010

Trading symbol: FTEXX

Start date: January 2, 1980

Size: as of August 31, 2000, more than $7.9 billion

Manager: Diane McLaughlin, since 1996; manager, various Fidelity and Spartan municipal money market funds; joined Fidelity in 1992

3Annual Report

Investment Changes

Maturity Diversification

Days

% of fund's

investments % of fund's

investments

2/29/00

% of fund's 0 - 30

83.4

75.8

73.0

31 - 90

9.0

14.9

7.7

91 - 180

3.4

3.2

9.2

181 - 397

4.2

6.1

10.1

Weighted Average Maturity

8/31/00

2/29/00

8/31/99

Fidelity Municipal Money 27 Days

32 Days

54 Days

All Tax-Free Money Market 42 Days

39 Days

51 Days

Asset Allocation (% of fund's net assets)

As of August 31, 2000

As of February 29, 2000

Variable Rate

Variable Rate

Commercial Paper

(including

Commercial Paper

(including

Tender Bonds 4.5%

Tender Bonds 4.5%

Municipal Notes 2.9%

Municipal Notes 5.8%

Other Investments

Other Investments

Annual Report

Investments August 31, 2000

Showing Percentage of Net Assets

Municipal Securities - 99.1%

Principal

Amount (000s)

Value (Note 1)

(000s)

Alabama - 1.1%

Alabama Hsg. Fin. Auth. Multi-family Hsg. Rev. (Gazebo East Proj.) Series 1991 B, 4.4%, LOC Amsouth Bank NA, Birmingham, VRDN (b)

$ 3,240

$ 3,240

Alabama Ind. Dev. Auth. Rev. (Southern Ionics Proj.) 4.45%, LOC Southtrust Bank NA, VRDN (b)(c)

3,000

3,000

Alabama Pub. School & College Auth. Rev. Participating VRDN Series ROC 00 1, 4.33% (Liquidity Facility Salomon Smith Barney Hldgs., Inc.) (b)(e)

11,345

11,345

Cap. City Edl. Bldg. Auth. Rev. (Montgomery Academy Proj.) Series 1999 B, 4.35%, LOC Amsouth Bank NA, Birmingham, VRDN (b)

6,000

6,000

Courtland Ind. Dev. Board Rev. (Specialty Minerals, Inc. Proj.) 4.45%, LOC Wachovia Bank NA, VRDN (b)(c)

5,000

5,000

Daphne-Villa Mercy Spl. Care Facilities Fing. Auth. Rev. (Mercy Med. Hosp. Proj.) 4.25%, LOC Southtrust Bank NA, VRDN (b)

11,700

11,700

Decatur Ind. Dev. Board Ind. Dev. Rev. (Monsanto Co. Proj.) Series 1996, 4.45%, VRDN (b)(c)

1,900

1,900

Decatur Ind. Dev. Board Solid Waste Disp. Rev. (Trico Steel Co. Proj.) Series 1997, 4.3%, LOC Chase Manhattan Bank, VRDN (b)(c)

8,300

8,300

Jackson Ind. Dev. Board Rev. (Specialty Minerals, Inc. Proj.) 4.45%, LOC Wachovia Bank NA, VRDN (b)(c)

6,100

6,100

Lafayette Ind. Dev. Rev. (Kardoes Rubber Co., Inc. Proj.) 4.45%, LOC Amsouth Bank NA, Birmingham, VRDN (b)(c)

3,485

3,485

Mobile Ind. Dev. Board Rev. (Newark Group Ind. Proj.) 4.5%, LOC First Union Nat'l. Bank, North Carolina, VRDN (b)(c)

6,675

6,675

Montgomery Ind. Dev. Board Poll. Cont. Rev. Bonds (Gen. Elec. Co. Proj.) Series 1990, 4.25% tender 9/22/00, CP mode

14,600

14,600

Montgomery Ind. Dev. Board Rev. (Feldmeier/Alabama Equip. Proj.) Series 1996, 4.45%, LOC Southtrust Bank NA, VRDN (b)(c)

805

805

Roanoke Ind. Dev. Board Indl. Dev. Rev. (Steelfab, Inc. Proj.) Series 1997, 4.45%, LOC Bank of America NA, VRDN (b)(c)

1,330

1,330

Tuscaloosa County Ind. Dev. Auth. Rev. (Hanna Steel Co. Proj.) 4.4%, LOC Bank of America NA, VRDN (b)(c)

785

785

84,265

Alaska - 1.5%

Alaska Arpt. Participating VRDN Series Merlots 99 I, 4.42% (Liquidity Facility First Union Nat'l. Bank, North Carolina) (b)(c)(e)

7,500

7,500

Alaska Hsg. Fin. Corp. Participating VRDN:

Series BA 97 F, 4.33% (Liquidity Facility Bank of America NA) (b)(e)

7,185

7,185

Municipal Securities - continued

Principal

Amount (000s)

Value (Note 1)

(000s)

Alaska - continued

Alaska Hsg. Fin. Corp. Participating VRDN: - continued

Series FRRI 00 N13, 4.5% (Liquidity Facility Bank of New York NA) (b)(e)

$ 7,500

$ 7,500

Series FRRI 98 2, 4.45% (Liquidity Facility Bank of New York NA) (b)(e)

5,600

5,600

Series FRRI 99 2, 4.5% (Liquidity Facility Commerzbank AG) (b)(e)

2,400

2,400

Series Merlots 99 D, 4.37% (Liquidity Facility First Union Nat'l. Bank, North Carolina) (b)(e)

10,900

10,900

Alaska Ind. Dev. & Export Auth. Rev. (Fairbanks Gold Mining Proj.) Series 1997, 4.45%, LOC Bank of Nova Scotia, VRDN (b)(c)

52,400

52,400

Valdez Marine Term. Rev.:

Participating VRDN Series MSDW 98 146, 4.33% (Liquidity Facility Morgan Stanley Dean Witter & Co.) (b)(e)

15,500

15,500

Rfdg. Bonds (Atlantic Richfield Co. Proj.) Series 1994 A, 4.3% tender 10/11/00, CP mode

13,100

13,100

122,085

Arizona - 2.0%

Arizona Health Facilities Auth. Rev.:

(Arizona Health Care Pooled Fing. Prog.) Series 2000 A, 4.35%, (Liquidity Facility Landesbank Hessen-Thurigen), VRDN (b)

35,600

35,600

(Blood Sys., Inc. Proj.) Series 1995, 4.35%, LOC Bank One, Arizona NA, VRDN (b)

7,045

7,045

Casa Grande Indl. Dev. Auth. Indl. Dev. Rev. (Aztec Pulp & Paper Prod. Proj.) Series 2000 A, 4.45%, LOC Bank of America NA, VRDN (b)(c)

5,000

5,000

Cochise County Poll. Cont. Rev. Solid Waste Disp. Rev. Bonds (Arizona Elec. Pwr. Coop. Proj.) 4.1%, tender 9/1/00 (Nat'l. Rural Util. Coop. Fin.

Corp. Guaranteed) (c)

6,800

6,800

Maricopa County Ind. Dev. Auth. Ind. Dev. Rev.:

Bonds (Citizens Communications Co. Proj.) Series 1988, 4.65% tender 9/1/00, CP mode (c)

2,920

2,920

(Clayton Homes Proj.) Series 1998, 4.4%, LOC Wachovia Bank NA, VRDN (b)(c)

4,200

4,200

Maricopa County Poll. Cont. Rev. Bonds (Southern California Edison Co. Proj.) Series 1985 E:

4.35% tender 10/13/00, CP mode

2,900

2,900

4.5% tender 9/7/00, CP mode

2,000

2,000

Mohave County Ind. Dev. Auth. Ind. Dev. Rev. Bonds

4.4% tender 9/8/00, CP mode (c)

5,100

5,100

4.65% tender 9/8/00, CP mode (c)

14,260

14,260

Municipal Securities - continued

Principal

Amount (000s)

Value (Note 1)

(000s)

Arizona - continued

Navajo County Ind. Dev. Auth. Ind. Rev. (Citizens Utils. Co. Proj.) Series 1997, 4.6%, VRDN (b)(c)

$ 3,800

$ 3,800

Phoenix Ind. Dev. Auth. Multi-family Hsg. Rev. (Bell Square Apt. Proj.) Series 1995, 4.4%, (OEC The Lakes LLC) 6,000

6,000

Phoenix Ind. Dev. Auth. Rev.:

(Marlyn Nutraceuticals Proj.) 4.5%, LOC Bank One, 3,300

3,300

(Plastican Proj.) Series 1997, 4.5%, LOC Fleet Bank NA, VRDN (b)(c)

2,625

2,625

Rfdg. (V.A.W. of America Proj.) Series 1997, 4.45%, 1,100

1,100

Phoenix Indl. Dev. Auth. Rev. (Independent Newspaper, Inc. Proj.) Series 2000, 4.45%, LOC First Union Nat'l. Bank, North Carolina, VRDN (b)(c)

2,100

2,100

Pima County Ind. Dev. Auth. Single Family Hsg. Rev. Participating VRDN Series RF 99 5, 4.43% (Liquidity Facility Bank of New York NA) (b)(c)(e)

12,350

12,350

Pima County Indl. Dev. Auth. Single Family Mtg. Rev. Bonds 4.1% 9/1/00 (Pacific Life Ins. Co. Guaranteed) (c)

3,750

3,750

Salt River Proj. Agric. Impt. & Pwr. District Elec. Sys. Rev.:

Participating VRDN Series MSDW 00 274, 4.33% (Liquidity Facility Morgan Stanley Dean Witter & Co.) (b)(e)

10,000

10,000

Series 1997 A, 4.3% 10/5/00, CP

4,950

4,950

Series B, 4.2% 10/20/00, CP

8,065

8,065

Yavapai County Ind. Dev. Auth. Ind. Dev. Rev.:

Bonds:

(Citizens Communications Co. Proj.) Series 1993, 4.4% tender 9/11/00, CP mode (c)

6,500

6,500

(Citizens Utils. Co. Proj.) Series 1997, 4.4% tender 9/8/00, CP mode (c)

3,000

3,000

(Oxycal Lab. Proj.) Series 1999 A, 4.5%, LOC Bank One, Arizona NA, VRDN (b)(c)

2,900

2,900

156,265

Arkansas - 1.0%

Arkansas Dev. Auth. Ind. Dev. Rev. (Stratton Seed Co. Proj.) Series 1999, 4.45%, LOC Bank of America NA, VRDN (b)(c)

3,700

3,700

Arkansas Dev. Fin. Auth. Participating VRDN Series BA 98 C, 4.38% (Liquidity Facility Bank of America NA) (b)(c)(e)

6,475

6,475

Arkansas Dev. Fin. Auth. Multi-family Hsg. Rev. (Kiehl Partners LP Proj.) Series 1998, 4.45%, LOC Bank One, Louisiana NA, VRDN (b)(c)

5,200

5,200

Municipal Securities - continued

Principal

Amount (000s)

Value (Note 1)

(000s)

Arkansas - continued

Arkansas Hosp. Equip. Fin. Auth. (Arkansas Hosp. Assoc. Pooled Fing. Prog.) Series 1998 A, 4.35%, LOC Bank of America NA, VRDN (b)

$ 18,000

$ 18,000

Clark County Solid Waste Disp. Rev. (Reynolds Metals Co. Proj.) Series 1992, 4.45%, LOC Suntrust Bank, VRDN (b)(c)

15,800

15,800

Columbia County Solid Waste Disp. Rev. (Albemarle Corp. Proj.) Series 1999, 4.45%, LOC Bank of America NA, VRDN (b)(c)

5,500

5,500

Miller County Solid Waste Disp. Rev. (Tyson Foods, Inc. Proj.) Series 1996, 4.33%, LOC Commerzbank AG, 21,850

21,850

Pine Bluff Ind. Dev. Rev. (Rolling Pin Corp. Proj.) Series 1998, 4.5%, LOC Wells Fargo Bank NA, San Francisco, VRDN (b)(c)

3,400

3,400

West Memphis Ind. Dev. Rev. (Proform Co. LLC Proj.) 975

975

80,900

California - 0.1%

California Student Ed. Ln. Marketing Corp. Student Ln. Rev. Rfdg. Bonds Series 1994 A, 4.8%, tender 6/1/01, LOC State Street Bank & Trust Co. (c)

6,000

6,000

Orange County Hsg. Fin. Auth. Participating VRDN Series 96C0906, 4.35% (Liquidity Facility Citibank NA, New York) (b)(c)(e)

4,310

4,310

10,310

Colorado - 3.4%

Aurora Multi-family Hsg. Rev. (Aurora Meadows Apts. Proj.) Series 1996, 4.5% (Fannie Mae Guaranteed), VRDN (b)(c)

8,300

8,300

Colorado Hsg. Fin. Auth. Multi-family Hsg. Rev. Participating VRDN:

Series BA 96 E, 4.38% (Liquidity Facility Bank of America NA) (b)(c)(e)

7,700

7,700

Series FRRI 00 A4, 4.55% (Liquidity Facility Bayerische Hypo-und Vereinsbank AG) (b)(c)(e)

6,900

6,900

Series Putters 120, 4.35% (Liquidity Facility Morgan Guaranty Trust Co., NY) (b)(c)(e)

7,865

7,865

Colorado Springs Utils. Rev. Participating VRDN Series SGB 28, 4.33% (Liquidity Facility Societe Generale) (b)(e)

11,480

11,480

Colorado Student Oblig. Auth.:

Series 1999 A2, 4.35% (AMBAC Insured), VRDN (b)(c)

9,500

9,500

Series 1999 A3, 4.35% (AMBAC Insured), VRDN (b)(c)

7,300

7,300

Municipal Securities - continued

Principal

Amount (000s)

Value (Note 1)

(000s)

Colorado - continued

Denver City & County Arpt. Rev.:

Bonds:

Series 1997 A:

4.2% tender 10/20/00, LOC Bayerische Landesbank Girozentrale, CP mode (c)

$ 13,100

$ 13,100

4.3% tender 10/19/00, LOC Bayerische Landesbank Girozentrale, CP mode (c)

3,300

3,300

4.3% tender 11/10/00, LOC Bayerische Landesbank Girozentrale, CP mode (c)

7,800

7,800

4.3% tender 11/17/00, LOC Bayerische Landesbank Girozentrale, CP mode (c)

11,000

11,000

4.35% tender 11/16/00, LOC Bayerische Landesbank Girozentrale, CP mode (c)

9,600

9,600

Series PT 249, 4.45%, tender 2/22/01 (Liquidity Facility Banco Santander SA) (c)(e)(f)

6,050

6,050

Participating VRDN:

Series 1997 Q, 4.37% (Liquidity Facility First Union Nat'l. Bank, North Carolina) (b)(e)

6,600

6,600

Series CDC 97 K, 4.4% (Liquidity Facility Caisse des Depots et Consignations) (b)(c)(e)

32,430

32,430

Series FRRI A44, 4.5% (Liquidity Facility Bank of New York NA) (b)(c)(e)

10,000

10,000

Series FRRI A72, 4.5% (Liquidity Facility Bayerische Hypo-und Vereinsbank AG) (b)(c)(e)

17,700

17,700

Series FRRI A73, 4.5% (Liquidity Facility Bayerische Hypo-und Vereinsbank AG) (b)(c)(e)

9,750

9,750

Series MSDW 98 153, 4.33% (Liquidity Facility Morgan Stanley Dean Witter & Co.) (b)(e)

6,000

6,000

Series PA 762, 4.38% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(c)(e)

4,995

4,995

Series PA 764R, 4.38% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(c)(e)

4,995

4,995

Series 2000 A, 4.3% 11/10/00, LOC Westdeutsche Landesbank Girozentrale, LOC Bayerische Landesbank Girozentrale, CP (c)

17,300

17,300

Series 2000 C, 4.35% (MBIA Insured), VRDN (b)(c)

13,600

13,600

Denver City & County Spl. Facilites Arpt. Rev. (Worldport at DIA Proj.) Series A, 4.5%, LOC Morgan Guaranty Trust Co., NY, VRDN (b)(c)

22,580

22,580

Fort Collins Ind. Dev. Rev. (Phelps-Tointon Millwork Proj.) Series 1993, 4.5%, LOC Bank One, Colorado NA, VRDN (b)(c)

1,180

1,180

Municipal Securities - continued

Principal

Amount (000s)

Value (Note 1)

(000s)

Colorado - continued

Fort Collins Multi-family Hsg. Rev. Bonds (Dry Creek Apt. Proj.) 5.05%, tender 11/1/00, (Redwood Housing LP) LOC Fifth Third Bank, Cincinnati (c)

$ 4,490

$ 4,490

Westminster County Multi-family Hsg. Rev. Rfdg. (Lakeview Apts. Proj.) Series 1997, 4.5% (68th Ave. Partners LP) (Fannie Mae Guaranteed),

VRDN (b)(c)

4,510

4,510

266,025

Connecticut - 0.1%

Connecticut Hsg. Fin. Auth. Participating VRDN Series Merlots 97 L, 4.32% (Liquidity Facility First Union Nat'l. Bank, North Carolina) (b)(c)(e)

4,625

4,625

Delaware - 0.6%

Delaware Econ. Dev. Auth. Multi-family Rev. (Schoolhouse 23,600

23,600

Delaware Econ. Dev. Auth. Rev.:

(Delmarva Pwr. & Lt. Co. Proj.):

Series 1987, 4.55%, VRDN (b)(c)

1,100

1,100

Series 1994, 4.55%, VRDN (b)(c)

2,000

2,000

Series 1999 B, 4.3%, VRDN (b)(c)

5,500

5,500

Rfdg. (Philip Morris Co., Inc. Proj.) Series 1992, 4.4%, VRDN (b)

3,300

3,300

Delaware Gen. Oblig. Participating VRDN Series ROC 00 9, 4.33% (Liquidity Facility Salomon Smith Barney Hldgs., Inc.) (b)(e)

9,215

9,215

Delaware Hsg. Auth. Rev. Participating VRDN Series 96C0801, 4.35% (Liquidity Facility Citibank NA, New York) (b)(c)(e)

5,830

5,830

50,545

District of Columbia - 1.4%

District of Columbia Gen. Oblig. Participating VRDN:

Series ROC 2 99 10, 4.33% (Liquidity Facility Salomon Smith Barney Hldgs., Inc.) (b)(e)

5,905

5,905

Series ROC 2 99 12, 4.33% (Liquidity Facility Salomon Smith Barney Hldgs., Inc.) (b)(e)

6,420

6,420

District of Columbia Hsg. Fin. Agcy. Single Family Mtg. Rev. Participating VRDN Series RF 00 4, 4.48% (Liquidity Facility Bank of New York

NA) (b)(c)(e)

8,505

8,505

District of Columbia Hsg. Fin. Agcy. Mtg. Rev.:

Bonds:

Series 2000 B, 4.35% 3/21/01 (Trinity Fdg. Guaranteed) (c)

21,500

21,500

Series 2000 E, 4.6% 7/23/01 (c)

8,500

8,500

Participating VRDN Series CDC 00 I, 4.4% (Liquidity Facility Caisse des Depots et Consignations) (b)(c)(e)

6,555

6,555

Municipal Securities - continued

Principal

Amount (000s)

Value (Note 1)

(000s)

District of Columbia - continued

District of Columbia Rev.:

(Arnold & Porter Proj.) Series 1999, 4.35%, LOC Crestar Bank, VRDN (b)(c)

$ 7,250

$ 7,250

(Fort Lincoln New Town/Premdist LLC Proj.) Series 2000, 4.35%, LOC First Union Nat'l. Bank, North Carolina, VRDN (b)(c)

7,200

7,200

District of Columbia Wtr. & Swr. Auth. Participating VRDN:

Series 985201, 4.33% (Liquidity Facility Citibank NA, 12,300

12,300

Series ROC 2 99 5, 4.33% (Liquidity Facility Salomon Smith Barney Hldgs., Inc.) (b)(e)

4,750

4,750

Metro. Washington Apts. Auth. PFC Rev. Series A:

4.3% 9/7/00 (Liquidity Facility Westdeutsche Landesbank Girozentrale), CP (c)

1,700

1,700

4.3% 11/7/00 (Liquidity Facility Westdeutsche Landesbank Girozentrale), CP (c)

5,000

5,000

4.35% 11/16/00 (Liquidity Facility Westdeutsche Landesbank Girozentrale), CP (c)

15,600

15,600

111,185

Florida - 4.4%

Broward County Port Facilities Rev. Rfdg. (Port Everglades Proj.) Series 1998, 4.3% (AMBAC Insured) (BPA Bank of Nova Scotia), VRDN (b)(c)

7,000

7,000

Dade County Spl. Rev. (Youth Fair & Exposition Proj.) 4.3%, LOC Suntrust Bank, VRDN (b)

4,225

4,225

Escambia County Hsg. Fin. Rev. Participating VRDN 12,700

12,700

Florida Board of Ed. Cap. Outlay Participating VRDN:

Series MSDW 00 374, 4.33% (Liquidity Facility Morgan Stanley Dean Witter & Co.) (b)(e)

9,330

9,330

Series PT 1223, 4.33% (Liquidity Facility Merrill Lynch & Co., Inc.) (b)(e)

4,000

4,000

Florida Cap. Projects Fin. Auth. (Florida Hosp. Assoc. Cap. Proj.) Series 1998 A, 4.25% (FSA Insured), VRDN (b)

3,600

3,600

Florida Division Bond Fin. Dept. Gen. Svcs. Revs. Participating VRDN Series MSDW 00 317, 4.33% (Liquidity Facility Morgan Stanley Dean Witter

& Co.) (b)(e)

6,955

6,955

Florida Hsg. Fin. Agcy.:

(Banyan Bay Apts. Proj.) 4.25%, LOC Fannie Mae, VRDN (b)(c)

5,275

5,275

(Kings Colony Proj.) Series 1985 D, 4.25%, (Gables Realty Ltd. Partnership) LOC Cr. Suisse First Boston Bank, VRDN (b)

6,900

6,900

Municipal Securities - continued

Principal

Amount (000s)

Value (Note 1)

(000s)

Florida - continued

Florida Hsg. Fin. Agcy.: - continued

Rfdg. (Hillsborough-Oxford Proj.) Series D, 4.45% (Continental Casualty Co. Guaranteed), VRDN (b)

$ 8,790

$ 8,790

Florida Hsg. Fin. Corp. Rev. (Valencia Village Apts. Proj.) Series G, 4.3%, LOC Key Bank Nat'l. Assoc., 5,880

5,880

Florida Local Govt. Fin. Auth. Rev.:

Series A:

4.1% 9/7/00, LOC First Union Nat'l. Bank, North Carolina, CP

6,100

6,100

4.2% 10/6/00, LOC First Union Nat'l. Bank, North Carolina, CP

11,832

11,832

4.35% 11/16/00, LOC First Union Nat'l. Bank, North Carolina, CP

7,350

7,350

Series B, 4.35% 12/6/00, LOC First Union Nat'l. Bank, North Carolina, CP (c)

6,500

6,500

Highlands County Health Facilities Auth. Rev. (Adventist Health Sys. Sunbelt Proj.) 4.32% (MBIA Insured) (BPA Bank One NA, Chicago), VRDN (b)

12,600

12,600

Lee County Hosp. Board Directors Hosp. Rev. Bonds

Series 1985 C, 4.45% tender 9/12/00 (Liquidity Facility Suntrust Bank), CP mode

17,000

17,000

Series 1985 D, 4.45% tender 9/12/00 (Liquidity Facility Suntrust Bank), CP mode

6,000

6,000

Series 1992 B, 4.45% tender 9/12/00 (Liquidity Facility Suntrust Bank), CP mode

20,600

20,600

Series 1995 A, 4.45% tender 9/12/00 (Liquidity Facility Suntrust Bank), CP mode

1,600

1,600

Series 1997 B, 4.45% tender 9/12/00 (Liquidity Facility Suntrust Bank), CP mode

22,905

22,905

Miami Dade County Hsg. Fin. Auth. Participating VRDN 6,580

6,580