|

|

|

|

|

Previous: WESTBURY METALS GROUP INC, 8-K, EX-99.1, 2000-11-24 |

Next: US CAN CORP, S-8 POS, POS AM, 2000-11-24 |

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrant /x/ |

||

| Filed by a party other than the Registrant / / | ||

| Check the appropriate box: |

||

| /x/ | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| / / | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 24.14a-12 | |

| DAMARK INTERNATIONAL, INC. |

||

| (Name of Registrant as Specified In Its Charter) | ||

| |

||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||

Payment of Filing Fee (Check the appropriate box):

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / |

|

Fee paid previously with preliminary materials. |

||

| / / |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

||

| |

|

(1) |

|

Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

|

December 6, 2000

To Our Shareholders:

The Board of Directors of DAMARK International, Inc.® joins me in extending to you a cordial invitation to attend our 2000 Annual Meeting of Shareholders. The meeting will be held in our corporate headquarters located at 7101 Winnetka Avenue North, Brooklyn Park, Minnesota 55428, at 10:30 a.m., Minneapolis Time, on Friday, December 29, 2000.

In addition to voting on the matters described in the accompanying Proxy Statement, we will review Damark's business and discuss our direction for the coming year. There will also be an opportunity to discuss matters of interest to you as a shareholder.

It is important that your shares be represented at the meeting whether or not you plan to attend in person. Therefore, please sign and return the enclosed proxy in the envelope provided. If you do attend the meeting and desire to vote in person, you may do so even though you have previously sent in a proxy.

We hope that you will be able to attend the meeting and we look forward to seeing you.

Sincerely,

Mark

A. Cohn

Chairman and Chief Executive Officer

Enclosures

DAMARK INTERNATIONAL, INC.®

7101 Winnetka Avenue North

Minneapolis, Minnesota 55428

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be Held on December 29, 2000

Damark International, Inc.

To Our Shareholders:

The 2000 Annual Meeting of Shareholders of Damark International, Inc. will be held in our corporate headquarters located at 7101 Winnetka Avenue North, Brooklyn Park, Minnesota 55428, at 10:30 a.m., Minneapolis Time, on December 29, 2000 for the following purposes:

The Board of Directors has fixed the close of business on November 30, 2000, as the record date for the determination of shareholders entitled to notice of and to vote at the meeting and any adjournment thereof.

YOUR VOTE IS IMPORTANT. PLEASE SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED RETURN ENVELOPE, WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING. YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON IF YOU DECIDE TO ATTEND THE MEETING.

Stephen

P. Letak

Secretary

Minneapolis, Minnesota

December 6, 2000

PROXY STATEMENT

OF

DAMARK INTERNATIONAL, INC.

7101 Winnetka Avenue North

Minneapolis, Minnesota 55428

Annual Meeting of Shareholders

December 29, 2000

PROXIES AND VOTING

We are providing these proxy materials in connection with the solicitation by the Board of Directors of Damark International, Inc. of proxies to be used at Damark's Annual Meeting of Shareholders to be held on December 29, 2000 for the purposes set forth in the notice of the meeting. Each shareholder entitled to vote at the Annual Meeting who signs and returns a proxy in the form enclosed with this Proxy Statement may revoke the same at any time prior to its use by giving notice of such revocation to the Company in writing or in open meeting. Unless so revoked, the shares represented by each proxy will be voted at the Annual Meeting and at any adjournments thereof. Presence at the Annual Meeting of a shareholder who has signed a proxy does not alone revoke that proxy. This Proxy Statement and the accompanying proxy were first mailed to shareholders on or about December 7, 2000.

Only shareholders of record as of the close of business on November 30, 2000 will be entitled to vote at the Annual Meeting. At the close of business on November 30, 2000, the Company had shares of Class A Common Stock, $.01 par value (the "Common Stock"), outstanding. Holders of Common Stock of record at the close of business on this date, voting together as a single class, will be entitled to one vote per share on (1) election of one director, (2) approval of the Damark 2000 Stock Incentive Plan, (3) approval of the ClickShip Direct 2000 Stock Incentive Plan, (4) approval of the amendment to our Articles of Incorporation to change our corporate name to Provell, Inc., (5) approval of the issuance of our Common Stock in payment of dividends on and the redemption of our Series D Preferred Stock, (6) ratification of the appointment of the independent auditors for the fiscal year ending December 31, 2000, and (7) all other business to be transacted at the Annual Meeting.

The affirmative vote, in person or by proxy, of a majority of the shares of Common Stock present and entitled to vote at the Annual Meeting, voting together as a single class, will be necessary for the adoption of proposals 1, 2, 3, 4, 5, 6 and 7 listed in the notice of the meeting. Broker non-votes are treated as not being present in person or by proxy at the Annual Meeting. Abstentions are treated as being present and, because the affirmative vote of a majority of the shares of Common Stock present is necessary for adoption of any proposal, the effect of an abstention is a vote against the proposal.

1

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of the Company's Common Stock as of November 3, 2000 by each shareholder known to the Company who then beneficially owned more than 5% of the outstanding shares of Common Stock, each director of the Company, each nominee for director, each executive officer named in the Compensation Table set forth later in this Proxy Statement and all executive officers and directors as a group. As of November 3, 2000, there were 5,852,269 shares of Common Stock outstanding.

| Name and Address of Beneficial Owners(1) |

Amount and Nature of Beneficial Ownership |

Percent of Ownership |

|||

|---|---|---|---|---|---|

| Mark A. Cohn(2) | 1,331,157 | (3) | 21.9 | % | |

| SAFECO Asset Management Company(4) | 1,076,300 | 18.4 | % | ||

| Dimensional Fund Advisors(5) | 421,100 | 7.2 | % | ||

| Woodland Partners L.L.C(6) | 407,100 | 7.0 | % | ||

| George S. Richards(2) | 173,334 | (7) | 2.9 | % | |

| Michael D. Moroz(2) | 90,000 | (8) | 1.5 | % | |

| Stephen P. Letak(2) | 100,911 | (9) | 1.7 | % | |

| Kim M. Mageau(2) | — | (10) | — | % | |

| Rodney C. Merry(2) | 70,000 | (11) | 1.2 | % | |

| Thomas A. Cusick(2) | 64,858 | (12) | 1.1 | % | |

| Stephen J. Hemsley(2) | 80,000 | (13) | 1.3 | % | |

| Ralph Strangis(2) | 94,675 | (14) | 1.6 | % | |

| All executive officers and directors as a group (9 Persons) | 2,004,939 | (15) | 30.1 | % |

2

3

Proposal No. 1

ELECTION OF DIRECTOR

Nominees for Election

One director is to be elected at the Annual Meeting for a three-year term. The Restated Articles of Incorporation of the Company provide the number of directors are divided as equally as possible into three classes of directors. The Board of Directors proposes the following nominee for the three year term expiring at the Company's Annual Meeting of Shareholders in the year 2003 or until their successors are duly elected:

George S. Richards—President and Chief Operating Officer of Damark

Except where authority has been withheld by a shareholder, the enclosed proxy will be voted for the election of the one nominee to the Board of Directors. The Board of Directors unanimously recommends a vote FOR the proposal to elect the nominee as a director of the Company. In the event the above named nominee shall unexpectedly become unavailable before election, votes will be cast pursuant to authority granted by the enclosed proxy for such person or persons as may be designated by the Board of Directors.

Information Concerning Nominees and Directors

Thomas A. Cusick (55) has been a director since May 1993. Mr. Cusick has been Chief Operating Officer of TCF Financial Corporation since January 1997 and Vice Chairman since January 1993. Prior thereto, he was President and Chief Operating Officer of TCF Financial Corporation since its formation in 1987. Mr. Cusick was also elected Chairman of TCF Bank, a federally chartered stock savings bank and a wholly-owned subsidiary of TCF Financial Corporation, in January 1997 and has served as Chief Executive Officer of TCF Bank since 1993. He served as Vice Chairman of TCF Bank from 1991 to January 1997 and prior thereto as Executive Vice President and the Director of Banking Services of TCF Bank. Currently, he serves as a director of TCF Financial Corporation and TCF Bank. Mr. Cusick was elected as a director of the Company at its Annual Meeting of Shareholders in 1999 for a term expiring at the Annual Meeting of Shareholders in 2002.

Mark A. Cohn (43) has been a director since its inception in 1986. He is a founder of the Company and has been the Chief Executive Officer since 1986. Mr. Cohn was elected as a director of the Company at its Annual Meeting of Shareholders in 1998 for a term expiring at the Annual Meeting of Shareholders in 2001.

Stephen J. Hemsley (48) has been a director since June 1997. Mr. Hemsley has been Senior Executive Vice President and Chief Operating Officer of United Healthcare Corporation since June 1997. Prior to Mr. Hemsley's appointment at United Healthcare, he served 23 years with Arthur Andersen LLP, his last position being Managing Partner, Strategy and Planning, and Chief Financial Officer for Arthur Andersen Worldwide. Mr. Hemsley was elected as a director of the Company at its Annual Meeting of Shareholders in 1998 for a term expiring at the Annual Meeting of Shareholders in 2001.

George S. Richards ( ) has been President and Chief Operating Officer of Damark since September 1998. Mr. Richards was appointed to the Board of Directors in February 2000 for a term expiring at the next annual meeting of shareholders. Mr. Richards has served in various executive capacities of Damark since 1995.

Ralph Strangis (64) has been a director of the Company since February 1991; he was elected lead director in May 1995. Mr. Strangis has been a member of the law firm of Kaplan, Strangis and Kaplan, P.A., counsel to the Company, for more than five years. Mr. Strangis is also a director of TCF Financial Corporation, the parent company of TCF Bank Minnesota, fsb ("TCF Bank"). Mr. Strangis was elected as

4

a director of the Company at its Annual Meeting of Shareholders in 1998 for a term expiring at the Annual Meeting of Shareholders in 2001.

Meetings and Committees of the Board of Directors

During 1999, the Board of Directors held four meetings and took three actions by unanimous written consent. Each director attended at least 75% of the meetings of the Board of Directors and any committee on which such director served.

The Board of Directors has an Audit Committee and a Compensation Committee but does not have a Nominating Committee. The Audit Committee reviews with the Company's independent auditors the annual financial statements of the Company and the Company's internal controls and financial management practices. The Audit Committee also recommends the appointment of the independent auditors for the Company. Messrs. Cusick and Hemsley currently serve on the Audit Committee. The Audit Committee met two times during 1999. The Compensation Committee, among other matters, reviews the compensation arrangements for the officers of the Company and administers the Damark 1991 Stock Option Plan. Messrs. Cusick and Hemsley currently serve on the Compensation Committee. The Compensation Committee met one time during 1999 and took three actions by unanimous written consent.

Compensation Committee Interlocks and Insider Participation

None of the two directors who serve on the Company's Compensation Committee (Messrs. Cusick and Hemsley) is or has been an executive officer of the Company.

Report of Audit Committee

The Audit Committee has reviewed the Company's audited financial statements for the last fiscal year and discussed them with management.

The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended, by the Independence Standards Board, and have discussed with the auditors the auditors' independence.

The Audit Committee, based on the review and discussion described above, has recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the last fiscal year.

Board of Director Compensation

Directors who are not employees of the Company (Messrs. Cusick, Hemsley and Strangis) receive an annual director fee of $10,000, plus a committee meeting fee of $1,000 per committee meeting which is held on a date other than a date of a Board of Directors meeting. Directors who are not employees or officers of the Company may participate, at their election, in the Company's Deferred Compensation Plan for Non-Employee Directors, pursuant to which director fees deferred by the director are converted into common stock equivalents distributable to the director as Common Stock upon termination of services or death of the director or in the event of a change in control. As indicated in the above Beneficial Ownership Table, the non-employee directors of the Company have certain stock options which were granted to them in connection with their election as directors and, in the case of Mr. Strangis, when he was elected the Lead Director. Non-employee director options were granted at fair market value on the date of grant and become exercisable in three equal installments on the anniversary date of the grant. As the Lead Director, Mr. Strangis has been elected by the non-employee directors to address on behalf of the Board of Directors various governance matters. On January 30, 1998, the Board of Directors adopted a Director Stock Purchase Plan pursuant to which the non-employee directors may purchase up to 50,000 shares of Common Stock of the Company at a price per share equal to the average last reported sale price for the

5

Company's Common Stock for the twenty trading days preceding the date of purchase. No shares have been purchased under this plan.

Certain Relationships and Related Transactions

As of October 31, 2000, Mark A. Cohn, Chairman and Chief Executive Officer, owed Damark the principal amount of $855,291 under a loan made by Damark in January 1999. The loan bears interest at 1% over the prime interest rate announced from time to time by USBancorp and is due on January 4, 2001.

Ralph Strangis, a director of the Company, is also a member of the law firm of Kaplan, Strangis and Kaplan, P.A. which provided legal services to the Company in 1999. The firm has also been retained by and will render legal services to the Company in 2000 and 2001.

Section 16(b) Reporting

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's directors and executive officers and persons who own more than ten percent of the Company's outstanding Common Stock to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Directors, executive officers and persons owning more than ten percent of the Company's outstanding Common Stock are required by SEC regulation to furnish the Company with copies of all Section 16(a) reports that they file. To the Company's knowledge and based solely on a review of the copies of such reports furnished to the Company during 1999 and until the date of this Proxy Statement, the Company's directors and executive officers and persons owning more than ten percent of the Company's outstanding Common Stock complied with all applicable Section 16(a) filing requirements, except for the failure of Mr. Letak to report an aggregate of 911 shares of Common Stock acquired under the Company's employee stock purchase plan.

6

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary of Cash and Certain Other Compensation

The following table provides certain summary information concerning the compensation paid by the Company to the Company's Chief Executive Officer, each of the four other highest compensated executive officers of the Company (as determined as of the end of the Company's most recent fiscal year) for each of the fiscal years ended December 31, 1999, 1998 and 1997.

SUMMARY COMPENSATION TABLE

| |

|

|

|

|

Long Term Compensation |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Annual Compensation ($) |

||||||||||

| Name and Principal Position |

|

Common Shares Underlying Options or SARs(3) |

|

|||||||||

| Year |

Salary |

Bonus(1) |

Other(2) |

Other ($)(4) |

||||||||

| Mark A. Cohn Chairman of the Board and Chief Executive Officer |

1999 1998 1997 |

475,000 475,000 475,000 |

712,500 — — |

— — — |

— 400,000 100,000 |

(5) (5) |

— — |

|||||

| George S. Richards President and Chief Operating Officer |

|

1999 1998 1997 |

|

325,000 274,519 209,808 |

|

487,500 — — |

|

— — — |

|

30,000 110,000 30,000 |

(6) (6) (7) |

1,440 1,440 45,947 |

| Stephen P. Letak Executive Vice President and Chief Financial Officer |

|

1999 1998 1997 |

|

250,000 73,077 — |

|

337,500 25,000 — |

|

— — — |

|

— 75,000 — |

(8) |

695 — — |

| Rodney C. Merry Chief Information Officer Senior Vice President |

|

1999 1998 1997 |

|

200,000 183,096 155,000 |

|

270,000 — — |

|

— — — |

|

15,000 — |

(9) |

1,440 1,440 3,081 |

| Michael D. Moroz Senior Vice President Marketing Services |

|

1999 1998 1997 |

|

250,000 250,000 209,808 |

|

337,500 25,000 — |

|

— — — |

|

— 29,500 — |

(10) |

1,440 1,440 1,440 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

7

statutory option to purchase 400,000 shares of Damark common stock at $10.00 per share, vesting in equal installments in January 1999, 2000, 2001, 2002 and 2003.

The Company has not made any restricted stock grants to any of the executive officers named in the Summary Compensation Table.

Option Grants During Fiscal Year Ended December 31, 1999

The following table summarizes information relating to options granted during the fiscal year ended December 31, 1999 to the executive officers named in the Summary Compensation Table above.

OPTION/SAR GRANTS IN LAST FISCAL YEAR

| |

|

Percent of Total Options and SARs to be Granted to Employees in Fiscal Year |

|

|

|

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

|

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term |

|||||||||||

| |

Common Shares Underlying Options and SARs to be Granted |

|

|

||||||||||||

| |

Exercise or Base Price per Share |

|

|||||||||||||

| |

Expiration Date |

||||||||||||||

| Name |

5% |

10% |

|||||||||||||

| Mark A. Cohn | — | — | — | — | — | — | |||||||||

| George S. Richards | 30,000 | 14.9 | % | $ | 6.625 | August 2009 | $ | 323,743 | $ | 515,500 | |||||

| Stephen P. Letak | — | — | — | — | — | — | |||||||||

| Michael D. Moroz | — | — | — | — | — | — | |||||||||

| Rodney C. Merry | — | — | — | — | — | — | |||||||||

All of the above option grants vest in equal installments on the first three anniversaries of the date of grant, subject to continued employment with the Company.

Option Exercises and Year-End Value Table

The following table summarizes information relating to options exercised in 1999 and unexercised stock options as of December 31, 1999 of the executive officers named in the Summary Compensation Table above. There were no stock appreciation rights (SARs) outstanding at December 31,1999.

8

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION/SAR VALUES

| |

|

|

Number of Securities Underlying Unexercised Options/SARs at December 31, 1999 |

Value of Unexerciesed In the Money Options/SARs at December 31, 1999($)(1) |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Shares Acquired upon Exercise (#) |

|

||||||||||

| |

Value Realized |

|||||||||||

| Name |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

||||||||

| Mark A. Cohn | — | — | 180,000 | 320,000 | 1,135,000 | 1,840,000 | ||||||

| George S. Richards | — | — | 116,000 | 113,334 | 847,495 | 915,005 | ||||||

| Stephen P. Letak | — | — | 25,000 | 50,000 | 248,425 | 496,850 | ||||||

| Michael D. Moroz | — | — | 65,000 | 10,000 | 357,500 | 92,500 | ||||||

| Rodney C. Merry | — | — | 81,166 | 9,834 | 369,040 | 20,897 | ||||||

Employment Contracts, Severance and Change in Control Arrangements

The Company has entered into an employment agreement, as amended, with Mark A. Cohn in connection with Mr. Cohn's employment as Chairman and Chief Executive Officer of the Company which provides that Mr. Cohn's employment may not be terminated by the Company before December 31, 2002 other than for cause; in addition, the employment term automatically extends for one year on each January 1, unless notice of non-extension is given. Mr. Cohn's minimum annual base salary during the term of the employment agreement is $475,000 and Mr. Cohn is eligible to receive incentive compensation under the Company's management incentive plan. Mr. Cohn's employment agreement provides for the payment of severance benefits in the event of termination of employment under certain circumstances. Prior to a change in control (as defined) or following 24 months after a change in control, in the event of a termination of Mr. Cohn's employment by the Company without cause (as defined) or by Mr. Cohn with good reason (as defined), Mr. Cohn is entitled to receive his base salary for 36 months, a bonus based on the average of the last two years' bonus, continued participation in the Company's benefit plans for the balance of the term of the employment agreement and outplacement services. In the event of a termination of Mr. Cohn's employment prior to a change in control by the Company for cause or by Mr. Cohn's voluntary resignation, Mr. Cohn's compensation and benefits shall be as determined in the Company's applicable benefit plans and policies, except that in the event of voluntary resignation by Mr. Cohn, he shall be entitled to receive a pro rata portion of the bonus for the year of resignation. Within 24 months after a change in control, if Mr. Cohn's employment is terminated by the Company without cause or by Mr. Cohn with good reason (including termination by Mr. Cohn regardless of reason within the 60-day period immediately following the first anniversary of a change in control and including death or disability within one year after a change in control), Mr. Cohn is entitled to receive a lump sum payment equal to three times his annual salary, a bonus based on the average of the last two years' bonus plus a pro rata portion of the bonus for the year of termination, continued participation in the Company's benefits plans for three years, outplacement services, a lump sum payment of the value of forfeited stock incentives, a lump sum payment for the unvested portion of all other deferred benefits and a full gross-up payment for excise taxes. Following a change in control, if Mr. Cohn's employment is terminated by the Company with cause or by Mr. Cohn without good reason, Mr. Cohn's compensation and benefits shall be as determined under the Company's applicable benefit plans and policies. Under the employment agreement, Mr. Cohn has agreed not to compete with the Company during the term of his employment and, in the event he voluntarily resigns or the Company terminates his employment for cause, for a period of the longer of one year after such termination or the balance of the term of the employment agreement. In the event of a change in control, Mr. Cohn has agreed not to compete with the Company for a period of one year

9

regardless of the reason for termination. In addition, Mr. Cohn has made certain nonsolicitation and nondisparagement agreements for a three-year period following termination prior to a change in control and for a one-year period following termination after a change in control.

The Company and Mr. Cohn have entered into an agreement providing Mr. Cohn's estate the right to require the Company to repurchase all or a portion of Mr. Cohn's shares of Common Stock in the event of his death based on and at the then current market price, up to an aggregate amount of $5,000,000. The Company carries insurance on Mr. Cohn's life in excess of its obligation under this repurchase agreement. The agreement also provides that Mr. Cohn's shares after his death are subject to a right of first refusal in favor of the Company before any transfer can be made of such shares except for transfers to a family member or trust for the benefit of a family member, a registered public offering, or any sale made pursuant to Rule 144. In addition, the agreement provides Mr. Cohn with piggyback registration rights so long as he owns more than 250,000 shares of the Company's Common Stock. The agreement terminates if the number of shares beneficially owned by Mr. Cohn is less than 5% of the outstanding shares of Common Stock.

The Company has entered into severance, confidentiality and noncompete agreements with Messrs. Letak and Merry, executive officers of the Company. Prior to a change in control (as defined), in the event of a termination of the executive's employment by the Company without cause (as defined) or by voluntary resignation of the executive, the executive is entitled to receive his base salary for 24 months, a pro rata bonus for the year of termination if the executive terminates on or after July 1 in any year, continued participation in the Company's benefit plans for 24 months and outplacement services, provided that if the executive voluntarily resigns the Company has the option to waive the noncompete covenants of the agreement and pay no severance benefits, modify the term of the noncompete covenants to one year and pay 50% of the severance benefits or pay all severance benefits and receive a two-year noncompete covenant. In the event of termination of the executive's employment for cause prior to a change in control by the Company, the executive's compensation and benefits shall be as determined under the Company's applicable benefit plans and policies.

In addition, the Company has entered into change in control, confidentiality and noncompete agreements with Messrs. Letak, Merry and Moroz and Ms. Mageau, executive officers of the Company. Within 24 months following a change in control, if the executive is terminated by the Company without cause or by the executive with good reason (including termination by the executive regardless of reason within the 60-day period immediately following the first anniversary of the change in control and including death or disability within one year after a change in control), the executive is entitled to receive a lump sum payment equal to two times his or her annual salary, a bonus equal to the greater of the average of the bonuses for the last three years and the target bonus for the current year assuming 100% payout, plus the target bonus for the current year assuming 100% payout pro-rated for the portion of the year prior to termination, continued participation in the Company's benefits plans for two years, outplacement services, a lump sum payment for the value of forfeited stock incentives, a lump sum payment for the unvested portion of all other deferred benefits and a full gross-up payment for excise taxes. Following a change in control, if the executive's employment is terminated by the Company with cause or by the executive without good reason (other than as described above), the executive's compensation and benefits shall be as determined under the Company's applicable benefits plans and policies. In the event of a change of control the executives have agreed not to compete with the Company for a period of one year regardless of the reason for termination. In addition, the executives have made certain nonsolicitation and nondisparagement agreements for a three-year period following termination prior to a change in control and for a one-year period following termination after a change in control.

All options granted under the Company's 1991 Stock Option Plan (the "Option Plan") and the options granted to Mr. Cohn in 1998 vest immediately in the event of a change in control. None of the obligations of the Company under any employment, severance or change in control agreement are funded obligations.

10

BOARD COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Company's Compensation Committee (the "Committee") is currently composed of the following two directors who are not executive officers of the Company: Thomas A. Cusick and Stephen J. Hemsley. The Committee is authorized to review compensation arrangements for the executive officers of the Company and to administer the Company's Option Plan including the award of option grants under the Option Plan. In determining compensation for executive officers, the Committee considers base salary, bonus and stock incentives in constructing a total compensation package that will provide base salary at a level consistent with comparable companies and reflect normal average percentage increases, bonuses for achieving performance results that are expected to enhance the value of the Company's Common Stock and stock incentives which encourage retention of executive officers and provide them with long-term rewards which are consistent with the interests of the Company's shareholders.

Base Salary

The following general factors are taken into consideration in determining annual base salaries for the executive officers: (i) recommendations from the Chairman of the Board and Chief Executive Officer, and (ii) the level of compensation required to attract new executive officers to the Company. No specific weighting is assigned by the Company.

The Committee intends that base salaries of the executive officers be set on a basis that is competitive with other growth companies comparable to the businesses of the Company in terms of expected annual revenues. The Committee believes that base salary levels are competitive if they approximate the level of average base salaries for comparable companies. For 1999, the base salary of Mr. Richards was increased approximately $50,000 to reflect the additional duties he has assumed as the chief operating officer in September of 1998. In connection with the employment of Mr. Letak in September 1998, the Committee established his base salary at $200,000 and subsequently increased his base salary to $250,000. In 1999, the base salary of Mr. Merry was increased approximately $25,000 to recognize his appointment to Senior Vice President and Chief Information Officer. The Committee believes that the established levels of compensation for these executive officers met the overall objectives established by the Committee and were within the compensation range based on the responsibilities of the executive officers.

Incentive Compensation

In January 1999, the Committee adopted an incentive plan to provide a bonus pool for eligible employees, including executive officers, based on achievement of established performance levels targeting pre-tax income for the year ended December 31, 1999. Based on achievement of the 1999 performance target, the executive officers received incentive compensation detailed in the Summary Compensation Table. In April 2000, the Committee adopted an incentive plan to provide a bonus pool for eligible employees, including Messrs. Richards and Merry, of the Company's membership business based on achievement of established performance levels targeting membership services pre-tax income for the year ended December 31, 2000. To the extent actual performance in 2000 exceeded the established performance target, the incentive compensation would be increased based on a formula related to the amount by which actual performance exceeded the established performance target, but in no event would the incentive compensation exceed the following percentage of annual base salary: 150% for the Chief Executive Officer and the President, 135% for each Senior Vice President and 120% for each Vice President. The Committee retains the discretion to modify the income target to take into account special factors that may affect 2000 performance and extraordinary circumstances, as the Committee deems appropriate. Because ClickShip Direct, the Company's order fulfillment and customer care subsidiary, was in a start-up mode, the Committee established three strategic performance goals for executives of ClickShip Direct (Messrs. Cohn, Letak and Moroz): acquire new business quickly, deliver on certain mission-critical information technology targets, and deliver operational excellence to clients. However, no specific awards have been made for the executives of ClickShip Direct.

11

Stock Incentives

The Compensation Committee believes that stock options are an integral part of the compensation package of the Company's executive officers. By granting options at current market prices and providing for vesting of the options over a period of years, the Committee believes that stock options can be used to attract new executive officers, to retain their services and to align directly the interests of the executive officers and shareholders in the long-term performance of the Company and the appreciation of its Common Stock. The Committee has granted options to attract new executive officers as it did for Mr. Richards in 1995, Mr. Merry in 1996 and Mr. Letak in 1998. The Committee also grants additional stock options to executive officers when they are promoted or assume significantly increased responsibilities, or to recognize significant contributions to the Company. During 1999, the Committee granted Mr. Richards an option on 30,000 shares at $6.625, the then market price, that vests in three equal annual installments in June 2000, 2001 and 2002.

Chief Executive Officer Compensation

Mark A. Cohn is a founder of the Company and has been the Chief Executive Officer of the Company since its inception in 1986. In recognition of Mr. Cohn's importance to the Company as well as his knowledge of the operations and business of the Company, the Committee approved an employment agreement with Mr. Cohn in August 1992, which was subsequently amended and extended in July 1995 and restated in January 1998. See "Employment Contracts, Severance and Change in Control Arrangements." The employment agreement provides that Mr. Cohn will be employed as Chairman and Chief Executive Officer for a rolling term of three years. Under the agreement, Mr. Cohn's minimum annual base salary is $475,000 per annum, the level established for 1997. Mr. Cohn received a bonus of $712,500 under the 1999 management incentive plan described above. Since Mr. Cohn serves as the Chief Executive Officer of ClickShip Direct, he was not included in the Company's 2000 management incentive plan described above, but the Committee will consider a bonus for Mr. Cohn based on his individual performance and the performance of ClickShip Direct for the fiscal year ended December 31, 2000.

Other Information

In 1993, Section 162(m) of the Internal Revenue Code was adopted which, beginning in 1994, imposes an annual deduction limitation of $1.0 million on the compensation of certain executive officers of publicly held companies. The Committee does not believe that the Section 162(m) limitation will materially affect the Company in the near future based on the level of the compensation of the executive officers and, if the limitation would otherwise apply, the Committee could consider alternatives, including deferral of a portion of the incentive compensation, if the amount in excess of the $1.0 million annual deduction limitation is material.

| Thomas A. Cusick Compensation Committee |

Stephen J. Hemsley Compensation Committee |

12

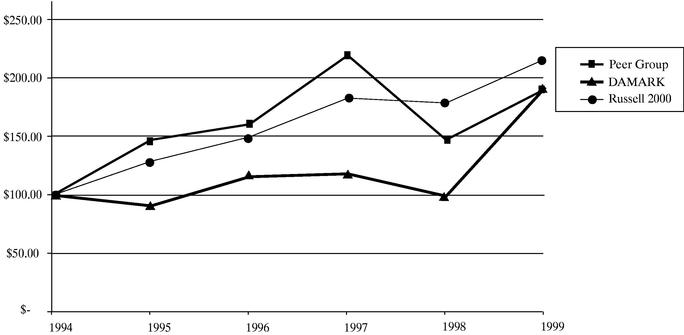

The graph below compares the cumulative total shareholder return on the Common Stock of the Company for the period beginning December 31, 1994 on a five year annual basis until December 31, 1999 with the cumulative total return of the Nasdaq Stock Market Total U.S. Return Index (the "Nasdaq (U.S.) Index") and the cumulative total return of the Company's peer group index (the "Peer Group Index") constructed by the Company as describe more fully below, over the same period, assuming an initial investment of $100 on December 31, 1994.

The following table reflects the value of a $100 investment made on December 31, 1994 as shown in the above graph as of December 31:

| |

1995 |

1996 |

1997 |

1998 |

1999 |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DAMARK | $ | 90.91 | $ | 115.15 | $ | 118.18 | $ | 98.48 | $ | 190.91 | |||||

| Russell 2000 Index | 128.44 | 149.62 | 183.08 | 178.42 | 216.35 | ||||||||||

| Peer Group Index | 146.75 | 160.19 | 219.49 | 147.26 | 190.20 | ||||||||||

The Peer Group includes companies focusing on membership services activities including Cendant Corp., Memberworks, Inc, Metris Companies, Inc. Fingerhut Companies, Inc. as well as companies focused on direct to consumer merchandise sales with similar customers as Damark, including Acxiom Corp., Creative Computers, Inc. and Sharper Image, Corp.

Proposal No. 2

APPROVAL OF DAMARK INTERNATIONAL, INC. 2000 STOCK INCENTIVE PLAN

Options under the Company's 1991 Stock Option Plan cannot be granted after March 20, 2001, the tenth anniversary of the adoption of the 1991 Plan. On November 20, 2000, the Board of Directors has approved, subject to shareholder approval, the Damark International, Inc. 2000 Stock Incentive Plan (the "2000 Plan"). Since options under the 1991 Plan will not be able to be granted after March 20, 2001, the Board of Directors determined that a new stock incentive plan should be implemented to provide stock incentives to key employees and to prospective new employees and consultants to retain and attract employees and consultants who will contribute to the Company's success and enhance shareholder value. A copy of the 2000 Plan is attached as Exhibit A to this Proxy Statement. The following summary of the 2000 Plan is qualified by reference to the attached text of the 2000 Plan.

The 2000 Plan provides for the granting of stock options to key employees of the Company and its subsidiaries. An aggregate of 1,500,000 shares of the Company's Common Stock is reserved for issuance

13

upon exercise of options granted under the 2000 Plan, as amended. No options may be granted under the 2000 Plan after November 19, 2010.

Administration

A committee appointed by the Board of Directors or, if no committee is appointed, the entire Board of Directors administers the 2000 Plan. The Board of Directors has appointed the Compensation Committee (the "Committee") to be responsible for the administration of the 2000 Plan. The Committee is intended to be constituted of non-employee, outside directors so as to permit the 2000 Plan to comply with Rule 16b-3 promulgated by the SEC and Section 162(m) of the Internal Revenue Code. The Committee has general authority and discretion to determine the employees to whom and the time or times at which options may be granted, and the number of shares to be subject to each option. In addition, the Committee may prescribe the terms applicable to each grant of an option. The Committee is currently comprised of the following two directors: Messrs. Cusick and Hemsley.

The Committee does not intend to grant options under the 2000 Plan until after ClickShip Direct has been spun off to the Company's shareholders or another strategic alternative for ClickShip Direct has been accomplished.

Terms and Conditions of Options

Either incentive stock options ("ISOs") within the meaning of Section 422A of the Internal Revenue Code of 1986, as amended (the "Code"), or non-statutory options may be granted under the 2000 Plan. Options may be granted only to key employees and consultants of the Company and its subsidiaries who contributed, and are expected to contribute, materially to the success of the Company and its subsidiaries.

The purchase price of shares of Common Stock subject to options granted under the 2000 Plan is determined by the Committee, but shall not be less than 100% of the fair market value of the Company's Common Stock on the date the option is granted for ISOs and not less than 85% of the fair market value on the date the option is granted for non-statutory options. An option granted under the 2000 Plan shall vest at such rate and upon such conditions as the Committee shall determine at the time the option is granted. The 2000 Plan provides that all options will accelerate upon retirement after the normal retirement date, death or disability of an optionee and immediately before a change of control (as defined) occurs. A change of control will occur if (1) any person other than Mark Cohn, the Company's founder, Chairman and Chief Executive Officer, acquires more than 35% of the voting power of the Company's securities, (2) there is a merger, consolidation or other reorganization of the Company and the shares of the Company's Common Stock held by shareholders of the Company immediately before the transaction represent less than 50% of the voting power of the shares of the entity resulting from the transaction, or (3) the Company sells all or substantially all of its assets. The distribution of ClickShip Direct to its shareholders or the disposition of ClickShip Direct will not be considered a change of control.

No option granted under the 2000 Plan is transferable by the optionee during his lifetime. An option may be exercised only while the optionee is an employee of or consultant to the Company or any of its subsidiaries or, in the event of a termination of employment other than by death or disability, within thirty (30) days after termination of employment (but not later than the expiration of the term of the option). Upon the death or disability of an optionee, the optionee or his legal or personal representative or beneficiaries may exercise an option to the extent exercisable by the optionee within one year after the optionee's death or disability (but not later than the expiration of the term of the option). In the event any option expires or is cancelled, surrendered or terminated without being exercised, the shares subject to such option (or the unexercised portion thereof) will again be available for options under the 2000 Plan.

14

Payment

Payment for shares of Common Stock purchased upon the exercise of an option under the 2000 Plan and of all taxes that the Company is required to withhold in connection with the exercise of an option must be made in full at the time the option is exercised. The Committee may, at its discretion, permit shares of the Company's Common Stock to be tendered in payment of the exercise price, permit payment to be made by the optionee's broker from the sale or loan proceeds for such shares or any other securities the optionee may have in his account with the broker, or permit payment under the terms of a promissory note as the Committee may determine.

Surrender and Cancellation of Options

The Committee is authorized to permit the surrender and cancellation of a previously granted option under the 2000 Plan and the grant of a replacement option. The previously granted option surrendered and cancelled may be exercisable at prices substantially higher than the exercise price of the shares of Common Stock on the date the replacement option is granted.

Amendment

The 2000 Plan may be amended by the Board of Directors, except that without the affirmative vote of the holders of a majority of the shares of the Company's Common Stock present and entitled to vote at a meeting at which a quorum is present, the Board of Directors may not amend the 2000 Plan (a) to increase the aggregate number of shares of Common Stock which may be issued and sold under the 2000 Plan (except such number of shares may be adjusted in the event of a recapitalization, stock dividend or similar event), (b) to decrease the minimum exercise price at which options may be granted under the 2000 Plan, (c) to extend the period during which the options may be granted or (d) to change the requirements as to the class of employees eligible to receive options.

Tax Consequences

Incentive Stock Options. Under the present federal tax regulations, there will be no federal income tax consequences to either the Company or the optionee upon the grant of an ISO, nor will an optionee's exercise of an ISO result in federal income tax consequences to the Company. Although an optionee will not realize ordinary income upon his exercise of an ISO, the excess of the fair market value of the shares of Common Stock acquired at the time of exercise over the exercise price will constitute an "item of tax preference"' within the meaning of Section 57 of the Code and, thus, may result in the imposition of the "alternative minimum tax" pursuant to Section 55 of the Code on the optionee. If an optionee does not dispose of shares of Common Stock acquired through the exercise of an ISO within two (2) years from the date of grant and within one (1) year of the exercise of the ISO, any gain realized upon a subsequent disposition of such shares will constitute long-term capital gain to the optionee. If an optionee disposes of such shares within two (2) years from the date of grant or within one (1) year of the date of exercise of the ISO, an amount equal to the lesser of (i) the excess of the fair market value of such shares on the date of exercise over the exercise price, or (ii) the actual gain realized upon such disposition will constitute ordinary income to the optionee in the year of disposition. Any additional gain upon such disposition will be taxed as short-term capital gain. The Company will receive a deduction in an amount equal to the amount constituting ordinary income to the optionee.

Non-Statutory Options. Under the present federal income tax regulations, there will be no federal income tax consequences to either the Company or the optionee upon the grant of a nonstatutory option. However, the optionee will realize ordinary income upon the exercise of a nonstatutory option in an amount equal to the excess of the fair market value of the shares of Common Stock acquired upon exercise of such option over the exercise price, and the Company will receive a corresponding tax deduction. With respect to officers who are subject to Section 16(b) of the Securities and Exchange Act of 1934, the

15

realization of income (and the Company's corresponding deduction) will be delayed until six (6) months following such exercise. The gain, if any, realized upon a subsequent disposition of such shares will constitute short-term or long-term capital gain, depending upon the optionee's holding period.

Non-Employee Director Options

The 2000 Plan also provides for an automatic grant of an option on 50,000 shares of Common Stock to each new member of the Company's Board of Directors who has not been an employee of the Company upon his or her election to the Board of Directors. The exercise price of the non-employee director options is the fair market value of the Common Stock on the date of grant. The non-employee director options vest in three equal annual installments commencing on the first anniversary of the date of grant and vesting is accelerated upon a change of control or the death or disability of the non-employee director. The non-employee director options may be exercised within one year after the non-employee director ceases to be a member of the Company's Board of Directors or ten years after the date of grant, whichever sooner occurs. The maximum number of shares of Common Stock that can be issued for non-employee director options is 250,000 shares. None of the current non-employee directors of the Company (Messrs. Cusick, Hemsley and Strangis) are eligible to receive the non-employee director options under the 2000 Plan. If the spinoff of ClickShip Direct to the Company's shareholders occurs, it is anticipated that Messrs. Cusick, Hemsley and Strangis will become the non-employee directors of ClickShip Direct and other non-employees will be elected to the Company's Board of Directors. The prospective new non-employee directors of the Company have not yet been determined.

Outstanding Options

No options have been granted under the 2000 Plan. The Committee does not currently intend to grant options under the 2000 Plan until ClickShip Direct has been distributed to the Company's shareholders or another strategic alternative for ClickShip Direct has been accomplished.

Recommendation of Board of Directors

The Board of Directors unanimously recommends a vote FOR adoption of the 2000 Plan.

Proposal No. 3

APPROVAL OF CLICKSHIP DIRECT, INC. 2000 STOCK INCENTIVE PLAN

In connection with the possible spinoff of ClickShip Direct, the Company's order fulfillment and customer care subsidiary, to Damark shareholders, the Board of Directors of ClickShip Direct has approved, subject to shareholder approval, the ClickShip Direct, Inc. 2000 Stock Incentive Plan (the "ClickShip Plan"). Options under the ClickShip Plan will not be granted unless and until the spinoff of ClickShip Direct has been accomplished. Because of tax law and securities law requirements that the ClickShip Plan be approved by shareholders, the Company is presenting the ClickShip Plan for approval by the Company's shareholders. The ClickShip Direct Board of Directors has determined that a stock incentive plan should be implemented to provide stock incentives to key employees and to prospective new employees to retain and attract employees who will contribute to the success of ClickShip Direct after the spinoff has been consummated and enhance shareholder value of ClickShip Direct. In addition, the ClickShip Plan provides for a one-time grant to non-employee directors of ClickShip Direct when such person is elected to the ClickShip Direct Board of Directors. No options can be granted under the ClickShip Plan unless the distribution of the common stock of ClickShip Direct to the Company's shareholders has been consummated. A copy of the ClickShip Plan is attached as Exhibit B to this Proxy Statement. The following summary of the ClickShip Plan is qualified by reference to the text of the ClickShip Plan.

16

The ClickShip Plan provides for the granting of stock options to key employees of the Company and its subsidiaries. An aggregate of 3,000,000 shares of ClickShip Direct's common stock (the "ClickShip Common Stock") are reserved for issuance upon exercise of options granted under the ClickShip Plan, including up to 700,000 shares for non-employee director options. No options may be granted under the ClickShip Plan after November 19, 2010.

Administration

A committee appointed by the Board of Directors or, if no committee is appointed, the entire Board of Directors administers the ClickShip Plan. The Committee is intended to be constituted of non-employee, outside directors so as to permit the ClickShip Plan to comply with Rule 16b-3 promulgated by the SEC and Section 162(m) of the Internal Revenue Code. The Committee has general authority and discretion to determine the employees to whom and the time or times at which options may be granted, and the number of shares to be subject to each option. In addition, the Committee may prescribe the terms applicable to each grant of an option. If the spinoff of ClickShip Direct is accomplished, it is currently expected that, the Committee will be comprised of the following two directors: Messrs. Cusick and Hemsley.

No options can be granted under the ClickShip Plan until after ClickShip Direct has been spun off to the Company's shareholders.

Terms and Conditions of Options

Either incentive stock options ("ISOs") within the meaning of Section 422A of the Code or non-statutory options may be granted under the ClickShip Plan. Options may be granted only to key employees and consultants of ClickShip Direct and its subsidiaries who contributed, and are expected to contribute, materially to the success of the ClickShip Direct.

The purchase price of shares of ClickShip Common Stock subject to options granted under the ClickShip Plan is determined by the Committee, but shall not be less than 100% of the fair market value of ClickShip Common Stock on the date the option is granted for ISOs and not less than 85% of the fair market value on the date the option is granted for non-statutory options. An option granted under the ClickShip Plan shall vest at such rate and upon such conditions as the Committee shall determine at the time the option is granted. The ClickShip Plan provides that all options will accelerate upon retirement after the normal retirement date, death or disability of an optionee and immediately before a change of control (as defined) occurs. A change of control of ClickShip Direct will occur if (1) any person other than Mark Cohn, the Damark's founder, who is also Chairman, President and Chief Executive Officer of ClickShip Direct, acquires more than 35% of the voting power of ClickShip Direct's securities, (2) there is a merger, consolidation or other reorganization of ClickShip Direct and the shares of ClickShip Common Stock held by shareholders of ClickShip Direct immediately before the transaction represent less than 50% of the voting power of the shares of the entity resulting from the transaction, or (3) ClickShip Direct sells all or substantially all of its assets.

No option granted under the ClickShip Plan is transferable by the optionee during his lifetime. An option may be exercised only while the optionee is an employee of or consultant to the Company or any of its subsidiaries or, in the event of a termination of employment other than by death or disability, within thirty (30) days after termination of employment (but not later than the expiration of the term of the option). Upon the death or disability of an optionee, the optionee or his legal or personal representative or beneficiaries may exercise an option to the extent exercisable by the optionee within one year after the optionee's death or disability (but not later than the expiration of the term of the option). In the event any option expires or is cancelled, surrendered or terminated without being exercised, the shares subject to such option (or the unexercised portion thereof) will again be available for options under the ClickShip Plan.

17

Payment

Payment for shares of ClickShip Common Stock purchased upon the exercise of an option under the ClickShip Plan and of all taxes that the Company is required to withhold in connection with the exercise of an option must be made in full at the time the option is exercised. The Committee may, at its discretion, permit shares of ClickShip Common Stock to be tendered in payment of the exercise price, permit payment to be made by the optionee's broker from the sale or loan proceeds for such shares or any other securities the optionee may have in his account with the broker, or permit payment under the terms of a promissory note as the Committee may determine.

Surrender and Cancellation of Options

The Committee is authorized to permit the surrender and cancellation of a previously granted option under the ClickShip Plan and the grant of a replacement option. The previously granted option surrendered and cancelled may be exercisable at prices substantially higher than the exercise price of the shares of ClickShip Common Stock on the date the replacement option is granted.

18

Amendment

The ClickShip Plan may be amended by the Board of Directors, except that without the affirmative vote of the holders of a majority of the shares of ClickShip Common Stock present and entitled to vote at a meeting at which a quorum is present, the Board of Directors may not amend the ClickShip Plan (a) to increase the aggregate number of shares of ClickShip Common Stock which may be issued and sold under the ClickShip Plan (except such number of shares may be adjusted in the event of a recapitalization, stock dividend or similar event), (b) to decrease the minimum exercise price at which options may be granted under the ClickShip Plan, (c) to extend the period during which the options may be granted or (d) to change the requirements as to the class of employees eligible to receive options.

Tax Consequences

Incentive Stock Options. Under the present federal tax regulations, there will be no federal income tax consequences to either ClickShip Direct or the optionee upon the grant of an ISO, nor will an optionee's exercise of an ISO result in federal income tax consequences to ClickShip Direct. Although an optionee will not realize ordinary income upon his exercise of an ISO, the excess of the fair market value of the shares of ClickShip Common Stock acquired at the time of exercise over the exercise price will constitute an "item of tax preference' within the meaning of Section 57 of the Code and, thus, may result in the imposition of the "alternative minimum tax" pursuant to Section 55 of the Code on the optionee. If an optionee does not dispose of shares of ClickShip Common Stock acquired through the exercise of an ISO within two (2) years from the date of grant and within one (1) year of the exercise of the ISO, any gain realized upon a subsequent disposition of such shares will constitute long-term capital gain to the optionee. If an optionee disposes of such shares within two (2) years from the date of grant or within one (1) year of the date of exercise of the ISO, an amount equal to the lesser of (i) the excess of the fair market value of such shares on the date of exercise over the exercise price, or (ii) the actual gain realized upon such disposition will constitute ordinary income to the optionee in the year of disposition. Any additional gain upon such disposition will be taxed as short-term capital gain. ClickShip Direct will receive a deduction in an amount equal to the amount constituting ordinary income to the optionee.

Non-Statutory Options. Under the present federal income tax regulations, there will be no federal income tax consequences to either ClickShip Direct or the optionee upon the grant of a nonstatutory option. However, the optionee will realize ordinary income upon the exercise of a nonstatutory option in an amount equal to the excess of the fair market value of the shares of ClickShip Common Stock acquired upon exercise of such option over the exercise price, and ClickShip Direct will receive a corresponding tax deduction. With respect to officers who are subject to Section 16(b) of the Securities and Exchange Act of 1934, the realization of income (and ClickShip Direct's corresponding deduction) will be delayed until six (6) months following such exercise. The gain, if any, realized upon a subsequent disposition of such shares will constitute short-term or long-term capital gain, depending upon the optionee's holding period.

Non-Employee Director Options

The ClickShip Plan also provides for an automatic grant of an option on 100,000 shares of ClickShip Common Stock to each new member of the ClickShip Direct Board of Directors who has not been an employee of ClickShip upon his or her election to the ClickShip Direct Board of Directors after or contemporaneous with the spinoff of ClickShip Direct. The exercise price of the non-employee director options is the fair market value of the ClickShip Direct Common Stock on the date of grant. The non-employee director options vest in three equal annual installments commencing on the first anniversary of the date of grant and vesting is accelerated upon a change of control or the death or disability of the non-employee directors. The non-employee director options may be exercised within one year after the non-employee director ceases to be a member of the ClickShip Board of Directors or ten years after the date of grant, whichever sooner occurs. The maximum number of shares of ClickShip Common Stock that can be issued for non-employee director options is 700,000 shares. It is expected that the three

19

non-employee directors of Damark (Messrs. Cusick, Hemsley and Strangis) will become non-employee directors of Click Ship Direct if and when the spinoff of ClickShip Direct occurs and will receive non-employee director options under the ClickShip Plan. Upon completion of the spinoff of ClickShip Direct and their election as non-employee directors of ClickShip Direct, Messrs. Cusick, Hemsley and Strangis would each be granted a non-employee director stock option under the ClickShip Plan.

Outstanding Options

No options have been granted under the ClickShip Plan. No options can be granted under the ClickShip Plan unless the common stock of ClickShip owned by the Company has been distributed to the Damark shareholders.

Recommendation of Board of Directors

The Board of Directors unanimously recommends a vote FOR adoption of the ClickShip Plan.

Proposal No. 4

APPROVAL OF AMENDMENT TO THE RESTATED ARTICLES OF INCORPORATION

OF DAMARK INTERNATIONAL, INC.

In anticipation of the spinoff of ClickShip Direct, the Company's membership services business began operating under the name "Provell" beginning in 2000. In the event the ClickShip Direct spinoff occurs or if the Company's Board of Directors otherwise determines, the Board of Directors has approved, subject to shareholder approval, a change of the Company's corporate name to "Provell, Inc." To effect a change in the Company's name, the shareholders need to approve an amendment to the Company's restated articles of incorporation. The change of name will be effective when the appropriate documents are, at the direction of the Board of Directors, filed with the Minnesota Secretary of State.

The Board of Directors recommends that the shareholders approve an amendment to Article I of the Company's restated articles of incorporation to change the corporate name to "Provell, Inc." with authority to the Board of Directors to effect the name change when it determines appropriate.

Proposal No. 5

APPROVAL OF ISSUANCE OF COMMON STOCK FOR DIVIDENDS ON SERIES D PREFERRED STOCK, AND UPON REDEMPTION OF SERIES D PREFERRED STOCK

On September 29, 2000, the Company issued 200,000 shares of a newly created Series D Preferred Stock, stated value of $100 per share, in a private placement. The shares of Series D Preferred Stock are convertible into the Company's Common Stock at $12.94 per share (101% of the closing bid price for the Company's Common Stock on September 28, 2000), subject to certain adjustments for future events, including the spinoff of ClickShip Direct or any delay therein. As part of the transaction, the Company also issued Common Stock Purchase Warrants to the purchasers of the Series D Preferred Stock for an aggregate 772,798 shares of Class A Common Stock at an exercise price of $16.17 per share (125% of the closing bid price for the Company's Common Stock on September 28, 2000), subject to adjustments similar to the Series D Preferred Stock. The net cash proceeds from the issuance of the Series D Preferred Stock were approximately $18.8 million and will be used to supplement working capital. In addition, the Company would also receive $12.5 million if the Common Stock Purchase Warrants are exercised.

The Series D Preferred Stock has a dividend rate of 6.5% per annum and is payable quarterly in cash or, at the option of the Company, shares of the Company's Common Stock valued at 90% of then current market price. Unless converted to Common Stock, the Series D Preferred Stock will be redeemed on September 29, 2002 at the stated value of the shares in cash or, at the option of the Company, for shares of the Company's Class A Common Stock valued at 90% of then current market price. As a result of the

20

dividend and redemption provisions of the Series D Preferred Stock, shares of Common Stock may be issued at less than the then fair market value of the Common Stock.

The Company's Common Stock is listed on the Nasdaq National Stock Market. Under Nasdaq rules, shareholder approval is required if 20% or more of the outstanding shares of the Company's Common Stock are issued at less than fair market value. The Board of Directors recommends that the shareholders approve the issuance of shares of Common Stock in respect of the payment of dividends on the Series D Preferred Stock. Such approval will enable the Board of Directors to determine whether to use cash or shares of the Company's Common Stock to pay the dividends that accrue on the Series D Preferred Stock and the redemption price of the Series D Preferred Stock on September 29, 2002, and thereby determine the best use of the Company's capital resources.

As of November 3, 2000, the Company had 5,852,269 shares of Common Stock outstanding. The following chart sets forth the aggregate number of shares of Common Stock that would be used to pay the dividends on the Series D Preferred Stock and the redemption price of the Series D Preferred Stock if amounts were only paid in Common Stock based on different levels of the average closing bid price for the Common Stock during the ten trading days immediately preceding the payment.

| Stock Price |

Shares Issued as Dividends |

Shares Issued in Redemption |

Total Shares Issued |

Percent of Outstanding Shares |

|||||

|---|---|---|---|---|---|---|---|---|---|

| $18.00 | 160,494 | 1,234,568 | 19,395,062 | 23.8 | % | ||||

| $15.00 | 192,593 | 1,481,482 | 1,674,075 | 28.6 | % | ||||

| $12.00 | 240,741 | 1,851,852 | 2,092,593 | 35.8 | % | ||||

| $9.00 | 320,988 | 2,469,136 | 2,790,124 | 47.7 | % |

As the above chart demonstrates, the number of shares of Common Stock that may be issued to pay the dividend and redemption price of the Series D Preferred Stock, depending on the level of the stock price, will likely exceed 20% of the outstanding shares of Common Stock if only stock is used as payment.

The following is a summary of the terms of the Series D Preferred Stock and the Common Stock Purchase Warrants issued by the Company on September 29, 2000.

Series D Convertible Preferred Stock

Dividends. The Series D Preferred Stock carries a cumulative dividend rate of 6.5% per annum, payable quarterly in arrears on the last day of March, June, September and December, commencing on December 31, 2000. Such dividend accrues from day-to-day, whether or not earned or declared, beginning as of September 29, 2000. At the option of our Board of Directors, dividends may be paid in cash or shares of common stock. If we choose to pay dividends in shares of our common stock, the number of shares to be issued in payment of a dividend on the Series D Preferred Stock will be equal to the accrued dividends divided by 90% of the then market price of our common stock.

For purposes of this calculation, the market price of our common stock will be equal to 90% of the average of the closing bid price of our common stock during the ten trading days immediately preceding the dividend date. For example, if the quarterly dividend of $325,000, assuming all 200,000 shares of Series D Preferred Stock are outstanding, was payable on September 29, 2000, and we elected to pay the dividend in shares of our common stock, then 90% of the average of the closing bid prices of our common stock during the ten consecutive trading days ending on September 28, 2000 would have been $14.125 per share, and we would have been required to issue 25,571 shares of common stock per share of Series D Preferred Stock in lieu of a cash dividend.

Conversion. The holders have the right to convert the shares of Series D Preferred Stock at any time after the date of initial issuance. The number of shares of common stock to be issued upon conversion of a series D preferred share is determined by dividing the sum of $100 plus accrued and unpaid dividends by the applicable conversion price as described below. The current conversion price is $12.94 per share,

21

subject to certain adjustments for future events, including the spinoff of ClickShip Direct or any delay therein. The terms of the Series D Preferred Stock also contain customary provisions for the adjustment of the conversion price in the event a stock dividend or stock split is declared or any recapitalization, reorganization, or similar transaction occurs.

If the ClickShip spinoff is completed, the conversion price of the Series D Preferred Stock will be reduced by the greater of:

If the ClickShip spinoff or other disposition is not completed by March 31, 2001, the conversion price then in effect will be reduced to an amount equal to the lesser of:

In the event we issue or sell any additional shares of our common stock, or any stock or other securities convertible into or exchangeable for additional shares of our common stock without consideration or for a consideration that is less than the conversion price of the Series D Preferred Stock in effect immediately prior to such event, then the conversion price of the Series D Preferred Stock will be reduced to a price equal to the price paid upon such issuance or sale. The conversion price of the Series D Preferred Stock will not be adjusted for issuances of common stock occurring as a result of:

Under the terms of the Series D Preferred Stock, a strategic financing means the issuance of additional shares of our common stock for consideration other than cash or its equivalent to any person or entity for the purpose of establishing or furthering a material business, technology or commercial relationship, provided that our board of directors has determined that the strategic financing is likely to result in or further such a relationship. An aggregate of up to 750,000 shares may be issued in strategic financings.

The terms of the Series D Preferred Stock and the related warrants provide that the preferred stock is convertible and the warrants are exercisable by any holder only to the extent that the number of shares of common stock issuable at that time, together with the number of shares of common stock beneficially

22

owned by that holder and its affiliates as determined in accordance with Section 13(d) of the Securities Exchange Act, would not exceed 4.99% of our then outstanding common stock. Any holder may, however, elect to waive this restriction by giving us written notice at least sixty-one days prior to the date on which the series D shares are to be converted or the warrants exercised in an amount that would exceed the 4.99% limitation.

Mandatory Redemption. The Series D Preferred Stock matures on September 29, 2002, at which time the Series D Preferred Stock must be redeemed or converted at our option. If we elect to redeem any Series D Preferred Stock outstanding on September 29, 2002, the amount required to be paid will be equal to the liquidation preference of the Series D Preferred Stock, which equals the price originally paid for such shares plus accrued and unpaid dividends. If we elect to convert any Series D Preferred Stock outstanding on September 29, 2002, we will be required to issue shares in an amount equal to the price paid for the Series D Preferred Stock plus accrued and unpaid dividends divided by the mandatory redemption price. The mandatory redemption price will be equal to 90% of the average of the closing bid price of our common stock during the ten trading days immediately preceding the redemption date.

Right to require redemption upon triggering event. If a triggering event occurs, the holders of the Series D Preferred Stock will have the right to require us to redeem all or a portion of any outstanding Series D Preferred Stock for cash. The redemption price in such a case is the greater of:

A "triggering event" is deemed to have occurred if:

Redemption upon consummation of a major transaction. On the date a major transaction is completed, we, or our successor, must redeem for cash all of the selling shareholders, Series D Preferred Stock outstanding on that date at a price per share equal to 125% of the price paid for the Series D Preferred Stock plus all accrued and unpaid dividends. A "major transaction" means the occurrence of any of the following events:

23

Within five days after we enter into an agreement to effect a major transaction, we are required to deliver a written notice of the major transaction to each holder of Series D Preferred Stock.

Optional Redemption. We also have the right, provided specified conditions are satisfied, to redeem all of the outstanding Series D Preferred Stock for cash equal to the price paid for each preferred share plus accrued but unpaid dividends, at any time after September 29, 2001. The conditions to our right to redeem Series D Preferred Stock include:

Liquidation Preference. In the event of our liquidation, the holders of the Series D Preferred Stock will be entitled to a liquidation preference, after payment to holders of indebtedness which is senior in rank to the Series D Preferred Stock but before any amounts are paid to the holders of our common stock. The liquidation preference is equal to 125% of the amount originally paid for the Series D Preferred Stock, or $100 per share, plus accrued and unpaid dividends on any outstanding Series D Preferred Stock.

Voting rights. Other than as required by law, the holders of the Series D Preferred Stock have no voting rights except that the consent of holders of at least two-thirds of the outstanding Series D Preferred Stock will be required to effect any change in either our restated articles of incorporation or certificate of designations that would change any of the rights of the Series D Preferred Stock.

Warrants

Warrants to purchase 772,798 shares of our common stock were issued in connection with the sale of the Series D Preferred Stock as of September 29, 2000 at an exercise price of $16.17 per share, subject to anti-dilution adjustments. These warrants are presently exercisable and will expire in 2003. The exercise price is subject to adjustments if we declare a stock split or dividend of our common stock and will be reduced if we issue shares of our common stock at a price that is below the average of the closing bid prices of the common stock for the ten trading days immediately preceding such issuance.

In addition, in the event that we distribute the shares or assets of ClickShip to our shareholders or complete a similar transaction, the warrants will continue as outstanding obligations and the exercise price then in effect will be reduced by an amount equal to the greater of:

24

If the ClickShip distribution or other disposition is not completed by March 31, 2001, the exercise price then in effect will be reduced, but not increased, to an amount equal to the lesser of:

We intend to use the proceeds if the warrants are exercised primarily for working capital and general corporate purposes. As of September 29, 2000, other than the warrants issued to the holders of the Series D Preferred Stock, there were no warrants outstanding.

Registration Rights

Pursuant to a registration rights agreement between us and the holders of the Series D Preferred Stock, we agreed to file a registration statement of which this prospectus constitutes a part, covering the resales by the selling shareholders of:

We are also required to provide the holders of the Series D Preferred Stock and related warrants with a current prospectus upon their request to use in the resale of the common stock.