|

|

|

|

|

Previous: WATSON PHARMACEUTICALS INC, 424B3, 2001-01-12 |

Next: BITWISE DESIGNS INC, PRE 14A, EX-1, 2001-01-12 |

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

| Check the appropriate box: | |||

| [X] | Preliminary Proxy Statement | [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement | ||

| [ ] | Definitive Additional Materials | ||

| [ ] | Soliciting Material Pursuant to §240.14a-12 | ||

| BITWISE DESIGNS, INC. |

|

|

| (Name of Registrant as Specified In Its Charter) |

| Ira C. Whitman, Secretary |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

|

|

||

| (1) | Title of each class of securities to which transaction applies: | |

|

|

||

| (2) | Aggregate number of securities to which transaction applies: | |

|

|

||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

|

||

| (4) | Proposed maximum aggregate value of transaction: | |

|

|

||

| (5) | Total fee paid: | |

|

|

||

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

|

|

||

| (2) | Form, Schedule or Registration Statement No.: | |

|

|

||

| (3) | Filing Party: | |

|

|

||

| (4) | Date Filed: | |

|

|

Notes:

BITWISE DESIGNS, INC.

2165 Technology Drive

Schenectady, NY 12308

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on February 28, 2001

To the Stockholders of

BITWISE DESIGNS, INC.

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of BITWISE DESIGNS, INC. (the “Corporation”) will be held at The Holiday Inn Turf Hotel at 205 Wolf Road, Albany, New York 12205, on February 28, 2001 at 10:00 a.m. New York time, for the purpose of:

| 1. | Electing seven Directors to the Company’s Board of Directors; | |

| 2. | To consider and act upon a proposal to adopt the Company’s 2000 Employees Stock Option Plan; | |

| 3. | To consider and act upon a proposal to amend the Articles of Incorporation of the Company to change the name of the Company from Bitwise Designs, Inc. to Authentidate Holding Corp.; | |

| 4. | To consider and act upon a proposal to amend the Articles of Incorporation of the Company to increase the number of authorized shares of the Common Stock of the Company from 20,000,000 Shares to 40,000,000 Shares; | |

| 5. | To consider and act upon a proposal to exchange the currently outstanding securities of the Company’s subsidiary Authentidate, Inc., not held by the Company for securities of the Company on a 1 for 1.5249 basis; and | |

| 6. | To transact such other business as may properly be brought before the meeting or any adjournment thereof. | |

The close of business on January 8, 2001 has been fixed as the Record Date for the determination of Stockholders entitled to notice of, and to vote at, the meeting and any adjournment thereof.

You are cordially invited to attend the meeting. Whether or not you plan to attend, please complete, date and sign the accompanying proxy and return it promptly in the enclosed envelope to assure that your shares are represented at the meeting. If you do attend, you may revoke any prior proxy and vote your shares in person if you wish to do so. Any prior proxy will automatically be revoked if you execute the accompanying proxy or if you notify the Secretary of the Corporation, in writing, prior to the Annual Meeting of Stockholders.

| By Order of the Board of Directors, | |||

| Ira C. Whitman, Secretary | |||

| Dated: January 25, 2001 |

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ASSURE REPRESENTATION OF YOUR SHARES. NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED STATES.

BITWISE DESIGNS, INC.

2165 Technology Drive

Schenectady, NY 12308

PROXY STATEMENT

for

Annual Meeting of Stockholders

To Be Held on February 28, 2001

This Proxy Statement and the accompanying form of proxy have been mailed on or about January 25, 2001 to the Stockholders of record of shares of Common Stock and Series A Preferred Stock as of January 8, 2001, of BITWISE DESIGNS, INC., a Delaware corporation (the “Company”) in connection with the solicitation of proxies by the Board of Directors of the Company for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 10:00 a.m. at the Holiday Inn Turf Hotel, 205 Wolf Road, Albany, New York, on Wednesday, February 28, 2001 and at any adjournment thereof.

SOLICITATION, VOTING AND REVOCABILITY OF PROXIES

On January 8, 2001 (the “Record Date”), there were 14,856,730 shares of Common Stock, par value $.001 par value (“ Common Stock”), 100 shares of Series A Preferred Stock, $.10 par value, issued and outstanding and 50,000 shares of Series B Preferred Stock, $.10 par value, issued and outstanding. Only holders of Common Stock and Series A Preferred Stock of record at the close of business on the Record Date are entitled to receive notice of, and to vote at, the Annual Meeting and any adjournment thereof. Each share of Common Stock and each share of Series A Preferred Stock is entitled to one vote on each matter submitted to Stockholders. Shares of the Company’s Common Stock and Series A Preferred Stock represented by an effective proxy in the accompanying form will, unless contrary instructions are specified in the proxy, be voted:

| 1. | FOR the election of the seven (7) persons nominated by the Board of Directors; and | ||

| 2. | FOR the proposal to adopt the Company’s 2000 Employees Stock Option Plan; | ||

| 3. | FOR the proposal to amend the Company’s Certificate of Incorporation to change the Company’s name to Authentidate Holding Corp.; | ||

| 4. | FOR the proposal to amend the Company’s Certificate of Incorporation to increase the number of authorized shares of Common Stock from 20,000,000 shares to 40,000,000 shares; | ||

| 5. | FOR the proposal to exchange the currently outstanding securities of Authentidate, Inc. for securities of the Company; and | ||

| 6. | FOR such other matters as may be properly brought before the meeting and for which the persons named on the enclosed proxies determine, in their sole discretion to vote in favor. | ||

Any proxy may be revoked at any time before it is voted. A Stockholder may revoke a Proxy by notifying the Secretary of the Company either in writing prior to the Annual Meeting or in person at the Annual Meeting, by submitting a Proxy bearing a later date or by voting in person at the Annual Meeting. Election of Directors is by plurality vote, with the seven (7) nominees receiving the highest vote totals to be elected as Directors of the Company. Accordingly, abstentions and broker non-votes will not affect the outcome of the Election of Directors. The affirmative vote of a majority of the shares eligible to vote and voting at the Annual Meeting is required to approve Proposal II—Adoption of the 2000 Employees Stock Option Plan and Proposal V—Proposal to Exchange the Securities of Authentidate for the Securities of the Company. Therefore, abstentions shall be counted as “no” votes and broker non-votes will not be counted. The affirmative vote of a majority of the shares eligible to vote and issued and outstanding is required to approve Proposal III—Amendment of the Certificate of Incorporation to Change the Name of the Company and Proposal IV—Amendment of the Certificate of Incorporation to Increase the Authorized Shares of Common Stock of the Company. Therefore, abstentions and broker non-votes will be counted as “no” votes. Broker non-votes and abstentions will be counted towards the determination of a quorum which, according to the Company’s Bylaws, will be the presence, in person or by proxy, of a majority of the issued and outstanding shares of Common Stock entitled to vote.

The Company will bear the cost of the solicitation of proxies by the Board of Directors. The Board of Directors may use the services of its executive officers and certain directors to solicit proxies from stockholders in person and by mail, telegram and telephone. Arrangements may also be made with brokers, fiduciaries, custodians, and nominees to send proxies, proxy statements and other material to the beneficial owners of the Company’s Common Stock and Series A Preferred Stock held of record by such persons, and the Company may reimburse them for reasonable out-of-pocket expenses incurred by them in so doing.

The Annual Report to Stockholders for the fiscal year ended June 30, 2000, including financial statements, accompanies this Proxy Statement.

The principal executive offices of the Company are located at 2165 Technology Road, Schenectady, New York 12308. The Company’s telephone number is (518) 346-7799.

Independent Public Accountants

The Board of Directors of the Company has selected PricewaterhouseCoopers LLP Certified Public Accountants, as independent accountants of the Company for the fiscal year ending June 30, 2001. Stockholders are not being asked to approve such selection because such approval is not required. The services provided by PricewaterhouseCoopers LLP consisted of an audit of the financial statements, services relative to filings with the Securities and Exchange Commission, and consultation in regard to various accounting matters. Representatives of PricewaterhouseCoopers LLP are expected to be present at the meeting and will have the opportunity to make a statement if they so desire and answer appropriate questions.

VOTING SECURITIES AND SECURITY OWNERSHIP

OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The securities entitled to vote at the meeting are the Company’s Common Stock, $.001 par value and Series A Preferred Stock, $.10 par value per share. Each share of Common Stock and Series A Preferred Stock entitles its holder to one vote on each matter submitted to Stockholders, voting together as a single class [SUBJECT TO CHANGE]. As of the Record Date, there were 14,856,730 shares of Common Stock and 100 shares of Series A Preferred Stock issued and outstanding.

Under the terms of the Series A Preferred Stock, no shares of Series A Preferred Stock may be issued to any persons other than John Botti, the Company’s Chief Executive Officer and President, and Ira Whitman, the Company’s Senior Vice President and Secretary. Additionally, the holders of the Series A Preferred Stock, voting as a separate class, have the sole right to elect a majority of the Board of Directors, and to remove any such directors elected by the holders of the Series A Preferred Stock. The Company has been advised by the holders of the Series A Preferred Stock that they have elected not to exercise their rights. The Series A Preferred Stock are deemed automatically canceled upon the occurrence of any of the following (i) the death of the holder; (ii) the voluntary termination of employment by the holder; (iii) the voluntary resignation by a holder from the Board of Directors; or (iv) the failure by such holder to own, beneficially, as determined under Regulation 13d-3 of the Exchange Act of 1934, at least 5% of the issued and outstanding Common Stock of the Company. Currently, Mr. Botti beneficially owns 100 shares of Series A Preferred Stock and the 100 shares owned by Mr. Whitman were deemed cancelled since he no longer owns in excess of the 5% of the issued and outstanding Common Stock of the Company.

The following table sets forth certain information as of January 8, 2001, with respect to (i) each director and each executive officer, (ii) and all directors and officers as a group, and (iii) the persons (including any “group” as that term is used in Section l3(d)(3) of the Securities Exchange Act of l934), known by the Company to be the beneficial owner of more than five (5%) percent of the Company’s Common Stock and Series A Preferred Stock.

| Type of Class |

Name and Address of Beneficial Holder |

Amount and Nature of Beneficial Ownership (1)(12) |

Percentage of Class |

||||

| Common | John T. Botti | 1,474,391 | (2) | 9.03 | % | ||

| c/o Bitwise Designs 2165 Technology Drive Schenectady, NY 12308 |

|||||||

| Common | Ira C. Whitman | 410,381 | (3) | 2.72 | % | ||

| c/o Bitwise Designs 2165 Technology Drive Schenectady, NY 12308 |

|||||||

| Common | Steven Kriegsman | 50,000 | (4) | 0.34 | % | ||

| c/o Bitwise Designs 2165 Technology Drive Schenectady, NY 12308 |

|||||||

| Common | Dennis Bunt | 52,883 | (5) | 0.35 | % | ||

| c/o Bitwise Designs 2165 Technology Drive Schenectady, NY 12308 |

|||||||

| Common | J. Edward Sheridan | 50,000 | (9) | 0.34 | % | ||

| c/o Bitwise Designs 2165 Technology Drive Schenectady, NY 12308 |

|||||||

| Common | Charles Johnston | 118,750 | (6) | 0.79 | % | ||

| c/o Bitwise Designs 2165 Technology Drive Schenectady, NY 12308 |

|||||||

| Common | Nicholas Themelis | 117,500 | (7) | 0.78 | % | ||

| c/o Bitwise Designs 2165 Technology Drive Schenectady, NY 12308 |

|||||||

| Common | Robert Van Naarden | 0 | (10) | 0 | % | ||

| c/o Bitwise Designs 2165 Technology Drive Schenectady, NY 12308 |

|||||||

| Common | Gateway Network, LLC | 818,954 | (11) | 5.22 | % | ||

| and Affiliates 165 EAB Plaza Uniondale, NY 11556 |

|||||||

| Common | Tami Skelly, Family Members | 802,865 | (11) | 5.13 | % | ||

| and Affiliates 165 Royal Palm Way Palm Beach, FL 33480 |

|||||||

| Series A Preferred Stock | John T. Botti | 100 | (8) | 100 | % | ||

| c/o Bitwise Designs 2165 Technology Drive Schenectady, NY 12308 |

|||||||

| Directors, Officers and 5% owners as a group (2)(3)(4)(5)(6)(7)(9)(10)(11) | 3,895,824 | 23 | % |

______________

| (1) | Unless otherwise indicated below, each director, officer and 5% shareholder has sole voting and sole investment power with respect to all shares that he beneficially owns. | ||

| (2) | Includes vested stock options to purchase 1,065,000 shares of Common Stock. | ||

| (3) | Includes vested stock options to purchase 225,000 shares of Common Stock. | ||

| (4) | Includes vested options to purchase 50,000 shares of Common Stock. | ||

| (5) | Includes vested options to purchase 51,000 shares of Common Stock. Includes 1,000 shares of Common Stock owned by Mr. Bunt’s wife. | ||

| (6) | Includes vested options to purchase 60,000 shares of Common Stock. | ||

| (7) | Includes vested options to purchase 100,000 shares of Common Stock and warrants to purchase 10,000 shares of Common Stock and excludes 100,000 non-vested options. | ||

| (8) | See footnote (2). Each share of Series A Preferred Stock is entitled to one vote per share. | ||

| (9) | Includes vested options to purchase 50,000 shares of Common Stock. | ||

| (10) | Excludes 200,000 non-vested options. | ||

| (11) | Includes 300,000 shares of Common Stock issuable upon the exercise of Series B Warrants and 146,667 shares of Common Stock issuable upon the conversion of shares of Series B Preferred Stock. | ||

| (12) | Excludes shares of Common Stock which may be issued if the Exchange (as defined in Proposal V herein) is approved by the Company’s shareholders | ||

| * | Percentage not significant. | ||

CERTAIN REPORTS

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires the Company’s directors and executive officers, and persons who own more than 10% of a registered class of the Company’s equity securities, to file with the Securities and Exchange Commission (“SEC”) reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than 10% stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based solely on review of the copies of such reports received by the Company, the Company believes that during the fiscal year ended June 30, 2000, all officers, Directors and greater than 10% beneficial owners complied with the Section 16(a) filing requirements during the 2000 fiscal year.

PROPOSAL I

ELECTION OF DIRECTORS

The precise number of persons on the Board of Directors is determined by the Board of Directors which has set the number at seven persons. The Board of Directors currently consists of seven members elected for a term of one year and until their successors are duly elected and qualified.

The affirmative vote of a plurality of the outstanding shares of Common Stock and Series A Preferred Stock voting together as a single class [CONFIRM] entitled to vote at the Annual Meeting is required to elect the directors. All proxies received by the Board of Directors will be voted for the election as directors of the nominees listed below if no direction to the contrary is given. In the event any nominee is unable to serve, the proxy solicited hereby may be voted, in the discretion of the proxies, for the election of another person in his stead. The Board of Directors knows of no reason to anticipate this will occur.

The following table sets forth certain information as of January 8, 2001 with respect to the directors and executive officers of the Company, including the seven nominees who will be selected at the 2000 Annual Meeting.

| Name | Age | Office | ||

| John T. Botti | 37 | President, Chief Executive Officer and Chairman of the Board | ||

| Robert Van Naarden | 53 | Director and Chief Executive Officer of Authentidate, Inc. | ||

| Ira C. Whitman | 37 | Senior Vice-President, General Manager—DocStar Division, Secretary and Director | ||

| Steven A. Kriegsman | 57 | Director | ||

| J. Edward Sheridan | 63 | Director | ||

| Charles C. Johnston | 64 | Director | ||

| Nicholas Themelis | 37 | Director and Chief Technology Officer |

All directors hold office until the next Annual Meeting of Shareholders or until their successors are elected and qualify. Officers are elected annually by, and serve at the discretion of, the Board of Directors. There are no familial relationships between or among any officers or directors of the Company.

In connection with the Company’s private placement through Whale Securities Co., L.P. (“Whale”), completed in December 1995, the Company granted Whale the right to nominate one person to the Company’s Board of Directors, or in the alternative, a person to attend meetings of the Board of Directors for a period of three years from the date of the closing of the private placement. In December, 1997, Whale selected Steven Kriegsman as its representative on the Board and Mr. Kriegsman continues to serve on the Board.

John T. Botti, co-founded the Company in 1985 and has served as President, Chief Executive Officer and Director since the incorporation of the Company in August 1985. Mr. Botti graduated from Rensselaer Polytechnic Institute (“RPI”) with a B.S. degree in electrical engineering in 1994 with a concentration in computer systems design and in 1996 earned a Master of Business Administration degree from RPI.

Robert Van Naarden, joined Bitwise in July 2000. Mr. Van Naarden has more than 33 years experience in general management, marketing, sales and engineering with computer related companies. Most recently he was Vice President of Sales, Marketing, Business Development and Professional Services with Sensar, Inc. He has also held senior positions with Netframe, Firepower Systems, Supermac Technology and Digital. Mr. Van Naarden was also a founder of Stardent and Convergent Technologies. He has a M.S. in Electrical Engineering from Northeastern University and a B.S. in Physics from the University of Pittsburgh.

Ira C. Whitman, co-founded the Company in 1985 and has served as Senior Vice President and a Director of the Company since the incorporation of the Company in August 1985. Mr. Whitman graduated from RPI in 1984 with a B.S. in Computer and Systems Engineering and in 1990 he earned a Masters in Engineering from RPI.

J. Edward Sheridan joined the Board of Directors in June, 1992. From 1985 to the present, Mr. Sheridan served as the President of Sheridan Management Corp. From 1975 to 1985, Mr. Sheridan served as the Vice President of Finance and Chief Financial Officer of AMF. From 1973 to 1975, he was Vice President and Chief Financial Officer of Fairchild Industries. From 1970 to 1973 he was the Vice President, Corporate Finance of F.S.

Smithers. From 1967 to 1970 Mr. Sheridan was the Director of Acquisitions of Westinghouse Electric. From 1964 to 1967 he was employed by Corporate Equities, Inc., a venture capital firm, Mr. Sheridan holds an M.B.A. from Harvard University and a B.A. from Dartmouth College.

Steven A. Kriegsman joined the Board of Directors in December, 1997. In 1989, Mr. Kriegsman founded The Kriegsman Group, a private financial consulting services firm and has served as its President since such time. In 1981 Mr. Kriegsman co-founded ANA Financial Services, Inc., a holding company engaged, through its subsidiaries, in securities brokerage, financial planning and investment advisory services and franchising of certified public accountants. Mr. Kriegsman served as Chairman and Chief Executive Officer of ANA Financial until 1989. Mr. Kriegsman is a former Certified Public Accountant. Mr. Kriegsman holds a B.S. from New York University.

Charles C. Johnston joined the Board of Directors in December, 1997. Mr. Johnston has been the Chairman of Ventex Technology, Inc., a privately-held neon light transformer company since July 1993. Mr. Johnston has also served as Chairman of AFD Technologies, a private corporation since 1994 and J&C Resources a private corporation since 1987. Mr. Johnston serves as a Trustee of Worcester Polytechnic Institute (“WPI”) and earned his B.S. degree from WPI in 1957.

Nicholas Themelis joined the Board of Directors in October, 1999 and became the Company’s Chief Technology Officer in April, 2000. Prior to joining the Company, Mr. Themelis was a Senior Vice President of Lehman Brothers since 1991 and was based at various times in the New York, Hong Kong and Tokyo offices. While working in Asia at Lehman Brothers, he founded the firm’s Internet committee in Asia. Mr. Themelis also co-founded Nutrisserie, Inc in 1991, a retail health food store. In 1986, Mr. Themelis also co-founded Bentley, Themelis and Associates, a software consulting company.

Committees of the Board of Directors

The Board of Directors has three (3) Committees: Audit, Compensation and Executive Committee.

Audit Committee. The Audit Committee of the Board of Directors acts to: (i) acquire a complete understanding of the Company’s audit functions; (ii) review with management the finances, financial condition and interim financial statements of the Company; (iii) review with the Company’s independent accountants the year-end financial statements; and (iv) review implementation with the independent accountants and management any action recommended by the independent accountants. During the fiscal year ended June 30, 2000, the Audit Committee met on one occasion.

The Audit Committee adopted a written charter governing its actions on May 5, 2000. The Charter of the Audit Committee of the Company appears in full at Exhibit 1 of this Proxy Statement. All three members of the Company’s Audit Committee are “independent” within the definition of that term as provided by Rule 4200(a)(14) of the listing standards of the National Association of Securities Dealers.

The audit committee hereby states that it:

The Audit Committee of the Board of Directors of Bitwise Designs, Inc.:

J. Edward Sheridan, Steven Kriegsman and Charles Johnston.

Executive Committee. The members of the Executive Committee are John Botti and Ira C. Whitman. The Executive Committee has all of the powers of the Board of Directors except it may not; (i) amend the Certificate of

Incorporation or Bylaws; (ii) enter into agreements to borrow money in excess of $250,000; (iii) grant security interests to secure obligations of more than $250,000; (iv) authorize private placements or public offerings of the Company’s securities; (v) authorize the acquisition of any major assets or business or change the business of the Company; or (vi) authorize any employment agreements in excess of $75,000. The Executive Committee meets when actions must be approved in an expedient manner and a meeting of the Board of Directors cannot be convened. During Fiscal 2000, the Executive Committee did not deem it necessary to meet.

Compensation Committee. The members of the Compensation Committee are Steven Kriegsman, J. Edward Sheridan and Charles C. Johnston. The Compensation Committee functions include administration of the Company’s 1992 Employee Stock Option Plan and Non-Executive Director Stock Option Plan and negotiation and review of all employment agreements of executive officers of the Company. During the fiscal year ended June 30, 2000, the Compensation Committee held no meetings and voted by unanimous written consent on two occasions.

Compensation Committee Report on Executive Compensation

The Company’s compensation committee is composed of three non-executive directors and is responsible for negotiating and reviewing all employment agreements for executive officers of the Company and for administering the Employee Stock Option Plan, as amended. During the fiscal year ended June 30, 2000, the Compensation Committee held no meetings and voted by unanimous written consent on two occasions.

The compensation committee and the Board of Directors have established the following ongoing principles and objectives for determining the Company’s executive compensation:

During the last fiscal year, the cash portion of the Chief Executive Officer’s compensation was reviewed and approved by the Compensation Committee in connection with the Compensation Committee’s approval of the terms of the new employment agreement entered into with Mr. Botti in January, 2000. Similarly, the cash compensation of the Chief Technology Officer was reviewed and approved by the Compensation Committee in connection with the Compensation Committee’s approval of the terms of the employment agreement entered into by Mr. Themelis, in February, 2000. Shareholders are directed to the discussion of these agreements under the heading “Employment Agreements” appearing elsewhere in this Proxy Statement.

No cash bonuses were awarded to these executives during the last fiscal year.

The Compensation Committee authorized the grant of stock options to the Company’s Chief Executive Officer and Chief Technology Officer during the last fiscal year as appearing in the Option Grants Table appearing in this Proxy Statement. The Compensation Committee determined that the options awarded to the Chief Executive Officer were warranted due to the Company’s recent financial performance and the expiration of 320,000 options previously granted to Mr. Botti which he was unable to exercise due to restrictions on the resale of the underlying shares. The options awarded to the Chief Technology Officer were approved by the Compensation Committee in connection with the Company’s negotiation of the employment agreement with Mr. Themelis.

| The Compensation Committee | ||

| J. Edward Sheridan | Steven Kriegsman | Charles C. Johnston |

Compensation Committee Interlocks and Insider Participation

There are no compensation committee interlocks between the members of the Company’s compensation committee and any other entity. At present, J. Edward Sheridan, Steven Kriegsman and Charles C. Johnston are the members of the compensation committee. None of the members of the Board’s compensation committee (a) was an officer or employee of the Company during the last fiscal year; (b) was formerly an officer of the Company or any of its subsidiaries; or (c) had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K.

Meetings of the Board of Directors; Committees

During the fiscal year ended June 30, 2000, the Board of Directors of the Company met on four occasions and voted by unanimous written consent on two occasions. No member of the Board of Directors attended less than 75% of the aggregate number of (i) the total number of meetings of the Board of Directors or (ii) the total number of meetings held by all Committees of the Board of Directors.

Compensation of Directors

Directors are compensated for their services during the each fiscal year in the amount of $5,000 annually. The Directors receive options to purchase 10,000 shares for each year of service under the Non-Executive Director Stock Option Plan (“Stock Options”) and are reimbursed for expenses incurred in order to attend meetings of the Board of Directors. Directors also receive 20,000 Stock Options upon being elected to the Board.

Vote Required

The affirmative vote of the holders of a plurality of the shares of Common Stock voting at the Annual Meeting is required for the approval of the nominees for Directors.

THE BOARD OF DIRECTORS DEEMS THE ELECTION OF THE NOMINEES FOR DIRECTORS TO BE IN THE BEST INTERESTS OF THE COMPANY AND ITS SHAREHOLDERS AND RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL I.

PROPOSAL II

ADOPTION OF

2000 EMPLOYEES STOCK OPTION PLAN

In April 1992, the Company adopted the 1992 Employees Stock Option Plan (the “1992 Plan”) which provided for the grant of options to purchase up to 600,000 shares of the Company’s Common Stock. On January 26, 1995, the stockholders of the Company approved an amendment to the 1992 Plan to increase the number of shares of Common Stock available under the 1992 Plan to 3,000,000 shares. Under the terms of the 1992 Plan, options granted thereunder may be designated as options which qualify for incentive stock option treatment (“ISOs”) under Section 422A of the Code, or options which do not so qualify (“Non-ISOs”). As of January 8, 2001, there were outstanding 2,094,713 options under the 1992 Plan with exercise prices ranging from $.84 to $11.25 and a total of 905,287 options granted under the 1992 Plan have been exercised.

The Board of Directors has unanimously approved the adoption of the 2000 Employees Stock Option Plan (the “2000 Plan”) to provide for the grant of options to purchase up to 5,000,000 shares of the Company’s common stock to all employees of the Company since there are no additional options reserved under the 1992 Plan available to be granted under the 1992 Plan. The Board approved the 2000 Plan instead of approving an increase in the number of options available under the 1992 Plan since the 1992 Plan will expire in April, 2002 and the adoption of a new employee stock option plan in 2002 would also require shareholder approval. Accordingly, the Board determined that the adoption of a new option plan at this Annual Meeting would help conserve the Company’s resources.

The Board of Directors has recommended the adoption of the 2000 Plan because it believes that the maintenance of an employee stock option plan is required in order to continue to attract qualified employees to the Company. The Board believes that the Company competes with numerous other companies for a limited number of talented persons. As a result, there must be provided a level of incentives to such persons. It is the Board’s opinion that the grant of stock options has several attractive characteristics, both to the employees and the Company, which make such grants more attractive than raising the level of cash compensation. First, granting stock options provides incentive to individuals because they share in the growth of the Company. The Company benefits because these employees will be more motivated and the Company benefits from motivated employees. Second, the grant of options preserves the Company’s cash resources.

Since no additional options may be granted under the 1992 Plan, if the 2000 Plan is adopted by the Shareholders, any further grants of options by the Company to its employees will be made from the 2000 Plan.

Holders of unexercised options granted under the 1992 Plan will be able to exercise those options until the expiration date set forth in their option certificate. However, unless Proposal IV, “Amendment of the Certificate of Incorporation to Increase the Number of Authorized Shares of Common Stock,” is approved by the Shareholders, the Company will not be able to grant options under the 2000 Plan, even if it is approved by the Shareholders.

The 2000 Plan will administered by the Compensation Committee designated by the Board of Directors. As under the 1992 Plan, options granted under the terms of the proposed 2000 Plan may be designated as options which qualify for incentive stock option treatment (“ISOs”) under Section 422A of the Code, or options which do not so qualify (“Non-ISO’s”). The Compensation Committee has the discretion to determine the eligible employees to whom, and the times and the price at which, options will be granted; whether such options shall be ISOs or Non-ISOs; the periods during which each option will be exercisable; and the number of shares subject to each option. The Committee has full authority to interpret the 2000 Plan and to establish and amend rules and regulations relating thereto.

Under the 2000 Plan, the exercise price of an option designated as an ISO shall not be less than the fair market value of the common stock on the date the option is granted. However, in the event an option designated as an ISO is granted to a ten percent (10%) shareholder (as defined in the 2000 Plan), such exercise price shall be at least 110% of such fair market value. Exercise prices of Non-ISO options may be less than such fair market value.

The aggregate fair market value of shares subject to options granted to a participant, which are designated as ISOs and which become exercisable in any calendar year, shall not exceed $100,000.

In addition, under the 2000 Plan the Compensation Committee would have the authority to extend the time period within which the holder of a Non-ISO option would be permitted to exercise the option after the termination of his or her employment. The 2000 Plan will also include a requirement that option holders that wish to pay for the exercise price of their option with shares of the Company’s Common Stock must have beneficially owned such stock for at least six months prior to the exercise date.

The Compensation Committee may, in its sole discretion, grant bonuses or authorize loans to or guarantee loans obtained by an optionee to enable such optionee to pay the exercise price or any taxes that may arise in connection with the exercise or cancellation of an option. The Compensation Committee can also permit the payment of the exercise price in the common stock of the Company held by the optionee for at least six months prior to exercise.

The full text of the 2000 Plan is annexed to this Proxy Statement as Exhibit 2.

Vote Required

The affirmative vote of the holders of a majority of the shares of Common Stock voting at the Annual Meeting is required for the adoption of the 2000 Plan.

THE BOARD OF DIRECTORS DEEMS PROPOSAL II TO BE IN THE BEST INTERESTS OF THE COMPANY AND ITS SHAREHOLDERS AND RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL II.

PROPOSAL III

AMENDMENT TO CERTIFICATE OF INCORPORATION

TO CHANGE THE NAME OF THE COMPANY

The Board of Directors has also submitted for shareholder approval its proposal to change the name of the Company from Bitwise Designs, Inc. to Authentidate Holding Corp. The Board recommends this change as it believes that the new name will better reflect the Company’s core growth strategy, which is its Authentidate business line. Currently, the Company’s majority-owned subsidiary, Authentidate, Inc., is engaged in the business of providing end users with a service which will accept and store electronic images from networks and personal computers throughout the world and from different operating systems via the Internet; indelibly date and time stamp all electronic images received using a secure clock; allow users to transmit only the “secure codes” to Authentidate fileservers while maintaining the original within the customers “firewall”; and allow users to prove authenticity of time, date and content of stored electronic documents.

Although the Company presently remains engaged in its historic business of assembling and distributing electronic document management systems, the Company intends to focus in the future on its Authentidate business. The Board believes that the Company’s current name does not reflect the direction in which the Company is evolving. In addition, the Board believes that its Authentidate subsidiary has created goodwill in its name and that the Company should utilize this goodwill to facilitate the establishment of a market for the Authentidate business. If this Proposal is approved by the Stockholders, the Company’s trading symbol on the Nasdaq National Market will be changed from “BTWS” to “ADAT” and its Authentidate subsidiary will continue to operate as Authentidate, Inc.

A form of the Amendment to the Company’s Amended Certificate of Incorporation reflecting the name change is annexed to this Proxy Statement as Exhibit 3. This Exhibit also includes the amendment to the Certificate of Incorporation increasing the number of authorized shares of Common Stock, as discussed in Proposal IV.

If Proposal III is approved by the Shareholders, the Shareholders will be requested to submit their share certificates to the Company Stock Transfer Agent for exchange. Following the adoption of Proposal III and the filing of an Amendment to the Company’s Amended Certificate of Incorporation with the Secretary of State of Delaware changing the name of the Company, all new share certificates issued by the Company will be printed with the Company’s new name. The Company estimates that the costs of this change of name, including printing expenses, license modifications, various state regulatory and local filings and other related costs, will not exceed $125,000. In the event that the Company determines that the costs of changing the name will exceed its expectations or a conflict in the use of the name arises, the name change may not be implemented.

Vote Required

The affirmative vote of the holders of a majority of the outstanding shares of the Company eligible to vote is required for the approval of this Proposal III.

THE BOARD OF DIRECTORS DEEMS PROPOSAL III TO BE IN THE BEST INTERESTS OF THE COMPANY AND ITS STOCKHOLDERS AND RECOMMENDS A VOTE “FOR” APPROVAL THEREOF.

PROPOSAL IV

AMENDMENT TO CERTIFICATE OF INCORPORATION

TO INCREASE THE NUMBER OF

AUTHORIZED SHARES OF COMMON STOCK

The Board of Directors has adopted, subject to stockholder approval, an amendment to Article FOURTH of the Company’s Certificate of Incorporation to increase the number of authorized shares of Common Stock to 40,000,000 shares from 20,000,000. The text of the first sentence of Article FOURTH, as it is proposed to be amended, is as follows:

The total number of shares of all classes of stock which the Corporation shall have authority to issue is FORTY FIVE MILLION (45,000,000) shares, consisting of FORTY MILLION (40,000,000) shares of Common Stock, par value $.00l per share (hereinafter, the “Common Stock”), and FIVE MILLION (5,000,000) shares of Preferred Stock, par value $.10 per share (hereinafter, the “Preferred Stock”), of which two hundred (200) shares have been designated Series A Preferred Stock, the relative rights, preferences and limitations of which are as set forth in sub-paragraph B of this Article FOURTH.

A form of the Amendment to the Company’s Amended Certificate of Incorporation reflecting the increase in the authorized capital of the Company is annexed to this Proxy Statement as Exhibit 3. This Exhibit also includes the proposal to change the name of the Company to Authentidate, Inc., discussed in Proposal IV.

Under the present Certificate of Incorporation, as amended, the Company has the authority to issue 20,000,000 shares of Common Stock and 5,000,000 shares of Preferred Stock. As of the Record Date, 14,856,730 shares of Common Stock were issued and outstanding and 50,100 shares of Preferred Stock were outstanding. As of the Record Date, after taking into account the shares reserved for issuance (i) upon the exercise of currently outstanding Company stock options and warrants, (ii) upon the conversion of the Company’s Series B Preferred Stock, (iii) pursuant to the adoption of the 2000 Plan discussed in Proposal II, and (iv) pursuant to the

exchange proposed in Proposal V of this Proxy Statement, the Company will not have sufficient shares of Common Stock authorized to allow it to issue the shares if the holders of all the outstanding convertible securities of the Company exercised or converted their securities. The proposed amendment would authorize the Company to issue an additional 20,000,000 shares of Common Stock, permitting the Company to issue shares of Common Stock to the holders of convertible securities listed above. Further, unless this Proposal IV is approved by the Shareholders, the Company will not be able to implement the actions discussed by Proposal II (Adoption of the 2000 Plan) and Proposal V (Exchange of Securities) of this Proxy Statement.

The purpose of the increase in authorized shares is to provide additional shares of Common Stock that could be issued for corporate purposes without further stockholder approval unless required by applicable law or regulation. The Company currently expects that reasons for issuing additional shares of either Common Stock will include ensuring that a sufficient number of shares of Common Stock are available for issuance upon the exercise or conversion of currently issued convertible securities and ensuring that the Company has sufficient shares of Common Stock to implement the exchange proposed in Proposal V of this Proxy Statement. Reasons for issuing additional shares of Common Stock also include securing additional financing for the operation of the Company through the issuance of additional shares or other equity-based securities, paying stock dividends or subdividing outstanding shares through stock splits and providing equity incentives to employees, officers or directors. Although the Company does not have any current plans to effectuate any of the foregoing actions, the Board of Directors believes that it is in the best interests of the Company to have additional shares of Common Stock authorized at this time to alleviate the expense and delay of holding a special meeting of stockholders to authorize additional shares of Common Stock when and if the need arises.

The Company could also use the additional shares of Common Stock to oppose a hostile takeover attempt or delay or prevent changes of control (whether by merger, tender offer, proxy contest or assumption of control by a holder of a large block of the Company’s securities) or changes in or removal of management of the Company. For example, without further stockholder approval, the Board of Directors could strategically sell shares of Common Stock in a private transaction to purchasers who would oppose a takeover or favor the current Board of Directors. Although the Board of Directors is motivated by business and financial considerations in proposing this amendment, and not by the threat of any attempt to accumulate shares or otherwise gain control of the Company (and the Board of Directors is not currently aware of any such attempts), stockholders nevertheless should be aware that approval of the amendment could facilitate efforts by the Company to deter or prevent changes of control of the Company in the future, including transactions in which the stockholders might otherwise receive a premium for their shares over then-current market prices or benefit in some other manner. The proposal to increase the number of authorized shares of Common Stock, however, is not part of any present plan to adopt a series of amendments having an antitakeover effect, and the Company’s management presently does not intend to propose antitakeover measures in future proxy solicitations.

The additional Common Stock to be authorized by adoption of the proposed amendment would have rights identical to the currently outstanding Common Stock of the Company. Adoption of the proposed amendment and issuance of additional shares of Common Stock would not affect the rights of the holders of currently outstanding Common Stock, except for effects incidental to increasing the number of shares of Common Stock outstanding, such as dilution of the earnings per share and voting rights of current holders of Common Stock. The holders of Common Stock do not presently have preemptive rights to subscribe for the additional shares of Common Stock proposed to be authorized. The proposed amendment would not change the par value of the Common Stock. If the amendment is adopted, it will become effective upon filing a Certificate of Amendment to the Company’s Certificate of Incorporation with the Secretary of State of the State of Delaware. However, pursuant to Delaware law, the Board of Directors retains the discretion to abandon and not implement the proposed amendment.

Vote Required

The affirmative vote of the holders of a majority of the outstanding shares of the Company eligible to vote is required for the approval of this Proposal IV.

THE BOARD OF DIRECTORS DEEMS PROPOSAL IV TO BE IN THE BEST INTERESTS OF THE COMPANY AND ITS STOCKHOLDERS AND RECOMMENDS A VOTE “FOR” APPROVAL THEREOF.

PROPOSAL V

EXCHANGE OF SECURITIES OF AUTHENTIDATE, INC.

FOR SECURITIES OF BITWISE DESIGNS, INC.

The Board of Directors has unanimously determined that in connection with its decision to change the name of the Company from Bitwise Designs, Inc. to Authentidate, Inc. and to focus the Company’s efforts on implementing the Authentidate business plan, the Company must exchange the currently issued and outstanding securities of Authentidate, Inc. for securities of Bitwise (the “ Exchange”). Included in the Exchange would be Authentidate securities beneficially owned by officers, directors and 5% shareholders of the Company. Authentidate securities beneficially owned by the Company, however, would not be included in the Exchange. Accordingly, the Board of Directors has unanimously approved, and recommends Shareholder approval of, a resolution granting authority to the Board of Directors to implement the foregoing Exchange at an exchange rate of 1.5249 shares of the Common Stock of Bitwise Designs for each share of Authentidate Common Stock. Shareholders are urged to carefully read the materials that follow as they involve matters of particular importance. The Company has engaged First Albany Corporation to render an opinion as to the fairness of the Exchange to the Company, and the Exchange is subject to the Company’s receipt of such fairness opinion. In the event First Albany Corporation is unable to render an opinion that the terms of the Exchange are fair to the Company, the terms will be modified. Accordingly, the foregoing exchange rate is preliminary and subject to adjustment, which may be significant. Therefore, the information contained in the following discussion may be amended. A copy of this opinion will be attached as Exhibit 4 to this Proxy Statement.

Background of the Proposed Transaction

The Board of Directors has unanimously approved a proposal to exchange all issued and outstanding securities of Authentidate, Inc. into securities of the Company, whereby each share of Common Stock of Authentidate, Inc. will be exchanged for 1.5249 shares of Common Stock of the Company, not including Authentidate securities beneficially owned by the Company. Similarly, under the Exchange, holders of outstanding Authentidate options and warrants (other than the Company) will be able to exchange their Authentidate options and warrants for like securities of Bitwise at the exchange ratio. By way of example, a shareholder holding 100 shares of Common Stock of Authentidate prior to the exchange will be issued 152 shares of the Common Stock of the Company after the exchange. All fractional shares resulting from the reverse stock split will be settled in cash, based upon the last sale price of the Common Stock on the day prior to the effective date of the exchange. The Company has engaged First Albany Corporation to render an opinion as to the fairness of the Exchange to the Company and the Exchange is subject to the Company’s receipt of such fairness opinion. In the event First Albany Corporation is unable to render an opinion that the terms of the Exchange are fair to the Company, the terms will be modified. Accordingly, the foregoing exchange rate is preliminary and subject to adjustment, which may be significant. Therefore, the information contained in this discussion may be amended. A copy of this opinion will be attached as Exhibit 4 to this Proxy Statement.

Currently, the Company’s Chief Executive Officer, John T. Botti, holds 369,020 options exercisable at $1.00 per share, and the Company’s Chief Technology Officer, Nicholas Themelis, holds 72,049 options exercisable at $5.55 per share. Further, Robert Van Naarden, the Chief Executive Officer of Authentidate holds 230,637 options exercisable at $4.00 per share. The options held by Messrs. Botti, Themelis and Van Naarden were approved by the Compensation Committee of the Company in connection with the employment agreements entered into between the Company and these officers during the fiscal year ended June 30, 2000. Further, Mr. Craig Gross and Mr. Frank Skelly, two investors in the Company’s private placement which closed in October 1999, own in the aggregate 576,225 shares of the Common Stock of Authentidate, and are each members of a group (as defined under Section l3(d)(3) of the Securities Exchange Act of l934) owning more than 5% of the Company’s Common Stock. The interest of these investors is non-dilutible up to the contribution of an additional $1,500,000 of capital to Authentidate.

There are presently 3,602,436 shares of Common Stock, $.001 par value per share, of Authentidate issued and outstanding, and an additional 1,010,308 shares underlying outstanding warrants and options. However, since the Company owns 2,946,312 shares of Authentidate Common Stock, a total of 1,666,432 shares of Authentidate Common Stock, on a fully-diluted basis, would be subject to the Exchange. In addition, there are 14,856,730 shares of the Company’s Common Stock issued and outstanding and an additional 5,195,286 underlying outstanding

convertible securities. If the Exchange is approved there will be 22,062,863 shares issued and outstanding of the Company’s Common Stock, including shares issuable upon the conversion or exercise of various securities of the Company. Accordingly, unless Proposal IV, “Amendment of the Certificate of Incorporation to Increase the Number of Authorized Shares of Common Stock,” is approved by the Shareholders, the Company will not be able to implement the Exchange, even if approved by the Shareholders.

Transaction Proposed by the Board of Directors

The Company’s Articles of Incorporation currently authorizes the issuance of 20,000,000 shares of Common Stock, par value $.001 per share. If Proposal IV is approved by the shareholders, the Company will be authorized to issue 40,000,000 shares of Common Stock. As of the Record Date, the Company had 14,856,730 issued and outstanding shares of Common Stock. As of such date, there was also reserved for issuance upon the conversion or exercise of various securities of the Company 5,195,286 shares of Common Stock, leaving no shares authorized, unissued and unreserved shares available for future issuances unless Proposal IV is approved by the shareholders. If Proposal IV is approved by the shareholders, the Company will have a total of 19,947,984 authorized, unissued and unreserved shares of Common Stock available for future issuances, not including the shares of Common Stock which would be issued if the Exchange is approved by the shareholders. If the Exchange is effected, the number of shares of Common Stock issued and outstanding will be 15,857,269 and the number of shares of Common Stock reserved for issuance will be 6,659,193, leaving a total of 17,937,137 authorized, unissued and unreserved shares of Common Stock available for future issuances.

If the Exchange is approved by Shareholders, every outstanding share of Authentidate would be exchanged for 1.5249 shares of Common Stock of the Company in accordance with the terms of the Exchange, as of the date on which the amendment to the Company’ s Articles of Incorporation changing its name is filed with the Secretary of State of the State of Delaware (the “Effective Date”). By way of example, if a shareholder owns 100 shares of Authentidate prior to the Effective Date of the Exchange and the Exchange is authorized by the Shareholders and approved by the Board of Directors, then the shareholder would own 152 shares of the Common Stock of the Company. Securities of Authentidate beneficially owned by officers, directors and 5% shareholders of the Company would be included in the Exchange. Authentidate securities beneficially owned by the Company, however, would not be included in the Exchange. If the Exchange is approved, a total of 656,124 shares of Authentidate Common Stock would be exchanged for an aggregate of 1,010,308 shares of the Common Stock of Bitwise Designs and the 960,602 shares of Authentidate Common Stock issuable upon conversion of options and warrants would be exchange for an aggregate of 1,463,907 options and warrants to purchase the Common Stock of Bitwise Designs. The 2,946,312 shares of Authentidate Common Stock owned by the Company are not subject to the Exchange.

No fractional shares of new Common Stock will be issued for any fractional new share interest. Rather, each Shareholder who would otherwise receive a fractional new share of Common Stock as a result of the Exchange will receive an amount of cash equal to the last sale price of a share of Common Stock as reported by the Nasdaq Stock Market on the date immediately preceding the Effective Date multiplied by the number of shares of Common Stock held by such holder that would otherwise have been exchanged for such fractional interest. Because the price of the Common Stock fluctuates, the amount to be paid for fractional shares cannot be determined until the Effective Date and may be greater or less than the price on the date that any Shareholder executes his proxy.

As a result of the Exchange, cash proceeds received from the settlement of fractional shares by holders of Authentidate securities may result in such person realizing taxable gain or loss to the extent of the difference between such proceeds and the cost or other basis applicable to the fractional shares. No officer, director, associate or affiliate of the Company is expected to derive any material benefit from approval of the Exchange other than the benefits which would be enjoyed by any other person holding the same number of shares.

The Board of Directors believes that it is in the best interest of the Company to grant the Board of Directors authority to declare and implement the Exchange on a 1-for-1.5249 basis or such other Exchange rate as determined after completion of the fairness opinion by First Albany Corporation.

Vote Required

The affirmative vote of the holders of a majority of the shares of Common Stock voting at the annual meeting is required for the approval of this Proposal V.

THE BOARD OF DIRECTORS DEEMS THE EXCHANGE TO BE IN THE BEST INTERESTS OF THE COMPANY AND ITS SHAREHOLDERS AND RECOMMENDS A VOTE “FOR” APPROVAL THEREOF.

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Executive Compensation

The following table provides certain information concerning all Plan and Non-Plan (as defined in Item 402 (a)(ii) of Regulation S-K) compensation awarded to, earned by, paid by the Company during the years ended June 30, 2000, 1999 and 1998 to each of the named executive officers of the Company.

SUMMARY COMPENSATION TABLE

Annual Compensation

| Long Term Compensation Awards | |||||||||||||||||||

| Name and Principal Position | Fiscal Year | Salary | Bonus | Other Annual Compensation | Restricted Stock Award(s) | No. of Securities Underlying Options/ SARs | |||||||||||||

| John Botti | 2000 | $ | 203,665 | 0 | (1) | $ | 1,702 | (1) | 0 | (2) | 890,000 | ||||||||

| Chairman, | 1999 | $ | 132,794 | 0 | $ | 1,702 | 0 | 0 | |||||||||||

| President and | 1998 | $ | 121,000 | 0 | $ | 1,702 | 0 | 0 | |||||||||||

| Chief Executive | |||||||||||||||||||

| Officer | |||||||||||||||||||

| Nicholas Themelis | 2000 | $ | 71,923 | (3) | $ | 0 | $ | 5,000 | (3) | 0 | 220,000 | ||||||||

| Vice-President, Chief | |||||||||||||||||||

| Technology Officer and | |||||||||||||||||||

| Director | |||||||||||||||||||

______________

| (1) | Includes: (i) for 2000, an automobile and expenses of $1,500 and the payment of premiums on term life insurance policy of $202; (ii) for 1999, an automobile and expenses of $1,500 and the payment of premiums on a term life insurance policy of $202; and (iii) for 1998, an automobile and expenses of $1,500 and the payment of premiums on a term life insurance policy of $202. | ||

| (2) | No restricted stock awards were granted to Mr. Botti in fiscal 2000. Mr. Botti, however, owned 409,391 restricted shares of the Company’s Common Stock on June 30, 2000, the market value of which was $2,405,172.12 on such date (based on the closing price of the common stock of $5.875), without giving effect to the diminution in value attributed to the restriction on such shares. | ||

| (3) | Represents salary earned by the employee and paid by the Company during the fiscal year ended June 30, 2000. Mr. Themelis commenced employment with the Company on April 3, 2000. The Company also contributed $5,000 towards a life and disability insurance policy for Mr. Themelis. | ||

OPTION/SAR GRANTS IN LAST FISCAL YEAR

| Individual Grants |

Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation For Option Term |

Alternative to (f) and (g) Grant Date Value |

||||||||||||||||||||

| Name(a) | Number of Securities Underlying Option/ SARs Granted (#) (b) |

Percent of Total Option/SARs Granted To Employees In Fiscal Year(1) (c) |

Exercise of Base Price (S/Sh) (d) |

Expiration Date (c) |

5% ($) (f) | 10% ($) (g) | Grant Date Present Value ($) (h) |

|||||||||||||||

| John Botti | 50,000 | 3.2% | $ | 9.125 | 4/20/05 | $ | 126,750 | $ | 278,750 | |||||||||||||

| John Botti | 840,000 | 54.5% | $ | 5.875 | 6/30/05 | $ | 1,365,000 | $ | 3,014,400 | |||||||||||||

| Nicholas Themelis | 20,000 | 1.2% | $ | 0.96875 | 9/20/04 | $ | 5,425 | $ | 11,825 | |||||||||||||

| Nicholas Themelis | 200,000 | 12.9% | $ | 11.25 | 2/28/05 | $ | 622,000 | $ | 1,374,000 | |||||||||||||

______________

| (1) | No Stock Appreciation Rights were granted to any of the named executive officers during the last fiscal year. | ||

AGGREGATED OPTION/SAR EXERCISES IN LAST

FISCAL YEAR AND FY-END OPTION/SAR VALUES

The following table contains information with respect to the named executive officers concerning options held as of the year ended June 30, 2000.

AGGREGATED OPTION/SAR EXERCISES IN LAST

FISCAL YEAR AND FY-END OPTION/SAR VALUES

| Name | Shares Acquired on Exercise |

Value Realized |

Number of Unexercised Options as of June 30, 2000 Exercisable/Unexercisable |

Value of Unexercised In-the- Money Options at June 30, 2000(1) Exercisable/Unexercisable |

|||||||||

| John T. Botti | 320,000 | $ | 500,000 | 1,065,000/50,000 | $ | 618,750/0 | |||||||

| Nicholas Themelis | 20,000 | $ | 26,250 | 50,000/150,000 | $ | 0/0 | |||||||

______________

| (1) | Based upon the closing bid price ($5.875 per share) of the Company’s Common Stock on June 30, 2000 less the exercise price for the aggregate number of shares subject to the options. | ||

Stock Option Plans

1992 Employees Stock Option Plan

In April 1992, the Company adopted the 1992 Employees Stock Option Plan (the “1992 Plan”) which provided for the grant of options to purchase up to 600,000 shares of the Company’s Common Stock. On January 26, 1995, the stockholders of the Company approved an amendment to the 1992 Plan to increase the number of shares of Common Stock available under the 1992 Plan to 3,000,000 shares. Under the terms of the 1992 Plan, options granted thereunder may be designated as options which qualify for incentive stock option treatment (“ISOs”) under Section 422A of the Code, or options which do not so qualify (“ Non-ISOs”). As of January 8, 2001, there were outstanding 2,094,713 options under the 1992 Plan with exercise prices ranging from $.84 to $11.25. The Board of Directors has proposed to adopt the 2000 Employees Stock Option Plan and has submitted a proposal for stockholder vote at the Annual Meeting. Please refer to the discussion under the heading “Proposal II Adoption of 2000 Employee Stock Option Plan.”

The 1992 Plan is administered by a Compensation Committee designated by the Board of Directors. The Compensation Committee has the discretion to determine the eligible employees to whom, and the times and the price at which, options will be granted. Whether such options shall be ISOs or Non-ISOs; the periods during which each option will be exercisable; and the number of shares subject to each option, shall be determined by the

Committee. The Board or Committee shall have full authority to interpret the 1992 Plan and to establish and amend rules and regulations relating thereto.

Under the 1992 Plan, the exercise price of an option designated as an ISO shall not be less than the fair market value of the Common Stock on the date the option is granted. However, in the event an option designated as an ISO is granted to a ten percent stockholder (as defined in the 1992 Plan) such exercise price shall be at least 110% of such fair market value. Exercise prices of Non-ISOs options may be less than such fair market value. The aggregate fair market value of shares subject to options granted to a participant which are designated as ISOs which become exercisable in any calendar year shall not exceed $100,000. The “fair market value” will be the closing NASDAQ bid price, or if the Company’s Common Stock is not quoted by NASDAQ, as reported by the National Quotation Bureau, Inc., or a market maker of the Company’s Common Stock, or if the Common Stock is not quoted by any of the above, by the Board of Directors acting in good faith.

The Compensation Committee may, in its sole discretion, grant bonuses or authorize loans to or guarantee loans obtained by an optionee to enable such optionee to pay any taxes that may arise in connection with the exercise or cancellation of an option.

Unless sooner terminated, the 1992 Plan will expire in April, 2002.

1992 Non-executive Director Stock Option Plan

In April, 1992, the Board of Directors adopted the Non-Executive Director Stock Option Plan (the “Director Plan”) which was approved by the Company’s stockholders in May, 1992. With the approval of the shareholders, the Director Plan was amended in December, 1997. Options are granted under the Director Plan until April, 2002 to (i) non-executive directors as defined and (ii) members of any advisory board established by the Company who are not full-time employees of the Company or any of its subsidiaries. The Director Plan provides that each non-executive director will automatically be granted an option to purchase 20,000 shares, upon joining the Board of Directors, and 10,000 shares on each September 1st thereafter, provided such person has served as a director for the 12 months immediately prior to such September 1st. Each eligible director of an advisory board will receive, upon joining the advisory board, and on each September 1st thereafter, an option to purchase 5,000 shares of the Company’s Common Stock, providing such person has served as a director of the advisory board for the previous 12 month period.

As of January 8, 2001, there are outstanding 160,000 options under the Director Plan with exercise prices from $.84375 to $4.8125.

The exercise price for options granted under the Director Plan is 100% of the fair market value of the Common Stock on the date of grant. The “ fair market value” is the closing NASDAQ bid price, or if the Company’s Common Stock is not quoted by NASDAQ, as reported by the National Quotation Bureau, Inc., or a market maker of the Company’s Common Stock, or if the Common Stock is not quoted by any of the above by the Board of Directors acting in good faith. Until otherwise provided in the Stock Option Plan the exercise price of options granted under the Director Plan must be paid at the time of exercise, either in cash, by delivery of shares of common Stock of the Company or by a combination of each. The term of each option commences on the date it is granted and unless terminated sooner as provided in the Director Plan, expires five years from the date of grant. The Director Plan is administered by a committee of the board of directors composed of not fewer than three persons who are officers of the Company (the “Committee”). The Committee has no discretion to determine which non-executive director or advisory board member will receive options or the number of shares subject to the option, the term of the option or the exercisability of the option. However, the Committee will make all determinations of the interpretation of the Director Plan. Options granted under the Director Plan are not qualified for incentive stock option treatment.

Employment Agreements

In January, 2000, the Company entered into a new three year employment agreement with its Chief Executive Officer, Mr. John T. Botti, which will expire on January 1, 2003. The agreement provides for (i) a base salary of $250,000 in the first year of the agreement, increasing by 10% in each year thereafter; (ii) a bonus equal to 3% of the Company’s pre-tax net income, with such additional bonuses as may be awarded in the discretion of the Board of Directors; (iii) certain insurance and severance benefits; and (iv) automobile and expenses.

In February 2000, the Company entered into an employment agreement with its new Chief Technology Officer and Vice President of Technology, Mr. Nicholas Themelis, for a one-year term. The employment agreement provides for (i) annual salary of $240,000 with an increase to $260,000 one month after the one-year anniversary of the employment agreement; (ii) annual salary of $50,000 from Authentigraph for service in the capacity of Chief Executive Officer of Authentigraph; (iii) a bonus as determined by the Board of Directors; (iv) $5,000 for life insurance; (v) the award of 200,000 employee stock options to purchase the Company’s common stock at an exercise price of $11.25 per share, with 50,000 vested immediately and 50,000 vesting in six month increments; (vi) the award of stock options to purchase such number of shares of Authentigraph as shall equal 10% of the total issued and outstanding shares of Authentigraph, at an aggregate exercise price of $50,000, vesting immediately; and (vii) the award of stock options to purchase 2% of the issued and outstanding shares of common stock of Authentidate at the aggregate exercise price of $400,000, vesting 25% immediately and the balance vesting in six month increments of 25% of the total grant.

In July 2000, Authentidate entered into an employment agreement with its new Chief Executive Officer, Mr. Robert Van Naarden, for a three year term. The employment agreement provides for (i) annual salary of $250,000; (ii) an annual bonus of up to $200,000, with a minimum bonus of $80,000 during the first year; (iii) a severance agreement equal to twelve months salary in the event employment agreement is terminated without cause; (iv) the award of such number of shares of common stock of Authentidate as shall equal 5% of the shares outstanding on the date of the employment agreement, vesting in equal amounts over a four year period, commencing one year from the date of the agreement; and (v) the award of employee stock options to purchase 200,000 shares of common stock of Bitwise Designs, Inc., vesting in equal amounts over a four year period, at an exercise price of $6.3125 per share.

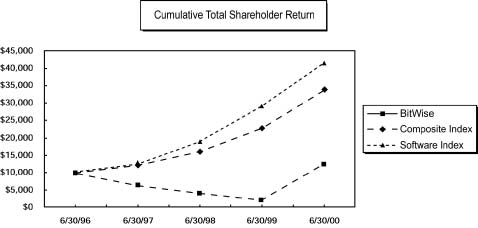

Shareholder Return Performance Presentation

Set forth below is a line graph comparing the total cumulative return on the Company’s common stock and the Nasdaq Composite Index and a Software Index (assuming reinvestment of dividends). The Company’s common stock is listed for trading in the Nasdaq National Market under the trading symbol BTWS.

Listed below is the value of a $10,000 investment at each of the Company’s last 5 year ends:

CUMULATIVE TOTAL SHAREHOLDER RETURN

| Date | Bitwise | NASDAQ Composite Index |

NASDAQ Software Index |

|||||||

| 6/30/96 | $ | 10,000 | $ | 10,000 | $ | 10,000 | ||||

| 6/30/97 | $ | 6,382 | $ | 12,165 | $ | 12,623 | ||||

| 6/30/98 | $ | 3,816 | $ | 16,011 | $ | 19,065 | ||||

| 6/30/99 | $ | 2,040 | $ | 23,031 | $ | 29,173 | ||||

| 6/30/00 | $ | 12,368 | $ | 34,031 | $ | 41,432 | ||||

______________

Footnotes:

| (1) | Assumes $10,000 was invested at June 30, 1996 in Bitwise and each Index presented. | ||

| (2) | The comparison indices were chosen in good faith by management. Most of the Company’s peers are divisions of large multi-national companies therefore a comparison is not meaningful. In addition, the Company is involved in three distinct businesses: document imaging software, authentidation/security software and computer systems integration, for which there is no peer comparison. Therefore the Company has chosen the NASDAQ Computer and Data Processing Index, which is primarily comprised of software companies. | ||

Indemnification of Directors and Officers

The General Corporation Law of Delaware provides generally that a corporation may indemnify any person who was or is a party to or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative, or investigative in nature to procure a judgment in its favor, by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees) and, in a proceeding not by or in the right of the corporation, judgments, fines and amounts paid in settlement, actually and reasonably incurred by him in connection with such suit or proceeding, if he acted in good faith and in a manner believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reason to believe his conduct was unlawful. Delaware law further provides that a corporation will not indemnify any person against expenses incurred in connection with an action by or in the right of the corporation if such person shall have been adjudged to be liable for negligence or misconduct in the performance of his duty to the corporation unless and only to the extent that the court in which such action or suit was brought shall determine that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for the expenses which such court shall deem proper.

The By-Laws of the Company provide for indemnification of officers and directors of the Company to the greatest extent permitted by Delaware law for any and all fees, costs and expenses incurred in connection with any action or proceeding, civil or criminal, commenced or threatened, arising out of services by or on behalf of the Company, providing such officer’s or director’s acts were not committed in bad faith. The By-Laws also provide for advancing funds to pay for anticipated costs and authorizes the Board to enter into an indemnification agreement with each officer or director.

In accordance with Delaware law, the Company’s Certificate of Incorporation contains provisions eliminating the personal liability of directors, except for breach of a director’s fiduciary duty of loyalty to the Company or to its stockholders, acts or omission not in good faith or which involve intentional misconduct or a knowing violation of the law, and in respect of any transaction in which a director receives an improper personal benefit. These provisions only pertain to breaches of duty by directors as such, and not in any other corporate capacity, e.g., as an officer. As a result of the inclusion of such provisions, neither the Company nor stockholders may be able to recover monetary damages against directors for actions taken by them which are ultimately found to have constituted negligence or gross negligence, or which are ultimately found to have been in violation of their fiduciary duties, although it may be possible to obtain injunctive or equitable relief with respect to such actions. If equitable remedies are found not to

be available to stockholders in any particular case, stockholders may not have an effective remedy against the challenged conduct.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Company pursuant to the foregoing provisions, the Company has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and therefore is unenforceable.

Certain Relationships and Related Transactions

Except as disclosed herein, the Company has not entered into any material transactions or series of similar transactions with any director, executive officer or any security holder owning 5% or more of the Company’s Common Stock.

On October 10, 2000, the Company entered into a Letter of Intent with Authentidate and Internet Venture Capital, LLC, to enter into a Joint Venture Agreement and License Agreement providing for the development of the AuthentiGraph.com, Inc. business plan and to market the AuthentiGraph service of authenticating and recording signatures on sports and entertainment memorabilia. Two of the members of Internet Venture Capital are affiliated with the “groups” (as defined in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended) listed in this Proxy Statement as owning more that 5% of the outstanding common stock of the Company, see “Voting Securities and Security Ownership of Certain Beneficial Owners and Management.”

For information concerning employment agreements with, and compensation of, the Company’s executive officers and directors, see “ MANAGEMENT—Executive Compensation.”

STOCKHOLDER PROPOSALS

Proposals of Stockholders intended to be presented at the Company’s Year 2001 Annual Meeting of Stockholders must be received by the Company on or prior to October 31, 2001 to be eligible for inclusion in the Company’s proxy statement and form of proxy to be used in connection with the Year 2001 Annual Meeting of Stockholders.

FINANCIAL INFORMATION

A COPY OF THE COMPANY’S ANNUAL REPORT ON FORM l0-KSB FOR THE FISCAL YEAR ENDED JUNE 30, 2000 FILED WITH THE SECURITIES AND EXCHANGE COMMISSION WILL BE FURNISHED WITHOUT THE ACCOMPANYING EXHIBITS TO STOCKHOLDERS WITHOUT CHARGE UPON WRITTEN REQUEST THEREFOR SENT TO IRA C. WHITMAN, SECRETARY, BITWISE DESIGNS, INC., 2165 TECHNOLOGY DRIVE, SCHENECTADY, NY 12308. Each such request must set forth a good faith representation that as of January 8, 2001 the person making the request was the beneficial owner of Common Shares or Series A Preferred Stock of the Company entitled to vote at the Annual Meeting of Stockholders. You may also obtain a copy of the Company’s Form 10-KSB over the Internet from the SEC’s Web Site, “WWW.SEC.GOV”.

VI. OTHER BUSINESS

As of the date of this Proxy Statement, the only business which the Board of Directors intends to present, and knows that others will present, at the Annual Meeting is that herein above set forth. If any other matter or matters are properly brought before the Annual Meeting, or any adjournments thereof, it is the intention of the persons named in the accompanying form of proxy to vote the proxy on such matters in accordance with their judgment.

| By Order of the Board of Directors | |||

| Ira C. Whitman, Secretary | |||

| January 25, 2001 |

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE

COMPLETE AND RETURN YOUR PROXY PROMPTLY IN THE ENCLOSED ENVELOPE.

NO POSTAGE IS REQUIRED IF IT IS MAILED IN THE UNITED STATES OF AMERICA.

BITWISE DESIGNS, INC.

Annual Meeting of Stockholders - February 28, 2001

PROXY SOLICITED BY THE BOARD OF DIRECTORS