|

|

|

|

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ |

||

| Filed by a Party other than the Registrant / / | ||

| Check the appropriate box: |

||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-12 |

|

| The Rottlund Company, Inc. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

| |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

THE ROTTLUND COMPANY, INC.

3065 Centre Pointe Road

Roseville, Minnesota 55113

August 10, 2000

Dear Shareholder of The Rottlund Company, Inc.:

You are cordially invited to attend the annual meeting of shareholders of The Rottlund Company, Inc. (the "Company"), to be held at the offices of the Company at 3065 Centre Pointe Road, Roseville, Minnesota, on Thursday, September 7, 2000 at 3:30 p.m.

At the annual meeting you will be asked to elect directors and to ratify the appointment by the board of directors of Arthur Andersen LLP as the Company's independent public accountants for the fiscal year ending March 31, 2001.

I encourage you to vote FOR each of the nominees for director and FOR ratification of the appointment of Arthur Andersen LLP. Whether or not you are able to attend the annual meeting in person, I urge you to complete, sign and date the enclosed proxy card and return it promptly in the enclosed envelope. If you do attend the meeting in person, you may withdraw your proxy and vote personally on any matters brought properly before the meeting.

Very truly yours,

THE ROTTLUND COMPANY, INC.

David H. Rotter

President

THE ROTTLUND COMPANY, INC.

3065 Centre Pointe Road

Roseville, Minnesota 55113

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| Date: | Thursday, September 7, 2000 | |||

| Time: | 3:30 p.m. | |||

| Place: | Offices of the Company 3065 Centre Pointe Road Roseville, Minnesota |

Matters to be voted on:

Only shareholders of record at the close of business on August 7, 2000, are entitled to notice of the meeting and are entitled to vote at the meeting.

Your vote at the annual meeting is important to us. Please vote your shares of common stock by completing the enclosed proxy card and signing it exactly as your name appears on the card. Return the proxy card to us in the enclosed envelope, which requires no postage if mailed in the United States. Proxies may be revoked at any time and if you attend the meeting in person, your executed proxy will be returned to you upon request.

By order of the board of directors,

David

H. Rotter

President

Roseville,

Minnesota

August 10, 2000

THE ROTTLUND COMPANY, INC.

3065 Centre Pointe Road

Roseville, Minnesota 55113

Proxy Statement

for

Annual Meeting of Shareholders

to be held

September 7, 2000

This proxy statement has information about the annual meeting and was prepared by the management of The Rottlund Company, Inc. (the "Company") for the board of directors in connection with the solicitation of proxies by the board of directors for use at the annual meeting of shareholders to be held at the offices of the Company at 3065 Centre Pointe Road, Roseville, Minnesota, on Thursday, September 7, 2000 at 3:30 p.m. The notice of annual meeting, this proxy statement and the form of proxy are first being mailed to shareholders of the Company on or about August 10, 2000.

General Information About Voting

Who can vote? You can vote your shares of common stock if our records show that you owned the shares on August 7, 2000. A total of 5,815,572 shares of common stock can vote at the annual meeting. You get one vote for each share of common stock. The enclosed proxy card shows the number of shares you can vote.

How do I vote by proxy? Follow the instructions on the enclosed proxy card to vote on each proposal to be considered at the annual meeting. Sign and date the proxy card and mail it back to us in the enclosed envelope. The proxyholders named on the proxy card will vote your shares as you instruct. If you sign and return the proxy card but do not vote on a proposal, the proxyholders will vote for you on that proposal. Unless you instruct otherwise, the proxyholders will vote for each of the six director nominees and for the ratification of the appointment of Arthur Anderson LLP as independent public accountants for the fiscal year ending March 31, 2001.

What if other matters come up at the annual meeting? The matters described in this proxy statement are the only matters we know will be voted on at the annual meeting. If other matters are properly presented at the meeting, the proxyholders will vote your shares as they deem appropriate.

Can I change my vote after I return my proxy card? Yes. At any time before you vote on a proposal, you can change your vote by giving written notice to the Secretary of the Company, by executing a later-dated proxy or by attending the meeting and giving oral notice to the Secretary of the Company.

Can I vote in person at the annual meeting? Although we encourage you to complete and return the proxy card to insure that your vote is counted, you can attend the annual meeting and vote your shares in person.

What do I do if my shares are held in "street name"? If your shares are held in the name of a bank, broker or other nominee, that party should give you instructions for voting your shares.

How are the votes counted? We will hold the annual meeting if holders of a majority of the shares of common stock entitled to vote either sign and return their proxy cards or attend the meeting. If you sign and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on any of the proposals listed on the proxy card.

If your shares are held in the name of a nominee, and you do not tell the nominee how to vote your shares (so-called "broker nonvotes"), the nominee can vote them as it deems appropriate only on routine matters. Broker nonvotes will be counted as present to determine if a quorum exists but will not be counted as present and entitled to vote on nonroutine matters.

Who pays for this proxy solicitation? We do. In addition to sending you these materials, some of our employees may contact you by telephone, by mail or in person. None of these employees will receive any extra compensation for doing this. We will also request brokerage houses, nominees, custodians and fiduciaries to forward soliciting material to the beneficial owners of common stock of the Company and will reimburse any expenses so incurred.

The following table shows the number of shares of common stock beneficially owned (as of August 7, 2000) by:

Unless otherwise indicated, each person in the table has sole voting and investment power as to the shares shown.

The securities "beneficially owned" by a person are determined in accordance with the definition of "beneficial ownership" set forth in the regulations of the Securities and Exchange Commission and, accordingly, may include securities owned by or for, among others, the spouse, children or certain other relatives of such person, as well as other securities as to which the person has or shares voting or investment power or has the right to acquire within 60 days after August 7, 2000. The same shares may be beneficially owned by more than one person.

| Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class |

|||

|---|---|---|---|---|---|

| David H. Rotter 3065 Centre Pointe Road Roseville, MN 55113 |

2,179,195 | (1)(3)(4) | 37.5 | % | |

| Bernard J. Rotter 3065 Centre Pointe Road Roseville, MN 55113 |

2,117,695 | (2)(3)(4) | 36.4 | % | |

| Shirley A. Rotter 10985 57th Avenue North Plymouth, MN 55126 |

786,500 | (3) | 13.5 | % | |

| Heartland Advisors, Inc. 790 North Milwaukee Street Milwaukee, WI 53202 |

593,200 | (5) | 10.2 | % | |

| Todd M. Stutz | 152,604 | (4) | 2.6 | % | |

| Lawrence B. Shapiro | 135,721 | (4) | 2.3 | % |

2

| John J. Dierbeck, III |

|

100,875 |

(4) |

1.7 |

% |

| Dennis J. Doyle | 4,000 | (4) | * | ||

| Scott D. Rued | 11,000 | (4) | * | ||

| All directors and officers as a group (7 persons) | 4,701,090 | (1)(2)(4) | 80.8 | % |

The Shareholders' Agreement divides the Rotter families who own shares into two groups the "DR Group" and the "BR Group." The members of the groups, who collectively own 4,199,500 shares of common stock, have agreed to vote their shares in accordance with the instructions of the controlling shareholder of their respective group so long as they own their respective shares.

Members of the respective groups have further agreed to certain restrictions upon their ability to transfer or otherwise dispose of their shares to third parties in the event of certain voluntary lifetime transfers, upon death and in the case of involuntary transfers if any of the members in the DR Group desire to dispose of their shares without the consent of Mr. David H. Rotter, such member must first offer the shares to Mr. David H. Rotter, and if he does not elect to acquire these shares, then to Mr. Bernard J. Rotter. Similarly, if any member of the BR Group desires to dispose of his or her shares without the consent of Mr. Bernard J. Rotter, the member must first offer such shares to Mr. Bernard J. Rotter, and if he does not elect to purchase these shares, then to Mr. David H. Rotter.

Messrs. David H. Rotter and Bernard J. Rotter have agreed that they will offer their respective shares to the other in the event of proposed lifetime transfers, and each has given to the other the option to purchase his shares upon death, disability or in the event of an involuntary transfer.

The Shareholders' Agreement will terminate upon:

This information is based, in part, on a Schedule 13G filed with the Securities and Exchange Commission by Shirley A. Rotter, on September 2, 1999.

3

The following report and the performance graph do not constitute soliciting materials and are not considered filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, unless we state otherwise.

Report of the Compensation Committee

The Compensation Committee (the "Committee") determined the compensation arrangements for the Company's executive officers for fiscal year 2000 in July 1999. To ensure the objectivity and independence of the Committee, it is composed of the two outside directors of the Company, Messrs. Doyle and Rued. The Committee's principal responsibility is to ensure the Company's executive compensation plans are aligned with and support the Company's business objectives. The Committee continually evaluates the overall design and administration of the executive compensation plans in order to fulfill its responsibility.

Currently, the primary elements of the executives' total compensation program are base salary, annual incentives and long-term incentives. In general, the compensation program promotes a pay-for-performance philosophy by placing a significant portion of total compensation "at risk" while providing compensation opportunities which are comparable to market levels. The Company's executive compensation package consists of three main components: base salary, annual bonuses based on Company performance and stock options.

Base Salary. The Committee determines the annual base salary of each named executive officers after considering the compensation levels of personnel with similar responsibilities at other companies within the home construction industry, and after considering the responsibilities and performance of the individual officer.

Annual Cash Bonus. Under the Company's annual bonus program, cash bonuses are paid annually to the named executive officers and other officers and employees from a bonus pool. The size of the bonus pool is derived from a pre-determined formula of percentages of levels of pre-tax profits of the Company. The officers and employees participating in the annual bonus program receive a percentage of the bonus pool that is established based on the same considerations as were used to determine the base salary of each officer and employee.

Under the annual bonus program, each executive officer's compensation for fiscal year 2000 was tied directly to the financial performance of the Company, except for Mr. Todd Stutz, whose bonus is tied directly to the financial performance of the Company's Minnesota operations. For the annual bonus program in fiscal 2000, a bonus of $122,845 was paid to Mr. David Rotter, chief executive officer of the Company, and aggregate bonuses paid to all of the named executive officers of the Company, as a group, including the chief executive officer, represents approximately 43% of the group's total fiscal 2000 compensation.

Stock Options. The purpose of the stock option program is to align the long-term interests of the Company's executives and its shareholders and, through the use of vesting periods, to assist in the retention of executives.

Compensation of Chief Executive Officer

In determining the compensation package for Mr. David H. Rotter, the Committee applied the compensation policies described above.

Compensation Committee Interlocks

None of the compensation committee members is or has been a Company officer or employee during fiscal year 2000. No Company executive office currently serves on the compensation committee or any similar committee of another public company.

4

The following table discloses compensation received by the Company's Chief Executive Officer and the four other most highly paid executive officers for the three fiscal years ended March 31, 2000.

| |

|

|

|

Long Term Compensation Awards |

||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Annual Compensation |

|||||||||

| |

Securities Underlying Options(#) |

|||||||||

| Name and Principal Position |

Year |

Salary |

Bonus |

|||||||

| David H. Rotter President |

2000 1999 1998 |

$ |

250,000 250,000 250,000 |

$ |

129,522 122,845 -0- |

-0- -0- -0- |

||||

| Bernard J. Rotter Vice President, Treasurer |

|

2000 1999 1998 |

|

|

250,000 250,000 250,000 |

|

|

129,522 122,845 -0- |

|

-0- -0- -0- |

| Todd M. Stutz Executive Vice President |

|

2000 1999 1998 |

|

|

140,000 140,000 85,000 |

|

|

262,610 345,451 23,018 |

|

-0- 60,000 -0- |

| John J. Dierbeck, III(1) Executive Vice President |

|

2000 1999 1998 |

|

|

117,500 117,500 100,000 |

|

|

55,509 52,648 50,000 |

|

-0- 60,000 -0- |

| Lawrence B. Shapiro Chief Financial Officer |

|

2000 1999 1998 |

|

|

105,000 105,000 100,000 |

|

|

74,013 70,197 -0- |

|

-0- 60,000 -0- |

Options Granted in Last Fiscal Year

None.

Aggregated Fiscal Year-End Option Values

The following table provides the value of the named executive officers' unexercised options at March 31, 2000.

| |

Number of Securities Underlying Unexercised Options at Fiscal Year-End(#) |

Value of Unexercised In-the-Money Options at Fiscal Year-End($)(1) |

||||||

|---|---|---|---|---|---|---|---|---|

| Name |

(Exercisable) |

(Unexercisable) |

(Exercisable) |

(Unexercisable) |

||||

| David H. Rotter | 62,751 | 7,529 | -0- | -0- | ||||

| Bernard J. Rotter | 62,751 | 7,529 | -0- | -0- | ||||

| Todd M. Stutz | 145,130 | 75,285 | -0- | -0- | ||||

| John J. Dierbeck, III | 100,675 | -0- | -0- | -0- | ||||

| Lawrence B. Shapiro | 107,847 | 51,378 | -0- | -0- | ||||

5

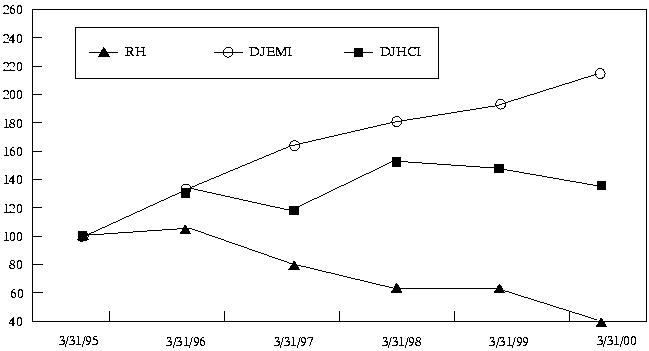

The graph below compares the cumulative total shareholder return on $100 invested in the common stock of the Company for the last five fiscal years with the cumulative total return on the same amount invested in the Dow Jones Equity Market Index and Dow Jones Home Construction Index for the same periods.

Section 16(a) Beneficial Ownership Reporting Requirement

Our directors and officers must file reports with the Securities and Exchange Commission indicating the number of shares of the Company's common stock they beneficially own and any changes in their beneficial ownership. Copies of these reports must be provided to us. Based on our review of these reports and written representations from the persons required to file them, we believe each of our directors and executive officers filed all the required reports during fiscal year 2000.

PROPOSAL NO. 1

Election of Directors

Each of the six nominees for director is currently a member of the board of directors and was elected by the shareholders. All nominees have agreed to stand for election at the annual meeting. If, prior to the annual meeting, the board of directors learns that any nominee will be unable to serve by reason of death, incapacity or other unexpected occurrence, the proxies that would have otherwise been voted for such nominee will be voted for a substitute nominee, if any, elected by the board. Election of each nominee requires the affirmative vote of the holders of a majority of the shares of common stock represented at the meeting.

David H. Rotter, age 53, is a founder of the Company and has been a member of its board of directors since its inception. He served as the Company's Vice President from 1973 through March 1990 and has served as its President from April 1990 through the present. He has also served as the Company's Secretary since its inception. He is the brother of Bernard J. Rotter.

Bernard J. Rotter, age 57, has served as Chairman of the Board, Vice President and Treasurer of the Company since July 1984. He is the brother of David H. Rotter.

6

Todd M. Stutz, age 42, was elected a Director of the Company in August 1992 and has served as Executive Vice President since June 1991. He joined the Company in April 1989 and served as its Land Development Manager until June 1991. Between April 1980 and March 1989 he was employed by the Housing and Redevelopment Authority of the City of Columbia Heights, Minnesota, as Executive Director.

Lawrence B. Shapiro, age 44, was elected Chief Financial Officer and a Director of the Company in August 1992. He has served as the Company's Controller since January 1989.

Scott D. Rued, age 43, was elected as a Director of the Company effective December 10, 1993. Mr. Rued has served as Executive Vice President and Chief Financial Officer of Hidden Creek Industries (a management company) since January 1, 1994, as Vice President of Finance and Corporate Development of Hidden Creek from June 1989 to December 1993, and as Vice President and Director of Tower Automotive, Inc. (a producer of automotive parts) since April 1993.

Dennis J. Doyle, age 48, was elected as a Director of the Company on April 23, 1996. For more than the last five years Mr. Doyle has been President and Chief Executive Officer of Welsh Companies, Inc. (a full service real estate company). Mr. Doyle is also a director of Grow Biz International.

The board of directors held three meetings in fiscal year 2000. Each of the incumbent directors attended at least 75% of the board meetings and committee meetings of which he was a member during fiscal year 2000, except that Messrs. Doyle and Rued missed one of the three meetings. Directors of the Company who are not employees of the Company receive $8,000 per year of service, reimbursement of the out-of-pocket expenses incurred on behalf of the Company and they participate in the Company's Director Stock Option Plan.

Audit Committee. The members of the audit committee are Dennis J. Doyle and Scott D. Rued, both of whom are independent as that term is defined in Section 121(A) of the AMEX listing standards. The audit committee held one meeting during fiscal year 2000. The primary responsibilities of the audit committee, as more fully set forth in the Audit Committee Charter adopted by the Company on June 13, 2000, and attached hereto as Appendix A, include:

The audit committee has reviewed and discussed the audited financial statements for fiscal year 2000 with the management of the Company. Additionally, the audit committee has discussed with the independent auditors the matters required by SAS 61 and has received the written disclosures and the letter from the independent auditors required by the Independence Standards Board Standard No. 1.

Compensation Committee. The members of the compensation committee are Dennis J. Doyle and Scott D. Rued. The compensation committee is authorized by the board of directors to:

The compensation committee held one meeting during fiscal year 2000.

7

PROPOSAL NO. 2

Ratification of Selection of Independent Public Accountants

The board of directors has appointed Arthur Andersen LLP as independent public accountants for the Company for the year ending March 31, 2001. A proposal to ratify that appointment will be presented to shareholders at the annual meeting. Representatives of Arthur Andersen LLP will be present at the annual meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions from shareholders in attendance. The board of directors recommends that you vote in favor of the proposal.

If you want to include a shareholder proposal in the proxy statement for the 2001 annual meeting, it must be delivered to the Company's executive offices before March 30, 2001. Due to the complexity of the respective rights of the shareholders and the Company in this area, we advise shareholders desiring to propose an action to consult with his or her legal counsel. We suggest that proposals be submitted by certified mail, return receipt requested.

As of the date of mailing of this proxy statement, we are not aware of any business to be presented at the annual meeting other than the proposals discussed above. If other proposals are properly brought before the meeting, any proxies returned to us will be voted as the proxyholders deem appropriate.

We have included a copy of the Company's Annual Report to shareholders for the fiscal year ended March 31, 2000, which contains the Company's Form 10-K, with this notice of annual meeting, proxy statement and proxy card.

By order of the board of directors,

David

H. Rotter

President

Roseville,

Minnesota

August 10, 2000

8

Appendix A

CHARTER

OF THE

AUDIT COMMITTEE

OF

THE ROTTLUND COMPANY, INC.

I. PURPOSE

The primary function of the audit committee of the Board of Directors (the "Audit Committee") of The Rottlund Company, Inc. (the "Company") is to assist the Board of Directors in fulfilling its oversight responsibilities by reviewing the financial reports and other financial information provided by the Company to any governmental body or the public; by reviewing the Company's systems of internal controls regarding finance, accounting, legal compliance and ethics, as established by management and the Board; and reviewing the Company's auditing, accounting and financial reporting processes generally. Consistent with this function, the Audit Committee should encourage continuous improvement of, and should foster adherence to, the Company's policies, procedures and practices at all levels. The Audit Committee's primary duties and responsibilities are to:

The Audit Committee will primarily fulfill these responsibilities through the activities enumerated in Section IV of this Charter.

II. COMPOSITION

The Audit Committee shall be comprised of two (2) members, each of whom shall be independent, as defined by the AMEX listing standards, and free from any relationship that, in the opinion of the Board of Directors, would interfere with the exercise of his or her independent judgment as a member of the Audit Committee. In order to remain in compliance with the AMEX listing standards, the Board of Directors shall appoint an additional member to the Audit Committee before June, 2001, so that the Audit Committee shall be comprised of at least three (3) members, each of whom shall be independent, as defined by the AMEX listing standards, and free from any relationship that, in the opinion of the Board of Directors, would interfere with the exercise of his or her independent judgment as a member of the Audit Committee. Under exceptional circumstances, one (1) non-independent director will be allowed to serve on the

Audit Committee; provided that, the Board determines it to be in the best interests of the Company and its shareholders, and further provided that, the Board discloses the reasons for such determination in the Company's next annual proxy statement. In no instance, however, will current employees or officers, or the immediate families thereof, be permitted to serve on the Audit Committee.

All members of the Audit Committee shall have a working familiarity with basic finance and accounting statements, including the Company's balance sheet, income statement and cash flow statement. Additionally, at least one (1) member of the Audit Committee must have past employment experience or requisite professional certification in accounting or related financial management expertise. Audit Committee members may enhance their familiarity with finance and accounting by participating in educational programs conducted by the Company or an outside consultant.

The members of the Audit Committee shall be elected by the Board at the annual organizational meeting of the Board and shall serve for the period of one (1) year or until their successors shall be duly elected and qualified. Unless a Chair is elected by the full Board, the members of the Audit Committee may designate a Chair by a majority vote of the full Audit Committee.

III. MEETINGS

The Audit Committee shall meet at least four (4) times annually, or more frequently as circumstances dictate. As the Audit Committee has responsibility to foster open communication, the Audit Committee should meet at least annually with management and the independent accountants. Each meeting should be a separate executive session in order to discuss any matters that the Audit Committee or these groups believe should be discussed privately. In addition, the Audit Committee, or the Chair of the Audit Committee, should meet quarterly with the independent accountants and management to review the Company's financials.

IV. RESPONSIBILITIES AND DUTIES

To fulfill its responsibilities and duties the Audit Committee shall:

Preparation of Reports

Documents/Reports Review

Independent Accountants

Financial Reporting Processes

Process Improvement

Ethical and Legal Compliance

| THE ROTTLAND COMPANY, INC. | ||

| |

|

ANNUAL MEETING OF SHAREHOLDERS |

| |

|

Thursday, September 7, 2000 3:30 p.m. |

| |

|

THE ROTTLUND COMPANY, INC. 3065 Centre Pointe Road Roseville, Minnesota 55113 |

| |

|

|

| THE ROTTLUND COMPANY, INC. Centre Pointe Road Roseville, Minnesota 55113 |

proxy | |||

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned, having duly received the Notice of Annual Meeting of Shareholders and the Proxy Statement, dated August 10, 2000, hereby appoints David H. Rotter and Bernard J. Rotter as proxies (each with the power to act alone and with the power of substitution and revocation), to represent the undersigned and to vote, as designated below, all common shares of The Rottlund Company, Inc. held of record by the undersigned on August 7, 2000, at the Annual Meeting of Shareholders to be held on September 7, 2000, at 3:30 p.m. at the Company's offices, 3065 Centre Pointe Road, Roseville, Minnesota, and at any adjournments thereof.

See reverse for voting instructions

Please detach here

The Board of Directors Recommends a Vote FOR Items 1, 2 and 3.

| 1. | To elect six directors of the Company, each for a term of one year and until their successors shall be elected and duly qualified. | |||||||||||||

| 01 David H. Rotter 04 Lawrence B. Shapiro |

02 Bernard J. Rotter 05 Scott D. Rued |

03 Todd M. Stutz 06 Dennis J. Doyle |

/ / | FOR all nominees listed below (except as marked) | / / | WITHHOLD AUTHORITY to vote for all nominees listed below | ||||||||

| (Instructions: To withhold authority to vote for any individual, write that nominee's name in the box provided to the right.) |

|

|

||||||||||||

| 2. | To ratify the appointment of Arthur Andersen LLP as the Company's independent public accounants for the fiscal year ending March 31, 2001. | / / | For | / / | Against | / / | Abstain | |||||||

| 3. | To transact such other business as may properly come before the meeting or any adjournment thereof. | / / | For | / / | Against | / / | Abstain |

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED ON THE PROXY BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR PROPOSALS 1 THROUGH 3. ABSTENTIONS WILL BE COUNTED TOWARDS THE EXISTENCE OF A QUORUM.

| Address Change? Mark Box / / | |||||

| Indicate changes below: | |||||

| |

|

Please sign exactly as name appears on this proxy. When shares are held by joint tenants, both should sign. If signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by president or other authorized officer. If a partnership, please sign in partnership name by an authorized person. |

|||

| |

|

Dated: |

|

|

|

| |

|

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY PROMPTLY USING THE ENCLOSED ENVELOPE. |

|||

|

|