|

|

|

|

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: |

||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-12 |

|

SCHNITZER STEEL INDUSTRIES, INC. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

SCHNITZER STEEL INDUSTRIES, INC.

December 29, 2000

Dear Shareholder:

You are invited to attend the Annual Meeting of Shareholders of your Company, which will be held on Monday, January 29, 2001 at 8 A.M., local time, at the Multnomah Athletic Club, 1849 SW Salmon Street, Portland, Oregon 97205.

The formal notice of the meeting and the proxy statement appear on the following pages and describe the matters to be acted upon. Time will be provided during the meeting for discussion and you will have an opportunity to ask questions about your Company.

Whether or not you plan to attend the meeting in person, it is important that your shares be represented and voted. After reading the enclosed notice of the meeting and proxy statement, please sign, date and return the enclosed proxy at your earliest convenience. Return of the signed and dated proxy card will not prevent you from voting in person at the meeting should you later decide to do so.

| Sincerely, | ||

/s/ ROBERT W. PHILIP Robert W. Philip President |

SCHNITZER STEEL INDUSTRIES, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JANUARY 29, 2001

The Annual Meeting of Shareholders of Schnitzer Steel Industries, Inc. (the Company) will be held at the Multnomah Athletic Club, 1849 SW Salmon Street, Portland, Oregon 97205, on Monday, January 29, 2001 at 8 A.M., local time, for the following purposes:

Only shareholders of record at the close of business on November 20, 2000 are entitled to notice of and to vote at the meeting or any adjournments thereof.

Please sign and date the enclosed proxy and return it promptly in the enclosed reply envelope. If you are able to attend the meeting, you may, if you wish, revoke the proxy and vote personally on all matters brought before the meeting.

| By Order of the Board of Directors, | ||

/s/ CHARLES A. FORD Charles A. Ford Assistant Secretary |

SCHNITZER STEEL INDUSTRIES, INC.

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Schnitzer Steel Industries, Inc., an Oregon corporation (the Company), to be voted at the Annual Meeting of Shareholders to be held at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting.

All proxies in the enclosed form that are properly executed and received by the Company prior to or at the Annual Meeting and not revoked will be voted at the Annual Meeting or any adjournments thereof in accordance with the instructions thereon. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by (i) filing with the Assistant Secretary of the Company, at or before the taking of the vote at the Annual Meeting, a written notice of revocation bearing a later date than the proxy, (ii) duly executing a subsequent proxy relating to the same shares and delivering it to the Assistant Secretary of the Company before the Annual Meeting, or (iii) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy). Any written notice revoking a proxy should be sent to Schnitzer Steel Industries, Inc., P.O. Box 10047, Portland, Oregon 97296-0047, Attention: Charles A. Ford, Assistant Secretary, or hand-delivered to the Assistant Secretary at or before the taking of the vote at the Annual Meeting.

The mailing address of the principal executive offices of the Company is P.O. Box 10047, Portland, Oregon 97296-0047. This Proxy Statement and the accompanying Notice of Annual Meeting and Proxy Card are first being mailed to shareholders on or about December 29, 2000.

VOTING SECURITIES AND PRINCIPAL SHAREHOLDERS

The record date for determination of shareholders entitled to receive notice of and to vote at the Annual Meeting is November 20, 2000. At the close of business on November 20, 2000, 5,244,426 shares of Class A Common Stock (Class A), par value $1.00 per share, and 4,311,828 shares of Class B Common Stock (Class B), par value $1.00 per share, of the Company (collectively, the Common Stock) were outstanding and entitled to vote at the Annual Meeting. Each share of Class A Common Stock is entitled to one vote and each share of Class B Common Stock is entitled to ten votes with respect to each matter to be voted on at the Annual Meeting.

The following table sets forth certain information regarding the beneficial ownership of the Common Stock, as of August 31, 2000 (unless otherwise noted in the footnotes to the table), by (i) persons known to the Company to be the beneficial owner of more than 5% of either class of the Company's Common Stock, (ii) each of the Company's directors and nominees for director, (iii) each executive officer of the Company named in the Summary Compensation Table, and (iv) all directors and executive officers of the Company as a group. Unless otherwise noted in the footnotes to the table, the persons named in the table have sole voting and investment power with respect to all outstanding shares of Common Stock shown as beneficially owned by them. Except as noted below, the address of each shareholder in the table is Schnitzer Steel Industries, Inc., P.O. Box 10047, Portland, Oregon 97296-0047.

1

| |

Class A Shares Beneficially Owned(1) |

Class B Shares Beneficially Owned(1) |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name of Beneficial Owner or Number of Persons in Group |

||||||||||

| Number |

Percent |

Number |

Percent |

|||||||

| Schnitzer Steel Industries, Inc. Voting Trust (the Schnitzer Trust) |

4,311,128 | 99.9 | % | |||||||

| Manuel Schnitzer(2) | 27,500 | * | 281,166 | 6.5 | % | |||||

| Marilyn S. Easly(2) | 536 | * | 299,856 | 7.0 | % | |||||

| Carol S. Lewis(2) | 1,000 | * | 193,870 | 4.5 | % | |||||

| Scott Lewis | 46,000 | 0.9 | % | 49,455 | 1.1 | % | ||||

| MANUEL SCHNITZER FAMILY GROUP, Carol S. Lewis, Trustee(3) |

1,126,927 | 26.1 | % | |||||||

| Dori Schnitzer(2) | 441,170 | 10.2 | % | |||||||

| Susan Schnitzer(2) | 335,009 | 7.8 | % | |||||||

| Jean S. Reynolds(2) | 274,342 | 6.4 | % | |||||||

| MORRIS SCHNITZER FAMILY GROUP, Dori Schnitzer, Trustee(3) |

1,079,314 | 25.0 | % | |||||||

| Gilbert and Thelma S. Schnitzer(2) | 54,757 | (4) | 1.0 | % | 479,729 | 11.1 | % | |||

| Kenneth M. and Deborah S. Novack(2) | 66,359 | (4,5) | 1.2 | % | 272,037 | 6.3 | % | |||

| Gary Schnitzer(2) | 63,152 | (6) | 1.2 | % | 207,097 | 4.8 | % | |||

| GILBERT SCHNITZER FAMILY GROUP, Gary Schnitzer, Trustee(3) |

963,288 | 22.3 | % | |||||||

| Leonard and Lois T. Schnitzer(2) | 112,937 | (7) | 2.1 | % | 185,875 | 4.3 | % | |||

| Robert W. and Rita S. Philip(2) | 107,488 | (8) | 2.0 | % | 143,289 | 3.3 | % | |||

| LEONARD SCHNITZER FAMILY GROUP, Rita S. Philip, Trustee(3) |

1,141,599 | 26.5 | % | |||||||

| Artisan Partners Limited Partnership(13) | 875,100 | (9) | 16.2 | % | ||||||

| Cascade Investment L.L.C.(14) | 602,200 | (9) | 11.2 | % | ||||||

| WM Advisors, Inc.(15) | 503,890 | (9) | 9.4 | % | ||||||

| Tweedy Browne Company LLC(16) | 407,505 | (9) | 7.6 | % | ||||||

| Dimensional Fund Advisors, Inc.(17) | 389,700 | (9) | 7.2 | % | ||||||

| SAFECO Asset Management Company(18) | 319,900 | (9) | 5.9 | % | ||||||

| Robert S. Ball | 5,000 | 0.1 | % | |||||||

| William A. Furman | 3,500 | 0.1 | % | |||||||

| Ralph R. Shaw | 5,000 | 0.1 | % | |||||||

| Barry A. Rosen | 50,915 | (10) | 0.9 | % | ||||||

| Kurt C. Zetzsche | 55,446 | (11) | 1.0 | % | ||||||

| All directors and executive officers as a group (15 persons)(2). | 522,996 | (12) | 9.7 | % | 1,767,135 | 41.0 | % | |||

2

Schnitzer Steel Industries, Inc. Voting Trust and Buy-Sell Agreement

Voting Trust Provisions. Pursuant to the terms of the Schnitzer Steel Industries, Inc. Voting Trust and Buy-Sell Agreement dated March 31, 1991 (the Schnitzer Trust Agreement), the beneficial owners of substantially all outstanding shares of Class B Common Stock have made their shares subject to the terms of the Schnitzer Steel Industries, Inc. Voting Trust (the Schnitzer Trust). The Schnitzer Trust is divided into four separate groups, one for each branch of the Schnitzer family. Carol S. Lewis, Dori Schnitzer, Gary Schnitzer, and Rita S. Philip are the four trustees of the Schnitzer Trust and each is also the separate trustee for his or her separate family group. Pursuant to the Schnitzer Trust Agreement, the trustees as a group have the power to vote the shares subject to the Schnitzer Trust Agreement and, in determining how the trust shares will be voted, each trustee separately has the number of votes equal to the number of shares held in trust for his or her family group. Any action by the trustees requires the approval of trustees with votes equal to at least 52.5% of the total number of shares subject to the Schnitzer Trust Agreement. Before voting with respect to the following actions, each trustee is required to obtain the approval of holders of a majority of the voting trust certificates held by his or her family group: (a) any merger or consolidation of the Company with any other corporation, (b) the sale of all or substantially all the Company's assets or any other sale of assets requiring approval of the Company's shareholders, (c) any reorganization of the Company requiring approval of the Company's shareholders, (d) any partial liquidation or dissolution requiring approval of the Company's shareholders, and (e) dissolution of the Company. The Schnitzer Trust Agreement will terminate on March 31, 2001 unless terminated prior thereto by agreement of the holders of trust certificates representing two-thirds of the shares held in trust for each family group.

Provisions Restricting Transfer. The trustees are prohibited from selling or encumbering any shares held in the Schnitzer Trust. The Schnitzer Trust Agreement prohibits shareholders who are parties thereto from selling or otherwise transferring their voting trust certificates or their shares of Class B Common Stock except to other persons in their family group or to entities controlled by such persons. Such transfers are also restricted by the Company's Restated Articles of Incorporation. A holder of voting trust certificates is permitted to sell or make a charitable gift of the shares of Class B Common Stock represented by his or her certificates by first directing the trustees to convert the shares into Class A Common Stock, which will then be distributed to the holder free from restrictions under the agreement. However, before causing any shares to be

3

converted for sale, a holder must offer the shares (or the voting trust certificates representing the shares) to the other voting trust certificate holders who may purchase the shares at the current market price for the Class A Common Stock. After the expiration of the Schnitzer Trust Agreement, these transfer restrictions will continue to apply to the Class B Common Stock formerly held by the Schnitzer Trust unless terminated by agreement of the holders of two-thirds of the Class B Common Stock held by each family group.

Eleven directors are to be elected at the Annual Meeting, each to hold office until the next Annual Meeting and until his or her successor has been duly elected and qualified. Proxies received from shareholders, unless directed otherwise, will be voted FOR the election of the following nominees: Leonard Schnitzer, Robert W. Philip, Kenneth M. Novack, Gary Schnitzer, Dori Schnitzer, Carol S. Lewis, Jean S. Reynolds, Scott Lewis, Robert S. Ball, William A. Furman, and Ralph R. Shaw. If any nominee is unable to stand for election, the persons named in the proxy will vote the same for a substitute nominee. All of the nominees are currently directors of the Company. The Company is not aware that any nominee is or will be unable to stand for reelection. Directors shall be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. Abstentions and broker non-votes will have no effect on the results of the vote.

Set forth below is the name, age, position with the Company, present principal occupation or employment and five-year employment history of each of the nominees for director of the Company.

| Name and Year First Became Director |

Business Experience |

Age |

||

|---|---|---|---|---|

| Leonard Schnitzer 1948 |

Chief Executive Officer since August 1973; became Chairman of the Board in March 1991. | 76 | ||

Robert W. Philip 1991 |

President and a director since March 1991. He had been a Vice President of the Company since 1984 with responsibility for the Company's Metra Steel distribution division from 1984 to the time of its sale in July 1990. Mr. Philip is Leonard Schnitzer's son-in-law. |

53 |

||

Kenneth M. Novack 1991 |

Executive Vice President of the Company and President of Schnitzer Investment Corp. (SIC) and certain other Schnitzer Group Companies. From 1975 to 1980, he worked for the Company as Vice President and then Executive Vice President. Mr. Novack was also President of SIC from 1978 to 1980. From 1981 until April 1991, he was a partner in the law firm known formerly as Ball, Janik & Novack. Mr. Novack is the son-in-law of Gilbert Schnitzer, a brother of Leonard Schnitzer. |

54 |

||

Gary Schnitzer 1993 |

Executive Vice President in charge of the Company's California Metals Recycling operations since 1980 and a director since September 1993. Gary Schnitzer is the son of Gilbert Schnitzer, a brother of Leonard Schnitzer. |

58 |

||

Dori Schnitzer 1991 |

Secretary of the Company from June 1987 until June 2000 and became a director in March 1991. She also served as corporate counsel of the Company from October 1987 to May 1991. From May 1991 until June 2000, she was the Vice President of Lasco Shipping Co., a subsidiary of Schnitzer Investment Corp. Dori Schnitzer is a daughter of Morris Schnitzer, a deceased brother of Leonard Schnitzer. |

47 |

||

4

Carol S. Lewis 1987 |

Director of the Company since December 1987. She is the former proprietor of Virginia Jacobs, which has three linen and home accessories stores. From 1991 until 1995 she worked as a marketing and fund-raising consultant. From 1981 until 1991 she worked for Oregon Public Broadcasting, the nonprofit operator of public television and radio in Oregon, most recently as President of the Oregon Public Broadcasting Foundation. Carol Lewis is a daughter of Manuel Schnitzer, a brother of Leonard Schnitzer. |

63 |

||

Scott Lewis 1998 |

Director of the Company since 1998. Mr. Lewis is the Chief Executive Officer of Help1.com. He formerly was Director of Business Development of Conversational Computing Corporation, President of Sora Corporation, and an information technology consultant. Scott Lewis is the son of Carol S. Lewis, who is the daughter of Manuel Schnitzer, a brother of Leonard Schnitzer. |

41 |

||

Jean S. Reynolds 1993 |

Director of the Company since September 1993. Jean S. Reynolds was previously a marketing consultant. She is a daughter of Morris Schnitzer, a deceased brother of Leonard Schnitzer. |

51 |

||

Robert S. Ball 1993 |

Director of the Company since September 1993. Since 1982, he has been a partner in the Portland, Oregon law firm of Ball Janik LLP. He is also a director of EC Company. |

59 |

||

William A. Furman 1993 |

Director of the Company since September 1993. Since 1981, he has been President, Chief Executive Officer and a director of The Greenbrier Companies of Portland, Oregon, a publicly held company with subsidiaries, including Gunderson, Inc., engaged in manufacturing, marketing and leasing of railcars and other equipment. |

55 |

||

Ralph R. Shaw 1993 |

Director of the Company since September 1993. Mr. Shaw is President of Shaw Management, Inc., a financial services and venture capital firm. He is also a director of Dendreon Corporation. |

62 |

The Board of Directors held four meetings during the fiscal year ended August 31, 2000. Each director attended at least 75% of the aggregate number of meetings of the Board and of committees of the Board on which they served.

The Company has Compensation and Audit Committees of the Board of Directors. Messrs. Ball, Furman, and Shaw are members of the Audit Committee and Messrs. Furman and Shaw are members of the Compensation Committee. The principal function of the Audit Committee is to make recommendations to the Board as to the engagement of independent auditors, to review the scope of the audit and audit fees, and to discuss the results of the audit with the independent auditors. The Compensation Committee administers the Company's 1993 Stock Incentive Plan and makes recommendations to the Board of Directors regarding compensation for executive officers of the Company. During fiscal 2000, the Audit Committee held five meetings and the Compensation Committee held two meetings. The Company does not have a nominating committee of the Board of Directors. Shareholders who wish to submit names for consideration for Board membership should do so in writing addressed to the Board of Directors, c/o Charles A. Ford, Assistant Secretary, Schnitzer Steel Industries, Inc., P.O. Box 10047, Portland, Oregon 97296-0047.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF THE NOMINEES NAMED IN THIS PROXY STATEMENT.

5

Summary Compensation Table

The following table provides certain summary information concerning compensation paid or accrued by the Company to or on behalf of the Company's Chief Executive Officer and each of the four other most highly compensated executive officers of the Company (hereinafter referred to as the Named Executive Officers) for the fiscal years ended August 31, 2000, 1999, and 1998:

| |

|

|

|

|

Long-Term Compensation |

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

|

|

Awards |

|

|||||||||

| |

|

Annual Compensation |

|

||||||||||||

| Name and Principal Position |

Fiscal Year |

Securities Underlying Options |

All Other Compensation(1,2) |

||||||||||||

| Salary |

Bonus |

Other |

|||||||||||||

| Leonard Schnitzer(1) | 2000 | $ | 299,387 | $ | 150,000 | 28,401 | $ | 8,500 | |||||||

| Chief Executive Officer | 1999 | $ | 294,534 | $ | 148,800 | 34,132 | $ | 8,000 | |||||||

| 1998 | $ | 288,869 | $ | 124,000 | 16,888 | $ | 8,000 | ||||||||

| Robert W. Philip(1) | 2000 | $ | 426,550 | $ | 315,000 | 40,500 | $ | 8,500 | |||||||

| President | 1999 | $ | 420,000 | $ | 297,600 | 46,615 | $ | 8,000 | |||||||

| 1998 | $ | 394,626 | $ | 248,000 | 21,154 | $ | 8,000 | ||||||||

| Gary Schnitzer(1) | 2000 | $ | 282,778 | $ | 120,000 | 21,861 | $ | 8,500 | |||||||

| Executive Vice President | 1999 | $ | 278,235 | $ | 115,200 | 25,506 | $ | 8,000 | |||||||

| 1998 | $ | 273,073 | $ | 96,000 | 12,621 | $ | 8,000 | ||||||||

| Kurt C. Zetzsche | 2000 | $ | 258,177 | $ | 125,000 | 19,666 | $ | 17,000 | |||||||

| President of Steel Operations | 1999 | $ | 250,300 | $ | 120,000 | 22,944 | $ | 16,000 | |||||||

| 1998 | $ | 239,853 | $ | 100,000 | 11,353 | $ | 16,000 | ||||||||

| Barry A. Rosen(1) | 2000 | $ | 235,818 | $ | 87,000 | 18,240 | $ | 8,500 | |||||||

| Vice President—Finance | 1999 | $ | 232,150 | $ | 79,200 | 20,212 | $ | 8,000 | |||||||

| 1998 | $ | 211,166 | $ | 66,000 | 10,002 | $ | 8,000 | ||||||||

6

Stock Option Grants in Last Fiscal Year

The following table provides information regarding stock options for Class A Common Stock granted to the Named Executive Officers in the fiscal year ended August 31, 2000.

| |

INDIVIDUAL GRANTS |

|

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2) |

||||||||||||||

| |

|

Percent of Total Options Granted to Employees in Fiscal Year |

|

|

|||||||||||

| |

Number of Securities Underlying Options Granted(1) |

|

|

||||||||||||

| |

Exercise Price Per Share |

Expiration Date |

|||||||||||||

| Name |

5% |

10% |

|||||||||||||

| Leonard Schnitzer | 28,401 | 12.4 | % | $ | 14.00 | 6/01/10 | $ | 250,057 | $ | 633,694 | |||||

| Robert W. Philip | 40,500 | 17.6 | % | $ | 14.00 | 6/01/10 | 356,583 | 903,652 | |||||||

| Gary Schnitzer | 21,861 | 9.5 | % | $ | 14.00 | 6/01/10 | 192,476 | 487,771 | |||||||

| Kurt C. Zetzsche | 19,666 | 8.6 | % | $ | 14.00 | 6/01/10 | 173,150 | 438,796 | |||||||

| Barry A. Rosen | 18,240 | 7.9 | % | $ | 14.00 | 6/01/10 | 160,595 | 406,978 | |||||||

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table provides certain information concerning exercises of stock options during the fiscal year ended August 31, 2000 by each of the Named Executive Officers as well as the number and value of unexercised options held by such persons at August 31, 2000.

| |

|

|

Number of Unexercised Options at Fiscal Year-End |

Value of Unexercised in the Money Options at Fiscal Year-End(1) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Shares Acquired on Exercise |

|

||||||||||||

| |

Value Realized |

|||||||||||||

| Name |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

||||||||||

| Leonard Schnitzer | — | — | 84,377 | 77,495 | $ | 18,773 | $ | 96,391 | ||||||

| Robert W. Philip | — | — | 97,438 | 106,381 | $ | 25,638 | $ | 132,928 | ||||||

| Gary Schnitzer | — | — | 61,852 | 58,783 | $ | 14,028 | $ | 72,509 | ||||||

| Kurt C. Zetzsche | — | — | 55,346 | 52,159 | $ | 12,619 | $ | 65,227 | ||||||

| Barry A. Rosen | — | — | 46,915 | 47,007 | $ | 11,117 | $ | 58,146 | ||||||

7

Defined Benefit Retirement Plans

Pension Retirement Plan. The Company's Pension Retirement Plan (the Plan) is a defined benefit plan qualified under Section 401(a) of the Internal Revenue Code of 1986 (the Code). All employees (except Leonard Schnitzer and certain union and on-call employees) of the Company and certain other Schnitzer Group companies are eligible to participate in the Plan after meeting certain service requirements. Generally, pension benefits become fully vested after five years of service and are paid in monthly installments beginning when the employee retires at age 65. Annual benefits equal 2% of qualifying compensation for each Plan year of service after August 31, 1986. Upon their retirement, assuming retirement at age 65 and no increase in annual compensation from current levels, Messrs. Gary Schnitzer, Robert W. Philip, and Barry A. Rosen would receive annual benefits for life of $77,993, $92,909, and $88,797, respectively.

Supplemental Executive Retirement Bonus Plan. The Supplemental Executive Retirement Bonus Plan (the Supplemental Plan) was adopted to provide a competitive level of retirement income for key executives selected by the Board of Directors. The Supplemental Plan establishes an annual target benefit for each participant based on continuous years of service (up to a maximum of 25 years) and the average of the participant's five highest consecutive calendar years of compensation, with the target benefit subject to an inflation-adjusted limit equal to $182,889 in 2000. The target benefit is reduced by 100% of primary social security benefits and the Company-paid portion of all benefits payable under the Company's qualified retirement plans to determine the actual benefit payable under the Supplemental Plan. The actual benefit shall be paid as a straight life annuity or in other actuarially equivalent forms. Benefits are payable under the plan only to participants who terminate employment after age 55 with 10 credited years of service or after age 60. The following table shows the estimated annual target benefits under the Supplemental Plan, before the reductions based on social security and Company-paid retirement benefits, for executives who retire at age 60 (the normal retirement age under the Supplemental Plan) with various levels of pay and service, based on the 2000 value for the inflation-adjusted cap.

| |

Credited Years of Service |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Highest Consecutive Five-Year Average Qualifying Compensation |

||||||||||||

| 10 |

15 |

20 |

25 |

|||||||||

| $200,000 | $ | 52,000 | $ | 78,000 | $ | 104,000 | $ | 130,000 | ||||

| $250,000 | $ | 65,000 | $ | 97,500 | $ | 130,000 | $ | 162,500 | ||||

| $300,000 | $ | 73,156 | $ | 109,733 | $ | 146,311 | $ | 182,889 | ||||

| $350,000 | $ | 73,156 | $ | 109,733 | $ | 146,311 | $ | 182,889 | ||||

| $400,000 | $ | 73,156 | $ | 109,733 | $ | 146,311 | $ | 182,889 | ||||

As of December 31, 1999, Messrs. Gary Schnitzer, Robert W. Philip and Barry A. Rosen had 35, 28 and 18 years of service, respectively, and highest consecutive five-year average qualifying compensation of $343,275, $632,478 and $338,134, respectively. For Mr. Philip and Mr. Rosen, the compensation differs significantly from that shown in the Summary Compensation Table because benefits under the Supplemental Plan are based on total qualifying compensation received from all Schnitzer Group companies.

Director Compensation

Through 1999, directors who are not employees of Schnitzer Group companies received an annual fee of $10,000 plus $500 for attending each Board meeting or committee meeting held other than on the same day as a Board meeting, and were reimbursed for expenses of attending Board and committee meetings.

In their October 4, 1999 board meeting, the Company's board of directors raised non-employee board member annual compensation from $10,000 to $15,000, authorized directors to elect to receive annual compensation in stock options in lieu of cash compensation based on a pre-defined exchange ratio, and raised per meeting compensation from $500 to $1,000. These changes in board compensation were based upon the recommendations of the Company's compensation consultant to bring board compensation more in line with industry standards. These changes became effective January 1, 2000.

8

The Company is part of the Schnitzer Group of companies, all of which are controlled by members of the Schnitzer family. Other companies in the group include: Schnitzer Investment Corp. (SIC), engaged in the real estate and shipping agency businesses; Pacific Coast Shipping Co. (PCS) and its wholly-owned subsidiary, Trans-Pacific Shipping Co. (TPS), and Liberty Shipping Group Limited Partnership (LSGLP) and its general partner LSGGP Corp. (LSGGP), all engaged in the ocean shipping business, and Island Equipment Company, Inc. (IECO), engaged in various businesses in Guam and other South Pacific islands.

Certain executive officers of the Company fulfill similar executive functions for other companies in the Schnitzer Group. Leonard Schnitzer, Robert W. Philip and Kenneth M. Novack, the members of the Company's Office of the President, also make up the Office of the President of SIC. Robert W. Philip has the principal operating responsibility for the Company, but he also spends time on the businesses of other Schnitzer Group companies. Leonard Schnitzer serves as Chairman of the Schnitzer Group's shipping companies and spends substantial amounts of his time on their businesses. Kenneth M. Novack spends substantial amounts of his time on the businesses of PCS, SIC, IECO, and other Schnitzer Group companies. Barry A. Rosen serves as Chief Financial Officer for all of the Schnitzer Group companies. The Company believes that the sharing of top management and other resources (such as data processing, accounting, legal, financial, tax, treasury, risk management and human resources) provides benefits to the Company and the other Schnitzer Group companies by giving each of them access to a level of experience and expertise that can only be supported by a larger organization.

The Company leases certain properties used in its business from SIC. These properties and certain lease terms are set forth in the following table:

| PROPERTY |

ANNUAL RENT |

EXPIRATION OF LEASES |

|||

|---|---|---|---|---|---|

| Corporate Headquarters | $ | 246,000 | 2002-2006 | ||

| Scrap Operations: Portland facility and marine terminal | 1,112,000 | 2063 | |||

| Sacramento facility | 88,000 | 2003 | |||

| Total | $ | 1,446,000 | |||

The rent for the Portland scrap operations was adjusted on September 1, 1998 and will adjust every five years thereafter. The adjustments made on September 1, 2003 and every fifteen years thereafter will be to appraised fair market rent. Intervening rent adjustments will be based on the average of the percentage increases or decreases in two inflation indexes over the five years prior to the adjustment. The Sacramento facility rent was also adjusted on September 1, 1998 based on the same inflation indexes. The Company subleases a portion of the Portland facility to a third party for approximately $30,000 per year until 2003.

The Company ships steel scrap on vessels chartered from PCS and TPS. In fiscal 2000, the Company incurred a total of $9,411,000 in charter expense to PCS and TPS for shipments of steel scrap. SIC acts as managing agent for PCS and TPS and was paid $53,000 in agency fees by the Company during fiscal 2000. In May 1993, the Company entered into a five-year time charter of a ship from TPS. At the end of the charter, the Company guaranteed that TPS would be able to sell the ship for TPS's remaining capital investment at that time of $2,500,000, and the Company was entitled to either purchase the ship or receive any proceeds in excess of $2,500,000. Upon expiration of the agreement, the Company paid TPS the guaranteed residual of $2,500,000 and entered into an additional five-year time charter accounted for as a capital lease, at the end of which ownership of the vessel was to have been transferred to the Company. During the five-year time charter, the Company paid TPS the actual cost of operating the ship. During fiscal 2000 the Company and its outside board members approved the sale of the ship. The sale resulted in a $1.0 million loss for the Company. In May 1995, the Company entered into two additional seven-year time charters for other vessels with TPS. In August 1996, these two time charters were re-negotiated due to the condition of the vessels and lower charter rates experienced in the shipping industry. Under each of these re-negotiated charters, the Company pays to TPS the actual cost of operating the ship plus approximately $200,000 per quarter. Additionally, the vessels discussed above are periodically sub-chartered to third parties. In this case, SIC acts as the Company's agent in the collection of income and payment of expenses related to sub-charter activities. Charter expense to PCS and TPS incurred for these vessels while sub-chartered totaled $250,000 in 2000. These charter expenses were offset by sub-charter income of $154,000 in 2000.

9

The Company provides management and administrative services to, and in some cases receives services from, SIC, LSGLP, LSGGP, IECO, and other Schnitzer Group companies pursuant to a Second Amended Shared Services Agreement, as amended as of September 1, 1994. The agreement provides that all service providing employees, except executive officers, are charged out at rates based on the actual hourly compensation expense to the Company for such employees (including fringe benefits but excluding bonuses) plus an hourly charge for reimbursement of space costs associated with such employees, all increased by 15% as a margin for additional overhead and profit. The Company independently determines the salaries to pay its executive officers, and the other companies reimburse the Company fully for salaries and related benefits the other companies decide to pay, plus the hourly space charge and the 15% overhead and profit margin. Under the agreement, the Company independently determines the amount of bonus to pay to each of its employees, and the other companies reimburse the Company fully for any bonuses the other companies decide to pay. The agreement also provides for the monthly payment by these related parties to the Company of amounts intended to reimburse the Company for their proportionate use of the Company's telephone and computer systems. Charges by the Company under the agreement in fiscal 2000 totaled $1,069,000.

From time to time, the law firm of Ball Janik LLP, of which director Robert S. Ball is a partner, provides legal services to the Company. Ball Janik LLP provides legal services on a more regular basis to other companies in the Schnitzer Group.

Pursuant to a policy adopted by the Board of Directors, all transactions with other Schnitzer Group companies require the approval of a majority of the independent directors or must be within guidelines established by them.

REPORT OF COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors (the Committee) is composed of three outside directors. The Committee is responsible for developing and making recommendations to the Board with respect to the Company's compensation policies and the levels of compensation to be paid to executive officers. In addition, the Committee has sole responsibility for the administration of, and the grant of stock options and other awards under, the Company's 1993 Stock Incentive Plan, as amended.

The objectives of the Company's executive compensation program are to attract and retain highly qualified executives, and to motivate them to maximize shareholder returns by achieving both short-term and long-term strategic Company goals. The three basic components of the executive compensation program are base salary, annual bonus dependent on corporate performance, and stock options.

Base Salary

The Company's salary revisions generally become effective in June of each year. For purposes of determining salaries effective June 2000, the Committee considered the improvement in the Company's results in relation to the Company's peers and the metals recycling and steel industries in general.

Annual Bonuses

Executive officers are eligible to receive annual bonuses, based on Company performance, which provide them a direct financial incentive to achieve corporate objectives each year. Bonuses for 2000 for all named executive officers were determined with reference to target bonus amounts expressed as a percentage of salary. Target bonuses are higher as a percentage of salary for more senior officers. The determination of actual bonuses is discretionary for the Committee and is based generally on overall Company profitability, business unit profitability, and subjective judgements as to individual performance. No specific weight is accorded to any single factor and difference factors may be accorded greater or lesser weight in particular years or for particular officers.

As a result of the Company's overall performance and achievement of other objectives during 2000, all named executive officers received bonuses within the target range.

Stock Options

The stock option program is the Company's principal long-term incentive plan for executive officers. The objectives of the stock option program are to align executive and shareholder long-term interests by creating a strong and direct link between executive compensation and shareholder return, and to create incentives for executives to remain with the Company for the long term. Options are awarded with an exercise price equal to the market price of Class A Common Stock on the date of grant and have a term of 10 years.

10

The Committee has implemented an annual option grant program. Annual awards to the top five executive officers are normally made based on grant guidelines expressed as a percentage of salary.

Section 162(m) of the Internal Revenue Code of 1986 limits to $1,000,000 per person the amount that the Company may deduct for compensation paid to any of its most highly compensated officers in any year. The levels of salary and bonus generally paid by the Company do not exceed this limit. Under IRS regulations, the $1,000,000 cap on deductibility will not apply to compensation received through the exercise of a nonqualified stock option that meets certain requirements. This option exercise compensation is equal to the excess of the market price at the time of exercise over the option price and, unless limited by Section 162(m), is generally deductible by the Company. It is the Company's current policy generally to grant options that meet the requirements of the IRS regulations.

Chief Executive Officer Compensation

The Company's salary adjustments are generally effective in June of each year. Mr. Schnitzer's base salary effective June 2000 was fixed at $315,151 representing an increase over his prior salary due to the improvement in the Company's results in relation to the Company's peers and the metals recycling and steel industries in general. The Committee believes that a lower than average salary level is appropriate since Mr. Schnitzer devotes time to the businesses of other companies in the Schnitzer Group to a greater extent than most executive officers of the Company.

Mr. Schnitzer received a bonus for 2000 of $150,000, which was 50% of the salary established for him for fiscal 2000. This is within the range of target bonuses payable under the annual bonus program and was awarded for the reasons discussed above.

During fiscal 2000, Mr. Schnitzer received an option for 28,401 shares of Class A Common Stock as part of the Company's annual option grant program.

COMPENSATION COMMITTEE

Ralph

R. Shaw, Chair

Robert S. Ball

William A. Furman

The Audit Committee has:

The Board of Directors has determined that the members of the Audit Committee are independent. The Audit Committee has adopted a written charter. The charter is included as Exhibit A to this proxy statement.

AUDIT COMMITTEE

Ralph

R. Shaw, Chairman

Robert S. Ball

William A. Furman

11

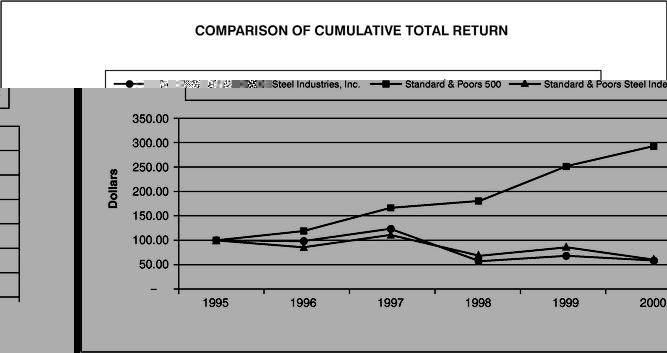

SHAREHOLDER RETURN PERFORMANCE GRAPH

Set forth below is a line graph comparing the cumulative total shareholder return on the Company's Common Stock with the cumulative total return of the Standard & Poor's 500 Stock Index and the Standard & Poor's Steel Industry Group Index for the period commencing on August 31, 1995 and ending on August 31, 2000. The graph assumes that $100 was invested in the Company's Common Stock and each index on August 31, 1995, and that all dividends were reinvested.

| |

8/31/95 |

8/31/96 |

8/31/97 |

8/31/98 |

8/31/99 |

8/31/00 |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Schnitzer Steel Industries, Inc. | 100.00 | 98.83 | 124.19 | 57.39 | 68.76 | 57.86 | ||||||

| Standard & Poors 500 Index | 100.00 | 118.73 | 166.99 | 180.51 | 252.39 | 293.58 | ||||||

| Standard & Poors Steel Index | 100.00 | 86.23 | 110.71 | 68.24 | 85.98 | 60.29 |

APPROVAL AND RATIFICATION OF SELECTION OF AUDITORS

The Board of Directors of the Company has, subject to approval and ratification by the shareholders, selected PricewaterhouseCoopers LLP as independent auditors for the Company for the fiscal year ending August 31, 2001.

A representative of PricewaterhouseCoopers LLP is expected to be present at the meeting. Such representative will have the opportunity to make a statement if he desires to do so and will be available to respond to appropriate questions.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE APPROVAL AND RATIFICATION OF THE SELECTION OF PRICEWATERHOUSECOOPERS LLP AS THE COMPANY'S INDEPENDENT AUDITORS.

12

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's directors, executive officers and persons who own more than 10% of the outstanding Common Stock of the Company, to file with the Securities and Exchange Commission reports of changes in ownership of the Common Stock of the Company held by such persons. Officers, directors and greater than 10% shareholders are also required to furnish the Company with copies of all forms they file under this regulation. To the Company's knowledge, based solely on a review of the copies of such reports furnished to the Company and representations that no other reports were required, during fiscal 2000 all of its officers, directors and 10% shareholders complied with all applicable Section 16(a) filing requirements, except that initial statements of beneficial ownership on Form 3 have been filed late by Kelly E. Lang and Terry Glucoft, and Terry Glucoft has filed a late report that included five late transactions.

SHAREHOLDER PROPOSALS FOR 2002 ANNUAL MEETING

Any proposal by a shareholder of the Company to be considered for inclusion in proxy materials for the Company's 2002 Annual Meeting of Shareholders must be received in proper form by the Company at its principal office no later than August 31, 2001.

Although the Notice of Annual Meeting of Shareholders provides for transaction of any other business that properly comes before the meeting, the Board of Directors has no knowledge of any matters to be presented at the meeting other than the matters described in this Proxy Statement. The enclosed proxy, however, gives discretionary authority to the proxy holders to vote in accordance with their judgment if any other matters are presented.

For the 2002 Annual Meeting of Shareholders, unless notice of a shareholder proposal to be raised at the meeting without inclusion in the Company's proxy materials is received by the Company at its principal office prior to November 14, 2001, proxy voting on that proposal at the Annual Meeting will be subject to the discretionary voting authority of the Company's designated proxy holders. If timely notice is received by the Company, the designated proxy holders may still have discretionary voting authority over the proposal depending upon compliance by the Company and the proponents with certain requirements set forth in rules of the Securities and Exchange Commission.

The cost of preparing, printing and mailing this Proxy Statement and of the solicitation of proxies by the Company will be borne by the Company. Solicitation will be made by mail and, in addition, may be made by directors, officers and employees of the Company personally, or by telephone or telegram. The Company will request brokers, custodians, nominees and other like parties to forward copies of proxy materials to beneficial owners of stock and will reimburse such parties for their reasonable and customary charges or expenses in this connection.

The Company will provide to any person whose proxy is solicited by this proxy statement, without charge, upon written request to its Corporate Assistant Secretary, a copy of the Company's Annual Report on Form 10-K for the fiscal year ended August 31, 2000.

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. THEREFORE, SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETING IN PERSON ARE URGED TO EXECUTE AND RETURN THE ENCLOSED PROXY IN THE REPLY ENVELOPE PROVIDED.

| By Order of the Board of Directors, | ||

/s/ CHARLES A. FORD Charles A. Ford Assistant Secretary |

December 29, 2000

13

EXHIBIT A

SCHNITZER STEEL INDUSTRIES, INC.

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

CHARTER

The primary purpose of the Audit Committee (the "Committee") is to assist the Board of Directors (the "Board") in achieving its oversight responsibilities in the following areas:

The Committee shall be comprised of three or more directors as determined by the Board, each of whom shall be independent directors, and free from any relationship that, in the opinion of the Board, would interfere with the exercise of his or her independent judgement as a member of the Committee. The directors' independence shall further be determined in accordance with Nasdaq's independent director listing standards. All directors who are members of the Audit Committee must be able to read and understand fundamental financial statements. At least one of member of the Committee must have past employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background, including a current or past position as a chief executive or financial officer or other senior officer with financial oversight responsibilities.

The members of the Committee shall be elected by the Board at the annual meeting of the Board and shall serve until their successors shall be duly elected and qualified. Unless a Chair is elected by the full Board, the members of the committee may designate a Chair by majority vote of the full Committee membership.

The Committee shall meet at least four times annually, or more frequently as circumstances dictate. As part of its job to foster open communication, the Committee should meet at least annually with management, the internal audit director and the independent accountants in separate executive sessions to discuss any matters that the Committee or each of these groups believes should be discussed privately. In addition, the Committee or at least its Chair should meet (telephonically or in person) with the independent accountants and management quarterly to review the Company's financials.

In fulfilling its overall purpose, the Committee shall schedule and carry out the following activities. The five broad areas of activities include:

| |

|

|

Timing |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Activities |

All Meetings |

As Required |

Quarterly |

Annually |

Blue Ribbon Committee Suggestion |

|||||||||

| Area: GENERAL | ||||||||||||||

| 1. | Determine that each Committee member is independent and free from any relationships that would interfere with the exercise of his or her judgement as a member of the Committee. Definition of independence would exclude directors who have: | X | #1, and #2 | |||||||||||

| • | been employed by the Company or its affiliates in the current or past three years; | |||||||||||||

| • | accepted any compensation from the Company or its affiliates in excess of $60,000 during the previous fiscal year (except for board service, retirement plan benefits, or non-discretionary compensation); | |||||||||||||

| • | an immediate family member who is, or has been in the past three years, employed by the Company or its affiliates as an executive officer; | |||||||||||||

| • | been a partner, controlling shareholder or an executive officer of any for-profit business to which the Company made, or from which it received, payments (other than those which arise solely from investments in the Company's securities) that exceed five percent of the organization's consolidated gross revenues for that year, or $200,000, whichever is more, in any of the past three years; or | |||||||||||||

| • | been employed as an executive of any other entity where any of the Company's executives serve on the entity's compensation committee. | |||||||||||||

| 2. | Determine that all members of the Committee are able to read and understand fundamental financial statements and that at least one member of the Committee has past employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background, including a current or past position as a chief executive or financial officer or other senior officer with financial oversight responsibilities. | #3 | ||||||||||||

| 3. | Review and update this Charter periodically, at least annually, as conditions dictate. Full Board approval isrequired for adoption and significant changes to the Charter. | X | #4 | |||||||||||

| 4. | Submit the minutes of all meetings of the Committee to, or discuss the matters discussed at each meeting with the full Board. | X | ||||||||||||

| 5. | The Committee shall have the power to conduct or authorize investigations into any matters within the Committee's scope of responsibilities. The Committee shall be empowered to retain independent counsel, accountants, or others to assist it in the conduct of any investigation. | X | ||||||||||||

| |

|

|

Timing |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Activities |

All Meetings |

As Required |

Quarterly |

Annually |

Blue Ribbon Committee Suggestion |

|||||||||

| Area: REPORTING | ||||||||||||||

| 1. | Review the Company's annual financial statements, including any report rendered by the Company's independent public accountants (the "IPA"). | X | ||||||||||||

| 2. | Review with management and the Company's IPA the applicability and impact of any new pronouncements issued by FASB or other applicable regulatory agencies. | X | ||||||||||||

| 3. | Publish the written Charter in the annual Proxy Statement as and when required by SEC rules. | X | #5 | |||||||||||

| 4. | Prepare a report to shareholders for inclusion in the annual Proxy Statement. In addition to listing the names of each Committee member and indication whether its members are independent, the report should state that the Committee has: | X | #9 | |||||||||||

| • | Adopted a written charter for the Committee; | |||||||||||||

| • | Reviewed the financial statements with | |||||||||||||

| • | Discussed with the IPA the matters required to be discussed by Statement on Auditing Standards No. 61; | |||||||||||||

| • | Received from the IPA disclosures regarding their independence required by Independence Standards Board Standard No. 1 and discussed with the IPA their independence; | |||||||||||||

| • | Based on the review and discussions noted above, the Committee recommended to the Board that the audited financial statements be included in the Company's Annual Report on Form 10-K for the last filing year with the SEC. | |||||||||||||

| 5. | Meet with (telephonic or in person) financial management following the completion of the IPA's SAS #71 interim financial review and prior to the Form 10Q filing/release of earnings. | X | #10 | |||||||||||

| |

|

|

Timing |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Activities |

All Meetings |

As Required |

Quarterly |

Annually |

Blue Ribbon Committee Suggestion |

|||||||||

| Area: INDEPENDENT ACCOUNTANTS | ||||||||||||||

| 1. | Review and approve the selection of the IPA. It should be clear to the IPA that they are ultimately accountable to the Board and the Committee as representatives of the shareholders. | X | #6 | |||||||||||

| 2. | Review with the IPA and the internal auditors the scope of their examinations of the books and records of the Company and its subsidiaries and direct the special attention of the IPA and the internal auditors to specific matters or areas deemed by the Committee or the IPA and the internal auditors to be of special significance; authorize them to perform such supplemental reviews or audits as the Committee may deem desirable. | X | X | |||||||||||

| 3. | On an annual basis, receive a formal written statement from the IPA as to all significant relationships the IPA has with the corporation to determine the IPA's independence. Discuss any disclosed relationships or services that may impact the IPA's independence. It is the Committee's responsibility to oversee the independence of the IPA. | X | #7 | |||||||||||

| 4. | Review with management and the IPA their qualitative judgements about the appropriateness, not just the acceptability, of accounting principles and financial disclosure practices used or proposed and, particularly, about the degree of aggressiveness or conservatism of its accounting principles and underlying estimates. | X | X | #8 | ||||||||||

| 5. | Review with management and the IPA at the completion of their audit: | X | ||||||||||||

| • | The existence of any fraud or illegal acts that the IPA may have become aware of; | |||||||||||||

| • | Any significant deficiencies in the design or operation of internal controls noted during the audit; | |||||||||||||

| • | Selection of and changes in significant accounting policies or their application; | |||||||||||||

| • | Process used by management in making significant accounting judgements or estimates; | |||||||||||||

| • | Significant audit adjustments; | |||||||||||||

| • | Review by the IPA of other information in the audited financial statements; | |||||||||||||

| • | Disagreements with management; | |||||||||||||

| • | Consultation, if any, with other auditors on significant accounting matters; | |||||||||||||

| • | Serious difficulties encountered during the audit. | |||||||||||||

| 6. | Consider recommendations from the IPA and internal auditors regarding internal controls, information technology controls and security and other matters relating to the Company and its subsidiaries and reviewing the correction of controls or processes deemed in need of improvement. | X | ||||||||||||

| 7. | Provide sufficient opportunity for the internal auditors and the IPA to meet with the members of the Committee without members of management present. Among the items to be discussed in these meetings are the IPA's evaluation of the Company's financial, accounting, and auditing personnel, and the cooperation that the IPA received during the course of the audit. | X | ||||||||||||

SCHNITZER STEEL INDUSTRIES, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

2001 ANNUAL MEETING OF STOCKHOLDERS

The undersigned hereby appoints ROBERT W. PHILIP, KENNETH M. NOVACK, and BARRY A. ROSEN, and each of them, with full power of substitution, as proxies, and authorizes them to represent and to vote, as designated below, all the stock of SCHNITZER STEEL INDUSTRIES, INC. that the undersigned is entitled to vote at the 2001 Annual Meeting of Stockholders of SCHNITZER STEEL INDUSTRIES, INC. to be held on January 29, 2001, at 8:00 a.m., local time, at the Multnomah Athletic Club, 1849 SW Salmon Street, Portland, OR 97205, and at any adjournment or postponement thereof, as indicated on the reverse side.

This proxy, when properly executed, will be voted in the manner directed herein by the under-signed stockholder(s).

If no direction is made, this proxy will be voted FOR the Election of Directors and FOR the proposal to ratify the selection of PricewaterhouseCoopers LLP as the Company's independent auditors for the current fiscal year. If this proxy is executed in such manner as not to withhold authority to vote for the election of any nominee to the Board of Directors, it shall be deemed to grant such authority.

(Continued, and to be dated and signed on the reverse side.)

SCHNITZER

STEEL INDUSTRIES, INC.

P.O. BOX 11119

NEW YORK, N.Y. 10203-0119

Detach Proxy Card Here

Please Detach Here

You Must Detach This Portion of the Proxy Card

Before Returning it in the Enclosed Envelope

Directors recommend a vote "FOR"

| 1. | Election of Directors | FOR all nominees listed below |

/x/ | WITHHOLD AUTHORITY to vote for all nominees listed below. | /x/ | EXCEPTIONS* | /x/ |

Nominees: |

Leonard E. Schnitzer, Robert W. Philip, Kenneth M. Novack, Gary Schnitzer, Dori Schnitzer, Carol S. Lewis, Jean S. Reynolds, Scott Lewis, Robert S. Ball, William A. Furman, and Ralph R. Shaw |

|||

(INSTRUCTIONS: To withhold authority to vote for any individual nominee, mark the "Exceptions" box and write that nominee's name in the space provided below. |

||||

*Exceptions |

||||

Directors recommend a vote "FOR"

| 2. | Proposal to ratify the selection of PricewaterhouseCoopers LLP as independent auditors for the fiscal year ending August 31, 2001. |

3. | These proxies may vote in their discretion as to other matters which may come before the meeting. |

FOR |

/x/ |

AGAINST |

/x/ |

ABSTAIN |

/x/ |

Change of Address and or Comments Mark Here |

/x/ |

Note: Please sign exactly as shown at left. If stock is jointly held, each owner should sign. Executors, administrators, trustees, guardians, attorneys and corporate officers should indicate their fiduciary capacity or full title when signing |

||||

Dated: |

, 2000 |

|||

| Signature | ||||

| Signature (if jointly held) |

||||

Please Mark, Date, Sign and Mail This Proxy Card Promptly in the Enclosed Envelope. |

Votes MUST be indicated (X) in Black or Blue Ink. |

/x/ |

|

|