|

|

|

|

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by Registrant /x/ | |||

| Filed by Party other than the Registrant / / | |||

Check the appropriate box: |

|||

| / / | Preliminary Proxy Statement | ||

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14-6(e)(2) | ||

| /x/ | Definitive Proxy Statement | ||

| / / | Definitive Additional Materials | ||

| / / | Soliciting Material Pursuant to Sec. 240.14a-11(c) or 240.14a-12 |

||

Beazer Homes USA, Inc.

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required. | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies: |

|||

| 2) | Aggregate number of securities to which transaction applies: |

|||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11(Set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| 4) | Proposed maximum aggregate value of transaction: |

|||

| 5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing by registration for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid: |

|||

| 2) | Form, Schedule or Registration Statement No.: |

|||

| 3) | Filing Party: |

|||

| 4) | Date Filed: |

|||

Beazer Homes USA, Inc.

5775 Peachtree Dunwoody Road, Suite B-200, Atlanta, Georgia 30342

***

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO THE SHAREHOLDERS OF BEAZER HOMES USA, INC.:

Notice is hereby given that the Annual Meeting of Shareholders of Beazer Homes USA, Inc. (the "Company") will be held at 10:00 a.m. on Thursday, February 1, 2001 at the Company's offices at 5775 Peachtree Dunwoody Road, Suite B-200, Atlanta, Georgia 30342 for the following purposes:

The Board of Directors has fixed the close of business on December 8, 2000 as the record date for the determination of shareholders entitled to notice of and to vote at the meeting. A copy of the Company's Proxy Statement and Annual Report to Shareholders is being mailed to you together with this notice.

We encourage you to take part in the affairs of your Company either in person or by executing and returning the enclosed proxy.

By Order of the Board of Directors,

![]() BRIAN C. BEAZER

BRIAN C. BEAZER

Non-executive Chairman of the Board

Dated: December 22, 2000

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THIS MEETING, PLEASE PROMPTLY MARK, DATE, SIGN AND MAIL THE ENCLOSED PROXY. A RETURN ENVELOPE, WHICH REQUIRES NO ADDITIONAL POSTAGE, IF MAILED IN THE UNITED STATES, IS ENCLOSED FOR THAT PURPOSE.

BEAZER HOMES USA, INC.

5775 Peachtree Dunwoody Road

Suite B-200

Atlanta, Georgia 30342

PROXY STATEMENT

Purpose

This Proxy Statement is being furnished to you in connection with the solicitation of proxies by the Board of Directors of Beazer Homes USA, Inc., a Delaware corporation (the "Company"), for use at the Annual Meeting of Shareholders of the Company to be held on February 1, 2001 and at any adjournment or postponement thereof. Shareholders of record at the close of business on December 8, 2000 are entitled to notice of and to vote at the annual meeting. On December 8, 2000, the Company had outstanding 8,483,824 shares of common stock. Each share of common stock entitles the holder to one vote with respect to each matter to be considered. The common stock is the Company's only outstanding class of voting securities. This Proxy Statement and the enclosed form of proxy are being mailed to shareholders, together with the Company's Annual Report (which includes audited consolidated financial statements for the Company's fiscal year ended September 30, 2000), commencing on or about December 22, 2000.

Voting Instructions

General—Shares represented by a proxy will be voted in the manner directed by a shareholder. If no direction is made, the signed proxy will be voted

Signature Requirements—If stock is registered in the name of more than one person, each named person should sign the proxy. If the stockholder is a corporation, the proxy should be signed in the corporation's name by a duly authorized officer. If a proxy is signed as an attorney, trustee, guardian, executor, administrator or a person in any other representative capacity, the signer's full title should be given.

Authority Withheld or Non Votes—Shares represented by proxies as to which the authority to vote has been withheld with respect to some or all matters being acted upon will be deemed present and entitled to vote for purposes of determining the existence of a quorum and calculating the votes cast, but will be deemed not to have been voted in favor of the proposals or other matters with respect to which the proxy authority has been withheld. Broker non-votes are included in the determination of the number of shares present and voting for the purpose of determining whether a quorum is present. In determining whether a proposal has been approved, broker non-votes and abstentions are not counted for or against a proposal or as votes present and voting on a proposal.

1

Revocation—A shareholder giving the enclosed proxy may revoke it at any time before the vote is cast at the annual meeting by executing and returning to the Secretary of the Company (David S. Weiss) or Transfer Agent (American Stock Transfer & Trust Company) either a written revocation or a proxy bearing a later date prior to the annual meeting. Any shareholder who attends the annual meeting in person will not be considered to have revoked his or her proxy unless such shareholder affirmatively indicates at the annual meeting his or her intention to vote the shares represented by such proxy in person.

Expenses of Solicitation

Expenses incurred in connection with the solicitation of proxies will be paid by the Company. Proxies are being solicited primarily by mail but, in addition, officers and other employees of the Company may solicit proxies by telephone, in person or by other means of communication but will receive no extra compensation for such services. The Company will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for costs incurred in connection with this solicitation.

Principal Stockholders

The following table sets forth information as of December 8, 2000 with respect to the beneficial ownership of the Company's common stock by all persons known by us to beneficially own more than 5% of our common stock. In order to provide the most timely information available regarding principal stockholders, we included ownership information as provided in the most recently available (September 30, 2000) Form 13F filed by each respective holder, unless otherwise indicated.

| Name and Address Of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class |

|||

|---|---|---|---|---|---|

Fidelity Management & Research Company 82 Devonshire Street Boston, Massachusetts 02109 |

1,220,600(1 |

) |

14.39 |

% |

|

Wellington Management Company, LLP 75 State Street Boston, Massachusetts 02109 |

863,464(2 |

) |

10.18 |

% |

|

Neuberger & Berman, LLC 605 Third Avenue New York, New York 10158-3698 |

702,198(3 |

) |

8.28 |

% |

|

Dimensional Fund Advisors, Inc. 1299 Ocean Avenue, 11th floor Santa Monica, California 90401 |

635,900(4 |

) |

7.50 |

% |

|

Greenhaven Associates, Inc. Three Manhattanville Road Purchase, New York 10577 |

448,937(5 |

) |

5.29 |

% |

2

General

Our by-laws provide that the affirmative vote of a plurality of the shares of the Company's voting stock is required to approve the election of directors. For other matters presented for shareholder approval, our by-laws require the affirmative vote of a majority of the shares present or represented at the meeting, unless some other percentage is required by law or by the certificate of incorporation. Please refer to page one of this proxy statement for voting instructions.

Following is a discussion of the matters to be presented for shareholder approval at the annual meeting.

1. ELECTION OF DIRECTORS

General

Each of the nominees listed below has been nominated as a director for the fiscal year ending September 30, 2001 and until their respective successors are elected and have qualified. Each of the following nominees is presently serving as a director of the Company. In the event any nominee should not be available as a candidate for director, votes will be cast pursuant to authority granted by the enclosed proxy for such other candidate or candidates as may be nominated by management. The Board of Directors has no reason to believe that any nominee will be unable or unwilling to serve as a director if elected.

Recommendation

We recommend that you vote your shares to elect the following nominees. Please see the Voting Instructions on page 1 of this proxy statement for instructions on how to cast your vote.

3

Nominees

The information appearing below with respect to each nominee has been furnished to the Company by the nominee.

Brian C. Beazer, 65, is the Non-Executive Chairman of the Company's Board of Directors and has served as a director of the Company since its inception in November 1993. Mr. Beazer began work in the construction industry in the late 1950's. He served as Chief Executive Officer of Beazer PLC, a company organized under the laws of the United Kingdom, or its predecessors, from 1968 to 1991, and Chairman of that company from 1983 to the date of its acquisition by an indirect, wholly-owned subsidiary of Hanson PLC (effective December 1, 1991). During that time, Beazer PLC expanded its activities to include homebuilding, quarrying, contracting and real-estate, and became an international group with annual revenue of approximately $3.4 billion, employing 28,000 people at December 1991. Mr. Beazer was educated at Cathedral School, Wells, Somerset, England. Mr. Beazer is also a director of Beazer Japan, Ltd., Seal Mint, Ltd., Jade Holdings Pte. Ltd., Jade Technologies Singapore Pte. Ltd., FSM Europe B.V., United Pacific Industries Limited and U.S. Industries, Inc., and is a private investor.

Thomas B. Howard, Jr., 72, was appointed a director of the Company on November 2, 1995. Mr. Howard held various positions with Gifford-Hill & Company, a construction and aggregates company, from 1969 to 1986 and served as its Chairman and Chief Executive Officer from 1986 to 1989. Gifford-Hill & Company was acquired by Beazer PLC in 1989 and Mr. Howard served as Chairman and Chief Executive Officer of the successor company until 1992. During the period from 1957 to 1969, Mr. Howard held various positions with Vulcan Materials Company. Mr. Howard holds a degree in Industrial Engineering from Georgia Institute of Technology. Mr. Howard currently serves on the Board of Trustees of the Methodist Hospitals Foundation and previously served as a director of Lennox International, Inc., director of the Dallas Chamber of Commerce and as a member of the Dallas Citizens Council.

Ian J. McCarthy, 47, is the President and Chief Executive Officer of the Company and has served as a director of the Company since the Company's initial public offering of common stock (the "IPO") in March 1994. Mr. McCarthy has served as President of predecessors of the Company since January 1991 responsible for all United States residential homebuilding operations in that capacity. During the period May 1981 to January 1991, Mr. McCarthy was employed in Hong Kong and Thailand becoming a director of Beazer Far East and from January 1980 to May 1981 was employed by Kier, Ltd., a company engaged in the United Kingdom construction industry which became an indirect, wholly-owned subsidiary of Beazer PLC. Mr. McCarthy is a Chartered Civil Engineer with a Bachelor of Science degree from The City University, London. Mr. McCarthy currently serves as a Director of HomeAid's National Advisory Board.

George W. Mefferd, 73, has served as a director of the Company since the IPO. Mr. Mefferd had previously been retired since 1986. During the period 1974 to 1986, Mr. Mefferd held various positions with Fluor Corporation, an engineering and construction company, including Senior Vice President—Finance, Treasurer, Group Vice President and Chief Financial Officer. Additionally, Mr. Mefferd served on Fluor Corporation's Executive Committee and Board of Directors. Mr. Mefferd earned a Bachelor of Science degree in Business Administration from the University of California, Los Angeles.

D.E. Mundell, 68, has served as a director of the Company since the IPO. Mr. Mundell is currently an advisor and director of ORIX USA Corporation, a financial services company, and served as Chairman of ORIX from 1991 to 1999. During the period from 1959-1990, Mr. Mundell held various

4

positions within United States Leasing International, Inc., retiring as Chairman in 1990. Mr. Mundell attended the Royal Military College of Canada, McGill University and Harvard Business School. Mr. Mundell is also Chairman of Varian, Inc., and a director of Stockton Holdings LTD and ORIX USA Corporation.

Larry T. Solari, 58, has served as a director of the Company since the IPO. Mr. Solari is the Chairman and CEO of BSI Holdings, Inc., Carmel, California. Mr. Solari was the Chairman and CEO of Sequentia, Inc. from 1996 to 1997. Mr. Solari was the President of the Building Materials Group of Domtar, Inc. from 1994 to 1996. Mr. Solari was the President of the Construction Products Group of Owens-Corning Fiberglas from 1986 to 1994. In that capacity he had been the Chief Operating Officer responsible for key company lines, such as building insulation and roofing materials. Mr. Solari held various other positions with Owens-Corning Fiberglas since 1966. Mr. Solari earned a Bachelor of Science degree in Industrial Management and a Master of Business Administration degree from San Jose State University. Mr. Solari is a director of BSI Holdings, Inc., Pacific Coast Building Products, Inc., Therma-Tru, Inc., ANECO Inc. and PCG Holdings and has been a director of the Policy Advisory Board of the Harvard Joint Center for Housing Studies and an Advisory Board Member of the National Home Builders Association.

David S. Weiss, 40, is the Executive Vice President and Chief Financial Officer of the Company and has served as a director of the Company since the IPO. Mr. Weiss served as the Assistant Corporate Controller of Hanson Industries, the United States arm of Hanson PLC, for the period from February 1993 to March 1994. Mr. Weiss was Manager of Financial Reporting for Colgate-Palmolive Company from November 1991 to February 1993 and was with the firm of Deloitte & Touche from 1982 to November 1991, at which time he served as a Senior Audit Manager. Mr. Weiss holds a Master of Business Administration degree from the Wharton School and undergraduate degrees in Accounting and English from the University of Pennsylvania. Mr. Weiss is a licensed Certified Public Accountant.

Board of Directors Committees and Meetings

For fiscal year 2000 our Board of Directors had two committees—the Audit Committee and the Compensation Committee, and one subcommittee of the Compensation Committee—the Stock Option and Incentive Committee. During fiscal 2000, we had no standing nominating committee, however, we formed a nominating committee effective October 1, 2000. In fiscal 2000 the Board of Directors had four meetings and each meeting was attended in full, except that Mr. Mundell did not attend one meeting. Membership in the committees and subcommittee is as follows:

| Compensation Committee |

Audit Committee |

Stock Option & Incentive Committee |

|||

|---|---|---|---|---|---|

| Brian C. Beazer* | Thomas B. Howard, Jr. | Thomas B. Howard, Jr. | |||

| Thomas B. Howard, Jr. | George W. Mefferd* | George W. Mefferd | |||

| George W. Mefferd | D.E. Mundell | D.E. Mundell | |||

| D.E. Mundell | Larry T. Solari | Larry T. Solari* | |||

| Larry T. Solari |

5

as it deems appropriate. This committee met two times during fiscal year 2000 and each meeting was attended in full, except that Mr. Mundell did not attend one meeting.

Director Compensation

Non-employee Directors (excluding Brian C. Beazer): Non-employee directors other than Mr. Beazer receive annual compensation of $24,000 (increased to $25,000 for fiscal 2001) for services to the Company as members of the Board of Directors and, in addition thereto, receive $1,000 for each meeting of the Board of Directors or any of its committees and an additional $500 for attending any second committee meeting held on the same day. Directors may elect to defer receipt of up to 50% of their annual compensation. Pursuant to the Company's Non-Employee Director Stock Option Plan, each director received a grant of 10,000 options to acquire common stock of the Company on the date of each director's initial election to the Board. In addition, the Board has periodically granted each non-employee director (excluding Mr. Beazer) stock options pursuant to the 1999 Stock Incentive Plan and the Amended and Restated 1994 Stock Incentive Plan in the period subsequent to their initial election to the Board. Each non-employee director (excluding Mr. Beazer) was granted 4,705 stock options during fiscal 2000. All directors receive reimbursement for reasonable out-of-pocket expenses incurred by them in connection with participating in meetings of the Board of Directors and any committees thereof. Other than described above, no director otherwise receives any compensation from the Company for services rendered as a director.

Brian C. Beazer: For fiscal year 2000, the Company paid its Non-Executive Chairman of the Board $180,000 for services rendered to the Company. For Fiscal Year 2001, the Compensation Committee of the Board (excluding Mr. Beazer) recommended and the Company has agreed to pay Mr. Beazer $190,000 for his services. Pursuant to the Company's Non-Employee Director Stock Option Plan, Mr. Beazer received a grant of 10,000 options to acquire common stock of the Company on the date of his initial election to the Board. In addition, the Board has periodically granted Mr. Beazer stock options pursuant to the 1999 Stock Incentive Plan and the Amended and Restated 1994 Stock Incentive Plan in the period subsequent to his initial election to the Board. Mr. Beazer was granted 35,244 stock options during fiscal 2000. In addition, the Company has agreed to pay an amount up to 200% of Mr. Beazer's base compensation based on predetermined criteria relating to, among other things, the performance of the market price of the Company's common stock, the Total Return (as

6

defined) to the Company's shareholders relative to a selected peer group and his personal commitments to the Company. Mr. Beazer received no incentive compensation for fiscal year 2000.

Report of the Audit Committee

The Audit Committee operates under a written charter adopted by the Board of Directors in fiscal 2000, which is included in this proxy statement as Appendix A. Each member of the Audit Committee is independent in the judgment of the Company's Board of Directors and as required by the listing standards of the New York Stock Exchange.

Management is responsible for the Company's internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and for issuing a report thereon. The Audit Committee's responsibility is generally to monitor and oversee these processes, as described in the Audit Committee Charter.

The Audit Committee reviewed and discussed the audited financial statements of the Company for the fiscal year ended September 30, 2000 with the Company's management. The Audit Committee has discussed with its independent auditors, Deloitte and Touche LLP, the matters required to be discussed by Statement of Auditing Standards No. 61 (Communication with Audit Committees).

The Audit Committee has also received a letter from Deloitte required by Independence Standards Board Statement No. 1 (Independence Discussion with Audit Committees) and discussed with Deloitte their independence.

Based on the review and discussions described above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2000 for filing with Securities and Exchange Commission.

Thomas

B. Howard, Jr.

George W. Mefferd

D.E. Mundell

Larry T. Solari

The Members of the Committee

7

Upon the recommendation of the Audit Committee, the Board of Directors has selected the firm of Deloitte & Touche LLP to serve as the Company's independent auditor for the fiscal year ending September 30, 2001. Deloitte & Touche LLP served as independent auditor for the Company's fiscal year ended September 30, 2000. Representatives of Deloitte & Touche LLP will be present at the annual meeting, will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from shareholders.

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth information as of December 8, 2000 with respect to the beneficial ownership of the Company's common stock by individual directors and nominees for the Board of Directors, executive officers named in the Summary Compensation Table below, and all directors and executive officers as a group. Except as otherwise indicated, each beneficial owner possesses sole voting and investment power with respect to all shares.

| Name of Beneficial Owner |

Number of Common Shares Beneficially Owned(1)(2)(3)(4) |

Percent of Outstanding |

|||

|---|---|---|---|---|---|

Brian C. Beazer Non-Executive Chairman of the Board of Directors |

73,500 |

* |

% |

||

| Ian J. McCarthy President, Chief Executive Officer and Director |

315,917 | 3.65 | % | ||

| Thomas B. Howard, Jr. Director |

13,500 | * | |||

| George W. Mefferd Director |

14,000 | * | |||

| D. E. Mundell Director |

16,000 | * | |||

| Larry T. Solari Director |

14,500 | * | |||

| David S. Weiss(5) Executive Vice President, Chief Financial Officer and Director |

138,162 | 1.61 | % | ||

| Michael H. Furlow Executive Vice President, Chief Operating Officer |

30,600 | * | |||

| John Skelton Senior Vice President, Financial Planning |

76,636 | * | |||

| Peter H. Simons Senior Vice President, E-Business Development |

47,314 | * | |||

| Directors and Executive Officers as a Group (11 persons) | 740,129 | 8.29 | % |

8

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's executive officers and directors and persons who own more than ten percent of the Company's stock, as well as certain affiliates of such persons, to file initial reports of ownership and changes of ownership with the SEC and the NYSE. These parties are required to furnish the Company with copies of the forms they file. Based solely on a review of the copies of the Section 16(a) forms and amendments thereto received by the Company and on written representations that no other reports were required, the Company believes that all reports required pursuant to Section 16(a) for fiscal year 2000 were timely filed by all persons known by the Company to be required to file such reports with respect to the Company's securities other than Messr. Ball who inadvertently failed to file a timely Form 3, the initial statement of beneficial ownership, upon joining the Company.

Report of the Compensation Committee

The Company's Compensation Committee of the Board (the "Committee") in fiscal year 2000 consisted of Messrs. Beazer, Howard, Mefferd, Mundell and Solari, none of whom is employed by the Company, other than Mr. Beazer who is the Non-Executive Chairman of the Company and Chairman of the Committee. However, he is not a member of the Stock Option and Incentive Committee, a subcommittee of the Committee, which in fiscal year 2000 consisted of four independent directors, Messrs. Howard, Mefferd, Mundell and Solari. The Stock Option and Incentive Committee has been appointed to administer the Company's 1999 Stock Incentive Plan, the Amended and Restated 1994

9

Stock Incentive Plan and the 1999 Value Created Incentive Plan, as well as any other bonus or incentive compensation plans. The Stock Option and Incentive Committee also recommends the Non-executive Chairman's compensation arrangement to the Company.

The Committee is accountable to the Board of Directors for developing, monitoring and managing the executive compensation programs of the Company. More specifically, the Committee administers cash-based compensation programs for all Management Committee members, which includes all of the executive officers named in the Summary Compensation Table below (the "Named Executives"). The Committee consults with Watson Wyatt & Company, compensation consultants, on all matters regarding executive compensation and the Company's compensation plans.

The Company's compensation programs have been aligned with the Committee's beliefs that:

It is the Committee's further belief that managing a compensation program around these principles will place executives' and shareholders' interests together and enhance the financial returns to the Company's shareholders relative to the group of comparable homebuilding companies (the "Peer Group"), consisting of Centex, Del Webb, D.R. Horton, Hovnanian, Kaufman & Broad, Lennar, NVR, Pulte, Ryland, and Toll Brothers. During fiscal year 2000, and for fiscal year 2001 the Committee retained the services of Watson Wyatt to give advice on the total compensation provided to executives. Watson Wyatt has confirmed that the compensation being paid is consistent with the Company's performance-based principles and competitive practices among the Peer Group. Each component of compensation is described more fully below.

Base Salary

Base salaries for executives are determined by the Committee based on comparisons of industry salary practices for positions of similar responsibilities and size, and on individual and business unit performance as presented by the Committee's Chairman, Mr. Beazer, based upon input from the Chief Executive Officer, Mr. McCarthy, other than for himself. It is the Committee's objective and practice to set base salaries at levels equivalent to the median (50th percentile) salary of comparable jobs in the Peer Group. Effective October 2000, the Committee approved salary increases for the Named Executives, other than the Chief Executive Officer, that ranged from 3% to 15% and averaged 9%.

Annual Incentives—The Value Created Incentive Plan (the "VCIP")

The Company pays incentive compensation to its corporate executives and certain key employees under the VCIP. The awards under this Plan are made based upon the Company and its operating divisions making operating profit in excess of their cost of capital. The amount of operating profit in excess of cost of capital is referred to as "Value Created".

10

Employees participating in the VCIP, each year are paid a set percentage of Value Created and a set percentage of the increase in Value Created over the prior year, referred to as "Incremental Value Created". In addition, the same percentages of Value Created and Incremental Value Created are put into a "bank", which is always at risk, may be paid out over three years, and can be reduced by future negative performance. This summary of the VCIP is qualified in its entirety by reference to the full text of the Plan, a copy of which may be obtained by shareholders upon written request directed to the Secretary of the Company, 5775 Peachtree Dunwoody Road, Suite B-200, Atlanta, Georgia 30342.

Based upon the Company's financial performance, incentive payments under the VCIP in fiscal 2000 were $1,100,000 to Mr. McCarthy and an aggregate of $1,772,490 to the other four Named Executives. Such amounts include $330,008 and $467,501, respectively, which was deposited into a bookkeeping account (the "Account") as restricted stock units ("RSUs") issuable in three years, under the Company's Executive Stock Purchase Plan (see below). The number of shares related to these amounts, 15,138 and 21,445, respectively, is based upon a stock price of $21.80 per share, which is a 20% discount from the actual closing stock price ($27.25 per share) at September 29, 2000.

Annual Incentives—The Executive Stock Purchase Plan

In order to promote ownership of the Company's stock by key executives, the Company maintains an Executive Stock Purchase Plan (the "ESPP"). Under this program, certain key executives may, at their option, have a portion of their bonuses deposited into the Account as RSUs to purchase shares of the Company's common stock at a 20% discount from the closing fair market value of the Company's common stock on the date of deposit. Such shares are issuable three years from the date of deposit into the Account; until issued the shares cannot be sold, assigned, pledged or encumbered. In addition, employees may elect, one year prior to vesting of the RSUs, to defer receipt of such shares.

Equity-based Incentives

The Company utilizes two equity-based, longer-term incentive programs: stock options and performance accelerated restricted stock ("PARS"). It is anticipated that grants of stock options will not be made more often than every year and grants of PARS will be made every three years to key executives. Interim grants are made for new executive appointments. During Fiscal Year 2000, an aggregate of 510,579 stock options were granted to members of the Company's management, of which 256,567 were granted to the Named Executives.

Stock options are granted at 100% of fair market value on the date of grant, fully vest after three years from grant and expire 10 years after grant. PARS are restricted from use or sale for seven years from grant, provided, however, that if the Company's stock price appreciation and dividend payments, if any, reach certain targeted goals, the restrictions can lapse as early as three years (50%) and four years (50%) from the date of grant. Executives who resign from the Company, or are terminated for cause before grants are vested, forfeit their unvested options and PARS.

Grants of stock options and PARS are based on the Stock Option and Incentive Committee's assessment of competitive practices, past award histories and recommendations from the Company's Non-Executive Chairman of the Board and the Company's Chief Executive Officer.

11

Chief Executive Officer Compensation

In determining Mr. McCarthy's compensation the Committee considers the Company's financial and non-financial performance, as well as an analysis of Mr. McCarthy's total compensation in relation to other Chief Executive Officers in the homebuilding industry.

Mr. McCarthy's base salary at the end of fiscal year 2000 was $550,000, which the Company believes was below the median salary level for Chief Executive Officers in the Peer Group based on publicly available data. In light of this salary relationship and his leadership in positioning the Company for future growth and profitability, the Committee granted Mr. McCarthy a salary increase of 27.3% effective October 2000, raising his annual salary to $700,000, which the Committee recognizes remains below the industry median salary for Chief Executive Officers in the Peer Group.

Under the VCIP, Mr. McCarthy receives 3% each of Value Created and Incremental Value Created as a bonus and has the same percentage put into his bank. Based upon the Company's financial performance in fiscal year 2000, Mr. McCarthy received $1,100,000 (of which $330,008 was deferred in Company stock under the ESPP) under the VCIP and his ending bank balance is $1,724,540, which is always at risk, may be paid out over three years, and can be reduced by future negative performance.

Tax Deductibility of Compensation

It is the Committee's general policy to consider whether particular payments and awards are deductible to the Company for Federal income tax purposes, along with other factors which may be relevant in setting executive compensation practices. In accordance with recently enacted Federal income tax legislation, beginning in 1994, the Internal Revenue Service limits the deductibility for Federal income tax purposes of executive compensation payments in excess of $1 million subject to certain exemptions and exceptions. During fiscal year 2000, no Executive Officer of the Company received executive compensation in excess of such limitation which was not exempt.

Brian

C. Beazer

Thomas B. Howard, Jr.

George W. Mefferd

D.E. Mundell

Larry T. Solari

The Members of the Committee

12

The following table sets forth the cash and non-cash compensation for each of the Company's last three fiscal years awarded to or earned by the Company's Chief Executive Officer and four other most highly paid executive officers whose salary and bonus earned in fiscal year 2000 for services rendered to the Company exceeded $100,000.

| |

|

Annual Compensation |

Long-term Compensation |

|

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

|

|

Awards |

Payouts |

|

|||||||||||||

| Name and Principal Position |

Fiscal Year |

Salary |

Bonus(1) |

Other Annual Compensation(2) |

Restricted Stock Awards(3) |

Securities Underlying Options (#) |

LTIP Payouts |

All Other Compensation(4) |

||||||||||||

Ian J. McCarthy: President and Chief Executive Officer |

2000 1999 1998 |

$ $ $ |

550,000 465,000 445,000 |

$ $ $ |

1,100,000 930,000 503,780 |

— — — |

$ |

— — 1,453,500 |

140,972 — 60,000 |

— — — |

$ $ $ |

5,025 4,800 4,800 |

||||||||

Michael Furlow: Executive Vice President and Chief Operating Officer |

2000 1999 1998 |

$ $ $ |

385,000 325,500 308,959 |

$ $ $ |

770,000 651,000 336,580 |

— — — |

$ |

— — 605,625 |

58,739 — 30,000 |

— — — |

$ $ $ |

5,025 4,800 2,400 |

||||||||

David S. Weiss: Executive Vice President and Chief Financial Officer |

2000 1999 1998 |

$ $ $ |

275,000 230,000 220,000 |

$ $ $ |

550,000 460,000 250,640 |

— — — |

$ |

— — 363,375 |

35,244 — 18,000 |

— — — |

$ $ $ |

5,025 4,800 4,800 |

||||||||

Peter H. Simons: Senior Vice President of E-Business Development |

2000 1999 1998 |

$ $ $ |

200,000 182,000 175,000 |

$ $ $ |

262,490 300,327 114,923 |

— — — |

$ |

— — 181,688 |

17,622 — 9,000 |

— — — |

$ $ $ |

5,025 4,800 4,800 |

||||||||

John Skelton: Senior Vice President of Financial Planning |

2000 1999 1998 |

$ $ $ |

190,000 190,000 183,000 |

$ $ $ |

190,000 303,216 119,256 |

— — — |

$ |

— — 95,891 |

3,990 — 4,750 |

— — — |

$ $ $ |

5,025 4,800 4,800 |

||||||||

Stock Options

The following tables summarize stock options grants and exercises during fiscal year 2000 to or by the executive officers named in the Summary Compensation Table above, and the grant date present values of the options held by such persons at the end of fiscal year 2000.

13

Option Grants for Fiscal Year 2000(1)

| Name |

Number of Securities Underlying Options Granted |

Percentage of Total Options Granted to Employees in Fiscal Year 2000 |

Exercise or Base Price |

Expiration Date |

Grant Date Present Value(2) |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Ian J. McCarthy |

81,127 59,845 |

14.4 10.6 |

% |

17.75 24.0625 |

2/3/10 9/14/10 |

$ |

713,627 694,387 |

||||

Michael H. Furlow |

33,803 24,936 |

6.0 4.4 |

17.75 24.0625 |

2/3/10 9/14/10 |

254,936 248,068 |

||||||

David S. Weiss |

20,282 14,962 |

3.6 2.6 |

17.75 24.0625 |

2/3/10 9/14/10 |

178,409 173,606 |

||||||

Peter H. Simons |

10,141 7,481 |

1.8 1.3 |

17.75 24.0625 |

2/3/10 9/14/10 |

76,482 74,423 |

||||||

John Skelton |

3,990 |

.7 |

24.0625 |

9/14/10 |

39,693 |

||||||

Aggregated Option Exercises in Fiscal Year 2000 and Value at End of Fiscal Year 2000

| |

|

|

Number of Securities Underlying Unexercised Options Held at End of Fiscal Year 2000 |

|

|

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

Value of Unexercised In-the-Money Options at End of Fiscal Year 2000(1) |

||||||||||

| |

Shares Acquired on Exercise |

Value Realized |

|||||||||||

| Name |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

|||||||||

| Ian J. McCarthy | — | — | 181,000 | 200,972 | $ | 1,636,625 | 1,385,212 | ||||||

| Michael H. Furlow | — | — | — | 88,739 | — | 612,487 | |||||||

| David S. Weiss | — | — | 90,000 | 53,244 | 796,250 | 367,495 | |||||||

| John Skelton | — | — | 51,500 | 8,740 | 472,594 | 46,265 | |||||||

| Peter H. Simons | — | — | 28,000 | 26,622 | 246,750 | 183,748 | |||||||

14

Employment Agreements

The Company has entered into employment agreements (the "Employment Agreements") with each of the Named Executives. The Employment Agreements set forth the basic terms of employment for each Executive, including base salary, bonus, and benefits, including benefits to which each Executive is entitled if his employment is terminated for various reasons. Each Employment Agreement is effective for one-year periods and will be extended in each successive year unless earlier terminated by the Company or the Executive or otherwise terminated in accordance with the respective Employment Agreement. In addition, each Employment Agreement contains certain non-competition and confidentiality provisions.

Generally, if an Executive's employment is terminated by the Company for "cause" (as defined in the Employment Agreements) or as a result of the Executive's incapacity or death, the Executive will be entitled to receive an amount equal to his base salary through the effective date of termination, and all other amounts to which the Executive may be entitled under his Employment Agreement to the effective date of termination, including bonus amounts (for the termination reasons described, other than for "cause"), which will be prorated to the date of termination.

In the event the Executive's employment is terminated for any other reason (including without cause), and by reason of retirement, the Executive will be entitled to receive an amount equal to his base salary for the remainder of the term of his Employment Agreement then in effect, bonus amounts to which the Executive would have been entitled under his Employment Agreement for the remainder of the term of his Employment Agreement (subject to the prior approval of the Compensation Committee of the Board of Directors), and all other amounts to which the Executive may be entitled under his Employment Agreement to the effective date of termination.

Supplemental Employment Agreements

Each of the Named Executives has entered into a supplemental employment agreement (or has had equivalent terms incorporated into his Employment Agreement) (the "Supplemental Employment Agreement") which supersedes the terms and provisions of such Named Executive's Employment Agreement in the event of a Change of Control (as defined in the Supplemental Employment Agreement). The Supplemental Employment Agreements automatically renew every year for a successive two year period.

Pursuant to the Supplemental Employment Agreements, the Company will continue to employ the Named Executive for a period of two years from the date the Change of Control occurs (the "Effective Date"). During this two-year period, the Named Executive will be entitled to receive an amount approximating his most recent annual base salary ("Annual Base Salary"). In addition, the Named Executive shall be awarded an annual bonus at least equal to the highest bonus for the last three years ("Annual Bonus").

If the Named Executive's employment is terminated by the Company for cause, the Named Executive will be entitled to receive an amount equal to the portion of his Annual Base Salary accrued through the effective date of termination and any deferred compensation previously deferred and all other payments to which the Named Executive may be entitled under his Supplemental Agreement

If the Named Executive's employment is terminated by the Company as a result of the Named Executive's death or disability, or by the Named Executive for a reason other than a Good Reason (as

15

defined in the Supplemental Employment Agreements), the Named Executive will be entitled to receive an amount equal to the portion of his Annual Base Salary and Annual Bonus accrued through the effective date of termination and any deferred compensation previously deferred (the "Accrued Obligations") and all other amounts to which the Named Executive may be entitled under his Supplemental Employment Agreement.

If the Named Executive's employment is terminated by the Company for any reason other than for cause or as a result of the Named Executive's death or disability, or by the Named Executive for Good Reason, the Named Executive shall be entitled to receive an amount equal to the sum of (i) the Accrued Obligations; (ii) the product of (A) a multiple ranging from 1.5 to 3.0 and (B) the sum of his Annual Base Salary and Annual Bonus; (iii) certain excess pension benefits; and (iv) all other amounts to which the Named Executive may be entitled under his Supplemental Employment Agreement. In addition, the Company must provide the Named Executive and his family certain benefits for a three-year period following the effective date of termination.

16

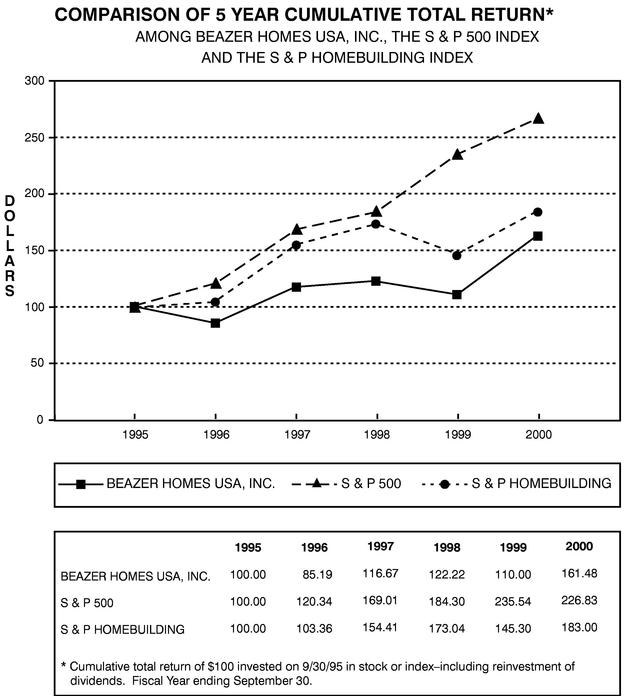

COMPARATIVE STOCK PERFORMANCE GRAPH

The graph below compares the cumulative total return on the Company's common stock with the cumulative total return of the Standard and Poor's 500 Stock Index and the Standard and Poor's Homebuilding Index for the last five fiscal years (assuming the investment of $100 in each vehicle on October 1, 1995 and the reinvestment of all dividends).

17

PROPOSALS FOR THE NEXT ANNUAL MEETING

Any proposal by a shareholder to be presented at the next annual meeting of shareholders must be received at the Company's principal executive offices, 5775 Peachtree Dunwoody Road, Suite B-200, Atlanta, Georgia 30342, by not later than August 24, 2001.

By Order of the Board of Directors,

![]() Brian C. Beazer

Brian C. Beazer

Non-Executive Chairman of the Board

Dated: December 22, 2000

18

APPENDIX A

BEAZER HOMES USA, INC.

AUDIT COMMITTEE CHARTER

PURPOSE

The primary function of the Audit Committee is to provide assistance to the Board of Directors in fulfilling its responsibility relating to corporate accounting and auditing, reporting practices of the Corporation, the quality and integrity of the financial reports of the corporation, and the Corporation's systems of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board have established.

COMPOSITION

The Audit Committee is a Committee of the Board of Directors and shall be composed of three or more directors who are independent of the management of the corporation and are free of any relationship that, in the opinion of the Board of Directors, would interfere with their exercise of independent judgment as a Committee member.

All members of the Committee shall have a working familiarity with basic finance and accounting practices, and at least one member of the Committee shall have accounting or related financial management expertise.

The members of the Committee shall be elected by the Board at the annual organizational meeting of the Board or until their successors shall be duly elected and qualified. Unless a Chair is elected by the full Board, the members of the Committee may designate a Chair by majority vote of the full Committee membership. A majority of the Committee shall constitute a quorum.

AUTHORITY

The Audit Committee's direct reporting relationship is to the Board of Directors of the company. The Committee is authorized to have full and unrestricted access to all personnel, records, operations, properties, and other informational sources of the company as required to properly discharge its responsibilities. Further, the Committee is granted the authority to conduct or authorize investigations into any matters within the Committee's scope of responsibilities. The Committee shall be empowered to retain independent counsel, accountants, or others to assist it in the discharge of its responsibilities, upon Board approval.

MEETINGS

The Committee shall meet at least three times per year or more frequently as circumstances require. The Committee may ask members of management, internal audit, the independent accountants or others to attend the meeting and provide pertinent information as necessary.

MINUTES

The minutes of all Audit Committee meetings will be prepared and distributed to all Committee members and approved at subsequent meetings. If the Corporate Secretary did not take the minutes, they should be sent to the secretary for distribution to the full Board and placed in permanent filing.

RESPONSIBILITIES

In meeting its responsibilities, the Audit Committee is expected to:

A-2

The Committee will perform such other functions as assigned by law, the company's charter or bylaws, or the Board of Directors.

A-3

P R O X Y

BEAZER HOMES USA, INC.

5775 Peachtree Dunwoody Road

Suite B-200

Atlanta, Georgia 30342

This Proxy is Solicited on behalf of the Board of Directors.

The undersigned, having duly received the Notice of Annual Meeting and Proxy Statement dated December 22, 2000, hereby appoints Ian J. McCarthy and David S. Weiss (each with full power to act alone and with power of substitution and revocation), to represent the undersigned and to vote, as designated on the reverse side, all shares of Common Stock of Beazer Homes USA, Inc. which the undersigned is entitled to vote at the Annual Meeting of Shareholders of Beazer Homes USA, Inc. to be held at 10:00 a.m. on Thursday, February 1, 2001 at The Company's offices at 5775 Peachtree Dunwoody Road, Suite B-200, Atlanta, Georgia 30342 and at any adjournment or adjournments thereof.

(Continued and to be signed and dated on reverse side.)

SEE REVERSE SIDE

Please date, sign and mail your proxy card back as soon as possible!

Annual Meeting of Shareholders

BEAZER HOMES USA, INC.

February 1, 2001

Please Detach and Mail in the Envelope Provided

A /x/ Please mark your votes as

in this sample.

| 1. | Election of Directors: | FOR / / |

WITHHOLD AUTHORITY / / |

Nominees: Brian C. Beazer Thomas B. Howard, Jr. |

2. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting. | ||||

| For, except vote withheld from the following nominee(s): | Ian J. McCarthy George W. Mefferd D.E. Mundell Larry T. Solari |

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder. If no direction is made, this proxy will be voted FOR Proposal 1. | |||||||

| David S. Weiss | PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD USING THE ENCLOSED ENVELOPE. | ||||||||

SIGNATURE(S): |

DATE |

SIGNATURE(S): |

DATE |

||||

NOTE: Please sign exactly as name appears hereon. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by the President or other authorized officer separately stating full name and title. If a partnership, please sign in partnership name by authorized person.

|

|