|

|

|

|

|

Previous: IGEN INTERNATIONAL INC /DE, S-3/A, EX-23.2, 2001-01-10 |

Next: FIBERCORE INC, 8-K, 2001-01-10 |

Spartan®

Fund

Semiannual Report

October 31, 2000

(2_fidelity_logos)(Registered_Trademark)

|

President's Message |

3 |

Ned Johnson on investing strategies. |

|

Performance |

4 |

How the fund has done over time. |

|

Fund Talk |

6 |

The manager's review of fund performance, strategy and outlook. |

|

Investment Changes |

8 |

A summary of major shifts in the fund's

investments over the past six months |

|

Investments |

9 |

A complete list of the fund's investments. |

|

Financial Statements |

12 |

Statements of assets and liabilities,

operations, and changes in net assets, |

|

Notes |

16 |

Notes to the financial statements. |

|

|

|

|

To reduce expenses, only one copy of most financial reports and prospectuses may be mailed to households, even if more than one person in the household has an account in the fund. Call Fidelity at 1-800-544-8544 if you need additional copies of financial reports or prospectuses. If you do not want the mailing of these documents to be combined with those for other members of your household, contact Fidelity in writing at P.O. Box 5000, Cincinnati, OH 45273-8692.

Third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Semiannual Report

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

A sixth-straight year of double-digit positive returns for the Dow Jones Industrial Average, NASDAQ and S&P 500® could be in jeopardy unless the U.S. stock market shows marked improvement in the final two months of 2000. Through October, all three indexes had negative year-to-date returns. On the other hand, most fixed-income sectors were solidly in the black. Treasuries and other long-term government securities led the way, returning nearly 14%.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

First, investors are encouraged to take a long-term view of their portfolios. If you can afford to leave your money invested through the inevitable up and down cycles of the financial markets, you will greatly reduce your vulnerability to any single decline. We know from experience, for example, that stock prices have gone up over longer periods of time, have significantly outperformed other types of investments and have stayed ahead of inflation.

Second, you can further manage your investing risk through diversification. A stock mutual fund, for instance, is already diversified, because it invests in many different companies. You can increase your diversification further by investing in a number of different stock funds, or in such other investment categories as bonds. You should also keep money you'll need in the near future in a more stable investment.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Semiannual Report

To evaluate a money market fund's historical performance, you can look at either total return or yield. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income. Yield measures the income paid by a fund. Since a money market fund tries to maintain a $1 share price, yield is an important measure of performance. If Fidelity had not reimbursed certain fund expenses, the past 10 year total return would have been lower.

Cumulative Total Returns

|

Periods ended October 31, 2000 |

Past 6 |

Past 1 |

Past 5 |

Past 10 |

|

Spartan US Government Money Market |

3.10% |

5.89% |

29.47% |

61.56% |

|

Government Retail Money Market |

2.90% |

5.47% |

27.12% |

55.76% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, six months, one year, five years or 10 years. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. To measure how the fund's performance stacked up against its peers, you can compare it to the government retail money market funds average, which reflects the performance of government retail money market funds with similar objectives tracked by iMoneyNet, Inc. The past six months average represents a peer group of 211 money market funds.

Average Annual Total Returns

|

Periods ended October 31, 2000 |

|

Past 1 |

Past 5 |

Past 10 |

|

Spartan US Government Money Market |

|

5.89% |

5.30% |

4.91% |

|

Government Retail Money Market |

|

5.47% |

4.91% |

4.53% |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year.

Semiannual Report

Performance - continued

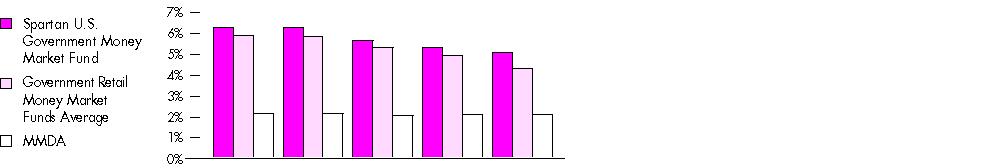

Yields

|

|

10/31/00 |

8/1/00 |

5/2/00 |

2/1/00 |

11/2/99 |

|

Spartan U.S. Government Money Market Fund |

6.20% |

6.19% |

5.61% |

5.28% |

5.04% |

|

Government Retail Money Market Funds Average |

5.83% |

5.76% |

5.25% |

4.90% |

4.57% |

|

|

11/1/00 |

8/2/00 |

5/3/00 |

2/2/00 |

11/3/99 |

|

MMDA |

2.11% |

2.12% |

2.03% |

2.07% |

2.07% |

Yield refers to the income paid by the fund over a given period. Yields for money market funds are usually for seven-day periods, expressed as annual percentage rates. A yield that assumes income earned is reinvested or compounded is called an effective yield. The table above shows the fund's current seven-day yield at quarterly intervals over the past year. You can compare these yields to the government retail money market funds average and the bank money market deposit account (MMDA) average. Figures for the government retail money market funds average are from iMoneyNet, Inc. The MMDA average is supplied by BANK RATE MONITOR(TM).

Comparing

Performance

There are some important differences between a bank money market deposit account (MMDA) and a money market fund. First, the U.S. government neither insures nor guarantees a money market fund. In fact, there is no assurance that a money market fund will maintain a $1 share price. Second, a money market fund returns to its shareholders income earned by the fund's investments after expenses. This is in contrast to banks, which set their MMDA rates periodically based on current interest rates, competitors' rates, and internal criteria.

3A money market fund's total returns and yields will vary, and reflect past results rather than predict future performance.

Semiannual Report

An interview with Robert Litterst, Portfolio Manager of Spartan U.S. Government Money Market Fund

Q. Bob, what was the investment environment like during the six months that ended October 31, 2000?

A. Market expectations shifted dramatically from the beginning of the period. In May, the Federal Reserve Board raised the rates banks charge each other for

overnight loans - known as the fed funds target rate - continuing a rate-hike policy that had started in mid-1999. Sentiment in the market reflected the belief

that the Fed would continue hiking short-term rates at least through the end of 2000. However, economic indicators emerged showing that the Fed's rate hikes

were beginning to take effect, and the torrid pace of economic growth that prevailed over the past year was moderating. In addition to the Fed's rate hikes, rising

energy prices and a struggling stock market had a dampening effect on the economy. The slowdown did not develop into something worse primarily because

consumer spending - which represents about two-thirds of gross domestic product - remained solid. Consumer activity was underpinned by a strong job

market, solid income gains and high levels of consumer confidence. Despite higher energy prices, inflation remained under control, helped by intense

competition that limited pricing power and surging productivity growth that offset higher wages and benefits. As market participants realized that the Fed would

not have to raise rates as much as previously expected, market rates began to fall. By the end of the period, market rates looking out to 2001 priced in the likelihood

that the next Fed move would actually be a rate cut. The Fed publicly maintained a cautious stance, indicating a continued bias toward raising rates in the

future, saying that the risks of higher inflation outweighed those of a faltering economy. (Portfolio Manager photograph)

Q. Were there any developments of note within the government money market?

A. Yes, there were. Government agencies such as the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Bank (Freddie Mac) - which enjoy the implicit backing of the federal government - came under scrutiny by Congress. Specifically, some in Congress raised concerns that the agencies were involved in activities that fell outside their mission and that were perhaps too risky, and that they had grown too far too fast during the past few years. These concerns hurt agency debt in longer maturities, but short-term agency debt was unaffected. In October, the heads of the agencies reassured members of Congress that they would increase capital, liquidity and disclosure, and would work more closely with Congressional leaders to strengthen regulatory oversight. This announcement significantly reduced the political risk associated with the agencies. Still, we will continue to closely monitor this situation going forward.

Semiannual Report

Fund Talk: The Manager's Overview - continued

Q. What was your strategy with the fund?

A. During the period, the fund's average maturity fluctuated from the mid 40-day range to the low 70-day range, depending on where I could find value. Midway through the period, it became clear that the Fed would hold short-term interest rates steady for the time being. As a result, my approach - and the fund's average maturity - was not a reflection of a stance calling for aggressive Fed action one way or the other. Instead, I tried to keep the fund's average maturity within about 10 to 15 days of its peer group, buying securities in the one- to six-month range that offered particular value at specific points in time. In addition, I reduced the fund's variable-rate holdings and increased its stake in repurchase agreements, because the former group became expensive and the latter group tends to become cheap and offer attractive yields late in each calendar year.

Q. How did the fund perform?

A. The fund's seven-day yield on October 31, 2000, was 6.20%, compared to 5.61% six months ago. For the six months that ended October 31, 2000, the fund had a total return of 3.10%, compared to 2.90% for the government retail money market funds average, according to iMoneyNet, Inc.

Q. What is your outlook?

A. The Fed appears to have achieved its goal of a soft landing, where economic growth slows to a sustainable, non-inflationary pace, but not so much that the economy enters a recession. In this environment, the Fed is likely to maintain a stable monetary policy. However, if growth slows sharply or if fragile financial conditions in certain parts of the world deteriorate into crises, the Fed does have the flexibility to lower rates to restore confidence and liquidity. I plan to continue to pursue opportunities that offer favorable risk and reward trade-offs for shareholders. Also, I expect to maintain an average maturity moderately longer than my peers.

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fund Facts

Goal: seeks as high a level of current income as is consistent with preservation of capital and liquidity by investing in U.S. Government securities and repurchase agreements, and entering into reverse repurchase agreements.

Fund number: 458

Trading symbol: SPAXX

Start date: February 5, 1990

Size: as of October 31, 2000, more than $758 million

Manager: Robert Litterst, since 1997; manager, several Fidelity and Spartan taxable money market funds; joined Fidelity in 1991

3Semiannual Report

|

Maturity Diversification |

|||

|

Days |

% of fund's investments 10/31/00 |

% of fund's investments 4/30/00 |

% of fund's investments 10/31/99 |

|

0 - 30 |

57.6 |

41.8 |

49.3 |

|

31 - 90 |

9.9 |

40.7 |

17.9 |

|

91 - 180 |

25.7 |

9.3 |

18.4 |

|

181 - 397 |

6.8 |

8.2 |

14.4 |

|

Weighted Average Maturity |

|||

|

|

10/31/00 |

4/30/00 |

10/31/99 |

|

Spartan U.S. Government |

61 Days |

61 Days |

72 Days |

|

Government Retail |

45 Days |

43 Days |

54 Days |

|

Asset Allocation (% of fund's net assets) |

|||||||

|

As of October 31, 2000 |

As of April 30, 2000 |

||||||

|

Federal Agency |

|

|

Federal Agency |

|

||

|

U.S. Treasury |

|

|

U.S. Treasury |

|

||

|

Repurchase |

|

|

Repurchase |

|

||

Semiannual Report

(Unaudited)

Showing Percentage of Net Assets

|

Federal Agencies - 63.6% |

||||

|

Due Date |

Annualized Yield at Time of Purchase |

Principal |

Value |

|

|

Fannie Mae - 31.8% |

||||

|

Agency Coupons - 9.2% |

||||

|

11/1/00 |

6.48% (a) |

$ 10,000,000 |

$ 9,994,764 |

|

|

11/1/00 |

6.49 (a) |

16,000,000 |

15,992,077 |

|

|

11/7/00 |

6.53 (a) |

11,000,000 |

10,997,800 |

|

|

11/13/00 |

6.46 (a) |

18,000,000 |

17,999,500 |

|

|

3/1/01 |

6.55 |

6,000,000 |

5,999,783 |

|

|

3/20/01 |

6.49 |

9,000,000 |

8,998,941 |

|

|

|

69,982,865 |

|||

|

Discount Notes - 22.6% |

||||

|

11/2/00 |

6.68 |

7,000,000 |

6,998,744 |

|

|

11/9/00 |

6.84 |

8,000,000 |

7,988,253 |

|

|

11/22/00 |

6.90 |

7,000,000 |

6,972,723 |

|

|

11/30/00 |

6.85 |

7,164,000 |

7,125,796 |

|

|

11/30/00 |

6.89 |

33,690,000 |

33,509,256 |

|

|

12/1/00 |

6.56 |

7,000,000 |

6,962,375 |

|

|

2/1/01 |

6.64 |

10,000,000 |

9,835,678 |

|

|

2/1/01 |

6.67 |

10,000,000 |

9,835,167 |

|

|

2/22/01 |

6.63 |

10,000,000 |

9,798,797 |

|

|

3/19/01 |

6.54 |

30,000,000 |

29,269,750 |

|

|

3/28/01 |

6.55 |

30,000,000 |

29,223,767 |

|

|

5/10/01 |

7.20 |

14,000,000 |

13,503,467 |

|

|

|

171,023,773 |

|||

|

|

241,006,638 |

|||

|

Federal Home Loan Bank - 14.3% |

||||

|

Agency Coupons - 11.0% |

||||

|

11/3/00 |

6.00 |

8,000,000 |

7,999,978 |

|

|

11/3/00 |

6.02 |

3,000,000 |

2,999,989 |

|

|

11/7/00 |

6.74 (a) |

20,000,000 |

19,998,471 |

|

|

12/1/00 |

6.03 |

6,500,000 |

6,499,151 |

|

|

1/12/01 |

6.58 (a) |

15,000,000 |

14,990,323 |

|

|

1/19/01 |

6.55 (a) |

20,000,000 |

19,986,836 |

|

|

2/7/01 |

6.48 |

11,000,000 |

10,993,376 |

|

|

|

83,468,124 |

|||

|

Discount Notes - 3.3% |

||||

|

2/23/01 |

6.57 |

25,000,000 |

24,495,708 |

|

|

|

107,963,832 |

|||

|

Federal Agencies - continued |

||||

|

Due Date |

Annualized Yield at Time of Purchase |

Principal |

Value |

|

|

Freddie Mac - 17.4% |

||||

|

Agency Coupons - 7.1% |

||||

|

11/1/00 |

6.47% (a) |

$ 10,000,000 |

$ 9,991,770 |

|

|

11/7/00 |

6.80 (a) |

15,000,000 |

14,992,020 |

|

|

1/10/01 |

6.59 (a) |

15,000,000 |

14,997,275 |

|

|

1/16/01 |

6.43 |

9,000,000 |

8,884,661 |

|

|

1/16/01 |

6.63 |

5,000,000 |

4,931,354 |

|

|

|

53,797,080 |

|||

|

Discount Notes - 10.3% |

||||

|

11/9/00 |

6.85 |

6,000,000 |

5,991,180 |

|

|

2/7/01 |

6.50 |

10,000,000 |

9,833,944 |

|

|

3/1/01 |

6.60 |

25,000,000 |

24,467,500 |

|

|

3/29/01 |

6.54 |

27,186,000 |

26,477,412 |

|

|

5/24/01 |

7.22 |

7,000,000 |

6,733,043 |

|

|

10/11/01 |

6.51 |

5,000,000 |

4,707,122 |

|

|

|

78,210,201 |

|||

|

|

132,007,281 |

|||

|

Private Export Funding Corp. - 0.1% |

||||

|

Agency Coupons - 0.1% |

||||

|

1/31/01 |

6.88 |

1,000,000 |

1,002,637 |

|

|

TOTAL FEDERAL AGENCIES |

481,980,388 |

|||

|

U.S. Treasury Obligations - 3.7% |

||||

|

|

||||

|

U.S. Treasury Notes - Principal Strips - 3.7% |

||||

|

8/15/01 |

6.37 |

20,000,000 |

19,034,825 |

|

|

9/30/01 |

6.53 |

10,000,000 |

9,429,189 |

|

|

TOTAL U.S. TREASURY OBLIGATIONS |

28,464,014 |

|||

|

Repurchase Agreements - 35.6% |

|||

|

Maturity |

|

||

|

In a joint trading account |

|

|

|

|

9/5/00 due 11/3/00 At 6.56% |

$ 30,322,533 |

30,000,000 |

|

|

9/7/00 due 11/6/00 At 6.54% |

15,163,500 |

15,000,000 |

|

|

9/18/00 due: |

|

|

|

|

11/14/00 At 6.54% |

60,621,300 |

60,000,000 |

|

|

11/22/00 At 6.53% |

20,235,806 |

20,000,000 |

|

|

Repurchase Agreements - continued |

|||

|

Maturity |

Value |

||

|

In a joint trading account (U.S. Government Obligations) dated: - continued |

|

|

|

|

10/11/00 due 11/8/00 At 6.52% |

$ 25,126,778 |

$ 25,000,000 |

|

|

10/17/00 due 11/20/00 At 6.53% |

20,123,344 |

20,000,000 |

|

|

10/31/00 due 11/1/00 At 6.62% |

100,080,398 |

100,062,000 |

|

|

TOTAL REPURCHASE AGREEMENTS |

270,062,000 |

||

|

TOTAL INVESTMENT PORTFOLIO - 102.9% |

780,506,402 |

||

|

NET OTHER ASSETS - (2.9)% |

(22,196,412) |

||

|

NET ASSETS - 100% |

$ 758,309,990 |

||

|

Total Cost for Income Tax Purposes $ 780,506,402 |

|

Legend |

|

(a) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. The due dates on these types of securities reflects the next interest rate reset date or, when applicable, the final maturity date. |

|

Income Tax Information |

|

At April 30, 2000, the fund had a capital loss carryforward of approximately $123,000 of which $33,000, $53,000 and $37,000 will expire on April 30, 2002, 2003 and 2004, respectively. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Assets and Liabilities

|

|

October 31, 2000 (Unaudited) |

|

|

Assets |

|

|

|

Investment in securities, at value (including |

|

$ 780,506,402 |

|

Cash |

|

357 |

|

Receivable for investments sold |

|

19,454,433 |

|

Receivable for fund shares sold |

|

1,363,369 |

|

Interest receivable |

|

3,418,023 |

|

Total assets |

|

804,742,584 |

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 44,928,689 |

|

|

Payable for fund shares redeemed |

1,077,836 |

|

|

Distributions payable |

123,083 |

|

|

Accrued management fee |

293,095 |

|

|

Other payables and accrued expenses |

9,891 |

|

|

Total liabilities |

|

46,432,594 |

|

Net Assets |

|

$ 758,309,990 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 758,435,898 |

|

Accumulated net realized gain (loss) on investments |

|

(125,908) |

|

Net Assets, for 758,435,898 shares outstanding |

|

$ 758,309,990 |

|

Net Asset Value, offering price and redemption price |

|

$1.00 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Operations

|

|

Six months ended October 31, 2000 (Unaudited) |

|

|

Investment Income Interest |

|

$ 25,935,049 |

|

Expenses |

|

|

|

Management fee |

$ 1,787,761 |

|

|

Non-interested trustees' compensation |

1,562 |

|

|

Total expenses before reductions |

1,789,323 |

|

|

Expense reductions |

(17,094) |

1,772,229 |

|

Net investment income |

|

24,162,820 |

|

Net Realized Gain (Loss) on Investments |

|

(2,511) |

|

Net increase in net assets resulting from operations |

|

$ 24,160,309 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Changes in Net Assets

|

|

Six months ended October 31, 2000 (Unaudited) |

Year ended |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

$ 24,162,820 |

$ 41,854,574 |

|

Net realized gain (loss) |

(2,511) |

13,792 |

|

Net increase (decrease) in net assets resulting |

24,160,309 |

41,868,366 |

|

Distributions to shareholders from net investment income |

(24,162,820) |

(41,854,574) |

|

Share transactions at net asset value of $1.00 per share |

205,375,084 |

637,554,338 |

|

Reinvestment of distributions from net investment income |

22,958,490 |

39,748,091 |

|

Cost of shares redeemed |

(285,680,005) |

(708,990,552) |

|

Net increase (decrease) in net assets and shares resulting from share transactions |

(57,346,431) |

(31,688,123) |

|

Total increase (decrease) in net assets |

(57,348,942) |

(31,674,331) |

|

Net Assets |

|

|

|

Beginning of period |

815,658,932 |

847,333,263 |

|

End of period |

$ 758,309,990 |

$ 815,658,932 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

|

|

Six months ended October 31, 2000 |

Years ended April 30, |

||||

|

|

(Unaudited) |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value,

beginning |

$ 1.000 |

$ 1.000 |

$ 1.000 |

$ 1.000 |

$ 1.000 |

$ 1.000 |

|

Income from Investment

Operations |

.031 |

.050 |

.049 |

.052 |

.050 |

.054 |

|

Less Distributions |

|

|

|

|

|

|

|

From net investment income |

(.031) |

(.050) |

(.049) |

(.052) |

(.050) |

(.054) |

|

Net asset value, |

$ 1.000 |

$ 1.000 |

$ 1.000 |

$ 1.000 |

$ 1.000 |

$ 1.000 |

|

Total Return B, C |

3.10% |

5.17% |

5.02% |

5.37% |

5.16% |

5.52% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

|

Net assets, end |

$ 758,310 |

$ 815,659 |

$ 847,333 |

$ 773,172 |

$ 815,751 |

$ 761,475 |

|

Ratio of expenses |

.45% A |

.45% |

.45% |

.45% |

.45% |

.45% |

|

Ratio of expenses to average net assets after expense reductions |

.45% A |

.45% |

.44% D |

.45% |

.45% |

.41% D |

|

Ratio of net investment income to average net assets |

6.08% A |

5.03% |

4.90% |

5.24% |

5.02% |

5.42% |

A Annualized

B The total returns would have been lower had certain expenses not been reduced during the periods shown.

C Total returns do not include the account closeout fee and for periods of less than one year are not annualized.

D FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

For the period ended October 31, 2000 (Unaudited)

1. Significant Accounting Policies.

Spartan U.S. Government Money Market Fund (the fund) is a fund of Fidelity Hereford Street Trust (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware business trust. The financial statements have been prepared in conformity with generally accepted accounting principles which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. As permitted under Rule 2a-7 of the 1940 Act, and certain conditions therein, securities are valued initially at cost and thereafter assume a constant amortization to maturity of any discount or premium.

Income Taxes. As a qualified regulated investment company under Subchapter M of the Internal Revenue Code, the fund is not subject to income taxes to the extent that it distributes substantially all of its taxable income for its fiscal year. The schedule of investments includes information regarding income taxes under the caption "Income Tax Information."

Investment Income. Interest income, which includes amortization of premium and accretion of discount, is accrued as earned.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among the funds in the trust.

Distributions to Shareholders. Dividends are declared daily and paid monthly from net investment income.

Security Transactions. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost.

2. Operating Policies.

Joint Trading Account. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission (the SEC), the fund, along with other affiliated entities of Fidelity Management & Research Company (FMR), may transfer uninvested cash balances into one or more joint trading accounts. These balances are invested in one or more repurchase agreements for U.S. Treasury or Federal Agency obligations.

Repurchase Agreements. The underlying U.S. Treasury, Federal Agency, or other obligations found to be satisfactory by FMR are transferred to an account of the fund, or to the Joint Trading Account, at a custodian bank. The securities are marked-to-market daily and maintained at a value at least equal to the principal amount of the repurchase agreement (including accrued interest). FMR, the fund's investment adviser, is responsible for determining that the value of the underlying securities remains in accordance with the market value requirements stated above.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

3. Joint Trading Account.

At the end of the period, the fund had 20% or more of its total investments in repurchase agreements through a joint trading account. These repurchase agreements were with entities whose creditworthiness has been reviewed and found satisfactory by FMR. The investments in repurchase agreements through the joint trading account are summarized as follows:

Summary of Joint Trading

Dated September 5, 2000, due November 3, 2000 6.56%

|

Number of dealers or banks |

1 |

|

Maximum amount with one dealer or bank |

100% |

|

Aggregate principal amount of agreements |

$500,000,000 |

|

Aggregate maturity amount of agreements |

$505,375,556 |

|

Aggregate market value of transferred assets |

$510,002,933 |

|

Coupon rates of transferred assets |

6.09% to 6.63% |

|

Maturity dates of transferred assets |

2/22/01 to 5/14/09 |

Dated September 7, 2000, due November 6, 2000 6.54%

|

Number of dealers or banks |

1 |

|

Maximum amount with one dealer or bank |

100% |

|

Aggregate principal amount of agreements |

$250,000,000 |

|

Aggregate maturity amount of agreements |

$252,725,000 |

|

Aggregate market value of transferred assets |

$255,003,594 |

|

Coupon rates of transferred assets |

5.13% to 6.63% |

|

Maturity dates of transferred assets |

4/10/01 to 10/15/08 |

Dated September 18, 2000, due November 14, 2000 6.54%

|

Number of dealers or banks |

1 |

|

Maximum amount with one dealer or bank |

100% |

|

Aggregate principal amount of agreements |

$500,000,000 |

|

Aggregate maturity amount of agreements |

$505,177,500 |

|

Aggregate market value of transferred assets |

$514,083,573 |

|

Coupon rates of transferred assets |

5.50% to 11.50% |

|

Maturity dates of transferred assets |

11/1/00 to 11/1/30 |

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

3. Joint Trading Account - continued

Summary of Joint Trading - continued

Dated September 18, 2000, due November 22, 2000 6.53%

|

Number of dealers or banks |

1 |

|

Maximum amount with one dealer or bank |

100% |

|

Aggregate principal amount of agreements |

$500,000,000 |

|

Aggregate maturity amount of agreements |

$505,895,139 |

|

Aggregate market value of transferred assets |

$510,000,001 |

|

Coupon rates of transferred assets |

5.00% to 9.00% |

|

Maturity dates of transferred assets |

3/1/05 to 10/1/30 |

Dated October 11, 2000, due November 8, 2000 6.52%

|

Number of dealers or banks |

1 |

|

Maximum amount with one dealer or bank |

100% |

|

Aggregate principal amount of agreements |

$200,000,000 |

|

Aggregate maturity amount of agreements |

$201,014,222 |

|

Aggregate market value of transferred assets |

$204,739,703 |

|

Coupon rates of transferred assets |

0.00% to 8.50% |

|

Maturity dates of transferred assets |

11/24/00 to 11/1/30 |

Dated October 17, 2000, due November 20, 2000 6.53%

|

Number of dealers or banks |

1 |

|

Maximum amount with one dealer or bank |

100% |

|

Aggregate principal amount of agreements |

$200,000,000 |

|

Aggregate maturity amount of agreements |

$201,233,444 |

|

Aggregate market value of transferred assets |

$204,613,305 |

|

Coupon rates of transferred assets |

6.00% to 11.00% |

|

Maturity dates of transferred assets |

11/1/00 to 11/1/30 |

Dated October 31, 2000, due November 1, 2000 6.62%

|

Number of dealers or banks |

17 |

|

Maximum amount with one dealer or bank |

18.7% |

|

Aggregate principal amount of agreements |

$20,005,000,000 |

|

Aggregate maturity amount of agreements |

$20,008,678,234 |

|

Aggregate market value of transferred assets |

$20,456,856,001 |

|

Coupon rates of transferred assets |

0.00% to 16.00% |

|

Maturity dates of transferred assets |

11/01/00 to 6/1/40 |

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

4. Fees and Other Transactions with Affiliates.

Management Fee. As the fund's investment adviser, FMR receives a fee that is computed daily at an annual rate of .45% of the fund's average net assets. FMR pays all other expenses, except the compensation of the non-interested Trustees and certain exceptions such as interest, taxes, brokerage commissions and extraordinary expenses. The management fee paid to FMR by the fund is reduced by an amount equal to the fees and expenses paid by the fund to the non-interested Trustees.

FMR also bears the cost of providing shareholder services to the fund. To offset the cost of providing these services, FMR or its affiliates collected certain transaction fees from shareholders which amounted to $5,081.

Sub-Adviser Fee. As the fund's investment sub-adviser, Fidelity Investments Money Management, Inc., a wholly owned subsidiary of FMR, receives a fee from FMR of 50% of the management fee payable to FMR. The fee is paid prior to any voluntary expense reimbursements which may be in effect.

Money Market Insurance. Pursuant to an Exemptive Order issued by the SEC, the fund, along with other money market funds advised by FMR or its affiliates, has entered into insurance agreements with FIDFUNDS Mutual Limited (FIDFUNDS), an affiliated mutual insurance company. FIDFUNDS provides limited coverage for certain loss events including issuer default as to payment of principal or interest and bankruptcy or insolvency of a credit enhancement provider. The insurance does not cover losses resulting from changes in interest rates, ratings downgrades or other market conditions. The fund may be subject to a special assessment of up to approximately 2.5 times the fund's annual gross premium if covered losses exceed certain levels. During the period, FMR has borne the cost of the fund's premium payable to FIDFUNDS.

5. Expense Reductions.

Through arrangements with the fund's custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce a portion of the fund's expenses. During the period, the fund's expenses were reduced by $17,094 under these arrangements.

Semiannual Report

Fidelity offers several ways to conveniently manage your personal investments via your telephone or PC. You can access your account information, conduct trades and research your investments 24 hours a day.

By Phone

Fidelity Automated Service Telephone provides a single toll-free number to access account balances, positions, quotes and trading. It's easy to navigate the service, and on your first call, the system will help you create a personal identification number (PIN) for security.

(phone_graphic)Fidelity Automated

Service Telephone (FAST®)

1-800-544-5555

Press

1 For mutual fund and brokerage trading.

2 For quotes.*

3 For account balances and holdings.

4 To review orders and mutual

fund activity.

5 To change your PIN.

*0 To speak to a Fidelity representative.

By PC

Fidelity's web site on the Internet provides a wide range of information, including daily financial news, fund performance, interactive planning tools and news about Fidelity products and services.

(computer_graphic)Fidelity's Web Site

www.fidelity.com

If you are not currently on the Internet, call EarthLink Sprint at 1-800-288-2967, and be sure to ask for registration number SMD004 to receive a special Fidelity package that includes 30 days of free Internet access. EarthLink is North America's #1 independent Internet access provider.

(computer_graphic)

Fidelity On-line Xpress+®

Fidelity On-line Xpress+ software for Windows combines comprehensive portfolio management capabilities, securities trading and access to research and analysis tools . . . all on your desktop. Call Fidelity at 1-800-544-0240 or visit our web site for more information on how to manage your investments via your PC.

* When you call the quotes line, please remember that a fund's yield and return will vary and, except for money market funds, share price will also vary. This means that you may have a gain or loss when you sell your shares. There is no assurance that money market funds will be able to maintain a stable $1 share price; an investment in a money market fund is not insured or guaranteed by the U.S. government. Total returns are historical and include changes in share price, reinvestment of dividends and capital gains, and the effects of any sales charges.

Semiannual Report

If more than one address is listed, please locate the address that is closest to you. We'll give your correspondence immediate attention and send you written confirmation upon completion of your request.

(letter_graphic)Making Changes

To Your Account

(such as changing name, address, bank, etc.)

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0002

(letter_graphic)For Non-Retirement

Accounts

Buying shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0003

Overnight Express

Fidelity Investments

2300 Litton Lane - KH1A

Hebron, KY 41048

Selling shares

Fidelity Investments

P.O. Box 660602

Dallas, TX 75266-0602

Overnight Express

Fidelity Investments

Attn: Redemptions - CP6I

400 East Las Colinas Blvd.

Irving, TX 75039-5587

General Correspondence

Fidelity Investments

P.O. Box 500

Merrimack, NH 03054-0500

(letter_graphic)For Retirement

Accounts

Buying shares

Fidelity Investments

P.O. Box 770001

Cincinnati, OH 45277-0003

Selling shares

Fidelity Investments

P.O. Box 660602

Dallas, TX 75266-0602

Overnight Express

Fidelity Investments

Attn: Redemptions - CP6R

400 East Las Colinas Blvd.

Irving, TX 75039-5587

General Correspondence

Fidelity Investments

P.O. Box 500

Merrimack, NH 03054-0500

Semiannual Report

For directions and hours,

please call 1-800-544-9797.

Arizona

7373 N. Scottsdale Road

Scottsdale, AZ

California

815 East Birch Street

Brea, CA

851 East Hamilton Avenue

Campbell, CA

527 North Brand Boulevard

Glendale, CA

19200 Von Karman Avenue

Irvine, CA

10100 Santa Monica Blvd.

Los Angeles, CA

251 University Avenue

Palo Alto, CA

1760 Challenge Way

Sacramento, CA

7676 Hazard Center Drive

San Diego, CA

8 Montgomery Street

San Francisco, CA

950 Northgate Drive

San Rafael, CA

1400 Civic Drive

Walnut Creek, CA

6300 Canoga Avenue

Woodland Hills, CA

Colorado

1625 Broadway

Denver, CO

Connecticut

48 West Putnam Avenue

Greenwich, CT

265 Church Street

New Haven, CT

300 Atlantic Street

Stamford, CT

29 South Main Street

West Hartford, CT

Delaware

222 Delaware Avenue

Wilmington, DE

Florida

4400 N. Federal Highway

Boca Raton, FL

90 Alhambra Plaza

Coral Gables, FL

4090 N. Ocean Boulevard

Ft. Lauderdale, FL

1907 West State Road 434

Longwood, FL

8880 Tamiami Trail, North

Naples, FL

2401 PGA Boulevard

Palm Beach Gardens, FL

8065 Beneva Road

Sarasota, FL

1502 N. Westshore Blvd.

Tampa, FL

Georgia

3445 Peachtree Road, N.E.

Atlanta, GA

1000 Abernathy Road

Atlanta, GA

Illinois

One North Franklin Street

Chicago, IL

1415 West 22nd Street

Oak Brook, IL

1700 East Golf Road

Schaumburg, IL

3232 Lake Avenue

Wilmette, IL

Indiana

4729 East 82nd Street

Indianapolis, IN

Maine

Three Canal Plaza

Portland, ME

Maryland

7401 Wisconsin Avenue

Bethesda, MD

One W. Pennsylvania Ave.

Towson, MD

Massachusetts

801 Boylston Street

Boston, MA

155 Congress Street

Boston, MA

25 State Street

Boston, MA

300 Granite Street

Braintree, MA

44 Mall Road

Burlington, MA

416 Belmont Street

Worcester, MA

Semiannual Report

Michigan

280 Old N. Woodward Ave.

Birmingham, MI

29155 Northwestern Hwy.

Southfield, MI

Minnesota

7600 France Avenue South

Edina, MN

Missouri

700 West 47th Street

Kansas City, MO

8885 Ladue Road

Ladue, MO

New Jersey

150 Essex Street

Millburn, NJ

56 South Street

Morristown, NJ

501 Route 17, South

Paramus, NJ

New York

1055 Franklin Avenue

Garden City, NY

999 Walt Whitman Road

Melville, L.I., NY

1271 Avenue of the Americas

New York, NY

71 Broadway

New York, NY

350 Park Avenue

New York, NY

North Carolina

4611 Sharon Road

Charlotte, NC

Ohio

600 Vine Street

Cincinnati, OH

28699 Chagrin Boulevard

Woodmere Village, OH

Oregon

16850 SW 72nd Avenue

Tigard, OR

Pennsylvania

1735 Market Street

Philadelphia, PA

439 Fifth Avenue

Pittsburgh, PA

Rhode Island

47 Providence Place

Providence, RI

Tennessee

6150 Poplar Avenue

Memphis, TN

Texas

10000 Research Boulevard

Austin, TX

4017 Northwest Parkway

Dallas, TX

1155 Dairy Ashford Street

Houston, TX

2701 Drexel Drive

Houston, TX

400 East Las Colinas Blvd.

Irving, TX

14100 San Pedro

San Antonio, TX

19740 IH 45 North

Spring, TX

Utah

215 South State Street

Salt Lake City, UT

Virginia

1861 International Drive

McLean, VA

Washington

411 108th Avenue, N.E.

Bellevue, WA

511 Pine Street

Seattle, WA

Washington, DC

1900 K Street, N.W.

Washington, DC

Wisconsin

595 North Barker Road

Brookfield, WI

Fidelity Brokerage Services, Inc., 100 Summer St., Boston, MA 02110 Member NYSE/SIPC

Semiannual Report

Investment Adviser

Fidelity Management & Research Company

Boston, MA

Investment Sub-Adviser

Fidelity Investments

Money Management, Inc.

Officers

Edward C. Johnson 3d, President

Robert C. Pozen, Senior Vice President

Dwight D. Churchill, Vice President

Boyce I. Greer, Vice President

Robert A. Litterst, Vice President

Eric D. Roiter, Secretary

Robert A. Dwight, Treasurer

Maria F. Dwyer, Deputy Treasurer

Stanley N. Griffith, Assistant Vice President

John H. Costello, Assistant Treasurer

Thomas J. Simpson, Assistant Treasurer

Board of Trustees

Ralph F. Cox *

Phyllis Burke Davis *

Robert M. Gates *

Edward C. Johnson 3d

Donald J. Kirk *

Ned C. Lautenbach*

Peter S. Lynch

Marvin L. Mann *

William O. McCoy *

Gerald C. McDonough *

Robert C. Pozen

Thomas R. Williams *

Advisory Board

J. Michael Cook

Abigail P. Johnson

Marie L. Knowles

* Independent trustees

General Distributor

Fidelity Distributors Corporation

Boston, MA

Transfer and Shareholder

Servicing Agent

Fidelity Service Company, Inc.

Boston, MA

Custodian

The Bank of New York

New York, NY

Fidelity's Taxable

Money Market Funds

Fidelity® Cash Reserves

Fidelity Daily Income Trust

Fidelity U.S. Government Reserves

Spartan® Money Market Fund

Spartan U.S. Government

Money Market Fund

Spartan U.S. Treasury

Money Market Fund

The Fidelity Telephone Connection

Mutual Fund 24-Hour Service

Exchanges/Redemptions

and Account Assistance 1-800-544-6666

Product Information 1-800-544-6666

Retirement Accounts 1-800-544-4774 (8 a.m. - 9 p.m.)

TDD Service 1-800-544-0118

for the deaf and hearing impaired

(9 a.m. - 9 p.m. Eastern time)

Fidelity Automated Service

Telephone (FAST®) (automated graphic) 1-800-544-5555

(automated graphic) Automated line for quickest service

(Fidelity Investment logo)(registered trademark)

Corporate Headquarters

82 Devonshire St., Boston, MA 02109

www.fidelity.com

SPU-SANN-1200 119007

1.538283.103

Spartan®

Fund

Semiannual Report

October 31, 2000

(2_fidelity_logos)(Registered_Trademark)

|

President's Message |

3 |

Ned Johnson on investing strategies. |

|

Performance |

4 |

How the fund has done over time. |

|

Fund Talk |

6 |

The manager's review of fund performance, strategy and outlook. |

|

Investment Changes |

8 |

A summary of major shifts in the fund's

investments over the past six months |

|

Investments |

9 |

A complete list of the fund's investments. |

|

Financial Statements |

11 |

Statements of assets and liabilities,

operations, and changes in net assets, |

|

Notes |

15 |

Notes to the financial statements. |

|

|

|

|

To reduce expenses, only one copy of most financial reports and prospectuses may be mailed to households, even if more than one person in the household has an account in the fund. Call Fidelity at 1-800-544-8544 if you need additional copies of financial reports or prospectuses. If you do not want the mailing of these documents to be combined with those for other members of your household, contact Fidelity in writing at P.O. Box 5000, Cincinnati, OH 45273-8692.

Third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Semiannual Report

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

A sixth-straight year of double-digit positive returns for the Dow Jones Industrial Average, NASDAQ and S&P 500® could be in jeopardy unless the U.S. stock market shows marked improvement in the final two months of 2000. Through October, all three indexes had negative year-to-date returns. On the other hand, most fixed-income sectors were solidly in the black. Treasuries and other long-term government securities led the way, returning nearly 14%.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

First, investors are encouraged to take a long-term view of their portfolios. If you can afford to leave your money invested through the inevitable up and down cycles of the financial markets, you will greatly reduce your vulnerability to any single decline. We know from experience, for example, that stock prices have gone up over longer periods of time, have significantly outperformed other types of investments and have stayed ahead of inflation.

Second, you can further manage your investing risk through diversification. A stock mutual fund, for instance, is already diversified, because it invests in many different companies. You can increase your diversification further by investing in a number of different stock funds, or in such other investment categories as bonds. You should also keep money you'll need in the near future in a more stable investment.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Semiannual Report

To evaluate a money market fund's historical performance, you can look at either total return or yield. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income. Yield measures the income paid by a fund. Since a money market fund tries to maintain a $1 share price, yield is an important measure of performance. If Fidelity had not reimbursed certain fund expenses, the past 10 year total return would have been lower.

Cumulative Total Returns

|

Periods ended October 31, 2000 |

Past 6 |

Past 1 |

Past 5 |

Past 10 |

|

Spartan US Treasury Money Market |

2.92% |

5.53% |

27.57% |

58.29% |

|

Treasury Retail Money Market |

2.77% |

5.23% |

26.14% |

55.26% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, six months, one year, five years or 10 years. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. To measure how the fund's performance stacked up against its peers, you can compare it to the treasury retail money market funds average, which reflects the performance of treasury retail money market funds with similar objectives tracked by iMoneyNet, Inc. The past six months average represents a peer group of 36 money market funds.

Average Annual Total Returns

|

Periods ended October 31, 2000 |

|

Past 1 |

Past 5 |

Past 10 |

|

Spartan US Treasury Money Market |

|

5.53% |

4.99% |

4.70% |

|

Treasury Retail Money Market |

|

5.23% |

4.75% |

4.49% |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year.

Semiannual Report

Performance - continued

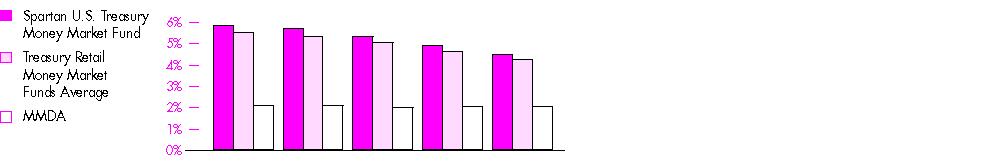

Yields

|

|

10/31/00 |

8/1/00 |

5/2/00 |

2/1/00 |

11/2/99 |

|

Spartan U.S. Treasury |

5.90% |

5.77% |

5.40% |

4.97% |

4.56% |

|

Treasury Retail Money Market Funds Average |

5.58% |

5.38% |

5.12% |

4.68% |

4.29% |

|

|

11/1/00 |

8/2/00 |

5/3/00 |

2/2/00 |

11/3/99 |

|

MMDA |

2.11% |

2.12% |

2.03% |

2.07% |

2.07% |

Yield refers to the income paid by the fund over a given period. Yields for money market funds are usually for seven-day periods, expressed as annual percentage rates. A yield that assumes income earned is reinvested or compounded is called an effective yield. The table above shows the fund's current seven-day yield at quarterly intervals over the past year. You can compare these yields to the treasury retail money market funds average and the bank money market deposit account (MMDA) average. Figures for the treasury retail money market funds average are from iMoneyNet, Inc. The MMDA average is supplied by BANK RATE MONITOR(TM).

Comparing

Performance

There are some important differences between a bank money market deposit account (MMDA) and a money market fund. First, the U.S. government neither insures nor guarantees a money market fund. In fact, there is no assurance that a money market fund will maintain a $1 share price. Second, a money market fund returns to its shareholders income earned by the fund's investments after expenses. This is in contrast to banks, which set their MMDA rates periodically based on current interest rates, competitors' rates, and internal criteria.

3A money market fund's total returns and yields will vary, and reflect past results rather than predict future performance.

Semiannual Report

An interview with Robert Litterst, Portfolio Manager of Spartan U.S. Treasury Money Market Fund

Q. Bob, what was the investment environment like during the six months that ended October 31, 2000?

A. Market expectations shifted dramatically from the beginning of the period. In May, the Federal Reserve Board raised the rates banks charge each

other for overnight loans - known as the fed funds target rate - continuing a rate-hike policy that had started in mid-1999. Sentiment in the market

reflected the belief that the Fed would continue hiking short-term rates at least through the end of 2000. However, economic indicators emerged showing

that the Fed's rate hikes were beginning to take effect, and the torrid pace of economic growth that prevailed over the past year was moderating. In

addition to the Fed's rate hikes, rising energy prices and a struggling stock market had a dampening effect on the economy. The slowdown did not develop

into something worse primarily because consumer spending - which represents about two-thirds of gross domestic product - remained solid. Consumer

activity was underpinned by a strong job market, solid income gains and high levels of consumer confidence. Despite higher energy prices, inflation

remained under control, helped by intense competition that limited pricing power and surging productivity growth that offset higher wages and benefits. As

market participants realized that the Fed would not have to raise rates as much as previously expected, market rates began to fall. By the end of the

period, market rates looking out to 2001 priced in the likelihood that the next Fed move would actually be a rate cut. The Fed publicly maintained a

cautious stance, indicating a continued bias toward raising rates in the future, saying that the risks of higher inflation outweighed those of a faltering

economy. (Portfolio Manager photograph)

Q. Were there any developments of note within the Treasury market itself?

A. Yes, there were. The federal government is currently generating a large budget surplus. As a result, the Treasury's financing needs have declined sharply, and the Treasury is buying back Treasury securities with longer maturities while reducing issuance overall. One maturity in particular where issuance was reduced was the one-year Treasury bill. At the same time, the Treasury increased issuance of three- and six-month Treasury securities in order to maintain liquidity in the market for that maturity range, where demand is stronger. Since the fund must maintain an average maturity of 90 days or less, this three- to six-month maturity area receives much more of my focus than the one-year area. The additional supply created a significant number of opportunities for me to buy three- and six-month Treasuries at very attractive yields.

Semiannual Report

Fund Talk: The Manager's Overview - continued

Q. What was your strategy during the period?

A. During the past six months, the fund's average maturity fluctuated from the low 50-day range to the low 80-day range. The fund's average maturity was more the result of a number of individual purchases of securities offering attractive values than an explicit attempt to target a specific average maturity. In this context, I tried to keep the fund's average maturity within about 10 to 15 days of its peer group, buying securities generally in the one- to six-month maturity range.

Q. How did the fund perform?

A. The fund's seven-day yield on October 31, 2000, was 5.90%, compared to 5.41% six months ago. For the six months that ended October 31, 2000, the fund had a total return of 2.92%, compared to 2.77% for the Treasury retail money market funds average, according to iMoneyNet, Inc.

Q. What is your outlook?

A. The Federal Reserve appears to have achieved its goal of a soft landing, where economic growth slows to a sustainable, non-inflationary pace, but not so much that the economy enters a recession. In this environment, the Fed is likely to maintain a stable monetary policy. However, if growth slows sharply or if fragile financial conditions in certain parts of the world deteriorate into crises, the Fed does have the flexibility to lower rates to restore confidence and liquidity. I plan to continue to pursue opportunities that offer favorable risk and reward trade-offs for shareholders. Also, I expect to maintain an average maturity moderately longer than my peers.

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fund Facts

Goal: to maintain as high a level of income as is consistent with security of principal and liquidity by investing in U.S. Treasury money market securities whose interest is free from state and local taxes, repurchase agreements, and reverse repurchase agreements

Fund number: 415

Trading symbol: FDLXX

Start date: January 5, 1988

Size: as of October 31, 2000, more than $1.9 billion

Manager: Robert Litterst, since 1997; manager, several Fidelity and Spartan taxable money market funds; joined Fidelity in 1991

3Semiannual Report

|

Maturity Diversification |

|||

|

Days |

% of fund's investments 10/31/00 |

% of fund's investments 4/30/00 |

% of fund's |

|

0 - 30 |

26.0 |

11.7 |

33.5 |

|

31 - 90 |

25.9 |

61.1 |

11.7 |

|

91 - 180 |

43.4 |

24.4 |

50.8 |

|

181 - 397 |

4.7 |

2.8 |

4.0 |

|

Weighted Average Maturity |

|||

|

|

10/31/00 |

4/30/00 |

10/31/99 |

|

Spartan U.S. Treasury |

80 Days |

54 Days |

72 Days |

|

Treasury Retail Money Market Funds Average * |

62 Days |

51 Days |

66 Days |

|

Asset Allocation (% of fund's net assets) |

|||||||

|

As of October 31, 2000 |

As of April 30, 2000 |

||||||

|

U.S. Treasury Bills 63.9% |

|

|

U.S. Treasury Bills 45.8% |

|

||

|

U.S. Treasury |

|

|

U.S. Treasury |

|

||

*Source: iMoneyNet, Inc.®

Semiannual Report

(Unaudited)

Showing Percentage of Net Assets

|

U.S. Treasury Obligations - 110.6% |

||||

|

Due Date |

Annualized Yield at Time of Purchase |

Principal Amount (000s) |

Value (Note 1) (000s) |

|

|

U.S. Treasury Bills - 63.9% |

||||

|

11/2/00 |

6.17% |

$ 37,348 |

$ 37,342 |

|

|

11/2/00 |

6.20 |

50,358 |

50,349 |

|

|

11/9/00 |

6.01 |

40,000 |

39,947 |

|

|

11/16/00 |

6.18 |

115,639 |

115,346 |

|

|

11/16/00 |

6.20 |

53,864 |

53,727 |

|

|

12/21/00 |

6.44 |

250,000 |

247,785 |

|

|

1/4/01 |

6.17 |

65,381 |

64,675 |

|

|

1/4/01 |

6.19 |

60,000 |

59,350 |

|

|

1/11/01 |

6.17 |

10,769 |

10,640 |

|

|

1/11/01 |

6.20 |

60,000 |

59,278 |

|

|

1/25/01 |

6.27 |

75,000 |

73,907 |

|

|

1/25/01 |

6.28 |

25,000 |

24,635 |

|

|

2/1/01 |

6.29 |

130,000 |

127,966 |

|

|

2/1/01 |

6.32 |

45,000 |

44,296 |

|

|

2/8/01 |

6.25 |

20,000 |

19,667 |

|

|

2/22/01 |

6.27 |

60,000 |

58,855 |

|

|

2/22/01 |

6.29 |

15,000 |

14,713 |

|

|

3/1/01 |

6.28 |

30,000 |

29,391 |

|

|

3/29/01 |

6.17 |

115,000 |

112,161 |

|

|

|

1,244,030 |

|||

|

U.S. Treasury Notes - 18.0% |

||||

|

11/15/00 |

6.39 |

50,000 |

49,985 |

|

|

11/15/00 |

6.48 |

20,000 |

19,994 |

|

|

11/15/00 |

6.52 |

11,496 |

11,492 |

|

|

11/30/00 |

6.14 |

11,888 |

11,872 |

|

|

11/30/00 |

6.16 |

30,000 |

29,959 |

|

|

11/30/00 |

6.30 |

25,000 |

24,963 |

|

|

12/31/00 |

6.36 |

17,261 |

17,200 |

|

|

1/31/01 |

6.29 |

35,000 |

34,831 |

|

|

2/28/01 |

6.18 |

125,000 |

124,707 |

|

|

2/28/01 |

6.29 |

25,000 |

24,939 |

|

|

|

349,942 |

|||

|

U.S. Treasury Notes - Principal Strips - 28.7% |

||||

|

11/15/00 |

6.17 |

30,000 |

29,926 |

|

|

11/15/00 |

6.21 |

35,000 |

34,916 |

|

|

11/15/00 |

6.31 |

50,000 |

49,879 |

|

|

2/15/01 |

6.18 |

44,000 |

43,219 |

|

|

2/15/01 |

6.23 |

25,000 |

24,552 |

|

|

2/15/01 |

6.24 |

20,000 |

19,640 |

|

|

2/15/01 |

6.26 |

10,000 |

9,820 |

|

|

2/15/01 |

6.27 |

25,000 |

24,548 |

|

|

U.S. Treasury Obligations - continued |

||||

|

Due Date |

Annualized Yield at Time of Purchase |

Principal Amount (000s) |

Value (Note 1) (000s) |

|

|

U.S. Treasury Notes - Principal Strips - continued |

||||

|

2/15/01 |

6.30% |

$ 100,000 |

$ 98,180 |

|

|

2/15/01 |

6.31 |

30,000 |

29,453 |

|

|

2/15/01 |

6.33 |

30,000 |

29,452 |

|

|

2/15/01 |

6.35 |

25,000 |

24,541 |

|

|

2/15/01 |

6.71 |

40,000 |

39,244 |

|

|

5/15/01 |

6.31 |

20,000 |

19,343 |

|

|

5/15/01 |

6.47 |

15,000 |

14,500 |

|

|

5/15/01 |

6.86 |

20,000 |

19,304 |

|

|

7/31/01 |

6.53 |

25,000 |

23,825 |

|

|

8/15/01 |

6.37 |

25,000 |

23,794 |

|

|

|

558,136 |

|||

|

|

|

||

|

TOTAL INVESTMENT PORTFOLIO - 110.6% |

2,152,108 |

||

|

|

|

|

|

|

NET OTHER ASSETS - (10.6)% |

(206,698) |

||

|

NET ASSETS - 100% |

$ 1,945,410 |

||

|

Total Cost for Income Tax Purposes $ 2,152,108 |

|

Income Tax Information |

|

At April 30, 2000, the fund had a capital loss carryforward of approximately $52,000 of which $32,000 and $20,000 will expire on April 30, 2004 and 2008, respectively. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Assets and Liabilities

|

Amounts in thousands (except per share amount) |

October 31, 2000 (Unaudited) |

|

|

Assets |

|

|

|

Investment in securities, at value - |

|

$ 2,152,108 |

|

Receivable for investments sold |

|

244,910 |

|

Receivable for fund shares sold |

|

5,128 |

|

Interest receivable |

|

5,583 |

|

Total assets |

|

2,407,729 |

|

Liabilities |

|

|

|

Payable to custodian bank |

$ 1 |

|

|

Payable for investments purchased |

375,751 |

|

|

Payable for fund shares purchased |

277 |

|

|

Distributions payable |

547 |

|

|

Accrued management fee |

729 |

|

|

Payable for reverse repurchase agreements |

84,994 |

|

|

Other payables and accrued expenses |

20 |

|

|

Total liabilities |

|

462,319 |

|

Net Assets |

|

$ 1,945,410 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 1,945,298 |

|

Accumulated net realized gain (loss) on investments |

|

112 |

|

Net Assets, for 1,945,167 shares outstanding |

|

$ 1,945,410 |

|

Net Asset Value, offering price and redemption price per share ($1,945,410 ÷ 1,945,167 shares) |

|

$1.00 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Operations

|

Amounts in thousands |

Six months ended October 31, 2000 (Unaudited) |

|

|

Investment Income Interest |

|

$ 60,015 |

|

Expenses |

|

|

|

Management fee |

$ 4,375 |

|

|

Non-interested trustees' compensation |

6 |

|

|

Interest |

76 |

|

|

Total expenses before reductions |

4,457 |

|

|

Expense reductions |

(20) |

4,437 |

|

Net investment income |

|

55,578 |

|

Net Realized Gain (Loss) on Investments |

|

226 |

|

Net increase in net assets resulting from operations |

|

$ 55,804 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Changes in Net Assets

|

Amounts in thousands |

Six months ended

October 31, 2000 |

Year ended |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

$ 55,578 |

$ 96,864 |

|

Net realized gain (loss) |

226 |

(19) |

|

Net increase (decrease) in net assets resulting |

55,804 |

96,845 |

|

Distributions to shareholders from net investment income |

(55,578) |

(96,864) |

|

Share transactions at net asset value of $1.00 per share |

520,520 |

1,802,762 |

|

Reinvestment of distributions from net investment income |

51,987 |

90,125 |

|

Cost of shares redeemed |

(627,087) |

(1,982,838) |

|

Net increase (decrease) in net assets and shares resulting from share transactions |

(54,580) |

(89,951) |

|

Total increase (decrease) in net assets |

(54,354) |

(89,970) |

|

Net Assets |

|

|

|

Beginning of period |

1,999,764 |

2,089,734 |

|

End of period |

$ 1,945,410 |

$ 1,999,764 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

|

|

Six months ended October 31, 2000 |

Years ended April 30, |

||||

|

|

(Unaudited) |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value, beginning of period |

$ 1.000 |

$ 1.000 |

$ 1.000 |

$ 1.000 |

$ 1.000 |

$ 1.000 |

|

Income from Investment

Operations |

.029 |

.047 |

.046 |

.050 |

.048 |

.051 |

|

Less Distributions |

|

|

|

|

|

|

|

From net investment income |

(.029) |

(.047) |

(.046) |

(.050) |

(.048) |

(.051) |

|

Net asset value, |

$ 1.000 |

$ 1.000 |

$ 1.000 |

$ 1.000 |

$ 1.000 |

$ 1.000 |

|

Total Return B, C |

2.92% |

4.81% |

4.67% |

5.08% |

4.92% |

5.25% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

|

Net assets, end of period (in millions) |

$ 1,945 |

$ 2,000 |

$ 2,090 |

$ 1,913 |

$ 1,911 |

$ 1,795 |

|

Ratio of expenses to average net assets |

.46% A |

.45% |

.47% |

.46% |

.45% |

.45% |

|

Ratio of expenses to average net assets after expense reductions |

.46% A |

.45% |

.46% D |

.46% |

.45% |

.43% D |

|

Ratio of net investment income to average net assets |

5.71% A |

4.70% |

4.57% |

4.96% |

4.82% |

5.14% |

A Annualized

B The total returns would have been lower had certain expenses not been reduced during the periods shown.

C Total returns do not include the account closeout fee and for periods of less than one year are not annualized.

D FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

For the period ended October 31, 2000 (Unaudited)

1. Significant Accounting Policies.

Spartan U.S. Treasury Money Market Fund (the fund) is a fund of Fidelity Hereford Street Trust (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware business trust. The financial statements have been prepared in conformity with generally accepted accounting principles which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. As permitted under Rule 2a-7 of the 1940 Act, and certain conditions therein, securities are valued initially at cost and thereafter assume a constant amortization to maturity of any discount or premium.