|

|

|

|

|

Previous: TELCOM SEMICONDUCTOR INC, 8-K, EX-99, 2000-11-20 |

Next: SECURITY LIFE SEPARATE ACCOUNT L1, S-6, EX-1.A(5)(A)(VI), 2000-11-20 |

As filed with the Securities and Exchange Commission on November 20, 2000

Registration No. ___-_____

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM S-6

FOR REGISTRATION UNDER THE SECURITIES ACT OF 1933

OF SECURITIES OF UNIT INVESTMENT TRUSTS

REGISTERED ON FORM N-8B-2

Initial Registration

_________________

SECURITY LIFE SEPARATE ACCOUNT L1

(Exact Name of Trust)

SECURITY LIFE OF DENVER INSURANCE COMPANY

(Name of Depositor)

1290 Broadway

Denver, Colorado 80203-5699

(Address of Depositor's Principal Executive Offices)

| Copy to: | |

| GARY W. WAGGONER, ESQ. | KIMBERLY J. SMITH, ESQ. |

| Security Life of Denver Insurance Company | Sutherland Asbill & Brennan LLP |

| 1290 Broadway | 1275 Pennsylvania Avenue, NW |

| Denver, CO 80203-5699 | Washington, D.C. 20004-2415 |

| (202) 383-0314 |

(Name and Address of Agent for Service)

____________________________

Approximate date of proposed public offering: as soon as practicable after the effective date of this Registration Statement.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Title of securities being registered: Asset Portfolio Manager variable life insurance policies.

SECURITY LIFE SEPARATE ACCOUNT L1 (File No. ___-_____)

Cross-Reference Table

| Form N-8B-2 Item No. | Caption in Prospectus |

| 1, 2 | Cover; Security Life of Denver Insurance Company; Security Life Separate Account L1 |

| 3 | Inapplicable |

| 4 | Security Life of Denver Insurance Company |

| 5, 6 | Security Life Separate Account L1 |

| 7 | Inapplicable |

| 8 | Financial Statements |

| 9 | Inapplicable |

| 10(a), (b), (c), (d), (e) | Policy Summary; Policy Values; Determining Values in the Variable Division; Charges and Deductions; Surrender; Partial Withdrawals; Guaranteed Interest Division; Transfers of Account Value; Right to Exchange Policy; Lapse; Reinstatement; Premiums |

| 10(f) | Voting Privileges; Right to Change Operations |

| 10(g), (h) | Right to Change Operations |

| 10(i) | Tax Considerations; Detailed Information about the Policy; General Policy Provisions; Guaranteed Interest Division |

| 11, 12 | Security Life Separate Account L1 |

| 13 | Policy Summary; Charges and Deductions; Group or Sponsored Arrangements, or Corporate Purchasers |

ii

| Form N-8B-2 Item No. | Caption in Prospectus |

| 14, 15 | Policy Summary; Free Look Period; General Policy Provisions; Applying for a Policy |

| 16 | Premiums; Investment Date and Allocation of Net Premiums; How We Calculate Accumulation Unit Values |

| 17 | Premium Payments Affecting Your Coverage; Surrender; Partial Withdrawal |

| 18 | Policy Summary; Tax Considerations; Detailed Information about the Policy; Security Life Separate Account L1 |

| 19 | Reports to Owners; Notification and Claims Procedures; Performance Information (Appendix C) |

| 20 | See 10(g) & 10(a) |

| 21 | Policy Loans |

| 22 | Policy Summary; Premiums; Grace Period; Security Life Separate Account L1; Detailed Information about the Policy |

| 23 | Inapplicable |

| 24 | Inapplicable |

| 25 | Security Life of Denver Insurance Company |

| 26 | Inapplicable |

| 27, 28, 29, 30 | Security Life of Denver Insurance Company |

| 31, 32, 33, 34 | Inapplicable |

| 35 | Inapplicable |

| 36 | Inapplicable |

iii

| Form N-8B-2 Item No. | Caption in Prospectus |

| 37 | Inapplicable |

| 38, 39, 40, 41(a) | General Policy Provisions; Distribution of the Policies; Security Life of Denver Insurance Company |

| 41(b), 41(c), 42, 43 | Inapplicable |

| 44 | Determining Values in the Variable Division; How We Calculate Accumulation Unit Values |

| 45 | Inapplicable |

| 46 | Partial Withdrawals; Detailed Information about the Policy |

| 47, 48, 49, 50 | Inapplicable |

| 51 | Detailed Information about the Policy |

| 52 | Determining Values in the Variable Division; Right to Change Operations |

| 53(a) | Tax Considerations |

| 53(b), 54, 55 | Inapplicable |

| 56, 57, 58 | Inapplicable |

| 59 | Financial Statements |

iv

Prospectus

ASSET PORTFOLIO MANAGER VARIABLE UNIVERSAL LIFE

A FLEXIBLE PREMIUM VARIABLE UNIVERSAL LIFE INSURANCE POLICY

issued by

Security Life of Denver Insurance Company

and

Security Life Separate Account L1

|

Consider carefully the policy

charges, deductions, and refunds

beginning on page 44 in this

prospectus.

You should read this prospectus and keep it for future reference. A prospectus for each underlying investment portfolio must accompany and should be read together with this prospectus. This policy is not available in all jurisdictions. This policy is not offered in any jurisdiction where this type of offering is not legal. Depending on the state where it is issued, policy features may vary. You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information that is different. Replacing your existing life insurance policy(ies) with this policy may not be beneficial to you. |

Your Policy

Your Premium Payments

Your Account Value

Death Proceeds

* Option 1 - a fixed minimum death benefit;

* Option 2 - a stated death benefit plus your account value; and

* Option 3 - a stated death benefit plus the sum of the

premiums we receive minus partial withdrawals you have

taken; and

Neither the SEC nor any state securities commission has approved these securities or determined that this Prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

This life insurance policy IS NOT a bank deposit or obligation, federally insured or backed by any bank or government agency.

Date of Prospectus ___________________ __, 2000

| ISSUED BY: | Security Life of Denver

Insurance Company

ING Security Life Center 1290 Broadway Denver, CO 80203-5699 (800) 525-9852 |

UNDERWRITTEN BY: | ING America Equities, Inc.

1290 Broadway Denver, CO 80203-5699 (303) 860-2000 |

| THROUGH ITS: | Security Life Separate Account L1 |

| ADMINISTERED BY: | Customer Service Center

P.O. Box 173888 Denver, CO 80217-3888 (800) 848-6362 |

Asset Portfolio Manager 2

TABLE OF CONTENTS

| POLICY SUMMARY | 4 |

| Your Policy | 4 |

| Free Look Period | 4 |

| Premium Payments | 4 |

| Charges and Deductions | 4 |

| Variable Division | 5 |

| Fees and Expenses of the Investment Portfolios | 6 |

| Guaranteed Interest Division | 8 |

| Policy Values | 8 |

| Transfers of Account Value | 9 |

| Special Policy Features | 9 |

| Policy Modification, Termination and Continuation Features | 9 |

| Death Benefits | 10 |

| Tax Considerations | 10 |

|

SECURITY LIFE, THE SEPARATE ACCOUNT

AND THE

INVESTMENT OPTIONS | 12 |

| Security Life of Denver Insurance Company | 12 |

| Security Life Separate Account L1 | 12 |

| Investment Portfolio Objectives | 13 |

| Guaranteed Interest Division | 18 |

| Maximum Number of Investment Options | 19 |

| DETAILED INFORMATION ABOUT THE POLICY | 19 |

| Applying for a Policy | 19 |

| Temporary Insurance | 19 |

| Policy Issuance | 20 |

| Premiums | 20 |

| Premium Payments Affect Your Coverage | 22 |

| Death Benefits | 22 |

| Riders | 28 |

| Special Features | 29 |

| Policy Values | 31 |

| Transfers of Account Value | 32 |

| Dollar Cost Averaging | 33 |

| Automatic Rebalancing | 33 |

| Policy Loans | 34 |

| Partial Withdrawals | 35 |

| Lapse | 36 |

| Reinstatement | 37 |

| Surrender | 38 |

| General Policy Provisions | 38 |

| Free Look Period | 38 |

| Your Policy | 38 |

| Guaranteed Issue | 39 |

| Age | 39 |

| Ownership | 39 |

| Beneficiary(ies) | 39 |

| Collateral Assignment | 39 |

| Incontestability | 40 |

| Misstatements of Age or Gender | 40 |

| Suicide | 40 |

| Transaction Processing | 40 |

| Notification and Claims Procedures | 40 |

| Telephone Privileges | 41 |

| Non-participation | 41 |

| Distribution of the Policies | 41 |

|

Advertising Practices and Sales Literature | 42 |

| Settlement Provisions | 42 |

| Administrative Information About the Policy | 42 |

| CHARGES AND DEDUCTIONS | 44 |

| Deductions from Premiums | 44 |

| Monthly Deductions from Account Value | 45 |

| Policy Transaction Fees | 46 |

| Surrender Charge | 47 |

| Group or Sponsored Arrangements, or Corporate Purchasers | 48 |

| TAX CONSIDERATIONS | 49 |

| Tax Status of the Policy | 49 |

|

Diversification and Investor Control Requirements | 50 |

| Tax Treatment of Policy Death Benefits | 50 |

| Modified Endowment Contracts | 50 |

| Multiple Policies | 51 |

|

Distributions Other than Death Benefits from

Modified Endowment Contracts | 51 |

|

Distributions Other than Death Benefits from

Policies That Are Not Modified Endowment Contracts | 51 |

| Investment in the Policy | 51 |

| Policy Loans | 51 |

| Section 1035 Exchanges | 52 |

| Continuation of Policy Beyond Age 100 | 52 |

| Tax-exempt Policy Owners | 52 |

| Possible Tax Law Changes | 52 |

| Changes to Comply with the Law | 52 |

| Other | 52 |

| ADDITIONAL INFORMATION | 54 |

| Directors and Officers | 54 |

| Regulation | 55 |

| Legal Matters | 55 |

| Legal Proceedings | 55 |

| Experts | 55 |

| Registration Statement | 55 |

| INDEX OF SPECIAL TERMS | 56 |

| FINANCIAL STATEMENTS | 57 |

| APPENDIX A | 60 |

| APPENDIX B | 61 |

| APPENDIX C | 62 |

Asset Portfolio Manager 3

Your policy provides life insurance protection on the insured person. The policy includes the basic policy, applications and riders or endorsements. As long as the policy remains in force, we pay a death benefit at the death of the insured person. While your policy is in force, you may access a portion of your policy value by taking loans or partial withdrawals. You may surrender your policy for its net cash surrender value. At the policy anniversary nearest the insured person's 100th birthday if the insured person is still alive you may surrender your policy or continue it under the continuation of coverage option. See Policy Maturity, page 30 and Continuation of Coverage, page 30.

Life insurance is not a short-term investment. You should evaluate your need for life insurance coverage and this policy's long-term investment potential and risks before purchasing a policy.

Within limits as specified by law, you have the right to examine your policy and return it for a refund of all premium payments we have received or the account value, if you are not satisfied for any reason. The policy is then void. See Free Look Period, page 38.

The policy is a flexible premium policy because the amount and frequency of the premium payments you make may vary within limits. You must make premium payments:

Depending on the amount of premium you choose to pay, it may not be enough to keep your policy or certain riders in force. See Premium Payments Affect Your Coverage, page 22.

Allocation of Net Premiums

This policy has premium-based charges which are subtracted from your payments. We add the balance, or net premium, to your policy based on your investment instructions. You may allocate the net premium among one or more variable investment options and the guaranteed interest division. See Investment Date and Allocation of Net Premiums, page 21.

All charges presented here are current unless stated otherwise.

____________________

This summary highlights some important points about your policy. The policy is more fully described in the attached, complete prospectus. Please read it carefully. "We," "us," "our" and the "company" refer to Security Life of Denver Insurance Company. "You" and "your" refer to the policy owner. The owner is the individual, entity, partnership, representative or party who may exercise all rights over the policy and receive the policy benefits during the insured person's lifetime.

State variations are covered in a special policy form used in that state. This prospectus provides a general description of the policy. Your actual policy and any riders are the controlling documents. If you would like to review a copy of the policy and riders, contact our customer service center or your agent/registered representative.

Asset Portfolio Manager 4

Charges

Other Than Investment Portfolio Annual Expenses

See Charges, Deductions and Refunds, page 44)

| Charge | When Charge is Deducted | Amount Deducted |

| Tax Charges | Each premium payment received | 2.5% for state and local taxes; 1.5% for estimated federal income tax treatment of deferred acquisition costs. |

| Sales Charge | Each premium payment received | For segment years 1-5, 6% sales charge on amount up to target premium; for segment years 6+, 3.5% sales charge on amount up to target premium. |

| Surrender Charge | First nine policy or segment years | Dollar amount for each $1,000 of stated death benefit; surrender charge will vary by issue age and will decline to zero in the tenth policy or segment year. |

| Mortality & Expense Risk Charge | Monthly from account value | 0.075% in policy years 1-10 (0.90% on an annual basis); 0.0375% in policy years 11-20 (0.45% on an annual basis); 0% thereafter. |

| Policy Charge | Monthly from account value | $15 per month for first three policy years; $7.50 per month thereafter. |

| Administrative Charge | Monthly from account value | Dollar amount for each $1,000 of death benefit; applied to first $5 million of death benefit, based on original issue age and policy duration. |

| Cost of Insurance Charge | Monthly from account value | Varies based on current cost of insurance rates and net amount at risk. |

| Rider Charges (excluding Guaranteed Minimum Death Benefit Charge) | Monthly from account value | Varies depending on the rider benefits you choose. |

| Partial Withdrawal Fee | Transaction date from account value | Up to $25. |

| Illustration Fee | Transaction date from account value | One free illustration per policy year; thereafter, $25 per illustration. |

| Guaranteed Minimum Death Benefit Charge | Monthly from account value | Currently, $0.005 per $1,000 of the stated death benefit during guarantee period. |

If you invest in the variable investment options, you may make or lose money depending on market conditions. The variable investment options are described in the prospectuses for the underlying investment portfolios. Each investment portfolio has its own investment objective. See Investment Portfolio Objectives, page 13.

Asset Portfolio Manager 5

Fees and Expenses of the Investment Portfolios

The separate account purchases shares of the underlying investment portfolios, at net asset value. This price reflects investment management fees, any 12b-1 fees and other direct expenses deducted from the portfolio assets. This table describes these fees and expenses in gross amounts and net amounts after waiver or reimbursement of fees or expenses by the investment portfolio advisers. Waivers or reimbursements are voluntary and subject to change. The portfolio expense information was provided to us by the portfolios and we have not independently verified this information.

These expenses are not direct charges against variable division assets or reductions from contract values. Rather, these expenses are included in computing each underlying portfolio's net asset value, which is the share price used to calculate the unit values of the variable investment options. For a more complete description of the portfolios' costs and expenses, see the prospectuses for the portfolios.

Asset Portfolio Manager 6

Investment Portfolio Annual Expenses (As a Percentage of Portfolio Average Net Assets)

| Portfolio | Investment Management Fees | 12b-1 Fees | Other Expenses | Total Portfolio Expenses | Fees and Expenses Waived or Reimbursed | Total Net Portfolio Expenses |

| AIM Variable Insurance Funds | ||||||

| AIM V.I. Capital Appreciation Fund | 0.62% | N/A | 0.11% | 0.73% | N/A | 0.73% |

| AIM V.I. Government Securities Fund | 0.50% | N/A | 0.40%1 | 0.90% | N/A | 0.90% |

| The Alger American Fund | ||||||

| Alger American Growth Portfolio | 0.75% | N/A | 0.04% | 0.79% | N/A | 0.79% |

| Alger American Leveraged AllCap Portfolio | 0.85% | N/A | 0.08%2 | 0.93% | N/A | 0.93% |

| Alger American MidCap Growth Portfolio | 0.80% | N/A | 0.05% | 0.85% | N/A | 0.85% |

| Alger American Small Capitalization Portfolio | 0.85% | N/A | 0.05% | 0.90% | N/A | 0.90% |

| Fidelity Variable Insurance Products Fund | ||||||

| VIP Growth Portfolio Service Class | 0.58% | 0.10% | 0.09% | 0.77% | 0.02% | 0.75%3 |

| VIP Overseas Portfolio Service Class | 0.73% | 0.10% | 0.18% | 1.01% | 0.03% | 0.98%3 |

| Fidelity Variable Insurance Products Fund II | ||||||

| VIP II Asset Manager Portfolio Service Class | 0.53% | 0.10% | 0.11% | 0.74% | 0.01% | 0.73%3 |

| VIP II Index 500 Portfolio | 0.24% | N/A | 0.10% | 0.34% | 0.06% | 0.28% |

| The GCG Trust 4 | ||||||

| GCG Trust Liquid Assets Fund | 0.56% | N/A | N/A | 0.56% | N/A | 0.56% |

| INVESCO Variable Investment Funds, Inc. | ||||||

| INVESCO VIF-Equity Income Fund 5 | 0.75% | N/A | 0.44% | 1.19% | 0.02% | 1.17% |

| INVESCO VIF-High Yield Fund 6 | 0.60% | N/A | 0.48% | 1.08% | 0.01% | 1.07% |

| INVESCO VIF-Small Company Growth Fund 7 | 0.75% | N/A | 3.35% | 4.10% | 2.39% | 1.71% |

| INVESCO VIF-Total Return Fund 8 | 0.75% | N/A | 0.55% | 1.30% | 0.13% | 1.17% |

| INVESCO VIF-Utilities Fund 9 | 0.60% | N/A | 1.08% | 1.68% | 0.47% | 1.21% |

| Janus Aspen Series Service Shares 10 | ||||||

| Janus Aspen Aggressive Growth Service Shares | 0.65% | 0.25% | 0.02% | 0.92% | N/A | 0.92% |

| Janus Aspen Growth Service Shares | 0.65% | 0.25% | 0.02% | 0.92% | N/A | 0.92% |

| Janus Aspen International Growth Service Shares | 0.65% | 0.25% | 0.11% | 1.01% | N/A | 1.01% |

| Janus Aspen Worldwide Growth Service Shares | 0.65% | 0.25% | 0.05% | 0.95% | N/A | 0.95% |

| Neuberger Berman Advisers Management Trust | ||||||

| Growth Portfolio | 0.84% | N/A | 0.08% | 0.92% | N/A | 0.92% |

| Limited Maturity Bond Portfolio | 0.65% | N/A | 0.11% | 0.76% | N/A | 0.76% |

| Partners Portfolio | 0.80% | N/A | 0.07% | 0.87% | N/A | 0.87% |

| Van Eck Worldwide Insurance Trust | ||||||

| Worldwide Bond Fund | 1.00% | N/A | 0.22% | 1.22% | N/A | 1.22% |

| Worldwide Emerging Markets Fund | 1.00% | N/A | 0.54% | 1.54% | 0.20%11 | 1.34% |

| Worldwide Hard Assets Fund | 1.00% | N/A | 0.26% | 1.26% | N/A | 1.26% |

| Worldwide Real Estate Fund | 1.00% | N/A | 2.23% | 3.23% | 1.79%12 | 1.44% |

____________________________

Asset Portfolio Manager 7

1Included in AIM V.I. Government Securities Fund's "Other Expenses" is 0.10% of interest expense.

2Included in Alger American Leveraged AllCap portfolio's "Other Expenses" is 0.01% of interest expense.

3Fidelity absorbed a portion of the portfolio and custodian expenses for some portfolios with part of the brokerage commissions and un-invested cash balances. Before this absorption, "Total Portfolio Expenses" are 0.77% for Growth portfolio, 1.01% for Overseas portfolio and 0.74% for Asset Manager portfolio.

4The GCG Trust pays Directed Services, Inc. ("DSI") for its services a monthly management fee based on the annual rates of the average daily net assets of the investment portfolios. DSI (and not the GCG Trust) in turn pays each portfolio manager a monthly fee for managing the assets of the portfolios.

5INVESCO absorbed a portion of VIF-Equity Income Fund's "Other Expenses" and "Total Portfolio Expenses." After this absorption, these expenses are 0.42% and 1.17% respectively.

6INVESCO absorbed a portion of VIF-High Yield Fund's "Other Expenses" and "Total Portfolio Expenses." After this absorption, these expenses are 0.47% and 1.07% respectively.

7INVESCO absorbed a portion of VIF-Small Company Growth Fund's "Other Expenses" and "Total Portfolio Expenses." After this absorption, these expenses are 0.96% and 1.71%, respectively.

8INVESCO absorbed a portion of VIF-Total Return Fund's "Other Expenses" and "Total Portfolio Expenses." After this absorption, these expenses are 0.42% and 1.17%, respectively.

9INVESCO absorbed a portion of VIF-Utilities Fund's "Other Expenses" and "Total Portfolio Expenses." After this absorption, these expenses are 0.61% and 1.21%, respectively.

10Janus Aspen Series Service Shares have a distribution plan or "Rule 12b-1 plan" which is described in the Funds' prospectuses. Expenses are based on the estimated expenses that the Service Shares Class of each Portfolio expects to incur in its initial fiscal year. All expenses are shown without the effect of any expense offset arrangements.

11Van Eck Associates Corporation absorbed expenses exceeding 1.30% of the Fund's average daily assets, effective May 13, 1999.

12Van Eck Associates Corporation absorbed certain expenses exceeding 1.50%. The fund's expenses were also reduced by a fee arrangement based on cash balances left on deposit with the custodian and a directed brokerage arrangement where the fund directs certain portfolio trades to a broker that, in turn, pays a potion of the fund's expenses.

The guaranteed interest division guarantees principal and is part of our general account. Any amount you direct into the guaranteed interest division is credited with interest at a fixed rate. See Guaranteed Interest Division, page 18.

Your policy account value is the amount you have in the guaranteed interest division, plus the amount you have in each variable investment option. If you have an outstanding policy loan, your account value includes the amount in the loan division. See Policy Values, page 31 and Partial Withdrawals, page 35.

Your Account Value in the Variable Division

Accumulation units are the way we measure value in the variable division. Accumulation unit value is the value of one unit of a variable investment option on a valuation date. Each variable investment option has a different accumulation unit value. See Determining Values in the Variable Division, page 31.

The accumulation unit value for each variable investment option reflects the investment performance of the underlying investment portfolio during the valuation period. Each accumulation unit value reflects the expenses of the investment portfolios. See Determining Values in the Variable Division, page 31 and How We Calculate Accumulation Unit Values, page 32.

Asset Portfolio Manager 8

With some limitations, you may make twelve free transfers among the variable investment options or to the guaranteed interest division each policy year. There are restrictions on transfers from the guaranteed interest division. See Transfers of Account Value, page 32 and Policy Transaction Fees, page 46.

Designated Deduction Investment Option

You may designate one investment option from which we will deduct all of your monthly deductions. See Designated Deduction Investment Option, page 29.

Riders

You may attach additional benefits to your policy by rider. In most cases, we deduct a monthly charge from your account value for these benefits. See Riders, page 28.

Dollar Cost Averaging

Dollar cost averaging is a systematic plan of transferring account values to selected investment options. It is intended to protect your policy's value from short-term price fluctuations. However, dollar cost averaging does not assure a profit, nor does it protect against a loss in a declining market. Dollar cost averaging is free. See Dollar Cost Averaging, page 33.

Automatic Rebalancing

Automatic rebalancing periodically reallocates your net account value among your selected investment options to maintain your specified distribution of account value among those investment options. Automatic rebalancing is free. See Automatic Rebalancing, page 33.

Loans

You may take loans against your policy's net cash surrender value. We charge an annual loan interest rate of 3.75% in policy years 1-10 and 3.15% thereafter. We credit an annual interest rate of 3% on amounts held in the loan division as collateral for your loan. See Policy Loans, page 34.

Loans may have tax consequences. See Tax Considerations, page 49.

Partial Withdrawals

You may withdraw part of your net cash surrender value any time after your first policy anniversary. You may make only one partial withdrawal per policy year. Partial withdrawals may reduce your policy's death benefit and will reduce your account value. We assess a fee for each partial withdrawal; surrender charges may apply as well. See Partial Withdrawals, page 35.

Partial withdrawals may have tax consequences. See Tax Considerations, page 49.

Policy Modification, Termination and Continuation Features

Right to Exchange Policy

For 24 months after the policy date you may exchange your policy for a guaranteed policy, unless law requires differently. There is no charge for this exchange. See Right to Exchange Policy, page 30.

Surrender

You may surrender your policy for its net cash surrender value at any time before the death of the insured person. All insurance coverage ends on the date we receive your request. If the surrender charge exceeds the available cash value, there will be no proceeds paid to you on surrender.See Surrender, page 38. A surrender may have tax consequences. See Tax Considerations, page 29.

Lapse

In general, insurance coverage continues as long as your net account value is enough to pay the monthly deductions. However, your policy is guaranteed not to lapse during the guarantee period if you have elected the guaranteed minimum death benefit feature and certain conditions have been met. See Lapse, page 36 and Guaranteed Minimum Death Benefit, page 27.

Reinstatement

You may reinstate your policy and its riders within five years of its lapse if you still own the policy and the insured person meets our underwriting requirement.

Asset Portfolio Manager 9

You will need to give proof of insurability as at policy issue. You will also need to pay required reinstatement premiums.

If the guaranteed minimum death benefit lapses and you do not correct it, this feature terminates. Once it terminates, you cannot reinstate this feature.

If you had a policy loan existing when coverage ended, we will reinstate it with accrued loan interest to the date of the lapse. See Reinstatement, page 37.

Policy Maturity

If the insured person is still living on the maturity date or the policy anniversary nearest the insured person's 100th birthday and you do not choose to let the continuation of coverage feature become effective, you must surrender your policy. We will pay the net account value. Your policy then ends. See Policy Maturity, page 30.

Continuation of Coverage

At the policy anniversary nearest the insured person's 100th birthday, you may choose to let the continuation of coverage feature become effective. See Continuation of Coverage, page 30.

After the death of the insured person, we pay death proceeds to the beneficiary(ies) if your policy is still in force. Based on the death benefit option you have chosen, the base death benefit varies.

We generally require a minimum target death benefit of $100,000 for fully underwritten policies, and $50,000 for guaranteed issue policies. However, we may lower this minimum for group or sponsored arrangements, or corporate purchasers. A separate cost of insurance applies to your base death benefit. See Applying for a Policy, page 19 and Death Benefits, page 22.

You may change your death benefit amount while your policy is in force, subject to certain restrictions. See Changes in Death Benefit Amounts, page 26.

Under current federal income tax law, death benefits of life insurance policies generally are not subject to income tax. In order for this treatment to apply, the policy must qualify as a life insurance contract. We believe it is reasonable to conclude that the policy will qualify as a life insurance contract. See Tax Status of the Policy, page 49.

Assuming the policy qualifies as a life insurance contract under current federal income tax law, your account value earnings are generally not subject to income tax as long as they remain within your policy. However depending on circumstances, the following events may cause taxable consequences for you:

In addition, if your policy is a modified endowment contract, a loan against or secured by the policy may cause income taxation. A penalty tax may be imposed on a distribution from a modified endowment contract as well. See Modified Endowment Contracts, page 50.

In recent years, Congress has adopted new rules relating to life insurance owned by businesses. Any business contemplating the purchase of a new policy or a change in an existing policy should consult a tax adviser.

You should consult a qualified legal or tax adviser before you purchase your policy.

Asset Portfolio Manager 10

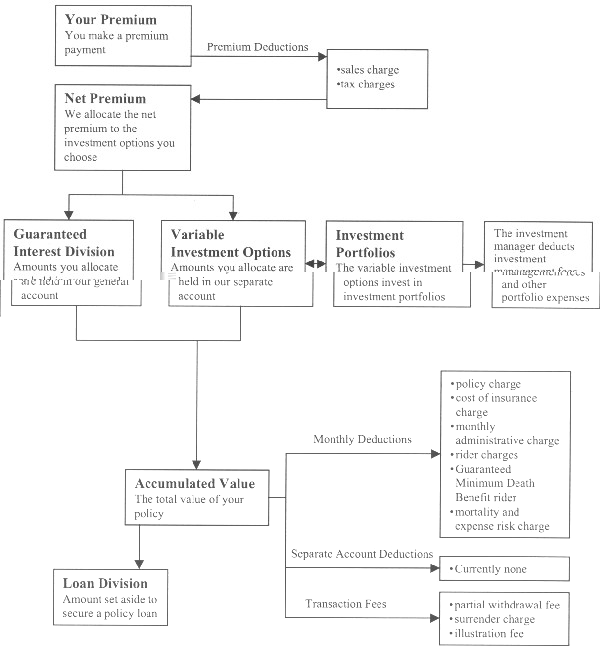

How the Policy Works

|

Asset Portfolio Manager 11

SECURITY LIFE, THE SEPARATE ACCOUNT AND THE INVESTMENT OPTIONS

Security Life of Denver Insurance Company

Security Life of Denver Insurance Company (Security Life) is a stock life insurance company organized under the laws of the State of Colorado in 1929. Our headquarters are located at 1290 Broadway, Denver, Colorado 80203-5699. We are admitted to do business in the District of Columbia and all states except New York. At the close of 1999, the company and its consolidated subsidiaries had over $184.2 billion of life insurance in force. As of December 31, 1999 our total assets were over $11.3 billion and our shareholder's equity was over $899 million.

We have a complete line of life insurance products, including:

Security Life is a wholly owned indirect subsidiary of ING Groep, N.V. ("ING"). ING is one of the world's three largest diversified financial services organizations. ING is headquartered in Amsterdam, The Netherlands. It has consolidated assets over $495.0 billion on a Dutch (modified U.S.) generally accepted accounting principles basis, as of December 31, 1999.

The principal underwriter and distributor for our policies is ING America Equities, Inc. ING America Equities is a stock corporation organized under the laws of the State of Colorado in 1993. It is a wholly owned subsidiary of Security Life and is registered as a broker-dealer with the SEC and the NASD. ING America Equities, Inc. is located at 1290 Broadway, Denver, Colorado 80203-5699.

Security Life Separate Account L1

Separate Account Structure

We established Security Life Separate Account L1 (the separate account) on November 3, 1993, under Colorado's insurance law. It is a unit investment trust, registered with the SEC under the Investment Company Act of 1940. The SEC does not supervise our management of the separate account or Security Life.

The separate account is used to support our variable life insurance policies and for other purposes allowed by law and regulation. We keep the separate account assets separate from our general account and other separate accounts. We may offer other variable life insurance contracts with different benefits and charges that invest in the separate account. We do not discuss these contracts in this prospectus. The separate account may invest in other securities not available for the policy described in this prospectus.

The company owns all the assets in the separate account. We credit gains to or charge losses against the separate account without regard to performance of other investment accounts.

Order of Separate Account Liabilities

Law provides that we may not charge general account liabilities against separate account assets equal to its reserves and other liabilities. This means that if we ever become insolvent, the separate account assets will be used first to pay separate account policy claims. Only if separate account assets remain after these claims have been satisfied can these assets be used to pay other policy owners and creditors.

The separate account may have liabilities from assets credited to other variable life policies offered by the separate account. If the assets of the separate account are greater than required reserves and policy liabilities, we may transfer the excess to our general account.

Investment Options

Investment options include the variable and the guaranteed interest divisions, but not the loan division. The separate account has several variable investment options which invest in shares of underlying investment portfolios. This means that the investment performance of a policy depends on the performance of the investment portfolios you choose. Each investment portfolio has its own investment objective. These investment portfolios are not available directly to individual investors. They are available only as underlying investments for variable annuity and variable life insurance contracts and certain pension accounts.

Asset Portfolio Manager 12

Investment Portfolios

Each of the investment portfolios is a separate series of an open-end management investment company. The investment company receives investment advice from a registered investment adviser who is not associated with us.

The investment portfolios sell shares to separate accounts of insurance companies. These insurance companies may or may not be affiliated with us. This is known as "shared funding." Investment portfolios may sell shares as the underlying investment for both variable annuity and variable life insurance contracts. This process is known as "mixed funding."

The investment portfolios may sell shares to certain qualified pension and retirement plans that qualify under Section 401 of the Internal Revenue Code ("IRC"). As a result, a material conflict of interest may arise between insurance companies, owners of different types of contracts and retirement plans or their participants.

If there is a material conflict, we will consider what should be done, including removing the investment portfolio from the separate account. There are certain risks with mixed and shared funding, and with selling shares to qualified pension and retirement plans. See the investment portfolios' prospectuses.

Investment Portfolio Objectives

Each investment portfolio has a different investment objective that it tries to achieve by following its own investment strategy. The objectives and policies of each investment portfolio affect its return and its risks. With this prospectus, you must receive the current prospectus for each investment portfolio. We summarize the investment objectives for each investment portfolio here. You should read each investment portfolio prospectus.

Certain investment portfolios offered under this policy have investment objectives and policies similar to other funds managed by the portfolio's investment adviser. The investment results of a portfolio may be higher or lower than those of other funds managed by the same adviser. There is no assurance, and no representation is made, that the investment results of any investment portfolio will be comparable to those of another fund managed by the same investment adviser.

Some investment portfolio advisers (or their affiliates) may pay us compensation for servicing, administration or other expenses. The amount of compensation is usually based on the aggregate assets of the investment portfolio from contracts that we issue or administer. Some advisers may pay us more or less than others and our affiliates may pay us significantly more. We receive 12b-1 fees from some investment portfolios.

Asset Portfolio Manager 13

| INVESTMENT PORTFOLIO OBJECTIVES | ||

| Variable Investment Option | Investment Company/ Adviser/ Manager/ Sub-Adviser | Investment Objective |

| AIM V.I. Capital Appreciation Fund | Investment Company:

AIM Variable Insurance Funds Investment Adviser:

|

Seeks growth of capital through investment in common stocks. |

| AIM V.I. Government Securities Fund | Investment Company:

AIM Variable Insurance Funds Investment Adviser:

|

Seeks to achieve high current income consistent with reasonable concern for safety of principal. |

| Alger American Growth Portfolio | Investment Company:

The Alger American Fund Investment Adviser:

|

Seeks long-term capital appreciation by focusing on growing companies that generally have broad product lines, markets, financial resources and depth of management. Under normal circumstances, the portfolio invests primarily in the equity securities of large companies. The portfolio considers a large company to have a market capitalization of $1 billion or greater. |

| Alger American Leveraged AllCap Portfolio | Investment Company:

The Alger American Fund Investment Adviser:

|

Seeks long-term capital appreciation by investing, under normal circumstances, in the equity securities of companies of any size which demonstrate promising growth potential. The portfolio can leverage, that is, borrow money, up to one-third of its total assets to buy additional securities. By borrowing money, the portfolio has the potential to increase its returns if the increase in the value of the securities purchased exceeds the cost of borrowing, including interest paid on the money borrowed. |

| Alger American MidCap Growth Portfolio | Investment Company:

The Alger American Fund Investment Adviser:

|

Seeks long-term capital appreciation by focusing on midsize companies with promising growth potential. Under normal circumstances, the portfolio invests primarily in the equity securities of companies having a market capitalization within the range of companies in the S&P MidCap 400 Index. |

| Alger American Small Capitalization Portfolio | Investment Company:

The Alger American Fund Investment Adviser:

|

Seeks long-term capital appreciation by focusing on small, fast-growing companies that offer innovative products, services or technologies to a rapidly expanding marketplace. Under normal circumstances, the portfolio invests primarily in the equity securities of small capitalization companies. A small capitalization company is one that has a market capitalization within the range of the Russell 2000 Growth Index or the S&P SmallCap 600 Index. |

Asset Portfolio Manager 14

|

INVESTMENT PORTFOLIO OBJECTIVES | ||

| Variable Investment Option | Investment Company/ Adviser/ Manager/ Sub-Adviser | Investment Objective |

| VIP Growth Portfolio Service Class | Investment Company: Fidelity

Variable Insurance Products

Fund

Investment Manager:

|

Seeks capital appreciation by investing in common stocks of companies that it believes have above-average growth potential, either domestic or foreign issuers. |

| VIP Overseas Portfolio Service Class | Investment Company: Fidelity

Variable Insurance Products

Fund

Investment Manager:

|

Seeks long-term growth of capital by investing at least 65% of total assets in foreign securities. |

| VIP II Asset Manager Portfolio Service Class | Investment Company: Fidelity

Variable Insurance Products

Fund II

Investment Manager:

|

Seeks high total return with reduced risk over the long term by allocating its assets among stocks, bonds, and short-term instruments. |

| VIP II Index 500 Portfolio | Investment Company: Fidelity

Variable Insurance Products

Fund II

Investment Manager:

Sub-Adviser:

|

Seeks investment results that correspond to the total return of common stocks publicly traded in the United States as represented by the S&P® 500. |

| Liquid Assets Fund | Investment Company:

The GCG Trust Investment Manager:

Portfolio Manager:

|

Seeks high level of current income consistent with the preservation of capital and liquidity. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. |

| VIF-Equity Income Fund | Investment Company:

INVESCO Variable

Investment Funds, Inc.

Investment Adviser:

Sub-Adviser:

|

Seeks high current income, with growth of capital as a secondary objective by investing at least 65% of its assets in dividend-paying common and preferred stocks. The rest of the fund's assets are invested in debt securities, and lower-grade debt securities. |

Asset Portfolio Manager 15

|

INVESTMENT PORTFOLIO OBJECTIVES | ||

| Variable Investment Option | Investment Company/ Adviser/ Manager/ Sub-Adviser | Investment Objective |

| VIF-High Yield Fund | Investment Company:

INVESCO Variable

Investment Funds, Inc.

Investment Adviser:

Sub-Adviser:

|

Seeks to provide a high level of current income by investing substantially all of its assets in lower-rated debt securities and preferred stock, including securities issued by foreign companies. |

| VIF-Small Company Growth Fund | Investment Company:

INVESCO Variable

Investment Funds, Inc.

Investment Adviser:

Sub-Adviser:

|

Seeks long-term capital growth by investing at least 65% of its assets in equity securities of companies with market capitalizations of $2 billion or less. The remainder of the fund's assets can be invested in a wide range of securities that may or may not be issued by small companies. |

| VIF-Total Return Fund | Investment Company:

INVESCO Variable

Investment Funds, Inc.

Investment Adviser:

Sub-Adviser:

|

Seeks to provide high total return through both growth and current income by investing at least 30% of its assets in common stocks of companies with a strong history of paying regular dividends and 30% of its assets in debt securities. The remaining 40% of the fund is allocated among these and other investments at INVESCO's discretion, based upon current business, economic and market conditions. |

| VIF-Utilities Fund | Investment Company:

INVESCO Variable

Investment Funds, Inc.

Investment Adviser:

Sub-Adviser:

|

Seeks capital appreciation and income by investing at least 80% of its assets in companies doing business in the utilities economic sector. The remainder of the fund's assets are not required to be invested in the utilities economic sector. |

| Aspen Aggressive Growth Portfolio Service Shares | Investment Company:

Janus Aspen Series Investment Adviser:

|

Seeks long-term growth of capital by investing primarily in common stocks selected for their growth potential and normally investing at least 50% of its equity assets in medium-sized companies which fall within the range of companies in the S&P® MidCap 400 Index. |

| Aspen Growth Portfolio Service Shares | Investment Company: Janus

Aspen Series

Investment Adviser:

|

Seeks long-term growth of capital in a manner consistent with preservation of capital by investing primarily in common stocks selected for their growth potential. Although the portfolio can invest in companies of any size, it generally invests in larger, more established companies. |

Asset Portfolio Manager 16

|

INVESTMENT PORTFOLIO OBJECTIVES | ||

| Variable Investment Option | Investment Company/ Adviser/ Manager/ Sub-Adviser | Investment Objective |

| Aspen International Growth Portfolio Service Shares | Investment Company:

Janus Aspen Series Investment Adviser:

|

Seeks long-term growth of capital by investing at least 65% of its total assets in securities of issuers from at least five different countries, excluding the United States. Although the portfolio intends to invest substantially all of its assets in issuers located outside the United States, it may at times invest in U.S. issuers and it may at times invest all of its assets in fewer than five countries or even a single country. |

| Aspen Worldwide Growth Portfolio Service Shares | Investment Company:

Janus Aspen Series Investment Adviser:

|

Seeks long-term growth of capital in a manner consistent with preservation of capital by investing primarily in common stocks of companies of any size throughout the world. The portfolio normally invests in issuers from at least five different countries, including the United States. The portfolio may at times invest in fewer than five countries or even a single country. |

| Growth Portfolio | Investment Company:

Neuberger Berman Advisers

Management Trust

Investment Adviser:

Sub-Adviser:

|

Seeks growth of capital by investing mainly in common stock mid-capitalization companies. |

| Limited Maturity Bond Portfolio | Investment Company:

Neuberger Berman Advisers

Management Trust

Investment Adviser:

Sub-Adviser:

|

Seeks the highest available current income consistent with liquidity and low risk to principal by investing mainly in investment-grade bonds and other debt securities from U.S. Government and corporate issuers. |

| Partners Portfolio | Investment Company:

Neuberger Berman Advisers

Management Trust

Investment Adviser:

Sub-Adviser:

|

Seeks growth of capital by investing mainly in common stock of mid- to large-capitalization companies. |

Asset Portfolio Manager 17

|

INVESTMENT PORTFOLIO OBJECTIVES | ||

| Variable Investment Option | Investment Company/ Adviser/ Manager/ Sub-Adviser | Investment Objective |

| Worldwide Bond Fund | Investment Company:

Van Eck Worldwide Insurance Trust Investment Adviser and

Manager:

|

Seeks high total return--income plus capital appreciation--by investing globally, primarily in a variety of debt securities. |

| Worldwide Emerging Markets Fund | Investment Company:

Van Eck Worldwide Insurance Trust Investment Adviser and

Manager:

|

Seeks long-term capital appreciation by investing in equity securities in emerging markets around the world. |

| Worldwide Hard Assets Fund | Investment Company:

Van Eck Worldwide Insurance Trust Investment Adviser and

Manager:

|

Seeks long-term capital appreciation by investing primarily in "hard asset securities." Hard assets include precious metals, natural resources, real estate and commodities. Income is a secondary consideration. |

| Worldwide Real Estate Fund | Investment Company:

Van Eck Worldwide Insurance Trust Investment Adviser and

Manager:

|

Seeks high total return by investing in equity securities of companies that own significant real estate or that principally do business in real estate. |

You may allocate all or a part of your net premium and transfer your net account value into the guaranteed interest division. The guaranteed interest division guarantees principal and is part of our general account. It pays interest at a fixed rate that we declare.

The general account contains all of our assets other than those held in the separate account (variable investment options) or other separate accounts.

The general account supports our non-variable insurance and annuity obligations. We have not registered interests in the guaranteed interest division under the Securities Act of 1933. Also, we have not registered the guaranteed interest division or the general account as an investment company under the Investment Company Act of 1940 (because of exemptive and exclusionary provisions). This means that the general account, the guaranteed interest division and its interests are generally not subject to regulation under these Acts.

The SEC staff has not reviewed the disclosures in this prospectus relating to the general account and the guaranteed interest division. These disclosures, however, may be subject to certain requirements of the federal securities law regarding accuracy and completeness of statements made.

Asset Portfolio Manager 18

The amount you have in the guaranteed interest division is all of the net premium you allocate to that division, plus transfers you make to the guaranteed interest division plus interest earned.

Amounts you transfer out of or withdraw from the guaranteed interest division reduce this amount. It is also reduced by deductions for charges from your account value allocated to the guaranteed interest division.

We declare the interest rate that applies to all amounts in the guaranteed interest division. This interest rate is never less than the minimum guaranteed interest rate of 3% and will be in effect for at least twelve months. Interest compounds daily at an effective annual rate that equals the declared rate. We credit interest to the guaranteed interest division on a daily basis. We pay interest regardless of the actual investment performance of our account. We bear all of the investment risk for the guaranteed interest division.

Maximum Number of Investment Options

There are three divisions: the variable division, the guaranteed interest division and the loan division. Under the variable division, there are numerous variable investment options. See Security Life Separate Account L1, page 12 and Investment Portfolio Objectives, page 13.

You may invest in a total of eighteen investment options over the life of your policy. Investment options include the variable and the guaranteed interest divisions, but not the loan division.

As an example, if you have had funds in seventeen variable investment options and the guaranteed interest division, these are the only investment options to which you may later add or transfer funds. However, you could still take a policy loan and access the loan division.

You may want to use fewer investment options in the early years of your policy, so that you can invest in others in the future. If you invest in eighteen variable investment options, you will not be able to invest in the guaranteed interest division.

DETAILED INFORMATION ABOUT THE POLICY

This prospectus describes our standard Asset Portfolio Manager variable universal life insurance policy. There may be differences in the policy because of state requirements where we issue your policy. We will describe any such differences in your policy.

You purchase this variable universal life policy by submitting an application to us. On the policy date, the insured person should be no older than age 85. The minimum age to issue a policy for smokers is age 15. For groups, the maximum issue age is 70. The insured person is the person on whose life we issue the policy. See Age, page 39.

You may request that we back-date the policy up to six months to allow the insured person to give proof of a younger age for the purposes of your policy.

We may reduce the minimum death benefit for group or sponsored arrangements, or corporate purchasers. Our underwriting and reinsurance procedures in effect at the time you apply limit the maximum death benefit.

If you apply and qualify, we may issue temporary insurance in an amount equal to the face amount of the permanent insurance for which you applied. The maximum amount of temporary insurance for binding limited life insurance coverage is $3 million, which includes any other in-force coverage you have with us.

Temporary coverage begins when:

Asset Portfolio Manager 19

Temporary life insurance coverage ends on the earliest of:

There is no death benefit under the temporary insurance agreement if:

Before we issue a policy, we require satisfactory evidence of insurability of the insured person and payment of your initial premium. This evidence may include a medical examination and completion of all underwriting and issue requirements.

The policy date shown on your policy schedule determines:

The policy date is not affected by when you receive the policy. We charge monthly deductions from the policy date unless your policy specifies otherwise.

The policy date is determined one of three ways:

Definition of Life Insurance Choice

At policy issue, you may choose one of two tests for the federal income tax definition of life insurance. You cannot change your choice later. The tests are the cash value accumulation test and the guideline premium/cash value corridor test. If you choose the guideline premium/cash value corridor test, we may limit premium payments relative to your policy death benefit under this test. See Tax Status of the Policy, page 49.

You may choose the amount and frequency of premium payments, within limits. You cannot make premium payments after the death of the insured person or after the continuation of coverage period begins. See Continuation of Coverage, page 30.

We consider payments we receive to be premium payments if you do not have an outstanding loan and your policy is not in the continuation of coverage period. After we deduct certain charges from your premium payment, we add the remaining net premium to your policy.

Scheduled Premiums

Your premiums are flexible. You may select your scheduled premium (within our limits) when you apply for your policy. The scheduled premium, shown in your policy and schedule, is the amount you choose to pay over a stated time period. This amount may or may not be enough to keep your policy in force. You may receive premium reminder notices for the scheduled premium on a quarterly, semi-annual or annual basis. You are not required to pay the scheduled premium.

You may choose to pay your premium by electronic funds transfer each month. This option is not available for your initial premium. The financial institution that makes your electronic funds transfer may charge for this service.

You can change the amount of your scheduled premium within our minimum and maximum limits at any time. If you fail to pay your scheduled premium or if you change the amount of your scheduled premium, your policy performance will be affected. During the special continuation period, your scheduled premium should not be less than the minimum annual premium shown in your policy.

Asset Portfolio Manager 20

If you want the guaranteed minimum death benefit, your scheduled premium should not be less than the guarantee period annual premium shown in your policy. See Guaranteed Minimum Death Benefit, page 27.

Unscheduled Premium Payments

Generally speaking, you may make unscheduled premium payments at any time, however:

See Modified Endowment Contracts, page 50 and Changes to Comply with the Law, page 52.

If you have an outstanding policy loan and you make an unscheduled payment, we will consider it a loan repayment, unless you tell us otherwise. If your payment is a loan repayment, we do not take tax or sales charges which apply to premium payments.

Target Premium

Target premium is not based on your scheduled premium. Target premium is actuarially determined based on the age and gender of the insured person. The target premium is used in determining your initial sales charge and the sales compensation we pay. It may or may not be enough to keep your policy in force. You are not required to pay the target premium and there is no penalty for paying more or less. The target premium for your policy and each additional segment is listed in the policy schedule we provide to you. See Premiums, page 20.

Investment Date and Allocation of Net Premiums

The net premium is the balance remaining after we deduct tax and sales charges from your premium payment.

Insurance coverage does not begin until we receive your initial premium. It must be at least the sum of the scheduled premiums due from your policy date through your investment date.

The investment date is the first date we apply the net premium we have received to your policy. If we receive your initial premium after we approve your policy for issue, the investment date is the date we receive your initial premium.

We apply the initial net premium to your policy after:

a)we receive the required amount of premium;

b)all issue requirements have been received by our customer service center; and

c)we approve your policy for issue.

Amounts you designate for the guaranteed interest division will be allocated to that division on the investment date. If your state requires the return of your premium during the free look period, we initially invest amounts you have designated for the variable division in The GCG Trust Liquid Assets fund. We later transfer these amounts from the Liquid Assets fund to your selected variable investment options, based on your most recent premium allocation instructions, at the earlier of the following dates:

If your state provides for return of account value during the free look period or no free look period, we invest amounts you designated for the variable division directly into your selected variable investment options.

Asset Portfolio Manager 21

We allocate all later premium payments to your policy on the valuation date of receipt. We use your most recent premium allocation instructions specified in whole numbers totaling 100% and using up to eighteen investment options over the life of your policy. See Maximum Number of Investment Options, page 19.

You may make premium allocation changes throughout the year without charge. If you change your designated deduction investment option from which monthly deductions are taken, we consider this a premium allocation change.

Premium Payments Affect Your Coverage

Unless you have the guaranteed minimum death benefit feature, your coverage lasts only as long as your net account value is enough to pay the monthly charges and your cash surrender value is more than your outstanding policy loan plus accrued loan interest. If you do not meet these conditions, your policy will enter the 61-day grace period and you must make a premium payment to avoid lapse. See Lapse, page 36 and Grace Period, page 37.

Under the guaranteed minimum death benefit option, the base death benefit portion of your policy remains effective until the end of the guarantee period. The guaranteed minimum death benefit feature does not apply to riders which terminate when your policy is kept in force under this feature. You must meet all conditions of the guarantee. See Guaranteed Minimum Death Benefit, page 27.

Modified Endowment Contracts

There are special federal income tax rules for distributions from life insurance policies which are modified endowment contracts. These rules apply to policy loans, surrenders and partial withdrawals. Whether or not these rules apply depends upon whether or not the premiums we receive are greater than the "seven-pay" limit.

If we find that your scheduled premium causes your policy to be a modified endowment contract on your policy date, we will require you to acknowledge that you know the policy is a modified endowment contract. We will issue your policy based on the scheduled premium you selected. If you do not want your policy to be issued as a modified endowment contract, you may reduce your scheduled premium to a level which does not cause your policy to be a modified endowment contract. We will then issue your policy based on the revised scheduled premium. See Modified Endowment Contracts, page 50.

You can decide the amount of insurance you need, now and in the future. You can combine the long-term advantages of permanent life insurance (base coverage) with the flexibility and short-term advantages of term life insurance. Both permanent and term life insurance are available with your one policy. The stated death benefit is the permanent element of your policy. The adjustable term insurance rider is the term insurance element of your policy. See Adjustable Term Insurance Rider, page 28.

When we issue your policy, we base the initial insurance coverage on the instructions in your application. The death benefit at issue may vary from the stated death benefit plus adjustable term insurance coverage for some 1035 exchanges.

It may be to your economic advantage to include part of your insurance coverage under the adjustable term insurance rider. Both the cost of insurance under the adjustable term insurance rider and the cost of insurance for the base death benefit are deducted monthly from your account value and generally increase with the age of the insured person. Use of the adjustable term insurance rider may reduce sales compensation, but may increase the monthly cost of insurance. See Adjustable Term Insurance Rider, page 28.

Your death benefit is calculated as of the date of death of the insured person.

Asset Portfolio Manager 22

Death Benefit Summary

This chart assumes no death benefit option changes and no requested or scheduled increases or decreases in stated or target death benefit and that partial withdrawals are less than the premium we receive.

| Option 1 | Option 2 | Option 3 | |

| Stated Death Benefit | The amount of policy death benefit at issue, not including rider coverage. This amount stays level throughout the life of the policy. | The amount of policy death benefit at issue, not including rider coverage. This amount stays level throughout the life of the policy. | The amount of policy death benefit at issue, not including rider coverage. This amount stays level throughout the life of the policy. |

| Base Death Benefit | The greater of the stated death benefit or the account value multiplied by the appropriate factor from the definition of life insurance factors. | The greater of the stated death benefit plus the account value or the account value multiplied by the appropriate factor from the definition of life insurance factors. | The greater of the stated death benefit plus the sum of all premiums we receive minus partial withdrawals you have taken or the account value multiplied by the appropriate factor from the definition of life insurance factors. |

| Target Death Benefit | Stated death benefit plus adjustable term insurance rider benefit. This amount remains level throughout the life of the policy. | Stated death benefit plus adjustable term insurance rider benefit. This amount remains level throughout the life of the policy. | Stated death benefit plus adjustable term insurance rider benefit. This amount remains level throughout the life of the policy. |

| Total Death Benefit | It is the greater of the target death benefit or the base death benefit. | It is the greater of the target death benefit plus the account value or the base death benefit. | It is the greater of the target death benefit plus the sum of all premiums we receive minus partial withdrawals you have taken or the base death benefit. |

Asset Portfolio Manager 23

| Option 1 | Option 2 | Option 3 | |

| Adjustable Term Insurance Rider Benefit | The adjustable term insurance rider benefit is the total death benefit minus base death benefit, but it will not be less than zero. If the account value multiplied by the death benefit corridor factor is greater than the stated death benefit, the adjustable term insurance benefit will be decreased. It will be decreased so that the sum of the base death benefit and the adjustable term insurance rider benefit is not greater than the target death benefit. If the base death benefit becomes greater than the target death benefit, then the adjustable term insurance rider benefit is zero. | The adjustable term insurance rider benefit is the total death benefit minus the base death benefit, but it will not be less than zero. If the account value multiplied by the death benefit corridor factor is greater than the stated death benefit plus the account value, the adjustable term insurance rider benefit will be decreased. It will be decreased so that the sum of the base death benefit and the adjustable term insurance rider benefit is not greater than the target death benefit plus the account value. If the base death benefit becomes greater than the target death benefit plus the account value, then the adjustable term insurance rider benefit is zero. | The adjustable term insurance rider benefit is the total death benefit minus the base death benefit, but it will not be less than zero. If the account value multiplied by the death benefit corridor factor is greater than the stated death benefit plus the sum of all premiums we receive minus partial withdrawals you have taken, the adjustable term insurance rider benefit will be decreased. It will be decreased so that the sum of the base death benefit and the adjustable term insurance rider benefit is not greater than the target death benefit; plus the sum of all premiums we receive minus partial withdrawals you have taken. If the base death benefit becomes greater than the target death benefit plus the sum of all premiums we receive minus partial withdrawals you have taken, then the adjustable term insurance rider benefit is zero. |

Base Death Benefit

Your base death benefit can be different from your stated death benefit as a result of:

Federal income tax law requires that your death benefit be at least as much as your account value multiplied by a factor defined by law. This factor is based on:

As long as your policy is in force, we will pay the death proceeds to your beneficiary(ies) calculated at the death of the insured person. The beneficiary(ies) is(are) the person (people) you name to receive the death proceeds from your policy. The death proceeds are:

There could be outstanding policy charges if the insured person dies while your policy is in the grace period.

Death Benefit Options

You have a choice of three death benefit options (described below). Your choice may result in your base death benefit being greater than your stated death benefit.

Under death benefit option 1, your base death benefit is the greater of:

Asset Portfolio Manager 24

With option 1, positive investment performance generally reduces your net amount at risk, which lowers your policy's cost of insurance charge. Option 1 offers insurance coverage that is a set amount with potentially lower cost of insurance charges over time.

Under death benefit option 2, your base death benefit is the greater of:

With option 2, investment performance is reflected in your insurance coverage.

Under death benefit option 3, the base death benefit is the greater of:

With option 3, the base death benefit generally will increase as we receive premiums and decrease if you take partial withdrawals. In no event will your base death benefit be less than your stated death benefit.

Death benefit options 2 and 3 are not available during the continuation of coverage period. If you have option 2 or 3 on your policy, it automatically converts to death benefit option 1 when the continuation of coverage period begins. See Continuation of Coverage, page 30.

Changes in Death Benefit Options

You may request a change in your death benefit option at any time on or after your first monthly processing date and before the continuation of coverage period begins. A death benefit option change applies to your entire stated or base death benefit. Changing your death benefit option may reduce or increase your target death benefit, as well as your stated death benefit.

Your death benefit option change is effective on your next monthly processing date after we approve it, so long as at least one day remains before your monthly processing date. If less than one day remains before your monthly processing date, your change will be effective on your second following monthly processing date.

You may change from death benefit option 1 to option 2, from option 2 to option 1, or from option 3 to option 1. For you to change from death benefit option 1 to option 2, we may require proof that the insured person is insurable under our normal rules of underwriting.

After we approve your request, we send a new policy schedule page to you. You should attach it to your policy. We may ask you to return your policy to our customer service center so that we can make this change for you.

We may not approve a death benefit option change if it reduces the target or stated death benefit below the minimum we require to issue your policy.

On the effective date of your option change, your stated death benefit changes as follows:

| Change From | Change To | Stated Death Benefit Following Change: |

| Option 1 | Option 2 | your stated death benefit before the change minus your account value as of the effective date of the change. |

| Option 2 | Option 1 | your stated death benefit before the change plus your account value as of the effective date of the change. |

| Option 3 | Option 1 | your stated death benefit before the change plus the sum of the premiums we have received, minus partial withdrawals you have taken as of the effective date of the change. |

Asset Portfolio Manager 25

We increase or decrease your stated death benefit on the date of your death benefit option change to keep

the net amount at risk the same. There is no change to the amount of term insurance if you have an adjustable term insurance rider. See Cost of Insurance Charge, page 45.

If you change your death benefit option, we adjust the stated death benefit for each of your segments by allocating your account value to each benefit segment. For example, if you change from death benefit option 1 to option 2, your stated death benefit is decreased by the amount of your account value allocation to that segment. If you change from death benefit option 2 to option 1, your stated death benefit is increased by the amount allocated to that segment.

We do not impose a surrender charge for a decrease in your stated death benefit because you change your death benefit option. We do not adjust the target premium when you change your death benefit option. See Surrender Charge, page 47.

Changing your death benefit option may have tax consequences. You should consult a tax adviser before making changes.

Changes in Death Benefit Amounts

Contact your agent/registered representative or our customer service center to request a change in your policy's death benefit. The request is effective on the next monthly processing date after we receive and approve your request. There may be underwriting or other requirements which must be met before your request can be approved. Your requested change must be for at least $1,000.

After we make your requested change, we will send you a new policy schedule page. Keep it with your policy. We may ask you to send your policy to us so that we can make the change for you.

We may not approve a requested change if it will disqualify your policy as life insurance under federal income tax law. If we disapprove a change for any reason, we provide you with a notice of our decision. See Tax Considerations, page 49.

You may request a decrease in the stated death benefit only after your first policy anniversary.

If you decrease your death benefit, you may not decrease your target death benefit below the minimum we require to issue your policy.

Requested reductions in the death benefit will first decrease the target death benefit. We decrease your stated death benefit only after your adjustable term insurance rider coverage is reduced to zero. If you have more than one segment, we divide decreases in stated death benefit among your benefit segments pro rata unless law requires differently.

You must provide satisfactory evidence that the insured person is still insurable to increase your death benefit. Unless you tell us differently, we assume your request for an increase in your target death benefit is also a request for an increase to your stated death benefit. Thus, the amount of your adjustable term insurance rider will not change. You may change your target death benefit once a policy year.

The initial death benefit segment, or first segment, is the stated death benefit on your policy's effective date. A requested increase in stated death benefit will cause a new segment to be created. Once we create a new segment, it is permanent unless law requires differently. The segment year runs from the segment effective date to its anniversary.

Each new segment may have:

We allocate the net amount at risk among segments in the same proportion that each segment bears to the total stated death benefit. Premiums we receive after an increase are applied to your policy segments in the same proportion as the target premium for each segment bears to the total target premium for all segments. Sales charges are deducted from each segment's premium based on the length of time that segment has been effective.

Asset Portfolio Manager 26

There may be tax consequences as a result of a decrease in your death benefit, as well as a possible surrender charge. You should consult a tax adviser before changing your death benefit amount. See Tax Status of the Policy, page 49 and Modified Endowment Contracts, page 50.

Guaranteed Minimum Death Benefit

Usually, your coverage lasts only as long as your net account value is enough to pay the monthly charges and your cash surrender value is more than your outstanding policy loan plus accrued loan interest. Your account value depends on:

The guaranteed minimum death benefit is available only at policy issue. This option extends the period that your policy's stated death benefit remains in effect even if the variable investment options perform poorly. It has a guarantee period that lasts until the insured person turns age 65 or ten policy years, whichever is later.

The guaranteed minimum death benefit coverage does not apply to riders, including the adjustable term insurance rider. Therefore, if your net account value is not enough to pay the deductions as they come due on your policy, only the stated death benefit portion of your coverage is guaranteed to stay in force. See Lapse, page 36.

Charges for your guaranteed minimum death benefit and base coverage are deducted each month to the extent that there is sufficient net account value to pay these charges. If there is not sufficient net account value to pay a charge, it is not permanently waived. Deduction of charges will resume once there is sufficient net account value.

The guaranteed minimum death benefit feature is not available in some states.

Requirements to Maintain the Guarantee Period

To qualify for the guaranteed minimum death benefit you must pay an annual premium higher than the minimum annual premium. During the guarantee period we also will deduct a monthly charge from your account value. This higher premium is called the guarantee period annual premium. The guarantee period monthly premium is one-twelfth of the guarantee period annual premium. Your net account value must meet certain diversification requirements. See Charges, Deduction and Refunds, page 44.

Your guarantee period annual premium depends on:

At each monthly processing date we test to see if you have paid enough premium to keep your guarantee in place. We calculate:

You must continually meet the requirements of the guarantee period for this feature to remain in effect. We show the guarantee period annual premium on your policy schedule. If your policy benefits increase, the guarantee period annual premium increases.

In addition, the guarantee period ends if your net account value on any monthly processing date is not diversified as follows:

Your policy will continue to meet the diversification requirements if:

Asset Portfolio Manager 27

See Dollar Cost Averaging, page 33 and Automatic Rebalancing, page 33.

If you select the guaranteed minimum death benefit option, you must make sure your policy satisfies the premium test and diversification test. If you fail to satisfy either test and you do not correct the condition, this feature terminates. Once it has terminated, you cannot reinstate the guaranteed minimum death benefit feature. The guarantee period annual premium then no longer applies to your policy.

Your policy may include benefits, attached by rider. A rider may have an additional cost. You may cancel riders at any time.

Periodically we may offer other riders not listed here. Contact your agent/registered representative for a complete list of riders available.

Adding or canceling riders may have tax consequences. See Modified Endowment Contracts, page 50.

Adjustable Term Insurance Rider

You may increase your death proceeds by adding an adjustable term insurance rider. This rider allows you to schedule the pattern of death benefits appropriate for anticipated needs. As the name suggests, the adjustable term insurance rider adjusts over time to maintain your desired level of coverage.