|

|

|

|

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

| Check the appropriate box: |

||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-12 |

|

| LEARN2.COM, INC. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

| |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

LEARN2.COM, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held August 8, 2000

The Annual Meeting of Stockholders (the "Annual Meeting") of Learn2.com Inc., a Delaware corporation (the "Corporation"), will be held at the Le Parker Meridien Hotel, 119 West 56th Street, Third Floor, New York, New York 10019, on August 8, 2000, at 10:00 a.m., local time, and any adjournment or postponement thereof, for the following purposes:

The foregoing items of business, including the nominees for directors, are more fully described in the Proxy Statement which is attached to and made a part of this Notice.

The Board of Directors has fixed the close of business on June 21, 2000 as the record date for determining the Stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof.

All Stockholders are cordially invited to attend the Annual Meeting in person. However, whether or not you plan to attend the Annual Meeting in person, you are urged to mark, date, sign and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope provided to ensure your representation and the presence of a quorum at the Annual Meeting. If you send in your proxy card and then decide to attend the Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the Proxy Statement.

By Order of the Board of Directors,

![]() Donald Schupak

Donald Schupak

Chairman of the Board of Directors

New

York, New York

July 10, 2000

LEARN2.COM, INC.

1311 Mamaroneck Avenue Suite 210

White Plains, New York 10605

PROXY STATEMENT

General

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the "Board of Directors") of Learn2.com, Inc., a Delaware corporation (the "Corporation"), of proxies in the enclosed form for use in voting at the Annual Meeting of Stockholders (the "Annual Meeting"), to be held at the Le Parker Meridien Hotel, 119 West 56th Street, Third Floor, New York, New York 10019, on August 8, 2000, at 10:00 a.m., local time, and any adjournment or postponement thereof.

This Proxy Statement, the enclosed proxy card and the Corporation's Annual Report on Form 10-K for the fiscal year ended December 31, 1999 are being mailed to Stockholders entitled to vote at the Annual Meeting on or about July 10, 2000.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Corporation a written notice of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person. Written notices of revocation and related correspondence should be delivered to: Learn2.com, Inc., 1311 Mamaroneck Avenue, Suite 210, White Plains, New York 10605, Attention: Secretary.

Record Date; Voting Securities

The close of business on June 21, 2000 has been fixed as the record date (the "Record Date") for determining the holders of shares of common stock, par value $0.01 per share ("Common Stock"), of the Corporation entitled to notice of and to vote at the Annual Meeting. At the close of business on the Record Date, the Corporation had approximately 52,849,186 shares of Common Stock outstanding.

Voting and Solicitation

Each outstanding share of Common Stock on the Record Date is entitled to one vote on all matters, subject to the conditions described below.

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of the Corporation's Common Stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum. Directors will be elected by a plurality of the votes cast by the holders of the Corporation's Common Stock voting in person or by proxy at the Annual Meeting. The proposal to adopt the Corporation's 2000 Non-Employee Directors' Stock Option Plan will require the affirmative vote of a majority of the votes represented by the shares of Common Stock present in person or represented by proxy at the Annual Meeting. Abstentions will have the same practical effect as a negative vote on the proposal to adopt the Corporation's 2000 Non-Employee Directors' Stock Option Plan, but will have no effect on the vote for election of directors.

1

The shares represented by the proxies received, properly marked, dated, signed and not revoked will be voted at the Annual Meeting. Where such proxies specify a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the specifications made. Any proxy in the enclosed form which is returned but is not marked will be voted FOR the election of each of the five nominees named below, FOR adoption of the 2000 Non-Employee Directors' Stock Option Plan, and as the proxy holders deem advisable on other matters that may properly come before the Annual Meeting. If a broker indicates on the enclosed proxy or its substitute that it does not have discretionary authority as to certain shares to vote on a particular matter, those shares will not be considered as voting with respect to that matter.

The solicitation of proxies will be conducted by mail and the Corporation will bear all attendant costs. These costs will include the expense of preparing and mailing proxy solicitation materials for the Annual Meeting and reimbursements paid to brokerage firms and others for their expenses incurred in forwarding solicitation materials regarding the Annual Meeting to beneficial owners of the Corporation's Common Stock. The Corporation may conduct further solicitation personally, telephonically, by email or by facsimile through its officers, directors and employees, none of whom will receive additional compensation for assisting with the solicitation.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At the Annual Meeting, the Stockholders will elect five directors to serve until the 2001 Annual Meeting of Stockholders or until their respective successors are elected and qualified. The Board of Directors has recommended the persons named in the table below as nominees for election as directors. All such persons are presently directors of the Corporation. In the event any nominee should be unable or unwilling to serve as a director at the time of the Annual Meeting, it is intended that such proxy will be voted for the election, in such nominee's place, of a substitute nominee recommended by the Board of Directors. As of the date of this Proxy Statement, the Board of Directors has no reason to believe that any nominee will be unable or unwilling to serve as a director if elected.

Assuming a quorum is present, the five nominees receiving the highest number of affirmative votes of shares entitled to be voted for them will be elected as directors of the Corporation for the ensuing year. Unless marked otherwise, proxies received will be voted FOR the election of each of the nominees named below.

The following information, as of June 21, 2000, is supplied with respect to the nominees for election as directors of the Corporation:

Nominees for Director

| Name |

Age |

Position with the Corporation |

||

|---|---|---|---|---|

| Donald Schupak | 57 | Chairman of the Board of Directors | ||

| Robert Alan Ezrin | 51 | Vice Chairman of the Board of Directors | ||

| Stephen P. Gott | 51 | President, Chief Executive Officer and Director | ||

| James A. Cannavino | 56 | Director | ||

| S. Lee Kling | 71 | Director |

Donald Schupak currently serves as Chairman of the Board of Directors. Mr. Schupak has been a member of the Board of Directors since January 1997 and has been Chairman of the Board of Directors since March 1997. Mr. Schupak is the President and Chief Executive Officer of The Schupak Group, Inc., an organization that provides strategic planning, management consulting and corporate services to corporations worldwide. Mr. Schupak has been with The Schupak Group, Inc. since 1990. Mr. Schupak is also Chairman of the Board of Directors of Danskin, Inc., a women's apparel company. He previously

2

served as Chairman and Chief Executive Officer of the Horn & Hardart Company (now known as Hanover Direct) from 1988 to 1990 and as Vice Chairman from 1977 to 1988. Mr. Schupak also served as a member of the Advisory Board of the Maxwell School of Citizenship and Public Affairs at Syracuse University from 1995 to 1999. Mr. Schupak was also the founder of the High School for Leadership and Public Service, an experimental high school in New York City established in 1993.

Robert Alan Ezrin currently serves as Vice Chairman of the Board of Directors. Mr. Ezrin is one of the Corporation's founders and has served as a Director since inception in April 1993 and has served as Vice Chairman of the Board of Directors since April 1998. Mr. Ezrin served as the Corporation's President from November 1995 until April 1998 and Chief Executive Officer from March 1997 until April 1998. Mr. Ezrin served as Co-Chairman of the Board of Directors from inception in April 1993 until November 1995. Mr. Ezrin served as Executive Vice President of Production from April 1994 to November 1995 and served as Vice President from April 1993 to April 1994. From 1984 through 1994, Mr. Ezrin was a Producer with Lozem Productions, Inc. Mr. Ezrin has more than 25 years of experience in the international entertainment business, producing music, video and television projects for numerous internationally known stars such as Pink Floyd, Rod Stewart, KISS, Peter Gabriel and Roger Daltry. Mr. Ezrin is currently Chairman and co-CEO of Enigma Digital. Mr. Ezrin is also a member of the Boards of Directors of eMaiMai, Inc., Communities in Schools/LAMP, the Mr. Holland's Opus Foundation, and the California African American Museum.

Stephen P. Gott has served as President, Chief Executive Officer and a Director since February 1999. From November 1994 to February 1999, Mr. Gott served as the President, Chief Executive Officer and Chairman of the Board of Directors of Street Technologies, Inc. (now known as Learn2, Inc.) which the Corporation acquired in February 1999. From June 1986 to November 1994, Mr. Gott served as the Chief Technology and Operations Officer at Lehman Brothers.

James A. Cannavino has served as a Director of the Corporation since January 1997. Mr. Cannavino is Chief Executive Officer and Chairman of the Board of Directors of CyberSafe Corporation, a developer of software used for security applications. Prior to joining CyberSafe, Mr. Cannavino served as President and Chief Operating Officer for Perot Systems Corporation. Until March 1995, he also held a variety of senior executive positions at IBM, serving as senior vice president for strategy and development at the time of his departure from IBM. Mr. Cannavino has served as a member of the IBM Corporate Executive Committee and Worldwide Management Council and also served as a member of the Board of Directors of IBM's Integrated Services and Solutions Company. Mr. Cannavino currently serves as Chairman of Computer Concepts and is a Director of OPUS360 Corporation and Marist College.

S. Lee Kling has a served as a Director of the Corporation since April 2000. Since 1991, Mr. Kling has been Chairman of the Board of Kling Rechter & Co., L.P., a merchant banking company. Mr. Kling is also Director of Bernard Chaus, Inc., Electro Rent Corporation, National Beverage Corp., Top Air Manufacturing, Inc. and Engineered Support Systems, Inc.

Meetings and Committees of the Board of Directors

During the 1999 fiscal year, the Board of Directors met and took action by unanimous written consent on 27 occasions, and no director then in office attended fewer than 90% of the aggregate number of meetings of the Board of Directors and meetings of the committees of the Board of Directors on which he served. The Board of Directors has an Audit Committee, Compensation Committee and an Executive Committee. There is no standing nominating committee.

The Audit Committee consists of James A. Cannavino, Robert Alan Ezrin and S. Lee Kling (since April, 2000), and met one time during the 1999 fiscal year. The Audit Committee is responsible for approving the scope of the annual audit, recommending the engagement of the Corporation's independent public accountants, and monitoring the Corporation's financial and accounting organization and its system of internal accounting controls.

3

The Compensation Committee consists of James A. Cannavino, Robert Alan Ezrin, and S. Lee Kling (since April 2000) and met one time during the 1999 fiscal year. The Compensation Committee is responsible for determining the compensation for the Corporation's senior management, establishing compensation policies for the Corporation's employees generally, and administering the Incentive Stock Option Plans.

The Executive Committee consists of Donald Schupak (Chairman), James A. Cannavino and Merv Adelson (through October 1999), and met 12 times during the 1999 fiscal year. The Executive Committee has all the authority of the Board of Directors in the management of the business and affairs of the Corporation, except those powers that by law or by the Corporation's Restated Certificate of Incorporation or By-Laws cannot be delegated by the Board of Directors.

Director Compensation

Neither Messrs. Schupak or Gott receives any compensation for his services as a Director. The Corporation's outside directors earn $15,000 per annum, $4,000 per annum for each committee membership, $1,000 per meeting for each Board of Directors' meeting in which he participates and $500 for each Audit Committee and Compensation Committee meeting in which he participates. Directors are reimbursed for their out-of-pocket expenses incurred in attending Board of Directors' and committee meetings.

In January 2000, the Corporation amended a March 1997 agreement with The Schupak Group, Inc. such that it currently pays $28,666 per month to Schupak West, Inc., an affiliate of The Schupak Group, Inc. for the consulting services of Donald Schupak, reimbursement for the use of office space and other administrative expenses. Additionally, Mr. Schupak is entitled to the reimbursement of reasonable travel and other expenses. Mr. Schupak is entitled to have the Board of Directors consider a bonus at the end of each fiscal year.

In February 1999, the Corporation paid to Mr. Ezrin $40,000 and issued to him an option to purchase 20,000 shares of Common Stock exercisable at a price equal to $3.00 per share as full payment for Mr. Ezrin's severance entitlement as the Corporation's former President and Chief Executive Officer. Such options vested immediately.

In February 1999, in connection with the acquisition of Street Technologies, Inc. (now known as Learn2, Inc.) and as an inducement to Mr. Schupak to act as Chairman of the Board of Directors of the combined corporation, Mr. Schupak was granted an option to purchase 500,000 shares of Common Stock exercisable at a price equal to $3.25 per share. Such options vest ratably on each anniversary over three years.

Recommendation of the Board of Directors

The Board of Directors recommends a vote FOR the election of the five nominee directors of the Corporation to serve until the 2001 Annual Meeting of Stockholders or until their respective successors are elected and qualified.

PROPOSAL NO. 2

ADOPTION OF THE CORPORATION'S

2000 NON-EMPLOYEE DIRECTORS' STOCK OPTION PLAN

On June 8, 2000, the Board of Directors of the Corporation approved, subject to stockholder approval, the Corporation's 2000 Non-Employee Directors' Stock Option Plan.

The Board of Directors believes that the 2000 Non-Employee Directors' Stock Option Plan will assist in advancing the interests of the Corporation and its stockholders by enabling the Corporation to attract directors and encouraging increased stock ownership by members of the Board of Directors of the

4

Corporation who are not employees of the Corporation or any of its subsidiaries, in order to promote long-term stockholder value through continuing ownership of the Corporation's Common Stock.

Under the 2000 Non-Employee Directors' Stock Option Plan, stock options were granted, subject to stockholder approval of the 2000 Non-Employee Directors' Stock Option Plan, to Messrs. Schupak, Cannavino, Ezrin and Kling exercisable to purchase 500,000, 285,000, 40,000 and 150,000, respectively, on May 25, 2000 at an exercise price of $2.00 per share.

A summary of the principal provisions of the 2000 Non-Employee Directors' Stock Option Plan is set forth below. This summary is qualified in its entirety by reference to the full text of the 2000 Non-Employee Directors' Stock Option Plan, which is attached as Appendix A to this Proxy Statement. Capitalized terms used herein will, unless otherwise defined, have the meanings assigned to them in the text of the 2000 Non-Employee Directors' Stock Option Plan.

Administration of the 2000 Non-Employee Directors' Stock Option Plan

The 2000 Non-Employee Directors' Stock Option Plan is administered by the Board of Directors or a committee thereof. The Board of Directors is authorized, among other things, to construe, interpret and implement the provisions of the 2000 Non-Employee Directors' Stock Option Plan, to select the non-employee directors to whom options will be granted, to determine the number of shares of Common Stock for which an option will be granted, the terms and conditions of any Options and to make all other determinations deemed necessary or advisable for the administration of the 2000 Non-Employee Directors' Stock Option Plan.

Eligibility

Persons eligible to participate in the 2000 Non-Employee Directors' Stock Option Plan include all non-employee directors of the Corporation and its subsidiaries, as determined by the Board of Directors.

Shares Available

The aggregate number of shares of Common Stock available for issuance under the 2000 Non-Employee Directors' Stock Option Plan will be 2,500,000, subject in each case to adjustment as described below. On June 8, 2000, the closing price of the Corporation's Common Stock on The Nasdaq Stock Market was $2.06 per share. No option may be granted if the number of shares to which such Option relates, when added to the number of shares previously issued under the 2000 Non-Employee Directors' Stock Option Plan and the number of shares which may then be acquired pursuant to other outstanding, unexercised options, exceeds the number of shares available for issuance pursuant to the 2000 Non-Employee Directors' Stock Option Plan. If any shares subject to an option are forfeited or such option is settled in cash or otherwise terminates for any reason whatsoever without an actual distribution of shares to the participant, any shares counted against the number of shares available for issuance pursuant to the 2000 Non-Employee Directors' Stock Option Plan with respect to such Option shall, to the extent of any such forfeiture, settlement, or termination, again be available for Options under the 2000 Non-Employee Directors' Stock Option Plan; provided, however, that the Board of Directors may adopt procedures for the counting of shares relating to any option to ensure appropriate counting, avoid double counting, and provide for adjustments in any case in which the number of shares actually distributed differs from the number of shares previously counted in connection with such Option.

Awards

Awards under the Plan shall consist only of Options, to acquire shares of Common Stock of the Corporation. Options granted under the 2000 Non-Employee Directors' Stock Option Plan are not intended to qualify as "incentive stock options" within the meaning of Section 422 of the Code.

5

Stock Options

The Board of Directors is authorized to grant nonqualified stock options. The Option exercise price shall be the Fair Market Value of the shares of Common Stock subject to such Option on the date the Option is granted. Options may be exercised by payment of the exercise price in cash or in Common Stock, outstanding awards or other property having a fair market value equal to the exercise price, as the Board of Directors may determine from time to time.

Other Terms of Awards

The Board of Directors may impose on any Option or the exercise thereof, at the date of grant or thereafter (subject to adjustment), such additional terms and conditions, not inconsistent with the provisions of the 2000 Non-Employee Directors' Stock Option Plan, as the Board of Directors shall determine; provided, however, that the Board of Directors shall retain full power to accelerate or waive any such additional term or condition as it may have previously imposed. All Options shall be evidenced by an Option Agreement.

Adjustments

In the event that the Board of Directors shall determine that any stock dividend, recapitalization, forward split or reverse split, reorganization, merger, consolidation, spin-off, combination, repurchase or share exchange, or other similar corporate transaction or event, affects the Common Stock such that an adjustment is appropriate in order to prevent dilution or enlargement of the rights of Participants under the 2000 Non-Employee Directors' Stock Option Plan, then the Option shall be automatically adjusted to give effect to the occurrence of such event, and the number or kind of shares subject to, or the Option price per share under, any outstanding Option shall be automatically adjusted so that the proportionate interest of the participant shall be maintained as before the occurrence of such event; such adjustment in outstanding Options shall be made without change in the total Option exercise price applicable to the unexercised portion of such Options and with a corresponding adjustment in the Option exercise price per share, and such adjustment shall be conclusive and binding for all purposes of the Plan.

Amendment and Termination

The Plan may be amended at any time and from time to time by the Board of Directors as the Board of Directors shall deem advisable, provided, however, that no amendment or modification may become effective without approval by the stockholders of the Corporation if the Corporation, on advice of counsel, determines that stockholder approval is required to enable the Plan to satisfy any applicable statutory or regulatory requirements, or if the Corporation determines that stockholder approval is otherwise necessary or desirable.

Certain Federal Income Tax Consequences

The following discussion is a brief summary of the principal United States Federal income tax consequences under current federal income tax laws relating to awards under the 2000 Non-Employee Directors' Stock Option Plan. This summary is not intended to be exhaustive and, among other things, does not describe state, local or foreign income and other tax consequences.

The holder of a stock option awarded under the 2000 Non-Employee Directors' Stock Option Plan will recognize no income as a result of the grant of such option. Upon the exercise of a stock option, a holder generally will recognize compensation income equal to the difference between the exercise price of the stock option and the market value of the Common Stock on the exercise date. The tax basis of the Common Stock acquired upon the exercise of a stock option will be equal to the sum of (i) the exercise price and (ii) the amount included in the holder's income as a result of the exercise of such option. Any additional gain or any loss recognized upon the subsequent disposition of the acquired Common Stock will be a capital gain or loss, provided that the holder holds the shares of Common Stock as a capital asset (i.e., generally for investment purposes), and such capital gain or loss will be a long-term gain or loss if the Common Stock is held for more than one year.

6

The Corporation will, subject to the usual rule of reasonableness of compensation and the Corporation satisfying its reporting requirements, be entitled to a deduction in connection with the exercise of a stock option at such time and to the extent that the holder recognizes ordinary income.

If a holder surrenders shares of Common Stock in payment of the exercise price of an option under the 2000 Non-Employee Directors' Stock Option Plan, he will not recognize gain or loss on his surrender of such shares, but will recognize ordinary income on the exercise of the option as described above. Of the shares received in such an exchange, that number of shares equal to the number of shares surrendered will have the same tax basis and capital gains holding period as the shares surrendered. The balance of the shares received will have a tax basis equal to their fair market value on the date of exercise, and the capital gains holding period will begin on the date of exercise.

If the Corporation delivers cash, in lieu of fractional shares, or shares of Common Stock to a holder pursuant to a cashless exercise program, he will recognize ordinary income equal to the cash paid and the fair market value of the shares of Common Stock delivered as of the date of exercise.

The 2000 Non-Employee Directors' Stock Option Plan is not qualified under Section 401(a) of the Code.

Section 162(m) provisions

Section 162(m) of the Code generally disallows a deduction to the Corporation for compensation paid in any year in excess of $1.0 million to covered employees. Because only non-employee directors will be granted stock options under the 2000 Non-Employee Directors' Stock Option Plan and such non-employee directors are not considered covered employees under Section 162(m) of the Code, it is not expected that the compensation element of stock options granted under the 2000 Non-Employee Directors' Stock Option Plan will be subject to the deduction limitations of Section 162(m) of the Code.

Required Vote

Approval of the Corporation's 2000 Non-Employee Directors' Stock Option Plan requires the affirmative vote of a majority of the votes represented by the shares of Common Stock present in person or represented by proxy at the Annual Meeting.

Recommendation of the Board

The Board of Directors recommends a vote FOR the proposal to adopt the Corporation's 2000 Non-Employee Directors' Stock Option Plan.

INFORMATION REGARDING BENEFICIAL OWNERSHIP OF

PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table sets forth certain information that has been provided to the Corporation with respect to beneficial ownership of shares of the Corporation's Common Stock as of June 21, 2000 by (i) each person known by us to be the beneficial owner of more than 5% of the outstanding shares of Common Stock, (ii) each of the directors of the Corporation, (iii) each of the Named Executive Officers (defined below) and (iv) all directors and executive officers of the Corporation as a group. Unless otherwise noted, the Corporation believes that all persons named in the table have sole voting and

7

investment power with respect to all shares of voting stock beneficially owned by them. As of June 21, 2000, there were 52,849,186 shares of Common Stock outstanding.

| Name of Person Identity of Group |

Amount and Nature of Beneficial Ownership (1) |

Approximate Percentage of Common Stock Outstanding (2) |

||||

|---|---|---|---|---|---|---|

| Stephen P. Gott (3) | 6,933,399 | 13.04 | % | |||

| Marc E. Landy (4) | 472,430 | * | ||||

| Richard S. Merrick | 145,000 | * | ||||

| Donald Schupak (5) | 1,891,759 | 3.53 | ||||

| James S. Cannavino (6) | 500,000 | * | ||||

| Robert Alan Ezrin (7) | 817,391 | 1.55 | ||||

| S. Lee Kling (8) | 242,942 | * | ||||

| Kevin C. Riley (9) | 50,691 | * | ||||

| All current directors and executive officers as a group (6 persons) (10) | 10,801,597 | 19.73 | % | |||

8

EXECUTIVE OFFICERS OF THE CORPORATION

The following table sets forth the names, ages and all positions and offices of each of the persons who were serving as executive officers of the Corporation as of June 21, 2000:

| Name |

Age |

Position with the Corporation |

||

|---|---|---|---|---|

| Donald Schupak | 57 | Chairman of the Board of Directors | ||

| Robert Alan Ezrin | 51 | Vice Chairman of the Board of Directors | ||

| Stephen P. Gott | 51 | President, Chief Executive Officer and Director | ||

| Marc E. Landy | 39 | Executive Vice President, Chief Financial Officer and Secretary |

Executive officers of the Corporation are appointed by the Board of Directors each year and serve at the discretion of the Board of Directors.

Marc E. Landy currently serves as the Corporation's Executive Vice President, Chief Financial Officer and Secretary. From November 1996 to February 1999, Mr. Landy served as the Vice President and Chief Financial Officer of Street Technologies, Inc. (now known as Learn2, Inc.) which the Corporation acquired in February 1999. From April 1993 to November 1996, Mr. Landy served in several management capacities including Controller and Director of Consulting for Flexi International. Mr. Landy is a CPA and from 1990 to 1992 he was a Senior Audit Manager at Ernst & Young.

EXECUTIVE OFFICER COMPENSATION AND OTHER MATTERS

Summary Compensation Table

The following table summarizes the compensation earned by (a) two individuals who served as the Corporation's Chief Executive Officer during the 1999 fiscal year, (b) each person serving as an executive officer on December 31, 1999 who earned more than $100,000 in salary and bonus during the fiscal year ended December 31, 1999 and (c) one individual who was among the highest paid employee for the fiscal year ended December 31, 1999 but was not an executive officer on December 31, 1999 (collectively, the "Named Executives").

| |

|

|

|

Long-Term Compensation: Securities Underlying Options (1) |

|

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Annual Compensation |

|

||||||||||

| |

Fiscal Year |

Other (2) |

|||||||||||

| Name and Principal Position |

Salary |

Bonus |

|||||||||||

| Stephen P. Gott | 1999 | $ | 175,000 | $ | 50,000 | 1,000,000 | — | ||||||

| President, Chief Executive Officer | 1998 | — | — | — | — | ||||||||

| and Director | 1997 | — | — | — | — | ||||||||

| Richard S. Merrick (3) |

|

1999 |

|

|

65,000 |

|

|

— |

|

— |

|

— |

|

| Former Chief Executive Officer | 1998 | 145,167 | 20,000 | 700,000 | 3,004 | ||||||||

| Chief Technology Officer and | 1997 | 115,500 | — | 42,500 | 2,230 | ||||||||

| Director | |||||||||||||

| Marc E. Landy |

|

1999 |

|

|

131,250 |

|

|

40,000 |

|

150,000 |

|

5,000 |

|

| Chief Financial Officer, Executive | 1998 | — | — | — | — | ||||||||

| Vice President and Secretary | 1997 | — | — | — | — | ||||||||

| Kevin C. Riley |

|

1999 |

|

|

243,000 |

|

|

30,000 |

|

— |

|

22,700 |

|

| Executive Vice President Sales | 1998 | — | — | — | — | ||||||||

| and Marketing | 1997 | — | — | — | — | ||||||||

9

Stock Option Grants

The following table provides certain information relating to stock options granted to the Named Executive Officers during the fiscal year ended December 31, 1999. In addition, as required by the Commission's rules, the table sets forth the hypothetical gains that would exist for the shares subject to such options based on assumed annual compounded rates of stock price appreciation during the option term.

| |

|

Percent of Total Options Granted to Employees Fiscal Year (1) |

|

|

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (2) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Number of Securities Underlying Granted Options |

|

|

||||||||||||

| |

Exercise Price |

Expiration Date |

|||||||||||||

| Name |

5% |

10% |

|||||||||||||

| Stephen P. Gott | 1,000,000 | 13.0 | % | $ | 3.25 | 02/16/2009 | $ | 2,043,908 | $ | 5,179,663 | |||||

| Marc E. Landy | 150,000 | 2.0 | % | 3.25 | 02/16/2009 | 306,586 | 776,949 | ||||||||

Option Exercises and Fiscal Year-End Values

The following table provides information about exercised stock options held by the Named Executives Officers. During the 1999 fiscal year, only one of the Named Executive Officers exercised stock options.

| |

|

|

Securities Underlying Unexercised Options At December 31, 1999 |

|

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

Value of Unexercised In-the-Money Options At December 31, 1999 (1) |

||||||||||||

| |

Shares Exercised |

Value Realized |

Number of Exercisable |

|

|||||||||||

| Name |

Unexercisable |

Exercisable |

Unexercisable |

||||||||||||

| Stephen P. Gott | — | $ | — | — | 1,000,000 | $ | — | $ | 31,000 | ||||||

| Richard S. Merrick | 318,630 | 776,820 | (2) | — | — | — | — | ||||||||

| Marc E. Landy | — | — | 366,106 | 150,000 | 466,194 | 4,650 | |||||||||

| Kevin C. Riley | — | — | — | 337,944 | — | 40,795 | |||||||||

Underlying options that are not in-the-money are not valued in this table.

10

Notwithstanding anything to the contrary set forth in any of the Corporation's filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (the "Exchange Act"), that might incorporate future filings, including this Proxy Statement, in whole or in part, the following Report of the Compensation Committee and the Stock Performance Graph which follows shall not be deemed to be incorporated by reference into any such filings.

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS ON EXECUTIVE COMPENSATION

Compensation Philosophy and Review

The Corporation's approach to executive compensation is designed to attract, motivate and retain the executive resources that the Corporation needs in order to maximize its return to Stockholders. The Corporation attempts to provide its executives with a total compensation package that, at expected levels of performance, is competitive with those provided to executives who hold comparable positions or having similar qualifications in other similar organizations.

Cash compensation for executive officers named in the Summary Compensation Table includes base salary, annual bonus and other compensation such as car allowance and employer contribution to the Corporation's 401(k) Plan.

Base salaries are reviewed on an annual basis with a variety of factors considered including the individual's contribution to the success of the Corporation, and salary trends for individuals in similar positions. Annual bonuses are determined based on annual accomplishments including the individual's contribution to the development and success of the Corporation.

Compensation of the Chief Executive Officer

The Corporation entered into an Employment Agreement, dated as of February 16, 1999, employing Stephen P. Gott as its President and Chief Executive Officer for a two year term, subject to earlier termination for death, disability, resignation or removal. Pursuant to his employment agreement the Compensation Committee approved Mr. Gott's annual base salary of $200,000 and an annual performance bonus of not less than $50,000. Mr. Gott will be eligible to participate in any corporation-wide bonus plan that we may adopt. In addition, the Compensation Committee approved a grant of options to purchase 1,000,000 shares of Common Stock exercisable at a price equal to $3.25 per share. The options vest ratably over three years on the anniversaries of February 16, 1999. In the event of a "change of control" (as defined in the employment agreement), the stock options shall vest immediately. If Mr. Gott resigns his employment for "good reason" (as defined in the employment agreement), if his employment is terminated without "cause" (as defined in the employment agreement), or if the Board of Directors elects not to extend the term of Mr. Gott's employment, Mr. Gott will be entitled to (1) receive, in a lump sum, an amount equal to one year's base salary and performance bonus and (2) vesting of all stock options. Mr. Gott's employment agreement also contains confidentiality, non-competition and indemnification provisions. In January 2000, the Compensation Committee amended Mr. Gott's employment agreement to increase his annual base salary to $250,000.

In determining the base salary, performance bonus and options, the Compensation Committee sought to induce Mr. Gott to become the President and Chief Executive Officer of the Corporation and provide Mr. Gott a total compensation package that is competitive with individuals who hold comparable positions or have similar qualifications in other similar organizations and closely link such compensation to corporate performance and returns to stockholders.

11

Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code") generally disallows a tax deduction to public companies for annual compensation over $1 million paid to their chief executive officer and other highly compensated executive officers. The Code generally excludes from the calculation of the $1 million cap compensation that is based on the attainment of pre-established, objective performance goals. Where practicable, it is the policy of the Compensation Committee to establish compensation practices that are both cost-efficient from a tax standpoint and effective as a compensation program. The Compensation Committee also considers it important to be able to utilize the full range of incentive compensation, even though some compensation may not be fully deductible. To maintain a competitive position within the Corporation's peer group of corporations, the Compensation Committee retains the authority to authorize payments, including salary and bonus, that may not be deductible.

By

the Compensation Committee

of the Board of Directors,

James A. Cannavino (Chairman)

12

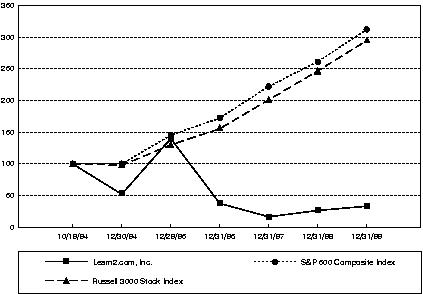

The performance graph shown below was prepared by the Corporation for use in this Proxy Statement. The historic stock price performance is not necessarily indicative of future stock performance. As required by applicable rules of the Commission. The performance graph was prepared based on a $100 investment in the Corporation's Common Stock, the Russell 3000 Stock Index and the S&P 500 Composite Index on October 19, 1994 (the date of the Corporation's initial inclusion in the NASDAQ National Market System).

LEARN2.COM, INC. COMPARATIVE TOTAL RETURNS

OCTOBER 19, 1994 THROUGH DECEMBER 31, 1999

| |

October 19, 1994 |

December 30, 1994 |

December 29, 1995 |

December 31, 1996 |

December 31, 1997 |

December 31, 1998 |

December 31, 1999 |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Learn2.com, Inc. | $ | 100.00 | $ | 52.50 | $ | 140.00 | $ | 37.50 | $ | 16.88 | $ | 26.56 | $ | 32.81 | |||||||

| Russell 3000 Stock Index | $ | 100.00 | $ | 97.62 | $ | 130.40 | $ | 155.42 | $ | 201.23 | $ | 246.14 | $ | 293.96 | |||||||

| S&P 500 Composite Index | $ | 100.00 | $ | 100.42 | $ | 145.17 | $ | 172.33 | $ | 221.88 | $ | 261.38 | $ | 312.42 | |||||||

As of June 2, 2000, the closing price of the Corporation's Common Stock on The Nasdaq Stock Market was $2.16 per share.

13

In February 1999, Donald Schupak, the Chairman of the Board of Directors, exercised options to purchase an aggregate of 600,000 shares of Common Stock for an aggregate exercise price of $1,200,000. Mr. Schupak paid the Corporation $6,000 which represented the par value of the shares of Common Stock purchased. Mr. Schupak borrowed the remaining $1,194,000 which accrues interest at the annual rate of 6% payable quarterly or, at the option of Mr. Schupak, accrues at the annual rate of 7% payable upon maturity of the loan in February 2004. As collateral for the loan, Mr. Schupak pledged the 600,000 shares of Common Stock purchased plus an additional 213,000 shares of Common Stock. If the market value of the pledged shares of Common Stock is equal to more than 200% of the principal amount of the loan, then Mr. Schupak may request that we release a number of shares which have a market value in excess of such amount. If the market value of the pledged shares of Common Stock is equal to less than 125% of the principal amount of the loan, then Mr. Schupak must pledge additional shares of Common Stock to bring the market value of the pledged shares to such amount.

In March 1999, Robert Alan Ezrin, the Vice Chairman of the Board of Directors, exercised options to purchase an aggregate of 145,000 shares of Common Stock for an aggregate exercise price of $310,000. Mr. Ezrin paid the Corporation $103,333 and borrowed the remaining $206,667. The loan accrues interest at the annual rate of 6% payable quarterly or, at the option of Mr. Ezrin, accrues at the annual rate of 7% payable upon maturity of the loan in March 2004. As collateral for the loan, Mr. Ezrin pledged the 145,000 shares of Common Stock purchased plus an additional 1,964 shares of Common Stock. If the market value of the pledged shares of Common Stock is equal to more than 200% of the principal amount of the loan, then Mr. Ezrin may request that we release a number of shares which have a market value in excess of such amount. If the market value of the pledged shares of Common Stock is equal to less than 125% of the principal amount of the loan, then Mr. Ezrin must pledge additional shares of Common Stock to bring the market value of the pledged shares to such amount. In March 2000, as a result of the increase in the market value of the Corporation's Common Stock, 20,000 of the pledged shares were released to Mr. Ezrin per his request.

In March 1999, James A. Cannavino, a Director, exercised options to purchase an aggregate of 215,000 shares of Common Stock for an aggregate of $430,000. Mr. Cannavino paid the Corporation $143,333 and borrowed the remaining $286,667. The loan accrues at the annual rate of 6% payable quarterly or, at the option of Mr. Cannavino, accrues at the annual rate of 7% payable upon maturity of the loan in March 2004. As collateral for the loan, Mr. Cannavino pledged the 215,000 shares of Common Stock purchased. If the market value of the pledged shares of Common Stock is equal to more than 200% of the principal amount of the loan, then Mr. Cannavino may request that we release a number of shares which have a market value in excess of such amount. If the market value of the pledged shares of Common Stock is equal to less than 125% of the principal amount of the loan, then Mr. Cannavino must pledge additional shares of the Corporation's Common Stock to bring the market value of the pledged shares to such amount.

On February 16, 1999, the Corporation acquired all of the outstanding Common Stock and preferred stock of Street Technologies, Inc. (now known as Learn2, Inc.). Pursuant to the Agreement and Plan of Merger, the Corporation issued 4,948,182 shares of Common Stock and 21,644 shares of Series D Preferred Stock to the stockholders of Street Technologies, Inc. Stephen Gott, the Corporation's President, Chief Executive Officer and a Director, received 557,846 shares of Common Stock and 17,969 shares of Series D Stock. On July 28, 1999, the Common Stockholders of the Corporation approved a proposal at 1999 annual meeting to convert the shares of Series D Stock to shares of Common Stock. As a result, Mr. Gott's 17,969 shares of Series D Stock has been converted into 5,989,786 shares of the Common Stock.

14

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The Corporation's executive officers, directors and persons who own more than 10% of the Corporation's Common Stock (collectively, "Reporting Persons") are required under the Securities Exchange Act of 1934, as amended, to file reports of ownership and changes in ownership of the Corporation's Common Stock with the Commission. The Commission's regulations require that copies of those reports be furnished to the Corporation. Based solely on the Corporation's review of the copies of such reports it has received from its Reporting Persons, the Corporation believes that during the fiscal year ended December 31, 1999 all Reporting Persons complied with all applicable filing requirements except that Jason Roberts, a former Director of the Corporation, filed a late Form 3.

STOCKHOLDER PROPOSALS FOR 2001 ANNUAL MEETING OF STOCKHOLDERS

Proposals of Stockholders intended to be included in the Corporation's proxy statement relating to the 2001 Annual Meeting of Stockholders must be received no later than December 31, 2000. Proposals to be considered for presentation at the 2001 Annual Meeting of Stockholders, although not included in the proxy statement, must be received no later than December 31, 2000. All stockholder proposals should be marked for the attention of the Secretary, Learn2.com, Inc., 1311 Mamaroneck Avenue Suite 210, White Plains, New York 10605. The Corporation reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

ANNUAL REPORTS AND FINANCIAL STATEMENTS

The Corporation's Annual Report on Form 10-K for the year ended December 31, 1999 is being furnished simultaneously herewith. The Annual Report on Form 10-K for the year ended December 31, 1999 is not to be considered a part of this Proxy Statement.

The Corporation will also furnish to any stockholder of the Corporation a copy of any exhibit to the Annual Report on Form 10-K for the year ended December 31, 1999 as listed thereon, upon request and upon payment of the Corporation's reasonable expenses of furnishing such exhibit. Requests should be directed to Secretary, Learn2.com, Inc., 1311 Mamaroneck Avenue Suite 210 White Plains, New York 10605.

RELATIONSHIP WITH INDEPENDENT PUBLIC ACCOUNTANTS

The Corporation's financial statements for the years ended December 31, 1999 and 1998 have been examined by the firm of Arthur Andersen LLP independent public accountants. The Corporation's financial statements for the year ended December 31, 1997 had been examined by the firm of KPMG LLP independent public accountants. KPMG LLP was dismissed as the Corporation's independent public accountants on January 15, 1999 on the recommendation of the Board of Directors. (See Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosures in the Corporation's Annual Report on Form 10-K for the year ended December 31, 1999.)

15

The Board of Directors of the Corporation knows of no other business that will be presented at the Annual Meeting. If any other business is properly brought before the Annual Meeting, or any adjournment thereof, proxies in the enclosed form will be voted in respect thereof as the proxy holders deem advisable.

It is important that the proxies be returned promptly and that your shares be represented. Stockholders are urged to mark, date, sign and promptly return the accompanying proxy card in the enclosed envelope.

By Order of the Board of Directors,

![]() Donald Schupak

Donald Schupak

Chairman of the Board of Directors

New

York, New York

July 10, 2000

16

APPENDIX A

LEARN2.COM, INC.

2000 NON-EMPLOYEE DIRECTORS' STOCK OPTION PLAN

1. Purpose. The purpose of the Learn2.com, Inc. 2000 Non-Employee Directors' Stock Option Plan (the "Plan") is to advance the interests of Learn2.com, Inc. (the "Corporation") and its stockholders by encouraging increased stock ownership by members of the Board of Directors (the "Board of Directors") of the Corporation who are not employees of the Corporation or any of its subsidiaries, in order to promote long-term stockholder value of the Corporation's common stock, par value $.01 per share ("Common Stock").

2. Administration. The Plan shall be administered by the Board of Directors or a committee thereof. The Board of Directors shall have all the powers vested in it by the terms of the Plan, such powers to include authority (within the limitations described herein) to select from among the eligible individuals those to whom options are to be granted and to prescribe the form of the agreement embodying awards of stock options made under the Plan ("Options"). The Board of Directors shall have the power to construe the Plan, to determine all questions arising thereunder and, subject to the provisions of the Plan, to adopt and amend such rules and regulations for the administration of the Plan as it may deem desirable. Any decision of the Board of Directors in the administration of the Plan shall be final and conclusive. The Board of Directors may act only by a majority of its members in office, except that the members thereof may authorize any one or more of the officers of the Corporation to execute and deliver documents on behalf of the Corporation. No member of the Board of Directors shall be liable for anything done or omitted to be done by him or by any other member of the Board of Directors in connection with the Plan, except for his own willful misconduct or as expressly provided by statute.

3. Participation. Each member of the Board of Directors of the Corporation who is not an employee of the Corporation or any of its subsidiaries (a "Non-Employee Director") shall be eligible to receive an Option in accordance with Paragraph 5 below. As used herein, the term "subsidiary" means any corporation at least fifty percent of whose outstanding voting stock is owned, directly or indirectly, by the Corporation.

4. Awards Under the Plan.

a. Types of Awards. Awards under the Plan shall consist only of Options to acquire shares of Common Stock of the Corporation. Options granted under the Plan are not intended to qualify as "incentive stock options" within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"). Options are subject to the terms, conditions and restrictions specified in Paragraph 5 below.

b. Maximum Number of Shares That May Be Issued. There may be issued under the Plan pursuant to the exercise of Options an aggregate of not more than 2,500,000 shares of Common Stock, subject to adjustment as provided in Paragraph 6 below. No Option may be granted if the number of shares to which such Option relates, when added to the number of shares previously issued under the Plan and the number of shares which may then be acquired pursuant to other outstanding, unexercised Options, exceeds the number of shares available for issuance pursuant to the Plan. If any shares subject to an Option are forfeited or such Option is settled in cash or otherwise terminates for any reason whatsoever without an actual distribution of shares to the Participant, any shares counted against the number of shares available for issuance pursuant to the Plan with respect to such Option shall, to the extent of any such forfeiture, settlement, or termination, again be available for Options under the Plan; provided, however, that the Board of Directors may adopt procedures for the counting of shares relating to any Option to ensure appropriate counting, avoid double counting, and provide for adjustments in any case in which the number of shares actually distributed differs from the number of shares previously counted in connection with such Option.

17

c. Rights With Respect to Shares. A Non-Employee Director to whom an Option is granted (and any person succeeding to such a Non-Employee Director's rights pursuant to the Plan) shall have no rights as a stockholder with respect to any shares of Common Stock issuable pursuant to any such Option until the date of the issuance of a stock certificate to him for such shares. Except as provided in Paragraph 6 below, no adjustment shall be made for dividends, distributions or other rights (whether ordinary or extraordinary, and whether in cash, securities or other property) for which the record date is prior to the date such stock certificate is issued.

5. Option Provisions. Each Option granted under the Plan shall be evidenced by an agreement (the "Option Agreement") in such form as the Board of Directors shall prescribe from time to time in accordance with the Plan and shall comply with the following terms and conditions:

a. An Option shall be exercisable in full on the date the Option is granted; provided that the Board of Directors does not determine otherwise. Notwithstanding the foregoing, an Option shall automatically become immediately exercisable in full when the Non-Employee Director ceases to be a Director of the Corporation for any reason other than death.

b. The Option exercise price shall be the Fair Market Value of the shares of Common Stock subject to such Option on the date the Option is granted. For purposes of the Plan, "Fair Market Value" shall mean the mean of the high and low sales prices of Common Stock on the relevant date as reported on the stock exchange or market on which the Common Stock is primarily traded, or if no sale is made on such date, then the Fair Market Value is the weighted average of the mean of the high and low sales prices of the Common Stock on the next preceding day and the next succeeding day on which such sales were made as reported on the stock exchange or market on which the Common Stock is primarily traded. If the Corporation's Common Stock is not traded on a stock exchange or market, the Fair Market Value of Common Stock shall be determined by the Board of Directors in good faith.

c. Subject to Section 5(d) hereof and except as otherwise determined by the Board of Directors, an Option shall have a term of 10 years from the date it is granted.

d. An Option shall be transferable only by will or the laws of descent and distribution, and shall be exercisable during the optionee's lifetime only by him. Notwithstanding the foregoing, the Board of Directors may, in its discretion, provide that Options be transferable, without consideration, to immediate family members (i.e., children, grandchildren or spouse), to trusts for the benefit of such immediate family members and to partnerships in which such family members are the only partners. The Board of Directors may attach to such transferability feature such terms and conditions as it deems advisable.

e. The Option shall not be exercisable unless payment in full is made for the shares of Common Stock being acquired thereunder at the time of exercise; such payment shall be made

6. Dilution and Other Adjustments. In the event of any corporate transaction involving the Corporation (including, without limitation, any subdivision or combination or exchange of the outstanding shares of Common Stock, stock dividend, stock split, spin-off, split-off, recapitalization, capital reorganization,

18

liquidation, reclassification of shares of Common Stock, merger, consolidation, extraordinary cash dividend, or sale, lease or transfer of substantially all of the assets of the Corporation), the number or kind of shares that may be issued upon the exercise of Options granted under the Plan shall be automatically adjusted to give effect to the occurrence of such event, and the number or kind of shares subject to, or the Option price per share under, any outstanding Option shall be automatically adjusted so that the proportionate interest of the participant shall be maintained as before the occurrence of such event; such adjustment in outstanding Options shall be made without change in the total Option exercise price applicable to the unexercised portion of such Options and with a corresponding adjustment in the Option exercise price per share, and such adjustment shall be conclusive and binding for all purposes of the Plan.

7. Miscellaneous Provisions.

a. Except as expressly provided for in the Plan, no Non-Employee Director or other person shall have any claim or right to be granted an Option under the Plan. Neither the Plan nor any action taken hereunder shall be construed as giving any Non-Employee Director any right to be retained in the service of the Corporation.

b. A participant's rights and interest under the Plan may not be assigned or transferred in whole or in part either directly or by operation of law or otherwise (except, in the event of a participant's death, by will or the laws of descent and distribution), including, but not by way of limitation, execution, levy, garnishment, attachment, pledge, bankruptcy or in any other manner, and no such right or interest of any participant in the Plan shall be subject to any obligation or liability of such participant.

c. No shares of Common Stock shall be issued hereunder unless counsel for the Corporation shall be satisfied that such issuance will be in compliance with applicable federal, state and other securities laws.

d. It shall be a condition to the obligation of the Corporation to issue shares of Common Stock upon exercise of an Option, that the participant pay to the Corporation, upon its demand, such amount as may be requested by the Corporation for the purpose of satisfying any liability to withhold federal, state, local or foreign income or other taxes. If the amount requested is not paid, the Corporation may refuse to issue shares of Common Stock.

d. The expenses of the Plan shall be borne by the Corporation.

e. The Plan shall be unfunded. The Corporation shall not be required to establish any special or separate fund or to make any other segregation of assets to assure the issuance of shares upon exercise of any Option under the Plan and issuance of shares upon exercise of Options shall be subordinate to the claims of the Corporation's general creditors.

f. By accepting any Option or other benefit under the Plan, each participant and each person claiming under or through him shall be conclusively deemed to have indicated his acceptance and ratification of, and consent to, the Plan, the terms and conditions of any agreement embodying awards of Options and the Plan by the Corporation or the Board of Directors.

g. The masculine pronoun means the feminine and the singular means the plural wherever appropriate.

h. The appropriate officers of the Corporation shall cause to be filed any reports, returns or other information regarding Options hereunder or any shares of Common Stock issued pursuant hereto as may be required by Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, or any other applicable statute, rule or regulation.

8. Amendment or Discontinuance. The Plan may be amended at any time and from time to time by the Board of Directors as the Board of Directors shall deem advisable, provided, however, that (a) no amendment or modification may become effective without approval by the stockholders of the Corporation if the Corporation, on advice of counsel, determines that stockholder approval is required to enable the Plan to

19

satisfy any applicable statutory or regulatory requirements, or if the Corporation determines that stockholder approval is otherwise necessary or desirable; and (b) Paragraph 3 and subparagraphs 5(a) and 5(d) shall not be amended more than once every six months, other than to comport with changes in the Code, the Employee Retirement Income Security Act of 1974, as amended, or the rules under either of such laws. Except to the extent otherwise required by the Corporation's Certificate of Incorporation or By-Laws, the stockholders shall be deemed to have approved an amendment or modification to the Plan which is submitted to the stockholders for approval if and when such amendment or modification is approved by a plurality of the votes cast at a meeting of the stockholders. No amendment of the Plan shall materially and adversely affect any right of any participant with respect to any Option theretofore granted without such participant's written consent.

9. Termination. The Plan shall terminate upon the earlier of the following dates or events to occur: (i) upon the adoption of a resolution of the Board of Directors terminating the Plan; or (ii) June 8, 2010. No termination of the Plan shall materially and adversely affect any of the rights or obligations of any person, without his consent, under any Option theretofore granted under the Plan.

10. Effective Date. The Plan shall be effective as of June 8, 2000, the date of adoption of the Plan by the Board of Directors; provided, however, that it shall be a condition to the effectiveness of the Plan, and any award hereunder, that the shareholders of the Corporation approve the Plan within one year after the date of the original adoption hereof by the Board of Directors. Such approval shall meet the requirements of Section 162(m) of the Code and the regulations thereunder. If such approval is not obtained, then the Plan shall not be effective and any aware made hereunder shall be terminated.

20

PROXY LEARN2.COM, INC. COMMON STOCK

PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

OF THE CORPORATION FOR ANNUAL MEETING OF STOCKHOLDERS

August 8, 2000

The undersigned hereby constitutes and appoints DONALD SCHUPAK and STEPHEN P. GOTT, and each of them, with full power of substitution, attorneys and proxies to represent and to vote all of the shares of Common Stock, par value $0.01 per share, of LEARN2.COM, INC. that the undersigned would be entitled to vote, with all powers the undersigned would possess if personally present, at the Annual Meeting of the Stockholders of LEARN2.COM, INC., to be held at the Le Parker Meridien Hotel, 119 West 56th Street, Third Floor, New York, New York 10019, on August 8, 2000, at 10:00 a.m., local time, and at any adjournment thereof, on all matters coming before said meeting:

( ) VOTE FOR ALL NOMINEES LISTED ABOVE, EXCEPT VOTE WITHHELD AS TO THE FOLLOWING NOMINEES (IF ANY):

( ) VOTE WITHHELD FROM ALL NOMINEES.

/ / FOR / / AGAINST / / ABSTAIN

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED (i) FOR THE ELECTION AS DIRECTORS OF THE NOMINEES OF THE BOARD OF DIRECTORS, AND (ii) FOR THE PROPOSAL TO APPROVE THE 2000 NON-EMPLOYEE DIRECTORS' STOCK OPTION PLAN.

The undersigned acknowledges receipt of the accompanying Proxy Statement dated July 10, 2000.

DATED: , 2000

Signature of Stockholder(s)

(When signing as attorney, trustee, executor, administrator, guardian, corporate officer, etc., please give full title. If more than one trustee, all should sign. Joint owners must each sign.)

Please date and sign exactly as name appears your stock certificate.

I plan ( ) I do not plan ( ) to attend the Annual Meeting.

|

|