|

|

|

|

(2_fidelity_logos)

Balanced Portfolio

Semiannual Report

June 30, 2000

|

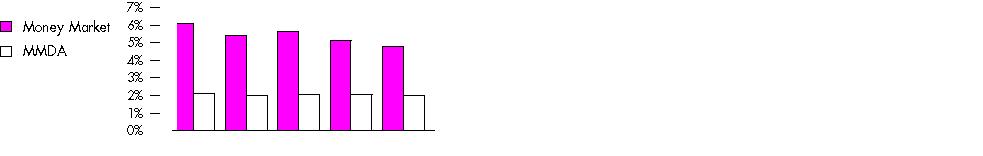

Market Environment |

3 |

A review of what happened in world markets during the past six months. |

|

Performance and Investment Summary |

4 |

How the fund has done over time, and an overview of the fund's investments at the end of the period. |

|

Fund Talk |

7 |

The managers' review of fund performance, strategy |

|

Investments |

8 |

A complete list of the fund's investments with their |

|

Financial Statements |

19 |

Statements of assets and liabilities, operations, and |

|

Notes |

23 |

Notes to the financial statements. |

|

Proxy Voting Results |

26 |

|

Fidelity Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

The views expressed in this report reflect those of the fund's portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

After reaching record heights in the first quarter of 2000, several of the most notable U.S. equity market indexes - including the Standard & Poor's 500SM, NASDAQ and Dow Jones Industrial Average - tumbled into negative territory by the end of the second quarter. Leading the market down was the same sector that drove it to new highs just a few months prior: technology. Beginning in mid-March, investors abandoned technology en masse, as concerns about excessive valuations and impending inflation pervaded the market. The ripple effect of the tech sell-off spread rapidly around the world, and international equity markets trended downward in response. As stocks cooled, domestic bond performance heated up, helping many U.S. fixed-income categories outpace their equity counterparts for the overall six-month period. Meanwhile, emerging-market bonds held on to most of their strong first quarter gains, but international developed-market bonds felt the pinch of inflation, as several central banks around the world began to implement interest-rate hikes to slow their respective economies.

At the mid-way point of 2000, the U.S. stock market's unprecedented streak of five consecutive double-digit annual increases appeared to be in jeopardy. The Dow Jones Industrial Average - an index of 30 blue-chip stocks - declined 8.42% during the six-month period ending June 30, 2000. The broad-based S&P 500® and the technology-concentrated NASDAQ index also disappeared below the surface, returning -0.42% and -2.44%, respectively. In a 10-week stretch from March through June, the NASDAQ dropped 33%, making dot-com investors anything but dot-calm as Internet stocks bore the brunt of the decline. As the spectacular growth of the technology sector waned, previously out-of-favor sectors began to lure investors' attention. The consistent, steady growth of the health sector was the primary beneficiary, as it wore the crown of best-performing sector for the first six months of 2000. The natural resources and real-estate sectors were surprising runners-up in the performance derby. But not all was lost for the technology sector. In June, economic reports showed strong evidence that the Federal Reserve Board's series of interest-rate hikes - including three during the first half of this year - were winning the battle against inflation. This news, combined with the Fed's decision to eschew another hike in June, fueled a renewed enthusiasm for tech stocks, as evidenced by the NASDAQ's 16.64% return for the final month of the period.

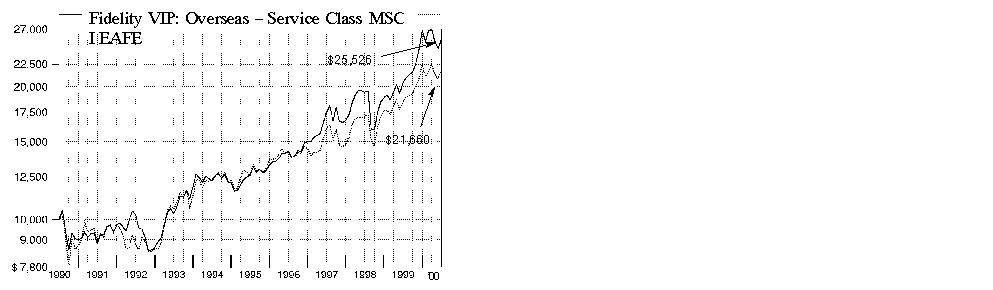

Reacting similarly to the U.S. stock market - and no doubt largely as a direct result of the U.S. market - most foreign stock markets started the six-month period off on a high note before stumbling in the second quarter. Japan and the Pacific Region in general fell particularly hard. After a stellar 1999, Japanese equities were shaken by their country's economic downturn and an unsteady U.S. market. "New Japan" stocks - Internet, electronic, telecom and software securities - led the

decline. The TOPIX Index, a benchmark of the Japanese market, fell 10.34% during the period. And even the best-performing Pacific Region fund had a negative return, according to Lipper Inc. Weak tech performance in the second quarter also hurt European stock markets, causing the Morgan Stanley Capital International Europe Index to decline 3.10% for the first half of 2000. One of the only non-U.S. stock markets that didn't suffer a negative second quarter was Canada. Often overlooked, the Canadian stock market quietly piled up an impressive six-month return of 21.89% - as measured by the Toronto Stock Exchange (TSE) 300.

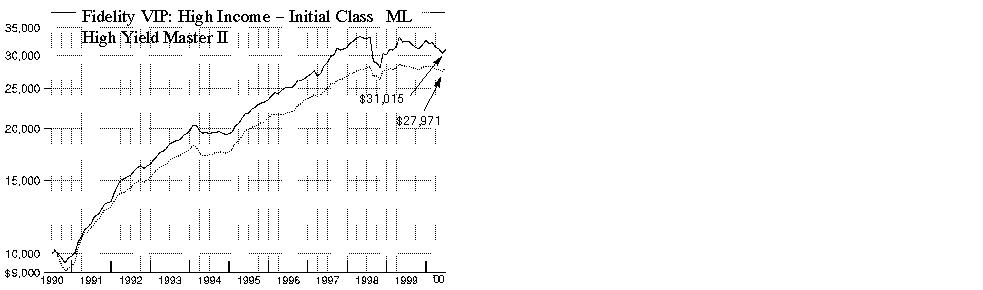

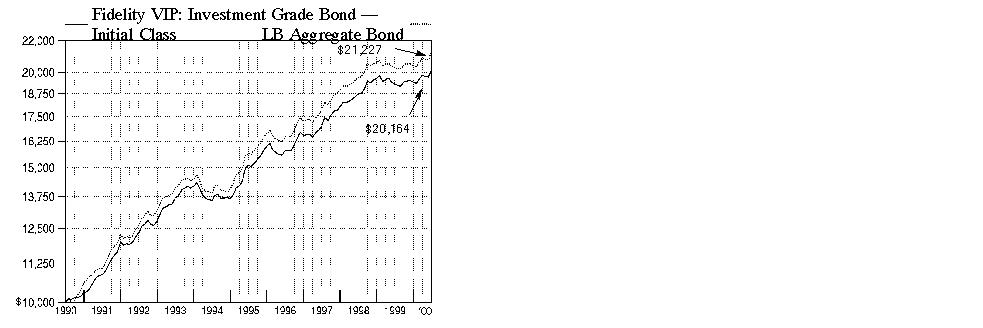

Despite being challenged with a series of interest-rate hikes - almost always a detriment to fixed-income offerings - U.S. bond markets still managed to post solid returns relative to equities through the first six months of this year. U.S. government bonds were one of the top performers. In January, the U.S. Treasury announced its intent to repurchase long-term debt and curtail future issuance. Treasury prices soared in response and helped the Lehman Brothers Long-Term Government Bond Index return 8.77% for the period. The Lehman Brothers Aggregate Bond Index, a popular measure of taxable-bond performance, rose 3.99% for the past six months, while tax-free municipals were even more robust, gaining 4.48% according to the Lehman Brothers Municipal Bond Index. Underperformance in the bond market was pretty much limited to the high-yield sector. Faced with a rising interest-rate backdrop and poor technicals - including an unfavorable supply/demand condition and an increased default rate - the high-yield market stumbled to a negative return of 1.00%, as measured by the Merrill Lynch High Yield Master II Index, for the past six months.

International bond investors faced a myriad of negative factors throughout the majority of the six-month period ending June 30, 2000. Strong global economic growth and the threat of rising interest rates, currency fluctuations, and a weakening euro continued to plague global debt issues. Additionally, poor liquidity hampered bond prices in non-U.S. developed markets. Combined, those factors helped drag down the Salomon Brothers Non-U.S. World Government Bond Index, which returned -1.95%. On the bright side, a number of favorable factors propelled demand for emerging-market bonds, which was reflected in the 6.95% return of the J.P. Morgan Emerging Markets Bond Index Global - a popular benchmark of emerging-market debt. Credit momentum, which was driven by improving fundamentals - such as the Russian government's Soviet-era debt restructuring and new political leadership - fostered the rally in emerging-market bonds. Elsewhere, Brazil's better-than-expected economic growth fueled a sharp increase in foreign direct investment. Often large commodity suppliers, emerging-market countries also benefited from a sharp increase in oil prices.

Semiannual Report

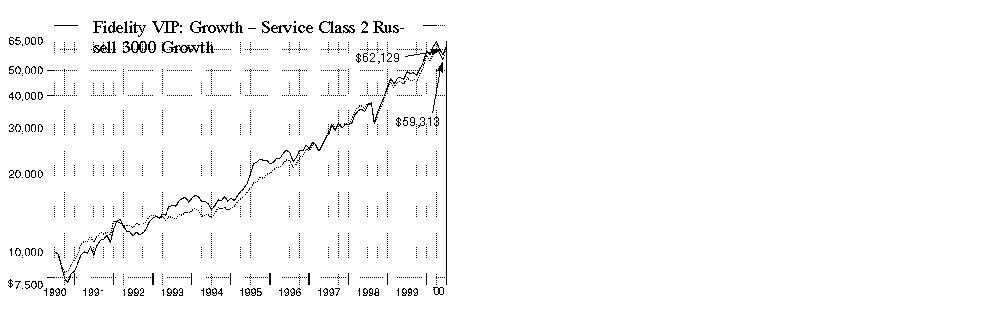

Performance

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). If Fidelity had not reimbursed certain fund expenses, the past five years and life of fund total returns would have been lower.

Average Annual Total Returns

|

Periods ended |

Past 1 |

Past 5 |

Life of |

|

Fidelity® VIP: Balanced - |

-0.43% |

11.87% |

12.20% |

|

Fidelity Balanced 60/40 Composite |

6.44% |

16.78% |

18.45% |

|

S&P 500 ® |

7.25% |

23.80% |

25.60% |

|

LB Aggregate Bond |

4.57% |

6.25% |

7.81% |

Average annual total returns take the fund's cumulative return and show what would have happened if the fund had performed at a constant rate each year.

You can compare the fund's returns to the performance of the Fidelity Balanced 60/40 Composite Index - a hypothetical combination of unmanaged indices using a weighting of 60% equity and 40% bond. The composite index combines the total returns of the Standard & Poor's 500 Index and the Lehman Brothers Aggregate Bond Index.

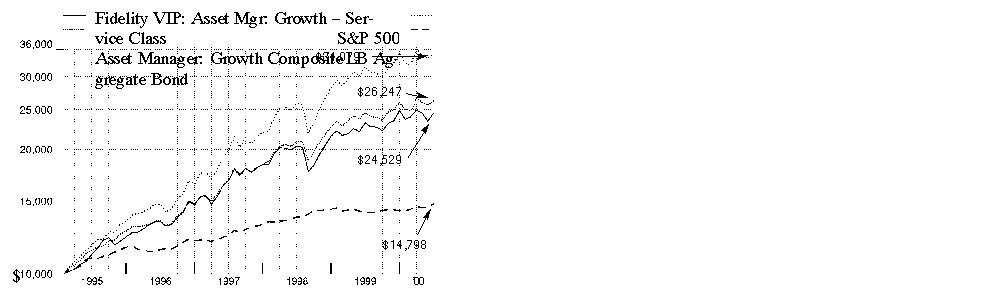

Figures for more than one year assume a steady compounded rate of return and are not the fund's year-by-year results, which fluctuated over the periods shown. The life of fund figures are from commencement of operations, January 3, 1995.

Performance numbers are net of all fund operating expenses, but do not include any insurance charges imposed by your insurance company's separate account. If performance information included the effect of these additional charges, the total returns would have been lower.

Past performance is no guarantee of future results. Principal and investment return will vary and you may have a gain or loss when you withdraw your money.

Understanding Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. The stock market, for example, has a history of long-term growth and short-term volatility. In turn, the share price and return of a fund that invests in stocks will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

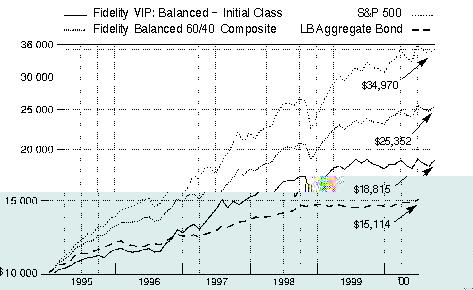

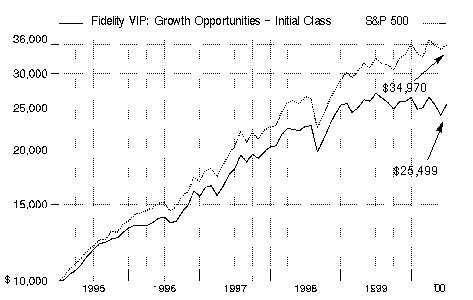

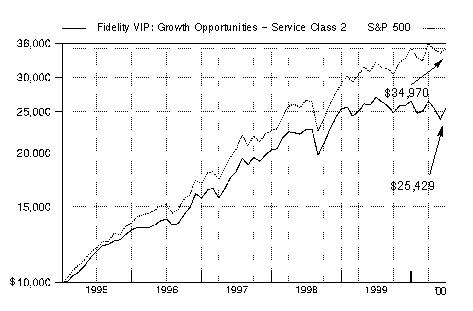

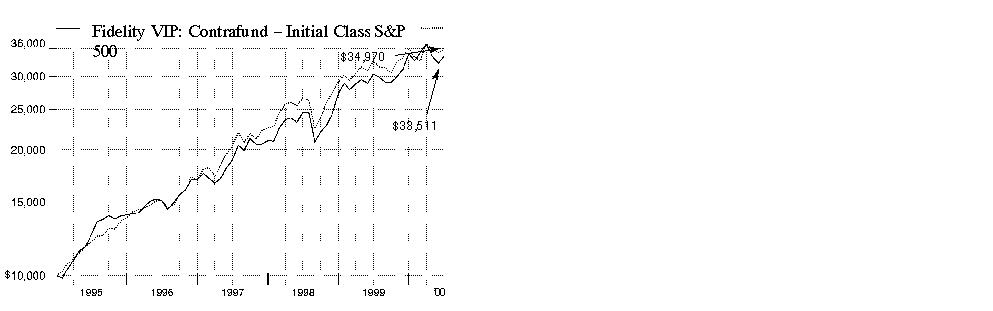

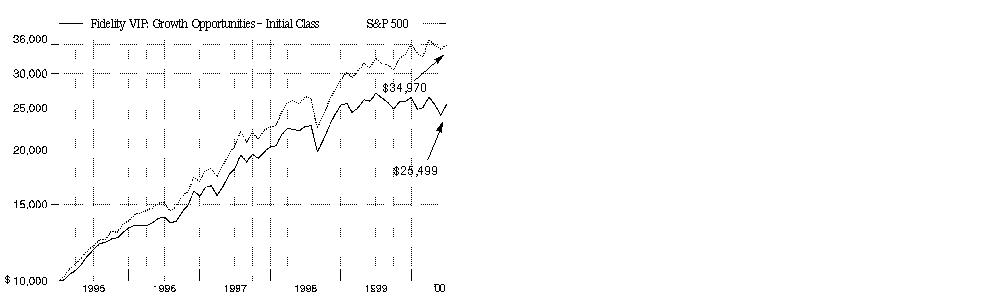

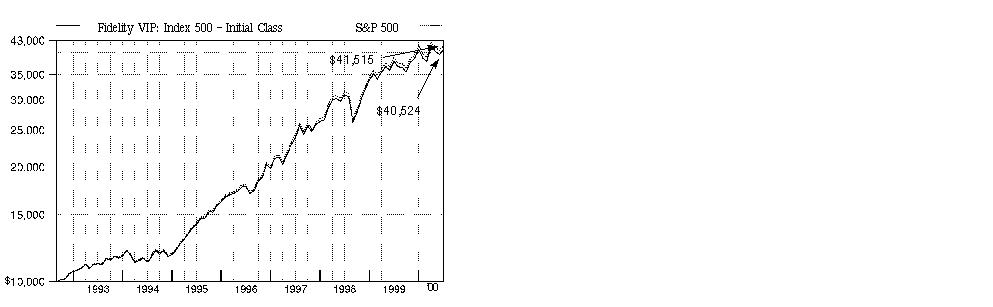

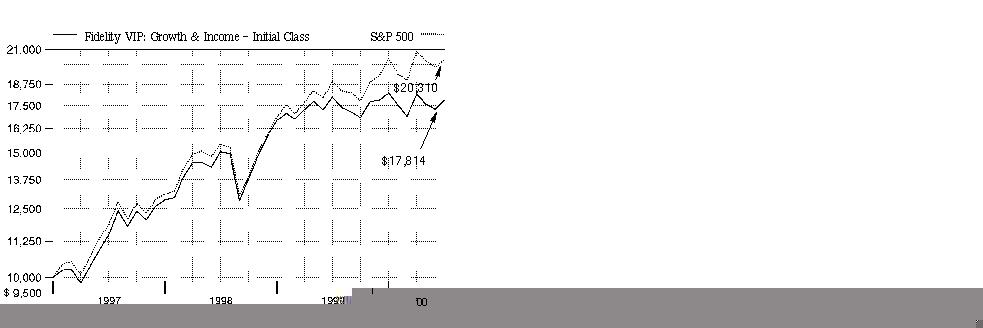

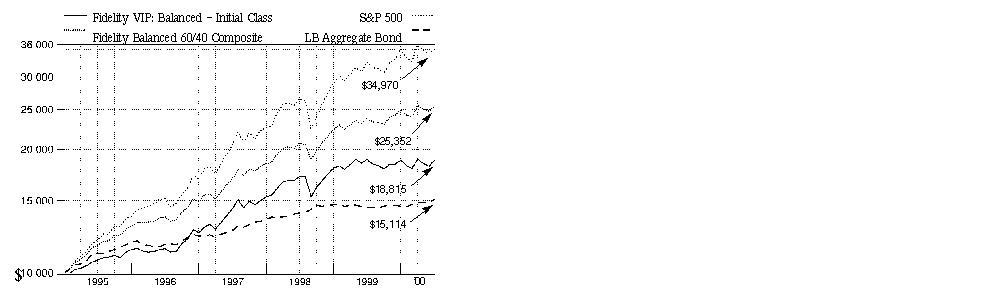

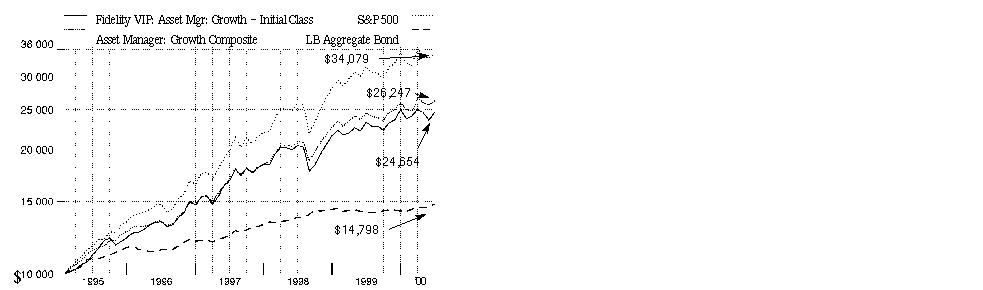

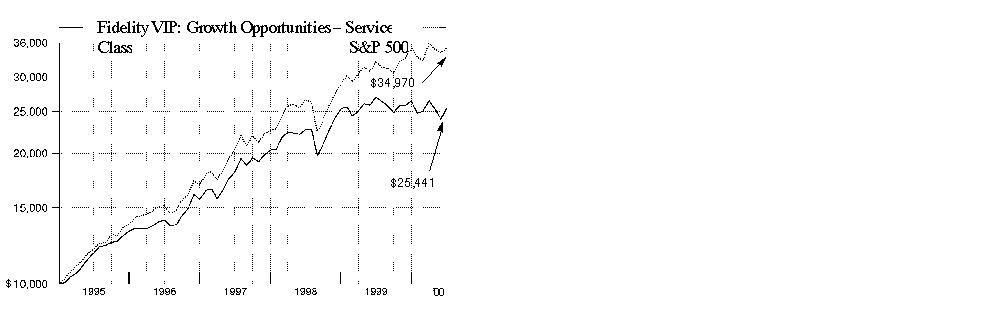

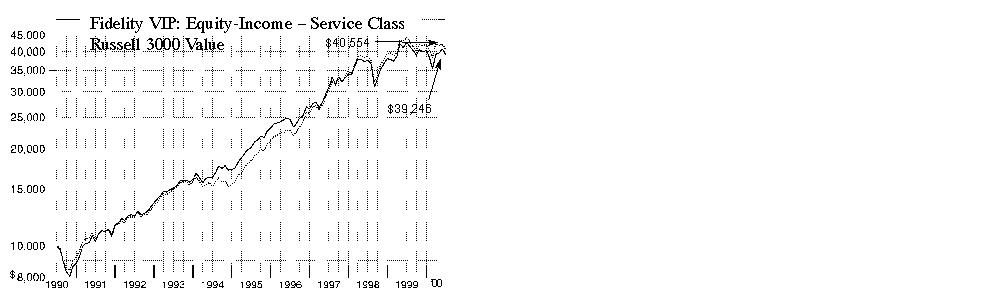

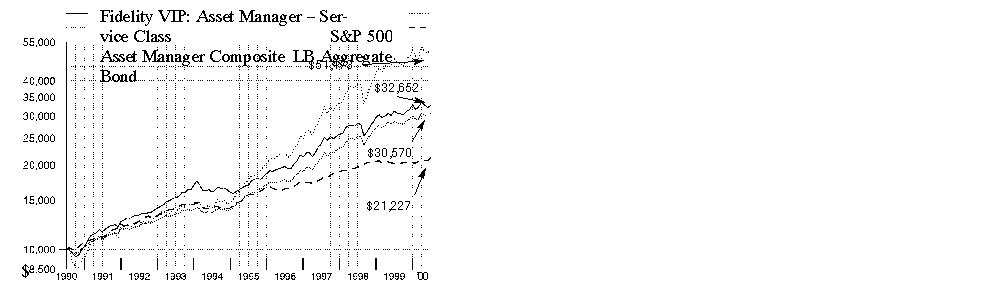

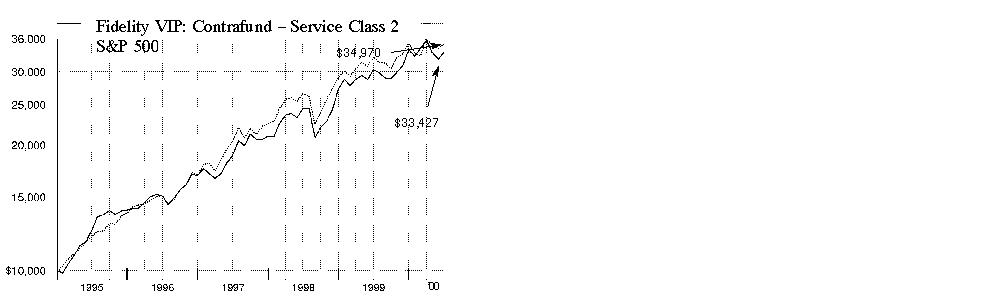

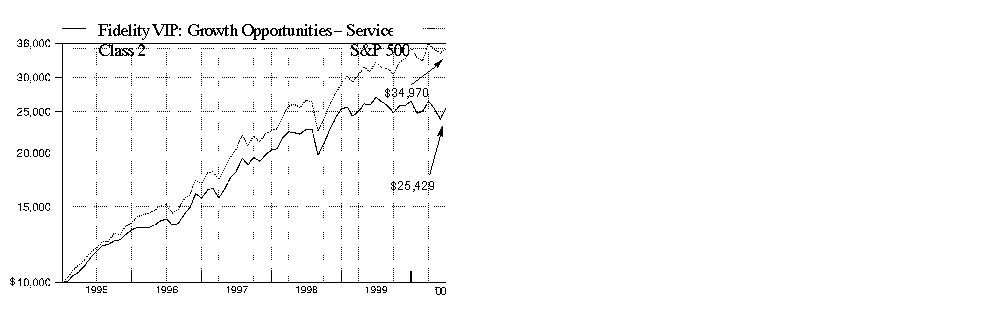

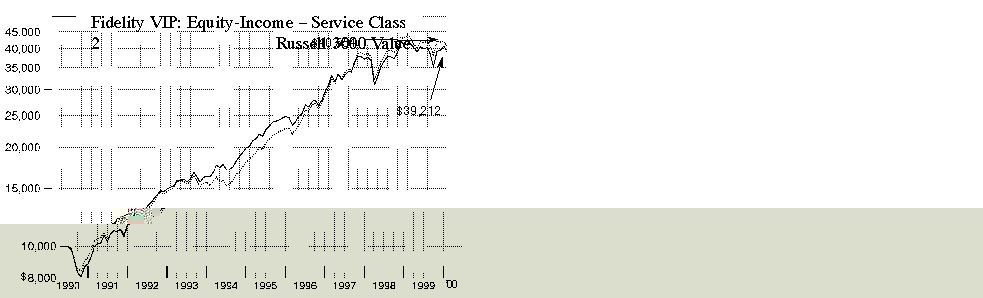

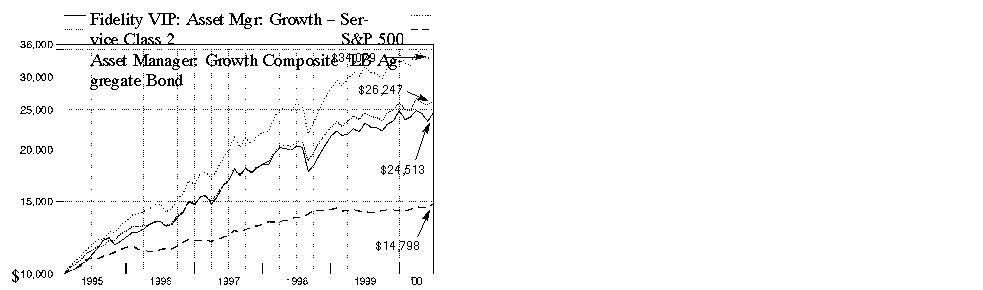

3$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity® Variable Insurance Products: Balanced Portfolio - Initial Class on January 3, 1995, when the fund started. As the chart shows, by June 30, 2000, the value of the investment would have grown to $18,815 - an 88.15% increase on the initial investment. For comparison, look at how both the Standard & Poor's 500 Index, a market capitalization-weighted index of common stocks, and the Lehman Brothers Aggregate Bond Index, a market value-weighted index of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of one year or more, did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment in the Standard & Poor's 500 Index would have grown to $34,970 - a 249.70% increase. If $10,000 was invested in the Lehman Brothers Aggregate Bond Index, it would have grown to $15,114 - a 51.14% increase. You can also look at how the Fidelity Balanced 60/40 Composite Index did over the same period. With dividends and interest, if any, reinvested, the same $10,000 would have grown to $25,352 - a 153.52% increase.

Investment Summary

|

Top Five Stocks as of June 30, 2000 |

|

|

|

% of fund's |

|

General Electric Co. |

3.6 |

|

Cisco Systems, Inc. |

2.3 |

|

Intel Corp. |

1.7 |

|

Exxon Mobil Corp. |

1.4 |

|

Pfizer, Inc. |

1.3 |

|

|

10.3 |

|

Top Five Market Sectors as of June 30, 2000 |

|

|

|

% of fund's |

|

Technology |

20.0 |

|

Finance |

10.4 |

|

Utilities |

9.2 |

|

Media & Leisure |

7.8 |

|

Health |

6.4 |

|

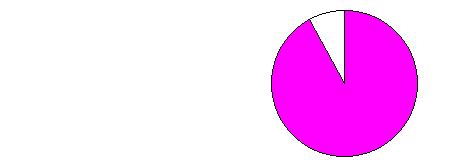

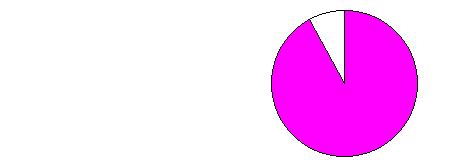

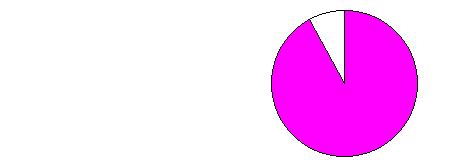

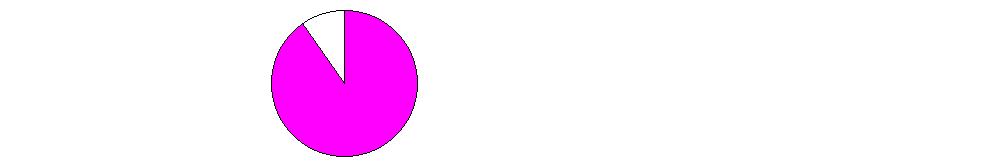

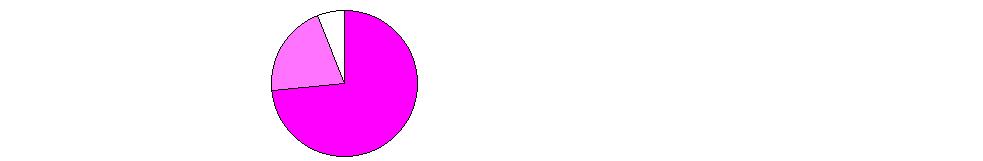

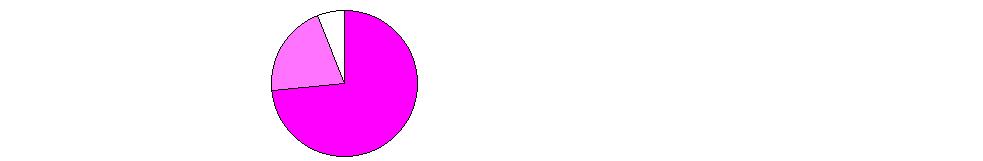

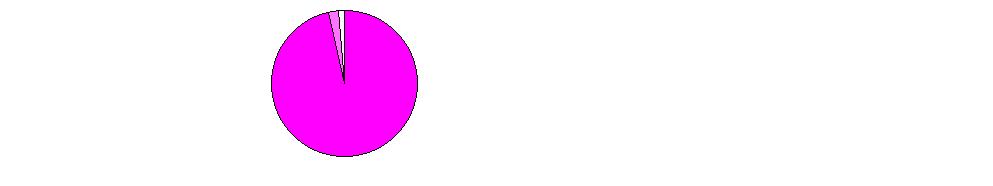

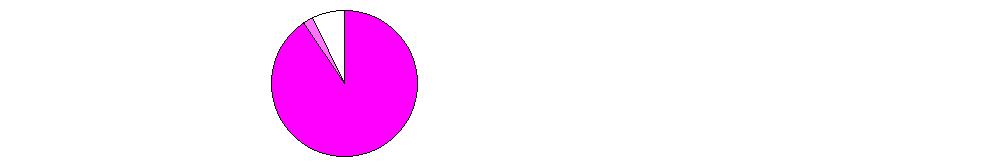

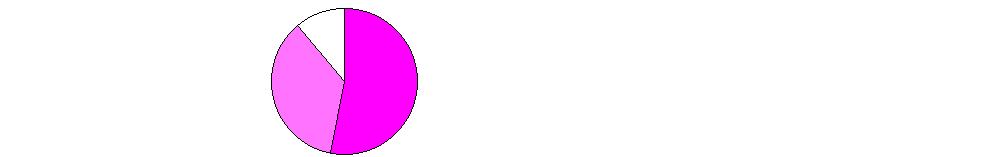

Asset Allocation as of June 30, 2000 |

|||

|

% of fund's net assets * |

|||

|

Stocks 57.2% |

|

|

|

Bonds 40.7% |

|

|

|

Short-Term Investments |

|

|

|

* Foreign investments 6.4% |

Semiannual Report

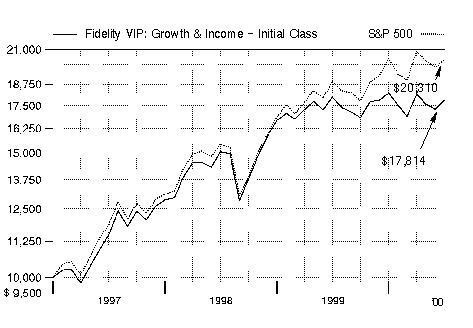

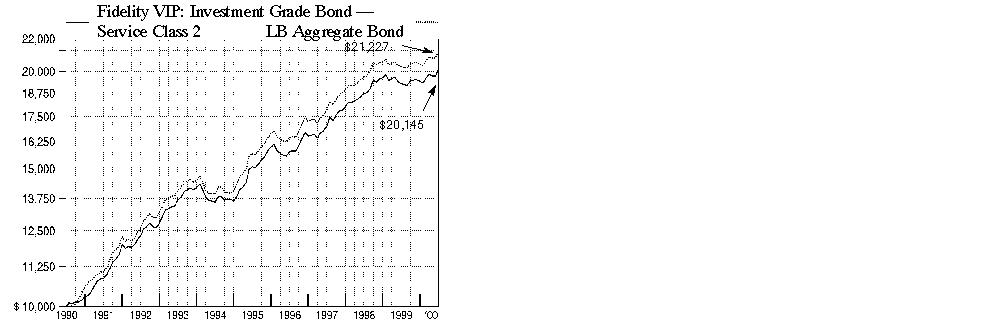

Performance

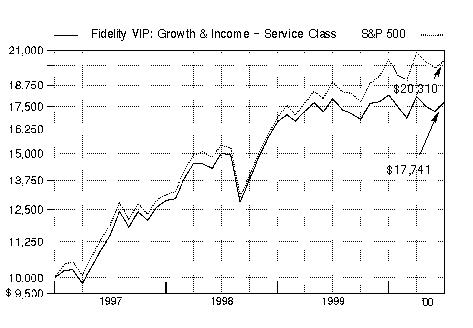

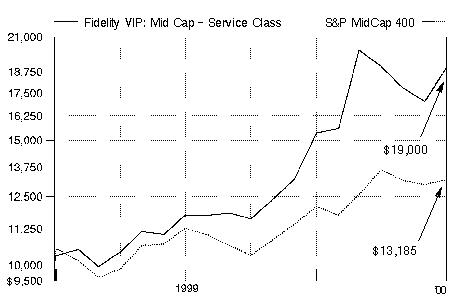

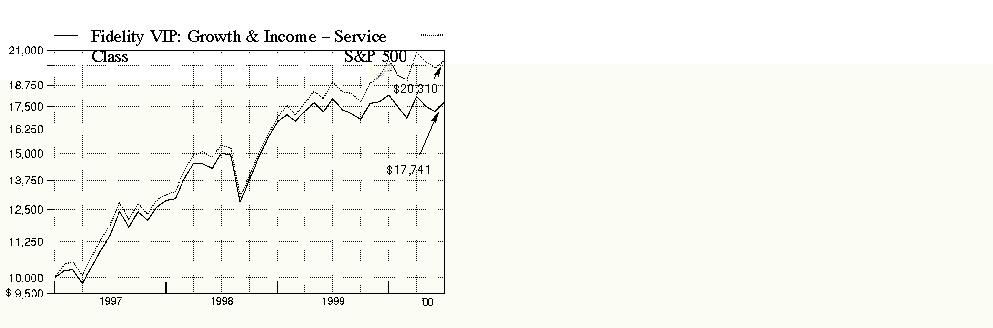

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). The initial offering of Service Class shares took place on November 3, 1997. Performance for Service Class shares reflects an asset based distribution fee (12b-1 fee), and returns prior to November 3, 1997 are those of Initial Class and do not include the effects of Service Class' 12b-1 fee. Had Service Class shares' 12b-1 fee been reflected, returns prior to November 3, 1997 would have been lower. If Fidelity had not reimbursed certain fund expenses, the past five years and life of fund total returns would have been lower.

Average Annual Total Returns

|

Periods ended |

Past 1 |

Past 5 |

Life of |

|

Fidelity VIP: Balanced - |

-0.57% |

11.77% |

12.11% |

|

Fidelity Balanced 60/40 Composite |

6.44% |

16.78% |

18.45% |

|

S&P 500 |

7.25% |

23.80% |

25.60% |

|

LB Aggregate Bond |

4.57% |

6.25% |

7.81% |

Average annual total returns take the fund's cumulative return and show what would have happened if the fund had performed at a constant rate each year.

You can compare the fund's returns to the performance of the Fidelity Balanced 60/40 Composite Index - a hypothetical combination of unmanaged indices using a weighting of 60% equity and 40% bond. The composite index combines the total returns of the Standard & Poor's 500 Index and the Lehman Brothers Aggregate Bond Index.

Figures for more than one year assume a steady compounded rate of return and are not the fund's year-by-year results, which fluctuated over the periods shown. The life of fund figures are from commencement of operations, January 3, 1995.

Performance numbers are net of all fund operating expenses, but do not include any insurance charges imposed by your insurance company's separate account. If performance information included the effect of these additional charges, the total returns would have been lower.

Past performance is no guarantee of future results. Principal and investment return will vary and you may have a gain or loss when you withdraw your money.

Understanding Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. The stock market, for example, has a history of long-term growth and short-term volatility. In turn, the share price and return of a fund that invests in stocks will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

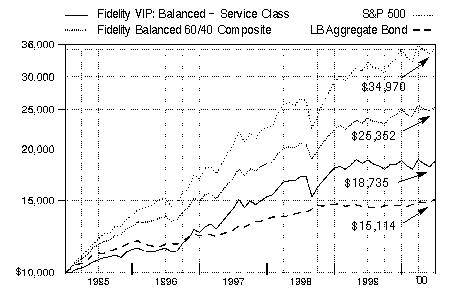

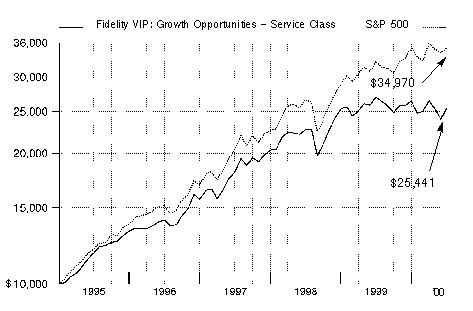

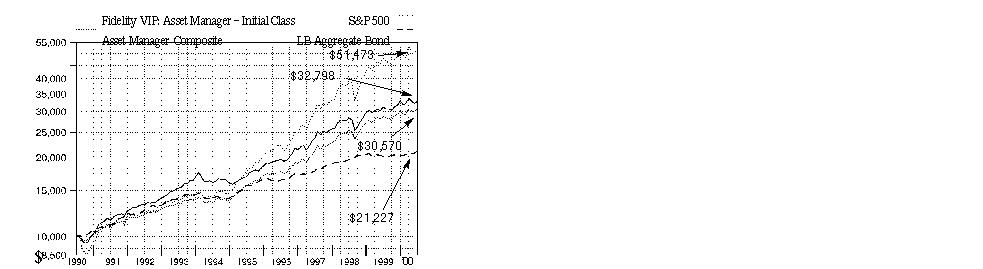

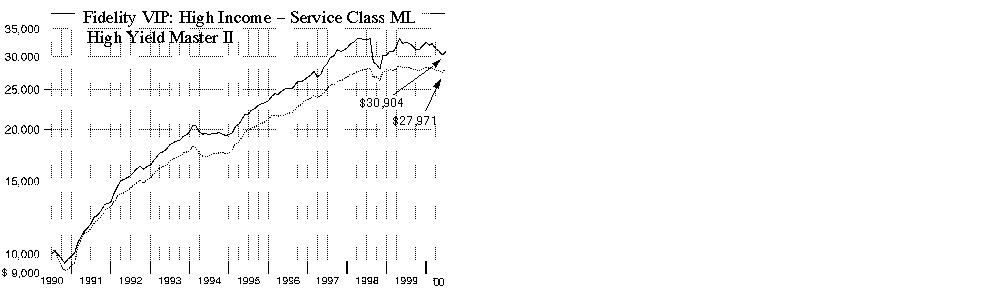

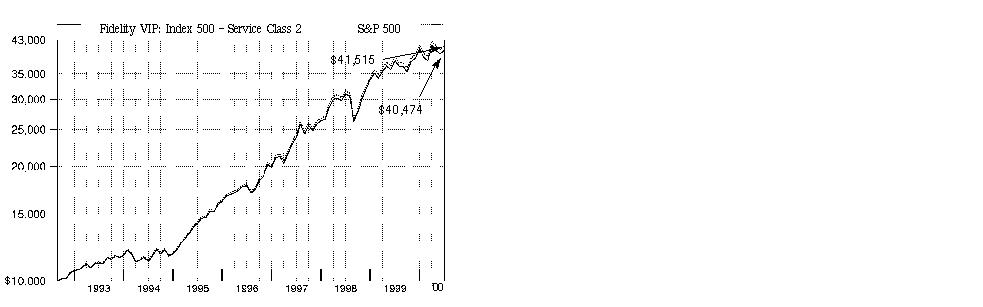

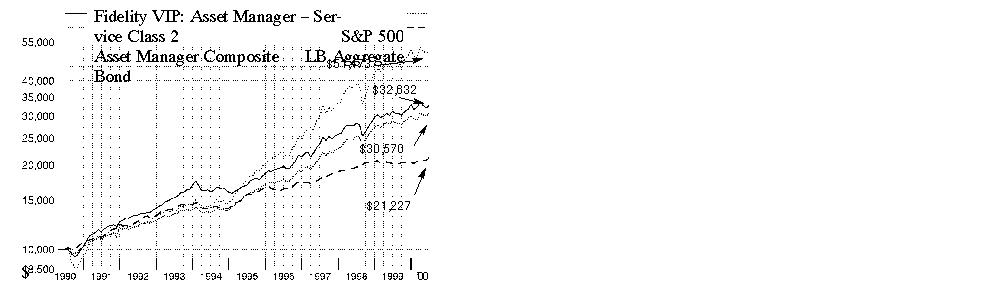

3$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity Variable Insurance Products: Balanced Portfolio - Service Class on January 3, 1995, when the fund started. As the chart shows, by June 30, 2000, the value of the investment would have grown to $18,735 - an 87.35% increase on the initial investment. For comparison, look at how both the Standard & Poor's 500 Index, a market capitalization-weighted index of common stocks, and the Lehman Brothers Aggregate Bond Index, a market value-weighted index of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of one year or more, did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment in the Standard & Poor's 500 Index would have grown to $34,970 - a 249.70% increase. If $10,000 was invested in the Lehman Brothers Aggregate Bond Index, it would have grown to $15,114 - a 51.14% increase. You can also look at how the Fidelity Balanced 60/40 Composite Index did over the same period. With dividends and interest, if any, reinvested, the same $10,000 would have grown to $25,352 - a 153.52% increase.

Investment Summary

|

Top Five Stocks as of June 30, 2000 |

|

|

|

% of fund's |

|

General Electric Co. |

3.6 |

|

Cisco Systems, Inc. |

2.3 |

|

Intel Corp. |

1.7 |

|

Exxon Mobil Corp. |

1.4 |

|

Pfizer, Inc. |

1.3 |

|

|

10.3 |

|

Top Five Market Sectors as of June 30, 2000 |

|

|

|

% of fund's |

|

Technology |

20.0 |

|

Finance |

10.4 |

|

Utilities |

9.2 |

|

Media & Leisure |

7.8 |

|

Health |

6.4 |

|

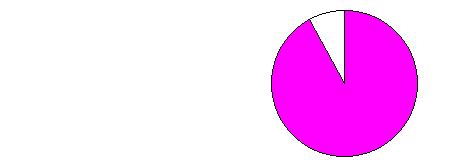

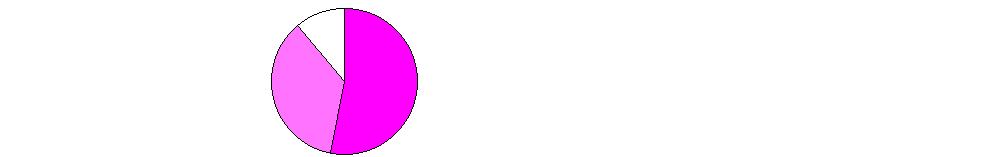

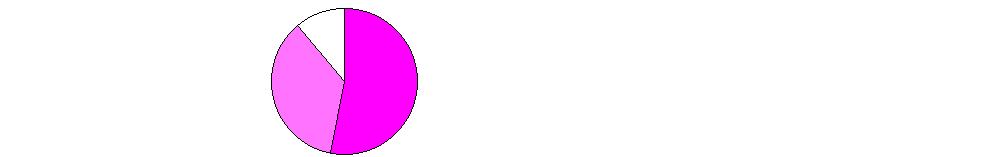

Asset Allocation as of June 30, 2000 |

|||

|

% of fund's net assets * |

|||

|

Stocks 57.2% |

|

|

|

Bonds 40.7% |

|

|

|

Short-Term Investments |

|

|

|

* Foreign investments 6.4% |

Semiannual Report

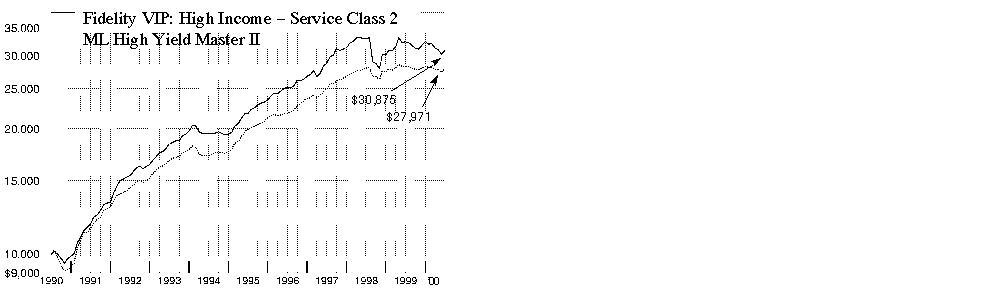

Performance

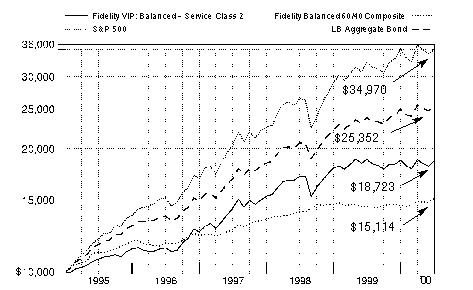

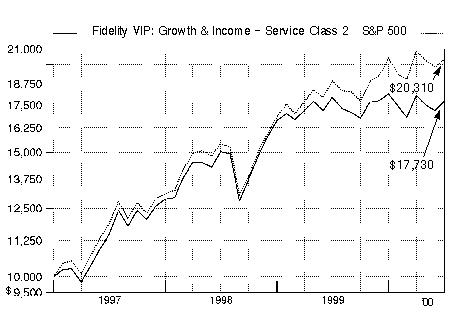

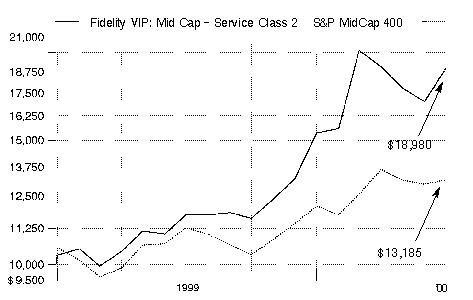

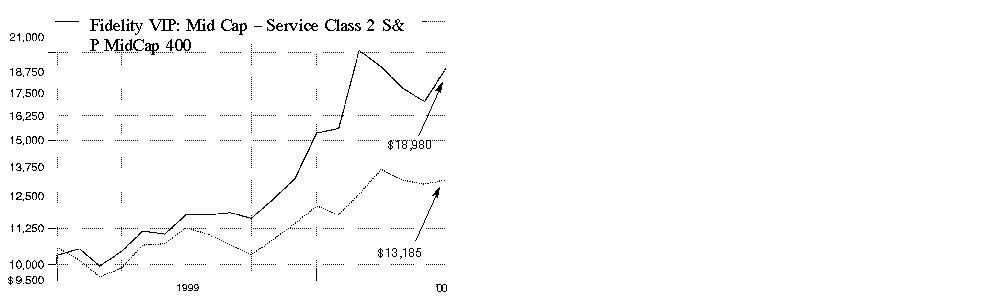

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). The initial offering of Service Class 2 shares took place on January 12, 2000. Performance for Service Class 2 shares reflects an asset based distribution fee (12b-1 fee). Returns from November 3, 1997 through January 12, 2000 are those of Service Class which reflects a different 12b-1 fee. Service Class 2 returns prior to November 3, 1997 are those of Initial Class, and do not include the effects of a 12b-1 fee. Had Service Class 2's 12b-1 fee been reflected, returns prior to January 12, 2000 would have been lower. If Fidelity had not reimbursed certain fund expenses, the past five years and life of fund total returns would have been lower.

Average Annual Total Returns

|

Periods ended |

Past 1 |

Past 5 |

Life of |

|

Fidelity VIP: Balanced - |

-0.63% |

11.76% |

12.09% |

|

Fidelity Balanced 60/40 Composite |

6.44% |

16.78% |

18.45% |

|

S&P 500 |

7.25% |

23.80% |

25.60% |

|

LB Aggregate Bond |

4.57% |

6.25% |

7.81% |

Average annual total returns take the fund's cumulative return and show what would have happened if the fund had performed at a constant rate each year.

You can compare the fund's returns to the performance of the Fidelity Balanced 60/40 Composite Index - a hypothetical combination of unmanaged indices using a weighting of 60% equity and 40% bond. The composite index combines the total returns of the Standard & Poor's 500 Index and the Lehman Brothers Aggregate Bond Index.

Figures for more than one year assume a steady compounded rate of return and are not the fund's year-by-year results, which fluctuated over the periods shown. The life of fund figures are from commencement of operations, January 3, 1995.

Performance numbers are net of all fund operating expenses, but do not include any insurance charges imposed by your insurance company's separate account. If performance information included the effect of these additional charges, the total returns would have been lower.

Past performance is no guarantee of future results. Principal and investment return will vary and you may have a gain or loss when you withdraw your money.

Understanding Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. The stock market, for example, has a history of long-term growth and short-term volatility. In turn, the share price and return of a fund that invests in stocks will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

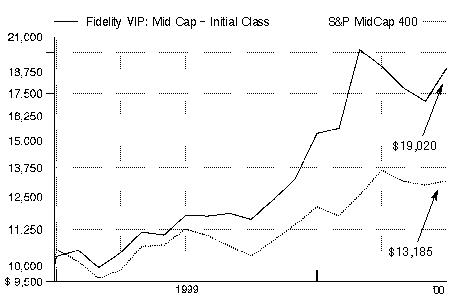

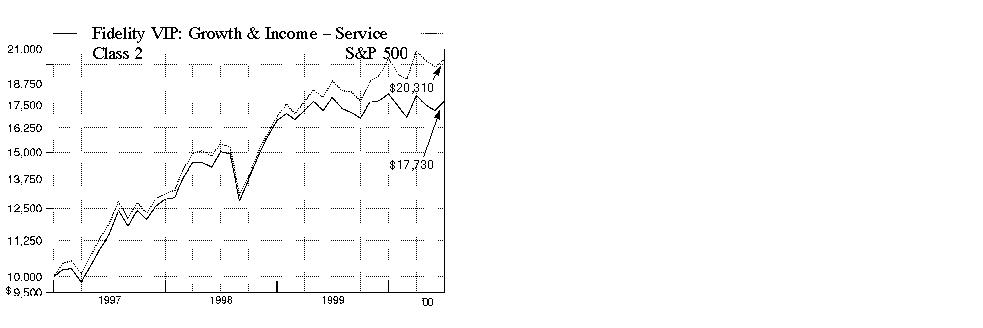

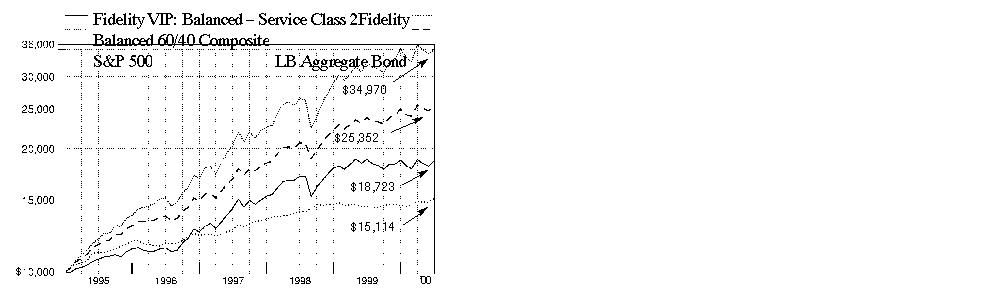

3$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity Variable Insurance Products: Balanced Portfolio - Service Class 2 on January 3, 1995, when the fund started. As the chart shows, by June 30, 2000, the value of the investment would have grown to $18,723 - an 87.23% increase on the initial investment. For comparison, look at how both the Standard & Poor's 500 Index, a market capitalization-weighted index of common stocks, and the Lehman Brothers Aggregate Bond Index, a market value-weighted index of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of one year or more, did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment in the Standard & Poor's 500 Index would have grown to $34,970 - a 249.70% increase. If $10,000 was invested in the Lehman Brothers Aggregate Bond Index, it would have grown to $15,114 - a 51.14% increase. You can also look at how the Fidelity Balanced 60/40 Composite Index did over the same period. With dividends and interest, if any, reinvested, the same $10,000 would have grown to $25,352 - a 153.52% increase.

Investment Summary

|

Top Five Stocks as of June 30, 2000 |

|

|

|

% of fund's |

|

General Electric Co. |

3.6 |

|

Cisco Systems, Inc. |

2.3 |

|

Intel Corp. |

1.7 |

|

Exxon Mobil Corp. |

1.4 |

|

Pfizer, Inc. |

1.3 |

|

|

10.3 |

|

Top Five Market Sectors as of June 30, 2000 |

|

|

|

% of fund's |

|

Technology |

20.0 |

|

Finance |

10.4 |

|

Utilities |

9.2 |

|

Media & Leisure |

7.8 |

|

Health |

6.4 |

|

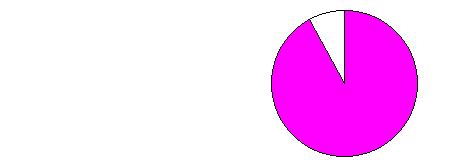

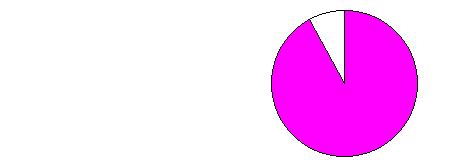

Asset Allocation as of June 30, 2000 |

|||

|

% of fund's net assets * |

|||

|

Stocks 57.2% |

|

|

|

Bonds 40.7% |

|

|

|

Short-Term Investments |

|

|

|

* Foreign investments 6.4% |

Semiannual Report

(automated graphic) (automated graphic)

An interview with John Avery (right), Lead Portfolio Manager of Balanced Portfolio, and Kevin Grant, manager for fixed-income investments

Q. How did the fund perform, John?

J.A. For the six- and 12-month periods that ended June 30, 2000, the fund underperformed the Fidelity Balanced 60/40 Composite Index, which returned 1.45% and 6.44%, respectively, during these time frames.

Q. Why did the fund trail its benchmark during the

six-month period?

J.A. Having an average underweighting in technology hurt during the sector's impressive run-up early in the period. The fund's underexposure to tech was double trouble in the sense that most other areas of the market in which the fund was invested had a difficult period. So, even though the technology group corrected sharply in the spring - as the market turned elsewhere for growth - it was up so much in the first half that, for all intents and purposes, our fate was sealed.

Q. What were some of your strategies and how did they influence performance?

J.A. I maintained an emphasis on equities during the market's upturn, adding convertible securities in lieu of pure stocks. I used convertibles as an indirect, less volatile way to participate in some of the growth stories I liked within the technology sector. This strategy helped provide some nice yield and afforded us the added benefit of downside protection, as convertible securities gave back less than their pure stock equivalents during the correction. When things started to fall apart for tech, I took advantage of the opportunity to increase the fund's concentration in large, high-quality companies, many of which had dropped sharply from their highs of the period. However, the fund was hurt for not owning enough of the period's top performers along the way, namely Oracle and Intel. On a more positive note, the fund's healthy exposure to large drug companies such as Warner-Lambert and Eli Lilly helped, as the group rallied behind renewed enthusiasm for strong new product pipelines. Warner-Lambert merged with Pfizer - another fund holding - just prior to the close of the period. The fund's lack of exposure to a generally weak consumer nondurables sector, and some good picks in media stocks such as Viacom, further aided relative performance.

Q. What other stocks performed well for the fund? Which disappointed?

J.A. A number of the fund's financial holdings performed well - most notably Bank of New York and Morgan Stanley Dean Witter - benefiting from strong capital markets activity. Tech stocks we did own, including Texas Instruments, EMC and Micron Technology, also added meaningfully to performance. Conversely, those that weren't so hot included Motorola, Alltel and Lucent. Motorola was, by far, the fund's worst performer, slipping on execution problems and narrowing margins in its cellular handset business. Traditional telecommunications providers AT&T and WorldCom fell prey to increased competition and falling prices.

Q. Turning to you, Kevin, how did the fund's bond investments fare?

K.G. The investment-grade portion of the fund performed well during the six-month period, benefiting from its exposure to a strong rally in the government market. An announcement by the U.S. Treasury in January of its intent to repurchase long-term debt and reduce future issuance sent the price of the long bond higher and its yield lower. This action, coupled with rising short-term interest rates, induced an inverted yield curve, which occurs when short-term issues provide a higher yield than their longer-term counterparts. This inversion hurt the spread sectors - most notably corporate bonds and mortgage securities - with yield spreads widening out significantly relative to comparable duration Treasuries. The fund was well-positioned for these changes, as we responded to the buybacks by reducing our exposure to long-term corporates in exchange for more Treasuries, which worked out beautifully. This strategy helped the fund's bond subportfolio outperform the Lehman Brothers Aggregate Bond Index during the period. So, despite the Federal Reserve Board's efforts to raise rates during the period, the supply/demand imbalance spurred by the Treasury buybacks helped ensure our success.

Q. John, what's your outlook?

J.A. I'm bullish overall, as business remains strong in many areas of the economy, although I temper that enthusiasm with concern about interest rates rising further. In this uncertain environment, I believe the market will begin to focus more on revenues and earnings. As such, the companies capable of delivering robust top-line growth and strong bottom-line earnings should be the ones to reap the rewards. Given the extent to which technology and the Internet have transformed the global landscape, I expect we'll see strong performance from this sector going forward.

The views expressed in this report reflect those of the portfolio managers only through the end of the period of the report as stated on the cover. The managers' views are subject to change at any time based on market or other conditions. For more information, see page 2.

Fund Facts

Goal: seeks income and capital growth consistent with reasonable risk by investing in a diversified portfolio of stocks and bonds

Start date: January 3, 1995

Size: as of June 30, 2000, more than $304 million

Manager: John Avery, since 1998, and

Kevin Grant, since 1996; John Avery joined

Fidelity in 1995; Kevin Grant joined Fidelity in 1993

Semiannual Report

Fidelity Variable Insurance Products: Balanced Portfolio

(Unaudited)

Showing Percentage of Net Assets

|

Common Stocks - 56.8% |

|||

|

Shares |

Value (Note 1) |

||

|

AEROSPACE & DEFENSE - 0.4% |

|||

|

Aerospace & Defense - 0.2% |

|||

|

Boeing Co. |

13,700 |

$ 572,831 |

|

|

Textron, Inc. |

4,200 |

228,113 |

|

|

|

800,944 |

||

|

Ship Building & Repair - 0.2% |

|||

|

General Dynamics Corp. |

9,700 |

506,825 |

|

|

TOTAL AEROSPACE & DEFENSE |

1,307,769 |

||

|

BASIC INDUSTRIES - 0.5% |

|||

|

Chemicals & Plastics - 0.4% |

|||

|

E.I. du Pont de Nemours and Co. |

14,104 |

617,050 |

|

|

Praxair, Inc. |

16,100 |

602,744 |

|

|

|

1,219,794 |

||

|

Metals & Mining - 0.1% |

|||

|

Alcoa, Inc. |

13,000 |

377,000 |

|

|

TOTAL BASIC INDUSTRIES |

1,596,794 |

||

|

DURABLES - 0.3% |

|||

|

Autos, Tires, & Accessories - 0.2% |

|||

|

AutoNation, Inc. |

3,700 |

26,131 |

|

|

Danaher Corp. |

9,600 |

474,600 |

|

|

|

500,731 |

||

|

Consumer Electronics - 0.1% |

|||

|

General Motors Corp. Class H (a) |

5,400 |

473,850 |

|

|

TOTAL DURABLES |

974,581 |

||

|

ENERGY - 3.7% |

|||

|

Energy Services - 0.8% |

|||

|

Diamond Offshore Drilling, Inc. |

15,200 |

533,900 |

|

|

Halliburton Co. |

12,900 |

608,719 |

|

|

Nabors Industries, Inc. (a) |

16,800 |

698,250 |

|

|

Schlumberger Ltd. (NY Shares) |

9,000 |

671,625 |

|

|

|

2,512,494 |

||

|

Oil & Gas - 2.9% |

|||

|

BP Amoco PLC |

63,962 |

602,975 |

|

|

Burlington Resources, Inc. |

15,000 |

573,750 |

|

|

Chevron Corp. |

10,000 |

848,125 |

|

|

Conoco, Inc. Class B |

50,800 |

1,247,775 |

|

|

Exxon Mobil Corp. |

53,366 |

4,189,231 |

|

|

Royal Dutch Petroleum Co. (NY Shares) |

21,400 |

1,317,438 |

|

|

|

8,779,294 |

||

|

TOTAL ENERGY |

11,291,788 |

||

|

FINANCE - 7.4% |

|||

|

Banks - 1.0% |

|||

|

Bank of America Corp. |

15,100 |

649,300 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Bank of New York Co., Inc. |

41,700 |

$ 1,939,050 |

|

|

Chase Manhattan Corp. |

10,500 |

483,656 |

|

|

|

3,072,006 |

||

|

Credit & Other Finance - 2.3% |

|||

|

American Express Co. |

70,900 |

3,695,663 |

|

|

Citigroup, Inc. |

56,325 |

3,393,581 |

|

|

|

7,089,244 |

||

|

Federal Sponsored Credit - 1.2% |

|||

|

Fannie Mae |

32,400 |

1,690,875 |

|

|

Freddie Mac |

45,300 |

1,834,650 |

|

|

|

3,525,525 |

||

|

Insurance - 1.5% |

|||

|

AFLAC, Inc. |

9,300 |

427,219 |

|

|

American International Group, Inc. |

30,300 |

3,560,250 |

|

|

Hartford Financial Services Group, Inc. |

8,400 |

469,875 |

|

|

|

4,457,344 |

||

|

Securities Industry - 1.4% |

|||

|

Charles Schwab Corp. |

25,150 |

845,669 |

|

|

Merrill Lynch & Co., Inc. |

7,500 |

862,500 |

|

|

Morgan Stanley Dean Witter & Co. |

31,900 |

2,655,675 |

|

|

|

4,363,844 |

||

|

TOTAL FINANCE |

22,507,963 |

||

|

HEALTH - 5.9% |

|||

|

Drugs & Pharmaceuticals - 5.6% |

|||

|

American Home Products Corp. |

15,900 |

934,125 |

|

|

Amgen, Inc. |

11,600 |

814,900 |

|

|

Bristol-Myers Squibb Co. |

48,200 |

2,807,650 |

|

|

Eli Lilly & Co. |

39,000 |

3,895,125 |

|

|

Merck & Co., Inc. |

11,300 |

865,863 |

|

|

Pfizer, Inc. |

84,700 |

4,065,600 |

|

|

Schering-Plough Corp. |

72,400 |

3,656,200 |

|

|

|

17,039,463 |

||

|

Medical Equipment & Supplies - 0.3% |

|||

|

Johnson & Johnson |

4,600 |

468,625 |

|

|

Medtronic, Inc. |

10,000 |

498,125 |

|

|

|

966,750 |

||

|

TOTAL HEALTH |

18,006,213 |

||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 4.4% |

|||

|

Electrical Equipment - 3.6% |

|||

|

General Electric Co. |

206,400 |

10,939,184 |

|

|

Industrial Machinery & Equipment - 0.8% |

|||

|

Tyco International Ltd. |

53,870 |

2,552,091 |

|

|

TOTAL INDUSTRIAL MACHINERY & EQUIPMENT |

13,491,275 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

MEDIA & LEISURE - 4.3% |

|||

|

Broadcasting - 1.6% |

|||

|

AT&T Corp. - Liberty Media Group |

44,000 |

$ 1,067,000 |

|

|

Cable Satisfaction International, Inc. warrants 3/1/10 (a) |

200 |

540 |

|

|

Clear Channel Communications, Inc. (a) |

15,400 |

1,155,000 |

|

|

Infinity Broadcasting Corp. Class A (a) |

29,600 |

1,078,550 |

|

|

NTL, Inc. warrants 10/14/08 (a) |

199 |

8,159 |

|

|

Time Warner, Inc. |

20,208 |

1,535,808 |

|

|

UIH Australia/Pacific, Inc. warrants 5/15/06 (a) |

150 |

4,500 |

|

|

|

4,849,557 |

||

|

Entertainment - 1.8% |

|||

|

MGM Grand, Inc. |

12,500 |

401,563 |

|

|

Viacom, Inc. Class B (non-vtg.) (a) |

56,389 |

3,845,025 |

|

|

Walt Disney Co. |

29,100 |

1,129,444 |

|

|

|

5,376,032 |

||

|

Publishing - 0.7% |

|||

|

McGraw-Hill Companies, Inc. |

42,100 |

2,273,400 |

|

|

Restaurants - 0.2% |

|||

|

McDonald's Corp. |

20,500 |

675,219 |

|

|

TOTAL MEDIA & LEISURE |

13,174,208 |

||

|

NONDURABLES - 1.6% |

|||

|

Beverages - 0.9% |

|||

|

Anheuser-Busch Companies, Inc. |

16,700 |

1,247,281 |

|

|

Seagram Co. Ltd. |

6,100 |

358,460 |

|

|

The Coca-Cola Co. |

19,300 |

1,108,544 |

|

|

|

2,714,285 |

||

|

Household Products - 0.5% |

|||

|

Clorox Co. |

14,700 |

658,744 |

|

|

Colgate-Palmolive Co. |

12,100 |

724,488 |

|

|

|

1,383,232 |

||

|

Tobacco - 0.2% |

|||

|

Philip Morris Companies, Inc. |

22,400 |

595,000 |

|

|

TOTAL NONDURABLES |

4,692,517 |

||

|

RETAIL & WHOLESALE - 2.9% |

|||

|

Apparel Stores - 0.2% |

|||

|

Mothers Work, Inc. (a)(k) |

3 |

34 |

|

|

The Limited, Inc. |

26,800 |

579,550 |

|

|

|

579,584 |

||

|

General Merchandise Stores - 1.6% |

|||

|

Kohls Corp. (a) |

9,300 |

517,313 |

|

|

Target Corp. |

21,400 |

1,241,200 |

|

|

Wal-Mart Stores, Inc. |

54,900 |

3,163,613 |

|

|

|

4,922,126 |

||

|

Retail & Wholesale, Miscellaneous - 1.1% |

|||

|

Best Buy Co., Inc. (a) |

800 |

50,600 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Home Depot, Inc. |

53,550 |

$ 2,674,153 |

|

|

Lowe's Companies, Inc. |

11,100 |

455,794 |

|

|

|

3,180,547 |

||

|

TOTAL RETAIL & WHOLESALE |

8,682,257 |

||

|

SERVICES - 0.7% |

|||

|

Advertising - 0.5% |

|||

|

Omnicom Group, Inc. |

17,200 |

1,531,875 |

|

|

Services - 0.2% |

|||

|

Ecolab, Inc. |

18,100 |

707,031 |

|

|

TOTAL SERVICES |

2,238,906 |

||

|

TECHNOLOGY - 19.0% |

|||

|

Communications Equipment - 5.3% |

|||

|

Cisco Systems, Inc. (a) |

111,000 |

7,055,438 |

|

|

Comverse Technology, Inc. (a) |

8,100 |

753,300 |

|

|

Corning, Inc. |

4,000 |

1,079,500 |

|

|

Lucent Technologies, Inc. |

30,200 |

1,789,350 |

|

|

Nokia AB sponsored ADR |

34,200 |

1,707,863 |

|

|

Nortel Networks Corp. |

53,100 |

3,683,465 |

|

|

|

16,068,916 |

||

|

Computer Services & Software - 3.4% |

|||

|

America Online, Inc. (a) |

25,950 |

1,368,863 |

|

|

BEA Systems, Inc. (a) |

14,100 |

697,069 |

|

|

DecisionOne Corp. |

583 |

6 |

|

|

DecisionOne Corp.: |

|

|

|

|

Class A warrants 4/18/07 (a) |

342 |

0 |

|

|

Class B warrants 4/18/07 (a) |

590 |

0 |

|

|

Class C warrants 4/18/07 (a) |

350 |

0 |

|

|

Inktomi Corp. (a) |

3,400 |

402,050 |

|

|

Microsoft Corp. (a) |

40,400 |

3,232,000 |

|

|

Oracle Corp. (a) |

38,700 |

3,253,219 |

|

|

VeriSign, Inc. (a) |

4,392 |

775,188 |

|

|

Yahoo!, Inc. (a) |

6,200 |

768,025 |

|

|

|

10,496,420 |

||

|

Computers & Office Equipment - 4.5% |

|||

|

Compaq Computer Corp. |

33,600 |

858,900 |

|

|

Dell Computer Corp. (a) |

42,700 |

2,105,644 |

|

|

EMC Corp. (a) |

50,100 |

3,854,569 |

|

|

Hewlett-Packard Co. |

8,400 |

1,048,950 |

|

|

International Business Machines Corp. |

24,000 |

2,629,500 |

|

|

Network Appliance, Inc. (a) |

8,300 |

668,150 |

|

|

Pitney Bowes, Inc. |

11,000 |

440,000 |

|

|

Sun Microsystems, Inc. (a) |

22,800 |

2,073,375 |

|

|

|

13,679,088 |

||

|

Electronic Instruments - 0.5% |

|||

|

Applied Materials, Inc. (a) |

10,400 |

942,500 |

|

|

KLA-Tencor Corp. (a) |

8,400 |

491,925 |

|

|

|

1,434,425 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

TECHNOLOGY - continued |

|||

|

Electronics - 5.3% |

|||

|

Analog Devices, Inc. (a) |

12,900 |

$ 980,400 |

|

|

Broadcom Corp. Class A (a) |

4,200 |

919,538 |

|

|

Flextronics International Ltd. (a) |

6,500 |

446,469 |

|

|

Insilco Corp. warrants 8/15/07 (a) |

60 |

0 |

|

|

Intel Corp. |

39,300 |

5,253,919 |

|

|

JDS Uniphase Corp. (a) |

12,200 |

1,462,475 |

|

|

Micron Technology, Inc. (a) |

20,400 |

1,796,475 |

|

|

Motorola, Inc. |

32,900 |

956,156 |

|

|

Sanmina Corp. (a) |

7,900 |

675,450 |

|

|

Texas Instruments, Inc. |

55,100 |

3,784,681 |

|

|

|

16,275,563 |

||

|

TOTAL TECHNOLOGY |

57,954,412 |

||

|

UTILITIES - 5.7% |

|||

|

Cellular - 2.5% |

|||

|

China Telecom (Hong Kong) Ltd. (a) |

90,000 |

800,156 |

|

|

Leap Wireless International, Inc.: |

|

|

|

|

warrants 4/15/10 (a)(g) |

75 |

0 |

|

|

warrants 4/15/10 (a) |

65 |

0 |

|

|

Loral Orion Network Systems, Inc.: |

|

|

|

|

warrants 1/15/07 (CV ratio .47) (a) |

290 |

725 |

|

|

warrants 1/15/07 (CV ratio .6) (a) |

50 |

213 |

|

|

McCaw International Ltd. warrants 4/16/07 (a)(g) |

290 |

725 |

|

|

Nextel Communications, Inc. Class A (a) |

23,400 |

1,431,788 |

|

|

Sprint Corp. - PCS Group Series 1 (a) |

35,100 |

2,088,450 |

|

|

Vodafone AirTouch PLC sponsored ADR |

37,800 |

1,566,338 |

|

|

VoiceStream Wireless Corp. (a) |

14,700 |

1,709,564 |

|

|

|

7,597,959 |

||

|

Electric Utility - 0.3% |

|||

|

AES Corp. (a) |

21,800 |

994,625 |

|

|

Gas - 0.5% |

|||

|

Dynegy, Inc. Class A |

11,600 |

792,425 |

|

|

Enron Corp. |

9,200 |

593,400 |

|

|

|

1,385,825 |

||

|

Telephone Services - 2.4% |

|||

|

Allegiance Telecom, Inc. (a) |

6,900 |

441,600 |

|

|

AT&T Corp. |

16,604 |

525,102 |

|

|

BellSouth Corp. |

32,000 |

1,364,000 |

|

|

KMC Telecom Holdings, Inc. warrants 4/15/08 (a)(g) |

70 |

175 |

|

|

Level 3 Communications, Inc. (a) |

5,400 |

475,200 |

|

|

McLeodUSA, Inc. Class A (a) |

37,600 |

777,850 |

|

|

Ono Finance PLC rights 5/31/09 (a)(g) |

210 |

2,100 |

|

|

Qwest Communications |

13,600 |

675,750 |

|

|

SBC Communications, Inc. |

37,170 |

1,607,603 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Sprint Corp. - FON Group |

12,300 |

$ 627,300 |

|

|

WorldCom, Inc. (a) |

19,489 |

894,058 |

|

|

|

7,390,738 |

||

|

TOTAL UTILITIES |

17,369,147 |

||

|

TOTAL COMMON STOCKS (Cost $133,038,091) |

173,287,830 |

||

|

Preferred Stocks - 0.4% |

|||

|

|

|

|

|

|

Convertible Preferred Stocks - 0.2% |

|||

|

MEDIA & LEISURE - 0.2% |

|||

|

Broadcasting - 0.2% |

|||

|

MediaOne Group, Inc. |

4,700 |

423,000 |

|

|

Nonconvertible Preferred Stocks - 0.2% |

|||

|

ENERGY - 0.0% |

|||

|

Energy Services - 0.0% |

|||

|

R&B Falcon Corp. 13.875% |

113 |

128,255 |

|

|

FINANCE - 0.0% |

|||

|

Insurance - 0.0% |

|||

|

American Annuity Group Capital |

50 |

44,513 |

|

|

HEALTH - 0.1% |

|||

|

Medical Facilities Management - 0.1% |

|||

|

Fresenius Medical Care Capital |

190 |

173,333 |

|

|

MEDIA & LEISURE - 0.1% |

|||

|

Broadcasting - 0.1% |

|||

|

CSC Holdings, Inc. 11.125% pay-in-kind |

2,136 |

223,212 |

|

|

Publishing - 0.0% |

|||

|

PRIMEDIA, Inc. Series D, $10.00 |

600 |

55,500 |

|

|

TOTAL MEDIA & LEISURE |

278,712 |

||

|

TOTAL NONCONVERTIBLE PREFERRED STOCKS |

624,813 |

||

|

TOTAL PREFERRED STOCKS (Cost $970,382) |

1,047,813 |

||

|

Corporate Bonds - 15.2% |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount |

|

|||

|

Convertible Bonds - 1.1% |

|||||

|

HEALTH - 0.4% |

|||||

|

Drugs & Pharmaceuticals - 0.4% |

|||||

|

Roche Holdings, Inc. |

- |

|

$ 1,261,000 |

1,153,815 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount |

Value |

|||

|

Convertible Bonds - continued |

|||||

|

MEDIA & LEISURE - 0.2% |

|||||

|

Broadcasting - 0.2% |

|||||

|

Liberty Media Corp. |

Baa3 |

|

$ 481,000 |

$ 521,885 |

|

|

TECHNOLOGY - 0.4% |

|||||

|

Computers & Office Equipment - 0.4% |

|||||

|

Juniper Networks, Inc. 4.75% 3/15/07 |

B- |

|

1,220,000 |

1,349,625 |

|

|

UTILITIES - 0.1% |

|||||

|

Cellular - 0.1% |

|||||

|

Nextel Communications, Inc. 5.25% 1/15/10 (g) |

B1 |

|

308,000 |

318,780 |

|

|

Telephone Services - 0.0% |

|||||

|

Level 3 Communications, Inc. 6% 3/15/10 |

Caa1 |

|

203,000 |

183,842 |

|

|

TOTAL UTILITIES |

502,622 |

||||

|

TOTAL CONVERTIBLE BONDS |

3,527,947 |

||||

|

Nonconvertible Bonds - 14.1% |

|||||

|

AEROSPACE & DEFENSE - 0.1% |

|||||

|

Defense Electronics - 0.1% |

|||||

|

Raytheon Co. |

Baa2 |

|

240,000 |

240,662 |

|

|

BASIC INDUSTRIES - 0.4% |

|||||

|

Chemicals & Plastics - 0.2% |

|||||

|

Huntsman Corp. |

B2 |

|

370,000 |

337,625 |

|

|

Lyondell Chemical Co. 10.875% 5/1/09 |

B2 |

|

340,000 |

337,450 |

|

|

|

675,075 |

||||

|

Metals & Mining - 0.0% |

|||||

|

Kaiser Aluminum & Chemical

Corp. |

B3 |

|

160,000 |

145,600 |

|

|

Packaging & Containers - 0.1% |

|||||

|

Gaylord Container Corp. 9.75% 6/15/07 |

Caa1 |

|

210,000 |

163,800 |

|

|

Paper & Forest Products - 0.1% |

|||||

|

APP China Group Ltd. |

B3 |

|

150,000 |

94,500 |

|

|

|

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount |

Value |

|||

|

Fort James Corp. |

Baa2 |

|

$ 45,000 |

$ 43,274 |

|

|

Repap New Brunswick, Inc. yankee 10.625% 4/15/05 |

Caa1 |

|

230,000 |

202,400 |

|

|

|

340,174 |

||||

|

TOTAL BASIC INDUSTRIES |

1,324,649 |

||||

|

CONSTRUCTION & REAL ESTATE - 1.1% |

|||||

|

Building Materials - 0.1% |

|||||

|

Dayton Superior Corp. |

B3 |

|

160,000 |

158,400 |

|

|

Construction - 0.0% |

|||||

|

Lennar Corp. |

Ba1 |

|

25,000 |

24,625 |

|

|

Real Estate - 0.2% |

|||||

|

Duke Realty LP |

Baa1 |

|

500,000 |

491,350 |

|

|

LNR Property Corp. |

B1 |

|

160,000 |

139,200 |

|

|

|

630,550 |

||||

|

Real Estate Investment Trusts - 0.8% |

|||||

|

CenterPoint Properties Trust 6.75% 4/1/05 |

Baa2 |

|

100,000 |

93,160 |

|

|

Equity Office |

|

|

|

|

|

|

6.5% 1/15/04 |

Baa1 |

|

1,000,000 |

954,410 |

|

|

6.625% 2/15/05 |

Baa1 |

|

200,000 |

188,948 |

|

|

6.75% 2/15/08 |

Baa1 |

|

100,000 |

91,609 |

|

|

Ocwen Asset Investment Corp. 11.5% 7/1/05 |

- |

|

120,000 |

92,400 |

|

|

ProLogis Trust |

Baa1 |

|

70,000 |

66,675 |

|

|

Spieker Properties LP: |

|

|

|

|

|

|

6.8% 5/1/04 |

Baa2 |

|

90,000 |

86,265 |

|

|

6.875% 2/1/05 |

Baa2 |

|

1,000,000 |

956,150 |

|

|

|

2,529,617 |

||||

|

TOTAL CONSTRUCTION & REAL ESTATE |

3,343,192 |

||||

|

ENERGY - 0.6% |

|||||

|

Coal - 0.0% |

|||||

|

P&L Coal Holdings Corp. 9.625% 5/15/08 |

B2 |

|

135,000 |

125,213 |

|

|

Energy Services - 0.0% |

|||||

|

R&B Falcon Corp. |

Ba3 |

|

100,000 |

109,000 |

|

|

Oil & Gas - 0.6% |

|||||

|

Anadarko Petroleum Corp. 7.2% 3/15/29 |

Baa1 |

|

385,000 |

351,209 |

|

|

Apache Corp.: |

|

|

|

|

|

|

7.625% 7/1/19 |

Baa1 |

|

155,000 |

149,662 |

|

|

7.7% 3/15/26 |

Baa1 |

|

65,000 |

62,636 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount |

Value |

|||

|

Nonconvertible Bonds - continued |

|||||

|

ENERGY - continued |

|||||

|

Oil & Gas - continued |

|||||

|

Apache Finance Property Ltd. 6.5% 12/15/07 |

Baa1 |

|

$ 100,000 |

$ 90,750 |

|

|

Chesapeake Energy Corp. 9.625% 5/1/05 |

B2 |

|

250,000 |

243,750 |

|

|

Conoco, Inc. |

A3 |

|

125,000 |

119,300 |

|

|

Ocean Energy, Inc. |

Ba1 |

|

190,000 |

179,550 |

|

|

Phillips Petroleum Co. 6.375% 3/30/09 |

Baa2 |

|

250,000 |

225,868 |

|

|

Plains Resources, Inc. Series B 10.25% 3/15/06 |

B2 |

|

200,000 |

198,000 |

|

|

YPF Sociedad Anonima |

B1 |

|

50,000 |

49,050 |

|

|

|

1,669,775 |

||||

|

TOTAL ENERGY |

1,903,988 |

||||

|

FINANCE - 3.0% |

|||||

|

Banks - 1.1% |

|||||

|

ABN-Amro Bank NV, Chicago 6.625% 10/31/01 |

A1 |

|

500,000 |

494,055 |

|

|

Bank of Tokyo-Mitsubishi Ltd. 8.4% 4/15/10 |

A3 |

|

200,000 |

201,960 |

|

|

BankBoston Corp. |

A3 |

|

200,000 |

192,736 |

|

|

Barclays Bank PLC yankee 5.95% 7/15/01 |

A1 |

|

350,000 |

347,501 |

|

|

Capital One Bank |

Baa2 |

|

250,000 |

239,713 |

|

|

Capital One Financial Corp. 7.125% 8/1/08 |

Baa3 |

|

210,000 |

195,437 |

|

|

Commonwealth Bank of Australia 8.5% 6/1/10 |

A1 |

|

100,000 |

103,774 |

|

|

Korea Development Bank: |

|

|

|

|

|

|

6.625% 11/21/03 |

Baa2 |

|

170,000 |

163,537 |

|

|

7.375% 9/17/04 |

Baa2 |

|

160,000 |

155,056 |

|

|

MBNA Corp.: |

|

|

|

|

|

|

6.34% 6/2/03 |

Baa2 |

|

100,000 |

95,790 |

|

|

6.875% 11/15/02 |

Baa2 |

|

300,000 |

295,734 |

|

|

Sanwa Finance Aruba AEC 8.35% 7/15/09 |

Baa1 |

|

600,000 |

597,336 |

|

|

Sumitomo Bank International Finance NV 8.5% 6/15/09 |

Baa1 |

|

100,000 |

100,469 |

|

|

Summit Bancorp |

BBB+ |

|

100,000 |

101,231 |

|

|

|

3,284,329 |

||||

|

|

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount |

Value |

|||

|

Credit & Other Finance - 1.8% |

|||||

|

Ahmanson Capital Trust I 8.36% 12/1/26 (g) |

A3 |

|

$ 250,000 |

$ 227,325 |

|

|

AMRESCO, Inc. |

Caa3 |

|

220,000 |

102,300 |

|

|

Associates Corp. of North America 6% 7/15/05 |

Aa3 |

|

250,000 |

233,693 |

|

|

Bellsouth Capital Funding Corp. 7.75% 2/15/10 |

Aa3 |

|

160,000 |

160,006 |

|

|

Daimler-Chrysler NA Holding

Corp. |

A1 |

|

100,000 |

98,811 |

|

|

ERP Operating LP: |

|

|

|

|

|

|

6.55% 11/15/01 |

A3 |

|

50,000 |

49,279 |

|

|

7.1% 6/23/04 |

A3 |

|

200,000 |

193,952 |

|

|

Finova Capital Corp.: |

|

|

|

|

|

|

6.11% 2/18/03 |

Baa2 |

|

200,000 |

176,000 |

|

|

7.25% 11/8/04 |

Baa2 |

|

100,000 |

89,000 |

|

|

Ford Motor Credit Co.: |

|

|

|

|

|

|

6.5% 2/28/02 |

A2 |

|

1,000,000 |

984,150 |

|

|

7.875% 6/15/10 |

A2 |

|

1,040,000 |

1,041,477 |

|

|

Household Finance Corp. 8% 5/9/05 |

A2 |

|

300,000 |

302,541 |

|

|

Imperial Credit Capital Trust I 10.25% 6/14/02 |

B2 |

|

20,000 |

17,000 |

|

|

Imperial Credit Industries 9.875% 1/15/07 |

B3 |

|

330,000 |

237,600 |

|

|

Newcourt Credit Group, Inc. 6.875% 2/16/05 |

A1 |

|

340,000 |

323,513 |

|

|

Sprint Capital Corp.: |

|

|

|

|

|

|

5.875% 5/1/04 |

Baa1 |

|

375,000 |

353,265 |

|

|

6.875% 11/15/28 |

Baa1 |

|

735,000 |

635,510 |

|

|

Trizec Finance Ltd. yankee 10.875% 10/15/05 |

Baa3 |

|

100,000 |

98,000 |

|

|

TXU Eastern Funding 6.75% 5/15/09 |

Baa1 |

|

100,000 |

89,417 |

|

|

U.S. West Capital Funding, Inc. 6.875% 7/15/28 |

Baa1 |

|

60,000 |

51,537 |

|

|

|

5,464,376 |

||||

|

Savings & Loans - 0.1% |

|||||

|

Long Island Savings Bank FSB 6.2% 4/2/01 |

Baa3 |

|

500,000 |

499,445 |

|

|

TOTAL FINANCE |

9,248,150 |

||||

|

HEALTH - 0.0% |

|||||

|

Medical Facilities Management - 0.0% |

|||||

|

Unilab Corp. |

B3 |

|

70,000 |

72,100 |

|

|

INDUSTRIAL MACHINERY & EQUIPMENT - 0.4% |

|||||

|

Industrial Machinery & Equipment - 0.3% |

|||||

|

Tyco International Group SA yankee 6.875% 1/15/29 |

Baa1 |

|

1,000,000 |

844,770 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount |

Value |

|||

|

Nonconvertible Bonds - continued |

|||||

|

INDUSTRIAL MACHINERY & EQUIPMENT - continued |

|||||

|

Pollution Control - 0.1% |

|||||

|

Allied Waste |

|

|

|

|

|

|

7.625% 1/1/06 |

Ba2 |

|

$ 155,000 |

$ 134,850 |

|

|

7.875% 1/1/09 |

Ba2 |

|

170,000 |

144,500 |

|

|

WMX Technologies, Inc. 7.1% 8/1/26 |

Ba1 |

|

120,000 |

112,946 |

|

|

|

392,296 |

||||

|

TOTAL INDUSTRIAL MACHINERY & EQUIPMENT |

1,237,066 |

||||

|

MEDIA & LEISURE - 3.0% |

|||||

|

Broadcasting - 2.6% |

|||||

|

ACME Television LLC/ACME Financial Corp. 0% 9/30/04 (e) |

B3 |

|

200,000 |

191,000 |

|

|

Adelphia Communications Corp. 9.875% 3/1/05 |

B1 |

|

150,000 |

146,250 |

|

|

Ascent Entertainment Group, Inc. 0% 12/15/04 (e) |

Ba1 |

|

230,000 |

186,300 |

|

|

British Sky Broadcasting Group PLC 8.2% 7/15/09 |

Baa3 |

|

650,000 |

608,036 |

|

|

Cable Satisfaction International, Inc. 12.75% 3/1/10 |

Caa1 |

|

200,000 |

194,500 |

|

|

Callahan Nordrhein Westfalen 14% 7/15/10 (g) |

B3 |

|

250,000 |

250,000 |

|

|

CapStar Broadcasting

Partners, Inc. |

B2 |

|

190,000 |

173,375 |

|

|

Charter Communications Holdings LLC/Charter Communications Holdings Capital Corp.: |

|

|

|

|

|

|

0% 1/15/10 (e) |

B2 |

|

320,000 |

181,600 |

|

|

8.25% 4/1/07 |

B2 |

|

180,000 |

159,300 |

|

|

8.625% 4/1/09 |

B2 |

|

180,000 |

158,850 |

|

|

Continental Cablevision, Inc. 8.3% 5/15/06 |

A2 |

|

215,000 |

220,093 |

|

|

Diamond Cable

Communications PLC |

B3 |

|

210,000 |

161,175 |

|

|

Earthwatch, Inc. 0% 7/15/07 unit (e)(g) |

- |

|

130,000 |

83,200 |

|

|

EchoStar DBS Corp. 9.375% 2/1/09 |

B2 |

|

260,000 |

250,900 |

|

|

Impsat Fiber Networks, Inc. 13.75% 2/15/05 (g) |

B3 |

|

195,000 |

173,550 |

|

|

International Cabletel, Inc. 0% 2/1/06 (e) |

B3 |

|

250,000 |

230,000 |

|

|

LIN Holdings Corp. |

B3 |

|

270,000 |

177,525 |

|

|

|

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount |

Value |

|||

|

Nielsen Media Research, Inc. 7.6% 6/15/09 |

Baa2 |

|

$ 150,000 |

$ 143,127 |

|

|

NorthPoint Communication Holdings, Inc. 12.875% 2/15/10 |

Caa1 |

|

150,000 |

103,500 |

|

|

NTL, Inc. 0% 4/1/08 (e) |

B3 |

|

560,000 |

347,200 |

|

|

Olympus Communications LP/Olympus Capital Corp. 10.625% 11/15/06 |

B1 |

|

170,000 |

166,600 |

|

|

Satelites Mexicanos SA de CV 11.28% 6/30/04 (g)(i) |

B1 |

|

74,000 |

67,340 |

|

|

Shaw Communications, Inc. 8.25% 4/11/10 |

Baa2 |

|

140,000 |

141,135 |

|

|

Spectrasite Holdings, Inc.: |

|

|

|

|

|

|

0% 3/15/10 (e) |

B3 |

|

65,000 |

34,938 |

|

|

10.75% 3/15/10 |

B3 |

|

25,000 |

24,875 |

|

|

TCI Communications

Financing III |

A3 |

|

180,000 |

198,864 |

|

|

Telewest PLC 0% 10/1/07 (e) |

B1 |

|

270,000 |

257,850 |

|

|

Time Warner, Inc. |

Baa3 |

|

910,000 |

927,918 |

|

|

UIH Australia/Pacific, Inc.: |

|

|

|

|

|

|

Series B 0% 5/15/06 (e) |

B2 |

|

380,000 |

349,600 |

|

|

Series D 0% 5/15/06 (e) |

B2 |

|

30,000 |

27,600 |

|

|

United Pan-Europe Communications NV: |

|

|

|

|

|

|

0% 8/1/09 (e) |

B2 |

|

230,000 |

115,000 |

|

|

0% 2/1/10 (e) |

B2 |

|

270,000 |

126,900 |

|

|

10.875% 11/1/07 |

B2 |

|

480,000 |

432,000 |

|

|

10.875% 8/1/09 |

B2 |

|

275,000 |

242,000 |

|

|

11.25% 11/1/09 |

B2 |

|

15,000 |

13,125 |

|

|

USA Networks, Inc./USANi

LLC |

Baa3 |

|

580,000 |

552,450 |

|

|

|

7,817,676 |

||||

|

Entertainment - 0.0% |

|||||

|

Regal Cinemas, Inc. 9.5% 6/1/08 |

Ca |

|

355,000 |

88,750 |

|

|

Lodging & Gaming - 0.0% |

|||||

|

Horseshoe Gaming LLC 8.625% 5/15/09 |

B2 |

|

70,000 |

65,800 |

|

|

KSL Recreation Group, Inc. 10.25% 5/1/07 |

B2 |

|

90,000 |

85,500 |

|

|

|

151,300 |

||||

|

Publishing - 0.3% |

|||||

|

News America Holdings, Inc. 7.375% 10/17/08 |

Baa3 |

|

500,000 |

480,685 |

|

|

News America, Inc.: |

|

|

|

|

|

|

7.125% 4/8/28 |

Baa3 |

|

80,000 |

66,850 |

|

|

7.28% 6/30/28 |

Baa3 |

|

200,000 |

172,432 |

|

|

7.3% 4/30/28 |

Baa3 |

|

170,000 |

145,143 |

|

|

|

865,110 |

||||

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount |

Value |

|||

|

Nonconvertible Bonds - continued |

|||||

|

MEDIA & LEISURE - continued |

|||||

|

Restaurants - 0.1% |

|||||

|

AFC Enterprises, Inc. 10.25% 5/15/07 |

B3 |

|

$ 170,000 |

$ 161,500 |

|

|

TOTAL MEDIA & LEISURE |

9,084,336 |

||||

|

NONDURABLES - 0.2% |

|||||

|

Beverages - 0.1% |

|||||

|

Seagram JE & Sons, Inc.: |

|

|

|

|

|

|

6.625% 12/15/05 |

Baa3 |

|

150,000 |

143,370 |

|

|

6.8% 12/15/08 |

Baa3 |

|

200,000 |

187,565 |

|

|

|

330,935 |

||||

|

Tobacco - 0.1% |

|||||

|

RJ Reynolds Tobacco

Holdings, Inc. |

Baa2 |

|

200,000 |

185,752 |

|

|

TOTAL NONDURABLES |

516,687 |

||||

|

RETAIL & WHOLESALE - 0.3% |

|||||

|

Drug Stores - 0.1% |

|||||

|

Rite Aid Corp.: |

|

|

|

|

|

|

6.5% 12/15/05 (g) |

Caa1 |

|

420,000 |

216,300 |

|

|

7.125% 1/15/07 |

Caa1 |

|

110,000 |

58,300 |

|

|

|

274,600 |

||||

|

General Merchandise Stores - 0.1% |

|||||

|

Federated Department Stores,

Inc. |

Baa1 |

|

500,000 |

483,520 |

|

|

Grocery Stores - 0.1% |

|||||

|

Jitney-Jungle Stores |

|

|

|

|

|

|

10.375% 9/15/07 (d) |

C |

|

450,000 |

9,000 |

|

|

12% 3/1/06 (d) |

Caa3 |

|

10,000 |

1,250 |

|

|

Kroger Co. 6% 7/1/00 |

Baa3 |

|

200,000 |

199,962 |

|

|

|

210,212 |

||||

|

TOTAL RETAIL & WHOLESALE |

968,332 |

||||

|

SERVICES - 0.1% |

|||||

|

Printing - 0.0% |

|||||

|

Sullivan Graphics, Inc. 12.75% 8/1/05 |

Caa1 |

|

40,000 |

40,200 |

|

|

Services - 0.1% |

|||||

|

SITEL Corp. |

B3 |

|

250,000 |

220,000 |

|

|

TOTAL SERVICES |

260,200 |

||||

|

|

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount |

Value |

|||

|

TECHNOLOGY - 0.6% |

|||||

|

Computer Services & Software - 0.3% |

|||||

|

Concentric Network Corp. 12.75% 12/15/07 |

B- |

|

$ 50,000 |

$ 52,500 |

|

|

Covad Communications

Group, Inc. |

B3 |

|

355,000 |

275,125 |

|

|

Exodus Communications, Inc. 11.625% 7/15/10 (g) |

B |

|

280,000 |

281,400 |

|

|

PSINet, Inc. |

B3 |

|

260,000 |

239,200 |

|

|

|

848,225 |

||||

|

Computers & Office Equipment - 0.2% |

|||||

|

Comdisco, Inc.: |

|

|

|

|

|

|

5.95% 4/30/02 |

Baa1 |

|

300,000 |

284,763 |

|

|

7.25% 9/1/02 |

Baa1 |

|

250,000 |

241,973 |

|

|

Globix Corp. |

B- |

|

95,000 |

78,375 |

|

|

|

605,111 |

||||

|

Electronic Instruments - 0.0% |

|||||

|

Telecommunications Techniques Co. LLC 9.75% 5/15/08 |

B3 |

|

80,000 |

73,600 |

|

|

Electronics - 0.1% |

|||||

|

ChipPAC International Ltd. 12.75% 8/1/09 |

B3 |

|

40,000 |

43,000 |

|

|

Hadco Corp. |

B2 |

|

140,000 |

140,350 |

|

|

SCG Holding Corp./Semiconductor Components Industries LLC 12% 8/1/09 |

B2 |

|

52,000 |

55,510 |

|

|

|

238,860 |

||||

|

TOTAL TECHNOLOGY |

1,765,796 |

||||

|

TRANSPORTATION - 0.9% |

|||||

|

Air Transportation - 0.4% |

|||||

|

Atlas Air, Inc.: |

|

|

|

|

|

|

8.77% 1/2/11 |

Ba1 |

|

86,129 |

83,115 |

|

|

9.375% 11/15/06 |

B3 |

|

220,000 |

213,400 |

|

|

Continental Airlines, Inc. pass thru trust certificates: |

|

|

|

|

|

|

7.434% 3/15/06 |

Baa1 |

|

70,000 |

67,683 |

|

|

7.73% 9/15/12 |

Baa1 |

|

28,243 |

26,975 |

|

|

Delta Air Lines, Inc. |

Baa3 |

|

500,000 |

464,750 |

|

|

US Air, Inc. |

B3 |

|

430,000 |

425,700 |

|

|

|

1,281,623 |

||||

|

Railroads - 0.5% |

|||||

|

Burlington Northern |

|

|

|

|

|

|

6.875% 12/1/27 |

Baa2 |

|

1,000,000 |

860,780 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount |

Value |

|||

|

Nonconvertible Bonds - continued |

|||||

|

TRANSPORTATION - continued |

|||||

|

Railroads - continued |

|||||

|

Burlington Northern |

|

|

|

|

|

|

7.29% 6/1/36 |

Baa2 |

|

$ 150,000 |

$ 146,609 |

|

|

Norfolk Southern Corp. 7.05% 5/1/37 |

Baa1 |

|

340,000 |

332,302 |

|

|

|

1,339,691 |

||||

|

TOTAL TRANSPORTATION |

2,621,314 |

||||

|

UTILITIES - 3.4% |

|||||

|

Cellular - 0.5% |

|||||

|

Cellnet Data Systems, Inc. 0% 10/1/07 (e) |

- |

|

300,000 |

24,000 |

|

|

Clearnet Communications, Inc. yankee 0% 12/15/05 (e) |

B3 |

|

200,000 |

206,000 |

|

|

Crown Castle International Corp. 10.75% 8/1/11 |

B3 |

|

45,000 |

45,675 |

|

|

Dobson Communications Corp. 10.875% 7/1/10 (g) |

- |

|

50,000 |

50,375 |

|

|

Leap Wireless International, Inc.: |

|

|

|

|

|

|

0% 4/15/10 (e)(g) |

- |

|

65,000 |

27,300 |

|

|

12.5% 4/15/10 (g) |

Caa2 |

|

75,000 |

66,000 |

|

|

McCaw International Ltd. 0% 4/15/07 (e) |

Caa1 |

|

270,000 |

205,200 |

|

|

Millicom International Cellular

SA |

Caa1 |

|

241,000 |

204,850 |

|

|

Nextel |

|

|

|

|

|

|

0% 10/31/07 (e) |

B1 |

|

420,000 |

312,900 |

|

|

9.375% 11/15/09 |

B1 |

|

170,000 |

163,200 |

|

|

VoiceStream |

|

|

|

|

|

|

0% 11/15/09 (e) |

B2 |

|

295,000 |

197,650 |

|

|

10.375% 11/15/09 |

B2 |

|

170,000 |

176,800 |

|

|

|

1,679,950 |

||||

|

Electric Utility - 0.4% |

|||||

|

Avon Energy Partners Holdings 6.46% 3/4/08 (g) |

Baa2 |

|

300,000 |

267,204 |

|

|

Dominion Resources, Inc. 8.125% 6/15/10 |

Baa1 |

|

165,000 |

166,115 |

|

|

Illinois Power Co. |

Baa1 |

|

150,000 |

146,427 |

|

|

Israel Electric Corp. Ltd. 7.75% 12/15/27 (g) |

A3 |

|

545,000 |

467,147 |

|

|

|

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount |

Value |

|||

|

Niagara Mohawk Power Corp. 8.875% 5/15/07 |

Baa3 |

|

$ 75,000 |

$ 77,640 |

|

|

Texas Utilities Co. |

Baa3 |

|

100,000 |

90,325 |

|

|

|

1,214,858 |

||||

|

Gas - 0.3% |

|||||

|

CMS Panhandle |

|

|

|

|

|

|

6.125% 3/15/04 |

Baa3 |

|

150,000 |

141,675 |

|

|

7% 7/15/29 |

Baa3 |

|

150,000 |

125,880 |

|

|

Reliant Energy Resources Corp. 8.125% 7/15/05 (g) |

Baa1 |

|

500,000 |

499,900 |

|

|

|

767,455 |

||||

|

Telephone Services - 2.2% |

|||||

|

Allegiance Telecom, Inc. 12.875% 5/15/08 |

B3 |

|

200,000 |

216,500 |

|

|

Cable & Wireless Optus Ltd. 8% 6/22/10 (g) |

Baa1 |

|

700,000 |

695,681 |

|

|

Deutsche Telekom International Finance BV 8.25% 6/15/30 |

Aa2 |

|

935,000 |

949,895 |

|

|

Esat Telecom Group PLC 0% 2/1/07 (e) |

Aa1 |

|

230,000 |

213,900 |

|

|

Global Crossing Holdings Ltd. 9.625% 5/15/08 |

Ba2 |

|

180,000 |

176,400 |

|

|

Global TeleSystems Group, Inc. 9.875% 2/15/05 |

Caa1 |

|

330,000 |

227,700 |

|

|

Globenet Communication

Group Ltd. |

Caa1 |

|

560,000 |

565,600 |

|

|

Hermes Europe Railtel BV 11.5% 8/15/07 |

B3 |

|

150,000 |

125,250 |

|

|

ICG Holdings, Inc. |

B3 |

|

260,000 |

249,600 |

|

|

Intermedia Communications,

Inc. |

B3 |

|

330,000 |

200,475 |

|

|

KMC Telecom Holdings, Inc. 13.5% 5/15/09 |

Caa2 |

|

170,000 |

141,100 |

|

|

NEXTLINK Communications,

Inc. |

B2 |

|

500,000 |

287,500 |

|

|

Ono Finance PLC |

Caa1 |

|

215,000 |

203,175 |

|

|

Rhythms NetConnections, Inc. 14% 2/15/10 (g) |

B3 |

|

200,000 |

144,000 |

|

|

Telecomunicaciones de Puerto

Rico, Inc. |

Baa2 |

|

220,000 |

204,882 |

|

|

Teleglobe Canada, Inc.: |

|

|

|

|

|

|

7.2% 7/20/09 |

Baa1 |

|

449,000 |

429,626 |

|

|

7.7% 7/20/29 |

Baa1 |

|

666,000 |

627,152 |

|

|

Versatel Telecom |

B3 |

|

150,000 |

152,250 |

|

|

Viatel, Inc. 11.25% 4/15/08 |

B3 |

|

250,000 |

187,500 |

|

|

Corporate Bonds - continued |

|||||

|

Moody's Ratings (unaudited) (b) |

Principal Amount |

Value |

|||

|

Nonconvertible Bonds - continued |

|||||

|

UTILITIES - continued |

|||||

|

Telephone Services - continued |

|||||

|

WinStar Communications, Inc. 12.75% 4/15/10 (g) |

B3 |

|