SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the registrant |X|

Filed by a party other than the registrant |_|

Check the appropriate box:

| | Preliminary proxy statement |_| Confidential, for use of the Commission only

(as permitted by Rule 14a-6(e)(2))

|_| Definitive proxy statement

|_| Definitive additional materials

|_| Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12

MOVIE STAR, INC.

________________________________________________________________________________

(Name of Registrant as Specified in Its Charter)

________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check the appropriate box):

|X| No fee required.

|_| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

________________________________________________________________________________

(2) Aggregate number of securities to which transaction applies:

________________________________________________________________________________

(3) Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11:*

________________________________________________________________________________

(4) Proposed maximum aggregate value of transaction:

________________________________________________________________________________

(5) Total fee paid:

________________________________________________________________________________

|_| Fee paid previously with preliminary materials:________________________

|_| Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting fee

was paid previously. Identify the previous filing by registration

statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

________________________________________________________________________________

(2) Form, Schedule or Registration Statement No.:

________________________________________________________________________________

(3) Filing party:

(4) Date filed:

__________________________________

* Set forth the amount on which the filing fee is calculated and state how it

was determined.

MOVIE STAR, INC.

NOTICE OF ANNUAL SHAREHOLDERS' MEETING

The Annual Meeting of Shareholders of Movie Star, Inc. will be held on

Tuesday, November 28, 2000, at 10:00 A.M. at Club 101 on the Main Floor at 101

Park Avenue, New York, New York, for the following purposes:

1) To elect directors.

2) To approve the 2000 Performance Equity Plan.

3) To ratify the selection of Deloitte & Touche LLP as auditors.

4) To transact such other business as may properly come before the

meeting or any adjournments thereof.

The Company's Board of Directors has fixed October 17, 2000 as the

record date for the determination of shareholders entitled to receive notice of

and to vote at the Annual Meeting, and only shareholders of record at the close

of business on that date will be entitled to vote at the Annual Meeting.

By Authority of the Board of Directors

Saul Pomerantz, Secretary

New York, New York

October 24, 2000

All shareholders are cordially invited to attend the Annual Meeting in

person. YOU ARE URGED TO PROMPTLY COMPLETE, SIGN, DATE AND RETURN THE

ACCOMPANYING PROXY IN THE ENCLOSED ENVELOPE WHETHER OR NOT YOU PLAN TO ATTEND

THE ANNUAL MEETING. Your proxy will not be used if you are present at the Annual

Meeting and desire to vote your shares personally.

MOVIE STAR, INC.

136 Madison Avenue

New York, New York 10016

PROXY STATEMENT

GENERAL INFORMATION

This Proxy Statement and the accompanying form of proxy are furnished

in connection with the solicitation of proxies by the Board of Directors of

Movie Star, Inc., a New York corporation (the "Company"), for use at the Annual

Meeting of its Shareholders to be held at Club 101 on the Main Floor at 101 Park

Avenue, New York, New York, on Tuesday, November 28, 2000, at 10:00 A.M. local

time. The Annual Report to Shareholders for the fiscal year ended June 30, 2000,

including financial statements and the report of the independent accountants,

also accompanies this statement.

This Proxy Statement, the accompanying Notice and the accompanying

proxy card are first being mailed on or about October 24, 2000, to shareholders

of record on October 17, 2000.

What matters am I voting on?

You are being asked to vote on the following matters:

o The election of Directors to serve for the ensuing one-year

period and until their respective successors are elected and

qualified;

o A proposal to adopt our 2000 Performance Equity Plan under

which options to purchase shares of our common stock may be

granted to our directors, officers, employees and consultants;

and

o To ratify the selection of Deloitte & Touche LLP as auditors.

o To transact such other business as may properly come before

the meeting and any and all adjournments thereof.

Who is entitled to vote?

Persons who were holders of our common stock as of the close of

business on October 17, 2000, the record date, are entitled to vote at the

meeting. As of October 17, 2000, we had issued and outstanding 14,896,977 shares

of the Company's common stock, par value $0.01 per share (the "Common Stock"),

the Company's only class of voting securities outstanding.

What is the effect of giving a proxy?

Proxies in the form enclosed are solicited by and on behalf of the

board. The persons named in the proxy have been designated as proxies by the

board. If you sign and return the proxy in accordance with the procedures set

2

forth in this proxy statement, the persons designated as proxies by the board

will vote your shares at the meeting as specified in your proxy.

If you sign and return your proxy in accordance with the procedures set

forth in this proxy statement but you do not provide any instructions as to how

your shares should be voted, your shares will be voted as follows:

o FOR the election of the nominees listed below under Proposal 1;

o FOR the approval of our 2000 Performance Equity Plan as described

below under Proposal 2;

o FOR the ratification of the selection of Deloitte & Touche LLP as

auditors under Proposal 3.

If you give your proxy, your shares also will be voted in the

discretion of the proxies named on the proxy card with respect to any other

matters properly brought before the meeting and any adjournments thereof. In the

event that any other matters are properly presented at the meeting for action,

the persons named in the proxy will vote the proxies in accordance with their

best judgment.

May I change my vote after I return my proxy card?

Any proxy given pursuant to this solicitation may be revoked by you at

any time before it is exercised. You may effectively revoke your proxy by:

o delivering written notification of your revocation to the

Secretary of Movie Star;

o voting in person at the meeting; or

o delivering another proxy bearing a later date.

Please note that your attendance at the meeting will not alone serve to

revoke your proxy.

What is a quorum?

The presence, in person or by proxy, of a majority of the votes

entitled to be cast at the meeting will constitute a quorum at the meeting. A

proxy submitted by a shareholder may indicate that all or a portion of the

shares represented by the proxy are not being voted ("shareholder withholding")

with respect to a particular matter. Proxies that are marked "abstain" and

proxies relating to "street name" shares that are returned to the Company but

marked by brokers as "not voted" ("broker non-votes") and proxies reflecting

shares subject to shareholder withholding will be treated as shares present for

purposes of determining the presence of a quorum on all matters unless authority

to vote is completely withheld on the proxy. Abstentions are voted neither "for"

nor "against" a matter, but are counted in the determination of a quorum.

What is a "broker non-vote"?

A "broker non-vote" occurs when a broker submits a proxy that states

that the broker does not vote for some of the proposals because the broker has

not received instructions from the beneficial owners on how to vote on such

proposals and does not have discretionary authority to vote in the absence of

instructions.

3

How many votes are needed for approval of each matter?

o The election of directors requires a plurality vote of the votes

cast at the meeting. "Plurality" means that the individuals who receive the

largest number of votes cast "FOR" are elected as directors. Consequently, any

shares not voted "FOR" a particular nominee (whether as a result of a direction

of the shareholder to withhold authority, abstentions or a broker non-vote) will

not be counted in such nominee's favor.

o 2000 Performance Equity Plan must be approved by the affirmative

vote of a majority of the votes cast at the meeting. Abstentions from voting

with respect to this proposal are counted as "votes cast" with respect to such

proposal and, therefore, have the same effect as a vote against the proposal.

Shares which are subject to shareholder withholding or broker non-vote are not

counted as "votes cast" with respect to such proposal and therefore will have no

effect on such vote.

o The ratification of the selection of Deloitte & Touche LLP must be

approved by the affirmative of a majority of the votes cast at the meeting.

Abstentions from voting with respect to this proposal are counted as "votes

cast" with respect to such proposal and, therefore, have the same effect as a

vote against the proposal. Shares which are subject to shareholder withholding

or broker non-vote are not counted as "votes cast" with respect to such proposal

and therefore will have no effect on such vote.

How do I vote?

You may vote your shares in one of two ways: by mail or in person at

the meeting. The prompt return of the completed proxy card vote will assist

Movie Star in preparing for the meeting. Date, sign and return the accompanying

proxy in the envelope enclosed for that purpose (to which no postage need to be

affixed if mailed in the United States). You can specify your choices by marking

the appropriate boxes on the proxy card.

If you attend the meeting, you may deliver your completed proxy card in person

or fill out and return a ballot that will be supplied to you.

4

Security Ownership of Certain Beneficial Owners and Management as of August 31,

2000

The following table sets forth certain information as of August 31,

2000 with respect to the stock ownership of (i) those persons or groups (as that

term is used in Section 13(d)(3) of the Securities Exchange Act of 1934) who

beneficially own more than 5% of the Company's Common Stock, (ii) each director

of the Company and (iii) all directors and officers of the Company as a group.

AMOUNT AND NATURE OF PERCENT OF

NAME OF BENEFICIAL OWNER BENEFICIAL OWNERSHIP CLASS(1)

Mark M. David 3,095,428(2)(6) 20.7789%

136 Madison Avenue

New York, NY 10016

Republic National 845,814;Direct 5.6778%

Bank as Trustee for

the Movie Star, Inc.

Employee Stock

Ownership Plan

452 Fifth Avenue

New York, NY 10018

Mrs. Abraham David 1,582,159(3)(7) 10.6207%

8710 Banyan Court

Tamarac, FL 33321

Melvyn Knigin 421,437(4) 2.7721%

136 Madison Avenue

New York, NY 10016

Saul Pomerantz 442,824(5) 2.9042%

136 Madison Avenue

New York, NY 10016

Thomas Rende 229,300(12) 1.5327%

136 Madison Avenue

New York, NY 10016

Joel M. Simon 74,166(10) 0.4979%

136 Madison Avenue

New York, NY 10016

Gary W. Krat 253,333(11) 1.7006%

733 Third Avenue

New York, NY 10017

Abraham David 25,000;Direct(9) 0.1678%

8710 Banyan Court

Tamarac, FL 33321

All directors and officers 6,098,647(2)(4)(5) 39.0493%

as a group (6 persons) (8)(10)(11)(12)

5

____________________________

(1) Based upon 14,896,977 shares (excluding 2,016,802 treasury shares)

outstanding and options, where applicable, to purchase shares of Common

Stock, exercisable within 60 days.

(2) Includes 336,072 shares owned by his spouse.

(3) Includes 542,697 shares owned by Annie David as a trustee for the

benefit of her daughters, Marcia Sussman and Elaine Greenberg and her

grandchildren, Michael Sussman and David Greenberg.

(4) Includes options granted to Melvyn Knigin for 260,937 shares pursuant

to the 1994 ISOP, 25,000 pursuant to the 1988 Non-Qualified Plan and

20,000 pursuant to the 2000 Plan exercisable within 60 days and 100,000

shares subject to the Affiliates Agreement (see Certain Transactions).

(5) Includes options granted to Saul Pomerantz for 282,914 shares and

Shelley Pomerantz for 40,000 shares (his wife who also is employed by

the Company) pursuant to the 1994 ISOP, 15,000 pursuant to the 1988

Non-Qualified Plan and 13,000 pursuant to the 2000 Plan exercisable

within 60 days, 66,666 shares subject to the Affiliates Agreement (see

Certain Transactions); and 244 shares owned by his spouse and 8,000

shares held jointly with his spouse.

(6) Does not include Mrs. Abraham David's shares for which he holds the

proxy.

(7) Mark M. David holds a proxy for these shares.

(8) Includes the shares held by Mrs. Abraham David.

(9) Abraham David is the husband of Annie David and the father of Mark M.

David.

(10) Includes 26,666 shares subject to the Affiliates Agreement (see Certain

Transactions).

(11) Includes 233,333 shares subject to the Affiliates Agreement (see

Certain Transactions).

(12) Represents options granted to Thomas Rende for 57,000 shares, pursuant

to the 1994 ISOP, and 7,000 pursuant to the 2000 Plan exercisable

within 60 days, 46,000 shares held jointly with his spouse, 3,300

shares owned by his spouse and 116,000 shares subject to the Affiliates

Agreement (see Certain Transactions).

6

PROPOSAL 1

Election of Directors

The Board of Directors, pursuant to the Bylaws, has set the number of

directors constituting the full Board at six directors. All five nominees have

agreed to serve if elected; there will be one vacancy on the Board of Directors.

All directors hold office until the next Annual Meeting of Shareholders and

until their successors have been elected and qualified. Assuming the presence of

a quorum, the directors shall be elected by a plurality of the votes cast at the

meeting with respect to the election of directors. "Plurality" means that the

individuals who receive the largest number of votes cast "For" are elected as

directors up to the maximum number of directors to be elected. Consequently, any

shares not voted "For" a particular director (whether as a result of a direction

to withhold authority or a broker non-vote) will not be counted for purposes of

determining a plurality.

___________________________

Information Concerning Nominees for Directors

a) All nominees are the current directors.

Director

Since Name Age Position

1981 Mark M. David 53 Chairman of the Board

1997 Melvyn Knigin 57 President, Chief Executive

Officer and Director

1983 Saul Pomerantz 51 Executive Vice President,

Chief Operating Officer,

Secretary and Director

1996 Gary W. Krat 52 Director

1996 Joel Simon 55 Director

Mark M. David was re-elected Chairman of the Board on November 18, 1999.

Effective as of July 1, 1999, Mr. David retired as a full-time executive

employee of the Company. Mr. David relinquished the position of Chief Executive

Officer in February 1999, but remained as Chairman of the Board. He had been

Chairman of the Board and Chief Executive Officer from December 1985 to August

1995 and from April 1996 until February 1999, President from April 1983 to

December 1987 and Chief Operating Officer of the Company since the merger with

Stardust Inc. in 1981 until December 1987. Prior to the merger, he was founder,

Executive Vice President and Chief Operating Officer of Sanmark Industries Inc.

Melvyn Knigin was elected Chief Executive Officer and to the Board of Directors

on November 18, 1999. Mr. Knigin had been appointed Chief Executive Officer in

February 1999. Mr. Knigin was appointed to fill a vacancy on the Board of

Directors and promoted to Senior Vice President and Chief Operating Officer on

7

February 5, 1997 and was promoted to President on September 4, 1997. Since

joining the Company in 1987, he was the President of Cinema Etoile, the

Company's upscale intimate apparel division. Prior to joining the Company, he

had spent most of his career in the intimate apparel industry.

Saul Pomerantz, CPA, was re-elected to the Board of Directors and elected Chief

Operating Officer on November 18, 1999. Mr. Pomerantz had been appointed Chief

Operating Officer in February 1999. Mr. Pomerantz was elected Senior Vice

President on December 3, 1987 and was promoted to Executive Vice President on

September 4, 1997. Previously, he was Vice President-Finance since 1981. He was

Chief Financial Officer from 1982 to February 1999 and has been Secretary of the

Company since 1983.

Gary W. Krat was re-elected to the Board of Directors on November 18, 1999. Mr.

Krat is currently Chairman Emeritus of SunAmerica, Inc. From 1990 and until his

retirement in 1999, Mr. Krat was Senior Vice President of SunAmerica Inc. and

Chairman and Chief Executive Officer of SunAmerica Financial Network, Inc. and

its six NASD broker dealer companies with nearly ten thousand registered

representatives. From 1977 until 1990, Mr. Krat was a senior executive with

Integrated Resources, Inc. Prior to joining Integrated Resources, Mr. Krat was a

practicing attorney. He has a law degree from Fordham University and a Bachelor

of Arts degree from the University of Pittsburgh.

Joel M. Simon was re-elected to the Board of Directors on November 18, 1999. Mr.

Simon is a principal of Crossroads, LLC, a financial consulting firm. Mr. Simon

was the President and Chief Executive Officer of Starrett Corporation, a real

estate construction, development and management company from March to December

1998. From 1996 to 1998, Mr. Simon was self-employed as a private investor.

The Board of Directors unanimously recommends that you mark your proxy

"FOR" the election of all nominees to the Board.

Board of Directors Meetings and Committees

The Board of Directors, pursuant to the Bylaws, has set the number of

directors constituting the full Board of Directors at six directors. Five

directors will be elected at the Annual Meeting, each to hold office for a term

of one year or until his or her successor is duly elected and qualified or until

his or her earlier resignation or removal; there will be one vacancy on the

Board of Directors. During the fiscal year ended June 30, 2000, the Board of

Directors met four times.

The members of the Nominating Committee are Mark M. David, Saul

Pomerantz and Gary W. Krat. This committee was formed in order to nominate

officers and/or directors. The Nominating Committee met once during the fiscal

year. Mark M. David, Saul Pomerantz and Gary W. Krat will serve on the

Nominating Committee again, subject to their election as directors.

Two non-employee directors, Messrs. Krat and Simon, serve as the Audit

Committee. It recommends to the Board the engagement and discharge of the

independent auditors for the Company (subject to shareholder ratification),

analyzes the reports of such auditors, and makes such recommendations to the

Board with respect thereto as the committee may deem advisable. The Audit

Committee, met twice relating to fiscal year 2000. Messrs. Krat and Simon will

serve on the Audit Committee again, subject to their election as directors.

The members of the Compensation Committee are Mark M. David, Gary W.

Krat and Joel M. Simon. This committee was formed in order to set compensation

and benefit levels for the Company's officers and other highly paid employees

and to decide which employees would be granted options. Prior to the appointment

of Messrs. Krat and Simon as Directors, decisions on executive compensation were

made by the entire Board of Directors. Mark M. David, Gary W. Krat and Joel M.

Simon will serve on the Compensation Committee again, subject to their election

as directors. The Compensation Committee met once during fiscal year 2000.

Board of Directors Compensation

The Company currently pays its outside directors an annual fee of

8

$15,000 and a fee of $1,500 per meeting for attendance at meetings of the Board

and its Committees. Directors are also reimbursed for out-of-pocket expenses.

There are no family relationships between the various executive

officers and directors.

Consulting and Employment Agreements

Effective as of July 1, 1999, Mr. David retired as a full-time

executive employee of the Company. The Company and Mr. David have entered into a

series of written agreements which provided for the payment to Mr. David of a

lump sum retirement benefit of $500,000, the continuation of health insurance

benefits and a split dollar life insurance policy on Mr. David's life and the

retention of Mr. David's services as a consultant to the Company for a term of

five years. Pursuant to the consulting agreement, Mr. David receives an annual

fee of $200,000 and is prohibited from disclosing any confidential information

of the Company and from engaging in any business which is competitive with the

business of the Company.

Movie Star has entered into written employment agreements with each of

Messrs. Knigin and Pomerantz, effective as of July 1, 1999. The agreements

provide for an initial term of two years ending June 30, 2001. Mr. Knigin's

annual base salary during the initial term is $400,000 and Mr. Pomerantz's

annual base salary is $250,000 and they are each entitled to bonuses under the

Movie Star Senior Executive Incentive Compensation Plan (the "IC Plan"). In

addition, subject to shareholder approval of the 2000 Plan, each of Messrs.

Knigin and Pomerantz were granted incentive options. In the event the 2000 Plan

is not approved by the shareholders, Messrs. Knigin and Pomerantz will be

granted options under the 1988 Non-Qualified Plan. The agreements with Messrs.

Knigin and Pomerantz contain non-compete provisions which provide that for one

year after termination of employment in certain circumstances, these persons are

prohibited from competing with the Company without our prior written consent.

Mr. Rende does not have a written employment agreement with Movie Star.

However, the Compensation Committee has determined that Mr. Rende is eligible to

receive a bonus under the IC Plan and, subject to shareholder approval of the

2000 Plan, he has been granted incentive options.

Executive Officers

The Company's executive officers are Melvyn Knigin, President and Chief

Executive Officer, Saul Pomerantz, Executive Vice President, Secretary and Chief

Operating Officer and Thomas Rende, Chief Financial Officer. Effective as of

June 30, 1999, Mark M. David is no longer an executive officer of the Company.

Except for the Company's Chief Financial Officer, Thomas Rende, information

concerning each executive officer's age and length of service with the Company

can be found herein under the section entitled "ELECTION OF DIRECTORS." Mr.

Rende is thirty-nine years old and was appointed Chief Financial Officer in

February 1999. Since joining Movie Star in 1989, Mr. Rende has held various

positions within the finance department.

Report of the Compensation Committee on Executive Compensation

Joel M. Simon, Gary W. Krat and Mark M. David were appointed by the Board of

Directors, and each of them agreed to serve, as members of the Compensation

Committee (the "Committee").

Following the realignment of senior management which resulted from the

retirement of Mark M. David at the end of fiscal year 1999, the Company entered

into comprehensive written employment agreements with Melvyn Knigin, who assumed

the additional position of Chief Executive Officer, and Saul Pomerantz, who

assumed the additional duties of Chief Operating Officer. In addition, Thomas

Rende was promoted to the position of Chief Financial Officer. In light of Mr.

David's retirement and the new duties assumed by the Company's remaining senior

executives, the Compensation Committee determined the salaries for Messrs.

Knigin, Pomerantz and Rende for fiscal year 2000.

9

Compensation Policies

In determining the appropriate levels of executive compensation for fiscal year

2000, the Committee based its decisions on (1) the realignment of senior

management following the retirement of Mark M. David, (2) the Company's

continued improved financial condition, (3) the need to retain experienced

individuals with proven leadership and managerial skills, (4) the executives'

motivation to enhance the Company's performance for the benefit of its

shareholders and customers, and (5) the executives' contributions to the

accomplishment of the Company's annual and long-term business objectives.

Salaries generally are determined based on the Committee's evaluation of the

value of each executive's contribution to the Company, the results of recent

past fiscal years in light of prevailing business conditions, the Company's

goals for the ensuing fiscal year and, to a lesser extent, prevailing levels at

companies considered to be comparable to and competitors of the Company.

In addition to base salary compensation, the Committee has also, from time to

time, recommended that stock options be granted to the executive officers of the

Company in order to reward the officers' commitment to maximizing shareholder

return and long-term results.

Base Salary Compensation

Based on recommendations from the Company's Chairman of the Board, the

collective business experience of the other Committee members and negotiations

with Messrs. Knigin and Pomerantz, their base salaries were established for the

two-year terms of their respective employment agreements. The Committee does not

utilize outside consultants to obtain comparative salary information, but

believes that the salaries paid by the Company are competitive, by industry

standards, with those paid by companies with similar sales volume to the

Company. The Committee places considerably more weight on each executive's

contribution to the Company's development and maintenance of its sources of

supply, manufacturing capabilities, marketing strategies and customer

relationships than on the compensation policies of the Company's competitors;

however, the Committee does not establish or rely on target levels of

performance in any of these areas to arrive at its recommendations.

The current senior executives of the Company have been associated with the

Company in senior management positions for periods ranging from eleven to more

than twenty-one years. They have been primarily responsible for the formulation

and implementation of the Company's recent financial and operational

restructuring and provide the Company with a broad range of management skills

which are considered by the Committee to be an essential source of stability and

a base for the Company's future growth.

Stock Option Grants

In 1983, the Company adopted an Incentive Stock Option Plan (the "1983 ISOP") to

provide a vehicle to supplement the base salary compensation paid to key

employees. All of the Company's senior executives were eligible to receive

grants under the 1983 ISOP. Options under the 1983 ISOP were granted at fair

market value at the date of grant. In the past, the Committee recommended and

the Board of Directors granted options under the 1983 ISOP to each of the senior

executives, except Mr. David. The options granted under the 1983 ISOP were

exercisable at a rate of 11% per year for the first eight years of service after

grant and 12% for the ninth year after grant. No options have been granted to

the Company's senior executives under the 1983 ISOP since 1986 and no further

options may be granted under the 1983 ISOP. The 1983 ISOP has expired.

On July 15, 1994, the Committee adopted a new Incentive Stock Option Plan (the

"1994 ISOP") to replace the expired 1983 ISOP. The 1994 ISOP authorized the

grant of options to purchase up to 2,000,000 shares of the Company's common

stock. Options for all of the shares of the Company's common stock under the

1994 ISOP have been granted. All of the Company's management and administrative

employees are eligible to receive grants under the 1994 ISOP. Subject to

shareholder approval, options under the 1994 ISOP were granted to each of the

Company's senior executives (except Mark M. David) on July 15, 1994 at fair

market value at that date. As a condition to the grant of options

10

to the Company's senior executives, the Committee required each of the

recipients to surrender for cancellation any interest in options granted prior

to July 15, 1994. The 1994 ISOP was approved by the Company's shareholders at

the Company's Annual Meeting on December 8, 1994.

On February 21, 2000, the Committee adopted a new Performance Equity Plan

(including a new Incentive Stock Option Plan) (the "2000 Plan" ). The 2000 Plan

authorizes the Company to grant qualified and non-qualified options to

participants for the purchase of up to an additional 750,000 shares of the

Company's common stock and to grant other stock-based awards to eligible

employees of the Company. The 2000 Plan is subject to shareholder approval and

will be presented to the shareholders at the Company's next Annual Meeting.

In addition to the incentive stock option plans, in 1988, the Committee

recommended and the Board of Directors adopted a non-qualified Management Option

Plan (the "1988 Non-Qualified Plan") to provide an additional continuing form of

long-term incentive to selected officers of the Company. The 1988 Non-Qualified

Plan was approved by the Company's shareholders at the Company's Annual Meeting

on December 13, 1988. Generally, options under the 1988 Non-Qualified Plan are

issued with a 10-year exercise period in order to encourage the executive

officers to take a long-term approach to the formulation and accomplishment of

the Company's goals. In 1988, the Committee recommended and the Board of

Directors approved the grant of options under the non-qualified option plan to

all of the Company's then executive officers.

In January 1997, the independent directors serving on the Committee recommended

that the Company grant new options under the 1994 ISOP to Saul Pomerantz and

Melvyn Knigin at a price equal to the market price for the Company's shares on

the date of the grant. The grant of new options to Messrs. Pomerantz and Knigin

was also subject to the condition that they surrender for cancellation any

interest in options granted to them prior to January 29, 1997.

In November 1998, the independent directors serving on the Committee recommended

that the Company grant new options to Messrs. Knigin and Pomerantz under the

1994 ISOP and the 1988 Non-Qualified Plan and to Mr. Rende under the 1994 ISOP.

In February 2000, the Committee recommended that the Company grant additional

options to Messrs. Knigin and Pomerantz in conjunction with their respective

employment agreements and to Mr. Rende in connection with his promotion to Chief

Financial Officer.

Incentive Compensation

In September 1998, the Compensation Committee adopted an incentive compensation

plan for senior executives, other than Mr. David (the "Incentive Plan"). Under

the 1998 Incentive Plan, the Compensation Committee had the discretion to award

bonus compensation to senior executives in an amount not to exceed five (5%)

percent of any increases in net income before taxes over the base amount of

$1,200,000 (the "Bonus Pool"). Based on the collective efforts of Messrs. Knigin

and Pomerantz, the Compensation Committee determined to award bonuses to them

under the 1998 Incentive Plan for fiscal year 1999. Mr. Knigin was eligible to

receive incentive compensation equal to three (3%) percent and Mr. Pomerantz was

eligible to receive two (2%) of net income before taxes in excess of $1,200,000.

In fiscal 2000, the Committee amended the Incentive Plan to increase the Bonus

Pool from 5% to 6.75%. Pursuant to their respective employment agreements, Mr.

Knigin was eligible to receive incentive compensation equal to three (3%)

percent and Mr. Pomerantz was eligible to receive two (2%) percent of net income

before taxes in excess of $1,200,000 for fiscal year 2000. In addition, the

Committee determined that Mr. Rende was eligible to participate in the Bonus

Pool and awarded him incentive compensation equal to 0.25% of net income before

taxes in excess of $1,200,000 for fiscal year 2000.

11

Compensation of the Chief Executive Officer

For fiscal year 2000, the annual base salary paid to the Company's Chief

Executive Officer, Melvyn Knigin, pursuant to his employment agreement was

$400,000. Mr. Knigin's employment agreement provides for the same annual base

salary in fiscal year 2001.

Compensation Committee Interlocks and Insider Participation

There are no Compensation Committee interlocks or insider participation.

Mark M. David

Gary W. Krat

Joel M. Simon

12

Summary Compensation Table

LONG-TERM COMPENSATION

ANNUAL RESTRICTED

NAME AND PRINCIPAL FISCAL COMPENSATION STOCK OPTIONS ALL OTHER

POSITION YEAR SALARY ($) AWARDS($) (# SHARES) COMPENSATION

Mark M. David 2000 - - - -

Chairman of 1999 340,355 - - (1) 508,145(2)

the Board 1998 335,000 - 350,000(1) 8,145(2)

Melvyn Knigin 2000 405,127 - 800,000(3) 52,194

President and 1999 405,406 - 600,000(3) 67,495

Chief Executive 1998 350,000 - 350,000(5) -

Officer of the

Company; Director

Saul Pomerantz 2000 252,254 - 630,000(4) 38,005

Executive Vice 1999 228,342 - 500,000(4) 44,996

President and 1998 200,000 - 350,000(5) -

Chief Operating

Officer of the

Company; Director

Thomas Rende 2000 148,843 - 175,000(6) 3,772

Chief Financial 1999 126,300 - 105,000(6) -

Officer

(1) Represents options to purchase 350,000 shares of Common Stock granted

on January 29, 1997 under the 1988 Non-Qualified Plan. Mr. David

surrendered these options on November 4, 1998.

(2) Represents annual premiums of $8,145 paid by the Company for a split

dollar form of life insurance policy on the life of Mark M. David and

an accrual for the retirement payment made to Mr. David in connection

with his retirement as a full-time employee of the Company.

(3) Represents options to purchase shares of Common Stock under the 1994

ISOP of which 350,000 shares were granted on January 29, 1997 and

125,000 were granted on November 4, 1998 and 125,000 shares granted on

November 4, 1998 under the Company's 1988 Non-Qualified Plan. Fiscal

Year 2000 also includes 200,000 shares granted on February 22, 2000

pursuant to the 2000 Plan, which are subject to shareholder approval.

(4) Represents options to purchase shares of Common Stock under the 1994

ISOP of which 350,000 shares were granted on January 29, 1997 and

75,000 were granted on November 4, 1998 and 75,000 shares granted on

November 4, 1998 under the Company's 1988 Non-Qualified Plan. Fiscal

Year 2000 also includes 130,000 shares granted on February 22, 2000

pursuant to the 2000 Plan, which are subject to shareholder approval.

(5) Represents options to purchase 350,000 shares of Common Stock granted

on January 29, 1997 under the 1994 ISOP.

(6) Represents options to purchase shares of Common Stock under the 1994

ISOP of which 20,000 shares were granted on July 15, 1994, 50,000 were

13

granted on January 29, 1997 and 35,000 were granted on November 4,

1998. Fiscal Year 2000 also includes 70,000 shares granted on February

22, 2000 pursuant to the 2000 Plan, which are subject to shareholder

approval.

14

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION/SAR VALUES

Value of Unexercised,

Number of In-the-Money

Shares Dollar Number of Unexercised Options/SARs at

Acquired on Value Options/SARs at Fiscal Fiscal Year-End

Name Exercise Realized Year-End(#) ($)(3)

Exer- Unexer- Exer- Unexer-

cisable cisable cisable cisable

MELVYN KNIGIN - - 305,937(1) 494,063(1) 17,871 19,629

SAUL POMERANTZ - - 310,914(1) 319,086(1) 18,620 12,630

THOMAS RENDE - - 64,000(2) 111,000(2) 2,313 3,000

____________________________

(1) Consists of options to purchase shares pursuant to the Company's 1988

Non-Qualified Plan, the 1994 ISOP, and the 2000 Plan. Options granted

pursuant to the 2000 Plan are subject to shareholder approval.

(2) Consists of options granted pursuant to the 1994 ISOP and the 2000

Plan. Options granted pursuant to the 2000 Plan are subject to

shareholder approval.

(3) The value attributed to unexercised options/SARs at fiscal year-end is

based on the market value at June 30, 2000 less the cost to exercise

the Options/SARs.

15

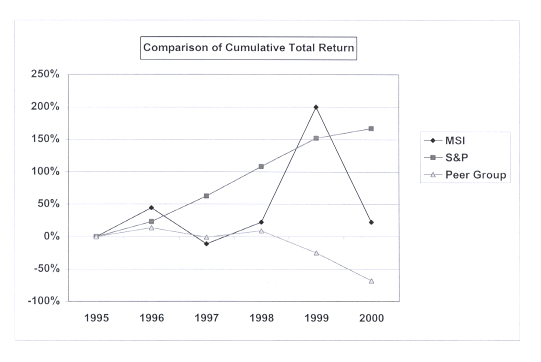

STOCK PRICE PERFORMANCE GRAPH

The Stock Price Performance Graph below compares cumulative total

return of the Company, the S&P 500 Index and a selected peer group index

selected by the Company.* The graph plots the growth in value of an initial $100

investment over the indicated time periods, with dividends reinvested. The stock

price performance shown on the graph below is not necessarily indicative of

future price performance.

__________________________________________________________________

Comparison of Cumulative Total Return

__________________________________________________________________

06/30/95 06/30/96 06/30/97 06/30/98 06/30/99 06/30/00

MSI 0.00% 44.44% -11.11% 22.22% 200.00% 22.22%

S&P 0.00% 23.11% 62.49% 108.14% 151.99% 167.02%

Peer Group 0.00% 13.77% -0.74% 9.06% -24.94% -67.96%

_____________

*The peer group index is selected by the Company and is comprised of the

Company and the following apparel companies, as adjusted for relative market

capitalization: Hampton Industries, Nitches Inc., Warnaco Group, Inc. and

Donnkenny, Inc.

16

Employee Stock Ownership Plan

The Company adopted an Employee Stock Ownership and Capital

Accumulation Plan ("ESOP") as of July 1, 1983. The ESOP is intended to comply

with the provisions of the Employee Retirement Income Security Act of 1974, as

amended, the Tax Equity and Fiscal Responsibility Act of 1982, the Deficit

Reduction Act of 1984 and the Retirement Equity Act of 1984. A favorable

determination letter was initially issued by the Internal Revenue Service with

regard to the ESOP in February 1985. From time to time, the ESOP is amended as

required to comply with amendments to the applicable statutes. Contributions to

the ESOP by the Company are discretionary. The allocation of the contribution

made in any year to eligible employees is based on their earnings. All employees

over the age of 18 years who have been employed by the Company for one year are

eligible to participate in the ESOP. All participants in the ESOP at June 30,

1996 are fully vested. Employees hired on and after July 1, 1996 vest in the

ESOP as follows:

Service with Company after June 30, 1996

up to five years.... 0%

five years.......... 100%

For the fiscal year ended June 30, 2000, the Company did not make a

contribution.

As of August 31, 2000, the ESOP owns 845,814 shares or 5.6778% of the

outstanding shares of the Company's Common Stock. Withdrawal of vested balances

by participants can take place upon death, disability or early or normal

retirement. Vested benefits will be paid to participants who have terminated

their employment for reasons other than death, disability or early or normal

retirement as quickly as possible after the third June 30 following departure.

Stock Options

2000 Performance Equity Plan

On February 21, 2000, the Board of Directors adopted the 2000

Performance Equity Plan authorizing the grant of up to 750,000 options, subject

to shareholder approval. To date, options to purchase 490,000 shares have been

granted under the plan, of which 40,000 will be vested upon shareholder approval

of the plan. See discussion under Proposal 2 for details of the plan.

1994 Incentive Stock Option Plan

In 1994, the Company adopted an Incentive Stock Option Plan (the "1994

ISOP"). The 1994 ISOP was approved by the shareholders of the Company on

December 8, 1994. The purpose of the 1994 ISOP is to enable the Company to

attract and retain key employees by providing them with an opportunity to

participate in the Company's ownership. Awards under the 1994 ISOP are made by

the Compensation Committee. The 1994 ISOP is intended to comply with Section

422A of the Internal Revenue Code of 1986, as amended. All options are granted

at market value as determined by reference to the price of shares of the Common

Stock on the American Stock Exchange.

As of June 30, 2000, there were options outstanding to purchase

1,980,000 shares, exercisable at prices ranging from $.625 to $1.75 over the

period June 30, 2000 to December 20, 2009, of which 1,111,851 are vested. An

aggregate of thirty-one persons hold options under the 1994 ISOP. For Fiscal

2000, 110,000 options were granted under the 1994 ISOP.

1983 Incentive Stock Option Plan

In 1983, the Company adopted an Incentive Stock Option Plan (the "1983

ISOP"). The 1983 ISOP expired by its terms in 1993 and was replaced by the 1994

ISOP. As of June 30, 2000, one person holds options which were granted under the

1983 ISOP to purchase 5,000 shares at a price of $1.375, all of which shares are

vested.

17

1988 Non-Qualified Stock Option Plan

On December 13, 1988, the Company's shareholders approved a

non-qualified stock option plan of up to 1,666,666 shares. As of June 30, 2000,

two persons hold options to purchase an aggregate of 200,000 shares, at an

exercise price of $.625 per share. These options vest over a period of five

years commencing November 4, 1999 and the vested portion may be exercised at any

time until November 3, 2008.

Certain Transactions

In December 1997, certain affiliates of the Company including Messrs.

Knigin, Pomerantz, Krat, Simon and Rende (collectively, the "Affiliates"),

purchased from unrelated third parties 8% Convertible Senior Notes of the

Company in the aggregate face amount of $278,500 (the "Notes"). The Affiliates

entered into a written Agreement with the Company dated December 7, 1997 (the

"Affiliates Agreement") pursuant to which they agreed to (i) certain

restrictions on the circumstances under which the Notes and the shares of Common

Stock underlying the Notes could be sold or transferred, and (ii) granted the

Company the right to purchase the shares of Common Stock underlying the Notes at

a price equal to ninety (90%) of the market price at the time any of the

Affiliates is permitted under the Affiliates Agreement to sell the shares of

Common Stock in the open market and wishes to do so. As required by the

Affiliates Agreement, all of the Affiliates converted the Notes into shares of

Common Stock on March 31, 1999. On and after January 2, 2001, these restrictions

will expire.

Compliance With Section 16(a) of the Exchange Act

Section 16(a) of the Securities Exchange Act of 1934 requires our

directors and executive officers and persons who beneficially own more than ten

percent of our common stock to file initial reports of ownership and reports of

changes of in ownership of common stock with the Securities and Exchange

Commission (SEC) and the American Stock Exchange. Executive officers, directors

and greater-than-ten percent shareholders are required by SEC regulations to

furnish us with copies of all such reports they file. To our knowledge, based

solely on review of the copies of such reports furnished to us and written

representations that no other reports were required during the year ended June

30, 2000, all filings under Section 16(a) were made as required.

PROPOSAL 2

Approval of the 2000 Performance Equity Plan

In February 2000, our board adopted the 2000 Performance Equity Plan

("Plan"), subject to shareholder approval at the Annual Meeting. Movie Star

operates in a competitive market. A particularly competitive area of Movie

Star's business is attracting and retaining talented employees (including

executives, sales and support personnel and others). In order to effectively

compete in today's market for qualified employees, Movie Star must compensate

employees with stock options and align their interests with those of the

shareholders. During 2000, Movie Star granted Messrs. Knigin, Pomerantz and

Rende, options to purchase 200,000, 150,000 and 70,000 shares of Common Stock,

respectively, at an exercise prices on the dates of grant ranging from $0.6875to

$1.0625 per share, subject to approval of the Plan by the shareholders. In

addition, options under the 2000 Plan were granted to two other employees,

subject to shareholder approval of the 2000 Plan.

It is imperative that Movie Star continue to attract and retain the

quality and quantity of employees that it has in the past in order to continue

its growth and effect its business plan. If unable to do this, Movie Star will

be at a significant competitive disadvantage in the marketplace and shareholder

value could be adversely impacted. There is an aggregate of 1,466,666 shares

still available for grant under the 1988 Non-Qualified plan and there are no

shares remaining available under the 1994 ISOP. The ability to continue to

compensate employees with equity- based grants such as stock options is key to

competing for talent. For these reasons, we are requesting that the shareholders

approve the Plan.

18

The Board of Directors recommends voting "FOR" Proposal 2.

Summary of the Plan

Administration

The Plan is administered by the board or a compensation committee of

the board (as used in this summary, the "Committee"). The Committee has full

authority, subject to the provisions of the Plan, to award (i) Stock Options,

(ii) Restricted Stock, (iii) Deferred Stock, (iv) Stock Reload Options and/or

(v) Other Stock-Based Awards (collectively, "Awards"). Subject to the provisions

of the Plan, the Committee determines, among other things, the persons to whom

from time to time Awards may be granted ("Holders"), the specific type of Awards

to be granted (e.g., Stock Options, Restricted Stock), the number of shares

subject to each Award, share prices, any restrictions or limitations on such

Awards (e.g., the "Deferral Period" in the grant of Deferred Stock and the

"Restriction Period" when Restricted Stock is subject to forfeiture), and any

vesting, exchange, deferral, surrender, cancellation, acceleration, termination,

exercise or forfeiture provisions related to such Awards.

Stock Subject to the Plan

The Plan authorizes the granting of Awards whose exercise would allow

up to an aggregate of 750,000 shares of common stock to be acquired by the

Holders of such Awards. In order to prevent the dilution or enlargement of the

rights of Holders under the Plan, the number of shares of common stock

authorized by the Plan is subject to adjustment by the Committee in the event of

any dividend on shares of common stock payable in shares of common stock, common

stock split or reverse split or other extraordinary or unusual event which

results in a change in the shares of common stock as a whole. The Committee, in

the event of any of the foregoing, will make equitable adjustments in the terms

of any awards and the aggregate number of shares reserved for issuance under the

Plan.

If any Award granted under the Plan is forfeited or terminated prior to

exercise, the shares of common stock that were available pursuant to such Award

shall again be available for distribution in connection with Awards subsequently

granted under the Plan. If a Holder pays the exercise price of a Stock Option by

surrendering any previously owned shares and/or arranges to have the appropriate

number of shares otherwise issuable upon exercise withheld to cover the

withholding tax liability associated with the Stock Option exercise, then the

number of shares available under the Plan will be increased by the lesser of (i)

the number of such surrendered shares and shares used to pay taxes; and (ii) the

number of shares purchased under such Stock Option.

Eligibility

Subject to the provisions of the Plan, Awards may be granted to

employees, officers, directors and consultants who are deemed to have rendered

or to be able to render significant services to Movie Star and who are deemed to

have contributed or to have the potential to contribute to Movie Star's success.

Incentive Stock Options, as hereinafter defined, may be awarded only to persons

who, at the time of grant of such awards, are, or have agreed to become,

employees of Movie Star or its wholly- or majority-owned subsidiaries.

Types of Awards

Options. The Plan provides both for "Incentive" stock options

("Incentive Stock Options") as defined in Section 422 of the Internal Revenue

Code of 1986, as amended ("Code"), and for options not qualifying as Incentive

Options ("Non-Qualified Stock Options"), both of which may be granted with any

other stock-based award under the Plan. The Committee determines the exercise

price per share of common stock purchasable under an Incentive or Non-Qualified

Stock Option (collectively, "Stock Options"). The exercise price of Stock

Options may not be less than 100% of the fair market value on the day of the

grant (or, if greater, the par value of a share of common stock). However, (i)

the exercise price of an Incentive Stock Option granted to a person possessing

more than 10% of the total combined voting power of all classes of Movie Star

stock may not be less than 110% of such fair market value on the date of grant

and (ii) if the Stock Option is granted in connection with the recipient's

hiring, promotion or similar event, the exercise price may not be less than the

fair market value of the common stock on the trading date immediately preceding

the date on which the recipient is hired or promoted (or similar event) if the

grant of the Stock Option occurs not more than 120 days after the date of such

19

hiring, promotion or other event. In the case of an Incentive Stock Option, the

aggregate fair market value (on the date of grant of the Stock Option) with

respect to which Incentive Stock Options become exercisable for the first time

by a Holder during any calendar year shall not exceed $100,000. An Incentive

Stock Option may only be granted within a ten-year period from the date the

Plan is adopted and approved and may only be exercised within ten years from the

date of the grant (or within five years in the case of an Incentive Stock Option

granted to a person who, at the time of the grant, owns common stock possessing

more than 10% of the total combined voting power of all classes of Movie Star

stock). Subject to any limitations or conditions the Committee may impose, Stock

Options may be exercised, in whole or in part, at any time during the term of

the Stock Option by giving written notice of exercise to Movie Star specifying

the number of shares of common stock to be purchased. Such notice must be

accompanied by payment in full of the purchase price, either in cash or, if

provided in the agreement, in securities of Movie Star or in combination

thereof.

Generally, Stock Options granted under the Plan may not be transferred

other than by will or by the laws of descent and distribution and all Stock

Options are exercisable during the Holder's lifetime (or in the event of legal

incapacity or incompetency, the Holder's guardian or legal representative).

However, a Holder, with the approval of the Committee, may transfer a

Non-Qualified Stock Option by gift to a family member of the Holder, by domestic

relations order to a family member of the Holder or by transfer to an entity in

which more than fifty percent of the voting interests are owned by family

members of the Holder or the Holder, in exchange for an interest in that entity.

Generally, if the Holder is an employee, no Stock Options, or any

portion thereof, granted under the Plan may be exercised by the Holder unless he

or she is employed by Movie Star or a subsidiary at the time of the exercise and

has been so employed continuously from the time the Stock Options were granted.

However, in the event the Holder's employment with Movie Star is terminated due

to disability, the Holder may still exercise his or her vested Stock Options for

a period of 12 months (or such other greater or lesser period as the Committee

may determine) from the date of such termination or until the expiration of the

stated term of the Stock Option, whichever period is shorter. Similarly, should

a Holder die while in the employment of Movie Star or a subsidiary, his or her

legal representative or legatee under his or her will may exercise the decedent

Holder's vested Stock Options for a period of 12 months from the date of his or

her death (or such other greater or lesser period as the Committee may

determine) or until the expiration of the stated term of the Stock Option,

whichever period is shorter. If the Holder's employment with Movie Star is

terminated due to normal retirement (upon such age as designated by the

Committee, and if no age is designated, then upon attaining the age of 62), the

Holder may still exercise his or her vested Stock Options for a period of three

years from the date of such termination or until the expiration of the stated

term of the Stock Option, whichever period is shorter. If the Holder's

employment is terminated for any reason other than death, disability or normal

retirement, the Stock Option shall automatically terminate, except that if the

Holder's employment is terminated by Movie Star without cause, then the portion

of any Stock Option that has vested on the date of termination may be exercised

for the lesser of three months after termination of employment (or such other

greater or lesser period as the Committee may determine) or the balance of the

Stock Option's term.

Restricted Stock. The Committee may award shares of restricted stock

("Restricted Stock") either alone or in addition to other Awards granted under

the Plan. The Committee determines the persons to whom grants of Restricted

Stock are made, the number of shares to be awarded, the price (if any) to be

paid for the Restricted Stock by the person receiving such stock from Movie

Star, the time or times within which awards of Restricted Stock may be subject

to forfeiture (the "Restriction Period"), the vesting schedule and rights to

acceleration thereof, and all other terms and conditions of the Restricted Stock

awards.

Restricted Stock awarded under the Plan may not be sold, exchanged,

assigned, transferred, pledged, encumbered or otherwise disposed of other than

to Movie Star during the applicable Restriction Period. Other than regular cash

dividends and other cash equivalent distributions as the Committee may

designate, pay or distribute, Movie Star will retain custody of all

distributions ("Retained Distributions") made or declared with respect to the

Restricted Stock during the Restriction Period. A breach of any restriction

regarding the Restricted Stock will cause a forfeiture of such Restricted Stock

and any Retained Distributions with respect thereto. Except for the foregoing

restrictions, the Holder will, even during the Restriction Period, have all of

the rights of a shareholder, including the right to receive and retain all

regular cash dividends and other cash equivalent distributions as the Committee

may designate, pay or distribute on such Restricted Stock and the right to vote

such shares.

20

In order to enforce the foregoing restrictions, the Plan requires that

all shares of Restricted Stock awarded to the Holder remain in the physical

custody of Movie Star until the restrictions on such shares have terminated and

all vesting requirements with respect to the Restricted Stock have been

fulfilled.

Deferred Stock. The Committee may award shares of deferred stock

("Deferred Stock") either alone or in addition to other Awards granted under the

Plan. The Committee determines the eligible persons to whom, and the time or

times at which, Deferred Stock will be awarded, the number of shares of Deferred

Stock to be awarded to any person, the duration of the period (the "Deferral

Period") during which, and the conditions under which, receipt of the stock will

be deferred, and all the other terms and conditions of such Deferred Stock

Awards.

Deferred Stock awards granted under the Plan may not be sold,

exchanged, assigned, transferred, pledged, encumbered or otherwise disposed of

other than to Movie Star during the applicable Deferral Period. The Holder shall

not have any rights of a shareholder until the expiration of the applicable

Deferral Period and the issuance and delivery of the certificates representing

such common stock. The Holder may request to defer the receipt of a Deferred

Stock award for an additional specified period or until a specified event. Such

request must generally be made at least one year prior to the expiration of the

Deferral Period for such Deferred Stock award.

Stock Reload Options. The Committee may grant Stock Reload Options to a

Holder who tenders shares of common stock to pay the exercise price of a Stock

Option ("Underlying Option") and/or arranges to have a portion of the shares

otherwise issuable upon exercise withheld to pay the applicable withholding

taxes. A Stock Reload Option permits a Holder who exercises a Stock Option by

delivering stock owned by the Holder for a minimum of six months to receive back

from Movie Star a new Stock Option (at the current market price) for the same

number of shares delivered to exercise the Option. The Committee determines the

terms, conditions, restrictions and limitations of the Stock Reload Options. The

exercise price of Stock Reload Options shall be the fair market value as of the

date of exercise of the Underlying Option. Unless the Committee determines

otherwise, a Stock Reload Option may be exercised commencing one year after it

is granted and expires on the expiration date of the Underlying Option.

Other Stock-Based Awards. The Committee may grant Other Stock-Based

Awards, subject to limitations under applicable law, that are denominated or

payable in, valued in whole or in part by reference to, or otherwise based on,

or related to, shares of common stock, as deemed by the Committee to be

consistent with the purposes of the Plan, including purchase rights, shares of

common stock awarded which are not subject to any restrictions or conditions,

convertible or exchangeable debentures or other rights convertible into shares

of common stock and awards valued by reference to the value of securities of or

the performance of specified subsidiaries. Subject to the terms of the Plan, the

Committee has complete discretion to determine the terms and conditions

applicable to Other Stock-Based Awards. Other Stock-Based Awards may be awarded

either alone or in addition to or in tandem with any other awards under the Plan

or any other Plan of Movie Star.

Competition with Movie Star; Solicitation of Customers and Employees;

Disclosure of Confidential Information

Unless the written agreement with a Holder expressly provides

otherwise, if a Holder's employment with Movie Star or a subsidiary is

terminated as a result of the voluntary resignation of the Holder, and within

one hundred and eighty (180) days after the date thereof such Holder either (i)

accepts employment with any competitor of, or otherwise engages in competition

with, the Company or (ii) discloses to anyone outside the Company or uses any

confidential information or material of the Company in violation of the

Company's policies or any agreement between the Holder and the Company, the

Committee, in its sole discretion, may require such Holder to return to the

Company the economic value of any award that was realized or obtained by such

Holder at any time during the period beginning on the date that is one hundred

and eighty (180) days prior to the date such Holder's employment with the

Company is terminated, unless the award is a stock option which the Holder

exercised at least one hundred and eighty (180) days prior to such voluntary

resignation. The provisions of this Section shall not apply to any awards

granted prior to the date upon which the Plan shall have been approved by the

Company's stockholders.

Termination for Cause

Except as otherwise expressly provided in the Agreement, the Committee

may, if a Holder's employment with the Company or a Subsidiary is terminated for

cause, annul any award granted under this Plan to such employee and, in such

event, the Committee, in its sole discretion, may require such Holder to return

to the Company the economic value of any award that was realized or obtained by

21

such Holder at any time during the period beginning on the date that is one

hundred and eighty (180) days prior to the date such Holder's employment with

the Company is terminated.

Withholding Taxes

Upon the exercise of any Award granted under the Plan, the Holder may

be required to remit to Movie Star an amount sufficient to satisfy all federal,

state and local withholding tax requirements prior to delivery of any

certificate or certificates for shares of Common Stock.

Agreements

Stock options, restricted stock, deferred stock, stock reload options

and other stock-based awards granted under the Plan will be evidenced by

agreements consistent with the Plan in such form and having such additional

terms (not contrary to the requirements of the Plan) as the Committee may

prescribe. Neither the Plan nor agreements thereunder confer any right to

continued employment upon any holder of a stock option, restricted stock,

deferred stock, stock reload options or other stock-based award.

Term and Amendments

Unless terminated by the board, the Plan shall continue to remain

effective until such time as no further Awards may be granted and all Awards

granted under the Plan are no longer outstanding. Notwithstanding the foregoing,

grants of incentive stock options may be made only during the ten-year period

following the date the Plan becomes effective. The board may at any time, and

from time to time, amend the Plan, provided that no amendment will be made that

would impair the rights of a holder under any agreement entered into pursuant to

the Plan without the holder's consent.

Federal Income Tax Consequences

The following discussion of the federal income tax consequences of

participation in the Plan is only a summary of the general rules applicable to

the grant and exercise of Stock Options and other Awards and does not give

specific details or cover, among other things, state, local and foreign tax

treatment of participation in the Plan. The information contained in this

section is based on present law and regulations, which are subject to being

changed prospectively or retroactively.

Incentive Stock Options

The Holder will recognize no taxable income upon the grant of an

Incentive Stock Option. The Holder will realize no taxable income when the

Incentive Stock Option is exercised if the Holder has been an employee of Movie

Star or its subsidiaries at all times from the date of the grant until three

months before the date of exercise (one year if the Holder is disabled). Movie

Star will not qualify for any deduction in connection with the grant or exercise

of Incentive Stock Options. Upon a disposition of the shares after the later of

two years from the date of grant or one year after the transfer of the shares to

the Holder, the Holder will recognize the difference, if any, between the amount

realized and the exercise price as long-term capital gain or long-term capital

loss (as the case may be) if the shares are capital assets. The excess, if any,

of the fair market value of the shares on the date of exercise of an Incentive

Stock Option over the exercise price will be treated as an item of adjustment

for a Holder's taxable year in which the exercise occurs and may result in an

alternative minimum tax liability for the Holder.

If common stock acquired upon the exercise of an Incentive Stock Option

is disposed of prior to the expiration of the holding periods described above,

(i) the Holder will recognize ordinary compensation income in the taxable year

of disposition in an amount equal to the excess, if any, of the lesser of the

fair market value of the shares on the date of exercise or the amount realized

on the disposition of the shares, over the exercise price paid for such shares

and (ii) Movie Star will qualify for a deduction equal to any such amount

recognized, subject to the limitation that the compensation be reasonable. In

the case of a disposition of shares earlier than two years from the date of the

grant or in the same taxable year as the exercise, where the amount realized on

the disposition is less than the fair market value of the shares on the date of

exercise, there will be no adjustment since the amount treated as an item of

adjustment, for alternative minimum tax purposes, is limited to the excess of

the amount realized on such disposition over the exercise price, which is the

same amount included in regular taxable income.

22

Non-Qualified Stock Options

With respect to Non-Qualified Stock Options (i) upon grant of the Stock

Option, the Holder will recognize no income, (ii) upon exercise of the Stock

Option (if the shares of common stock are not subject to a substantial risk of

forfeiture), the Holder will recognize ordinary compensation income in an amount

equal to the excess, if any, of the fair market value of the shares on the date

of exercise over the exercise price, and Movie Star will qualify for a deduction

in the same amount, subject to the requirement that the compensation be

reasonable and (iii) Movie Star will be required to comply with applicable

federal income tax withholding requirements with respect to the amount of

ordinary compensation income recognized by the Holder. On a disposition of the

shares, the Holder will recognize gain or loss equal to the difference between

the amount realized and the sum of the exercise price and the ordinary

compensation income recognized. Such gain or loss will be treated as capital

gain or loss if the shares are capital assets and as short-term or long-term

capital gain or loss, depending upon the length of time that the Holder held the

shares.

If the shares acquired upon exercise of a Non-Qualified Stock Option

are subject to a substantial risk of forfeiture, the Holder will recognize

ordinary income at the time when the substantial risk of forfeiture is removed,

unless such Holder timely files under Code Section 83(b) to elect to be taxed on

the receipt of shares, and Movie Star will qualify for a corresponding deduction

at such time. The amount of ordinary income will be equal to the excess of the

fair market value of the shares at the time the income is recognized over the

amount (if any) paid for the shares.

Restricted Stock

A Holder who receives Restricted Stock will recognize no income on the

grant of the Restricted Stock and Movie Star will not qualify for any deduction.

At the time the Restricted Stock is no longer subject to a substantial risk of

forfeiture, a Holder will recognize ordinary compensation income in an amount

equal to the excess, if any, of the fair market value of the Restricted Stock at

the time the restriction lapses over the consideration paid for the Restricted

Stock. A Holder's shares are treated as being subject to a substantial risk of

forfeiture so long as his or her sale of the shares at a profit could subject

him or her to a suit under Section 16 (b) of the Exchange Act. The holding

period to determine whether the Holder has long-term or short-term capital gain

or loss begins when the Restriction Period expires, and the tax basis for the

shares will generally be the fair market value of the shares on such date.

A Holder may elect, under Section 83(b) of the Code, within 30 days of

the transfer of the Restricted Stock, to recognize ordinary compensation income

on the date of transfer in an amount equal to the excess, if any, of the fair

market value on the date of such transfer of the shares of Restricted Stock

(determined without regard to the restrictions) over the consideration paid for

the Restricted Stock. If a Holder makes such election and thereafter forfeits

the shares, no ordinary loss deduction will be allowed. Such forfeiture will be

treated as a sale or exchange upon which there is realized loss equal to the

excess, if any, of the consideration paid for the shares over the amount

realized on such forfeiture. Such loss will be a capital loss if the shares are

capital assets. If a Holder makes an election under Section 83(b), the holding

period will commence on the day after the date of transfer and the tax basis

will equal the fair market value of shares (determined without regard to the

restrictions) on the date of transfer.

On a disposition of the shares, a Holder will recognize gain or loss

equal to the difference between the amount realized and the tax basis for the

shares.

Whether or not the Holder makes an election under Section 83(b), Movie

Star generally will qualify for a deduction (subject to the reasonableness of

compensation limitation) equal to the amount that is taxable as ordinary income

to the Holder, in its taxable year in which such income is included in the

Holder's gross income. The income recognized by the Holder will be subject to

applicable withholding tax requirements.

Dividends paid on Restricted Stock which is subject to a substantial

risk of forfeiture generally will be treated as compensation that is taxable as

ordinary compensation income to the Holder and will be deductible by Movie Star

subject to the reasonableness limitation. If, however, the Holder makes a

Section 83(b) election, the dividends will be treated as dividends and taxable

as ordinary income to the Holder, but will not be deductible by Movie Star.

23

Deferred Stock

A Holder who receives an award of Deferred Stock will recognize no

income on the grant of such award. However, he or she will recognize ordinary

compensation income on the transfer of the Deferred Stock (or the later lapse of

a substantial risk of forfeiture to which the Deferred Stock is subject, if the

Holder does not make a Section 83(b) election), in accordance with the same

rules as discussed above under the caption "Restricted Stock."

Other Stock-Based Awards

The federal income tax treatment of Other Stock-Based Awards will

depend on the nature of any such award and the restrictions applicable to such

award.

PROPOSAL 3

Ratification of Selection of Deloitte & Touche LLP as Auditors

The Board of Directors has selected Deloitte & Touche LLP to audit the

books and records of the Company for its fiscal year ending June 30, 2001. The

Company has been advised by Deloitte & Touche LLP, that the firm has no

relationship with the Company or its subsidiaries other than that arising from

the firm's engagement as auditors, tax advisors and consultants.

In the event the shareholders fail to ratify the appointment, the Board

of Directors will consider it as direction to select other auditors for the

subsequent year. Even if the selection is ratified, the Board in its discretion

may direct the appointment of a different independent accounting firm at any

time during the year if the Board feels that such a change would be in the best

interest of the Company and its shareholders. The ratification requires a

majority vote of those shares of Common Stock represented at the meeting.

Consequently, any shares not voted "For" ratification (whether as a result of a

direction to withhold authority or a broker non-vote) will not be counted for

purposes of determining a majority.

The appointment of Deloitte & Touche LLP continues a relationship that

began prior to 1980. Representatives of Deloitte & Touche LLP will be present at

the Annual Meeting, during which they will be afforded the opportunity to make a

statement if they so desire, and shareholders will be afforded the opportunity

to ask appropriate questions.

___________________________________

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU MARK YOUR

PROXY "FOR" RATIFICATION OF THE SELECTION OF DELOITTE & TOUCHE LLP

TO AUDIT THE BOOKS AND RECORDS OF THE COMPANY FOR THE

FISCAL YEAR ENDING JUNE 30, 2001

___________________________________

OTHER BUSINESS

The Board of Directors does not intend to present any other business

for action at the Annual Meeting and does not know of any other business

intended to be presented by others.

SHAREHOLDERS' PROPOSALS

Proposals of shareholders for consideration at the 2001 Annual Meeting

of Shareholders must be received by the Company no later than September 1, 2001,

in order to be included in the Company's Proxy Statement and proxy relating to

the meeting.

24

ANNUAL REPORT AND FINANCIAL INFORMATION

A copy of the Company's Annual Report to Shareholders for the year

ended June 30, 2000, has been or will be mailed on or about October 24, 2000,

concurrently with or prior to the mailing of this Proxy Statement, by first

class mail, to each shareholder of record as of October 17, 2000.