|

|

|

|

|

Previous: WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORP, 10-Q, EX-27, 2000-10-31 |

Next: WSI INTERACTIVE CORP, 8-K, 2000-10-31 |

TABLE OF CONTENTS

COMPANY OVERVIEW

OUR VISION

OUR GUIDING PRINCIPLE

THE BUSINESS MODEL OF WSi

CORE BUSINESS DIVISIONS - 100% OWNED BY WSi

Western Shores

TargetPacks

MediaNet Solutions

INTERNET BUSINESS DEVELOPMENT

Strategic Relationship with IBM

EARLY STAGE DEVELOPMENT PROJECTS

INVESTMENTS IN BUSINESSES NOT MANAGED BY WSi

MANAGEMENT'S DISCUSSION AND ANALYSIS

FINANCIAL STATEMENTS

MANAGEMENT'S RESPONSIBILITY FOR FINANCIAL REPORTING

AUDITORS' REPORT

CONSOLIDATED STATEMENTS OF EARNINGS AND DEFICIT

CONSOLIDATED BALANCE SHEETS

CONSOLIDATED STATEMENTS OF CASH FLOWS

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

This annual report may contain forward-looking statements that involve risks and uncertainties, including the impact of competitive products and pricing and general economic conditions as they affect WSi Interactive Corporation's clients. Actual results and developments may therefore differ materially from those described in this annual report.

"WSi is focused on profitability and anticipates that the Company

will become profitable by the end of the 2001 fiscal year through

strong revenue growth and judicious expense management"

On behalf of the Board of Directors, I am very pleased to present the Annual Report for the fiscal year ending June 30, 2000.

In July, 1999, the Company changed its name from "JSS Resources Inc." to "WSi Interactive Corporation" and completed a change of business by acquiring all of the shares and assets of WSi Management Group which now comprise the core business of the Company.

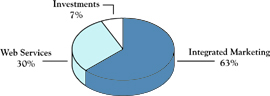

The Company's business consists of three operating segments: (1) integrated marketing (2) web services and (3) investments and e-businesss development. Our first year under the new company structure has been extremely active; we achieved rapid growth and gained a wealth of valuable experience. Aggressive goals were set and I am very pleased with our achievements. By identifying and investing in strategically complementary businesses, we have been able to lever our core strengths to build a strong network of businesses.

Over the past year, WSi has expanded its team to build a strong management group, an active Board of Directors and a talented pool of employees. We have focused on attracting people with creative and technological excellence as well as marketing proficiency and experience.

The Company's revenue for the year ended June 30, 2000 totaled $6,007,375, meeting its target for the year. The net loss for the year was $1,810,783 of which $702,125 was amortization of capital assets. The loss before amortization was $1,108,658. Assets grew to $9,160,200 by June 30, 2000.

Most importantly, this was a year of evolution for WSi. We adhered to our business model and achieved many successes. Due to our rapid growth we met with some challenges that taught us valuable lessons. As a result, we ended our first year stronger, more disciplined and sharply focused on our vision.

From the very beginning it has been apparent that our business model and our organizational structure are well suited to meet our objectives. The number of business opportunities presented to us has been steadily increasing. As our reputation has grown, we have seen opportunities of greater scope and caliber. Alliances with other companies including IBM Canada Inc. have assisted our development in this area.

While growth is a key part of our business plan, we have learned to be very strategic in the selection of opportunities and stringent in our due diligence. We are focusing on reviewing opportunities which are complementary to our existing business and have excellent potential for near term profitability.

We have worked to streamline the organization in order to improve communication, increase efficiency and reduce expenses. Currently WSi has a work-force of approximately 65 people with valuable collective experience, who are committed to our success.

I believe that one of our greatest achievements has been to earn the trust and loyalty of our shareholders, who, despite our initial challenges and the vagaries of the market, have continued to support the Company. In the process of fine-tuning our organization, the importance of clear and consistent communications with all stakeholders has become paramount. Steps are ongoing to ensure that this is achieved.

Looking to the future, WSi is in a strong position to take advantage of the growth of the Internet in both content and infrastructure opportunities. Our focus will be to identify opportunities for acquisition, consolidation and acceleration of Internet centric businesses which are complementary to our core competencies.

As WSi takes the necessary steps to grow into the future, it does so with a continued commitment to its plan and a clarity of purpose that is greatly enhanced by the experience of this past year. I am very excited about WSi's future and hope that we will continue to earn your support in our endeavors. We firmly believe that the simple maxims of commitment, discipline and focus will ensure our success.

Sincerely,

Theo Sanidas,

President & CEO. WSi Interactive Corporation

SUMMARY OF HIGHLIGHTS (to October 10, 2000)

FUTURE PLANS

WSi generates revenue by marketing and selling

products and services based on its core competencies

of integrated marketing, web and business

development services and by investing in content

and infrastructure of Internet businesses. The three

divisions that represent the core of WSi are Western

Shores (direct marketing), TargetPacks (Internet

marketing), and MediaNet Solutions (web

development and hosting services). All three are

complementary and provide total solutions to a

wide variety of client objectives. WSi also generates

revenue from new businesses by providing

development support based on those same core

competencies.

As Internet services expand to include live casting

and other streaming media, WSi intends to be at the

forefront of this technology by establishing strategic

partnerships with high-speed transmission networks.

The shares of WSi Interactive Corporation are listed

on the Canadian Venture Exchange (CDNX) as

a Tier 1 company and on the third segment

"Freiverkehr" of the Frankfurt Stock Exchange in

Germany. WSi's shares are also listed on the OTC

Bulletin Board in the United States.

WSi currently has approximately 65 personnel.

OUR VISION

WSi will be recognized as the best total Internet

business development partner. WSi will strive to

be the leading resource for top quality business,

marketing and technological expertise, people and

venture capital, to Internet centric companies.

OUR GUIDING PRINCIPLE

In everything we do, we exist to profitably accelerate

the success of Internet centric businesses. We

measure our success by how well our partners

ultimately perform in their markets.

Integrated marketing - provides conventional and

on line direct marketing services. Includes Western

Shores and TargetPacks divisions.

Web services - provides high-end web development

and advanced hosting services. Includes MediaNet

Solutions and DNSMedia.

Investment - includes business development and corporate services.

CORPORATE HISTORY

On June 30, 1999, the Canadian Venture Exchange

(CDNX) approved the acquisition by JSS Resources

Inc., a CDNX listed company, of all of the

outstanding shares of WSi Management Group Inc.

("WSi Group"), a private company founded by Theo

Sanidas. JSS Resources Inc. subsequently changed its

name to WSi Interactive Corporation.

In March 2000, WSi Interactive Corporation

simplified its corporate structure by officially

winding up the WSi Group and its three subsidiary

companies. However, the original WSi Group of

companies continue as the core divisions of WSi.

CORE BUSINESS DIVISIONS - 100% OWNED BY WSi

Western Shores

As the direct marketing arm of WSi, this division

creates revenue through the sale of a full range of

direct and database marketing programs. These

include: direct mail campaigns, geodemographic

profiling, database design and management, graphic

design, print, media buying, and other services.

Similar to an advertising agency but wider in scope

and capability, Western Shores is able to provide

integrated campaigns that utilize all media or

individual marketing services depending on the

needs of the client.

Western Shores has been in business for ten years

and represents a key core competency of WSi,

providing solid revenue and, most importantly,

marketing expertise, which is leveraged by all

other WSi businesses.

Western Shores' business plan calls for an increase

of revenue which will be achieved through the

activities of a growing sales force and improved

operational efficiencies. It is anticipated that

additional revenue will be earned from activities

related to the development of new Internet

related marketing clients.

TargetPacks.com

This is a permission-based Internet marketing

division which levers WSi's direct marketing

expertise specifically in the Internet arena.

TargetPacks provides opt-in email marketing

programs for advertisers, either in conjunction with

other advertisers in interest-specific "packs," or as a

solo program. Consumers may also take advantage

of the website by subscribing to a topic-specific

newsletter mailing lists. Customers can rent opt-in

lists, advertise in newsletters, and/or have

TargetPacks manage and rent their proprietary

lists. The major asset of the business will be the

accumulation of proprietary opt-in names.

TargetPacks has recently acquired a license for a

list management software at a cost of US $120,000

which serves as an added-value feature to opt-in

email campaigns. This software package integrates

a relational database into an advanced e-mail list

server which will allow TargetPacks to create

customized e-mail marketing campaigns. In addition,

TargetPacks will become the aggregator and

marketing arm for the subscriber lists of all other

WSi Internet divisions.

TargetPacks anticipates that an increase in the next

fiscal year's revenue will be realized through

escalated sales of integrated marketing campaigns

that take advantage of TargetPacks' Internet

expertise combined with the experience of WSi's

direct marketing division. A growing database of

proprietary opt-in names will expand the asset base

of TargetPacks and simultaneously increase the

profit margins for each campaign.

MediaNet Solutions

MediaNet Solutions offers comprehensive web

development solutions to clients who need an

effective presence on the World Wide Web, and also

to those clients who want to enhance and maximize

their current site. This division offers a full range

of design and content development services, as well

as back-end programming.

MediaNet Solutions has access to a powerful data

center/ISP capable of handling 750 million hits

per day and 9,000 simultaneous on-demand video

streams. The data center delivers state-of-the-art

reliability, security and scalability to meet the

escalating demands of e-business activities. The

facility will be used specifically for internet

technologies, hosting applications, data

warehousing and streaming video technologies.

MediaNet Solutions is on the leading edge of

"convergence" Internet applications, specifically

Internet broadcasting and telephony.

INTERNET BUSINESS DEVELOPMENT

In addition to providing marketing, web site

development and hosting services, WSi has an

innovative Internet business development division.

WSi focuses on start-up or early-stage companies

where significant value can be added to the

investment through WSi's experience in providing

complete Internet business development and

marketing solutions.

This division of WSi operates under the website

"Shellco.com" which provides resources for private

companies interested in going public and/or

seeking business acquisitions. The website is also

a marketing tool for WSi's Internet business

development segment.

As a developer of Internet companies, WSi receives

a constant flow of business plans and investment

opportunities. WSi evaluates these proposals by

conducting a stringent due diligence review of both

the business and its management team. All proposed

investments are subject to the review and approval

of WSi's Board of Directors. Once a partner company

has been successfully established, WSi may elect to

assist the business to enter the public markets with

WSi retaining a significant share equity position.

Rather than taking over a selected business in its

entirely, WSi acquires a share equity position in

the partner company by providing a combination

of business development services and/or funding.

Payment for WSi's development services is usually in

the form of cash. WSi may also be compensated by

receiving equity in the partner business in addition

to any cash payments. This model increases WSi's

revenues and investments while strengthening its

infrastructure to include management personnel of

the partner companies. Each partner business is

managed as a separate profit and loss centre with

its own management team.

Strategic Relationship with IBM

In April 2000 WSi announced that it had formed

an alliance with IBM Canada Ltd. This partnership

with IBM allows WSi to take on projects of virtually

unlimited scope and significantly accelerate their

early stage development. IBM submits business plans

to WSi's business development program and provides

hardware, software and services to selected start up

projects. WSi has access to IBM's Industry Solutions

Lab, and is registered in IBM's Service Provider

Business Partner Program.

BUSINESSES IN DEVELOPMENT

DNSMedia.com - 100% owned

A full-service digital solutions company that

provides network solutions to clients, DNSMedia

makes the web move faster and gives the customer's

presentation an interactive and visually compelling

presence. Services include streaming media

production and broadband delivery, video-on-demand,

web design interactivity, audio and

video slide presentations, animation and flash,

e-commerce and online marketing.

DNSMedia has developed the production and

streaming infrastructure for the Los Angeles Film

School and Hollywood Broadcasting, both located

in Los Angeles, California.

DNSMedia is a Nevada corporation which

maintains a business office in Los Angeles.

StockSecrets.com - 100% owned

StockSecrets.com is a financial portal targeting both

investors and those interested in financial markets,

small cap companies and trends that affect financial

investments. Currently the site offers daily content,

real-time stock quotations and links to other related

sites. A beta version of the new website was launched

in September, 2000.

Revenue for StockSecrets is derived from the sale of

opt-in email campaigns in addition to the sale of

audio, text and video streaming corporate profiles,

and banner advertising. Cross selling between this

portal and InvestmentWorldNews.com provides

added value for its clients.

StockSecrets.com is owned and operated by a

private British Columbia corporation, Stock Secrets

Enterprises Ltd., which is wholly owned by WSi.

Investment World News - 100% owned

Investment World News is a quarterly, four-color

magazine that is produced by StockSecrets.com and

distributed through business publications in the US

and Canada. It targets small cap companies and

provides advertising opportunities to attract

investors. The publication generates traffic to a

companion web site (InvestmentWorldNews.com),

thus providing leads for advertisers and building

Stocksecrets' opt-in database.

During the next year, Investment World News will

focus on developing brand awareness and recognition

in the financial community. Revenues are derived

from payments by corporations profiled in the

magazine and from other advertisements. The

costs of producing the magazine are fully covered

by revenue received and content is provided by

the clients.

iaNett.com

iaNett.com is a software development firm

specializing in search engine technology. The

company has developed a search engine that it

considers superior to its competition, both in terms

of performance and price. The software can be

easily and usefully adopted by any website. The

iaNett.com website and assets are owned and

operated by IaNett.com Internet Technologies Ltd.,

a private company incorporated in British Columbia

and currently 50.1% owned by WSi. Under the terms

of the acquisition agreement, WSi's interest will

reduce to 45% by the end of fiscal year 2001.

Moving forward, iaNett will identify a viable market

for its product and develop a supporting sales and

marketing plan.

EARLY STAGE DEVELOPMENT PROJECTS

DiamondReplacement.com

DiamondReplacement.com is designed to become

the leading online supplier of replacement diamonds

and jewelry in both the business and consumer

marketplace.

In April, 2000, WSi signed an agreement to launch

this Internet business through a strategic alliance

with RG Diamonds Inc., of Chicago, Illinois.

WSi will earn a 50% interest in the newly formed

company by contributing its website design and

development services.

YourRestaurantHelp.com

YourRestaurantHelp.com is an online resource

for restaurant owners and is designed to help the

restaurant operator meet the daily challenges of the

restaurant business. The site provides a venue for

staff hiring, the purchase and sale of restaurant

equipment and products, and a place to advertise

the sale of restaurant businesses themselves.

YourRestaurantHelp.com is owned and operated by

Restaurant-Help.com, Inc., a private company

incorporated under the laws of the State of Illinois.

WSi currently has a 25% interest in this company,

which it earned by providing development services.

YourWineStore.com - 100% owned

YourWineStore.com is an informational web site

with a comprehensive listing of wineries available

online, and was designed to provide information

for wine-loving consumers. Any other wine-related

site is able to co-brand their site with YourWineStore.com.

Healthcreator.com - 90% owned

Heathcreator.com is a database-driven health and

wellness web site. An integrated assessment system

uncovers the health and fitness goals of subscribers

and provides them with a free daily health regimen

personalized to their current lifestyles. The daily

health and fitness plans are presented as a personal

page offering a daily meal plan, exercise plan,

supplement plan, as well as goal setting and results

tracking to keep subscribers motivated to reach

their goals.

The Healthcreator.com site is available to any

other health-related website at no charge as a co-branding

opportunity.

This business has been developed to a functional

stage and now requires an infusion of approximately

$2 million in order to effectively market it. WSi is

seeking an investment partner to provide financing

for this property.

The database engine that is the backbone of the

Healthcreator.com site may be utilized in a wide

variety of applications. It may be possible to

generate additional revenues by selling the database

engine to other companies.

INVESTMENTS IN BUSINESSES NOT MANAGED BY WSi

Ariel Wireless Technologies, Inc.

WSi holds a 40% interest in Ariel Wireless

Technologies Inc. On June 1, 2000, Petra Resource

Corp., a CDNX listed company, announced an

agreement to acquire all of the issued shares of Ariel

in exchange for 6,000,000 shares of Petra, subject

to regulatory approval. Upon completion of the

acquisition, WSi will be issued 2,400,000 shares of

Petra and Theo Sanidas, President and CEO of

WSi will become a director of Petra.

Ariel is in the wireless communications hardware and

software business. This investment complements

the Company's interest in broadband, rich media

and convergence technologies. On August 21, 2000,

Ariel changed its name to Alphastream Wireless Inc.

eReservation Systems Inc.

On June 23, 2000, WSi announced the formation

of a business alliance with eReservation Systems Inc.

whereby WSi will facilitate eReservation going

public through its acquisition by Techgroup Ventures

Inc., a CDNX capital pool company. WSi will be

issued 642,000 shares of Techgroup as a finder's fee.

The business of eReservation is the development of

a website to provide commercial services to the

travel and leisure industry focusing on electronic

transaction fee processing and on-line reservation

services for golf courses and resorts throughout

the world.

Nerve Media Corporation

In March, 2000, the Company acquired a 12%

interest (6,818 shares) of Nerve Media Corporation

("Nerve"). Nerve designs multimedia marketing

campaigns. Nerve is currently trying to raise

additional capital to continue operations. The

realization of this investment is dependent on

their success in this endeavour.

FlashCandy.com

WSi owns 25% of this company, which it earned

through the provision of web development services.

Flashcandy.com is a content-driven web business

based on a viral marketing concept. It spreads its

message by having users send animated online

greeting cards to people they want to connect with

and encouraging the recipient to do the same.

Each time someone "uses" the site they are providing

a marketing service to FlashCandy. Revenue is

generated from advertising opportunities on the

site and on the cards, as well as in the accumulation

of opt-in names that represent a valuable asset and

opportunity for additional revenue streams.

Current plans are to work with the majority owner

to continue to add value to the business and

complete the proof of concept process. During the

next fiscal year, WSi plans to either sell its interest

to the majority shareholder or assist with the process

of taking the company public.

HollywoodBroadcasting.com, Inc.

On June 30, 2000, the Company acquired a nominal

interest of HollywoodBroadcasting.com, Inc.

("HBC"). HBC is in the business of creating,

producing and distributing original content

for the web by streaming video. The Company has

been providing web services to HBC.

Southport Capital Corp.

WSi has recently entered into an agreement with a

CDNX capital pool company, Southport Capital

Corp., under which WSi will receive 600,000 shares

of Southport as a finder's fee in consideration of WSi

introducing Active Ortho Research & Development

Inc. to Southport. All of the shares and business

of Active Ortho will be acquired by Southport as its

qualifying transaction, subject to the approval of

CDNX and the Southport shareholders.

DIRECTORS

Theo Sanidas - President and

Mr. Sanidas has been an executive in the marketing

and technology sectors for over 14 years. In 1990, he

founded a direct marketing and database company

(Western Shores Direct Marketing Group Inc.)

which was subsequently acquired by the Company

and now forms one of WSi's core divisions

Mr. Sanidas is the entrepreneurial driving force

behind WSi and the architect of the Company's

current structure. He is extremely active in the North

American business community and constantly seeks

new opportunities for WSi.

Mike Donald - has been a Director of WSi since

November 4, 1999. Mr. Donald has been Chairman

and CEO of Concord National Inc., one of Canada's

most successful food brokerage firms, since 1999.

Prior to that, Mr. Donald was President and CEO of

Concord Sales Ltd. since 1987. Mike Donald is co-founder

of HomeGrocer.com, a neighborhood grocery

shopping and delivery service available over the

Internet which is the fastest growing online grocer

in the United States. Mr. Donald is also Chairman

of the executive board of the Canadian Food Brokers

Association and an active member of the World

Entrepreneurs Organization, an extension of the

Young Entrepreneurs Organization.

Marcus New - founded Stockgroup.com in 1995 and

developed its website as a news and information site

for small and microcap stocks, providing analysis and

information. Stockgroup.com currently employs

more than 80 staff in offices located in Vancouver,

Toronto, Calgary, San Francisco, and New York.

Mr. New is also a director of Investrend Inc., the "for

profit" company for the Investor Research Institute

headquartered in New York. Previously, Mr. New was

the Vice President of Ancan Public Relations Group.

OFFICERS

Bryan Kanarens - has been the Vice President and

General Manager of WSi and its predecessor,

Western Shores, since April 1996. From February

1991 to February 1996, he was the Director of

Thompson & Associates, a direct marketing

agency in Toronto.

From August 1981 to January 1991, Mr. Kanarens

worked for American Express, where he was General

Manager of the Expressly Yours Merchandising

business, a card member incentive and

merchandising program. Prior to this he worked for

a management consulting company in California.

John York - has been the Chief Financial Officer

of WSi since December 31, 1999. From May 1999

to December 1999, Mr. York was self-employed as a

Chartered Accountant. From December 1995 to

May 1999, Mr. York was the Chief Financial Officer

of Battlefield Minerals Corporation located in

Vancouver, British Columbia. From early 1994 to

November 1995, Mr. York was the Chief Financial

Officer of Zamora Gold Corp. located in Vancouver,

British Columbia.

Lance Morginn - has been WSi's Vice President of

Technology since December 1, 1999. Mr. Morginn

has also been President of MediaNet Solutions Inc.,

a subsidiary of the Company. Mr. Morginn has been

a director of Safe ID Corp. since September 1999.

From May 17, 1996 to January 1998, Mr. Morginn

was a director of Planet City, and from January 1996

to August 1998, he was the President of Planet City

Graphics. Prior to that, from November 1995 to

January 1996, Mr. Morginn was the President of

WebWorks Multimedia.

James L. Harris - is the Secretary of WSi Interactive

Corporation. He is a member of the law firm Watson

Goepel Maledy of Vancouver, BC, and is a British

Columbia lawyer specializing in securities and

corporate law. His clients include companies listed on

the Canadian Venture Exchange, The Toronto Stock

Exchange, and trading on the OTCBB in the United

States.

Management's Discussion and Analysis

The following discussion and analysis should be read in conjunction with the audited consolidated financial

statements of the Corporation for the year ended June 30, 2000 and the six months ended June 30, 1999.

OVERVIEW

On June 30, 1999, the Company acquired all

the shares of the WSi Group consisting of three

subsidiary companies: Western Shores Direct

Marketing Group Inc., MediaNet Solutions Inc.

and TargetPacks Enterprises Corp. These core

businesses continue to form the basis of the

Company's activities, although in March 2000 the

corporate entities were dissolved and the businesses

were continued as divisions of the Company. Until

June 30, 1999, WSi itself was a publicly traded

company known as JSS Resources Inc. but was

inactive, therefore the results to June 1999 in the

attached financial statements are not comparable

to the year ended June 30, 2000.

During the year ended June 30, 2000 the Company

pursued its goal of developing competencies suited

to the development of Internet businesses. The

integrated marketing skills of WSi combine the many

years of direct marketing experience of Western

Shores with TargetPacks' Internet marketing skills.

MediaNet Solutions supplies the web development

services and hosting services. WSi has also facilitated

the development of Internet businesses by providing

a combination of development services for cash

and/or equity investments. The future success of

such businesses should be reflected in the Company's

results in the coming years.

OPERATING RESULTS

During the year ended June 30, 2000, the Company

had an operating loss of $1.8 million, or $0.05 per

share after amortization of capital assets. Although

revenue was close to the expected level for the year,

costs increased dramatically as the Company grew

during the year from less than 20 to over 80

personnel. This explosive growth during WSi's first

year of its combined businesses was a challenge

to manage. The Company has since stabilized its

workforce at the level of approximately 65 people,

which is considered closer to a realistic level

based on the current activity. In the future,

where appropriate, growth will be managed by

subcontracting services until an ongoing permanent

need is established, at which time additional

employees will be hired. This will efficiently

manage the Company's forecasted growth and

contain the associated overhead costs. During the

year, the Company opened three new offices to

develop its business. After a trial period in both

Toronto and Seattle, those offices were closed to

reduce the overhead costs. The Company will focus

on the local markets from its existing locations in

Vancouver and Los Angeles. In the near future, the

Company plans to service the Toronto market

from Vancouver, but does not rule out creating a

permanent presence if the level of business makes

economic sense. The Company's business in

Los Angeles is operated under the name of

DNSMedia.com, Inc., which is a wholly owned

subsidiary and a full service media streaming

company. The business showed initial rapid growth

but now has only two employees who largely service

the needs of two clients. However, other staff located

in Vancouver assist with DNSMedia's activities.

WSi is reviewing how this business will be developed,

but is convinced there is a good market for its

services. The lower labour costs for Canadian staff

(due to the value of the Canadian dollar) should

enable the Company to compete effectively in

the US market.

The Company's revenues and direct costs for the year can be broken down as follows:

The gross margin on Integrated Marketing is being

affected by a contract for the sale of database

information for $1.4 million, which carried no

cost on the Company's books. One other contract

accounted for $1,283,000 of Integrated Marketing

revenue during the year. It is not known if these

contracts will be repeated in the future; however,

it is anticipated that new business can replace the

revenue. During the summer of 2000, the Company

has revamped and increased its sales effort. Sales

personnel have increased from 3 full-time and 4 part-time

in 1999 to 10 full-time and are very focused

on selling the core business services. Web services

revenue includes $769,000 of services, largely from

web site development, which have been paid by

taking an equity stake in the businesses concerned.

This model for assisting Internet companies to

develop will likely continue during the next year.

WSi will focus on transactions where a large part of

the services rendered by WSi will be paid in cash, at

least covering the direct and indirect costs. WSi will

take equity for the balance.

General and Administrative Costs

General and administrative costs for fiscal 2000 were

$3.5 million. These costs reflects the rapid growth

of the Company during the year, the many deals

that were accomplished and start-up costs after the

businesses were brought into the public entity in

the second half of 1999. In summary, the costs for

the past fiscal year were higher than predicted

future costs, in spite of now having a much larger

infrastructure and workforce than existed at the start

of fiscal 2000.

LIQUIDITY AND CAPITAL RESOURCES

Cash reserves were reduced during the year from

$1.7 million to $1.3 million. Private placement

shares were issued to raise $1.8 million, stock

purchase warrants were exercised to provide cash of

$4.4 million and stock options were exercised to

provide cash of $1.1 million. During the year, the

primary cash use was to fund operations, including

working capital, amounting to $3.9 million, made

up of the net loss of $1.8 million, non-cash items

and non-monetary exchanges of $1.3 million and

an increase in working capital requirements of $0.8

million. In addition, major cash expenditures were

as follows. Capital assets, being mainly computer

hardware and software, were purchased for $1.5

million. This was largely to equip an enhanced web

services production department and to develop

(partially) the Company's state-of-the-art data centre.

The major part of the data centre was funded

through lease financing from IBM, with whom WSi

has a formal alliance to develop Internet businesses.

Investments in "partner" companies were made

totaling $1.7 million, of which $0.8 million was

through the provision of services and $0.2 was

written off at the year end. In addition, development

costs of $0.9 million were incurred on the Company's

own Internet businesses. The Company anticipates

that these investments will create earnings for

shareholders in the coming years.

The Company's working capital position has

decreased since June 30 2000 due to continuing

losses. The Company does not expect to become

profitable until the last quarter of fiscal 2001,

therefore new capital is required. The drop in the

Company's share price makes it less attractive for

holders to exercise existing options and warrants,

which was a significant source of funds during

fiscal 2000, however options and warrants to

purchase 2.1 million shares are exercisable and

priced close to the current market and could provide

over $0.9 million in cash. The Company is actively

seeking new private placement funding.

RISKS AND UNCERTAINTIES

WSi's business model is based on the provision of a

range of services for both Internet and conventional

businesses. From these services the Company will

not only create revenue, but will create increased

shareholder value through the growth of partner

companies in which WSi has invested.

A major risk facing the Company is keeping current

with technology change as it operates in one of the

most dynamic industries of the 21st century. The

Internet business changes rapidly, as has been seen

in the year under review, and revenue models that at

one time seemed realistic, change almost overnight.

Monitoring change is a constant priority.

Management believes that its full range of services

will provide not only protection from some of

the technology risk, but will limit the risks of

competition. Part of WSi's business is to invest in

new, developing businesses. Any investment in

companies at the early stages carries some risk and

the likelihood is that some investments will not be

successful. Conversely, when a partner business is

successful the rewards can be high. The Company

is limiting the risk of such investments by being

highly selective and not financing the early stages

from its own resources.

OUTLOOK

The Company is now firmly focused on the key area

of sales, with a larger and better trained sales force,

and also on the important objective of overhead cost

containment and reduction. The Company has

built the infrastructure to provide WSi's dedicated

employees with the tools to execute the business

plan and provide increased shareholder value in the

new fiscal year.

MANAGEMENT'S RESPONSIBILITY FOR FINANCIAL REPORTING

The financial statements contained in this annual

report have been prepared by management in

accordance with generally accepted accounting

principles in Canada and have been approved by the

Board of Directors. The integrity and objectivity of

these financial statements are the responsibility of

management. In addition, management is responsible

for all other information in the annual report and

for ensuring that this information is consistent,

where appropriate, with the information contained

in the financial statements.

In support of this responsibility, management

maintains a system of internal controls to provide

reasonable assurance as to the reliability of

financial information and the safe-guarding of

assets. The financial statements include amounts

which are based on the best estimates and

judgments of management.

The Board of Directors is responsible for ensuring

that management fulfills its responsibility for

financial reporting and internal control and exercises

this responsibility principally through the Audit

Committee. The Audit Committee consists of two

directors not involved in the daily operations of

the Company, and the Chairman of the Board. The

Audit Committee meets with management and meets

independently with the external auditors to satisfy

itself that management's responsibilities are properly

discharged and to review the financial statements

prior to their presentation to the Board of Directors

for approval.

The external auditors, Bedford Curry & Co.

Chartered Accountants, conduct an independent

examination, in accordance with generally accepted

auditing standards, and express their opinion on the

financial statements. Their examination includes a

review of the Company's system of internal controls

and appropriate tests and procedures to provide

reasonable assurance that the financial statements

are, in all material respects, presented fairly in

accordance with accounting principles generally

accepted in Canada. The external auditors have free

and full access to the Audit Committee with respect

to their findings concerning the fairness of financial

reporting and the adequacy of internal controls.

Theo Sanidas

John York

AUDITORS' REPORT

To the Shareholders of WSi Interactive Corporation

We have audited the consolidated balance sheets of

WSi Interactive Corporation as at June 30, 2000 and

1999 and the consolidated statements of earnings

and deficit and cash flows for the year ended June 30,

2000 and for the six months ended June 30, 1999.

These financial statements are the responsibility of

the company's management. Our responsibility is to

express an opinion on these financial statements

based on our audits.

We conducted our audits in accordance with

generally accepted auditing standards. Those

standards require that we plan and perform an

audit to obtain reasonable assurance whether

the financial statements are free of material

misstatement. An audit includes examining, on a

test basis, evidence supporting the amounts and

disclosures in the financial statements. An audit also

includes assessing the accounting principles used

and significant estimates made by management, as

well as evaluating the overall financial statement

presentation.

In our opinion, these consolidated financial

statements present fairly, in all material respects,

the financial position of the company as at June 30,

2000 and 1999 and the results of its operations and

cash flows for the periods then ended in accordance

with generally accepted accounting principles in

Canada. As required by the British Columbia

Company Act, we report that, in our opinion, these

principles have been applied on a consistent basis.

BEDFORD CURRY & CO.

CONSOLIDATED STATEMENTS OF EARNINGS AND DEFICIT

CONSOLIDATED BALANCE SHEETS

"Mike Donald"

CONSOLIDATED STATEMENTS OF CASH FLOWS

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Year ended June 30, 2000 and six months ended June 30, 1999 1. NATURE OF OPERATIONS AND GOING CONCERN WSi Interactive Corporation (the "Company"), incorporated in

British Columbia, Canada, has shares listed on the Canadian Venture

Exchange (previously on the Vancouver Stock Exchange) and on the OTC

Bulletin Board in the United States. Subsequent to the year end the

Company obtained a listing on the third segment of the Frankfurt

Stock Exchange The Company is primarily engaged in the business of providing integrated

marketing, web services and business development services to both

internet and traditional businesses. In June, 1999 the Company completed a reorganization which included changing

its name from JSS Resources Inc. and changing its fiscal year from

December 31 to June 30. It then acquired 100% of the shares of

W.S.I. Management Group Inc. ("Management") pursuant to the

transfer from existing shareholders of 15,000,000 common shares of

the Company to the shareholders of Management, cash consideration of

$40 and a finders fee of 150,000 common shares. Management owned all

the issued and outstanding shares of Western Shores Direct Marketing

Group Inc., MediaNet Solutions Inc. and Targetpacks Enterprises Corp.

The acquisitions were accounted for using the purchase method of

accounting and goodwill of $36,341 was written off as the amount

was considered immaterial and not indicative of its economic value. Prior to the acquisition of Management the Company had incurred losses of

$22,713,075 for the period from incorporation to June 30, 1999 from

previous business operations. These consolidated financial statements have been prepared on the going

concern basis. The Company's ability to continue its operations and

to realize assets at their carrying values is dependent upon the

continued support of its shareholders, obtaining additional financing

and generating revenues sufficient to cover its operating costs in an

industry characterized by rapid technological change. There is no

assurance that the Company will be successful in achieving any or all

of these objectives over the coming year and, accordingly, it is

possible that the company will be unable to continue as a going

concern. 2. SIGNIFICANT ACCOUNTING POLICIES Principles of consolidation and basis of accounting - The consolidated

financial statements include the accounts of the Company and its

wholly owned subsidiaries, D.N.S. Media.com Inc. and Stock

Secrets Enterprises Ltd. As at June 30, 1999, the Company's accounts included the wholly owned

subsidiaries, W.S.I. Management Group Inc., Western Shores Direct

Marketing Group Inc., Targetpacks Enterprises Corporation and

MediaNet Solutions Inc. In March of 2000, these subsidiaries were

wound up under the Company Act (British Columbia) and continue

to operate as divisions of the Company. The Company's consolidated financial statements are prepared in

accordance with generally accepted accounting principles in Canada. Cash and cash equivalents - The Company considers deposits in bank

and short term investments with original maturities of three

months or less to be cash equivalents. Capital assets - Capital assets are recorded at cost less

accumulated amortization. Amortization is provided over the

estimated useful lives of the assets using the following basis and

annual rates: Investments - The Company makes investments in technology businesses. Such

investments, where the Company does not exert significant influence,

have been accounted for under the cost method whereby the investments

are carried at cost. When, in the opinion of management, the cost

of an investment is permanently impaired, the investment is written

down to recognize the loss. Where the Company does exert significant

influence, investments are accounted for under the equity method.

Where the Company's initial investment is more than 20% but where

plans are in place for the investee to issue additional securities

that will dilute the ownership investment below 20%, such investments

are accounted for using the cost method. Development costs - Development costs are expensed as incurred unless a

product meets generally accepted deferral criteria in accordance with

generally accepted accounting principles. The development costs

consists primarily of labour costs incurred in developing the

Company's web businesses. Development costs are amortized at the

point that the product is available to the market and over its

estimated useful life. Foreign currency translation and transactions - The Company's

consolidated financial statements are expressed in Canadian dollars.

Monetary assets and liabilities denominated in foreign currencies are

translated into Canadian dollars at the prevailing rates of exchange

at the balance sheet date. Non monetary assets and liabilities

are translated at historic exchange rates. Revenues and expenses are

translated into Canadian dollars at the rates of exchange in effect

at the related transaction dates. Exchange gains and losses arising

from translation of foreign currency items are included in the

determination of net income. Use of estimates in the preparation of financial statements - The

preparation of financial statements in conformity with Canadian

generally accepted accounting principles requires management to make

estimates and assumptions that affect the reported amounts of assets

and liabilities and disclosures of contingent assets and liabilities

at the date of the financial statements and the reported amounts of

revenue and expenses for the period. Actual results could differ

from those estimates. Revenue recognition - Revenue predominantly results from

service related activities. Services can be on a time and

materials basis or a fixed fee basis. For fixed fee contracts,

revenue is recognized on a percentage of completion basis. For

contracts that are on a time and materials basis, revenue is

recognized as the services are performed. Provisions for estimated

losses on contracts, if any, are recorded when identifiable. Stock based compensation - The Company has a stock based

compensation plan, which is described in note 8. No compensation

expense is recognized for this plan when stock or stock options are

issued to employees. Any consideration paid by employees in exercise

of stock options or purchase of stock is credited to share capital. Income taxes - Future income taxes relate to the expected future

tax consequences of differences between the carrying amount of

balance sheet items and their corresponding tax values. Future

income tax assets, if any, are recognized only to the extent that, in

the opinion of management, it is more likely than not that future

income tax assets will be realized. Future income tax assets and

liabilities are adjusted for the effects of changes in tax laws and

rates at the date of enactment or substantive enactment. Statement of cash flows - The Company has adopted the indirect method

of reporting cash flows, under which the net cash flow from

operations is reported by adjusting net income for the effects of

non cash items and changes in non cash working capital

balances. 3. LOANS RECEIVABLE Loans receivable includes a loan to E.R.S.S. Equity Retirement Savings

Systems Corp. in the amount of $200,000. The amount is due on demand

and bears interest at prime plus 1%. Other loans aggregating $150,000 are due on demand and bear interest at rates

from 0% to prime plus 3%. 4. CAPITAL ASSETS Included in the June 30, 2000 amounts is computer hardware under capital leases,

having a cost of $77,804 (1999 - nil) and accumulated

amortization of $11,670 (1999 - nil). No depreciation was taken during the six months ended June 30, 1999 as

the assets were all acquired on that date. 5. INVESTMENTS There were no investments as at June 30, 1999. Restaurant-Help.com, Inc. - On November 26, 1999 the Company entered into a

Letter of Intent to acquire a 25% (25,000 shares) interest in

Restaurant-Help.com, Inc. ("Restaurant"). In

consideration for its interest the Company provided services to

build, manage and market the business of Restaurant-Help.com.

The services had a fair value of US $250,000. Restaurant provides a

resource web site for restaurants and employees in the restaurant

business. Nerve Media Corporation - On March 20, 2000 the Company paid US

$250,000 for a 12% interest (6,818 shares) of Nerve Media Corporation

("Nerve"). Nerve designs multimedia marketing campaigns.

Nerve is currently trying to raise new capital to continue

operations. The realization of this investment is dependent on their

success in this endeavour. FlashCandy.com - On January 1, 2000 the Company entered into an agreement

to acquire a 25% interest in FlashCandy.com, Inc. ("FlashCandy").

In consideration for its interest the Company provided web

development services with a fair value of $255,000 to FlashCandy.

FlashCandy.com is in the business of developing a greeting card web

site. HollywoodBroadcasting.com, Inc. - On June 30, 2000 the Company paid $150,000 for 166,667

shares, a nominal interest, of HollywoodBroadcasting.com, Inc.

("HBC"). HBC is in the business of creating, producing and

distributing original entertainment for the web by streaming video.

The Company has been providing web services to HBC. Digital Video Display Technology Corp. - On January 20, 2000 the

Company acquired 75,000 common shares, a nominal interest, of Digital

Video Display Technology Corp. ("DVDT"). In consideration

for its interest the Company provided Internet services with a fair

value of $108,000. The shares are restricted from trading for one

year from the date of issuance. DVDT shares trade on the OTC

Bulletin Board in the United States. As of June 30, 2000 they had a

value of $68,250 Ariel Wireless Technologies, Inc. - On May 8, 2000 the Company

acquired a 40% (66 shares) interest in Ariel Wireless Technologies,

Inc. ("Ariel") for a cash payment of $100,000. Ariel is in

the wireless communications hardware and software business. The

investment complements the Company's interest in broadband, rich

media and convergence technologies. On August 21, 2000 Ariel changed

its name to Alphastream Wireless Inc. 6. DEFERRED DEVELOPMENT COSTS During the year ended June 30, 2000, there was no amortization charged to

operations on deferred development costs. 7. OBLIGATIONS UNDER CAPITAL LEASES The Company has financed certain office equipment and computer hardware by entering into capital lease arrangements. Future minimum lease payments of the capital leases for the fiscal years ending June 30 are as follows: 8. SHARE CAPITAL The Company has authorized share capital of 100,000,000 common shares without par

value and 20,000,000 preferred shares with a par value of $0.001 per

share. The issued share capital consists of common shares as follows: Escrow Shares - There are 3,112,500 (1999: 112,500) shares held in

escrow subject to release only with regulatory approval. Warrants - The Company has stock purchase warrants outstanding as follows:

(a) On June 20, 2000, the terms of the warrants were

amended commencing July 1, 2000 to extend the expiry date from June

30, 2000 to September 30, 2000 and to increase the exercise price

from $1.00 to $1.15.

(b) The exercise price of the warrants prior to November

30, 2000 is $0.40. The exercise price after December 1, 2000 is

$0.46.

Company Overview

"We have been focusing on both content and infrastructure opportunities."

The Company has three separate operating segments:

Percentage of WSi Revenues by Segment

(based on total revenues of $6,007,375

for fiscal year ended June 30, 2000)

Chief Executive Officer.

Mr. Sanidas is the President, Chief Executive Officer

and Director of the Company. Mr. Sanidas has a

diploma in Marketing Management and

International Business. He also holds a Bachelor

of Business Administration Degree.

$000's

Integrated

MarketingWeb

ServicesOther

Total

Revenue

$3734

1824

$449

$6007

Direct Costs

Labour

$248

$944

$128

$1320

Materials/Services

$1609

$246

$206

$2061

Other

$20

$5

$25

Total Direct Costs

$1877

1195

$334

$3406

Gross Margin

(Revenue minus

Total Direct Costs)$1857

$629

$115

$2601

President, CEO

Chief Financial Officer

CHARTERED ACCOUNTANTS

Vancouver, British Columbia, Canada

September 28, 2000

Year ended June 30, 2000 and six months ended June 30, 1999

2000

(12 Months)1999

(6 Months)![]()

REVENUE [Note 13]

$ 6,007,375

-

EXPENSES

Direct costs

3,405,916

-

General and administrative

3,492,317

74,579

Amortization of capital assets

702,125

-

![]()

7,600,358

74,579

![]()

Net loss before other items

(1,592,983

)

(74,579

)

OTHER ITEMS

Write-off of license costs [Note 10]

(217,800

)

-

Write-off of goodwill

-

(36,341

) ![]()

NET LOSS

(1,810,783

)

(110,920

) ![]()

Deficit, beginning of period [Note 1]

(22,823,995

)

(22,713,075

) ![]()

DEFICIT, end of period

$ (24,634,778

)

(22,823,995

) ![]()

LOSS PER SHARE

$ (0.05

)

(0.00

) ![]()

June 30, 2000 and 1999

2000

1999 ![]()

ASSETS

Current

Cash and cash equivalents

$ 1,313,692

1,706,824

Accounts receivable

2,364,938

300,532

Loans receivable [Note 3]

350,000

-

Prepaid expenses

198,073

45,956

![]()

4,226,703

2,053,312

Capital assets [NOTE 4]

2,517,852

217,586

Investments [NOTE 5]

1,507,274

-

Deferred development costs [Note 6]

908,371

-

![]()

$ 9,160,200

2,270,898

![]()

LIABILITIES

Current

Accounts payable and accrued expenses

$ 1,646,752

257,941

Current portion of obligation under capital leases [NOTE 7]

18,422

-

![]()

1,665,174

257,941

Obligation under capital leases [Note 7]

50,156

-

Amounts due to shareholder

-

60,835

![]()

1,715,330

318,776

![]()

SHAREHOLDERS' EQUITY

Share capital [Note 8]

32,079,648

22,779,187

Share subscriptions

-

1,996,930

Deficit

(24,634,778

)

(22,823,995

) ![]()

7,444,870

1,952,122

![]()

$ 9,160,200

2,270,898

APPROVED ON BEHALF OF THE BOARD:

"Theo Sanidas"

Director

Director

Year ended June 30, 2000 and six months ended June 30, 1999

2000

(12 months)1999

(6 months)![]()

OPERATIONS

Net loss

$ (1,810,783

)

(110,920

)

Add (deduct) items not involving cash

Amortization of capital assets

702,125

-

Write-off of license costs

217,800

-

Write-off of goodwill

-

36,341

Non-monetary exchanges [Note 13]

(2,228,625

)

-

![]()

(3,119,483

)

(74,579

)

Net changes in non-cash working capital items:

Increase in accounts receivable

(2,064,406

)

(207,275

)

Increase in accounts payable

1,388,811

5,039

Increase in prepaid expenses and deposits

(152,117

)

-

![]()

(3,947,195

)

(276,815

) ![]()

FINANCING

Issuance of share capital

7,303,531

5,000

Increase in obligations under capital leases

68,578

-

Share subscriptions, net of issuance costs

-

1,996,930

Decrease in amounts due to shareholder

(60,835

)

-

![]()

7,311,274

2,001,930

![]()

INVESTING

Purchase of capital assets

(1,543,491

)

-

Purchase of investments

(955,349

)

-

Increase in deferred development costs

(908,371

)

-

Increase in loans receivable

(350,000

)

-

Acquisition of subsidiaries, net of bank indebtedness

-

(32,808

) ![]()

(3,757,211

)

(32,808

) ![]()

Increase (decrease) in cash

(393,132

)

1,692,307

![]()

Cash and cash equivalents, beginning of period

1,706,824

14,517

![]()

CASH AND CASH EQUIVALENTS, end of period

$ 1,313,692

1,706,824

![]()

One half of the above rates are used in the year of acquisition.

Asset

Basis

Rate ![]()

Computer software

Straight-line

33% - 100%

Computer hardware

Straight-line

33

Office equipment, furniture and fixtures

Declining balance

20% - 30%

Automotive

Declining balance

30

Leasehold improvements

Straight-line

Over the term of the lease

and one renewal period

Accumulated

Net Book Value

Cost

Depreciation

2000

1999 ![]()

Computer software [Note 13]

$ 1,791,406

475,250

1,316,156

61,095

Computer hardware

1,232,035

200,975

1,031,060

24,743

Office equipment, furniture and fixtures

146,612

21,700

124,912

131,748

Leasehold improvements

29,524

1,100

28,424

-

Automotive

20,400

3,100

17,300

-

![]()

$ 3,219,977

702,125

2,517,852

217,586

![]()

2000 ![]()

Restaurant-Help.com, Inc.

$ 364,725

Nerve Media Corporation

363,000

FlashCandy.com, Inc.

255,000

HollywoodBroadcasting.com, Inc.

150,000

Digital Video Display Technology Corp.

108,000

Ariel Wireless Technologies Inc.

100,000

Other

166,549

![]()

$ 1,507,274

![]()

Deferred costs, beginning of period

$ -

Add: Labour cost

627,338

Domain name - Stocksecrets.com

187,500

Other costs

93,533 ![]()

Deferred costs, end of period

$ 908,371 ![]()

The Company has the following web businesses in development: ![]()

Stocksecrets.com

$ 325,577

HealthCreator.com

188,431

Targetpacks.com

161,086

Yourwinestore.com

152,341

Shellco.com

61,529

Other

19,407 ![]()

$908,371 ![]()

![]()

2001

$ 26,458

2002

26,458

2003

26,458

2004

7,362

![]()

Total minimum capital lease payments

86,736

Less imputed interest at rates averaging 12%

(18,158

) ![]()

Present value of capital lease payments

68,578

Less current portion

(18,422

) ![]()

$ 50,156

![]()

2000

1999

Number

Amount

Number

Amount ![]()

Balance, beginning of period

31,203,447

$ 22,779,187

31,020,114

$ 22,717,187

Shares issued for cash:

Special warrants

5,250,000

1,996,930

-

-

Finder's fee

-

-

150,000

57,000

Warrants

5,337,334

4,367,057

33,333

5,000

Private placement

3,031,000

1,800,130

-

-

Stock options

2,770,397

1,125,320

-

-

Performance shares

3,000,000

30,000

-

-

Shares issued for other consideration:

Finder's fee

50,000

-

-

-

Cash share issuance costs

-

(18,976

)

-

-

![]()

Balance, end of period

50,642,178

$ 32,079,648

31,203,447

$ 22,779,187

![]()

Exercise

Price

Outstanding

June 30,

1999

Granted

Exercised

Outstanding

June,

2000

Expiry

date![]()

$

0.17

500,334

-

(500,334)

-

June 18, 2000

(a)

$

1.00/$1.15

-

5,250,000

(3,912,000)

1,338,000

September 30, 2000

(b)

$

0.40/$0.46

-

1,250,000

(925,000)

325,000

November 26, 2001

$

0.91

-

1,781,000

-

1,781,000

June 2, 2002 ![]()

500,334

8,281,000

(5,337,334)

3,444,000

June 2, 2002 ![]()

Stock Option Plan - On May 18, 1999 and by amendment dated June 25, 1999, the Company established a stock option plan for employees, directors and consultants, reserving a total of 7,200,000 shares. Under the plan, the exercise price of each option equals the market price of the Company's stock on the last business day prior to the date of the grant. An option's maximum term is five years from the date of the grant. Options granted vest at various dates ranging from the date of grant to the end of the eighteenth month from the date of grant.

A summary of the change in the Company's stock options plan for the year ended June 30, 2000 is presented below.

| Options | Weighted Average Exercise Price | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Outstanding, beginning of year | $ | - | ||||||||||

| Granted | 7,265,000 | 0.46 | ||||||||||

| Exercised | (2,770,397 | ) | 0.41 | |||||||||

| Cancelled or expired | (785,334 | ) | 0.63 | |||||||||

| Outstanding, end of year | 3,709,269 | $ | 0.47 | |||||||||

The following table summarizes the information about stock options outstanding and exercisable at June 30, 2000:

| Options Outstanding | Options Exercisable | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Exercise Price Per Share | Number Outstanding at June 30, 2000 | Expiry Date | Exercisable at June 30, 2000 | Weighted Average Exercise Price | |||||||||

| $ | 0.50 | 1,738,735 | July 12,2004 | 1,063,734 | |||||||||

| $ | 0.35 | 1,175,000 | July 30, 2004 | 450,000 | |||||||||

| $ | 0.35 | 296,734 | November 8, 2000 | 116,734 | |||||||||

| $ | 0.52 | 315,400 | December 21, 2004 | 114,500 | |||||||||

| $ | 1.45 | 13,400 | January 26, 2005 | 3,400 | |||||||||

| $ | 1.10 | 170,000 | June 8, 2005 | 33,333 | |||||||||

| 3,709,269 | 1,781,701 | $ | 0.47 | ||||||||||

9. RELATED PARTY TRANSACTIONS

Accounts receivable includes amounts due from an officer and a director of the Company of $185,446, which was repaid after the year end (1999-nil).

The Company entered into the following related party transactions with individuals or companies that were controlled by directors or by officers of the Company.

| a) | Legal fees of $199,721 (1999 - $48,472) were paid to a director of the Company; |

| b) | Management fees of $162,465 were paid to an officer and director of the Company; |

| c) | Consulting fees of $45,000 were paid to a director of the Company; |

| d) | A business was acquired from a partnership, of which a partner was an officer of the Company, for consideration of $20,134; and |

| e) | An automobile was purchased from a director and officer of the company for $20,400. |

10. WRITE OFF OF LICENSE COSTS

On March 10, 2000 the Company entered into 6 letters of intent with Global Communications, Inc. ("Global"). The letters of intent gave the Company the right to purchase the exclusive marketing rights of Global products and certain communication capabilities and information services for the licensed areas. In consideration for entering into the agreements the Company paid non-refundable fees aggregating US $150,000. Due to a dispute between Global and the Company, management has decided not to pursue the licensing agreement and the fees were written-off. The Company is evaluating its legal options in this matter.

11. INCOME TAXES

The company has non-capital losses for income tax purposes which may, subject to certain restrictions, be available to offset future taxable income or taxes payable. No benefit in respect of the future application of these losses has been recognized in the financial statements. The tax losses expire as follows:

| 2001 | $291,000 |

| 2002 | $775,000 |

| 2003 | $493,000 |

| 2005 | $290,000 |

| 2006 | $160,000 |

| 2007 | $3,115,000 |

The Company also has $19,765,101 in capital losses which are available to be applied against future capital gains without time limit.

12. COMMITMENTS

The Company is committed to minimum annual lease payments under various operating leases for certain office premises and equipment rentals.

Minimum annual lease payments for the fiscal years ending June 30 are as follows:

| 2001 | $635,136 |

| 2002 | 443,448 |

| 2003 | 56,776 |

| 2004 | 4,111 |

| $1,139,471 | |

13. NON-MONETARY EXCHANGES

During the year the Company acquired a restricted license to certain computer software source code and its underlying source code, for application in its marketing web services businesses. In exchange for the source code, the Company provided to the licensor certain of its custom data base information. The market value of the database and computer software source code was considered by the parties to be $1,458,900 and this amount is included in revenue and capital assets as the exchange amount of the transaction. In addition, the Company also provided various services in exchange for shares of certain companies in the amount of $769,725. This exchange is recorded at the fair market value of these services provided by the Company. Total non-monetary transactions amounted to $2,228,625 for the year ended June 30, 2000 (1999 - nil).

14. FINANCIAL INSTRUMENTS

The Company's financial instruments consist of cash and cash equivalents, accounts receivable, loans receivable, investments, accounts payable and accrued expenses and obligations under capital lease.

It is management's opinion that the Company is not exposed to significant interest, currency or credits risks on its financial instruments.

The fair values of cash and cash equivalents, accounts receivable, loans receivable and accounts payable and accrued expenses approximate their carrying amounts due to their relative short terms of maturity.

The fair value of investments in private companies is not readily determinable because these investments are not publicly traded. The fair value of investments in public companies is provided in Note 5.

The fair value of obligations under capital leases approximate their carrying value because the rates used reflect current rates charged for similar leases.

15. SEGMENTED INFORMATION

The Company has identified three separate operating segments:

Web services - This segment provides high-end web development and advanced hosting services.

Investment and other - This segment includes business development services, hardware sales and corporate costs.

| June 30, 2000 | Integrated Marketing |

Web Services |

Investment & Other |

Consolidated | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | $ | 3,733,913 | $ | 1,823,954 | $ | 449,508 | $ | 6,007,375 | ||||||

| Amortization of capital assets | 217,439 | 484,686 | - | 702,125 | ||||||||||

| Segment profit (loss) | 843,294 | (937,838 | ) | (1,716,239 | ) | (1,810,783 | ) | |||||||

| Significant non-cash items | 1,458,900 | 769,725 | - | 2,228,625 | ||||||||||

| Capital asset additions | 477,999 | 1,065,492 | - | 1,543,491 | ||||||||||

| Total assets | 4,681,211 | 2,670,465 | 1,808,524 | 9,160,200 | ||||||||||

Geographic segments - The Company derives a majority of its business and revenue from its segments in Canada.

16. CONTINGENCIES

A claim has been filed against the Company and its directors for damages of an unspecified amount in the Supreme Court of British Columbia, Canada. The claim alleges that the Company and its directors did not meet certain contractual obligations with respect to a reorganization of the Company in June, 1999. Management is of the opinion that the claim is without merit and plans to defend the action.

Management has been notified of a possible claim to be filed against it by Tech-Web Graphics Ltd. ("Tech"). Tech alleges that services of $77,077 were not paid for Web design services. Management is of the opinion that the claim is without merit.

17. SUBSEQUENT EVENTS

Stock options - Subsequent to the year end 175,067 stock options were exercised for proceeds of $66,226, and 39,200 options were cancelled. On September 5, 2000 542,500 stock options were granted at a price of $0.70 per share.

On July 14, 2000, subject to shareholder and Canadian Venture Exchange approval, the Company established a second stock option plan for employees, directors and consultants. A total of 5,000,000 shares are to be reserved under the second stock option plan. The terms are the same as the 1999 plan, except that the second plan requires a four-month hold period from the date the options are granted. Canadian Venture Exchange approval was received on August 14, 2000.

Warrants -Subsequent to the year-end 250,000 warrants were exercised for an aggregate consideration of $100,000.

|

BOARD OF DIRECTORS

Theo Sanidas

Mike Donald

Marcus New

CORPORATE OFFICERS Bryan Kanarens John York Lance Morginn James L. Harris Registered Office |

CORPORATE OFFICE

WSi Interactive Corporation Investor Relations: Stock Exchange Listings Registrar and Transfer Agent: Auditors: Legal Counsel: |

|

|