|

|

|

|

|

Previous: NATIONWIDE VARIABLE ACCOUNT, 497J, 2000-12-19 |

Next: FIDELITY COMMONWEALTH TRUST, N-30D, 2000-12-19 |

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

| Check the appropriate box: | |||

| [ ] | Preliminary Proxy Statement | [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement | ||

| [ ] | Definitive Additional Materials | ||

| [ ] | Soliciting Material Pursuant to §240.14a-12 | ||

| VARIAN MEDICAL SYSTEMS, INC. |

|

|

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

|

|

||

| (1) | Title of each class of securities to which transaction applies: | |

|

|

||

| (2) | Aggregate number of securities to which transaction applies: | |

|

|

||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

|

||

| (4) | Proposed maximum aggregate value of transaction: | |

|

|

||

| (5) | Total fee paid: | |

|

|

||

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

|

|

||

| (2) | Form, Schedule or Registration Statement No.: | |

|

|

||

| (3) | Filing Party: | |

|

|

||

| (4) | Date Filed: | |

|

|

Notes:

Varian Medical Systems, Inc.

3100 Hansen Way

Palo Alto, CA 94304

December 19, 2000

Dear Stockholder:

You are cordially invited to attend the 2001 Annual Meeting of Stockholders of Varian Medical Systems, Inc. to be held on Thursday, February 8, 2001 at 1:00 p.m. at Little America, Idaho Conference Room, 1st Floor, 500 South Main Street, Salt Lake City, Utah.

The Secretary’s formal notice of the meeting and the Proxy Statement appear on the following pages and describe the matters to be acted upon at the annual meeting. You also will have the opportunity to hear what has happened in our business in the past year and to ask questions.

We hope that you can join us. However, whether or not you plan to be there, please sign and return your proxy in the enclosed envelope as soon as possible so that your vote will be counted.

| Sincerely, | |||

Richard M. Levy | |||

| President and Chief Executive Officer |

Varian Medical Systems, Inc.

3100 Hansen Way

Palo Alto, CA 94304

December 19, 2000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Varian Medical Systems, Inc. will hold its Annual Meeting of Stockholders at Little America, Idaho Conference Room, 1st Floor, 500 South Main Street, Salt Lake City, Utah, on Thursday, February 8, 2001 at 1:00 p.m.

At this meeting we will ask you:

Your Board of Directors has selected December 11, 2000 as the record date for determining stockholders entitled to vote at the meeting. A list of stockholders on that date will be available for inspection during normal business hours at our offices at 1678 South Pioneer Road, Salt Lake City, Utah, for ten days before the meeting.

This Proxy Statement, a proxy card, and the 2000 Annual Report to Stockholders are being distributed on or about December 19, 2000 to those entitled to vote.

| By Order of the Board of Directors | |||

Joseph B. Phair | |||

| Secretary |

TABLE OF CONTENTS

| Page | |||

| GENERAL INFORMATION | 1 | ||

| Nominees for Election for Three-Year Terms Ending with the 2004 Annual Meeting | 3 | ||

| Directors Continuing in Office Until the 2002 Annual Meeting | 3 | ||

| Directors Continuing in Office Until the 2003 Annual Meeting | 3 | ||

| Committees of the Board of Directors; Meetings | 4 | ||

| ADOPTION OF AMENDED AND RESTATED EMPLOYEE STOCK PURCHASE PLAN | 5 | ||

| New Plan Benefits | 6 | ||

| STOCK OWNERSHIP | 7 | ||

| Beneficial Ownership of Certain Stockholders, Directors, and Executive Officers | 7 | ||

| COMPENSATION OF DIRECTORS AND THE NAMED EXECUTIVE OFFICERS | 8 | ||

| Compensation of Directors | 8 | ||

| Compensation of the Named Executive Officers—Summary Compensation Table | 9 | ||

| Aggregated Options/SAR Exercises in Last Fiscal Year and Fiscal Year-End Options/SAR Values | 10 | ||

| Deferred Compensation Plan | 10 | ||

| Change in Control Agreements | 10 | ||

| ORGANIZATION AND COMPENSATION COMMITTEE REPORT | 11 | ||

| AUDIT COMMITTEE REPORT | 13 | ||

| PERFORMANCE GRAPHS | 14 | ||

GENERAL INFORMATION

| Q: | Who is soliciting my proxy? | |

| A: | We—the Board of Directors of Varian Medical Systems (VMS)—are sending you this Proxy Statement in connection with our solicitation of proxies for use at VMS’s 2001 Annual Meeting of Stockholders. Certain directors, officers, and employees of VMS also may solicit proxies on our behalf by mail, phone, fax or in person. Corporate Investor Communications, Inc., 111 Commerce Road, Carlstadt, New Jersey, 07072-2586, may be hired to assist us with the solicitation of Proxies from brokers, bank nominees, and other holders. | |

| Q: | Who is paying for this solicitation? | |

| A: | VMS will pay for the solicitation of proxies. VMS directors, officers, and employees will not receive extra remuneration. CIC would be paid a fee not to exceed $25,000 plus reasonable out-of-pocket expenses. VMS also will reimburse banks, brokers, custodians, nominees, and fiduciaries for their reasonable charges and expenses to forward our proxy materials to the beneficial owners of VMS common stock. | |

| Q: | What am I voting on? | |

| A: | The election of John Seely Brown, Samuel Hellman, and Terry R. Lautenbach to the Board of Directors, and the adoption of an amended and restated Employee Stock Purchase Plan. | |

| Q: | Who can vote? | |

| A: | Only those people who owned VMS common stock at the close of business on December 11, 2000, the record date for the Annual Meeting, can vote. Each share of common stock outstanding on that date is entitled to one vote on all matters to come before the meeting, except that cumulative voting will apply in the election of directors. Under the cumulative voting method of election, the stockholder computes the number of votes available to him or her by multiplying the number of shares he or she owned on the record date by the number of directors to be elected, and may cast the votes all for a single nominee or may distribute them in any manner among the nominees. | |

| Q: | How do I vote? | |

| A: | You may vote your shares either in person or by proxy. To vote by proxy, you should mark, date, sign, and mail the enclosed proxy in the prepaid envelope. Giving a proxy will not affect your right to vote your shares if you attend the Annual Meeting and want to vote in person—by voting you automatically revoke your proxy. You also may revoke your proxy at any time before the voting by giving our Secretary written notice of your revocation or by submitting a later-dated proxy. If you sign and return your proxy in time, the individuals named as proxyholders will vote your shares as you instruct. If you sign and return your proxy but do not mark your voting instructions, the individuals named as proxyholders will vote your shares FOR the election of the nominees for director and FOR the adoption of an amended and restated Employee Stock Purchase Plan. | |

| Q: | What constitutes a quorum? | |

| A: | On the record date, VMS had 32,341,837 shares of common stock, $1.00 par value, outstanding. Voting can take place at the Annual Meeting only if stockholders owning a majority of the issued and outstanding stock entitled to vote at the meeting are present in person or represented by proxy. We include the shares of persons who abstain in determining those present and entitled to vote, but exclude shares held by brokers in “street” or “nominee” name when the broker indicates that you have not voted and it lacks discretionary authority to vote your shares on any matter (i.e., “broker non-votes”). | |

| Q: | What vote is needed to approve the proposals? | |

| A: | The nominees receiving the most votes are elected as directors. As a result, if you withhold your authority to vote for any nominee, your vote will not count for or against the nominee, nor will a broker “non-vote” affect the outcome of the election. Adoption of an amended and restated Employee Stock Purchase Plan requires the affirmative vote of the majority of shares represented at the meeting. An abstention or a broker non-vote is the same as a vote against the proposal. | |

| Q: | Can I vote on other matters? | |

| A: | VMS’s by-laws limit the business conducted at any annual meeting to (1) business in the notice of the meeting, (2) business directed by the Board of Directors, and (3) business brought by a stockholder of record entitled to vote at the meeting so long as the stockholder has notified our Secretary in writing (at our Palo Alto headquarters) not less than 60 days nor more than 90 days before the anniversary of the mailing of the proxy statement for the prior year’s annual meeting. The notice must briefly describe the business to be brought and the reasons; give the name, address and number of shares owned by the stockholder of record and any beneficial holder for which the proposal is made; and identify any material interest the stockholder of record or any beneficial owner has in the business. | |

| We do not expect any matters not listed in the Proxy Statement to come before the meeting. If any other matter is presented, your signed proxy card gives the individuals named as proxyholders the authority to vote your shares to the extent authorized by Rule 14a-4(c) under the Securities Exchange Act of 1934 (the “Exchange Act”) (which would include matters that the proxyholders did not know were to be presented at least 60 days before the anniversary of last year’s proxy statement). | ||

| Q: | When are stockholder proposals due for the 2002 Annual Meeting? | |

| A: | To be considered for presentation in the proxy statement for VMS’s 2002 Annual Meeting of Stockholders, a stockholder proposal must be received at VMS’s offices no later than August 20, 2001. | |

| Q: | How do I nominate someone to be a VMS director? | |

| A: | A stockholder may recommend nominees for director notifying our Secretary in writing (at our Palo Alto headquarters) not less than 60 days nor more than 90 days before the anniversary of the mailing of the proxy statement for the prior year’s annual meeting. The notice must include the full name, age, business and residence addresses, principal occupation or employment of the nominee, the number of shares of VMS common stock the nominee beneficially owns, any other information about the nominee that must be disclosed in proxy solicitations under Rule 14(a) of the Exchange Act, and the nominee’s written consent to the nomination and to serve, if elected. | |

| Q: | Will the auditors be at the meeting? | |

| A: | PricewaterhouseCoopers, our fiscal year 2000 auditors, also will be our auditors in fiscal year 2001. A PricewaterhouseCoopers representative will attend the meeting, have the opportunity to make a statement if he or she desires, and will be available to answer appropriate questions. | |

PROPOSAL ONE

ELECTION OF DIRECTORS

VMS’s Board of Directors is divided into three classes serving staggered three-year terms. At the Annual Meeting, you and the other stockholders will elect three individuals to serve as directors until the 2004 Annual Meeting. Each of the nominees is now a member of the Board of Directors.

The individuals named as proxyholders will vote your proxy for the election of the three nominees unless you direct them to withhold your votes. If any nominee becomes unable to serve as a director before the meeting (or decides not to serve), the individuals named as proxyholders may vote for a substitute. We recommend a vote FOR each nominee.

Below are the names and ages of the directors, the years they became directors, their principal occupations or employment for at least the past five years, and certain of their other directorships.

Nominees for Election for a Three-Year Term Ending with the 2004 Annual Meeting

| John Seely Brown | Age 60, a director since 1998. Vice President of Xerox Corporation since 1986 and Chief Scientist since 1992. Director of the Xerox Palo Alto Research Center from 1990-2000. Chief Innovation Officer of 12 Entrepreneuring since June 2000. Also a director of Corning Incorporated and Polycom. | ||

| Samuel Hellman | Age 66, a director since 1992. A. N. Pritzker Distinguished Service Professor in the Department of Radiation and Cellular Oncology at the University of Chicago since 1993. From 1988 to 1993, Dean of the University’s Division of Biological Sciences and its Pritzker School of Medicine, Vice President of the University’s Medical Center, and the A. N. Pritzker Professor in the Department of Radiation and Cellular Oncology. | ||

| Terry R. Lautenbach | Age 62, a director since 1993. Retired; Senior Vice President of International Business Machines Corporation from 1988 to 1992; responsible for IBM’s worldwide manufacturing and development, and North American marketing and services from 1990 to 1992; served on IBM’s Management Committee in 1991 and 1992. Also a director of Air Products and Chemicals, Inc., CVS Corporation, and Footstar, Inc. |

Directors Continuing in Office Until the 2002 Annual Meeting

| Richard M. Levy | Age 62, a director since 1999. Our President and Chief Executive Officer since April 2, 1999; our Executive Vice President responsible for our medical systems business from 1990 to April 2, 1999. Also a director of Pharmacyclics, Inc. | ||

| Burton Richter | Age 69, a director since 1990. Paul Pigott Professor in Physical Sciences at Stanford University since 1980. Director of the Stanford Linear Accelerator Center from 1984 to 1999. |

Directors Continuing in Office Until the 2003 Annual Meeting

| David W. Martin, Jr | Age 60, a director since 1994. President and Chief Executive Officer of Eos Biotechnology, Inc. (a biotechnology company) since 1997; from 1995 to 1996, Chief Executive Officer and a director of LYNX Therapeutics, Inc. (a biotechnology company); from 1994 to 1995, Senior Vice President of Chiron Corporation and President of Chiron Therapeutics (a biotechnology company); and from 1990 through 1993, Executive Vice President for Research and Development at |

| |

The DuPont Merck Pharmaceutical Company. Also a director of Cubist Pharmaceuticals, Inc. and Telik, Inc. | ||

| Richard W. Vieser | Age 73, a director since 1991. Retired; Chairman of our Board of Directors since April 2, 1999; Chairman of the Board, Chief Executive Officer and President of Lear Siegler, Inc. (a diversified manufacturing company) from 1987 to 1989. Also a director of Harvard Industries, Inc., International Wire Group, Inc., Sybron International Corporation, and Viasystems Group, Inc. |

Committees of the Board of Directors; Meetings

We have five standing committees:

Executive Committee

The current members are Richard M. Levy and Richard W. Vieser (Chairman). The Executive Committee did not meet in fiscal year 2000, but conducted all of its business by unanimous written consent.

Nominating and Corporate Governance Committee

The current members are John Seely Brown, Samuel Hellman, Burton Richter, and Richard W. Vieser (Chairman). The Nominating and Corporate Governance Committee met one time in fiscal year 2000.

Stock Grant Committee

The current members are Richard M. Levy (Chairman) and Burton Richter. The Stock Grant Committee did not meet in fiscal year 2000, but conducted all of its business by unanimous written consent.

Audit Committee

The current members are Terry R. Lautenbach (Chairman), David W. Martin, Jr., and Richard W. Vieser. The Audit Committee met four times in fiscal year 2000.

Organization and Compensation Committee

The current members are John Seely Brown, Samuel Hellman, Terry R. Lautenbach, David W. Martin, Jr., Burton Richter, and Richard W. Vieser (Chairman). The Organization and Compensation Committee met four times in fiscal year 2000.

PROPOSAL TWO

ADOPTION OF AMENDED AND RESTATED

EMPLOYEE STOCK PURCHASE PLAN

| Q: | What is the Employee Stock Purchase Plan? | |

| A: | VMS’s Employee Stock Purchase Plan—the Plan—which we originally adopted in 1985, gives our eligible employees an opportunity to purchase our common stock for a 15% discount, thereby increasing their interest in our growth and success and encouraging them to remain employees. As of the end of fiscal year 2000, there were 1,321,476 shares available for purchase under the Plan. | |

| Q: | Who administers the Employee Stock Purchase Plan? | |

| A: | The Plan is currently being administered by our Organization and Compensation committee—the Committee. All questions of interpretation or application of the Plan are determined in the sole discretion of the Committee. No charges for administrative or other costs (except stamp duties or transfer taxes on purchased shares) may be made against the payroll deductions of a participant in the Plan. Brokerage fees for the purchase of shares or issuance of physical share certificates to participants are paid by the individual participants. | |

| Q: | Why are we making this proposal? | |

| A: | In September 1995, we amended the Plan so that it would no longer qualify under Section 423 of the Internal Revenue Code to simplify the administration of the Plan, even though that resulted in employees being subject to tax withholding on their discount at the time of purchase. The amendments to the Plan (and its submission as amended and restated to stockholders) are intended to requalify the Plan under Section 423. | |

| Q: | Who can participate in the Employee Stock Purchase Plan? | |

| A: | Most employees of VMS and its participating subsidiaries are eligible to participate in the Plan. However, an employee is not eligible if he or she owns or has the right to acquire five percent or more of our voting stock or of our subsidiaries. Also, an employee is not eligible if he or she normally is not scheduled to work at least five months every calendar year or at least 20 hours per week. Directors who are not employees are not eligible to participate in the Plan. Approximately 845 employees currently participate in the Plan. | |

| Q: | How does the Employee Stock Purchase Plan work? | |

| A: | Throughout each purchase period, eligible employees have the right to make contributions to the Plan through payroll deductions generally ranging from 1% to 10% of their regular wages. At the end of the purchase period (currently, the end of each fiscal quarter), a participant’s accumulated payroll deductions are used to purchase our common stock at 85% of the lower of its then fair market value or the fair market value at the start of the purchase period. The employee immediately becomes the vested owner of the shares purchased, but acquires the rights of a stockholder only upon issuance of the shares. No employee will have a right to purchase more than $25,000 of our common stock in any calendar year (based on the fair market value at the time the right is granted). Currently, purchase periods begin on the first trading day of each fiscal quarter (near the beginning of October, January, April, and July) or on other dates as the Committee may provide. A participant may withdraw from the Plan at such times as the Committee permits and automatically ceases to be a participant when no longer an eligible employee. | |

| Q: | Can the Employee Stock Purchase Plan be amended? | |

| A: | Our board of directors may amend the Plan at any time and for any reason. | |

| Q: | How many shares are being reserved for issuance under the Plan? | |

| A: | 1,321,476 shares currently available for issuance under the Plan will be available for issuance under the amended and restated Plan. In addition, in order to insure that sufficient shares remain available for purchase, | |

the Board may add to the Plan at the beginning of the fiscal year beginning after the effective date of the Plan up to 675,000 additional shares. In the event of certain changes affecting our common stock (such as stock splits and similar events), the number of shares available for purchase under the Plan is adjusted.

| Q: | What are the tax consequences of Employee Stock Purchase Plan participation? | |

| A: | The granting of the right to purchase shares under the Plan has no immediate tax consequence to either the participating employee or us. For tax purposes, employees do not recognize income at the time they purchase stock under the Plan. If the employee does not dispose of the stock acquired within the later of two years from the date the purchase right was granted and one year from the date the shares were transferred, upon subsequent disposition of the shares the employee will recognize ordinary income to the extent of the lesser of (a) the amount by which the fair market value (i.e., the market price) of the shares at the time the purchase right was granted exceeded the purchase price or (b) the amount by which the fair market value of shares at the time of their disposition exceeded the purchase price. Any further gain will be taxed as a capital gain. We will not be allowed an income tax deduction for shares transferred to an employee under the Plan if those shares are not held for the required period. | |

| If the employee disposes of the stock within the one and/or two-year periods described above, the employee will recognize ordinary income to the extent the fair market value of the shares on the date of purchase exceeded the purchase price. Any further gain will be taxed as a capital gain. We will be allowed an income tax deduction to the extent the employee recognizes ordinary income in such a disposition. | ||

| On December 1, 2000, the closing price of VMS common stock on the New York Stock Exchange was $58.25. | ||

New Plan Benefits

Because purchases under the Employee Stock Purchase Plan are voluntary, future benefits under the Plan are not determinable. However, shares of our common stock were purchased during purchase periods in fiscal year 2000 under the Plan by the following persons and groups:

| Name and Principal Position | Number of Shares Purchased |

|||

| Richard M. Levy President and Chief Executive Officer |

547 | |||

| Elisha W. Finney Chief Financial Officer |

547 | |||

| John C. Ford Corporate Vice President |

0 | |||

| Timothy E. Guertin Corporate Vice President |

0 | |||

| Joseph B. Phair Corporate Vice President, Administration, Secretary and General Counsel |

333 | |||

| All Executive Officers as a Group | 1,974 | |||

| All Non-Employee Directors as a Group(1) | 0 | |||

| All Employees other than Executive Officers as a Group | 134,378 | |||

______________

(1) Non-employees are not eligible to participate in the Employee Stock Purchase Plan.

The Board of Directors recommends that Stockholders vote FOR adoption of the Amended and Restated Employee Stock Purchase Plan.

STOCK OWNERSHIP

Beneficial Ownership of Certain Stockholders, Directors and Executive Officers

This table shows as of December 1, 2000: (1) the beneficial owners of more than 5% of the common stock and the number of shares they beneficially owned; and (2) the number of shares each director, each executive officer named in the Summary Compensation Table on page 9 and all directors and executive officers as a group beneficially owned, as reported by each person. Except as noted, each person has sole voting and investment power over the shares shown in this table.

| Amount and Nature of Common Stock Beneficially Owned |

|||||||

| Number of Shares Beneficially Owned (1) |

Percent of Class |

||||||

| Stockholders | |||||||

| IG Investment Management Ltd.; Investors Group Trust Co. Ltd.; Investors Group, Inc.; Investors Group Trustco Inc. One Canada Centre 447 Portage Avenue Winnipeg, Manitoba R3C 3B6 |

3,823,500 | (2) | 11.83 | ||||

| Directors and Other Named Executive Officers | |||||||

| John Seely Brown | 28,113 | (3) | * | ||||

| Samuel Hellman | 37,227 | (4) | * | ||||

| Terry R. Lautenbach | 40,463 | (5) | * | ||||

| David W. Martin, Jr. | 34,741 | (6) | * | ||||

| Burton Richter | 38,623 | (7) | * | ||||

| Richard W. Vieser | 148,985 | (8) | * | ||||

| Richard M. Levy | 651,047 | (9) | 2.0 | ||||

| Elisha W. Finney | 47,194 | (10) | * | ||||

| John C. Ford | 98,818 | (11) | * | ||||

| Timothy E. Guertin | 61,803 | (12) | * | ||||

| Joseph B. Phair | 101,303 | (13) | * | ||||

| All VMS directors and executive officers as a group (13 persons) | 1,367,478 | (14) | 4.2 | ||||

______________

| * | The percentage of shares of VMS’s common stock beneficially owned does not exceed one percent of the shares of VMS’s common stock outstanding at December 1, 2000. | |

| (1) | Based on 32,323,054 shares outstanding on December 1, 2000. Includes shares the officers and directors could acquire by exercising stock options within 60 days of December 1, 2000. | |

| (2) | Shares based on a Form 4, dated March 9, 2000 according to an amendment to a Schedule 13G dated June 21, 1999, each of these entities has shared voting and disposition power over all of these shares. According to the Form 4, Power Financial Corporation owns 67.7% of the common stock of the Investors Group, Inc. Power Corporation of Canada, of which Paul Desmaris controls 67.7% of the voting power, owns 67.5% of the common stock of Power Financial. Any of Mr. Desmaris or these entities may therefore be deemed to beneficially own the shares referenced. | |

| (3) | Includes 27,913 shares which may be acquired under exercisable stock options. | |

| (4) | Includes 30,827 shares which may be acquired under exercisable stock options. | |

| (5) | Includes 35,198 shares which may be acquired under exercisable stock options. | |

| (6) | Includes 33,741 shares which may be acquired under exercisable stock options. | |

| (7) | Includes (a) 34,023 shares which may be acquired under exercisable stock options and (b) 3,800 shares held in a trust of which Dr. Richter is co-trustee with his wife, as to which voting and investment powers are shared with Dr. Richter’s wife. | |

| (8) | Includes 143,385 shares which may be acquired under exercisable stock options. | |

| (9) | Includes (a) 567,935 shares which may be acquired under exercisable stock options and (b) 82,565 shares held in a trust of which Dr. Levy is co-trustee with his wife, as to which voting and investment powers are shared with Dr. Levy’s wife. | |

| (10) | Includes 42,715 shares which may be acquired under exercisable stock options. | |

| (11) | Includes 90,468 shares which may be acquired under exercisable stock options. | |

| (12) | Includes 61,803 shares which may be acquired under exercisable stock options. | |

| (13) | Includes (a) 74,273 shares which may be acquired under exercisable stock options, (b) 1,789 shares held by Mr. Phair’s son and (c) 1,785 shares held by Mr. Phair’s second son. Mr. Phair shares voting and investment powers over the 1,789 shares held by his first son. Mr. Phair has sole voting and investment power over the 1,785 shares held by Mr. Phair’s second son. | |

| (14) | Includes (a) 1,223,817 shares which may be acquired under exercisable stock options and (b) 91,075 shares as to which voting and/or investment power is shared (see footnotes). | |

COMPENSATION OF DIRECTORS AND THE NAMED EXECUTIVE OFFICERS

Compensation of Directors

Annual Compensation. Our non-employee Chairman of the Board receives an annual retainer of $70,000. Each other director who is not a VMS employee—an “outside director”—currently receives an annual retainer of $30,000, plus $1,000 for each VMS Board and committee meeting he attends. Directors who are VMS employees receive no compensation for their services as directors.

A director may convert his annual retainer to stock options at the rate of $1 cash to $4 of stock options, at a price equal to the fair market value of the common stock on the grant date. These options are immediately exercisable and expire ten years after the grant date unless earlier terminated. Beginning September 30, 2000, a director could alternatively elect to defer his retainer and/or meeting fees under our Deferred Compensation Plan. See “Deferred Compensation Plan” below.

During fiscal year 2000, we paid to directors (or deferred on their behalf) a total of $299,000 in fees. We also reimbursed the directors for their out-of-pocket expenses in attending Board and committee meetings. The Board met six times in fiscal year 2000. Each director attended at least 75% of the total Board and applicable committee meetings.

Stock Options. A non-employee Chairman of the Board receives an initial non-qualified stock option to acquire 100,000 shares of the common stock when first appointed. Each outside director receives an initial non-qualified stock option to acquire 10,000 shares of the common stock when first appointed. All outside directors receive annually thereafter a non-qualified stock option to acquire 5,000 shares of the common stock.

Compensation of the Named Executive Officers—Summary Compensation Table

| Annual Compensation | Long-Term Compensation | ||||||||||||||||||||||||

| Awards | Payouts | ||||||||||||||||||||||||

| Name and Principal Position | Year | Salary ($) |

Bonus ($)(1) |

Other Annual Compensation ($)(2) |

Restricted Stock Award(s) ($)(3) |

Securities Underlying Options/ SARs (#)(4) |

LTIP Payouts ($)(5) |

All Other Compensation ($)(6) |

|||||||||||||||||

| Richard M. Levy President and Chief Executive Officer |

2000 | 562,430 | 828,704 | 38,043 | 0 | 0 | 0 | 50,192 | |||||||||||||||||

| 1999 | 450,451 | 535,436 | 24,043 | 79,800 | 400,000 | 503,535 | 80,139 | ||||||||||||||||||

| 1998 | 338,910 | 250,607 | 21,620 | 0 | 36,000 | 195,763 | 85,676 | ||||||||||||||||||

| Elisha W. Finney Corporate Vice President, Chief Financial Officer and Treasurer |

2000 | 217,324 | 296,995 | 11,298 | 0 | 0 | 0 | 17,421 | |||||||||||||||||

| 1999 | 159,044 | 108,937 | 9,805 | 31,703 | 43,000 | 58,500 | 13,335 | ||||||||||||||||||

| 1998 | 111,700 | 17,890 | 6,522 | 0 | 13,099 | 11,280 | 8,619 | ||||||||||||||||||

| John C. Ford Corporate Vice President |

2000 | 252,320 | 257,176 | 8,829 | 0 | 0 | 0 | 20,984 | |||||||||||||||||

| 1999 | 228,306 | 171,027 | 0 | 0 | 52,000 | 0 | 40,560 | ||||||||||||||||||

| 1998 | 203,138 | 101,013 | 1,448 | 0 | 8,500 | 0 | 36,068 | ||||||||||||||||||

| Timothy E. Guertin Corporate Vice President |

2000 | 268,056 | 338,533 | 16,450 | 0 | 0 | 0 | 24,795 | |||||||||||||||||

| 1999 | 245,192 | 218,274 | 0 | 45,600 | 88,000 | 254,970 | 46,141 | ||||||||||||||||||

| 1998 | 216,680 | 112,526 | 8,288 | 0 | 15,000 | 93,988 | 45,434 | ||||||||||||||||||

| Joseph B. Phair Corporate Vice President, Administration, Secretary and General Counsel |

2000 | 247,328 | 223,860 | 5,472 | 0 | 0 | 0 | 16,042 | |||||||||||||||||

| 1999 | 134,590 | 111,973 | 149,843 | 45,600 | 70,000 | 339,668 | 1,667,436 | ||||||||||||||||||

| 1998 | 194,724 | 295,044 | 15,284 | 0 | 13,099 | 284,310 | 42,722 | ||||||||||||||||||

______________

| (1) | Consist of Employee Incentive Plan awards in 2000, and Management Incentive Plan and Cash Profit-Sharing Plan payments in 1999 and 1998, and (in some cases) special cash bonuses. Amounts for 2000 include amounts deferred under the Deferred Compensation Plan. | |

| (2) | Consists of amounts reimbursed for the payment of taxes on certain perquisites and personal benefits and (in some cases) cash payments for unused accrued vacation time. The amounts for Mr. Phair also include aggregate incremental costs for perquisites and personal benefits (including $53,671 for the purchase of his company-leased vehicle in 1999). | |

| (3) | Consists of restricted shares of common stock (valued at the closing market price on the date of grant). All such shares vested in full on April 2, 1999. | |

| (4) | Consists of shares of common stock that may be acquired or formerly could be acquired under stock options granted pursuant to the Omnibus Stock Plan. (No stock appreciation rights have been granted.) At the spinoff the outstanding fiscal year 1998 options for the employees and officers remaining with VMS, including Dr. Levy, Ms. Finney, Mr. Guertin, and Mr. Ford, were adjusted as to number and exercise price to preserve as closely as possible their economic values immediately before the spinoff. The outstanding options for Mr. Phair were accelerated and one-third exchanged for options in Varian Inc. and Varian Semiconductor Equipment Associates, Inc.; the one-third remaining options in VMS were adjusted. | |

| (5) | Consists of cash payouts in fiscal years 1999 and 1998 under the long-term incentive feature of the Omnibus Stock Plan for three-year cycles ended with fiscal years 1998 and 1997, respectively, and payouts made in fiscal year 1999 in connection with the spinoff. | |

| (6) | Consists of (a) company contributions (including interest) to Retirement and Profit-Sharing Program and Supplemental Retirement Plan accounts for fiscal years 2000, 1999 and 1998, respectively (Dr. Levy, $47,082, $76,365,

and $83,521; Ms. Finney, $16,141, $11,989, and $7,552; Dr. Ford, $17,938, $38,557, and $34,770; Mr. Guertin, $21,969, $43,818, and $44,053; and Mr. Phair, $13,562, $30,182, and $40,919); (b) company-paid premiums for group term

life insurance in fiscal years 2000, 1999, and 1998, respectively (Dr. Levy, $2,352, $2,987, and $2,155; Ms. Finney, $754, $964, and $784; Dr. Ford, $2,681, $1,646, and |

| $1,298; Mr. Guertin, $2,218, $1,765, and $1,281; and Mr. Phair, $1,757, $1,542, and $1,311); (c) cash severance payments to Mr. Phair in fiscal year 1999 ($1,306,418) and (e) consulting payments to Mr. Phair in fiscal year 1999 ($329,045). | ||

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year-End Options/SAR Values

| Number of Securities Underlying Unexercised Options/SARs at Fiscal Year-End (#) |

Value of Unexercised In-the-Money Options/SARs at Fiscal Year-End ($) |

||||||||||||||||||

| Name | Shares Acquired on Exercise (#) | Value Realized ($) | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||||

| Richard M. Levy | 0 | 0 | 408,404 | 292,865 | $ | 10,047,597 | $ | 13,233,837 | |||||||||||

| Elisha W. Finney | 0 | 0 | 45,116 | 33,034 | $ | 1,109,555 | $ | 1,492,724 | |||||||||||

| John C. Ford | 0 | 0 | 101,747 | 40,853 | $ | 2,623,784 | $ | 1,846,045 | |||||||||||

| Timothy E. Guertin | 0 | 0 | 125,391 | 69,583 | $ | 2,698,665 | $ | 3,144,282 | |||||||||||

| Joseph B. Phair | 8,733 | 153,146 | 85,916 | 46,667 | $ | 3,882,329 | $ | 2,108,765 | |||||||||||

Deferred Compensation Plan

Effective September 30, 2000, we adopted a voluntary deferred compensation plan which allows directors, executive officers, and certain other management and highly compensated employees to forgo current compensation (up to 75% of base salary and up to 100% of incentive plan payments and directors’ fees) and invest it in various mutual funds or on a phantom basis in our common stock. As required, amounts deferred for fiscal year 2000 are included in the compensation of directors and the appropriate columns of the summary compensation table.

Change in Control Agreements

Under change of control agreements with senior executives, including the executive officers named in the Summary Compensation Table, VMS will pay any of these executives who are terminated other than for “cause” or who resign for “good reason” within 18 months after a change in control a lump sum severance amount equal to 3.0 (in the case of the CEO) or 2.50 (in the case of the other executives) times the sum of the executive’s annual base salary, plus the highest annual and multi-year bonuses paid to the individual in any of the three years ending before the termination date. “Good reason” includes generally a change in duties, a reduction in compensation, a material change in employee benefits, relocation, and certain VMS breaches of the agreement.

Under the agreements, unvested stock options will become immediately exercisable and restrictions on restricted stock will be released as of the termination date. In addition, VMS will continue the insurance and other benefits of the executive under the then-existing terms for up to 24 months (or, if earlier, the start of full time employment). If any of the payments are subject to excise tax under the excess parachute provisions of the Internal Revenue Code, VMS will increase the payments so that the person is in the same after-tax economic position.

In general, a “change in control” occurs when (a) a person becomes the beneficial owner of 30% or more of VMS’s voting power, (b) “continuing directors”—generally those already on the Board or nominated by those on the Board—are no longer a majority of directors, (c) VMS engages in a merger or similar transaction after which our stockholders do not hold more than 50% of the resulting company, or (d) VMS dissolves, liquidates or sells all or substantially all of its assets. The officers agree not to voluntarily leave VMS when VMS is faced with a transaction that might result in a change in control.

ORGANIZATION AND COMPENSATION COMMITTEE REPORT

The Organization and Compensation Committee of the Board—the Committee—determines the compensation of executive officers. It has provided you with this report to help you to understand the goals, policies and procedures it follows in making its determinations.

The Committee’s executive compensation philosophy is that compensation programs should:

Compensation of executive officers, including the Chief Executive Officer, is comprised of four elements—base salary, annual bonuses, stock ownership, and other compensation.

Base Salaries

Base salary is designed primarily to operate in conjunction with our overall philosophy (which emphasizes variable compensation and incentives for executive officers) to provide compensation at competitive levels which enables the company to attract and retain executives.

In determining fiscal year 2000 salaries, the Committee considered each executive officer’s fiscal year 1999 compensation, each executive officer’s potential incentive compensation in fiscal year 2000, each executive officer’s position and responsibilities, published market data on other companies’ anticipated salary increases for 2000, and the Company’s financial performance in fiscal year 1999. The Committee also reviewed 1999 executive compensation surveys on salaries paid to executive officers of electrical/electronic businesses and medical companies with comparable sales volume and peer group proxy surveys. The Committee fixed salaries that placed each slightly above the 75 percentile.

Annual Incentive Awards

We also have created annual incentives for executive officers through potential cash awards under a management incentive plan intended to link compensation directly to improved financial performance.

The Committee based executive officers awards for fiscal year 2000 on return on sales (“ROS”) and cash flow (“CF”) achieved by the executive’s business unit and the Company as a whole. For Mr. Guertin and Mr. Ford the Committee based 40% of their award on Company ROS and CF and 60% on their respective business unit ROS and CF. The Committee based 100% of Dr. Levy’s, Mr. Phair’s, and Ms. Finney’s awards on company ROS and CF. Awards targets for VMS’s executive officers listed in the Summary Compensation Table could have ranged from zero to 200% of the executive officer’s base salary for fiscal year 2000 depending on the ROS and CF targets achieved and the predetermined participation levels for that executive. The Committee determined each executive officer’s participation level based on the amounts fixed for comparably situated officers for fiscal year 2000.

Stock Options

We believe that executive officers and other employees who are in a position to make a substantial contribution to our long-term success and to build stockholder value should have a significant stake in our on-going success. As a result, we have generally granted non-qualified stock options under an omnibus stock plan in order to retain talented executive officers and to align their compensation with stockholder value. Non-qualified stock option awards that were intended for fiscal year 2000 were relinquished by all executive officers and other recipients to accommodate pooling of interests accounting treatment of a proposed acquisition which was subsequently abandoned by the Company.

Other Compensation

To attract and retain talented executive officers, the Committee also has approved arrangements giving executive officers certain perquisites, such as use and purchase of an automobile under our executive car program, reimbursement for tax planning and return preparation and financial counseling services, reimbursement for any taxes paid on certain perquisites, and reimbursement for annual medical examinations. In order to make retirement contributions which could not be contributed to executive officers’ qualified retirement accounts due to Internal Revenue Code limitations in fiscal year 2000, we also maintained a Supplemental Retirement Plan under which we made unfunded supplemental retirement contributions. We also permit executive officers to participate in compensation and benefit programs generally available to other employees, such as the Employee Incentive Plan, Retirement and Profit-Sharing Program, and supplemental life and disability insurance program.

Tax Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code generally provides that publicly held corporations may not deduct in any taxable year certain compensation in excess of $1,000,000 paid to the chief executive officer and the next four most highly compensated executive officers. Stockholders approved the management incentive plans under which fiscal year 2000 awards were made (and the omnibus stock plan under which stock options would have been granted) so that awards under those plans would be eligible for continued tax deductibility. However, the Committee considers one of its primary responsibilities to be structuring a compensation program that will attract, retain, and reward executive talent necessary to maximize stockholder return. Accordingly, the Committee believes that the Company’s interests are best served in some circumstances by providing compensation (such as salary, perquisites, and special cash bonuses) which might be subject to the tax deductibility limitation of Section 162(m).

Bases for CEO Compensation

The Committee followed generally the same policies and programs described above for compensation of executive officers in determining fiscal year 2000 compensation for Dr. Levy as President and Chief Executive Officer.

Dr. Levy

The Committee set Dr. Levy’s annual base salary for fiscal year 2000 in accordance with the policies and considerations used to determine the fiscal year 2000 salaries of the other executive officers. In line with other VMS executive officers, this salary placed him slightly below the 75th percentile of chief executive officers based on the survey data that the Committee considered.

We also paid Dr. Levy an incentive award for fiscal year 2000 (in accordance with the management incentive plan described above) equal to 141.5% of his base salary during the fiscal year.

| John Seely Brown | David W. Martin | |||

| Samuel Hellman | Burton Richter | |||

| Terry R. Lautenbach | Richard W. Vieser (Chairman) |

AUDIT COMMITTEE REPORT

The Audit Committee of the Board—the Audit Committee—consists of the three directors whose signatures appear below. Each member of the Audit Committee is “independent”, as defined in the New York Stock Exchange Rules.

The Audit Committee’s general role is to assist the Board in monitoring VMS’s financial reporting process and related matters. Its specific responsibilities are set forth in its charter, which is attached as Appendix I to this proxy statement.

As required by the charter, the Audit Committee reviewed VMS’s financial statements for fiscal year 2000 and met with management, as well as with representatives of PricewaterhouseCoopers, our independent public accountants, to discuss the financial statements. The Audit Committee also discussed with representatives of PricewaterhouseCoopers the matters required to be discussed by Statement on Auditing Standards 61, Communication with Audit Committees.

In addition, the Audit Committee discussed with representatives of PricewaterhouseCoopers their independence from management and VMS, including the matters in the written disclosures required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees.

Based on these discussions, the financial statement review and other matters it deemed relevant, the Audit Committee recommended to the Board of Directors (and the Board approved) that the audited financial statements be included in the VMS’s Annual Report on Form 10-K for the year ended September 29, 2000.

Terry R. Lautenbach (Chairman)

David W. Martin, Jr.

Richard W. Vieser

PERFORMANCE GRAPHS

Varian Associates, Inc.

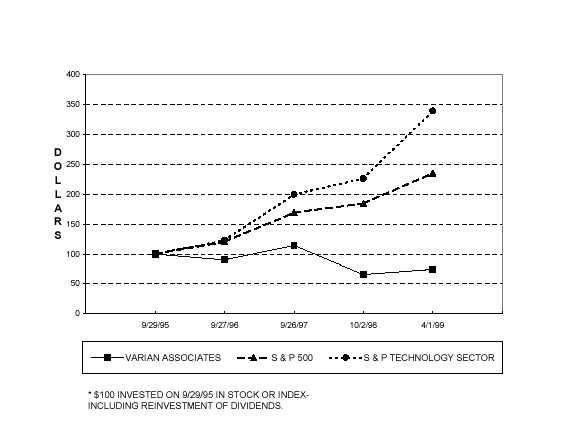

This graph shows the total return on Varian Associates, Inc. common stock and certain indices from September 30, 1995 until the date of the spinoff, April 2, 1999.

COMPARISON OF 42 MONTH CUMULATIVE TOTAL RETURN*

AMONG VARIAN ASSOCIATES, THE S & P 500 INDEX

AND THE S & P TECHNOLOGY SECTOR INDEX

| 9/29/95 | 9/27/96 | 9/26/97 | 10/2/98 | 4/1/99 | ||||||||||||

| VARIAN ASSOCIATES | 100.00 | 90.04 | 114.16 | 65.62 | 74.16 | |||||||||||

| S & P 500 | 100.00 | 120.34 | 169.01 | 184.30 | 234.69 | |||||||||||

| S & P TECHNOLOGY SECTOR | 100.00 | 122.85 | 199.52 | 225.89 | 339.09 | |||||||||||

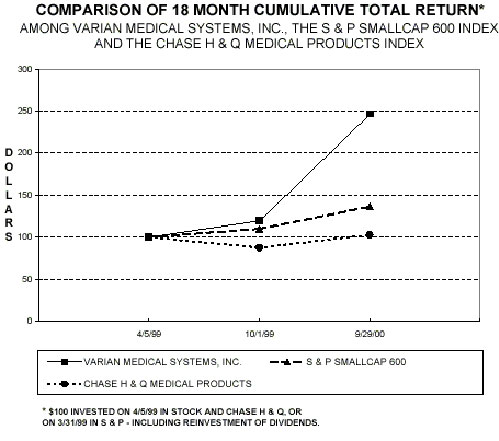

Varian Medical Systems, Inc.

This graph shows the total return on Varian Medical Systems, Inc. common stock and certain indices from April 5, 1999, the date VMS common stock began when-issued trading on the New York Stock Exchange (except as indicated) and the last day of fiscal year 2000.

| 4/5/99 | 10/1/99 | 9/29/00 | ||||||||

| VARIAN MEDICAL SYSTEMS, INC. | 100.00 | 119.45 | 246.76 | |||||||

| S & P SMALLCAP 600 | 100.00 | 109.83 | 136.38 | |||||||

| CHASE H & Q MEDICAL PRODUCTS | 100.00 | 87.44 | 102.84 | |||||||

APPENDIX I

AUDIT COMMITTEE

CHARTER

(Effective May 19, 2000)

Purpose

The Audit Committee (Committee”) is appointed by the Board of Directors (“Board”) as a standing committee to assist the Board in monitoring (1) the integrity of the corporation’s financial statements, (2) the corporation’s compliance with legal and regulatory requirements, and (3) the independence of the corporation’s auditors.

Composition

The Committee shall be comprised of a minimum of three directors including a Chairperson, each of whom shall qualify as an independent director under rules of the New York Stock Exchange (“Exchange”) and shall be financially literate as interpreted by the Board, or become so financially literate within a reasonable time after appointment to the Committee. At least one Committee member shall have accounting or related financial management experience. The committee shall have a secretary who need not be a member of the Committee.

Meetings

The Committee shall meet as often as it deems necessary to discharge its functions, but not less than three times each fiscal year.

Functions

The Committee shall:

| 1. | Annually review and assess the adequacy of this Charter and recommend any proposed changes to the Board for approval. | ||

| 2. | Annually report to the Board the Committee’s evaluation of the corporation’s outside auditor (“Independent Auditor”), and any recommendations with regard to its reappointment or replacement. | ||

| 3. | Inform the Independent Auditor of its ultimate accountability to the Committee and the Board and the Committee and Board’s ultimate authority and responsibility to select, evaluate, and, where appropriate in the exercise of their business judgment, replace the corporation’s Independent Auditor. | ||

| 4. | Periodically receive and review written reports from the Independent Auditor regarding its independence (including any disclosed relationship or service that may impact objectivity or independence) consistent with Independent Standards Board Standard 1 and recommend to the Board any actions the Committee deems necessary to maintain such independence. | ||

| 5. | Meet with the Independent Auditor to review annual audit planning and staffing and approve the Independent Auditor’s fees. | ||

| 6. | Periodically discuss with the Independent Auditor its judgment of the quality of the corporation’s accounting principles and underlying estimates, including the matters required to be discussed by Statement of Auditing Standards (“SAS”) No. 61. Communications with Audit Committees & SAS No. 90. | ||

| 7. | Review major changes to the corporation’s auditing and accounting principles and practices suggested by the Independent Auditor, internal or external audit functions (“Corporate Auditor”), or the corporation’s management (“Management”). | ||

| 8. | Review with Management and the Independent Auditor, either through the full Committee or its Chairperson, the corporation’s quarterly financial statements prior to filing with the Securities and Exchange Commission (the “SEC”). |

| 9. | Review the corporation’s annual audited financial statements with Management, including major issues regarding accounting and auditing principles and practices as well as the adequacy of internal controls that could significantly affect the financial statements. | ||

| 10. | Review an analysis, prepared by Management and the Independent Auditor, of significant financial reporting issues and judgments made in connection with the preparation of the corporation’s financial statements. | ||

| 11. | Review with the Independent Auditor any problems or difficulties encountered in the course of its audit work, including any restrictions on the scope of activities or access to required information, any management letter or significant reports provided and any Management’s response thereto, and any changes required in the planned audit scope. | ||

| 12. | Meet periodically with Management to review the corporation’s major financial risk exposures and the steps Management has taken to monitor and control such exposures. | ||

| 13. | Review the appointment and replacement of the external Corporate Auditor or, if applicable, the corporation’s internal audit function senior executive. | ||

| 14. | Cause a copy of this Charter to be included in the corporation’s Proxy Statement at least every three years. | ||

| 15. | Oversee the corporation’s compliance with SEC requirements for disclosure of auditor’s services and Audit Committee members and activities. | ||

| 16. | As required, file the Exchange’s prescribed form of written affirmation confirming Committee member independence, qualification, and Charter adoption and annual review. |

While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Committee to plan or conduct audits or to determine that the corporation’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. This is the responsibility of Management and the Independent Auditor.

VARIAN MEDICAL SYSTEMS, INC.

EMPLOYEE STOCK PURCHASE PLAN

(amended and restated effective April 1, 2001)

VARIAN MEDICAL SYSTEMS, INC.

EMPLOYEE STOCK PURCHASE PLAN

(as amended and restated effective as of April 1, 2001)

SECTION 1

PURPOSE

Varian Medical Systems, Inc., a Delaware corporation has established the Varian Medical Systems, Inc. Employee Stock Purchase Plan in order to provide eligible employees of the Company and its participating Subsidiaries with the opportunity to purchase Common Stock through payroll deductions. The Plan as amended and restated effective as of April 1, 2001, is intended to qualify as an employee stock purchase plan under Section 423(b) of the Code.

SECTION 2

DEFINITIONS

2.1 “1934 Act” means the Securities Exchange Act of 1934, as amended. Reference to a specific Section of the 1934 Act or regulation thereunder shall include such Section or regulation, any valid regulation promulgated under such Section, and any comparable provision of any future legislation or regulation amending, supplementing or superseding such Section or regulation.

2.2 “Board” means the Board of Directors of the Company.

2.3 “Code” means the Internal Revenue Code of 1986, as amended. Reference to a specific Section of the Code or regulation thereunder shall include such Section or regulation, any valid regulation promulgated under such Section, and any comparable provision of any future legislation or regulation amending, supplementing or superseding such Section or regulation.

2.4 “Committee” shall mean the committee appointed by the Board to administer the Plan. Any member of the Committee may resign at any time by notice in writing mailed or delivered to the Secretary of the Company. As of the effective date of the Plan, the Plan shall be administered by the Organization and Compensation Committee of the Board.

2.5 “Common Stock” means the common stock of the Company.

2.6 “Company” means Varian Medical Systems, Inc., a Delaware corporation.

2.7 “Compensation” means a Participant’s regular wages. The Committee, in its discretion, may (on a uniform and nondiscriminatory basis) establish a different definition of Compensation prior to an Enrollment Date for all options to be granted on such Enrollment Date.

2.8 “Eligible Employee” means every Employee of an Employer, except (a) any Employee who immediately after the grant of an option under the Plan, would own stock and/or hold outstanding options to purchase stock possessing five percent (5%) or more of the total combined voting power or value of all classes of stock of the Company or of any Subsidiary of the Company (including stock attributed to such Employee pursuant to Section 424(d) of the Code), or (b) as provided in the following sentence. The Committee, in its discretion, from time to time may, prior to an Enrollment Date for all options to be granted on such Enrollment Date, determine (on a uniform and nondiscriminatory basis) that an Employee or class of Employees shall not be an Eligible Employee.

2.9 “Employee” means an individual who is a common-law employee of any Employer, whether such employee is so employed at the time the Plan is adopted or becomes so employed subsequent to the adoption of the Plan.

2.10 “Employer” or “Employers” means any one or all of the Company, and those Subsidiaries which, with the consent of the Board, have adopted the Plan.

2.11 “Enrollment Date” means such dates as may be determined by the Committee (in its discretion and on a uniform and nondiscriminatory basis) from time to time.

2.12 “Grant Date” means any date on which a Participant is granted an option under the Plan.

2.13 “Participant” means an Eligible Employee who (a) has become a Participant in the Plan pursuant to Section 4.1 and (b) has not ceased to be a Participant pursuant to Section 8 or Section 9.

2.14 “Plan” means the Varian Medical Systems, Inc. Employee Stock Purchase Plan, as set forth in this instrument and as hereafter amended from time to time.

2.15 “Purchase Date” means such dates as may be determined by the Committee (in its discretion and on a uniform and nondiscriminatory basis) from time to time prior to an Enrollment Date for all options to be granted on such Enrollment Date.

2.16 “Subsidiary” means any corporation in an unbroken chain of corporations beginning with the Company if each of the corporations other than the last corporation in the unbroken chain then owns stock possessing fifty percent (50%) or more of the total combined voting power of all classes of stock in one of the other corporations in such chain.

SECTION 3

SHARES SUBJECT TO THE PLAN

3.1 Number Available. In addition to shares of Common Stock previously reserved by the Company’s Board of Directors for sale to participants pursuant to the Plan, beginning with the first fiscal year of the Company beginning after the effective date of the amendment and restatement of the Plan, 675,000 Shares or such lesser amount as determined by the Board will be added to the Plan. Shares sold under the Plan may be newly issued shares or treasury shares.

3.2 Adjustments. In the event of any reorganization, recapitalization, stock split, reverse stock split, stock dividend, combination of shares, merger, consolidation, offering of rights or other similar change in the capital structure of the Company, the Board may make such adjustment, if any, as it deems appropriate in the number, kind and purchase price of the shares available for purchase under the Plan and in the maximum number of shares subject to any option under the Plan.

SECTION 4

ENROLLMENT

4.1 Participation. Each Eligible Employee may elect to become a Participant by enrolling or re-enrolling in the Plan effective as of any Enrollment Date. In order to enroll, an Eligible Employee must complete, sign and submit to the Company an enrollment form in such form, manner and by such deadline as may be specified by the Committee from time to time (in its discretion and on a nondiscriminatory basis). Any Participant whose option expires and who has not withdrawn from the Plan automatically will be re-enrolled in the Plan on the Enrollment Date immediately following the Purchase Date on which his or her option expires.

4.2 Payroll Withholding. On his or her enrollment form, each Participant must elect to make Plan contributions via payroll withholding from his or her Compensation. Pursuant to such procedures as the Committee may specify from time to time. A Participant may elect to have withholding equal to a whole percentage from 1% to 10% (or such lesser, or greater, percentage that the Committee may establish from time to time for all options to be granted on any Enrollment Date). A Participant may elect to increase or decrease his or her rate of payroll withholding by submitting a new enrollment form in accordance with such procedures as may be established by the Committee from time to time. A Participant may stop his or her payroll withholding by submitting a new enrollment form in accordance with such procedures as may be established by the Committee from time to time. In order to be effective as of a specific date, an enrollment form must be received by the Company no later than the deadline specified by the Committee, in its discretion and on a nondiscriminatory basis, from time to time. Any Participant who is automatically re-enrolled in the Plan will be deemed to have elected to continue his or her contributions at the percentage last elected by the Participant.

SECTION 5

OPTIONS TO PURCHASE COMMON STOCK

5.1 Grant of Option. On each Enrollment Date on which the Participant enrolls or re-enrolls in the Plan, he or she shall be granted an option to purchase shares of Common Stock.

5.2 Duration of Option. Each option granted under the Plan shall expire upon the conclusion of the option’s offering period which will end on the earliest to occur of (a) the completion of the purchase of shares on the last Purchase Date occurring within 27 months of the Grant Date of such option, (b) such shorter option period as may be established by the Committee from time to time prior to an Enrollment Date for all options to be granted on such Enrollment Date, or (c) the date on which the Participant ceases to be such for any reason. Until otherwise determined by the Committee for all options to be granted on an Enrollment Date, the period referred to in clause (b) in the preceding sentence shall mean the period from the applicable Enrollment Date through the last business day prior to the immediately following Enrollment Date.

5.3 Number of Shares Subject to Option. The number of shares available for purchase by each Participant under the option will be established by the Committee from time to time prior to an Enrollment Date for all options to be granted on such Enrollment Date.

5.4 Other Terms and Conditions. Each option shall be subject to the following additional terms and conditions:

(a) payment for shares purchased under the option shall be made only through payroll withholding under Section 4.2;

(b) purchase of shares upon exercise of the option will be accomplished only in accordance with Section 6.1;

(c) the price per share under the option will be determined as provided in Section 6.1; and

(d) the option in all respects shall be subject to such other terms and conditions (applied on a uniform and nondiscriminatory basis), as the Committee shall determine from time to time in its discretion.

SECTION 6

PURCHASE OF SHARES

6.1 Exercise of Option. Subject to Section 6.2, on each Purchase Date, the funds then credited to each Participant’s account shall be used to purchase whole shares of Common Stock. Any cash remaining after whole shares of Common Stock have been purchased shall be carried forward in the Participant’s account for the purchase of shares on the next Purchase Date. The price per Share of the Shares purchased under any option granted under the Plan shall be eighty-five percent (85%) of the lower of:

(a) the closing price per Share on the New York Stock Exchange as reported in the Western Edition of The Wall Street Journal on the Grant Date for such option; or

(b) the closing price per Share on the New York Stock Exchange as reported in the Western Edition of The Wall Street Journal on the Purchase Date.

6.2 Delivery of Shares. As directed by the Committee in its sole discretion, shares purchased on any Purchase Date shall be delivered directly to the Participant or to a custodian or broker (if any) designated by the Committee to hold shares for the benefit of the Participants. As determined by the Committee from time to time, such shares shall be delivered as physical certificates or by means of a book entry system.

6.3 Exhaustion of Shares. If at any time the shares available under the Plan are over-enrolled, enrollments shall be reduced proportionately to eliminate the over-enrollment. Such reduction method shall be “bottom up,” with the result that all option exercises for one share shall be satisfied first, followed by all exercises for two shares, and so on, until all available shares have been exhausted. Any funds that, due to over-enrollment, cannot be applied to the purchase of whole shares shall be refunded to the Participants (without interest thereon).

SECTION 7

WITHDRAWAL

7.1 Withdrawal. A Participant may withdraw from the Plan by submitting a completed Employee Stock Purchase Plan Authorization form to the Company. A withdrawal will be effective only if it is received by the Company by the deadline specified by the Committee (in its discretion and on a uniform and nondiscriminatory basis) from time to time. When a withdrawal becomes effective, the Participant’s payroll contributions shall cease and all amounts then credited to the Participant’s account shall be distributed to him or her (without interest thereon).

SECTION 8

CESSATION OF PARTICIPATION

8.1 Termination of Status as Eligible Employee. A Participant shall cease to be a Participant immediately upon the cessation of his or her status as an Eligible Employee (for example, because of his or her termination of employment from all Employers for any reason). As soon as practicable after such cessation, the Participant’s payroll contributions shall cease and all amounts then credited to the Participant’s account shall be distributed to him or her (without interest thereon). If a Participant is on a Company-approved leave of absence, his or her participation in the Plan shall continue for so long as he or she remains an Eligible Employee and has not withdrawn from the Plan pursuant to Section 7.1.

SECTION 9

DESIGNATION OF BENEFICIARY

9.1 Designation. Each Participant may, pursuant to such uniform and nondiscriminatory procedures as the Committee may specify from time to time, designate one or more Beneficiaries to receive any amounts credited to the Participant’s account at the time of his or her death. Notwithstanding any contrary provision of this Section 9, Sections 9.1 and 9.2 shall be operative only after (and for so long as) the Committee determines (on a uniform and nondiscriminatory basis) to permit the designation of Beneficiaries.

9.2 Changes. A Participant may designate different Beneficiaries (or may revoke a prior Beneficiary designation) at any time by delivering a new designation (or revocation of a prior designation) in like manner. Any designation or revocation shall be effective only if it is received by the Committee. However, when so received, the designation or revocation shall be effective as of the date the designation or revocation is executed (whether or not the Participant still is living), but without prejudice to the Committee on account of any payment made before the change is recorded. The last effective designation received by the Committee shall supersede all prior designations.

9.3 Failed Designations. If a Participant dies without having effectively designated a Beneficiary, or if no Beneficiary survives the Participant, the Participant’s Account shall be payable to his or her estate.

SECTION 10

ADMINISTRATION

10.1 Plan Administrator. The Plan shall be administered by the Committee. The Committee shall have the authority to control and manage the operation and administration of the Plan.

10.2 Actions by Committee. Each decision of a majority of the members of the Committee then in office shall constitute the final and binding act of the Committee. The Committee may act with or without a meeting being called or held and shall keep minutes of all meetings held and a record of all actions taken by written consent.

10.3 Powers of Committee. The Committee shall have all powers and discretion necessary or appropriate to supervise the administration of the Plan and to control its operation in accordance with its terms, including, but not by way of limitation, the following discretionary powers:

(a) To interpret and determine the meaning and validity of the provisions of the Plan and the options and to determine any question arising under, or in connection with, the administration, operation or validity of the Plan or the options;

(b) To determine any and all considerations affecting the eligibility of any employee to become a Participant or to remain a Participant in the Plan;

(c) To cause an account or accounts to be maintained for each Participant;

(d) To determine the time or times when, and the number of shares for which, options shall be granted;

(e) To establish and revise an accounting method or formula for the Plan;

(f) To designate a custodian or broker to receive shares purchased under the Plan and to determine the manner and form in which shares are to be delivered to the designated custodian or broker;

(g) To determine the status and rights of Participants and their Beneficiaries or estates;

(h) To employ such brokers, counsel, agents and advisers, and to obtain such broker, legal, clerical and other services, as it may deem necessary or appropriate in carrying out the provisions of the Plan;

(i) To establish, from time to time, rules for the performance of its powers and duties and for the administration of the Plan;

(j) To adopt such procedures and subplans as are necessary or appropriate to permit participation in the Plan by employees who are foreign nationals or employed outside of the United States;

(k) To delegate to any one or more of its members or to any other person, severally or jointly, the authority to perform for and on behalf of the Committee one or more of the functions of the Committee under the Plan.

10.4 Decisions of Committee. All actions, interpretations, and decisions of the Committee shall be conclusive and binding on all persons, and shall be given the maximum possible deference allowed by law.

10.5 Administrative Expenses. All expenses incurred in the administration of the Plan by the Committee, or otherwise, including legal fees and expenses, shall be paid and borne by the Employers, except any stamp duties or transfer taxes applicable to the purchase of shares may be charged to the account of each Participant. Any brokerage fees for the purchase of shares by a Participant, fees and taxes (including brokerage fees) for the transfer, sale or resale of shares by a Participant, or the issuance of physical share certificates, shall be borne solely by the Participant.

10.6 Eligibility to Participate. No member of the Committee who is also an employee of an Employer shall be excluded from participating in the Plan if otherwise eligible, but he or she shall not be entitled, as a member of the Committee, to act or pass upon any matters pertaining specifically to his or her own account under the Plan.

10.7 Indemnification. Each of the Employers shall, and hereby does, indemnify and hold harmless the members of the Committee and the Board, from and against any and all losses, claims, damages or liabilities (including attorneys’ fees and amounts paid, with the approval of the Board, in settlement of any claim) arising out of or resulting from the implementation of a duty, act or decision with respect to the Plan, so long as such duty, act or decision does not involve gross negligence or willful misconduct on the part of any such individual.

SECTION 11

AMENDMENT, TERMINATION, AND DURATION

11.1 Amendment, Suspension, or Termination. The Board, in its sole discretion, may amend, suspend or terminate the Plan, or any part thereof, at any time and for any reason. If the Plan is terminated, the Board, in its discretion, may elect to terminate all outstanding options either immediately or upon completion of the

purchase of shares on the next Purchase Date, or may elect to permit options to expire in accordance with their terms (and participation to continue through such expiration dates). If the options are terminated prior to expiration, all amounts then credited to Participants’ accounts which have not been used to purchase shares shall be returned to the Participants (without interest thereon) as soon as administratively practicable.

SECTION 12

GENERAL PROVISIONS

12.1 Participation by Subsidiaries. One or more Subsidiaries of the Company may become participating Employers by adopting the Plan and obtaining approval for such adoption from the Board. By adopting the Plan, a Subsidiary shall be deemed to agree to all of its terms, including (but not limited to) the provisions granting exclusive authority (a) to the Board to amend the Plan, and (b) to the Committee to administer and interpret the Plan. An Employer may terminate its participation in the Plan at any time. The liabilities incurred under the Plan to the Participants employed by each Employer shall be solely the liabilities of that Employer, and no other Employer shall be liable for benefits accrued by a Participant during any period when he or she was not employed by such Employer.

12.2 Inalienability In no event may either a Participant, a former Participant or his or her Beneficiary, spouse or estate sell, transfer, anticipate, assign, hypothecate, or otherwise dispose of any right or interest under the Plan; and such rights and interests shall not at any time be subject to the claims of creditors nor be liable to attachment, execution or other legal process. Accordingly, for example, a Participant’s interest in the Plan is not transferable pursuant to a domestic relations order.

12.3 Severability. In the event any provision of the Plan shall be held illegal or invalid for any reason, the illegality or invalidity shall not affect the remaining parts of the Plan, and the Plan shall be construed and enforced as if the illegal or invalid provision had not been included.

12.4 Requirements of Law. The granting of options and the issuance of shares shall be subject to all applicable laws, rules, and regulations, and to such approvals by any governmental agencies or securities exchanges as the Committee may determine are necessary or appropriate.

12.5 Compliance with Rule 16b-3. Any transactions under this Plan with respect to officers (as defined in Rule 16a-1 promulgated under the 1934 Act) are intended to comply with all applicable conditions of Rule 16b-3. To the extent any provision of the Plan or action by the Committee fails to so comply, it shall be deemed null and void, to the extent permitted by law and deemed advisable by the Committee. Notwithstanding any contrary provision of the Plan, if the Committee specifically determines that compliance with Rule 16b-3 no longer is required, all references in the Plan to Rule 16b-3 shall be null and void.

12.6 No Enlargement of Employment Rights. Neither the establishment or maintenance of the Plan, the granting of options, the purchase of shares, nor any action of any Employer or the Committee, shall be held or construed to confer upon any individual any right to be continued as an employee of the Employer nor, upon dismissal, any right or interest in any specific assets of the Employers other than as provided in the Plan. Each Employer expressly reserves the right to discharge any employee at any time, with or without cause.

12.7 Apportionment of Costs and Duties. All acts required of the Employers under the Plan may be performed by the Company for itself and its Subsidiaries, and the costs of the Plan may be equitably apportioned by the Committee among the Company and the other Employers. Whenever an Employer is permitted or required under the terms of the Plan to do or perform any act, matter or thing, it shall be done and performed by any officer or employee of the Employers who is thereunto duly authorized by the Employers.

12.8 Construction and Applicable Law. The Plan is intended to qualify as an “employee stock purchase plan” within the meaning of Section 423(b) of the Code. Any provision of the Plan which is inconsistent with Section 423(b) of the Code shall, without further act or amendment by the Company or the Committee, be reformed to comply with the requirements of Section 423(b). The provisions of the Plan shall be construed, administered and enforced in accordance with such Section and with the laws of the State of California (excluding California’s conflict of laws provisions).

12.9 Captions. The captions contained in and the table of contents prefixed to the Plan are inserted only as a matter of convenience, and in no way define, limit, enlarge or describe the scope or intent of the Plan nor in any way shall affect the construction of any provision of the Plan.

12.10 Duration. The Plan shall commence on the date specified herein, and subject to Section ll.1 (regarding the Board’s right to amend, suspend or terminate the Plan), shall remain in effect for ten (10) years thereafter.

EXECUTION

IN WITNESS WHEREOF, Varian Medical Systems, Inc., by its duly authorized officer, has executed this Plan.

| VARIAN MEDICAL SYSTEMS, INC. | |||

| Dated: _______________, 2000 | By: | ||

| Joseph B. Phair Title: Vice President, Administration General counsel and Secretary |

|

P

R

O

X

Y |

VARIAN MEDICAL SYSTEMS, INC.

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS—FEBRUARY 8,

2001 THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS