|

|

|

|

Fidelity's

Funds

Fidelity® Global Balanced Fund

Fidelity International Growth & Income Fund

Fidelity Diversified International Fund

Fidelity Aggressive International Fund

Fidelity Overseas Fund

Fidelity Worldwide Fund

Annual Report

for the year ending

October 31, 2000

and

Prospectus

dated December 29, 2000

(2_fidelity_logos)(registered_trademark)

|

Market Recap |

A-3 |

A review of what happened in world markets |

|

Global Balanced Fund |

A-4 |

Performance |

|

|

A-5 |

Fund Talk: The Manager's Overview |

|

|

A-7 |

Investment Changes |

|

|

A-8 |

Investments |

|

|

A-15 |

Financial Statements |

|

International Growth & Income Fund |

A-17 |

Performance |

|

|

A-18 |

Fund Talk: The Manager's Overview |

|

|

A-20 |

Investment Changes |

|

|

A-21 |

Investments |

|

|

A-25 |

Financial Statements |

|

Diversified International Fund |

A-27 |

Performance |

|

|

A-28 |

Fund Talk: The Manager's Overview |

|

|

A-30 |

Investment Changes |

|

|

A-31 |

Investments |

|

|

A-39 |

Financial Statements |

|

Aggressive International Fund |

A-41 |

Performance |

|

|

A-42 |

Fund Talk: The Manager's Overview |

|

|

A-44 |

Investment Changes |

|

|

A-45 |

Investments |

|

|

A-47 |

Financial Statements |

|

Overseas Fund |

A-49 |

Performance |

|

|

A-5 |

Fund Talk: The Manager's Overview |

|

|

A-7 |

Investment Changes |

|

|

A-8 |

Investments |

|

|

A-15 |

Financial Statements |

|

Worldwide Fund |

A-58 |

Performance |

|

|

A-59 |

Fund Talk: The Manager's Overview |

|

|

A-61 |

Investment Changes |

|

|

A-62 |

Investments |

|

|

A-67 |

Financial Statements |

|

Notes to Financial Statements |

A-69 |

Notes to the Financial Statements |

|

Report of Independent Accountants |

A-73 |

|

|

Independent Auditors' Report |

A-74 |

|

|

Distributions |

A-75 |

|

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by

Fidelity Distributors Corporation.

Third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the funds nor Fidelity Distributors Corporation is a bank. For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Annual Report

The 12-month period that ended October 31, 2000, marked an incredible display of synchronization among global equity markets. Many of the similarities came from the parallel performance of technology stocks in the U.S. and TMT stocks - those in the technology, media and telecommunications areas - overseas. In a nutshell, investors who took any form of risk during the first half of the period were rewarded; those who took risks from April on were firmly punished for their bravado. Rising interest rates, uncertainty over energy prices and the continued dominance of the dollar over other world currencies also played key roles.

Europe: Just as technology stocks propelled the U.S. market to extraordinary heights in 1999 and early 2000, new economy stocks - particularly those in the wireless communications and Internet groups - were responsible for much of Europe's lofty gains. Unfortunately, the old saying "what goes up must come down" was validated in April, when U.S. technology stocks crashed amid concerns over extended valuations. The decline sent shock waves across all oceans of the world, hitting home particularly hard for many of Europe's leading telecommunications stocks. Rising oil and gas prices, meanwhile, made it difficult for Europe's manufacturing industries, and the euro - the underachieving uniform currency for 11 European nations - continued to weaken. For the period, the Morgan Stanley Capital International (MSCI) Europe Index returned 1.16%.

Emerging Markets: Call it guilt by association, but with risk-taking appetites low from April through October, most emerging markets weren't the best place to be during the period. The worldwide technology decline hurt everything from semiconductor stocks in Taiwan to broadcasting stocks in Mexico. Asian semiconductor companies also had to grapple with weak global demand for PCs and cellular handsets. For the period, the MSCI All Country Asia Free ex-Japan Index was down 20.11%. Judging by the 14.24% return of the MSCI Emerging Markets Free-Latin America Index, performance was much better in Latin America. Mexico was a clear winner, as investors reacted positively to the government's repayment of debt to the International Monetary Fund, as well as to the election of the country's new president, who was widely seen as business-friendly.

Japan and the Far East: After flirting with investors throughout 1999, the Japanese market fell back to earth. Initial euphoria over economic progress gave way to the actual corporate restructuring work that needed to be done, and many high-flying technology stocks tumbled. To compound matters, the Japanese yen continued to dip relative to the dollar. The Tokyo Stock Exchange Index - also known as TOPIX - fell 15.16% during the period. Hong Kong and China continued to perform well, as the Hang Seng Index returned 14.26% during the 12 months. Both regions continued to benefit from fast-improving economies, as well as from China's pending admission to the World Trade Organization.

U.S. and Canada: The technology correction, higher interest rates and soaring oil and gas prices eroded much of the U.S. market's gains during the period. The NASDAQ Composite Index gave back much of its previous advance, finishing the period up 13.81%. The Standard & Poor's 500SM Index - a barometer of large-cap stock performance - was up 6.09% during the period, but was in negative territory from January through the end of October. The Russell 2000® Index - which tracks smaller stocks - returned 17.41%, mostly from strong first-half performance. America's neighbor to the north, meanwhile, continued to perform well. Canadian stocks enjoyed a very nice run, mostly aided by the phenomenal performance of telecommunications and technology stocks. Natural resource-related stocks also fared well. For the period, the Toronto Stock Exchange 300 gained 29.44%.

Bonds: For the most part, U.S. fixed-income investments shrugged off rising interest rates and the increased volatility in the equity markets. Many investors, in fact, gravitated to bonds as a safer haven following the technology correction. The Lehman Brothers Aggregate Bond Index - which tracks the performance of U.S. taxable bonds - returned 7.30% during the period. Treasury issues were a strong sector, particularly after the Treasury announced in January that it would be buying back debt and limiting the amount of new borrowings. The Lehman Brothers Long Term Government Bond Index climbed 11.33% during the period. Foreign government bonds couldn't match the U.S.' performance, however, as the Salomon Brothers Non-U.S. World Government Bond Index fell 9.70%. Emerging-markets bonds enjoyed a very strong 12-month showing. The J.P. Morgan Emerging Markets Bond Index returned 19.37%.

[BAR GRAPH]

Standard & Poor's 500 Index Morgan Stanley Capital International

Europe, Australasia, Far East Index

Row: 1, Col: 1, Value: nil

Row: 1, Col: 2, Value: nil

Row: 2, Col: 1, Value: 6.1

Row: 2, Col: 2, Value: 7.38

Row: 3, Col: 1, Value: 31.57

Row: 3, Col: 2, Value: 56.16

Row: 4, Col: 1, Value: 18.56

Row: 4, Col: 2, Value: 69.44000000000001

Row: 5, Col: 1, Value: 5.1

Row: 5, Col: 2, Value: 24.63

Row: 6, Col: 1, Value: 16.61

Row: 6, Col: 2, Value: 28.27

Row: 7, Col: 1, Value: 31.69

Row: 7, Col: 2, Value: 10.53

Row: 8, Col: 1, Value: -3.1

Row: 8, Col: 2, Value: -23.45

Row: 9, Col: 1, Value: 30.47

Row: 9, Col: 2, Value: 12.13

Row: 10, Col: 1, Value: 7.619999999999999

Row: 10, Col: 2, Value: -12.17

Row: 11, Col: 1, Value: 10.08

Row: 11, Col: 2, Value: 32.56

Row: 12, Col: 1, Value: 1.32

Row: 12, Col: 2, Value: 7.78

Row: 13, Col: 1, Value: 37.58

Row: 13, Col: 2, Value: 11.21

Row: 14, Col: 1, Value: 22.96

Row: 14, Col: 2, Value: 6.05

Row: 15, Col: 1, Value: 32.11

Row: 15, Col: 2, Value: 4.819999999999999

Row: 16, Col: 1, Value: 28.58

Row: 16, Col: 2, Value: 20.27

Row: 17, Col: 1, Value: 21.04

Row: 17, Col: 2, Value: 27.22

Row: 18, Col: 1, Value: -1.81

Row: 18, Col: 2, Value: -13.75

%

* YEAR TO DATE THROUGH OCTOBER 31, 2000.

Annual Report

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value).

Cumulative Total Returns

|

Periods ended October 31, 2000 |

Past 1 |

Past 5 |

Life of |

|

Fidelity Global Balanced |

4.45% |

72.91% |

125.25% |

|

Fidelity Global Balanced |

-1.22% |

60.03% |

n/a* |

|

MSCI World |

1.09% |

97.65% |

187.02% |

|

SSB World Govt Bond |

-5.08% |

12.67% |

n/a* |

|

Global Flexible Portfolio |

7.65% |

78.30% |

n/a* |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, one year, five years or since the fund started on February 1, 1993. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's returns to the performance of the Fidelity Global Balanced Composite Index - a hypothetical combination of unmanaged indices, combining the total returns of the Morgan Stanley Capital International World (MSCI) Index and the Salomon Smith Barney World Government Bond Index using a weighting of 60% to 40%, respectively. To measure how the fund's performance stacked up against its peers, you can compare it to the global flexible portfolio funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past one year average represents a peer group of 94 mutual funds. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended October 31, 2000 |

Past 1 |

Past 5 |

Life of |

|

Fidelity Global Balanced |

4.45% |

11.57% |

11.04% |

|

Fidelity Global Balanced Composite |

-1.22% |

9.86% |

n/a* |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year.

* Not available

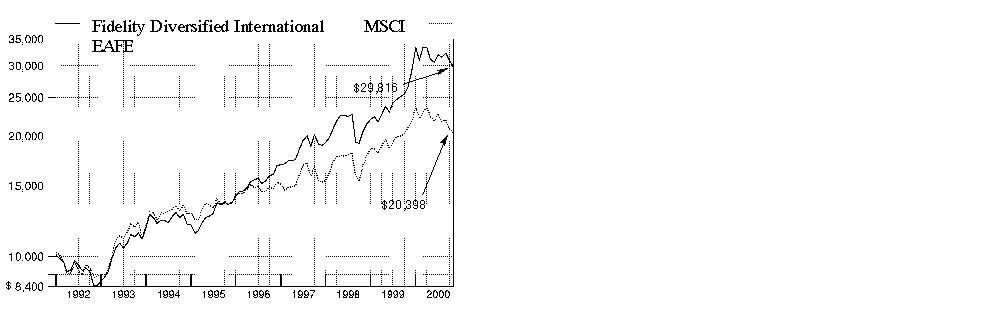

$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity Global Balanced Fund on February 26, 1993, shortly after the fund started. As the chart shows, by October 31, 2000, the value of the investment would have grown to $21,473 - a 114.73% increase on the initial investment. For comparison, look at how both the Morgan Stanley Capital International World Index and Salomon Smith Barney World Government Bond Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment in the Morgan Stanley Capital International World Index would have grown to $28,107 - a 181.07% increase and the Salomon Smith Barney World Government Bond Index would have grown to $14,665 - a 46.65% increase. You can also look at how the Fidelity Global Balanced Composite Index did over the same period. The composite index combines the total returns of the Morgan Stanley Capital International World (MSCI) Index and the Salomon Smith Barney World Government Bond Index, and assumes monthly rebalancing of the mix. With dividends and interest, if any, reinvested, the same $10,000 would have grown to $22,027 - a 120.27% increase.

Understanding Performance

Many markets around the globe offer the potential for significant growth over time; however, investing in foreign markets means assuming greater risks than investing in the United States. Factors like changes in a country's financial markets, its local political and economic climate, and the fluctuating value of its currency create these risks. For these reasons an international fund's performance may be more volatile than a fund that invests exclusively in the United States. Past performance is no guarantee of future results and you may have a gain or loss when you sell your shares.

3Annual Report

(Portfolio Manager photograph)

An interview with

Rick Mace, Portfolio

Manager of Fidelity

Global Balanced Fund

Q. How did the fund perform, Rick?

A. For the 12-month period that ended October 31, 2000, the fund returned 4.45%. In comparison, the fund outperformed the Fidelity Global Balanced Composite Index - a 60%/40% blend of the Morgan Stanley Capital International World Index and the Salomon Smith Barney World Government Bond Index - which fell 1.22%. However, the fund lagged the 7.65% return of the global flexible portfolio funds average tracked by Lipper Inc.

Q. What factors helped the fund outperform its composite index during the period?

A. The fund's equity component outperformed largely because of favorable stock selection in the telephone utilities and technology sectors. Specifically, the fund's underweighting in underperforming telephone stocks such as Lucent Technologies, AT&T, WorldCom and Nippon Telegraph and Telephone provided a boost to relative performance. At the same time, holding an out-of-benchmark position in Dynegy, an energy and communications company that was rewarded for its acquisition of utilities holding company Illinova and an expansion into the European broadband telecommunications industry, helped the fund. Turning to technology, holding an out-of-benchmark position in U.K.-based Autonomy and an overweighted stake in Furukawa Electric, a Japanese optic-fiber manufacturer, were highlights of our stock selection in the sector, as each stock performed well. Additionally, the fund's performance got a boost from holding several small positions in strong-performing U.S. technology stocks, such as Exodus Communications, Juniper Networks, Redback Networks and Agilent Technologies. The fund no longer held several of these stocks at the period's end.

Q. How did the fund's bond component perform?

A. An overweighting in U.S. Treasury bonds and an underweighting in Japanese bonds worked well, particularly during the first half of the period. During the latter half of the period, the fund's overall performance was hindered by an underweighting in fixed-income securities as bonds generally outperformed equities. The European bond component of the fund, in particular, detracted from performance as interest-rate concerns and a weakening euro depressed prices.

Q. The fund's equity holdings in the financial services sector rose to 11.7% from 8.9% six months ago. What did you like about this sector?

A. The reasons varied according to the economic and market conditions in different countries. In the U.S., a slowdown in the economy put the brakes on further interest-rate hikes by the Federal Reserve Board, which chose to leave rates unchanged on three consecutive occasions - June, August and October - after raising rates six consecutive times since mid-1999. Historically, the stabilization of interest rates has benefited financial stocks. Elsewhere, the fund has owned significant positions in a handful of Japanese financial services companies, such as Nomura Securities, for some time. But I increased our positions in those stocks because I believed that Japanese investors using the securities markets for wealth building is only the initial stage of a long-term growth trend. With the recent deregulation of financial services in Japan, these stocks could benefit going forward. Furthermore, I opportunistically added to the fund's holdings in other selected financial services stocks as the period progressed. In the United Kingdom, the prices and valuations of several banks reached such low levels that I couldn't ignore them, and I added to our holdings in such names as Lloyds TSB Group.

Q. The fund's position in another sector - health care - also increased since the last shareholder report . . .

A. That's right, and it was part of an overall strategy to steer the fund toward the most undervalued companies in the market. As I did with financial stocks, I increased the fund's holdings in many European health stocks because I was attracted to their relative earnings growth. Drug and pharmaceutical companies had been out of favor for some time and appeared to be positioned to benefit from a broadening of global markets. I thought these stocks could benefit from a stable interest-rate environment in the U.S. and declining rates in other countries.

Q. What specific stocks or strategies delivered disappointing results?

A. Within our equity component, our underweighting in several leading U.S. technology companies that performed well, such as Oracle, Cisco Systems and Hewlett-Packard, hurt overall performance. These companies were hurt by the correction in U.S. technology stocks during the spring, but recovered faster than expected in the following months as investors gravitated toward those technology companies with a history of consistent earnings growth. Similarly, holding an underweighted position in U.S. optical component producer Corning, which soared during the period on demand for its products, was a significant detractor. Meanwhile, overweighted positions in Hikari Tsushin, DDI and Telewest Communications also hampered the fund's gain.

Annual Report

Global Balanced

Fund Talk: The Manager's Overview - continued

Q. What's your outlook, Rick?

A. I think we'll continue to see more of the global volatility that we've witnessed during the past six months. Several factors - such as the declining value of the euro, historically high oil prices and slowing demand for products in the technology sectors - have recently shown little evidence of reversing course. As a result, this volatility should present compelling trading opportunities going forward. I will continue to position the fund in a broad range of industries and countries, harnessing the in-depth research capabilities of Fidelity's international team of analysts.

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fund Facts

Goal: seeks income and capital growth with reasonable risk by investing in a broadly diversified portfolio of high-yielding equity and debt securities issued anywhere in the world

Fund number: 334

Trading symbol: FGBLX

Start date: February 1, 1993

Size: as of October 31, 2000, more than $104 million

Manager: Richard Mace, since 1996; manager, Fidelity Overseas Fund, since 1996; Fidelity Aggressive International Fund, 1994-1999; group leader, Fidelity international funds; joined Fidelity in 1987

3Rick Mace on the recent volatility in global markets:

"As we've seen during the past six months, volatility in the equity markets - both domestically and internationally - has increased this year. I believe it is here to stay for awhile.

"It's important to realize that volatility is truly global, influenced a great deal by economic conditions in the United States. When the U.S. economy cools down, the rest of the world freezes. When U.S. markets warm up, the rest of the world catches fire. Part of the reason volatility is global is that merger and acquisition activity is sweeping the world, with companies buying one another not just within their own geographic markets, but on a global basis. This acquisition activity suggests that industries are consolidating around the world.

"Turning to individual markets, I think we will see the European and Japanese economies sputter along in the short term. However, looking with a longer perspective, the corporate culture in both Europe and Japan is changing - for the better. For example, an increasing number of companies are offering stock options to senior employees, a move that should improve bottom lines and add value for shareholders. Additionally, the increase in merger and acquisition activity is driving efficiency into companies and improving returns for shareholders. In the emerging markets, the outlook is mixed. Although Southeast Asian economies have stabilized, the rise in oil costs could hinder future short-term growth. There is a slightly better outlook in Latin America, because a number of countries are self-sufficient in energy production.

"Understandably, most people fear volatility. But in my opinion, volatility can be a good thing, because it creates great opportunities to buy and sell."

Annual Report

|

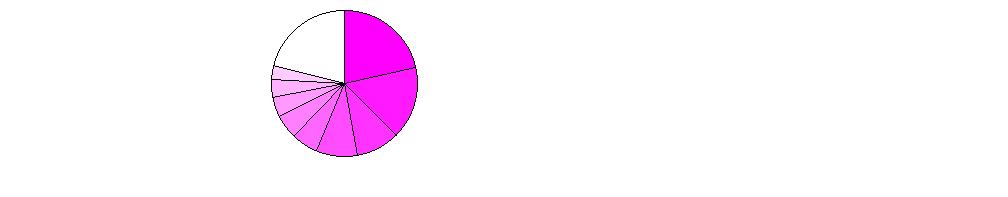

Geographic Diversification (% of fund's net assets) |

|||

|

As of October 31, 2000 |

|||

|

United States of America |

51.3% |

|

|

Japan |

11.8% |

|

|

United Kingdom |

9.6% |

|

|

Germany |

7.4% |

|

|

France |

5.6% |

|

|

Netherlands |

2.2% |

|

|

Switzerland |

1.8% |

|

|

Italy |

1.8% |

|

|

Spain |

1.5% |

|

|

Other |

7.0% |

|

|

|

|||

|

As of April 30, 2000 |

|||

|

United States of America |

51.0% |

|

|

Japan |

11.4% |

|

|

United Kingdom |

10.5% |

|

|

France |

7.1% |

|

|

Germany |

6.1% |

|

|

Switzerland |

1.8% |

|

|

Spain |

1.6% |

|

|

Italy |

1.6% |

|

|

Sweden |

1.5% |

|

|

Other |

7.4% |

|

|

Percentages are adjusted for the effect of futures contracts, if applicable. |

|

Asset Allocation |

||

|

|

% of fund's |

% of fund's net assets |

|

Stocks |

64.3 |

63.8 |

|

Bonds |

28.1 |

27.9 |

|

Short-Term Investments |

7.6 |

8.3 |

|

Top Five Stocks as of October 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

General Electric Co. |

1.3 |

1.2 |

|

Cisco Systems, Inc. |

1.2 |

1.2 |

|

EMC Corp. |

0.9 |

0.7 |

|

Exxon Mobil Corp. |

0.9 |

0.7 |

|

Vodafone Group PLC |

0.9 |

0.9 |

|

|

5.2 |

4.7 |

|

Top Five Bond Issuers as of October 31, 2000 |

||

|

(with maturities greater than |

% of fund's |

% of fund's net assets |

|

U.S. Treasury Obligations |

8.7 |

8.3 |

|

Federal Home Loan Bank |

4.8 |

4.4 |

|

United Kingdom, Great Britain & Northern Ireland |

4.3 |

4.3 |

|

Germany Federal Republic |

4.2 |

2.7 |

|

French Government |

1.8 |

3.3 |

|

|

23.8 |

23.0 |

|

Top Ten Market Sectors as of October 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

Technology |

11.8 |

16.3 |

|

Finance |

11.7 |

8.9 |

|

Utilities |

6.9 |

11.0 |

|

Health |

5.9 |

4.4 |

|

Retail & Wholesale |

4.3 |

3.0 |

|

Industrial Machinery & Equipment |

4.1 |

3.5 |

|

Nondurables |

3.9 |

2.4 |

|

Media & Leisure |

3.8 |

3.6 |

|

Durables |

3.2 |

2.1 |

|

Energy |

3.1 |

3.5 |

Annual Report

Global Balanced

Showing Percentage of Net Assets

|

Common Stocks - 64.1% |

|||

|

Shares |

Value (Note 1) |

||

|

Australia - 0.7% |

|||

|

AMP Ltd. |

4,500 |

$ 40,704 |

|

|

Australia & New Zealand Banking |

2,438 |

18,071 |

|

|

Australian Gas Light Co. |

1,946 |

11,768 |

|

|

Australian Stock Exchange Ltd. |

1,700 |

10,425 |

|

|

BHP Ltd. |

5,904 |

57,427 |

|

|

Billabong International Ltd. (a) |

6,600 |

14,178 |

|

|

Brambles Industries Ltd. |

800 |

20,814 |

|

|

Cable & Wireless Optus Ltd. (a) |

9,800 |

20,828 |

|

|

Coles Myer Ltd. |

2,381 |

8,657 |

|

|

Commonwealth Bank of Australia |

2,223 |

33,196 |

|

|

Fosters Brewing Group Ltd. |

9,600 |

21,821 |

|

|

Harvey Norman Holdings Ltd. |

6,300 |

13,927 |

|

|

Leighton Holdings Ltd. |

3,000 |

10,441 |

|

|

Lend Lease Corp. Ltd. |

748 |

8,787 |

|

|

Lion Nathan Ltd. |

3,900 |

7,539 |

|

|

Macquarie Bank Ltd. |

800 |

11,631 |

|

|

National Australia Bank Ltd. |

6,900 |

96,186 |

|

|

News Corp. Ltd. |

13,725 |

147,544 |

|

|

Rio Tinto Ltd. |

1,000 |

13,775 |

|

|

Tabcorp Holdings Ltd. |

2,500 |

13,638 |

|

|

Telstra Corp. Ltd. |

20,400 |

66,807 |

|

|

Telstra Corp. Ltd. (installment receipt) (e) |

5,800 |

9,793 |

|

|

Wesfarmers Ltd. |

1,345 |

10,304 |

|

|

Westfield Holdings Ltd. |

2,700 |

17,485 |

|

|

Westpac Banking Corp. |

3,300 |

22,613 |

|

|

WMC Ltd. |

3,600 |

13,810 |

|

|

Woodside Petroleum Ltd. (a) |

800 |

5,867 |

|

|

Woolworths Ltd. |

3,800 |

15,192 |

|

|

TOTAL AUSTRALIA |

743,228 |

||

|

Bermuda - 0.2% |

|||

|

ACE Ltd. |

4,000 |

157,000 |

|

|

Brazil - 0.5% |

|||

|

Banco Itau SA |

787,000 |

61,510 |

|

|

Companhia de Bebidas das Americas (AmBev) sponsored ADR |

4,600 |

103,787 |

|

|

Embratel Participacoes SA ADR |

4,400 |

71,225 |

|

|

Petrobras SA (PN) |

4,935 |

131,453 |

|

|

Telesp Celular Participacoes SA ADR |

2,700 |

85,388 |

|

|

Votorantim Celulose e Papel SA |

1,466,000 |

49,227 |

|

|

TOTAL BRAZIL |

502,590 |

||

|

Canada - 1.4% |

|||

|

Abitibi-Consolidated, Inc. |

1,260 |

11,048 |

|

|

Agrium, Inc. |

890 |

9,178 |

|

|

Alberta Energy Co. Ltd. |

930 |

34,360 |

|

|

Alcan Aluminium Ltd. |

650 |

20,514 |

|

|

Anderson Exploration Ltd. (a) |

320 |

5,885 |

|

|

Ballard Power Systems, Inc. (a) |

400 |

43,087 |

|

|

Bank of Montreal |

590 |

27,320 |

|

|

Bank of Nova Scotia |

1,200 |

34,286 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

BCE, Inc. |

1,730 |

$ 46,588 |

|

|

Biovail Corp. (a) |

615 |

26,256 |

|

|

Bombardier, Inc. Class B (sub. vtg.) |

3,770 |

59,305 |

|

|

Bro-X Minerals Ltd. (a) |

600 |

0 |

|

|

C.I. Fund Management, Inc. |

600 |

12,552 |

|

|

Canada Occidental Petroleum Ltd. |

340 |

8,185 |

|

|

Canadian Hunter Exploration Ltd. (a) |

570 |

11,980 |

|

|

Canadian Imperial Bank of Commerce |

760 |

24,160 |

|

|

Canadian Natural Resources Ltd. (a) |

420 |

12,414 |

|

|

Canadian Pacific Ltd. |

2,390 |

69,463 |

|

|

Celestica, Inc. (sub. vtg.) (a) |

535 |

38,232 |

|

|

Cognos, Inc. (a) |

230 |

9,668 |

|

|

Enbridge, Inc. |

1,790 |

48,204 |

|

|

Gulf Canada Resources Ltd. (a) |

2,080 |

8,948 |

|

|

Imperial Oil Ltd. |

320 |

8,092 |

|

|

Inco Ltd. (a) |

300 |

4,670 |

|

|

Loblaw Companies Ltd. |

800 |

27,429 |

|

|

Mackenzie Financial Corp. |

310 |

4,174 |

|

|

Magna International, Inc. Class A |

270 |

12,112 |

|

|

Manulife Financial Corp. |

1,370 |

35,634 |

|

|

Molson, Inc. Class A |

160 |

4,041 |

|

|

National Bank of Canada |

660 |

10,816 |

|

|

Nortel Networks Corp. |

8,409 |

382,610 |

|

|

Petro-Canada |

730 |

15,343 |

|

|

Potash Corp. of Saskatchewan |

340 |

20,154 |

|

|

Power Corp. of Canada |

510 |

11,557 |

|

|

Precision Drilling Corp. (a) |

140 |

4,005 |

|

|

Rogers Communications, Inc. |

560 |

10,887 |

|

|

Royal Bank of Canada |

2,660 |

84,386 |

|

|

Seagram Co. Ltd. |

1,120 |

63,980 |

|

|

Sun Life Financial Services Canada, Inc. |

1,550 |

32,069 |

|

|

Suncor Energy, Inc. |

1,820 |

35,563 |

|

|

Talisman Energy, Inc. (a) |

770 |

24,251 |

|

|

Thomson Corp. |

1,340 |

54,128 |

|

|

Westcoast Energy, Inc. |

320 |

7,146 |

|

|

TOTAL CANADA |

1,414,680 |

||

|

China - 0.0% |

|||

|

China Petroleum & Chemical Corp. |

46,000 |

9,025 |

|

|

Denmark - 0.2% |

|||

|

Novo-Nordisk AS Series B (a) |

950 |

201,592 |

|

|

Finland - 0.7% |

|||

|

Nokia AB |

13,240 |

566,010 |

|

|

UPM-Kymmene Corp. |

7,500 |

212,306 |

|

|

TOTAL FINLAND |

778,316 |

||

|

France - 3.8% |

|||

|

Alcatel SA (RFD) (a) |

3,800 |

237,025 |

|

|

Aventis SA |

2,400 |

172,950 |

|

|

AXA SA de CV |

1,800 |

238,343 |

|

|

BNP Paribas SA |

2,175 |

187,568 |

|

|

BNP Paribas SA warrants 7/1/02 (a) |

286 |

1,372 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

France - continued |

|||

|

Castorama Dubois Investissements SA |

2,265 |

$ 460,639 |

|

|

Clarins SA (a) |

1,015 |

78,486 |

|

|

Clarins SA rights 12/29/00 (a) |

1,015 |

10,700 |

|

|

Groupe Danone (a) |

662 |

92,602 |

|

|

ILOG SA sponsored ADR (a) |

8,500 |

255,000 |

|

|

Integra SA (a) |

7,400 |

59,985 |

|

|

Pernod-Ricard |

2,600 |

119,172 |

|

|

Remy Cointreau SA (RFD) (a) |

59 |

1,973 |

|

|

Royal Canin SA |

1,600 |

144,636 |

|

|

Sanofi-Synthelabo SA |

3,350 |

176,296 |

|

|

Societe Generale Class A (a) |

720 |

40,885 |

|

|

Suez Lyonnaise des Eaux |

1,790 |

273,179 |

|

|

Television Francaise 1 SA (a) |

2,180 |

118,980 |

|

|

TotalFinaElf SA Class B |

5,846 |

837,440 |

|

|

Vivendi Environment (a) |

5,600 |

209,144 |

|

|

Vivendi SA |

3,902 |

280,528 |

|

|

TOTAL FRANCE |

3,996,903 |

||

|

Germany - 1.9% |

|||

|

ACG AG |

2,100 |

110,514 |

|

|

Allianz AG (Reg.) |

895 |

303,529 |

|

|

Arxes Information Design AG (a) |

2,700 |

35,064 |

|

|

DaimlerChrysler AG (Reg.) |

3 |

138 |

|

|

Deutsche Lufthansa AG (Reg.) |

8,400 |

163,988 |

|

|

Douglas Holding AG |

6,700 |

199,612 |

|

|

Fresenius Medical Care AG |

1,300 |

103,470 |

|

|

Kali Und Salz Beteiligungs AG |

5,520 |

79,651 |

|

|

Karstadt Quelle AG |

8,100 |

264,423 |

|

|

Moebel Walther AG |

23,300 |

235,545 |

|

|

Muenchener Ruckversicherungs-Gesellschaft AG (Reg.) |

550 |

172,964 |

|

|

Software AG |

1,000 |

71,639 |

|

|

United Internet AG (a) |

10,000 |

64,339 |

|

|

Wella AG |

4,000 |

152,105 |

|

|

TOTAL GERMANY |

1,956,981 |

||

|

Greece - 0.2% |

|||

|

Antenna TV SA sponsored ADR (a) |

10,800 |

213,300 |

|

|

Hong Kong - 0.7% |

|||

|

Asat Holdings Ltd. sponsored ADR |

700 |

4,638 |

|

|

Cathay Pacific Airways Ltd. |

13,000 |

23,590 |

|

|

Cheung Kong Holdings Ltd. |

6,000 |

66,364 |

|

|

China Mobile (Hong Kong) Ltd. (a) |

2,000 |

12,250 |

|

|

China Unicom Ltd. |

10,000 |

20,069 |

|

|

CLP Holdings Ltd. |

6,000 |

28,007 |

|

|

Dairy Farm International Holdings Ltd. |

22,500 |

9,225 |

|

|

Dao Heng Bank Group Ltd. |

3,000 |

15,158 |

|

|

Great Eagle Holdings Ltd. |

8,129 |

11,675 |

|

|

Hang Seng Bank Ltd. |

2,900 |

34,121 |

|

|

Henderson Land Development Co. Ltd. |

5,000 |

21,544 |

|

|

Hong Kong & China Gas Co. Ltd. |

21,137 |

26,699 |

|

|

Hongkong Land Holdings Ltd. |

6,000 |

11,100 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Hutchison Whampoa Ltd. |

15,400 |

$ 191,069 |

|

|

JCG Holdings Ltd. |

26,000 |

13,837 |

|

|

Johnson Electric Holdings Ltd. |

24,000 |

47,705 |

|

|

Li & Fung Ltd. |

20,000 |

37,189 |

|

|

Pacific Century Cyberworks Ltd. (a) |

21,355 |

16,431 |

|

|

Pacific Century Cyberworks Ltd. |

641 |

0 |

|

|

Sun Hung Kai Properties Ltd. |

10,000 |

82,714 |

|

|

Swire Pacific Ltd. (A Shares) |

5,000 |

30,841 |

|

|

Wharf Holdings Ltd. |

10,000 |

20,390 |

|

|

Wing Hang Bank Ltd. |

6,000 |

18,313 |

|

|

TOTAL HONG KONG |

742,929 |

||

|

Ireland - 0.1% |

|||

|

Bank of Ireland, Inc. |

10,480 |

80,770 |

|

|

Israel - 0.0% |

|||

|

Orad Hi-Tech Systems Ltd. |

1,700 |

51,009 |

|

|

Italy - 0.8% |

|||

|

Alleanza Assicurazioni Spa |

18,500 |

244,430 |

|

|

Banca Intesa Spa |

35,900 |

150,074 |

|

|

Banca Nazionale del Lavoro (BNL) |

38,450 |

124,018 |

|

|

Beni Stabili Spa |

10,760 |

4,740 |

|

|

Eni Spa |

12,280 |

66,396 |

|

|

Telecom Italia Mobile Spa |

22,900 |

194,861 |

|

|

Telecom Italia Spa |

5,700 |

66,975 |

|

|

TOTAL ITALY |

851,494 |

||

|

Japan - 11.8% |

|||

|

Asahi Glass Co. Ltd. |

8,000 |

82,119 |

|

|

Asahi Techno Glass Corp. |

10,000 |

79,736 |

|

|

Bank of Tokyo-Mitsubishi Ltd. |

11,000 |

131,968 |

|

|

Canon, Inc. |

6,000 |

243,375 |

|

|

Chiba Bank |

13,000 |

53,973 |

|

|

Chubu Electric Power Co., Inc. |

5,000 |

82,486 |

|

|

Coca-Cola West Japan Co. Ltd. |

32 |

1,091 |

|

|

Credit Saison Co. Ltd. |

6,000 |

127,028 |

|

|

Daito Trust Construction Co. |

5,000 |

84,319 |

|

|

Daiwa Securities Group, Inc. |

17,000 |

188,370 |

|

|

DDI Corp. |

20 |

93,850 |

|

|

Fast Retailing Co. Ltd. |

900 |

221,474 |

|

|

Fuji Coca-Cola Bottling Co. Ltd. |

3,000 |

23,508 |

|

|

Fuji Heavy Industries Ltd. |

20,000 |

139,309 |

|

|

Fuji Photo Film Co. Ltd. |

4,000 |

148,474 |

|

|

Fujikura Ltd. |

19,000 |

167,519 |

|

|

Fujisawa Pharmaceutical Co. Ltd. |

2,000 |

62,872 |

|

|

Fujitsu Ltd. |

13,000 |

231,619 |

|

|

Furukawa Co. Ltd. |

25,000 |

51,324 |

|

|

Furukawa Electric Co. Ltd. |

21,000 |

552,378 |

|

|

Gunze Ltd. |

15,000 |

49,904 |

|

|

Hirose Electric Co. Ltd. |

500 |

57,740 |

|

|

Hitachi Chemical Co. Ltd. |

6,000 |

150,674 |

|

|

Hitachi Information Systems Co. Ltd. |

3,000 |

117,679 |

|

|

Honda Motor Co. Ltd. (a) |

4,000 |

138,375 |

|

|

Hosiden Corp. |

2,000 |

63,789 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

Japan - continued |

|||

|

Ines Corp. |

7,000 |

$ 87,508 |

|

|

Japan Medical Dynamic Marketing, Inc. |

4,500 |

148,886 |

|

|

Kaneka Corp. |

6,000 |

58,290 |

|

|

Kansai Electric Power Co., Inc. |

6,000 |

98,268 |

|

|

Kao Corp. |

5,000 |

149,849 |

|

|

Kappa Create Co. Ltd. |

4,000 |

130,144 |

|

|

Komatsu Ltd. |

26,000 |

115,333 |

|

|

Konami Co. Ltd. |

1,300 |

109,614 |

|

|

Konica Corp. (a) |

10,000 |

77,261 |

|

|

Kyocera Corp. |

1,000 |

133,750 |

|

|

Matsushita Electric Industrial Co. Ltd. |

11,000 |

321,475 |

|

|

Mitsumi Electric Co. Ltd. |

2,000 |

65,988 |

|

|

Mizuho Holdings, Inc. |

25 |

192,237 |

|

|

Mkc-Stat Corp. |

4,000 |

65,988 |

|

|

Nakanishi, Inc. |

4,000 |

68,555 |

|

|

NEC Corp. |

6,000 |

114,380 |

|

|

NGK Insulators Ltd. |

15,000 |

198,653 |

|

|

Nichicon Corp. |

6,000 |

107,176 |

|

|

Nintendo Co. Ltd. |

800 |

132,344 |

|

|

Nippon Computer Systems Corp. |

5,000 |

96,233 |

|

|

Nippon Paper Industries Co. Ltd. |

14,000 |

79,809 |

|

|

Nippon Sheet Glass Co. Ltd. |

5,000 |

76,070 |

|

|

Nippon Telegraph & Telephone Corp. |

75 |

682,568 |

|

|

Nippon Thompson Co. Ltd. |

10,000 |

98,524 |

|

|

Nitto Denko Corp. |

3,000 |

101,457 |

|

|

Nomura Securities Co. Ltd. |

10,000 |

212,171 |

|

|

NTT DoCoMo, Inc. (d) |

7 |

172,578 |

|

|

Oki Electric Industry Co. Ltd. (a) |

18,000 |

107,066 |

|

|

Omron Corp. |

6,000 |

147,924 |

|

|

ORIX Corp. |

2,000 |

209,880 |

|

|

Ricoh Co. Ltd. |

5,000 |

76,987 |

|

|

Saizeriya Co. Ltd. |

1,900 |

106,223 |

|

|

Sakura Bank Ltd. |

25,000 |

182,156 |

|

|

Sanyo Electric Co. Ltd. |

10,000 |

76,070 |

|

|

Secom Co. Ltd. |

1,000 |

71,304 |

|

|

Shin-Etsu Chemical Co. Ltd. |

2,000 |

82,119 |

|

|

SKY Perfect Communications, Inc. (a) |

25 |

46,054 |

|

|

Softbank Corp. |

1,200 |

72,037 |

|

|

Sony Corp. |

6,500 |

539,500 |

|

|

Sumitomo Electric Industries Ltd. |

6,000 |

110,806 |

|

|

Sumitomo Trust & Banking Ltd. |

20,000 |

153,973 |

|

|

Takeda Chemical Industries Ltd. |

5,000 |

329,484 |

|

|

The Suruga Bank Ltd. |

6,000 |

82,376 |

|

|

THK Co. Ltd. |

2,000 |

49,491 |

|

|

Toko, Inc. |

15,000 |

78,361 |

|

|

Tokyo Broadcasting System, Inc. |

2,000 |

78,270 |

|

|

Tokyo Electric Power Co. |

5,000 |

121,437 |

|

|

Tokyo Tomin Bank Ltd. |

5,000 |

139,767 |

|

|

Tokyu Corp. |

7,000 |

36,184 |

|

|

Toto Ltd. |

20,000 |

151,773 |

|

|

Toyoda Gosei Co. Ltd. |

4,000 |

244,890 |

|

|

Toyota Motor Corp. |

20,000 |

799,193 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Trans Cosmos, Inc. |

1,000 |

$ 72,312 |

|

|

Tsubaki Nakashima Co. Ltd. |

6,000 |

75,172 |

|

|

Yakult Honsha Co. Ltd. |

19,000 |

216,625 |

|

|

Yamada Denki Co. Ltd. |

2,400 |

211,163 |

|

|

Yamanouchi Pharmaceutical Co. Ltd. |

4,000 |

181,102 |

|

|

Yokogawa Electric Corp. |

7,000 |

54,917 |

|

|

Yoshinoya D&C Co. Ltd. |

60 |

112,730 |

|

|

Zeon Corp. |

20,000 |

86,701 |

|

|

TOTAL JAPAN |

12,344,109 |

||

|

Luxembourg - 0.1% |

|||

|

Societe Europeen Des Satellite unit |

600 |

79,957 |

|

|

Mexico - 0.6% |

|||

|

Banacci SA de CV Series O (a) |

60,000 |

93,181 |

|

|

Grupo Iusacell SA de CV |

6,000 |

78,000 |

|

|

Grupo Televisa SA de CV |

1,700 |

92,013 |

|

|

Telefonos de Mexico SA de CV Series L sponsored ADR |

3,790 |

204,423 |

|

|

TV Azteca SA de CV sponsored ADR |

5,425 |

67,813 |

|

|

Wal-Mart de Mexico SA de CV |

50,000 |

113,132 |

|

|

TOTAL MEXICO |

648,562 |

||

|

Netherlands - 2.2% |

|||

|

Aegon NV |

3,120 |

123,938 |

|

|

Hunter Douglas NV |

7,700 |

220,909 |

|

|

ING Groep NV (Certificaten Van Aandelen) |

6,664 |

457,716 |

|

|

Koninklijke Ahold NV |

12,526 |

363,936 |

|

|

Koninklijke KPN NV |

3,020 |

61,188 |

|

|

Koninklijke Philips Electronics NV |

3,880 |

152,515 |

|

|

Numico NV |

4,846 |

226,642 |

|

|

Nutreco Holding NV |

8,620 |

371,686 |

|

|

Oce NV |

12,000 |

178,757 |

|

|

United Pan-Europe Communications NV Class A (a) |

2,400 |

42,067 |

|

|

Vendex KBB NV |

4,970 |

62,350 |

|

|

TOTAL NETHERLANDS |

2,261,704 |

||

|

Netherlands Antilles - 0.1% |

|||

|

Schlumberger Ltd. (NY Shares) |

800 |

60,900 |

|

|

New Zealand - 0.0% |

|||

|

Air New Zealand Ltd. Class B |

9,000 |

8,071 |

|

|

Telecom Corp. of New Zealand Ltd. |

5,000 |

11,120 |

|

|

TOTAL NEW ZEALAND |

19,191 |

||

|

Norway - 0.8% |

|||

|

Bergesen dy ASA (A Shares) |

7,500 |

149,322 |

|

|

Norsk Hydro AS (a) |

4,900 |

194,587 |

|

|

TANDBERG ASA (a) |

14,300 |

378,584 |

|

|

VMETRO ASA |

8,200 |

95,308 |

|

|

TOTAL NORWAY |

817,801 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

Papua New Guinea - 0.0% |

|||

|

Oil Search Ltd. (a) |

6,800 |

$ 5,482 |

|

|

Singapore - 0.3% |

|||

|

Chartered Semiconductor |

5,000 |

21,659 |

|

|

City Developments Ltd. |

3,000 |

13,850 |

|

|

Datacraft Asia Ltd. |

2,000 |

13,700 |

|

|

DBS Group Holdings Ltd. |

3,652 |

43,087 |

|

|

DBS Land Ltd. |

5,000 |

7,609 |

|

|

Oversea-Chinese Banking Corp. Ltd. |

4,300 |

27,449 |

|

|

Overseas Union Bank Ltd. |

4,281 |

20,740 |

|

|

Singapore Airlines Ltd. |

4,000 |

40,125 |

|

|

Singapore Press Holdings Ltd. |

2,000 |

28,612 |

|

|

Singapore Technologies Engineering Ltd. |

13,000 |

20,969 |

|

|

Singapore Telecommunications Ltd. |

16,000 |

26,537 |

|

|

United Overseas Bank Ltd. |

5,280 |

39,122 |

|

|

Venture Manufacturing Singapore Ltd. |

3,000 |

29,068 |

|

|

TOTAL SINGAPORE |

332,527 |

||

|

Spain - 0.7% |

|||

|

Aldeasa SA |

2,900 |

54,892 |

|

|

Banco Santander Central Hispano SA |

17,988 |

174,363 |

|

|

Cortefiel SA |

10,880 |

195,319 |

|

|

Sogecable SA (a) |

1,500 |

36,668 |

|

|

Telefonica SA (a) |

16,560 |

315,841 |

|

|

TOTAL SPAIN |

777,083 |

||

|

Sweden - 0.4% |

|||

|

Tele1 Europe Holding AB (a) |

12,200 |

93,968 |

|

|

Telefonaktiebolaget LM Ericsson |

20,920 |

290,265 |

|

|

TV 4 AB (A Shares) |

1,700 |

51,695 |

|

|

TOTAL SWEDEN |

435,928 |

||

|

Switzerland - 1.8% |

|||

|

Credit Suisse Group (Reg.) |

1,219 |

228,541 |

|

|

Givaudan AG (a) |

19 |

4,556 |

|

|

Gretag Imaging Holding AG (Reg. D) |

300 |

53,908 |

|

|

Julius Baer Holding AG |

26 |

128,734 |

|

|

Nestle SA (Reg.) |

154 |

319,138 |

|

|

Novartis AG (Reg.) |

163 |

247,288 |

|

|

PubliGroupe SA (Reg.) |

21 |

12,325 |

|

|

Richemont Compagnie Financier |

51 |

141,864 |

|

|

The Swatch Group AG (Bearer) |

200 |

264,812 |

|

|

Zurich Financial Services Group AG |

1,042 |

504,334 |

|

|

TOTAL SWITZERLAND |

1,905,500 |

||

|

United Kingdom - 5.3% |

|||

|

3i Group PLC |

5,500 |

124,783 |

|

|

Amvescap PLC |

11,530 |

257,412 |

|

|

AstraZeneca Group PLC (Sweden) |

583 |

27,526 |

|

|

Barclays PLC |

3,500 |

100,058 |

|

|

Boots Co. PLC |

43,100 |

343,651 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

British Land Co. PLC |

15,400 |

$ 91,981 |

|

|

Diageo PLC |

21,450 |

202,280 |

|

|

HSBC Holdings PLC: |

|

|

|

|

(Hong Kong) (Reg.) |

1,468 |

21,169 |

|

|

(United Kingdom) (Reg.) |

7,374 |

106,333 |

|

|

Lloyds TSB Group PLC |

38,279 |

389,561 |

|

|

Marconi PLC |

3,400 |

42,882 |

|

|

Misys PLC |

9,100 |

94,720 |

|

|

Reed International PLC |

15,000 |

138,519 |

|

|

Reuters Group PLC |

18,500 |

363,448 |

|

|

Shell Transport & Trading Co. PLC (Reg.) |

56,590 |

463,920 |

|

|

SMG PLC |

105,360 |

412,399 |

|

|

Smith & Nephew PLC |

80,476 |

330,165 |

|

|

SmithKline Beecham PLC |

18,414 |

240,073 |

|

|

Somerfield PLC |

196,900 |

219,793 |

|

|

SSL International PLC |

41,631 |

484,329 |

|

|

Telewest Communications PLC (a) |

100,289 |

165,743 |

|

|

Vodafone Group PLC |

210,175 |

894,557 |

|

|

WPP Group PLC |

6,580 |

88,236 |

|

|

TOTAL UNITED KINGDOM |

5,603,538 |

||

|

United States of America - 28.8% |

|||

|

Abbott Laboratories |

3,100 |

163,719 |

|

|

ADC Telecommunications, Inc. (a) |

3,600 |

76,950 |

|

|

AES Corp. (a) |

1,800 |

101,700 |

|

|

Affiliated Computer Services, Inc. |

1,800 |

100,238 |

|

|

AFLAC, Inc. |

2,300 |

168,044 |

|

|

Alcoa, Inc. |

4,028 |

115,553 |

|

|

AMBAC Financial Group, Inc. |

2,300 |

183,569 |

|

|

American Express Co. |

4,900 |

294,000 |

|

|

American Home Products Corp. |

2,000 |

127,000 |

|

|

American International Group, Inc. |

8,588 |

841,575 |

|

|

Anadarko Petroleum Corp. |

409 |

26,196 |

|

|

Associates First Capital Corp. Class A |

5,548 |

205,970 |

|

|

AT&T Corp. |

6,262 |

145,200 |

|

|

AT&T Corp. - Wireless Group |

3,400 |

84,788 |

|

|

Avery Dennison Corp. |

1,500 |

75,750 |

|

|

Avon Products, Inc. |

6,000 |

291,000 |

|

|

Baker Hughes, Inc. |

1,600 |

55,000 |

|

|

Bank of New York Co., Inc. |

11,200 |

644,700 |

|

|

Bank One Corp. |

5,000 |

182,500 |

|

|

Baxter International, Inc. |

1,800 |

147,938 |

|

|

Bed Bath & Beyond, Inc. (a) |

2,800 |

72,275 |

|

|

BellSouth Corp. |

7,000 |

338,188 |

|

|

BFGoodrich Co. |

3,000 |

122,813 |

|

|

Biomet, Inc. |

2,100 |

75,994 |

|

|

Black & Decker Corp. |

3,000 |

112,875 |

|

|

Boeing Co. |

1,800 |

122,063 |

|

|

Bristol-Myers Squibb Co. |

11,400 |

694,688 |

|

|

Broadcom Corp. Class A (a) |

200 |

44,475 |

|

|

Burlington Northern Santa Fe Corp. |

5,700 |

151,406 |

|

|

Calpine Corp. (a) |

500 |

39,469 |

|

|

Cardinal Health, Inc. |

900 |

85,275 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

United States of America - continued |

|||

|

Ceridian Corp. (a) |

4,000 |

$ 100,000 |

|

|

Charles Schwab Corp. |

3,000 |

105,375 |

|

|

Ciena Corp. (a) |

4,000 |

420,500 |

|

|

Cisco Systems, Inc. (a) |

22,800 |

1,228,350 |

|

|

Citigroup, Inc. |

15,300 |

805,163 |

|

|

Clear Channel Communications, Inc. (a) |

11,996 |

720,510 |

|

|

Comstock Resources, Inc. (a) |

6,200 |

64,325 |

|

|

Conoco, Inc. Class B |

6,000 |

163,125 |

|

|

Corning, Inc. |

1,500 |

114,750 |

|

|

Crown Castle International Corp. (a) |

3,500 |

106,094 |

|

|

Danaher Corp. |

2,000 |

126,250 |

|

|

Dell Computer Corp. (a) |

16,200 |

477,900 |

|

|

Devon Energy Corp. |

1,500 |

75,600 |

|

|

Dynegy, Inc. Class A |

5,848 |

270,836 |

|

|

EchoStar Communications Corp. |

4,000 |

181,000 |

|

|

Eli Lilly & Co. |

7,200 |

643,500 |

|

|

EMC Corp. (a) |

11,000 |

979,688 |

|

|

Exxon Mobil Corp. |

10,876 |

970,003 |

|

|

Fannie Mae |

7,000 |

539,000 |

|

|

Firstar Corp. |

9,000 |

177,188 |

|

|

Forcenergy, Inc. (a) |

3,000 |

65,250 |

|

|

Freddie Mac |

4,600 |

276,000 |

|

|

Gap, Inc. |

7,000 |

180,688 |

|

|

Gateway, Inc. (a) |

3,000 |

154,830 |

|

|

General Electric Co. |

24,900 |

1,364,831 |

|

|

General Motors Corp. Class H |

4,500 |

145,800 |

|

|

Georgia-Pacific Corp. |

3,000 |

80,625 |

|

|

Halliburton Co. |

2,600 |

96,363 |

|

|

Harrah's Entertainment, Inc. (a) |

5,000 |

143,125 |

|

|

Home Depot, Inc. |

10,350 |

445,050 |

|

|

Household International, Inc. |

3,093 |

155,617 |

|

|

Ingersoll-Rand Co. |

1,800 |

67,950 |

|

|

Intel Corp. |

17,400 |

783,000 |

|

|

International Business Machines Corp. |

1,000 |

98,500 |

|

|

International Paper Co. |

3,000 |

109,875 |

|

|

JDS Uniphase Corp. (a) |

600 |

48,863 |

|

|

Juniper Networks, Inc. (a) |

1,000 |

195,000 |

|

|

Kohls Corp. (a) |

1,200 |

65,025 |

|

|

Leggett & Platt, Inc. |

7,700 |

126,088 |

|

|

Lexmark International Group, Inc. |

3,500 |

143,500 |

|

|

Mandalay Resort Group (a) |

3,000 |

62,438 |

|

|

MBIA, Inc. |

2,000 |

145,375 |

|

|

Merck & Co., Inc. |

3,000 |

269,813 |

|

|

Meredith Corp. |

1,800 |

57,150 |

|

|

Merrill Lynch & Co., Inc. |

2,400 |

168,000 |

|

|

Metromedia Fiber Network, Inc. |

1,500 |

28,500 |

|

|

Micron Technology, Inc. (a) |

2,000 |

69,500 |

|

|

Microsoft Corp. (a) |

5,500 |

378,813 |

|

|

Nabisco Group Holdings Corp. |

4,000 |

115,500 |

|

|

Nabisco Holdings Corp. Class A |

1,800 |

97,313 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Navistar International Corp. (a) |

1,000 |

$ 33,063 |

|

|

Network Appliance, Inc. (a) |

800 |

95,200 |

|

|

Nextel Communications, Inc. Class A (a) |

8,200 |

315,188 |

|

|

Noble Drilling Corp. (a) |

800 |

33,250 |

|

|

NRG Energy, Inc. |

3,500 |

91,000 |

|

|

Omnicom Group, Inc. |

3,800 |

350,550 |

|

|

Oracle Corp. (a) |

6,000 |

198,000 |

|

|

Parker-Hannifin Corp. |

3,300 |

136,538 |

|

|

Patina Oil & Gas Corp. |

2,000 |

35,125 |

|

|

Pfizer, Inc. |

18,325 |

791,411 |

|

|

Pharmacia Corp. |

5,000 |

275,000 |

|

|

Philip Morris Companies, Inc. |

2,500 |

91,563 |

|

|

Phone.com, Inc. (a) |

2,000 |

185,125 |

|

|

Praxair, Inc. |

2,500 |

93,125 |

|

|

Procter & Gamble Co. |

5,600 |

400,050 |

|

|

Quaker Oats Co. |

2,000 |

163,125 |

|

|

Redback Networks, Inc. (a) |

800 |

85,150 |

|

|

Safeway, Inc. (a) |

1,700 |

92,969 |

|

|

SBA Communications Corp. Class A (a) |

4,000 |

200,500 |

|

|

SBC Communications, Inc. |

12,580 |

725,709 |

|

|

Schering-Plough Corp. |

10,300 |

532,381 |

|

|

Shaw Industries, Inc. |

6,000 |

111,375 |

|

|

Sprint Corp. - PCS Group Series 1 (a) |

4,800 |

183,000 |

|

|

Sun Microsystems, Inc. (a) |

6,500 |

720,688 |

|

|

Texas Instruments, Inc. |

4,300 |

210,969 |

|

|

The Chubb Corp. |

2,800 |

236,425 |

|

|

The Coca-Cola Co. |

9,300 |

561,488 |

|

|

Thermo Electron Corp. (a) |

4,000 |

116,000 |

|

|

Time Warner, Inc. |

2,404 |

182,488 |

|

|

Tyco International Ltd. |

6,900 |

391,144 |

|

|

Unisys Corp. (a) |

4,300 |

54,825 |

|

|

United Technologies Corp. |

2,800 |

195,475 |

|

|

VeriSign, Inc. (a) |

1,000 |

132,000 |

|

|

Viacom, Inc. Class B (non-vtg.) (a) |

6,791 |

386,238 |

|

|

VoiceStream Wireless Corp. (a) |

2,400 |

315,600 |

|

|

Wal-Mart Stores, Inc. |

10,000 |

453,750 |

|

|

Walgreen Co. |

8,800 |

401,500 |

|

|

Walt Disney Co. |

2,000 |

71,625 |

|

|

Washington Mutual, Inc. |

2,000 |

88,000 |

|

|

Waters Corp. (a) |

1,000 |

72,563 |

|

|

WorldCom, Inc. (a) |

2,956 |

70,205 |

|

|

TOTAL UNITED STATES OF AMERICA |

30,177,830 |

||

|

TOTAL COMMON STOCKS (Cost $55,823,397) |

67,169,929 |

||

|

Preferred Stocks - 0.2% |

|||

|

|

|

|

|

|

Convertible Preferred Stocks - 0.0% |

|||

|

Australia - 0.0% |

|||

|

WBK STRYPES Trust (Westpac Banking Corp.) $3.135 |

1,100 |

34,032 |

|

|

Preferred Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

Nonconvertible Preferred Stocks - 0.2% |

|||

|

Germany - 0.2% |

|||

|

Wella AG |

4,384 |

$ 175,824 |

|

|

TOTAL PREFERRED STOCKS (Cost $153,359) |

209,856 |

||

|

Nonconvertible Bonds - 0.0% |

|||||

|

Moody's Ratings (unaudited) |

Principal Amount (c) |

|

|||

|

United Kingdom - 0.0% |

|||||

|

BAE Systems PLC 7.45% 11/30/03 |

- |

GBP |

1,137 |

1,599 |

|

|

Government Obligations (f) - 28.1% |

|||||

|

|

|||||

|

France - 1.8% |

|||||

|

French Government OAT 5.5% 4/25/04 |

Aaa |

EUR |

2,200,000 |

1,886,967 |

|

|

Germany - 5.3% |

|||||

|

Germany Federal Republic: |

|

|

|

|

|

|

3.75% 1/4/09 |

Aaa |

EUR |

800,000 |

613,581 |

|

|

4.5% 3/15/02 |

Aaa |

EUR |

1,200,000 |

1,009,597 |

|

|

4.5% 5/17/02 |

Aaa |

EUR |

1,550,000 |

1,303,405 |

|

|

6.25% 1/4/30 |

Aaa |

EUR |

320,000 |

296,686 |

|

|

7.375% 1/3/05 |

Aaa |

EUR |

1,225,000 |

1,123,274 |

|

|

Treuhandanstalt: |

|

|

|

|

|

|

6.625% 7/9/03 |

Aaa |

EUR |

877,507 |

770,897 |

|

|

7.5% 9/9/04 |

Aaa |

EUR |

500,000 |

457,715 |

|

|

TOTAL GERMANY |

5,575,155 |

||||

|

Italy - 1.0% |

|||||

|

Italian Republic: |

|

|

|

|

|

|

6.75% 2/1/07 |

Aa3 |

EUR |

700,000 |

635,751 |

|

|

10.5% 9/1/05 |

Aa3 |

EUR |

361,519 |

372,034 |

|

|

TOTAL ITALY |

1,007,785 |

||||

|

Spain - 0.8% |

|||||

|

Spanish Kingdom 4.5% 7/30/04 |

Aa2 |

EUR |

1,000,000 |

826,222 |

|

|

United Kingdom - 4.3% |

|||||

|

United Kingdom, Great Britain & Northern Ireland: |

|

|

|

|

|

|

5% 6/7/04 |

Aaa |

GBP |

650,000 |

922,328 |

|

|

9% 10/13/08 |

Aaa |

GBP |

2,000,000 |

3,573,786 |

|

|

TOTAL UNITED KINGDOM |

4,496,114 |

||||

|

United States of America - 14.9% |

|||||

|

Federal Home Loan Bank: |

|

|

|

|

|

|

4.875% 1/22/02 |

Aaa |

|

1,500,000 |

1,471,635 |

|

|

|

|||||

|

Moody's Ratings (unaudited) |

Principal Amount (c) |

Value (Note 1) |

|||

|

5.125% 9/15/03 |

Aaa |

|

$ 1,495,000 |

$ 1,442,914 |

|

|

5.19% 10/20/03 |

Aaa |

|

650,000 |

626,438 |

|

|

5.28% 1/6/04 |

Aaa |

|

1,515,000 |

1,460,081 |

|

|

Freddie Mac 5.75% 7/15/03 |

Aaa |

|

1,480,000 |

1,454,840 |

|

|

U.S. Treasury Bonds: |

|

|

|

|

|

|

7.125% 2/15/23 |

Aaa |

|

1,350,000 |

1,536,044 |

|

|

8% 11/15/21 |

Aaa |

|

1,700,000 |

2,101,098 |

|

|

8.125% 8/15/19 |

Aaa |

|

1,300,000 |

1,606,306 |

|

|

12.75% 11/15/10 (callable) |

Aaa |

|

880,000 |

1,133,546 |

|

|

13.875% 5/15/11 (callable) |

Aaa |

|

980,000 |

1,337,857 |

|

|

U.S. Treasury Notes: |

|

|

|

|

|

|

5.5% 1/31/03 |

Aaa |

|

640,000 |

634,099 |

|

|

6.5% 10/15/06 |

Aaa |

|

400,000 |

412,436 |

|

|

7% 7/15/06 |

Aaa |

|

425,000 |

448,020 |

|

|

TOTAL UNITED STATES OF AMERICA |

15,665,314 |

||||

|

TOTAL GOVERNMENT OBLIGATIONS (Cost $33,407,609) |

29,457,557 |

||||

|

Cash Equivalents - 6.8% |

|||

|

Shares |

|

||

|

Fidelity Cash Central Fund, 6.61% (b) |

7,150,069 |

7,150,069 |

|

|

Fidelity Securities Lending Cash Central Fund, 6.66% (b) |

26,709 |

26,709 |

|

|

TOTAL CASH EQUIVALENTS (Cost $7,176,778) |

7,176,778 |

||

|

TOTAL INVESTMENT PORTFOLIO - 99.2% (Cost $96,562,482) |

104,015,719 |

||

|

NET OTHER ASSETS - 0.8% |

804,372 |

||

|

NET ASSETS - 100% |

$ 104,820,091 |

||

|

Security Type Abbreviations |

||

|

STRYPES |

- |

Structured Yield Product Exchangeable |

|

Currency Abbreviations |

||

|

AUD |

- |

Australian dollar |

|

EUR |

- |

European Monetary Unit |

|

GBP |

- |

British pound |

|

Legend |

|

(a) Non-income producing |

|

(b) The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

|

(c) Principal amount is stated in United States dollars unless otherwise noted. |

|

(d) Security exempt from registration under Rule 144A of the Securities Act |

|

(e) Purchased on an installment basis. Market value reflects only those payments made through October 31, 2000. The remaining installments aggregating AUD 17,690 are due November 2, 2000. |

|

(f) For foreign government obligations not individually rated by S&P |

|

Other Information |

|

Purchases and sales of securities, other than short-term securities, |

|

The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of Fidelity Management & Research Company. The commissions paid to these affiliated firms were $1,124 for the period. |

|

The fund participated in the security lending program. At period end, the value of securities loaned amounted to $24,643. The fund received cash collateral of $26,709 which was invested in cash equivalents. |

|

The composition of long-term debt holdings as a percentage of total value of investments in securities, is as follows (ratings are unaudited): |

|

Moody's Ratings |

S&P Ratings |

|||

|

Aaa, Aa, A |

28.3% |

|

AAA, AA, A |

24.1% |

|

Baa |

0.0% |

|

BBB |

0.0% |

|

Ba |

0.0% |

|

BB |

0.0% |

|

B |

0.0% |

|

B |

0.0% |

|

Caa |

0.0% |

|

CCC |

0.0% |

|

Ca, C |

0.0% |

|

CC, C |

0.0% |

|

|

|

|

D |

0.0% |

|

Income Tax Information |

|

At October 31, 2000, the aggregate cost of investment securities for income tax purposes was $96,699,139. Net unrealized appreciation aggregated $7,316,580, of which $15,673,233 related to appreciated investment securities and $8,356,653 related to depreciated investment securities. |

|

The fund hereby designates approximately $1,904,000 as a capital gain dividend for the purpose of the dividend paid deduction. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Global Balanced

Statement of Assets and Liabilities

|

|

October 31, 2000 |

|

|

Assets |

|

|

|

Investment in securities, at value |

|

$ 104,015,719 |

|

Foreign currency held at value |

|

83,786 |

|

Receivable for investments sold |

|

956,868 |

|

Receivable for fund shares sold |

|

105,216 |

|

Dividends receivable |

|

95,625 |

|

Interest receivable |

|

634,625 |

|

Other receivables |

|

815 |

|

Total assets |

|

105,892,654 |

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 818,831 |

|

|

Payable for fund shares redeemed |

65,020 |

|

|

Accrued management fee |

63,330 |

|

|

Other payables and |

98,673 |

|

|

Collateral on securities loaned, |

26,709 |

|

|

Total liabilities |

|

1,072,563 |

|

Net Assets |

|

$ 104,820,091 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 88,741,140 |

|

Undistributed net investment income |

|

1,149,212 |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

7,483,063 |

|

Net unrealized appreciation (depreciation) on investments |

|

7,446,676 |

|

Net Assets, for 5,486,881 |

|

$ 104,820,091 |

|

Net Asset Value, offering price |

|

$19.10 |

Statement of Operations

|

|

Year ended October 31, 2000 |

|

|

Investment Income Dividends |

|

$ 768,099 |

|

Special dividend from BCE, Inc. |

|

206,945 |

|

Interest |

|

2,403,620 |

|

Security lending |

|

1,218 |

|

|

|

3,379,882 |

|

Less foreign taxes withheld |

|

(64,905) |

|

Total income |

|

3,314,977 |

|

Expenses |

|

|

|

Management fee |

$ 788,156 |

|

|

Transfer agent fees |

273,375 |

|

|

Accounting and security lending fees |

66,171 |

|

|

Non-interested trustees' compensation |

458 |

|

|

Custodian fees and expenses |

132,142 |

|

|

Registration fees |

36,521 |

|

|

Audit |

59,285 |

|

|

Legal |

3,152 |

|

|

Miscellaneous |

5,076 |

|

|

Total expenses before reductions |

1,364,336 |

|

|

Expense reductions |

(10,378) |

1,353,958 |

|

Net investment income |

|

1,961,019 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities |

7,514,054 |

|

|

Foreign currency transactions |

(88,402) |

7,425,652 |

|

Change in net unrealized appreciation (depreciation) on: |

|

|

|

Investment securities |

(5,198,528) |

|

|

Assets and liabilities in |

(6,243) |

(5,204,771) |

|

Net gain (loss) |

|

2,220,881 |

|

Net increase (decrease) in net assets resulting from operations |

|

$ 4,181,900 |

|

Other Information |

|

|

|

Expense reductions |

|

|

|

Directed brokerage arrangements |

|

$ 6,792 |

|

Transfer agent credits |

|

3,586 |

|

|

|

$ 10,378 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Global Balanced

Financial Statements - continued

Statement of Changes in Net Assets

|

Increase (Decrease) in Net Assets |

Year ended

October 31, |

Three months |

Year ended |

|

Operations |

$ 1,961,019 |

$ 451,563 |

$ 1,727,776 |

|

Net realized gain (loss) |

7,425,652 |

3,699,763 |

4,660,042 |

|

Change in net unrealized appreciation (depreciation) |

(5,204,771) |

403,420 |

2,979,683 |

|

Net increase (decrease) in net assets resulting from operations |

4,181,900 |

4,554,746 |

9,367,501 |

|

Distributions to shareholders |

(772,133) |

(973,940) |

(1,574,612) |

|

From net realized gain |

(1,286,888) |

- |

- |

|

Total distributions |

(2,059,021) |

(973,940) |