|

|

|

|

|

Previous: AVANT IMMUNOTHERAPEUTICS INC, S-3, EX-99.2, 2000-12-26 |

Next: FIDELITY INVESTMENT TRUST, N-30D, 2000-12-26 |

Fidelity's

Funds®

Fidelity® Canada Fund

Fidelity China Region Fund (formerly Fidelity Hong Kong & China Fund)

Fidelity Emerging Markets Fund

Fidelity Europe Fund

Fidelity Europe Capital Appreciation Fund

Fidelity Japan Fund

Fidelity Japan Smaller Companies Fund

Fidelity Latin America Fund

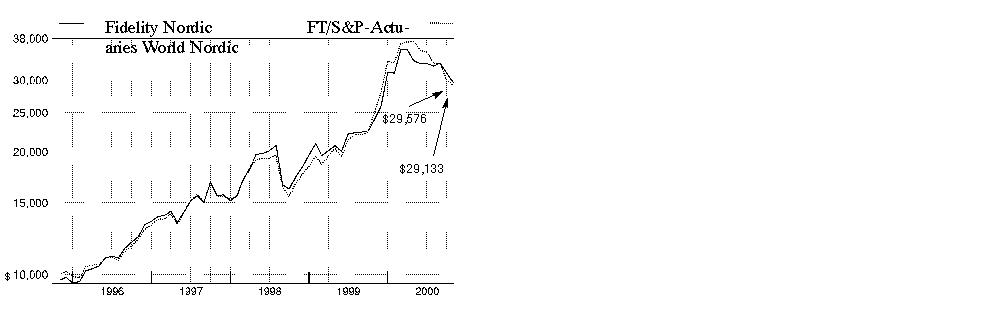

Fidelity Nordic Fund

Fidelity Pacific Basin Fund

Fidelity Southeast Asia Fund

Annual Report

for the year ending

October 31, 2000

and

Prospectus

dated December 29, 2000

(2_fidelity_logos)(registered_trademark)

|

Market Recap |

A-4 |

A review of what happened in world markets |

|

Canada Fund |

A-5 |

Performance |

|

|

A-6 |

Fund Talk: The Manager's Overview |

|

|

A-7 |

Investment Changes |

|

|

A-8 |

Investments |

|

|

A-11 |

Financial Statements |

|

China Region Fund |

A-13 |

Performance |

|

|

A-14 |

Fund Talk: The Manager's Overview |

|

|

A-15 |

Investment Changes |

|

|

A-16 |

Investments |

|

|

A-18 |

Financial Statements |

|

Emerging Markets Fund |

A-20 |

Performance |

|

|

A-21 |

Fund Talk: The Manager's Overview |

|

|

A-22 |

Investment Changes |

|

|

A-23 |

Investments |

|

|

A-26 |

Financial Statements |

|

Europe Fund |

A-28 |

Performance |

|

|

A-29 |

Fund Talk: The Manager's Overview |

|

|

A-30 |

Investment Changes |

|

|

A-31 |

Investments |

|

|

A-34 |

Financial Statements |

|

Europe Capital Appreciation Fund |

A-36 |

Performance |

|

|

A-37 |

Fund Talk: The Manager's Overview |

|

|

A-38 |

Investment Changes |

|

|

A-39 |

Investments |

|

|

A-41 |

Financial Statements |

|

Japan Fund |

A-43 |

Performance |

|

|

A-44 |

Fund Talk: The Manager's Overview |

|

|

A-45 |

Investment Changes |

|

|

A-46 |

Investments |

|

|

A-49 |

Financial Statements |

|

Japan Smaller Companies Fund |

A-51 |

Performance |

|

|

A-52 |

Fund Talk: The Manager's Overview |

|

|

A-53 |

Investment Changes |

|

|

A-54 |

Investments |

|

|

A-57 |

Financial Statements |

|

Latin America Fund |

A-59 |

Performance |

|

|

A-60 |

Fund Talk: The Manager's Overview |

|

|

A-61 |

Investment Changes |

|

|

A-62 |

Investments |

|

|

A-64 |

Financial Statements |

|

Nordic Fund |

A-66 |

Performance |

|

|

A-67 |

Fund Talk: The Manager's Overview |

|

|

A-68 |

Investment Changes |

|

|

A-69 |

Investments |

|

|

A-71 |

Financial Statements |

|

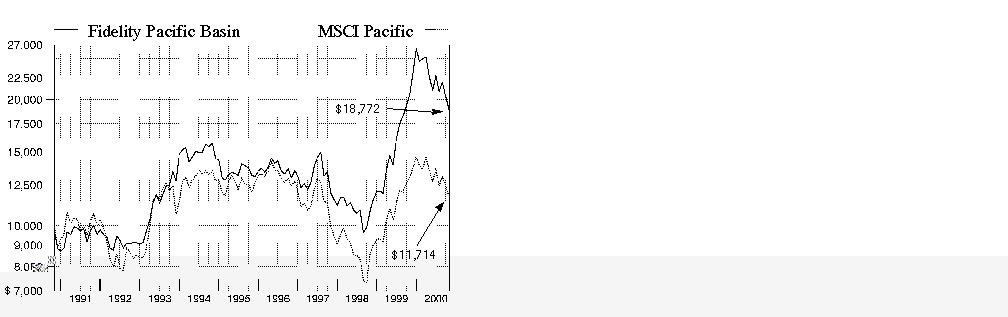

Pacific Basin Fund |

A-73 |

Performance |

|

|

A-74 |

Fund Talk: The Manager's Overview |

|

|

A-75 |

Investment Changes |

|

|

A-76 |

Investments |

|

|

A-79 |

Financial Statements |

|

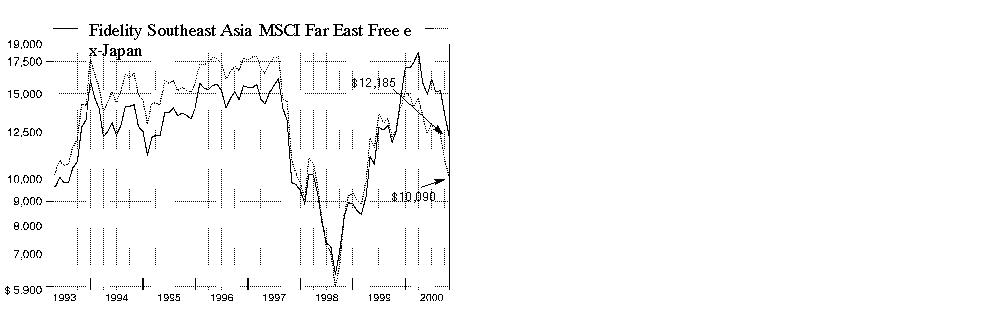

Southeast Asia Fund |

A-81 |

Performance |

|

|

A-82 |

Fund Talk: The Manager's Overview |

|

|

A-83 |

Investment Changes |

|

|

A-84 |

Investments |

|

|

A-86 |

Financial Statements |

|

Notes to Financial Statements |

A-88 |

Notes to the Financial Statements |

|

Report of Independent Accountants |

A-92 |

The auditors' opinion. |

|

Independent Auditors' Report |

A-93 |

The auditors' opinion. |

|

Distributions |

A-94 |

|

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by

Fidelity Distributors Corporation.

Third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

The views expressed in this report reflect those of each fund's portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the funds nor Fidelity Distributors Corporation is a bank. For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Annual Report

The 12-month period that ended October 31, 2000, marked an incredible display of synchronization among global equity markets. Many of the similarities came from the parallel performance of technology stocks in the U.S. and TMT stocks - those in the technology, media and telecommunications areas - overseas. In a nutshell, investors who took any form of risk during the first half of the period were rewarded; those who took risks from April on were firmly punished for their bravado. Rising interest rates, uncertainty over energy prices and the continued dominance of the dollar over other world currencies also played key roles.

Europe: Just as technology stocks propelled the U.S. market to extraordinary heights in 1999 and early 2000, new economy stocks - particularly those in the wireless communications and Internet groups - were responsible for much of Europe's lofty gains. Unfortunately, the old saying "what goes up must come down" was validated in April, when U.S. technology stocks crashed amid concerns over extended valuations. The decline sent shock waves across all oceans of the world, hitting home particularly hard for many of Europe's leading telecommunications stocks. Rising oil and gas prices, meanwhile, made it difficult for Europe's manufacturing industries, and the euro - the underachieving uniform currency for 11 European nations - continued to weaken. For the period, the Morgan Stanley Capital International (MSCI) Europe Index returned 1.16%.

Emerging Markets: Call it guilt by association, but with risk-taking appetites low from April through October, most emerging markets weren't the best place to be during the period. The worldwide technology decline hurt everything from semiconductor stocks in Taiwan to broadcasting stocks in Mexico. Asian semiconductor companies also had to grapple with weak global demand for PCs and cellular handsets. For the period, the MSCI All Country Asia Free ex-Japan Index was down 20.11%. Judging by the 14.24% return of the MSCI Emerging Markets Free-Latin America Index, performance was much better in Latin America. Mexico was a clear winner, as investors reacted positively to the government's repayment of debt to the International Monetary Fund, as well as to the election of the country's new president, who was widely seen as business-friendly.

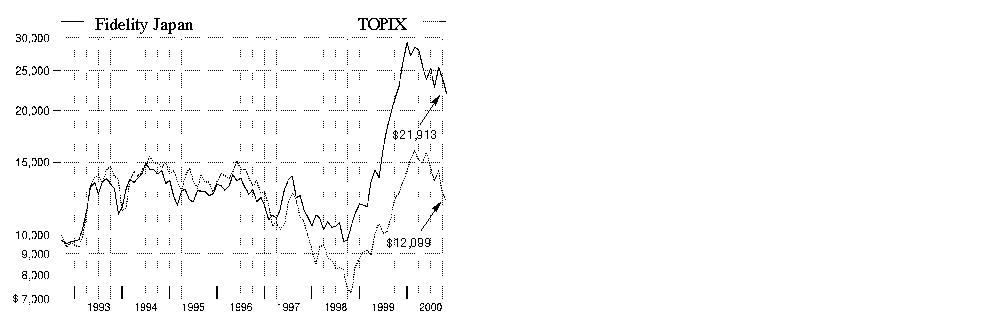

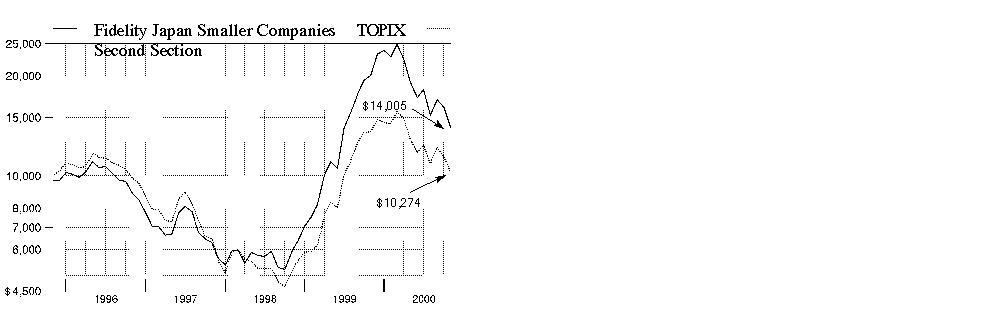

Japan and the Far East: After flirting with investors throughout 1999, the Japanese market fell back to earth. Initial euphoria over economic progress gave way to the actual corporate restructuring work that needed to be done, and many high-flying technology stocks tumbled. To compound matters, the Japanese yen continued to dip relative to the dollar. The Tokyo Stock Exchange Index - also known as TOPIX - fell 15.16% during the period. Hong Kong and China continued to perform well, as the Hang Seng Index returned 14.26% during the 12 months. Both regions continued to benefit from fast-improving economies, as well as from China's pending admission to the World Trade Organization.

U.S. and Canada: The technology correction, higher interest rates and soaring oil and gas prices eroded much of the U.S. market's gains during the period. The NASDAQ Composite Index gave back much of its previous advance, finishing the period up 13.81%. The Standard & Poor's 500SM Index - a barometer of large-cap stock performance - was up 6.09% during the period, but was in negative territory from January through the end of October. The Russell 2000® Index - which tracks smaller stocks - returned 17.41%, mostly from strong first-half performance. America's neighbor to the north, meanwhile, continued to perform well. Canadian stocks enjoyed a very nice run, mostly aided by the phenomenal performance of telecommunications and technology stocks. Natural resource-related stocks also fared well. For the period, the Toronto Stock Exchange 300 gained 29.44%.

Bonds: For the most part, U.S. fixed-income investments shrugged off rising interest rates and the increased volatility in the equity markets. Many investors, in fact, gravitated to bonds as a safer haven following the technology correction. The Lehman Brothers Aggregate Bond Index - which tracks the performance of U.S. taxable bonds - returned 7.30% during the period. Treasury issues were a strong sector, particularly after the Treasury announced in January that it would be buying back debt and limiting the amount of new borrowings. The Lehman Brothers Long Term Government Bond Index climbed 11.33% during the period. Foreign government bonds couldn't match the U.S.' performance, however, as the Salomon Brothers Non-U.S. World Government Bond Index fell 9.70%. Emerging-markets bonds enjoyed a very strong 12-month showing. The J.P. Morgan Emerging Markets Bond Index returned 19.37%.

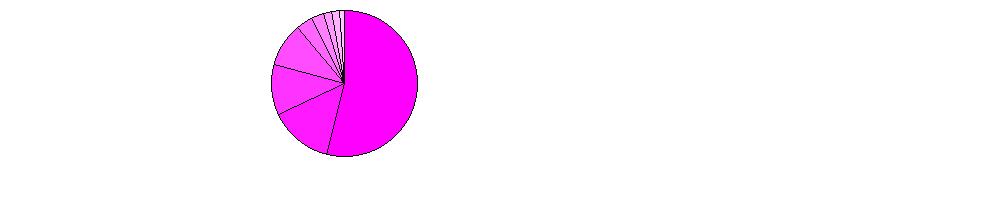

[BAR GRAPH]

Standard & Poor's 500 Index Morgan Stanley Capital International

Europe, Australasia, Far East Index

Row: 1, Col: 1, Value: nil

Row: 1, Col: 2, Value: nil

Row: 2, Col: 1, Value: 6.1

Row: 2, Col: 2, Value: 7.38

Row: 3, Col: 1, Value: 31.57

Row: 3, Col: 2, Value: 56.16

Row: 4, Col: 1, Value: 18.56

Row: 4, Col: 2, Value: 69.44000000000001

Row: 5, Col: 1, Value: 5.1

Row: 5, Col: 2, Value: 24.63

Row: 6, Col: 1, Value: 16.61

Row: 6, Col: 2, Value: 28.27

Row: 7, Col: 1, Value: 31.69

Row: 7, Col: 2, Value: 10.53

Row: 8, Col: 1, Value: -3.1

Row: 8, Col: 2, Value: -23.45

Row: 9, Col: 1, Value: 30.47

Row: 9, Col: 2, Value: 12.13

Row: 10, Col: 1, Value: 7.619999999999999

Row: 10, Col: 2, Value: -12.17

Row: 11, Col: 1, Value: 10.08

Row: 11, Col: 2, Value: 32.56

Row: 12, Col: 1, Value: 1.32

Row: 12, Col: 2, Value: 7.78

Row: 13, Col: 1, Value: 37.58

Row: 13, Col: 2, Value: 11.21

Row: 14, Col: 1, Value: 22.96

Row: 14, Col: 2, Value: 6.05

Row: 15, Col: 1, Value: 32.11

Row: 15, Col: 2, Value: 4.819999999999999

Row: 16, Col: 1, Value: 28.58

Row: 16, Col: 2, Value: 20.27

Row: 17, Col: 1, Value: 21.04

Row: 17, Col: 2, Value: 27.22

Row: 18, Col: 1, Value: -1.81

Row: 18, Col: 2, Value: -13.75

%

* YEAR TO DATE THROUGH OCTOBER 31, 2000.

Annual Report

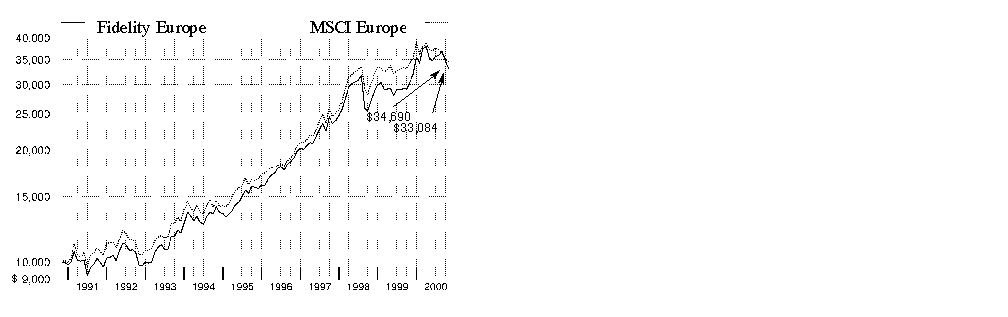

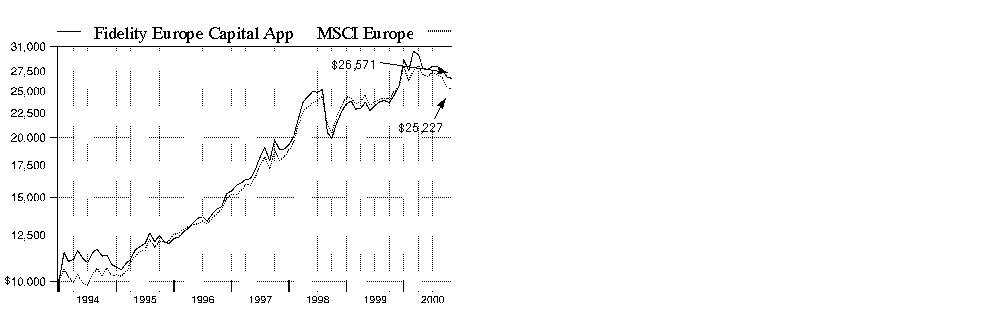

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). If Fidelity had not reimbursed certain fund expenses, the past 10 year total return would have been lower.

Cumulative Total Returns

|

Periods ended |

|

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Canada |

|

40.22% |

81.71% |

167.91% |

|

Fidelity Canada |

|

36.01% |

76.26% |

159.88% |

|

Toronto Stock Exchange 300 |

|

29.44% |

106.85% |

201.16% |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, one year, five years or 10 years. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's returns to the performance of the Toronto Stock Exchange (TSE) 300 Index - a market capitalization-weighted index of 300 stocks traded in the Canadian market.

Average Annual Total Returns

|

Periods ended |

Past 1 |

Past 5 |

Past 10 |

|

Fidelity Canada |

40.22% |

12.69% |

10.36% |

|

Fidelity Canada |

36.01% |

12.00% |

10.02% |

|

Toronto Stock Exchange 300 |

29.44% |

15.65% |

11.66% |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year.

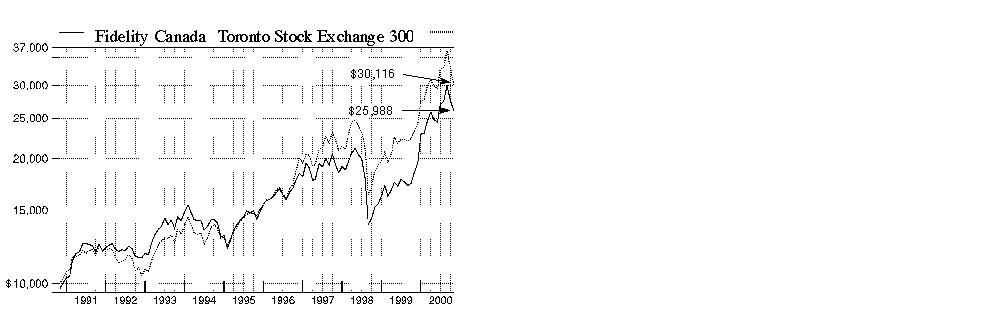

$10,000 Over 10 Years

$10,000 Over 10 Years: Let's say hypothetically that $10,000 was invested in Fidelity Canada Fund on October 31, 1990, and the current 3.00% sales charge was paid. As the chart shows, by October 31, 2000, the value of the investment would have grown to $25,988 - a 159.88% increase on the initial investment. For comparison, look at how the Toronto Stock Exchange 300 Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 would have grown to $30,116 - a 201.16% increase.

Understanding Performance

Many markets around the globe offer the potential for significant growth over time; however, investing in foreign markets means assuming greater risks than investing in the United States. Factors like changes in a country's financial markets, its local political and economic climate, and the fluctuating value of its currency create these risks. For these reasons an international fund's performance may be more volatile than a fund that invests exclusively in the United States. Past performance is no guarantee of future results and you may have a gain or loss when you sell your shares.

3Annual Report

(Portfolio Manager photograph)

An interview with

Stephen Binder,

Portfolio Manager

of Fidelity Canada Fund

Q. How did the fund perform, Stephen?

A. Very well. For the 12 months that ended October 31, 2000, the fund returned 40.22%, outpacing the Toronto Stock Exchange (TSE) 300, which returned 29.44% during the same time frame.

Q. What factors helped the fund outpace its benchmark during the 12-month period?

A. Good stock picking and favorable industry positioning allowed us to maintain a healthy lead over the index during the period. A majority of our gains came by way of the technology and telecommunications- heavy utilities sectors. Investors rallied around top firms engaged in the rollout of next-generation communications networks. Fortunately, we had ample exposure to many of the winners in this space, most notably market giants BCE and Nortel Networks, the fund's top holding. Shares of Nortel - the leading supplier of optical networking equipment in North America - rode investor enthusiasm sharply higher during the period, only to give most of its gains back in the fall amid the global tech correction. We couldn't own enough of the stock early on, which hurt relative performance given that its share of the overall stock market exceeded 35% at its peak in July. However, we more than made up for this shortfall by overweighting BCE - Canada's largest telecom company and a major shareholder in Nortel - relative to the TSE 300 index. BCE's announcement in January of its intention to spin off its holdings in Nortel further boosted BCE's stock and helped narrow the discount it was trading at relative to the aggregate value of its underlying businesses and investments. Following the spin-off in May, I reduced our stake in BCE, but still remained underweighted in Nortel, a posture that hurt relative performance during the summer, but which helped when the stock suffered precipitous declines late in the period.

Q. Why did the Canadian market perform so well during this volatile period?

A. Canada's economy continued to expand steadily behind low inflation, a healthy fiscal policy and rising exports particularly to the U.S., its top trading partner. Despite unusually high levels of volatility, fundamentals remained reasonably strong for tech stocks overall thanks to a boom in tech-related spending triggered by companies worldwide looking to stay ahead by improving productivity. For much of the period, this environment favored firms such as Nortel, which had a weighty influence on the direction of the Toronto market.

Q. Could you mention some of your other strategies that worked?

A. Sure. Increasing our exposure to a handful of key tech names that posted triple-digit returns during the period, such as C-Mac and Celestica, helped quite a bit. These firms are electronics manufacturers that benefited from the growing trend of outsourcing the manufacturing of commodity components by telecom equipment carriers such as Nortel. Holding a sizable position in JDS Uniphase - a leading maker of optical components - also paid off nicely for the fund, as did many of our financial holdings. I liquidated our stake in JDS Uniphase prior to the close of the period. Banks enjoyed a strong period, driven in large part by stronger-than-expected earnings as well as optimism about potential consolidation activity. Royal Bank of Canada was a top contributor here. We also were handsomely rewarded for participating in several IPOs involving mutual life insurance companies, namely Sun Life and Industrial Alliance, whose share prices shot up after being issued at particularly attractive valuations. Our investments in the energy sector capitalized on strengthening oil and gas prices, further bolstering relative performance. Canadian Pacific and Tidewater were standouts here.

Q. What moves didn't pan out?

A. Although 11 out of 14 sectors in the market gained ground during the period, even being slightly overexposed to two of the three laggards - metals and minerals, and paper and forest products - hurt. Lack of investor interest in most natural resources stocks, coupled with concerns about a slowing economy late in the period, felled paper and mining stocks such as Domtar and Falconbridge, respectively. Domtar was no longer held at the close of the period. Poor positioning among media stocks further detracted from relative returns.

Q. What's your outlook?

A. I remain optimistic about the prospects for oil and gas stocks, given my belief in the sustainability of higher energy prices. I feel that tech stocks will continue to be volatile in the coming months, as market fears about a slowing global economy have begun to put pressure on sector fundamentals. However, it's possible that a slowdown could result in lower interest rates, which could provide some support for a volatile market. I'm considering raising our exposure a bit to beaten-up cyclical stocks, which currently present extremely attractive value opportunities.

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover. The manager's views are subject to change at any time based on market or other conditions. For more information, see page A-3.

Fund Facts

Goal: long-term growth of capital by investing mainly in equity securities of Canadian issuers

Fund number: 309

Trading symbol: FICDX

Start date: November 17, 1987

Size: as of October 31, 2000, more than $163 million

Manager: Stephen Binder, since 1999; associate portfolio manager, Fidelity Canada Fund, 1998-1999; manager, several Fidelity Select Portfolios, 1990-1997; research analyst, 1989-1999; joined Fidelity in 1989

3Annual Report

Canada

|

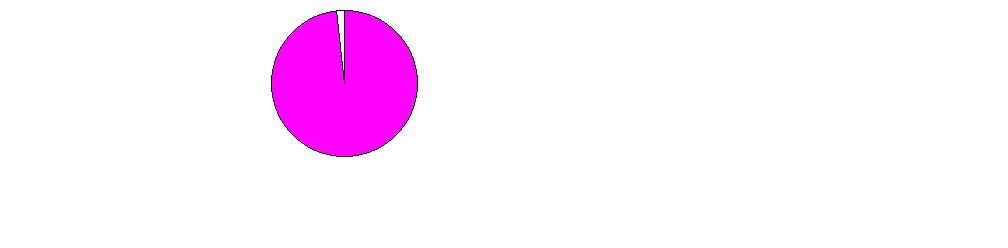

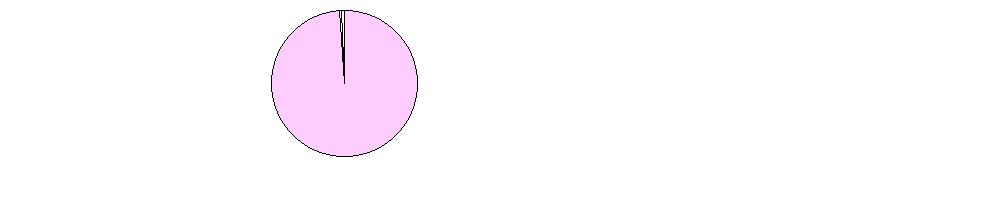

Geographic Diversification (% of fund's net assets) |

|||

|

As of October 31, 2000 |

|||

|

Canada |

94.7% |

|

|

United States of America |

5.3% |

|

|

|

|||

|

As of April 30, 2000 |

|||

|

Canada |

89.2% |

|

|

United States of America |

10.3% |

|

|

Cayman Islands |

0.2% |

|

|

Finland |

0.2% |

|

|

Bermuda |

0.1% |

|

|

Percentages are adjusted for the effect of futures contracts, if applicable. |

|

Asset Allocation |

||

|

|

% of fund's |

% of fund's net assets |

|

Stocks |

98.0 |

97.7 |

|

Short-Term Investments |

2.0 |

2.3 |

|

Top Ten Stocks as of October 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

Nortel Networks Corp. (Communications Equipment) |

15.0 |

11.2 |

|

C-Mac Industries, Inc. (Electronics) |

5.0 |

3.5 |

|

Royal Bank of Canada (Banks) |

4.6 |

3.1 |

|

BCE, Inc. (Telephone Services) |

3.3 |

14.9 |

|

Toronto Dominion Bank (Banks) |

3.2 |

3.3 |

|

Bombardier, Inc. Class B (sub. vtg.) (Aerospace & Defense) |

3.0 |

2.4 |

|

Canadian Pacific Ltd. (Railroads) |

3.0 |

1.5 |

|

Celestica, Inc. (sub. vtg.) (Electronics) |

2.6 |

1.6 |

|

Canadian Imperial Bank of Commerce (Banks) |

2.5 |

1.9 |

|

Sun Life Financial Services Canada, Inc. (Insurance) |

2.3 |

1.2 |

|

|

44.5 |

44.6 |

|

Top Ten Market Sectors as of October 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

Technology |

23.6 |

20.7 |

|

Finance |

22.6 |

15.0 |

|

Energy |

13.8 |

10.4 |

|

Utilities |

9.3 |

19.4 |

|

Transportation |

5.5 |

2.9 |

|

Basic Industries |

5.2 |

7.4 |

|

Retail & Wholesale |

4.9 |

4.8 |

|

Aerospace & Defense |

3.0 |

2.8 |

|

Nondurables |

2.9 |

3.8 |

|

Media & Leisure |

1.8 |

1.8 |

Annual Report

Canada

Showing Percentage of Net Assets

|

Common Stocks - 98.0% |

|||

|

Shares |

Value (Note 1) |

||

|

AEROSPACE & DEFENSE - 3.0% |

|||

|

Bombardier, Inc. Class B (sub. vtg.) |

310,000 |

$ 4,876,519 |

|

|

BASIC INDUSTRIES - 5.2% |

|||

|

Chemicals & Plastics - 1.6% |

|||

|

NOVA Chemicals Corp. |

49,000 |

1,010,575 |

|

|

Potash Corp. of Saskatchewan |

27,700 |

1,641,987 |

|

|

|

2,652,562 |

||

|

Iron & Steel - 0.2% |

|||

|

Dofasco, Inc. |

21,000 |

291,724 |

|

|

Metals & Mining - 2.3% |

|||

|

Alcoa, Inc. |

70,000 |

2,008,125 |

|

|

Falconbridge Ltd. |

66,040 |

785,106 |

|

|

Inco Ltd. (a) |

68,000 |

1,058,522 |

|

|

|

3,851,753 |

||

|

Paper & Forest Products - 1.1% |

|||

|

Abitibi-Consolidated, Inc. |

120,000 |

1,052,217 |

|

|

Tembec, Inc. Class A (a) |

79,100 |

698,782 |

|

|

|

1,750,999 |

||

|

TOTAL BASIC INDUSTRIES |

8,547,038 |

||

|

CONSTRUCTION & REAL ESTATE - 0.2% |

|||

|

Building Materials - 0.2% |

|||

|

Richelieu Hardware Ltd. (a) |

30,800 |

273,103 |

|

|

DURABLES - 1.4% |

|||

|

Home Furnishings - 0.3% |

|||

|

Teknion Corp. (sub. vtg.) (a) |

46,000 |

546,864 |

|

|

Textiles & Apparel - 1.1% |

|||

|

Gildan Activewear, Inc. Class A (a) |

49,000 |

1,702,750 |

|

|

TOTAL DURABLES |

2,249,614 |

||

|

ENERGY - 13.8% |

|||

|

Energy Services - 3.4% |

|||

|

Ensign Resource Service Group, Inc. |

113,000 |

3,043,021 |

|

|

Santa Fe International Corp. |

25,500 |

930,750 |

|

|

Tidewater, Inc. |

29,000 |

1,339,438 |

|

|

Trican Well Service Ltd. (a) |

39,400 |

297,603 |

|

|

|

5,610,812 |

||

|

Oil & Gas - 10.4% |

|||

|

Alberta Energy Co. Ltd. |

16,900 |

624,384 |

|

|

Anderson Exploration Ltd. (a) |

36,000 |

662,069 |

|

|

Baytex Energy Ltd. (a) |

74,800 |

564,992 |

|

|

Bonavista Petroleum Ltd. (a) |

27,000 |

478,818 |

|

|

Canada Occidental Petroleum Ltd. |

74,400 |

1,790,975 |

|

|

Canadian Hunter Exploration Ltd. (a) |

47,500 |

998,358 |

|

|

Canadian Natural Resources Ltd. (a) |

66,600 |

1,968,473 |

|

|

Crestar Energy, Inc. (a) |

92,000 |

1,489,524 |

|

|

Rio Alto Exploration Ltd. (a) |

149,400 |

2,541,517 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Suncor Energy, Inc. |

178,000 |

$ 3,478,161 |

|

|

Talisman Energy, Inc. (a) |

73,000 |

2,299,080 |

|

|

|

16,896,351 |

||

|

TOTAL ENERGY |

22,507,163 |

||

|

FINANCE - 22.6% |

|||

|

Banks - 13.3% |

|||

|

Bank of Montreal |

44,000 |

2,037,438 |

|

|

Bank of Nova Scotia |

85,000 |

2,428,571 |

|

|

Canadian Imperial Bank of Commerce |

127,000 |

4,037,307 |

|

|

Laurentian Bank |

26,000 |

418,391 |

|

|

Royal Bank of Canada |

236,000 |

7,486,897 |

|

|

Toronto Dominion Bank |

192,000 |

5,290,246 |

|

|

|

21,698,850 |

||

|

Credit & Other Finance - 0.4% |

|||

|

Home Capital Group Class B (sub. vtg.) |

176,700 |

696,355 |

|

|

Insurance - 6.7% |

|||

|

Canada Life Financial Corp. |

42,000 |

982,069 |

|

|

Fairfax Financial Holdings Ltd. (a) |

4,800 |

640,000 |

|

|

Industrial Alliance Life Insurance Co. (a) |

96,900 |

2,148,030 |

|

|

Kingsway Financial Services, Inc. (a) |

136,000 |

468,966 |

|

|

Manulife Financial Corp. |

114,000 |

2,965,123 |

|

|

Sun Life Financial Services Canada, Inc. |

176,000 |

3,641,379 |

|

|

|

10,845,567 |

||

|

Securities Industry - 2.2% |

|||

|

AGF Management Ltd. Class B (non-vtg.) |

108,000 |

1,801,773 |

|

|

C.I. Fund Management, Inc. |

61,000 |

1,276,092 |

|

|

Mackenzie Financial Corp. |

29,100 |

391,823 |

|

|

Maverick Tube Canada Ltd. (a) |

7,644 |

117,484 |

|

|

|

3,587,172 |

||

|

TOTAL FINANCE |

36,827,944 |

||

|

HEALTH - 1.2% |

|||

|

Drugs & Pharmaceuticals - 1.2% |

|||

|

Biovail Corp. (a) |

36,000 |

1,536,946 |

|

|

QLT, Inc. (a) |

9,100 |

454,253 |

|

|

|

1,991,199 |

||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 1.3% |

|||

|

Ballard Power Systems, Inc. (a) |

15,600 |

1,680,394 |

|

|

GSI Lumonics, Inc. (a) |

36,300 |

469,695 |

|

|

TOTAL INDUSTRIAL MACHINERY & EQUIPMENT |

2,150,089 |

||

|

MEDIA & LEISURE - 1.8% |

|||

|

Broadcasting - 0.2% |

|||

|

Cogeco, Inc. (sub. vtg.) |

17,200 |

359,816 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

MEDIA & LEISURE - continued |

|||

|

Entertainment - 0.7% |

|||

|

Alliance Atlantis Communications Corp. Class B (non-vtg.) (a) |

25,800 |

$ 389,754 |

|

|

Astral Media, Inc. Class A (non-vtg.) |

28,800 |

782,187 |

|

|

|

1,171,941 |

||

|

Publishing - 0.8% |

|||

|

Thomson Corp. |

33,000 |

1,333,005 |

|

|

Restaurants - 0.1% |

|||

|

Sportscene Restaurants, Inc. Class A |

20,000 |

85,386 |

|

|

TOTAL MEDIA & LEISURE |

2,950,148 |

||

|

NONDURABLES - 2.9% |

|||

|

Beverages - 2.6% |

|||

|

Molson, Inc. Class A |

22,700 |

573,277 |

|

|

Seagram Co. Ltd. |

54,600 |

3,119,025 |

|

|

The Coca-Cola Co. |

8,100 |

489,038 |

|

|

|

4,181,340 |

||

|

Household Products - 0.3% |

|||

|

Procter & Gamble Co. |

7,000 |

500,063 |

|

|

TOTAL NONDURABLES |

4,681,403 |

||

|

PRECIOUS METALS - 1.0% |

|||

|

Barrick Gold Corp. |

58,000 |

771,429 |

|

|

Goldcorp, Inc. Class A (a) |

51,000 |

306,502 |

|

|

Meridian Gold, Inc. (a) |

36,200 |

183,080 |

|

|

Placer Dome, Inc. |

39,300 |

326,532 |

|

|

TOTAL PRECIOUS METALS |

1,587,543 |

||

|

RETAIL & WHOLESALE - 4.9% |

|||

|

Grocery Stores - 4.2% |

|||

|

Loblaw Companies Ltd. |

53,000 |

1,817,143 |

|

|

Onex Corp. |

176,400 |

2,803,862 |

|

|

Weston George Ltd. |

47,000 |

2,343,054 |

|

|

|

6,964,059 |

||

|

Retail & Wholesale, Miscellaneous - 0.7% |

|||

|

Future Shop Ltd. (a) |

209,000 |

1,098,194 |

|

|

TOTAL RETAIL & WHOLESALE |

8,062,253 |

||

|

SERVICES - 0.3% |

|||

|

Mosaic Group, Inc. (a) |

65,000 |

490,969 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

TECHNOLOGY - 23.6% |

|||

|

Communications Equipment - 15.1% |

|||

|

Ciena Corp. (a) |

2,000 |

$ 210,250 |

|

|

Nortel Networks Corp. |

538,017 |

24,479,773 |

|

|

|

24,690,023 |

||

|

Computer Services & Software - 0.9% |

|||

|

Cognos, Inc. (a) |

22,700 |

954,220 |

|

|

Open Text Corp. (a) |

19,000 |

474,220 |

|

|

|

1,428,440 |

||

|

Electronics - 7.6% |

|||

|

C-Mac Industries, Inc. (a) |

144,000 |

8,133,990 |

|

|

Celestica, Inc. (sub. vtg.) (a) |

59,000 |

4,216,223 |

|

|

|

12,350,213 |

||

|

TOTAL TECHNOLOGY |

38,468,676 |

||

|

TRANSPORTATION - 5.5% |

|||

|

Air Transportation - 1.0% |

|||

|

Air Canada (a) |

21,543 |

234,886 |

|

|

Air Canada Class A (non-vtg.) (a) |

7,300 |

69,284 |

|

|

CHC Helicopter Corp. Class A (a) |

125,000 |

923,645 |

|

|

WestJet Airlines Ltd. (a) |

23,600 |

384,420 |

|

|

|

1,612,235 |

||

|

Railroads - 4.5% |

|||

|

Canadian National Railway Co. |

81,000 |

2,553,695 |

|

|

Canadian Pacific Ltd. |

167,000 |

4,853,695 |

|

|

|

7,407,390 |

||

|

TOTAL TRANSPORTATION |

9,019,625 |

||

|

UTILITIES - 9.3% |

|||

|

Cellular - 0.3% |

|||

|

Rogers Communications, Inc. |

25,300 |

491,875 |

|

|

Gas - 3.4% |

|||

|

ATCO Ltd. Class I (non-vtg.) |

118,000 |

2,980,033 |

|

|

Canadian Utilities Ltd. Class A (non-vtg.) |

1,200 |

34,483 |

|

|

Enbridge, Inc. |

52,950 |

1,425,911 |

|

|

Westcoast Energy, Inc. |

48,000 |

1,071,921 |

|

|

|

5,512,348 |

||

|

Telephone Services - 5.6% |

|||

|

BCE, Inc. |

200,000 |

5,385,878 |

|

|

Manitoba Telecom Services, Inc. |

115,000 |

2,379,310 |

|

|

TELUS Corp. (non-vtg.) |

51,000 |

1,306,404 |

|

|

|

9,071,592 |

||

|

TOTAL UTILITIES |

15,075,815 |

||

|

TOTAL COMMON STOCKS (Cost $153,315,955) |

159,759,101 |

||

|

Cash Equivalents - 4.7% |

|||

|

Shares |

Value (Note 1) |

||

|

Fidelity Cash Central Fund, 6.61% (b) |

2,906,933 |

$ 2,906,933 |

|

|

Fidelity Securities Lending Cash Central Fund, 6.66% (b) |

4,693,013 |

4,693,013 |

|

|

TOTAL CASH EQUIVALENTS (Cost $7,599,946) |

7,599,946 |

||

|

TOTAL INVESTMENT PORTFOLIO - 102.7% (Cost $160,915,901) |

167,359,047 |

||

|

NET OTHER ASSETS - (2.7)% |

(4,333,820) |

||

|

NET ASSETS - 100% |

$ 163,025,227 |

||

|

Legend |

|

(a) Non-income producing |

|

(b) The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

|

Other Information |

|

Purchases and sales of securities, other than short-term securities, aggregated $202,994,766 and $86,651,035, respectively. |

|

The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of Fidelity Management & Research Company. The commissions paid to these affiliated firms were $3,465 for the period. |

|

The fund participated in the security lending program. At period end, the value of securities loaned amounted to $5,321,970. The fund received cash collateral of $4,693,013 which was invested in cash equivalents. |

|

Income Tax Information |

|

At October 31, 2000, the aggregate cost of investment securities for income tax purposes was $161,760,126. Net unrealized appreciation aggregated $5,598,921, of which $20,250,969 related to appreciated investment securities and $14,652,048 related to depreciated investment securities. |

|

At October 31, 2000, the fund had a capital loss carryforward of approximately $3,354,000, all of which will expire on October 31, 2006. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Canada

Statement of Assets and Liabilities

|

|

October 31, 2000 |

|

|

Assets |

|

|

|

Investment in securities, at value |

|

$ 167,359,047 |

|

Receivable for investments sold |

|

3,352,825 |

|

Receivable for fund shares sold |

|

579,757 |

|

Dividends receivable |

|

101,158 |

|

Interest receivable |

|

31,295 |

|

Redemption fees receivable |

|

2,860 |

|

Other receivables |

|

13,613 |

|

Total assets |

|

171,440,555 |

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 2,887,985 |

|

|

Payable for fund shares redeemed |

640,450 |

|

|

Accrued management fee |

101,049 |

|

|

Other payables and |

92,831 |

|

|

Collateral on securities loaned, |

4,693,013 |

|

|

Total liabilities |

|

8,415,328 |

|

Net Assets |

|

$ 163,025,227 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 152,433,665 |

|

Undistributed net investment income |

|

8,350,012 |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

(4,196,973) |

|

Net unrealized appreciation (depreciation) on investments |

|

6,438,523 |

|

Net Assets, for 7,319,715 |

|

$ 163,025,227 |

|

Net Asset Value and redemption price per share ($163,025,227 ÷ 7,319,715 shares) |

|

$22.27 |

|

Maximum offering price per share (100/97.00 of $22.27) |

|

$22.96 |

Statement of Operations

|

|

Year ended October 31, 2000 |

|

|

Investment Income Dividends |

|

$ 813,038 |

|

Special dividend from BCE, Inc. |

|

8,288,947 |

|

Interest |

|

311,060 |

|

Security lending |

|

42,007 |

|

|

|

9,455,052 |

|

Less foreign taxes withheld |

|

(120,145) |

|

Total income |

|

9,334,907 |

|

Expenses |

|

|

|

Management fee |

$ 671,144 |

|

|

Performance adjustment |

(127,562) |

|

|

Transfer agent fees |

252,860 |

|

|

Accounting and security lending fees |

70,172 |

|

|

Non-interested trustees' compensation |

468 |

|

|

Custodian fees and expenses |

64,778 |

|

|

Registration fees |

44,501 |

|

|

Audit |

35,588 |

|

|

Legal |

969 |

|

|

Miscellaneous |

182 |

|

|

Total expenses before reductions |

1,013,100 |

|

|

Expense reductions |

(28,738) |

984,362 |

|

Net investment income |

|

8,350,545 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities |

510,655 |

|

|

Foreign currency transactions |

19,177 |

529,832 |

|

Change in net unrealized appreciation (depreciation) on: |

|

|

|

Investment securities |

320,096 |

|

|

Assets and liabilities in |

(3,754) |

316,342 |

|

Net gain (loss) |

|

846,174 |

|

Net increase (decrease) in net assets resulting from operations |

|

$ 9,196,719 |

|

Other Information |

|

$ 183,657 |

|

Sales charges - Retained by FDC |

|

$ 183,657 |

|

Deferred sales charges withheld |

|

$ 1,233 |

|

Expense reductions |

|

|

|

Directed brokerage arrangements |

|

$ 22,808 |

|

Custodian credits |

|

3,629 |

|

Transfer agent credits |

|

2,301 |

|

|

|

$ 28,738 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Canada

Financial Statements - continued

Statement of Changes in Net Assets

|

Increase (Decrease) in Net Assets |

Year ended

October 31, |

Year ended

October 31, |

|

Operations |

$ 8,350,545 |

$ 116,686 |

|

Net realized gain (loss) |

529,832 |

3,321,252 |

|

Change in net unrealized appreciation (depreciation) |

316,342 |

5,467,083 |

|

Net increase (decrease) in net assets resulting from operations |

9,196,719 |

8,905,021 |

|

Distributions to shareholders from net investment income |

(85,857) |

(248,416) |

|

Share transactions |

160,756,968 |

10,888,952 |

|

Reinvestment of distributions |

82,250 |

237,716 |

|

Cost of shares redeemed |

(51,055,541) |

(23,488,113) |

|

Net increase (decrease) in net assets resulting from share transactions |

109,783,677 |

(12,361,445) |

|

Redemption fees |

360,425 |

53,318 |

|

Total increase (decrease) in net assets |

119,254,964 |

(3,651,522) |

|

Net Assets |

|

|

|

Beginning of period |

43,770,263 |

47,421,785 |

|

End of period (including undistributed net investment income of $8,350,012 and $66,029, respectively) |

$ 163,025,227 |

$ 43,770,263 |

|

Other Information Shares |

|

|

|

Sold |

6,834,177 |

743,930 |

|

Issued in reinvestment of distributions |

4,754 |

17,767 |

|

Redeemed |

(2,270,606) |

(1,618,570) |

|

Net increase (decrease) |

4,568,325 |

(856,873) |

Financial Highlights

|

Years ended October 31, |

2000 |

1999 |

1998 |

1997 |

1996 |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, beginning of period |

$ 15.91 |

$ 13.14 |

$ 18.88 |

$ 21.84 |

$ 17.55 |

|

Income from Investment Operations |

|

|

|

|

|

|

Net investment income C |

1.98 E |

.04 |

.09 |

.03 |

.08 |

|

Net realized and unrealized gain (loss) |

4.32 F |

2.78 |

(3.70) |

1.39 |

4.27 |

|

Total from investment operations |

6.30 |

2.82 |

(3.61) |

1.42 |

4.35 |

|

Less Distributions |

|

|

|

|

|

|

From net investment income |

(.03) |

(.07) |

(.05) |

(.13) |

(.08) |

|

From net realized gain |

- |

- |

(2.08) |

(4.29) |

- |

|

Total distributions |

(.03) |

(.07) |

(2.13) |

(4.42) |

(.08) |

|

Redemption fees added to paid in capital |

.09 |

.02 |

- |

.04 |

.02 |

|

Net asset value, end of period |

$ 22.27 |

$ 15.91 |

$ 13.14 |

$ 18.88 |

$ 21.84 |

|

Total Return A, B |

40.22% |

21.71% |

(21.27)% |

8.21% |

24.99% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 163,025 |

$ 43,770 |

$ 47,422 |

$ 96,458 |

$ 129,671 |

|

Ratio of expenses to average net assets |

1.09% |

1.22% |

.94% |

.93% |

1.01% |

|

Ratio of expenses to average net assets after expense reductions |

1.06% D |

1.06% D |

.80% D |

.92% D |

.98% D |

|

Ratio of net investment income to average net assets |

9.00% |

.26% |

.57% |

.18% |

.40% |

|

Portfolio turnover rate |

97% |

286% |

215% |

139% |

139% |

|

A The total returns would have been lower had certain expenses not been reduced during the periods shown. B Total returns do not include the one time sales charge. C Net investment income per share has been calculated based on average shares outstanding during the period. D FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses. E Investment income per share reflects a special dividend (from BCE, Inc.) which amounted to $1.97 per share. F The amount shown for a share outstanding does not correspond with the aggregate net gain on investments for the period due to the timing of sales and repurchases of |

|||||

See accompanying notes which are an integral part of the financial statements.

Annual Report

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value).

Cumulative Total Returns

|

Periods ended |

|

Past 1 |

Life of |

|

Fidelity China Region |

|

6.77% |

59.35% |

|

Fidelity China Region |

|

3.57% |

54.57% |

|

Hang Seng |

|

14.26% |

75.62% |

|

Fidelity China Region Fund Linked Index |

|

11.00% |

70.62% |

|

China Region Funds Average |

|

13.44% |

n/a* |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, one year or since the fund started on November 1, 1995. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's returns to the performance of the Hang Seng Index - a market capitalization-weighted index of the stocks of the 33 largest companies in the Hong Kong market and to the performance of the Fidelity China Region Fund Linked Index - an index which links the returns of the Hang Seng Index from the commencement of the fund on November 1, 1995 through September 1, 2000, and the MSCI Golden Dragon Plus Index beginning September 1, 2000. It is designed to represent the equity markets of Hong Kong through September 1, 2000 and the equity markets of Hong Kong, Taiwan, and China beginning September 1, 2000. You can also compare the fund's performance to the China region funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past one year average represents a peer group of 22 mutual funds. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges.

Average Annual Total Returns

|

Periods ended |

Past 1 |

Life of |

|

Fidelity China Region |

6.77% |

9.76% |

|

Fidelity China Region |

3.57% |

9.09% |

|

Hang Seng |

14.26% |

11.91% |

|

Fidelity China Region Fund Linked Index |

11.00% |

11.27% |

|

China Region Funds Average |

13.44% |

n/a* |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year.

* Not available

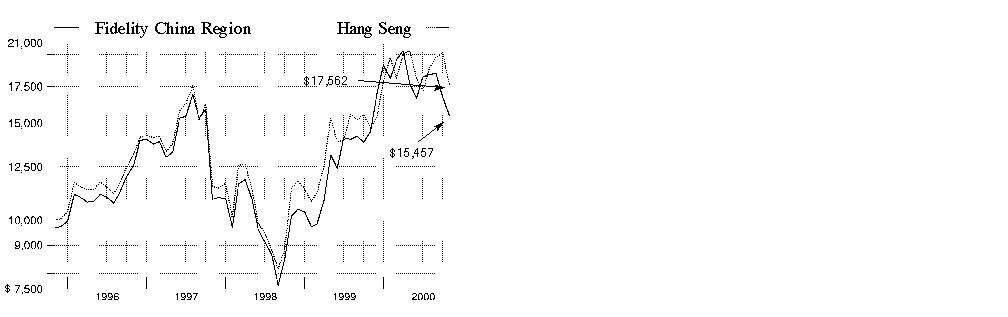

$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Fidelity China Region Fund on November 1, 1995, when the fund started, and the current 3.00% sales charge was paid. As the chart shows, by October 31, 2000, the value of the investment would have grown to $15,457 - a 54.57% increase on the initial investment. For comparison, look at how the Hang Seng Index did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 would have grown to $17,562 - a 75.62% increase.

Understanding Performance

Many markets around the globe offer the potential for significant growth over time; however, investing in foreign markets means assuming greater risks than investing in the United States. Factors like changes in a country's financial markets, its local political and economic climate, and the fluctuating value of its currency create these risks. For these reasons an international fund's performance may be more volatile than a fund that invests exclusively in the United States. Past performance is no guarantee of future results and you may have a gain or loss when you sell your shares.

3Annual Report

(Portfolio Manager photograph)

An interview with

Joseph Tse, Portfolio

Manager of Fidelity

China Region Fund

Q. How did the fund perform, Joseph?

A. For the 12 months that ended October 31, 2000, the fund returned 6.77%, trailing the Hang Seng Index, which returned 14.26%. The fund also compares its performance to the Fidelity China Region Fund Linked Index - a measure of the performance of the Hong Kong, Taiwanese and Chinese markets - which returned 11.00%, while the China region funds average tracked by Lipper Inc. returned 13.44%.

Q. What factors helped set the stage for market performance in the region during the 12-month period?

A. Hong Kong, similar to many countries in the region, enjoyed a period of economic expansion, fueled in large part by strong exporting to the U.S. and China. Stocks moved sharply higher early on, riding the worldwide enthusiasm for the so-called TMT - or technology, media and telecommunications - sectors. However, growing concerns about a slowdown in global demand - particularly in the U.S. - during the second half of the period spawned persistent volatility that shook much of the speculative excess out of stock prices. The Taiwanese market - a hotbed of PC and semiconductor manufacturing - was the hardest hit by this global sectoral shift away from technology.

Q. Why did the fund underperform both the Hang Seng Index and the Lipper peer group during this time frame?

A. The fund's positioning in Taiwan led us to underperform the Hang Seng during the period. In particular, chip manufacturers Taiwan Semiconductor and United Microelectronics hurt relative performance. Seeing a downturn coming for TMT stocks in March, I took profits in several lower-quality dot-com type names and invested the proceeds in chip stocks, the only area of the new economy I felt would outlast a correction. Unfortunately, I was wrong and, in hindsight, I wish I had moved more money into more defensive areas of the market. Although many of our peers also had exposure to Taiwan, they were more heavily invested in China on average, specifically in old economy stocks that held up better amid the period's volatility.

Q. On September 1, 2000, the fund's name changed, along with its investment policies. What prompted these changes?

A. We wanted to broaden the fund's investment policies to include Taiwan as one of its primary markets for investment. The policy changes give the fund more flexibility to invest in Taiwan, which is a market that has grown in size and importance, as well as more flexibility relative to the fund's peers. We also added an additional performance comparison for the fund - the Fidelity China Region Linked Index, which blends the Hang Seng Index and the MSCI Golden Dragon Plus Index.

Q. How did some of your other strategies work out for the fund?

A. Underweighting telecom was a plus. The decision to hold fewer traditional telecom providers, such as Cable & Wireless HKT, than the Hang Seng index paid off, as these stocks wilted in response to increased competition. Even more important was our underweighting in Internet investment company Pacific Century CyberWorks, which merged with Cable & Wireless in August. Shares of Pacific Century swooned - as did those of tech firms worldwide that lacked a clear path to profitability - following a series of failed joint ventures and several write-downs in the company's collection of assets. I sold off Pacific Century prior to the close of the period. However, not owning enough of the market's top performers - China Mobile (formerly China Telecom) and conglomerate Hutchison Whampoa - which together accounted for over 25% of the index on average, detracted from relative performance. In the summer, continuing the shift away from new economy TMT stocks, I boosted the fund's weighting in banks, a group that was poised to benefit from peaking U.S. interest rates. Adding more Hang Seng Bank and HSBC, the fund's largest holding, helped, as did heavily underweighting the same two stocks earlier in the period.

Q. What's your outlook?

A. I'm still rather cautious and believe that we should be selling on strength and switching from growth to value, TMT to non-TMT and global to local - that is, more of an emphasis on domestic economy plays given the uncertainty surrounding large multinational companies. I may look to prudently increase our China exposure during the next 12 months as more companies from the finance and telecom sectors move toward privatization. I'm still bullish on chip stocks over the long term, so I plan to watch Taiwan closely in the coming months, looking for a signal that it's time to invest some more money there.

Note to shareholders: Fidelity China Region Fund may invest up to 35% of its total assets in any industry that represents more than 20% of the Hong Kong and Chinese market. As of October 31, 2000, the fund did not have more than 25% of its total assets invested in any one industry.

The views expressed in this report reflect those of the portfolio manager only through the end of the period of the report as stated on the cover. The manager's views are subject to change at any time based on market or other conditions. For more information, see page A-3.

Fund Facts

Goal: long-term growth of capital by investing mainly in equity securities of Hong Kong, Taiwanese and Chinese issuers

Fund number: 352

Trading symbol: FHKCX

Start date: November 1, 1995

Size: as of October 31, 2000, more than $179 million

Manager: Joseph Tse, since inception; director of research, Fidelity Investments Management (Hong Kong), since 1994; manager, Asian portion of various global equity funds, since 1993; joined Fidelity in 1990

3

Annual Report

China Region

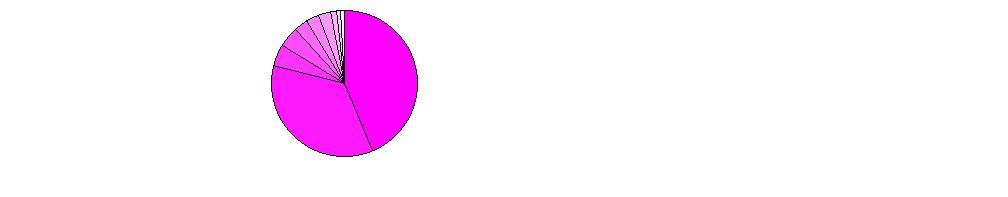

|

Geographic Diversification (% of fund's net assets) |

|||

|

As of October 31, 2000 |

|||

|

Hong Kong |

71.7% |

|

|

United Kingdom |

14.8% |

|

|

Taiwan |

8.3% |

|

|

United States of America |

3.6% |

|

|

China |

1.2% |

|

|

Cayman Islands |

0.3% |

|

|

Canada |

0.1% |

|

|

|

|||

|

As of April 30, 2000 |

|||

|

Hong Kong |

79.6% |

|

|

Taiwan |

8.3% |

|

|

United Kingdom |

8.2% |

|

|

United States of America |

3.3% |

|

|

China |

0.3% |

|

|

Bermuda |

0.1% |

|

|

Cayman Islands |

0.1% |

|

|

Singapore |

0.1% |

|

|

Percentages are adjusted for the effect of futures contracts, if applicable. |

|

Asset Allocation |

||

|

|

% of fund's |

% of fund's net assets |

|

Stocks |

96.4 |

97.1 |

|

Short-Term Investments |

3.6 |

2.9 |

|

Top Ten Stocks as of October 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

HSBC Holdings PLC (Hong Kong) (Reg.) (Banks) |

14.4 |

7.2 |

|

China Mobile (Hong Kong) Ltd. (Cellular) |

11.3 |

14.8 |

|

Cheung Kong Holdings Ltd. |

10.8 |

8.5 |

|

Hutchison Whampoa Ltd. (Electrical Equipment) |

8.9 |

10.9 |

|

Sun Hung Kai Properties Ltd. |

5.0 |

4.8 |

|

Hang Seng Bank Ltd. (Banks) |

4.9 |

1.2 |

|

Johnson Electric Holdings Ltd. (Electrical Equipment) |

3.9 |

3.2 |

|

Taiwan Semiconductor Manufacturing Co. Ltd. (Electronics) |

3.4 |

1.5 |

|

United Microelectronics Corp. (Electronics) |

3.1 |

1.8 |

|

Li & Fung Ltd. |

3.0 |

3.6 |

|

|

68.7 |

57.5 |

|

Top Ten Market Sectors as of October 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

Finance |

21.8 |

12.0 |

|

Utilities |

19.5 |

19.1 |

|

Construction & Real Estate |

18.5 |

16.8 |

|

Industrial Machinery & Equipment |

13.3 |

15.4 |

|

Technology |

9.4 |

11.5 |

|

Media & Leisure |

4.4 |

5.9 |

|

Retail & Wholesale |

3.4 |

6.4 |

|

Transportation |

3.1 |

2.5 |

|

Durables |

1.4 |

1.1 |

|

Energy |

1.1 |

0.0 |

Annual Report

China Region

Showing Percentage of Net Assets

|

Common Stocks - 96.4% |

|||

|

Shares |

Value (Note 1) |

||

|

BASIC INDUSTRIES - 0.2% |

|||

|

Chemicals & Plastics - 0.2% |

|||

|

China Agrotech Holdings Ltd. |

1,886,000 |

$ 205,580 |

|

|

Yizheng Chemical Fibre Co. Ltd. |

1,036,000 |

188,655 |

|

|

|

394,235 |

||

|

CONSTRUCTION & REAL ESTATE - 18.5% |

|||

|

Real Estate - 18.5% |

|||

|

Amoy Properties Ltd. |

818,000 |

744,785 |

|

|

Cheung Kong Holdings Ltd. |

1,745,000 |

19,300,746 |

|

|

Great Eagle Holdings Ltd. |

511,457 |

734,593 |

|

|

Henderson Land Development Co. Ltd. |

731,000 |

3,149,751 |

|

|

New World Development Co. Ltd. |

6,738 |

7,993 |

|

|

Sun Hung Kai Properties Ltd. |

1,095,021 |

9,057,362 |

|

|

Wharf Holdings Ltd. |

118,485 |

241,591 |

|

|

|

33,236,821 |

||

|

DURABLES - 1.4% |

|||

|

Textiles & Apparel - 1.4% |

|||

|

Glorious Sun Enterprises Ltd. |

5,820,000 |

873,230 |

|

|

Yue Yuen Industrial Holdings Ltd. |

830,000 |

1,538,032 |

|

|

|

2,411,262 |

||

|

ENERGY - 1.1% |

|||

|

Oil & Gas - 1.1% |

|||

|

PetroChina Co. Ltd. (H Shares) |

9,638,000 |

2,026,984 |

|

|

FINANCE - 21.8% |

|||

|

Banks - 21.4% |

|||

|

Citic Ka Wah Bank Ltd. |

1,892,000 |

576,241 |

|

|

Dao Heng Bank Group Ltd. |

316,000 |

1,596,625 |

|

|

Hang Seng Bank Ltd. |

747,500 |

8,795,020 |

|

|

HSBC Holdings PLC (Hong Kong) (Reg.) |

1,789,182 |

25,800,001 |

|

|

Liu Chong Hing Bank Ltd. |

647,000 |

622,279 |

|

|

Standard Chartered PLC |

51,357 |

740,055 |

|

|

Wing Hang Bank Ltd. |

116,000 |

354,042 |

|

|

|

38,484,263 |

||

|

Credit & Other Finance - 0.3% |

|||

|

Aeon Credit Service (ASIA) Co. Ltd. |

1,623,600 |

541,342 |

|

|

Insurance - 0.1% |

|||

|

Manulife Financial Corp. |

8,000 |

194,923 |

|

|

TOTAL FINANCE |

39,220,528 |

||

|

INDUSTRIAL MACHINERY & EQUIPMENT - 13.3% |

|||

|

Electrical Equipment - 13.3% |

|||

|

Chen Hsong Holdings Ltd. |

3,870,000 |

476,433 |

|

|

Delta Electronics, Inc. |

112,000 |

357,152 |

|

|

Hutchison Whampoa Ltd. |

1,285,500 |

15,949,336 |

|

|

Johnson Electric Holdings Ltd. |

3,578,320 |

7,112,633 |

|

|

|

23,895,554 |

||

|

|

|||

|

Shares |

Value (Note 1) |

||

|

MEDIA & LEISURE - 4.4% |

|||

|

Broadcasting - 2.3% |

|||

|

Asia Satellite Telecommunications Holdings Ltd. |

526,500 |

$ 1,066,780 |

|

|

Television Broadcasts Ltd. |

549,000 |

3,006,213 |

|

|

|

4,072,993 |

||

|

Lodging & Gaming - 0.6% |

|||

|

Mandarin Oriental International Ltd. |

342,000 |

218,880 |

|

|

Shangri-La Asia Ltd. |

828,000 |

817,600 |

|

|

|

1,036,480 |

||

|

Restaurants - 1.5% |

|||

|

Cafe de Coral Holdings Ltd. |

7,498,000 |

2,788,451 |

|

|

TOTAL MEDIA & LEISURE |

7,897,924 |

||

|

NONDURABLES - 0.3% |

|||

|

Beverages - 0.3% |

|||

|

Vitasoy International Holdings Ltd. |

3,496,500 |

502,194 |

|

|

RETAIL & WHOLESALE - 3.4% |

|||

|

General Merchandise Stores - 0.4% |

|||

|

China Everbright Ltd. |

808,000 |

735,681 |

|

|

Trading Companies - 3.0% |

|||

|

Li & Fung Ltd. |

2,890,000 |

5,373,848 |

|

|

TOTAL RETAIL & WHOLESALE |

6,109,529 |

||

|

TECHNOLOGY - 9.4% |

|||

|

Computer Services & Software - 0.6% |

|||

|

Prosten Technology Holdings Ltd. |

3,197,000 |

471,477 |

|

|

SINA.com (a) |

89,300 |

622,309 |

|

|

|

1,093,786 |

||

|

Computers & Office Equipment - 0.6% |

|||

|

Asustek Computer, Inc. (a) |

92,000 |

458,576 |

|

|

Quanta Computer, Inc. |

80,000 |

272,446 |

|

|

Stark Technology, Inc. |

40,000 |

245,201 |

|

|

|

976,223 |

||

|

Electronic Instruments - 0.1% |

|||

|

Group Sense International Ltd. |

5,136,000 |

220,643 |

|

|

Electronics - 8.1% |

|||

|

Asat Holdings Ltd. sponsored ADR |

113,400 |

751,275 |

|

|

Compeq Manufacturing Co. Ltd. (a) |

120,000 |

453,251 |

|

|

Hon Hai Precision Industries Co. Ltd. (a) |

158,800 |

830,873 |

|

|

Nanya Technology Corp. |

280,000 |

214,985 |

|

|

Realtek Semiconductor Corp. |

200 |

746 |

|

|

Taiwan Semiconductor |

2,020,308 |

6,129,727 |

|

|

United Microelectronics Corp. (a) |

3,108,600 |

5,485,765 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

TECHNOLOGY - continued |

|||

|

Electronics - continued |

|||

|

Varitronix International Ltd. |

336,000 |

$ 385,640 |

|

|

Winbond Electronics Corp. (a) |

319,310 |

309,424 |

|

|

|

14,561,686 |

||

|

TOTAL TECHNOLOGY |

16,852,338 |

||

|

TRANSPORTATION - 3.1% |

|||

|

Air Transportation - 2.2% |

|||

|

Cathay Pacific Airways Ltd. |

1,682,000 |

3,052,123 |

|

|

Swire Pacific Ltd. (A Shares) |

150,000 |

925,243 |

|

|

|

3,977,366 |

||

|

Railroads - 0.7% |

|||

|

MTR Corp. Ltd. |

843,000 |

1,248,617 |

|

|

Shipping - 0.1% |

|||

|

IMC Holdings Ltd. (a) |

1,823,000 |

147,281 |

|

|

Trucking & Freight - 0.1% |

|||

|

New World Infrastructure Ltd. |

296,000 |

269,507 |

|

|

TOTAL TRANSPORTATION |

5,642,771 |

||

|

UTILITIES - 19.5% |

|||

|

Cellular - 14.2% |

|||

|

China Mobile (Hong Kong) Ltd. (a) |

3,316,500 |

20,313,561 |

|

|

China Unicom Ltd. |

2,596,000 |

5,210,010 |

|

|

|

25,523,571 |

||

|

Electric Utility - 3.5% |

|||

|

CLP Holdings Ltd. |

891,500 |

4,161,427 |

|

|

Hong Kong Electric Holdings Ltd. |

672,000 |

2,219,045 |

|

|

|

6,380,472 |

||

|

Gas - 1.8% |

|||

|

Hong Kong & China Gas Co. Ltd. |

2,508,380 |

3,168,466 |

|

|

TOTAL UTILITIES |

35,072,509 |

||

|

TOTAL COMMON STOCKS (Cost $135,592,736) |

173,262,649 |

||

|

Convertible Bonds - 0.0% |

|||||

|

Moody's Ratings (unaudited) |

Principal Amount |

|

|||

|

MEDIA & LEISURE - 0.0% |

|||||

|

Lodging & Gaming - 0.0% |

|||||

|

Mandarin Oriental International Ltd. 6.75% 3/23/05 |

- |

|

$ 5 |

25,750 |

|

|

Cash Equivalents - 6.0% |

|||

|

Shares |

Value (Note 1) |

||

|

Fidelity Cash Central Fund, 6.61% (b) |

9,878,200 |

$ 9,878,200 |

|

|

Fidelity Securities Lending Cash |

877,800 |

877,800 |

|

|

TOTAL CASH EQUIVALENTS (Cost $10,756,000) |

10,756,000 |

||

|

TOTAL INVESTMENT PORTFOLIO - 102.4% (Cost $146,373,736) |

184,044,399 |

||

|

NET OTHER ASSETS - (2.4)% |

(4,335,701) |

||

|

NET ASSETS - 100% |

$ 179,708,698 |

||

|

Legend |

|

(a) Non-income producing |

|

(b) The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

|

Other Information |

|

Purchases and sales of securities, other than short-term securities, aggregated $230,453,968 and $227,132,957, respectively. |

|

The fund participated in the security lending program. At period end, the value of securities loaned amounted to $847,174. The fund received cash collateral of $877,800 which was invested in cash equivalents. |

|

The fund participated in the bank borrowing program. The average daily loan balance during the period for which loans were outstanding amounted to $2,104,500. The weighted average interest rate was 6.85%. |

|

Income Tax Information |

|

At October 31, 2000, the aggregate cost of investment securities for income tax purposes was $147,483,654. Net unrealized appreciation aggregated $36,560,745, of which $48,874,600 related to appreciated investment securities and $12,313,855 related to depreciated investment securities. |

|

At October 31, 2000, the fund had a capital loss carryforward of approximately $40,369,000, all of which will expire on October 31, 2006. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

China Region

Statement of Assets and Liabilities

|

|

October 31, 2000 |

|

|

Assets |

|

|

|

Investment in securities, at value |

|

$ 184,044,399 |

|

Cash |

|

242,989 |

|

Foreign currency held at value |

|

3,164,309 |

|

Receivable for investments sold |

|

403,619 |

|

Receivable for fund shares sold |

|

275,982 |

|

Dividends receivable |

|

8,829 |

|

Interest receivable |

|

36,807 |

|

Redemption fees receivable |

|

167 |

|

Other receivables |

|

1,257 |

|

Total assets |

|

188,178,358 |

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 6,911,519 |

|

|

Payable for fund shares redeemed |

414,043 |

|

|

Accrued management fee |

113,560 |

|

|

Other payables and |

152,738 |

|

|

Collateral on securities loaned, |

877,800 |

|

|

Total liabilities |

|

8,469,660 |

|

Net Assets |

|

$ 179,708,698 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 178,478,276 |

|

Undistributed net investment income |

|

6,212,134 |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

(42,634,885) |

|

Net unrealized appreciation (depreciation) on investments |

|

37,653,173 |

|

Net Assets, for 12,012,618 |

|

$ 179,708,698 |

|

Net Asset Value and redemption price per share ($179,708,698 ÷ 12,012,618 shares) |

|

$14.96 |

|

Maximum offering price per share (100/97.00 of $14.96) |

|

$15.42 |

Statement of Operations

|

|

Year ended October 31, 2000 |

|

|

Investment Income Dividends |

|

$ 3,741,235 |

|

Interest |

|

396,758 |

|

Security lending |

|

1,272 |

|

|

|

4,139,265 |

|

Less foreign taxes withheld |

|

(6,274) |

|

Total income |

|

4,132,991 |

|

Expenses |

|

|

|

Management fee |

$ 1,699,464 |

|

|

Transfer agent fees |

676,307 |

|

|

Accounting and security lending fees |

140,064 |

|

|

Non-interested trustees' compensation |

733 |

|

|

Custodian fees and expenses |

220,507 |

|

|

Registration fees |

67,950 |

|

|

Audit |

36,384 |

|

|

Legal |

3,489 |

|

|

Interest |

1,603 |

|

|

Reports to shareholders |

10,465 |

|

|

Miscellaneous |

3,851 |

|

|

Total expenses before reductions |

2,860,817 |

|

|

Expense reductions |

(24,581) |

2,836,236 |

|

Net investment income |

|

1,296,755 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities |

16,231,680 |

|

|

Foreign currency transactions |

(156,061) |

16,075,619 |

|

Change in net unrealized appreciation (depreciation) on: |

|

|

|

Investment securities |

(5,924,680) |

|

|

Assets and liabilities in |

(17,764) |

(5,942,444) |

|

Net gain (loss) |

|

10,133,175 |

|

Net increase (decrease) in net assets resulting from operations |

|

$ 11,429,930 |

|

Other Information |

|

$ 477,585 |

|

Sales charges - Retained by FDC |

|

$ 477,585 |

|

Expense reductions |

|

|

|

Directed brokerage arrangements |

|

$ 21,189 |

|

Transfer agent credits |

|

3,392 |

|

|

|

$ 24,581 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

China Region

Financial Statements - continued

Statement of Changes in Net Assets

|

Increase (Decrease) in Net Assets |

Year ended

October 31, |

Year ended

October 31, |

|

Operations |

$ 1,296,755 |

$ 2,362,496 |

|

Net realized gain (loss) |

16,075,619 |

9,831,552 |

|

Change in net unrealized appreciation (depreciation) |

(5,942,444) |

35,812,522 |

|

Net increase (decrease) in net assets resulting from operations |

11,429,930 |

48,006,570 |

|

Distributions to shareholders from net investment income |

(2,289,574) |

(4,312,427) |

|

Share transactions |

183,395,667 |

89,140,338 |

|

Reinvestment of distributions |

2,213,416 |

4,182,802 |

|

Cost of shares redeemed |

(177,672,782) |

(116,955,228) |

|

Net increase (decrease) in net assets resulting from share transactions |

7,936,301 |

(23,632,088) |

|

Redemption fees |

1,114,437 |

631,730 |

|

Total increase (decrease) in net assets |

18,191,094 |

20,693,785 |

|

Net Assets |

|

|

|

Beginning of period |

161,517,604 |

140,823,819 |

|

End of period (including undistributed net investment income of $6,212,134 and $1,848,938, respectively) |

$ 179,708,698 |

$ 161,517,604 |

|

Other Information Shares |

|

|

|

Sold |

10,586,910 |

7,169,572 |

|

Issued in reinvestment of distributions |

129,289 |

415,738 |

|

Redeemed |

(10,118,064) |

(9,914,200) |

|

Net increase (decrease) |

598,135 |

(2,328,890) |

Financial Highlights

|

Years ended October 31, |

2000 |

1999 |

1998 |

1997 |

1996 E |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, beginning of period |

$ 14.15 |

$ 10.25 |

$ 11.06 |

$ 12.97 |

$ 10.00 |

|

Income from Investment Operations |

|

|

|

|

|

|

Net investment income C |

.10 |

.19 |

.31 |

.17 |

.29 |

|

Net realized and unrealized gain (loss) |

.80 |

3.98 |

(1.10) |

(1.95) |

2.64 |

|

Total from investment operations |

.90 |

4.17 |

(.79) |

(1.78) |