|

|

|

|

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

| Check the appropriate box: | |||

| [ ] | Preliminary Proxy Statement | [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement | ||

| [ ] | Definitive Additional Materials | ||

| [ ] | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | ||

| IKOS Systems, Inc. |

|

|

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

|

|

||

| (1) | Title of each class of securities to which transaction applies: | |

|

|

||

| (2) | Aggregate number of securities to which transaction applies: | |

|

|

||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

|

||

| (4) | Proposed maximum aggregate value of transaction: | |

|

|

||

| (5) | Total fee paid: | |

|

|

||

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

|

|

||

| (2) | Form, Schedule or Registration Statement No.: | |

|

|

||

| (3) | Filing Party: | |

|

|

||

| (4) | Date Filed: | |

|

|

Notes:

IKOS SYSTEMS, INC.

19050 Pruneridge Avenue

Cupertino, California 95014

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JANUARY 23, 2001

Dear Stockholder:

You are invited to attend the Annual Meeting of the Stockholders of IKOS Systems, Inc. (the “Company”), which will be held Tuesday, January 23, 2001, at 10:00 a.m. Pacific Standard Time, at the South San Jose Residence Inn, San Jose, California for the following purposes:

| 1. | To elect six directors of the Company to serve for the ensuing year. | ||

| 2. | To approve an amendment to the Company’s 1996 Employee Stock Purchase Plan increasing by 400,000 the maximum number of shares of the Company’s common stock that may be issued thereunder. | ||

| 3. | To ratify the appointment of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending September 29, 2001. | ||

| 4. | To transact such other business as may properly come before the meeting. | ||

Stockholders of record at the close of business on December 15, 2000 are entitled to notice of, and to vote at, this meeting and any continuations or adjournments thereof. For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder for any purpose germane to the meeting during ordinary business hours at the principal executive offices of IKOS Systems, Inc. 19050 Pruneridge Avenue, Cupertino, California 95014.

| By Order of the Board of Directors, | |||

| /s/ Joseph W. Rockom | |||

| Joseph W. Rockom, Secretary |

| Cupertino, California December 21, 2000 |

|||

IKOS SYSTEMS, INC.

19050 Pruneridge Avenue

Cupertino, California 95014

(408) 255-4567

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

The accompanying proxy is solicited by the Board of Directors of IKOS Systems, Inc., a Delaware corporation (the “Company”), for use at the Annual Meeting of Stockholders to be held Tuesday, January 23, 2001 (the “Annual Meeting”), or any adjournment thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The date of this Proxy Statement is December 21, 2000, the approximate date on which this Proxy Statement and the accompanying form of proxy were first sent or given to stockholders.

GENERAL INFORMATION

Annual Report. An annual report for the fiscal year ended September 30, 2000 is enclosed with this Proxy Statement.

Voting Securities. Only stockholders of record as of the close of business on December 15, 2000 will be entitled to vote at the meeting and any adjournment thereof. As of that date, there were 8,847,282 shares of Common Stock of the Company, par value $0.01 per share, issued and outstanding. Stockholders may vote in person or by proxy. Each holder of shares of Common Stock is entitled to one (1) vote for each share of stock held on the proposals presented in this Proxy Statement. The Company’s Bylaws provide that a majority of all of the shares of stock entitled to vote, whether present in person or represented by proxy, shall constitute a quorum for the transaction of business at the meeting.

Solicitation of Proxies. The cost of soliciting proxies will be borne by the Company. In addition, the Company will solicit stockholders by mail through its regular employees, and will request banks and brokers and other custodians, nominees and fiduciaries to solicit their customers who have stock of the Company registered in the names of such persons and will reimburse them for their reasonable, out-of-pocket costs. The Company may use the services of its officers, directors and others to solicit proxies, personally or by telephone, without additional compensation.

Voting of Proxies. All valid proxies received prior to the meeting will be voted. All shares represented by a proxy will be voted, and where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the specification so made. If no choice is indicated on the proxy, the shares will be voted in favor of the proposal. A stockholder giving a proxy has the power to revoke his or her proxy, at any time prior to the time it is voted, by delivery to the Secretary of the Company of a written instrument revoking the proxy or a duly executed proxy with a later date, or by attending the meeting and voting in person.

Security Ownership of Certain Beneficial Owners and Management. The following table contains information as of October 31, 2000 regarding the ownership of the Common Stock of the Company by all persons who, to the knowledge of the Company, were (i) the beneficial owners of 5% or more of the outstanding shares of Common Stock of the Company, (ii) each director and director nominee of the Company, (iii) the Chief Executive Officer and the four other most highly compensated executive officers of the Company as of September 30, 2000 whose salary and bonus for the fiscal year ended September 30, 2000 exceeded $100,000 and (iv) all current executive officers and directors of the Company as a group.

| Shares Beneficially Owned(2) | |||||||

| Name of Beneficial Owner(1) | Number | Percentage | |||||

| Ramon A. Nuñez | 316,591 | (3) | 3.49 | % | |||

| Gerald S. Casilli | 240,758 | (4) | 2.73 | % | |||

| Robert Hum | 101,209 | (5) | 1.14 | % | |||

| Thomas Gardner | 30,625 | (6) | * | ||||

| William Stevens | 8,500 | (7) | * | ||||

| Glenn E. Penisten | 24,115 | (8) | * | ||||

| Shares Beneficially Owned(2) | |||||||

| Name of Beneficial Owner(1) | Number | Percentage | |||||

| Nader Fathi | 68,187 | (9) | * | ||||

| James R. Oyler | 18,500 | (10) | * | ||||

| Jackson Hu | 8,500 | (11) | * | ||||

| All Directors and Executive Officers as a Group (11 persons) | 989,446 | (12) | 10.52 | % | |||

______________

| * | Less than 1% | |

| (1) | Except as otherwise indicated, the address of each beneficial owner is c/o the Company, 19050 Pruneridge Avenue, Cupertino, California 95014. | |

| (2) | This table is based on information supplied by officers, directors and principal stockholders. Except as otherwise indicated in the footnotes to the above table, the Company believes that the persons named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, subject to community property laws, where applicable. | |

| (3) | Includes 286,554 shares subject to options exercisable within 60 days of October 31, 2000. | |

| (4) | Includes 28,875 shares subject to options exercisable within 60 days of October 31, 2000. | |

| (5) | Includes 101,209 shares subject to options exercisable within 60 days of October 31, 2000. | |

| (6) | Includes 5,625 shares subject to options exercisable within 60 days of October 31, 2000. | |

| (7) | Includes 8,500 shares subject to options exercisable within 60 days of October 31, 2000. | |

| (8) | Includes 16,000 shares subject to options exercisable within 60 days of October 31, 2000. | |

| (9) | Includes 58,587 shares subject to options exercisable within 60 days of October 31, 2000. | |

| (10) | Includes 16,000 shares subject to options exercisable within 60 days of October 31, 2000. | |

| (11) | Includes 8,500 shares subject to options exercisable within 60 days of October 31, 2000. | |

| (12) | Includes 621,449 shares subject to options exercisable within 60 days of October 31, 2000. |

PROPOSAL 1

ELECTION OF DIRECTORS

Management’s nominees for election to the Board of Directors (the “Board”) at the Annual Meeting are Gerald S. Casilli, Ramon A. Nuñez, James R. Oyler, Glenn E. Penisten, William Stevens, and Jackson Hu. If elected, each nominee will hold office until the next annual meeting of stockholders or until his successor is elected and qualified unless he shall resign or his office becomes vacant by death, removal, or other cause in accordance with the Bylaws of the Company. If a quorum is present and voting, the nominees for director receiving the highest number of votes will be elected as directors. Abstentions and shares held by brokers that are present, but not voted because the brokers were prohibited from exercising discretionary authority, i.e., “broker non-votes,” will be counted as present in determining if a quorum is present.

It is intended that votes pursuant to the Proxies will be cast for the named nominees. The persons named in the accompanying form of proxy will vote the shares represented thereby for the named nominees. Management knows of no reason why any of the named nominees should be unable or unwilling to serve. However, if any named nominee(s) should for any reason be unable or unwilling to serve, the Proxies will be voted for the election of such other person(s) for the office of director as management may recommend in the place of such nominee(s).

At the Annual Meeting, six (6) directors of the Company are to be elected for the ensuing year and until their successors are elected and qualified. Proxies cannot be voted for a greater number of persons than the number of nominees named. The nominees for election to the office of director and certain information with respect to their age and background are set forth below. Messrs. Casilli, Nuñez, Oyler, Penisten, Stevens and Hu each was elected to his present term of office at the Annual Meeting of Stockholders of the Company held on January 19, 2000.

|

Nominee |

Positions with the Company |

Age |

Director Since |

|||||||

| Gerald S. Casilli | Chairman of the Board | 61 | 1986 | |||||||

| Ramon A. Nuñez | Chief Executive Officer, President and Director | 46 | 1994 | |||||||

| James R. Oyler | Director | 54 | 1991 | |||||||

| Glenn E. Penisten | Director | 69 | 1985 | |||||||

| William Stevens | Director | 59 | 1998 | |||||||

| Jackson Hu | Director | 41 | 1998 | |||||||

Mr. Casilli has served as Chairman of the Board since July 1989 and served as Chief Executive Officer from April 1989 to August 1995. He has served as a director since 1986. Mr. Casilli is also a Director for Cepheid Corporation and Evans & Sutherland Computer Corporation. From January 1986 to December 1989, he was a general partner of Trinity Ventures, Ltd., a venture capital firm and a former investor in the Company. Mr. Casilli was a general partner of Genesis Capital, a venture capital firm, from February 1982 to 1990. Mr. Casilli founded Millennium Systems, a manufacturer of microprocessor development systems, in 1973 and served as its President and Chief Executive Officer until 1982.

Mr. Nuñez was appointed Chief Executive Officer in August 1995. Mr. Nuñez had been President, Chief Operating Officer and Director of the Company since October 1994. He had served as Vice President of Worldwide Sales since July 1993. Mr. Nuñez joined the Company in April 1990 as Vice President of North American Sales after five years in sales management with Zycad Corporation. Earlier he was branch sales manager for Cadnetix (now part of Intergraph) in Southern California.

Mr. Oyler has served as a member of the Board since October 1991. He is presently President, Chief Executive Officer and Director of Evans & Sutherland Computer Corporation. Evans & Sutherland develops, manufactures and markets high performance systems for various applications with demanding graphics requirements. Prior to his position with Evans & Sutherland, Mr. Oyler was President of AMG, Inc., a process machine design company. From 1976 to 1990, Mr. Oyler worked at Harris Corporation, most recently as Senior Vice President and Sector Executive, where he was responsible for nine operating divisions. Prior to that time, he held positions as consultant and associate with Booz, Allen & Hamilton in New York.

Mr. Penisten has been a member of the Board since September 1985. Since September 1985, he has been a general partner of Alpha Partners, a venture capital firm and former investor in the Company. From January 1985 to August 1985, he was a general partner of P&C Venture Partners, a venture capital firm. From 1982 to 1985, he was

a Senior Vice President at Gould/AMI. From 1976 to 1982, Mr. Penisten served as Chief Executive Officer of AMI, a semiconductor manufacturer. Mr. Penisten is also a director of Bell Microproducts, Inc. and Pinnacle Systems, Inc. and is Chairman of the Board of Network Peripherals, Inc. and Superconductor Technologies.

Mr. Stevens joined the Company’s Board in December 1998. He was a founder of the Triad Systems Corporation and was President and Chairman of the Board from 1972 to 1985 and Chairman from 1985 to 1996. Prior to founding Triad, he was employed from 1961 to 1971 by Data Disc, Inc., a manufacturer of computer peripherals, where he served in various technical management positions including President. Mr. Stevens has served on numerous boards of both private and public companies.

Mr. Hu joined the Company’s Board in December 1998. He has 20 years of experience in the semiconductor industry, including all phases of development, marketing and management. Since October 1996, he has been the President and Chief Executive Officer of Sirf Technology, Inc., a communications IC and IP company. From June 1989 to September 1996, Mr. Hu held various positions at S3, Inc., most recently as senior vice president and general manager, where he helped to grow the company from a start-up to a company with revenues of approximately $450 million. In addition to architecting and managing the development of S3’s venerable 2D GUI accelerator families, he established the company’s analog and COT design capabilities. He also created an operations and quality infrastructure for very high volume production. Mr. Hu started and managed the audio and communications business unit at S3. Before, S3 he held positions at Western Digital as Director of Graphics Engineering, Verticom as Director of Engineering, and Zilog as project leader. Mr. Hu holds a Ph.D in computer science from the University of Illinois, Urbana and an MBA from the University of Santa Clara.

Board Meetings. During the fiscal year ended September 30, 2000, the Board held four meetings and took action by unanimous written consent three times. No director serving on the Board in fiscal year 2000 attended fewer than 75% of such meetings of the Board and the Committees on which he serves.

Committees of the Board. The Company has an Audit Committee and a Compensation Committee. The Audit Committee’s function is to review with the Company’s independent auditors and management the annual financial statements and independent auditors’ opinion, review the scope and results of the examination of the Company’s financial statements by the independent auditors, approve all professional services and related fees performed by the independent auditors, recommend the retention of the independent auditors to the Board, subject to ratification by the stockholders, and periodically review the Company’s accounting policies and internal accounting and financial controls. The members of the Audit Committee during the fiscal year ended September 30, 2000 were Messrs. Stevens, Oyler and Penisten. All members of the Audit Committee are “independent” under the rules of the NASDAQ Stock Market currently applicable to the Company. During the fiscal year ended September 30, 2000, the Audit Committee held four meetings and took action by unanimous written consent zero times. The Board of Directors has adopted a charter for the Audit Committee, which is attached as Appendix A to this Proxy Statement. For additional information concerning the Audit Committee see “Report of the Audit Committee.”

The Compensation Committee’s function is to review and recommend salary and bonus levels for executive officers and certain other management employees and to recommend stock option grants. The members of the Compensation Committee during the fiscal year ended September 30, 2000 were Messrs. Stevens, Hu and Penisten. During the fiscal year ended September 30, 2000, the Compensation Committee held three meetings and took action by unanimous written consent one time. For additional information concerning the Compensation Committee, see “REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION.”

Compensation of Directors

The Company pays each of its outside directors $4,000 per quarter for their services as members of the Board. In lieu of the directors fees, and as an employee of the Company, the Chairman of the Board receives $100,000 per year plus bonus and is eligible to receive options to purchase the Company’s Common Stock under the Company’s 1995 Stock Option Plan. In addition, all directors who were not members of management during the fiscal year ended September 30, 2000 received stock options to purchase 6,000 shares of Common Stock pursuant to the 1995 Outside Directors Stock Option Plan upon the date of the 2000 annual meeting of stockholders.

The following table provides the specified information concerning all compensation paid to persons who were directors of the Company during the fiscal year ended September 30, 2000 who are not named in the Summary Compensation Table.

DIRECTOR COMPENSATION FOR LAST FISCAL YEAR

|

Cash Compensation |

Security Grants |

||||||

| Name | Annual Retainer Fees | Number of Securities Underlying Options (#) |

|||||

| Gerald S. Casilli | $150,404(1) | 0 | |||||

| James R. Oyler | 16,000 | 6,000 | |||||

| Glenn E. Penisten | 16,000 | 6,000 | |||||

| William Stevens | 16,000 | 6,000 | |||||

| Jackson Hu | 16,000 | 6,000 | |||||

______________

| (1) | Includes $100,000 paid to Mr. Casilli in compensation for his service to the Company as Chairman of the Board and $50,000 paid to Mr. Casilli as an objective bonus. |

EXECUTIVE COMPENSATION AND OTHER MATTERS

Compensation of Executive Officers

The following table sets forth information concerning the compensation during the fiscal years ended September 30, 2000, October 2, 1999 and October 3, 1998 of the Chief Executive Officer and the four other most highly compensated executive officers of the Company as of September 30, 2000 whose salary and bonus for the fiscal year ended September 30, 2000 exceeded $100,000.

SUMMARY COMPENSATION TABLE

| Annual Compensation | Long Term Compensation |

|||||||||||||||

| Name and Principal Position | Year | Salary | Bonus | Other Annual Compensation |

Awards Option Shares |

|||||||||||

| Ramon A. Nuñez | 2000 | $ | 289,231 | $ | 79,164 | (4) | 35,000 | |||||||||

| Chief Executive Officer, President and Director | 1999 | 255,193 | 25,000 | (4) | 80,000 | |||||||||||

| 1998 | 240,492 | 32,000 | (4) | 30,000 | ||||||||||||

| Robert Hum(1) | 2000 | 231,384 | 60,519 | (4) | 41,000 | |||||||||||

| Vice President of Engineering and Chief | 1999 | 212,404 | 12,800 | (4) | 55,000 | |||||||||||

| Operation Officer | 1998 | 180,951 | 29,836 | (4) | 10,000 | |||||||||||

| Dan Hafeman | 2000 | 180,731 | 52,267 | (4) | 13,000 | |||||||||||

| Vice President of Advanced Research and | 1999 | 177,842 | — | (4) | 40,000 | |||||||||||

| Chief Technical Officer | 1998 | 164,499 | 23,656 | (4) | 10,000 | |||||||||||

| Thomas Gardner(2) | 2000 | 147,724 | — | 138,142 | (5) | 18,000 | ||||||||||

| Vice President of Domestic Sales | 1999 | 126,590 | — | 107,121 | (5) | 25,000 | ||||||||||

| 1998 | 96,813 | — | 75,158 | (5) | 15,000 | |||||||||||

| Nader Fathi(3) | 2000 | 171,137 | 156,629 | (6) | 15,000 | |||||||||||

| Vice President of International Sales | 1999 | 166,402 | — | 137,779 | (6) | 20,000 | ||||||||||

| 1998 | 159,156 | — | 78,628 | (6) | 41,250 | |||||||||||

______________

| (1) | Mr. Hum was promoted to Chief Operating Officer in April 2000. | |

| (2) | Mr. Gardner was appointed Vice President of Domestic Sales on June 5, 1998. | |

| (3) | Mr. Fathi was appointed Vice President of International Sales June 5, 1998. | |

| (4) | Total amount of personal benefits paid to this executive officer during the fiscal year was less than the lesser of (i) $50,000 or (ii) 10% of such executive officer’s total reported salary and bonus. | |

| (5) | Represents amounts paid to Mr. Gardner as sales commissions. | |

| (6) | Represents amounts paid to Mr. Fathi as sales commissions. |

Stock Options Granted During Fiscal 2000

The following table provides the specified information concerning grants of options to purchase the Company’s Common Stock made during the fiscal year ended September 30, 2000 to the persons named in the Summary Compensation Table.

STOCK OPTION GRANTS IN LAST FISCAL YEAR

| Individual Grants in Fiscal 2000 | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(3) |

||||||||||||||||||

| Name | Number of Securities Underlying Options Granted(1) |

% of Total Options Granted to Employees in Fiscal Year |

Exercise or Base Price(2) ($/Sh) |

Expiration Date |

5% ($) | 10% ($) | |||||||||||||

| Ramon A. Nuñez | 25,000 | 4.43 | % | $ | 7.42 | 11/16/09 | $ | 116,691 | $ | 295,7187 | |||||||||

| 10,000 | 1.78 | % | $ | 7.42 | 11/16/09 | $ | 46,676 | $ | 118,28 | ||||||||||

| Thomas Gardner | 18,000 | 3.19 | % | $ | 7.42 | 11/16/09 | $ | 84,017 | $ | 212,917 | |||||||||

| Robert Hum | 17,500 | 3.10 | % | $ | 7.42 | 11/16/09 | $ | 81,683 | $ | 207,003 | |||||||||

| 8,500 | 1.51 | % | $ | 7.42 | 11/16/09 | $ | 39,675 | $ | 100,544 | ||||||||||

| 15,000 | 2.66 | % | $ | 9.875 | 04/18/10 | $ | 93,155 | $ | 236,073 | ||||||||||

| Daniel Hafeman | 5,000 | 0.88 | % | $ | 7.42 | 11/16/09 | $ | 23,338 | $ | 59,143 | |||||||||

| 8,000 | 1.42 | % | $ | 7.42 | 11/16/09 | $ | 37,341 | $ | 94,630 | ||||||||||

| Nader Fathi | 15,000 | 2.66 | % | $ | 7.42 | 1/19/10 | $ | 44,752 | $ | 112,956 | |||||||||

______________

| (1) | Options granted in fiscal 2000 under the Company’s 1995 Stock Option Plan (the “Option Plan”) generally vest 12.5% six months after commencement of employment or grant and continue to vest thereafter in equal monthly increments over three and one-half years, conditioned upon continued employment with the Company. Under the Option Plan, the Board retains discretion to modify the terms, including the price of outstanding options. See “EXECUTIVE COMPENSATION AND OTHER MATTERS-Employment Contracts and Termination of Employment and Change-in-Control Arrangements.” | |

| (2) | All options were granted at fair market value on the date of grant. | |

| (3) | Potential gains are net of exercise price, but before taxes associated with exercise. These amounts represent certain assumed rates of appreciation only, in accordance with the Securities and Exchange Commission’s rules. Actual gains, if any, on stock option exercises are dependent on the future performance of the Common Stock, overall market conditions and the option holders’ continued employment through the vesting period. The amounts reflected in this table may not necessarily be achieved. One share of stock purchased at $7.42 in fiscal 2000 would yield profits of approximately $4.67 per share at 5% appreciation over ten years, or approximately $11.83 per share at 10% appreciation over the same period. One share of stock purchased at $9.875 in fiscal 2000 would yield profits of approximately $6.21 per share at 5% appreciation over ten years, or approximately $15.74 per share at 10% appreciation over the same period. |

Option Exercises and Fiscal 2000 Year-End Values

The following table provides the specified information concerning exercises of options to purchase the Company’s Common Stock in the fiscal year ended September 30, 2000 and unexercised options held as of September 30, 2000 by the persons named in the Summary Compensation Table. A portion of the shares subject to these options may not yet be vested and may be subject to repurchase by the Company at a price equal to the option exercise price, if the corresponding options were exercised before such shares had vested.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

| Shares Acquired on |

Value Realized |

Number of Securities Underlying Unexercised Options at 9/30/00 |

Value in Dollars of Unexercised In-the-Money Options at 9/30/00 |

||||||||||||||||

| Name | Exercise | ($) | Exercisable (1)(2) | Unexercisable (3) | Exercisable (2) | Unexercisable (4) | |||||||||||||

| Ramon A. Nuñez | — | $ | — | 279,179 | 63,020 | $ | 1,677,532 | $ | 247,797 | ||||||||||

| Robert Hum | — | $ | — | 92,397 | 63,602 | $ | 567,366 | $ | 202,536 | ||||||||||

| Daniel Hafeman | 10,000 | $ | 58,750 | 38,416 | 70,133 | $ | 270,284 | $ | 528,227 | ||||||||||

| Thomas Gardner | 25,000 | $ | 180,625 | 4,437 | 48,562 | $ | 14,253 | $ | 335,711 | ||||||||||

| Nader Fathi | — | $ | — | 55,325 | 34,125 | $ | 353,992 | $ | 163,031 | ||||||||||

______________

| (1) | Options granted in fiscal 2000 under the Option Plan generally vest 12.5% six months after commencement of employment or grant and continue to vest thereafter in equal monthly increments over three and one-half years, conditioned upon continued employment with the Company. | |

| (2) | Represents shares which are immediately exercisable and/or vested. Based on the closing price of $10.375, as reported on the Nasdaq National Market on September 29, 2000, less the exercise price. | |

| (3) | Represents shares, which are unvested and/or not immediately exercisable. | |

| (4) | Based on the closing price of $10.375, as reported on the Nasdaq National Market on September 29, 2000, less the exercise price. |

Employment Contracts and Termination of Employment and Change-in-Control Arrangements

The Company has an employment agreement with Ramon A. Nuñez, the Company’s Chief Executive Officer, President and Director. Mr. Nuñez's employment agreement provides that Mr. Nuñez shall receive an annual salary, subject to review, and other benefits on the same basis as other members of senior management. Mr. Nuñez's salary for the year ended September 30, 2000 was $289,230. Mr. Nuñez participates in a Management Incentive Plan whereby he and other members of our senior management are entitled to a performance bonus for attaining certain earnings objectives as outlined by the Compensation Committee. In addition, Mr. Nuñez and other executives are granted options to purchase shares of Common Stock at the discretion and recommendation of the Chairman of the Board and approved by the Compensation Committee. Mr. Nuñez's employment pursuant to his employment agreement may be terminated by the Company at any time, with or without cause; provided, however, if Mr. Nuñez’s employment is terminated by the Company for any reason other than cause (as defined in the employment agreement) he shall be entitled to the following severance benefits: (i) payment over a nine (9) month period of a monthly amount equal to his average monthly salary for the twelve (12) months prior to his termination; (ii) continued vesting of stock options granted pursuant to his employment agreement; and (iii) continued provision of employee benefits for the nine (9) month period following termination.

The Company has entered into severance agreements with each of its current executive officers. In general, such agreements provide that if within one year of a transfer of control of the Company, as defined in the agreement, an executive officer’s employment is terminated by the Company without cause, the executive officer terminates his employment with the Company as a result of being required to relocate, as defined in the agreement, or the executive officer’s base salary immediately prior to the transfer of control is reduced, he shall continue to receive his base salary and benefits for a period of one (1) year after his date of termination. In addition, such agreements provide that any unvested stock options held by an executive officer on his date of termination shall become fully vested.

Options granted under the Company’s Option Plan contain provisions pursuant to which, under certain circumstances, all outstanding options and shares granted under such plan will become fully vested and immediately exercisable upon a “transfer of control” as defined in such plan.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers, directors and persons who beneficially an owner of 10% or more of the Company’s common stock to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission (SEC). These persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. Based solely upon the Company’s review of the forms furnished to it and written representation from certain reporting persons, the Company believes that all filing requirements applicable to its executive officers, directors and 10% beneficial owners were complied with in fiscal 2000.

Changes to Benefit Plans

1996 Employee Stock Purchase Plan. The Company has proposed the approval of an amendment to the Company’s 1996 Employee Stock Purchase Plan (the “Purchase Plan”) to increase the maximum aggregate number of shares of the Company’s Common Stock issuable under the Purchase Plan by 400,000 shares from 650,000 shares to 1,050,000 shares, as described below under the caption, “APPROVAL OF AMENDMENT TO 1996 EMPLOYEE STOCK PURCHASE PLAN.” Purchases of stock under the Purchase Plan are made at the discretion of participants. Accordingly, future purchases under the Purchase Plan are not determinable. Non-employee directors are not eligible to participate in the Purchase Plan.

The following table sets forth shares purchased pursuant to the 1996 Employee Stock Purchase Plan during the fiscal year ended September 30, 2000 by:

| Name | Exercise Price | Number of Shares | |||||

| Ramon Nuñez | $ | 6.47 | 1,590 | ||||

| Robert Hum | $ | — | — | ||||

| Dan Hafeman | $ | 5.74 | 641 | ||||

| Thomas Gardner | $ | — | — | ||||

| Nader Fathi | $ | 6.72 | 2,000 | ||||

| Executive Group | $ | 6.56 | 7,947 | ||||

| Non-executive officer employee group | $ | 6.58 | 141,840 | ||||

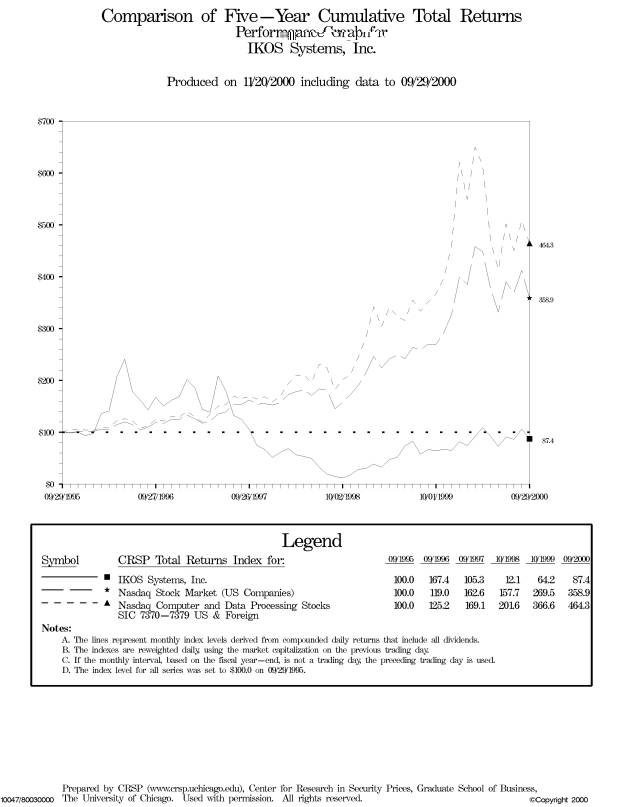

COMPARISON OF STOCKHOLDER RETURN(1)

Set forth below is a line graph comparing the annual percentage change in the cumulative total return on the Company’s Common Stock with the CRSP Total Return Index for the Nasdaq Stock Market (U.S. Companies) and the Nasdaq Computer and Data Processing Stocks (SIC 7370-7379 US & Foreign) for the period commencing October 1, 1995 and ending September 30, 2000.

REPORT OF THE AUDIT COMMITTEE

The following is the report of the Audit Committee with respect to the Company’s audited financial statements for the fiscal year ended September 30, 2000. The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the 1934 Securities Exchange Act, as amended, except to the extent that the Company specifically incorporates it by reference in such filing.

The Audit Committee has reviewed and discussed the Company’s audited financial statements with management. The Audit Committee has discussed with Ernst & Young LLP, the Company’s independent auditors, the matters required to be discussed by SAS 61 (Codification of Statements on Accounting Standards) which includes, among other items matters related to the conduct of the audit of the Company’s financial statements. The committee has also received written disclosures and the letter form Ernst & Young LLP required by the Independence Standards Board Standard No. 1 (which relates to the auditors’ independence from the Company and its related entities) and has discussed with Ernst & Young LLP their independence form the Company.

Based on the review and discussions referred to above, the committee recommended to the Company’s Board of Directors that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2000.

| AUDIT COMMITTEE | |

| James R. Oyler Glenn E. Penisten William Stevens |

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The Compensation Committee is comprised of three outside directors of the Board and is responsible for setting and monitoring policies governing compensation of executive officers. The Compensation Committee reviews the performance and compensation levels for executive officers and sets salary and bonus levels and option grants under the Option Plan. The objectives of the Committee are to correlate executive compensation with the Company’s business objectives and performance, and to enable the Company to attract, retain and reward executive officers who contribute to the long-term success of the Company.

Salary

The Compensation Committee annually assesses the performance and sets the salary of the Company’s President and Chief Executive Officer, Ramon A. Nuñez. In turn, Mr. Nuñez annually assesses the performance of all other executive officers and recommends salary increases which are reviewed and approved by the Compensation Committee.

In particular, Mr. Nuñez’s compensation as the Company’s President and Chief Executive Officer is based on compensation levels of President/Chief Executive Officers of comparable size companies. In addition, the Compensation Committee considers certain incentive objectives based on the Company’s performance as it relates to revenue levels and earnings per share levels.

In determining executive officer salaries, the Compensation Committee reviews recommendations from Mr. Nuñez which include information from salary surveys, performance evaluations and the financial condition of the Company. The Compensation Committee also establishes both financial and operational based objectives and goals in determining executive officer salaries. These goals and objectives include sales and spending forecasts for the upcoming year and published executive compensation literature for comparable sized companies.

For more information regarding the compensation and employment arrangements of Mr. Nuñez and other executive officers of the Company, see “EXECUTIVE COMPENSATION AND OTHER MATTERS—Compensation of Executive Officers and Employment Contracts and Termination of Employment and Change-in-Control Arrangements.”

Bonuses

The Compensation Committee administers a bonus plan to provide additional incentives to executives who meet established performance goals for the Company. In consultation with the Chief Executive Officer, the Compensation Committee annually determines the total amount of cash bonuses available for executive officers and certain other management employees. In fiscal 2000, awards under this bonus plan were contingent upon the Company’s attainment of revenue and operating profit targets, recommended by the Chief Executive Officer and approved by the Compensation Committee. The target amount of the bonus for the Chief Executive Officer and more senior executive officers was set by the Compensation Committee; the amounts of individual bonuses for the remaining executive officers and other management were proposed by the Chief Executive Officer, subject to approval by the Compensation Committee. Awards are weighted so that proportionately higher awards are received when the Company’s performance reaches maximum targets, proportionately smaller awards are received when the Company’s performance reaches minimum targets and no awards are received when the Company does not meet minimum performance targets.

Stock Options

The Compensation Committee believes that employee equity ownership provides significant motivation to executive officers to maximize value for the Company’s stockholders and, therefore, periodically grants stock options under the Option Plan. Stock options are granted at the current market price and will only have value if the Company’s stock price increases over the exercise price.

The Compensation Committee determines the size and frequency of option grants for executive officers, after consideration of recommendations from the Chairman of the Board. Recommendations for options are based upon the relative position and responsibilities of each executive officer, previous and expected contributions of each officer to the Company and previous option grants to such executive officers. Generally, option grants vest 12.5% six months after commencement of employment or six months after the date of grant and continue to vest thereafter in equal monthly installments over three and one-half years, conditioned upon continued employment with the Company.

| COMPENSATION COMMITTEE | |

| Jackson Hu William Stevens Glenn E. Penisten |

PROPOSAL 2

APPROVAL OF AMENDMENT TO 1996 EMPLOYEE STOCK PURCHASE PLAN

General

In October 1995, the Board adopted the 1996 Employee Stock Purchase Plan (the “Purchase Plan”). The Purchase Plan provides a means by which employees may purchase Common Stock of the Company through payroll deductions. As of December 15, 2000 approximately 178,000 shares remained available for future issuance under the Purchase Plan. In December 2000, subject to stockholder approval, the Board increased the number of shares authorized for issuance under the Purchase Plan by 400,000 to 1,050,000 shares.

Description of Plan

The following summary of the Purchase Plan is qualified in its entirety by the specific language of the Purchase Plan, a copy of which is available to any stockholder upon request.

General. The Purchase Plan is intended to qualify as an “employee stock purchase plan” under section 423 of the Code. Each participant in the Purchase Plan is granted at the beginning of each offering under the plan (an “Offering”) the right to purchase through accumulated payroll deductions up to a number of shares of the Common Stock of the Company (a “ Purchase Right”) determined on the first day of the Offering. The Purchase Right is automatically exercised on the last day of the Offering unless the participant has withdrawn from participation in the Offering or in the Purchase Plan prior to such date.

Shares Subject to Plan. Currently, a maximum of 650,000 of the Company’s authorized but unissued or reacquired shares of Common Stock may be issued under the Purchase Plan, subject to appropriate adjustment in the event of a stock dividend, stock split, reverse stock split, recapitalization, combination, reclassification or similar change in the Company’s capital structure or in the event of any merger, sale of assets or other reorganization of the Company. In December 2000, the Board, subject to stockholder approval, amended the Purchase Plan to increase its share reserve by 400,000 shares to an aggregate of 1,050,000 shares. The stockholders are now being requested to approve the increase in the Purchase Plan reserve at the Annual Meeting. If any Purchase Right expires or terminates, the shares subject to the unexercised portion of such Purchase Right will again be available for issuanc e under the Purchase Plan.

Administration. The Purchase Plan is administered by the Board or a duly appointed committee of the Board. Subject to the provisions of the Purchase Plan, the Board determines the terms and conditions of Purchase Rights granted under the plan. The Board will interpret the Purchase Plan and Purchase Rights granted thereunder, and all determinations of the Board will be final and binding on all persons having an interest in the Purchase Plan or any Purchase Rights.

Eligibility. Any employee of the Company or of any present or future parent or subsidiary corporation of the Company designated by the Board for inclusion in the Purchase Plan is eligible to participate in an Offering under the plan so long as the employee has completed at least six months of continuous employment prior to the start of the Offering (the “Eligibility Service Requirement”) and is customarily employed for more than 20 hours per week; provided, however, that the Eligibility Service Requirement will not apply to Offerings commencing on or after August 1, 1996, except for employees who are executive officers. However, no employee who owns or holds options to purchase, or as a result of participation in the Purchase Plan would own or hold options to purchase, five percent or more of the total combined voting power or value of all classes of stock of the Company or of a ny parent or subsidiary corporation of the Company is entitled to participate in the Purchase Plan.

Offerings. Generally, each Offering of Common Stock under the Purchase Plan is for a period of six months (an “Offering Period”) commencing on or about February 1 and August 1 of each year (an “Offering Date”). The Board may establish a different term for one or more Offerings, not to exceed 27 months, or different commencement or ending dates for any Offering Period. Generally, shares are purchased on the last day of the Offering Period (a “Purchase Date”). The Purchase Plan also authorizes the Board to establish one or more additional Purchase Dates during an Offering Period.

Participation and Purchase of Shares. Participation in an Offering under the Purchase Plan is limited to eligible employees who authorize payroll deductions prior to the Offering Date. Payroll deductions may not exceed 10% (or such other rate as the Board determines) of an employee’s compensation on any payday during the Offering

Period. Once an employee becomes a participant in the Purchase Plan, that employee will automatically participate in each successive Offering Period until such time as the employee withdraws from the Purchase Plan, becomes ineligible to participate, or terminates employment.

Subject to certain limitations, each participant in an Offering has a Purchase Right equal to the lesser of (i) a number of whole shares determined by dividing $12,500 by the fair market value of a share of Common Stock on the Offering Date, or (ii) 1,000 shares. These dollar and share amounts will be prorated for any Offering Period that is less than 5½ months or more than 6½ months in duration. However, no participant may purchase under the Purchase Plan shares of Common Stock having a fair market value exceeding $25,000 in any calendar year (measured by the fair market value of the Company’s Common Stock on the first day of the Offering Period in which the shares are purchased).

On each Purchase Date, the Company issues to each participant in the Offering the number of shares of the Company’s Common Stock determined by dividing the amount of payroll deductions accumulated for the participant during the Offering Period by the purchase price, limited in any case by the number of shares subject to the participant’s Purchase Right for that Offering. The price at which shares are sold under the Purchase Plan is established by the Board but may not be less than 85% of the lesser of the fair market value per share of the Company’s Common Stock on the Offering Date or on the Purchase Date. The fair market value of the Common Stock on any relevant date generally will be the closing price per share on such date as reported on the Nasdaq National Market. Any payroll deductions under the Purchase Plan not applied to the purchase of shares will be returned to the participant, u nless the amount remaining is less than the amount necessary to purchase a whole share of Common Stock, in which case the remaining amount may be applied to the next Offering Period.

A participant may withdraw from an Offering at any time without affecting his or her eligibility to participate in future Offerings. However, once a participant withdraws from an Offering, that participant may not again participate in the same Offering.

Transfer of Control. The Purchase Plan provides that, in the event of (i) a sale or exchange by the stockholders in a single or series of related transactions of more than 50% of the Company’s voting stock, (ii) a merger or consolidation in which the Company is a party, (iii) the sale, exchange or transfer of all or substantially all of the assets of the Company, or (iv) a liquidation or dissolution of the Company wherein, upon any such event, the stockholders of the Company immediately before such event do not retain direct or indirect beneficial ownership of more than 50% of the total combined voting power of the voting stock of the Company, its successor, or the corporation to which the assets of the Company were transferred (a “Transfer of Control”), the acquiring or successor corporation may assume the Company’s rights and obligations under the Purchase Plan or substitute substantially equivalent Purchase Rights for such corporation’s stock. If the acquiring or successor corporation elects not to assume or substitute for the outstanding Purchase Rights, the Board may adjust the next Purchase Date to a date on or before the date of the Transfer of Control. Any Purchase Rights that are not assumed, substituted for, or exercised prior to the Transfer of Control will terminate.

Termination or Amendment. The Purchase Plan will continue until terminated by the Board or until all of the shares reserved for issuance under the plan have been issued. The Board may at any time amend or terminate the Purchase Plan, except that the approval of the Company’s stockholders is required within twelve months of the adoption of any amendment increasing the number of shares authorized for issuance under the Purchase Plan, or changing the definition of the corporations which may be designated by the Board as corporations the employees of which may participate in the Purchase Plan.

Summary of United States Federal Income Tax Consequences

The following summary is intended only as a general guide as to the United States federal income tax consequences under current law of participation in the Purchase Plan and does not attempt to describe all possible federal or other tax consequences of such participation or tax consequences based on particular circumstances.

Generally, there are no tax consequences to an employee of either becoming a participant in the Purchase Plan or purchasing shares under the Purchase Plan. The tax consequences of a disposition of shares vary depending on the period such stock is held before its disposition. If a participant disposes of shares within two years after the Offering Date or within one year after the Purchase Date on which the shares are acquired (a “disqualifying disposition”), the participant recognizes ordinary income in the year of disposition in an amount equal to the difference between the fair market value of the shares on the Purchase Date and the purchase price. Such income may be subject to

withholding of tax. Any additional gain or resulting loss recognized by the participant from the disposition of the shares is a capital gain or loss. If the participant disposes of shares at least two years after the Offering Date and at least one year after the Purchase Date on which the shares are acquired, the participant recognizes ordinary income in the year of disposition in an amount equal to the lesser of (i) the difference between the fair market value of the shares on the date of disposition and the purchase price or (ii) 15% of the fair market value of the shares on the Offering Date. Any additional gain recognized by the participant on the disposition of the shares is a capital gain. If the fair market value of the shares on the date of disposition is less than the purchase price, there is no ordinary income, and the loss recognized is a capital loss. If the participant owns the shares at the time of the participant’s death, the lesser of (i) the difference between the fair market value of the shares on the date of death and the purchase price or (ii) 15% of the fair market value of the shares on the Offering Date is recognized as ordinary income in the year of the participant’s death .

If the exercise of a Purchase Right does not constitute an exercise pursuant to an “employee stock purchase plan” under section 423 of the Code, the exercise of the Purchase Right will be treated as the exercise of a nonstatutory stock option. The participant would therefore recognize ordinary income on the Purchase Date equal to the excess of the fair market value of the shares acquired over the purchase price. Such income is subject to withholding of income and employment taxes. Any gain or loss recognized on a subsequent sale of the shares, as measured by the difference between the sale proceeds and the sum of (i) the purchase price for such shares and (ii) the amount of ordinary income recognized on the exercise of the Purchase Right, will be treated as a capital gain or loss, as the case may be.

A capital gain or loss will be long-term if the participant holds the shares for more than 12 months and short-term if the participant holds the shares for 12 months or less. Long-term capital gains are currently subject to a maximum tax rate of 20%. Short-term capital gains are generally subject to the same tax rates as ordinary income.

If the participant disposes of the shares in a disqualifying disposition the Company should be entitled to a deduction equal to the amount of ordinary income recognized by the participant as a result of the disposition, except to the extent such deduction is limited by applicable provisions of the Code or the regulations thereunder. In all other cases, no deduction is allowed the Company.

Vote Required and Board’s Recommendation

The affirmative vote of a majority of the votes present or represented by proxy and entitled to a vote at the Annual Meeting, at which a quorum representing a majority of all outstanding shares of Common Stock of the Company is present and voting, is required for approval of this proposal. Abstentions and broker nonvotes will each be counted present for purposes of determining the presence of a quorum. However, abstention and broker non-votes will have no effect on the outcome of the vote.

The Board believes that the availability of an opportunity to purchase shares under the Purchase Plan at a discount from market price is important to attracting and retaining qualified officers and employees essential to the success of the Company, and that stock ownership is important to providing such persons with incentive to perform in the best interest of the Company. THEREFORE, THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PROPOSAL TO APPROVE THE INCREASE IN THE NUMBER OF SHARES RESERVED FOR ISSUANCE UNDER THE 1996 EMPLOYEE STOCK PURCHASE PLAN TO 1,050,000 SHARES.

PROPOSAL 3

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Board of the Company has appointed Ernst & Young LLP to serve as independent auditors to audit the financial statements of the Company for the fiscal year ending September 29, 2001. Ernst & Young LLP has acted in such capacity since its appointment for fiscal 1986. A representative of Ernst & Young LLP will be present at the Annual Meeting, will be given the opportunity to make a statement if the representative desires and will be available to respond to appropriate questions.

In the event that ratification by the stockholders of the appointment of Ernst & Young LLP as the Company’s independent auditors is not obtained, the Board will reconsider said appointment.

The affirmative vote of a majority of the shares present or represented by proxy and entitled to vote at the Annual Meeting, at which a quorum representing a majority of all outstanding shares of Common Stock of the Company is present and voting, either in person or by proxy, is required for approval of this proposal. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum. Abstentions will have the same effect as a negative vote on this proposal. Broker non-votes will have no effect on the outcome of the vote on this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” RATIFICATION OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING September 29, 2001.

STOCKHOLDER PROPOSALS TO BE PRESENTED

AT NEXT ANNUAL MEETING

The Company has an advance notice provision under its bylaws for stockholder business to be presented at meetings of stockholders. Such provision states that in order for stockholder business to be properly brought before a meeting by a stockholder, such stockholder must have given timely notice thereof in writing to the Secretary of the Company. A stockholder proposal, to be timely, must be received at the Company’s principal executive offices not less than 120 calendar days in advance of the one year anniversary of the date the Company’s proxy statement was released to stockholders in connection with the previous year’s annual meeting of stockholders; except that (i) if no annual meeting was held in the previous year, (ii) if the date of the annual meeting has been changed by more than thirty calendar days from the date contemplated at the time of the previous year’ s proxy statement, or (iii) in the event of a special meeting, then notice must be received not later than the close of business on the tenth day following the day on which notice of the date of the meeting was mailed or public disclosure of the meeting date was made.

Proposals of stockholders intended to be presented at the next annual meeting of stockholders of the Company (i) must be received by the Company at its offices at 79 Great Oaks Avenue, Cupertino, California 95014 no later than August 27, 2001 and (ii) must satisfy the conditions established by the Securities and Exchange Commission for stockholder proposals to be included in the Company’ s proxy statement for that meeting.

TRANSACTION OF OTHER BUSINESS

At the date of this Proxy Statement, the Board knows of no other business that will be conducted at the Annual Meeting, other than as described in this Proxy Statement. If any other matter or matters are properly brought before the meeting, or any adjournment thereof, it is the intention of the persons named in the accompanying form of Proxy to vote the Proxy on such matters in accordance with their best judgment.

| By Order of the Board of Directors | |||

| /s/ Joseph W. Rockom | |||

| Joseph W. Rockom, Secretary | |||

| December 21, 2000 |

APPENDIX A

AUDIT COMMITTEE CHARTER

Organization: There shall be a committee of the Board of Directors to be known as the Audit Committee. The Audit Committee shall be composed of at lease three directors who are independent of the management of the corporation, are financially literate and are free of any relationship that, in the opinion of the Board of Directors, would interfere with their exercise of independent judgment as a Committee member.

Statement of Policy: The Audit Committee shall provide assistance to the corporate directors in fulfilling their responsibility to the shareholders, potential shareholders, and investment community relating to corporate accounting, reporting practices of the corporation, and the quality and integrity of the financial reports of the corporation. In so doing, it is the responsibility of the Audit Committee to maintain free and open means of communication between the directors, the independent auditors, the internal auditors, and the financial management of the corporation.

Responsibilities: In carrying out its responsibilities, the Audit Committee believes its policies and procedures should remain flexible, in order to best react to changing conditions and to ensure to the directors and shareholders that the corporate accounting and reporting practices of the corporation are in accordance with all requirements and are of the highest quality.

In carrying out these responsibilities, the Audit Committee will:

| 1. | Review and recommend to the directors the independent auditors to be selected to audit the financial statements of the corporation and its divisions and subsidiaries. | ||

| 2. | Meet with the independent auditors and financial management of the corporation to review the scope of the proposed audit for the current year and the audit procedures to be utilized, review fee arrangements and at the conclusion thereof review such audit, including any comments or recommendations of the independent auditors. | ||

| 3. | Review with the independent auditors and the Company’s financial and accounting personnel, the adequacy and effectiveness of the accounting and financial controls of the corporation, and elicit any recommendations for the improvement of such internal control procedures or particular areas where new or more detailed controls or procedures are desirable. Particular emphasis should be given to the adequacy of such internal controls to expose any payments, transactions, or procedures that might be deemed illegal or otherwise improper. Further, the Committee periodically should review Company policy statements to determine their adherence to the code of conduct. | ||

| 4. | Review the internal audit function of the corporation including the independence and authority of its reporting obligations, the proposed audit plans for the coming year and the coordination of such plans with the independent auditors. If there is no internal audit function, determine the criteria for establishing one. | ||

| 5. | Receive prior to each meeting, a summary of findings from completed internal and/or external audits and a progress report on the proposed internal and/or external audit plan, with explanations for any deviations from the original plan. | ||

| 6. | Review before release the audited financial statements and Management’s Discussion and Analysis in the Company’s annual report on Form 10-K. | ||

| ; | |||

| 7. | Review before release the unaudited quarterly operating results in the Company’s 10Q. | ||

| 8. | Oversee compliance with SEC requirements for disclosure of auditor’s services and audit committee members’ activities. | ||

| 9. | Review management’s monitoring of compliance with the Company’s Standards of Business Conduct and with the Foreign Corrupt Practices Act. | ||

| 10. | Review in conjunction with counsel, any legal matters that could have a significant impact on the Company’s financial statements. | ||

| 11. | Provide oversight and review of the Company’s asset management policies, including an annual review of the Company’s investment policies and performance for cash and short-term investments. | ||

| 12. | Review related party transactions for potential conflict of interest. | ||

| 13. | Review the financial statements contained in the annual report to shareholders with management and the independent auditors to determine that the independent auditors are satisfied with the disclosure and content of the financial statements to be presented to the shareholders. Any changes in accounting principles should be reviewed. | ||

| 14. | Provide sufficient opportunity for the internal and independent auditors to meet with the members of the Audit Committee without members of management present. Among the items to be discussed in these meetings are the independent auditors’ evaluation of the corporation’s financial, accounting, and auditing personnel, and the cooperation that the independent auditors received during the course of the audit. | ||

| 15. | Review accounting and financial human resources and succession planning with the Company. | ||

| 16. | Submit the minutes of all meetings of the Audit Committee to, or discuss the matters discussed at each Committee meeting with, the Board of Directors. | ||

| ; | |||

| 17. | Investigate any matter brought to its attention within the scope of its duties, with the power to retain outside counsel for this purpose if, in its judgment, that is appropriate. | ||

| 18. | Perform other oversight functions as requested by the full Board of Directors. | ||

The Audit Committee will report, at least annually, to the Board regarding the Committee’s examinations and recommendations.

20

EXHIBIT A

IKOS SYSTEMS, INC.

1996 EMPLOYEE STOCK PURCHASE PLAN

(As Proposed to Be Amended Effective January 23, 2001)

1. Establishment, Purpose and Term of Plan.

1.1 Establishment. The IKOS Systems, Inc. 1996 Employee Stock Purchase Plan (the “Plan”) is hereby established effective upon its approval by the stockholders of the Company.

1.2 Purpose. The purpose of the Plan is to provide Eligible Employees of the Participating Company Group with an opportunity to acquire a proprietary interest in the Company through the purchase of Stock. The Company intends that the Plan shall qualify as an “employee stock purchase plan” under Section 423 of the Code (including any amendments or replacements of such section), and the Plan shall be so construed.

1.3 Term of Plan. The Plan shall continue in effect until the earlier of its termination by the Board or the date on which all of the shares of Stock available for issuance under the Plan have been issued.

2. Definitions and Construction.

(a) “Board” means the Board of Directors of the Company. If one or more Committees have been appointed by the Board to administer the Plan, “Board” also means such Committee(s).

(b) “Code” means the Internal Revenue Code of 1986, as amended, and any applicable regulations promulgated thereunder.

(c) “Committee” means a committee of the Board duly appointed to administer the Plan and having such powers as shall be specified by the Board. Unless the powers of the Committee have been specifically limited, the Committee shall have all of the powers of the Board granted herein, including, without limitation, the power to amend or terminate the Plan at any time, subject to the terms of the Plan and any applicable limitations imposed by law.

(d) “Company” means IKOS Systems, Inc., a Delaware corporation, or any successor corporation thereto.

(e) “Compensation” means, with respect to an Offering Period under the Plan, base salary, overtime, commissions and bonuses paid during such Offering Period before deduction for any contributions to any plan maintained by a Participating Company and described in Section 401(k) or Section 125 of the Code. Compensation shall not include other incentive payments, long-term disability, workers’ compensation or any other payments not included in base salary, overtime, commissions and bonuses.

(f) “Eligible Employee” means an Employee who meets the requirements set forth in Section 5 for eligibility to participate in the Plan.

(g) “Employee” means any person treated as an employee (including an officer or a Director who is also treated as an employee) in the records of a Participating Company and for purposes of Section 423 of the Code; provided, however, that neither service as a Director nor payment of a director’s fee shall be sufficient to constitute employment for purposes of the Plan.

(h) “Exchange Act” means the Securities Exchange Act of 1934, as amended.

(i) “Fair Market Value” means, as of any date, if there is then a public market for the Stock, the closing price of a share of Stock (or the mean of the closing bid and asked prices of a share of Stock if the Stock is so reported instead) as reported on the National Association of Securities Dealers Automated Quotation (“NASDAQ”) System, the NASDAQ National Market System or such other national or regional securities exchange or market system constituting the primary market for the Stock. If the relevant date does not fall on a day on which the Stock is trading on NASDAQ, the NASDAQ National Market System or other national or regional securities exchange or market system, the date on which the Fair Market Value shall be established shall be the last day on

21

which the Stock was so traded prior to the relevant date, or such other appropriate day as shall be determined by the Board, in its sole discretion. If there is then no public market for the Stock, the Fair Market Value on any relevant date shall be as determined by the Board without regard to any restriction other than a restriction which, by its terms, will never lapse.

(j) “Offering” means an offering of Stock as provided in Section 6.

(k) “Offering Date” means, for any Offering Period, the first day of such Offering Period.

(l) “Offering Period” means a period determined in accordance with Section 6.1.

(m) “Parent Corporation” means any present or future “parent corporation” of the Company, as defined in Section 424(e) of the Code.

(n) “Participant” means an Eligible Employee participating in the Plan.

(o) “Participating Company” means the Company or any Parent Corporation or Subsidiary Corporation designated by the Board for inclusion in the Plan. The Board shall have the sole and absolute discretion to determine from time to time which Parent Corporations or Subsidiary Corporations shall be Participating Companies.

(p) “Participating” Company Group” means, at any point in time, the Company and all other corporations collectively which are then Participating Companies.

(q) “Purchase Date” means, for any Offering Period (or Purchase Period if so determined by the Board in accordance with Section 6.2), the last day of such period.

(r) “Purchase Period” means any period determined in accordance with Section 6.2.

(s) “Purchase Price” means the price at which a share of Stock may be purchased pursuant to the Plan, as determined in accordance with Section 9.

(t) “Purchase Right” means an option pursuant to the Plan to purchase such shares of Stock as provided in Section 8 which may or may not be exercised during an Offering Period. Such option arises from the right of a Participant to withdraw such Participant’s accumulated payroll deductions not previously applied to the purchase of Stock under the Plan (if any) and terminate participation in the Plan or any Offering therein at any time during an Offering Period.

(v) “Subsidiary Corporation” means any present or future “subsidiary corporation” of the Company, as defined in Section 424(f) of the Code.

2.2 Construction. Captions and titles contained herein are for convenience only and shall not affect the meaning or interpretation of any provision of the Plan. Except when otherwise indicated by the context, the singular shall include the plural, the plural shall include the singular, and use of the term “or” shall include the conjunctive as well as the disjunctive.

3. Administration. The Plan shall be administered by the Board, including any duly appointed Committee of the Board. All questions of interpretation of the Plan or of any Purchase Right shall be determined by the Board and shall be final and binding upon all persons having an interest in the Plan or such Purchase Right. Subject to the provisions of the Plan, the Board shall determine all of the relevant terms and conditions of Purchase Rights granted pursuant to the Plan; provided, however, that all Participants granted Purchase Rights pursuant to the Plan shall have the same rights and privileges within the meaning of Section 423(b)(5) of the Code. All expenses incurred in connection with the administration of the Plan shall be paid by the Company.

4. Shares Subject to Plan.

4.1 Maximum Number of Shares Issuable. Subject to adjustment as provided in Section 4.2, the maximum aggregate number of shares of Stock that may be issued under the Plan shall be one million and fifty thousand (1,050,000) and shall consist of authorized but unissued or reacquired shares of the Stock, or any combination thereof. If an outstanding Purchase Right for any reason expires or is terminated or canceled, the shares

22

of Stock allocable to the unexercised portion of such Purchase Right shall again be available for issuance under the Plan.

4.2 Adjustments for Changes in Capital Structure. In the event of any stock dividend, stock split, reverse stock split, recapitalization, combination, reclassification or similar change in the capital structure of the Company, or in the event of any merger (including a merger effected for the purpose of changing the Company’s domicile), sale of assets or other reorganization in which the Company is a party, appropriate adjustments shall be made in the number and class of shares subject to the Plan, to the Per Offering Share Limit set forth in Section 8.1 and to each Purchase Right and in the Purchase Price.

5. Eligibility.

5.1 Employees Eligible to Participate. Any Employee of a Participating Company shall be eligible to participate in the Plan except the following:

(a) Employees who have not completed at least six (6) months of continuous employment with the Participating Company Group as of the commencement of an Offering Period; provided, however, that this subsection (a) shall not apply to Offering Periods commencing on and after August 1, 1996, except with respect to those employees whose transactions in Stock are subject to Section 16 of the Exchange Act (“Insiders”);

(b) Employees who are customarily employed by the Participating Company Group for twenty (20) hours or less per week; and

(c) Employees who own or hold options to purchase or who, as a result of participation in the Plan, would own or hold options to purchase, stock of the Company or of any Parent Corporation or Subsidiary Corporation possessing five percent (5%) or more of the total combined voting power or value of all classes of stock of such corporation within the meaning of Section 423(b)(3) of the Code.

5.2 Leased Employees Excluded. Notwithstanding anything herein to the contrary, any individual performing services for a Participating Company solely through a leasing agency or employment agency shall not be deemed an “Employee” of such Participating Company.

6. Offerings.

6.1 Offering Periods. Except as otherwise set forth below, the Plan shall be implemented by sequential Offerings of approximately six (6) months duration (an “Offering Period”). The first Offering Period shall commence on February 8, 1996 and end on July 31, 1996. Subsequent Offerings shall commence on the first days of February and August of each year and end on the last days of the next July and January, respectively, occurring thereafter. Notwithstanding the foregoing, the Board may establish a different term for one or more Offerings or different commencing or ending dates for such Offerings; provided, however, that no Offering may exceed a term of twenty-seven (27) months. An Employee who becomes an Eligible Employee after an Offering Period has commenced shall not be eligible to participate in such Offering but may participate in any subsequent Offerin g provided such Employee is still an Eligible Employee as of the commencement of any such subsequent Offering. Eligible Employees may not participate in more than one Offering at a time. In the event the first or last day of an Offering Period is not a business day, the Company shall specify the business day that will be deemed the first or last day, as the case may be, of the Offering Period.

6.2 Purchase Periods. If the Board shall so determine, in its discretion, each Offering Period may consist of two (2) or more consecutive purchase periods having such duration as the Board shall specify (individually, a “Purchase Period”), and the last day of each such Purchase Period shall be a Purchase Date. In the event the first or last day of a Purchase Period is not a business day, the Company shall specify the business day that will be deemed the first or last day, as the case may be, of the Purchase Period.

6.3 Governmental Approval; Stockholder Approval. Notwithstanding any other provision of the Plan to the contrary, any Purchase Right granted pursuant to the Plan shall be subject to (a) obtaining all necessary governmental approvals or qualifications of the sale or issuance of the Purchase Rights or the shares of Stock and (b) obtaining stockholder approval of the Plan.

7. Participation in the Plan.

23

7.1 Initial Participation. An Eligible Employee shall become a Participant on the first Offering Date after satisfying the eligibility requirements of Section 5 and delivering to the Company’s payroll office or other office designated by the Company not later than the close of business for such office on the last business day before such Offering Date (the “Subscription Date”) a subscription agreement indicating the Employee’s election to participate in the Plan and authorizing payroll deductions. An Eligible Employee who does not deliver a subscription agreement to the Company’s payroll or other designated office on or before the Subscription Date shall not participate in the Plan for that Offering Period or for any subsequent Offering Period unless such Employee subsequently enrolls in the Plan by filing a subscription agreement with the Com pany by the Subscription Date for such subsequent Offering Period. The Company may, from time to time, change the Subscription Date as deemed advisable by the Company in its sole discretion for proper administration of the Plan.

7.2 Continued Participation. A Participant shall automatically participate in the Offering Period commencing immediately after the final Purchase Date of each Offering Period in which the Participant participates until such time as such Participant (a) ceases to be an Eligible Employee, (b) withdraws from the Plan pursuant to Section 13.2 or (c) terminates employment as provided in Section 14. If a Participant automatically may participate in a subsequent Offering Period pursuant to this Section 7.2, then the Participant is not required to file any additional subscription agreement for such subsequent Offering Period in order to continue participation in the Plan. However, a Participant may file a subscription agreement with respect to a subsequent Offering Period if the Participant desires to change any of the Participant’s elections contained in the Pa rticipant’s then effective subscription agreement.

8. Right to Purchase Shares.

8.1 Purchase Right. Except as set forth below, during an Offering Period each Participant in such Offering Period shall have a Purchase Right consisting of the right to purchase that number of whole shares of Stock arrived at by dividing Twelve Thousand Five Hundred Dollars ($12,500) by the Fair Market Value of a share of Stock on the Offering Date of such Offering Period; provided, however, that such number shall not exceed one thousand (1,000) shares (the “Per Offering Share Limit”). Shares of Stock may only be purchased through a Participant’s payroll deductions pursuant to Section 10.

8.2 Pro Rata Adjustment of Purchase Right. Notwithstanding the foregoing, if the Board shall establish an Offering Period of less than five and one-half (52) months or more than six and one-half (62) months in duration, (a) the dollar amount in Section 8.1 shall be determined by multiplying $2,083.33 by the number of months in the Offering Period and rounding to the nearest whole dollar, and (b) the Per Offering Share Limit shall be determined by multiplying 166.67 shares by the number of months in the Offering Period and rounding to the nearest whole share. For purposes of the preceding sentence, fractional months shall be rounded to the nearest whole month.