|

|

|

|

|

Previous: PROVIDENT BANKSHARES CORP, 8-K, EX-99.1, 2000-10-19 |

Next: COVA SERIES TRUST, 497, 2000-10-19 |

Funds

Semiannual Report

August 31, 2000

(2_fidelity_logos) (Registered_Trademark)

|

President's Message |

Ned Johnson on investing strategies. |

|

|

|

||

|

Spartan Total Market Index Fund |

Performance |

|

|

|

Fund Talk: The Manager's Overview |

|

|

|

Investment Changes |

|

|

|

Investments |

|

|

|

Financial Statements |

|

|

|

||

|

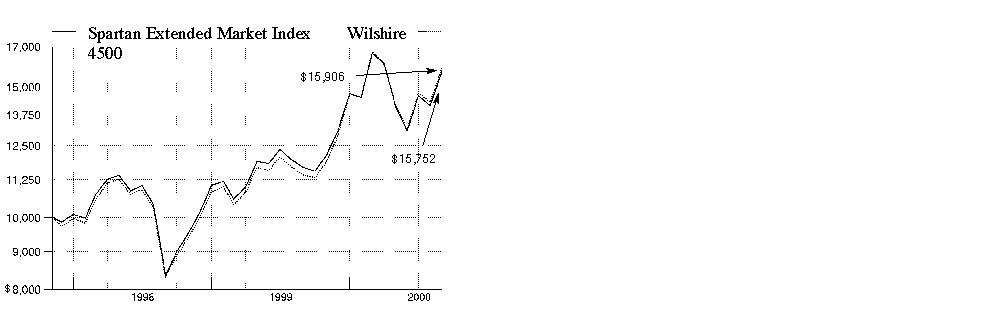

Spartan Extended Market Index Fund |

Performance |

|

|

|

Fund Talk: The Manager's Overview |

|

|

|

Investment Changes |

|

|

|

Investments |

|

|

|

Financial Statements |

|

|

|

||

|

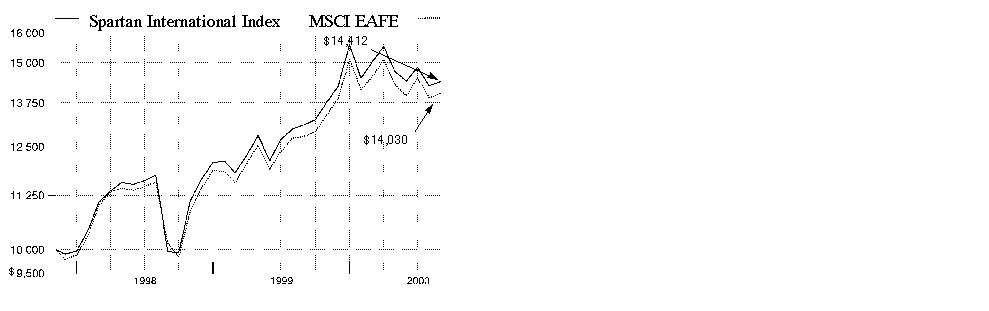

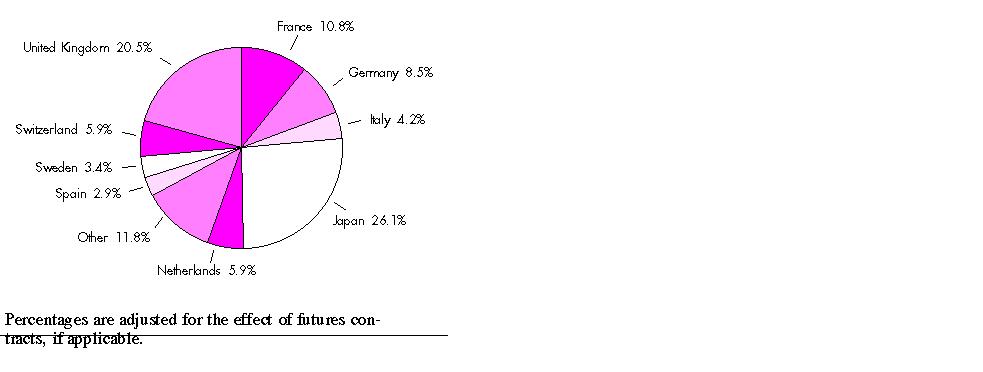

Spartan International Index Fund |

Performance |

|

|

|

Fund Talk: The Manager's Overview |

|

|

|

Investment Changes |

|

|

|

Investments |

|

|

|

Financial Statements |

|

|

|

||

|

Notes |

Notes to the Financial Statements. |

|

|

|

||

Standard & Poor's 500, S&P, and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by

Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

The views expressed in this report reflect those of Bankers Trust only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the funds nor Fidelity Distributors Corporation is a bank.

For more information on any Fidelity fund, including charges and expenses, call 1-800-544-6666 for a free prospectus. Read it carefully before you invest or send money.

Semiannual Report

(Photograph of Edward C. Johnson 3d.)

Dear Shareholder:

A slowing U.S. economy triggered an equity market rally during the later stages of summer, boosting most major stock indexes back into positive territory for calendar year 2000. One notable exception, however, was the Dow Jones Industrial Average, which posted a negative return during that timeframe. Fixed-income markets - particularly Treasuries - continued their yearlong trend of strong performance, as nearly every bond sector outperformed the stock market on a year-to-date basis.

While it's impossible to predict the future direction of the markets with any degree of certainty, there are certain basic principles that can help investors plan for their future needs.

First, investors are encouraged to take a long-term view of their portfolios. If you can afford to leave your money invested through the inevitable up and down cycles of the financial markets, you will greatly reduce your vulnerability to any single decline. We know from experience, for example, that stock prices have gone up over longer periods of time, have significantly outperformed other types of investments and have stayed ahead of inflation.

Second, you can further manage your investing risk through diversification. A stock mutual fund, for instance, is already diversified, because it invests in many different companies. You can increase your diversification further by investing in a number of different stock funds, or in such other investment categories as bonds. If you have a short investment time horizon, you might want to consider moving some of your investment into a money market fund, which seeks income and a stable share price by investing in high-quality, short-term investments. Of course, it's important to remember that an investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these types of funds.

Finally, no matter what your time horizon or portfolio diversity, it makes good sense to follow a regular investment plan, investing a certain amount of money in a fund at the same time each month or quarter and periodically reviewing your overall portfolio. By doing so, you won't get caught up in the excitement of a rapidly rising market, nor will you buy all your shares at market highs. While this strategy - known as dollar cost averaging - won't assure a profit or protect you from a loss in a declining market, it should help you lower the average cost of your purchases. Of course, you should consider your financial ability to continue your purchases through periods of low price levels before undertaking such a strategy.

If you have questions, please call us at 1-800-544-6666, or visit our web site at www.fidelity.com. We are available 24 hours a day, seven days a week to provide you the information you need to make the investments that are right for you.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Semiannual Report

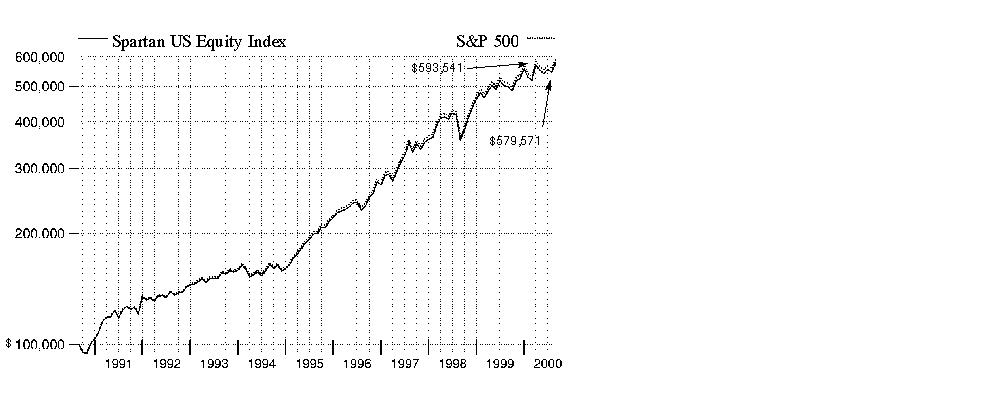

There are several ways to evaluate a fund's historical performance. You can look at the total percentage change in value, the average annual percentage change or the growth of a hypothetical $10,000 investment. Total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value). If Fidelity had not reimbursed certain fund expenses, the total returns would have been lower.

Cumulative Total Returns

|

Periods ended August 31, 2000 |

Past 6 |

Past 1 |

Life of |

|

Spartan Total Market Index |

6.12% |

19.70% |

64.24% |

|

Wilshire 5000 Total Market |

6.32% |

20.00% |

62.33% |

|

Growth & Income Funds Average |

12.83% |

13.70% |

n/a* |

Cumulative total returns show the fund's performance in percentage terms over a set period - in this case, six months, one year or since the fund started on November 5, 1997. For example, if you had invested $1,000 in a fund that had a 5% return over the past year, the value of your investment would be $1,050. You can compare the fund's return to the performance of the Wilshire 5000 Total Market Index (Wilshire 5000) - a market capitalization-weighted index of approximately 7,000 U.S. equity securities. The index contains all actively traded common stocks with readily available price data traded on the New York Stock Exchange, American Stock Exchange, and NASDAQ. To measure how the fund's performance stacked up against its peers, you can compare it to the growth & income funds average, which reflects the performance of mutual funds with similar objectives tracked by Lipper Inc. The past six months average represents a peer group of 1,025 mutual funds. These benchmarks include reinvested dividends and capital gains, if any, and exclude the effect of sales charges. Lipper has created new comparison categories that group funds according to portfolio characteristics and capitalization, as well as by capitalization only. These averages are listed on the bottom of this page.(dagger)

Average Annual Total Returns

|

Periods ended August 31, 2000 |

Past 1 |

Life of |

|

Spartan Total Market Index |

19.70% |

19.22% |

|

Wilshire 5000 Total Market |

20.00% |

18.73% |

|

Growth & Income Funds Average |

13.70% |

n/a* |

Average annual total returns take the fund's cumulative return and show you what would have happened if the fund had performed at a constant rate each year.

* Not available

(dagger) The Lipper multi-cap core funds average reflects the performance (excluding sales charges) of mutual funds with similar portfolio characteristics and capitalization. The Lipper multi-cap supergroup average reflects the performance (excluding sales charges) of mutual funds with similar capitalization. As of August 31, 2000, the six month and one year cumulative total returns for the multi-cap core funds average were 9.71% and 23.95%, respectively. The one year average annual return was 23.95%. The six month and one year cumulative total returns for the Lipper multi-cap supergroup was 8.95% and 30.43%, respectively. The one year average annual return was 30.43%.

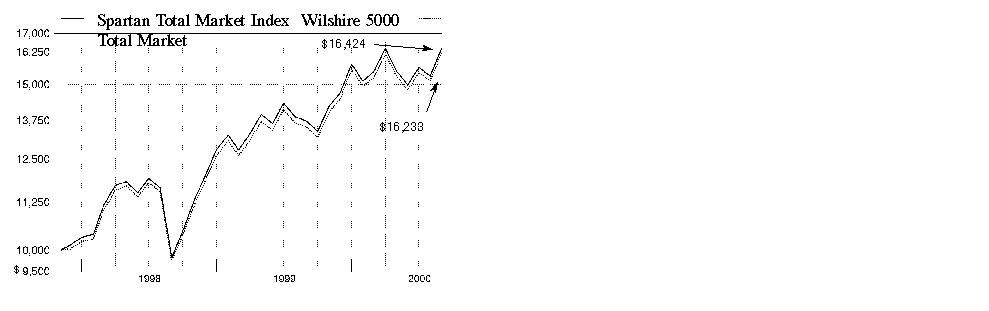

$10,000 Over Life of Fund

$10,000 Over Life of Fund: Let's say hypothetically that $10,000 was invested in Spartan Total Market Index Fund on November 5, 1997, when the fund started. As the chart shows, by August 31, 2000, the value of the investment would have been $16,424 - a 64.24% increase on the initial investment. For comparison, look at how the Wilshire 5000 did over the same period. With dividends and capital gains, if any, reinvested, the same $10,000 investment would have been $16,233 - a 62.33% increase.

Understanding Performance

How a fund did yesterday is no guarantee of how it will do tomorrow. The stock market, for example, has a history of long-term growth and short-term volatility. In turn, the share price and return of a fund that invests in stocks will vary. That means if you sell your shares during a market downturn, you might lose money. But if you can ride out the market's ups and downs, you may have a gain.

3Semiannual Report

(Portfolio Manager photograph)

An interview with

Dean Barr, who oversees the Spartan Total Market Index Fund's investment management personnel as

Managing Director for Bankers Trust, sub-adviser of the fund

Q. How did the fund perform, Dean?

A. For the six months that ended August 31, 2000, the fund returned 6.12%, while the Wilshire 5000 Total Market Index returned 6.32%. In comparison, the growth & income funds average tracked by Lipper Inc. returned 12.83%. For the 12 months that ended August 31, 2000, the fund returned 19.70%, while the Wilshire 5000 index and Lipper average returned 20.00% and 13.70%, respectively.

Q. How would you describe the market environment during the six-month period?

A. It was one marked by historically high levels of volatility and rapid sector rotations. Concerns about seemingly overstretched valuations and further tightening by the Federal Reserve Board sent jittery investors fleeing smaller-sized tech stocks in droves for the perceived predictability of large, well-established companies elsewhere in the market. This group of big-cap stocks rose sharply in response, helping to offset the losses incurred by smaller-cap stocks. Midway through the period, investors - sensing a slowing economy and an end to the Fed's yearlong tightening cycle - eased their way back into tech stocks, this time focusing on seasoned growth companies with demonstrated revenues and earnings. However, earnings worries related to a decelerating economy tempered optimism surrounding rates and spawned confusion and persistent volatility during the summer months, with few industries enjoying market leadership for long. With the Fed choosing not to raise rates in August, stocks staged a "relief rally," with tech shares reclaiming the lead for the first time since early March.

Q. Which segments of the market scored the highest gains during the period?

A. The finance sector laid claim to some of the period's best performers, many of which emerged from the brokerage and investment management spaces. Strong capital markets activity, combined with industry consolidation, painted a healthy backdrop for key players such as Citigroup and Morgan Stanley Dean Witter. Not to be left out, insurance stocks also performed well, posting gains on signs of margin improvement. American International Group was the standout here. Not too far behind were pharmaceuticals, the lifeblood of the health sector. Drug stocks such as Pfizer - which traditionally outperform in a slowing economy - rallied behind exciting new product pipelines and industry consolidation. Rising oil and gas prices resulting from supply shortages sparked the energy sector, led by top contributors Anadarko Petroleum and Exxon Mobil. Offsetting these gains were lagging retailers, such as Home Depot, and traditional telecommunications providers, such as AT&T.

Q. What determined the fate of tech stocks during the period?

A. Following the spring swoon, blue-chip tech names - such as Intel and Oracle - received the bulk of the support from valuation-conscious investors seeking quality of earnings and industry leadership. With corporate America spending hand over fist for new technology, firms engaged in the build-out of Internet infrastructure gained widespread appeal with investors. Attempting to satisfy the growing need for communications bandwidth, networking and telecommunications equipment providers Juniper and Corning enjoyed strong advances. Overall, it was a mixed bag for semiconductor companies, with many stocks struggling to shake off their Y2K hangovers. Communications chip manufacturers benefited as a play on Internet infrastructure, led by the impressive run-up in stocks including Altera and Advanced Micro Devices. Similarly, database and e-commerce software providers Oracle and Siebel Systems also were big winners, as were leaders in the data storage space, such as EMC and Network Appliance. Additionally, computer hardware heavyweights Sun Microsystems and IBM performed well, recovering nicely in August. Conversely, those stocks that fought a losing battle throughout the period included Microsoft, Qualcomm, Lucent, Motorola and CMGI.

Q. What's your outlook?

A. It appears as if the economy is poised for a soft landing, though it's still too early to know for sure. Inaction on the rate front of late by the Fed tells me that growth is slowing enough right now to keep rates steady for at least the time being. Technology-enabled productivity gains, coupled with slower economic growth, should help neutralize spiking energy prices and keep inflation under wraps. Combine that with the presidential election, and I think we may see a Fed that's on hold for the remainder of 2000. Robust tech spending should further dampen inflationary pressures and keep corporate profits rising. If so, I expect growth stocks to prosper and continue to outperform in the coming months.

The views expressed in this report reflect those of Bankers Trust only through the end of the period of the report as stated on the cover. Any such views are subject to change at any time based on market or other conditions. For more information, see page 2.

Fund Facts

Goal: seeks to provide investment results that correspond to the total return of a broad range of United States stocks

Fund number: 397

Trading symbol: FSTMX

Start date: November 5, 1997

Size: as of August 31, 2000, more than $1.1 billion

Sub-adviser: Bankers Trust, since inception

3Semiannual Report

Spartan Total Market Index Fund

|

Top Ten Stocks as of August 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

General Electric Co. |

3.5 |

2.7 |

|

Intel Corp. |

3.0 |

2.4 |

|

Cisco Systems, Inc. |

2.8 |

2.7 |

|

Microsoft Corp. |

2.2 |

2.9 |

|

Exxon Mobil Corp. |

1.7 |

1.7 |

|

Pfizer, Inc. |

1.6 |

0.8 |

|

Citigroup, Inc. |

1.6 |

1.1 |

|

Oracle Corp. |

1.5 |

1.3 |

|

International Business |

1.4 |

1.2 |

|

EMC Corp. |

1.3 |

0.8 |

|

|

20.6 |

17.6 |

|

Top Ten Market Sectors as of August 31, 2000 |

||

|

|

% of fund's |

% of fund's net assets |

|

Technology |

34.2 |

35.8 |

|

Finance |

14.3 |

11.5 |

|

Health |

10.2 |

9.4 |

|

Utilities |

8.9 |

10.5 |

|

Industrial Machinery |

5.0 |

4.2 |

|

Media & Leisure |

4.8 |

5.5 |

|

Energy |

4.4 |

4.1 |

|

Retail & Wholesale |

4.3 |

4.9 |

|

Nondurables |

4.0 |

4.1 |

|

Basic Industries |

2.6 |

2.8 |

Semiannual Report

Spartan Total Market Index Fund

(Unaudited)

Showing Percentage of Net Assets

|

Common Stocks - 99.3% |

|||

|

Shares |

Value (Note 1) |

||

|

AEROSPACE & DEFENSE - 1.1% |

|||

|

Aerospace & Defense - 0.9% |

|||

|

AAR Corp. |

850 |

$ 9,563 |

|

|

Advanced Aerodynamics & |

600 |

1,500 |

|

|

Alliant Techsystems, Inc. (a) |

2,108 |

162,448 |

|

|

Aviall, Inc. (a) |

2,800 |

16,800 |

|

|

BE Aerospace, Inc. (a) |

6,100 |

98,744 |

|

|

BFGoodrich Co. |

6,862 |

280,055 |

|

|

Blount International, Inc. (a) |

800 |

6,700 |

|

|

Boeing Co. |

63,500 |

3,405,188 |

|

|

Datron Systems, Inc. (a) |

3,400 |

49,088 |

|

|

Harsco Corp. |

2,400 |

66,750 |

|

|

Honeywell International, Inc. |

52,675 |

2,031,280 |

|

|

ITT Industries, Inc. |

5,800 |

195,025 |

|

|

Kellstrom Industries, Inc. (a) |

800 |

4,100 |

|

|

Lockheed Martin Corp. |

27,077 |

768,310 |

|

|

Northrop Grumman Corp. |

4,900 |

381,281 |

|

|

Orbital Sciences Corp. (a) |

1,700 |

15,194 |

|

|

Precision Castparts Corp. |

2,200 |

167,200 |

|

|

Rockwell International Corp. |

13,200 |

533,775 |

|

|

Standex International Corp. |

100 |

1,856 |

|

|

Sturm Ruger & Co., Inc. |

300 |

2,494 |

|

|

Textron, Inc. |

11,600 |

650,325 |

|

|

United Technologies Corp. |

32,671 |

2,039,896 |

|

|

Woodward Governor Co. |

1,600 |

63,400 |

|

|

|

10,950,972 |

||

|

Defense Electronics - 0.1% |

|||

|

Alpha Industries, Inc. (a) |

5,000 |

252,188 |

|

|

Anaren Microwave, Inc. (a) |

1,450 |

171,191 |

|

|

Ashton Technology Group, Inc. (a) |

4,800 |

17,250 |

|

|

Comarco, Inc. (a) |

300 |

9,450 |

|

|

Giga-Tronics, Inc. (a) |

2,400 |

19,800 |

|

|

Herley Industries, Inc. (a) |

3,600 |

66,375 |

|

|

Raytheon Co. Class B |

22,900 |

636,906 |

|

|

REMEC, Inc. (a) |

4,200 |

119,700 |

|

|

|

1,292,860 |

||

|

Ship Building & Repair - 0.1% |

|||

|

Dril-Quip, Inc. (a) |

1,000 |

45,438 |

|

|

General Dynamics Corp. |

12,900 |

811,894 |

|

|

Newport News Shipbuilding, Inc. |

3,100 |

131,750 |

|

|

|

989,082 |

||

|

TOTAL AEROSPACE & DEFENSE |

13,232,914 |

||

|

BASIC INDUSTRIES - 2.6% |

|||

|

Chemicals & Plastics - 1.5% |

|||

|

A. Schulman, Inc. |

2,300 |

27,744 |

|

|

Aceto Corp. |

600 |

5,925 |

|

|

AEP Industries, Inc. (a) |

600 |

17,738 |

|

|

Air Products & Chemicals, Inc. |

16,100 |

584,631 |

|

|

Airgas, Inc. (a) |

5,200 |

34,450 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Albemarle Corp. |

3,240 |

$ 80,393 |

|

|

American Pacific Corp. (a) |

800 |

4,300 |

|

|

American Vanguard Corp. |

400 |

2,975 |

|

|

Arch Chemicals, Inc. |

1,600 |

29,100 |

|

|

Armstrong Holdings, Inc. |

6,900 |

109,969 |

|

|

Ashland, Inc. |

7,800 |

274,950 |

|

|

Associated Materials, Inc. |

600 |

9,600 |

|

|

Atlantis Plastics, Inc. Class A (a) |

600 |

3,300 |

|

|

ATMI, Inc. (a) |

3,100 |

83,070 |

|

|

Avery Dennison Corp. |

7,900 |

427,094 |

|

|

Balchem Corp. |

500 |

5,594 |

|

|

Bush Boake Allen, Inc. (a) |

1,400 |

61,425 |

|

|

Cabot Corp. |

4,700 |

173,900 |

|

|

Cabot Microelectronics Corp. |

700 |

40,863 |

|

|

Carbide/Graphite Group, Inc. (a) |

5,100 |

22,950 |

|

|

CFC International, Inc. (a) |

600 |

4,200 |

|

|

Channell Commercial Corp. (a) |

800 |

10,700 |

|

|

ChemFirst, Inc. |

1,200 |

27,675 |

|

|

ChinaB2BSourcing.com, Inc. (a) |

500 |

2,938 |

|

|

Crompton Corp. |

8,171 |

73,539 |

|

|

Cytec Industries, Inc. (a) |

2,900 |

96,788 |

|

|

Diversa Corp. |

400 |

11,400 |

|

|

Dow Chemical Co. |

47,300 |

1,238,669 |

|

|

E.I. du Pont de Nemours and Co. |

73,185 |

3,284,177 |

|

|

Eastman Chemical Co. |

5,400 |

232,875 |

|

|

Engelhard Corp. |

9,000 |

168,750 |

|

|

Environmental Technologies Corp. (a) |

700 |

10,413 |

|

|

Ethyl Corp. |

400 |

825 |

|

|

First Years, Inc. |

800 |

8,800 |

|

|

Flamemaster Corp. |

400 |

2,550 |

|

|

FMC Corp. (a) |

3,600 |

244,125 |

|

|

Foamex International, Inc. (a) |

2,000 |

11,625 |

|

|

Geon Co. |

1,900 |

33,131 |

|

|

Georgia Gulf Corp. |

2,300 |

29,900 |

|

|

Great Lakes Chemical Corp. |

3,900 |

131,625 |

|

|

H.B. Fuller Co. |

3,200 |

109,800 |

|

|

Hawkins Chemicals, Inc. |

1,000 |

7,750 |

|

|

Hercules, Inc. |

7,600 |

100,700 |

|

|

IMC Global, Inc. |

8,100 |

118,969 |

|

|

International Specialty Products, Inc. (a) |

5,100 |

29,325 |

|

|

Ivex Packaging Corp. (a) |

1,600 |

17,600 |

|

|

Lamson & Sessions Co. (a) |

2,300 |

45,425 |

|

|

LESCO, Inc. |

3,100 |

54,444 |

|

|

Lubrizol Corp. |

3,800 |

82,413 |

|

|

Lyondell Chemical Co. |

8,300 |

108,419 |

|

|

M.A. Hanna Co. |

3,700 |

30,756 |

|

|

MacDermid, Inc. |

2,200 |

55,000 |

|

|

Medical Manager Corp. (a) |

2,937 |

128,494 |

|

|

Millennium Chemicals, Inc. |

4,800 |

79,200 |

|

|

Minerals Technologies, Inc. |

1,500 |

77,813 |

|

|

Myers Industries, Inc. |

1,650 |

23,100 |

|

|

Newell Rubbermaid, Inc. |

18,501 |

479,870 |

|

|

NL Industries, Inc. |

3,600 |

83,925 |

|

|

North American Scientific, Inc. (a) |

3,400 |

82,025 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

BASIC INDUSTRIES - continued |

|||

|

Chemicals & Plastics - continued |

|||

|

NuCo2, Inc. (a) |

700 |

$ 5,163 |

|

|

Oil-Dri Corp. of America |

600 |

5,663 |

|

|

Olin Corp. |

3,300 |

54,450 |

|

|

OM Group, Inc. |

1,700 |

80,538 |

|

|

Pharmacia Corp. |

88,100 |

5,159,356 |

|

|

PPG Industries, Inc. |

12,400 |

502,200 |

|

|

Praxair, Inc. |

11,000 |

486,750 |

|

|

PW Eagle, Inc. (a) |

700 |

11,988 |

|

|

Quaker Chemical Corp. |

700 |

11,288 |

|

|

Rohm & Haas Co. |

15,296 |

442,628 |

|

|

Scotts Co. Class A (a) |

2,000 |

62,000 |

|

|

Sealed Air Corp. (a) |

5,860 |

300,691 |

|

|

Solutia, Inc. |

11,600 |

174,725 |

|

|

Southwall Technologies, Inc. (a) |

800 |

4,900 |

|

|

Spartech Corp. |

2,000 |

49,500 |

|

|

Stepan Co. |

700 |

14,613 |

|

|

Summa Industries, Inc. (a) |

500 |

6,094 |

|

|

Sybron Chemical Industry Corp. (a) |

500 |

17,219 |

|

|

Synalloy Corp. |

700 |

4,638 |

|

|

Terra Industries, Inc. (a) |

400 |

625 |

|

|

Tredegar Industries, Inc. |

2,700 |

52,650 |

|

|

Triple S Plastics, Inc. (a) |

300 |

9,600 |

|

|

Tuscarora Plastics, Inc. |

800 |

11,400 |

|

|

Union Carbide Corp. |

9,500 |

380,594 |

|

|

Uniroyal Technology Corp. (a) |

1,900 |

32,063 |

|

|

USEC, Inc. |

15,300 |

66,938 |

|

|

Valhi, Inc. |

8,200 |

105,063 |

|

|

Valspar Corp. |

3,000 |

88,500 |

|

|

W.R. Grace & Co. (a) |

4,900 |

38,894 |

|

|

Wellman, Inc. |

1,300 |

15,681 |

|

|

|

17,536,116 |

||

|

Iron & Steel - 0.1% |

|||

|

AK Steel Holding Corp. |

8,263 |

89,860 |

|

|

Allegheny Technologies, Inc. |

9,614 |

209,105 |

|

|

APW Ltd. (a) |

3,000 |

132,000 |

|

|

Barnes Group, Inc. |

700 |

13,606 |

|

|

Bethlehem Steel Corp. (a) |

24,204 |

84,714 |

|

|

Birmingham Steel Corp. |

1,100 |

3,094 |

|

|

Carpenter Technology Corp. |

1,200 |

39,000 |

|

|

Cleveland-Cliffs, Inc. |

3,000 |

75,375 |

|

|

Commercial Metals Co. |

600 |

16,763 |

|

|

Crane Co. |

2,200 |

55,275 |

|

|

Gibraltar Steel Corp. |

100 |

1,750 |

|

|

LTV Corp. |

1,500 |

2,719 |

|

|

Material Sciences Corp. (a) |

1,300 |

13,650 |

|

|

Mueller Industries, Inc. |

2,000 |

63,125 |

|

|

National Steel Corp. Class B |

1,800 |

7,313 |

|

|

NS Group, Inc. (a) |

800 |

14,100 |

|

|

Nucor Corp. |

5,900 |

216,825 |

|

|

Oregon Steel Mills, Inc. |

700 |

1,794 |

|

|

SPS Technologies, Inc. (a) |

600 |

28,238 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Steel Dynamics, Inc. (a) |

2,300 |

$ 27,888 |

|

|

Titan International, Inc. |

600 |

3,038 |

|

|

USX - U.S. Steel Group |

9,600 |

166,800 |

|

|

Watts Industries, Inc. Class A |

900 |

10,125 |

|

|

WHX Corp. (a) |

500 |

1,906 |

|

|

Worthington Industries, Inc. |

11,900 |

124,206 |

|

|

|

1,402,269 |

||

|

Metals & Mining - 0.3% |

|||

|

Alcoa, Inc. |

60,532 |

2,012,689 |

|

|

Amcol International Corp. |

400 |

1,325 |

|

|

Belden, Inc. |

2,700 |

70,538 |

|

|

Brush Engineered Materials, Inc. |

100 |

2,338 |

|

|

Century Aluminum Co. |

500 |

6,531 |

|

|

Commonwealth Industries, Inc. |

500 |

2,531 |

|

|

CommScope, Inc. (a) |

4,300 |

107,231 |

|

|

Encore Wire Corp. (a) |

4,700 |

36,131 |

|

|

Freeport-McMoRan Copper & Gold, Inc. Class B (a) |

14,700 |

144,244 |

|

|

General Cable Corp. |

1,100 |

9,213 |

|

|

Hecla Mining Co. (a) |

18,600 |

16,275 |

|

|

Kaiser Aluminum Corp. (a) |

1,400 |

7,963 |

|

|

Martin Marietta Materials, Inc. |

5,400 |

216,000 |

|

|

Matthews International Corp. Class A |

400 |

11,600 |

|

|

Optical Cable Corp. (a) |

3,500 |

137,813 |

|

|

Phelps Dodge Corp. |

5,172 |

230,154 |

|

|

Quanex Corp. |

400 |

7,475 |

|

|

Reliance Steel & Aluminum Co. |

1,400 |

28,875 |

|

|

RTI International Metals, Inc. (a) |

600 |

8,438 |

|

|

Ryerson Tull, Inc. |

711 |

6,710 |

|

|

Super Vision International, Inc. |

3,300 |

23,100 |

|

|

Superior Telecom, Inc. |

515 |

4,345 |

|

|

Titanium Metals Corp. |

4,200 |

36,750 |

|

|

Tremont Corp. |

200 |

6,450 |

|

|

U.S. Aggregates, Inc. |

400 |

6,900 |

|

|

Wolverine Tube, Inc. (a) |

200 |

3,325 |

|

|

|

3,144,944 |

||

|

Packaging & Containers - 0.1% |

|||

|

Alltrista Corp. (a) |

500 |

10,906 |

|

|

Ball Corp. |

2,200 |

76,175 |

|

|

Bemis Co., Inc. |

3,200 |

107,200 |

|

|

Crown Cork & Seal Co., Inc. |

12,100 |

156,544 |

|

|

Greif Brothers Corp. Class A |

900 |

25,988 |

|

|

Liqui-Box Corp. |

400 |

17,100 |

|

|

Longview Fibre Co. |

2,200 |

25,025 |

|

|

Owens-Illinois, Inc. (a) |

9,900 |

129,319 |

|

|

Packaging Corp. of America |

9,300 |

108,694 |

|

|

Sonoco Products Co. |

6,150 |

118,772 |

|

|

Tupperware Corp. |

3,800 |

76,713 |

|

|

U.S. Can Corp. (a) |

300 |

5,738 |

|

|

|

858,174 |

||

|

Paper & Forest Products - 0.6% |

|||

|

Albany International Corp. Class A |

1,000 |

13,938 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

BASIC INDUSTRIES - continued |

|||

|

Paper & Forest Products - continued |

|||

|

American Biltrite, Inc. |

400 |

$ 5,150 |

|

|

American Pad & Paper Co. (a) |

100 |

5 |

|

|

Boise Cascade Corp. |

5,600 |

167,300 |

|

|

Bowater, Inc. |

5,800 |

297,975 |

|

|

Buckeye Technologies, Inc. (a) |

1,700 |

42,394 |

|

|

Caraustar Industries, Inc. |

900 |

13,894 |

|

|

Chesapeake Corp. |

500 |

11,938 |

|

|

Consolidated Papers, Inc. |

6,000 |

235,875 |

|

|

Fort James Corp. |

13,900 |

439,588 |

|

|

Georgia-Pacific Corp. |

11,200 |

299,600 |

|

|

Georgia-Pacific Corp. - Timber Group |

5,300 |

155,356 |

|

|

International Paper Co. |

33,272 |

1,060,545 |

|

|

Kimberly-Clark Corp. |

38,738 |

2,266,173 |

|

|

Louisiana-Pacific Corp. |

10,800 |

114,075 |

|

|

Mail-Well, Inc. (a) |

1,500 |

10,875 |

|

|

MCSi, Inc. (a) |

1,900 |

65,313 |

|

|

Mead Corp. |

6,500 |

174,281 |

|

|

P.H. Glatfelter Co. |

1,300 |

13,650 |

|

|

Pactiv Corp. (a) |

15,900 |

174,900 |

|

|

Pope & Talbot, Inc. |

200 |

3,975 |

|

|

Potlatch Corp. |

1,500 |

50,438 |

|

|

Rayonier, Inc. |

1,500 |

62,344 |

|

|

Rock-Tenn Co. Class A |

100 |

1,031 |

|

|

Smurfit-Stone Container Corp. (a) |

22,998 |

301,849 |

|

|

Temple-Inland, Inc. |

4,600 |

195,213 |

|

|

The St. Joe Co. |

4,100 |

120,181 |

|

|

Trex Co., Inc. (a) |

1,400 |

43,400 |

|

|

Wausau-Mosinee Paper Corp. |

1,800 |

15,975 |

|

|

Westvaco Corp. |

6,400 |

175,200 |

|

|

Weyerhaeuser Co. |

16,100 |

745,631 |

|

|

Willamette Industries, Inc. |

7,200 |

219,600 |

|

|

Workflow Management, Inc. (a) |

2,300 |

13,513 |

|

|

|

7,511,175 |

||

|

TOTAL BASIC INDUSTRIES |

30,452,678 |

||

|

CONSTRUCTION & REAL ESTATE - 1.4% |

|||

|

Building Materials - 0.3% |

|||

|

American Standard Companies, Inc. (a) |

4,700 |

217,669 |

|

|

American Woodmark Corp. |

100 |

2,319 |

|

|

Ameron International Corp. |

300 |

10,125 |

|

|

Barnett, Inc. (a) |

700 |

8,706 |

|

|

Carlisle Companies, Inc. |

2,200 |

100,788 |

|

|

Centex Construction Products, Inc. |

800 |

20,650 |

|

|

CoorsTek, Inc. (a) |

300 |

14,063 |

|

|

Dal-Tile International, Inc. (a) |

2,800 |

31,500 |

|

|

Elcor Corp. |

900 |

14,794 |

|

|

Fastenal Co. |

3,400 |

217,175 |

|

|

Ferro Corp. |

2,550 |

52,594 |

|

|

Florida Rock Industries, Inc. |

1,000 |

38,438 |

|

|

Flowserve Corp. |

1,900 |

35,150 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Fortune Brands, Inc. |

10,900 |

$ 277,950 |

|

|

Hexcel Corp. (a) |

1,700 |

23,481 |

|

|

Huttig Building Products, Inc. (a) |

1,077 |

4,914 |

|

|

Industrial Holdings, Inc. (a) |

100 |

238 |

|

|

Johns Manville Corp. |

9,600 |

120,000 |

|

|

Lafarge Corp. |

4,400 |

107,250 |

|

|

Lennox International, Inc. |

3,207 |

44,297 |

|

|

Lilly Industries, Inc. Class A |

1,700 |

52,063 |

|

|

Manitowoc Co., Inc. |

1,250 |

28,672 |

|

|

Masco Corp. |

35,200 |

686,400 |

|

|

Mobile Mini, Inc. (a) |

2,300 |

42,981 |

|

|

Nanophase Technologies Corp. (a) |

4,100 |

57,400 |

|

|

Nortek, Inc. (a) |

200 |

4,088 |

|

|

Omnova Solutions, Inc. |

3,100 |

18,600 |

|

|

Owens Corning |

2,200 |

11,413 |

|

|

Patrick Industries, Inc. |

600 |

4,031 |

|

|

Penn Engineering & Manufacturing Corp. (non-vtg.) |

300 |

9,994 |

|

|

Pitt-Des Moines, Inc. |

100 |

3,206 |

|

|

Plymouth Rubber, Inc. (a) |

500 |

2,625 |

|

|

Puerto Rican Cement Co., Inc. |

100 |

3,025 |

|

|

Quixote Corp. |

700 |

11,200 |

|

|

Robbins & Myers, Inc. |

200 |

4,775 |

|

|

ROHN Industries, Inc. (a) |

2,300 |

9,488 |

|

|

RPM, Inc. |

7,525 |

71,958 |

|

|

Shaw Group (a) |

2,700 |

150,356 |

|

|

Sherwin-Williams Co. |

15,800 |

363,400 |

|

|

Southdown, Inc. |

2,376 |

149,094 |

|

|

Swiss Army Brands, Inc. (a) |

700 |

3,128 |

|

|

Tecumseh Products Co. Class A |

1,800 |

71,550 |

|

|

Texas Industries, Inc. |

1,100 |

37,538 |

|

|

U. S. Concrete, Inc. (a) |

100 |

713 |

|

|

United Dominion Industries Ltd. |

100 |

1,614 |

|

|

USG Corp. |

6,300 |

202,781 |

|

|

Vulcan Materials Co. |

7,100 |

314,619 |

|

|

Watsco, Inc. |

1,050 |

13,388 |

|

|

York International Corp. |

2,700 |

67,163 |

|

|

|

3,739,364 |

||

|

Construction - 0.1% |

|||

|

American Homestar Corp. (a) |

800 |

1,050 |

|

|

Avatar Holdings, Inc. (a) |

300 |

5,775 |

|

|

Beazer Homes USA, Inc. (a) |

400 |

9,900 |

|

|

Butler Manufacturing Co. |

200 |

4,438 |

|

|

California Coastal Communities, Inc. |

6,400 |

35,200 |

|

|

Centex Corp. |

7,100 |

205,013 |

|

|

Clayton Homes, Inc. |

8,575 |

83,606 |

|

|

Crossman Communities, Inc. (a) |

100 |

1,831 |

|

|

D.R. Horton, Inc. |

4,525 |

88,803 |

|

|

Del Webb Corp. (a) |

700 |

15,663 |

|

|

Dominion Homes, Inc. (a) |

300 |

2,063 |

|

|

Emcor Group, Inc. (a) |

2,800 |

67,769 |

|

|

Engle Homes, Inc. |

300 |

4,613 |

|

|

Fleetwood Enterprises, Inc. |

3,300 |

45,169 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

CONSTRUCTION & REAL ESTATE - continued |

|||

|

Construction - continued |

|||

|

Granite Construction, Inc. |

1,500 |

$ 34,125 |

|

|

Jacobs Engineering Group, Inc. (a) |

1,600 |

60,800 |

|

|

Kaufman & Broad Home Corp. |

5,300 |

131,506 |

|

|

Lennar Corp. |

3,000 |

82,875 |

|

|

M. D. C. Holdings, Inc. |

1,000 |

25,063 |

|

|

M/I Schottenstein Homes, Inc. |

100 |

1,969 |

|

|

NCI Building Systems, Inc. (a) |

800 |

14,100 |

|

|

NVR, Inc. (a) |

1,400 |

102,900 |

|

|

Oakwood Homes Corp. |

1,400 |

2,275 |

|

|

Palm Harbor Homes, Inc. (a) |

1,000 |

14,625 |

|

|

Pulte Corp. |

3,500 |

115,281 |

|

|

Ryland Group, Inc. |

500 |

12,281 |

|

|

Skyline Corp. |

100 |

2,213 |

|

|

Standard Pacific Corp. |

1,400 |

23,013 |

|

|

Toll Brothers, Inc. (a) |

3,100 |

101,138 |

|

|

Walter Industries, Inc. |

2,500 |

20,625 |

|

|

|

1,315,682 |

||

|

Engineering - 0.1% |

|||

|

Able Telcom Holding Corp. (a) |

4,700 |

14,688 |

|

|

Apogee Enterprises, Inc. |

800 |

3,550 |

|

|

DSP Group, Inc. (a) |

1,600 |

74,000 |

|

|

DualStar Technologies Corp. (a) |

5,500 |

17,703 |

|

|

Dycom Industries, Inc. (a) |

2,750 |

145,750 |

|

|

Encompass Services Corp. (a) |

1,166 |

6,413 |

|

|

Fluor Corp. |

7,400 |

221,538 |

|

|

Foster Wheeler Corp. |

6,200 |

43,788 |

|

|

Harris Interactive, Inc. |

4,600 |

18,975 |

|

|

Horizon Offshore, Inc. (a) |

700 |

13,038 |

|

|

Jupiter Communications, Inc. |

3,600 |

85,725 |

|

|

MasTec, Inc. (a) |

4,650 |

167,400 |

|

|

Morrison Knudsen Corp. (a) |

2,700 |

32,400 |

|

|

NetRatings, Inc. |

2,200 |

38,088 |

|

|

Quanta Services, Inc. (a) |

4,100 |

191,675 |

|

|

Tetra Tech, Inc. (a) |

5,625 |

152,578 |

|

|

ViaSource Communications, Inc. |

3,100 |

29,450 |

|

|

|

1,256,759 |

||

|

Real Estate - 0.1% |

|||

|

Bluegreen Corp. (a) |

900 |

3,263 |

|

|

Catellus Development Corp. (a) |

6,900 |

123,338 |

|

|

CB Richard Ellis Services, Inc. (a) |

800 |

8,400 |

|

|

Consolidated-Tomoka Land Co. |

3,900 |

47,531 |

|

|

Fairfield Communities, Inc. (a) |

3,200 |

25,600 |

|

|

Forest City Enterprises, Inc. Class A |

1,800 |

63,000 |

|

|

Getty Realty Corp. |

100 |

1,175 |

|

|

Insignia Financial Group, Inc. (a) |

733 |

6,918 |

|

|

Iron Mountain, Inc. (a) |

2,860 |

97,598 |

|

|

Jones Lang LaSalle, Inc. (a) |

2,600 |

37,863 |

|

|

LNR Property Corp. |

1,200 |

25,500 |

|

|

Merry Land Properties, Inc. (a) |

50 |

275 |

|

|

Newhall Land & Farming Co. |

1,600 |

39,400 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Plains All American Pipeline LP |

1,300 |

$ 24,538 |

|

|

Stewart Enterprises, Inc. Class A |

11,300 |

36,019 |

|

|

Trammell Crow Co. (a) |

2,900 |

40,238 |

|

|

Trendwest Resorts, Inc. (a) |

700 |

13,388 |

|

|

Vornado Operating Co. (a) |

60 |

405 |

|

|

W.P. Carey & Co. LLC |

1,200 |

20,775 |

|

|

|

615,224 |

||

|

Real Estate Investment Trusts - 0.8% |

|||

|

Alexander's, Inc. (a) |

100 |

8,075 |

|

|

Alexandria Real Estate Equities, Inc. |

500 |

17,500 |

|

|

AMB Property Corp. |

5,100 |

123,356 |

|

|

American Industrial Properties |

100 |

1,356 |

|

|

American Real Estate Partners LP (a) |

2,300 |

20,269 |

|

|

AMLI Residential Properties Trust (SBI) |

500 |

12,375 |

|

|

Apartment Investment & Management Co. Class A |

4,331 |

194,354 |

|

|

Archstone Communities Trust |

9,000 |

221,625 |

|

|

Arden Realty Group, Inc. |

3,800 |

96,900 |

|

|

Avalonbay Communities, Inc. |

6,000 |

268,125 |

|

|

Bedford Property Investors, Inc. |

400 |

7,775 |

|

|

Boston Properties, Inc. |

5,900 |

238,581 |

|

|

Boykin Lodging Co. |

500 |

4,969 |

|

|

Bradley Real Estate, Inc. (SBI) |

700 |

15,313 |

|

|

Brandywine Realty Trust |

1,700 |

34,850 |

|

|

BRE Properties, Inc. Class A |

2,600 |

75,888 |

|

|

Cabot Industrial Trust |

2,000 |

39,250 |

|

|

Camden Property Trust (SBI) |

2,075 |

62,120 |

|

|

Capital Automotive |

300 |

4,163 |

|

|

CarrAmerica Realty Corp. |

4,100 |

119,156 |

|

|

CBL & Associates Properties, Inc. |

1,000 |

23,875 |

|

|

CenterPoint Properties Trust |

1,000 |

43,813 |

|

|

Charles E. Smith Residential Realty, Inc. |

1,100 |

45,238 |

|

|

Chateau Communities, Inc. |

1,300 |

33,800 |

|

|

Chelsea GCA Realty, Inc. |

600 |

20,138 |

|

|

Colonial Properties Trust (SBI) |

900 |

24,075 |

|

|

Commercial Net Lease Realty, Inc. |

400 |

4,175 |

|

|

Cornerstone Realty Income Trust, Inc. |

900 |

9,450 |

|

|

Cousins Properties, Inc. |

1,900 |

78,138 |

|

|

Crescent Real Estate Equities Co. |

10,400 |

230,100 |

|

|

Developers Diversified Realty Corp. |

3,200 |

46,400 |

|

|

Duke-Weeks Realty Corp. |

10,300 |

244,625 |

|

|

Eastgroup Properties, Inc. |

300 |

6,563 |

|

|

Equity Inns, Inc. |

1,400 |

8,925 |

|

|

Equity Office Properties Trust |

27,050 |

781,069 |

|

|

Equity Residential Properties Trust (SBI) |

14,230 |

683,040 |

|

|

Essex Property Trust, Inc. |

800 |

39,350 |

|

|

Federal Realty Investment Trust (SBI) |

1,900 |

38,000 |

|

|

FelCor Lodging Trust, Inc. |

7,368 |

163,938 |

|

|

First Industrial Realty Trust, Inc. |

10,000 |

296,875 |

|

|

First Union Real Estate Equity & Mortgage Investments |

1,440 |

3,870 |

|

|

Franchise Finance Corp. of America |

3,200 |

72,000 |

|

|

Gables Residential Trust (SBI) |

1,100 |

30,525 |

|

|

General Growth Properties, Inc. |

3,800 |

122,075 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

CONSTRUCTION & REAL ESTATE - continued |

|||

|

Real Estate Investment Trusts - continued |

|||

|

Glenborough Realty Trust, Inc. |

8,900 |

$ 165,763 |

|

|

Glimcher Realty Trust (SBI) |

700 |

10,763 |

|

|

Great Lakes REIT, Inc. |

100 |

1,919 |

|

|

Health Care Property Investors, Inc. |

2,946 |

77,517 |

|

|

Health Care REIT, Inc. |

200 |

3,613 |

|

|

Healthcare Realty Trust, Inc. |

1,900 |

37,525 |

|

|

Highwoods Properties, Inc. |

3,800 |

91,438 |

|

|

Home Properties of New York, Inc. |

800 |

23,750 |

|

|

Hospitality Properties Trust (SBI) |

3,200 |

74,400 |

|

|

Host Marriott Corp. |

21,400 |

228,713 |

|

|

HRPT Properties Trust |

21,600 |

147,150 |

|

|

Innkeepers USA Trust |

700 |

7,263 |

|

|

IRT Property Co. |

300 |

2,644 |

|

|

iStar Financial, Inc. |

3,432 |

71,858 |

|

|

JDN Realty Corp. |

650 |

6,703 |

|

|

JP Realty, Inc. |

100 |

1,775 |

|

|

Kilroy Realty Corp. |

1,200 |

29,850 |

|

|

Kimco Realty Corp. |

3,800 |

154,375 |

|

|

Koger Equity, Inc. |

800 |

13,700 |

|

|

Liberty Property Trust (SBI) |

4,900 |

128,013 |

|

|

Macerich Co. |

1,600 |

33,500 |

|

|

Mack-Cali Realty Corp. |

4,000 |

104,750 |

|

|

Manufactured Home Communities, Inc. |

800 |

18,900 |

|

|

Meditrust Corp. unit |

18,096 |

41,847 |

|

|

MeriStar Hospitality Corp. |

2,400 |

53,100 |

|

|

Mid-America Apartment |

500 |

12,094 |

|

|

Mills Corp. |

800 |

14,500 |

|

|

National Golf Properties, Inc. |

100 |

2,050 |

|

|

Nationwide Health Properties, Inc. |

2,100 |

30,319 |

|

|

New Plan Excel Realty Trust |

7,400 |

102,213 |

|

|

Pacific Gulf Properties, Inc. |

800 |

22,350 |

|

|

Pan Pacific Retail Properties, Inc. |

600 |

11,438 |

|

|

Parkway Properties, Inc. |

100 |

3,175 |

|

|

Pinnacle Holdings, Inc. (a) |

5,200 |

209,300 |

|

|

Post Properties, Inc. |

2,400 |

101,550 |

|

|

Prentiss Properties Trust (SBI) |

1,800 |

43,763 |

|

|

Prison Realty Corp. |

6,750 |

16,031 |

|

|

ProLogis Trust |

18,400 |

420,900 |

|

|

PS Business Parks, Inc. |

900 |

23,850 |

|

|

Public Storage, Inc. |

8,100 |

197,438 |

|

|

Realty Income Corp. |

1,100 |

25,025 |

|

|

Reckson Associates Realty Corp. |

2,200 |

53,488 |

|

|

Redwood Trust, Inc. |

300 |

4,744 |

|

|

Regency Realty Corp. |

3,200 |

72,400 |

|

|

RFS Hotel Investors, Inc. |

400 |

5,000 |

|

|

Senior Housing Properties Trust (REIT) |

820 |

7,483 |

|

|

Shurgard Storage Centers, Inc. Class A |

1,300 |

30,956 |

|

|

Simon Property Group, Inc. |

11,500 |

262,344 |

|

|

SL Green Realty Corp. |

1,100 |

29,494 |

|

|

Spieker Properties, Inc. |

10,100 |

551,713 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Storage USA, Inc. |

1,400 |

$ 42,175 |

|

|

Summit Properties, Inc. |

1,100 |

25,575 |

|

|

Sun Communities, Inc. |

700 |

21,656 |

|

|

Taubman Centers, Inc. |

2,100 |

22,969 |

|

|

The Rouse Co. |

4,400 |

106,150 |

|

|

Thornburg Mortgage, Inc. |

400 |

3,275 |

|

|

Town & Country Trust |

100 |

1,769 |

|

|

United Dominion Realty Trust, Inc. |

5,600 |

60,550 |

|

|

Urban Shopping Centers, Inc. |

700 |

24,456 |

|

|

Ventas, Inc. (a) |

1,400 |

6,913 |

|

|

Vornado Realty Trust |

9,400 |

347,800 |

|

|

Washington (SBI) |

1,600 |

30,700 |

|

|

Weingarten Realty Investors (SBI) |

1,400 |

56,700 |

|

|

Westfield America, Inc. |

3,900 |

58,256 |

|

|

Wyndham International, Inc. Class A (a) |

5,312 |

11,288 |

|

|

|

9,220,736 |

||

|

TOTAL CONSTRUCTION & REAL ESTATE |

16,147,765 |

||

|

DURABLES - 2.0% |

|||

|

Autos, Tires, & Accessories - 1.0% |

|||

|

Aftermarket Technology Corp. (a) |

700 |

4,288 |

|

|

American Axle & Manufacturing Holdings, Inc. (a) |

2,100 |

30,188 |

|

|

ArvinMeritor, Inc. |

4,600 |

75,900 |

|

|

AutoNation, Inc. |

32,000 |

208,000 |

|

|

AutoZone, Inc. (a) |

9,100 |

204,750 |

|

|

Aviation Sales Co. (a) |

2,900 |

14,500 |

|

|

Bandag, Inc. |

1,300 |

42,331 |

|

|

Borg-Warner Automotive, Inc. |

1,600 |

55,000 |

|

|

Boyds Wheels, Inc. (a) |

4,800 |

336 |

|

|

Breed Technologies, Inc. (a) |

1,000 |

200 |

|

|

Casey's General Stores, Inc. |

9,800 |

111,475 |

|

|

CLARCOR, Inc. |

1,100 |

22,688 |

|

|

Cooper Tire & Rubber Co. |

3,700 |

44,631 |

|

|

Copart, Inc. (a) |

2,500 |

42,344 |

|

|

CSK Auto Corp. (a) |

1,300 |

7,069 |

|

|

Cummins Engine Co., Inc. |

2,900 |

102,950 |

|

|

Dana Corp. |

9,956 |

245,789 |

|

|

Danaher Corp. |

8,971 |

504,058 |

|

|

Delphi Automotive Systems Corp. |

38,223 |

628,291 |

|

|

Discount Auto Parts, Inc. (a) |

500 |

4,438 |

|

|

Dura Automotive Systems, Inc. |

1,683 |

18,092 |

|

|

Eaton Corp. |

5,300 |

351,788 |

|

|

Federal Signal Corp. |

1,400 |

30,188 |

|

|

Federal-Mogul Corp. |

5,100 |

52,594 |

|

|

Fidelity Holdings, Inc. (a) |

4,350 |

5,845 |

|

|

Ford Motor Co. |

128,397 |

3,105,602 |

|

|

General Motors Corp. |

37,946 |

2,739,227 |

|

|

GenTek, Inc. |

1,600 |

24,400 |

|

|

Gentex Corp. (a) |

6,000 |

155,250 |

|

|

Genuine Parts Co. |

11,800 |

242,638 |

|

|

Getty Petroleum Marketing, Inc. (a) |

100 |

388 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

DURABLES - continued |

|||

|

Autos, Tires, & Accessories - continued |

|||

|

Goodyear Tire & Rubber Co. |

11,000 |

$ 257,125 |

|

|

Group 1 Automotive, Inc. (a) |

200 |

2,200 |

|

|

Hayes Lemmerz International, Inc. (a) |

1,000 |

12,875 |

|

|

IMPCO Technologies, Inc. (a) |

2,100 |

50,531 |

|

|

Intermet Corp. |

400 |

3,100 |

|

|

Johnson Controls, Inc. |

5,900 |

315,281 |

|

|

Lear Corp. (a) |

3,900 |

84,094 |

|

|

Mascotech, Inc. |

1,700 |

28,156 |

|

|

McLaren Automotive Group, Inc. (a) |

500 |

938 |

|

|

Midas, Inc. |

1,400 |

23,800 |

|

|

Miller Industries, Inc. (a) |

1,800 |

2,588 |

|

|

Modine Manufacturing Co. |

1,400 |

39,375 |

|

|

Monaco Coach Corp. (a) |

200 |

3,500 |

|

|

Monro Muffler Brake, Inc. (a) |

1,100 |

11,138 |

|

|

NACCO Industries, Inc. Class A |

300 |

14,063 |

|

|

Navistar International Corp. (a) |

3,900 |

146,250 |

|

|

O'Reilly Automotive, Inc. (a) |

5,000 |

76,250 |

|

|

Oshkosh Truck Co. |

2,100 |

74,550 |

|

|

PACCAR, Inc. |

6,800 |

288,575 |

|

|

Pep Boys-Manny, Moe & Jack |

2,800 |

16,450 |

|

|

Sonic Automotive, Inc. Class A (a) |

3,200 |

33,800 |

|

|

SPX Corp. (a) |

2,772 |

454,608 |

|

|

Strattec Security Corp. (a) |

1,800 |

62,325 |

|

|

Superior Industries International, Inc. |

1,300 |

42,169 |

|

|

The Pantry, Inc. (a) |

900 |

11,700 |

|

|

Tower Automotive, Inc. (a) |

3,400 |

38,675 |

|

|

TRW, Inc. |

8,400 |

383,775 |

|

|

Ugly Duckling Corp. (a) |

100 |

694 |

|

|

United Auto Group, Inc. (a) |

800 |

6,750 |

|

|

Visteon Corp. |

9,056 |

142,066 |

|

|

Wabash National Corp. |

700 |

7,788 |

|

|

|

11,710,427 |

||

|

Consumer Durables - 0.3% |

|||

|

Ballantyne of Omaha, Inc. (a) |

100 |

119 |

|

|

Blyth, Inc. |

2,900 |

67,969 |

|

|

Boyds Collection, Ltd. (a) |

3,600 |

31,950 |

|

|

Department 56, Inc. (a) |

2,200 |

29,838 |

|

|

Dupont Photomasks, Inc. (a) |

2,100 |

159,338 |

|

|

Libbey, Inc. |

900 |

29,531 |

|

|

Lifetime Hoan Corp. |

300 |

1,950 |

|

|

Mikasa, Inc. |

2,300 |

22,281 |

|

|

Minnesota Mining & Manufacturing Co. |

27,700 |

2,576,100 |

|

|

Oneida Ltd. |

400 |

5,500 |

|

|

SAF T LOK, Inc. (a) |

18,900 |

19,491 |

|

|

Simpson Manufacturing Co. Ltd. (a) |

600 |

28,200 |

|

|

Snap-On, Inc. |

5,400 |

166,388 |

|

|

Sola International, Inc. (a) |

700 |

4,900 |

|

|

|

3,143,555 |

||

|

Consumer Electronics - 0.4% |

|||

|

American Technology Corp. (a) |

900 |

4,500 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Applica, Inc. (a) |

2,700 |

$ 28,013 |

|

|

Audible, Inc. |

4,000 |

7,000 |

|

|

Black & Decker Corp. |

6,200 |

248,388 |

|

|

Boston Acoustics, Inc. |

100 |

1,238 |

|

|

Digital Video Systems, Inc. (a) |

1,800 |

13,388 |

|

|

Fossil, Inc. (a) |

1,400 |

24,413 |

|

|

Gemstar-TV Guide International, Inc. (a) |

28,700 |

2,590,175 |

|

|

General Motors Corp. Class H |

47,526 |

1,574,299 |

|

|

Harman International Industries, Inc. |

1,000 |

76,750 |

|

|

Maytag Corp. |

5,800 |

221,125 |

|

|

Movado Group, Inc. |

400 |

5,600 |

|

|

National Presto Industries, Inc. |

900 |

27,394 |

|

|

Odetics, Inc. Class B |

400 |

5,650 |

|

|

Recoton Corp. (a) |

2,000 |

28,375 |

|

|

Rockford Corp. |

2,500 |

15,938 |

|

|

Salton, Inc. (a) |

1,100 |

41,388 |

|

|

Sunbeam Corp. (a) |

670 |

1,298 |

|

|

Sunbeam Corp. warrants 8/24/03 (a) |

114 |

0 |

|

|

TrueTime, Inc. |

3,100 |

12,788 |

|

|

U.S. Industries, Inc. |

6,600 |

84,150 |

|

|

Universal Electronics, Inc. (a) |

3,400 |

80,591 |

|

|

Whirlpool Corp. |

5,100 |

193,800 |

|

|

|

5,286,261 |

||

|

Home Furnishings - 0.1% |

|||

|

Bassett Furniture Industries, Inc. |

1,600 |

22,000 |

|

|

Bush Industries, Inc. Class A. |

1,500 |

19,500 |

|

|

Chromcraft Revington, Inc. (a) |

1,600 |

17,800 |

|

|

Craftmade International, Inc. |

1,700 |

13,494 |

|

|

Ethan Allen Interiors, Inc. |

3,200 |

86,200 |

|

|

Falcon Products, Inc. |

1,700 |

16,575 |

|

|

Flexsteel Industries, Inc. |

1,300 |

15,925 |

|

|

Furniture Brands International, Inc. (a) |

4,200 |

67,725 |

|

|

Haverty Furniture Companies, Inc. |

1,000 |

11,563 |

|

|

Heilig-Meyers Co. |

1,400 |

266 |

|

|

Herman Miller, Inc. |

5,900 |

188,431 |

|

|

Hillenbrand Industries, Inc. |

3,400 |

118,363 |

|

|

HON Industries, Inc. |

4,600 |

123,913 |

|

|

La-Z-Boy, Inc. |

4,950 |

79,509 |

|

|

Leggett & Platt, Inc. |

14,400 |

254,700 |

|

|

Linens'n Things, Inc. (a) |

2,600 |

70,200 |

|

|

Mity-Lite, Inc. (a) |

1,100 |

11,069 |

|

|

Restoration Hardware, Inc. (a) |

1,000 |

5,750 |

|

|

Rowe Furniture Corp. |

1,000 |

4,438 |

|

|

Stanley Furniture Co., Inc. (a) |

1,000 |

27,125 |

|

|

Steelcase, Inc. Class A |

3,200 |

53,000 |

|

|

Virco Manufacturing Co. |

1,600 |

20,600 |

|

|

|

1,228,146 |

||

|

Textiles & Apparel - 0.2% |

|||

|

Active Apparel Group, Inc. (a) |

1,000 |

4,875 |

|

|

Ashworth, Inc. (a) |

400 |

2,212 |

|

|

BEBE Stores, Inc. (a) |

2,100 |

32,944 |

|

|

Brown Shoe Co., Inc. |

500 |

5,375 |

|

|

Burlington Industries, Inc. (a) |

500 |

875 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

DURABLES - continued |

|||

|

Textiles & Apparel - continued |

|||

|

Collins & Aikman Corp. (a) |

1,300 |

$ 6,744 |

|

|

Columbia Sportswear Co. (a) |

1,400 |

57,225 |

|

|

Dixie Group, Inc. (a) |

2,900 |

11,600 |

|

|

Donna Karan International, Inc. (a) |

700 |

4,244 |

|

|

Interface, Inc. Class A |

9,900 |

68,681 |

|

|

Jones Apparel Group, Inc. (a) |

8,651 |

211,950 |

|

|

K-Swiss, Inc. Class A |

3,300 |

74,250 |

|

|

Kellwood Co. |

1,200 |

19,200 |

|

|

Liz Claiborne, Inc. |

6,400 |

281,200 |

|

|

Madden Steven Ltd. (a) |

4,800 |

59,100 |

|

|

Mohawk Industries, Inc. (a) |

4,200 |

99,750 |

|

|

Nautica Enterprises, Inc. (a) |

2,900 |

34,256 |

|

|

NIKE, Inc. Class B |

19,000 |

751,688 |

|

|

Oshkosh B'Gosh, Inc. Class A |

3,000 |

42,750 |

|

|

Pacific Sunwear of California, Inc. (a) |

6,100 |

81,206 |

|

|

Phillips-Van Heusen Corp. |

400 |

3,650 |

|

|

Polo Ralph Lauren Corp. Class A (a) |

4,000 |

77,500 |

|

|

Polymer Group, Inc. |

400 |

2,800 |

|

|

Quiksilver, Inc. (a) |

600 |

8,925 |

|

|

Reebok International Ltd. (a) |

8,900 |

170,769 |

|

|

Russell Corp. |

1,600 |

30,500 |

|

|

Samsonite Corp. (a) |

1,446 |

6,236 |

|

|

Saucony, Inc. (a) |

2,100 |

20,213 |

|

|

Shaw Industries, Inc. |

9,871 |

122,771 |

|

|

Sport-Haley, Inc. (a) |

100 |

325 |

|

|

Springs Industries, Inc. Class A |

800 |

23,900 |

|

|

Stride Rite Corp. |

1,400 |

8,400 |

|

|

Superior Uniform Group, Inc. |

1,000 |

7,625 |

|

|

Tarrant Apparel Group (a) |

2,700 |

20,756 |

|

|

Timberland Co. Class A (a) |

2,400 |

97,800 |

|

|

Unifi, Inc. (a) |

2,700 |

30,544 |

|

|

Vans, Inc. (a) |

3,600 |

56,250 |

|

|

VF Corp. |

7,400 |

169,275 |

|

|

Warnaco Group, Inc. Class A |

9,500 |

47,500 |

|

|

WestPoint Stevens, Inc. |

2,900 |

40,781 |

|

|

Wolverine World Wide, Inc. |

1,700 |

18,594 |

|

|

|

2,815,239 |

||

|

TOTAL DURABLES |

24,183,628 |

||

|

ENERGY - 4.4% |

|||

|

Coal - 0.0% |

|||

|

Arch Coal, Inc. |

1,919 |

14,393 |

|

|

CONSOL Energy, Inc. |

4,800 |

99,900 |

|

|

|

114,293 |

||

|

Energy Services - 1.1% |

|||

|

Atwood Oceanics, Inc. (a) |

400 |

18,150 |

|

|

Baker Hughes, Inc. |

20,950 |

765,984 |

|

|

BJ Services Co. (a) |

4,600 |

308,200 |

|

|

Cal Dive International, Inc. (a) |

500 |

28,750 |

|

|

Carbo Ceramics, Inc. |

700 |

25,419 |

|

|

|

|||

|

Shares |

Value (Note 1) |

||

|

Diamond Offshore Drilling, Inc. |

12,100 |

$ 542,231 |

|

|

ENSCO International, Inc. |

7,500 |

299,063 |

|

|

Global Industries Ltd. (a) |

13,400 |

166,663 |

|

|

Global Marine, Inc. (a) |

12,300 |

397,444 |

|

|

Halliburton Co. |

33,200 |

1,759,600 |

|

|

Hanover Compressor Co. (a) |

4,200 |

133,350 |

|

|

Helmerich & Payne, Inc. |

7,500 |

277,031 |

|

|

Key Energy Group, Inc. (a) |

9,900 |

102,713 |

|

|

Lone Star Technologies, Inc. (a) |

3,400 |

170,850 |

|

|

Marine Drilling Companies, Inc. (a) |

1,500 |

40,781 |

|

|

Maverick Tube Corp. (a) |

2,600 |

72,963 |

|

|

McDermott International, Inc. |

9,400 |

72,263 |

|

|

Nabors Industries, Inc. (a) |

8,430 |

400,952 |

|

|

Noble Drilling Corp. (a) |

9,500 |

460,750 |

|

|

Oceaneering International, Inc. (a) |

600 |

10,463 |

|

|

Offshore Logistics, Inc. (a) |

700 |

12,163 |

|

|

Parker Drilling Co. (a) |

2,900 |

20,844 |

|

|

Patterson Energy, Inc. (a) |

5,800 |

181,975 |

|

|

Pride International, Inc. (a) |

6,200 |

152,675 |

|

|

R&B Falcon Corp. (a) |

9,980 |

284,430 |

|

|

Rowan Companies, Inc. (a) |

3,800 |

117,800 |

|

|

Santa Fe International Corp. |

14,500 |

570,031 |

|

|

Schlumberger Ltd. (NY Shares) |

41,772 |

3,563,674 |

|

|

SEACOR SMIT, Inc. (a) |

1,350 |

61,509 |

|

|

Smith International, Inc. (a) |

2,500 |

198,750 |

|

|

Superior Energy Services, Inc. (a) |

1,200 |

13,200 |

|

|

TETRA Technologies, Inc. (a) |

1,100 |

14,988 |

|

|

Tidewater, Inc. |

9,200 |

371,450 |

|

|

Transocean Sedco Forex, Inc. |

13,257 |

792,106 |

|

|

Unit Corp. (a) |

700 |

10,938 |

|

|

Varco International, Inc. (a) |

11,446 |

231,066 |

|

|

Weatherford International, Inc. |

6,380 |

299,461 |

|

|

Zapata Corp. |

1,100 |

3,506 |

|

|

|

12,954,186 |

||

|

Oil & Gas - 3.3% |

|||

|

Amerada Hess Corp. |

9,000 |

615,938 |

|

|

American International Petroleum Corp. (a) |

100 |

53 |

|

|

Anadarko Petroleum Corp. |

17,268 |

1,135,716 |

|

|

Apache Corp. |

7,500 |

472,500 |

|

|

Barrett Resources Corp. (a) |

1,500 |

51,938 |

|

|

Basin Exploration, Inc. (a) |

3,600 |

72,000 |

|

|

Belco Oil & Gas Corp. (a) |

1,100 |

10,038 |

|

|

Bellwether Exploration Co. (a) |

5,600 |

44,625 |

|

|

Benton Oil & Gas Co. (a) |

1,200 |

2,550 |

|

|

Berry Petroleum Co. Class A |

200 |

3,800 |

|

|

BP Prudhoe Bay Royalty Trust |

4,900 |

61,556 |

|

|

Buckeye Partners LP |

1,700 |

47,813 |

|

|

Burlington Resources, Inc. |

14,400 |

566,100 |

|

|

Cabot Oil & Gas Corp. Class A |

800 |

16,000 |

|

|

Chesapeake Energy Corp. (a) |

4,400 |

33,550 |

|

|

Chevron Corp. |

46,000 |

3,887,000 |

|

|

Comstock Resources, Inc. (a) |

1,100 |

10,931 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (Note 1) |

||

|

ENERGY - continued |

|||

|

Oil & Gas - continued |

|||

|

Conoco, Inc. Class B |

43,389 |

$ 1,133,538 |

|

|

Cooper Cameron Corp. (a) |

3,700 |

287,906 |

|

|

Cross Timbers Oil Co. |

1,900 |

50,231 |

|

|

Crown Central Petroleum Corp. |

200 |

1,863 |

|

|

Devon Energy Corp. |

9,049 |

529,932 |

|

|

EEX Corp. (a) |

1,433 |

7,882 |

|

|

Enterprise Products Partners LP |

3,000 |

76,688 |

|

|

EOG Resources, Inc. |

8,200 |

313,650 |

|

|

Evergreen Resources, Inc. (a) |

1,900 |

55,456 |

|

|

Exxon Mobil Corp. |

248,056 |

20,247,571 |

|

|

Forcenergy, Inc. (a) |

600 |

14,513 |

|

|

Forest Oil Corp. (a) |

2,100 |

32,156 |

|

|

Friede Goldman Halter, Inc. (a) |

1,056 |

5,940 |

|

|

Frontier Oil Corp. (a) |

1,200 |

8,550 |

|

|

Gothic Energy Corp. (a) |

200 |

259 |

|

|

Grant Prideco, Inc. (a) |

6,500 |

152,750 |

|

|

Gulf Island Fabrication, Inc. (a) |

300 |

5,550 |

|

|

Harken Energy Corp. (a) |

4,800 |

3,900 |

|

|

Holly Corp. |

200 |

2,575 |

|

|

Houston Exploration Co. (a) |

700 |

18,113 |

|

|

HS Resources, Inc. (a) |

500 |

15,844 |

|

|

Hugoton Royalty Trust |

2,400 |

30,750 |

|

|

Kerr-McGee Corp. |

6,170 |

389,867 |

|

|

Louis Dreyfus Natural Gas Corp. (a) |

3,100 |

107,725 |

|

|

Murphy Oil Corp. |

4,600 |

307,050 |

|

|

National Energy Group, Inc. (a) |

500 |

175 |

|

|

National-Oilwell, Inc. (a) |

2,507 |

86,962 |

|

|

Newfield Exploration Co. (a) |

2,300 |

99,475 |

|

|

Noble Affiliates, Inc. |

3,200 |

124,000 |

|

|

Nuevo Energy Co. (a) |

700 |

13,431 |

|

|

Occidental Petroleum Corp. |

24,600 |

531,975 |

|

|

Ocean Energy, Inc. (a) |

9,828 |

149,263 |

|

|

Patina Oil & Gas Corp. |

100 |

2,125 |

|

|

Pennzoil-Quaker State Co. |

5,092 |

63,332 |

|

|

Phillips Petroleum Co. |

20,900 |

1,293,188 |

|

|

Pioneer Natural Resources Co. (a) |

5,000 |

69,375 |

|

|

Plains Resources, Inc. (a) |

900 |

15,975 |

|

|

Pogo Producing Co. |

1,700 |

45,688 |

|

|

Pure Resources, Inc. (a) |

800 |

15,450 |

|

|

Range Resources Corp. |

1,200 |

6,000 |

|

|

Resource America, Inc. Class A |

2,300 |

19,406 |

|

|

Seven Seas Petroleum, Inc. (a) |

1,700 |

4,888 |

|

|

Spinnaker Exploration Co. |

600 |