|

|

|

|

M A R K E T O V E R V I E W

Goldman Sachs CORE Equity Funds

Dear Shareholder:

During the period under review the financial markets experienced a dramatic increase in volatility. However, investors who stayed the course were generally rewarded for their disciplined approach, as many sectors of the market generated solid returns.

While a range of stocks were negatively impacted by the correction, technology issues experienced the brunt of the decline. At one point the technology-heavy Nasdaq composite was down 37% from its peak. While the Nasdaq posted a one-year return of 45.93% for the period ended August 31, 2000, this was largely due to the strong performance of technology stocks late in 1999 and in the summer of 2000. However, by the end of the reporting period the Nasdaq was still off 19% from its peak. In contrast, the S&P 500 Index, which also fell during the middle of the period, recovered to the point that it was again nearing its record high by the end of August.

As always, we appreciate your support and we look forward to serving your investment needs in the years to come.

| Sincerely, | |||

|

|

||

| David B. Ford

Co-Head, Goldman Sachs Asset Management |

David W. Blood

Co-Head, Goldman Sachs Asset Management |

||

| September 15, 2000 | |||

F U N D B A S I C S

CORESM

U.S. Equity Fund

as of August 31, 2000

| P E R F O R M A N C E R E V I E W | |||||

| August 31, 1999–August 31, 2000 | Fund Total Return (without sales charge)1 | S&P 500 Index2 | |||

| |

|||||

| Class A | 18.96% | 16.32% | |||

| Class B | 18.03 | 16.32 | |||

| Class C | 18.03 | 16.32 | |||

| Institutional | 19.41 | 16.32 | |||

| Service | 18.83 | 16.32 | |||

| |

|||||

| 1 | The net asset value represents the net assets of the Fund (ex-dividend) divided by the total number of shares. The Fund’s performance assumes the reinvestment of dividends and other distributions. | ||||||||

| 2 | The unmanaged S&P 500 Index (with dividends reinvested) figures do not reflect any fees or expenses. In addition, investors cannot invest directly in the Index. | ||||||||

| S T A N D A R D I Z E D T O T A L R E T U R N S 3 | ||||||||

| For the period ended 6/30/00 | Class A | Class B | Class C | Institutional | Service | |||

| |

||||||||

| One Year | 2.03% | 1.78% | 6.04% | 8.36% | 7.82% | |||

| Five Years | 20.22 | N/A | N/A | 22.34 | 21.624 | |||

| Since Inception | 15.76 | 19.60 | 15.63 | 22.68 | 16.504 | |||

| (5/24/91) | (5/1/96) | (8/15/97) | (6/15/95) | (5/24/91) | ||||

| |

||||||||

| 3 | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value. These returns reflect a maximum initial sales charge of 5.5% for Class A shares, the assumed deferred sales charge for Class B shares (5% maximum declining to 0% after six years) and the assumed deferred sales charge for Class C shares (1% if redeemed within 12 months of purchase). Because Institutional and Service shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. | |||

| 4 | Performance data for Service shares prior to 6/7/96 is that of Class A shares (excluding the impact of front-end sales charges applicable to Class A shares since Service shares are not subject to any sales charges). Performance of Class A shares of the CORE U.S. Equity Fund reflects the expenses applicable to the Fund’s Class A shares. The fees applicable to Services shares are different from those applicable to Class A shares which impact performance ratings and rankings for a class of shares. | |||

| Total return figures represent past performance and do not indicate future results, which will vary. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance reflects fee waivers and expense limitations in effect. In their absence, performance would be reduced. | ||||

| T O P 1 0 H O L D I N G S A S O F 8/ 3 1 / 0 0 | |||

| Holding | % of Total Net Assets | Line of Business | |

| |

|||

| General Electric Co. | 4.5 | % | Financial Services |

| Intel Corp. | 3.5 | Semiconductors | |

| Cisco Systems, Inc. | 3.3 | Computer Hardware | |

| Citigroup, Inc. | 2.7 | Banks | |

| Pfizer, Inc. | 2.5 | Drugs | |

| Nortel Networks Corp. | 2.3 | Electrical Equipment | |

| Exxon Mobil Corp. | 2.3 | Energy Resources | |

| Microsoft Corp. | 2.3 | Computer Software | |

| Oracle Corp. | 2.2 | Computer Software | |

| American International Group, Inc. | 1.6 | Property Insurance | |

| |

|||

| The top 10 holdings may not be representative of the Fund’s future investments. | |||

1

P E R F O R M A N C E O V E R V I E W

CORE U.S. Equity Fund

Dear Shareholder,

We are pleased to report on the performance of the Goldman Sachs CORE U.S. Equity Fund for the one year period that ended August 31, 2000.

Performance Review

Over the one-year period that ended August 31, 2000, the Fund’s Class A, B, C, Institutional and Service shares generated total cumulative returns, without sales charges, of 18.96%, 18.03%, 18.03%, 19.41%, and 18.83%, respectively. These figures compare favorably to the 16.32% total cumulative return of the Fund’s benchmark, the S&P 500 Index.

The CORE strategy is a well-defined investment process that has historically provided consistent, risk-managed performance. We seek to buy stocks that are attractively valued and favored by fundamental research analysts, have experienced good momentum and are more stable. The diversification of our models typically adds value, because when one theme doesn’t work, others usually do. For example, when momentum stocks underperform, value stocks typically advance more than average. Portfolios are constructed taking into account stocks’ risk characteristics as well as their expected returns.

Portfolio Positioning

The CORE investment process analyzes each stock based upon its Value and Momentum characteristics as well as a fundamental Research assessment. Over the 12-month period, on average Momentum contributed quite favorably to returns, whereas the return to Value was negative. The Research theme produced strong results during a few months, but overall, the return to Research was flat.

However, during much of the reporting period, our themes produced results that were contrary to what we would expect. This was typically the result of the dramatic shifts in investor preferences and the extreme volatility in the financial markets. For example, during the second quarter, the spread between the daily high and low prices for the S&P 500 index averaged 2.0%, versus the long-term average of 1.2%. In addition, the monthly return dispersion (the spread between the best- and worst-performing stocks) hit its highest level in over 20 years. However, in July and August market volatility decreased substantially and our themes produced results that were closer to our expectations, which enhanced our overall returns during the reporting period.

Portfolio Highlights

The Fund’s best relative performers were stocks in the technology and consumer non-cyclicals sectors. Some examples of particularly strong contributors to relative return include:

2

P E R F O R M A N C E O V E R V I E W

Portfolio Outlook

The market we’ve experienced during the last year has been highly unusual. While this year’s high level of volatility posed challenges, we believe it could positively impact the long-term health of the financial markets by creating a number of investment opportunities. To a great extent, the market’s speculative nature has diminished, and we’re beginning to see a return to more “normal” levels of volatility.

Looking ahead, we continue to believe that cheaper stocks should outpace more expensive ones, good momentum stocks should do better than poor momentum stocks, high-earnings-quality stocks should perform better than those with lower earnings quality as should those favored by research analysts. We anticipate remaining fully invested and expect that the value we add over time will be due to exposures to our investment themes coupled with careful management of portfolio risk.

We thank you for your investment and look forward to your continued confidence.

Goldman Sachs Quantitative Equity Investment Team

New York, September 15, 2000

3

F U N D B A S I C S

CORESM

Large Cap Growth Fund

as of August 31, 2000

| P E R F O R M A N C E R E V I E W | ||||

| August 31, 1999–August 31, 2000 | Fund Total Return (without sales charge)1 | Russell 1000 Growth Index2 | ||

| |

||||

| Class A | 33.73%

|

33.45%

|

||

| Class B | 32.78

|

33.45

|

||

| Class C | 32.84

|

33.45

|

||

| Institutional | 34.34

|

33.45

|

||

| Service | 33.64

|

33.45

|

||

| |

||||

| 1 |

The net asset value represents the net assets of the Fund (ex-dividend) divided by the total number of shares. The Fund’s performance assumes the reinvestment of dividends and other distributions. |

| 2 |

The unmanaged Russell 1000 Growth Index (with dividends reinvested) figures do not reflect any fees or expenses. In addition, investors cannot invest directly in the Index. |

| S TA N D A R D I Z E D T O T A L R E TU R N S 3 | |||||||||||

| For the period ended 6/30/00 | Class A | Class B | Class C | Institutional | Service | ||||||

| |

|||||||||||

| One Year | 18.69%

|

19.62%

|

23.63%

|

26.03 | % | 25.50 | % | ||||

| Five Years | 26.644

|

N/A

|

N/A

|

28.33 | 4 | 27.96 | 4 | ||||

| Since Inception | 21.834

|

26.99

|

23.45

|

22.80 | 4 | 27.59 | 4 | ||||

| (11/11/91)

|

(5/1/97)

|

(8/15/97)

|

(11/11/91) | (11/11/91) | |||||||

| |

|||||||||||

|

3 The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value. These returns reflect a maximum initial sales charge of 5.5% for Class A shares, the assumed deferred sales charge for Class B shares (5% maximum declining to 0% after six years) and the assumed deferred sales charge for Class C shares (1% if redeemed within 12 months of purchase). Because Institutional and Service shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

||||

| 4 Performance data for Institutional and Service shares prior to May 1, 1997 (commencement of operations) is that of Class A shares. Class A share performance for such period is that of a predecessor separate account (which converted into Class A shares) adjusted to reflect the higher fees and expenses applicable to the Fund’s Class A shares. Although the predecessor separate account was managed by Goldman Sachs Asset Management in a manner and pursuant to investment objectives in all material respects equivalent to management and investment objectives of the CORE Large Cap Growth Fund, the separate account was not registered under the Investment Company Act of 1940 (the “Act”) and was not subject to certain investment restrictions imposed by the Act. If it had registered under the Act, performance might have been adversely affected. | ||||

|

Total return figures represent past performance and do not indicate future results, which will vary. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance reflects fee waivers and expense limitations in effect. In their absence, performance would be reduced. |

||||

|

|

||||

| T O P 1 0 H O L D I N G S A S O F 8 / 3 1 / 0 0 | ||||

| Holding | % of Total Net Assets | Line of Business | ||

| |

||||

| Intel Corp. | 6.8 | % | Semiconductors | |

| General Electric Co. | 6.1 | Financial Services | ||

| Cisco Systems, Inc. | 5.8 | Computer Hardware | ||

| Pfizer, Inc. | 3.5 | Drugs | ||

| Microsoft Corp. | 3.2 | Computer Software | ||

| Oracle Corp. | 3.0 | Computer Software | ||

| Sun Microsystems, Inc. | 2.8 | Computer Hardware | ||

| EMC Corp. | 2.8 | Computer Hardware | ||

| Corning, Inc. | 2.4 | Electrical Equipment | ||

| Merck & Co., Inc. | 1.9 | Drugs | ||

| |

||||

|

The top 10 holdings may not be representative of the Fund’s future investments. |

||||

4

P E R F O R M A N C E O V E R V I E W

CORE Large Cap Growth Fund

Dear Shareholder,

We are pleased to report on the performance of the Goldman Sachs CORE Large Cap Growth Fund for the one year period that ended August 31, 2000.

Performance Review

Over the one-year period that ended August 31, 2000, the Fund’s Class A, B, C, Institutional and Service shares generated total cumulative returns, without sales charges, of 33.73%, 32.78%, 32.84%, 34.34%, and 33.64%, respectively. These figures compare to the 33.45% total cumulative return of the Fund’s benchmark, the Russell 1000 Growth Index.

The CORE strategy is a well-defined investment process that has historically provided consistent, risk-managed performance. We seek to buy stocks that are attractively valued and favored by fundamental research analysts, have experienced good momentum and are more stable. The diversification of our models typically adds value, because when one theme doesn’t work, others usually do. For example, when momentum stocks underperform, value stocks typically advance more than average. Portfolios are constructed taking into account stocks’ risk characteristics as well as their expected returns.

Portfolio Positioning

The CORE investment process analyzes each stock based upon its Value and Momentum characteristics as well as a fundamental Research assessment. During much of the reporting period, our themes produced erratic results, experiencing some of the best and some of the worst months since inception. This was typically the result of the dramatic shifts in investor preferences and the extreme volatility in the financial markets. For example, during the second quarter, the spread between the daily high and low prices for the NASDAQ Composite index averaged 4.3%, versus the long-term average of 1.1%. In addition, the monthly return dispersion (the spread between the best- and worst-performing stocks) hit its highest level in over 20 years. However, in July and August market volatility decreased substantially and our themes produced results that were closer to our expectations.

Portfolio Highlights

The Fund’s best performers were stocks in technology and financial sectors. Some examples of particularly strong contributors to relative return include:

5

P E R F O R M A N C E O V E R V I E W

Portfolio Outlook

Using any number of measures, the market we’ve experienced during the last year has been highly unusual. And while this year’s high level of volatility was difficult for novice and experienced investors alike, we believe it could serve to be a positive for the long-term health of the financial markets, as it created a number of investment opportunities. To a great extent, the very speculative nature of the market that was driving returns has diminished. And we’re already beginning to see a return to more “normal” levels of volatility.

Looking ahead, we continue to believe that cheaper stocks should outpace more expensive ones, good momentum stocks should do better than poor momentum stocks, high-earnings-quality stocks should perform better than those with lower earnings quality as should those favored by research analysts. As such, we anticipate remaining fully invested and expect that the value we add over time will be due to exposures to our investment themes coupled with careful management of portfolio risk.

We thank you for your investment and look forward to your continued confidence.

Goldman Sachs Quantitative Equity Investment Team

New York

September 13, 2000

6

F U N D B A S I C S

CORESM

Small Cap Equity Fund

as of August 31, 2000

| P E R F O R M A N C E R E V I E W | ||||||

| August 31, 1999–August 31, 2000 | Fund Total Return (without sales charge)1 | Russell 2000 Index2 | ||||

| |

||||||

| Class A | 26.10 | % | 27.15 | % | ||

| Class B | 25.17 | 27.15 | ||||

| Class C | 25.35 | 27.15 | ||||

| Institutional | 26.60 | 27.15 | ||||

| Service | 25.93 | 27.15 | ||||

| |

||||||

1

The net asset value represents the net assets of the Fund (ex-dividend) divided by the total number of shares.

The Fund’s performance assumes the reinvestment of dividends and other distributions.

2

The unmanaged Russell 2000 Index (with dividends reinvested) figures do not reflect any fees or expenses.

In addition, investors cannot invest directly in the Index.

| S TA N D A R D I Z E D TO T A L R E T U R N S 3 | |||||||||||||||

| For the period ended 6/30/00 | Class A | Class B | Class C | Institutional | Service | ||||||||||

| |

|||||||||||||||

| One Year | 8.10 | % | 8.49 | % | 12.56 | % | 14.81 | % | 14.26 | % | |||||

| Since Inception | 5.42 | 5.80 | 6.79 | 7.92 | 7.44 | ||||||||||

| (8/15/97) | |||||||||||||||

| |

|||||||||||||||

| 3 | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value. These returns reflect a maximum initial sales charge of 5.5% for Class A shares, the assumed deferred sales charge for Class B shares (5% maximum declining to 0% after six years) and the assumed deferred sales charge for Class C shares (1% if redeemed within 12 months of purchase). Because Institutional and Service shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

| Total return figures represent past performance and do not indicate future results, which will vary. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance reflects expense limitations in effect. In their absence, performance would be reduced. |

| T O P 1 0 H O L D I N G S A S O F 8 / 3 1 / 0 0 | |||

| Holding | % of Total Net Assets | Line of Business | |

| |

|||

| Silicon Valley Bancshares | 0.9 | % | Banks |

| CMP Group, Inc. | 0.7 | Electrical Utilities | |

| Precision Castparts Corp. | 0.7 | Defense/Aerospace | |

| RGS Energy Group, Inc. | 0.7 | Electrical Utilities | |

| C&D Technologies, Inc. | 0.6 | Heavy Electrical | |

| Bindley Western Industries, Inc. | 0.6 | Drugs | |

| Pulitzer, Inc. | 0.6 | Publishing | |

| MRV Communications, Inc. | 0.6 | Electrical Equipment | |

| Exar Corp. | 0.6 | Semiconductors | |

| The Dexter Corp. | 0.6 | Chemicals | |

| |

|||

|

The top 10 holdings may not be representative of the Fund’s future investments. |

|||

|

7 |

|||

P E R F O R M A N C E O V E R V I E W

CORE Small Cap Equity Fund

Dear Shareholder,

We are pleased to report on the performance of the Goldman Sachs CORE Small Cap Equity Fund for the one year period that ended August 31, 2000.

Performance Review

Over the one-year period that ended August 31, 2000, the Fund’s Class A, B, C, Institutional and Service shares generated cumulative total returns, without sales charges, of 26.10%, 25.17%, 25.35%, 26.60%, and 25.93%, respectively. These figures compare to the 27.15% cumulative total return of the Fund’s benchmark, the Russell 2000 Index.

The CORE strategy is a well-defined investment process that has historically provided consistent, risk-managed performance. We seek to buy stocks that are attractively valued and favored by fundamental research analysts, have experienced good momentum and are more stable. These themes are considered relative to the Russell 2000 Index. The diversification of our models typically adds value, because when one theme doesn’t work, others usually do. For example, when momentum stocks underperform, value stocks typically advance more than average. Portfolios are constructed taking into account stocks’ risk characteristics as well as their expected returns.

Portfolio Positioning

The CORE investment process analyzes each stock based upon its Value and Momentum Risk characteristics as well as a fundamental Research assessment. During the first part of the reporting period, Momentum produced results that were highly contrary to what we would expect, whereas returns to Research were extremely positive. In very late 1999 and early 2000, Value experienced its biggest shortfall since the inception of our data. Late in the period, growth and value jockeyed back and forth, and overall value produced much better results than early on. This was typically the result of the dramatic shifts in investor preferences and the extreme volatility in the financial markets. For example, during the second quarter, the spread between the daily high and low prices for the S&P 500 index averaged 2.0%, versus the long-term average of 1.2%. In addition, the monthly return dispersion (the spread between the best- and worst-performing stocks) hit its highest level in over 20 years. However, in July and August market volatility decreased substantially and our themes produced results that were closer to our expectations.

8

P E R F O R M A N C E O V E R V I E W

Portfolio Highlights

The Fund’s holdings beat their sector peers by the widest margin in the consumer services, basic materials and utilities sectors. Some examples of the biggest contributors to active returns included:

| § | Health care companies Quest Diagnostics (up 183%), Millenium Pharmaceuticals (up 279%), and Alpharma Inc. (up 68%). |

| § | Technology stocks Peregrine Systems (up 110%) and Sawtek (up 74%) |

| § | Utility company Avista Corp. (up170%) |

Portfolio Outlook

Using any number of measures, the market we’ve experienced during the last year has been highly unusual. And while this year’s high level of volatility was difficult for novice and experienced investors alike, we believe it could serve to be a positive for the long-term health of the financial markets, as it created a number of investment opportunities. To a great extent, the very speculative nature of the market that was driving returns has diminished. And we’re already beginning to see a return to more “normal” levels of volatility.

| Looking ahead, we continue to believe that cheaper stocks should outpace more expensive ones, good momentum stocks should do better than poor momentum stocks, high-earnings-quality stocks should perform better than those with lower earnings quality as should those favored by research analysts. As such, we anticipate remaining fully invested and expect that the value we add over time will be due to exposures to our investment themes coupled with careful management of portfolio risk. | |

| We thank you for your investment and look forward to your continued confidence. | |

| Goldman Sachs Quantitative Equity Investment Team | |

| New York

September 13, 2000 |

9

F U N D B A S I C S

CORESM

Large Cap Value Fund

as of August 31, 2000

| P E R F O R M A N C E R E V I E W | ||||

| August 31, 1999–August 31, 2000 | Fund Total Return (without sales charge)1 | Russell 1000 Value Index2 | ||

| |

||||

| Class A | 4.68% | 4.15% | ||

| Class B | 3.96 | 4.15 | ||

| Class C | 3.97 | 4.15 | ||

| Institutional | 5.20 | 4.15 | ||

| Service | 4.60 | 4.15 | ||

| |

||||

| 1 | The net asset value represents the net assets of the Fund (ex-dividend) divided by the total number of shares. The Fund’s performance assumes the reinvestment of dividends and other distributions. |

| 2 | The unmanaged Russell 1000 Value Index (with dividends reinvested) figures do not reflect any fees or expenses. In addition, investors cannot invest directly in the Index. |

| S TA N D A R D I Z E D T O T A L R ET U R N S 3 | ||||||||

| For the period ended 6/30/00 | Class A | Class B | Class C | Institutional | Service | |||

| |

||||||||

| One Year | –14.31% | –14.47% | –10.78% | –8.95% | –9.38% | |||

| Since Inception | –2.01 | –1.74 | 1.02 | 2.11 | 1.63 | |||

| (12/31/98) | ||||||||

| |

||||||||

| 3 | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value. These returns reflect a maximum initial sales charge of 5.5% for Class A shares, the assumed deferred sales charge for Class B shares (5% maximum declining to 0% after six years) and the assumed deferred sales charge for Class C shares (1% if redeemed within 12 months of purchase). Because Institutional and Service shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

| Total return figures represent past performance and do not indicate future results, which will vary. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance reflects expense limitations in effect. In their absence, performance would be reduced. |

| T O P 1 0 H O L D I N G S A S O F 8/ 3 1 / 0 0 | ||

| Holding | % of Total Net Assets | Line of Business |

| |

||

| Citigroup, Inc. | 4.8% | Banks |

| Exxon Mobil Corp. | 4.1 | Energy Resources |

| Johnson & Johnson | 2.5 | Medical Products |

| American International Group Inc. | 2.2 | Property Insurance |

| Verizon Communications | 2.2 | Telephone |

| AT&T Corp. | 2.1 | Telephone |

| Morgan Stanley Dean Witter & Co. | 1.9 | Security/Asset Managment |

| SBC Communications, Inc. | 1.9 | Telephone |

| Bank of America Corp. | 1.7 | Banks |

| The Walt Disney Co. | 1.7 | Entertainment |

| |

||

|

The top 10 holdings may not be representative of the Fund’s future investments. |

||

10

P E R F O R M A N C E O V E R V I E W

CORE Large Cap Value Fund

Dear Shareholder,

We are pleased to report on the performance of the Goldman Sachs CORE Large Cap Value Fund for the one year period that ended August 31, 2000.

Performance Review

Over the one-year period that ended August 31, 2000, the Fund’s Class A, B, C, Institutional and Service shares generated cumulative total returns, without sales charges, of 4.68%, 3.96%, 3.97%, 5.20%, and 4.60%, respectively. These figures compare to the 4.15% cumulative total return of the Fund’s benchmark, the Russell 1000 Value Index.

The CORE strategy is a well-defined investment process that has historically provided consistent, risk-managed performance. We seek to buy stocks that are attractively valued and favored by fundamental research analysts, have experienced good momentum and are more stable. These themes are considered relative to the Russell 1000 Value Index. The diversification of our models typically adds value, because when one theme doesn’t work, others usually do. For example, when momentum stocks underperform, value stocks typically advance more than average. Portfolios are constructed taking into account stocks’ risk characteristics as well as their expected returns.

As the Fund’s returns indicate, large-cap value stocks did not produce exceptionally strong results during the report period. In the first part of the period a small handful of growth stocks — mostly in the technology sector — led the market. As such, value stocks lagged their growth stock counterparts. However, the market correction that occurred this spring drew investors back to the compelling valuations offered by many value offerings. In fact, during five of the first eight months of 2000 value stocks outperformed growth stocks. Yet, growth stocks produced such strong results in the three months they led the market that they have outperformed value stocks by almost seven percentage points for the year-to-date period that ended August 31, 2000.

Portfolio Positioning

The CORE investment process analyzes each stock based upon its Value and Momentum characteristics as well as a fundamental Research assessment. During much of the reporting period our themes produced erratic results, experiencing some of the best and some of the worst months since inception. This was typically the result of the dramatic shifts in investor preferences and the extreme volatility in the financial markets. For example, during the second quarter, the spread between the daily high and low prices for the S&P 500 index averaged 2.0%, versus the long-term average of 1.2%. In addition, the monthly return dispersion (the spread between the best- and worst-performing stocks) hit its highest level in over 20 years. However, in July and August market volatility decreased substantially. Over the 12-month period, only the Research theme experienced negative returns within the Value universe. Returns to Value theme were flat during the period.

11

PERFORMANCE OVERVIEW

Portfolio Highlights

The Fund’s best performers were stocks in the financial, consumer cyclical, telecommunications and consumer non-cyclical sectors. Some examples of particularly strong contributors to relative return include:

| § | Telecommunications company BCE Inc. (up 116%). |

| § | Utility firm Calpine Corp. (up 337%) |

| § | Financial services holding Lehman Brothers (up 164%). |

Portfolio Outlook

Using any number of measures, the market we’ve experienced during the last year has been highly unusual. And while this year’s high level of volatility was difficult for novice and experienced investors alike, we believe it could serve to be a positive for the long-term health of the financial markets, as it created a number of investment opportunities. To a great extent, the very speculative nature of the market that was driving returns has diminished. And we’re already beginning to see a return to more “normal” levels of volatility.

Looking ahead, we continue to believe that cheaper stocks should outpace more expensive ones, good momentum stocks should do better than poor momentum stocks, high-earnings-quality stocks should perform better than those with lower earnings quality as should those favored by research analysts. As such, we anticipate remaining fully invested and expect that the value we add over time will be due to exposures to our investment themes coupled with careful management of portfolio risk.

| We thank you for your investment and look forward to your continued confidence. |

| Goldman Sachs Quantitative Equity Investment Team |

| New York

September 13, 2000 |

12

F U N D B A S I C S

CORESM

International Equity Fund

as of August 31, 2000

| P E R F O R M A N C E R E V I E W | ||||

| August 31, 1999–August 31, 2000 | Fund Total Return (without sales charge)1 | MSCI Gross EAFE Index2 | ||

| |

||||

| Class A | 6.92% | 9.81% | ||

| Class B | 6.36 | 9.81 | ||

| Class C | 6.34 | 9.81 | ||

| Institutional | 7.62 | 9.81 | ||

| Service | 7.05 | 9.81 | ||

| |

||||

1 The net asset value represents the net assets of the Fund (ex-dividend) divided by the total number of shares. The Fund’s performance assumes the reinvestment of dividends and other distributions.

2 The unmanaged Morgan Stanley Capital International (MSCI) Gross Europe, Australasia, Far East (EAFE) Index (with dividends reinvested) is a market capitalization weighted composite of securities in 21 developed markets, including Australia, Austria, Belgium, Denmark, Finland, Germany, Hong Kong, Ireland, Italy, Japan and the United Kingdom. Total returns are calculated without dividends reinvested. Investors cannot invest directly in the Index. The Index figures do not reflect any fees or expenses.

| S T A N D A R D I Z E D T O T A L R E T U R N S 3 | ||||||||||

| For the period ended 6/30/00 | Class A | Class B | Class C | Institutional | Service | |||||

| |

||||||||||

| One Year | 7.70% | 8.22% | 12.39% | 14.75% | 14.20% | |||||

| Since Inception | 4.76 | 5.39 | 6.37 | 7.54 | 7.04 | |||||

| (8/15/97) | ||||||||||

| |

||||||||||

|

3 The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value. These returns reflect a maximum initial sales charge of 5.5% for Class A shares, the assumed deferred sales charge for Class B shares (5% maximum declining to 0% after six years) and the assumed deferred sales charge for Class C shares (1% if redeemed within 12 months of purchase). Because Institutional and Service shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

||||

| Total return figures represent past performance and do not indicate future results, which will vary. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance reflects expense limitations in effect. In their absence, performance would be reduced. | ||||

| T O P 1 0 H O L D I N G S A S O F 8 / 31 / 00 | ||||

| Holding | % of Total Net Assets | Line of Business | ||

| |

||||

| Royal Dutch Petroleum Co. | 3.2 | % | Energy Resources | |

| Telefonica de Espana SA | 2.9 | Telecommunications | ||

| Siemens AG | 2.4 | Electrical Equipment | ||

| Nokia Oyj | 2.2 | Telecommunications | ||

| ING Groep NV | 2.1 | Financial Services | ||

| Koninklijke Royal Phillips Electronics NV | 1.9 | Appliance | ||

| Toyota Motor Corp. | 1.8 | Auto | ||

| Nippon Telephone & Telegraphic Corp. | 1.7 | Telecommunications | ||

| Allianz AG | 1.7 | Insurance | ||

| Deutsche Telekom AG | 1.6 | Telecommunications | ||

The top 10 holdings may not be representative of the Fund’s future investments.

13

P E R F O R M A N C E O V E R V I E W

CORE International Equity Fund

Dear Shareholder,

We are pleased to report on the performance of the Goldman Sachs CORE International Equity Fund for the one year period that ended August 31, 2000.

Performance Review

During the one-year period that ended August 31, 2000, the Fund’s Class A, B, C, Institutional and Service shares generated cumulative total returns, without sales charges, of 6.92%, 6.36%, 6.34%, 7.62%, and 7.05%, respectively. These figures compare to the 9.81% cumulative total return of the Fund’s benchmark, the Morgan Stanley Capital International (MSCI) Europe, Australia, Far East (EAFE) Index.

The CORE strategy is designed to add value at both the country and security level by focusing on three categories of investment themes — Relative Value, Momentum and Low Risk. Each strategy is based on sound economic reasoning and then validated through rigorous empirical research. These strategies are combined to form views on the countries and stocks in our investment universe. Our approach seeks to identify attractive equity markets, and attractive stocks within those markets, while managing the amount of risk relative to a specified benchmark. The goal of our portfolio construction process is to maximize exposure to our model’s return forecasts while mitigating unintended active risks.

Regional Allocations

In general, the Fund benefited from our strategy’s country tilts, especially an underweight position in the UK, which lagged most of the other countries in the index. In addition, a tilt towards Germany helped the Fund, although a small underexposure in Finland detracted from performance over the period.

Sector Allocations

Our strategy remains sector neutral within countries, so that sector tilts within the portfolio are residual to country allocation decisions. Among the strongest performing sectors were the Telecommunications and Consumer Discretionary sectors, while the Utilities sector generated the weakest results. During the reporting period stock selection was generally weakest within the Information Technology sector, and strongest within the Health Care sector.

Stock Selection

The portfolio lagged the benchmark primarily due to stock selection within countries, particularly within France and the UK. Despite good stock selection within the Netherlands, Italy and Switzerland, the overall portfolio was hampered by a difficult environment for our investment themes during this period. Over the long-term, we expect our focus on stocks with good momentum and value characteristics, as well as favorable risk profiles, should identify stocks that will outperform the index.

14

P E R F O R M A N C E O V E R V I E W

Portfolio Outlook

As always, the Fund remains substantially invested in stocks, and our general portfolio characteristics are targeted to stay relatively close to that of the MSCI EAFE index. Based on our investment strategy, we will continue to emphasize a diversified portfolio of stocks with strong value and momentum characteristics while managing the overall risk profile.

We thank you for your investment and look forward to your continued confidence.

Goldman Sachs Quantitative Equity Investment Team

New York

September 15, 2000

15

G O L D M A N S A C H S C O R E E Q U I T Y F U N D S

The Goldman Sachs Advantage

Founded in 1869, Goldman, Sachs & Co. is a premier financial services firm traditionally known on Wall Street and around the world for its institutional expertise.

Today, the firm’s Investment Management Division provides individual investors the opportunity to tap the resources of a global institutional powerhouse — and put this expertise to work in their individual portfolios .

What Sets Goldman Sachs Funds Apart?

To learn more about the Goldman Sachs Funds, call your investment professional today.

16

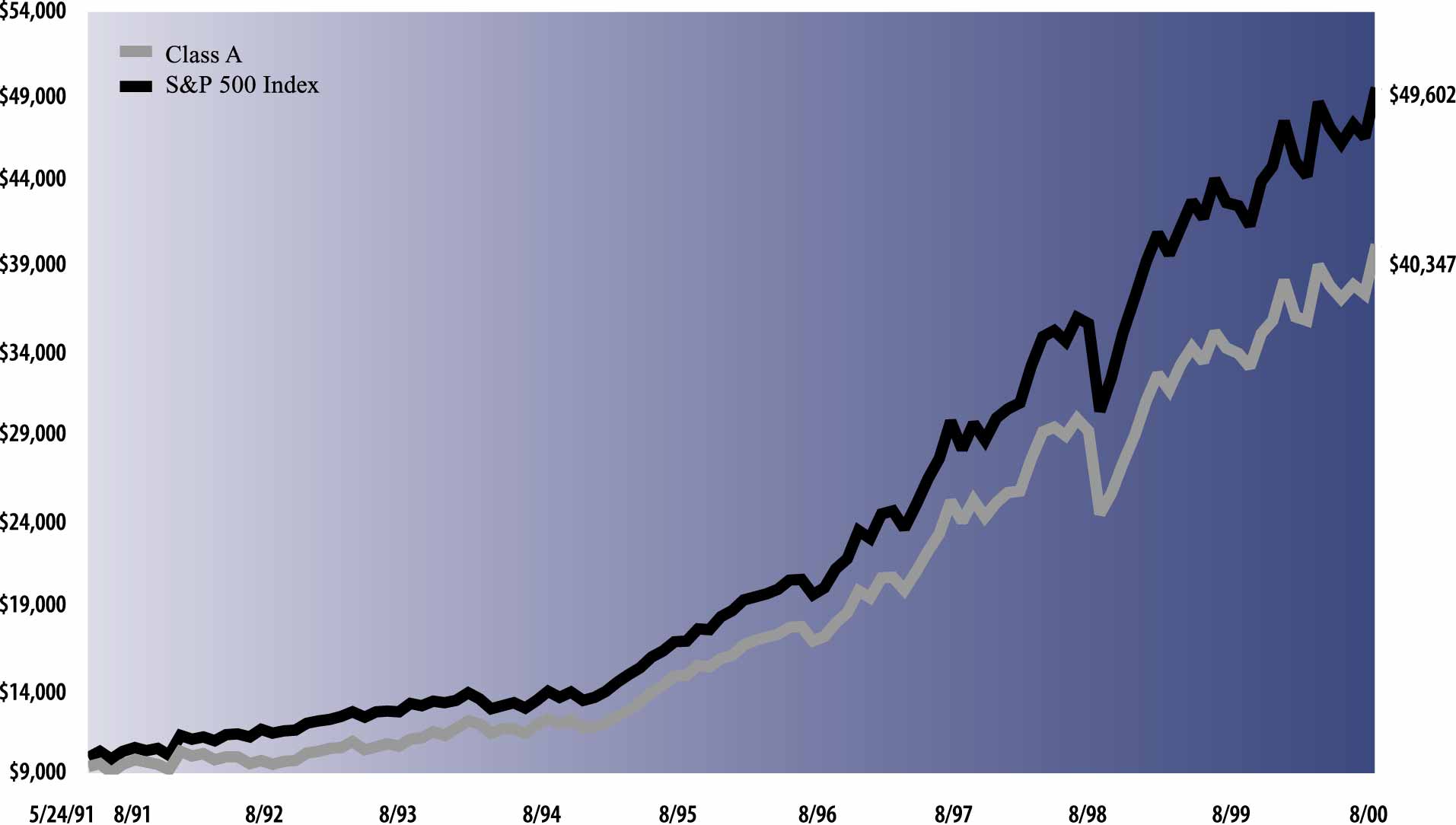

| The following graph shows the value, as of August 31, 2000, of a $10,000 investment made on May 24, 1991 (commencement of

operations) in Class A shares (maximum sales charge of 5.5%) of the Goldman Sachs CORE U.S. Equity Fund. For comparative purposes, the performance of the Fund’s benchmark (the Standard and Poor’s 500 Index with dividends reinvested (“S&

P 500 Index”)) is shown. This performance data represents past performance and should not be considered indicative of future performance which will fluctuate with changes in market conditions. These performance fluctuations will cause an

investor’s shares, when redeemed, to be worth more or less than their original cost. Performance of Class B, Class C, Institutional and Service shares will vary from Class A due to differences in fees and loads.

|

| CORE U.S. Equity Fund’s Lifetime Performance

|

| Growth of a $10,000 Investment, Distributions Reinvested May 24, 1991 to August 31, 2000.

|

|

| Average Annual Total Return through August 31, 2000 | Since Inception | Five Years | One Year | ||||

|---|---|---|---|---|---|---|---|

| Class A (commenced May 24, 1991) | |||||||

| Excluding sales charges | 16.92% | 22.05% | 18.96% | ||||

| Including sales charges | 16.22% | 20.68% | 12.42% | ||||

| |

|||||||

| Class B (commenced May 1, 1996) | |||||||

| Excluding contingent deferred sales charges | 20.75% | n/a | 18.03% | ||||

| Including contingent deferred sales charges | 20.43% | n/a | 12.49% | ||||

| |

|||||||

| Class C (commenced August 15, 1997) | |||||||

| Excluding contingent deferred sales charges | 16.97% | n/a | 18.03% | ||||

| Including contingent deferred sales charges | 16.97% | n/a | 16.92% | ||||

| |

|||||||

| Institutional Class (commenced June 15, 1995) | 23.32% | 22.71% | 19.41% | ||||

| |

|||||||

| Service Class (commenced June 7, 1996) | 21.32% | n/a | 18.83% | ||||

| |

|||||||

|

Shares |

Description | Value | ||||

|---|---|---|---|---|---|---|

| Common Stocks – 99.7% | ||||||

| Airlines – 0.4% | ||||||

| 70,800 | Delta Air Lines, Inc. | $ 3,504,600 | ||||

| 51,000 | UAL Corp. | 2,435,250 | ||||

| 5,939,850 | ||||||

| Banks – 6.5% | ||||||

| 189,562 | Bank of America Corp. | 10,153,415 | ||||

| 669,000 | Citigroup, Inc. | 39,052,875 | ||||

| 29,250 | Fifth Third Bancorp | 1,350,984 | ||||

| 106,900 | Firstar Corp. | 2,552,237 | ||||

| 244,500 | FleetBoston Financial Corp. | 10,437,094 | ||||

| 119,100 | Mellon Financial Corp. | 5,389,275 | ||||

| 90,100 | PNC Financial Services Group | 5,310,269 | ||||

| 72,500 | SunTrust Banks, Inc. | 3,579,687 | ||||

| 200,150 | The Chase Manhattan Corp. | 11,183,381 | ||||

| 124,500 | Wells Fargo & Co. | 5,376,844 | ||||

| 94,386,061 | ||||||

| Chemicals – 1.5% | ||||||

| 43,000 | Aptargroup, Inc. | 1,002,438 | ||||

| 25,400 | Avery Dennison Corp. | 1,373,187 | ||||

| 73,400 | Minnesota Mining & Manufacturing

Co. |

6,826,200 | ||||

| 22,200 | PPG Industries, Inc. | 899,100 | ||||

| 26,400 | Praxair, Inc. | 1,168,200 | ||||

| 391,700 | The Dow Chemicals Co. | 10,257,644 | ||||

| 21,526,769 | ||||||

| Clothing – 0.3% | ||||||

| 231,800 | The Limited, Inc. | 4,636,000 | ||||

| Computer Hardware – 9.6% | ||||||

| 176,900 | Apple Computer, Inc.* | 10,779,844 | ||||

| 42,200 | Cabletron Systems, Inc.* | 1,579,863 | ||||

| 690,800 | Cisco Systems, Inc.* | 47,406,150 | ||||

| 69,500 | Dell Computer Corp.* | 3,031,937 | ||||

| 196,000 | EMC Corp.* | 19,208,000 | ||||

| 150,100 | Hewlett-Packard Co. | 18,124,575 | ||||

| 79,300 | Network Appliance, Inc.* | 9,278,100 | ||||

| 56,943 | Palm, Inc.* | 2,505,492 | ||||

| 22,500 | SanDisk Corp.* | 1,878,750 | ||||

| 80,800 | Seagate Technology, Inc.* | 4,797,500 | ||||

| 157,900 | Sun Microsystems, Inc.* | 20,043,431 | ||||

| 138,633,642 | ||||||

| Computer Software – 7.0% | ||||||

| 14,500 | Adobe Systems, Inc. | 1,885,000 | ||||

| 129,200 | International Business Machines,

Inc. |

17,054,400 | ||||

| 470,500 | Microsoft Corp.* | 32,846,781 | ||||

| 346,100 | Oracle Corp.* | 31,473,469 | ||||

| 9,100 | Sabre Holdings Corp. | 253,662 | ||||

| 14,800 | Sapient Corp.* | 777,000 | ||||

| 22,400 | Siebel Systems, Inc.* | 4,431,000 | ||||

| 101,900 | VERITAS Software Corp.* | 12,285,319 | ||||

| 101,006,631 | ||||||

| Construction – 0.1% | ||||||

| 43,700 | Fluor Corp. | 1,308,269 | ||||

|

Shares |

Description | Value | ||||

|---|---|---|---|---|---|---|

| Common Stocks – (continued) | ||||||

| Consumer Durables – 0.5% | ||||||

| 68,100 | Sherwin-Williams Co. | $ 1,566,300 | ||||

| 132,800 | Whirlpool Corp. | 5,046,400 | ||||

| 6,612,700 | ||||||

| Defense/Aerospace – 0.7% | ||||||

| 22,400 | Northrop Grumman Corp. | 1,743,000 | ||||

| 153,200 | The Boeing Co. | 8,215,350 | ||||

| 9,958,350 | ||||||

| Department Store – 2.2% | ||||||

| 234,600 | Federated Department Stores, Inc.* | 6,480,825 | ||||

| 61,700 | Sears, Roebuck & Co. | 1,924,269 | ||||

| 217,400 | Target Corp. | 5,054,550 | ||||

| 373,800 | Wal-Mart Stores, Inc. | 17,732,137 | ||||

| 31,191,781 | ||||||

| Drugs – 7.6% | ||||||

| 156,300 | Allergan, Inc. | 11,429,437 | ||||

| 141,700 | Amgen, Inc.* | 10,742,631 | ||||

| 25,100 | Bristol-Myers Squibb Co. | 1,330,300 | ||||

| 44,200 | Cardinal Health, Inc. | 3,616,113 | ||||

| 14,500 | Celera Genomics* | 1,572,344 | ||||

| 31,200 | Chiron Corp.* | 1,686,750 | ||||

| 58,600 | Eli Lilly & Co. | 4,277,800 | ||||

| 18,200 | Genentech, Inc.* | 3,467,100 | ||||

| 57,600 | MedImmune, Inc.* | 4,845,600 | ||||

| 284,100 | Merck & Co., Inc. | 19,851,487 | ||||

| 23,200 | Millennium Pharmaceuticals* | 3,320,500 | ||||

| 22,500 | PE Corp-PE Biosystems Group | 2,213,438 | ||||

| 848,750 | Pfizer, Inc. | 36,708,437 | ||||

| 87,873 | Pharmacia Corp. | 5,146,063 | ||||

| 110,208,000 | ||||||

| Electrical Equipment – 6.5% | ||||||

| 117,000 | ADC Telecommunications, Inc.* | 4,789,687 | ||||

| 17,200 | Advanced Fibre Communications, Inc.* | 909,181 | ||||

| 8,600 | CIENA Corp.* | 1,906,512 | ||||

| 67,700 | Corning, Inc. | 22,201,369 | ||||

| 188,900 | General Dynamics Corp. | 11,888,894 | ||||

| 105,600 | Lucent Technologies, Inc. | 4,415,400 | ||||

| 44,300 | Motorola, Inc. | 1,597,569 | ||||

| 413,081 | Nortel Networks Corp. | 33,691,919 | ||||

| 31,800 | QUALCOMM, Inc.* | 1,904,025 | ||||

| 50,000 | Scientific-Atlanta, Inc. | 3,896,875 | ||||

| 19,400 | Teradyne, Inc. | 1,257,363 | ||||

| 26,500 | Terayon Communication Systems, Inc. | 1,470,750 | ||||

| 91,500 | Vishay Intertechnology, Inc.* | 3,688,594 | ||||

| 93,618,138 | ||||||

| Electrical Utilities – 2.2% | ||||||

| 117,800 | Calpine Corp.* | 11,662,200 | ||||

| 42,200 | Constellation Energy Group | 1,614,150 | ||||

| 67,400 | Duke Energy Corp. | 5,042,362 | ||||

| 48,400 | Dynegy, Inc. | 2,178,000 | ||||

| 50,000 | FPL Group, Inc. | 2,668,750 | ||||

| 122,700 | Public Service Enterprise | 4,447,875 | ||||

| 78,200 | Unicom Corp. | 3,572,763 | ||||

| 31,186,100 | ||||||

|

Shares |

Description | Value | ||||

|---|---|---|---|---|---|---|

| Common Stocks – (continued) | ||||||

| Energy Resources – 5.3% | ||||||

| 39,900 | Apache Corp. | $ 2,513,700 | ||||

| 122,300 | Chevron Corp. | 10,334,350 | ||||

| 72,300 | Enron Corp. | 6,136,462 | ||||

| 408,358 | Exxon Mobil Corp. | 33,332,222 | ||||

| 39,100 | Kerr-McGee Corp. | 2,470,631 | ||||

| 24,500 | Phillips Petroleum Co. | 1,515,938 | ||||

| 339,700 | Royal Dutch Petroleum Co. ADR | 20,785,394 | ||||

| 77,088,697 | ||||||

| Entertainment – 1.2% | ||||||

| 271,600 | The Walt Disney Co. | 10,575,425 | ||||

| 93,200 | Viacom, Inc. Class B* | 6,273,525 | ||||

| 16,848,950 | ||||||

| Financial Services – 5.8% | ||||||

| 43,500 | American Express Co. | 2,571,937 | ||||

| 99,200 | Comdisco, Inc. | 2,380,800 | ||||

| 68,900 | Federal National Mortgage Assn. | 3,703,375 | ||||

| 1,120,500 | General Electric Co. | 65,759,344 | ||||

| 60,900 | Marsh & McLennan Cos., Inc. | 7,231,875 | ||||

| 18,500 | Providian Financial Corp. | 2,126,344 | ||||

| 83,773,675 | ||||||

| Food & Beverage – 3.9% | ||||||

| 243,416 | Archer-Daniels-Midland Co. | 2,145,106 | ||||

| 168,800 | ConAgra, Inc. | 3,091,150 | ||||

| 41,300 | General Mills, Inc. | 1,326,762 | ||||

| 50,800 | H.J. Heinz Co. | 1,936,750 | ||||

| 88,500 | IBP, Inc. | 1,421,531 | ||||

| 346,000 | Nabisco Group Holdings Corp. | 9,709,625 | ||||

| 192,400 | Nabisco Holdings Corp. | 10,281,375 | ||||

| 385,400 | PepsiCo., Inc. | 16,427,675 | ||||

| 58,000 | Supervalu, Inc. | 866,375 | ||||

| 94,800 | The Coca-Cola Co. | 4,988,850 | ||||

| 73,900 | The Pepsi Bottling Group, Inc. | 2,346,325 | ||||

| 22,000 | The Quaker Oats Co. | 1,494,625 | ||||

| 56,036,149 | ||||||

| Forest – 0.4% | ||||||

| 153,100 | Georgia-Pacific Group | 4,095,425 | ||||

| 28,300 | Kimberly-Clark Corp. | 1,655,550 | ||||

| 5,750,975 | ||||||

| Gold – 0.1% | ||||||

| 115,500 | Barrick Gold Corp. | 1,840,781 | ||||

| Grocery – 0.4% | ||||||

| 63,034 | Safeway, Inc.* | 3,108,364 | ||||

| 101,400 | The Kroger Co.* | 2,300,513 | ||||

| 5,408,877 | ||||||

| Heavy Electrical – 0.3% | ||||||

| 63,100 | Emerson Electric Co. | 4,176,431 | ||||

| Home Products – 0.5% | ||||||

| 70,300 | Colgate-Palmolive Co. | 3,580,906 | ||||

| 1 | Energizer Holdings, Inc.* | 20 | ||||

| 95,600 | Fortune Brands, Inc. | 2,437,800 | ||||

|

Shares |

Description | Value | ||||

|---|---|---|---|---|---|---|

| Common Stocks – (continued) | ||||||

| Home Products – (continued) | ||||||

| 46,800 | Ralston Purina Group | $ 1,058,850 | ||||

| 7,077,576 | ||||||

| Hotels – 0.2% | ||||||

| 152,000 | Park Place Entertainment Corp.* | 2,232,500 | ||||

| Industrial Parts – 1.6% | ||||||

| 72,100 | Ingersoll-Rand Co. | 3,285,056 | ||||

| 54,600 | Parker-Hannifin Corp. | 1,900,762 | ||||

| 227,186 | Tyco International Ltd. | 12,949,602 | ||||

| 89,300 | United Technologies Corp. | 5,575,669 | ||||

| 23,711,089 | ||||||

| Industrial Services – 0.4% | ||||||

| 126,400 | Hertz Corp. | 3,871,000 | ||||

| 69,600 | Robert Half International, Inc.* | 2,214,150 | ||||

| 6,085,150 | ||||||

| Information Services – 0.8% | ||||||

| 73,500 | Automatic Data Processing, Inc. | 4,382,437 | ||||

| 19,400 | Computer Sciences Corp.* | 1,533,813 | ||||

| 36,600 | Electronic Data Systems Corp. | 1,823,138 | ||||

| 83,500 | First Data Corp. | 3,981,906 | ||||

| 11,721,294 | ||||||

| Internet – 1.5% | ||||||

| 245,900 | America Online, Inc.* | 14,415,888 | ||||

| 57,700 | Yahoo!, Inc.* | 7,010,550 | ||||

| 21,426,438 | ||||||

| Leisure – 0.8% | ||||||

| 181,800 | Eastman Kodak Co. | 11,317,050 | ||||

| Life Insurance – 1.6% | ||||||

| 34,400 | AFLAC, Inc. | 1,857,600 | ||||

| 25,800 | American General Corp. | 1,878,563 | ||||

| 84,000 | Cigna Corp. | 8,169,000 | ||||

| 112,300 | UnitedHealth Group, Inc. | 10,612,350 | ||||

| 22,517,513 | ||||||

| Media – 2.1% | ||||||

| 116,800 | Fox Entertainment Group, Inc.* | 3,379,900 | ||||

| 325,200 | General Motors Corp. Class H* | 10,772,250 | ||||

| 116,500 | Infinity Broadcasting Corp.* | 4,412,437 | ||||

| 140,500 | Time Warner, Inc. | 12,012,750 | ||||

| 30,577,337 | ||||||

| Medical Products – 2.3% | ||||||

| 75,700 | Abbott Laboratories | 3,311,875 | ||||

| 18,900 | Bausch & Lomb, Inc. | 675,675 | ||||

| 63,400 | Baxter International, Inc. | 5,278,050 | ||||

| 240,400 | Johnson & Johnson | 22,101,775 | ||||

| 25,600 | Medtronic, Inc. | 1,312,000 | ||||

| 32,679,375 | ||||||

| Medical Providers – 0.2% | ||||||

| 197,300 | Beverly Enterprises, Inc.* | 1,023,494 | ||||

| 67,400 | HCA-The Healthcare Corp. | 2,325,300 | ||||

|

Shares |

Description |

Value |

||||

|---|---|---|---|---|---|---|

| Common Stocks – (continued) | ||||||

| Medical Providers – (continued) | ||||||

| 1 | Lifepoint Hospitals, Inc.* | $ 30 | ||||

| 1 | Triad Hospitals, Inc.* | 29 | ||||

| 3,348,853 | ||||||

| Mining – 0.4% | ||||||

| 160,000 | Alcan Aluminium Ltd. | 5,250,000 | ||||

| 26,300 | Nucor Corp. | 966,525 | ||||

| 6,216,525 | ||||||

| Motor Vehicle – 1.9% | ||||||

| 399,283 | Ford Motor Co. | 9,657,657 | ||||

| 220,000 | General Motors Corp. | 15,881,250 | ||||

| 45,300 | Johnson Controls, Inc. | 2,420,719 | ||||

| 27,959,626 | ||||||

| Oil Refining – 0.1% | ||||||

| 70,600 | Tosco Corp. | 2,153,300 | ||||

| Oil Services – 0.4% | ||||||

| 59,600 | BJ Services Co.* | 3,993,200 | ||||

| 36,700 | Noble Drilling Corp.* | 1,779,950 | ||||

| 5,773,150 | ||||||

| Property Insurance – 3.0% | ||||||

| 209,112 | Allstate Corp. | 6,077,317 | ||||

| 259,789 | American International Group, Inc. | 23,153,695 | ||||

| 18,500 | Jefferson-Pilot Corp. | 1,224,469 | ||||

| 26,400 | Loews Corp. | 2,136,750 | ||||

| 85,500 | MGIC Investment Corp. | 5,028,469 | ||||

| 58,100 | The Hartford Financial Services

Group, Inc. |

3,870,912 | ||||

| 33,000 | The PMI Group, Inc. | 2,046,000 | ||||

| 43,537,612 | ||||||

| Publishing – 0.2% | ||||||

| 28,300 | Dow Jones & Co., Inc. | 1,770,519 | ||||

| 25,400 | Knight-Ridder, Inc. | 1,387,475 | ||||

| 3,157,994 | ||||||

| Railroads – 0.1% | ||||||

| 91,800 | Burlington Northern Santa Fe Corp. | 2,054,025 | ||||

| Restaurants – 0.2% | ||||||

| 43,800 | Brinker International, Inc.* | 1,390,650 | ||||

| 47,000 | Tricon Global Restaurants, Inc.* | 1,368,875 | ||||

| 2,759,525 | ||||||

| Security/Asset Management – 2.1% | ||||||

| 208,300 | AXA Financial, Inc. | 10,779,525 | ||||

| 21,900 | Lehman Brothers Holdings, Inc. | 3,175,500 | ||||

| 10,300 | Merrill Lynch & Co., Inc. | 1,493,500 | ||||

| 92,500 | Morgan Stanley Dean Witter & Co. | 9,949,531 | ||||

| 143,450 | The Charles Schwab Corp. | 5,477,997 | ||||

| 30,876,053 | ||||||

| Semiconductors – 8.7% | ||||||

| 141,400 | Advanced Micro Devices, Inc.* | 5,320,175 | ||||

| 58,500 | Analog Devices, Inc.* | 5,879,250 | ||||

| 70,100 | Applied Materials, Inc.* | 6,050,506 | ||||

| 23,300 | Applied Micro Circuits Corp.* | 4,728,444 | ||||

| 22,900 | Broadcom Corp.* | 5,725,000 | ||||

| 674,400 | Intel Corp. | 50,495,700 | ||||

| 148,700 | JDS Uniphase Corp.* | 18,510,827 | ||||

|

Shares |

Description |

Value |

||||

|---|---|---|---|---|---|---|

| Common Stocks – (continued) | ||||||

| Semiconductors – (continued) | ||||||

| 18,600 | KLA-Tencor Corp.* | $ 1,220,625 | ||||

| 92,500 | Micron Technology, Inc.* | 7,561,875 | ||||

| 7,400 | PMC-Sierra, Inc.* | 1,746,400 | ||||

| 14,200 | SDL, Inc.* | 5,641,837 | ||||

| 140,100 | Texas Instruments, Inc. | 9,377,944 | ||||

| 38,400 | Xilinx, Inc.* | 3,412,800 | ||||

| 125,671,383 | ||||||

| Specialty Retail – 1.5% | ||||||

| 24,500 | Avnet, Inc. | 1,466,938 | ||||

| 93,300 | Lowes Co., Inc. | 4,181,006 | ||||

| 256,900 | The Home Depot, Inc. | 12,347,256 | ||||

| 90,400 | Tiffany & Co. | 3,762,900 | ||||

| 21,758,100 | ||||||

| Telephone – 5.1% | ||||||

| 463,475 | AT&T Corp. | 14,599,462 | ||||

| 45,200 | BCE, Inc. | 1,017,000 | ||||

| 399,500 | BellSouth Corp. | 14,906,344 | ||||

| 74,800 | Citizens Communications Co.* | 1,220,175 | ||||

| 294,222 | SBC Communications, Inc. | 12,283,768 | ||||

| 218,100 | Sprint Corp. | 7,306,350 | ||||

| 260,118 | Verizon Communications | 11,347,648 | ||||

| 304,000 | WorldCom, Inc.* | 11,096,000 | ||||

| 73,776,747 | ||||||

| Thrifts – 0.2% | ||||||

| 46,700 | Golden West Financial Corp. | 2,224,088 | ||||

| Tobacco – 0.6% | ||||||

| 247,300 | Philip Morris Cos., Inc. | 7,326,263 | ||||

| 48,800 | R.J. Reynolds Tobacco Holdings, Inc. | 1,750,700 | ||||

| 9,076,963 | ||||||

| Wireless – 0.7% | ||||||

| 53,900 | AT&T Wireless Group* | 1,411,506 | ||||

| 50,600 | Telephone & Data Systems, Inc. | 5,869,600 | ||||

| 33,900 | United States Cellular Corp.* | 2,493,769 | ||||

| 9,774,875 | ||||||

| TOTAL COMMON STOCKS | ||||||

| (Cost $1,098,258,504) | $1,440,600,967 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Repurchase Agreement – 0.2% | ||||||||

| Joint Repurchase Agreement Account IIˆ | ||||||||

| $2,500,000 | 6.66 | % | 09/01/2000 | $ 2,500,000 | ||||

| TOTAL REPURCHASE AGREEMENT | ||||||||

| (Cost $2,500,000) | $ 2,500,000 | |||||||

| TOTAL INVESTMENTS | ||||||||

| (Cost $1,100,758,504) | $ 1,443,100,967 | |||||||

*

|

Non-income producing security.

|

|

ˆ

|

Joint repurchase agreement was entered into on August 31, 2000.

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of total net

assets.

|

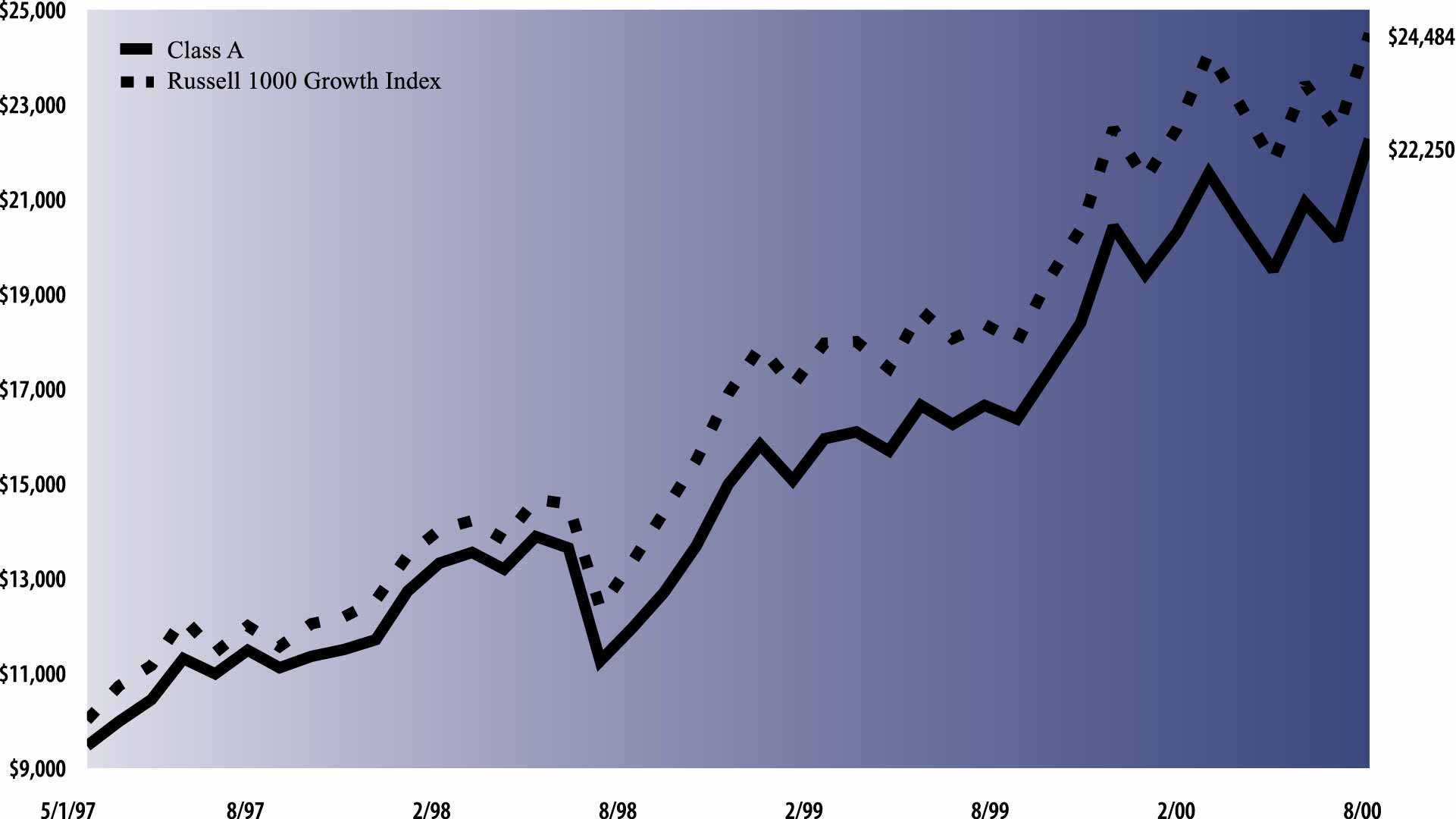

| The following graph shows the value, as of August 31, 2000, of a $10,000 investment made on May 1, 1997 (commencement of

operations) in Class A shares (maximum sales charge of 5.5%) of the Goldman Sachs CORE Large Cap Growth Fund. For comparative purposes, the performance of the Fund’s benchmark (Russell 1000 Growth Index with dividends reinvested) is shown. This

performance data represents past performance and should not be considered indicative of future performance which will fluctuate with changes in market conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be

worth more or less than their original cost. Performance of Class A shares will vary from Class B, Class C, Institutional and Service shares due to differences in fees and loads.

|

| CORE Large Cap Growth Fund’s Lifetime Performance

|

| Growth of a $10,000 Investment, Distributions Reinvested May 1, 1997 to August 31, 2000.

|

|

| Average Annual Total Return through August 31, 2000 | Since Inception | One Year | |||

|---|---|---|---|---|---|

| Class A (commenced May 1, 1997) | |||||

| Excluding sales charges | 29.22% | 33.73% | |||

| Including sales charges | 27.06% | 26.38% | |||

| |

|||||

| Class B (commenced May 1, 1997) | |||||

| Excluding contingent deferred sales charges | 28.32% | 32.78% | |||

| Including contingent deferred sales charges | 27.80% | 27.76% | |||

| |

|||||

| Class C (commenced August 15, 1997) | |||||

| Excluding contingent deferred sales charges | 24.49% | 32.84% | |||

| Including contingent deferred sales charges | 24.49% | 31.84% | |||

| |

|||||

| Institutional Class (commenced May 1, 1997) | 29.64% | 34.34% | |||

| |

|||||

| Service Class (commenced May 1, 1997) | 29.03% | 33.64% | |||

| |

|||||

| Shares | Description | Value | |||

|---|---|---|---|---|---|

| Common Stocks – 98.5% | |||||

| Apparel – 0.2% | |||||

| 55,900 | Nike, Inc. Class B | $ 2,211,544 | |||

| Chemicals – 0.6% | |||||

| 34,400 | Praxair, Inc. | 1,522,200 | |||

| 249,700 | The Dow Chemicals Co. | 6,539,019 | |||

| 8,061,219 | |||||

| Clothing – 0.8% | |||||

| 252,100 | Intimate Brands, Inc. | 4,065,112 | |||

| 243,300 | The Limited, Inc. | 4,866,000 | |||

| 25,000 | The Talbots, Inc. | 1,673,438 | |||

| 10,604,550 | |||||

| Computer Hardware – 16.6% | |||||

| 48,100 | 3Com Corp. | 799,663 | |||

| 4,500 | Alteon Websystems, Inc.* | 666,000 | |||

| 171,100 | Apple Computer, Inc.* | 10,426,406 | |||

| 20,400 | Brocade Communications Systems,

Inc.* |

4,606,575 | |||

| 1,154,900 | Cisco Systems, Inc.* | 79,255,012 | |||

| 98,400 | Dell Computer Corp.* | 4,292,700 | |||

| 13,100 | Digital Lightwave, Inc.* | 1,149,525 | |||

| 6,700 | Echelon Corp.* | 315,319 | |||

| 388,600 | EMC Corp.* | 38,082,800 | |||

| 10,200 | Extreme Networks, Inc.* | 949,237 | |||

| 161,100 | Hewlett-Packard Co. | 19,452,825 | |||

| 140,500 | Network Appliance, Inc.* | 16,438,500 | |||

| 98,909 | Palm, Inc.* | 4,351,996 | |||

| 19,300 | Redback Networks, Inc.* | 2,882,937 | |||

| 6,300 | RSA Security, Inc.* | 372,094 | |||

| 20,500 | SanDisk Corp.* | 1,711,750 | |||

| 50,000 | Seagate Technology, Inc.* | 2,968,750 | |||

| 300,100 | Sun Microsystems, Inc.* | 38,093,944 | |||

| 226,816,033 | |||||

| Computer Software – 10.9% | |||||

| 44,400 | Adobe Systems, Inc. | 5,772,000 | |||

| 2,400 | Agile Software Corp.* | 166,650 | |||

| 70,100 | BEA Systems, Inc.* | 4,771,181 | |||

| 6,100 | CheckFree Corp.* | 316,056 | |||

| 1,900 | Entrust Technologies, Inc.* | 56,525 | |||

| 18,100 | i2 Technologies, Inc.* | 3,062,294 | |||

| 132,800 | International Business Machines, Inc. | 17,529,600 | |||

| 6,600 | Internet Security Systems, Inc.* | 534,600 | |||

| 24,100 | Intuit, Inc.* | 1,442,988 | |||

| 12,100 | Mercury Interactive Corp.* | 1,478,469 | |||

| 617,600 | Microsoft Corp.* | 43,116,200 | |||

| 13,000 | Networks Associates, Inc.* | 336,375 | |||

| 443,600 | Oracle Corp.* | 40,339,875 | |||

| 12,600 | Rational Software Corp.* | 1,621,462 | |||

| 7,400 | Red Hat, Inc.* | 185,925 | |||

| 15,200 | Sapient Corp.* | 798,000 | |||

| 29,700 | Siebel Systems, Inc.* | 5,875,031 | |||

| 23,700 | TIBCO Software, Inc.* | 2,415,919 | |||

| 147,425 | VERITAS Software Corp.* | 17,773,927 | |||

| 39,300 | Vignette Corp.* | 1,498,312 | |||

| 149,091,389 | |||||

| Shares | Description | Value | |||

|---|---|---|---|---|---|

| Common Stocks – (continued) | |||||

| Defense/Aerospace – 0.8% | |||||

| 198,200 | The Boeing Co. | $ 10,628,475 | |||

| Department Store – 2.1% | |||||

| 190,100 | Federated Department Stores, Inc.* | 5,251,512 | |||

| 41,000 | Sears, Roebuck & Co. | 1,278,688 | |||

| 183,700 | Target Corp. | 4,271,025 | |||

| 368,000 | Wal-Mart Stores, Inc. | 17,457,000 | |||

| 28,258,225 | |||||

| Drugs – 11.4% | |||||

| 144,400 | Allergan, Inc. | 10,559,250 | |||

| 27,300 | Alpharma, Inc. | 1,545,863 | |||

| 245,400 | Amgen, Inc.* | 18,604,387 | |||

| 99,000 | Cardinal Health, Inc. | 8,099,437 | |||

| 33,800 | Celera Genomics* | 3,665,188 | |||

| 18,700 | Chiron Corp.* | 1,010,969 | |||

| 73,100 | Eli Lilly & Co. | 5,336,300 | |||

| 38,600 | Forest Laboratories, Inc.* | 3,777,975 | |||

| 46,200 | Genentech, Inc.* | 8,801,100 | |||

| 42,200 | IVAX Corp.* | 1,461,175 | |||

| 14,300 | Medarex, Inc.* | 1,580,150 | |||

| 61,400 | MedImmune, Inc.* | 5,165,275 | |||

| 380,300 | Merck & Co., Inc. | 26,573,462 | |||

| 39,700 | Millennium Pharmaceuticals* | 5,682,062 | |||

| 34,500 | PE Corp-PE Biosystems Group | 3,393,938 | |||

| 1,114,475 | Pfizer, Inc. | 48,201,044 | |||

| 43,700 | Schering-Plough Corp. | 1,753,463 | |||

| 155,211,038 | |||||

| Electrical Equipment – 9.4% | |||||

| 158,400 | ADC Telecommunications, Inc.* | 6,484,500 | |||

| 33,000 | Advanced Fibre Communications,

Inc.* |

1,744,359 | |||

| 22,500 | Amphenol Corp.* | 1,440,000 | |||

| 56,200 | AVX Corp. | 1,682,487 | |||

| 35,300 | CIENA Corp.* | 7,825,569 | |||

| 20,600 | Comverse Technology, Inc.* | 1,893,912 | |||

| 9,300 | Copper Mountain Networks, Inc.* | 557,419 | |||

| 99,000 | Corning, Inc. | 32,465,812 | |||

| 21,800 | Credence Systems Corp.* | 1,276,663 | |||

| 14,100 | Ditech Communications Corp.* | 831,900 | |||

| 7,000 | GlobeSpan, Inc.* | 843,063 | |||

| 4,000 | Harmonic, Inc.* | 134,000 | |||

| 194,400 | KEMET Corp.* | 5,832,000 | |||

| 36,400 | Level 3 Communications, Inc.* | 3,175,331 | |||

| 285,900 | Lucent Technologies, Inc. | 11,954,194 | |||

| 35,100 | Motorola, Inc. | 1,265,794 | |||

| 15,500 | Newport Corp. | 2,464,500 | |||

| 159,148 | Nortel Networks Corp. | 12,980,509 | |||

| 10,700 | Power-One, Inc.* | 1,695,281 | |||

| 27,300 | Powerwave Technologies, Inc.* | 1,313,812 | |||

| 91,800 | QUALCOMM, Inc.* | 5,496,525 | |||

| 114,300 | Scientific-Atlanta, Inc. | 8,908,256 | |||

| 15,000 | Sycamore Networks, Inc.* | 2,062,500 | |||

| 64,100 | Tektronix, Inc. | 4,883,619 | |||

| 37,900 | Teradyne, Inc. | 2,456,394 | |||

| Shares | Description | Value | ||||

|---|---|---|---|---|---|---|

| Common Stocks – (continued) | ||||||

| Electrical Equipment – (continued) | ||||||

| 21,800 | Terayon Communication Systems,

Inc.* |

$ 1,209,900 | ||||

| 140,550 | Vishay Intertechnology, Inc.* | 5,665,922 | ||||

| 128,544,221 | ||||||

| Electrical Utilities – 0.5% | ||||||

| 59,200 | Calpine Corp.* | 5,860,800 | ||||

| 23,964 | Dynegy, Inc. | 1,078,380 | ||||

| 6,939,180 | ||||||

| Energy Resources – 1.0% | ||||||

| 73,100 | Apache Corp. | 4,605,300 | ||||

| 54,700 | Devon Energy Corp. | 3,203,369 | ||||

| 61,300 | Kerr-McGee Corp. | 3,873,394 | ||||

| 32,500 | Murphy Oil Corp. | 2,169,375 | ||||

| 13,851,438 | ||||||

| Entertainment – 0.8% | ||||||

| 247,900 | The Walt Disney Co. | 9,652,606 | ||||

| 21,900 | Viacom, Inc. Class B* | 1,474,144 | ||||

| 11,126,750 | ||||||

| Environmental Services – 0.2% | ||||||

| 163,400 | Republic Services, Inc.* | 2,389,725 | ||||

| Financial Services – 6.1% | ||||||

| 1,429,900 | General Electric Co. | 83,917,256 | ||||

| Food & Beverage – 2.5% | ||||||

| 224,200 | ConAgra, Inc. | 4,105,662 | ||||

| 50,100 | Hormel Foods Corp. | 773,419 | ||||

| 285,100 | IBP, Inc. | 4,579,419 | ||||

| 50,800 | Keebler Foods Co. | 2,327,275 | ||||

| 289,200 | Nabisco Group Holdings Corp. | 8,115,675 | ||||

| 105,000 | PepsiCo., Inc. | 4,475,625 | ||||

| 54,900 | Supervalu, Inc. | 820,069 | ||||

| 31,300 | SYSCO Corp. | 1,324,381 | ||||

| 50,400 | The Coca-Cola Co. | 2,652,300 | ||||

| 144,000 | The Pepsi Bottling Group, Inc. | 4,572,000 | ||||

| 33,745,825 | ||||||

| Heavy Electrical – 0.1% | ||||||

| 21,700 | Molex, Inc. | 1,146,031 | ||||

| Hotels – 0.1% | ||||||

| 30,800 | Marriott International, Inc. | 1,216,600 | ||||

| Industrial Services – 0.5% | ||||||

| 169,200 | Hertz Corp. | 5,181,750 | ||||

| 58,500 | Robert Half International, Inc.* | 1,861,031 | ||||

| 7,042,781 | ||||||

| Information Services – 1.5% | ||||||

| 41,900 | Automatic Data Processing, Inc. | 2,498,287 | ||||

| 72,600 | Computer Sciences Corp.* | 5,739,937 | ||||

| 27,100 | Convergys Corp.* | 1,060,288 | ||||

| 15,900 | DST Systems, Inc.* | 1,494,600 | ||||

| 96,800 | Electronic Data Systems Corp. | 4,821,850 | ||||

| 500 | Healtheon/WebMD Corp.* | 8,813 | ||||

| Shares | Description | Value | ||||

|---|---|---|---|---|---|---|

| Common Stocks – (continued) | ||||||

| Information Services – (continued) | ||||||

| 8,000 | HomeStore.com, Inc.* | $ 433,500 | ||||

| 9,500 | Internap Network Services Corp.* | 342,000 | ||||

| 8,969 | MarchFirst, Inc.* | 173,774 | ||||

| 25,300 | Omnicom Group, Inc. | 2,110,969 | ||||

| 25,800 | The Interpublic Group of Cos., Inc. | 986,850 | ||||

| 12,800 | TMP Worldwide, Inc.* | 885,600 | ||||

| 20,556,468 | ||||||

| Internet – 5.6% | ||||||

| 6,000 | Akamai Technologies, Inc.* | 453,375 | ||||

| 29,700 | Amazon.com, Inc.* | 1,232,550 | ||||

| 415,500 | America Online, Inc.* | 24,358,687 | ||||

| 3,100 | Ameritrade Holding Corp.* | 58,319 | ||||

| 29,400 | Ariba, Inc.* | 4,626,825 | ||||

| 11,000 | Art Technology Group, Inc.* | 1,121,313 | ||||

| 9,800 | At Home Corp. Series A* | 142,713 | ||||

| 36,000 | BroadVision, Inc.* | 1,242,000 | ||||

| 600 | CacheFlow, Inc.* | 65,625 | ||||

| 34,600 | CMGI, Inc.* | 1,548,350 | ||||

| 3,100 | CNET Networks, Inc.* | 103,850 | ||||

| 31,700 | Commerce One, Inc.* | 1,982,241 | ||||

| 1,400 | Critical Path, Inc.* | 108,150 | ||||

| 5,900 | Digex, Inc.* | 499,656 | ||||

| 16,100 | DoubleClick, Inc.* | 655,069 | ||||

| 19,200 | E*TRADE Group, Inc.* | 340,800 | ||||

| 4,000 | E.piphany, Inc.* | 416,000 | ||||

| 19,400 | eBay, Inc.* | 1,202,800 | ||||

| 2,600 | Efficient Networks, Inc.* | 139,709 | ||||

| 72,300 | Exodus Communications, Inc.* | 4,948,031 | ||||

| 28,300 | InfoSpace.com, Inc.* | 1,103,700 | ||||

| 14,900 | Inktomi Corp.* | 1,942,587 | ||||

| 37,700 | Juniper Networks, Inc.* | 8,058,375 | ||||

| 11,000 | Kana Communications, Inc.* | 441,375 | ||||

| 12,200 | Liberate Technologies, Inc.* | 375,150 | ||||

| 13,400 | Lycos, Inc.* | 951,400 | ||||

| 7,900 | Macromedia, Inc.* | 545,964 | ||||

| 4,600 | Phone.com, Inc.* | 425,213 | ||||

| 14,500 | Portal Software, Inc.* | 801,125 | ||||

| 6,800 | Priceline.com, Inc.* | 184,875 | ||||

| 8,000 | Proxicom, Inc.* | 193,500 | ||||

| 18,700 | PSINet, Inc.* | 328,419 | ||||

| 14,700 | RealNetworks, Inc.* | 715,706 | ||||

| 5,600 | Scient Corp.* | 151,550 | ||||

| 6,800 | Software.com, Inc.* | 989,825 | ||||

| 35,812 | VeriSign, Inc.* | 7,122,111 | ||||

| 17,500 | VerticalNet, Inc.* | 931,875 | ||||

| 9,000 | Vitria Technology, Inc. | 423,000 | ||||

| 46,200 | Yahoo!, Inc.* | 5,613,300 | ||||

| 76,545,113 | ||||||

| Media – 1.8% | ||||||

| 31,000 | Fox Entertainment Group, Inc.* | 897,063 | ||||

| 207,700 | General Motors Corp. Class H* | 6,880,062 | ||||

| 102,500 | Infinity Broadcasting Corp.* | 3,882,188 | ||||

| 157,900 | Time Warner, Inc. | 13,500,450 | ||||

| 25,159,763 | ||||||

| Shares | Description | Value | ||||

|---|---|---|---|---|---|---|

| Common Stocks – (continued) | ||||||

| Medical Products – 2.4% | ||||||

| 142,700 | Abbott Laboratories | $ 6,243,125 | ||||

| 33,500 | Baxter International, Inc. | 2,788,875 | ||||

| 144,000 | Johnson & Johnson | 13,239,000 | ||||

| 102,800 | Medtronic, Inc. | 5,268,500 | ||||

| 19,000 | MiniMed, Inc.* | 1,364,140 | ||||

| 63,100 | Stryker Corp. | 2,827,669 | ||||

| 11,500 | Techne Corp.* | 1,098,250 | ||||

| 32,829,559 | ||||||

| Medical Providers – 0.1% | ||||||

| 17,500 | Quest Diagnostics, Inc.* | 2,165,625 | ||||

| Oil Services – 0.1% | ||||||

| 28,100 | BJ Services Co.* | 1,882,700 | ||||

| Publishing – 0.3% | ||||||

| 38,200 | Dow Jones & Co., Inc. | 2,389,887 | ||||

| 25,700 | Knight-Ridder, Inc. | 1,403,863 | ||||

| 3,793,750 | ||||||

| Security/Asset Management – 2.3% | ||||||

| 29,800 | A.G. Edwards, Inc. | 1,549,600 | ||||

| 84,300 | Lehman Brothers Holdings, Inc. | 12,223,500 | ||||

| 64,900 | Merrill Lynch & Co., Inc. | 9,410,500 | ||||

| 14,500 | Morgan Stanley Dean Witter & Co. | 1,559,656 | ||||

| 188,500 | The Charles Schwab Corp. | 7,198,344 | ||||

| 31,941,600 | ||||||

| Semiconductors – 15.1% | ||||||

| 149,000 | Advanced Micro Devices, Inc.* | 5,606,125 | ||||

| 68,800 | Analog Devices, Inc.* | 6,914,400 | ||||

| 39,700 | Applied Materials, Inc.* | 3,426,606 | ||||

| 73,700 | Applied Micro Circuits Corp.* | 14,956,494 | ||||

| 25,800 | Broadcom Corp.* | 6,450,000 | ||||

| 35,000 | Integrated Device Technology, Inc.* | 3,071,250 | ||||

| 1,233,000 | Intel Corp. | 92,320,875 | ||||

| 197,740 | JDS Uniphase Corp.* | 24,615,540 | ||||

| 113,700 | Micron Technology, Inc.* | 9,294,975 | ||||

| 23,100 | PMC-Sierra, Inc.* | 5,451,600 | ||||

| 12,000 | QLogic Corp.* | 1,362,000 | ||||

| 24,400 | RF Micro Devices, Inc.* | 1,088,850 | ||||

| 30,600 | SDL, Inc.* | 12,157,763 | ||||

| 242,600 | Texas Instruments, Inc. | 16,239,037 | ||||

| 26,700 | TriQuint Semiconductor, Inc.* | 1,476,844 | ||||

| 16,300 | Xilinx, Inc.* | 1,448,663 | ||||

| 205,881,022 | ||||||

| Shares | Description | Value | ||||

|---|---|---|---|---|---|---|

| Common Stocks – (continued) | ||||||

| Specialty Retail – 2.0% | ||||||

| 73,700 | CVS Corp. | $ 2,736,113 | ||||

| 24,000 | Lowes Co., Inc. | 1,075,500 | ||||

| 327,550 | The Home Depot, Inc. | 15,742,872 | ||||

| 154,100 | Tiffany & Co. | 6,414,412 | ||||

| 35,100 | Zale Corp.* | 1,296,506 | ||||

| 27,265,403 | ||||||

| Telephone – 1.7% | ||||||

| 108,080 | AT&T Corp. | 3,404,520 | ||||

| 344,700 | BCE, Inc. | 7,755,750 | ||||

| 27,200 | BellSouth Corp. | 1,014,900 | ||||

| 39,000 | NEXTLINK Communications, Inc.* | 1,367,437 | ||||

| 64,833 | SBC Communications, Inc. | 2,706,778 | ||||

| 200,850 | WorldCom, Inc.* | 7,331,025 | ||||

| 23,580,410 | ||||||

| Wireless – 1.0% | ||||||

| 299,100 | AT&T Wireless Group* | 7,832,682 | ||||

| 20,300 | Sprint Corp. (PCS Group)* | 1,018,806 | ||||

| 36,900 | Telephone & Data Systems, Inc. | 4,280,400 | ||||

| 13,131,888 | ||||||

| TOTAL COMMON STOCKS | ||||||

| (Cost $955,579,423) | $1,345,535,581 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | ||||

|---|---|---|---|---|---|---|---|

| Repurchase Agreement – 1.2% | |||||||

| Joint Repurchase Agreement Account IIˆ | |||||||

| $16,300,000 | 6.66% | 09/01/2000 | $ 16,300,000 | ||||

| TOTAL REPURCHASE AGREEMENT | |||||||

| (Cost $16,300,000) | $ 16,300,000 | ||||||

| TOTAL INVESTMENTS | |||||||

| (Cost $971,879,423) | $1,361,835,581 | ||||||

*

|

Non-income producing security.

|

|

ˆ

|

Joint repurchase agreement was entered into on August 31, 2000.

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of total net

assets.

|

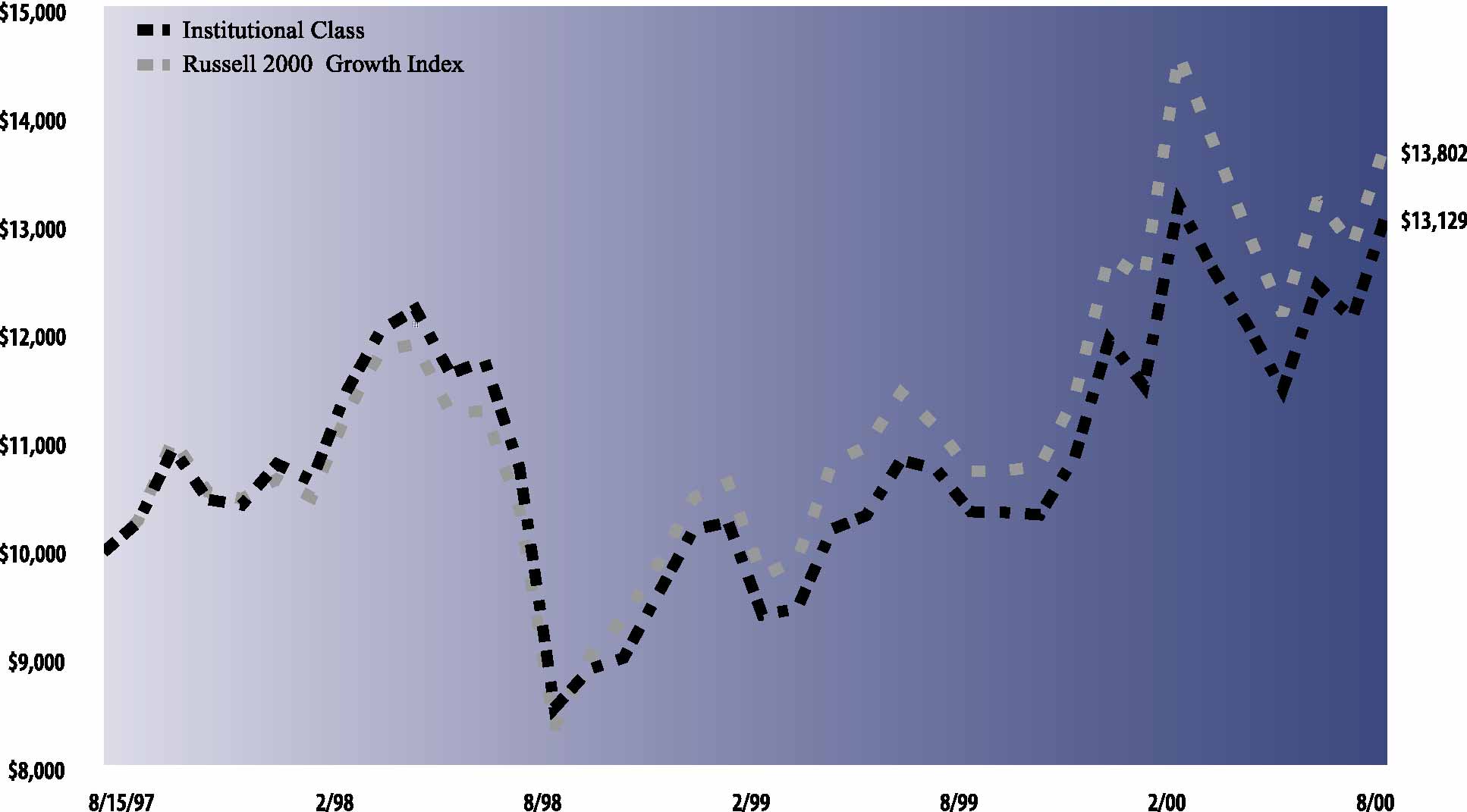

| The following graph shows the value, as of August 31, 2000, of a $10,000 investment made on August 15, 1997 (commencement of

operations) in Institutional shares at (NAV) of the Goldman Sachs CORE Small Cap Equity Fund. For comparative purposes, the performance of the Fund’s benchmark (Russell 2000 Growth Index with dividends reinvested) is shown. This performance data

represents past performance and should not be considered indicative of future performance which will fluctuate with changes in market conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less

than their original cost. Performance of Class A, Class B, Class C and Service shares will vary from Institutional shares due to differences in fees and loads.

|

| CORE Small Cap Equity Fund’s Lifetime Performance

|

| Growth of a $10,000 Investment, Distributions Reinvested August 15, 1997 to August 31, 2000.

|

|

| Average Annual Total Return through August 31, 2000 | Since Inception | One Year | ||

|---|---|---|---|---|

| Class A (commenced August 15, 1997) | ||||

| Excluding sales charges | 8.90% | 26.10% | ||

| Including sales charges | 6.90% | 19.11% | ||

| |

||||

| Class B (commenced August 15, 1997) | ||||

| Excluding contingent deferred sales charges | 8.11% | 25.17% | ||

| Including contingent deferred sales charges | 7.27% | 20.17% | ||

| |

||||

| Class C (commenced August 15, 1997) | ||||

| Excluding contingent deferred sales charges | 8.20% | 25.35% | ||

| Including contingent deferred sales charges | 8.20% | 24.35% | ||

| |

||||

| Institutional Class (commenced August 15, 1997) | 9.34% | 26.60% | ||

| |

||||

| Service Class (commenced August 15, 1997) | 8.81% | 25.93% | ||

| |

||||

|

Shares |

Description | Value | ||||

|---|---|---|---|---|---|---|

| Common Stocks – 99.6% | ||||||

| Airlines – 0.5% | ||||||

| 17,700 | America West Holdings Corp. Class B* | $ 258,863 | ||||

| 30,200 | Frontier Airlines, Inc.* | 517,175 | ||||

| 776,038 | ||||||

| Alcohol – 0.2% | ||||||

| 9,900 | The Robert Mondavi Corp.* | 405,900 | ||||

| Apparel – 0.5% | ||||||

| 23,600 | Phillips-Van Heusen Corp. | 215,350 | ||||

| 9,500 | Skechers U.S.A., Inc.* | 169,219 | ||||

| 12,300 | Springs Industries, Inc. | 367,462 | ||||

| 13,200 | Steven Madden Ltd.* | 162,525 | ||||

| 914,556 | ||||||

| Banks – 4.0% | ||||||

| 30,300 | Brookline Bancorp, Inc. | 357,919 | ||||

| 27,100 | Cullen/Frost Bankers, Inc. | 840,100 | ||||

| 9,900 | First Charter Corp. | 159,019 | ||||

| 9,900 | GBC Bancorp | 374,962 | ||||

| 8,500 | Greater Bay Bancorp | 527,000 | ||||

| 44,491 | Imperial Bancorp | 967,679 | ||||

| 30,600 | Independence Community Bank Corp. | 415,012 | ||||

| 2,600 | Net.B@nk, Inc.* | 29,575 | ||||

| 27,300 | Silicon Valley Bancshares* | 1,573,162 | ||||

| 13,300 | Southwest Bancorp of Texas, Inc.* | 386,531 | ||||