|

|

|

|

|

Previous: GOLDMAN SACHS TRUST, N-30D, 2001-01-10 |

Next: CENEX HARVEST STATES COOPERATIVES, 10-Q, 2001-01-10 |

GOLDMAN SACHS TAXABLE INVESTMENT GRADE FUNDS

Market Overview

Dear Shareholder:

During the period under review, bond markets around the world posted relatively solid returns, especially compared to some sectors of the equity market.

Market Review

Throughout the period, the U.S. bond market was also affected by the Treasury Department’s repurchase of long maturity deb t. The reduction in supply is aimed at reducing the average maturity and interest cost of Treasury debt. This led to a sharp increase in demand for 30-year bonds, resulting in strong performance for longer maturity issues and an inverted yield curve .

Elsewhere, the Australian and New Zealand markets initially performed well, but as the period progressed, a steep decline in their respective currencies versus the U.S. dollar caused their spreads to widen.

Outlook

Given recent supportive data, we continue to believe that the U.S. is headed for a “soft landing” following a period of benign inflation. However, given strong consumer confidence, low unemployment, and continued pockets of solid economic growth, a soft landing is not assured. Conversely, in the short term, ongoing equity volatility coupled with recent negative earnings news could lead to continued credit spread widening and investor flight to the “safe haven” of U.S. Treasuries.

GOLDMAN SACHS TAXABLE INVESTMENT GRADE FUNDS

Our outlook in Europe is relatively positive. Signs continue to indicate that GDP growth has peaked and that growth is moderating. However, the risk of further tightening remains, given inflation levels above the ECB target and a weak currency. We are maintaining a neutral position in Japan, as we feel the market has an overly optimistic view of future growth rates.

As always, we appreciate your support and we look forward to serving your investment needs in the years to come.

Sincerely,

| David B. Ford | David W. Blood | Sharmin Mossavar-Rahmani |

| Co-Head, Goldman Sachs | Co-Head, Goldman Sachs | CIO, Fixed Income Investments, |

| Asset Management | Asset Management | Goldman Sachs Asset Management |

| November 9, 2000 |

1

FUND BASICS

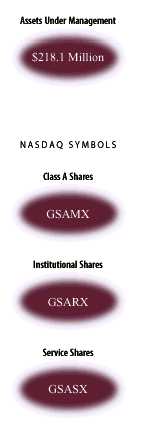

Enhanced Income Fund

as of October 31, 2000

| PERFORMANCE REVIEW | ||||||||

| August 2, 2000– | Fund Total Return

|

30-Day

|

6-Month

|

1-Year

|

||||

| October 31, 2000 | (based on NAV)1

|

Standardized Yield2

|

U.S.Treasury3

|

U.S.Treasury

3

|

||||

| |

||||||||

| Class A | 1.66%

|

5.79%

|

1.57%

|

1.41%

|

||||

| Institutional | 1.76%

|

6.43%

|

1.57%

|

1.41%

|

||||

| Administration | 1.68%

|

N/A

|

1.57%

|

1.41%

|

||||

| |

||||||||

| 1

The net asset value represents the net assets of the Fund (ex-dividend) divided by the total number of net shares outstanding.

The Fund’s performance reflects the reinvestment of

dividends and other distributions.

2 The 30-Day Standardized Yield of the Fund is calculated by dividing the net investment income per share (as defined by securities industry regulations) earned by the Fund over a 30-day period (ending on the stated month-end date) by the maximum public offering price per share of the Fund on the last day of the period. This number is compounded semiannually and then annualized. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. 3 The 6-Month and 1-Year U.S. Treasury securities reported by Merrill Lynch do not reflect any fees or expenses. |

||||||||

| STANDARDIZED TOTAL RETURNS4 | |||||||

| For the period ending 9/30/00 | Class A | Institutional | Administration | ||||

| |

|||||||

| Since Inception | –0.39%

|

1.17%

|

1.12%

|

||||

| (8/2/00) | |||||||

| |

|||||||

| 4 The Standardized Total Returns are average annual returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value. These returns reflect a maximum initial sales charge of 1.5% for Class A shares. Because Institutional and Administration shares do not involve sales charges, such charges have not been applied to their Standardized Total Returns. | |||||||

| PORTFOLIO COMPOSITION AS OF 10/31/005 | |||||||

| Sector Allocation | |||||||

| |

|||||||

| U.S. Treasuries | 39.3 | % | |||||

| Agency Debentures | 26.3 | % | |||||

| Asset-Backed Securities | 20.8 | % | |||||

| Corporate Bonds | 5.4 | % | |||||

| Cash Equivalents | 0.8 | % | |||||

| |

|||||||

| 5

Figures represent a percentage of net assets and may not sum to 100%. The Fund is actively

managed and, as such, its composition may differ over time.

Total return figures represent past performance and do not indicate future results, which will vary. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance reflects expense limitations in effect. In their absence, performance would be reduced. |

|||||||

2

PERFORMANCE OVERVIEW

Enhanced Income Fund

Dear Shareholder:

We are pleased to report on the performance of the Goldman Sachs Enhanced Income Fund from its inception through October 31, 2000.

Performance Review

Performance Review

During the short period of time from the Fund’s inception on August 2, 2000 through October 31, 2000, the Fund’s A, Institutional and Administration share classes generated cumulative total returns, at net asset value, of 1.66%, 1.76% and 1.68%, respectively. These figures outperformed the Fund’s benchmarks, the 1-Year and Six-Month U.S. Treasury Bills, which returned 1.41% and 1.57%, respectively.

Investment Objective

The Fund seeks to generate returns in excess of traditional money market products while maintaining an emphasis on preservation of capital and liquidity. It’s important to note that the Fund is not a money market fund and its net asset value will fluctuate.

Portfolio Composition

The Goldman Sachs Enhanced Income Fund targets a duration of nine months, with diversified holdings in high credit quality (minimum “A’’) sectors including U.S. Treasuries, Agency, Corporate, Asset-Backed and Money Market Instruments. By the end of the reporting period the Fund had its largest weighting in U.S. Treasuries (39.3% of net assets), followed by Agency issues (26.3%), Asset-Backed Securities (20.8%), Corporates (5.4%) and Cash (0.38%).

As we move beyond the Fund’s initial start-up phase, we look to more broadly diversify its portfolio by increasing its exposure to Corporate securities.

Outlook

We are anticipating slower growth in the coming quarters, but we have doubts that this will prove sufficient for the Federal Reserve Board (the “Fed”) to deliver the easing that is already priced into the market. We now expect the Fed will keep policy on hold throughout 2001. Previously, we had expected a modest tightening during the first half of the year. However, this was predicated on the view that the economy would expand rapidly enough to intensify the pressures in the labor market, reviving concerns about inflation. Although we continue to expect a modest increase in core inflation, we believe Fed officials will probably look pas t this if tensions in the labor market appear to be ebbing at the same time, which now seems likely.

We thank you for your investment and look forward to your continued confidence.

Goldman Sachs U.S. Fixed Income Investment Management Team

November 9, 2000

3

FUND BASICS

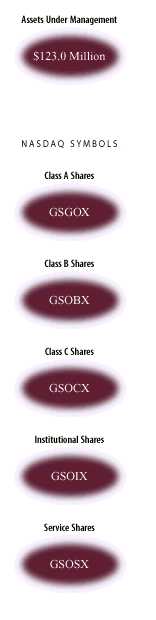

Adjustable Rate Government Fund

as of October 31, 2000

| PERFORMANCE REVIEW | ||||||||

| October 31, 1999– | Fund Total Return

|

30-Day

|

6-Month

|

1-Year

|

||||

| October 31, 2000 | (based on NAV)1

|

Standardized Yield2

|

U.S.Treasury3

|

U.S.Treasury3

|

||||

| |

||||||||

| Class A | 5.12% | 6.01% | 6.06%

|

5.57% | ||||

| Institutional | 5.65% | 6.50% | 6.06%

|

5.57% | ||||

| Service | 4.95% | 6.01% | 6.06%

|

5.57% | ||||

| |

||||||||

| 1

The net asset value represents the net assets of the Fund (ex-dividend) divided by the total number of net shares outstanding. The Fund’s performance reflects the

reinvestment of dividends and other distributions.

2 The 30-Day Standardized Yield of the Fund is calculated by dividing the net investment income per share (as defined by securities industry regulations) earned by the Fund over a 30-day period (ending on the stated month-end date) by the maximum public offering price per share of the Fund on the last day of the period. This number is compounded semiannually and then annualized. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. 3 The 6-Month and 1-Year U.S. Treasury securities reported by Merrill Lynch do not reflect any fees or expenses. |

||||||||

| STANDARDIZED TOTAL RETURNS4 | ||||||

| For the period ending 9/30/00 | Class A | Institutional | Service | |||

| |

||||||

| One Year | 3.41%

|

5.55%

|

4.85%

|

|||

| Five Years | 4.97%

|

5.69%

|

N/A

|

|||

| Since Inception | 5.04%

|

5.33%

|

4.69%

|

|||

| (5/15/95)

|

(7/17/91)

|

(3/27/97)

|

||||

| |

||||||

| 4 The Standardized Total Returns are average annual returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value. These returns reflect a maximum initial sales charge of 1.5% for Class A shares. Because Institutional and Service shares do not involve sales charges, such charges have not been applied to their Standardized Total Returns. | ||||||

| PORTFOLIO COMPOSITION AS OF 10/31/005 | ||||||

| Sector Allocation | ||||||

| |

||||||

| Adjustable Rate Mortgage Securities | 78.6

|

% | ||||

| Cash Equivalents | 8.5 | % | ||||

| Fixed Rate Pass-Throughs | 7.2

|

% | ||||

| Collateralized Mortgage Obligations | 4.9 | % | ||||

| |

||||||

| 5

Figures represent a percentage of net assets and may not sum to 100%. The Fund is actively managed

and, as such, its composition may differ over time.

Total return figures represent past performance and do not indicate future results, which will vary. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance reflects expense limitations in effect. In their absence, performance would be reduced. |

||||||

4

PERFOR MANCE OVERVIEW

Adjustable Rate Government Fund

Dear Shareholder,

We are pleased to report on the performance of the Goldman Sachs Adjustable Rate Government Fund for the one-year period that ended October 31, 2000.

Performance Review

Over the one-year reporting period that ended October 31, 2000, the Fund’s A, Institutional and Service share classes generated cumulative total returns, at net asset value, of 5.12%, 5.65% and 4.95%, respectively. These returns generally underperformed the Fund’s benchmarks, the six-month U.S. Treasury security and the one-year U.S. Treasury security, which returned 6.06% and 5.57%, respectively.

Investment Objective

The Fund seeks a high level of current income consistent with low volatility of principal, primarily through investments in securities issued by the U.S. government, its agencies, instrumentalities or sponsored enterprises that are adjustable rate mortgage pass-through securities and other mortgage securities with periodic interest rate resets.

Portfolio Composition

We maintained our strategy of focusing on sectors and securities that we believe will generate a competitive total rate of return relative to the benchmark, while de-emphasizing directional duration management.

Portfolio Highlights

5

PERFORMANCE OVERVIEW

Portfolio Outlook

Despite holding interest rates steady in recent months, the Fed continues to warn investors that the tight labor market and rising energy costs could lead to future rate hikes. We expect the Fed to keep its current policy stance unchanged for the balance of the year.

We thank you for your investment and look forward to your continued confidence.

Goldman Sachs U.S. Fixed Income Investment Management Team

November 9, 2000

6

FUND BASICS

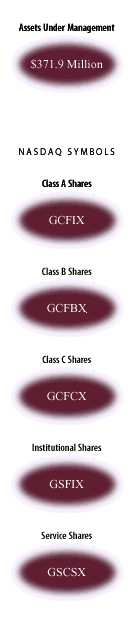

Short Duration Government Fund

as of October 31, 2000

| PERFORMANCE REVIEW | |||||||

| October 31, 1999– | Fund Total Return

|

30-Day

|

2-Year U.S.

|

||||

| October 31, 2000 | (based on NAV)1

|

Standardized Yield2

|

Treasury Security3

|

||||

| |

|||||||

| Class A | 5.65%

|

6.13%

|

5.44%

|

||||

| Class B | 4.80%

|

5.66%

|

5.44%

|

||||

| Class C | 4.76%

|

5.50%

|

5.44%

|

||||

| Institutional | 5.85%

|

6.67%

|

5.44%

|

||||

| Service | 5.32%

|

6.16%

|

5.44%

|

||||

| |

|||||||

| 1

The net asset value represents the net assets of the Fund (ex-dividend)

divided by the total number of net shares outstanding

. The Fund’s performance reflects the reinvestment of dividends and other distributions.

2 The 30-Day Standardized Yield of the Fund is calculated by dividing the net investment income per share (as defined by securities industry regulations) earned by the Fund over a 30-day period (ending on the stated month-end date) by the maximum public offering price per share of the Fund on the last day of the period. This number is compounded semiannually and then annualized. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. 3 The 2-Year U.S. Treasury security does not reflect any fees or expenses. |

|||||||

| STANDARDIZED TOTAL RETURNS4 | ||||||||||

| For the period ending 9/30/00 | Class A | Class B | Class C | Institutional | Service | |||||

| |

||||||||||

| One Year | 3.07%

|

2.40%

|

3.40%

|

5.53%

|

5.00%

|

|||||

| Five Years | N/A

|

N/A

|

N/A

|

5.84%

|

N/A

|

|||||

| Ten Years | N/A

|

N/A

|

N/A

|

6.16%

|

N/A

|

|||||

| Since Inception | 4.51%

|

4.50%

|

3.94%

|

6.67%

|

5.32%

|

|||||

| (5/1/97)

|

(5/1/97)

|

(8/15/97)

|

(8/15/88)

|

(4/10/96)

|

||||||

| |

||||||||||

| 4 The Standardized Total Returns are average annual returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value. These returns reflect a maximum initial sales charge of 2% for Class A shares, the assumed deferred sales charge for Class B shares (2% maximum declining to 0% after three years) and the assumed deferred sales charge for Class C shares (1% if redeemed within 12 months of purchase) . Because Institutional and Service shares do not involve sales charges, such charges have not been applied to their Standardized Total Returns. | ||||||||||

| PORTFOLIO COMPOSITION AS OF 10/31/005 | ||||||||||

| Sector Allocation | ||||||||||

| |

||||||||||

| Collateralized Mortgage Obligations | 42.7 | % | ||||||||

| Fixed Rate Pass-Throughs | 25.7 | % | ||||||||

| Adjustable Rate Mortgage Securities | 20.5 | % | ||||||||

| Agency Debentures | 6.7 | % | ||||||||

| U.S. Treasuries | 4.7 | % | ||||||||

| Cash Equivalents | 2.7 | % | ||||||||

| |

||||||||||

| 5

Figures represent a percentage of net assets and may not sum to 100%. The Fund is actively managed and, as such, its composition may differ over time.

Total return figures represent past performance and do not indicate future results, which will vary. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance reflects fee waivers and expense limitations in effect. In their absence, performance would be reduced. |

||||||||||

7

PERFORMANCE OVERVIEW

Short Duration Government Fund

Dear Shareholder,

We are pleased to report on the performance of the Goldman Sachs Short Duration Government Fund for the one-year period that ended October 31, 2000.

Performance Review

Over the one-year reporting period that ended October 31, 2000, the Fund’s A, B, C, Institutional and Service share classes generated total cumulative returns, at net asset value, of 5.65%, 4.80%, 4.76%, 5.85% and 5.32%, respectively. Over the same time period, the Fund’s benchmark, the two-year U.S. Treasury security, generated a 5. 44% cumulative total return.

Investment Objective

The Fund seeks a high level of current income and, secondarily, in seeking current income, may also consider the potential for capital appreciation, primarily through investing in U.S. government securities and repurchase agreements collateralized by such securities.

Portfolio Composition

During the one-year period, we maintained our strategy of focusing on sectors and securities that we believe will generate a competitive total rate of return relative to the benchmark, while de-emphasizing directional duration management.

Portfolio Highlights

8

PERFORMANCE OVERVIEW

Portfolio Outlook

Despite holding interest rates steady in recent months, the Fed continues to warn investors that the tight labor market and rising energy costs could lead to future rate hikes. We expect the Fed to keep its current policy stance unchanged for the balance of the year.

We thank you for your investment and look forward to your continued confidence.

Goldman Sachs U.S. Fixed Income Investment Management Team

November 9, 2000

9

FUND BASICS

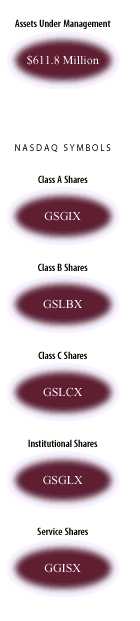

Government Income Fund

as of October 31, 2000

| PERFORMANCE REVIEW | |||||||

| October 31, 1999– | Fund Total Return | 30-Day

|

Lehman Govt./ | ||||

| October 31, 2000 | (based on NAV)1 | Standardized Yield2

|

Mortgage Index3 | ||||

| |

|||||||

| Class A | 7.33%

|

6.84%

|

7.84%

|

||||

| Class B | 6.45%

|

6.40%

|

7.84%

|

||||

| Class C | 6.46%

|

6.40%

|

7.84%

|

||||

| Institutional | 7.68%

|

7.57%

|

7.84%

|

||||

| Service | 7.62%

|

7.06%

|

7.84%

|

||||

| |

|||||||

1

The net asset value represents the net assets of the Fund (ex-dividend)

divided by the total

number of net shares

outstanding. The Fund’s performance reflects the reinvestment of dividends and other

distributions.

2

The 30-Day Standardized Yield of the Fund

is calculated by dividing the net investment income per share (as defined by securities industry regulations) earned by the Fund over a 30-day period (ending on the stated month-end date) by the maximum public offering price per share of the Fund on the last day of the period. This number is compounded semiannually and then annualized. This

yield does not necessarily reflect income actually earned and

distributed by the Fund and, therefore, may not be correlated with the dividends or other

distributions paid to shareholders.

3

The Lehman Brothers Government/Mortgage Index does not reflect any fees or expenses. Investors cannot invest directly in the Index.

| STANDARDIZED TOTAL RETURNS4 | |||||||||||||

| For the period ending 9/30/00 | Class A | Class B | Class C | Institutional | Service | ||||||||

| |

|||||||||||||

| One Year | 1.97%

|

0.73%

|

4.94%

|

7.13%

|

7.07%

|

||||||||

| Five Years | 5.12%

|

N/A

|

N/A

|

N/A

|

5.97%

|

||||||||

| Since Inception | 5.70%

|

5.22%

|

4.85%

|

5.97%

|

6.26%

|

||||||||

| (2

/10/93) |

(5/1/96)

|

(8/15/97)

|

(8/15/97)

|

(2/10/93)5

|

|||||||||

4

The Standardized Total Returns are average annual returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value. These returns reflect a maximum initial sales

charge of 4.5% for Class A shares, the assumed deferred sales charge for Class B shares (5% maximum declining to 0% after six years), and the assumed deferred sales charge for Class C shares (1% if redeemed within 12 months of purchase). Because

Institutional and Service shares do not involve sales charges, such charges have not been applied to their Standardized Total Returns.

5

Performance data for Service shares prior to 8/15/97 (commencement of operations) is that of Class A shares (excluding the impact of front-end sales charges applicable to Class A shares since Service shares are not

subject to any sales charges). Performance of Class A shares in the Fund reflects the expenses applicable to the Fund's Class A shares. The fees applicable to Service shares are different from those applicable to Class A shares which impact performance

ratings and rankings for a class of shares.

| PORTFOLIO COMPOSITION AS OF 10/31/006 | |||||

| Sector Allocation | |||||

| |

|||||

| Mortgage-Backed Securities | 60.5 | % | |||

| Cash Equivalents | 16.1 | % | |||

| Agency Debentures | 15.2 | % | |||

| Asset-Backed Securities | 12.2 | % | |||

| U.S. Treasuries | 10.9 | % | |||

| Municipal Bonds | 1.6 | % | |||

| |

|||||

6

Figures represent a percentage of net assets and may

not sum to 100% . The Fund is actively managed and, as such, its composition may differ over time.

Total return figures represent past performance and do not indicate future results, which will vary. The

investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance reflects fee waivers and expense limitations in effect. In their absence, performance would be reduced.

10

PERFORMANCE OVERVIEW

Government Income Fund

Dear Shareholder,

We are pleased to report on the performance of the Goldman Sachs Government Income Fund for the one-year period that ended October 31, 2000.

Performance Review

Over the one-year reporting period that ended October 31, 2000, the Fund’s A, B, C, Institutional and Service share classes generated cumulative total returns, at net asset value, of 7.33%, 6.45%, 6.46%, 7.68% and 7.62%, respectively. Over the same time period, the Fund’s benchmark, the Lehman Brothers Government/Mortgage Index, generated a 7.84% cumulative total return.

Investment Objective

The Fund seeks a high level of current income consistent with safety of principal, primarily through investing in U.S. government securities and repurchase agreements collateralized by such securities.

Portfolio Composition

During the one-year period, we maintained our strategy of focusing on sectors and securities that we believe will generate a competitive total rate of return relative to the benchmark, while de-emphasizing directional duration management.

Portfolio Highlights

11

PERFORMANCE OVERVIEW

Portfolio Outlook

Despite holding interest rates steady in recent months, the Fed continues to warn investors that the tight labor market and rising energy costs could lead to future rate hikes. We expect the Fed to keep its current policy stance unchanged for the balance of the year.

We thank you for your investment and look forward to your continued confidence.

Goldman Sachs U.S. Fixed Income Investment Management Team

November 9, 2000

12

FUND BASICS

Core Fixed Income Fund

as of October 31, 2000

| PERFORMANCE REVIEW | |||||||

| October 31, 1999– | Fund Total Return

|

30-Day

|

Lehman Aggregate

|

||||

| October 31, 2000 | (based on NAV)1

|

Standardized Yield2

|

Bond Index3

|

||||

| |

|||||||

| Class A | 6.48%

|

5.80%

|

7.30%

|

||||

| Class B | 5.69%

|

5.35%

|

7.30%

|

||||

| Class C | 5.80%

|

5.35%

|

7.30%

|

||||

| Institutional | 6.90%

|

6.52%

|

7.30%

|

||||

| Service | 6.37%

|

6.01%

|

7.30%

|

||||

| |

|||||||

| 1

The net asset value represents the net assets of the Fund (ex-dividend) divided by the total number of net shares outstanding. The Fund’s

performance reflects the reinvestment of dividends and other

distributions.

|

|||||||

| 2

The 30-Day Standardized Yield of the Fund is calculated by dividing the net investment

income per share (as defined by securities industry regulations)

earned by the Fund over a 30-day period (ending on the

stated month-end date) by the maximum public offering price per share of the Fund on the last day of the

period. This number is compounded semiannually and then annualized. This yield does not necessarily reflect income actually earned and distributed by the

Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders.

|

|||||||

| 3 The Lehman Aggregate Bond Index does not reflect any fees or expenses. Investors cannot invest directly in the Index. | |||||||

| STANDARDIZED TOTAL RETURNS4 | ||||||||||

| For the period ending 9/30/00 | Class A | Class B | Class C | Institutional | Service | |||||

| |

||||||||||

| One Year | 1.60%

|

0.24%

|

4.55%

|

6.70%

|

6.18%

|

|||||

| Five Years | N/A

|

N/A

|

N/A

|

6.29%

|

N/A

|

|||||

| Since Inception | 4.68%

|

4.39%

|

4.61%

|

6.23%

|

5.90%

|

|||||

| (5/1/97)

|

(5/1/97)

|

(8/15/97)

|

(1/5/94)

|

(3/13/96)

|

||||||

| |

||||||||||

| 4 The Standardized Total Returns are average annual returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value. These returns reflect a maximum initial sales charge of 4.5% for Class A shares, the assumed deferred sales charge for Class B shares (5% maximum declining to 0% after six years) and the assumed deferred sales charge for Class C shares (1% if redeemed within 12 months of purchase). Because Institutional and Service shares do not involve sales charges, such charges have not been applied to their Standardized Total Returns. | ||||||||||

| PORTFOLIO COMPOSITION AS OF 10/31/005 | ||||||||||

| Sector Allocation | ||||||||||

| |

||||||||||

| Mortgage-Backed Securities | 41.4%

|

U.S. Treasuries | 3.7% | |||||||

| Corporate Bonds | 33.6%

|

Agency Debentures | 2.2% | |||||||

| Asset-Backed Securities | 10.7%

|

Cash Equivalents | 1.4% | |||||||

| Emerging Market Debt | 7.3%

|

Sovereign Credit | 1.1% | |||||||

| |

||||||||||

| 5

Figures represent a percentage of net assets and may not sum to 100%. The Fund is actively managed and, as such, its composition may

differ over time.

Total return figures represent past performance and do not indicate future results, which will vary. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance reflects expense limitations in effect. In their absence, performance would be reduced. |

||||||||||

13

PERFORMANCE OVERVIEW

Core Fixed Income Fund

Dear Shareholder,

We are pleased to report on the performance of the Goldman Sachs Core Fixed Income Fund for the one-year period that ended October 31, 2000.

Performance Review

Over the one-year reporting period that ended October 31, 2000, the Fund’s A, B, C, Institutional and Service share classes generated cumulative total returns, at net asset value, of 6.48%, 5 .69%, 5.80%, 6.90% and 6. 37% respectively. Over the same time period, the Fund’s benchmark, the Lehman Brothers Aggregate Bond Index, generated a cumulative return of 7.30%.

Investment Objective

The Fund seeks total return consisting of capital appreciation and income that exceeds that of the Lehman Brothers Aggregate Bond Index, primarily through fixed income securities, including securities issued or guaranteed by the U.S. government, its agencies, instrumentalities or sponsored enterprises, corporate debt securities, mortgage-backed securities and asset-backed securities.

Portfolio Composition

During the one-year period, we maintained our strategy of focusing on sectors and securities that we believe will generate a competitive total rate of return relative to the benchmark, while de-emphasizing directional duration management. As such, during the period under review, we underweighted Treasury and agency securities relative to the benchmark, and overweighted corporate, mortgage- and asset-backed and emerging market debt securities.

14

PERFORMANCE OVERVIEW

Portfolio Highlights

Portfolio Outlook

Despite holding interest rates steady in recent months, the Fed continues to warn investors that the tight labor market and rising energy costs could lead to future rate hikes. We expect the Fed to keep its current policy stance unchanged for the balance of the year.

We thank you for your investment and look forward to your continued confidence.

Goldman Sachs U.S. Fixed Income Investment Management Team

November 9, 2000

15

FUND BASICS

Global Income Fund

as of October 31, 2000

| PERFORMANCE REVIEW | |||||||

| October 31, 1999– | Fund Total Return | 30-Day | JPM Global Govt. | ||||

| October 31, 2000 | (based on NAV)1 | Standardized Yield2 | Bond Index3 | ||||

| |

|||||||

| Class A | 5.58%

|

3.61%

|

7.80%

|

||||

| Class B | 5.14%

|

3.28%

|

7.80%

|

||||

| Class C | 5.13%

|

3.28%

|

7.80%

|

||||

| Institutional | 6.27%

|

4.43%

|

7.80%

|

||||

| Service | 5.76%

|

3.93%

|

7.80%

|

||||

| |

|||||||

| 1

The net asset value represents the net assets of the Fund (ex-dividend) divided by the total number of net shares

outstanding. The Fund’s performance reflects the reinvestment of dividends

and other distributions.

|

|||||||

| 2

The 30-Day Standardized Yield of the Fund is calculated by dividing

the net investment income per share (as defined by securities industry regulations) earned by the Fund over a 30-day

period (ending on the

stated month-end date) by the maximum public offering price

per share of the Fund on

the last day of the period. This number is compounded semiannually and then

annualized. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not

be correlated with the dividends or other distributions paid to shareholders.

|

|||||||

| 3 The composition and characteristics of the securities in the JP Morgan (JPM) Global Government Bond Index (hedged) are not identical to those of the Fund. Also, unlike the Fund’s return, the Index’s return does not reflect any fees or expenses. Investors cannot invest directly in the Index. | |||||||

| STANDARDIZED TOTAL RETURNS4 | ||||||||||||

| For the period ending 9/30/00 | Class A | Class B | Class C | Institutional | Service | |||||||

| |

||||||||||||

| One Year | 0.28%

|

–0.72%

|

3.40%

|

5.65%

|

5.13%

|

|||||||

| Five Years | 6.43%

|

N/A

|

N/A

|

8.03%

|

7.48%

|

|||||||

| Since Inception | 6.70%

|

5.96%

|

5.19%

|

8.30%

|

7.28%

|

|||||||

| (8/2/91)

|

(5/1/96)

|

(8/15/97)

|

(8/1/95)

|

(8/2/91)5

|

||||||||

| |

||||||||||||

| 4

The Standardized Total Returns are average annual returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value. These returns reflect a maximum initial sales charge of 4.5% for Class A shares, the assumed deferred sales charge for Class B shares

(5% maximum declining to 0% after six years), and the assumed deferred sales charge for Class C shares

(1% if redeemed within 12 months of purchase). Because Institutional and Service shares do not involve sales charges, such charges have not been applied

to their Standardized Total Returns.

|

||||||||||||

| 5 Performance data for Service shares prior to 3/12/97 (commencement of operations) is that of Class A shares (excluding the impact of front-end sales charges applicable to Class A shares since Service shares are not subject to any sales charges). Performance of Class A shares in the Fund reflects the expenses applicable to the Fund’s Class A shares. The fees applicable to Service shares are differ ent from those applicable to Class A shares which impact performance ratings and rankings for a class of shares. | ||||||||||||

| TOP POSITIONS AS OF 10/31/006 | |||||||

| Bonds Denomination | Bonds Denomination

|

||||||

| |

|||||||

| 1. U.S. Dollar | 33.8%

|

6. New Zealand Dollar

|

2.0%

|

||||

| 2. Euro | 25.8%

|

7. Greek Drachma

|

1.9%

|

||||

| 3. Japanese Yen | 18.7%

|

8. Danish Krone

|

1.8%

|

||||

| 4. British Pound | 6.4%

|

9. German Mark

|

1.3%

|

||||

| 5. Canadian Dollar | 2.2%

|

10. Swedish Krone

|

1.1%

|

||||

| |

|||||||

| 6

Figures represent a percentage of net assets and may not sum to 100%. The Fund is actively manage

d and, as such, its composition may differ over time.

Total return figures represent past performance and do not indicate future results, which will vary. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance reflects fee waivers and expense limitations in effect. In their absence performance would be reduced. |

|||||||

16

PERFORMANCE OVERVIEW

Global Income Fund

Dear Shareholder,

We are pleased to report on the performance of the Goldman Sachs Global Income Fund for the one-year period that ended October 31, 2000.

Performance Review

Over the one-year reporting period that ended October 31, 2000, the Fund’s A, B, C, Institutional and Service share classes generated cumulative total returns, at net asset value, of 5.58%, 5.14%, 5.13%, 6.27%, and 5.76%, respectively. Over the same time period, the Fund’s benchmark, the JP Morgan Global Government Bond Index (hedged into U.S. dollars), generated a 7.80% cumulative total return.

The Fund’s underperformance versus its benchmark is attributable to several factors. In recent months, the exposure to credit in the portfolio had an offsetting negative impact, due to a widening of swap spreads in the U.S. Currency management also retracted from overall performance, caused mainly by the fall in the Australian dollar. However, duration and yield curve positioning were positive contributors to performance over the period.

Investment Objective

The Fund seeks high total return, emphasizing current income and, to a lesser extent, providing opportunities for capital appreciation primarily through investments in fixed income securities of U.S. and foreign issuers and through transactions in foreign currencies.

Portfolio Positioning

The Fund began the reporting period with an overweight exposure in the U.S., as a slowing of economic growth was anticipated. However, we scaled back to a neutral and then an underweighted position, based on the continued robust economic expansion. As the period progressed we removed our underweight position in the U.S., as the weak equity markets dragged bond yields lower. As signs of slower growth began to appear later in the second quarter, w e introduced a long position in the middle portion of the U .S. curve. Then, at the beginning of the third quarter, we unwound our long duration position.

Overseas, during the first quarter of 2000, a position in the 2-3 year area of the UK yield curve was introduced. This was based on the belief that UK economy had entered the advanced stages of its economic upturn, and that aggressive tightening by the Monetary Policy Committee would start to have an effect on the manufacturing and retail sectors. During the summer we removed the small overweight position we had established in the UK, and increased the size of our overweight position in core Euro markets. Towards the end of the period we established an overweight position in Japan, due to weakening trends in the economic outlook for the country.

In currencies, at the start of the period, we had an underweight exposure to the dollar bloc, were neutral European currencies, and were overweight the Asian bloc. During the initial months of the period we decreased exposure within Europe, and in the first quarter of 2000 we opened a long exposure to the dollar bloc, reducing our short exposure in Europe. Over the second quarter of 2000 we increased our long exposure to the dollar bloc, reduced the short

17

PERFORMANCE OVERVIEW

exposure to Europe, and pared our long exposure to Asia. During the third quarter of 2000, we opened a short exposure to the dollar bloc, opened a long exposure in Europe and initiated a short exposure to Asia.

Portfolio Outlook

Given that global growth is slowing and inflation appears benign, we believe that interest rates may have peaked. In addition, current economic conditions and recent stock market fluctuations provide a positive backdrop for the global bond markets.

We continue to believe that the U.S. is headed for a “soft landing” with a period of benign inflation. Rising equity market volatility has also led investors to the “safe haven” of U.S. Treasuries, and, as a result, yields have reached their lowest level of the year. Although the U.S. bond markets have been the strongest performing of major bond markets this year, we believe that yields have already discounted the slowing growth scenario in the U.S.

The outlook in Europe is similarly positive. Signs continue to indicate that GDP growth has peaked and growth is moderating. The economic slowdown, however, is passing into Europe with a predictable lag. Overall, we continue to have a preference for the European bond markets relative to the U.S., as we believe the softer economic outlook is not fully reflecte d in the European yield curves.

In Japan, we are maintaining our long bond position, based on the market’s overly optimistic growth outlook for Japan. Despite signs of a modest corporate recovery in Japan, consumer demand remains weak. As such, we expect yields to continue to trade in a narrow range until the deflationary trend eases.

Overall, we continue to prefer higher quality, shorter-dated corporates, and are looking to eliminate any lower quality names that we view as vulnerable to negative event risk. Our sectoral bias at the moment is towards banks and utilities, as we continue to view these as defensive plays in the recent volatile environment. We have yet to reduce our U.S . corporate exposure, believing that there is room for these spreads to contract further from their current levels, as they still appear cheap on a relative basis to sterling and European corporates. We believe that the catalyst for this will be a reduction in volatility following the end of the earnings’ season. Nevertheless, security selection remains critical, as it has become increasingly important to avoid rapidly deteriorating credit stories in today’s challenging environment.

In currencies, we are currently overweight with respect to the U.S. dollar, supported by a positive asset market outlook and mergers and acquisition flows. We are underweight with respect to the yen, as we believe the market is continuing to overemphasize growth expectations in Japan, with spending remaining weak. We are currently neutral towards the euro against the U.S. dollar, despite intervention and the slowdown in the U.S., as economic fundamentals still point to a slowdown in Euroland.

We thank you for your investment and look forward to your continued confidence.

Goldman Sachs Global Fixed Income Investment Management Team

November 9, 2000

18

GOLDMAN SACHS TAXABLE INVESTMENT GRADE FUNDS

The Goldman Sachs Advantage

Founded in 1869, Goldman, Sachs & Co. is a premier financial services firm traditionally known on Wall Street and around the world for its institutional expertise.

Today, the firm’s Investment Management Division provides individual investors the opportunity to tap the resources of a global institutional powerhouse — and put this expertise to work in their individual portfolios.

What Sets Goldman Sachs Funds Apart?

To learn more about the Goldman Sachs Funds, call your investment professional today.

19

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Agency Debentures – 26.3% | ||||||||

| Federal Home Loan Banks | ||||||||

| $ 5,000,000 | 5.13 | % | 04/17/2001 | $ 4,965,255 | ||||

| 2,000,000 | 5.62 | 04/12/2002 | 1,969,280 | |||||

| 3,000,000 | 6.75 | 08/15/2002 | 3,014,055 | |||||

| 3,570,000 | 5.35 | 12/15/2003 | 3,448,399 | |||||

| 3,000,000 | 5.63 | 02/26/2004 | 2,910,804 | |||||

| $ 16,307,793 | ||||||||

| Federal Home Loan Mortgage Corp. | ||||||||

| $ 2,500,000 | 5.87 | % | 02/04/2002 | $ 2,478,125 | ||||

| 1,500,000 | 6.00 | 04/14/2004 | 1,466,334 | |||||

| $ 3,944,459 | ||||||||

| Federal National Mortgage Association | ||||||||

| $ 4,000,000 | 5.38 | % | 04/26/2001 | $ 3,971,240 | ||||

| 2,500,000 | 5.84 | 06/12/2001 | 2,490,250 | |||||

| 1,000,000 | 5.21 | 12/10/2001 | 984,220 | |||||

| 2,000,000 | 6.50 | 07/29/2002 | 1,989,972 | |||||

| 3,000,000 | 5.50 | 01/26/2004 | 2,899,230 | |||||

| 4,750,000 | 5.96 | 02/23/2004 | 4,634,955 | |||||

| 3,000,000 | 5.81 | 03/02/2004 | 2,929,170 | |||||

| 2,000,000 | 6.00 | 03/08/2004 | 1,967,600 | |||||

| 2,400,000 | 5.74 | 05/06/2004 | 2,334,624 | |||||

| $ 24,201,261 | ||||||||

| TOTAL AGENCY DEBENTURES | ||||||||

| (Cost $44,298,886) | $ 44,453,513 | |||||||

| Asset-Backed Securities – 20.8% | ||||||||

| Auto – 14.8% | ||||||||

| Associates Automobile Receivables Trust Series 2000-2,

Class A3 |

||||||||

| $ 3,000,000 | 6.82 | % | 02/15/2005 | $ 3,007,500 | ||||

| Carco Auto Loan Master Trust | ||||||||

| 3,000,000 | 5.78 | 03/15/2004 | 2,959,470 | |||||

| Daimlerchrysler Auto Trust Series 2000-D, Class A2 | ||||||||

| 5,000,000 | 6.70 | 06/08/2003 | 4,999,960 | |||||

| Ford Credit Auto Owner Trust Series 2000-C, Class A4 | ||||||||

| 5,000,000 | 7.24 | 02/15/2004 | 5,024,650 | |||||

| Ford Credit Auto Owner Trust Series 2000-E, Class A4 | ||||||||

| 5,000,000 | 6.74 | 06/15/2004 | 5,011,034 | |||||

| Household Automotive Trust | ||||||||

| 1,500,000 | 7.05 | 02/17/2005 | 1,512,404 | |||||

| WFS Financial Owner Trust Series 2000-A, Class A3 | ||||||||

| 2,000,000 | 7.22 | 09/20/2004 | 2,015,908 | |||||

| WFS Financial Owner Trust Series 2000-C, Class A2 | ||||||||

| 500,000 | 7.01 | 08/20/2003 | 500,607 | |||||

| 25,031,533 | ||||||||

| Credit Card – 6.0% | ||||||||

| Advanta Credit Card Master Trust Series 1996-D, Class A | ||||||||

| $ 1,150,000 | 6.77 | % | 06/15/2005 | $ 1,152,174 | ||||

| Chemical Master Credit Card Trust I Series 1995-4, Class A | ||||||||

| 1,000,000 | 6.88 | 07/25/2005 | 1,001,960 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Asset-Backed Securities – (continued) | ||||||||

| Credit Card – (continued) | ||||||||

| Discover Card Master Trust I Series 1999-4, Class A | ||||||||

| $ 5,000,000 | 5.65 | % | 11/15/2004 | $ 4,915,685 | ||||

| MBNA Master Credit Card Trust Series 1995-E, Class A | ||||||||

| 1,000,000 | 6.84 | 01/15/2005 | 1,002,890 | |||||

| Standard Credit Card Master Trust Series 1994-4, Class A | ||||||||

| 2,000,000 | 8.25 | 11/07/2003 | 2,024,940 | |||||

| $ 10,097,649 | ||||||||

| TOTAL ASSET-BACKED SECURITIES | ||||||||

| (Cost $35,112,128) | $ 35,129,182 | |||||||

| Corporate Bonds – 5.4% | ||||||||

| Automotive – 1.1% | ||||||||

| Ford Motor Credit Co. | ||||||||

| $ 1,150,000 | 6.50 | % | 02/28/2002 | $ 1,144,452 | ||||

| General Motors Acceptance Corp. | ||||||||

| 750,000 | 6.75 | 02/07/2002 | 748,907 | |||||

| 1,893,359 | ||||||||

| Commercial Banks – 2.2% | ||||||||

| Bank of America Corp. | ||||||||

| $ 900,000 | 8.38 | % | 03/15/2002 | $ 914,899 | ||||

| 500,000 | 7.75 | 07/15/2002 | 505,820 | |||||

| Citigroup, Inc. | ||||||||

| 750,000 | 7.45 | 06/06/2002 | 758,861 | |||||

| The Bank of New York Co., Inc. | ||||||||

| 400,000 | 7.63 | 07/15/2002 | 405,653 | |||||

| 460,000 | 7.88 | 11/15/2002 | 470,013 | |||||

| Wells Fargo & Co. | ||||||||

| 570,000 | 7.20 | 05/01/2003 | 574,827 | |||||

| 3,630,073 | ||||||||

| Mortgage Banks – 0.1% | ||||||||

| Countrywide Funding Corp. | ||||||||

| $ 215,000 | 6.38 | % | 10/08/2002 | $ 212,219 | ||||

| Retailers – 0.3% | ||||||||

| Sears Roebuck Acceptance Corp. | ||||||||

| $ 375,000 | 6.86 | % | 08/06/2001 | $ 375,327 | ||||

| 200,000 | 6.41 | 11/19/2002 | 197,654 | |||||

| 572,981 | ||||||||

| Tobacco – 0.5% | ||||||||

| Philip Morris Cos., Inc. | ||||||||

| $ 800,000 | 7.13 | % | 08/15/2002 | $ 798,648 | ||||

| Yankee Banks – 0.3% | ||||||||

| Quebec Province | ||||||||

| $ 430,000 | 7.50 | % | 07/15/2002 | $ 434,760 | ||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Bonds – (continued) | ||||||||

| Finance Companies – 0.9% | ||||||||

| Heller Financial, Inc. | ||||||||

| $ 585,000 | 7.50 | % | 08/23/2002 | $ 585,480 | ||||

| Household Finance Corp. | ||||||||

| 1,030,000 | 5.88 | 11/01/2002 | 1,009,417 | |||||

| $ 1,594,897 | ||||||||

| TOTAL CORPORATE BONDS | ||||||||

| (Cost $9,137,176) | $ 9,136,937 | |||||||

| U.S. Treasury Obligations – 39.3% | ||||||||

| United States Treasury Notes | ||||||||

| $ 8,200,000 | 5.25 | % | 05/31/2001 | $ 8,144,420 | ||||

| 58,600,000 | 5.50 | 08/31/2001 | 58,197,008 | |||||

| TOTAL U.S. TREASURY OBLIGATIONS | ||||||||

| (Cost $66,365,270) | $ 66,341,428 | |||||||

| Short-Term Obligation – 6.7% | ||||||||

| Federal National Mortgage Association | ||||||||

| $ 12,000,000 | 6.16 | % | 09/06/2001 | $ 11,361,600 | ||||

| TOTAL SHORT-TERM OBLIGATION | ||||||||

| (Cost $11,364,919) | $ 11,361,600 | |||||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Repurchase Agreement – 0.8% | ||||||||

| Joint Repurchase Agreement Account Ù V | ||||||||

| $ 1,300,000 | 6.62 | % | 11/01/2000 | $ 1,300,000 | ||||

| TOTAL REPURCHASE AGREEMENT | ||||||||

| (Cost $1,300,000) | $ 1,300,000 | |||||||

| TOTAL INVESTMENTS | ||||||||

| (Cost $167,578,379) | $ 167,722,660 | |||||||

V

|

Joint repurchase agreement was entered into on October 31, 2000.

|

Ù

|

A portion of this security is segregated as collateral for initial margin requirement on futures transactions.

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets.

|

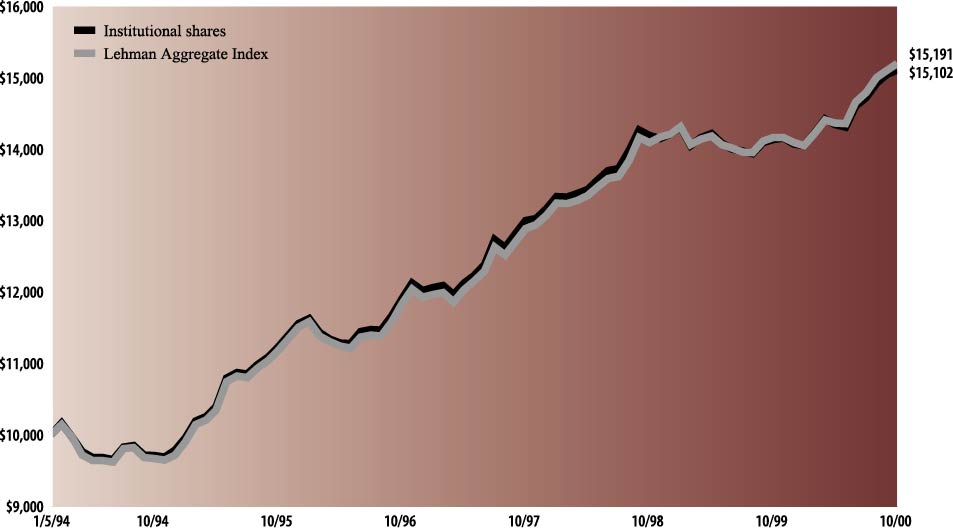

| The following graph shows the value as of October 31, 2000, of a $10,000 investment made on August 1, 1991 in the Institutional

shares of the Adjustable Rate Government Fund. For comparative purposes, the performance of the Fund’s benchmarks, the Six-Month and One-Year U.S. Treasury Bills (“Six-Month T-Bill/One-Year T-Bill”), as well as the Lehman Brothers Mutual

Fund Short (1-2) U.S. Government Index (“Lehman 1-2 Index”), are shown. This performance data represents past performance and should not be considered indicative of future performance which will fluctuate with changes in market conditions. These

performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance of Class A and Service shares will vary from Institutional shares due to differences in fees and loads.

|

| Adjustable Rate Government Fund’s Lifetime Performance

|

| Growth of a $10,000 Investment, Distributions Reinvested August 1, 1991 to October 31, 2000.

(a)

|

|

| Average Annual Total Return through October 31, 2000 | Since Inception | Five Years | One Year | ||||

|---|---|---|---|---|---|---|---|

| Class A shares (commenced May 15, 1995) | |||||||

| Excluding sales charges | 5.35% | 5.29% | 5.12% | ||||

| Including sales charges | 5.06% | 4.97% | 3.51% | ||||

| Institutional shares (commenced July 17, 1991) | 5.34% | 5.67% | 5.65% | ||||

| Service shares (commenced March 27, 1997) | 4.72% | n/a | 4.95% | ||||

(a)

|

For comparative purposes, initial investments are assumed to be made on the first day of the month following commencement of

operations.

|

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Mortgage Backed Obligations – 90.7% | ||||||||

| Adjustable Rate Federal Home Loan Mortgage Corp.

(FHLMC)# – 30.3% |

||||||||

| $ 1,178,139 | 8.06 | % | 07/01/2018 | $ 1,189,731 | ||||

| 2,697,454 | 7.61 | 11/01/2018 | 2,728,151 | |||||

| 621,619 | 7.85 | 12/01/2018 | 625,989 | |||||

| 3,473,096 | 7.65 | 05/01/2019 | 3,498,068 | |||||

| 6,609,267 | 8.06 | 11/01/2019 | 6,747,665 | |||||

| 5,334,864 | 7.89 | 01/01/2020 | 5,327,395 | |||||

| 2,004,000 | 8.12 | 05/01/2020 | 2,032,497 | |||||

| 10,306,993 | 7.94 | 06/01/2020 | 10,459,949 | |||||

| 15,220,227 | 8.11 | 02/01/2022 | 15,550,810 | |||||

| 2,997,035 | 7.81 | 06/01/2022 | 3,031,860 | |||||

| 1,714,344 | 7.82 | 08/01/2022 | 1,735,945 | |||||

| 2,259,167 | 7.67 | 09/01/2022 | 2,275,003 | |||||

| 2,886,251 | 8.06 | 09/01/2022 | 2,930,902 | |||||

| 3,978,843 | 8.02 | 06/01/2024 | 4,033,552 | |||||

| 1,457,524 | 7.62 | 02/01/2028 | 1,465,045 | |||||

| 2,436,496 | 7.98 | 07/01/2030 | 2,435,107 | |||||

| $ 66,067,669 | ||||||||

| Adjustable Rate Federal National Mortgage

Association (FNMA)# – 44.3% |

||||||||

| $ 557,913 | 7.33 | % | 04/01/2003 | 553,382 | ||||

| 480,720 | 8.22 | 11/01/2014 | 491,483 | |||||

| 2,896,404 | 7.28 | 03/01/2017 | 2,948,134 | |||||

| 1,584,973 | 7.68 | 03/01/2017 | 1,615,927 | |||||

| 6,362,111 | 7.26 | 04/01/2017 | 6,332,463 | |||||

| 252,822 | 8.03 | 11/01/2017 | 258,278 | |||||

| 2,166,191 | 7.00 | 03/01/2018 | 2,139,958 | |||||

| 517,987 | 7.66 | 03/01/2018 | 522,959 | |||||

| 378,512 | 7.97 | 05/01/2018 | 379,091 | |||||

| 4,026,763 | 8.03 | 06/01/2018 | 4,105,284 | |||||

| 1,649,219 | 8.03 | 08/01/2018 | 1,696,535 | |||||

| 913,107 | 7.75 | 10/01/2018 | 931,944 | |||||

| 85,540 | 7.51 | 11/01/2018 | 87,177 | |||||

| 2,743,913 | 7.85 | 11/01/2018 | 2,800,657 | |||||

| 1,473,865 | 7.57 | 06/01/2019 | 1,491,080 | |||||

| 1,808,891 | 8.30 | 07/01/2019 | 1,828,537 | |||||

| 764,183 | 7.30 | 08/01/2019 | 778,610 | |||||

| 297,551 | 7.09 | 09/01/2019 | 295,730 | |||||

| 2,780,858 | 8.28 | 11/01/2019 | 2,845,180 | |||||

| 8,772,111 | 8.14 | 05/01/2020 | 8,972,378 | |||||

| 4,290,902 | 8.00 | 07/01/2020 | 4,388,263 | |||||

| 4,408,951 | 6.86 | 12/25/2020 | 4,347,157 | |||||

| 2,438,075 | 8.02 | 01/01/2021 | 2,493,249 | |||||

| 19,808,910 | 7.96 | 09/01/2021 | 20,253,421 | |||||

| 185,804 | 7.60 | 01/01/2022 | 189,330 | |||||

| 1,017,314 | 7.14 | 05/01/2022 | 1,018,881 | |||||

| 758,760 | 8.08 | 08/01/2022 | 776,613 | |||||

| 2,304,073 | 8.31 | 02/01/2023 | 2,347,643 | |||||

| 130,532 | 6.71 | 12/01/2023 | 129,141 | |||||

| 6,829,426 | 7.11 | 06/01/2024 | 6,839,944 | |||||

| 2,849,675 | 7.76 | 08/01/2027 | 2,913,850 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Mortgage Backed Obligations – (continued) | ||||||||

| Adjustable Rate Federal National Mortgage

Association (FNMA)# – (continued) |

||||||||

| $ 1,137,484 | 7.84 | % | 10/01/2027 | $ 1,148,153 | ||||

| 398,978 | 7.97 | 01/01/2028 | 407,524 | |||||

| 8,463,449 | 7.08 | 07/01/2030 | 8,362,954 | |||||

| $ 96,690,910 | ||||||||

| Adjustable Rate Government National Mortgage

Association (GNMA)# – 4.0% |

||||||||

| $ 1,807,853 | 7.38 | % | 03/20/2016 | 1,823,102 | ||||

| 2,484,048 | 7.75 | 08/20/2018 | 2,524,141 | |||||

| 2,939,870 | 7.38 | 02/20/2021 | 2,994,698 | |||||

| 1,418,872 | 7.38 | 06/20/2022 | 1,431,600 | |||||

| $ 8,773,541 | ||||||||

| Federal Home Loan Mortgage Corp. (FHLMC) – 4.1% | ||||||||

| $ 1,661,580 | 6.50 | % | 03/01/2013 | $ 1,627,319 | ||||

| 3,260,042 | 6.50 | 04/01/2013 | 3,192,820 | |||||

| 1,410,739 | 6.50 | 05/01/2013 | 1,381,481 | |||||

| 2,703,361 | 6.50 | 06/01/2013 | 2,652,363 | |||||

| $ 8,853,983 | ||||||||

| Federal National Mortgage Association (FNMA) – 1.6% | ||||||||

| $ 3,549,407 | 8.00 | % | 11/01/2017 | $ 3,614,219 | ||||

| Government National Mortgage Association (GNMA) – 1.5% | ||||||||

| $ 3,287,870 | 6.50 | % | 08/15/2027 | $ 3,184,565 | ||||

| Collateralized Mortgage Obligations – 4.9% | ||||||||

| IOette· # – 0.1% | ||||||||

| FNMA Remic Trust Series 1990-145, Class B | ||||||||

| $ 10,834 | 35.00 | % | 12/25/2020 | $ 260,945 | ||||

| Regular Floater CMOs# – 2.7% | ||||||||

| FNMA Series 1998-66, Class FC | ||||||||

| $ 5,888,092 | 7.12 | % | 11/17/2028 | $ 5,883,793 | ||||

| Sequential Fixed Rate CMOs – 2.1% | ||||||||

| FHLMC Series 1980, Class C | ||||||||

| $ 496,598 | 6.85 | % | 10/15/2021 | $ 494,776 | ||||

| FNMA Remic Trust Series 1993-14, Class A | ||||||||

| 2,038,741 | 6.00 | 02/25/2008 | 2,001,085 | |||||

| FNMA Remic Trust Series G93-39, Class A | ||||||||

| 1,168,642 | 5.70 | 08/25/2016 | 1,156,173 | |||||

| FNMA Series 1996-22, Class B | ||||||||

| 911,456 | 7.25 | 02/25/2024 | 907,121 | |||||

| $ 4,559,155 | ||||||||

| TOTAL COLLATERALIZED

MORTGAGE OBLIGATIONS |

$ 10,703,893 | |||||||

| TOTAL MORTGAGE BACKED OBLIGATIONS | ||||||||

| (Cost $202,190,723) | $ 197,888,780 | |||||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Repurchase Agreement – 8.5% | ||||||||

| Joint Repurchase Agreement Account Ù V | ||||||||

| $18,500,000 | 6.62 | % | 11/01/2000 | $ 18,500,000 | ||||

| TOTAL REPURCHASE AGREEMENT | ||||||||

| (Cost $18,500,000) | $ 18,500,000 | |||||||

| TOTAL INVESTMENTS | ||||||||

| (Cost $220,690,723) | $ 216,388,780 | |||||||

#

|

Variable rate security. Coupon rate disclosed is that which is in effect at October 31, 2000.

|

Ù

|

A portion of this security is segregated as collateral for initial margin requirement on futures transactions.

|

V

|

Joint repurchase agreement was entered into on October 31, 2000.

|

Ÿ

|

Represents security with notional or nominal principal amount. The actual effective yield of this security is different than the

stated coupon due to the amortization of related premiums.

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of total net

assets.

|

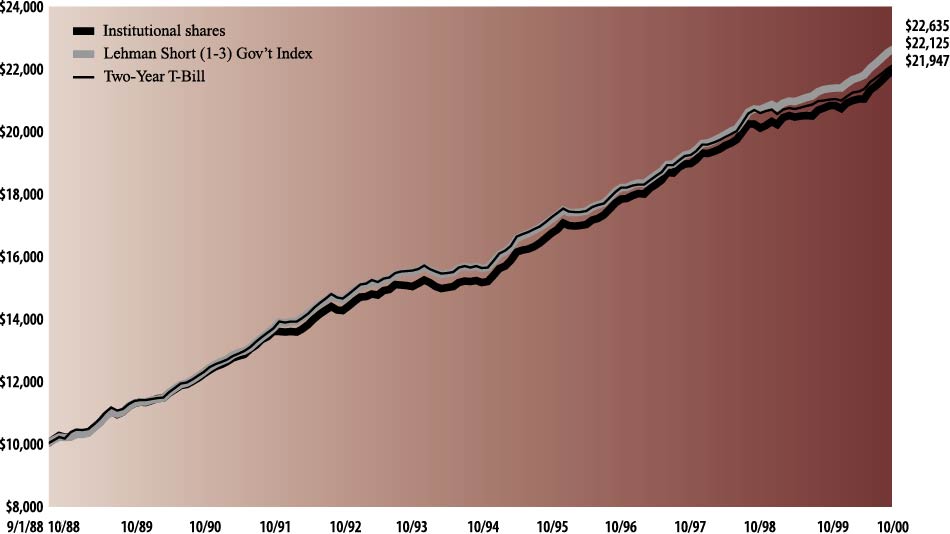

| The following graph shows the value as of October 31, 2000, of a $10,000 investment made on September 1, 1988 in the

Institutional shares of the Goldman Sachs Short Duration Government Fund. For comparative purposes, the performance of the Fund’s benchmark (the U.S. 2-Year Treasury Bill (“Two-Year T-Bill”)), as well as the Lehman Brothers Mutual Fund

Short (1-3) U.S. Government Index (“Lehman Short (1-3) Gov’t Index”), are shown. This performance data represents past performance and should not be considered indicative of future performance which will fluctuate with changes in market

conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance of Class A, Class B, Class C and Service shares will vary from Institutional shares due to

differences in fees and loads.

|

| Short Duration Government Fund’s Lifetime Performance

|

| Growth of a $10,000 Investment, Distributions Reinvested September 1, 1988 to October 31, 2000.(a)

|

|

| Average Annual Total Return through October 31, 2000 | Since Inception | Ten Years | Five Years | One Year | |||||

|---|---|---|---|---|---|---|---|---|---|

| Class A shares (commenced May 1, 1997) | |||||||||

| Excluding sales charges | 5.17% | n/a | n/a | 5.65% | |||||

| Including sales charges | 4.56% | n/a | n/a | 3.48% | |||||

| Class B shares (commenced May 1, 1997) | |||||||||

| Excluding contingent deferred sales charges | 4.54% | n/a | n/a | 4.80% | |||||

| Including contingent deferred sales charges | 4.54% | n/a | n/a | 2.71% | |||||

| Class C shares (commenced August 15, 1997) | |||||||||

| Excluding contingent deferred sales charges | 3.99% | n/a | n/a | 4.76% | |||||

| Including contingent deferred sales charges | 3.99% | n/a | n/a | 3.71% | |||||

| Institutional shares (commenced August 15, 1988) | 6.67% | 6.12% | 5.76% | 5.85% | |||||

| Service shares (commenced April 10, 1996) | 5.34% | n/a | n/a | 5.32% | |||||

(a)

|

For comparative purposes, initial investments are assumed to be made on the first day of the month following commencement of

operations.

|

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Mortgage Backed Obligations – 88.9% | ||||||||

| Adjustable Rate Federal Home Loan Mortgage Corp.

(FHLMC) # – 5.2% |

||||||||

| $ 788,342 | 8.13 | % | 08/01/2017 | $ 788,594 | ||||

| 810,208 | 7.37 | 05/01/2018 | 805,023 | |||||

| 2,303,972 | 7.67 | 06/01/2018 | 2,341,550 | |||||

| 836,312 | 7.61 | 12/01/2018 | 842,191 | |||||

| 3,434,594 | 7.97 | 02/01/2022 | 3,509,193 | |||||

| 952,937 | 7.78 | 10/01/2025 | 951,746 | |||||

| $ 9,238,297 | ||||||||

| Adjustable Rate Federal National Mortgage

Association (FNMA) # – 15.3% |

||||||||

| $ 1,153,727 | 8.22 | % | 11/01/2014 | $ 1,179,559 | ||||

| 1,934,599 | 7.85 | 11/01/2017 | 1,973,911 | |||||

| 2,192,373 | 7.41 | 02/01/2018 | 2,224,820 | |||||

| 2,143,343 | 7.85 | 06/01/2018 | 2,165,205 | |||||

| 1,990,536 | 8.07 | 03/01/2019 | 2,034,248 | |||||

| 4,350,529 | 8.14 | 05/01/2020 | 4,449,852 | |||||

| 2,844,489 | 7.83 | 12/01/2020 | 2,905,048 | |||||

| 2,925,690 | 8.02 | 01/01/2021 | 2,991,898 | |||||

| 758,760 | 8.08 | 08/01/2022 | 776,613 | |||||

| 2,227,227 | 7.98 | 01/01/2023 | 2,279,968 | |||||

| 2,758,629 | 7.47 | 07/01/2028 | 2,788,836 | |||||

| 1,503,881 | 8.04 | 01/01/2031 | 1,531,146 | |||||

| $ 27,301,104 | ||||||||

| Federal Home Loan Mortgage Corp. (FHLMC) – 7.4% | ||||||||

| $ 2,750,803 | 6.00 | % | 04/01/2003 | 2,704,232 | ||||

| 3,041,444 | 6.50 | 01/01/2013 | 2,986,789 | |||||

| 825,587 | 6.50 | 04/01/2013 | 810,752 | |||||

| 1,726,864 | 6.50 | 05/01/2013 | 1,690,828 | |||||

| 785,314 | 6.50 | 06/01/2013 | 769,992 | |||||

| 2,390,390 | 6.00 | 11/01/2028 | 2,247,349 | |||||

| 2,000,000 | 8.00 | 06/01/2030 | 2,027,420 | |||||

| $ 13,237,362 | ||||||||

| Federal National Mortgage Association (FNMA) – 13.6% | ||||||||

| $ 800,915 | 8.50 | % | 05/01/2010 | 822,027 | ||||

| 24,065 | 6.00 | 08/01/2010 | 23,392 | |||||

| 27,408 | 6.00 | 11/01/2010 | 26,641 | |||||

| 71,390 | 6.00 | 01/01/2011 | 69,100 | |||||

| 125,256 | 6.00 | 02/01/2011 | 121,238 | |||||

| 3,948,353 | 6.00 | 03/01/2011 | 3,823,374 | |||||

| 1,647,768 | 6.00 | 04/01/2011 | 1,595,138 | |||||

| 1,840,968 | 6.00 | 05/01/2011 | 1,781,910 | |||||

| 231,347 | 6.00 | 06/01/2011 | 223,926 | |||||

| 210,008 | 6.00 | 07/01/2011 | 204,134 | |||||

| 563,612 | 6.00 | 09/01/2011 | 547,847 | |||||

| 46,160 | 6.00 | 12/01/2011 | 44,679 | |||||

| 56,589 | 6.00 | 01/01/2012 | 54,581 | |||||

| 316,663 | 6.00 | 03/01/2012 | 305,425 | |||||

| 233,750 | 6.00 | 04/01/2013 | 226,251 | |||||

| 301,103 | 6.00 | 11/01/2013 | 291,443 | |||||

| 496,598 | 6.00 | 01/01/2014 | 469,593 | |||||

| 1,756,099 | 6.00 | 03/01/2014 | 1,646,342 | |||||

| 484,055 | 6.00 | 04/01/2028 | 454,901 | |||||

| 126,061 | 6.50 | 12/01/2028 | 121,316 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Mortgage Backed Obligations – (continued) | ||||||||

| Federal National Mortgage Association (FNMA) – continued | ||||||||

| $ 183,404 | 6.50 | % | 01/01/2029 | $ 176,501 | ||||

| 2,092,691 | 8.50 | 05/01/2030 | 2,138,583 | |||||

| 2,000,000 | 6.50 | TBA-30 yr® | 1,921,880 | |||||

| 2,000,000 | 7.00 | TBA-30 yr® | 1,960,000 | |||||

| 5,000,000 | 8.50 | TBA-30 yr® | 5,109,400 | |||||

| $ 24,159,622 | ||||||||

| Government National Mortgage Association (GNMA) – 4.7% | ||||||||

| $ 876,642 | 6.50 | % | 06/15/2008 | $ 871,014 | ||||

| 481,183 | 6.50 | 07/15/2008 | 478,093 | |||||

| 1,613,835 | 6.50 | 08/15/2008 | 1,603,474 | |||||

| 929,034 | 6.50 | 09/15/2008 | 923,070 | |||||

| 156,439 | 6.50 | 10/15/2008 | 155,435 | |||||

| 43,348 | 6.50 | 11/15/2008 | 43,070 | |||||

| 124,278 | 9.00 | 12/15/2008 | 129,867 | |||||

| 69,069 | 6.50 | 01/15/2009 | 68,593 | |||||

| 149,773 | 9.00 | 01/15/2009 | 156,485 | |||||

| 12,944 | 6.50 | 03/15/2009 | 12,854 | |||||

| 62,063 | 6.50 | 04/15/2009 | 61,635 | |||||

| 722,499 | 6.50 | 05/15/2009 | 717,514 | |||||

| 70,152 | 6.50 | 07/15/2009 | 69,668 | |||||

| 69,675 | 6.50 | 11/15/2009 | 69,194 | |||||

| 59,013 | 9.00 | 01/15/2010 | 61,645 | |||||

| 480,798 | 9.00 | 07/15/2012 | 502,001 | |||||

| 199,333 | 6.50 | 10/15/2023 | 193,700 | |||||

| 1,587,297 | 7.00 | 10/15/2023 | 1,572,043 | |||||

| 15,493 | 6.50 | 11/15/2023 | 15,055 | |||||

| 1,149,793 | 6.50 | 12/15/2023 | 1,117,300 | |||||

| 620,994 | 6.50 | 01/15/2024 | 603,271 | |||||

| 168,230 | 6.50 | 02/15/2024 | 163,429 | |||||

| 734,323 | 6.50 | 04/15/2024 | 713,366 | |||||

| 1,643,935 | 6.50 | 08/15/2027 | 1,592,283 | |||||

| $ 11,894,059 | ||||||||

| Collateralized Mortgage Obligations – 42.7% | ||||||||

| Inverse Floater# – 1.3% | ||||||||

| FNMA Remic Trust Series 1990-134, Class SC | ||||||||

| $ 751,873 | 11.66 | % | 11/25/2020 | $ 813,557 | ||||

| FNMA Remic Trust Series 1993-231, Class SA | ||||||||

| 1,580,751 | 2.63 | 12/25/2008 | 1,422,405 | |||||

| $ 2,235,962 | ||||||||

| Inverse Floating Rate – Interest Only # · – 0.0% | ||||||||

| FHLMC Series 1684, Class JD | ||||||||

| $ 752,646 | 2.99 | % | 08/15/2020 | $ 21,217 | ||||

| IOette· # – 0.3% | ||||||||

| FHLMC Series 1161, Class U | ||||||||

| $ 18,130 | 35.00 | % | 11/15/2021 | $ 550,051 | ||||

| Planned Amortization Class (PAC) CMOs – 13.2% | ||||||||

| FHLMC Series 1556, Class G | ||||||||

| $ 2,000,000 | 6.35 | % | 10/15/2010 | $ 1,982,200 | ||||

| FHLMC Series 1916, Class PC | ||||||||

| 3,700,000 | 6.75 | 12/15/2011 | 3,571,832 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Mortgage Backed Obligations – (continued) | ||||||||

| Planned Amortization Class (PAC) CMOs – continued | ||||||||

| FHLMC Series 1987, Class L | ||||||||

| $ 4,000,000 | 6.20 | % | 08/25/2022 | $ 3,869,720 | ||||

| FHLMC Series 2055, Class OD | ||||||||

| 3,000,000 | 6.00 | 01/15/2012 | 2,876,670 | |||||

| FHLMC Series 2130, Class QY | ||||||||

| 2,810,256 | 8.50 | 02/15/2019 | 2,876,307 | |||||

| FHLMC Series 2149, Class TF | ||||||||

| 1,500,000 | 6.50 | 05/15/2024 | 1,459,440 | |||||

| FNMA Remic Trust Series 1997-84, Class PA | ||||||||

| 4,000,000 | 5.90 | 11/25/2021 | 3,875,598 | |||||

| FNMA Series G93-32, Class PH | ||||||||

| 3,000,000 | 6.50 | 11/25/2022 | 2,947,530 | |||||

| $ 23,459,297 | ||||||||

| Planned Amortization – Interest Only· – 0.1% | ||||||||

| FHLMC Series 1587, Class HA | ||||||||

| $ 2,006,861 | 6.50 | % | 10/15/2008 | $ 218,640 | ||||

| Principal Only° – 1.1% | ||||||||

| FNMA Remic Trust Series G92-28, Class A | ||||||||

| $ 2,316,618 | 7.63 | % | 05/25/2007 | $ 2,007,628 | ||||

| Regular Floater CMOs# – 4.7% | ||||||||

| FHLMC Series 1684, Class JC | ||||||||

| $ 752,646 | 6.01 | % | 08/15/2020 | $ 743,705 | ||||

| FNMA Remic Trust Series 1993-226, Class F | ||||||||

| 3,000,000 | 8.00 | 12/25/2023 | 3,035,747 | |||||

| FNMA Series 1993-203, Class FA | ||||||||

| 4,510,858 | 7.88 | 10/25/2023 | 4,609,453 | |||||

| $ 8,388,905 | ||||||||

| Sequential Fixed Rate CMOs – 20.3% | ||||||||

| FHLMC Series 1033, Class G | ||||||||

| $ 850,887 | 8.00 | % | 01/15/2006 | $ 858,885 | ||||

| FHLMC Series 1468, Class ZB | ||||||||

| 5,468,620 | 9.00 | 02/15/2021 | 5,708,092 | |||||

| FHLMC Series 1812, Class D | ||||||||

| 778,862 | 6.00 | 07/15/2008 | 771,777 | |||||

| FHLMC Series 1883, Class E | ||||||||

| 5,915,762 | 7.00 | 03/15/2010 | 5,914,939 | |||||

| FHLMC Series 1998, Class DB | ||||||||

| 2,156,393 | 9.50 | 01/17/2025 | 2,226,300 | |||||

| FHLMC Series 2152, Class AB | ||||||||

| 2,744,309 | 6.25 | 01/15/2026 | 2,656,903 | |||||

| FNMA Remic Trust Series 1990-16, Class E | ||||||||

| 6,056,201 | 9.00 | 03/25/2020 | 6,288,032 | |||||

| FNMA Remic Trust Series 1989-74, Class J | ||||||||

| 1,320,803 | 9.80 | 10/25/2019 | 1,385,059 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Mortgage Backed Obligations – (continued) | ||||||||

| Sequential Fixed Rate CMOs – continued | ||||||||

| FNMA Remic Trust Series 1993-33, Class ZA | ||||||||

| $ 7,228,033 | 7.50 | % | 09/25/2021 | $ 7,259,653 | ||||

| FNMA Series 1988-12, Class A | ||||||||

| 1,749,171 | 10.00 | 02/25/2018 | 1,817,519 | |||||

| GNMA Remic Trust Series 1995-3, Class DZ | ||||||||

| 1,072,836 | 8.05 | 06/16/2025 | 1,109,892 | |||||

| $ 35,997,051 | ||||||||

| Super Floater# – 0.7% | ||||||||

| FNMA Remic Trust Series 88-12, Class B | ||||||||

| $ 1,380,925 | 5.27 | % | 02/25/2018 | $ 1,301,470 | ||||

| Support – 1.0% | ||||||||

| FHLMC Series 16, Class M | ||||||||

| $ 1,796,524 | 7.00 | % | 08/25/2023 | $ 1,725,975 | ||||

| TOTAL COLLATERALIZED

MORTGAGE OBLIGATIONS |

$ 75,906,196 | |||||||

| TOTAL MORTGAGE BACKED

OBLIGATIONS |

||||||||

| (Cost $164,435,979) | $ 161,736,640 | |||||||

| Agency Debentures – 6.7% | ||||||||

| Federal National Mortgage Association | ||||||||

| $ 4,530,000 | 7.25 | % | 01/15/2010 | $ 4,694,072 | ||||

| 2,000,000 | 7.13 | 06/15/2010 | 2,061,990 | |||||

| Small Business Administration | ||||||||

| 1,284,782 | 7.20 | 06/01/2017 | 1,289,449 | |||||

| 1,764,723 | 6.30 | 05/01/2018 | 1,691,493 | |||||

| 2,236,080 | 6.30 | 06/01/2018 | 2,141,899 | |||||

| TOTAL AGENCY DEBENTURES | ||||||||

| (Cost $12,138,878) | $ 11,878,903 | |||||||

| U.S. Treasury Obligation – 4.7% | ||||||||

| United States Treasury Note | ||||||||

| $ 8,500,000 | 5.25 | % | 08/15/2003 | $ 8,359,401 | ||||

| TOTAL U.S. TREASURY OBLIGATION | ||||||||

| (Cost $8,392,950) | $ 8,359,401 | |||||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Repurchase Agreement – 2.7% | ||||||||

| Joint Repurchase Agreement Account ÙV | ||||||||

| $ 4,700,000 | 6.62 | % | 11/01/2000 | $ 4,700,000 | ||||

| TOTAL REPURCHASE AGREEMENT | ||||||||

| (Cost $4,700,000) | $ 4,700,000 | |||||||

| TOTAL INVESTMENTS | ||||||||

| (Cost $189,667,807) | $ 186,674,944 | |||||||

#

|

Variable rate security. Coupon rate disclosed is that which is in effect at October 31, 2000.

|

®

|

TBA (To Be Assigned) securities are purchased on a forward commitment basis with an approximate (generally +/-2.5%) principal

amount and no definite maturity date. The actual principal amount and maturity date will be determined upon settlement when the specific mortgage pools are assigned.

|

·

|

Represents security with notional or nominal principal amount. The actual effective yield of this security is different than the

stated coupon due to the amortization of related premiums.

|

°

|

Security is issued with a zero coupon. The interest rate disclosed represents effective yield to maturity.

|

Ù

|

A portion of this security is segregated as collateral for initial margin requirement on futures transactions.

|

V

|

Joint repurchase agreement was entered into on October 31, 2000.

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets.

|

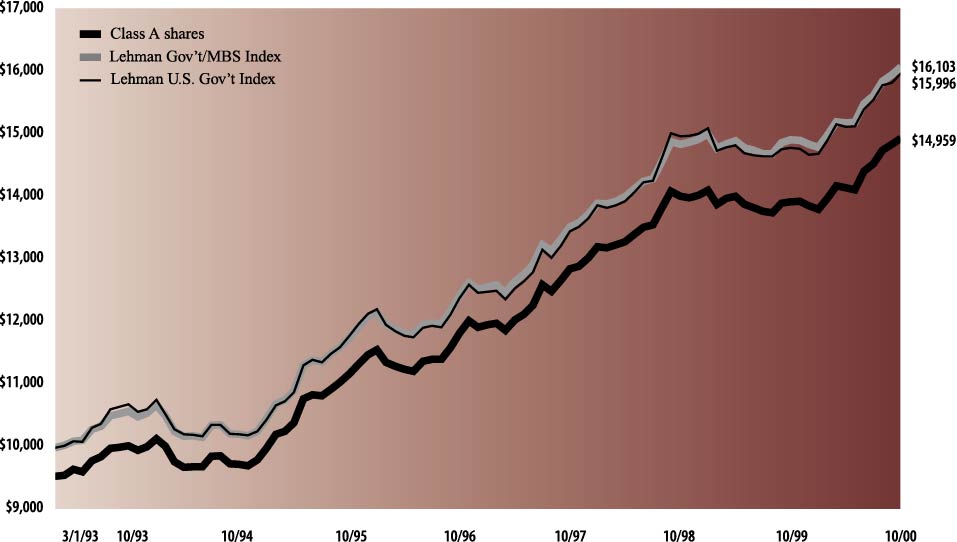

| The following graph shows the value as of October 31, 2000, of a $10,000 investment made on March 1, 1993 in Class A shares (with

the maximum sales charge of 4.5%) of the Goldman Sachs Government Income Fund. For comparative purposes, the performance of the Fund’s benchmark (the Lehman Brothers Mutual Fund Government/Mortgage Index (“Lehman Gov’t/MBS Index”)), as

well as the Lehman Brothers Mutual Fund General U.S. Government Index (“Lehman U.S. Gov’t Index”), are shown. This performance data represents past performance and should not be considered indicative of future performance which will

fluctuate with changes in market conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance of Class B, Class C, Institutional and Service shares will vary

from Class A shares due to differences in fees and loads.

|

| Government Income Fund’s Lifetime Performance

|

| Growth of a $10,000 Investment, Distributions Reinvested March 1, 1993 to October 31, 2000.(a)

|

|

| Average Annual Total Return through October 31, 2000 | Since Inception | Five Years | One Year | ||||

|---|---|---|---|---|---|---|---|

| Class A shares (commenced February 10, 1993) | |||||||

| Excluding sales charges | 6.36% | 5.98% | 7.33% | ||||

| Including sales charges | 5.73% | 5.01% | 2.47% | ||||

| Class B shares (commenced May 1, 1996) | |||||||

| Excluding contingent deferred sales charges | 5.73% | n/a | 6.45% | ||||

| Including contingent deferred sales charges | 5.26% | n/a | 1.18% | ||||

| Class C shares (commenced August 15, 1997) | |||||||

| Excluding contingent deferred sales charges | 4.91% | n/a | 6.46% | ||||

| Including contingent deferred sales charges | 4.91% | n/a | 5.40% | ||||

| Institutional shares (commenced August 15, 1997) | 6.04% | n/a | 7.68% | ||||

| Service shares (commenced August 15, 1997) | 5.57% | n/a | 7.62% | ||||

(a)

|

For comparative purposes, initial investments are assumed to be made on the first day of the month following commencement of

operations.

|

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Mortgage Backed Obligations – 60.5% | ||||||||

| Federal Home Loan Mortgage Corp. (FHLMC) – 5.2% | ||||||||

| $ 2,154,660 | 6.50 | % | 08/01/2010 | $ 2,127,942 | ||||

| 951,096 | 6.00 | 07/01/2028 | 894,183 | |||||

| 946,561 | 6.00 | 02/01/2029 | 889,919 | |||||

| 1,000,000 | 8.00 | 06/01/2030 | 1,013,710 | |||||

| 494,167 | 8.00 | 07/01/2030 | 500,942 | |||||

| 999,351 | 8.00 | 09/01/2030 | 1,013,052 | |||||

| $ 6,439,748 | ||||||||

| Federal National Mortgage Association (FNMA) – 28.6% | ||||||||

| $ 295,842 | 6.50 | % | 08/01/2025 | $ 285,949 | ||||

| 186,073 | 6.50 | 09/01/2025 | 179,974 | |||||

| 205,135 | 6.50 | 10/01/2025 | 198,411 | |||||

| 257,919 | 6.50 | 11/01/2025 | 249,756 | |||||

| 350,579 | 6.50 | 12/01/2025 | 338,887 | |||||

| 16,140 | 6.50 | 05/01/2026 | 15,611 | |||||

| 90,308 | 6.50 | 06/01/2028 | 86,908 | |||||

| 1,455,859 | 6.50 | 09/01/2028 | 1,401,061 | |||||

| 398,490 | 6.00 | 11/01/2028 | 374,489 | |||||

| 1,650,774 | 6.50 | 11/01/2028 | 1,588,639 | |||||

| 1,626,218 | 6.00 | 12/01/2028 | 1,528,271 | |||||

| 3,417,270 | 6.50 | 12/01/2028 | 3,288,643 | |||||

| 564,473 | 6.00 | 01/01/2029 | 530,474 | |||||

| 44,053 | 6.00 | 02/01/2029 | 41,400 | |||||

| 484,521 | 6.50 | 03/01/2029 | 465,969 | |||||

| 2,489,378 | 6.50 | 04/01/2029 | 2,394,060 | |||||

| 237,638 | 6.00 | 05/01/2029 | 223,325 | |||||

| 484,545 | 6.50 | 06/01/2029 | 465,992 | |||||