|

|

|

|

Goldman Sachs Funds

H I G H Y I E L D F U N D

Semiannual Report April 30, 2000

A high level of current income through a diversified portfolio of high yield securities.

[GRAPHIC]

[LOGO OF GOLDMAN SACHS FUNDS]

GOLDMAN SACHS HIGH YIELD FUND

Market Overview

Dear Shareholder:

During the period under review, U.S. bond markets generally posted lackluster results, due to expanding economies and higher interest rates.

Market Review

Another major factor affecting the U.S. bond market was the U.S. Treasury's decision to buy back long maturity debt. The reduction in supply is aimed at reducing the average maturity and interest cost of Treasury debt. This led to a sharp increase in demand for 30-year bonds, resulting in a strong rally and an inverted yield curve.

Outlook

Looking ahead, we fully expect the Fed to remain steadfast in its resolve to cool the economy and preempt inflation. The Fed has raised interest rates on five different occasions since the end of last June, yet economic growth shows no signs of abating. Based on recent economic data it now appears the Fed will need to tighten financial conditions more quickly, and by a greater amount, to prevent the economy from overheating. We now believe that the Fed will raise its Federal Funds rate target in the months to follow. When it appears that the economy has sufficiently slowed we would expect spreads to tighten.

As always, we appreciate your support and look forward to serving your investment needs in the years to come.

Sincerely,

| /s/ David B. Ford | /s/ David W. Blood | /s/ Sharmin Mossavar-Rahmani | ||

| David B. Ford | David W. Blood | Sharmin Mossavar-Rahmani | ||

| Co-Head, Goldman Sachs | Co-Head, Goldman Sachs | CIO, Fixed Income Investments, | ||

| Asset Management | Asset Management | Goldman Sachs Asset Management |

May 9, 2000

| NOT FDIC-INSURED | |

| May Lose Value | |

| No Bank Guarantee |

Fund Basics

as of April 30, 2000

Assets Under Management

$789.1 Million

Number of Holdings

322

NASDAQ SYMBOLS

Class A Shares

GSHAX

Class B Shares

GSHBX

Class C Shares

GSHCX

Institutional Shares

GSHIX

Service Shares

GSHSX

| PERFORMANCE REVIEW | |||

| October 31,1999- |

Fund Total Return |

30-Day |

Lehman High |

| April 30,2000 |

(based on NAV)1 |

Standardized Yield2 |

Yield Bond Index3 |

| Class A |

2.87% |

10.48% |

0.08% |

| Class B |

2.37% |

10.23% |

0.08% |

| Class C |

2.38% |

10.25% |

0.08% |

| Institutional |

3.07% |

11.40% |

0.08% |

| Service |

2.82% |

N/A |

0.08% |

1 The net asset value represents the net assets of the Fund (ex-dividend) divided by the total number of shares outstanding. The Fund's performance reflects the reinvestment of dividends and other distributions.

2 The 30-Day Standardized Yield of the Fund is calculated by dividing the net investment income per share (as defined by securities industry regulations) earned by the Fund over a 30-day period (ending on the stated month-end date) by the maximum public offering price per share of the Fund on the last day of the period. This number is compounded semiannually and then annualized. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders.

3 The Lehman High Yield Bond Index figures do not reflect any fees or expenses. Investors cannot invest directly in the Index.

| STANDARDIZED TOTAL RETURNS4 | |||||

| For the period ending 3/31/00 |

Class A |

Class B |

Class C |

Institutional |

Service |

| One Year |

-5.09% |

-6.30% |

-2.37% |

-0.23% |

-0.73% |

| Since Inception |

2.13% |

1.96% |

3.20% |

4.30% |

3.80% |

| (8/1/97) |

(8/1/97) |

(8/15/97) |

(8/1/97) |

(8/1/97) |

|

4 The Standardized Total Returns are average annual returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value. These returns reflect a maximum initial sales charge of 4.5% for Class A shares, the assumed deferred sales charge for Class B shares (5% maximum declining to 0% after six years) and the assumed deferred sales charge for Class C shares (1% if redeemed within 12 months of purchase). Because Institutional and Service shares do not involve sales charges, such charges have not been applied to their Standardized Total Returns.

| TOP 10 HOLDINGS AS OF 4/30/005 | ||||

| Company |

Line of Business |

% of Portfolio |

||

| Telewest Communications PLC |

Media-Cable |

3.5% |

||

| Nextel Communications, Inc. |

Telecommunications-Cellular |

2.4% |

||

| Riverwood International Corp. |

Paper |

2.2% |

||

| CSC Holdings, Inc. |

Media-Cable |

2.0% |

||

| Crown Castle International Corp. |

Media-Non Cable |

1.9% |

||

| NTL Communications Corp. |

Telecommunications-Cellular |

1.7% |

||

| Avecia Group PLC |

Chemicals |

1.5% |

||

| Kappa Beheer B.V. |

Packaging |

1.4% |

||

| Viasystems Group, Inc. |

Technology |

1.3% |

||

| SCG Holding & Semiconductor Corp. |

Technology |

1.3% |

||

| Credit Allocation: AAA 3.1% |

BBB 2.2% |

BB 8.6% |

B 78.5% |

CCC 6.1% |

5 The Fund is actively managed and, as such, its composition may differ over time.

Total return figures represent past performance and do not indicate future results, which will vary. The investment return and principal value of an investment will fluctuate and, therefore, an investor's shares, when redeemed, may be worth more or less than their original cost. Performance reflects expense limitations in effect. In their absence, performance would be reduced.

GOLDMAN SACHS HIGH YIELD FUND

Performance Overview

Dear Shareholder,

We are pleased to report on the performance of the Goldman Sachs High Yield Fund for the six month period that

ended April 30, 2000.

Performance Review

Over the six month reporting period that ended April 30, 2000, the Fund's Class A, B, C, Institutional and Service shares generated cumulative total returns, at net asset value, of 2.87%, 2.37%, 2.38%, 3.07% and 2.82%, respectively. These figures handily outperformed the 0.08% total return of the Fund's benchmark, the Lehman High Yield Bond Index.

The Fund benefited from astute sector allocation and from a broadening of investor interest beyond the telecommunications sector. This resulted in stronger demand for many of the Fund's industrial holdings. In addition, careful credit selection minimized losses from defaults during a period of time when default rates were on the rise.

High Yield Market

After poor performance during the third quarter of 1999, the high yield market ended the year on a positive note. Investor confidence improved on the heels of a rally in the stock market, in spite of concerns over rising interest rates. However, this reversal of fortune was short lived, as high yield bonds again faltered during the first quarter of 2000. After the traditional New Year rally failed to materialize, February was dominated by credit-specific events. In March, returns were hurt by a sharp sell-off. Rising short-term interest rates and accelerating outflows from U.S. mutual funds were the main culprits.

As the reporting period came to a close, the high yield market stabilized. Selling pressure abated, mutual fund redemptions slowed and new investors began funding portfolios. The lack of new supply also helped, with the new issue market coming to an almost complete halt.

Investment Objective

The Fund seeks a high level of current income and may also consider the potential for capital appreciation. The Fund invests primarily in high yield, fixed income securities rated, at the time of investment, below investment grade.

Portfolio Composition

As of April 30, 2000, the Fund was diversified among 322 companies. Holdings in the top 10 companies represented 19.2% of the portfolio.

In the first half of the reporting period, the Fund's overweight position in cyclical industries, such as paper and chemicals, fared well in the wake of the economic rebound in Asia. The Fund's overweight exposure to European companies also augmented performance.

GOLDMAN SACHS HIGH YIELD FUND

FIXED INCOME

INVESTMENT

PROCESS OVERVIEW

Sector

Allocation

1

Our sector specialists work

together to assess relative

value among sectors

and create investment

strategies to meet each

fund's objectives.

Security

Selection

2

In selecting securities for

each portfolio, our fixed

income teams have access

to the vast resources of

Goldman Sachs.

H

Yield Curve

Strategies

3

We adjust the term

structure of our portfolios

based on our expectations

of the relationship between

short- and long-term

interest rates, while keep-

ing each fund's duration

close to its benchmark.

During the second half of the period, Fund activity was focused on existing investments. The new issue market was relatively subdued, with more attractive opportunities originating in Europe. The Fund carefully added to its portfolio from a select group of securities in this region.

Portfolio Highlights

Viasystems Group, Inc.(1.3% of the portfolio) - Viasystems has transformed itself through a series of acquisitions from a printed circuit board manufacturer to an electronics manufacturing services company. This new business profile enabled the firm to successfully complete an equity offering in March at a higher valuation than previously warranted. This, in turn, helped its bonds to rally despite the weak market.

Kappa Beheer B.V.(1.4% of the portfolio) - Kappa Beheer, a leading European producer of linerboard, has delivered solid results since its leveraged buyout and August bond issue. Brighter prospects for most paper companies, coupled with an increase in merger activity in the sector, have caused Kappa's bonds to significantly outperform. During the reporting period, Kappa's euro-denominated bonds have returned over 8%, and its zero coupon bonds more than 16%.

New Acquisitions

Ineos Acrylics Finance PLC (0.3 % of the portfolio) - Ineos Acrylics, a European chemical producer, was added to the portfolio in April. The firm recently raised 200 million euro to refinance debt incurred in its leveraged buyout from Imperial Chemical Industries (ICI).

Portfolio Outlook

Despite the likelihood for short-term interest rate increases, we believe the near-term outlook for the high yield market is favorable. The liquidity pressures of recent months has spurred interest from new investors, and the market is now more technically balanced. In addition, fundamental news is also supportive, as early first quarter earnings reports exceeded expectations. Upbeat earnings across the board also has caused investors to re-evaluate bonds of industrial companies that has been overlooked in recent months.

We thank you for your investment and look forward to your continued confidence.

Goldman Sachs High Yield Investment Management Team

May 9, 2000

GOLDMAN SACHS HIGH YIELD FUND

The Goldman Sachs Advantage

Founded in 1869, Goldman, Sachs & Co. is a premier financial services firm traditionally known on Wall Street and around the world for its institutional expertise.

Today, the firm's Investment Management Division provides individual investors the opportunity to tap the resources of a global institutional powerhouse — and put this expertise to work in their individual portfolios.

What Sets Goldman Sachs Funds Apart?

1

Resources and Relationships

Our portfolio management teams are located on-site, around the world, in New York, London, Tokyo and Singapore. Their understanding of local economies, markets, industries and cultures helps deliver what many investors want: access to global investment opportunities and consistent, risk-adjusted performance.

2

In-Depth Research

Our portfolio management teams make on-site visits to hundreds of companies each month, then construct selective portfolios with an emphasis on their best ideas. Our teams also have access to Goldman, Sachs & Co.'s Global Investment Research Department.

3

Risk Management

In this, our institutional heritage is clear. Institutions, as well as many individual investors, often look to us to manage the risks of global investing over time in different market environments.

To learn more about the Goldman Sachs Funds, call your investment professional today.

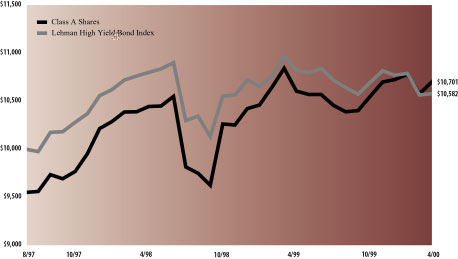

| The following

graph shows the value as of April 30, 2000, of a $10,000 investment made

on August 1, 1997 (commencement of operations) in Class A shares (with the

maximum sales charge of 4.5%) of the Goldman Sachs High Yield Fund. For

comparative purposes, the performance of the Fund’s benchmark (the

Lehman High Yield Bond Index) is shown. This performance data represents

past performance and should not be considered indicative of future

performance which will fluctuate with changes in market conditions. These

performance fluctuations will cause an investor’s shares, when

redeemed, to be worth more or less than their original cost. Performance

of Class B, Class C, Institutional and Service shares will vary from Class

A due to differences in fees and loads.

|

| High Yield Fund’s

Lifetime Performance

|

| Growth of a $10,000

Investment, Distributions Reinvested August 1, 1997 to April 30,

2000.

|

| |

| Average Annual Total Return through April 30, 2000 | Since Inception | One Year | Six Months(a) | |||||

|---|---|---|---|---|---|---|---|---|

| Class A (commenced August 1, 1997) | ||||||||

| Excluding sales charges | 4.22 | % | -1.31% | 2.87% | ||||

| Including sales charges | 2.49 | % | -5.78% | -1.79% | ||||

| Class B (commenced August 1, 1997) | ||||||||

| Excluding contingent deferred sales charges | 3.45 | % | -2.05% | 2.37% | ||||

| Including contingent deferred sales charges | 2.31 | % | -6.93% | -2.75% | ||||

| Class C (commenced August 15, 1997) | ||||||||

| Excluding contingent deferred sales charges | 3.51 | % | -2.05% | 2.38% | ||||

| Including contingent deferred sales charges | 3.51 | % | -3.03% | 1.35% | ||||

| Institutional Class (commenced August 1, 1997) | 4.62 | % | -0.81% | 3.07% | ||||

| Service Class (commenced August 1, 1997) | 4.11 | % | -1.41% | 2.82% | ||||

| (a) Not

annualized.

|

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Bonds – 74.5% | ||||||||

| Aerospace – 2.7% | ||||||||

| Argo-Tech Corp. (B-/B3) | ||||||||

| $ 7,500,000 | 8.63 | % | 10/01/2007 | $ 5,600,000 | ||||

| Burke Industries, Inc. (B-/Caa1) | ||||||||

| 2,000,000 | 10.00 | 08/15/2007 | 820,000 | |||||

| Communications Instruments, Inc. (B-/B3) | ||||||||

| 2,500,000 | 10.00 | 09/15/2004 | 1,887,500 | |||||

| Dunlop Standard Aerospace Holdings (B-/B3) | ||||||||

| 3,000,000 | 11.88 | 05/15/2009 | 2,940,000 | |||||

| Hexcel Corp. (B/B2) | ||||||||

| 5,000,000 | 9.75 | 01/15/2009 | 4,250,000 | |||||

| K&F Industries, Inc. (B-/Caa1) | ||||||||

| 5,000,000 | 9.25 | 10/15/2007 | 4,675,000 | |||||

| Transdigm, Inc. (B-/B3) | ||||||||

| 1,000,000 | 10.38 | 12/01/2008 | 790,000 | |||||

| Worldwide Flight Services, Inc. (B/B3)† | ||||||||

| 750,000 | 12.25 | 08/15/2007 | 600,000 | |||||

| 21,562,500 | ||||||||

| Automotive Parts – 2.8% | ||||||||

| Accuride Corp. (B-/B2) | ||||||||

| 3,000,000 | 9.25 | 02/01/2008 | 2,557,500 | |||||

| American Axle & Manufacturing, Inc. (B/B2) | ||||||||

| 3,750,000 | 9.75 | 03/01/2009 | 3,571,875 | |||||

| Anchor Lamina, Inc. (B-/B3) | ||||||||

| 1,500,000 | 9.88 | 02/01/2008 | 1,110,000 | |||||

| Federal-Mogul Corp. (BB+/Ba2) | ||||||||

| 2,000,000 | 7.50 | 01/15/2009 | 1,522,760 | |||||

| Hayes Lemmerz International, Inc. (B/B2) | ||||||||

| 3,500,000 | 9.13 | 07/15/2007 | 3,202,500 | |||||

| JL French Automotive Castings (B-/B3) | ||||||||

| 1,500,000 | 11.50 | 06/01/2009 | 1,481,250 | |||||

| Prestolite Electric, Inc. (B+/B3) | ||||||||

| 3,259,000 | 9.63 | 02/01/2008 | 1,955,400 | |||||

| Stanadyne Automotive Corp. (B/Caa1) | ||||||||

| 4,000,000 | 10.25 | 12/15/2007 | 3,250,000 | |||||

| Venture Holdings Trust (B/B2) | ||||||||

| 4,000,000 | 9.50 | 07/01/2005 | 3,320,000 | |||||

| 21,971,285 | ||||||||

| Building Materials – 2.9% | ||||||||

| Amatek Industries, Inc. (B/B3) | ||||||||

| 3,500,000 | 12.00 | 02/15/2008 | 3,255,000 | |||||

| Atrium Cos., Inc. (B-/B3) | ||||||||

| 2,000,000 | 10.50 | 05/01/2009 | 1,885,000 | |||||

| Better Minerals & Aggregates (B-/B3)† | ||||||||

| 2,500,000 | 13.00 | 09/15/2009 | 2,475,000 | |||||

| Nortek, Inc. (B+/B1) | ||||||||

| 3,000,000 | 9.13 | 09/01/2007 | 2,775,000 | |||||

| 2,125,000 | 8.88 | 08/01/2008 | 1,917,812 | |||||

| Nortek, Inc. (B-/B3) | ||||||||

| 2,000,000 | 9.88 | 03/01/2004 | 1,895,000 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Bonds – (continued) | ||||||||

| Building Materials – (continued) | ||||||||

| Republic Group, Inc. (B/B2) | ||||||||

| $ 3,000,000 | 9.50 | % | 07/15/2008 | $ 2,460,000 | ||||

| Werner Holdings Co., Inc. (B-/B2) | ||||||||

| 7,000,000 | 10.00 | 11/15/2007 | 6,545,000 | |||||

| 23,207,812 | ||||||||

| Capital Goods – 2.9% | ||||||||

| Axiohm Transaction Solutions, Inc. (D/Ca)D | ||||||||

| 3,000,000 | 9.75 | 10/01/2007 | 600,000 | |||||

| International Wire Group, Inc. (B-/B3) | ||||||||

| 2,500,000 | 11.75 | 06/01/2005 | 2,568,750 | |||||

| Packard BioScience Co. (B-/B3) | ||||||||

| 9,250,000 | 9.38 | 03/01/2007 | 8,140,000 | |||||

| Simonds Industries, Inc. (B-/B3) | ||||||||

| 750,000 | 10.25 | 07/01/2008 | 532,500 | |||||

| Thermadyne Holdings Corp. (CCC+/Caa1)§ | ||||||||

| 4,000,000 | 0.00/12.50 | 06/01/2008 | 1,680,000 | |||||

| Thermadyne Manufacturing LLC (CCC+/B3) | ||||||||

| 6,750,000 | 9.88 | 06/01/2008 | 5,467,500 | |||||

| Trench Electric S.A. (B-/B3) | ||||||||

| 5,000,000 | 10.25 | 12/15/2007 | 3,750,000 | |||||

| 22,738,750 | ||||||||

| Chemicals – 3.9% | ||||||||

| Avecia Group PLC (B/B2) | ||||||||

| 9,000,000 | 11.00 | 07/01/2009 | 9,112,500 | |||||

| Brunner Mond PLC (CCC/Caa2) | ||||||||

| 1,000,000 | 11.00 | 07/15/2008 | 520,000 | |||||

| Equistar Chemicals LP (BBB-/Baa3) | ||||||||

| 2,000,000 | 7.55 | 02/15/2026 | 1,618,860 | |||||

| General Chemicals Industries (B+/B3) | ||||||||

| 3,000,000 | 10.63 | 05/01/2009 | 2,580,000 | |||||

| Huntsman ICI Holdings LLC (B+/B2) | ||||||||

| 2,500,000 | 10.13 | 07/01/2009 | 2,487,500 | |||||

| Huntsman ICI Holdings LLC (B+/B3)@† | ||||||||

| 7,125,000 | 12.27 | 12/31/2009 | 2,244,375 | |||||

| Lyondell Chemical Co. (BB/Ba3) | ||||||||

| 4,500,000 | 9.88 | 05/01/2007 | 4,455,000 | |||||

| Lyondell Chemical Co. (B+/B2) | ||||||||

| 2,000,000 | 10.88 | 05/01/2009 | 1,980,000 | |||||

| Polymer Group, Inc. (B/B2) | ||||||||

| 1,750,000 | 9.00 | 07/01/2007 | 1,575,000 | |||||

| 3,000,000 | 8.75 | 03/01/2008 | 2,692,500 | |||||

| Sovereign Specialty Chemicals, Inc. (B-/B3)† | ||||||||

| 1,250,000 | 11.88 | 03/15/2010 | 1,262,500 | |||||

| Trans-Resources, Inc. (B-/B3)§ | ||||||||

| 1,000,000 | 0.00/12.00 | 03/15/2008 | 190,000 | |||||

| 30,718,235 | ||||||||

| Conglomerates – 0.7% | ||||||||

| Eagle-Picher Industries, Inc. (B-/B3) | ||||||||

| 6,500,000 | 9.38 | 03/01/2008 | 5,492,500 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Bonds – (continued) | ||||||||

| Consumer Cyclicals – 5.7% | ||||||||

| APCOA, Inc. (CCC+/Caa1) | ||||||||

| $ 5,000,000 | 9.25 | % | 03/15/2008 | $ 2,250,000 | ||||

| Fisher Scientific International, Inc. (B-/B3) | ||||||||

| 13,250,000 | 9.00 | 02/01/2008 | 12,190,000 | |||||

| Intertek Finance PLC (B-/B2) | ||||||||

| 7,000,000 | 10.25 | 11/01/2006 | 5,810,000 | |||||

| MSX International, Inc. (B-/B3) | ||||||||

| 1,000,000 | 11.38 | 01/15/2008 | 940,000 | |||||

| National Equipment Services, Inc. (B/B3) | ||||||||

| 4,000,000 | 10.00 | 11/30/2004 | 3,600,000 | |||||

| United Rentals, Inc. (BB-/B1) | ||||||||

| 4,750,000 | 9.50 | 06/01/2008 | 4,346,250 | |||||

| 4,000,000 | 8.80 | 08/15/2008 | 3,500,000 | |||||

| Volume Services America, Inc. (B-/B3) | ||||||||

| 2,750,000 | 11.25 | 03/01/2009 | 2,557,500 | |||||

| Wesco Distribution, Inc. (B/B2) | ||||||||

| 10,000,000 | 9.13 | 06/01/2008 | 9,050,000 | |||||

| Williams Scotsman, Inc. (B-/B3) | ||||||||

| 1,000,000 | 9.88 | 06/01/2007 | 910,000 | |||||

| 45,153,750 | ||||||||

| Consumer Products – 2.3% | ||||||||

| Cabot Safety Corp. (B/B3) | ||||||||

| 4,000,000 | 12.50 | 07/15/2005 | 4,030,000 | |||||

| Corning Consumer Products Co. (B/B3) | ||||||||

| 6,250,000 | 9.63 | 05/01/2008 | 3,968,750 | |||||

| Generac Portable Products LLC (B-/B3) | ||||||||

| 2,000,000 | 11.25 | 07/01/2006 | 1,985,000 | |||||

| Imperial Home Decor Group (D/C)D | ||||||||

| 2,000,000 | 11.00 | 03/15/2008 | 20,000 | |||||

| Polaroid Corp. (BB-/Ba3) | ||||||||

| 2,000,000 | 11.50 | 02/15/2006 | 2,035,000 | |||||

| Sealy Mattress Co. (B-/B3) | ||||||||

| 1,500,000 | 0.00/10.88 | § | 12/15/2007 | 1,050,000 | ||||

| 2,500,000 | 9.88 | 12/15/2007 | 2,375,000 | |||||

| The Scotts Co. (B+/B2)† | ||||||||

| 1,000,000 | 8.63 | 01/15/2009 | 950,000 | |||||

| United Industries Corp. (B-/B3) | ||||||||

| 1,750,000 | 9.88 | 04/01/2009 | 1,277,500 | |||||

| 17,691,250 | ||||||||

| Defense – 0.6% | ||||||||

| Condor Systems, Inc. (B-/B3)† | ||||||||

| 2,000,000 | 11.88 | 05/01/2009 | 970,000 | |||||

| Newport News Shipbuilding, Inc. (B+/Ba3) | ||||||||

| 4,000,000 | 9.25 | 12/01/2006 | 3,960,000 | |||||

| 4,930,000 | ||||||||

| Energy – 1.5% | ||||||||

| Benton Oil & Gas Co. (B/B3) | ||||||||

| 2,250,000 | 9.38 | 11/01/2007 | 1,350,000 | |||||

| Cross Timbers Oil Co. (B/B2) | ||||||||

| 2,750,000 | 8.75 | 11/01/2009 | 2,557,500 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Bonds – (continued) | ||||||||

| Energy – (continued) | ||||||||

| P&L Coal Holdings Corp. (B/B2) | ||||||||

| $ 4,250,000 | 9.63 | % | 05/15/2008 | $ 3,782,500 | ||||

| R&B Falcon Corp. (B+/Ba3) | ||||||||

| 500,000 | 6.75 | 04/15/2005 | 437,500 | |||||

| 500,000 | 9.50 | 12/15/2008 | 485,000 | |||||

| RBF Finance Co. (BB-/Ba3) | ||||||||

| 1,000,000 | 11.38 | 03/15/2009 | 1,070,000 | |||||

| Vintage Petroleum, Inc. (BB-/B1) | ||||||||

| 2,000,000 | 9.75 | 06/30/2009 | 2,020,000 | |||||

| 11,702,500 | ||||||||

| Entertainment – 0.9% | ||||||||

| Advanstar Communications, Inc. (B-/B2) | ||||||||

| 3,000,000 | 9.25 | 05/01/2008 | 2,730,000 | |||||

| Premier Parks, Inc. (B-/B3) | ||||||||

| 2,250,000 | 9.25 | 04/01/2006 | 2,115,000 | |||||

| SFX Entertainment, Inc. (B-/B3) | ||||||||

| 2,000,000 | 9.13 | 02/01/2008 | 2,000,000 | |||||

| V2 Music Holdings PLC (CCCg)†§ | ||||||||

| 1,750,000 | 0.00/14.00 | 04/15/2008 | 463,750 | |||||

| 7,308,750 | ||||||||

| Environmental – 1.7% | ||||||||

| Allied Waste North America, Inc. (BB-/Ba3) | ||||||||

| 2,500,000 | 7.63 | 01/01/2006 | 1,875,000 | |||||

| 5,750,000 | 7.88 | 01/01/2009 | 4,255,000 | |||||

| Allied Waste North America, Inc. (B+/B2) | ||||||||

| 8,000,000 | 10.00 | 08/01/2009 | 5,480,000 | |||||

| The IT Group, Inc. (B+/B3) | ||||||||

| 2,000,000 | 11.25 | 04/01/2009 | 1,800,000 | |||||

| 13,410,000 | ||||||||

| Food – 2.7% | ||||||||

| Agrilink Foods, Inc. (B-/B3) | ||||||||

| 1,500,000 | 11.88 | 11/01/2008 | 1,335,000 | |||||

| Aurora Foods, Inc. (CCC+/Caa1) | ||||||||

| 3,750,000 | 9.88 | 02/15/2007 | 2,100,000 | |||||

| 1,000,000 | 8.75 | 07/01/2008 | 550,000 | |||||

| Del Monte Foods Co. (B-/Caa1)§ | ||||||||

| 5,350,000 | 0.00/12.50 | 12/15/2007 | 4,012,500 | |||||

| Domino’s, Inc. (B-/B3) | ||||||||

| 5,000,000 | 10.38 | 01/15/2009 | 4,662,500 | |||||

| Eagle Family Foods (CCC+/B3) | ||||||||

| 5,000,000 | 8.75 | 01/15/2008 | 3,400,000 | |||||

| International Home Foods, Inc. (B-/B2) | ||||||||

| 2,750,000 | 10.38 | 11/01/2006 | 2,722,500 | |||||

| New World Pasta Co. (B-/B2) | ||||||||

| 1,000,000 | 9.25 | 02/15/2009 | 740,000 | |||||

| Premier International Foods PLC (B-/B3)† | ||||||||

| 1,500,000 | 12.00 | 09/01/2009 | 1,428,750 | |||||

| 20,951,250 | ||||||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Bonds – (continued) | ||||||||

| Health Care – 1.3% | ||||||||

| ALARIS Medical, Inc. (B-)§ | ||||||||

| $ 4,000,000 | 0.00/11.13 | % | 08/01/2008 | $ 1,080,000 | ||||

| Genesis Eldercare, Inc. (C/C)D | ||||||||

| 2,000,000 | 9.00 | 08/01/2007 | 60,000 | |||||

| Genesis Health Ventures, Inc. (C/C)D | ||||||||

| 1,000,000 | 9.88 | 01/15/2009 | 130,000 | |||||

| Genesis Health Ventures, Inc. (D/C)D | ||||||||

| 500,000 | 9.25 | 10/01/2006 | 75,000 | |||||

| Hudson Respiratory Care, Inc. (B-/B3) | ||||||||

| 3,500,000 | 9.13 | 04/15/2008 | 2,695,000 | |||||

| Iasis Healthcare Corp. (B-/B3)† | ||||||||

| 2,000,000 | 13.00 | 10/15/2009 | 1,985,000 | |||||

| Integrated Health Services, Inc. (C)D | ||||||||

| 3,750,000 | 9.25 | 01/15/2008 | 75,000 | |||||

| Kinetic Concepts, Inc. (CCC+/B3) | ||||||||

| 5,000,000 | 9.63 | 11/01/2007 | 3,625,000 | |||||

| Universal Hospital Services, Inc. (B/B3) | ||||||||

| 1,000,000 | 10.25 | 03/01/2008 | 400,000 | |||||

| 10,125,000 | ||||||||

| Home Construction – 0.1% | ||||||||

| D.R. Horton, Inc. (BB/Ba1) | ||||||||

| 1,000,000 | 8.00 | 02/01/2009 | 852,500 | |||||

| Insurance Companies – 0.7% | ||||||||

| Willis Corroon Corp. (B+/Ba3) | ||||||||

| 7,500,000 | 9.00 | 02/01/2009 | 5,662,500 | |||||

| Media-Cable – 5.3% | ||||||||

| Adelphia Communications Corp. (B+/B1) | ||||||||

| 3,000,000 | 9.38 | 11/15/2009 | 2,812,500 | |||||

| Charter Communications Holdings LLC (B+/B2) | ||||||||

| 1,000,000 | 8.25 | 04/01/2007 | 890,000 | |||||

| 2,000,000 | 8.63 | 04/01/2009 | 1,740,000 | |||||

| 13,750,000 | 0.00/9.92 | § | 04/01/2011 | 7,528,125 | ||||

| Echostar DBS Corp. (B/B2) | ||||||||

| 4,000,000 | 9.38 | 02/01/2009 | 3,870,000 | |||||

| Frontiervision Holdings LP (B+/B1)§ | ||||||||

| 5,000,000 | 0.00/11.88 | 09/15/2007 | 4,362,500 | |||||

| Ono Finance PLC (CCC+)† | ||||||||

| 1,250,000 | 13.00 | 05/01/2009 | 1,275,000 | |||||

| Renaissance Media Group LLC (B-/B2)§ | ||||||||

| 3,000,000 | 0.00/10.00 | 04/15/2008 | 2,040,000 | |||||

| Telewest Communications PLC (B+/B1) | ||||||||

| 7,500,000 | 0.00/11.00 | § | 10/01/2007 | 7,050,000 | ||||

| 5,000,000 | 11.25 | 11/01/2008 | 5,125,000 | |||||

| 1,000,000 | 0.00/9.78 | § | 04/15/2009 | 560,000 | ||||

| 2,000,000 | 0.00/11.38 | †§ | 02/01/2010 | 1,150,000 | ||||

| 1,000,000 | 9.88 | † | 02/01/2010 | 980,000 | ||||

| United Pan-Europe Communications N.V. (B/B2)† | ||||||||

| 1,000,000 | 0.00/13.75 | § | 02/01/2010 | 485,000 | ||||

| 2,000,000 | 11.25 | 02/01/2010 | 1,860,000 | |||||

| 41,728,125 | ||||||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Bonds – (continued) | ||||||||

| Media-Non Cable – 4.0% | ||||||||

| Chancellor Media Corp. (B/B1) | ||||||||

| $ 2,000,000 | 8.13 | % | 12/15/2007 | $ 1,992,500 | ||||

| 2,000,000 | 9.00 | 10/01/2008 | 2,020,000 | |||||

| Crown Castle International Corp. (B/B3)§ | ||||||||

| 10,500,000 | 0.00/10.63 | 11/15/2007 | 7,560,000 | |||||

| 6,000,000 | 0.00/10.38 | 05/15/2011 | 3,540,000 | |||||

| 5,500,000 | 0.00/11.25 | 08/01/2011 | 3,300,000 | |||||

| Lin Holdings Corp. (B-/B3)§ | ||||||||

| 5,000,000 | 0.00/10.00 | 03/01/2008 | 2,950,000 | |||||

| Pinnacle Holdings, Inc. (B/B3)§ | ||||||||

| 5,000,000 | 0.00/10.00 | 03/15/2008 | 3,312,500 | |||||

| PX Escrow Corp. (B-/B3)§ | ||||||||

| 1,000,000 | 0.00/9.63 | 02/01/2006 | 510,000 | |||||

| Spectrasite Holdings, Inc. (B-/B3)§ | ||||||||

| 3,500,000 | 0.00/11.25 | 04/15/2009 | 1,925,000 | |||||

| Young Broadcasting, Inc. (B/B2) | ||||||||

| 5,000,000 | 8.75 | 06/15/2007 | 4,425,000 | |||||

| 31,535,000 | ||||||||

| Metals – 0.9% | ||||||||

| Earle M. Jorgensen Co. (B-/B3) | ||||||||

| 3,500,000 | 9.50 | 04/01/2005 | 3,220,000 | |||||

| Haynes International, Inc. (B-/B3) | ||||||||

| 1,500,000 | 11.63 | 09/01/2004 | 810,000 | |||||

| Republic Technologies International (B/C)† | ||||||||

| 2,000,000 | 13.75 | 07/15/2009 | 440,000 | |||||

| WHX Corp. (B-/B3) | ||||||||

| 2,500,000 | 10.50 | 04/15/2005 | 2,318,750 | |||||

| 6,788,750 | ||||||||

| Packaging – 2.4% | ||||||||

| AEP Industries, Inc. (B/B2) | ||||||||

| 3,000,000 | 9.88 | 11/15/2007 | 2,475,000 | |||||

| Graham Packaging Co. (B-/B3) | ||||||||

| 3,500,000 | 8.75 | 01/15/2008 | 2,992,500 | |||||

| Graham Packaging Co. (B-/Caa1)§ | ||||||||

| 3,500,000 | 0.00/10.75 | 01/15/2009 | 1,960,000 | |||||

| Printpack, Inc. (B/Caa1) | ||||||||

| 3,000,000 | 10.63 | 08/15/2006 | 2,865,000 | |||||

| Printpack, Inc. (B+/B3) | ||||||||

| 3,000,000 | 9.88 | 08/15/2004 | 2,910,000 | |||||

| Tekni-Plex, Inc. (B-/B3) | ||||||||

| 3,000,000 | 11.25 | 04/01/2007 | 3,090,000 | |||||

| 3,000,000 | 9.25 | 03/01/2008 | 2,880,000 | |||||

| 19,172,500 | ||||||||

| Paper – 4.1% | ||||||||

| Ainsworth Lumber Co. Ltd. (B/B2) | ||||||||

| 6,000,000 | 12.50 | 07/15/2007 | 6,270,000 | |||||

| Packaging Corp. of America (B+/B2) | ||||||||

| 8,000,000 | 9.63 | 04/01/2009 | 8,040,000 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Bonds – (continued) | ||||||||

| Paper – (continued) | ||||||||

| Repap New Brunswick, Inc (CCC+/Caa) | ||||||||

| $ 1,500,000 | 10.63 | % | 04/15/2005 | $ 1,402,500 | ||||

| Riverwood International Corp. (B-/B3) | ||||||||

| 8,000,000 | 10.25 | 04/01/2006 | 7,880,000 | |||||

| Riverwood International Corp. (CCC+/Caa1) | ||||||||

| 9,500,000 | 10.88 | 04/01/2008 | 8,977,500 | |||||

| 32,570,000 | ||||||||

| Publishing – 1.6% | ||||||||

| American Lawyer Media, Inc. (B/B1) | ||||||||

| 3,500,000 | 9.75 | 12/15/2007 | 3,237,500 | |||||

| Day International Group, Inc. (B-/B3) | ||||||||

| 3,250,000 | 9.50 | 03/15/2008 | 2,795,000 | |||||

| Merrill Corp. (B/B3) | ||||||||

| 1,500,000 | 12.00 | 05/01/2009 | 1,410,000 | |||||

| Transwestern Publishing Co. (B-/B2) | ||||||||

| 3,000,000 | 9.63 | 11/15/2007 | 2,895,000 | |||||

| WRC Media Corp. (B-/B3) | ||||||||

| 2,250,000 | 12.75 | 11/15/2009 | 2,160,000 | |||||

| 12,497,500 | ||||||||

| Retailers – 0.8% | ||||||||

| Advance Holdings Corp. (B-/Caa2)§ | ||||||||

| 2,000,000 | 0.00/12.88 | 04/15/2009 | 930,000 | |||||

| Duane Reade, Inc. (B-/B3) | ||||||||

| 1,750,000 | 9.25 | 02/15/2008 | 1,636,250 | |||||

| Mattress Discounters Corp. (B+/B2) | ||||||||

| 750,000 | 12.63 | 07/15/2007 | 682,500 | |||||

| Musicland Stores Corp. (B+/B2) | ||||||||

| 3,250,000 | 9.00 | 06/15/2003 | 2,925,000 | |||||

| 6,173,750 | ||||||||

| Supermarkets – 0.1% | ||||||||

| Pathmark Stores, Inc. (C/Caa) | ||||||||

| 625,000 | 9.63 | 05/01/2003 | 443,750 | |||||

| Technology – 3.8% | ||||||||

| Details, Inc. (B+/Caa1)§ | ||||||||

| 2,000,000 | 0.00/12.50 | 11/15/2007 | 1,260,000 | |||||

| Details, Inc. (B-/B3) | ||||||||

| 5,000,000 | 10.00 | 11/15/2005 | 4,675,000 | |||||

| Integrated Circuit Systems, Inc. (B-/B3) | ||||||||

| 1,500,000 | 11.50 | 05/15/2009 | 1,650,000 | |||||

| Intersil Corp. (B/B3) | ||||||||

| 812,000 | 13.25 | 08/15/2009 | 909,440 | |||||

| Intira Corp. (CCCg)§ | ||||||||

| 2,000,000 | 0.00/13.00 | 02/01/2010 | 1,065,800 | |||||

| MCMS, Inc. (CCC+/Caa3) | ||||||||

| 2,000,000 | 9.75 | 03/01/2008 | 1,000,000 | |||||

| SCG Holding & Semiconductor Corp. (B/B2) | ||||||||

| 9,000,000 | 12.00 | 08/01/2009 | 9,517,500 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Bonds – (continued) | ||||||||

| Technology – (continued) | ||||||||

| Viasystems Group, Inc. (B/B3) | ||||||||

| $11,250,000 | 9.75 | % | 06/01/2007 | $ 9,618,750 | ||||

| 29,696,490 | ||||||||

| Telecommunications – 13.1% | ||||||||

| Allegiance Telecom, Inc. (B/B3) | ||||||||

| 1,500,000 | 0.00/11.75 | § | 02/15/2008 | 1,050,000 | ||||

| 1,000,000 | 12.88 | 05/15/2008 | 1,080,000 | |||||

| Birch Telecom, Inc. (CCCg) | ||||||||

| 1,000,000 | 14.00 | 06/15/2008 | 1,000,000 | |||||

| Carrier1 International S.A. (B-/B3)† | ||||||||

| 2,250,000 | 13.25 | 02/15/2009 | 2,250,000 | |||||

| Colt Telecom Group PLC (B+/B1)§ | ||||||||

| 5,500,000 | 0.00/12.00 | 12/15/2006 | 4,730,000 | |||||

| Completel Europe N.V. (CCC+/Caa1)§ | ||||||||

| 2,250,000 | 0.00/14.00 | 02/15/2009 | 1,125,000 | |||||

| Econophone, Inc. (CCCg)† | ||||||||

| 2,000,000 | 13.50 | 07/15/2007 | 2,082,500 | |||||

| Energis PLC (B/B1)† | ||||||||

| 4,500,000 | 9.75 | 06/15/2009 | 4,500,000 | |||||

| Exodus Communications, Inc. (B-) | ||||||||

| 3,000,000 | 11.25 | 07/01/2008 | 3,037,500 | |||||

| 1,250,000 | 10.75 | 12/15/2009 | 1,246,875 | |||||

| FLAG Telecom Holdings Ltd. (B/B2) | ||||||||

| 2,500,000 | 11.63 | 03/30/2010 | 2,125,021 | |||||

| Global Crossing Holdings Ltd. (BB/Ba2) | ||||||||

| 1,500,000 | 9.13 | † | 11/15/2006 | 1,451,250 | ||||

| 2,750,000 | 9.63 | 05/15/2008 | 2,688,125 | |||||

| 2,500,000 | 9.50 | † | 11/15/2009 | 2,425,000 | ||||

| GST Equipment Funding, Inc. | ||||||||

| 2,000,000 | 13.25 | 05/01/2007 | 1,100,000 | |||||

| GST Network Funding, Inc.§ | ||||||||

| 2,000,000 | 0.00/10.50 | 05/01/2008 | 770,000 | |||||

| GST Telecommunications, Inc. | ||||||||

| 1,000,000 | 12.75 | 11/15/2007 | 600,000 | |||||

| Hermes Europe Railtel B.V. (B/B3) | ||||||||

| 3,500,000 | 11.50 | 08/15/2007 | 3,150,000 | |||||

| 1,500,000 | 10.38 | 01/15/2009 | 1,260,000 | |||||

| ICG Holdings, Inc. (B-/B3)§ | ||||||||

| 500,000 | 0.00/12.00 | 05/01/2006 | 404,820 | |||||

| 5,000,000 | 0.00/11.63 | 03/15/2007 | 3,465,950 | |||||

| Intermedia Communications, Inc. (B/B2) | ||||||||

| 7,250,000 | 0.00/11.25 | § | 07/15/2007 | 5,600,625 | ||||

| 1,000,000 | 8.88 | 11/01/2007 | 935,000 | |||||

| 1,000,000 | 9.50 | 03/01/2009 | 957,500 | |||||

| Intermedia Communications, Inc. (CCC+/B3)§ | ||||||||

| 1,000,000 | 0.00/12.25 | 03/01/2009 | 600,000 | |||||

| Jazztel PLC (CCC+/Caa1) | ||||||||

| 750,000 | 14.00 | 04/01/2009 | 768,750 | |||||

| Leap Wireless International, Inc. (CCC/Caa2) | ||||||||

| 1,000,000 | 0.00/14.50 | § | 04/15/2010 | 482,500 | ||||

| 500,000 | 12.50 | 04/15/2010 | 488,750 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Bonds – (continued) | ||||||||

| Telecommunications – (continued) | ||||||||

| Level 3 Communications, Inc. (B/B3) | ||||||||

| $ 3,000,000 | 9.13 | % | 05/01/2008 | $ 2,610,000 | ||||

| McLeodUSA, Inc. (B+/B1) | ||||||||

| 1,000,000 | 0.00/10.50 | § | 03/01/2007 | 795,000 | ||||

| 2,000,000 | 9.50 | 11/01/2008 | 1,932,500 | |||||

| 750,000 | 8.13 | 02/15/2009 | 663,750 | |||||

| Metromedia Fiber Network, Inc. (B+/B2) | ||||||||

| 3,000,000 | 10.00 | 11/15/2008 | 2,865,000 | |||||

| 2,000,000 | 10.00 | 12/15/2009 | 1,905,000 | |||||

| Metronet Communications Corp. (BBB/Baa3) | ||||||||

| 7,000,000 | 0.00/9.95 | § | 06/15/2008 | 5,460,000 | ||||

| 750,000 | 10.63 | 11/01/2008 | 844,688 | |||||

| NEXTLINK Communications, Inc. (B/B2) | ||||||||

| 2,000,000 | 9.63 | 10/01/2007 | 1,860,000 | |||||

| 2,250,000 | 9.00 | 03/15/2008 | 2,053,125 | |||||

| 1,500,000 | 10.75 | 06/01/2009 | 1,473,750 | |||||

| Pathnet, Inc. | ||||||||

| 1,875,000 | 12.25 | 04/15/2008 | 1,200,000 | |||||

| PSINet, Inc. (B-/B3) | ||||||||

| 3,750,000 | 10.00 | 02/15/2005 | 3,300,000 | |||||

| 1,500,000 | 11.50 | 11/01/2008 | 1,372,500 | |||||

| 1,000,000 | 11.00 | 08/01/2009 | 900,000 | |||||

| RSL Communications PLC (B-/B2) | ||||||||

| 1,000,000 | 12.25 | 11/15/2006 | 990,000 | |||||

| 2,000,000 | 0.00/10.13 | § | 03/01/2008 | 1,025,000 | ||||

| 625,000 | 9.13 | 03/01/2008 | 487,500 | |||||

| 2,000,000 | 10.50 | 11/15/2008 | 1,660,000 | |||||

| Verio, Inc. (B-/B3) | ||||||||

| 1,500,000 | 11.25 | 12/01/2008 | 1,477,500 | |||||

| 2,000,000 | 10.63 | 11/15/2009 | 1,910,000 | |||||

| Versatel Telecom International N.V. (B-/B3) | ||||||||

| 1,000,000 | 13.25 | 05/15/2008 | 1,015,000 | |||||

| Viatel, Inc. (B-/B3) | ||||||||

| 1,343,000 | 11.50 | 03/15/2009 | 1,222,130 | |||||

| WAM!Net, Inc. (CCC+)§ | ||||||||

| 1,250,000 | 0.00/13.25 | 03/01/2005 | 812,500 | |||||

| Williams Communications Group, Inc. (BB-/B2) | ||||||||

| 2,000,000 | 10.70 | 10/01/2007 | 2,035,000 | |||||

| 3,000,000 | 10.88 | 10/01/2009 | 3,022,500 | |||||

| World Access, Inc. | ||||||||

| 2,250,000 | 13.25 | 01/15/2008 | 2,047,500 | |||||

| Worldwide Fiber, Inc. (B+/B3) | ||||||||

| 5,250,000 | 12.50 | 12/15/2005 | 5,197,500 | |||||

| 103,512,609 | ||||||||

| Telecommunications-Cellular – 4.6% | ||||||||

| Alamosa PCS Holdings, Inc. (CCC+/Caa1)§ | ||||||||

| 2,500,000 | 0.00/12.75 | 02/15/2010 | 1,281,250 | |||||

| Centennial Cellular Corp. (B-/B3) | ||||||||

| 5,000,000 | 10.75 | 12/15/2008 | 4,975,000 | |||||

| East Telecom Group PLC (B+/Aa1) | ||||||||

| 4,000,000 | 11.88 | 12/01/2008 | 4,680,000 | |||||

| Millicom International Cellular S.A. (B-/B3)§ | ||||||||

| 5,000,000 | 0.00/13.50 | 06/01/2006 | 4,225,000 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Bonds – (continued) | ||||||||

| Telecommunications-Cellular – (continued) | ||||||||

| Nextel Communications, Inc. (B/B1) | ||||||||

| $ 3,000,000 | 0.00/10.65 | %§ | 09/15/2007 | $ 2,272,500 | ||||

| 750,000 | 0.00/9.75 | § | 10/31/2007 | 538,125 | ||||

| 16,000,000 | 0.00/9.95 | § | 02/15/2008 | 11,240,000 | ||||

| 3,000,000 | 9.38 | 11/15/2009 | 2,842,500 | |||||

| Nextel Partners, Inc. (CCC+/B3)§ | ||||||||

| 650,000 | 0.00/14.00 | 02/01/2009 | 432,250 | |||||

| Orange PLC (BBB+/Ba3) | ||||||||

| 3,000,000 | 9.00 | 06/01/2009 | 3,090,000 | |||||

| Triton PCS Holdings, Inc. (CCC+/B3)§ | ||||||||

| 1,250,000 | 0.00/11.00 | 05/01/2008 | 893,750 | |||||

| 36,470,375 | ||||||||

| Textiles – 0.4% | ||||||||

| Delta Mills, Inc. (B+/B3) | ||||||||

| 3,000,000 | 9.63 | 09/01/2007 | 2,280,000 | |||||

| Galey & Lord, Inc. (B/Ca) | ||||||||

| 2,000,000 | 9.13 | 03/01/2008 | 920,000 | |||||

| Globe Manufacturing Corp. (CCC+/Ca) | ||||||||

| 2,000,000 | 10.00 | 08/01/2008 | 200,000 | |||||

| 3,400,000 | ||||||||

| TOTAL CORPORATE BONDS | ||||||||

| (Cost $679,818,299) | $587,467,431 | |||||||

| Emerging Market Debt – 3.7% | ||||||||

| APP China Group Ltd. (CCC+/B3) | ||||||||

| $ 670,000 | 14.00 | % | 03/15/2010 | $ 542,700 | ||||

| Cablevision S.A. (BB/B1)† | ||||||||

| 1,000,000 | 13.75 | 05/01/2009 | 950,000 | |||||

| Cellco Finance N.V. (B-/B1) | ||||||||

| 1,250,000 | 12.75 | 08/01/2005 | 1,282,813 | |||||

| Federal Republic of Brazil (B+/B2) | ||||||||

| 1,171,000 | 14.50 | 10/15/2009 | 1,230,721 | |||||

| Federal Republic of Brazil C-Bonds (B+/B2) | ||||||||

| 4,532,811 | 8.00 | 04/15/2014 | 3,240,960 | |||||

| Grupo Industrial Durango SA (BB-/B2) | ||||||||

| 2,100,000 | 12.63 | 08/01/2003 | 2,121,000 | |||||

| Grupo Isuacell S.A. de C.V. (B+/B1) | ||||||||

| 2,000,000 | 14.25 | 12/01/2006 | 2,080,000 | |||||

| Hanvit Bank (B/B1) | ||||||||

| 1,990,000 | 11.75 | 03/01/2010 | 1,980,050 | |||||

| Indah Kiat Finance Mauritius (CCC+/B3) | ||||||||

| 1,240,000 | 10.00 | 07/01/2007 | 827,080 | |||||

| MRS Logistica S.A. (B) † | ||||||||

| 120,000 | 10.63 | 08/15/2005 | 98,400 | |||||

| Multicanal S.A. (BB+/B1) † | ||||||||

| 1,000,000 | 13.13 | 04/15/2009 | 1,020,000 | |||||

| National Power Corp. (BB) | ||||||||

| 500,000 | 7.63 | 11/15/2000 | 498,125 | |||||

| National Republic of Bulgaria (B2) # | ||||||||

| 1,120,000 | 2.75 | 07/28/2012 | 772,800 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Emerging Market Debt – (continued) | ||||||||

| Pemex Finance Ltd. (BBB+/Baa1) | ||||||||

| $ 990,000 | 9.03 | % | 02/15/2011 | $ 995,841 | ||||

| PTC International Finance B.V. (B+/B2)§ | ||||||||

| 840,000 | 0.00/10.75 | 07/01/2007 | 562,800 | |||||

| Republic of Panama (BB+/Ba1)# | ||||||||

| 1,342,349 | 7.00 | 05/10/2002 | 1,315,502 | |||||

| Republic of Peru (BBB+/Ba3) | ||||||||

| 4,320,000 | 3.75 | 03/07/2017 | 2,624,400 | |||||

| Republic of Philippines (BB+/Ba1) | ||||||||

| 2,760,000 | 9.50 | 10/21/2024 | 2,622,000 | |||||

| Republic of Poland (BBB+/Baa1)# | ||||||||

| 3,010,000 | 3.50 | 10/27/2024 | 1,869,962 | |||||

| 650,000 | 4.00 | 10/27/2024 | 429,813 | |||||

| Slovak Wireless Finance Co. (B/B2) | ||||||||

| 750,000 | 11.25 | 03/30/2007 | 684,143 | |||||

| United Mexican States (BB+/Baa3) | ||||||||

| 2,100,000 | 6.25 | 12/31/2019 | 1,728,573 | |||||

| TOTAL EMERGING MARKET DEBT | ||||||||

| (Cost $29,474,064) | $ 29,477,683 | |||||||

| Foreign Debt ObligationsE – 12.5% | ||||||||

| British Pound Sterling – 3.5% | ||||||||

| Coral Group Holdings PLC (B-/B3) † | ||||||||

| GBP 1,500,000 | 10.00 | % | 02/15/2009 | $ 2,417,166 | ||||

| 2,206,255 | 13.50 | 09/30/2009 | 3,563,845 | |||||

| IPC Magazines Group PLC (B-/B3) | ||||||||

| 3,250,000 | 0.00/10.75 | § | 03/15/2008 | 2,896,902 | ||||

| 3,750,000 | 9.63 | 03/15/2008 | 4,991,974 | |||||

| Telewest Communications PLC (B+/B1)§ | ||||||||

| 12,500,000 | 0.00/9.88 | 04/15/2009 | 11,433,858 | |||||

| William Hill Finance PLC (B-/B3) | ||||||||

| 1,500,000 | 10.63 | 04/30/2008 | 2,370,458 | |||||

| 27,674,203 | ||||||||

| Euro Currency – 7.3% | ||||||||

| BSN Financing Co., S.A. (B/B1) | ||||||||

| EUR 5,000,000 | 10.25 | 08/01/2009 | 4,772,775 | |||||

| Clondalkin Industries PLC (B-/B3) | ||||||||

| 1,500,000 | 10.63 | 01/15/2010 | 1,418,196 | |||||

| Enitel ASA (B-/B3) | ||||||||

| 2,500,000 | 12.50 | 04/15/2010 | 2,340,933 | |||||

| Esat Telecom Group PLC (B+/Aa1) | ||||||||

| 2,000,000 | 11.88 | 11/01/2009 | 2,239,699 | |||||

| Exodus Communications, Inc. (B-) | ||||||||

| 1,000,000 | 10.75 | 12/15/2009 | 918,191 | |||||

| Huntsman ICI Holdings LLC (B+/B2) | ||||||||

| 4,750,000 | 10.13 | 07/01/2009 | 4,555,727 | |||||

| Ineos Acrylics Finance PLC (B+/B3) | ||||||||

| 2,750,000 | 10.25 | 05/15/2010 | 2,562,526 | |||||

| Jazztel PLC (CCC+/Caa1) | ||||||||

| 2,000,000 | 14.00 | 04/01/2009 | 1,863,655 | |||||

| Principal

Amount |

Interest

Rate |

Maturity

Date |

Value | |||||

|---|---|---|---|---|---|---|---|---|

| Foreign Debt ObligationsE – (continued) | ||||||||

| Euro Currency – (continued) | ||||||||

| Kappa Beheer B.V. (B/B2)† | ||||||||

| EUR 6,500,000 | 0.00/12.50 | %§ | 07/15/2009 | $ 3,929,585 | ||||

| 6,750,000 | 10.63 | 07/15/2009 | 6,535,292 | |||||

| Metromedia Fiber Network, Inc. (B+/B2) | ||||||||

| 2,750,000 | 10.00 | 12/15/2009 | 2,437,524 | |||||

| NTL Communications Corp. (B-/B3) | ||||||||

| 3,800,000 | 0.00/11.50 | § | 11/15/2009 | 1,986,383 | ||||

| 11,750,000 | 9.88 | 11/15/2009 | 10,414,877 | |||||

| Ono Finance PLC (CCC+/Caa1)† | ||||||||

| 5,000,000 | 13.00 | 05/01/2009 | 4,727,320 | |||||

| PTC International Finance II S.A. (B+/B2) | ||||||||

| 2,570,000 | 11.25 | 12/01/2009 | 2,488,252 | |||||

| Tele1 Europe B.V. (B-/B3)† | ||||||||

| 1,000,000 | 13.00 | 05/15/2009 | 927,282 | |||||

| 1,000,000 | 11.88 | 12/01/2009 | 909,100 | |||||

| United Pan-Europe Communications N.V. (B/B2) | ||||||||

| 1,500,000 | 11.25 | 02/01/2010 | 1,302,286 | |||||

| Viatel, Inc. (B-/B3) | ||||||||

| 1,000,000 | 11.50 | 03/15/2009 | 815,917 | |||||

| 57,145,520 | ||||||||

| German Mark – 1.7% | ||||||||

| Colt Telecom Group PLC (B+/B1) | ||||||||

| DEM 5,000,000 | 8.88 | 11/30/2007 | 2,358,938 | |||||

| Impress Metal Pack Holdings (B/B2) | ||||||||

| 10,000,000 | 9.88 | 05/29/2007 | 4,648,155 | |||||

| Ineos PLC (B+/B3) | ||||||||

| 6,500,000 | 8.63 | 04/30/2005 | 3,127,046 | |||||

| Sirona Dental Systems (B/B2)† | ||||||||

| 6,750,000 | 9.13 | 07/15/2008 | 2,619,816 | |||||

| Texon International PLC (B3)† | ||||||||

| 2,250,000 | 10.00 | 02/01/2008 | 979,947 | |||||

| 13,733,902 | ||||||||

| TOTAL FOREIGN DEBT OBLIGATIONS | ||||||||

| (Cost $112,374,185) | $ 98,553,625 | |||||||

| Repurchase Agreement — 0.5% | ||||||||

| Joint Repurchase Agreement Account | ||||||||

| $ 3,800,000 | 5.85 | % | 05/01/2000 | $ 3,800,000 | ||||

| TOTAL REPURCHASE AGREEMENT | ||||||||

| (Cost $3,800,000) | $ 3,800,000 | |||||||

| Shares | Value | |||||||

| Common Stocks — 0.5% | ||||||||

| Colt Telecom Group PLC* | ||||||||

| 59,200 | $ 2,432,259 | |||||||

| Completel Holdings LLC Cl.B† | ||||||||

| 12,500 | 1,125,000 | |||||||

| Shares | Value | |||||||

|---|---|---|---|---|---|---|---|---|

| Common Stocks – (continued) | ||||||||

| McleodUSA, Inc. | ||||||||

| 9,132 | $ 228,300 | |||||||

| RSL Communications Ltd | ||||||||

| 2,881 | 40,154 | |||||||

| Tele1 Europe Holding AB ADR | ||||||||

| 18,792 | 291,276 | |||||||

| World Access, Inc.* | ||||||||

| 7,069 | 111,337 | |||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $313,842) | $ 4,228,326 | |||||||

| Shares | Dividend

Rate |

Maturity

Date |

Value | |||||

| Preferred Stocks – 2.9% | ||||||||

| Avecia Group PLC (B-/B3)‡ | ||||||||

| 40,000 | 16.00 | % | 07/01/2010 | $ 1,000,000 | ||||

| CSC Holdings, Inc. (B+/B1)‡ | ||||||||

| 61,551 | 11.75 | 10/01/2007 | 6,709,059 | |||||

| 75,702 | 11.13 | 04/01/2008 | 8,100,114 | |||||

| Eagle-Picher Holdings, Inc. (CCC+/Caa) | ||||||||

| 200 | 11.75 | 03/01/2008 | 600,000 | |||||

| Global Crossing Holdings Ltd. (B+/B1)‡ | ||||||||

| 12,500 | 10.50 | 12/01/2008 | 1,250,000 | |||||

| Intermedia Communications, Inc. (CCC-/Caa)‡ | ||||||||

| 1,388 | 13.50 | 03/31/2009 | 1,353,618 | |||||

| Nextel Communications, Inc. (CCC+/B3)‡ | ||||||||

| 1,392 | 11.13 | 02/15/2010 | 1,301,520 | |||||

| River Holding Corp. (CCC+)‡ | ||||||||

| 4,701 | 11.50 | 04/15/2010 | 357,245 | |||||

| Rural Cellular Corp. (CCC+/Caa)‡ | ||||||||

| 2,062 | 12.25 | 05/15/2011 | 2,020,692 | |||||

| TOTAL PREFERRED STOCKS | ||||||||

| (Cost $20,800,653) | $ 22,692,248 | |||||||

| Shares | Value | |||||||

| Warrants* – 0.6% | ||||||||

| ASAT Finance LLC, expiring November 1, 2006 | ||||||||

| 2,000 | $ 240,000 | |||||||

| Avecia Group PLC, expiring July 1, 2010 | ||||||||

| 80,000 | 900,000 | |||||||

| Birch Telecom, Inc., expiring June 15, 2008 | ||||||||

| 1,000 | 55,000 | |||||||

| Cellnet Data Systems, Inc., expiring September 15, 2007 | ||||||||

| 3,000 | 0 | |||||||

| Coral Group Holdings PLC, expiring September 30, 2009 | ||||||||

| 2,000 | 435,946 | |||||||

| Intira Corp., expiring February 2, 2025 | ||||||||

| 44,618 | 0 | |||||||

| Jazztel PLC, expiring April 1, 2009 | ||||||||

| 10,000 | 2,290,932 | |||||||

| Shares | Value | ||||||

|---|---|---|---|---|---|---|---|

| Warrants* – (continued) | |||||||

| Knology Holdings, Inc., expiring October 15, 2007 | |||||||

| 1,750 | $ 87,500 | ||||||

| Ono Finance PLC, expiring May 31, 2009 | |||||||

| 6,250 | 869,325 | ||||||

| Pathnet, Inc., expiring April 15, 2008 | |||||||

| 1,875 | 18,750 | ||||||

| Republic

Technologies International Inc., expiring

July 15, 2009 |

|||||||

| 2,000 | 20 | ||||||

| V2 Music Holdings PLC, expiring April 15, 2008 | |||||||

| 1,750 | 0 | ||||||

| WAM!Net, Inc., expiring March 1, 2005 | |||||||

| 3,750 | 85,313 | ||||||

| Worldwide Flight Services, Inc., expiring August 15, 2007 | |||||||

| 750 | 75 | ||||||

| TOTAL WARRANTS | |||||||

| (Cost $93,750) | $ 4,982,861 | ||||||

| TOTAL INVESTMENTS | |||||||

| (Cost $846,674,793) | $751,202,174 | ||||||

†

|

Security is exempt

from registration under Rule 144A of the Securities Act of 1933. Such

security may be resold, normally to qualified institutional buyers in

transactions exempt from registration. The market value of 144A securities

amounts to $61,080,878 as of April 30, 2000.

|

§

|

These securities

are issued with a zero coupon or dividend rate which increases to the

stated rate at a set date in the future.

|

E

|

The principal

amount of each security is stated in the currency in which the bond is

denominated. See below.

|

| DEM = German Mark.

|

| EUR = Euro currency.

|

| GBP = Great Britain Pound.

|

#

|

Variable rate

security. Coupon rate disclosed is that which is in effect at April 30,

2000.

|

‡

|

Pay-in-kind

securities.

|

*

|

Non-income

producing security.

|

D

|

Security currently

in default.

|

@

|

Security is issued

with a zero coupon. The interest rate disclosed for this security

represents effective yield to maturity.

|

| The percentage

shown for each investment category reflects the value of investments in

that category as a percentage of total net assets.

|

| |

| Investment Abbreviations: | ||||||

| ADR—American Depositary Receipt | ||||||

| Assets:

|

| Investment in securities, at value (identified cost $846,674,793) | $751,202,174 | ||||||

| Cash, at value | 5,254,892 | ||||||

| Receivables: | |||||||

| Investment securities sold, at value | 3,833,007 | ||||||

| Interest, at value | 19,740,882 | ||||||

| Fund shares sold | 554,309 | ||||||

| Forward foreign currency exchange contracts, at value | 14,458,771 | ||||||

| Reimbursement from investment adviser | 56,737 | ||||||

| Deferred organization expenses, net | 14,488 | ||||||

| Other assets, at value | 42,485 | ||||||

| Total assets | 795,157,745 | ||||||

| Liabilities: | |||||||

| Payables: | |||||||

| Investment securities purchased, at value | 3,140,025 | ||||||

| Income distribution | 1,812,612 | ||||||

| Fund shares repurchased | 334,212 | ||||||

| Amounts owed to affiliates | 688,671 | ||||||

| Forward foreign currency exchange contracts, at value | 13,533 | ||||||

| Accrued expenses and other liabilities, at value | 57,186 | ||||||

| Total liabilities | 6,046,239 | ||||||

| Net Assets: | |||||||

| Paid-in capital | 879,778,645 | ||||||

| Accumulated distributions in excess of net investment income | (1,050,318 | ) | |||||

| Accumulated net realized loss on investment and foreign currency related transactions | (7,610,267 | ) | |||||

| Net unrealized loss on investments and translation of assets and liabilities denominated in foreign currencies | (82,006,554 | ) | |||||

| NET ASSETS | $789,111,506 | ||||||

| Net asset value, offering and redemption price per share: (a) | |||||||

| Class A | $8.81 | ||||||

| Class B | $8.81 | ||||||

| Class C | $8.80 | ||||||

| Institutional | $8.82 | ||||||

| Service | $8.82 | ||||||

| Shares outstanding: | |||||||

| Class A | 56,260,537 | ||||||

| Class B | 4,363,280 | ||||||

| Class C | 1,239,342 | ||||||

| Institutional | 27,651,203 | ||||||

| Service | 53,700 | ||||||

| Total shares outstanding, $.001 par value (unlimited number of shares authorized) | 89,568,062 | ||||||

(a)

|

Maximum public

offering price per share (NAV per share multiplied by 1.0471) for Class

A shares is $9.23. At redemption, Class B and Class C shares may be

subject to a deferred contingent sales charge, assessed on the amount

equal to the lesser of the current net asset value or the original

purchase price of the shares.

|

| Investment income: | |||

| Interest (a) | $43,598,332 | ||

| Dividends | 65,625 | ||

| Total income | 43,663,957 | ||

| Expenses: | |||

| Management fees | 2,877,643 | ||

| Distribution and Service fees (b) | 891,528 | ||

| Transfer Agent fees (c) | 586,318 | ||

| Custodian fees | 108,374 | ||

| Registration fees | 66,825 | ||

| Professional fees | 27,644 | ||

| Trustee fees | 4,921 | ||

| Amortization of deferred organization expenses | 3,207 | ||

| Service share fees | 1,003 | ||

| Other | 54,607 | ||

| Total expenses | 4,622,070 | ||

| Less — expenses reimbursed | (166,916 | ) | |

| Net expenses | 4,455,154 | ||

| NET INVESTMENT INCOME | 39,208,803 | ||

| Realized and unrealized gain (loss) on investment and foreign currency transactions: | |||

| Net realized gain from: | |||

| Investment transactions | 3,159,635 | ||

| Foreign currency related transactions | 339,892 | ||

| Net change in unrealized loss on: | |||

| Investments | (31,470,548 | ) | |

| Translation of assets and liabilities denominated in foreign currencies | 12,424,363 | ||

| Net realized and unrealized loss on investment and foreign currency transactions: | (15,546,658 | ) | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $23,662,145 | ||

(a)

|

Taxes withheld on

interest were $1,760.

|

(b)

|

Class A, Class B

and Class C had Distribution and Service fees of $640,336, $197,764 and

$53,428, respectively.

|

(c)

|

Class A, Class B,

Class C, Institutional Class and Service Class had Transfer Agent fees

of $486,657, $37,575, $10,151, $51,855 and $80,

respectively.

|

|

|

||||

|---|---|---|---|---|

| From operations: | ||||

| Net investment income | $ 39,208,803 | |||

| Net realized gain on investment and foreign currency transactions | 3,499,527 | |||

| Net change in unrealized loss on investments and foreign currency | (19,046,185 | ) | ||

| Net increase in net assets resulting from operations | 23,662,145 | |||

| Distributions to shareholders: | ||||

| From net investment income | ||||

| Class A shares | (29,011,197 | ) | ||

| Class B shares | (2,092,730 | ) | ||

| Class C shares | (569,974 | ) | ||

| Institutional shares | (15,096,099 | ) | ||

| Service shares | (22,060 | ) | ||

| In excess of net investment income | ||||

| Class A shares | (651,200 | ) | ||

| Class B shares | (46,974 | ) | ||

| Class C shares | (12,794 | ) | ||

| Institutional shares | (338,855 | ) | ||

| Service shares | (495 | ) | ||

| Total distributions to shareholders | (47,842,378 | ) | ||

| From share transactions: | ||||

| Proceeds from sales of shares | 129,543,645 | |||

| Reinvestment of dividends and distributions | 33,682,300 | |||

| Cost of shares repurchased | (182,371,069 | ) | ||

| Net decrease in net assets resulting from share transactions | (19,145,124 | ) | ||

| TOTAL DECREASE | (43,325,357 | ) | ||

| Net assets: | ||||

| Beginning of period | 832,436,863 | |||

| End of period | $789,111,506 | |||

| Accumulated distributions in excess of net investment income | $ (1,050,318 | ) | ||

|

|

||||

|---|---|---|---|---|

| From operations: | ||||

| Net investment income | $ 67,379,988 | |||

| Net realized loss on investment and foreign currency transactions | (2,720,050 | ) | ||

| Net change in unrealized loss on investments and futures | (21,099,547 | ) | ||

| Net increase in net assets resulting from operations | 43,560,391 | |||

| Distributions to shareholders: | ||||

| From net investment income | ||||

| Class A shares | (43,632,406 | ) | ||

| Class B shares | (2,990,090 | ) | ||

| Class C shares | (846,589 | ) | ||

| Institutional shares | (17,700,298 | ) | ||

| Service shares | (34,695 | ) | ||

| Total distributions to shareholders | (65,204,078 | ) | ||

| From share transactions: | ||||

| Proceeds from sales of shares | 479,200,997 | |||

| Reinvestment of dividends and distributions | 47,672,946 | |||

| Cost of shares repurchased | (210,201,224 | ) | ||

| Net increase in net assets resulting from share transactions | 316,672,719 | |||

| TOTAL INCREASE | 295,029,032 | |||

| Net assets: | ||||

| Beginning of year | 537,407,831 | |||

| End of year | $832,436,863 | |||

| Accumulated undistributed net investment income | $ 7,583,257 | |||

|

1. ORGANIZATION

|

| Goldman Sachs

Trust (the “Trust”) is a Delaware business trust registered

under the Investment Company Act of 1940 (as amended) as an open-end,

management investment company. The Trust includes the Goldman Sachs High

Yield Fund (the “Fund”). The Fund is a diversified portfolio

offering five classes of shares — Class A, Class B, Class

C, Institutional and Service.

|

| The Fund

invests primarily in non-investment grade fixed-income securities which

are considered predominantly speculative by traditional investment

standards. Non-investment grade fixed-income securities and unrated

securities of comparable credit quality (commonly known as “junk

bonds”) are subject to the increased risk of an issuer’s

inability to meet principal and interest obligations. These securities,

also referred to as high yield securities, may be subject to greater

price volatility due to such factors as specific corporate developments,

interest rate sensitivity, generally negative perceptions of the junk

bond markets and less secondary market liquidity.

|

| 2. SIGNIFICANT ACCOUNTING

POLICIES

|

| The following is

a summary of significant accounting policies consistently followed by

the Fund. The preparation of financial statements in conformity with

generally accepted accounting principles requires management to make

estimates and assumptions that may affect the reported amounts. Actual

results could differ from those estimates.

|

| A. Investment

Valuation — Portfolio

securities for which accurate market quotations are readily available

are valued on the basis of quotations furnished by a pricing service or

provided by dealers in such securities. Portfolio securities for which

accurate market quotations are not readily available are valued based on

yield equivalents, pricing matrices or other sources, under valuation

procedures established by the Trust’s Board of Trustees. Short-term

debt obligations maturing in sixty days or less are valued at amortized

cost.

|

| B. Security

Transactions and Investment Income — Security

transactions are recorded as of the trade date. Realized gains and

losses on sales of portfolio securities are calculated using the

identified cost basis. Interest income is recorded on the basis of

interest accrued. Market discounts and market premiums on debt

securities, other than mortgage backed securities, are amortized to

interest income over the life of the security with a corresponding

adjustment in the cost basis of that security.

|

| 2. SIGNIFICANT ACCOUNTING

POLICIES – continued

|

| C. Federal

Taxes — It is the

Fund’s policy to comply with the requirements of the Internal

Revenue Code applicable to regulated investment companies and to

distribute each year substantially all of its investment company taxable

income and capital gains to its shareholders. Accordingly, no federal

tax provision is required.

|

| The

characterization of distributions to shareholders for financial

reporting purposes is determined in accordance with income tax rules.

Therefore, the source of the portfolio’s distributions may be shown

in the accompanying financial statements as either from or in excess of

net investment income or net realized gain on investment transactions,

or from paid-in capital, depending on the type of book/tax differences

that may exist.

|

| The Fund,

at its most recent tax year-end of October 31, 1999 had approximately

$10,760,000 capital loss carryforwards expiring in 2006 and 2007 for

U.S. federal tax purposes. This amount is available to be carried

forward to offset future capital gains to the extent permitted by

applicable laws or regulations.

|

| At April

30, 2000, the aggregate cost of portfolio securities for federal income

tax purposes is $846,707,929. Accordingly, the gross unrealized gain on

investments was $14,273,579 and the gross unrealized loss on investments

was $109,779,334 resulting in a net unrealized loss of

$95,505,755.

|

| D. Expenses — Expenses incurred

by the Trust that do not specifically relate to an individual Fund of

the Trust are allocated to the funds on a straight-line or pro rata

basis depending upon the nature of the expense.

|

| Class A,

Class B and Class C shareholders of the Fund bear all expenses and fees

relating to their respective Distribution and Service Plans.

Shareholders of Service shares bear all expenses and fees paid to

service organizations. Each class of shares separately bears its

respective class-specific transfer agency fees.

|

| E. Deferred

Organization Expenses — Organization-related costs are amortized on a straight-line basis

over a period of five years.

|

|

2. SIGNIFICANT ACCOUNTING

POLICIES – continued

|

| F. Foreign

Currency Translations — The books and

records of the Fund are maintained in U.S. dollars. Amounts denominated

in foreign currencies are translated into U.S. dollars on the following

basis (i) investment valuations, foreign currency and other assets and

liabilities initially expressed in foreign currencies are converted each

business day into U.S. dollars based upon current exchange rates; (ii)

purchases and sales of foreign investments, income and expenses are

converted into U.S. dollars based upon currency exchange rates

prevailing on the respective dates of such transactions.

|

| Net

realized and unrealized gain (loss) on foreign currency transactions

will represent: (i) foreign exchange gains and losses from the sale and

holdings of foreign currencies and sale of investments; (ii) gains and

losses between trade date and settlement date on investment securities

transactions and forward exchange contracts; and (iii) gains and losses

from the difference between amounts of dividends, interest and foreign

withholding taxes recorded and the amounts actually

received.

|

| G. Segregation

Transactions — The Fund may

enter into certain derivative transactions to seek to increase total

return. Forward foreign currency exchange contracts, futures contracts,

written options, mortgage dollar rolls, when-issued securities and

forward commitments represent examples of such transactions. As a result

of entering into those transactions, the Fund is required to segregate

liquid assets on the accounting records equal to or greater than the

market value of the corresponding transactions.

|

| 3. AGREEMENTS

|

| Pursuant to the

Investment Management Agreement (the “Agreement”), Goldman

Sachs Asset Management (“GSAM”), a unit of the Investment

Management Division of Goldman, Sachs & Co. (“Goldman

Sachs”), serves as the investment adviser to the Fund. Under the

Agreement, the adviser, subject to the general supervision of the

Trust’s Board of Trustees, manages the Fund’s portfolio. As

compensation for the services rendered pursuant to the Agreement, the

assumption of the expenses related thereto and administering the

Fund’s business affairs, including providing facilities, the

adviser is entitled to a fee, computed daily and payable monthly, at an

annual rate equal to 0.70% of the average daily net assets of the

Fund.

|

| The adviser

has voluntarily agreed to limit certain “Other Expenses” of

the Fund (excluding Management fees, Distribution and Service fees,

Transfer Agent fees, taxes, interest, brokerage, litigation, Service

Share fees, indemnification costs and other extraordinary expenses), to

the extent that such expenses exceed, on an annual basis, 0.02% of the

average daily net assets of the Fund.

|

| The Trust,

on behalf of the Fund, has adopted Distribution and Service Plans. Under

the Distribution and Service Plans, Goldman Sachs and/or authorized

dealers are entitled to a monthly fee from the Fund for distribution and

shareholder maintenance services equal, on an annual basis, to 0.25%,

1.00%, and 1.00% of the Fund’s average daily net assets

attributable to Class A, Class B and Class C Shares,

respectively.

|

|

3. AGREEMENTS – continued

|

| Goldman

Sachs serves as the distributor of shares of the Fund pursuant to a

Distribution Agreement. Goldman Sachs may receive a portion of the Class

A sales load and Class B and Class C contingent deferred sales charges

and has advised the Fund that it retained approximately $309,000 during

the period ended April 30, 2000.

|

| Goldman

Sachs also serves as the transfer agent of the Fund for a fee. The fees

charged for such transfer agency services are calculated daily and

payable monthly at an annual rate as follows: 0.19% of the average daily

net assets for Class A, Class B, and Class C Shares and 0.04% of the

average daily net assets for Institutional and Services

Shares.

|

| The Trust,

on behalf of the Fund, has adopted a Service Plan. The Plan allows for

Service Shares to compensate service organizations for providing varying

levels of account administration and shareholder liaison services to

their customers who are beneficial owners of such shares. The Service

Plan provides for compensation to the service organizations in an amount

up to 0.50%, on an annualized basis, of the average daily net assets of

the Service Shares.

|

| As of April

30, 2000, the amounts owed to affiliates were approximately $455,000,

$141,000 and $93,000 for Management, Distribution and Service, and

Transfer Agent fees, respectively.

|

| 4. PORTFOLIO SECURITIES

TRANSACTIONS

|

| Purchases and

proceeds of sales or maturities of securities (excluding short-term

investments) for the period ended April 30, 2000, were $266,881,278 and

$291,234,971, respectively.

|

| Forward Foreign Currency

Exchange Contracts — The Fund may

enter into forward foreign currency exchange contracts for the purchase

or sale of a specific foreign currency at a fixed price on a future date

as a hedge or cross-hedge against either specific transactions or

portfolio positions. The Fund may also purchase and sell forward

contracts to seek to increase total return. All commitments are

“marked-to-market” daily at the applicable translation rates

and any resulting unrealized gains or losses are recorded in the

Fund’s financial statements. The Fund records realized gains or

losses at the time the forward contract is offset by entry into a

closing transaction or extinguished by delivery of the currency. Risks

may arise upon entering into these contracts from the potential

inability of counterparties to meet the terms of their contracts and

from unanticipated movements in the value of a foreign currency relative

to the U.S. dollar.

|

|

4. PORTFOLIO SECURITIES

TRANSACTIONS – continued

|

| At April

30, 2000, the Fund had outstanding forward foreign currency exchange

contracts as follows:

|

| Open Foreign Currency

Sale Contracts |

Value on

Settlement Date |

Current Value | Unrealized

Gain |

Unrealized

Loss |

|||||

|---|---|---|---|---|---|---|---|---|---|

| British Pound | |||||||||

| expiring 5/2/2000 | $ 2,812,072 | $ 2,721,581 | $ 90,491 | $ — | |||||

| expiring 5/30/2000 | 252,614 | 245,271 | 7,343 | — | |||||

| expiring 6/30/2000 | 3,782,710 | 3,668,833 | 113,877 | — | |||||

| expiring 8/15/2000 | 2,527,088 | 2,455,153 | 71,935 | — | |||||

| expiring 9/15/2000 | 5,174,941 | 4,960,437 | 214,504 | — | |||||

| expiring 10/18/2000 | 14,808,258 | 14,325,731 | 482,527 | — | |||||

| expiring 11/1/2000 | 1,476,969 | 1,443,105 | 33,864 | — | |||||

| expiring 11/30/2000 | 5,069,366 | 4,931,221 | 138,145 | — | |||||

| Euro Currency | |||||||||

| expiring 5/2/2000 | 561,754 | 476,003 | 85,751 | — | |||||

| expiring 5/15/2000 | 647,250 | 560,835 | 86,415 | — | |||||

| expiring 5/30/2000 | 389,228 | 333,408 | 55,820 | — | |||||

| expiring 6/1/2000 | 157,442 | 137,598 | 19,844 | — | |||||

| expiring 6/15/2000 | 120,894 | 105,401 | 15,493 | — | |||||

| expiring 6/30/2000 | 256,268 | 219,535 | 36,733 | — | |||||

| expiring 7/17/2000 | 3,912,729 | 3,597,588 | 315,141 | — | |||||

| expiring 7/18/2000 | 43,561 | 36,423 | 7,138 | — | |||||

| expiring 8/1/2000 | 637,014 | 534,209 | 102,805 | — | |||||

| expiring 9/15/2000 | 2,445,799 | 1,994,298 | 451,501 | — | |||||

| expiring 10/2/2000 | 2,389,952 | 1,966,821 | 423,131 | — | |||||

| expiring 10/30/2000 | 210,808 | 182,721 | 28,087 | — | |||||

| expiring 11/1/2000 | 5,871,132 | 4,903,735 | 967,397 | — | |||||

| expiring 11/15/2000 | 1,793,545 | 1,516,467 | 277,078 | — | |||||

| expiring 11/29/2000 | 5,962,297 | 5,115,561 | 846,736 | — | |||||

| expiring 11/30/2000 | 2,905,922 | 2,463,600 | 442,322 | — | |||||

| expiring 12/1/2000 | 152,492 | 133,401 | 19,091 | — | |||||

| expiring 12/15/2000 | 3,332,240 | 2,913,075 | 419,165 | — | |||||

| expiring 12/29/2000 | 5,395,695 | 4,614,084 | 781,611 | — | |||||

| expiring 1/16/2001 | 10,366,413 | 8,742,694 | 1,623,719 | — | |||||

| expiring 2/1/2001 | 7,021,510 | 5,884,104 | 1,137,406 | — | |||||

| expiring 4/1/2001 | 5,155,277 | 4,475,125 | 680,152 | — | |||||

| expiring 5/1/2001 | 2,804,607 | 2,477,059 | 327,548 | — | |||||

| expiring 5/15/2001 | 15,344,085 | 13,399,772 | 1,944,313 | — | |||||

| expiring 6/1/2001 | 8,834,710 | 7,881,921 | 952,789 | — | |||||

| expiring 7/16/2001 | 6,622,285 | 6,087,151 | 535,134 | — | |||||

| TOTAL OPEN FOREIGN

CURRENCY SALE

CONTRACTS |

$129,238,927 | $115,503,921 | $13,735,006 | $ — | |||||

| Closed but Unsettled

Forward Currency Contracts |

Purchase

Value |

Sale Value | Realized

Gain |

Realized

Loss |

|||||

| Euro Currency | |||||||||

| expiring 6/1/2000 | $ 613,498 | $ 670,267 | $ 56,769 | $ — | |||||

| expiring 6/15/2000 | 91,871 | 92,582 | 711 | — | |||||

| expiring 8/1/2000 | 42,104 | 41,501 | — | 603 | |||||

| expiring 11/1/2000 | 1,447,480 | 1,460,185 | 12,705 | — | |||||

| expiring 12/15/2000 | 1,976,304 | 1,995,880 | 19,576 | — | |||||

| expiring 2/1/2001 | 5,236,536 | 5,851,698 | 615,162 | — | |||||

| expiring 2/1/2001 | 873,904 | 860,974 | — | 12,930 | |||||

| expiring 6/1/2001 | 1,312,845 | 1,331,687 | 18,842 | — | |||||

| TOTAL CLOSED BUT

UNSETTLED FORWARD

CURRENCY CONTRACTS |

$ 11,594,542 | $ 12,304,77 4 | $ 723,765 | $13,533 | |||||

|

4. PORTFOLIO SECURITIES

TRANSACTIONS – continued

|

| The

contractual amounts of forward foreign currency exchange contracts do

not necessarily represent the amounts potentially subject to risk. The

measurement of the risks associated with these instruments is meaningful

only when all related and offsetting transactions are considered. At

April 30, 2000, the Fund had sufficient cash and/or securities to cover

any commitments under these contracts.

|

| Futures

Contracts — The Fund may

enter into futures transactions to hedge against changes in interest

rates, securities prices, currency exchange rates or to seek to increase

total return. Upon entering into a futures contract, the Fund is

required to deposit with a broker an amount of cash or securities equal

to the minimum “initial margin” requirement of the associated

futures exchange. Subsequent payments for futures contracts

(“variation margin”) are paid or received by the Fund daily,

dependent on the daily fluctuations in the value of the contracts, and

are recorded for financial reporting purposes as unrealized gains or

losses. When contracts are closed, the Fund realizes a gain or loss

which is reported in the Statement of Operations.

|

| The use of

futures contracts involves, to varying degrees, elements of market and

counterparty risk which may exceed the amounts recognized in the